Attached files

| file | filename |

|---|---|

| 8-K - AZZ Q3 PRESENTATION - AZZ INC | form8kq3presentation.htm |

| EX-99.2 - EX 99.2 FINANCIAL AND OTHER INFO - AZZ INC | ex992financialinfo.htm |

January

2010

2

Except for the

statements of historical fact, this report may contain forward-looking

statements that involve risks and uncertainties some of which are detailed from time to

time in documents filed by the company with the SEC. Those risks and uncertainties

include, but are not limited to: changes in customer demand and response to products

and services offered by the company, including demand by the electrical power

generation markets, electrical transmission and distribution markets, the industrial

markets, and the hot dip galvanizing markets; prices and raw material costs, including

zinc and natural gas which are used in the hot dip galvanizing process and steel,

aluminum and copper which are used in the electrical and industrial segment; changes in

the economic conditions of the various markets the company serves, foreign and

domestic, customer requested delays of shipments, acquisition opportunities, currency

exchange rates, adequacy of financing, and availability of experienced management

employees to implement the company's growth strategy, a downturn in market conditions

in any industry relating to the products we sell or the services that we provide; the effects

and duration of continuing economic recession in the U.S. and other markets in which we

operate; and laws and regulations related to environmental matters, including those

addressing the risks of global climate change; and other political developments and laws

and regulations. The company can give no assurance that such forward-looking

statements will prove to be correct. We undertake no obligation to affirm, publicly update

or revise any forward-looking statements, whether as a result of information, future

events or otherwise.

statements that involve risks and uncertainties some of which are detailed from time to

time in documents filed by the company with the SEC. Those risks and uncertainties

include, but are not limited to: changes in customer demand and response to products

and services offered by the company, including demand by the electrical power

generation markets, electrical transmission and distribution markets, the industrial

markets, and the hot dip galvanizing markets; prices and raw material costs, including

zinc and natural gas which are used in the hot dip galvanizing process and steel,

aluminum and copper which are used in the electrical and industrial segment; changes in

the economic conditions of the various markets the company serves, foreign and

domestic, customer requested delays of shipments, acquisition opportunities, currency

exchange rates, adequacy of financing, and availability of experienced management

employees to implement the company's growth strategy, a downturn in market conditions

in any industry relating to the products we sell or the services that we provide; the effects

and duration of continuing economic recession in the U.S. and other markets in which we

operate; and laws and regulations related to environmental matters, including those

addressing the risks of global climate change; and other political developments and laws

and regulations. The company can give no assurance that such forward-looking

statements will prove to be correct. We undertake no obligation to affirm, publicly update

or revise any forward-looking statements, whether as a result of information, future

events or otherwise.

Forward

Looking Statement

3

AZZ is

a specialty electrical equipment

manufacturer serving the global markets

of power generation, transmission,

distribution and industrial as well as a

leading provider of hot dip galvanizing

services to the steel fabrication market

nationwide.

manufacturer serving the global markets

of power generation, transmission,

distribution and industrial as well as a

leading provider of hot dip galvanizing

services to the steel fabrication market

nationwide.

Company

Overview

Total

Company

Sales By Segment

Sales By Segment

45%

43%

55%

57%

Actual

FY2009

$412.4

(in

millions)

Projected

FY2010

$355

to $365

(in

millions)

Projected

FY2011

$310

to $330

(in

millions)

51%

49%

Galvanizing

Electrical

and Industrial

4

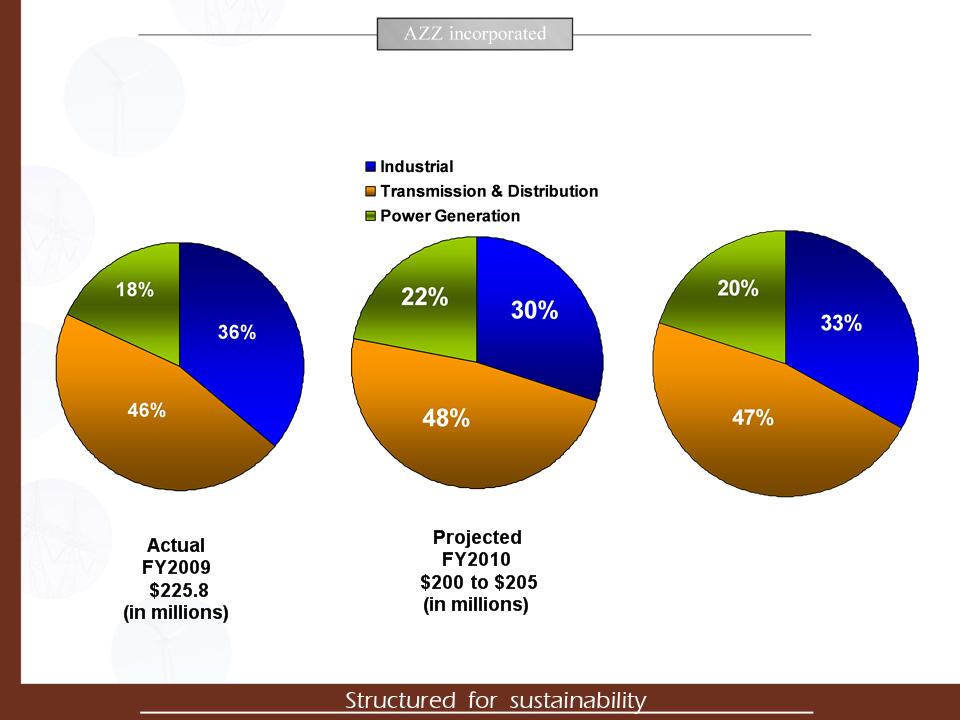

Total

Company

Sales By Market Segment

Sales By Market Segment

Actual

FY2009

$412.4

(in

millions)

Projected

FY2010

$355

to $365

(in

millions)

Projected

FY2011

$310

to $330

(in

millions)

5

Electrical

and Industrial Products

6

Electrical

and Industrial Products

Projected

2011

$150

to $160

(in

millions)

7

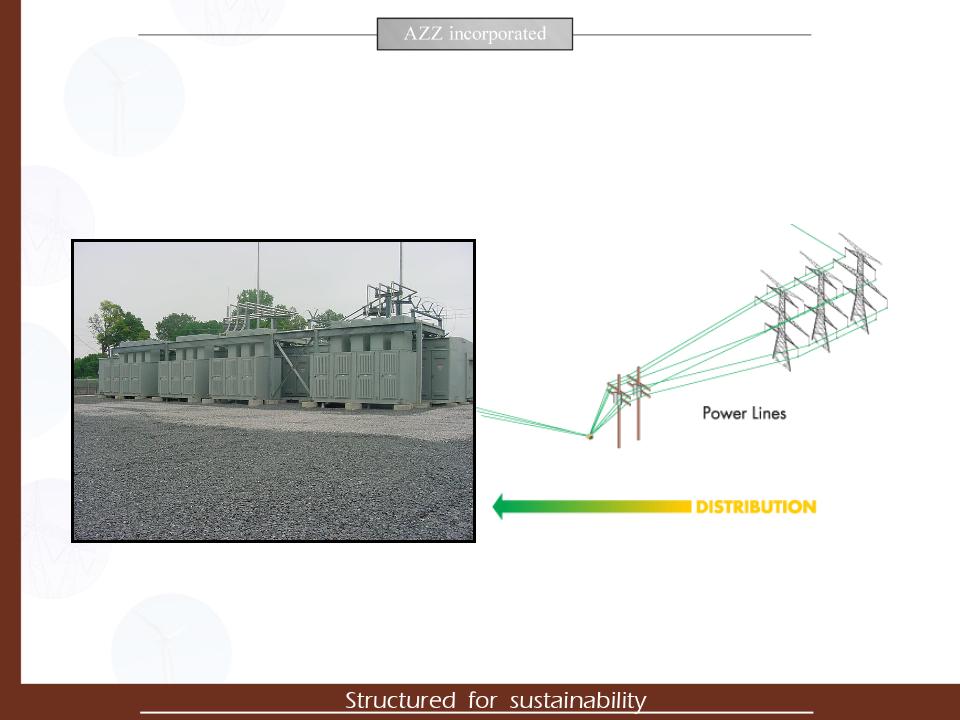

Power

Generation

8

Power

Transmission

9

Power

Distribution

10

Industrial

/ Commercial

11

12

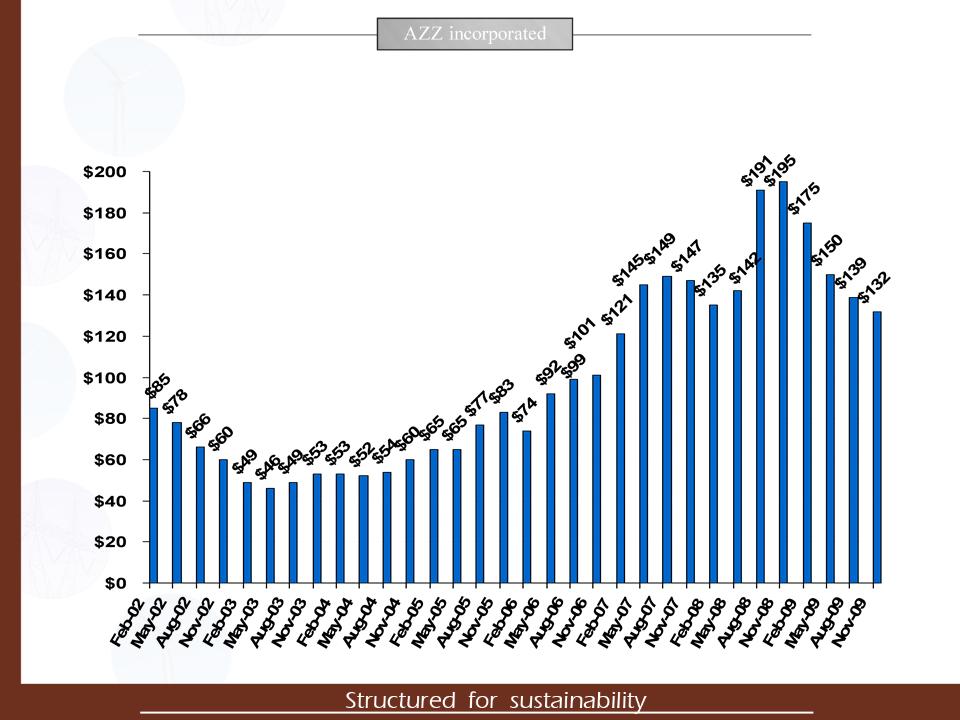

Backlog

($ In

Millions)

13

Backlog

($ In

Millions)

|

|

Fiscal

2008 |

Fiscal

2009 |

1st

Qtr 2010 |

2nd

Qtr

2010 |

3rd

Qtr

2010 |

|

Beginning

Backlog |

$120.7

|

$134.9

|

$174.8

|

$150.0

|

$139.4

|

|

Bookings

|

$334.4

|

$452.3

|

$70.7

|

$84.5

|

$73.9

|

|

Shipments

|

$320.2

|

$412.4

|

$95.5

|

$95.2

|

$81.5

|

|

Ending

Backlog |

$134.9

|

$174.8

|

$150.0

|

$139.4

|

$131.8

|

|

Book

to

Ship Ratio |

104%

|

106%

|

74%

|

89%

|

91%

|

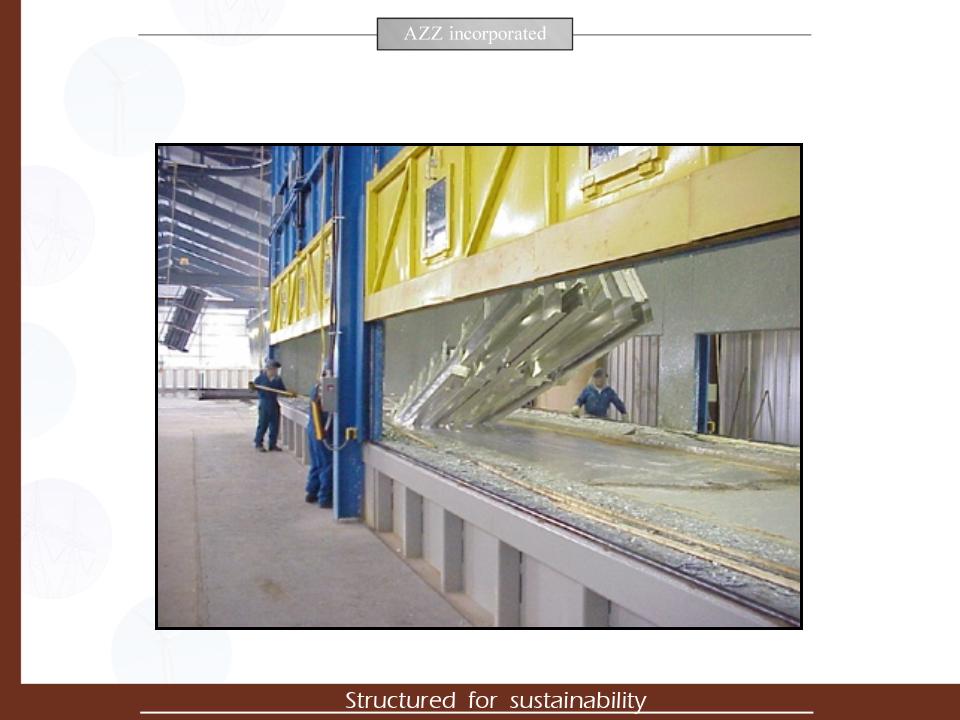

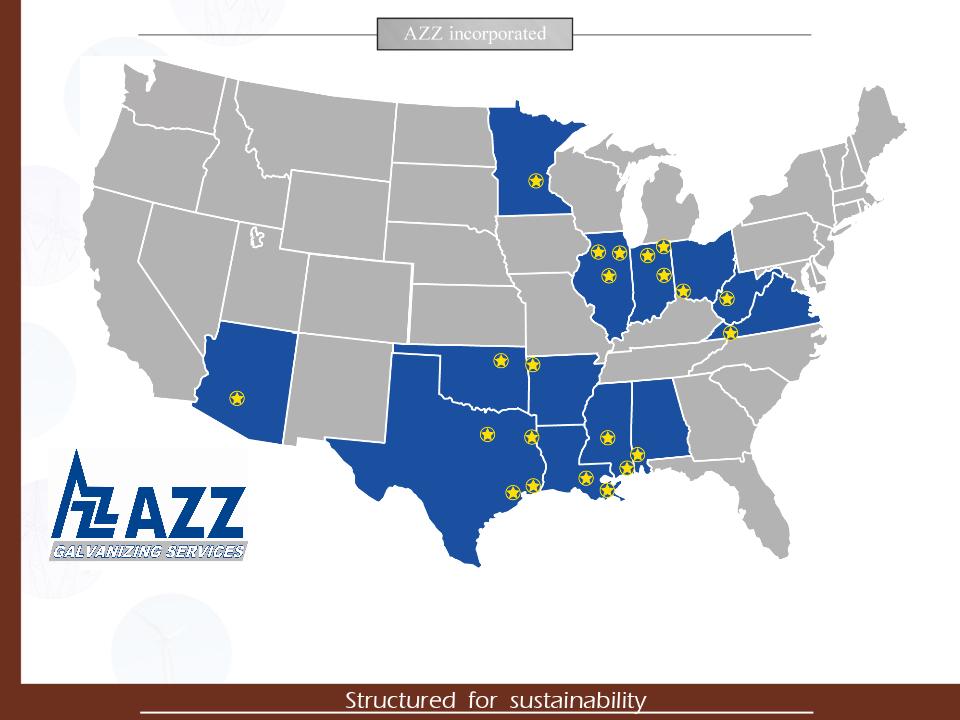

Galvanizing

Services

Application:

“After-fabrication”

steel corrosion protection

steel corrosion protection

Locations: 22

facilities in 13 states

15

16

Galvanizing

Services

Projected

FY2010

$155

to $165

(in

millions)

Projected

FY2011

$160

to $170

(in

millions)

18

Consolidated

Net Sales

($ In Millions)

($ In Millions)

$355

to

$365

$365

$310

to

$330

$330

19

Consolidated

Net Sales

First Nine Months FY10

($ In Millions)

First Nine Months FY10

($ In Millions)

20

Earnings

Per Share

(Fully Diluted)

(Fully Diluted)

$3.00

to

$3.10

$3.10

$1.85

to

$2.20

$2.20

21

Earnings

Per Share

First Nine Months FY10

(Fully Diluted)

First Nine Months FY10

(Fully Diluted)

22

Operating

Margins

23

Operating

Margins

First Nine Months FY10

First Nine Months FY10

Electrical

and Industrial

Products

24

Projected

25

Total

Bank Debt / Long Term Debt to Equity

($ In Millions)

($ In Millions)

Projected

Debt

Projected Debt to

Equity Ratio

Projected

Cash

Fiscal

Year

26

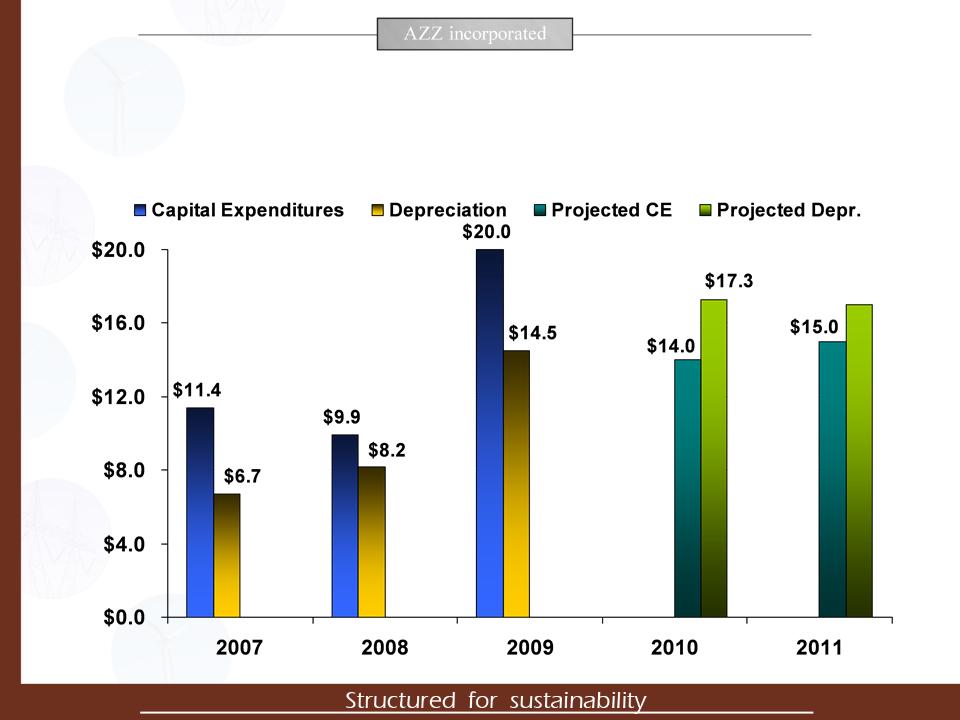

Capital

Expenditures / Depreciation

($ In Millions)

($ In Millions)

$17.0

27

Return

On Assets

28

Investment

Summary

• Strong

Historical Performance

Ø FY10 was 23rd consecutive year of

profitability

Ø 5 Yr CAGR - Revenues

19%, Net Income 51%, EPS 38%

Ø Significant

Operating Margins (above industry averages)

• Key

Growth Drivers

Ø Domestic &

international demand for electrical power and energy

Ø U.S. infrastructure

investment

• Niche

products and value added services with strong market

share position

share position

• Strong

Management Team

• Successful

acquisition track record and opportunities for further

expansion and growth

expansion and growth

• Strong

balance sheet and cash flows

January 2010