Attached files

| file | filename |

|---|---|

| 8-K - GC China Turbine Corp. | v171309_8k.htm |

Corporate Presentation

OTCBB:GCHT

Legal

Forward Looking Statements

This January 14, 2010 Corporate Presentation includes forward-looking information regarding GC China

Turbine Corp. and its subsidiaries that is intended to be covered by the safe harbor “forward-looking

statements” provided by the Private Securities Litigation Reform Act of 1995. Statements that are

predictive in nature, that depend upon or refer to future events or conditions, or that include words such

as “will”, “would”,

“should”, “plans”, “likely”, “expects”, “anticipates”, “intends”, “believes”, “estimates”,

“thinks”, “may”, and similar expressions, are forward-looking

statements. Statements that are not

historical facts are also forward looking statements. Although the Company believes that its expectations

are based on reasonable assumptions, there are risks, uncertainties and other factors that could

cause

actual results to be materially different from those in the forward-looking statements. These factors

include, among other things: our limited operating history and inability to predict future operations with

any certainty, the

ability to timely complete vendor agreements, construction and build out of

infrastructure, lengthy sales cycles, labor costs, political environment, cash flow estimates, future

financial performance, planned capital expenditures, market conditions,

uncertainties inherent in wind

energy generation, unexpected future capital expenditures, accuracy of test results, and other normal

business risks.

The foregoing factors do not constitute an exhaustive list of factors that could cause actual results to

differ materially from those anticipated in forward-looking statements, and should be read in conjunction

with the other cautionary statements and risk factors included in the Company's Current Report on Form

8-K filed with the Securities and Exchange Commission on November 5, 2009 and other cautionary

statements described in our reports filed with

the Securities and Exchange Commission. The Company

undertakes no obligation to publicly update any forward-looking statements for any reason, even if new

information becomes available or other events occur in the future. The Company

cautions readers not to

place undue reliance on those statements. The Corporate Presentation does not constitute an offer to

sell or solicitation of an offer to buy securities of the Company.

2

GC China Turbines Inc.

Manufactures state-of-the-art twin blade wind turbines

and development systems aimed at delivering economics

comparable to traditional electrical generation systems.

3

Company Overview

The Leader in Cost Effective

Megawatt Class Wind Energy Turbines

Existing Manufacturing, Sales and Distribution Capability

GC China Turbines is associated with Wuhan Guoce Sci & Tech Co., Ltd. (established

1993) Which offers direct access to previously developed, well established vertical

markets across

China. GC China Turbines has 135 million in sales currently in pipeline.

Licensed proprietary game-changing technology

Technology based on 10 year, 75 million dollar R&D investment by the Government of

Sweden

A Sound Operation

A venture of Wuhan Guoce Nordic New Energy Co. Ltd., an arm of the highly

regarded, well established and successful multi-division Wuhan Guoce Group of

Companies.

4

Investment Highlights

An established team with a proven track record

and immediate access to the massive Chinese market

Market

Large and growing wind turbine market in China’s energy hungry economy

The government is driven to source alternative clean energy solutions - quickly

$47B in 2008 growing to $100B in five years — 1 MW class wind turbines exceed

5,000 MW/year and $7.5 billion in sales

Chinese Government constantly developing new incentives for large producers

Company

Experienced management team with demonstrated expertise in large scale

manufacturing of complex systems and a robust, established parent organization

Extremely competitive proprietary technology on a cost of energy ($/kWh) and cost

of installation ($/kW) basis

Growing sales ($135 million) and customer prospects for 2010 and 2011 revenues

Financial

2009 - First Profitable year!

Projecting $500 million in annual sales by 2012

5

Management

6

Hou Tiexin, Chairman & CEO

Beginning in 1982-2001, Hou Tiexin served with the Power Research Institute, State Grid Corporation as a senior

engineer at professor-level, head of research offices and office of scientific research. He

published a number of

dissertations during this period and was awarded a number of scientific progress awards and patents. From 2001-

2008, he served as the Chairman and General Manager of Wuhan Guoce Sci & Tech Co., Ltd.

Qi Na, CEO & Director

Ms. Qi Na has been General Manger of Wuhan Guoce Nordic New Energy Corp. since 2006. From 2004, she was

General Manager of Wuhan Guoce Power Investment Corp. as well as Vice General Manager of Wuhan Guoce

Science & Tech Corp. Ms. Qi obtained a Bachelor of Engineering degree specializing in Marine Power Plants from

Shanghai Jiaotong University in 1978.

Zhao Ying, CFO

Zhao Ying holds a Masters degree in law and economics. She previously served with Wuhan Guoce Sci & Tech Co.,

Ltd. for 9 years during which time she raised approximately 100 million Yuan for the company.

Tomas Lyrner, CTO

Mr. Lyrner is a Swedish wind power technology expert with over thirty years in R & D, design, production and

assembly of wind turbines. He was fully involved in the design and development of the original

wind turbine

prototypes. These units were developed under the auspices of the Royal Swedish Fund and are installed in Sweden.

A 3.0MW 2-blade wind turbine designed by Mr. Lyrner has been in operation for more than 100,000 hours thereby

achieving

the electricity generation world record for a single wind turbine structure.

Preben Maegaard, Consultant

Preben Maegaard of Denmark is a Former Chairman of the World Wind Energy Association, and since 1999 is a

Director of EREF, the European Renewable Energy Federation. Since 2001 he has been the President

of the World Wind

Energy Association, WWEA.

Marcus Laun, Non-Executive Director

Mr. Laun is currently a senior banker at Wynston Hill Capital, LLC where he is responsible for all aspects of capital

raising and advisory engagements for micro- and small-cap ventures. From 2004 through

2008, Mr. Laun held various

senior positions at Knight Capital Group. Mr. Laun received a Masters’ in Business Administration degree from

Columbia Business School and received a Bachelor of Science degree from Cornell University.

Key Technology

7

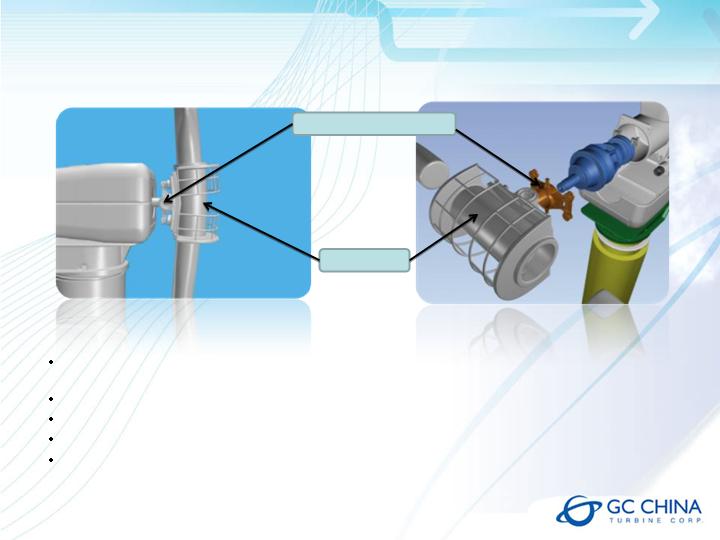

Flexible Hub

Load Absorbing Mounts

Exploded view of proprietary moving hub

and vibration damping system

The design is a patented, integrated system designed to minimize potentially damaging

vibrations

Flexible “moving-hub” avoids transferring most shock loads to the gearbox

Management and design of the control system is key

Uses automated blade sensors & controls. Constant feedback ensures highest efficiency

The technology offers a new approach and significant opportunities for large scale wind

farms including remote onshore and offshore installations

Product Differentiation

2-Bladed Turbine

3-Bladed Turbine

Simplified Internal

Mechanism and

Structure

Load shedding, “flexible”

design reduces stress

and impact loads

Lower loads, less weight,

less cost

Complicated Internal

Mechanism and Structure

Rigid & Massive

Much higher failure rate and

higher operational costs

Difficult to erect in many

locations

8

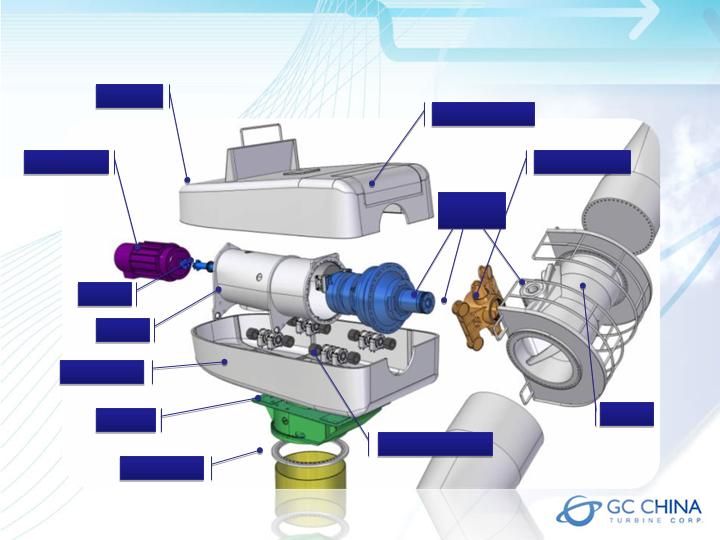

Simple Design when compared

to 3-Blade

Generator

Top access

Stand

Chassis

Lower access

Coupling

Yaw bearing

Main gearbox

Hubsupports

Flexible

Hub

Elastic support

Load

Absorbing

Mounts

Exploded internal structure of GC China 1MW

2-blade wind turbine

9

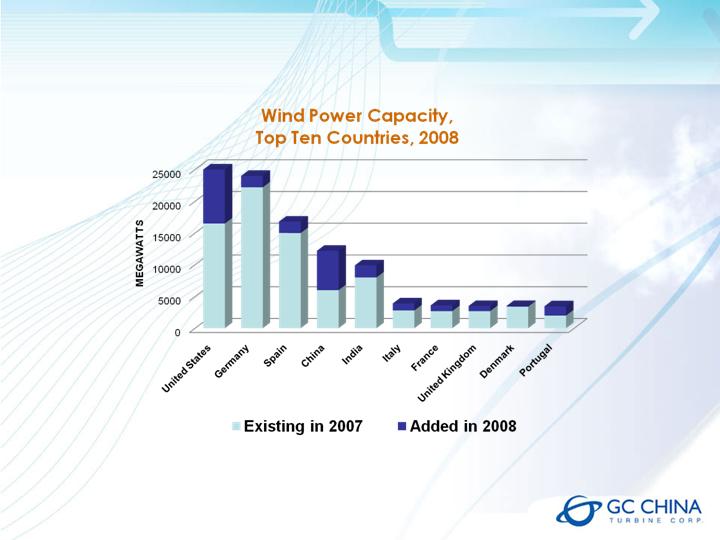

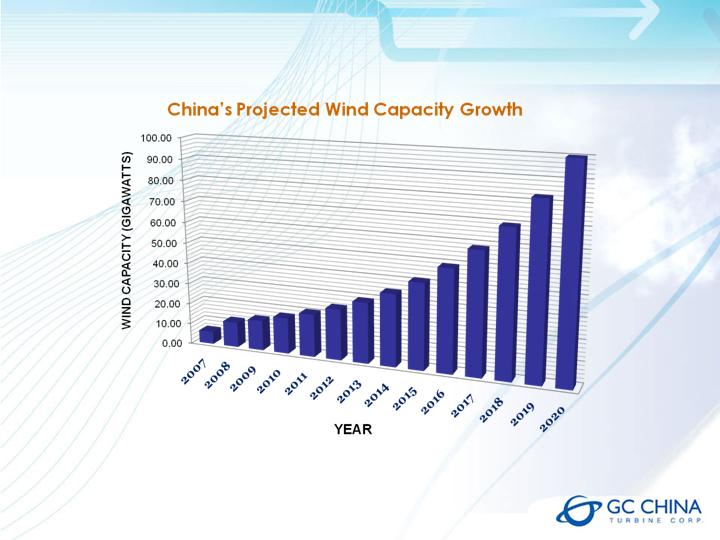

Global Market Positioning

China will soon possess the

largest wind generation capacity worldwide

10

Market Growth

GC China Turbines is well positioned to capture

this government mandated growth

11

China’s Wind Initiatives Likely to Benefit

Chinese Companies most

Government Stimulus funds are being allocated to Chinese

Companies

“Foreign Makers of wind turbines complain that they have been

shut out of bidding for a $5 billion stimulus financed power plant”

– AP 6/18/09

GE has pulled out of the bidding process for expansion of the

Jiangsu Wind Farm – believing that it can’t compete against the

Chinese

incumbents – Reuters “Foreigners swept aside as wind

power blows through China” 6/4/09

Foreign Manufacturers complain that China's efforts to eliminate

turbines with capacities of less than 1 megawatt is also a form of

restrictive practice that plays into the hands of domestic firms.

–

Reuters “Foreigners swept aside as wind power blows through

China” 6/4/09

Ministry of Energy projecting expenditures of $150 billion before

2020

12

Competitive Advantage Through Design

Cost Differences Between

3-bladed and 2-bladed

2-Bladed

parts

3-Bladed parts

Manufacturing

Cost Saving

2 blades

3 blades

$90,000 USD

Soft tower

Tower

$45,000 USD

No need

Frequency

converter

$200,000 USD

Blade bearing

Main bearing

Variable pitch

Main shaft

Yaw brake

system

Same parts

Total

$335,000 USD

2 blades vs. 3… a lighter, simpler

product

No need for main shaft, main

bearing, pitch bearing – saves

initial costs and fabrication lead

times. Saves on operational costs

No need for mechanical yaw

braking system

Built in blade tip braking system

outperforms anything else

Dedicated electronic sensor and

remote operations systems –

instant feedback & control

Lighter tower, saving materials

and foundation costs – allows for

installation in challenging

environments

13

Competitive Advantage Through Quality

Four 1MW turbines have been running in

Sweden continuously for 8-12 years

There were no drive train failures during the

entire timeline

The system has achieved 100,000 hours of

problem-free operation with 97.7% uptime

14

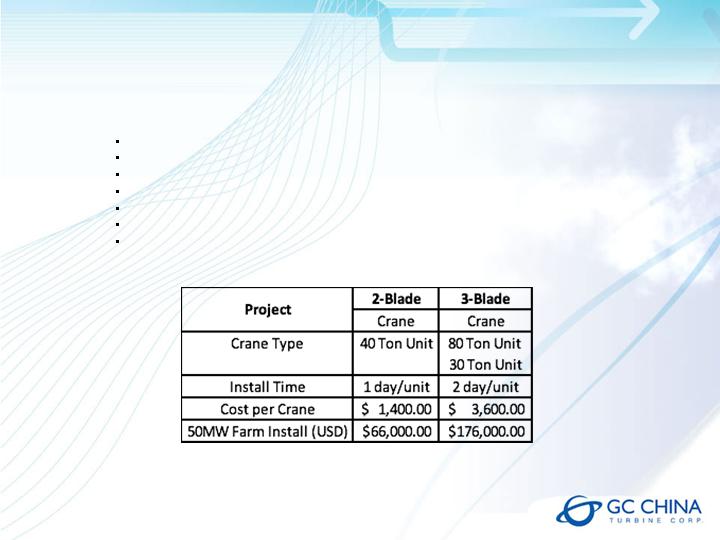

Competitive Advantage

Low Installation Cost

Two bladed installations are faster, simpler, lower risk and safer

On-ground assembly mitigates risk and overall difficulty

Fewer crane picks (3 vs. 5) simplifies scheduling

Use of cheaper 400 T Hydraulic truck-crane - arrives onsite and sets up faster.

Remote rural region non-hydraulic lift system under development.

Lower transportation costs because of fewer trailer loads (4 versus 6)

Installation cost ~ 50% of that for 3-bladed turbines

15

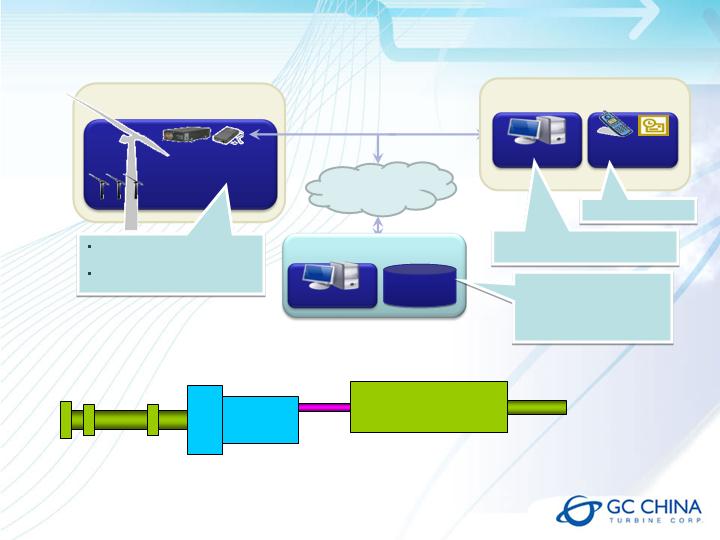

Competitive Advantage

Proprietary Monitoring

Technology

Input shaft

Gearbox

Generator

shaft

Generator

1

3

4

5

6

7

2

Wind Farm

Diagnosis & Forecast Data

WT-HUMS auto diagnosis

and result forecast

Status alarm (via SMS or

HSDPA)

Diagnosis center

WW-WT

Database

Diagnosis server

Remote Operator

Ground station

Mobile and email

Internet based wind turbine

management system

Via SMS or Email

Online diagnosis supports,

updates and interprets

wind turbine results

compared to database

WT-HUMS

Representative Detector Locations

Internet / LAN

1

3

4

5

6

7

Front bearing of horizontal input shaft

Rear bearing of input shaft

Planetary system

Output shaft & oil pump

Generator input bearing

Generator output bearing

2

Front bearing of vertical input shaft

16

Competitive Comparison

Figure 2: IEC2 wind farm return on investment analysis

Figure 3: IEC3 wind farm return on investment analysis

GC China Turbines generate the quickest payback on investment

Design Capacity:

50×1000Kw for 2-blade wind turbines

33×1500Kw for 3-blade wind turbines

1.0MW 2-blade wind

turbines (imported

components)

1.0MW 2-blade wind

turbines (domestic

components)

1.5MW 3-blade wind turbines

Total Estimated Investment

56,366,834.94

43,933,017.31

65,284,490.05

Per KW

1,127.40

878.60

1,318.85

Return on investment

8.10%

11.15%

7.06%

Return on capital

31.20%

33.49%

24.52%

Pre-tax return on investment

9.38%

12.80%

8.64%

IRR

14.81%

17.31%

14.08%

Payback period (years)

7.2

5.33

7.49

Design Capacity:

50×1000Kw for 2-blade wind turbines

33×1500Kw for 3-blade wind turbines

1.0MW 2-blade wind

turbines (imported

components)

1.0MW 2-blade wind turbines

(domestic components)

1.5MW 3-blade wind turbines

Total Estimated Investment

56,365,372.31

43,933,017.31

65,284,490.05

Per KW

1,127.40

878.60

1,318.85

Return on investment

5.13%

7.26%

4.49%

Return on capital

19.78%

21.80%

15.58%

Pre-tax return on investment

6.40%

8.89%

5.76%

IRR

11.44%

13.51%

10.53%

Payback period (years)

8.56

6.61

9.06

17

Supply Chain & Quality Control

All key components for 1.0 MW wind turbine are

fabricated locally in China to the highest standards

Efficient working capital

utilization

Quality driven purchasing for

outsourced components: two

suppliers for each part

Independent quality

substantiation offered on all

critical parts

GC China is in close

collaboration with certifying

authorities

Quality plan drives focus on

critical processes and

components

All outsource partners offer

verifiable inventories to ensure

timely logistics

18

Manufacturing and Installation

The production line for 1.0 MW turbines is operational

19

Joint Venture Announced

GC China signs MOU in Jiangsu Province that contemplates:

1 of 3 wind turbine suppliers in Development Zone

Will be the second manufacturing facility owned by GC

China Turbines

Multiple 500mw wind farms planned

Estimated Revenues of $750 million as part of the projects

Development and production of 3.0 MW offshore turbine

20

Recent Developments

Recent Capital Raises of $19 million

Successful ramp-up of production

Shenzhen Guohan orders 10 turbines

R&D agreement finalized for facility in Sweden

21

Future Growth

The Company aims to provide wind energy

at a price comparable to traditional

electrical generation projects.

GC China intends to achieve this by

identifying promising technologies and to

further minimize costs by sourcing the

majority or all components from within China.

GC China currently produces a 1.0 MW two-

blade wind turbine. Focusing on the Chinese

market, GC China will penetrate broader

reaches of the Chinese market with the

launch of the more powerful

2.3 and 3.0 MW

2-blade turbines. The 3.0 MW wind turbine is

specifically targeted for offshore applications.

22

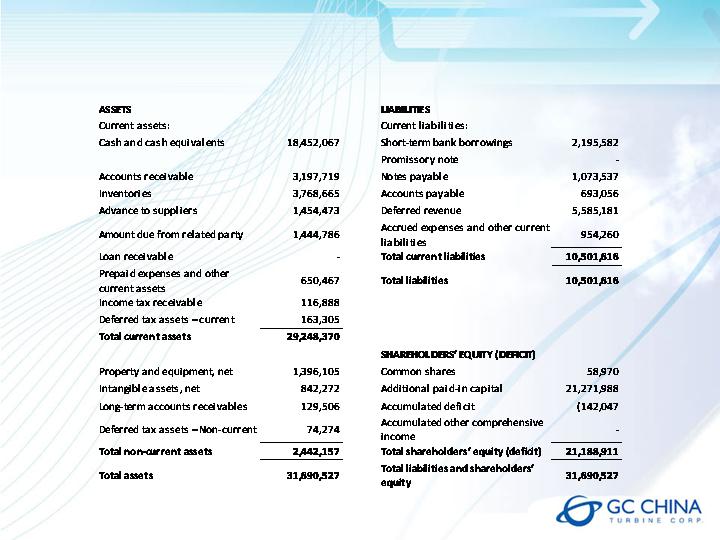

Financial - Balance Sheet

GC China Turbine Corp. - Pro Forma – 11/1/09

23

Financial – Income Statement

24

2008 est.

2009*est.

2010 est.

2011 est.

2012 est.

Net Sales

3.06

19.6

87.20

199.48

536.05

Cost of Sales

2.94

15.0

57.45

136.97

365.42

Gross Profit

0.12

4.638

29.75

62.51

170.63

4%

24%

34%

31%

32%

Operating Expense:

selling and marketing expenses

0.06

-

1.02

2.33

6.27

Research and development expenses

0.09

-

-

-

-

General and administrative expenses

0.4

1.45

9.18

19.67

45.89

Total operating expenses

0.55

1.92

10.20

22.00

52.16

Gain(loss)from operations

-0.43

2.72

19.54

40.51

118.47

-14%

14%

22%

20%

22%

Interest expense

0.11

-

-

-

-

Interest income

0.001

-

0.04

0.09

0.22

Gain on foreign exchange

0.06

-

-

-

-

other expenses

0.02

-

-

-

-

Earnings(loss before income taxes)

-0.50

2.79

19.59

40.59

118.70

Income Taxes

-0.12

1.29

4.90

10.15

29.67

Net income(loss)

-0.38

1.5

14.69

30.44

89.02

*Figures are unaudited and subject to revision and are subject to the officially audited financial

data issued by Deloitte

Touche Tohmatsu

GC China Turbine Corp. - OTCBB: GCHT

25

52 Wk Hi

Avg Volume

4.07

253K (90 day)

Market Cap

Shares

180m

58.97m

GCHT - Recent Trading Activity - $2.89 (01/08/10)

Financial Partners

26

NewMargin Ventures is a leading venture capital management company in

China. The company focuses on industry sectors that they believe will offer

phenomenal growth opportunities in the coming decades. NewMargin's team

consists of seasoned professionals with a combination of deep industry

knowledge and strong investment experience. NewMargin is the first venture

capital management company

in China that manages and advises both

domestic and offshore funds.

Ceyuan Ventures is a Beijing-based early stage venture capital firm focused

on IT and emerging growth companies. They emphasize backing great teams,

technology and business innovation. John S. Wadsworth, Jr. is Chairman, Co-

Founder and Special Director. He is also the Honorary Chairman of Morgan

Stanley Asia and an Advisory Director for Morgan Stanley & Co. Incorporated

(“Morgan

Stanley”) globally.

Financial Partners

Lead investors in our recent $8 million PIPE financing, Longboard

Capital Advisors invests

in clean energy businesses. Founded in

2006 to help capitalize cleantech companies that address global

warming and security issues head on. Staying ahead of complex

developments in clean technologies and markets provides

Longboard Capital with

a global understanding of key issues and

their opportunities.

27

Thank You

GC China Turbine Corp.

No. 86, Nanhu Avenue,

East Lake Development Zone,

Wuhan, Hubei Province 430223

People’s Republic of China

1-888-838-8478

info@gccturbine.com

For Investor Relations:

PR Financial Marketing LLC

Jim Blackman, 713-256-0369

jim@prfmonline.com

For Institutional Investors:

PR Financial Marketing LLC

Brian Blackman, 832-515-0928

brian@prfmonline.com

OTCBB; GCHT

28