Attached files

| file | filename |

|---|---|

| EX-4.12 - EMERALD DAIRY INC | v171400_ex4-12.htm |

| EX-5.1 - EMERALD DAIRY INC | v171400_ex5-1.htm |

| EX-23.1 - EMERALD DAIRY INC | v171400_ex23-1.htm |

| EX-10.14 - EMERALD DAIRY INC | v171400_ex10-14.htm |

As

filed with the Securities and Exchange Commission on January 14,

2010

(Registration

No. 333-162432)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

AMENDMENT

NO. 2

TO

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

EMERALD

DAIRY INC.

|

Nevada

|

2020

|

80-0137632

|

||

|

(State

or other jurisdiction of

incorporation

or organization)

|

(primary

standard industrial

classification

code number)

|

(I.R.S.

Employer

Indentification

No.)

|

11990

Market Street, Suite 205

Reston,

Virginia 20190

(703)

867-9247

Shu

Kaneko

Chief

Financial Officer

11990

Market Street, Suite 205

Reston,

Virginia 20190

Tel:

(703) 867-9247

Fax:

(678) 868-0633

Copies of

all communications to:

Jeffrey

A. Rinde, Esq.

Blank

Rome LLP

The

Chrysler Building

405

Lexington Ave.

New York,

NY 10174

Tel:

(212) 885-5000

Fax:

(212) 885-5001

Approximate

date of proposed sale to the public: From time to time after the effective date

of this Registration Statement.

If any of

the securities being registered on this Form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act, check the

following box: x

If this

Form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, please check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering. o

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. o

If this

Form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a small reporting

company. See the definition of “large accelerated filer,”

“accelerated filer,” and “small reporting company”:

|

Large

accelerated filer o

|

Accelerated

filer o

|

|

Non-accelerated

filer o (do not check if a

smaller reporting company)

|

Smaller

reporting company x

|

THE

REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS

MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A

FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT

SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE

SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME

EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A),

MAY DETERMINE.

PROSPECTUS

Subject

to completion, dated January 14, 2010

EMERALD

DAIRY INC.

12,589,979

SHARES OF COMMON STOCK

This

prospectus relates to disposition of up to 12,589,979 shares of our common stock

held by the selling stockholders referred to in this prospectus. The

shares covered by this prospectus include:

|

·

|

6,969,810

outstanding shares held by the selling stockholders;

and

|

|

·

|

5,620,169

shares issuable upon exercise of warrants held by the selling

stockholders.

|

We will

not receive any of the proceeds from the sale or other disposition of the shares

of common stock covered by this prospectus. However, we will receive gross

proceeds of $12,872,575 if all of the warrants held by the selling stockholders

are exercised for cash.

Our

common stock is traded in the over-the-counter market and prices are quoted on

the over-the-counter electronic bulletin board under the symbol

"EMDY.OB." On January 13, 2010, the last reported sale price for our

common stock was $1.70 per share.

The

selling stockholders may, from time-to-time, sell, transfer or otherwise dispose

of any or all of their shares of common stock on any exchange, market or trading

facility on which shares are traded or in private transactions and in other ways

described in the “Plan of Distribution”. These dispositions may be at

fixed prices, at the prevailing market price at the time of sale, at prices

related to the prevailing market price, at varying prices determined at the time

of sale, or at negotiated prices.

INVESTING

IN OUR STOCK INVOLVES A HIGH DEGREE OF RISK. SEE "RISK

FACTORS"

BEGINNING ON PAGE 5.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE

SECURITIES

COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES

OR

DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY

REPRESENTATION

TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date

of this prospectus is ____________, 2009

You

should rely only on the information contained in this prospectus. We have not,

and the selling stockholders have not, authorized anyone to provide you with

different information. If anyone provides you with different information, you

should not rely on it. We are not, and the selling stockholders are not, making

an offer to sell these securities in any jurisdiction where the offer or sale is

not permitted. You should assume that the information contained in this

prospectus is accurate only as of the date on the front cover of this

prospectus. Our business, financial condition, results of operations and

prospects may have changed since that date.

TABLE

OF CONTENTS

|

Page

|

|

|

Prospectus

Summary

|

1

|

|

Our

Company

|

1

|

|

Corporate

Information

|

2

|

|

The

Offering

|

3

|

|

Summary

Historical Financial Information

|

4

|

|

Risk

Factors

|

5

|

|

Forward

Looking Statements

|

17

|

|

Use

of Proceeds

|

18

|

|

Market

for Our Common Stock

|

18

|

|

Capitalization

|

|

|

Management's

Discussion and Analysis of Financial Condition and Results of

Operations

|

21

|

|

Business

|

52

|

|

Legal

Proceedings

|

65

|

|

Management

|

65

|

|

Executive

Compensation

|

67

|

|

Security

Ownership of Certain Beneficial Owners and Management

|

74

|

|

Certain

Relationships and Related Transactions

|

75

|

|

Description

of Securities

|

79

|

|

Selling

Stockholders

|

90

|

|

Plan

of Distribution

|

104

|

|

Legal

Matters

|

106

|

|

Experts

|

106

|

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosures

|

106

|

|

Where

You Can Find Additional Information

|

107

|

|

Financial

Statements

|

F-1

|

i

PROSPECTUS

SUMMARY

This

summary highlights selected information contained elsewhere in this prospectus.

To fully understand this offering, you should read the entire prospectus

carefully, including the more detailed information regarding the Company, the

risks of purchasing our common stock discussed under "risk factors," and our

financial statements and the accompanying notes. In this prospectus, the

“Company,” "we", "us" and "our", refer to Emerald Dairy Inc. and its

subsidiaries, unless the context otherwise requires. Unless otherwise indicated,

the term "year," "fiscal year" or "fiscal" refers to our fiscal year ending

December 31st. Except as specifically indicated otherwise, we have

adjusted all references to our common stock in this prospectus to reflect the

effect of a 1-for-40 reverse stock split on June 25, 2007.

Our

Company

We are a

producer of milk powder, rice powder and soybean milk powder, which currently

comprise approximately 95%, 3% and 2% of our sales,

respectively. We have an Infant & Baby Formula Milk Powder Production

Permit, issued by the State General Administration of Quality Supervision and

Inspection and Quarantine of the People’s Republic of China (“PRC”). Only

current license holders are permitted to produce formula milk powder in the

PRC. Through our network of over 800 salespeople, our products are

distributed throughout 20 provinces in the PRC, and sold in over 5,800 retail

outlets.

Our

products are marketed under two brand names:

|

|

·

|

“Xing

An Ling,” which is designed for high-end customers;

and

|

|

|

·

|

“Yi

Bai,” which is designed for middle and low-end

customers.

|

The

Chinese government has initiated programs to promote milk consumption and is

providing incentives to increase dairy production. The dairy market today in the

PRC is over $13.0 billion and is expected to grow at a rate of 15% per year for

the foreseeable future. We focus on the infant formula segment of the market,

which is expected to grow even faster, at a rate of approximately 23% through

2011. Currently, it is estimated that demand for infant formula in

the PRC outstrips supply by at least 2-to-1. During the past three

fiscal years our sales have grown at an average rate of more than 50% per year,

with sales of $44.3 million, $29.6 million and $18.8 million for the fiscal

years ended December 31, 2008, 2007 and 2006, respectively.

Because

of our close proximity to our sources of fresh milk, we are able to complete the

production process in approximately 30 – 35 hours, which is faster than

competitors of ours that are not similarly situated. We produced

approximately 7,000 tons of milk powder at our facility in Be’ian City,

Heilongjiang Province, PRC in fiscal 2007, up from approximately 5,000 tons in

fiscal 2006. In 2008, by adding a third shift to the existing two shifts working

schedule, we produced approximately 9,000 tons of milk powder. In

addition, in July 2008, through our wholly-owned subsidiary, Hailun Xinganling

Dairy Co., Ltd. (“HXD”), we commenced construction of a new production facility

in Hailun City, Heilongjiang Province, PRC, which we expect will enable us to

produce an additional 9,000 tons of milk powder in 2010 and a total of 18,000

tons of milk powder annually in 2011. As a result, we believe we will have the

capacity to produce approximately 27,000 tons of milk powder per year by the end

of fiscal 2011. It is expected that our production of rice powder and soymilk

powder will also increase in volume, while continuing to comprise an aggregate

of approximately 5% of our overall sales.

1

All of

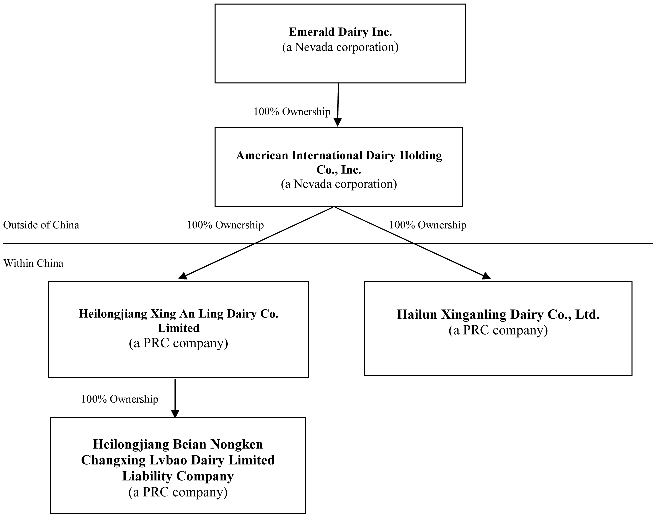

our business is conducted through our wholly-owned Chinese

subsidiaries:

|

|

·

|

Heilongjiang

Xing An Ling Dairy Co. Limited (“XAL”), which handles our promotion, sales

and administrative functions;

|

|

|

·

|

Heilongjiang

Be’ian Nongken Changxing Lvbao Dairy Limited Liability Company (“Lvbao”),

which handles production of our products in Be’ian City, Heilongjiang

Province, PRC; and

|

|

|

·

|

HXD,

which, upon completion of our new production facility, will handle

additional production of our products in Hailun City, Heilongjiang

Province, PRC.

|

Corporate

Information

Our

predecessor filer was incorporated under the name Micro-Tech Identification

Systems, Inc. (“Micro-Tech”) pursuant to the laws of the State of Nevada on

September 24, 1986. For several years prior to the Reverse Merger (described

below), Micro-Tech’s primary business operations involved seeking the

acquisition of assets, property, or businesses that may be beneficial to

Micro-Tech and its shareholders.

On

October 9, 2007, American International Dairy Holding Co., Inc., a Nevada

corporation (“AIDH”) became a wholly-owned subsidiary of Micro-Tech, when it

merged with Micro-Tech’s wholly-owned subsidiary, which was organized for that

purpose (the “Reverse Merger”). Immediately following the Reverse Merger,

Micro-Tech succeeded to the business of AIDH as its sole line of business, and

changed its name to Amnutria Dairy Inc. On January 25, 2008, we

changed our name from Amnutria Dairy Inc. to Emerald Dairy Inc.

AIDH was

organized pursuant to the laws of the State of Nevada on April 18, 2005, for the

purpose of acquiring the stock of Heilongjiang Xing An Ling Dairy,

Co. On May 30, 2005, AIDH acquired Heilongjiang Xing An Ling Dairy

Co. Limited, (“XAL”), a corporation formed on September 8, 2003 in Heilongjiang

Providence, PRC. This transaction was treated as a recapitalization of XAL for

financial reporting purposes. The effect of this recapitalization was rolled

back to the inception of XAL for financial reporting purposes.

Prior to

September 23, 2006, XAL owned approximately 57.7% of Heilongjiang Beian Nongken

Changxing LvbaoDairy Limited Liability Company (“LvBao”), with the remaining

balance being held by AIDH’s sole shareholder. On September 23, 2006, the

remaining 42.3% ownership in LvBoa was transferred to XAL and was treated as an

additional capital contribution. The effect of this contribution by the sole

shareholder was rolled back to September 8, 2003 for financial reporting

purposes.

On May

22, 2008, we formed AIDH’s wholly-owned subsidiary, HXD, under the laws of the

PRC. Upon completion of our new production facility, HXD will handle

additional production of our products in Hailun City, Heilongjiang Province,

PRC

All of

the business of AIDH is conducted through AIDH's wholly-owned subsidiaries, XAL

and HXD, and XAL's subsidiary, LvBao.

Our U.S.

offices are located at 11990 Market Street, Suite 205, Reston, Virginia 20190,

telephone number (703) 867-9247. Our corporate headquarters are

located at 10 Huashan-lu, Xiangfang-qu, 9th Floor, Wanda Building, Harbin City,

Heilongjiang Province, PRC 150001.

2

The

Offering

|

Common

Stock Offered by the Company

|

None

|

|

Common

Stock Offered by the Selling

Stockholders

|

Up

to 12,589,979 shares of our common stock, including: (i) up to 6,969,810

shares of issued and outstanding common stock held by the selling

stockholders, (ii) up to 373,334 shares issuable upon exercise of warrants

held by the selling stockholders, at an exercise price of $0.94 per share,

(iii) up to 1,333,333 shares issuable upon exercise of warrants held by

the selling stockholders, at an exercise price of $1.50 per share, (iv) up

to 700,583 shares issuable upon exercise of warrants held by the selling

stockholders, at an exercise price of $1.63 per share, (v) up to 857,110

shares issuable upon exercise of warrants held by the selling

stockholders, at an exercise price of $2.04 per share, (vi) up to 75,000

shares issuable upon exercise of warrants held by the selling

stockholders, at an exercise price of $2.61 per share, and (vii) up to

2,280,809 shares issuable upon exercise of warrants held by the selling

stockholders, at an exercise price of $3.26 per share.

|

|

Common

Stock Outstanding Prior to this Offering

|

32,927,191

shares

|

|

Use

of Proceeds

|

We

will not receive any proceeds from the shares sold in this

offering.

|

|

Symbol

for our Common Stock

|

“EMDY.OB”

|

Risk

Factors

We urge

you to read the "Risk Factors" section beginning on page 5 of this prospectus so

that you understand the risks associated with an investment in our common

stock.

3

Summary

Historical Financial Information

The

following tables set forth our summary historical financial information. You

should read this information together with the financial statements and the

notes thereto appearing elsewhere in this prospectus and the information under

"Management's Discussion and Analysis of Financial Condition and Results of

Operations."

Consolidated

Statements of Operations:

|

For the Nine Months

Ended September 30,

|

For the Fiscal Year

Ended December 31,

|

|||||||||||||||

|

2009

|

2008

|

2008

|

2007

|

|||||||||||||

|

(Unaudited)

|

(Unaudited)

|

(Audited)

|

(Audited)

|

|||||||||||||

|

Sales

|

$ | 31,261,491 | $ | 32,560,256 | $ | 44,325,179 | $ | 29,618,008 | ||||||||

|

Cost

of Goods Sold

|

17,057,583 | 19,845,232 | 26,546,291 | 19,064,905 | ||||||||||||

|

Gross

Profit

|

14,203,908 | 12,715,024 | 17,778,888 | 10,553,103 | ||||||||||||

|

Total

Operating Expenses

|

9,579,027 | 10,355,970 | 14,210,578 | 6,875,197 | ||||||||||||

|

Total

Other (Expense)

|

(63,466 | ) | (262,862 | ) | (413,605 | ) | (9,443 | ) | ||||||||

|

Provision

for Income Taxes

|

860,948 | 586,957 | 840,198 | 118,325 | ||||||||||||

|

Net

Income

|

$ | 3,700,467 | $ | 1,509,235 | $ | 2,314,507 | $ | 3,550,138 | ||||||||

|

Basic

Earnings Per Share

|

$ | 0.12 | $ | 0.05 | $ | 0.08 | $ | 0.15 | ||||||||

|

Basic

Weighted Average Shares Outstanding

|

29,979,356 | 29,299,332 | 29,299,332 | 24,211,872 | ||||||||||||

|

Diluted

Earnings Per Share

|

$ | 0.12 | $ | 0.05 | $ | 0.08 | $ | 0.15 | ||||||||

|

Diluted

Weighted Average Shares Outstanding

|

30,429,024 | 29,563,708 | 29,518,067 | 24,271,991 | ||||||||||||

|

Comprehensive

Income

|

$ | 3,690,611 | $ | 2,588,087 | $ | 3,481,375 | $ | 4,185,217 | ||||||||

Consolidated

Balance Sheets:

|

As at September 30,

|

As at December 31,

|

|||||||||||

|

2009

|

2008

|

2007

|

||||||||||

|

(Unaudited)

|

(Audited)

|

(Audited)

|

||||||||||

|

Cash

and cash equivalents

|

$ | 9,681,007 | $ | 7,343,588 | $ | 6,560,931 | ||||||

|

Total

current assets

|

$ | 22,297,720 | $ | 18,710,381 | $ | 16,594,937 | ||||||

|

Property,

plant and equipment, net

|

$ | 5,743,716 | $ | 6,101,566 | $ | 3,320,081 | ||||||

|

Total

assets

|

$ | 36,402,432 | $ | 28,674,375 | $ | 20,030,246 | ||||||

|

Total

current liabilities

|

$ | 7,577,525 | $ | 8,253,183 | $ | 3,480,666 | ||||||

|

Put/Call

Liability

|

— | — | $ | 3,169,444 | ||||||||

|

Total

stockholders' equity

|

$ | 28,824,907 | $ | 20,421,192 | $ | 13,380,136 | ||||||

4

RISK

FACTORS

An

investment in our common stock is speculative and involves a high degree of

risk. You should carefully consider the following important risks and

uncertainties before buying shares of our common stock in this offering. If any

of the damages threatened by any of the following risk factors actually occur,

our business, results of operations, financial condition and cash flows could be

materially adversely affected, the trading price of our common stock could

decline significantly, and you might lose all or part of your

investment.

Risks

Related to Our Business

Unstable

market conditions may have serious adverse consequences on our

business.

The

recent worldwide economic downturn and market instability have made the business

climate more volatile and more costly. Although all of our business

operations are currently conducted in the PRC, our general business strategy may

be adversely affected by unpredictable and unstable market

conditions. If the current equity and credit markets deteriorate

further, or do not improve, it may make any necessary debt or equity financing

more difficult, more costly, and more dilutive. While we believe we have

adequate capital resources to meet current working capital and capital

expenditure requirements for the next twelve months, a radical economic downturn

or increase in our expenses could require additional financing on less than

attractive rates or on terms that are excessively dilutive to existing

stockholders. Failure to secure any necessary financing in a timely

manner and on favorable terms could have a material adverse effect on our growth

strategy, financial performance and stock price and could require us to delay or

abandon our expansion plans. These factors may have a material

adverse effect on our results of operations, financial condition or cash flows

and could cause the price of our common stock to decline

significantly.

Our

products may not achieve or maintain market acceptance.

We market

our products in the PRC. Dairy product consumption in the PRC has historically

been lower than in many other countries in the world. Growing

interest in milk products in the PRC is a relatively recent phenomenon which

makes the market for our products less predictable. Consumers may

lose interest in the products. As a result, achieving and maintaining

market acceptance for our products will require substantial marketing efforts

and the expenditure of significant funds to encourage dairy consumption in

general, and the purchase of our products in particular. There is

substantial risk that the market may not accept or be receptive to our

products. Market acceptance of our current and proposed products will

depend, in large part, upon our ability to inform potential customers that the

distinctive characteristics of our products make them superior to competitive

products and justify their pricing. Our current and proposed products

may not be accepted by consumers or able to compete effectively against other

premium or non-premium dairy products. Lack of market acceptance

would limit our revenues and profitability.

In

addition, we market our product, in part, as a healthy and good source of

nutrition, however, periodically, medical and other studies are released and

announcements by medical and other groups are made which raise concerns over the

healthfulness of cow’s milk in the human diet. An unfavorable study

or medical finding could erode the popularity of milk in the Chinese diet and

negatively affect the marketing of our product causing sales, and cause our

revenues, to decline.

5

Contamination

of milk powder products produced in the PRC could result in negative publicity

and have a material adverse effect on our business.

In

mid-2008, a number of milk powder products produced within the PRC were found to

contain unsafe levels of tripolycyanamide, also known as melamine, sickening

thousands of infants. This prompted the Chinese government to

conduct a nationwide investigation

into how the milk powder was contaminated, and caused a worldwide recall of

certain milk powder products produced within the PRC. On

September 16, 2008, the PRC’s Administration of Quality Supervision, Inspection

and Quarantine (AQSIQ) revealed that it had tested samples from 175 dairy

manufacturers, and published a list of 22 companies whose products contained

melamine. We passed the emergency inspection and were not included on

AQSIQ’s list. Although we believe that the inevitable contraction in

the Chinese milk powder industry caused by this crisis will lead to increased

demand for our products, we can not be certain that the illnesses caused by

contamination in the milk powder industry, whether or not related to our

products, won’t lead to a sustained decrease in demand for milk powder products

produced within the PRC, thereby having a material adverse effect on our

business.

As

we increase the scale of our operations, we may be unable to maintain the level

of quality we currently attain by producing our products in small

batches. If quality of our product declines, sales may

decline.

Our

products are manufactured in small batches. If we are able to

increase our sales, we will be required to increase our

production. Increased production levels may force us to modify our

current manufacturing methods in order to meet demand. We may be unable to

maintain the quality of our dairy products at increased levels of

production. If quality declines, consumers may not wish to purchase

our products and a decline in the quality of our products could damage our

reputation, business, operations and finances.

We

depend on supplies of raw milk and other raw materials, a shortage of which

could result in reduced production and sales revenues and/or increased

production costs.

Raw milk

is the primary raw material we use to produce our products. As we pursue our

growth strategy, we expect raw milk demands to continue to grow. Because we own

only a small number of dairy cows, we depend on dairy farms and dairy farmers

for our supply of fresh milk. We expect that we will need to continue to

increase the number of dairy farmers from which we source raw milk. If we are

not able to renew our contracts with suppliers or find new suppliers to provide

raw milk we will not be able to meet our production goals and our sales revenues

will fall. If we are forced to expand our sources for raw milk, it

may be more and more difficult for us to maintain our quality control over the

handling of the product in our supply and manufacturing chain. A

decrease in the quality of our raw materials would cause a decrease in the

quality of our product and could damage our reputation and cause sales to

decrease.

Raw milk

production is, in turn, influenced by a number of factors that are beyond our

control including, but not limited to, the following:

|

|

·

|

seasonal factors: dairy

cows generally produce more milk in temperate weather than in cold or hot

weather and extended unseasonably cold or hot weather could lead to lower

than expected production;

|

|

|

·

|

environmental factors:

the volume and quality of milk produced by dairy cows is closely linked to

the quality of the nourishment provided by the environment around them,

and, therefore, if environmental factors cause the quality of nourishment

to decline, milk production could decline and we may have difficulty

finding sufficient raw milk; and

|

6

|

|

·

|

governmental agricultural and

environmental policy: declines in government grants, subsidies,

provision of land, technical assistance and other changes in agricultural

and environmental policies may have a negative effect on the viability of

individual dairy farms, and the numbers of dairy cows and quantities of

milk they are able to produce.

|

We also

source large volumes of soy beans, rice, and other raw materials from suppliers.

Interruption of or a shortage in the supply of raw milk or any of our other raw

materials could result in our being unable to operate our production facilities

at full capacity or, if the shortage is severe, at any production level at all,

thereby leading to reduced production output and sales and reduced

revenues.

Even if

we are able to source sufficient quantities of raw milk or our other raw

materials to meet our needs, downturns in the supply of such raw materials

caused by one or more of these factors could lead to increased raw material

costs which we may not be able to pass on to the consumers of our products,

causing our profit margins to decrease.

Volatility

of raw milk costs make our operating results difficult to predict, and a steep

cost increase could cause our profits to diminish significantly.

The

policy of the PRC since the mid-1990s has focused on moving the industry in a

more market-oriented direction. These reforms have resulted in the potential for

greater price volatility relative to past periods, as prices are more responsive

to the fundamental supply and demand aspects of the market. These changes in the

PRC’s dairy policy could increase the risk of price volatility in the dairy

industry, making our net income difficult to predict. Also, if prices are

allowed to escalate sharply, our costs will rise and we may not be able to pass

them on to consumers of our products, which will lead to a decrease in our

profits.

The

milk business is highly competitive and, therefore, we face substantial

competition in connection with the marketing and sale of our

products.

We face

competition from non-premium milk producers distributing milk in our marketing

area and other milk producers packaging their milk in glass bottles, and other

special packaging, which serve portions of our marketing area. Most of our

competitors are well established, have greater financial, marketing, personnel

and other resources, have been in business for longer periods of time than we

have, and have products that have gained wide customer acceptance in the

marketplace. Our largest competitors are state-owned dairies owned by the

government of the PRC. Large foreign milk companies have also entered the milk

industry in the PRC. The greater financial resources of such competitors will

permit them to procure retail store shelf space and to implement extensive

marketing and promotional programs, both generally and in direct response to our

advertising claims. The milk industry is also characterized by the frequent

introduction of new products, accompanied by substantial promotional campaigns.

We may be unable to compete successfully or our competitors may develop products

which have superior qualities or gain wider market acceptance than

ours.

7

We

face the potential risk of product liability associated with food products; Lack

of general liability insurance exposes us to liability risks in the event of

litigation against us.

We sell

products for human consumption, which involves risks such as product

contamination or spoilage, product tampering and other adulteration of our

products. We may be subject to liability if the consumption of any of our

products causes injury, illness or death. In addition, we may recall products in

the event of contamination or damage. A significant product liability judgment

or a widespread product recall may negatively impact our profitability for a

period of time depending on product availability, competitive reaction and

consumer attitudes. Even if a product liability claim is unsuccessful or is not

fully pursued, the negative publicity surrounding any assertion that our

products caused illness or injury could adversely affect our reputation with

existing and potential customers and our corporate and brand image. We would

also have to incur defense costs, including attorneys’ fees, even if a claim is

unsuccessful. We do not have liability insurance with respect to product

liability claims. Any product liabilities claims could have a material adverse

effect on its business, operating results and financial condition.

The

loss of any of our key executives could cause an interruption of our business

and an increase in our expenses if we are forced to recruit a replacement; We

have no key-man life insurance covering these executives.

We are

highly dependent on the services of Yang Yong Shan, our Chairman, Chief

Executive Officer and President. He has been primarily responsible

for the development and marketing of our products and the loss of his services

would have a material adverse impact on our operations. We have not applied for

key-man life insurance on his life and have no current plans to do

so.

We

do not have any independent directors serving on our board of directors, which

could present the potential for conflicts of interest and prevent our common

stock from being listed on a national securities exchange.

We

currently do not have any independent directors serving on our board of

directors and we cannot guarantee that our board of directors will have any

independent directors in the future. In the absence of a majority of independent

directors, our executive officers could establish policies and enter into

transactions without independent review and approval thereof. This could present

the potential for a conflict of interest between us and our stockholders,

generally, and the controlling officers, stockholders or directors.

In

addition, since none of the directors currently on our board of would qualify as

an independent director under the rules of the New York Stock Exchange, NYSE

Amex Equities or The Nasdaq Stock Market, we would fail to satisfy at least one

of the necessary initial listing requirements for any of these national

securities exchanges. Therefore, until we appoint a majority of

independent directors to our board we expect that our common stock will continue

to be listed on Over-the-Counter Bulletin Board (“OTCBB”) maintained by the

Financial Industry Regulatory Authority (“FINRA”), which might make our common

stock less attractive to potential investors.

Our

management has identified a material weakness in our internal control over

financial reporting, which if not properly remediated could result in material

misstatements in our future interim and annual financial statements and have a

material adverse effect on our business, financial condition and results of

operations and the price of our common stock.

Our

management is responsible for establishing and maintaining adequate internal

control over financial reporting. Internal control over financial

reporting is a process designed to provide reasonable assurance regarding the

reliability of financial reporting and the preparation of financial statements

in accordance with U.S. generally accepted accounting principles.

8

As

further described in “Management’s Discussion and Analysis of Financial

Condition and Results of Operations – Material Weakness in Internal Control Over

Financial Reporting,” our management has identified a material weakness in our

internal control over financial reporting. A material weakness, as

defined in the standards established by the Public Company Accounting Oversight

Board (“PCAOB”), is a deficiency, or a combination of deficiencies, in internal

control over financial reporting, such that there is a reasonable possibility

that a material misstatement of our annual or interim financial statements will

not be prevented or detected on a timely basis.

Although

we are in the process of implementing initiatives aimed at addressing this

material weakness, these initiatives may not remediate the identified material

weakness. Failure to achieve and maintain an effective internal

control environment could result in us not being able to accurately report our

financial results, prevent or detect fraud or provide timely and reliable

financial information pursuant to the reporting obligations we will have as a

public company, which could have a material adverse effect on our business,

financial condition and results of operations. Further, it could cause our

investors to lose confidence in the financial information we report, which could

adversely affect the price of our common stock.

Ensuring

that we have adequate internal financial and accounting controls and procedures

in place might entail substantial costs, may take a significant period of time,

and may distract our officers and employees from the operation of our business,

which could adversely affect our operating results and our ability to operate

our business.

Ensuring

that we have adequate internal financial and accounting controls and procedures

in place to help ensure that we can produce accurate financial statements on a

timely basis is a costly and time-consuming effort that needs to be re-evaluated

frequently. We became a public company on October 2007, by virtue of the Reverse

Merger described in “Management’s Discussion and Analysis of Financial Condition

and Results of Operations – Recent Developments – Reverse Merger, Private

Placements and Related Transactions.” As a public company, we need to

document, review, test and, if appropriate, improve our internal controls and

procedures in connection with Section 404 of the Sarbanes-Oxley Act, which

requires annual management assessments of the effectiveness of our internal

control over financial reporting and a report by our independent auditors. Both

the Company and its independent auditors will be testing our internal controls

in connection with the Section 404 requirements and, as part of that

documentation and testing, will identify areas for further attention and

improvement.

Implementing

any appropriate changes to our internal controls might entail substantial costs

in order to add personnel and modify our existing accounting systems, take a

significant period of time to complete, and distract our officers and employees

from the operation of our business. These changes might not, however,

be effective in maintaining the adequacy of our internal controls, and could

adversely affect our operating results and our ability to operate our

business.

Risks

Related to Doing Business in the PRC

Changes

in the PRC’s political or economic situation could harm us and our operational

results.

Economic

reforms which have been adopted by the Chinese government could change at any

time. Because many reforms are unprecedented or experimental, they

are expected to be refined and adjusted. Other political, economic and social

factors, such as political changes, changes in the rates of economic growth,

unemployment or inflation, or in the disparities in per capita wealth between

regions within the PRC, could lead to further readjustment of the reform

measures. This refining and readjustment process may negatively affect our

operations This could damage our operations and profitability. Some

of the things that could have this effect are:

|

|

·

|

level

of government involvement in the

economy;

|

9

|

|

·

|

control

of foreign exchange;

|

|

|

·

|

methods

of allocating resources;

|

|

|

·

|

balance

of payments position;

|

|

|

·

|

international

trade restrictions; or

|

|

|

·

|

international

conflict.

|

The

Chinese economy differs from the economies of most countries belonging to the

Organization for Economic Cooperation and Development, or OECD, in many ways. As

a result of these differences, we may not develop in the same way or at the same

rate as might be expected if the Chinese economy were similar to those of the

OECD member countries. It is possible that the Chinese government may

abandon its reforms all together and return to a more nationalized economy.

Negative impact upon economic reform policies or nationalization could result in

a total investment loss in our common stock.

Changes

in the interpretations of existing laws and the enactment of new laws may

negatively impact our business and results of operation.

There are

substantial uncertainties regarding the application of Chinese laws, especially

with respect to existing and future foreign investments in the PRC. The Chinese

legal system is a civil law system based on written statutes. Unlike common law

systems, it is a system in which precedents set in earlier legal cases are not

generally used. Laws and regulations effecting foreign invested enterprises in

the PRC have only recently been enacted and are evolving rapidly, and their

interpretation and enforcement involve uncertainties. Changes in existing laws

or new interpretations of such laws may have a significant impact on our methods

and costs of doing business. For example, new legislative proposals for product

pricing, approval criteria and manufacturing requirements may be proposed and

adopted. Such new legislation or regulatory requirements may have a material

adverse effect on our financial condition, results of operations or cash flows.

In addition, we will be subject to varying degrees of regulation and licensing

by governmental agencies in the PRC. Future regulatory, judicial and legislative

changes could have a material adverse effect on our Chinese operating

subsidiaries. Regulators or third parties may raise material issues

with regard to our Chinese subsidiaries or our compliance or non-compliance with

applicable laws or regulations or changes in applicable laws or regulations may

have a material adverse effect on our operations. Because of the evolving nature

in the law, it will be difficult for us to manage and plan for changes that may

arise.

It

will be difficult for any shareholder of ours to commence a legal action against

our executives. Enforcing judgments won against them or the Company

will be difficult.

Most of

our officers and directors reside outside of the United States. As a result, it

will be difficult, if not impossible, to acquire jurisdiction over those persons

in a lawsuit against any of them, including with respect to matters arising

under U.S. federal securities laws or applicable state securities

laws. Because the majority of our assets are located in the PRC, it

would also be extremely difficult to access those assets to satisfy an award

entered against us in United States court. Moreover, we have been advised that

the PRC does not have treaties with the United States providing for the

reciprocal recognition and enforcement of judgments of courts.

10

Recent

PRC regulations relating to mergers and acquisitions of domestic enterprises by

foreign investors may increase the administrative burden we face and create

regulatory uncertainties.

On August

8, 2006, six PRC regulatory agencies, namely, the PRC Ministry of Commerce

(“MOFCOM”), the State Assets Supervision and Administration Commission

(“SASAC”), the State Administration for Taxation, the State Administration for

Industry and Commerce, the China Securities Regulatory Commission (“CSRC”), and

the State Administration of Foreign Exchange (“SAFE”), jointly adopted the

Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign

Investors (the “New M&A Rule”), which became effective on September 8, 2006.

The New M&A Rule purports, among other things, to require offshore special

purpose vehicles (“SPVs”), formed for overseas listing purposes through

acquisitions of PRC domestic companies and controlled by PRC companies or

individuals, to obtain the approval of the CSRC prior to publicly listing their

securities on an overseas stock exchange.

On

September 21, 2006, pursuant to the New M&A Rule and other laws and

regulations of the PRC (“PRC Laws”), the CSRC, on its official website,

promulgated relevant guidance with respect to the issues of listing and trading

of domestic enterprises’ securities on overseas stock exchanges (the

“Administrative Permits”), including a list of application materials with

respect to the listing on overseas stock exchanges by SPVs.

On

October 9, 2007, AIDH, parent company of the Chinese corporations through which

we do all of our business, became a subsidiary through a Reverse Merger, as

further described in “Management’s Discussion and Analysis of Financial

Condition and Results of Operations — Recent Developments — Reverse Merger,

Private Placements and Related Transactions.”

Based on

our understanding of current PRC Laws, we believe that the New M&A Rule does

not require us or our Chinese shareholders or our entities in China to obtain

the CSRC approval in connection with the Reverse Merger because AIDH completed

the approval procedures of the acquisition of a majority equity interest in its

PRC subsidiary before September 8, 2006 when the New M&A Rule became

effective.

There

are, however, substantial uncertainties regarding the interpretation and

application of current or future PRC Laws, including the New M&A Rule. PRC

government authorities may take a view contrary to our understanding that we do

not need the CSRC approval, and Chinese government authorities may impose

additional approvals and requirements.

Further,

if the PRC government finds that we or our Chinese shareholders did not obtain

the CSRC approval, which should have been obtained before consummating the

Reverse Merger, we could be subject to severe penalties. The New M&A Rule

does not specify penalty terms, so we are not able to predict what penalties we

may face, but they could be materially adverse to our business and

operations.

Future

inflation in the PRC may inhibit our ability to conduct business in the

PRC.

In recent

years, the Chinese economy has experienced periods of rapid expansion and high

rates of inflation. During the past ten years, the rate of inflation in the PRC

has been as high as 20.7% and as low as 2.2%. These factors have led to the

adoption by the Chinese government, from time to time, of various corrective

measures designed to restrict the availability of credit or regulate growth and

contain inflation. High inflation may in the future cause the Chinese government

to impose controls on credit and/or prices, or to take other action, which could

inhibit economic activity in the PRC, which could harm the market for our

products and adversely effect our operations and business.

11

We

may have difficulty establishing adequate management, legal and financial

controls in the PRC.

The PRC

historically has been deficient in western-style management and financial

reporting concepts and practices, as well as in modern banking, computer and

other control systems. We may have difficulty in hiring and retaining a

sufficient number of qualified employees to work in the PRC. As a result of

these factors, we may experience difficulty in establishing management, legal

and financial controls, collecting financial data and preparing financial

statements, books of account and corporate records and instituting business

practices that meet western standards. If we are not able to maintain

adequate controls our financial statements may not properly represent our

financial condition, results of operation or cash flows. Weakness in

our controls could also delay disclosure of information to the public which is

material to an investment decision with respect to our stock.

Fluctuations

in the exchange rate between the Chinese currency and the United States dollar

could adversely affect our operating results.

The

functional currency of our operations in China is “Renminbi,” or “RMB.” However,

results of our operations are translated at average exchange rates into United

States dollars for purposes of reporting results. As a result, fluctuations in

exchange rates may adversely affect our expenses and results of operations as

well as the value of our assets and liabilities. Fluctuations may adversely

affect the comparability of period-to-period results. We currently do

not use hedging techniques, and even if in the future we do, we may not be able

to eliminate the effects of currency fluctuations. Thus, exchange rate

fluctuations could cause our profits to decline, which, in turn, may cause our

stock prices, to decline.

Changes

in foreign exchange regulations in the PRC may affect our ability to pay

dividends in foreign currency or conduct other foreign exchange

business.

The

Renminbi is currently not a freely convertible currency, and the restrictions on

currency exchange may limit our ability to use revenues generated in RMB to fund

our business activities outside the PRC, or to make dividends or other payments

in United States dollars. The PRC government strictly regulates conversion of

RMB into foreign currencies. Over the years, foreign exchange regulations in the

PRC have significantly reduced the government’s control over routine foreign

exchange transactions under current accounts. In the PRC, SAFE regulates the

conversion of the RMB into foreign currencies. Pursuant to applicable PRC laws

and regulations, foreign invested enterprises incorporated in the PRC are

required to apply for “Foreign Exchange Registration Certificates.” Currently,

conversion within the scope of the “current account” (e.g. remittance of foreign

currencies for payment of dividends, etc.) can be effected without requiring the

approval of SAFE. However, conversion of currency in the “capital account”

(e.g. for capital items

such as direct investments, loans, securities, etc.) still requires the approval

of SAFE.

In

addition, on October 21, 2005, SAFE issued the Notice on Issues Relating to the

Administration of Foreign Exchange in Fundraising and Reverse Investment

Activities of Domestic Residents Conducted via Offshore Special Purpose

Companies (“Notice 75”), which became effective as of November 1, 2005. Notice

75 replaced the two rules issued by SAFE in January and April 2005.

According

to Notice 75:

|

|

·

|

prior

to establishing or assuming control of an offshore company for the purpose

of obtaining overseas equity financing with assets or equity interests in

an onshore enterprise in the PRC, each PRC resident, whether a natural or

legal person, must complete the overseas investment foreign exchange

registration procedures with the relevant local SAFE

branch;

|

12

|

|

·

|

an

amendment to the registration with the local SAFE branch is required to be

filed by any PRC resident that directly or indirectly holds interests in

that offshore company upon either (1) the injection of equity interests or

assets of an onshore enterprise to the offshore company, or (2) the

completion of any overseas fund raising by such offshore company;

and

|

|

|

·

|

an

amendment to the registration with the local SAFE branch is also required

to be filed by such PRC resident when there is any material change in the

capital of the offshore company that does not involve any return

investment, such as (1) an increase or decrease in its capital, (2) a

transfer or swap of shares, (3) a merger or division, (4) a long term

equity or debt investment, or (5) the creation of any security

interests.

|

Moreover,

Notice 75 applies retroactively. As a result, PRC residents who have established

or acquired control of offshore companies that have made onshore investments in

the PRC in the past are required to complete the relevant overseas investment

foreign exchange registration procedures by March 31, 2006. Under the relevant

rules, failure to comply with the registration procedures set forth in Notice 75

may result in restrictions being imposed on the foreign exchange activities of

the relevant onshore company, including the payment of dividends and other

distributions to its offshore parent or affiliate and the capital inflow from

the offshore entity, and may also subject relevant PRC residents to penalties

under PRC foreign exchange administration regulations.

In

addition, SAFE issued updated internal implementing rules (“Implementing Rules”)

in relation to Notice 75. The Implementing Rules were promulgated and became

effective on May 29, 2007. Such Implementing Rules provide more detailed

provisions and requirements regarding the overseas investment foreign exchange

registration procedures. However, even after the promulgation of Implementing

Rules there still exist uncertainties regarding the SAFE registration for PRC

residents’ interests in overseas companies. It remains uncertain whether PRC

residents shall go through the overseas investment foreign exchange registration

procedures under Notice 75 or Implementing Rules.

Penalties

for non-compliance which may be issued by SAFE can impact the PRC resident

investors as well as the onshore subsidiary. However, certain matters related to

implementation of Circular No. 75 remain unclear or untested. As a result, we

may be impacted by potential penalties which may be issued by SAFE. For

instance, remedial action for violation of the SAFE requirements may be to

restrict the ability of our Chinese subsidiaries to repatriate and distribute

its profits to us in the United States. The results of non-compliance are

uncertain, and penalties and other remedial measures may have a material adverse

impact upon our financial condition and results of operations.

Extensive

regulation of the food processing and distribution industry in the PRC could

increase our expenses resulting in reduced profits.

We are

subject to extensive regulation by the PRC's Agricultural Ministry, and by other

county and local authorities in jurisdictions in which our products are

processed or sold, regarding the processing, packaging, storage, distribution

and labeling of our products. Applicable laws and regulations governing our

products may include nutritional labeling and serving size requirements. Our

processing facilities and products are subject to periodic inspection by

national, county and local authorities. To the extent that new regulations are

adopted, we will be required to conform our activities in order to comply with

such regulations. Our failure to comply with applicable laws and regulations

could subject us to civil remedies, including fines, injunctions, recalls or

seizures, as well as potential criminal sanctions, which could have a material

adverse effect on our business, operations and finances.

13

Limited

and uncertain trademark protection in the PRC makes the ownership and use of our

trademarks uncertain.

We have

obtained trademark registrations for the use of our tradenames “Xing An Ling”

and “Yi Bai”, which have been registered with the PRC’s Trademark Bureau of the

State Administration for Industry and Commerce with respect to our milk

products. We believe our trademarks are important to the establishment of

consumer recognition of our products. However, due to uncertainties in Chinese

trademark law, the protection afforded by our trademarks may be less than we

currently expect and may, in fact, be insufficient. Moreover even if it is

sufficient, in the event it is challenged or infringed, we may not have the

financial resources to defend it against any challenge or infringement and such

defense could in any event be unsuccessful. Moreover, any events or conditions

that negatively impact our trademarks could have a material adverse effect on

our business, operations and finances.

Risks

Relating to the Market for Our Common Stock

Because

we became public by means of a reverse merger, we may not be able to attract the

attention of major brokerage firms.

There may

be risks associated with our becoming public through a the Reverse Merger, as

described in “Management’s Discussion and Analysis of Financial Condition and

Results of Operations — Recent Developments — Reverse Merger, Private Placements

and Related Transactions.” Because of our Reverse Merger, we could be exposed to

undisclosed liabilities resulting from our operations prior to the merger and we

could incur losses, damages or other costs as a result. In addition,

securities analysts of major brokerage firms may not provide coverage of us

since there is no incentive to brokerage firms to recommend the purchase of our

common stock. Further, brokerage firms may not want to conduct any secondary

offerings on our behalf in the future. These factors may negatively

effect the market price and liquidity of our common stock.

There

is currently a limited trading market for our common stock and a more liquid

trading market may never develop or be sustained and stockholders may not be

able to liquidate their investment at all, or may only be able to liquidate the

investment at a price less than the Company’s value.

There is

currently a limited trading market for our common stock and a more liquid

trading market may never develop. As a result, the price if traded

may not reflect the value of the Company. Consequently, investors may not be

able to liquidate their investment at all, or if they are able to liquidate it

may only be at a price that does not reflect the value of our

business. Because the price for our stock is low, many brokerage

firms may not be willing to effect transactions in the securities. Even if an

investor finds a broker willing to effect a transaction in our stock, the

combination of brokerage commissions, transfer fees, taxes, if any, and any

other selling costs may exceed the selling price. Further, many lending

institutions will not permit the use of common stock like ours as collateral for

any loans. Even if a more active market should develop, the price may

be highly volatile.

Our

common stock is currently approved for quotation on the OTCBB. We do

not satisfy the initial listing standards of the New York Stock Exchange, NYSE

Amex Equities or The Nasdaq Stock Market. If we never are able to

satisfy any of those listing standards our common stock will never be listed on

an exchange. As a result, the trading price of our stock may be lower

than if we were listed on an exchange. Our stock may be subject to increased

volatility. When a stock is thinly traded, a trade of a large block

of shares can lead to a dramatic fluctuation in the share

price. These factor may make it more difficult for our shareholders

to sell their shares.

14

Our

stock price may be volatile in response to market and other

factors.

The

market price for our stock may be volatile and subject to price and volume

fluctuations in response to market and other factors, including the following,

some of which are beyond our control:

|

|

·

|

the

increased concentration of the ownership of our shares by a limited number

of affiliated stockholders following the Reverse Merger may limit interest

in our securities;

|

|

|

·

|

variations

in quarterly operating results from the expectations of securities

analysts or investors;

|

|

|

·

|

revisions

in securities analysts’ estimates or reductions in security analysts’

coverage;

|

|

|

·

|

announcements

of technological innovations or new products or services by us or our

competitors;

|

|

|

·

|

reductions

in the market share of our

products;

|

|

|

·

|

announcements

by us or our competitors of significant acquisitions, strategic

partnerships, joint ventures or capital

commitments;

|

|

|

·

|

general

technological, market or economic

trends;

|

|

|

·

|

volatility

in our results of operations;

|

|

|

·

|

investor

perception of our industry or

prospects;

|

|

|

·

|

insider

selling or buying;

|

|

|

·

|

investors

entering into short sale contracts;

|

|

|

·

|

regulatory

developments affecting our industry;

and

|

|

|

·

|

additions

or departures of key personnel.

|

These

factors may negatively effect the market price and liquidity of our common

stock.

“Penny

Stock” rules may make buying or selling our common stock difficult.

Trading

in our common stock is subject to the “penny stock” rules. The Securities and

Exchange Commission (“SEC”) has adopted regulations that generally define a

penny stock to be any equity security that has a market price of less than $5.00

per share, subject to certain exceptions. These rules require that any

broker-dealer that recommends our common stock to persons other than prior

customers and accredited investors, must, prior to the sale, make a special

written suitability determination for the purchaser and receive the purchaser’s

written agreement to execute the transaction. Unless an exception is available,

the regulations require the delivery, prior to any transaction involving a penny

stock, of a disclosure schedule explaining the penny stock market and the risks

associated with trading in the penny stock market. In addition, broker-dealers

must disclose commissions payable to both the broker-dealer and the registered

representative and current quotations for the securities they offer. The

additional burdens imposed upon broker-dealers by such requirements may

discourage broker-dealers from effecting transactions in our common stock, which

could severely limit the market price and liquidity of our common

stock.

15

We

have a concentration of stock ownership and control, which may have the effect

of delaying, preventing, or deterring certain corporate actions and may lead to

a sudden change in our stock price.

Our

common stock ownership is highly concentrated. As of the date hereof, one

shareholder, Yang Yong Shan, beneficially owns 14,063,329 shares, or

approximately 42.5% of our total outstanding common stock. He is also our

Chairman, Chief Executive Officer and President. His interests may

differ significantly from your interests. As a result of the

concentrated ownership of our stock, a relatively small number of stockholders,

acting together, will be able to control all matters requiring stockholder

approval, including the election of directors and approval of mergers and other

significant corporate transactions. In addition, because our stock is

so thinly traded, the sale by any of our large stockholders of a significant

portion of that stockholder’s holdings could cause a sharp decline in the market

price of our common stock.

We

have the right to issue up to 10,000,000 shares of "blank check" preferred

stock, which may adversely affect the voting power of the holders of other of

our securities and may deter hostile takeovers or delay changes in management

control.

Our

certificate of incorporation provides that we may issue up to 10,000,000 shares

of preferred stock from time to time in one or more series, and with such

rights, preferences and designations as our board of directors may determinate

from time to time. While none of our preferred stock has yet been issued, our

board of directors, without further approval of our common stockholders, is

authorized to fix the dividend rights and terms, conversion rights, voting

rights, redemption rights, liquidation preferences and other rights and

restrictions relating to any series of our preferred stock. Issuances of shares

of preferred stock could, among other things, adversely affect the voting power

of the holders of other of our securities and may, under certain circumstances,

have the effect of deterring hostile takeovers or delaying changes in management

control. Such an issuance would dilute existing stockholders, and the

securities issued could have rights, preferences and designations superior to

our common stock.

A

substantial number of shares of our common stock are issuable upon exercise of

outstanding warrants, the exercise of which will substantially reduce the

percentage ownership of holders of our currently outstanding shares of common

stock, and the sale of which may cause a decline in the price at which shares of

our common stock can be sold.

As of

the date of this prospectus, we have outstanding exercisable warrants to

purchase an aggregate of 7,460,813 shares of our common stock, of

which:

|

|

·

|

373,334

are exercisable at a price of $0.94 per

share;

|

|

|

·

|

1,333,333

are exercisable at a price of $1.50 per

share;

|

|

|

·

|

2,246,748

are exercisable at a price of $1.63 per

share;

|

|

|

·

|

906,190

are exercisable at a price of $2.04 per

share;

|

|

|

·

|

75,000

are exercisable at a price of $2.61 per share;

and

|

16

|

|

·

|

2,526,208

are exercisable at a price of $3.26 per

share.

|

5,620,169

of the shares underlying these exercisable warrants are being registered hereby

for possible resale by those selling stockholders who own the warrants. We also

have outstanding warrants to purchase 714,286 shares of our common stock at an

exercise price of $1.68 per share, which may become exercisable on March 2, 2010

if certain conditions are met. The issuance of all or substantially

all additional shares of common stock that are issuable upon exercise of our

outstanding warrants will substantially reduce the percentage equity ownership

of holders of shares of our common stock. In addition, the exercise

of a significant number of warrants, and subsequent sale of shares of common

stock received upon such exercise, could cause a sharp decline in the market

price of our common stock. The rights and obligations under the

warrants are further described in “Description of Securities –

Warrants.”

We

have not paid, and do not intend to pay, cash dividends in the foreseeable

future.

We

have not paid any cash dividends on our common stock and do not intend to pay

cash dividends in the foreseeable future. We intend to retain future earnings,

if any, for reinvestment in the development and expansion of our business.

Dividend payments in the future may also be limited by other loan agreements or

covenants contained in other securities which we may issue. Any future

determination to pay cash dividends will be at the discretion of our board of

directors and depend on our financial condition, results of operations, capital

and legal requirements and such other factors as our board of directors deems

relevant. In addition, the promissory notes we issued in the June

2008 Note Offering, as amended, and November 2008 Note Offering, further

described in “Management’s Discussion and Analysis of Financial Condition and

Results of Operations — Recent Developments — Sale of Notes and Warrants,”

contain restrictive covenants on our payment of dividends, as further described

in “—Description of Securities — Promissory Notes.”

FORWARD-LOOKING

STATEMENTS

Some of

the statements contained in this prospectus are not statements of historical or

current fact. As such, they are "forward-looking statements" based on our

current expectations, which are subject to known and unknown risks,

uncertainties and assumptions. They include statements relating to:

|

|

·

|

future

sales and financings;

|

|

|

·

|

the

future development of our business;

|

|

|

·

|

our

ability to execute our business

strategy;

|

|

|

·

|

projected

expenditures; and

|

|

|

·

|

the

market for our products.

|

You can

identify forward-looking statements by terminology such as "may," "will,"

"should," "could," "expects," "intends," "plans," "anticipates," "believes,"

"estimates," "predicts," "potential" or "continue" or the negative of these

terms or other comparable terminology. These statements are not predictions.

Actual events or results may differ materially from those suggested by these

forward-looking statements. In evaluating these statements and our prospects

generally, you should carefully consider the factors set forth below. All

forward-looking statements attributable to us or persons acting on our behalf

are expressly qualified in their entirety by these cautionary factors and to

others contained throughout this prospectus. We are under no duty to update any

of the forward-looking statements after the date of this prospectus or to

conform these statements to actual results.

17

Although

it is not possible to create a comprehensive list of all factors that may cause

actual results to differ from the results expressed or implied by our

forward-looking statements or that may affect our future results, some of these

factors are set forth under "Risk Factors" in this prospectus and in our

periodic filings made with the SEC.

USE

OF PROCEEDS

The

shares of common stock covered by this prospectus are, either issued and

outstanding, or issuable upon exercise of common stock purchase warrants owned

by the selling stockholders. Each of the selling stockholders will receive all

of the net proceeds from the sale of shares by that stockholder. We will not

receive any of the proceeds from the sale or other disposition of the shares

common stock covered by this prospectus. However, upon the exercise of warrants

by payments of cash, we will receive $12,872,575, in the aggregate, assuming all

of the warrants are exercised. To the extent that we receive cash upon the

exercise of the warrants, we expect to use that cash for the construction of a

new production facility and for general corporate purposes.

MARKET

INFORMATION

Market

Information

Our

common stock was approved for quotation on the OTCBB in the first quarter of

2007. Through October 9, 2007, our trading symbol was “MCTC.OB.” As

of October 9, 2007, we changed our name to Amnutria Dairy Inc. and were assigned

a new trading symbol of “AUDY.OB.” On January 25, 2008, we changed

our name to Emerald Dairy Inc. and received a new trading symbol of

“EMDY.OB”

On

October 20, 2008, shares of common stock purchased in two private offerings we

conducted in fiscal 2007 became eligible for sale pursuant to Rule 144 under the

Securities Act of 1933, as amended. Prior to that date, there had

been no established public trading market for shares of our common stock for

over five years. There is currently only a limited trading market for our common

stock and no assurance can be given that a more liquid trading market for our

common stock will develop or be maintained.

The

high and low sales prices for our common stock for the fourth quarter of fiscal

2008, first, second, third and fourth quarters of fiscal 2009, and the

subsequent interim period, were as follows:

|

Quarter Ended

|

High

|

Low

|

||||||

|

2008

|

||||||||

|

December

31, 2008

|

$ | 2.50 | $ | 0.70 | ||||

|

2009

|

||||||||

|

March

31, 2009

|

$ | 1.00 | $ | 0.26 | ||||

|

June

30, 2009

|

$ | 2.11 | $ | 0.60 | ||||

|

September

30, 2009

|

$ | 1.90 | $ | 1.30 | ||||

|

December

31, 2009

|

$ | 2.00 | $ | 1.50 | ||||

|

2010

|

||||||||

|

March

31, 2010 (through January

13, 2010)

|

$ | 1.80 | $ | 1.65 | ||||

18

Trading

in our common stock has been sporadic and the quotations set forth above are not

necessarily indicative of actual market conditions. All prices reflect

inter-dealer prices without retail mark-up, mark-down, or commission and may not

necessarily reflect actual transactions.

As of

the date hereof, we have outstanding exercisable warrants to purchase an

aggregate of 7,460,813 shares of our common stock, of which:

|

|

·

|

373,334

are exercisable at a price of $0.94 per

share;

|

|

|

·

|

1,333,333

are exercisable at a price of $1.50 per

share;

|

|

|

·

|

2,246,748

are exercisable at a price of $1.63 per

share;

|

|

|

·

|

906,190

are exercisable at a price of $2.04 per

share;

|

|

|

·

|

75,000

are exercisable at a price of $2.61 per share;

and

|

|

|

·