Attached files

| file | filename |

|---|---|

| EX-31.1 - EXH311 - Axius Inc. | exh31_1.htm |

| EX-32.1 - EXH321 - Axius Inc. | exh32_1.htm |

| EX-31.2 - EXH312 - Axius Inc. | exh31_2.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K

|

[X]

|

ANNUAL

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|||||

|

For

the fiscal year ended October 31,

2009

|

||||||

|

[ ]

|

TRANSITION

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT

|

|||||

|

For

the transition period from _________ to ________

|

||||||

|

Commission

file number: 333-147276

|

||||||

|

Axius, Inc.

|

|||

|

(Exact

name of registrant as specified in its charter)

|

|||

|

Nevada

|

N/A

|

||

|

(State

or other jurisdiction of incorporation or organization)

|

(I.R.S.

Employer Identification No.)

|

||

|

128

Seagull Ave. Baybreeze Exec Village

Taguig City, Philippines

|

________

|

||

|

(Address

of principal executive offices)

|

(Zip

Code)

|

||

|

Registrant’s

telephone number: 63 922

8480789

|

|||

|

Securities

registered under Section 12(b) of the Exchange Act:

|

|||

|

Title

of each class

|

Name

of each exchange on which registered

|

||

|

none

|

not applicable

|

||

|

Securities

registered under Section 12(g) of the Exchange Act:

|

|||

|

Title

of each class

|

Name

of each exchange on which registered

|

||

|

none

|

not applicable

|

||

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes [ ] No

[X]

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes

[X] No

[ ]

Check

whether the Issuer (1) filed all reports required to be filed by Section 13 or

15(d) of the Securities Exchange Act during the past 12 months (or for such

shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90

days. Yes [X] No

[ ]

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this

chapter) during the preceeding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes [ ] No

[ ]

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. Yes [X] No

[ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

Large

accelerated filer [ ] Accelerated filer [ ]

Non-accelerated filer [ ] Smaller reporting company [X]

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes [X] No

[ ]

State the

aggregate market value of the voting and non-voting common equity held by

non-affiliates computed by reference to the price at which the common equity was

last sold, or the average bid and asked price of such common equity, as of the

last business day of the registrant’s most recently completed second fiscal

quarter. Not

available

Indicate

the number of shares outstanding of each of the registrant’s classes of common

stock, as of the latest practicable date. 2,150,000 as of December 10,

2009.

|

Page

|

||

|

PART I

|

||

|

PART II

|

||

|

Item

6.

|

Selected

Financial Data

|

|

|

PART III

|

||

PART I

Item 1. Business

We were

incorporated on September 18, 2007, in the State of Nevada for the purpose of

developing, manufacturing, and selling wind and solar powered boilers

specifically for use as heating systems.

Business

of Company

We are

engaged in the business of developing, manufacturing, and selling wind and solar

powered boilers specifically for use as energy-efficient heating systems (our

"Product"). Our Product consists of three main components: a wind generator, a

solar generator, and an electric boiler. The wind generator can be used

autonomously to power our electric boiler or in parallel with the solar

generator to power the electric boiler. We are currently early in the process of

designing and developing our wind and solar powered boiler at our operations

office in the Philippines. Our Product is not yet ready for commercial sale.

When we are satisfied that our Product will compete effectively in the Asian

Boiler Industry by being the most efficient in terms of heating capability and

energy usage, we will begin the manufacture and distribution of the Product to

home improvement merchants throughout Asia.

Boilers

A boiler

is a closed vessel in which water or other fluid is heated under pressure. The

heated or vaporized fluid exits the boiler for use in various processes or

heating applications. Construction of boilers is mainly limited to carbon steel,

stainless steel, and cast iron. The source of heat for a boiler is usually

combustion of any of several fuels, such as wood, coal, oil, or natural gas.

Electric boilers use resistance or immersion type heating elements to heat the

water to a useful temperature.

The goal

of a boiler is to make the heat flow as completely as possible from the heat

source to the water. Most boilers heat water until it boils, and then the steam

is used at saturation temperature (i.e., saturated steam). Superheated steam

boilers boil the water and then further heat the steam in a superheater. Some

superheaters are radiant type (absorb heat by radiation), others are convection

type (absorb heat via a fluid i.e. gas) and some are a combination of the two.

So whether by convection or radiation the extreme heat in the boiler

furnace/flue gas path will also heat the superheater steam piping and the steam

within as well. It is important to note that while the temperature of the steam

in the superheater is raised, the pressure of the steam is not. The process of

superheating steam is most importantly designed to remove all moisture content

from the steam to prevent damage to the turbine blading and/or associated

piping.

Hydronic

boilers are typically used in generating heat for residential uses. They are the

typical power plant for central heating systems fitted to houses in northern

Europe (where they are commonly combined with domestic water heating), as

opposed to the forced-air furnaces or wood burning stoves more common in North

America. The hydronic boiler operates by way of heating water/fluid to a preset

temperature (or sometimes in the case of single pipe systems, until it boils and

turns to steam) and circulating that fluid or steam throughout the home by way

of radiators, baseboard heaters or through the floors. The fluid can be heated

by any means, but in built-up areas where piped gas is available, natural gas is

currently the most economical and therefore the common choice. The fluid is in

an enclosed system and circulated throughout by means of a motorized pump. Most

modern systems are fitted with condensing boilers for greater

efficiency.

Most

boilers now depend on mechanical draft equipment rather than natural draft. This

is because natural draft is subject to outside air conditions and temperature of

flue gases leaving the furnace, as well as the chimney height. All these factors

make proper draft hard to attain and therefore make mechanical draft equipment

much more economical.

There are

three types of mechanical draft:

Induced

draft: This is obtained one of three ways, the first being the "stack

effect" of a heated chimney, in which the flue gas is less dense than the

ambient air surrounding the boiler. The more dense column of ambient air forces

combustion air into and through the boiler. The second method is through use of

a steam jet. The steam jet oriented in the direction of flue gas flow induces

flue gasses into the stack and allows for a greater flue gas velocity increasing

the overall draft in the furnace. This method was common on steam driven

locomotives which could not have tall chimneys. The third method is by simply

using an induced draft fan (ID fan) which sucks flue gases out of the furnace

and up the stack. Almost all induced draft furnaces have a negative

pressure.

Forced

draft: Draft is obtained by forcing air into the furnace by means of a

fan (FD fan) and ductwork. Air is often passed through an air heater; which, as

the name suggests, heats the air going into the furnace in order to increase the

overall efficiency of the boiler. Dampers are used to control the quantity of

air admitted to the furnace. Forced draft furnaces usually have a positive

pressure.

Balanced

draft: Balanced draft is obtained through use of both induced and forced

draft. This is more common with larger boilers where the flue gases have to

travel a long distance through many boiler passes. The induced draft fan works

in conjunction with the forced draft fan allowing the furnace pressure to be

maintained slightly below atmospheric.

Wind

Power

Wind

power is most often captured by converting the rotation of turbine blades into

electrical current by means of an electrical generator. Wind energy is

plentiful, renewable, widely distributed, clean, and reduces toxic atmospheric

and greenhouse gas emissions if used to replace fossil-fuel-derived electricity.

The intermittency of wind seldom creates problems when using wind power at low

to moderate penetration levels. There is an estimated 50 to 100 times more wind

energy than plant biomass energy available on Earth. Most of this wind energy

can be found at high altitudes where continuous wind speeds of over 160 km/h

(100 mph) occur.

The power

in the wind can be extracted by allowing it to blow past moving wings that exert

torque on a rotor. The amount of power transferred is directly proportional to

the density of the air, the area swept out by the rotor, and the cube of the

wind speed. The mass flow of air that travels through the swept area of a wind

turbine varies with the wind speed and air density. Because so much power is

generated by higher wind speed, much of the average power available to a

windmill comes in short bursts. As a general rule, wind generators are practical

where the average wind speed is 10 mph (16 km/h or 4.5 m/s) or greater. An ideal

location would have a near constant flow of non-turbulent wind throughout the

year and would not suffer too many sudden powerful bursts of wind. An important

turbine siting factor is access to local demand or transmission capacity. The

wind blows faster at higher altitudes because of the reduced influence of drag

of the surface (sea or land) and the reduced viscosity of the air. The increase

in velocity with altitude is most dramatic near the surface and is affected by

topography, surface roughness, and upwind obstacles such as trees or buildings.

As the wind turbine extracts energy from the air flow, the air is slowed down,

which causes it to spread out and divert around the wind turbine to some extent.

Betz' law states that a wind turbine can extract at most 59% of the energy that

would otherwise flow through the turbine's cross section. The Betz limit applies

regardless of the design of the turbine. Intermittency and the non-dispatchable

nature of wind energy production can raise costs for regulation, incremental

operating reserve, and (at high penetration levels) could require demand-side

management or storage solutions.

Wind

Power Industry

Apart

from regulatory issues and externalities, decisions to invest in wind energy

also depend on the cost of alternative sources of energy. Natural gas, oil and

coal prices, the main production technologies with significant fuel costs, are

often determinants in the choice of the level of wind energy. Electricity

generated from wind power can be highly variable at several different

timescales: from hour to hour, daily, and seasonally. Annual variation also

exists, but is not as significant.

China,

which gets two-thirds of its power from coal, is also trying to cut pollution,

adding almost 500 megawatts ("MW") of wind energy capacity in 2005 - a jump of

66 percent to 1,260 MW, according to the Global Wind Energy Council. China has a

wind power target of 5,000 MW of wind capacity by 2010 and a goal of 30,000 MW

by 2020. That is making the market in China more attractive than countries like

Australia, where investments in wind projects have slowed as government targets

for renewable energy use are reached. In China, the renewable power market still

favors local companies over foreign ones. Led by China and India, the Asia

Pacific wind market will contribute a nearly a quarter of world MW added by

2010, emerging as a key global wind power region.

The

Philippines have the highest wind energy potential among Southeast Asian

countries. Within the next decade, the Philippines therefore hope to become the

leading wind power producer in Southeast Asia. However, growth is very slow due

to the absence of established national policies to allow a massive uptake of

wind energy. However, the Philippine government has started working on improving

the promotion of renewable energy on the islands.

Solar

Power

Solar

power (also known as solar energy) is a source of power that uses energy from

the sun. The term solar energy is used more specifically to describe the

utilization of this energy through human endeavor. Solar energy also broadly

describes technologies that utilize sunlight. Modern solar technologies continue

to harness the sun to provide water heating, day lighting and even flight. The

term solar power specifically describes technologies that convert sunlight into

electricity or mechanical power. At present, photovoltaic panels (“PVs”)

typically convert about 15% of incident sunlight into electricity.

A solar

cell or photovoltaic cell is a device that converts light into electricity using

the photovoltaic effect. Until recently, their use has been limited because of

high manufacturing costs. They are now useful for various functions, including

limited "off grid" home power applications. Solar panels produce more power

during summer months because they receive more sunlight. Photovoltaic (“PV”)

technology involves the generation of electricity from light. The key to this

process is the use of a semiconductor material which can be adapted to release

electrons, the negatively charged particles that form the basis of electricity.

The most common semiconductor material used in photovoltaic cells is silicon, an

element most commonly found in sand. All PV cells have at least two layers of

such semiconductors, one positively charged and one negatively charged. When

light shines on the semiconductor, the electric field across the junction

between these two layers causes electricity to flow, and the greater the

intensity of the light, the greater the flow of electricity. A photovoltaic

system does not therefore need bright sunlight in order to operate, and can

generate electricity even on cloudy days.

The most

important parts of a PV system are the cells which form the basic building

blocks, the modules which bring together large numbers of cells into a unit,

and, in some situations, the inverters used to convert the electricity generated

into a form suitable for everyday use.

There is

more than enough solar radiation available all over the world to satisfy a

vastly increased demand for solar power systems. The sunlight which reaches the

earth’s surface is enough to provide 2,850 times as much energy as we can

currently use. On a global average, each square meter of land is exposed to

enough sunlight to produce 1,700 kWh of power every year.

Solar

Power Industry

The

economic advantage of conventional heating fuels has varied over time, resulting

in periodic interest in solar hot water. The recent price spikes and erratic

availability of conventional fuels is renewing interest in solar heating

technologies. As of 2005, the total installed capacity of solar hot water

systems is 88 GWth and growth is 14% per year. China is the world leader in the

deployment of solar hot water systems with 80% of the market.

Declining

manufacturing costs (dropping at 3 to 5% a year in recent years) are expanding

the range of cost-effective uses. The average lowest retail cost of a large

photovoltaic array declined from $7.50 to $4 per watt between 1990 and 2005.

With many jurisdictions now giving tax and rebate incentives, solar electric

power can now pay for itself in five to ten years in many places.

"Grid-connected" systems - those systems that use an inverter to connect to the

utility grid instead of relying on batteries - now make up the largest part of

the market.

In 2003,

worldwide production of solar cells increased by 32%. Between 2000 and 2004, the

increase in worldwide solar energy capacity was an annualized 60%. 2005 was

expected to see large growth again, but shortages of refined silicon have been

hampering production worldwide since late 2004. Analysts have predicted similar

supply problems for 2006 and 2007, which may impact the price of PVs, and

consequently, of our Product.

Boiler

Industry

According

to a May 2006 report by Building Services Research and Information Association

("BSRIA"), the total world domestic boiler market was estimated at US$10.9

billion and 10.46 million units in 2005 and expected to grow at a moderate rate

over the next few years. The UK is still the biggest market in both value and

volume terms, followed by South Korea and Italy. Growth rates vary significantly

between countries, with smaller markets generally offering higher growth

potential. China is expected to grow at a rate of almost 7% a year. The relation

of the individual market segments is going to change over the forecast

period.

Supply

Structure:

- The

domestic boiler market is highly regionalized with the major players generally

only strong in their home continent. China is an exception because leading

European brands such as Bosch, Buderus and Viessmann hold significant market

shares there.

- Wall

hung units are dominated by some nine major companies, although there are many

more significant brands used by these companies in individual

countries.

- Other

markets such as the floor standing gas atmospheric and oil/gas pressure jet have

become progressively more localized.

- The

Asian market has many large domestic boiler manufacturers, who have a

significant share of the market in their home country. The exception is Rinnai

(Japan and China) and Kyungdong (Korea and China), who hold significant shares

in dual markets.

Continued

increases in energy costs and consumer demand for improved thermal comfort have

spurred the development of gas-fired condensing boilers, according to the April

2007 issue of Appliance Magazine. However, due to their complexity and high

initial equipment costs, boiler OEMs are faced with a limited customer base

unless they can meet the challenge of manufacturing a smaller, lower cost system

that can be marketed to more consumers. One key component toward this goal would

be a smaller, quieter, more reliable premix gas blower manufactured at a reduced

cost. The next generation of premix gas blowers will provide boiler

manufacturers with improved performance, reliability and cost savings that can

lead to a more affordable high-efficiency heating system for all

consumers.

Our

Product

Asia's

rising demand for renewable and environmentally friendly energy sources in the

face of the rising cost of electricity combined with the projected expansion of

the Asian Boiler Industry has resulted in what we anticipate will be a highly

receptive potential market for our Product. Our Product consists of three main

components: a wind generator, a solar generator, and an electric boiler. The

wind generator can be used autonomously or in parallel with the solar generator

to power our electric boiler. We are currently early in the process of designing

and developing our wind and solar-powered boiler at our operations office in the

Philippines. All of the raw materials related to the wind/solar powered boiler

are available through the public marketplace.

Our

Product is being designed to be installed in individual homes and apartment

buildings, initially in China, and later in other Asian countries. The boiler

will use electric-powered heating coils inside a container filled with a

thermally conductive medium, such as water, oil, or gas, to heat the medium to

high temperatures. The heated medium will then be transported throughout the

building via pipes within the walls or floor. Heat will radiate from the pipes

into the living space to provide a comfortable temperature for the

occupants.

The

electricity to run the boiler will be generated by a windmill and a solar panel

installed on the top of the building. The use of both alternative power sources

reduces the risk that there will not be enough electricity generated to power

the boiler. In most developed areas, other sources of electricity will kick in

if there is no wind or sun to generate electricity, but in less-developed areas,

there may be no other source of electricity available.

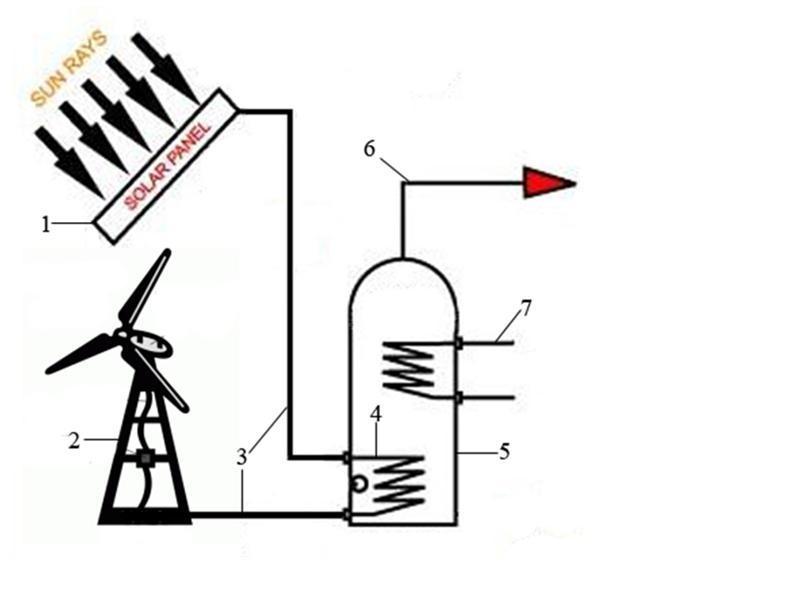

The

diagram below shows how our Product will work to generate heat and hot water for

a house or other residential building:

Our

Product works as follows: The solar panels (1) collect sun rays and convert the

thermal energy into electricity through PVs. At the same time, the windmill (2)

is collecting wind power and converting the mechanical energy into electricity

through an internal generator. The electricity is transmitted via electrical

lines (3) to the boiler and powers heating coils (4) inside the boiler (5) that

raise the temperature of the heating medium. The heated medium is then

transmitted through pipes (6) that run throughout the building. Heat radiates

from the pipes to raise the air temperature of the building. Future versions of

our Product may include water conduits (7) that run through the boiler, so that

the thermal energy in the boiler can be utilized to generate hot water for

household uses.

Competition

We face

some competition in the Boiler Market. We compete with a number of established

manufacturers, importers and distributors who sell boilers in China. These

companies enjoy brand recognition which exceeds that of our brand name. We

compete with several manufacturers, importers and distributors who have

significantly greater financial, distribution, advertising, and marketing

resources than we do. We compete primarily on the basis of quality, brand name

recognition, and price.

We

believe that our success will depend upon our ability to remain competitive in

our product areas. The failure to compete successfully in the future could

result in a material deterioration of customer loyalty and our image and could

have a material adverse effect on our business.

U.S.-based

water heater and electric motor maker A. O. Smith (Milwaukee, WI) and Spanish

appliance OEM Fagor Electrodomésticos (Arrasate) are planning to form a joint

venture to produce residential wall-hung gas combination boilers in China,

making them a major competitor in the Asian Boiler Market. Fagor-A. O. Smith

(Nanjing) Combi Boiler Co., Ltd. will occupy a facility in Nanjing close to A.

O. Smith's existing water heater operations. The venture will manufacture

"combi" boilers that provide both potable water and space heating for

residential applications. Production will begin in 2008. A. O. Smith Corporation

will invest in the venture, through its wholly owned subsidiary A. O. Smith

(China) Investment Co., with Fagor Electrodomésticos S. Coop., which is one of

Europe's biggest appliance OEMs, with 2006 sales of €1.7 billion (approx. US$2.3

Billion). The Chinese company will initially go to market with products based on

existing Fagor designs, but the partners plan to develop an engineering function

to design and develop new products for the Chinese market. Fagor makes

gas-fueled combi boilers in Spain for a number of global markets. The combi

boilers will be sold by each company's sales organization in China under the A.

O. Smith and Fagor brands. The new company will be a Wholly Owned Foreign

Enterprise under Chinese law.

The

world's largest wind turbine maker, Vestas Wind, and India's Suzian Energy Ltd.

continue to grow their alternative energy businesses in China. Also, many Danish

companies representing a comprehensive range of products and services, covering

everything from consultant design, manufacture, installation and ongoing support

within wind technology, are now bringing their expertise to China.

Intellectual

Property

We intend

to aggressively assert our rights under trade secret, unfair competition,

trademark and copyright laws to protect our intellectual property, including

product formulas, proprietary manufacturing processes and technologies, product

research and concepts, and recognized trademarks. These rights are protected

through the acquisition of patents and trademark registrations, the maintenance

of trade secrets, the development of trade dress, and, where appropriate,

litigation against those who are, in our opinion, infringing these

rights.

We are

currently consulting with law firms to protect our brand name and product

design. While there can be no assurance that registered trademarks will protect

our proprietary information, we intend to assert our intellectual property

rights against any infringer. Although any assertion of our rights can result in

a substantial cost to, and diversion of effort by, our company, management

believes that the protection of our intellectual property rights is a key

component of our operating strategy.

Regulatory

Matters

We are

subject to the laws and regulations of those jurisdictions in which we plan to

sell our product, which are generally applicable to business operations, such as

business licensing requirements, income taxes, and payroll taxes. In general,

the sale of our product in China is not subject to special regulatory and/or

supervisory requirements.

Employees

We have

no other employees other than our officers and directors. Our President and our

Chief Technology Officer are the only employees of the company. They oversee all

responsibilities in the areas of corporate administration, business development

and research. If finances permit, however, we intend to expand our current

management to retain skilled directors, officers and employees with experience

relevant to our business focus. Our current management team is highly skilled in

technical areas such as researching and developing our product, but not skilled

in areas such as marketing our product and business management. Obtaining the

assistance of individuals with an in-depth knowledge of operations and marketing

will allow us to build market share more effectively.

Item 1A. Risk Factors.

A smaller

reporting company is not required to provide the information required by this

Item.

Item 1B. Unresolved Staff Comments

A smaller

reporting company is not required to provide the information required by this

Item.

Item 2. Properties

We

maintain our corporate office at 50 West Liberty Street, Suite 880, Reno, NV

89501, and our operations office at 128 Seagull Avenue, Baybreeze Executive

Village, Taguig City, Republic of the Philippines.

Item 3. Legal Proceedings

We are

not a party to any pending legal proceeding. We are not aware of any pending

legal proceeding to which any of our officers, directors, or any beneficial

holders of 5% or more of our voting securities are adverse to us or have a

material interest adverse to us.

Item 4. Submission of Matters to a Vote of

Security Holders

No

matters were submitted to a vote of the Company's shareholders during the fiscal

year ended October 31, 2009.

PART II

Item 5. Market for Registrant’s Common

Equity and Related Stockholder Matters and Issuer Purchases of Equity

Securities

Market

Information

Our

common stock is currently quoted on the OTC Bulletin Board (“OTCBB”), which is

sponsored by FINRA. The OTCBB is a network of security dealers who buy and sell

stock. The dealers are connected by a computer network that provides information

on current "bids" and "asks", as well as volume information. Our shares are

quoted on the OTCBB under the symbol “AXIU.”

The

following table sets forth the range of high and low bid quotations for our

common stock for each of the periods indicated as reported by the OTCBB. These

quotations reflect inter-dealer prices, without retail mark-up, mark-down or

commission and may not necessarily represent actual transactions.

|

Fiscal

Year Ending October 31, 2009

|

||||

|

Quarter

Ended

|

High

$

|

Low

$

|

||

|

October

31, 2009

|

N/A

|

N/A

|

||

|

July

31, 2009

|

N/A

|

N/A

|

||

|

April

30, 2009

|

N/A

|

N/A

|

||

|

January

31, 2009

|

N/A

|

N/A

|

||

|

Fiscal

Year Ending October 31, 2008

|

||||

|

Quarter

Ended

|

High

$

|

Low

$

|

||

|

October

31, 2008

|

N/A

|

N/A

|

||

|

July

31, 2008

|

N/A

|

N/A

|

||

|

April

30, 2008

|

N/A

|

N/A

|

||

|

January

31, 2008

|

N/A

|

N/A

|

||

Penny

Stock

The SEC

has adopted rules that regulate broker-dealer practices in connection with

transactions in penny stocks. Penny stocks are generally equity securities with

a market price of less than $5.00, other than securities registered on certain

national securities exchanges or quoted on the NASDAQ system, provided that

current price and volume information with respect to transactions in such

securities is provided by the exchange or system. The penny stock rules require

a broker-dealer, prior to a transaction in a penny stock, to deliver a

standardized risk disclosure document prepared by the SEC, that: (a) contains a

description of the nature and level of risk in the market for penny stocks in

both public offerings and secondary trading; (b) contains a description of the

broker's or dealer's duties to the customer and of the rights and remedies

available to the customer with respect to a violation of such duties or other

requirements of the securities laws; (c) contains a brief, clear, narrative

description of a dealer market, including bid and ask prices for penny stocks

and the significance of the spread between the bid and ask price; (d) contains a

toll-free telephone number for inquiries on disciplinary actions; (e) defines

significant terms in the disclosure document or in the conduct of trading in

penny stocks; and (f) contains such other information and is in such form,

including language, type size and format, as the SEC shall require by rule or

regulation.

The

broker-dealer also must provide, prior to effecting any transaction in a penny

stock, the customer with (a) bid and offer quotations for the penny stock; (b)

the compensation of the broker-dealer and its salesperson in the transaction;

(c) the number of shares to which such bid and ask prices apply, or other

comparable information relating to the depth and liquidity of the market for

such stock; and (d) a monthly account statement showing the market value of each

penny stock held in the customer's account.

In

addition, the penny stock rules require that prior to a transaction in a penny

stock not otherwise exempt from those rules, the broker-dealer must make a

special written determination that the penny stock is a suitable investment for

the purchaser and receive the purchaser's written acknowledgment of the receipt

of a risk disclosure statement, a written agreement as to transactions involving

penny stocks, and a signed and dated copy of a written suitability

statement.

These

disclosure requirements may have the effect of reducing the trading activity for

our common stock. Therefore, stockholders may have difficulty selling our

securities.

As of

October 31, 2009, we had forty (40) shareholders of record.

Dividends

There are

no restrictions in our articles of incorporation or bylaws that prevent us from

declaring dividends. The Nevada Revised Statutes, however, do

prohibit us from declaring dividends where after giving effect to the

distribution of the dividend:

|

1.

|

we

would not be able to pay our debts as they become due in the usual course

of business, or;

|

|

2.

|

our

total assets would be less than the sum of our total liabilities plus the

amount that would be needed to satisfy the rights of shareholders who have

preferential rights superior to those receiving the

distribution.

|

We have

not declared any dividends and we do not plan to declare any dividends in the

foreseeable future.

Recent

Sales of Unregistered Securities

There

have been no recent sales of unregistered securities.

Securities

Authorized for Issuance under Equity Compensation Plans

We do not

have any equity compensation plans.

Item

6. Selected Financial Data

A smaller

reporting company is not required to provide the information required by this

Item.

Item 7. Management’s Discussion and Analysis of

Financial Condition and Results of Operations

Forward-Looking

Statements

Certain

statements, other than purely historical information, including estimates,

projections, statements relating to our business plans, objectives, and expected

operating results, and the assumptions upon which those statements are based,

are “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. These forward-looking

statements generally are identified by the words “believes,” “project,”

“expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,” “may,”

“will,” “would,” “will be,” “will continue,” “will likely result,” and similar

expressions. We intend such forward-looking statements to be covered by the

safe-harbor provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995, and are including this statement for

purposes of complying with those safe-harbor provisions. Forward-looking

statements are based on current expectations and assumptions that are subject to

risks and uncertainties which may cause actual results to differ materially from

the forward-looking statements. Our ability to predict results or the actual

effect of future plans or strategies is inherently uncertain. Factors which

could have a material adverse affect on our operations and future prospects on a

consolidated basis include, but are not limited to: changes in economic

conditions, legislative/regulatory changes, availability of capital, interest

rates, competition, and generally accepted accounting principles. These risks

and uncertainties should also be considered in evaluating forward-looking

statements and undue reliance should not be placed on such statements. We

undertake no obligation to update or revise publicly any forward-looking

statements, whether as a result of new information, future events or otherwise.

Further information concerning our business, including additional factors that

could materially affect our financial results, is included herein and in our

other filings with the SEC.

Results

of Operations for the Year Ended October 31, 2008 and Period from September 18,

2007 (Date of Inception) until October 31, 2008

We

generated no revenue for the period from September 18, 2007 (Date of Inception)

until October 31, 2009.

Operating

Expenses during the year ended October 31, 2009 were $10,000, as compared with

$45,000 for the year ended October 31, 2008. Our Operating Expenses for the

period from September 18, 2007 (Date of Inception) to October 31, 2009 were

$59,000. For all periods mentioned, our Operating Expenses consisting entirely

of Professional Fees. We, therefore, recorded a net loss of $10,000 for the year

ended October 31, 2008, as compared with $45,000 for the year ended October 31,

2008, and $59,000 for the period from September 18, 2007 (Date of Inception)

until October 31, 2009.

We

anticipate our operating expenses will increase as we undertake our plan of

operations. The increase will be attributable to the continued development of

our Product and the professional fees associated with our becoming a reporting

company under the Securities Exchange Act of 1934.

Liquidity

and Capital Resources

As of

October 31, 2009, we had total current assets of $0. We had $16,000

in current liabilities as of October 31, 2009. Thus, we had a working capital

deficit of $16,000 as of October 31, 2009.

Operating

activities used $43,000 in cash for the period from September 18, 2007 (Date of

Inception) until October 31, 2009. Our net loss of $59,000 offset by a loan due

to our officer of $16,000 was the sole basis of our negative operating cash

flow. Financing Activities during the period from September 18, 2007 (Date of

Inception) until October 31, 2008 generated $43,000 in cash during the

period.

As of

October 31, 2008, we have insufficient cash to operate our business at the

current level for the next twelve months and insufficient cash to achieve our

business goals. The success of our business plan beyond the next 12 months is

contingent upon us obtaining additional financing. We intend to fund operations

through debt and/or equity financing arrangements, which may be insufficient to

fund our capital expenditures, working capital, or other cash requirements. We

do not have any formal commitments or arrangements for the sales of stock or the

advancement or loan of funds at this time. There can be no assurance that such

additional financing will be available to us on acceptable terms, or at

all.

Going

Concern

We have

negative working capital and have not yet received revenues from sales of

products or services. These factors create substantial doubt about our ability

to continue as a going concern. The financial statements contained herein do not

include any adjustment that might be necessary if we are unable to continue as a

going concern.

Our

ability to continue as a going concern is dependent on our generating cash from

the sale of our common stock and/or obtaining debt financing and attaining

future profitable operations. Management’s plans include selling our equity

securities and obtaining debt financing to fund out capital requirement and

ongoing operations; however, there can be no assurance we will be successful in

these efforts.

Off

Balance Sheet Arrangements

As of

October 31, 2009, there were no off balance sheet arrangements.

Recently Issued Accounting

Pronouncements

We do not

expect the adoption of recently issued accounting pronouncements to have a

significant impact on our results of operations, financial position or cash

flow.

Item 7A. Quantitative and Qualitative Disclosures

About Market Risk

A smaller

reporting company is not required to provide the information required by this

Item.

Item 8. Financial Statements and Supplementary

Data

See the

financial statements annexed to this annual report.

Item 9. Changes In and Disagreements with

Accountants on Accounting and Financial

Disclosure

No events

occurred requiring disclosure under Item 307 and 308 of Regulation S-K during

the fiscal year ending October 31, 2009.

Item

9A(T). Controls and Procedures

Disclosure

controls and procedures are controls and other procedures that are designed to

ensure that information required to be disclosed in company reports filed or

submitted under the Securities Exchange Act of 1934 (the “Exchange Act”) is

recorded, processed, summarized and reported, within the time periods specified

in the Securities and Exchange Commission’s rules and forms. Disclosure controls

and procedures include without limitation, controls and procedures designed to

ensure that information required to be disclosed in company reports filed or

submitted under the Exchange Act is accumulated and communicated to management,

including our chief executive officer and treasurer, as appropriate to allow

timely decisions regarding required disclosure.

As

required by Rules 13a-15 and 15d-15 under the Exchange Act, our chief executive

officer and chief financial officer carried out an evaluation of the

effectiveness of the design and operation of our disclosure controls and

procedures as of October 31, 2009. Based on their evaluation, they concluded

that our disclosure controls and procedures were effective.

Management

is responsible for establishing and maintaining adequate internal control over

our financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) of the

Exchange Act). Our

internal control over financial reporting is a process designed by, or under the

supervision of, our chief executive officer and chief financial officer and

effected by our board of directors, management and other personnel, to provide

reasonable assurance regarding the reliability of our financial reporting and

the preparation of our financial statements for external purposes in accordance

with generally accepted accounting principles. Internal control over financial

reporting includes policies and procedures that pertain to the maintenance of

records that in reasonable detail accurately and fairly reflect the transactions

and dispositions of our assets; provide reasonable assurance that transactions

are recorded as necessary to permit preparation of our financial statements in

accordance with generally accepted accounting principles, and that our receipts

and expenditures are being made only in accordance with the authorization of our

board of directors and management; and provide reasonable assurance regarding

prevention or timely detection of unauthorized acquisition, use or disposition

of our assets that could have a material effect on our financial

statements.

Under the

supervision and with the participation of our management, including our chief

executive officer, we conducted an evaluation of the effectiveness of our

internal control over financial reporting based on the criteria established in

Internal Control – Integrated Framework issued by the Committee of Sponsoring

Organizations of the Treadway Commission (“COSO”). Based on this evaluation

under the criteria established in Internal Control – Integrated Framework, our

management concluded that our internal control over financial reporting was

effective as of October 31, 2009.

This

annual report does not include an attestation report of our registered public

accounting firm regarding internal control over financial reporting.

Management’s report was not subject to attestation by our registered public

accounting firm pursuant to temporary rules of the Securities and Exchange

Commission that permit us to provide only management’s report in this annual

report.

During

the most recently completed fiscal quarter, there has been no change in our

internal control over financial reporting that has materially affected or is

reasonably likely to materially affect, our internal control over financial

reporting.

Item

9B. Other Information

None

PART III

Item 10. Directors, Executive Officers and Corporate

Governance

Our

executive officers and directors and their respective ages as of October 1, 2007

are as follows:

|

Name

|

Age

|

Position

Held with the Company

|

|

Geraldine

Gugol

128

Seagull Ave.,

Baybreeze

Exec Village

Taguig

City, Philippines

|

37

|

President,

Chief Executive Officer, Principal Executive Officer, Chief Financial

Officer, Principal Financial Officer, Principal Accounting Officer and

Director

|

|

Leilane

E. Macatangay

128

Seagull Ave.,

Baybreeze

Exec Village

Taguig

City, Philippines

|

46

|

Chief

Technology Officer, Director

|

Set forth

below is a brief description of the background and business experience of our

sole executive officer and director.

Geraldine Gugol is our

President, Chief Executive Officer, Principal Executive Officer, Chief Financial

Officer, Principal Financial Officer, Principal Accounting Officer and Director.

Geraldine obtained a Bachelor of Science from Central Mindanao University in

1997, and has worked as a Senior Manager for Uni-star Business Systems since

that time.

Leilane E. Macatangay is our

CTO and director. Leilane obtained a Bachelor of Science Degree from Far Eastern

University in 1983. Since that time he has worked as an engineer for Eumac,

Inc.

Term

of Office

Our

directors are appointed for a one-year term to hold office until the next annual

general meeting of our shareholders or until removed from office in accordance

with our bylaws. Our officers are appointed by our board of directors

and hold office until removed by the board.

Significant

Employees

We do not

currently have any significant employees aside from Geraldine Gugol and Leilane

E. Macatangay.

Involvement

in Certain Legal Proceedings

To the

best of our knowledge, during the past five years, none of the following

occurred with respect to our present or former director, executive officer, or

employee: (1) any bankruptcy petition filed by or against any business of which

such person was a general partner or executive officer either at the time of the

bankruptcy or within two years prior to that time; (2) any conviction in a

criminal proceeding or being subject to a pending criminal proceeding (excluding

traffic violations and other minor offenses); (3) being subject to any order,

judgment or decree, not subsequently reversed, suspended or vacated, of any

court of competent jurisdiction, permanently or temporarily enjoining, barring,

suspending or otherwise limiting his or her involvement in any type of business,

securities or banking activities; and (4) being found by a court of competent

jurisdiction (in a civil action), the SEC or the Commodities Futures Trading

Commission to have violated a federal or state securities or commodities law,

and the judgment has not been reversed, suspended or vacated.

Committees

of the Board

Our

company currently does not have nominating, compensation or audit committees or

committees performing similar functions nor does our company have a written

nominating, compensation or audit committee charter. Our directors believe that

it is not necessary to have such committees, at this time, because the functions

of such committees can be adequately performed by the board of

directors.

Our

company does not have any defined policy or procedural requirements for

shareholders to submit recommendations or nominations for directors. The board

of directors believes that, given the stage of our development, a specific

nominating policy would be premature and of little assistance until our business

operations develop to a more advanced level. Our company does not currently have

any specific or minimum criteria for the election of nominees to the board of

directors and we do not have any specific process or procedure for evaluating

such nominees. The board of directors will assess all candidates, whether

submitted by management or shareholders, and make recommendations for election

or appointment.

A

shareholder who wishes to communicate with our board of directors may do so by

directing a written request addressed to our President and director, Geraldine

Gugol, at the address appearing on the first page of this annual

report.

Code

of Ethics

As of

October 31, 2009, we had not adopted a Code of Ethics for Financial Executives,

which would include our principal executive officer, principal financial

officer, principal accounting officer or controller, or persons performing

similar functions.

Item 11. Executive Compensation

Summary

Compensation Table

The table

below summarizes all compensation awarded to, earned by, or paid to both to our

officers and to our directors for all services rendered in all capacities to us

for our fiscal years ended October 31, 2009 and 2008.

|

SUMMARY

COMPENSATION TABLE

|

|||||||||

|

Name

and

principal

position

|

Year

|

Salary ($)

|

Bonus

($)

|

Stock

Awards

($)

|

Option

Awards

($)

|

Non-Equity

Incentive

Plan

Compensation

($)

|

Nonqualified

Deferred

Compensation

Earnings

($)

|

All

Other

Compensation

($)

|

Total

($)

|

|

Geraldine

Gugol

President,

Chief Executive Officer, Principal Executive Officer,

Chief

Financial Officer, Principal Financial Officer,

Principal

Accounting Officer and Director

|

2009

2008

|

0

0

|

0

0

|

0

0

|

0

0

|

0

0

|

0

0

|

0

0

|

|

|

Leilane

E. Macatangay, Chief Technology Officer

|

2009

2008

|

0

0

|

0

0

|

0

0

|

0

0

|

0

0

|

0

0

|

0

0

|

|

Narrative

Disclosure to the Summary Compensation Table

We have

not entered into any employment agreement or consulting agreement with our

executive officers. There are no arrangements or plans in which we

provide pension, retirement or similar benefits for executive

officers.

Although

we do not currently compensate our officers, we reserve the right to provide

compensation at some time in the future. Our decision to compensate

officers depends on the availability of our cash resources with respect to the

need for cash to further our business purposes.

Outstanding

Equity Awards at Fiscal Year-End

The table

below summarizes all unexercised options, stock that has not vested, and equity

incentive plan awards for each named executive officer as of October 31,

2009.

|

OUTSTANDING

EQUITY AWARDS AT FISCAL YEAR-END

|

|||||||||

|

OPTION

AWARDS

|

STOCK

AWARDS

|

||||||||

|

Name

|

Number

of

Securities

Underlying

Unexercised

Options

(#)

Exercisable

|

Number

of

Securities

Underlying

Unexercised

Options

(#)

Unexercisable

|

Equity

Incentive

Plan

Awards:

Number

of

Securities

Underlying

Unexercised

Unearned

Options

(#)

|

Option

Exercise

Price

($)

|

Option

Expiration

Date

|

Number

of

Shares

or

Units

of

Stock

That

Have

Not

Vested

(#)

|

Market

Value

of

Shares

or

Units

of

Stock

That

Have

Not

Vested

($)

|

Equity

Incentive

Plan

Awards:

Number

of

Unearned

Shares,

Units

or

Other

Rights

That

Have

Not

Vested

(#)

|

Equity

Incentive

Plan

Awards:

Market

or

Payout

Value

of

Unearned

Shares,

Units

or

Other

Rights

That

Have

Not

Vested

(#)

|

|

Geraldine

Gugol

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Leilane

E. Macatangay

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

Stock

Option Grants

We have

not granted any stock options to the executive officers or directors since our

inception.

Director

Compensation

We do not

pay any compensation to our directors at this time. However, we reserve the

right to compensate our directors in the future with cash, stock, options, or

some combination of the above.

We have

not reimbursed our directors for expenses incurred in connection with attending

board meetings nor have we paid any directors fees or other cash compensation

for services rendered as a director in the year ended October 31,

2009.

Stock

Option Plans

We did

not have a stock option plan as of October 31, 2009.

Item 12. Security Ownership of Certain Beneficial

Owners and Management and Related

Stockholder

Matters

The

following table sets forth, as of October 31, 2009, certain

information as to shares of our common stock owned by (i) each person known by

us to beneficially own more than 5% of our outstanding common stock, (ii) each

of our directors, and (iii) all of our executive officers and directors as a

group:

|

Name

and Address of Beneficial Owners of Common Stock

|

Title

of Class

|

Amount

and Nature of Beneficial Ownership1

|

%

of Common Stock2

|

|

Geraldine

Gugol

128

Seagull Ave.,

Baybreeze

Exec Village

Taguig

City, Philippines

|

Common

Stock

|

600,000

|

27.9%

|

|

Leilane

E. Macatangay

128

Seagull Ave.,

Baybreeze

Exec Village

Taguig

City, Philippines

|

Common

Stock

|

600,000

|

27.9%

|

|

DIRECTORS

AND OFFICERS – TOTAL

|

1,200,000

|

55.8%

|

|

|

5%

SHAREHOLDERS

|

|||

|

NONE

|

Common

Stock

|

NONE

|

NONE

|

|

|

1.

|

As

used in this table, "beneficial ownership" means the sole or shared power

to vote, or to direct the voting of, a security, or the sole or shared

investment power with respect to a security (i.e., the power to dispose

of, or to direct the disposition of, a security). In addition,

for purposes of this table, a person is deemed, as of any date, to have

"beneficial ownership" of any security that such person has the right to

acquire within 60 days after such

date.

|

|

|

2.

|

The

percentage shown is based on denominator of 2,150,000 shares of common

stock issued and outstanding for the company as of October 31,

2009.

|

Item 13. Certain Relationships and Related

Transactions, and Director Independence

None of

our directors or executive officers, nor any proposed nominee for election as a

director, nor any person who beneficially owns, directly or indirectly, shares

carrying more than 5% of the voting rights attached to all of our outstanding

shares, nor any members of the immediate family (including spouse, parents,

children, siblings, and in-laws) of any of the foregoing persons has any

material interest, direct or indirect, in any transaction over the last two

years or in any presently proposed transaction which, in either case, has or

will materially affect us.

Item 14. Principal Accounting Fees and

Services

Below is

the table of Audit Fees (amounts in US$) billed by our auditor in connection

with the audit of the Company’s annual financial statements for the years

ended:

|

Financial

Statements for the Year Ended October 31

|

Audit

Services

|

Audit

Related Fees

|

Tax

Fees

|

Other

Fees

|

|

2009

|

$9,000

|

-

|

-

|

-

|

|

2008

|

$9,000

|

-

|

-

|

-

|

PART IV

Item 15. Exhibits, Financial Statements

Schedules

Index to

Financial Statements Required by Article 8 of Regulation S-X:

|

Audited

Financial Statements:

|

|

|

F-1

|

Report

of Independent Registered Public Accounting Firm

|

|

F-2

|

Consolidated

BalaBalance Sheets as of October 31, 2009 and

2008;

|

|

F-3

|

Statements

of Operations for the years ended October 31, 2009 and 2008, and the

period from inception to October 31, 2009;

|

|

F-4

|

Statement

of Stockholders’ Equity for period from inception to October 31,

2009;

|

|

F-5

|

Statements

of Cash Flows for the years ended October 31, 2009 and 2008, and the

period from inception to October 31, 2009;

|

|

F-6

|

Notes

to Financial Statements

|

|

Exhibit

Number

|

Description

|

|

3.1

|

Articles

of Incorporation, as amended (1)

|

|

3.2

|

Bylaws,

as amended (1)

|

|

1

|

Incorporated

by reference to the Registration Statement on Form SB-2 filed on November

9, 2007.

|

SIGNATURES

In

accordance with Section 13 or 15(d) of the Exchange Act, the registrant caused

this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Axius,

Inc.

|

By:

|

/s/Geraldine

Gugol

|

|

Geraldine

Gugol

President,

Chief Executive Officer, Principal Executive Officer,

Chief

Financial Officer, Principal Financial Officer,

Principal

Accounting Officer and Director

|

|

|

December

14, 2009

|

In accordance with Section 13 or 15(d)

of the Exchange Act, this report has been signed below by the following persons

on behalf of the registrant and in the capacities and on the dates

indicated:

|

By:

|

/s/Geraldine

Gugol

|

|

Geraldine

Gugol

President,

Chief Executive Officer, Principal Executive Officer,

Chief

Financial Officer, Principal Financial Officer,

Principal

Accounting Officer and Director

|

|

|

December

14, 2009

|

|

By:

|

/s/Leilane

E. Macatangay

|

|

Leilane

E. Macatangay

Chief

Technology Officer and Director

|

|

|

December

14, 2009

|

Maddox Ungar Silberstein,

PLLC CPAs and Business

Advisors

Phone

(248) 203-0080

Fax (248)

281-0940

30600

Telegraph Road, Suite 2175

Bingham

Farms, MI 48025-4586

www.maddoxungar.com

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of

Directors

Axius,

Inc.

Taguig

City, Philippines

We have

audited the accompanying balance sheets of Axius, Inc. (a development stage

company) as of October 31, 2009 and 2008 and the related statements of

operations, stockholders’ deficit and cash flows for the periods then ended and

for the period from September 18, 2007 (date of inception) to October 31,

2009. These financial statements are the responsibility of the

Company’s management. Our responsibility is to express an opinion on

these financial statements based on our audits.

We

conducted our audits in accordance with the standards of the Public Company

Accounting Oversight Board (United States). Those standards require

that we plan and perform the audits to obtain reasonable assurance about whether

the financial statements are free of material misstatement. The Company has determined

that it is not required to have, nor were we engaged to perform, an audit of its

internal control over financial reporting. Our audits included

consideration of internal control over financial reporting as a basis for

designing audit procedures that are appropriate in the circumstances, but not

for the purpose of expressing an opinion on the effectiveness of the Company’s

internal control over financial reporting. Accordingly, we express no such

opinion. An audit includes examining on a test basis, evidence

supporting the amounts and disclosures in the financial

statements. An audit also includes assessing the accounting

principles used and significant estimates made by management, as well as

evaluating the overall financial statement presentation. We believe

that our audits provide a reasonable basis for our opinion.

In our

opinion, the financial statements referred to above present fairly, in all

material respects, the financial position of Axius, Inc. as of October 31, 2009

and 2008, and the results of its operations and cash flows for the periods then

ended and the period from September 18, 2007 (date of inception) to October 31,

2009, in conformity with accounting principles generally accepted in the United

States of America.

The

accompanying financial statements have been prepared assuming that the Company

will continue as a going concern. As discussed in Note 6 to the

financial statements, the Company has negative working capital, has not yet

received revenue from sales of products or services, and has incurred losses

from operations. These factors raise substantial doubt about the

Company’s ability to continue as a going concern. Management’s plans

with regard to these matters are described in Note 6. The accompanying financial

statements do not include any adjustments that might result from the outcome of

this uncertainty.

/s/ Maddox Ungar

Silberstein, PLLC

Maddox

Ungar Silberstein, PLLC

Bingham

Farms, Michigan

December

14, 2009

AXIUS,

INC.

(A

DEVELOPMENT STAGE COMPANY)

BALANCE

SHEETS

As

of October 31, 2009 and October 31, 2008

|

October

31,

|

October

31,

|

|||||||

|

2009

|

2008

|

|||||||

|

ASSETS

|

||||||||

|

Current

Assets

|

||||||||

|

Cash

and equivalents

|

$ | -0- | $ | -0- | ||||

|

Prepaid

expenses

|

-0- | -0- | ||||||

|

TOTAL

ASSETS

|

$ | -0- | $ | -0- | ||||

|

LIABILITIES

AND STOCKHOLDERS’ DEFICIT

|

||||||||

|

Current

Liabilities

|

||||||||

|

Accrued

expenses

|

$ | -0- | $ | 6,000 | ||||

|

Due

to officer

|

16,000 | -0- | ||||||

|

Total

liabilities

|

16,000 | 6,000 | ||||||

|

Stockholders’

Deficit

|

||||||||

|

Common

Stock, $.001 par value, 90,000,000

shares authorized,

2,150,000 shares issued and outstanding

|

2,150 | 2,150 | ||||||

|

Preferred

Stock, $.001 par value, 10,000,000

shares authorized,

-0- shares issued and outstanding

|

-0- | -0- | ||||||

|

Additional

paid-in capital

|

40,850 | 40,850 | ||||||

|

Deficit

accumulated during the development stage

|

(59,000 | ) | (49,000 | ) | ||||

|

Total

stockholders’ deficit

|

(16,000 | ) | (6,000 | ) | ||||

|

TOTAL

LIABILITIES AND STOCKHOLDERS’ DEFICIT

|

$ | -0- | $ | -0- | ||||

See

accompanying notes to financial statements.

AXIUS,

INC.

(A

DEVELOPMENT STAGE COMPANY)

STATEMENTS

OF OPERATIONS

Years

Ended October 31, 2009 and 2008

Period

from September 18, 2007 (Inception) to October 31, 2009

|

Period

from

|

||||||||||||

|

Year

|

Year

|

September

18, 2007

|

||||||||||

|

Ended

|

Ended

|

(Inception)

to

|

||||||||||

|

October

31,

|

October

31,

|

October

31,

|

||||||||||

|

2009

|

2008

|

2009

|

||||||||||

|

Revenues

|

$ | -0- | $ | -0- | $ | -0- | ||||||

|

Expenses

:

|

||||||||||||

|

Professional

fees

|

10,000 | 45,000 | 59,000 | |||||||||

|

Net

Loss

|

$ | (10,000 | ) | $ | (45,000 | ) | $ | (59,000 | ) | |||

|

Net

loss per share:

|

||||||||||||

|

Basic

and diluted

|

$ | (0.00 | ) | $ | (0.02 | ) | ||||||

|

Weighted

average shares outstanding:

|

||||||||||||

|

Basic

and diluted

|

2,150,000 | 2,150,000 | ||||||||||

See

accompanying notes to financial statements.

AXIUS,

INC.

(A

DEVELOPMENT STAGE COMPANY)

STATEMENT

OF STOCKHOLDERS’ DEFICIT

Period

from September 18, 2007 (Inception) to October 31, 2009

|

Common

stock

|

Additional

paid-in capital

|

Deficit

accumulated during the development stage

|

Total

|

||||||

|

Shares

|

Amount

|

||||||||

|

Issuance

of common stock

for

cash @$.001

|

2,150,000

|

$ 2,150

|

$ 40,850

|

$ -

|

$ 43,000

|

||||

|

Loss

for the period ended October 31, 2007

|

-

|

-

|

-

|

(4,000)

|

(4,000)

|

||||

|

Balance,

October 31, 2007

|

2,150,000

|

2,150

|

40,850

|

(4,000)

|

39,000

|

||||

|

Net

loss for the year

ended

October 31, 2008

|

-

|

-

|

-

|

(45,000)

|

(45,000)

|

||||

|

Balance,

October 31, 2008

|

2,150,000

|

2,150

|

40,850

|

(49,000)

|

(6,000)

|

||||

|

Net

loss for the year

ended

October 31, 2009

|

-

|

-

|

-

|

(10,000)

|

(10,000)

|

||||

|

Balance,

October 31, 2009

|

2,150,000

|

$ 2,150

|

$ 40,850

|

$ (59,000)

|

$ (16,000)

|

||||

See

accompanying notes to financial statements.

AXIUS,

INC.

(A

DEVELOPMENT STAGE COMPANY)

STATEMENTS

OF CASH FLOWS

Years

Ended October 31, 2009 and 2008

Period

from September 18, 2007 (Inception) to October 31, 2009

|

Period

From

|

||||||||||||

|

Year

|

Year

|

September

18, 2007

|

||||||||||

|

Ended

|

Ended

|

(Inception)

to

|

||||||||||

|

October

31,

|

October

31,

|

October

31,

|

||||||||||

|

2009

|

2008

|

2009

|

||||||||||

|

CASH

FLOWS FROM OPERATING ACTIVITIES

|

||||||||||||

|

Net

loss

|

$ | (10,000 | ) | $ | (45,000 | ) | $ | (59,000 | ) | |||

|

Change

in non-cash working capital items

Prepaid

expenses

|

-0- | 4,000 | -0- | |||||||||

|

Accrued

expenses

|

(6,000 | ) | 6,000 | -0- | ||||||||

|

Due

to officer

|

16,000 | -0- | 16,000 | |||||||||

|

CASH

FLOWS USED BY OPERATING ACTIVITIES

|

-0- | (35,000 | ) | (43,000 | ) | |||||||

|

CASH

FLOWS FROM FINANCING ACTIVITIES

|

||||||||||||

|

Proceeds

from sales of common stock

|

-0- | -0- | 43,000 | |||||||||

|

NET

INCREASE IN CASH

|

-0- | -0- | -0- | |||||||||

|

Cash,

beginning of period

|

-0- | 35,000 | -0- | |||||||||

|

Cash,

end of period

|

$ | -0- | $ | -0- | $ | -0- | ||||||

|

SUPPLEMENTAL

CASH FLOW

INFORMATION

|

||||||||||||

|

Interest

paid

|

$ | -0- | $ | -0- | $ | -0- | ||||||

|

Income

taxes paid

|

$ | -0- | $ | -0- | $ | -0- | ||||||

See

accompanying notes to financial statements.

AXIUS,

INC.

(A

DEVELOPMENT STAGE COMPANY)

NOTES

TO THE FINANCIAL STATEMENTS

October

31, 2009

NOTE 1 –

SUMMARY OF ACCOUNTING POLICIES

Nature of

Business

Axius,

Inc. (“Axius”) is a development stage company and was incorporated in Nevada on

September 18, 2007. The Company is developing wind and solar powered

boilers specifically for use as energy-efficient heating

systems. Axius operates out of office space owned by a director and

stockholder of the Company. The facilities are provided at no

charge. There can be no assurances that the facilities will continue

to be provided at no charge in the future.

Development

Stage Company

The

accompanying financial statements have been prepared in accordance with

generally accepted accounting principles applicable to development stage

companies. A development stage company is one in which planned

principal operations have not commenced or if its operations have commenced,

there has been no significant revenues there from.

Cash and

Cash Equivalents

Axius

considers all highly liquid investments with maturities of three months or less

to be cash equivalents. At October 31, 2009 and October 31, 2008 the

Company had $-0- of cash.

Fair

Value of Financial Instruments

Axius’s

financial instruments consist of cash and cash equivalents and an amoutn due to

officer. The carrying amount of these financial instruments approximates fair

value due either to length of maturity or interest rates that approximate

prevailing market rates unless otherwise disclosed in these financial

statements.

Income

Taxes

Income

taxes are computed using the asset and liability method. Under the

asset and liability method, deferred income tax assets and liabilities are

determined based on the differences between the financial reporting and tax

bases of assets and liabilities and are measured using the currently enacted tax

rates and laws. A valuation allowance is provided for the amount

of deferred tax

assets that, based on available evidence, are not expected to be

realized.

Basic

loss per share