Attached files

| file | filename |

|---|---|

| 8-K - TALBOTS INC | s1101018k.htm |

Exhibit

99.1

January

2010

Investor

Presentation

2

Confidential

TODAY’S

AGENDA

• Investment

Highlights

• Company

Overview

• Growth

Initiatives

• Recent Financial

Performance

• Financing

Transaction Terms and Summary

• Investment

Highlights

3

Confidential

INVESTMENT

HIGHLIGHTS

• Highly recognized

women’s apparel brand, 63 year legacy

• Distinct

positioning offers competitive strength

• Strong customer

loyalty

Established

Brand

Multi

Channel

Platform

Platform

Growth

Opportunities

Opportunities

• Allows 24/7

customer access: Retail, Catalog, On-line

• Consistent

customer service and brand experience

• Leverages

merchandising and support functions

• Merchandise

Categories Expansion: Accessories and Woman’s

• Upscale Outlets

offer access to new customers and channels

• Store Segmentation

Initiative

Experienced

Management Team

Management Team

• New leadership has

begun to reenergize and modernize the Company

• Almost all members

of the management team have arrived at Talbots

within the past 2 years

within the past 2 years

• Team has an

average of 23 years experience in the industry

Comprehensive

Financing

Solution

Financing

Solution

• Announced

transactions are expected to better position the Company

for the future

for the future

• Significantly

de-levers the Company’s balance sheet

4

Confidential

• Brand aimed at the

female “boomer

consumer”

consumer”

• Timeless classics,

yet modern, priced in

the better price category

the better price category

• Apparel and

non-apparel across Missy,

Woman and Petite concepts

Woman and Petite concepts

• Multi Channel

Retailer

– Stores

– Catalog

– Internet

– Upscale

Outlets

• Total Stores: 589

(at the end of Q3’09)

• Revenue

(Continuing

Operations):$1.2 billion

(LTM

period ending Q3’09)

period ending Q3’09)

Talbots

Snapshot

“Tradition

Transformed”

TALBOTS

BRAND OVERVIEW

5

Confidential

TALBOTS

CUSTOMER

6

Confidential

Gracious, Classic,

Cherished,

Genuine,

Authentic, Timeless

Authentic, Timeless

Modern,

Refined, Intuitive,

Surprising,

Innovative,

Imaginative,

Luxurious

ATTRACTIVELY

POSITIONED BRAND

WITH SIGNIFICANT CUSTOMER LOYALTY

WITH SIGNIFICANT CUSTOMER LOYALTY

• Core, loyal

Talbots customer is highly valuable:

– Represents 30% of

total Talbots customers

– Talbots captures

>50% share of wallet

• Attractive

demographic profile:

– Boomer: Average

age 55

– Upper Income:

$130,000 Household Income

– College Graduate:

79%

– Married: 80%, With

Children: 33%

– Employed:

70%

– Travel:

63%

– On-line:

81%

“Tradition Transformed”

Source: Company

research.

7

Confidential

Superior

Customer

Service & Store

Experience

Service & Store

Experience

Private

Label

Credit

Card

Convenient

Store

Locations

Locations

+

Easy

and Accessible

Multi

Channel

Platform

Platform

+

+

Key

Drivers

CUSTOMER

ACQUISITION STRATEGY:

Preserving Loyal, Reactivating Lapsed and Attracting New

Preserving Loyal, Reactivating Lapsed and Attracting New

Customer Marketing

Strategy

• Focus

on the Core: Nourish our

relationships with our loyal customers

• Expand

the Base: Re-engage lapsed

and attract new customers

• Migrate

Across Channels: Drive customers

across stores / web / catalog

seamlessly

seamlessly

• Change

Brand Perceptions: Find new,

innovative ways to introduce people

to Talbots

to Talbots

8

Confidential

• We have increased

shelf life discipline, and are keeping

sales floor cleaner, increasing freshness

sales floor cleaner, increasing freshness

Li

& Fung

Partnership

Partnership

Markdown

Cadence

RECENT

IMPROVEMENTS:

STRATEGIC

MERCHANDISING INITIATIVES

• New Li & Fung

sourcing relationship will drive further

margin improvement

margin improvement

• Over 380,000

full-price pants sold in stores during $5

“try on” launch period and sold over 590,000 pairs in

the 3rd quarter of 2009

“try on” launch period and sold over 590,000 pairs in

the 3rd quarter of 2009

• New merchandise /

creative teams

• Re-vamped the

architecture of the line

• Calibrated pricing

posture

“Good, Better,

Best”

Approach

Approach

Pant

Fit Initiative

9

Confidential

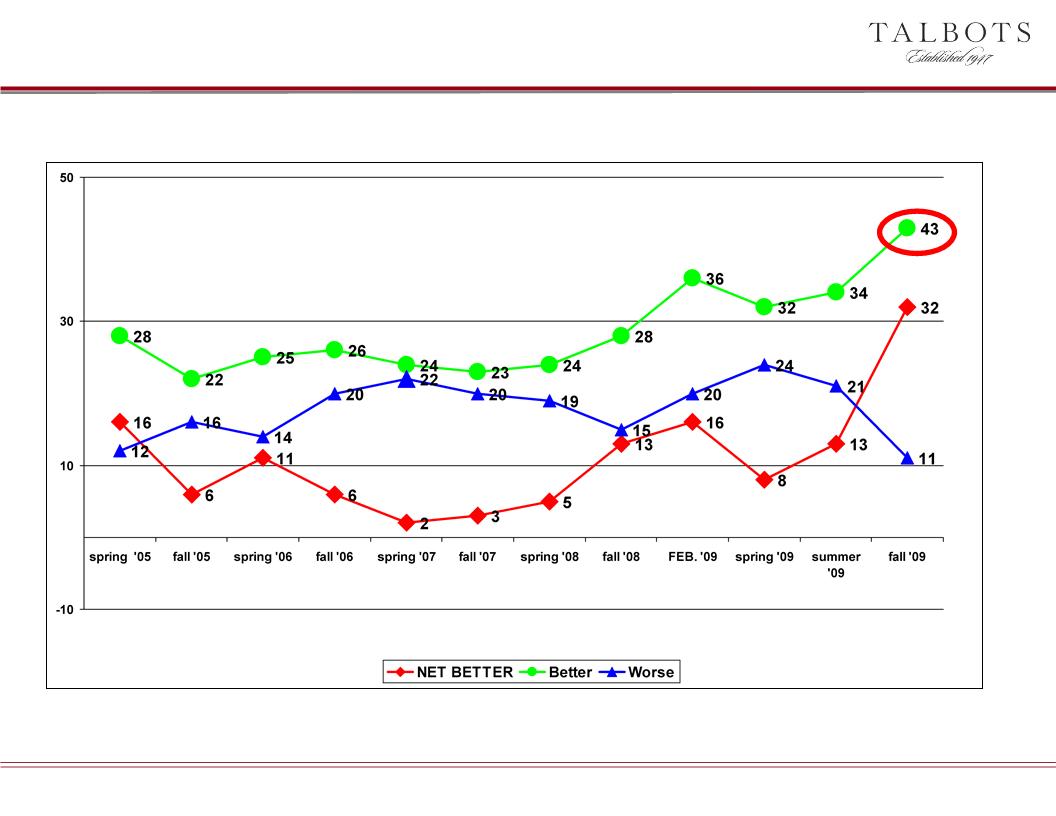

NET

BETTER MERCHANDISE SCORES: Among “Best” Customers

IMPROVING

BRAND PERCEPTION

Source: Company

research.

10

Confidential

2010-2012

GROWTH INITIATIVES

Upscale

Outlets

Accessories

Expand

Woman’s

Business

Business

• Seek to open over

60 outlets by 2012

• Look to achieve

margins of approximately 60%

• Accessories

expected to exceed $100 million in sales in

2012

2012

• Across multiple

store and size concepts

• Woman (plus-sized)

segment is still under-served

• Would complement

the Missy and Petite businesses

Store

Segmentation

• Optimize

resources

• Improve

productivity across store base

11

Confidential

GROWTH

INITIATIVE:

STORE

SEGMENTATION STRATEGY

• We are well

positioned to benefit from localization

– 589 stores, ~4

million gross square feet

– Wide range of

customer types, end use needs and real estate locations

– Ongoing exercise

to optimize size of store portfolio

• We must optimize

the resources we have today:

– Inventory

– Store

payroll

• We have divided

stores on 2 dimensions that showed important differences

in performance

in performance

– Customer

Lifestyle; based on how She

shops, Her fashion sense and

where the store is located

where the store is located

– Climate; based on

latitude and regional climate factors

12

Confidential

• This segmentation

will allow for tailored

assortments, layouts and merchandise

presentation that appeal to different lifestyles

assortments, layouts and merchandise

presentation that appeal to different lifestyles

• Implements a

business philosophy that is rooted

in a customer-centric segmentation approach

in a customer-centric segmentation approach

• Improve metrics:

increase turn, reduce

markdowns, and drive gross margins

markdowns, and drive gross margins

• Layering on of

weather breaks and assortment

pyramid gets the right product to the right stores

pyramid gets the right product to the right stores

GROWTH

INITIATIVE:

STORE

SEGMENTATION ENABLES LOCALIZATION

Flagship

2

Stores

Premium

~100

Stores

Always

~150

Stores

Classic

~315

Stores

Note: US Missy

store segmentation excludes Canada and Outlets

13

Confidential

|

Sales

|

26.2%

|

22.9%

|

13.5%

|

6% -

8%

|

|

COS,

B&O

|

950

bps

|

180

bps

|

840

bps

|

> 2,000

bps

|

|

SG&A

(BPS)

|

480

bps

|

50

bps

|

350

bps

|

790

- 810 bps

|

|

SG&A

($)

|

$19

|

$30

|

$28

|

$33 -

$36

|

|

Adjusted

Operating

(Loss) Income* |

$(15.8)

|

$(10.5)

|

$24.1

|

$0 - $5.0

|

|

Adjusted

Earnings

(Loss) Per Share* |

($0.23)

|

($0.33)

|

$0.31

|

($0.06)

- ($0.14)

|

*Excludes

restructuring, impairment and, as to outlook, potential special

items.

RECENT

FINANCIAL PERFORMANCE

(Continuing Operations)

(Continuing Operations)

Q1

Actual

Q2

Actual

Q3

Actual

Q4

Outlook**

($

in millions, except per share data)

We

turned the operating profit corner in Q3 2009

Singular focus on executing our plan in Q4 2009

Singular focus on executing our plan in Q4 2009

________________________________________________________________________________

**Q4

outlook provided in this

presentation is intended solely as a restatement of the public outlook provided

by the Company on December 8, 2009 as part of its 3Q earnings release and

conference call. The

reference to Q4 Outlook does not, and is not intended to, either re-confirm or update in any manner that December 8, 2009 publicly provided outlook and does not, and is not intended to, reflect any financial

or operating results of the Company or future expectations of the Company for any period following December 8, 2009. Such prior outlook is subject to the company’s forward looking statement

accompanying its December 8, 2009 earnings release, which is available on the Company’s website under “Investor Relations” at www.thetalbotsinc.com, and is not a guarantee of future performance.

reference to Q4 Outlook does not, and is not intended to, either re-confirm or update in any manner that December 8, 2009 publicly provided outlook and does not, and is not intended to, reflect any financial

or operating results of the Company or future expectations of the Company for any period following December 8, 2009. Such prior outlook is subject to the company’s forward looking statement

accompanying its December 8, 2009 earnings release, which is available on the Company’s website under “Investor Relations” at www.thetalbotsinc.com, and is not a guarantee of future performance.

14

Confidential

• Shut down

under-performing businesses

– Talbots Kids /

Mens / U.K. businesses

– Sold J. Jill to

Golden Gate Capital

Store

Concepts

Stores

Inventory

Labor

Expenses

RATIONALIZING

THE COST STRUCTURE

• Continued emphasis

on inventory and expense

management

management

• Rationalization of

store portfolio

• Headcount

reduction

• Rationalization of

hourly workforce

• Employee related

benefits

• Expected $150

million annualized expense

reduction program nearly complete

reduction program nearly complete

15

Confidential

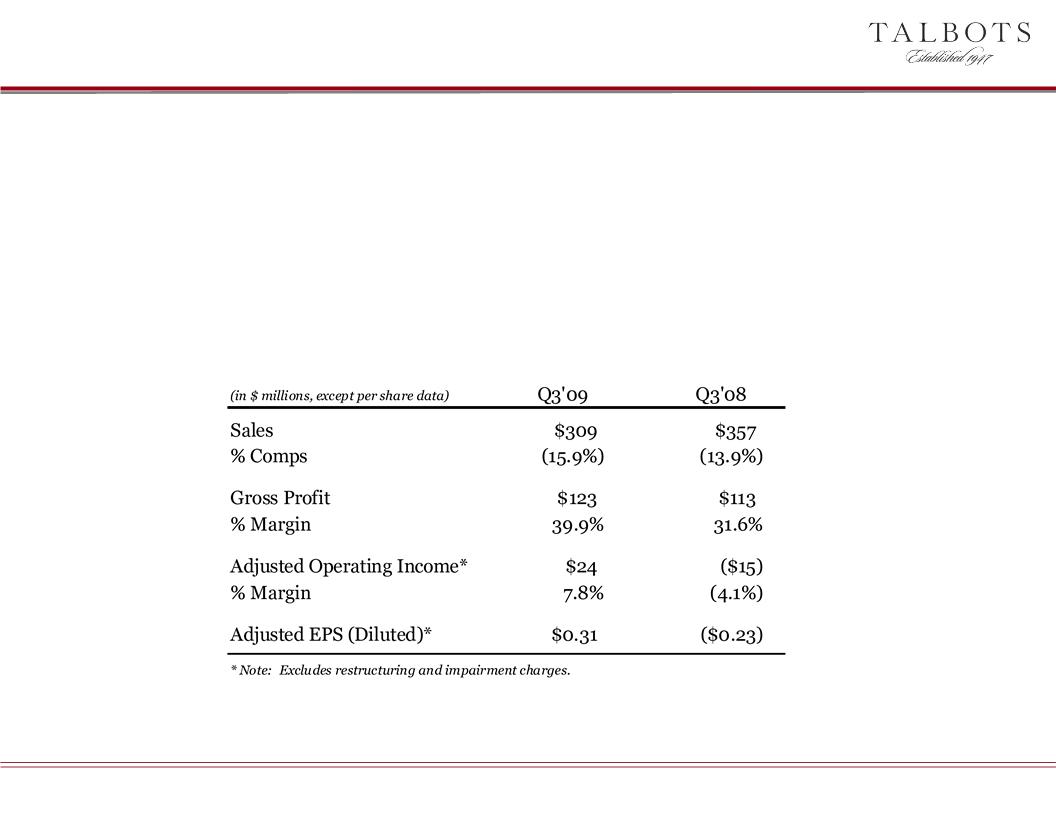

Q3

‘09 EARNINGS SUMMARY

(Continuing Operations)

(Continuing Operations)

• Margins drove

increased profitability during the quarter

– Strong IMUs and

improved full-price selling

• Cost savings

continued to have a significant positive impact on earnings

• Sales continued to

decrease - however, full price sales decreased at a

slower rate and were up 10% in October

slower rate and were up 10% in October

16

Confidential

*Note:

Excludes restructuring, impairment and, as to outlook, potential special

items.

($

in millions)

$5

$0

$3

$(2)

Continuing

to build on Q3 improvement can produce a solid

Q4 and FY ‘09

ADJUSTED

OPERATING INCOME*

(Continuing Operations)

(Continuing Operations)

________________________________________________________________________________

**Q4

outlook provided in this

presentation is intended solely as a restatement of the public outlook provided

by the Company on December 8, 2009 as part of its 3Q earnings release and

conference call. The

reference to Q4 Outlook does not, and is not intended to, either re-confirm or update in any manner that December 8, 2009 publicly provided outlook and does not, and is not intended to, reflect any financial

or operating results of the Company or future expectations of the Company for any period following December 8, 2009. Such prior outlook is subject to the company’s forward looking statement

accompanying its December 8, 2009 earnings release, which is available on the Company’s website under “Investor Relations” at www.thetalbotsinc.com, and is not a guarantee of future performance.

reference to Q4 Outlook does not, and is not intended to, either re-confirm or update in any manner that December 8, 2009 publicly provided outlook and does not, and is not intended to, reflect any financial

or operating results of the Company or future expectations of the Company for any period following December 8, 2009. Such prior outlook is subject to the company’s forward looking statement

accompanying its December 8, 2009 earnings release, which is available on the Company’s website under “Investor Relations” at www.thetalbotsinc.com, and is not a guarantee of future performance.

17

Confidential

OVERVIEW

OF THE COMPREHENSIVE

FINANCING SOLUTION

FINANCING SOLUTION

• Expected to

position the Company for future growth

• Reduces

outstanding indebtedness by approximately $330 million - significant

deleveraging event

deleveraging event

• Restores positive

net worth to the Company

• Provides

sufficient liquidity with longer-dated maturities to manage and grow

the

business

business

• Removes

uncertainty with respect to intentions of majority shareholder

• Delivers control

of the Company’s shares back to public shareholders

• Enhances trading

liquidity and reduces overhang

• Accomplished with

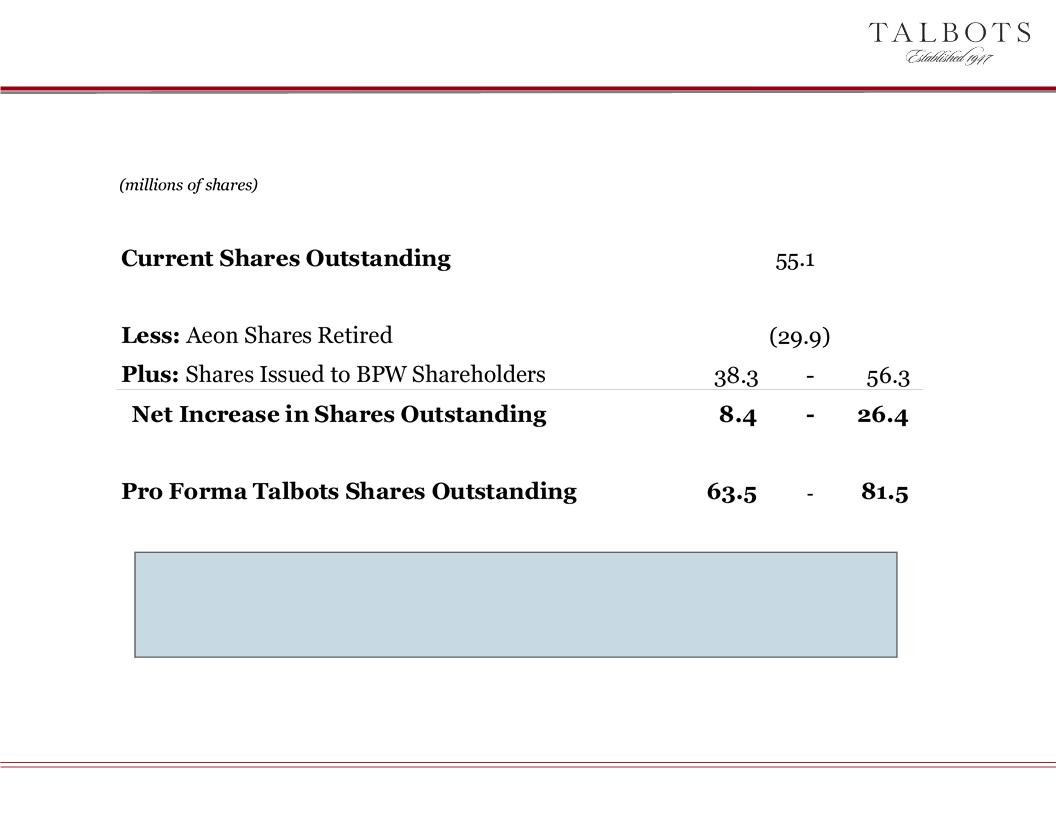

a net increase in outstanding shares of only 8 million to 26

million

– BPW shareholders

will receive a range of 0.9000 to 1.3235 Talbots shares per BPW

share

share

– BPW warrant

holders will receive a mix of Talbots shares and 16-23 million new

Talbots

warrants

warrants

– Aeon’s 29.9

million shares of Talbots to be retired

18

Confidential

• Talbots will

acquire BPW (AMEX: BPW), an acquisition vehicle with $350 million in

cash and liquid securities

cash and liquid securities

• Talbots will issue

between 38 million and 56 million shares to BPW shareholders in

accordance with a floating exchange ratio (with a collar mechanism) based on

Talbots trading price prior to closing

accordance with a floating exchange ratio (with a collar mechanism) based on

Talbots trading price prior to closing

– BPW shareholders

will receive a range of 0.9000 to 1.3235 Talbots shares per

BPW share

BPW share

• 50% of BPW public

warrants (AMEX: BPW/W) to be exchanged for Talbots shares at

ratio equivalent to 10 BPW warrants per 1 BPW share and the remaining 50% to be

exchanged for 16-23 million new Talbots warrants

ratio equivalent to 10 BPW warrants per 1 BPW share and the remaining 50% to be

exchanged for 16-23 million new Talbots warrants

• The sponsor and

directors of BPW will forfeit a total of 1.86 million shares of BPW

common stock and will exchange their BPW warrants for BPW shares at a 10 to 1

ratio

common stock and will exchange their BPW warrants for BPW shares at a 10 to 1

ratio

• Provides Talbots

with $350 million in gross cash proceeds assuming 100%

participation from BPW shareholders

participation from BPW shareholders

BPW

TRANSACTION TERMS

19

Confidential

The

GE Capital Secured Financing Commitment

• GE Capital

Commitment to provide up to $200 million loan facility

secured by a lien on substantially all assets of the Company

secured by a lien on substantially all assets of the Company

– BPW transaction

combined with GE Capital Commitment and cash on

hand provides $550 million gross funds

hand provides $550 million gross funds

Transaction

To Repay Debt And Retire Shares Held By AEON

• Talbots to repay

$491 million of existing indebtedness held by Aeon and

retire Aeon’s 29.9 million shares of Talbots for total cash consideration

of $491 million

retire Aeon’s 29.9 million shares of Talbots for total cash consideration

of $491 million

GE

/ AEON TRANSACTION TERMS

20

Confidential

Outstanding Debt

Reduced by Approximately $330 million

Notes: Assumes

100%

participation of BPW

shareholders and $50 million of transaction expenses

• Reduces leverage

to more normalized levels

• Repositions the

balance sheet going forward - capitalization better supports

business needs

business needs

SIGNIFICANT

DEBT REDUCTION

Current

(Q3

2009)

Pro

Forma For

Transactions

Debt

($MM)

$491

$160

Stockholders'

Equity ($MM)

($191)

$119

Debt/Total Book

Capitalization (%)

164%

57%

21

Confidential

PRO

FORMA OWNERSHIP

%

Talbots Public Shareholders 40% - 31%

% BPW

Shareholders 60% - 69%

PRO

FORMA SHARES OUTSTANDING AND

OWNERSHIP

OWNERSHIP

22

Confidential

INVESTMENT

HIGHLIGHTS

• Highly recognized

women’s apparel brand, 63 year legacy

• Distinct

positioning offers competitive strength

• Strong customer

loyalty

Established

Brand

Multi

Channel

Platform

Platform

Growth

Opportunities

Opportunities

• Allows 24/7

customer access: Retail, Catalog, On-line

• Consistent

customer service and brand experience

• Leverages

merchandising and support functions

• Merchandise

Categories Expansion: Accessories and Woman’s

• Upscale Outlets

offer access to new customers and channels

• Store Segmentation

Initiative

Experienced

Management Team

Management Team

• New leadership has

begun to reenergize and modernize the Company

• Almost all members

of the management team have arrived at Talbots

within the past 2 years

within the past 2 years

• Team has an

average of 23 years experience in the industry

Comprehensive

Financing

Solution

Financing

Solution

• Announced

transactions are expected to better position the Company

for the future

for the future

• Significantly

de-levers the Company’s balance sheet

23

Confidential

Forward

Looking Language

Cautionary

Statement and Certain Risk Factors to Consider

In

addition to the information set forth in this presentation, you should carefully

consider the risk factors and risks and uncertainties included in the

Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, as well as in this presentation.

Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, as well as in this presentation.

This

presentation contains forward-looking information. These statements may be

identified by such forward-looking terminology as “expect,”

“achieve,” “plan,” “look,” “believe,” “anticipate,” “outlook,” “will,” “would,” “should,” “potential” or similar statements or variations of such terms. All

of the information concerning our outlook, future liquidity, future financial performance and results, future credit facilities and availability, future

cash flows and cash needs, and other future financial performance or financial position, as well as our assumptions underlying such information,

constitute forward-looking information. Our forward looking statements are based on a series of expectations, assumptions, estimates and

projections about the Company, are not guarantees of future results or performance, and involve substantial risks and uncertainty, including

assumptions and projections concerning our liquidity, internal plan, regular-price and markdown selling, operating cash flows, and credit

availability for all forward periods. Our business and our forward-looking statements involve substantial known and unknown risks and

uncertainties, including the following risks and uncertainties:

“achieve,” “plan,” “look,” “believe,” “anticipate,” “outlook,” “will,” “would,” “should,” “potential” or similar statements or variations of such terms. All

of the information concerning our outlook, future liquidity, future financial performance and results, future credit facilities and availability, future

cash flows and cash needs, and other future financial performance or financial position, as well as our assumptions underlying such information,

constitute forward-looking information. Our forward looking statements are based on a series of expectations, assumptions, estimates and

projections about the Company, are not guarantees of future results or performance, and involve substantial risks and uncertainty, including

assumptions and projections concerning our liquidity, internal plan, regular-price and markdown selling, operating cash flows, and credit

availability for all forward periods. Our business and our forward-looking statements involve substantial known and unknown risks and

uncertainties, including the following risks and uncertainties:

• our

ability to satisfy the conditions to consummation of the BPW and related

transactions;

• BPW’s

ability to obtain the necessary support of its stockholders to approve the

transactions, including the risk that the exercise of conversion rights

by BPW’s stockholders, together with transaction costs incurred by BPW, may cause the balance of the BPW trust account to fall below the level

necessary to consummate the transaction;

by BPW’s stockholders, together with transaction costs incurred by BPW, may cause the balance of the BPW trust account to fall below the level

necessary to consummate the transaction;

• BPW’s

and our ability to obtain the necessary participation of BPW warrant holders in

the exchange of BPW warrants for Talbots stock or warrants;

• our

ability to satisfy the conditions to the $200 million credit commitment provided

by GE or, failing that, to obtain sufficient alternative financing

on a timely basis;

on a timely basis;

• the

availability of proceeds of the BPW trust account following any exercise by

stockholder of their conversion rights and the incurrence of

transaction expenses;

transaction expenses;

• the

continuing material impact of the deterioration in the U.S. economic environment

over the past two years on our business, continuing operations,

liquidity, financing plans, and financial results, including substantial negative impact on consumer discretionary spending and consumer

confidence, substantial loss of household wealth and savings, the disruption and significant tightening in the U.S. credit and lending markets, and

potential long-term unemployment levels;

liquidity, financing plans, and financial results, including substantial negative impact on consumer discretionary spending and consumer

confidence, substantial loss of household wealth and savings, the disruption and significant tightening in the U.S. credit and lending markets, and

potential long-term unemployment levels;

• our

level of indebtedness and our ability to refinance or otherwise address our

short-term debt maturities, including all Aeon short-term

indebtedness, on the terms or in amounts needed to satisfy these maturities and to address our longer-term maturities, as well as our working

capital, strategic initiatives and other cash requirements;

indebtedness, on the terms or in amounts needed to satisfy these maturities and to address our longer-term maturities, as well as our working

capital, strategic initiatives and other cash requirements;

• any

lack of sufficiency of available cash flows and other internal cash resources to

satisfy all future operating needs and other Company cash

requirements;

requirements;

• satisfaction

of all borrowing conditions under all Aeon credit facilities including no events

of default, accuracy of all representations and warranties,

solvency conditions, absence of material adverse effect or change, and all other borrowing conditions;

solvency conditions, absence of material adverse effect or change, and all other borrowing conditions;

24

Confidential

Forward

Looking Language (continued)

• risk

of any default under our credit facilities;

• our

ability to achieve our 2009 financial plan for operating results, working

capital, liquidity and cash flows;

• risks

associated with the appointment of and transition to a new exclusive global

merchandise buying agent and that the anticipated benefits and cost

savings from this arrangement may not be realized or may take longer to realize than expected, and risk that upon any cessation of the relationship for

any reason we would be able to successfully transition to an internal or other external sourcing function;

savings from this arrangement may not be realized or may take longer to realize than expected, and risk that upon any cessation of the relationship for

any reason we would be able to successfully transition to an internal or other external sourcing function;

• our

ability to continue to purchase merchandise on open account purchase terms at

existing or future expected levels and with extended payment of

accounts payable and risk that suppliers could require earlier or immediate payment or other security due to any payment concern or timing;

accounts payable and risk that suppliers could require earlier or immediate payment or other security due to any payment concern or timing;

• risks

and uncertainties in connection with any need to source merchandise from

alternate vendors;

• any

disruption in our supply of merchandise;

• our

ability to successfully execute, fund, and achieve our supply chain initiatives,

anticipated lower inventory levels, cost reductions, and our other

initiatives;

initiatives;

• the

risk that anticipated benefits from the sale of the J. Jill brand business may

not be realized or may take longer to realize than expected and the

risk

that estimated or anticipated costs, charges and liabilities to settle and complete the transition and exit from and disposal of the J. Jill brand business,

including both retained obligations and contingent risk for assigned obligations, may materially differ from or be materially greater than anticipated;

that estimated or anticipated costs, charges and liabilities to settle and complete the transition and exit from and disposal of the J. Jill brand business,

including both retained obligations and contingent risk for assigned obligations, may materially differ from or be materially greater than anticipated;

• our

ability to accurately estimate and forecast future regular-price and markdown

selling, operating cash flows and other future financial results and

financial position;

financial position;

• the

success and customer acceptance of our merchandise offerings;

• future

store closings and success of and necessary funding for closing underperforming

stores;

• risk

of impairment of goodwill and other intangible and long-lived assets;

and

• the

risk of continued compliance with NYSE continued listing

conditions.

All of

our forward-looking statements are as of the date of this presentation only. In

each case, actual results may differ materially from such forward-

looking information. The Company can give no assurance that such expectations or forward-looking statements will prove to be correct. An occurrence

of or any material adverse change in one or more of the risk factors or risks and uncertainties referred to in this presentation or included in our

periodic reports filed with the Securities and Exchange Commission could materially and adversely affect our continuing operations and our future

financial results, cash flows, prospects, and liquidity. Except as required by law, the Company does not undertake or plan to update or revise any such

forward-looking statements to reflect actual results, changes in plans, assumptions, estimates or projections, or other circumstances affecting such

forward-looking statements occurring after the date of this release, even if such results, changes or circumstances make it clear that any forward-

looking information will not be realized. Any public statements or disclosures by us following this release which modify or impact any of the forward-

looking statements contained in this release will be deemed to modify or supersede such statements in this release.

looking information. The Company can give no assurance that such expectations or forward-looking statements will prove to be correct. An occurrence

of or any material adverse change in one or more of the risk factors or risks and uncertainties referred to in this presentation or included in our

periodic reports filed with the Securities and Exchange Commission could materially and adversely affect our continuing operations and our future

financial results, cash flows, prospects, and liquidity. Except as required by law, the Company does not undertake or plan to update or revise any such

forward-looking statements to reflect actual results, changes in plans, assumptions, estimates or projections, or other circumstances affecting such

forward-looking statements occurring after the date of this release, even if such results, changes or circumstances make it clear that any forward-

looking information will not be realized. Any public statements or disclosures by us following this release which modify or impact any of the forward-

looking statements contained in this release will be deemed to modify or supersede such statements in this release.

25

Confidential

Important

Additional Information

Important

Additional Information and Where to Find It

• On December 23,

2009, Talbots filed with the SEC a Registration Statement on Form S-4

(Registration No. 333-163955)

containing a preliminary Prospectus/Proxy Statement/Information Statement regarding the proposed transaction between

Talbots and BPW. This material is not a substitute for the final Prospectus/Proxy Statement/Information Statement regarding

the proposed transaction. Talbots intends to file a tender offer statement and other documents, as required, with the SEC in

connection with the warrant exchange offer. Investors and security holders are urged to read the preliminary

Prospectus/Proxy Statement/Information Statement, the final Prospectus/Proxy Statement/Information

Statement, the tender offer statement and any other relevant documents filed with the SEC when available

carefully because they contain important information. The final Prospectus/Proxy Statement/Information Statement

will be mailed to stockholders of Talbots and BPW. Investors and security holders will be able to obtain free copies of the

Registration Statement, the final Prospectus/Proxy Statement/Information Statement, the tender offer statement and other

documents filed with the SEC by Talbots and BPW through the web site maintained by the SEC at www.sec.gov. In addition,

investors and security holders will be able to obtain free copies of the Registration Statement, the final Prospectus/Proxy

Statement/Information Statement and the tender offer statement when they become available from Talbots by requesting them

in writing at Investor Relations Department, One Talbots Drive, Hingham, MA 02043, or by telephone at (781) 741-4500. The

documents filed by BPW may also be obtained by requesting them in writing to BPW at BPW Acquisition Corp., Arjay (Richard)

Jensen, SVP at BPW Acquisition Corp., 767 Fifth Avenue, 5th Floor, NY, NY 10153, or by telephone at (212) 287-3310.

containing a preliminary Prospectus/Proxy Statement/Information Statement regarding the proposed transaction between

Talbots and BPW. This material is not a substitute for the final Prospectus/Proxy Statement/Information Statement regarding

the proposed transaction. Talbots intends to file a tender offer statement and other documents, as required, with the SEC in

connection with the warrant exchange offer. Investors and security holders are urged to read the preliminary

Prospectus/Proxy Statement/Information Statement, the final Prospectus/Proxy Statement/Information

Statement, the tender offer statement and any other relevant documents filed with the SEC when available

carefully because they contain important information. The final Prospectus/Proxy Statement/Information Statement

will be mailed to stockholders of Talbots and BPW. Investors and security holders will be able to obtain free copies of the

Registration Statement, the final Prospectus/Proxy Statement/Information Statement, the tender offer statement and other

documents filed with the SEC by Talbots and BPW through the web site maintained by the SEC at www.sec.gov. In addition,

investors and security holders will be able to obtain free copies of the Registration Statement, the final Prospectus/Proxy

Statement/Information Statement and the tender offer statement when they become available from Talbots by requesting them

in writing at Investor Relations Department, One Talbots Drive, Hingham, MA 02043, or by telephone at (781) 741-4500. The

documents filed by BPW may also be obtained by requesting them in writing to BPW at BPW Acquisition Corp., Arjay (Richard)

Jensen, SVP at BPW Acquisition Corp., 767 Fifth Avenue, 5th Floor, NY, NY 10153, or by telephone at (212) 287-3310.

• Talbots, BPW and

certain of their respective directors and executive officers may be deemed to be

participants in the solicitation

of proxies from the security holders of BPW in connection with the proposed transaction between Talbots and BPW. You can

find information regarding Talbots’ directors and executive officers in Talbots’ definitive proxy statement for

its 2009 Annual Meeting of Stockholders, which was filed with the SEC on April 24, 2009. You can find

information regarding BPW’s directors and executive officers in BPW’s Annual Report on Form 10-K for its

fiscal year ended December 31, 2008, which was filed with the SEC on March 30, 2009. These documents can

be obtained free of charge from the sources indicated above. Investors and security holders may obtain additional

information regarding the interests of such participants by reading the final Prospectus/Proxy Statement/Information Statement

when it becomes available.

of proxies from the security holders of BPW in connection with the proposed transaction between Talbots and BPW. You can

find information regarding Talbots’ directors and executive officers in Talbots’ definitive proxy statement for

its 2009 Annual Meeting of Stockholders, which was filed with the SEC on April 24, 2009. You can find

information regarding BPW’s directors and executive officers in BPW’s Annual Report on Form 10-K for its

fiscal year ended December 31, 2008, which was filed with the SEC on March 30, 2009. These documents can

be obtained free of charge from the sources indicated above. Investors and security holders may obtain additional

information regarding the interests of such participants by reading the final Prospectus/Proxy Statement/Information Statement

when it becomes available.

26

Confidential

Additional

Disclosures

|

SEC

Regulation G

|

||||||||||||||||||||||||||||||||

|

THE

TALBOTS, INC. AND SUBSIDIARIES

|

||||||||||||||||||||||||||||||||

|

Reconciliation

of GAAP presentation net income (loss) to non-GAAP net income (loss) from

continuing operations (unaudited)

|

||||||||||||||||||||||||||||||||

|

Amounts

in thousands except per share amounts

|

||||||||||||||||||||||||||||||||

|

For

the 13 weeks ended

January

31, 2009

|

For

the 52 weeks ended

January

31, 2008

|

|

||||||||||||||||||||||||||||||

|

(Loss)

income from continuing operations after taxes

|

$ | (131,313 | ) | $ | (2.45 | ) | $ | (139,521 | ) | $ | (2.61 | ) | ||||||||||||||||||||

|

Impact

of restructuring charges

|

7,645 | 0.14 | 17,793 | 0.33 | ||||||||||||||||||||||||||||

|

Impact

of asset impairments

|

269 | 0.01 | 2,845 | 0.05 | ||||||||||||||||||||||||||||

|

(Loss)

income from continuing operations before restructuring

|

||||||||||||||||||||||||||||||||

|

and

impairment charges after taxes

|

$ | (123,399 | ) | $ | (2.30 | ) | $ | (118,883 | ) | $ | (2.23 | ) | ||||||||||||||||||||

|

For

the 13 weeks ended

May

2, 2009

|

For

the 13 weeks ended

May

3, 2008

|

|

||||||||||||||||||||||||||||||

|

(Loss)

income from continuing operations after taxes

|

$ | (18,818 | ) | $ | (0.35 | ) | $ | 18,506 | $ | 0.35 | ||||||||||||||||||||||

|

Impact

of restructuring charges, net of taxes in 2008

|

6,396 | 0.12 | 3,173 | 0.06 | ||||||||||||||||||||||||||||

|

Impact

of asset impairments, net of taxes in 2008

|

19 | 0.00 | 653 | 0.01 | ||||||||||||||||||||||||||||

|

(Loss)

income from continuing operations before restructuring

|

||||||||||||||||||||||||||||||||

|

and

impairment charges after taxes

|

$ | (12,403 | ) | $ | (0.23 | ) | $ | 22,332 | $ | 0.42 | ||||||||||||||||||||||

|

For

the 13 weeks ended

August

1, 2009

|

For

the 13 weeks ended

August

2, 2008

|

For

the 26 weeks ended

August

1, 2009

|

For

the 26 weeks ended

August

2, 2008

|

|||||||||||||||||||||||||||||

|

Loss

from continuing operations after taxes

|

$ | (20,481 | ) | $ | (0.38 | ) | $ | (11,951 | ) | $ | (0.22 | ) | $ | (39,299 | ) | $ | (0.73 | ) | $ | 6,555 | $ | 0.12 | ||||||||||

|

Impact

of restructuring charges, net of taxes in 2008

|

2,875 | 0.05 | 2,957 | 0.06 | 9,271 | 0.17 | 5,505 | 0.10 | ||||||||||||||||||||||||

|

Impact

of asset impairments, net of taxes in 2008

|

12 | 0.00 | (429 | ) | (0.01 | ) | 31 | 0.00 | 225 | 0.00 | ||||||||||||||||||||||

|

Loss

from continuing operations before restructuring

|

||||||||||||||||||||||||||||||||

|

and

impairment charges after taxes

|

$ | (17,594 | ) | $ | (0.33 | ) | $ | (9,423 | ) | $ | (0.17 | ) | $ | (29,997 | ) | $ | (0.56 | ) | $ | 12,285 | $ | 0.22 | ||||||||||

|

For

the 13 weeks ended

October

31, 2009

|

For

the 13 weeks ended

November

1, 2008

|

For

the 39 weeks ended

October

31, 2009

|

For

the 39 weeks ended

November

1, 2008

|

|||||||||||||||||||||||||||||

|

Loss

from continuing operations after taxes

|

$ | 15,464 | $ | 0.28 | $ | (14,763 | ) | $ | (0.28 | ) | $ | (23,835 | ) | $ | (0.44 | ) | $ | (8,208 | ) | $ | (0.15 | ) | ||||||||||

|

Impact

of restructuring charges, net of taxes in 2008

|

389 | 0.01 | 959 | 0.02 | 9,660 | 0.18 | 6,464 | 0.12 | ||||||||||||||||||||||||

|

Impact

of asset impairments, net of taxes in 2008

|

1,320 | 0.02 | 1,416 | 0.03 | 1,351 | 0.02 | 1,641 | 0.03 | ||||||||||||||||||||||||

|

Loss

from continuing operations before restructuring

|

||||||||||||||||||||||||||||||||

|

and

impairment charges after taxes

|

$ | 17,173 | $ | 0.31 | $ | (12,388 | ) | $ | (0.23 | ) | $ | (12,824 | ) | $ | (0.24 | ) | $ | (103 | ) | $ | - | |||||||||||

27

Confidential

Additional

Disclosures

|

SEC

Regulation G

|

|||||||||

|

THE

TALBOTS, INC. AND SUBSIDIARIES

|

|||||||||

|

Reconciliation

of GAAP presentation operating income (loss) to non-GAAP operating income

(loss) from continuing operations (unaudited)

|

|||||||||

|

Amounts

in thousands except per share amounts

|

|||||||||

|

For

the 13 weeks ended

January

31, 2009

|

For

the 52 weeks ended

January

31, 2009

|

||||||||

|

Operating

(loss) income from continuing operations

|

$ | (100,762 | ) | $ | (98,389 | ) | |||

|

Impact

of restructuring charges

|

7,645 | 17,793 | |||||||

|

Impact

of asset impairments

|

269 | 2,845 | |||||||

|

Operating

(loss) profit from continuing operations, excluding

|

|||||||||

|

restructuring

and impairment charges

|

$ | (92,848 | ) | $ | (77,751 | ) | |||

|

For

the 13 weeks ended

May

2, 2009

|

For

the 13 weeks ended

May

3, 2008

|

||||||||

|

Operating

(loss) income from continuing operations

|

$ | (22,219 | ) | $ | 32,298 | ||||

|

Impact

of restructuring charges

|

6,396 | 4,580 | |||||||

|

Impact

of asset impairments

|

19 | 943 | |||||||

|

Operating

(loss) profit from continuing operations, excluding

|

|||||||||

|

restructuring

and impairment charges

|

$ | (15,804 | ) | $ | 37,821 | ||||

|

For

the 13 weeks ended

August

1, 2009

|

For

the 13 weeks ended

August

2, 2008

|

||||||||

|

Operating

income (loss) from continuing operations

|

$ | (13,365 | ) | $ | (11,650 | ) | |||

|

Impact

of restructuring charges

|

2,875 | 4,063 | |||||||

|

Impact

of asset impairments

|

12 | (590 | ) | ||||||

|

Operating

profit (loss) from continuing operations, excluding

|

|||||||||

|

restructuring

and impairment charges

|

$ | (10,478 | ) | $ | (8,177 | ) | |||

|

For

the 13 weeks ended

October

31, 2009

|

For

the 13 weeks ended

November

1, 2008

|

||||||||

|

Operating

income (loss) from continuing operations

|

$ | 22,375 | $ | (18,275 | ) | ||||

|

Impact

of restructuring charges

|

389 | 1,505 | |||||||

|

Impact

of asset impairments

|

1,320 | 2,223 | |||||||

|

Operating

profit (loss) from continuing operations, excluding

|

|||||||||

|

restructuring

and impairment charges

|

$ | 24,084 | $ | (14,547 | ) | ||||