UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

AMENDMENT

NO. 1 TO FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): March 30, 2009

OPTEX SYSTEMS HOLDINGS,

INC.

(Exact

Name of Registrant as Specified in Charter)

|

Delaware

|

|

333-143215

|

|

33-143215

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(IRS Employer Identification

No.)

|

||

|

1420 Presidential Drive, Richardson,

TX

|

75081-2439

|

|||

|

(Address

of principal executive offices)

|

(Zip

Code)

|

|||

Registrant’s

telephone number, including area code: 972-238-0722

|

Sustut Exploration, Inc. 1420 5th Avenue #220

Seattle, Washington 98101

|

|

(Former name or former address, if changed since

last report)

|

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions:

o Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 DFR 240.14a-12)

o Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

o Pre-commencement

communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR

240.13e-4(c))

ITEM

1.01 Entry into Material Definitive Agreement.

On March

30, 2009, Optex Systems Holdings, Inc. (formerly known as Sustut Exploration,

Inc., and the name was changed on March 26, 2009 pursuant to an amendment to the

Articles of Incorporation, filed with the State of Delaware) entered

into an Agreement and Plan of Reorganization (the “Reorganization Agreement”)

with Optex Systems, Inc., a privately-held Delaware corporation (“Optex Systems

Inc., (Delaware)”).

The

parties closed the transaction on or about March 30, 2009.

Thus, a reorganization occurred whereby

the then existing shareholders of Optex Systems Inc., (Delaware) exchanged their

shares of common stock with the shares of common stock of Optex Systems Holdings

as follows: (i) the outstanding 85,000,000 shares of Optex Systems

Inc., (Delaware) common stock were exchanged by Optex Systems Holdings for

113,333,282 shares of Optex Systems Holdings common stock, (ii) the

outstanding 1,027 shares of Optex Systems Inc., (Delaware) Series A preferred

stock were exchanged by Optex Systems Holdings for 1,027 shares of Optex

Systems Holdings Series A preferred stock and (iii) the 8,131,667 shares of

Optex Systems Inc., (Delaware) common stock purchased in the private placement,

which also occurred on March 30, 2009, were exchanged by Optex Systems Holdings

for 8,131,667 shares of Optex Systems Holdings common stock. The per

share price in the private placement was $0.15 per share of common stock, and

the closing date was March 30, 2009. Optex Systems Inc., (Delaware)

remains a wholly-owned subsidiary of Optex Systems Holdings.

At the

time of the reorganization, 25,000,000 shares owned by Andrey Oks, the former

CEO of Optex Systems Holdings, were cancelled. Immediately prior to

the closing, 17,449,991 shares of Company common stock were outstanding. The

17,449,991 shares derives from the 17,999,995 shares outstanding as

of December 31, 2008 plus the 26,999,996 shares issued

in conjunct with the 2.5:1 forward stock split authorized by

the Sustut Board and shareholders and effected on February 27, 2009 less

retirement of Andrey Oks’ 25,000,000 shares. The total outstanding common

shares of Optex Systems Holdings subsequent to the closing of the reorganization

is as follows:

|

Existing

Sustut Shareholders

|

17,449,991 | |||

|

Optex

Systems Inc., (Delaware) shares exchanged

|

113,333,282 | |||

|

Optex

Systems Inc., (Delaware) Private Placement shares

exchanged

|

8,131,667 | |||

|

Total

Shares after reorganization

|

138,914,940 |

Optex

Systems Holdings, Shareholders and Optex entered into this Agreement which

provides, among other things, that (i) the outstanding 85,000,000 shares of

Optex Common Stock be exchanged by Optex Systems Holdings for 113,333,282 shares

of Optex Systems Holdings Common Stock, (ii) the outstanding 1,027 shares of

Optex Series A Preferred Stock be exchanged by Optex Systems Holdings for 1,027

shares of Optex Systems Holdings Series A Preferred Stock and such additional

items as more fully described in the Agreement and (iii) the 8,131,667 shares of

Optex purchased in the private placement were exchanged by Optex Systems

Holdings for 8,131,667 shares of Optex Systems Holdings Common Stock, as

acknowledged by Optex Systems Holdings. Accordingly, following

closing, Optex will be a wholly-owned subsidiary of the Optex Systems Holdings,

and the Optex Systems Holdings will have a total of approximately 138,914,940

million common stock shares issued and outstanding, of which 17,449,991 million

will be owned by persons who were previously shareholders of the Optex Systems

Holdings and 121,464,949 will be owned by persons who were previously

shareholders of Optex, and/or their nominees. Optex Systems Holdings will also

have 1,027 shares of its Series A Preferred Stock outstanding which will be

owned by persons who were previously creditors of Optex.

In

addition, pursuant to the terms and conditions of the Reorganization Agreement

upon Closing:

|

|

-

|

The

Optex Systems Holdings’ board of directors was reconstituted to consist

initially of Stanley Hirschman, Merrick Okamoto and Ronald

Richards.

|

2

|

|

-

|

All

prior officers of the Optex Systems Holdings resigned and the newly

constituted board of directors appointed Stanley Hirschman as President,

and appointed such other officers as it deemed necessary and in the best

interests of the Optex Systems

Holdings.

|

|

|

-

|

Following closing, the Optex

Systems Holdings shall complete the sale, transfer or other disposition of

its pre-closing business operations, including all assets and liabilities

related to such operations.

|

Item

2.01 Completion of Acquisition or Disposition of Assets .

Information

regarding the principal terms of the reorganization and Optex Systems Holdings

and Optex Systems Inc., (Delaware) are set forth below.

The

Reorganization

Reorganization/Share

Exchange

On March

30, 2009, the reorganization occurred whereby the then existing shareholders of

Optex Systems Inc., (Delaware) exchanged their shares of common stock with the

shares of common stock of Optex Systems Holdings as follows: (i) the outstanding

85,000,000 shares of Optex Systems Inc., (Delaware) common stock were exchanged

by Optex Systems Holdings for 113,333,282 shares of Company common stock, (ii)

the outstanding 1,027 shares of Optex Systems Inc., (Delaware) Series A

preferred stock were exchanged by Optex Systems Holdings for 1,027 shares of

Company Series A preferred stock and (iii) the 8,131,667 shares of Optex Systems

Inc., (Delaware) common stock purchased in the private placement were exchanged

by Optex Systems Holdings for 8,131,667 shares of Company common stock.

Following the reorganization, Optex Systems Inc., (Delaware) remained a

wholly-owned subsidiary of Optex Systems Holdings.

Shares

outstanding of Optex Systems Holdings just prior to the close consisted of

17,449,991 shares of which 1,250,000 shares were issued on March 27, 2009 as

payment for Investor Relations Services, of which 700,000 were surrendered to

Optex Systems Holdings upon termination of one of the Investor Relations

contracts in June 2009. See Note 11 – “Subsequent Events” for a further

discussion of the termination of the relationship with one of Optex

Systems Holdings’ investor relations firms and appointment of a

replacement service provider.

Private

Placement

Prior to

the closing under the reorganization agreement, Optex Systems Inc., (Delaware)

accepted subscriptions from accredited investors for a total 27.1 units, for

$45,000 per unit, with each unit consisting of 300,000 shares of common stock of

Optex Systems Inc., (Delaware) and warrants to purchase 300,000 shares of common

Stock for $0.45 per share for a period of five years from the initial closing,

which were issued by Optex Systems Inc., (Delaware) after the closing referenced

above. Gross proceeds to Optex Systems Inc., (Delaware) were

$1,219,750, and after deducting (i) a cash finder’s fee of $139,555, (ii)

non-cash consideration of indebtedness owed to an investor of $146,250, and

(iii) stock issuance costs of $59,416, the net proceeds were

$874,529. The finder also received five year warrants to purchase

2.39 units, at an exercise price of $49,500 per unit.

Neither

Optex Systems Holdings nor Optex Systems Inc., (Delaware) had any options or

warrants to purchase shares of capital stock outstanding immediately prior to or

following the reorganization, except for 8,941,667 warrants issued in the

private placement. Immediately prior to the closing, Optex Systems Holdings

adopted the 2009 Stock Option Plan providing for the issuance of up to 6,000,000

shares for the purpose of having shares available for the granting of options to

officers, directors, employees and to independent contractors who provide

services. Each share of stock entitles the holder to one vote on

matters brought to a vote of the shareholders.

3

All of

the above equity transactions were made in reliance on Section 4(2) of the

Securities Act, with the exception of the equity sale completed just prior to

the closing of the reorganization agreement, which was exempt from registration

pursuant to Regulation D and for which a Form D was filed by Optex Systems Inc.,

(Delaware) with the Commission on December 16, 2008.

Changes Resulting from the

Reorganization. Registrant’s business is now the business of Optex

Systems Inc., (Delaware).

Optex

Systems Holdings manufactures optical sighting systems and assemblies primarily

for Department of Defense applications. Optical sighting systems are

used to enable a soldier to have improved vision and in some cases, protected

vision. One type of system would be a binocular which would have a

special optical filter applied to the external lens which would block long wave

length light (from a laser) from reaching the soldier’s eyes. Another

type of system would be a periscope where the soldier inside an armored vehicle

needs to view the external environment outside of the tank. In this

case, the visual path is reflected at two 90 degree angles enabling the soldier

to be at a different plane than that of the external lens.

The

following table describes the approximate percentage of revenue represented by

the types of systems mentioned in the third and fourth sentences of the above

paragraph. The table below reflects approximate product revenues and is a

balanced overview of our business based on the percentages.

|

% of Revenue

|

||||

|

Howitzer

Programs

|

11.0 | % | ||

|

Periscope

Programs

|

50.0 | % | ||

|

Sighting

Systems

|

20.0 | % | ||

|

All

Other

|

19.0 | % | ||

|

Total

|

100.0 | % | ||

Optex

Systems Holdings’ products consist primarily of build-to-customer print products

that are delivered both directly to the armed services and to other

defense prime contractors. Build-to-customer print products are

those devices where the customer completes the design of the product and then

brings these drawings to the supplier for production. In this case,

the supplier would procure the piece parts from suppliers, build the final

assembly, and then supply this product back to the original customer who

designed it.

Our

products are installed on a majority of types of U.S. military land vehicles,

such as the Abrams and Bradley fighting vehicles, light armored and armored

security vehicles and have been selected for installation on the Stryker family

of vehicles. Optex Systems Holdings also manufactures and delivers

numerous periscope configurations, rifle and surveillance sights and night

vision optical assemblies. Approximately 30% of our current revenue

is in support of Abrams vehicles, 5% in support of Stryker vehicles, and 25% in

support of Bradley vehicles. The products that we produce can be used

on other vehicles; however, they were originally designed for the Abrams, the

Bradley, and the Stryker vehicles. In addition, some of the periscopes

that we produce can be used on both the Bradley and the Styker vehicle.

Finally, some customers combine their volumes for new vehicles with those

requirements for replacement parts for vehicles coming back from the

field. At this time, no vehicle generates more revenues than the Stryker

vehicle other than the Abrams and Bradley vehicles.

Optex

Systems Inc., (Delaware), and its Predecessor Optex Systems Inc., (Texas), have

been in business since 1987. Optex Systems Holdings is located in

Richardson, TX and is ISO 9001:2008 certified.

Following

completion of the Reorganization, the Company has carried on Optex Systems Inc.,

(Delaware)’s business as its sole line of business. Optex Systems Holdings,

Inc.’s offices are located at 1420 Presidential Drive, Richardson,

TX 75081-2439, and its telephone number is (972) 238-1403.

Changes to the Board of Directors.

In conjunction with closing under the terms of the reorganization

agreement, the number of members of the Company’s board of directors was

increased to three and Stanley Hirschman, Ronald Richards and Merrick Okamoto

were appointed to serve as Directors of the Company and Andrey Oks

resigned. Ronald Richards was appointed as Chairman of the

board of directors.

4

All of

the Company’s directors will hold office until the next annual meeting of the

stockholders or until the election and qualification of their successors. The

Company’s officers are elected by the board of directors and serve at the

discretion of the board of directors.

Name Change and Stock Option

Plan. On or about March 26, 2009, the Registrant’s board of

directors and shareholders approved the change of the Registrant’s name to

“Optex Systems Holdings, Inc.” and approved the 2009 Stock Option

Plan.

2009

Stock Option Plan. The purpose of the Plan is to assist the

Registrant in attracting and retaining highly competent employees and to act as

an incentive in motivating selected officers and other employees of the

Registrant and its subsidiaries, and directors and consultants of the Registrant

and its subsidiaries, to achieve long-term corporate

objectives. There are 6,000,000 shares of common stock reserved for

issuance under this Plan. As of March 31, 2009, the Registrant had

not issued any stock options under this Plan.

BUSINESS

Background

Prior

History - Sustut Exploration, Inc.

Sustut

was a Delaware corporation formed on April 11, 2006 to search for available

properties in north central British Columbia. In May 2006, Sustut entered into

an agreement which was negotiated at arms length with Richard Simpson to acquire

a 100% interest in the WILLOW claim purported to be located in the Omineca

Mining Division, NTS map sheet 94D/10E. The property could have been acquired

from Simpson by paying a total of $75,000 in two option payments with the last

option payment being due on May 15, 2008, however, Sustut did not make the

required payments and did not acquire title to those property

rights.

The

mineral claim which was to be Sustut’s primary business expired on May 15, 2008

leaving Sustut with no operating business of which to dispose. The Company does

not believe it presently maintains any rights related to the Willowvale project

and does not intend to pursue a mining or mineral business. In the event that

Mr. Simpson seeks payment of any amount the Company does not intend to make any

payment to exercise any option or extend the term of the rights, if any continue

to exist.

Reorganization

On March

30, 2009, a reorganization occurred whereby the then existing shareholders of

Optex, Inc., a Delaware corporation (“Optex Systems, Inc. (Delaware)”) exchanged

their shares of Optex Systems, Inc. (Delaware) common stock with the shares of

common stock of Optex Systems Holdings as follows: (i) the

outstanding 85,000,000 shares of Optex Systems, Inc. (Delaware) common stock

were exchanged for 113,333,282 shares of Optex Systems Holdings common stock,

(ii) the outstanding 1,027 shares of Optex Systems, Inc. (Delaware) Series A

preferred stock were exchanged for 1,027 shares of Optex Systems Holdings Series

A preferred stock and (iii) the 8,131,667 shares of Optex Systems, Inc.

(Delaware) common stock purchased in the private placement were exchanged for

8,131,667 shares of Optex Systems Holdings common stock. Optex Systems,

Inc. (Delaware) has remained a wholly-owned subsidiary of Company, and the Optex

Systems, Inc. (Delaware) shareholders are now shareholders of Optex Systems

Holdings. As a result of the reorganization, Sileas Corporation

(“Sileas”) beneficially owns approximately 73.52% of the issued and outstanding

common stock of Optex Systems Holdings and Arland Holdings, Ltd. (“Arland”) owns

5.89% of the issued and outstanding common stock of Optex Systems

Holdings. Furthermore, at the time of the reorganization, Andrey Oks

resigned as the sole officer and director of the Optex Systems

Holdings. Additionally, Stanley Hirschman, Ronald Richards and

Merrick Okamoto were appointed as its Directors, and Stanley Hirschman, Danny

Schoening and Karen Hawkins were appointed as its President, COO and V.P. of

Finance/Controller, respectively.

5

Prior to

the closing under the reorganization agreement, Optex Systems, Inc. (Delaware)

accepted subscriptions from accredited investors for a total 27.1 units, for

$45,000 per unit, with each unit consisting of 300,000 shares of common stock of

Optex Systems, Inc. (Delaware) and warrants to purchase 300,000 shares of common

Stock for $0.45 per share for a period of five years from the initial closing,

which were issued by Optex Systems, Inc. (Delaware) after the closing referenced

above. Gross proceeds to Optex Systems, Inc. (Delaware) were

$1,219,750, and after deducting (i) a cash finder’s fee of $139,555, (ii)

non-cash consideration of indebtedness owed to an investor of $146,250, and

(iii) stock issuance costs of $59,416, the net proceeds were

$874,529. The finder also received five year warrants to purchase

2.39 units, at an exercise price of $49,500 per unit.

Contracts

Each

contract with Optex Systems Holdings’ customers has specific quantities of

material that need to be purchased, assembled, and finally shipped. Prior

to bidding a contract, Optex Systems Holdings contacts potential sources of

material and receives qualified quotations for this material. In some

cases, the entire volume is given to a single supplier and in other cases, the

volume might be split between several suppliers. If a contract has a

single source supplier and that supplier fails to meet their obligations (e.g.,

quality, delivery), then Optex Systems Holdings would attempt to find an

acceptable alternate supplier. Contractual deliverables would then be

re-negotiated (e.g., specifications, delivery, price.).

Currently, approximately 28% of our total material requirements are single

sourced across 21 suppliers representing approximately 20% of our active

supplier base. Single sourced component requirements span across all of

our major product lines. Of these single sourced components, we have

material contracts (purchase orders) with firm pricing and delivery schedules in

place with each of the suppliers to supply the parts necessary to satisfy our

current contractual needs.

We are

subject to, and must comply ,with various governmental regulations that impact,

among other things, our revenue, operating costs, profit margins and the

internal organization and operation of our business. The most significant

regulations affecting our U.S. government business are summarized in the table

below:

|

Regulation

|

Summary

|

|

|

Federal

Acquisition Regulation

|

The

principal set of rules in the Federal Acquisition Regulation System. This

system consists of sets of regulations issued by agencies of the Federal

government of the United States to govern what is called the "acquisition

process," which is the process through which the government purchases

("acquires") goods and services. That process consists of three phases:

(1) need recognition and acquisition planning, (2) contract formation, and

(3) contract administration. The Federal Acquisition Regulation System

regulates the activities of government personnel in carrying out that

process. It does not regulate the purchasing activities of private sector

firms, except to the extent that parts of it are incorporated into

government solicitations and contracts by reference.

|

|

|

International

Traffic in Arms Regulations

|

United

States government regulations that control the export and import of

defense-related articles and services on the United States Munitions

List. These regulations implement the provisions of the Arms

Export Control Act.

|

|

|

Truth

in Negotiations Act

|

A

public law enacted for the purpose of providing for full and fair

disclosure by contractors in the conduct of negotiations with the

Government. The most significant provision included is the requirement

that contractors submit certified cost and pricing data for negotiated

procurements above a defined threshold, currently

$650,000. Requires contractors to provide the Government with

an extremely broad range of cost or pricing information relevant to the

expected costs of contract performance. Requires contractors

and subcontractors to submit cost or pricing data to Government and to

certify that, to the best of their knowledge and belief, the data are

current, accurate, and

complete.

|

6

Optex

Systems Holdings is responsible for full compliance with the Federal Acquisition

Regulation. Upon award, the contract may identify certain regulations that Optex

Systems Holdings needs to meet. For example, a contract may allow

progress billing pursuant to specific Federal Acquisition Regulation clauses

incorporated into the contract. Other contracts may call for specific

first article acceptance and testing requirements. The Federal Acquisition

Regulation will identify the specific regulations that Optex Systems

Holdings must follow based on the type of contract awarded. The Federal

Acquisition Regulation also contains guidelines and regulations for managing a

contract after award, including conditions under which contracts may be

terminated, in whole or in part, at the government’s convenience or for default.

These regulations also subject us to financial audits and other reviews by the

government of our costs, performance, accounting and general business practices

relating to our government contracts, which may result in adjustment of our

contract-related costs and fees and, among other things and impose accounting

rules that define allowable and unallowable costs governing our right to

reimbursement under certain contracts. The full text of the Federal Acquisition

Regulation System is located at the Library of Congress.

First

Article Testing and Acceptance requirements are defined under the Federal

Acquisitions Regulation, Part 9 – Contractor Qualification, Subpart 9.3 – First

Article Testing and Approval. For example, first article testing on a Howitzer

type product is very comprehensive and very time consuming. Each piece part of

the assembly requires each dimension and material specification to be verified,

and each product has in excess of 100 piece parts. Once the individual piece

parts are verified to be compliant to the specification, the assembly processes

are documented and verified. A sample of the production (typically 3 units) is

verified to meet final performance specifications. Once the units meet the final

performance specification, they are then exposed to a series of tests which

simulate the lifetime use of the product in the field. This consists of exposing

the units to thermal extremes, humidity, mechanical shock, vibration, and other

physical exposure tests. Once completed, the units undergo a final verification

that no damage has occurred as a result of the testing and that they continue to

meet the performance specification. All of the information and data is recorded

into a final first article inspection and test report and submitted to the

customer along with the test units for final approval. First Article Acceptance

and Testing is generally required on new contracts/product awards but may also

be required on existing products or contracts where there has been a significant

gap in production, or where the product has undergone significant manufacturing

process, material, tooling, equipment or product configuration

changes.

Optex

Systems Holdings, Inc. is also subject to laws, regulations and executive orders

restricting the use and dissemination of information classified for national

security purposes and the exportation of certain products and technical data as

covered by the International Traffic in Arms Regulation. In order to import or

export items listed on the U.S. Munitions List, we are required to be

registered with the Directorate of Defense Trade Controls office. The

registration is valid for 1 year and the registration fees are established based

on the number of license applications submitted the previous year.

Optex Systems Holdings currently has an approved and current registration on

file with the Directorate of Defense Trade Controls office. Once the

registration is approved, each import/export license must be filed separately.

License approval requires the company to provide proof of need, such as a valid

contract or purchase order requirement for the specific product or technical

data requested on the license and requires a detailed listing of the items

requested for export/import, the end-user, the end-user statement, the value of

the items, consignees/freight forwarders and a copy of a valid contract or

purchase order from the end-user. The approval process for the license can vary

from several weeks to six months or more. The licenses Optex Systems Holdings

currently uses are the DSP-5 (permanent export) and DSP-73 (temporary

export). The aforementioned licenses are all valid for 48 months from date

of issue. Optex Systems Holdings currently has 7 active DSP-5’s and 4

active DSP-73’s. Licenses are subject to termination if a licensee is

found to be in violation of the Arms Export Control Act or the International

Traffic in Arms Regulations requirements. If a licensee is found to be in

violation, in addition to a termination of its licenses, it can be subject to

fines and penalties by the government.

7

Optex

Systems Holdings’ contracts may also be governed by the Truth in Negotiation Act

requirements where certain of our contracts or proposals exceed the $650,000

threshold and/or are deemed as sole source, or non competitive awards, covered

under this Act. These contracts require that Optex Systems Holdings provide a

vast array of cost and pricing data in addition to certification that our

pricing data and disclosure materials are current, accurate and complete upon

conclusion of the negotiation. Due to the additional disclosure and

certification requirements, if a post contract award audit were to uncover that

the pricing data provided was in any way not current accurate or complete as of

the certification date, Optex could be subjected to a defective pricing claim

adjustment with accrued interest. Currently, Optex does not have any pending

claims as a result of defective pricing as a result of these covered contracts.

Additionally, as a result of this requirement, contract price negotiations may

span from two to six months and will often result in undefinitized or not to

exceed ceiling priced contracts subject to future downward negotiations and

price adjustments. Currently, Optex Systems Holdings does not have any

undefinitized contracts subject to further price negotiation.

Our

failure to comply with applicable regulations, rules and approvals or misconduct

by any of our employees could result in the imposition of fines and penalties,

the loss of security clearances, the loss of our U.S. government contracts or

our suspension or debarment from contracting with the U.S. government generally,

any of which could have a material adverse effect our business, financial

condition, results of operations and cash flows. We are currently in compliance

with all applicable regulations and do not have any pending claims as a result

of non compliance.

The

material terms of our five largest contracts are as follows:

|

|

Contract Quantities

|

|||||||||||||||||||||

|

Customer

|

Customer

PO/Contract

|

Contract Type

|

Min Qty

|

Max Qty

|

Total Award

Value

|

Progress

Billable

(1)

|

Order Period

Expiration

|

Delivery Period

|

||||||||||||||

|

General

Dynamics

Land

Systems

|

PCL860000 thru

PCL860005 (Multiple

Prime Contracts)

|

1

year blanket order with Fixed Qty Contract release which includes ability

to in crease or decrease quantity on each release up to 20% from PO

release quantity.

|

N/A | N/A | $ | 14,813,100 |

Yes

|

Expired

|

Dec 2007 - Jan 2011

|

|||||||||||||

|

Tank-automotive

and Armaments Command - ROCK ISLAND

|

W52H09-05-D-0260 |

5

Year Firm Fixed Price (3)

|

138 | 2,100 | $ | 7,261,716 |

Yes

|

30-Jun-2010

|

Oct

2007-Jan 2011

|

|||||||||||||

|

Tank-automotive

and Armaments Command - ROCK ISLAND

|

W52H09-05-D-0248 |

5

Year Firm Fixed Price (3)

|

138 | 1,250 | $ | 5,006,119 |

Yes

|

30-Jun-2010

|

Apr

2007- Jul 2010

|

|||||||||||||

|

Tank-automotive

and Armaments Command - ROCK ISLAND

|

W52H09-09-D-0128 |

3 Yr

– Evaluated Pricing (3). Restricted Procurement between Optex

Systems & Miller Holzwarth

|

250

each supplier

|

250

each supplier

|

$ | 118,250 | (2) |

Yes

|

31-Dec-2011

|

Initial

award deliverable Aug - Sept 2009. Additional awards not to

exceed aggregate 2000 units per month total units.

|

||||||||||||

|

General

Dynamics Land Systems

|

40050551

(Multiple Prime Contracts)

|

Firm

Fixed Price and Fixed

Quantity

Purchase Order

|

N/A | N/A | $ | 5,380,137 |

Yes

|

N/A

|

Jan

2011 - Feb

2013

|

|||||||||||||

|

(1)

|

Payment terms on shipments are

all net 30 days.

|

|

(2)

|

Only first delivery order

awarded. Maximum order value potential of up to $22 million

with expected award value of $7.5 million. We estimate the maximum order

potential at $22 million based on the government’s estimated maximum order

quantity for each periscope type times the Optex not to exceed price per

unit for each of the solicited periscope assemblies. The $7.5

million expected value is derived based on the governments estimated

quantity requirement for each periscope type across the contract period

times Optex proposed not to exceed price per unit, assuming that the award

is split equally between Optex and the other

supplier.

|

|

(3)

|

Indefinite

Delivery/Indefinite Quantity type

contract.

|

8

Organizational

History

On

October 14, 2008, in a transaction that was consummated via public auction,

Optex Systems Inc., (Delaware) (Successor) purchased all of the assets of Optex

Systems Inc., (Texas) (Predecessor) in exchange for $15 million of Irvine

Sensors Corporation debt and the assumption of approximately $3.8 million of

certain liabilities of Optex Systems Inc., (Texas). Optex Systems

Inc., (Delaware) was formed by the Longview Fund, LP and Alpha Capital Antstalt,

former secured creditors of Irvine Sensors Corporation, to consummate the

transaction with Optex Systems Holdings, and subsequently, on February 20, 2009,

Longview Fund conveyed its ownership interest in Optex Systems Holdings to

Sileas, an entity owned by three of Optex Systems Holdings’ officers

(one of whom is also one of Optex Systems Holdings’ three

directors). On March 30, 2009, a reorganization occurred whereby

Optex Systems Inc., (Delaware) became a wholly-owned subsidiary of Optex Systems

Holdings.

Products

The

Company’s products are installed on a majority of types of U.S. military land

vehicles, such as the Abrams and Bradley fighting vehicles, light armored and

advanced security vehicles and have been selected for installation on the Future

Combat Systems (FCS) Stryker vehicle. Optex Systems Holdings also manufactures

and delivers numerous periscope configurations, rifle and surveillance sights

and night vision optical assemblies. Optex Systems Holdings delivers its

products both directly to the military services and to prime

contractors.

Optex

Systems Holdings delivers high volume products, under multi-year contracts, to

large defense contractors and government customers. Optex Systems Holdings has a

reputation for quality and credibility with its customers as a strategic

supplier. Optex Systems Holdings also anticipates the opportunity to integrate

some of its night vision and optical sights products into commercial

applications.

Specific

product lines include:

|

·

|

Electronic

sighting systems

|

|

·

|

Mechanical

sighting systems

|

|

·

|

Laser

protected glass periscopes

|

|

·

|

Laser

protected plastic periscopes

|

|

·

|

Non-laser

protected plastic periscopes

|

|

·

|

Howitzer

sighting systems

|

|

·

|

Ship

binoculars

|

|

·

|

Replacement

optics (e.g. filters, mirrors)

|

9

Location and

Facility

We

are located in Richardson, TX in a 49,000 square foot facility and

currently has 107 full time employees. We operate with a single shift, and

capacity could be expanded by adding a second shift. Our proprietary

processes and methodologies provide barriers to entry by other competing

suppliers. In many cases, we are the sole source provider or one of

only two providers of a product. We have capabilities which

include machining, bonding, painting, tracking, engraving and assembly and can

perform both optical and environmental testing in-house. We lease our

facility, and the lease currently expires on February 28, 2010. We

are presently in negotiations with the landlord regarding a lease extension,

and we are also exploring the possibility of moving to another

location. Mixed use space, such as that leased by us (which is

approximately 25% office space and 75% manufacturing space, in the case of us),

is readily available in our general geographic area. (See subsequent events

in Note 9 of Financial Statements)

Prior Operational/Financial

Challenges; Recovery; and Future Growth Potential

While

Optex Systems Inc., (Texas) (Predecessor) was a wholly-owned subsidiary of

Irvine Sensors Corporation, Irvine Sensors Corporation faced certain business

challenges and utilized the cash flow from Optex Systems Inc., (Texas) to meet

its own funding needs. This left Optex Systems Inc., (Texas) with

limited working capital to satisfy its own operating needs.

As of the

year ended September 28, 2008, Optex Systems Inc., (Texas) (Predecessor)

reported $4.3 million of liabilities attributable to corporate expenses

allocated to Optex Systems Inc., (Texas) (Predecessor) through an

intercompany payable account “Due to Parent”. These costs were for expenses

incurred by Irvine Sensors Corporation on behalf of Optex Systems Inc., (Texas),

including legal, audit, and consulting fees; insurance costs; and significant

amounts of Irvine Sensors Corporation general overhead allocated to Optex

Systems Inc., (Texas). The outstanding “Due to Parent” balance was not acquired

by the company as part of the October 14, 2008 transaction. Therefore, this

balance will have no impact on future operating results or liquidity. We

anticipate incurring similar expenses for fiscal year 2009 as

follows:

|

Accounting

& Auditing Fees

|

$ | 250,000 | ||

|

Legal

Fees

|

60,000 | |||

|

Consulting

Fees

|

60,000 | |||

|

Workers

Comp & General Insurance

|

70,000 | |||

|

Total

|

$ | 440,000 |

As a

result of the purchase of Optex Systems, Inc. (Texas) on October 14, 2008,

these general and administrative costs are incurred and paid directly by Optex

Systems, Inc. (Delaware) for the 2009 fiscal year, and have been reflected in

the financial statements to the extent incurred through December 28,

2008.

Since the

buyout, the business outlook for Optex Systems Holdings has changed

dramatically. Management has strengthened Optex

Systems Holdings’ balance sheet and has increased operational

efficiencies and productivity, as demonstrated by the significant $1.45 million

reduction in operating loss to $(15,193) versus $(1,468,192) for the total for

the periods September 29, 2008 through October 14, 2008 (Predecessor) and

October 15, 2008 through June 28, 2009 (Successor) and the nine

months ended June 28, 2008 (Predecessor), respectively. Management

expects to achieve additional improvement in operations over time.

Virtually

all of our contracts are prime or subcontracted directly with the Federal

government and are subject to Federal Acquisition

Regulation Subpart 49.5, “Contract Termination Clauses” and more

specifically Federal Acquisition Regulation clauses

52.249-2 “Termination for Convenience of the Government

(Fixed-Price)”, and 49.504 “Termination of fixed-price contracts for

default”. These clauses are standard clauses on our prime military

contracts and are generally “flowed down” to us as subcontractors on other

military business. It has been our experience that the termination for

convenience is rarely invoked, except where it has been mutually beneficial for

both parties. We are currently not aware of any pending terminations for

convenience or default on our existing contracts.

10

In the

event a termination for convenience were to occur, these Federal Acquisition

Regulation clause 52.249-2 provides for full recovery of all contractual

costs and profits reasonably occurred up to and as a result of the terminated

contract. In the event a termination for default were to occur, we

could be liable for any excess cost incurred by the government to acquire

replacement supplies from another supplier. We would not be liable

for any excess costs if the failure to perform the contract arises from causes

beyond the control and without the fault or negligence of the company as defined

by Federal Acquisition Regulation clause 52.249-8. In addition,

the U.S. government may require us to transfer title and deliver to it any

completed supplies, partially completed supplies and materials, parts, tools,

dies, jigs, fixtures, plans, drawings, information, and contract rights that we

specifically produced or acquired for the terminated portion of this

contract. The U.S. government is required to pay contract price for

completed supplies delivered and accepted, and the parties are required to

negotiate an agreed upon amount of payment for manufacturing materials delivered

and accepted and for the protection and preservation of the property. Failure to

agree on an amount for manufacturing materials is subject to the Federal

Acquisition Regulation Disputes clause 52.233-1.

In some

cases, we may receive orders subject to subsequent price negotiation on

contracts exceeding the $650,000 federal government simplified acquisition

threshold. These “undefinitized” contracts are considered firm contracts,

but as Cost Accounting Standards Board covered contracts, they are subject to

the Truth in Negotiations Act disclosure requirements and downward-only price

negotiation. As of September 28, 2008 and September 30, 2007,

approximately $4.0 million and $10.0 million of booked orders fell under this

criterion, respectively. As of December 28, 2008 there were $5.0 million

booked orders that fell under this criterion. Our experience has been that the

historically negotiated price differentials have been immaterial and we do not

anticipate any significant downward adjustments on these booked

orders.

We are

currently bidding on several substantial government contracts to expand sales

and production beyond the current production and backlog. We

are also exploring possibilities to adapt some of our products for

commercial use in those markets that demonstrate potential for solid revenue

growth.

Market Opportunity – U.S.

Military

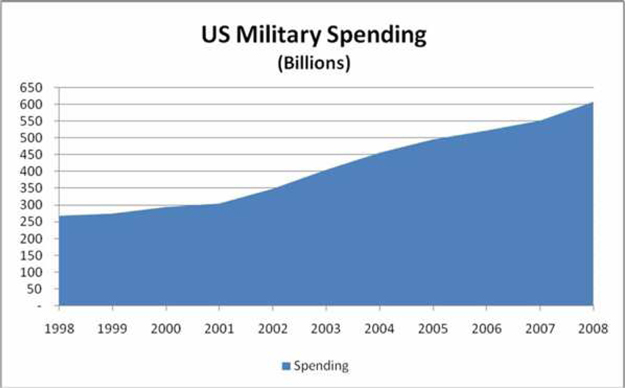

Our

products are currently marketed to the military and related government

markets. Since 1998, annual U.S. military spending has increased over

225% to over $600 billion. The trend of significant growth in government

spending on the military and defense is very positive for Optex Systems Holdings

and others in the defense industry sector. The data suggests that the

market continues to be robust and Optex Systems Holdings believes the markets

for new and replacement parts, such as those manufactured by Optex Systems

Holdings, are significant.

The chart

below was derived from public government spending sources and depicts total U.S.

Military Spending from 1998 through 2008. Total military spending

increased from $268.2 billion in 1998 to $607.3 billion in 2008 representing a

total increase in military spending of 226% in the last 10 years. It

is difficult to directly tie this spending to any specific military vehicles;

however, Optex Systems Holdings serves the U.S. armed forces and state national

guards. The purpose of including this chart is to provide the reader

with trend data showing increased military spending by the government since

1998, which is a favorable trend for Optex Systems Holdings’ overall

business.

Source:

Government Printing Office, U.S. Budget Historical Tables, FY 2008, Table 3.2

Outlays by function and subfunction, 1962-2012

The

following factors are important to the U.S. military:

|

·

|

Reliability

– failure can cost lives

|

|

|

·

|

Time

delivery to schedule

|

11

|

·

|

Cost

effectiveness

|

|

·

|

Armed

forces need to be able to see to

perform

|

|

·

|

Mission

critical products.

|

Optex

Systems Holdings focuses on delivering products that satisfy these factors and

believes it is well positioned to continue to service U.S. military

needs.

Market Opportunity –

Commercial

Optex

Systems Holdings’ products are currently sold exclusively to military and

related government markets. We believe there may be opportunities to

commercialize various products we presently manufacture to address other

markets. Our initial focus will be directed in three product

areas.

|

·

|

Big

Eye Binoculars – While the military application we produce is based on

mature military designs, Optex Systems Holdings owns all castings, tooling

and glass technology. These large fixed mount binoculars could

be sold to Cruise Ships, Personal Yachts and

Cities/Municipalities.

|

|

·

|

Night

Vision Sight – Optex Systems Holdings manufactured the Optical System

for the NL-61 Night Vision Sight for the Ministry of Defense of

Israel. This technology is based on the I Squared design and could be

implemented for commercial

applications.

|

|

·

|

Infrared

Imaging Equipment – Optex Systems Holdings manufactures and assembles

Infrared Imaging Equipment for Textron and components for Raytheon’s

Thermal Imaging M36 Mount product. This equipment and technology has

potential to be assembled for border patrol, police and security

agencies.

|

Customer

Base

Optex

Systems Holdings serves customers in three primary categories: as prime

contractor (Tank-automotive and Armaments Command , U.S. Army, Navy and Marine

Corps), as subcontractor (General Dynamics, BAE, Raytheon and Northrop) and also

as a supplier to foreign governments Israel, Australia and

NAMSA). For reference, TACOM is Tank-automotive and Armaments

Command, and NAMSA is the NATO Maintenance and Supply Agency, which is the main

logistics agency of NATO. Although we do serve all three of these

categories, at present, approximately 93% of the gross revenue from our business

is derived from two customers, General Dynamics Land System Division and

Tank-automotive and Armaments Command , with which we have approximately 50

discrete contracts that are utilized in vehicles, product lines and spare

parts. Given the size of General Dynamics Land System Division and

Tank-automotive and Armaments Command as well as the fact that the contracts are

not interdependent, we are of the opinion that this provides us with a fairly

well diversified revenue pool.

12

Marketing

Plan

Potential

Entrants – Low. In order to enter this market, potential competitors

must overcome several barriers to entry. The first hurdle is that an

entrant would need to prove the existence of a government approved accounting

systems for larger contracts. Second, the entrant would need to

develop the processes required to produce the product. Third, the

entrant would then need to produce the product and then submit successful test

requirements (many of which require lengthy government consultation for

completion). Finally, in many cases the customer has an immediate

need and therefore cannot wait for this qualification cycle and therefore must

issue the contracts to existing suppliers.

Buyers –

Medium. In most cases the buyers have two fairly strong

suppliers. It is in their best interest to keep at least two, and

therefore in some cases the contracts are split between suppliers. In

the case of larger contracts, the customer can request an open book policy on

costs and expects a reasonable margin to have been applied.

Substitutes

– Low. Optex Systems Holdings has both new vehicle contracts and

replacement part contracts for the exact same product. The US

Government has declared that the Abrams/Bradley base vehicles will be the ground

vehicle of choice out through 2040. The Bradley vehicle has been in

service for 28 years, the Abrams for 27 years. Therefore it appears that

the systems are capable of a life of approximately 30 years. In

February 2008, the Army signed a 5 year multi-year contract for the delivery of

improved Abrams and Bradleys. The contract is for up to 435 tanks and 540

Bradley vehicles. These are the only production tanks currently being

procured by the government. This in conjunction with the 30 year life span

supports their continued use through 2040. There are no replacement

systems being proposed or funded at this time. The Abrams is the principal

battle tank of the United States Army and Marine Corps, and the armies of Egypt,

Kuwait, Saudi Arabia, and since 2007, Australia. The new contract terms

allow efficiencies within the supply chain and a very long return on investment

on new vehicle proposals.

Suppliers

– Low to Medium. The suppliers of standard processes (e.g.: casting, machining,

plating) have very little power. Given the current state of the economy, they

need to be very competitive to gain and /or maintain contracts. Those suppliers

of products that use Top Secret Clearance processes are slightly better off;

however, there continues to be multiple avenues of supply and therefore moderate

power.

Industry

Competitors – Low. The current suppliers have been partitioned according to

their processes and the products. Optex Systems Holdings and Miller-Holzwarth,

Inc. both compete for plastic periscope products whereas Optex Systems Holdings

and Seiler Instrument & Manufacturing Co., Inc., have competed on the higher

level products. In the last 12-18 months, we have begun to challenge Seiler in

areas where they have long held the dominant role. For example, while the

existing Howitzer contracts are at low margins, the new bids will be at a much

higher margin now that we have proven we can produce the

product.

13

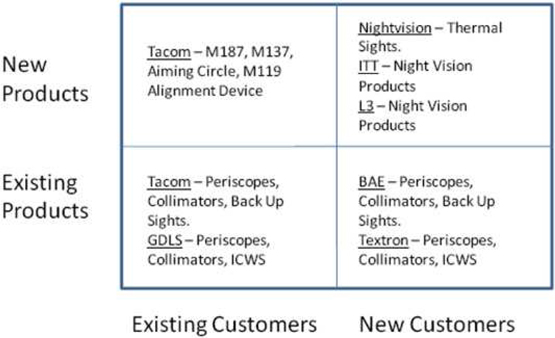

The

second model is a two by two matrix for Products and Customers.

This

Product/Customer matrix sets forth our four basic approaches:

|

1)

|

Sell

existing products to existing

customers.

|

|

2)

|

Sell

existing products to new customers.

|

|

3)

|

Develop

new products to meet the needs of our existing

customers.

|

|

|

4)

|

Develop

new products to meet the needs of new

customers.

|

The

product categories described in the above matrix are associated with the product

lines set forth below:

|

Name

|

Product Line

|

|

|

M137,

M187, M119 Aiming Device

|

Howitzer

Sighting Systems

|

|

|

Aiming

Circle

|

Howitzer

Sighting Systems

|

|

|

Periscopes

|

Laser

Protected Plastic Periscopes

|

|

|

Collimators

|

Electronic

Sighting Systems

|

|

|

Back

Up Sights

|

Mechanical

Sighting Systems

|

|

|

ICWS

|

Laser

Protected Glass Periscopes

|

Those

“new customers” listed (BAE and Textron) are producers of armored

vehicles. Optex Systems Holdings has provided them quotations for

Laser Protected Plastic Periscopes and Mechanical Sighting

Systems. Both of these companies have previously purchased products

from Optex Systems Holdings. “New Customers” listed (L3 and ITT) are

potential customers for night vision products.

Operations

Plan

Our

Operations Plan can be broken down into three distinct areas, Material

Management, Manufacturing Space Planning and Efficient Scales of

Economy.

Materials

Management –

The

largest portion of our costs are materials. We have completed the

following activities in order to demonstrate continuous

improvement:

|

-

|

Successful

Completion of ISO9001:2008

Certification

|

|

-

|

Weekly

Cycle Counts on Inventory Items

|

|

-

|

Weekly

Material Review Board Meeting on non-moving piece

parts

|

|

-

|

Kanban

kitting on products with consistent ship weekly ship

quantities

|

|

-

|

Daily

review of Yields and Product

Velocity

|

|

-

|

Bill

of Material Reviews prior to Work Order

Release

|

14

Future

continuous improvement opportunities include installation and training of Shop

Floor Control module within the ERP system and organizational efficiencies of

common procurement techniques among buyers.

Manufacturing

Space Planning –

We

currently lease approximately 49,000 square feet of manufacturing

space. Given the ample building opportunities along with competitive

lease rates, the objective is to maintain building and building-related costs

consistent with prior historical norms on a percentage of sales

basis.

Consistent

with the space planning, we will drive economies of scale to reduce support

costs on a percentage of sales perspective. These cost reductions can

then be either brought directly to the bottom line or used for business

investment.

This

process is driven by the use of six sigma techniques and process

standardization. Initial activities in this area have been the

success of 5S projects in several production areas which has lead to improved

output and customer approval on the aesthetics of the work

environment. In addition to the 5S projects, we have used the Define,

Measure, Analyze, Improve, Control Problem Solving technique to identify

bottlenecks within the process flow and improve product yields. These

successful techniques can then be duplicated across the production floor and

drive operational improvements.

Intellectual

Property

We

utilize several highly specialized and unique processes in the manufacture of

our products. While we believe that these trade secrets have value,

it is probable that our future success will depend primarily on the innovation,

technical expertise, manufacturing and marketing abilities of our personnel. We

cannot assure you that we will be able to maintain the confidentiality of our

trade secrets or that our non-disclosure agreements will provide meaningful

protection of our trade secrets, know-how or other proprietary information in

the event of any unauthorized use, misappropriation or other

disclosure. The confidentiality agreements that are designed to

protect our trade secrets could be breached, and we might not have adequate

remedies for the breach. Additionally, our trade secrets and

proprietary know-how might otherwise become known or be independently discovered

by others. We do not possess any patents.

Our

competitors, many of which have substantially greater resources, may have

applied for or obtained, or may in the future apply for and obtain, patents that

will prevent, limit or interfere with our ability to make and sell some of our

products. Although we believe that our products do not infringe on the patents

or other proprietary rights of third parties, we cannot assure you that third

parties will not assert infringement claims against us or that such claims will

not be successful.

Competition

The

markets for our products are competitive. We compete primarily on the basis of

our ability to design and engineer products to meet performance specifications

set by our customers. Our customers include the military and government end

users as well as prime contractors that purchase component parts or

subassemblies, which they incorporate into their end

products. Product pricing, quality, customer support, experience,

reputation and financial stability are also important competitive

factors.

There are

a limited number of competitors in each of the markets for the various types of

products that we design, manufacture and sell. At this time we consider our

primary competitors to be Seiler Instruments, Miller-Holzwarth, Kent Periscopes,

and EO System Co.

Our

competitors are often well entrenched, particularly in the defense markets. Some

of these competitors have substantially greater resources than we do. While we

believe that the quality of our technologies and product offerings provides us

with a competitive advantage over certain manufacturers, some of our competitors

have significantly more financial and other resources than we do to spend on the

research and development of their technologies and for funding the construction

and operation of commercial scale plants.

15

We expect

our competitors to continue to improve the design and performance of their

products. We cannot assure investors that our competitors will not develop

enhancements to, or future generations of, competitive products that will offer

superior price or performance features, or that new technology or processes will

not emerge that render our products less competitive or obsolete. Increased

competitive pressure could lead to lower prices for our products, thereby

adversely affecting our business, financial condition and results of operations.

Also, competitive pressures may force us to implement new technologies at a

substantial cost, and we may not be able to successfully develop or expend the

financial resources necessary to acquire new technology. We cannot assure you

that we will be able to compete successfully in the future.

External Growth

Potential/Roll-Up Opportunities

We

operate in a business environment which is highly fragmented with numerous

private companies, many of which were established more than 20 years ago. We

believe there may be opportunities to pursue mergers with these competitors. We

are not aware of any previous attempts to consolidate companies with our defense

manufacturing expertise.

The

typical company we compete with has 50-100 employees and annual revenue of

$20-$50 million dollars. Most of these private companies have never had the

opportunity to enjoy the benefits of consolidation and the resulting economies

of scale associated with a larger entity.

We plan

to engage our competition on a selective basis, and to explore all opportunities

to grow our operations through mergers and/or acquisitions. We have no

acquisition agreements pending at this time and are not currently in discussions

or negotiations with any third parties.

Employees

Optex

Systems Holdings has 107 full time equivalent employees. Optex Systems

Holdings uses a small temporary work force to handle peak loads. The

full time employee count is 101 and the temporary employee head count is

6. To the best of its knowledge, Optex Systems Holdings is compliant

with local prevailing wage, contractor licensing and insurance regulations, and

has good relations with its employees.

Forward-Looking

Statements

This

Current Report on Form 8-K contains forward-looking statements. To the extent

that any statements made in this Current Report on Form 8-K contain information

that is not historical, these statements are essentially forward-looking.

Forward-looking statements can be identified by the use of words such as

“expects,” “plans,” “will,” “may,” “anticipates,” believes,” “should,”

“intends,” “estimates,” and other words of similar meaning. These statements are

subject to risks and uncertainties that cannot be predicted or quantified and,

consequently, actual results may differ materially from those expressed or

implied by such forward-looking statements. Such risks and uncertainties are

outlined in “Risk Factors” and include, without limitation, the Company’s

ability to raise additional capital to finance the Company’s activities; the

effectiveness, profitability, and the marketability of its products; legal and

regulatory risks associated with the Reorganization ; the future trading of the

common stock of the Company; the ability of the Company to operate as a public

company; the period of time for which the proceeds of the Private Placement will

enable the Company to fund its operations; the Company’s ability to protect its

proprietary information; general economic and business conditions; the

volatility of the Company’s operating results and financial condition; the

Company’s ability to attract or retain qualified senior management personnel and

research and development staff; and other risks detailed from time to time in

the Company’s filings with the SEC, or otherwise.

Information

regarding market and industry statistics contained in this Report is included

based on information available to the Company that it believes is accurate. It

is generally based on industry and other publications that are not produced for

purposes of securities offerings or economic analysis. The Company has not

reviewed or included data from all sources, and cannot assure investors of the

accuracy or completeness of the data included in this Report. Forecasts and

other forward-looking information obtained from these sources are subject to the

same qualifications and the additional uncertainties accompanying any estimates

of future market size, revenue and market acceptance of products and services.

The Company does not undertake any obligation to publicly update any

forward-looking statements. As a result, investors should not place undue

reliance on these forward-looking statements.

Management’s

Discussion and Analysis or Plan of Operations

All

references to the “Company,” “we,” “our” and “us” for periods prior to the

closing of the Reorganization refer to Optex, and references to the “Company,”

“we,” “our” and “us” for periods subsequent to the closing of the Reorganization

refer to the Registrant and its subsidiaries.

The

following discussion highlights the principal factors that have affected our

financial condition and results of operations as well as our liquidity and

capital resources for the periods described. This discussion contains

forward-looking statements. Please see “Special cautionary statement concerning

forward-looking statements” and “Risk factors” for a discussion of the

uncertainties, risks and assumptions associated with these forward-looking

statements. The operating results for the periods presented were not

significantly affected by inflation.

16

Background

Management’s

Discussion and Analysis or Plan of Operations

This

management's discussion and analysis reflects information known to management as

at December 28, 2008. This MD&A is intended to supplement and complement our

audited financial statements and notes thereto for the year ended September 28,

2008 (Predecessor), prepared in accordance with U.S. generally accepted

accounting principles (GAAP). You are encouraged to review our financial

statements in conjunction with your review of this MD&A. The financial

information in this MD&A has been prepared in accordance with GAAP, unless

otherwise indicated. In addition, we use non-GAAP financial measures as

supplemental indicators of our operating performance and financial position. We

use these non-GAAP financial measures internally for comparing actual results

from one period to another, as well as for planning purposes. We will also

report non-GAAP financial results as supplemental information, as we believe

their use provides more insight into our performance. When non-GAAP measures are

used in this MD&A, they are clearly identified as a non-GAAP measure and

reconciled to the most closely corresponding GAAP measure.

The

following discussion highlights the principal factors that have affected our

financial condition and results of operations as well as our liquidity and

capital resources for the periods described. This discussion contains

forward-looking statements. Please see “Special cautionary statement concerning

forward-looking statements” and “Risk factors” for a discussion of the

uncertainties, risks and assumptions associated with these forward-looking

statements. The operating results for the periods presented were not

significantly affected by inflation.

Background

On March

30, 2009, the reorganization was consummated pursuant to which the then existing

shareholders of Optex Systems, Inc. (Delaware) exchanged their shares of common

stock with the shares of common stock of Optex Systems Holdings as

follows: (i) the outstanding 85,000,000 shares of Optex Systems,

Inc. (Delaware) common stock were exchanged by Optex Systems Holdings

for 113,333,282 shares of Company common stock, (ii) the outstanding 1,027

shares of Optex Systems, Inc. (Delaware) Series A preferred stock were

exchanged by Optex Systems Holdings for 1,027 shares of Company Series A

preferred stock, and (iii) the 8,131,667 shares of Optex Systems, Inc.

(Delaware) common stock purchased in the private placement were exchanged by

Optex Systems Holdings for 8,131,667 shares of Company common

stock. Optex Systems, Inc. (Delaware) has remained a wholly-owned

subsidiary of Optex Systems Holdings.

As a

result of the reorganization, Optex Systems Holdings changed its name from

Sustut Exploration Inc. to Optex Systems Holdings, Inc. and its year end from

December 31 to a fiscal year ending on the Sunday nearest September

30.

Immediately

prior to the closing under the reorganization agreement (and the shares included

above), as of March 30, 2009, Optex Systems, Inc. (Delaware) accepted

subscriptions from accredited investors for a total 27.1 units, for $45,000 per

unit, with each unit consisting of 300,000 shares of common stock, no par value,

of Optex Systems, Inc. (Delaware) and warrants to purchase 300,000 shares of

common stock for $0.45 per share for a period of five (5) years from the initial

closing, which were issued by Optex Systems, Inc. (Delaware) after the closing

referenced above. Gross proceeds to Optex Systems, Inc. (Delaware)

were $1,219,750, and after deducting (i) a cash finder’s fee of $139,555, (ii)

non-cash consideration of indebtedness owed to an investor of $146,250, and

(iii) stock issuance costs of $59,416, the net proceeds were

$874,529. The finder also received five year warrants to purchase

2.39 units, at an exercise price of $49,500 per unit. As described above, these

8,131,667 shares were exchanged for 8,131,667 shares of Optex Systems Holdings

common stock in the reorganization.

Optex

Systems, Inc. (Delaware) manufactures optical sighting systems and assemblies

primarily for Department of Defense applications. Its products are installed on

a majority of types of U.S. military land vehicles, such as the Abrams and

Bradley fighting vehicles, light armored and armored security vehicles and have

been selected for installation on the Stryker family of vehicles. Optex Systems,

Inc. (Delaware) also manufactures and delivers numerous periscope

configurations, rifle and surveillance sights and night vision optical

assemblies. Optex Systems, Inc. (Delaware) products consist

primarily of build-to-customer print products that are delivered both directly

to the armed services and to other defense prime

contractors. Less than 1% of today’s revenue is resale of products

“substantially manufactured by others”. In this case, the product

would likely be a simple replacement part of a larger system previously produced

by Optex Systems, Inc. (Delaware).

17

Optex

Systems, Inc. (Delaware) delivers high volume products, under multi-year

contracts, to large defense contractors. It has the reputation and

credibility with those customers as a strategic supplier. Irvine Sensors

Corporation (“Irvine Sensors Corporation”) is predominately a research and

design company with capabilities enabling only prototype or low quantity

volumes. Optex Systems, Inc. (Delaware) is predominately a high volume

manufacturing company. Therefore the systems and processes needed to meet

customer’s needs are quite different. While both companies serve the

military market, the customers within these markets are different. For

example, two of the largest customers for Optex are GDLS and TACOM. Irvine

Sensors Corporation did not have any contracts or business relations with either

of these two customers. Therefore the separation has allowed Optex

Systems, Inc. (Delaware) to fully focus on high volume manufacturing and

the use of the six sigma manufacturing methodology. This shift in

priorities has allowed Optex Systems, Inc. (Delaware) to improve delivery

performance and reduce operational costs.

Many of

our contracts allow for government contract financing in the form of contract

progress payments pursuant to Federal Acquisition Regulation

52.232-16. “Progress Payments”. As a small business, and subject

to certain limitations, this clause provides for government payment of up to 90%

of incurred program costs prior to product delivery. To the extent

our contracts allow for progress payments, we intend to utilize this benefit,

thereby minimizing the working capital impact on Optex Systems Holdings for

materials and labor required to complete the contracts.

Optex

Systems Holdings also anticipates the opportunity to integrate some of its night

vision and optical sights products into commercial

applications. Optex Systems Holdings plans to carry on the business

of Optex Systems, Inc. (Delaware) as its sole line of business, and all of Optex

Systems Holdings’ operations are expected to be conducted by and

through Optex Systems, Inc. (Delaware).

The

successful completion of the separation from Irvine Sensors

Corporation, which was accomplished by Optex Systems, Inc. (Delaware)’s

acquisition of all of the assets and assumption of certain liabilities of Optex

Systems, Inc. (Texas), reduced the general and administrative costs allocated by

Irvine Sensors Corporation. These costs represented services paid by Irvine

Sensors Corporation for expenses incurred on Optex Systems, Inc. (Texas)’ behalf

such as legal, accounting and audit, consulting fees and insurance costs in

addition to significant amounts of Irvine Sensors Corporation’s general overhead

allocated to Optex Systems, Inc. (Texas).

The

estimated total General and Administrative expenses assuming Optex Systems, Inc

(Texas) was operated under a stand-alone basis during the 2008 fiscal year

are:

|

Accounting

and Auditing Fees

|

$ | 250,000 | ||

|

Legal

Fees

|

60,000 | |||

|

Consulting

Fees

|

60,000 | |||

|

Workers

Comp and General Insurance

|

70,000 | |||

|

Total

|

$ | 440,000 |

As a

result of the purchase of Optex Systems, Inc. (Texas) on October 14, 2008,

these general and administrative costs are incurred and paid directly by Optex

Systems, Inc. (Delaware) for the 2009 fiscal year, and have been reflected in

the financial statements to the extent incurred through December 28,

2008.

18

The

liabilities not assumed relate to costs that would not have been incurred by

Optex Systems, Inc. (Texas) if they were operated on a stand alone basis,

including a note due to Timothy Looney. The 2007 promissory note had

a principal amount of $2,000,000 together with accrued interest unpaid

aggregating to approximately $2,300,000. The note was an amendment to

Looney’s earn-out agreement which was the consideration for Irvine Sensor’s

purchase of Optex Systems, Inc. (Texas).

The 2007

promissory note was not assumed by Optex Systems, Inc. (Delaware) in the October

2008 transaction. The note and accrued interest was reported on Optex

Systems, Inc. (Texas) financial statements as of September 28, 2008 as a result

of push down accounting for the acquisition of Optex Systems, Inc. (Texas) by

Irvine Sensors. The note would not have been incurred by Optex

Systems, Inc. (Texas) if operated as a stand alone entity because it relates to

Irvine Sensor’s consideration for its purchase of Optex Systems, Inc. (Texas).

Therefore, we expect no similar impact to the future operating results or

liquidity of the Company.

Additionally,

as of September 28, 2008, Optex Systems, Inc. (Texas) reported $4.3 million of

liabilities attributable to corporate expenses allocated to Optex Systems, Inc.

(Texas) through an intercompany payable. The outstanding intercompany

payable was not acquired by the company in the acquisition from Irvine

Sensors.

Plan

of Operation

Through a

private placement offering completed prior to consummation of the reorganization

agreement, Optex Systems, Inc. (Delaware) raised $1,219,750 ($874,529, net of

finders fees, issuance costs and non cash consideration resulting from

satisfaction of indebtedness owed to an investor) to fund

operations. The proceeds have been used as follows:

|

Description

|

Offering

|

|||

|

Additional

Personnel

|

$ | 150,000 | ||

|

Legal

and Accounting Fees

|

$ | 100,000 | ||

|

Investor

Relations Fees

|

96,000 | |||

|

Working

Capital

|

$ | 528,529 | ||

|

Totals

|

$ | 874,529 | ||

Results

of Operations

Based on