Attached files

| file | filename |

|---|---|

| 8-K - CHARLES RIVER LABORATORIES INTERNATIONAL, INC. | v171094_8k.htm |

Caution Concerning Forward-Looking

Statements. This

presentation includes forward-looking statements within the meaning of the

Private Securities Litigation

Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “anticipate,” “believe,” “expect,” “will,” “may,” “estimate,” “plan,”

“outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These statements

also include statements regarding our projected 2009 financial performance, including expectations regarding our projected 2009 sales and non-GAAP earnings; the

future demand for drug discovery and development products and services (particularly in light of the challenging economic environment), including the outsourcing of

these services and present spending trends by our customers; the impact of specific actions intended to improve overall operating efficiencies and profitability

(including without limitation our Six Sigma program, our ERP project, our sales force realignment and restructuring of our PCS segment); the expected impact of the

suspension of PCS Massachusetts operations on the Company, its products, service offerings and earnings; our intentions with respect to resuming the operations of

our PCS Massachusetts site; the timing of the opening of new and expanded facilities by us and our competitors; Charles River’s expectations with respect to the

impact of acquisitions on the Company, its service offerings, and earnings; the potential passage and impact of healthcare reform legislation; our future stock

purchase activities; future cost reduction activities by our customers; and Charles River’s future performance as delineated in our forward-looking guidance, and

particularly our expectations with respect to sales growth and foreign exchange impact. In addition, these statements include the availability of funding for our

customers and the impact of economic and market conditions on them generally, and the anticipated strength of our balance sheet, the effects of our 2009 and 2010

cost-saving actions and other actions designed to manage expenses, operating costs and capital spending, and to streamline efficiency, and the ability of the

Company to withstand the current market conditions. Forward-looking statements are based on Charles River’s current expectations and beliefs, and involve a

number of risks and uncertainties that are difficult to predict and that could cause actual results to differ materially from those stated or implied by the forward-looking

statements. Those risks and uncertainties include, but are not limited to: the ability to successfully integrate companies we acquire; the ability to successfully develop

and commercialize SPC’s technology platform; a decrease in research and development spending, a decrease in the level of outsourced services, or other cost

reduction actions by our customers; the ability to convert backlog to sales; special interest groups; contaminations; industry trends; new displacement technologies;

USDA and FDA regulations; changes in law; continued availability of products and supplies; loss of key personnel; interest rate and foreign currency exchange rate

fluctuations; changes in tax regulation and laws; changes in generally accepted accounting principles; and any changes in business, political, or economic conditions

due to the threat of future terrorist activity in the U.S. and other parts of the world, and related U.S. military action overseas. A further description of these risks,

uncertainties, and other matters can be found in the Risk Factors detailed in Charles River's Annual Report on Form 10-K as filed on February 23, 2009, and our

Quarterly Report on Form 10-Q as filed on November 4, 2009, as well as other filings we make with the Securities and Exchange Commission. Because forward-

looking statements involve risks and uncertainties, actual results and events may differ materially from results and events currently expected by Charles River, and

Charles River assumes no obligation and expressly disclaims any duty to update information contained in this presentation except as required by law.

Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “anticipate,” “believe,” “expect,” “will,” “may,” “estimate,” “plan,”

“outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These statements

also include statements regarding our projected 2009 financial performance, including expectations regarding our projected 2009 sales and non-GAAP earnings; the

future demand for drug discovery and development products and services (particularly in light of the challenging economic environment), including the outsourcing of

these services and present spending trends by our customers; the impact of specific actions intended to improve overall operating efficiencies and profitability

(including without limitation our Six Sigma program, our ERP project, our sales force realignment and restructuring of our PCS segment); the expected impact of the

suspension of PCS Massachusetts operations on the Company, its products, service offerings and earnings; our intentions with respect to resuming the operations of

our PCS Massachusetts site; the timing of the opening of new and expanded facilities by us and our competitors; Charles River’s expectations with respect to the

impact of acquisitions on the Company, its service offerings, and earnings; the potential passage and impact of healthcare reform legislation; our future stock

purchase activities; future cost reduction activities by our customers; and Charles River’s future performance as delineated in our forward-looking guidance, and

particularly our expectations with respect to sales growth and foreign exchange impact. In addition, these statements include the availability of funding for our

customers and the impact of economic and market conditions on them generally, and the anticipated strength of our balance sheet, the effects of our 2009 and 2010

cost-saving actions and other actions designed to manage expenses, operating costs and capital spending, and to streamline efficiency, and the ability of the

Company to withstand the current market conditions. Forward-looking statements are based on Charles River’s current expectations and beliefs, and involve a

number of risks and uncertainties that are difficult to predict and that could cause actual results to differ materially from those stated or implied by the forward-looking

statements. Those risks and uncertainties include, but are not limited to: the ability to successfully integrate companies we acquire; the ability to successfully develop

and commercialize SPC’s technology platform; a decrease in research and development spending, a decrease in the level of outsourced services, or other cost

reduction actions by our customers; the ability to convert backlog to sales; special interest groups; contaminations; industry trends; new displacement technologies;

USDA and FDA regulations; changes in law; continued availability of products and supplies; loss of key personnel; interest rate and foreign currency exchange rate

fluctuations; changes in tax regulation and laws; changes in generally accepted accounting principles; and any changes in business, political, or economic conditions

due to the threat of future terrorist activity in the U.S. and other parts of the world, and related U.S. military action overseas. A further description of these risks,

uncertainties, and other matters can be found in the Risk Factors detailed in Charles River's Annual Report on Form 10-K as filed on February 23, 2009, and our

Quarterly Report on Form 10-Q as filed on November 4, 2009, as well as other filings we make with the Securities and Exchange Commission. Because forward-

looking statements involve risks and uncertainties, actual results and events may differ materially from results and events currently expected by Charles River, and

Charles River assumes no obligation and expressly disclaims any duty to update information contained in this presentation except as required by law.

The presentation contains estimates

of certain preliminary 2009 (and indirectly fourth-quarter 2009) financial

information. We are continuing to review our finance and

operating results (including the effects of the decision to suspend the operations of PCS Massachusetts), and actual results may differ materially from those contained

herein. In particular, the preliminary financial information could vary from the above estimates based on the final accounting and/or determination as to whether non-

GAAP characterization is appropriate for certain items.

operating results (including the effects of the decision to suspend the operations of PCS Massachusetts), and actual results may differ materially from those contained

herein. In particular, the preliminary financial information could vary from the above estimates based on the final accounting and/or determination as to whether non-

GAAP characterization is appropriate for certain items.

Regulation G

This presentation includes discussion

of non-GAAP financial measures. We believe that the inclusion of

these non-GAAP financial measures provides useful

information to allow investors to gain a meaningful understanding of our core operating results and future prospects, without the effect of one-time charges, consistent

with the manner in which management measures and forecasts the Company’s performance. The non-GAAP financial measures included in this presentation are not

meant to be considered superior to or a substitute for results of operations prepared in accordance with GAAP. The company intends to continue to assess the

potential value of reporting non-GAAP results consistent with applicable rules and regulations. In accordance with Regulation G, you can find the comparable GAAP

measures and reconciliations to those GAAP measures on our website at ir.criver.com.

information to allow investors to gain a meaningful understanding of our core operating results and future prospects, without the effect of one-time charges, consistent

with the manner in which management measures and forecasts the Company’s performance. The non-GAAP financial measures included in this presentation are not

meant to be considered superior to or a substitute for results of operations prepared in accordance with GAAP. The company intends to continue to assess the

potential value of reporting non-GAAP results consistent with applicable rules and regulations. In accordance with Regulation G, you can find the comparable GAAP

measures and reconciliations to those GAAP measures on our website at ir.criver.com.

Safe Harbor

Statement

2

Charles River

accelerating drug development. exactly.

accelerating drug development. exactly.

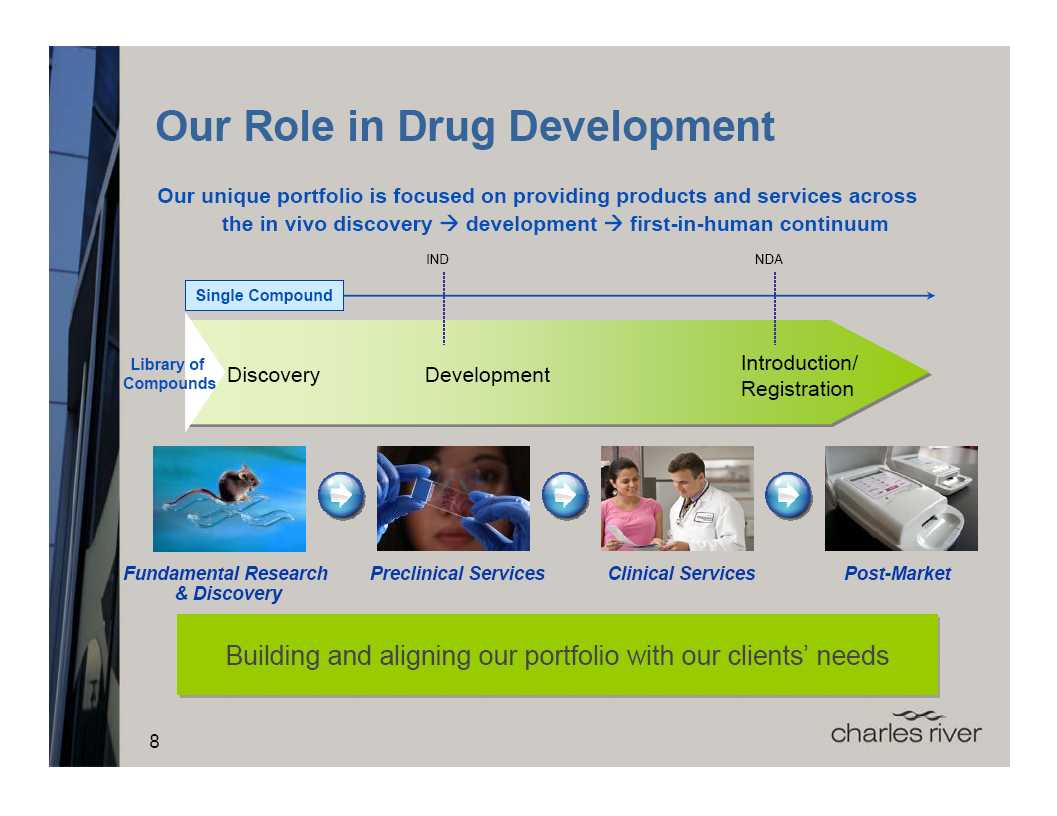

Strategically partnering with our

clients

to provide essential products and services

that expedite drug development

to provide essential products and services

that expedite drug development

3

4

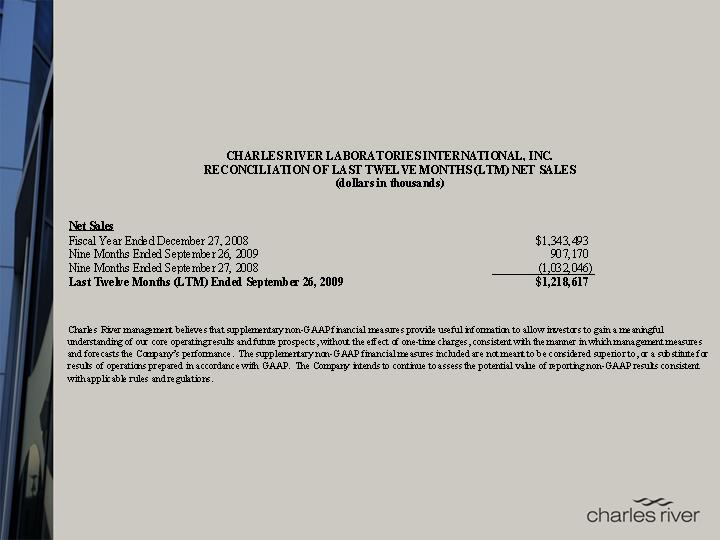

See website for reconciliations of

Non-GAAP to GAAP results.

Charles River

Snapshot

A leading in vivo biology company

$1.22B in net sales (LTM 9/09)

Unique portfolio of products and services focused on

the research and development continuum for new drugs

the research and development continuum for new drugs

A multinational company with ~8,000 employees

worldwide

~70 facilities in 17 countries

Continuous expansion to support

client needs

Source: Based on Charles River’s FY

2008 net sales.

Non-Commercial

16%

Commercial

84%

ROW

32%

North America

68%

Geographic

Sales

Sales

Client Base

Providing drug discovery and

development expertise in

North America, Europe, Japan, China

North America, Europe, Japan, China

Global Solutions

Emerging

Market

Market

Existing Pharma /

Biotech Cluster

Biotech Cluster

We are where our

clients are

5

Partnering with Charles River

reduces clients’ R&D costs and

improves efficiency and speed

improves efficiency and speed

Supports increasing virtualization of Big Pharma

Lower staff and operating costs

Using our facilities and staff instead of their own

Reduces the need for them to invest

in infrastructure

Flexible workload / workforce

management

Benefit from higher utilization and efficiency at Charles River

Facilities are purpose-built for high throughput

Charles River offers specialty services that are often cost

prohibitive for clients to maintain in-house

prohibitive for clients to maintain in-house

Partnering with

Charles River may deliver up to

20%-30% cost savings to clients and save 3-6 months

20%-30% cost savings to clients and save 3-6 months

CRL Value

Proposition

6

7

Attractive Market

Opportunities

*Represents Charles River’s

addressable market through Phase I clinical services.

Addressable market now includes in vivo discovery services and biopharmaceutical services.

Addressable market now includes in vivo discovery services and biopharmaceutical services.

RMS

Harlan-RMS

Taconic

Jackson

PCS

LSR MPI

SNBL WIL

Harlan-CRS

Charles River is the outsourcing

market leader

from discovery through first-in-human testing

from discovery through first-in-human testing

Other

CVD

CRL

Source: Wall Street research and

company estimates.

Market Size*:

~$7.0-7.5B (2009E)

~$7.0-7.5B (2009E)

Long-term

market growth:

Estimated in the

high-single digits

market growth:

Estimated in the

high-single digits

Leveraging our

leadership and

core competencies in in vivo biology

core competencies in in vivo biology

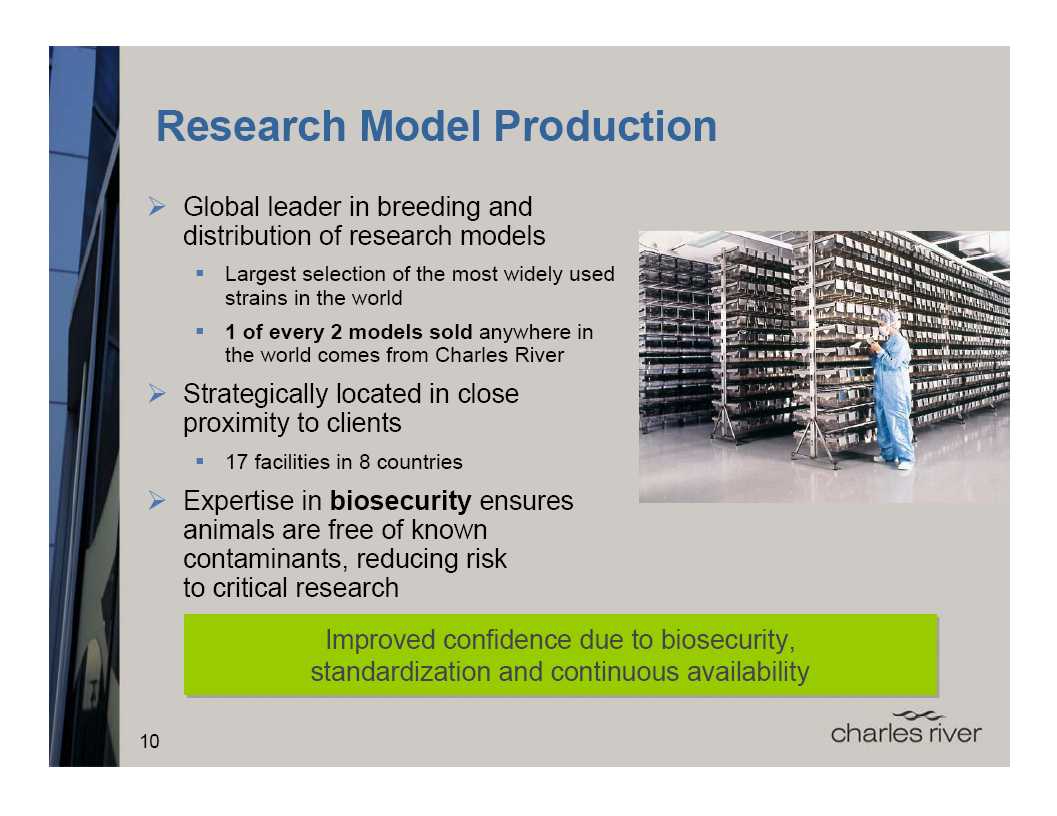

RMS Franchise

The market-leading provider of

research models and services

to support their use in research

to support their use in research

Models are essential to the drug

discovery and development

process

process

Stable demand for products and

services

Exceptional operating margin and free cash flow generation

Even in this challenging market

environment

Establishes our relationship with

clients early in the drug

development cycle

development cycle

Global infrastructure with

proximity to client operations

The in vivo biology

experts

9

Discovery & Imaging Services

(DIS)

We are now one of the largest

providers of non-GLP efficacy

testing

testing

Acquired MIR (Sept. ‘08) to add extensive

in vivo imaging

capabilities and enhance therapeutic area expertise in

oncology and inflammation pharmacology

capabilities and enhance therapeutic area expertise in

oncology and inflammation pharmacology

Acquisition of Piedmont Research

Center (May ‘09)

added

significant expertise in oncology

significant expertise in oncology

Added CNS through Cerebricon acquisition

(Aug. ’09)

(Aug. ’09)

DIS expertise currently includes

five

of the largest TAs

of the largest TAs

Oncology, CNS,

cardiovascular,

metabolism and inflammation

metabolism and inflammation

12

Investment in alternatives to

in vivo testing

The only FDA-approved in vitro non-clinical test

Used for lot release testing of

medical devices and injectable drugs

PTS (Portable Testing System) is a

significant advance over

existing technology

existing technology

Portable, hand-held device

with

rapid, accurate results

rapid, accurate results

Competitive differentiation

Promotes real-time testing of

in-process samples

in-process samples

Fastest-growing product

line

Endotoxin and Microbial Detection

(EMD):

Endosafe®-PTS™

Endosafe®-PTS™

13

Partnering with

clients

to enhance their scientific breadth and depth

to enhance their scientific breadth and depth

Preclinical

Services

Providing clients with expertise for

integrated drug development

integrated drug development

Regulatory and process consulting

Efficacy studies

Safety studies including general

and specialty toxicology

and specialty toxicology

Inhalation, infusion, developmental

and reproductive, juvenile / neonatal,

ocular, bone, immunotoxicology and

phototoxicology

and reproductive, juvenile / neonatal,

ocular, bone, immunotoxicology and

phototoxicology

Expert pathology services

Biopharmaceutical services

Phase I clinical trials

14

BioPharmaceutical Services

(BPS)

A market-leading provider of

services to support the

development and manufacture of biologics

development and manufacture of biologics

Global footprint of four sites in North America and

Europe

Europe

Expect to continue to develop this

business to support

the increasing proportion of biologics in the drug

development pipeline

the increasing proportion of biologics in the drug

development pipeline

Believe biologics are the future of

medicine

15

Strategic

Initiatives

Using this period of softer market

demand to streamline

internal operations and align our business portfolio to client

needs

internal operations and align our business portfolio to client

needs

Four distinct pathways:

Acquisition of strategic assets and other

alliances

Restructuring and

realignment of

our PCS business

operations and sales organization

operations and sales organization

Six Sigma and other efficiency initiatives

Strengthening our relationships with existing and potential

clients through discussions with senior-level decision makers

clients through discussions with senior-level decision makers

16

Portfolio

Expansion

Charles River has historically

driven growth through a

combination of internal development and strategic bolt-on

acquisitions

combination of internal development and strategic bolt-on

acquisitions

~30 acquisitions since ’89

Expanding our breadth of services as

clients continue to identify

capabilities as non-core

capabilities as non-core

Identifying strategic acquisitions and

alliances which

augment existing capabilities or add new ones

augment existing capabilities or add new ones

Goal to expand and fill out our

unique early development

portfolio and maintain market leadership position

portfolio and maintain market leadership position

Identifying novel technologies and innovative working

relationships

relationships

17

Portfolio Expansion

- Technology

Acquired Systems Pathology

Company,

developer of

Computer Assisted Pathology System (CAPS™)

Computer Assisted Pathology System (CAPS™)

A unique use of analytical smart-imaging

software

technology to increase efficiency of pathologists

technology to increase efficiency of pathologists

CAPS™ fully automates labor-intensive processes

Frees pathologists to focus more

time on high-value

interpretation

interpretation

Allows for the same number of

pathologists to evaluate a greater

number of tissues, speeding the reporting process

number of tissues, speeding the reporting process

A limited number of large global

pharmas are participating in

the development phase, providing important scientific input to

the validation process

the development phase, providing important scientific input to

the validation process

Can be licensed to

clients for

internal use

18

Business Changes: PCS

Reorganization

Implemented in 2Q09

Enhances our ability to provide

clients with a centralized ,

integrated global approach to their drug development

programs

integrated global approach to their drug development

programs

Enables us to manage global

operations centrally

Dual

accountability

structure provides both global functional

management and site-level management

management and site-level management

Migrated from site-level-only

accountability

Allows for standardization of all services across the PCS

organization

organization

Consistent delivery of services worldwide

Particularly important to our

clients who already use multiple

Charles River sites

Charles River sites

Client feedback continues to be

positive

19

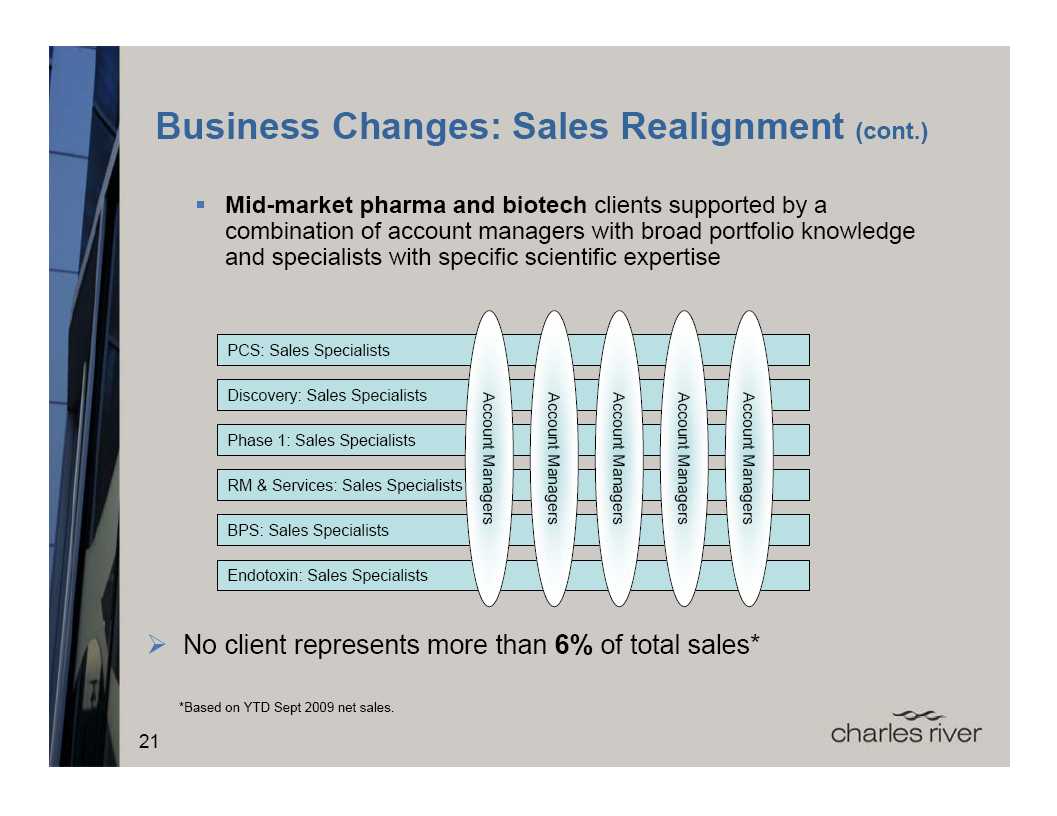

Key structural element in our

ability to enhance client service

and gain market share

and gain market share

Migrating to a sales approach

focused on solutions tailored

for individual and global clients

for individual and global clients

More comprehensive coverage of all

market segments

Diverse client

population

requires different sales strategies

Global account

managers already

in place for major pharma and

biotech clients

biotech clients

Expanded coverage of academic accounts

Supporting market share gains and

expected benefit from

increased NIH funding in ‘10

increased NIH funding in ‘10

Business Changes: Sales

Realignment

20

Process Efficiency

Initiatives

Driving efficiency and profitability through Six Sigma and ERP

Strengthening Six Sigma organization

Continuing to ramp up, with 100

projects underway

and more in the pipeline

and more in the pipeline

Achieved modest efficiency gains in

’09,

and expect more significant gains in ’10

and expect more significant gains in ’10

Successfully rolled out ERP to all

U.S. sites in late December

Total expense of $14-$15M in ’10, including

$2-$3M of implementation and conversion costs

$2-$3M of implementation and conversion costs

Operational benefits expected in

’10, with

substantial cost savings to begin in ‘11

substantial cost savings to begin in ‘11

Goal is to drive efficiencies which

enable us to offer clients

enhanced services at a lower cost

enhanced services at a lower cost

Expect to be able to improve our margins in the absence of

significant upward pricing

significant upward pricing

22

PCS Massachusetts

Announced decision to suspend operations of PCS

Massachusetts to improve global PCS capacity utilization

Massachusetts to improve global PCS capacity utilization

Decision based on surplus industry

capacity

Slowdown in demand from East Coast

biotechs

Cost structure of PCS-MA exacerbated

by current pricing

Leaner PCS infrastructure will

improve operating

margin while

maintaining ability to meet anticipated upturn in demand

maintaining ability to meet anticipated upturn in demand

Will complete ongoing in-life

studies by mid-year ’10

Expected to generate cost savings of

~$20M in 2010, with an

annual run rate ~$25M

annual run rate ~$25M

Anticipate retaining majority of

business, but

some loss

of revenue in ‘10

of revenue in ‘10

Intend to resume

operations as

PCS capacity fills and PCS-MA

is required

is required

23

Drivers of Market

Rebound

Major mergers are

closed, which

should galvanize the

pharmaceutical industry

pharmaceutical industry

Pfizer-Wyeth on 10/15/09 and

Merck-Schering on 11/04/09

Expected to quickly implement

integration plans

With clarity on mergers,

pharmaceutical industry expected to

refocus on driving therapies through the development pipeline

refocus on driving therapies through the development pipeline

Mergers closing coincides with

beginning of 2010 budget

year

year

New funding available for our

clients

However, budgets not expected to be

finalized until 1Q10,

delaying spending until 2Q09

delaying spending until 2Q09

Biotech funding improving

$30B in ’08 grows to an estimated

$47B in ’09 (Source: Burrill)

Resolution of healthcare reform will eliminate uncertainty for

the pharmaceutical industry

the pharmaceutical industry

24

Drivers of Market

Rebound

Our continuing discussions with

senior heads of

R&D of our

large pharma and biotech clients reinforces the desire for

enhanced strategic outsourcing

large pharma and biotech clients reinforces the desire for

enhanced strategic outsourcing

Continuing to identify additional

areas of expertise as non-core

Want broader and more innovative strategic

relationships

with

CROs like CRL who can provide support for a larger portion of the

drug development process

CROs like CRL who can provide support for a larger portion of the

drug development process

Exploring a myriad of partnership

arrangements – no

“one-size-

fits-all” answer

fits-all” answer

Dedicated resources

Long-term “Take-or-Pay” arrangements

Long-term contracts across all

product and service lines

Aspire to increasingly be

“on the same side of the

table” with

our clients, helping to enhance their decision-making process

our clients, helping to enhance their decision-making process

25

2009 Guidance/2010

Outlook

Reaffirming 2009 sales and expect

non-GAAP EPS to be

above the range*

above the range*

Limited preclinical

visibility

persists, but continue to believe

that demand will begin to improve in 2Q10

that demand will begin to improve in 2Q10

4Q09 PCS business trends consistent

with our expectations

Strategic discussions with clients

Stable inquiry levels and steady win

rates

Positive early indications for 1Q10

Do not expect major changes to PCS

pricing in ’10 from ’09

levels

levels

Pricing stabilized below ’08 levels

PCS-MA savings more than offset by

increased ERP costs,

merit increases and incentive compensation

merit increases and incentive compensation

*Guidance previously provided on

November 3, 2009.

26

2009 Guidance/2010 Outlook

(cont.)

New RMS catalog and pricing

effective 1/1/10

Anticipate RMS will benefit from

increased NIH funding

Expect to provide a more detailed

outlook with ’10 guidance

on February 8th

on February 8th

27

Operating efficiency and improved

capacity utilization to drive

longer-term margin improvement

longer-term margin improvement

Productivity and efficiency gains

through IT investment

and Six Sigma

and Six Sigma

Operating margin target >20%

Strong balance

sheet /

conservative capital structure

$215M of cash and marketable

securities on hand at 09/26/09

Low total debt to EBITDA ratio

Significant improvement in

free cash flow beginning in 2009

Long-term organic sales growth

potential in the low-double

digits

digits

CRL Investment

Thesis

28

© 2010 Charles River Laboratories

International, Inc.

Accelerating Drug

Development. Exactly.

Appendix

30

31