Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CTI BIOPHARMA CORP | d8k.htm |

JP

Morgan Healthcare Conference January, 2010 James A. Bianco, M.D. Chief Executive Officer Exhibit 99.1 |

Forward Looking Statement This presentation contains forward-looking statements within the meaning of the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking

statements contained in this presentation include statements about future financial and

operating results, and risks and uncertainties that could affect CTI’s products under

development. These statements are based on management’s current expectations and beliefs and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those

described in the forward-looking statements. These statements are not guarantees of future

performance, involve certain risks, uncertainties and assumptions that are difficult to

predict, and are based upon assumptions as to future events that may not prove accurate.

Therefore, actual outcomes and results may differ materially from what is expressed herein. In any forward-looking statement in which CTI expresses an expectation or belief as to future results,

such expectation or belief is expressed in good faith and believed to have a reasonable basis,

but there can be no assurance that the statement or expectation or belief will result or be

achieved or accomplished. The following factors, among others, could cause actual results

to differ materially from those described in the forward- looking statements: risks

associated with preclinical, clinical and sales and marketing developments in the biopharmaceutical industry in general and in particular including, without limitation, the potential

failure of Opaxio™ to prove safe and effective for treatment of non-small cell lung

and ovarian cancers, the potential failure of Pixuvri (pixantrone dimaleate) to prove safe and

effective (including complete and overall response rates) for treatment of non- Hodgkin’s lymphoma, determinations by regulatory, patent and administrative governmental authorities,

competitive factors, technological developments, costs of developing, producing and selling

CTI’s products under development; and other economic, business, competitive, and/or

regulatory factors affecting CTI’s business generally, including those set forth in

CTI’s filings with the SEC, including its Annual Report on Form 10-K for its most recent fiscal year and its most recent Quarterly Report on Form 10-Q, especially in the “Factors Affecting Our Operating

Results” and “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” sections, and its Current Reports on Form 8-K. Except as may be

required by law, CTI does not intend to update or alter its forward-looking statements whether as a result of new information, future events, or otherwise. |

Overview Focused on Profitability Pixantrone: a potential breakthrough therapy for aNHL Potential to become the anthracycline of choice ODAC panel February 10 th • Accelerated approval requested based on FDA guidance • Proposed PMC trials under review by FDA • Label and carton discussions in progress Management team with “big-pharma” oncology commercial experience • Novartis option provides additional upside to EPS forecasts |

A

Powerful Cancer Drug Portfolio Preclinical Phase I Phase II Phase III Marketed NDA review PH 2-3 completed Phase 3 Phase 2-3 Brostallicin Bisplatinates 3rd line relapse aggressive NHL 1st line Ovarian cancer 1st line aggressive NHL 1st line Esophageal cancer +XRT |

Opportunity

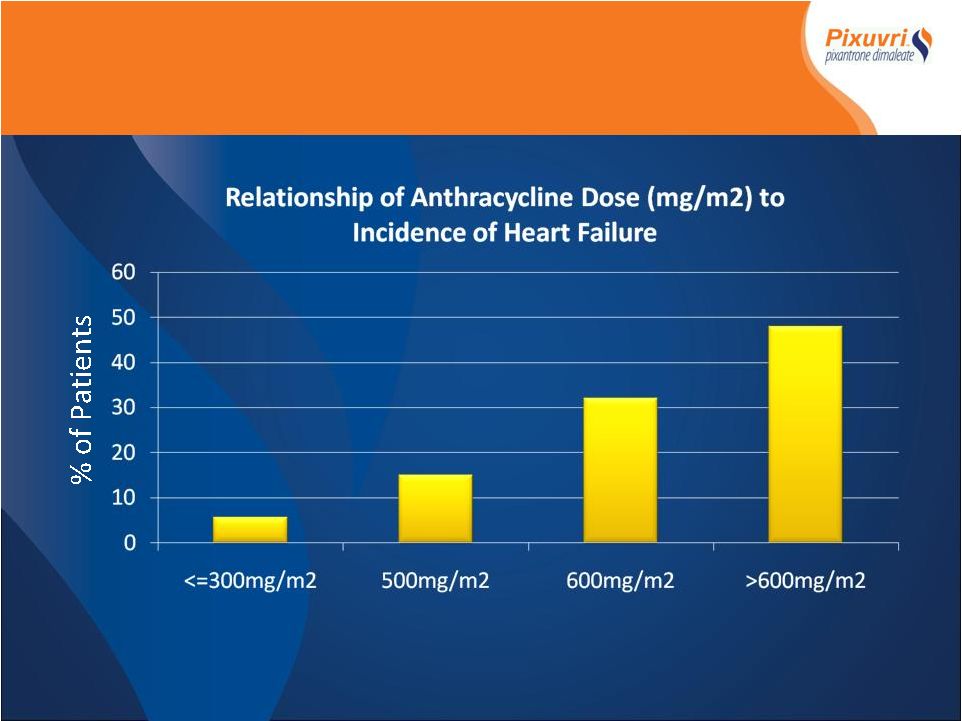

Assessment Opportunity Assessment • Anthracyclines – 3 rd most commonly used class cytotoxics • >300,000 pts receive anthracyclines each year • Potentially curative in NHL, leukemia, breast cancer • Cornerstone 1 st line therapy (CHOP-R) incorporates an anthracycline in 80% of the 32,000 pts/yr with aNHL • Anthracyclines infrequently used beyond 1 line (<5%) st |

Heart Failure

Limits Re-treatment Heart Failure Limits Re-treatment

|

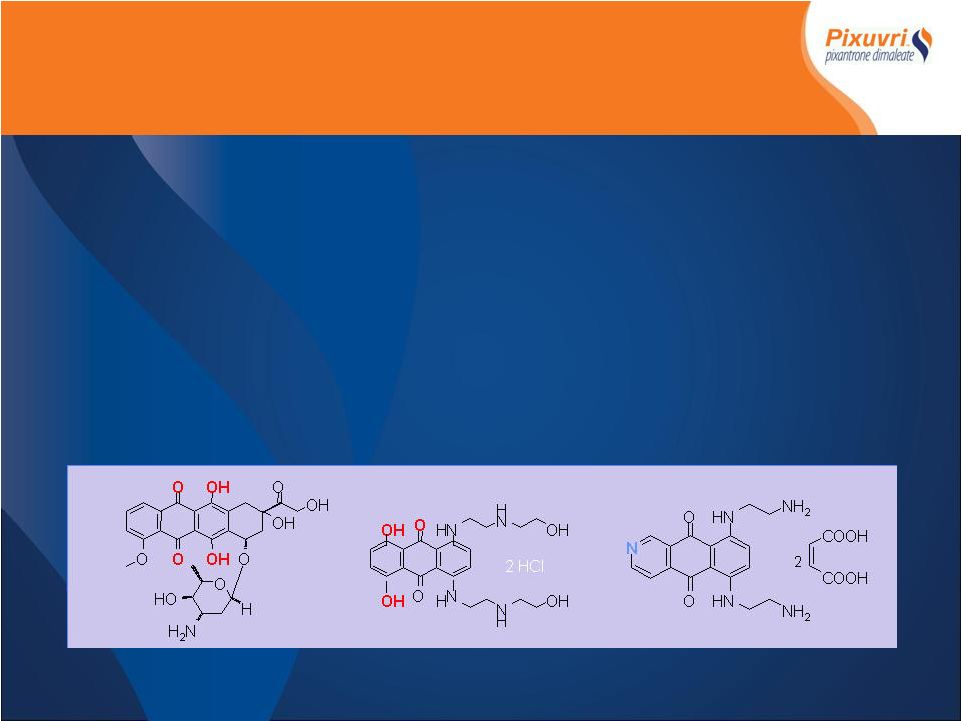

Best in Class

Next Generation Anthracycline Mitoxantrone Doxorubicin Pixantrone • Rationally Designed to Improve Effectiveness and Reduce Cardiotoxicity – Faster forming , more stable DNA adduct formation – Significant reduction in cardiac damage in animal models Vs Dox/Mitox – Inability to generate free radicals, or form toxic drug-metal complexes |

Encouraging CR

rates in NHL Encouraging CR rates in NHL Overall response rate, % Single agent studies AZA I-03 NHL/CLL n = 26 AZA II-01 Aggressive NHL n = 33 Combination therapy AZA-I-05 Aggressive NHL n = 19 AZA I-06 Indolent NHL FPDR n = 28 AZA I-07 Phase I aNHL CPOP - n = 31 AZA I-07 Phase II aNHL CPOP n = 30 |

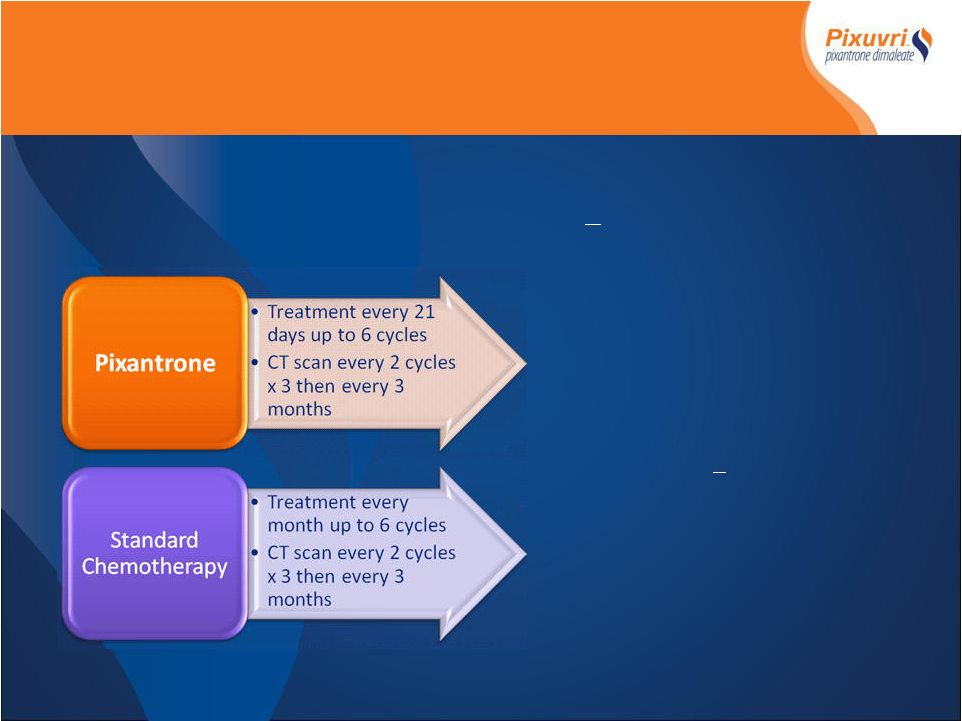

PIX 301Phase

III Study Design PIX 301Phase III Study Design - 1 st Randomized Controlled Phase III trial - Relapsed or refractory aggressive NHL >2 nd relapse - 140 patients Primary Endpoint* - Complete Remission (CR/CRu) Secondary Endpoints* - Overall Response Rate (ORR) - Responses > 4months - Time to response - Progression Free Survival - Overall Survival - Safety *All response and progression data determined by blinded Independent Assessment Panel

(IAP) |

Summary PIX301

Phase III Results End of Treatment Evaluation End of Treatment Evaluation *All response and progression data determined by blinded Independent Assessment Panel

(IAP) • Superior efficacy over standard of care • Primary endpoint achieved (ITT) • Superior CR rates 20% Vs. 5.7% p=0.021 • Secondary endpoints achieved (ITT) • Superior ORR 37% Vs. 14.3% p=0.003 • Superior PFS 4.7 months Vs. 2.6 months p=0.007 • Superior duration of response > 4months 25.7% Vs 8.6 p=0.012 • Superior OS 8.1 Vs 6.9 months p=0.5(NS) • Encouraging cardiac safety profile despite median dox- equivalent exposure of 515mg/m2 • Non-dose dependant occurrence of CHF (5 Vs 2) drug relationship unlikely

|

Lifetime

Anthracycline Exposure (Doxorubicin Equivalent Dose) Treatment Cycle Lifetime Cumulative Dose** Occurrence Congestive Heart Failure N Median (mg/m 2 ) 1 68 365.2 2/68 2 54 430.2 0/54 3 43 498.1 2/43 4 36 571.8 0/36 5 25 631.5 1/25 6 22 695.0 0/22 * Pixantrone dose converted to dox equivalent dose by factor 3.4 ** Dox equivalent dose based on “P. McLaughlin JCO Vol14, No 4, 1996”

|

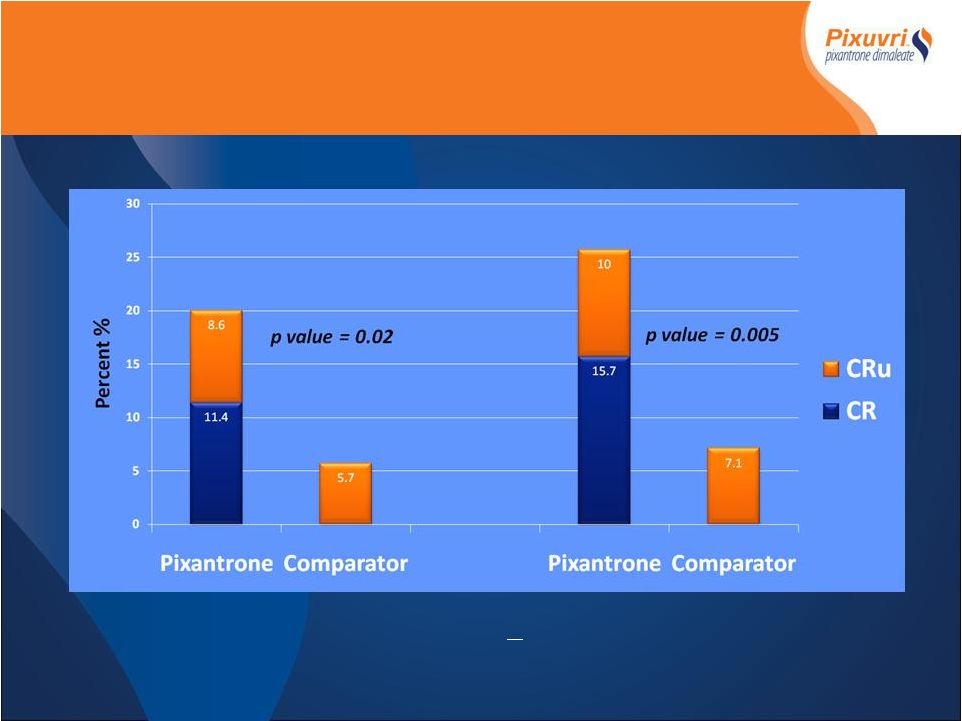

PIX301

CR/CRu End of Treatment Vs Follow-up End of Treatment > 9 month Follow-up *IAP determined, Intent to Treat |

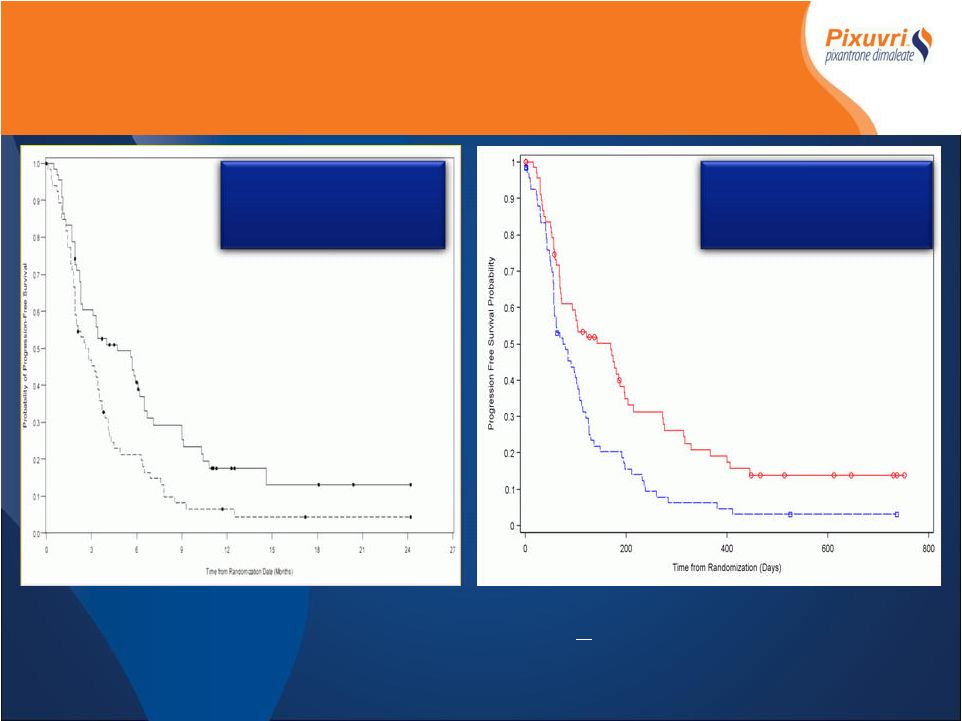

Median PFS

5.6 Vs 2.6 months HR 0.56 (p=0.002) *IAP determined, Intent to Treat PIX301 PFS End of Treatment Vs Follow-up Pixantrone Standard Chemotherapy Median PFS 4.7 Vs 2.6 months HR 0.60 (p=0.007) Pixantrone Standard Chemotherapy End of Treatment > 9 month Follow-up |

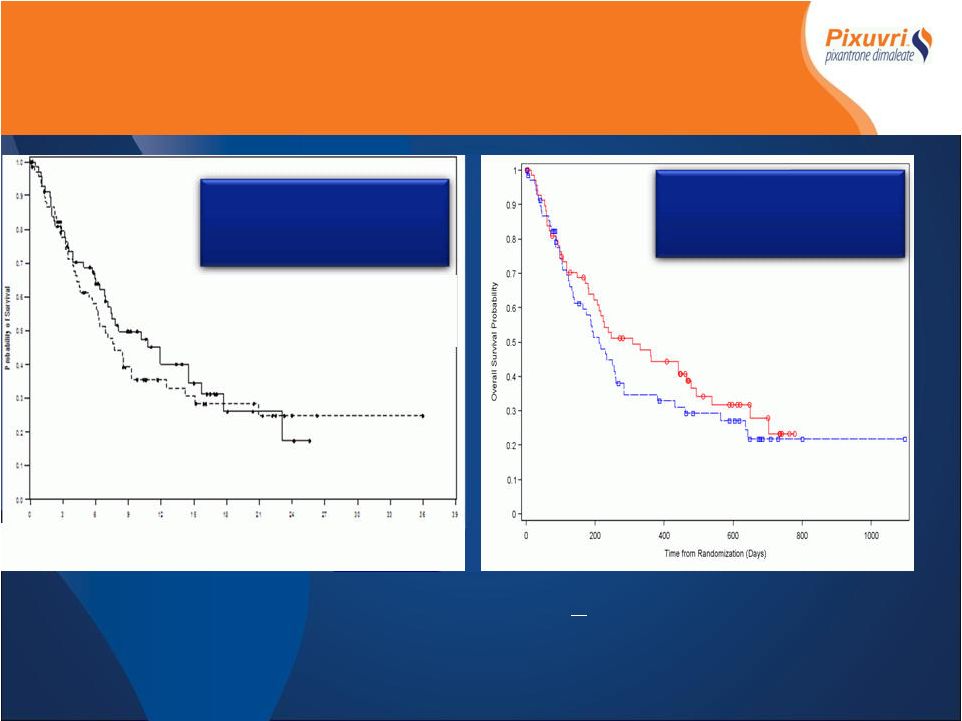

Median

Overall Survival 10.2 Vs 6.9 months HR 0.82 (p=0.3) Pixantrone Standard Chemotherapy *IAP determined, Intent to Treat > 9 month Follow-up Median Overall Survival 8.1 Vs 6.9 months HR 0.88 (p=0.5) End of Treatment Pixantrone Standard Chemotherapy PIX301 OS End of Treatment Vs Follow-up |

Commercial Opportunity 15 |

• Assumptions – Pricing $24/mg – $1,200 vial, = average use 36 vials/patient – Exclusivity in the market to 2018 (US) / 2020(EU) – Regulatory approval – aggressive relapsed NHL • US early Q2-2010, EU 2011 • Modeling assumptions (US only) – Only NHL is included • 1 line 32,029 patients • 2 line 10,150 patients • 3 line 9,767 patients • Peak Penetration – Assumes EU ~70% US market – 15,800 pts US +10,600 pts EU – Total peak patients/yr = 26,400 – Cost per patient/yr = $44,000 Commercial Analysis Commercial Analysis CTI peak Market Research NHL in model Peak Aggressive 1 -line 15% 26% 2 -line 20% 38% 3 -line+ 25% 36% Indolent 1 -line 4% 27% 2 -line 8% 34% 3 -line+ 8% 32% st nd rd st nd rd st nd rd |

Novartis – CTI Agreement(s) NVS has option to negotiate a license to pixantrone Provides $104 million in registration/sales milestones $17.5mm on approval for r/r aNHL 28% to 32% royalty on net sales NVS assumes certain costs and pays CTI to field 35 sales people CTI not obligated to license pixantrone to NVS if terms are not favorable |

|

Opaxio Regulatory Status Pivotal trial (GOG212) • GOG to conduct an interim “futility” PFS analysis in 1H 2010 • Market size 15,000 to 20,000 patients/year Additional registration trial in lower esophageal cancer • XRT sensitization • Impressive rates of (45%) pathologic complete remission rates with markedly reduced GI toxicity • Phase III SPA submission1H-2010 |

Novartis–CTI Agreement(s) Worldwide license to OPAXIO • Reimburses for 50% of certain expenses • $270M in potential registration and sales milestones • CTI to field 35 FTE at NVS expense up to $9M • NVS to assume certain development and commercial expenses • Royalties 20%-25% on WW net sales |

Capital Structure/Financials Dual Listed NASDAQ:CTIC, MTA:CTIC.MI • Liquid stock ~30mm shares/day US/EU (3 month average) • 587mm shares outstanding • 52 week share price ($0.05 - $2.23) • Current price $1.20/share Cleaned up Balance Sheet and Capital Structure • Exchanged $57.4mm debt Cut Burn Rate to $5mm/month Cash end Q3- $55 million |

Upcoming Events Upcoming Events ODAC meeting - Feb. 10, 2010 Potential NDA approval of Pixantrone File pixantrone MAA in Europe - mid 2010 GOG futility PFS analysis on 1 st line maintenance trial with OPAXIO ASCO pixantrone launch SPA Meeting with FDA for Registration Study of OPAXIO as Radiation Sensitizer in Treatment of Esophageal Cancer |