Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Six Flags Entertainment Corp | a10-1359_18k.htm |

| EX-99.2 - EX-99.2 - Six Flags Entertainment Corp | a10-1359_1ex99d2.htm |

Exhibit 99.1

JANUARY 2010

STRICTLY PRIVATE AND CONFIDENTIAL

SIX FLAGS THEME PARKS

$830,000,000 Exit Facility

CONFIDENTIAL INFORMATION MEMORANDUM FOR PUBLIC-SIDERS

See Special Notice on next page

|

|

|

|

|

CONFIDENTIAL

SIX FLAGS THEME PARKS

Table of contents

|

1. |

Executive summary |

3 |

|

|

Transaction overview |

3 |

|

|

Company overview |

3 |

|

|

Summary organization chart |

5 |

|

|

Current and pro forma capitalization |

5 |

|

|

Sources and uses |

6 |

|

|

Description of Exit Facilities |

6 |

|

|

Recent events |

7 |

|

|

Plan of Reorganization summary |

8 |

|

|

Postconfirmation governance |

10 |

|

|

Industry overview |

10 |

|

|

Partnership Parks overview |

11 |

|

|

Time Warner financing |

11 |

|

|

Historical financial summary |

12 |

|

|

2009 Financial highlights |

13 |

|

2. |

Key investment considerations |

14 |

|

|

Geographic diversity |

14 |

|

|

High barriers to entry |

14 |

|

|

Valuable advertising platform |

14 |

|

|

Sponsorship revenue opportunities |

15 |

|

|

Attractive IP portfolio |

16 |

|

|

Well-invested portfolio of state of the art rides |

18 |

|

|

Favorable industry characteristics |

19 |

|

|

Well-balanced capital structure |

19 |

|

|

Strong collateral coverage |

19 |

|

|

Proven management team |

20 |

|

|

Recent operational improvements position the Company for growth |

20 |

|

3. |

Partnership Parks overview |

22 |

|

4. |

Summary of terms and conditions |

26 |

|

5. |

Form of commitment advice |

27 |

|

6. |

Administrative questionnaire |

28 |

|

7. |

Business description |

29 |

|

8. |

Industry overview |

37 |

|

|

Industry composition and recent performance |

37 |

|

|

Industry outlook |

39 |

|

9. |

Management team |

40 |

|

|

Team overview |

40 |

|

10. |

Historic and financial overview |

42 |

|

11. |

Financial Projections |

45 |

|

|

Projected balance sheet |

47 |

|

|

Projected operations |

48 |

|

12. |

Long Range Plan and Financial Projections |

55 |

|

|

Long range plan assumptions and drivers |

56 |

|

13. |

Appendix |

59 |

|

|

Definitions: Modified EBITDA, Adjusted EBITDA, and Free Cash Flow |

59 |

|

|

Description of major parks |

61 |

CONFIDENTIAL

1. Executive summary

Transaction overview

Six Flags, Inc. and certain of its subsidiaries (collectively with its non debtor subsidiaries, “Six Flags” or the “Company”) filed for Chapter 11 protection in Delaware on June 13, 2009. The Company filed a fully-funded Plan of Reorganization (“POR” or the “Plan”) with the Bankruptcy Court on December 18, 2009 that includes a $450 million rights offering (the “Rights Offering”) backstopped by certain bondholders of Six Flags Operations Inc., an intermediate holding company (“SFO”). As part of the POR, the Company has mandated J.P. Morgan, Bank of America, Barclays and Deutsche Bank as Joint Bookrunners and Joint Lead Arrangers to arrange $830 million in Senior Secured Credit Facilities (the “Facilities” or the “Exit Facilities”) to finance the Company’s exit from bankruptcy. The Facilities consist of a $150 million Revolving Credit Facility (the “Exit Revolving Credit Facility”) and a $680 million Term Loan (“Exit Term Loan”). The Plan also features a financing commitment of $150 million from Time Warner (related to funding certain obligations) and has the support of the Steering Committee of the Company’s pre-petition secured creditors. Confirmation of the POR is expected to occur in March 2010, with Six Flags expected to emerge from bankruptcy shortly thereafter.

Company overview

Six Flags is the largest regional theme park operator in the world. The Company owns or operates 20 parks located in diverse markets across North America, including 18 domestic parks, one park in Mexico City, Mexico and one park in Montreal, Canada, and attracted 25.3 million visitors in 2008. The parks offer a complete family-oriented entertainment experience with a broad selection of state-of-the-art and traditional thrill rides, water attractions, themed areas, concerts and shows, restaurants, game venues and retail outlets. During 2008, Six Flags theme parks offered more than 800 rides, including over 120 roller coasters, making Six Flags the leading provider of “thrill rides” in the industry. The Company’s parks are located in diverse markets across North America, with no single park accounting for more than 13% of revenue or 18% of Modified EBITDA(1) in 2008. The parks are primarily marketed to guests who live within 100 miles, and the Company’s primary markets include nine of the top ten designated market areas (“DMAs”) in the United States.

Six Flags North American Footprint

(1) As defined in the Appendix

CONFIDENTIAL

Intellectual Property Rights

Six Flags holds exclusive long-term licensing rights to use certain Warner Bros. and DC Comics characters throughout the United States (excluding the Las Vegas metropolitan area), Canada, Mexico and other countries. These characters include Bugs Bunny, Daffy Duck, Tweety Bird, Yosemite Sam, Batman, Superman and others. In addition, Six Flags has certain rights to use Hanna-Barbera and Cartoon Network characters, including Yogi Bear, Scooby-Doo, The Flintstones and others. The Company uses these characters to market the parks and to provide an enhanced family entertainment experience. The licenses include the right to sell merchandise at the parks featuring the characters, and to use the characters in advertising and marketing materials, as walk-around characters and in theming for rides, attractions and retail outlets. The Company believes that using these characters promotes increased attendance, supports higher ticket prices, increases length of-stay in the parks and enhances in-park spending.

Corporate Alliances and Sponsorships

With approximately 25 million guests per year, Six Flags provides a strong platform for future sponsorship opportunities to reach a broad captive audience. As a result, Six Flags has increased sponsorship, licensing and other fees from approximately $16 million under contract at the time new management was installed in late 2005 and early 2006 to approximately $59 million for 2008. In 2009, the Company held over 40 national and regional deals and over 320 local park-specific partnerships, with brands such as Johnny Rockets, Papa John’s pizza, Coca Cola, and many others. These relationships typically include annual sponsorship fees, direct marketing opportunities and provide multiple marketing touch points for Six Flags. Additionally, the Company improves its reputation by associating itself with high quality brands.

dick clark productions, inc. (“dcp”)

and

Six Flags Great Escape Lodge & Indoor Waterpark (“HWP”)

On June 18, 2007, Six Flags acquired an original 40% interest (subsequently reduced to 39.2%) in a venture that owns dcp, an entertainment production company that is responsible for the development and production of a number of television shows, including American Bandstand, TV Bloopers & Practical Jokes, and Dick Clark’s New Year’s Rockin Eve and awards shows such as The American Music Awards, the Academy of Country Music Awards, and the Golden Globe Awards. Six Flags is paid an annual fee to manage dcp. In addition, Six Flags currently manages and owns a 41% interest in HWP, a hotel-indoor water park located in Lake George, New York, which is adjacent to the Company’s wholly-owned Great Escape theme park.

CONFIDENTIAL

Summary organization chart

The chart below summarizes Six Flags’ organizational structure. Six Flags Theme Parks Inc. (“SFTP”), which owns and operates 17 of the 20 parks, will be the Borrower under the Exit Facilities. The Exit Facilities will benefit from downstream guarantees from Six Flags, Inc. (“SFI”), its ultimate parent company, and SFO, its direct parent company, as well as upstream guarantees from the domestic subsidiaries of SFTP. The three remaining Six Flags parks, Six Flags Over Texas, Six Flags Over Georgia, and Six Flags White Water Atlanta (collectively the “Partnership Parks”), are partly owned by SFI through limited partnership structures and are operated by subsidiaries of SFI. Indirect subsidiaries of SFI (the “Acquisition Parties”) will be and are the borrowers under the new and existing Time Warner facilities, respectively. SFI, SFO, and SFTP are guarantors of the Existing TW Loan (as hereinafter defined) in an amount up to $10 million, and SFI, SFO, SFTP, and each of SFI’s domestic subsidiaries that become guarantors under the Exit Facilities will be guarantors of the New TW Loan (as hereinafter defined).

Summary organizational chart

Current and pro forma capitalization

The Six Flags capital structure, including leverage statistics, as of September 30, 2009 and pro forma following emergence from Chapter 11 is set forth below:

Summary capital structure ($ millions)

|

|

|

Amount |

|

x 2009PCA |

|

|

|

Minimum cash balance |

|

$ |

40 |

|

|

|

|

Six Flags Theme Parks Inc. |

|

|

|

|

|

|

|

$275MM revolver(1) |

|

272 |

|

|

|

|

|

$850MM term loan facility(1) |

|

839 |

|

|

|

|

|

Interest rate swap and LOCs |

|

22 |

|

|

|

|

|

Subtotal SFTP |

|

$ |

1,133 |

|

5.5x |

|

|

Six Flags Operations Inc. |

|

|

|

|

|

|

|

12.25% SFO senior notes(1) |

|

420 |

|

7.5x |

|

|

|

Six Flags, Inc. |

|

|

|

|

|

|

|

Unsecured SFI notes(1) |

|

898 |

|

|

|

|

|

Existing TW Loan(3) |

|

41 |

|

|

|

|

|

Other |

|

3 |

|

|

|

|

|

Subtotal SFO and SFI |

|

$ |

1,362 |

|

12.1x |

|

|

PIERS preferred stock |

|

307 |

|

|

|

|

|

Total debt including PIERS |

|

$ |

2,802 |

|

13.6x |

|

|

|

|

Amount |

|

x 2009PCA |

|

|

|

Minimum cash balance |

|

$ |

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$150MM revolver |

|

88 |

|

|

|

|

|

$680MM term loan facility |

|

680 |

|

|

|

|

|

Subtotal SFTP |

|

$ |

768 |

|

3.4x |

|

|

Six Flags Operations Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Flags, Inc. |

|

|

|

|

|

|

|

New TW Loan(4) |

|

— |

|

|

|

|

|

Existing TW Loan(3) |

|

30 |

|

|

|

|

|

Other |

|

10 |

|

|

|

|

|

Subtotal SFO and SFI |

|

$ |

40 |

|

3.6x |

|

|

|

|

|

|

|

|

|

|

Total debt |

|

$ |

808 |

|

3.6x |

|

(1) 12.25% SFO senior notes and unsecured SFI notes include accrued interest through June 12, 2009, default interest on term loan and revolver accrued through September 30, 2009

(2) Projected 2009 Cost Adjusted EBITDA of $206MM, which comprises the projected 2009 Adjusted EBITDA of $190MM and $16MM in additional cost savings projected for 2010 applied to such projected 2009 Adjusted EBITDA

(3) $10MM guarantee by SFI, SFO and SFTP of the Existing TW Loan

(4) Guaranteed by SFI, SFO, SFTP and each of SFI’s wholly owned subsidiaries that become guarantors under the Exit Facilities

(5) Leverage calculated based on year-one average RC drawn amount of $29mm

CONFIDENTIAL

Sources and uses

The following table sets forth the estimated sources and uses of funds for the Company’s execution of the POR and resulting emergence from Chapter 11, assuming a closing date in April 2010 (the “Closing Date”):

Sources and uses — based on 4/2010 emergence ($ millions)

|

Sources |

|

|

|

|

|

Cash Balance Prior to Emergence |

|

$ |

53 |

|

|

New Term Loan |

|

680 |

|

|

|

Rights Offering Proceeds |

|

450 |

|

|

|

Revolver Draw at Emergence |

|

88 |

|

|

|

Total sources of cash |

|

$ |

1,271 |

|

|

Uses |

|

|

|

|

|

Pay Bank Claims in full |

|

$ |

1,147 |

|

|

Minimum Cash Balance |

|

40 |

|

|

|

Pay Trade Claims in Full |

|

20 |

|

|

|

Fees and Expenses |

|

64 |

|

|

|

Total uses of cash |

|

$ |

1,271 |

|

Proceeds of the $680 million Exit Term Loan (along with the proceeds from the Rights Offering) will be used to repay the $1,147 million pre-petition bank debt (“Prepetition Credit Agreement Claims”) in cash in full upon consummation of the POR and the Company’s emergence from Chapter 11 (the “Effective Date”). Proceeds of the $150 million Exit Revolving Credit Facility will be used for general corporate purposes throughout its tenor. The Company has historically used its revolving credit facility to fund seasonal working capital needs during its off-season in the winter and spring months, before it enters the positive cash flow generating portion of its season following Memorial Day of each fiscal year.

Description of Exit Facilities

The following table summarizes the Exit Facilities:

Summary of the Exit Facilities terms and conditions

|

|

|

Amount |

|

Tenor |

|

Drawn Pricing |

|

Libor Floor |

|

Undrawn Spread |

|

|

Exit Revolving Credit Facility |

|

$150 million |

|

5 years |

|

L + 425bps |

|

2.0% |

|

150 bps |

|

|

Exit Term Loan |

|

$680 million |

|

6 years |

|

L + 425bps |

|

2.0% |

|

N/A |

|

Borrower

SFTP, a Delaware corporation and a fully owned subsidiary of SFO, will be the borrower (the “Borrower”) under the Exit Facilities. SFTP owns (directly and indirectly) all parks, excluding the Partnership Parks. In addition, SFTP manages and owns minority interests in dcp (39.2%) and HWP (41%).

Guarantors and Security

The Exit Facilities will be guaranteed by SFI, SFO and all of the Borrower’s domestic wholly-owned subsidiaries. The Exit Facilities shall be secured by a perfected first priority security interest in substantially all tangible and intangible assets of the Borrower, SFO, SFI and the Borrower’s wholly-owned domestic subsidiaries (including, without limitation, intellectual property (to the extent not prohibited by applicable contractual restrictions), real property and all of the capital stock of SFO and the Borrower and each of its direct and indirect subsidiaries) with exceptions to be agreed; provided that (a) not more than 65% of the capital stock of any foreign subsidiary, and none of the assets of any foreign subsidiary, shall secure the obligations of the Borrower in respect of the Exit Facilities and (b) the collateral shall exclude (i) any assets of SFI and its subsidiaries covered by a pledge or security interest under the Time Warner Facility or subject to a negative pledge thereunder, (ii) any assets of SFI and its subsidiaries in which the granting or pledge or security interest is prohibited under the partnership parks agreements, subordinated indemnity agreement and any related documentation (collectively, the “Partnership Parks Agreements”) and (iii) those assets as to which the Administrative Agent shall determine in its sole discretion that the costs of obtaining such a security interest are excessive in relation to the value of the security to be afforded thereby.

CONFIDENTIAL

Tenor and Scheduled Amortization

Exit Term Loan

The Exit Term Loan shall be repayable in quarterly installments (commencing on the last day of the first full calendar quarter ended following the Closing Date) in an amount equal to 0.25% of the initial aggregate principal amount of the Term Loans and in one final payment on the date six years after the Closing Date (the “Term Loan Maturity Date”) equal to the remaining aggregate principal amount of the Term Loans.

Exit Revolving Credit Facility

The Exit Revolving Credit Facility shall be available on a revolving basis during the period commencing on the Closing Date and ending on the date five years after the Closing Date (the “Revolving Credit Termination Date”). Up to $40 million of the facility may be used for letters of credit.

Financial Covenants

The Exit Facilities will include a maximum senior secured leverage ratio measured at SFTP, a minimum consolidated interest coverage ratio, and a maximum consolidated capital expenditures covenant. The leverage ratio will include an LTM quarterly average balance on the Exit Revolving Credit Facility (with a credit for available cash) and will be calculated on a pro forma basis to reflect asset sales and acquisitions.

Prepayments

The Borrowers will have the option to prepay the Exit Facilities at par throughout the life of the loans. The Facilities will contain mandatory prepayment provisions for (i) 100% of any indebtedness incurred at SFTP or any of its subsidiaries (other than permitted indebtedness), (ii) 25% of indebtedness at SFO and SFI when the SFTP leverage ratio is above a level to be agreed and (iii) 100% of asset sale proceeds, subject to reinvestment rights within 365 days. On an annual basis, commencing with the fiscal year ending December 31, 2010, the Borrower will be required to sweep 50% of its Excess Cash Flow (as defined) to prepay the Exit Term Loan.

(A more detailed term sheet has been posted separately to Intralinks)

Recent events

The current management team joined the Company in late 2005 and early 2006, and inherited a business in need of a comprehensive operational restructuring, a brand that had been tarnished over the course of several years, and a highly-leveraged balance sheet. The management team instituted a highly successful three-year turnaround plan that culminated in breakthrough operational results in 2008. Despite the strong results, the Company began 2009 still burdened with approximately $2.4 billion of debt and a consolidated leverage ratio of over 8.6x. In addition, Six Flags was facing a mandatory redemption of $307 million in preferred stock in August 2009 and a bond maturity in February 2010. In late 2008, the Company embarked upon a strategy to right-size its capital structure and commenced a debt to equity exchange in April of 2009 of over $800 million in bonds.

A series of events led management to re-evaluate its out-of-court restructuring strategy. The H1N1 virus (the “swine flu”) epidemic in early 2009 had a significant impact on early season attendance, particularly at the parks located in Texas and Mexico City. The Mexico City park was closed for two weeks during the peak of the crisis. Unusually inclement weather in the Northeast during June, as well the adverse taint of an impending bankruptcy, also contributed to lower than usual attendance levels. Additionally, the economic recession was having a material impact throughout the country on both attendance and in-park spending levels. As a result, the Company was concerned that the 2009 operating results might be weaker than 2008, which would make the out-of-court restructuring much less feasible. Facing the expiration of 30-day

CONFIDENTIAL

grace periods for interest payments under a series of unsecured notes, Six Flags commenced its Chapter 11 reorganization on June 13, 2009.

Plan of Reorganization summary

The amended Plan of Reorganization, filed on December 18, 2009, is based on a midpoint enterprise value of $1.4 billion. The Plan includes the issuance of $450 million of new equity pursuant to a Rights Offering supported by a fully-committed backstop and an additional $150 million delayed draw financing commitment from Time Warner to mitigate the risks posed by the annual Partnership Parks put obligations. From an ongoing operational perspective, the business plan continues the successful operational strategies adopted and implemented by current management. In addition, the Plan has the support of an informal committee of SFO bondholders, the Steering Committee of holders of Prepetition Credit Agreement Claims, and Time Warner, a key stakeholder and the provider of long term intellectual property rights to the Company.

Valuation

Houlihan Lokey, the Company’s financial advisors, has advised Six Flags with respect to the reorganization value of the Company on a going concern basis post-reorganization. The estimated range of reorganization value of Six Flags was derived by separately valuing SFTP and the partnership interests in the Partnership Parks held indirectly by SFI (each assuming a sum-of-the-parts analysis). Solely for purposes of the Plan, the estimated range of reorganization value for Six Flags was assumed to be approximately $1.25 billion to $1.55 billion (with a midpoint value of approximately $1.40 billion). The table below summarizes the components of the estimated range of reorganization value for Six Flags.

Estimated Range of Reorganization Value ($ billions)

|

|

|

Low |

|

Midpoint |

|

High |

|

|||

|

Enterprise Value SFTP |

|

$ |

1.21 |

|

$ |

1.35 |

|

$ |

1.49 |

|

|

Equity Value Partnership Parks |

|

0.04 |

|

0.05 |

|

0.06 |

|

|||

|

Estimated Total Enterprise Value |

|

$ |

1.25 |

|

$ |

1.40 |

|

$ |

1.55 |

|

Rights Offering

Along with the $680 million Exit Term Loan, holders of Prepetition Credit Agreement Claims will be paid in full in cash from the proceeds of the $450 million Rights Offering. The Rights Offering will be based on a $1.335 billion total enterprise value of Six Flags (as compared to the $1.4 billion midpoint of the POR valuation range). SFO bondholders that are accredited investors and vote to accept the Plan will be offered their limited pro rata share of the shares offered in the Rights Offering, for up to 25% of the $450 million Rights Offering. A subset of SFO Bondholders (the “Backstop Purchasers”) will purchase the remaining amount of the Rights Offering, plus any shortfall of the 25% offered to all SFO Bondholders. The new common stock offered in the Rights Offering will comprise 69.8% of the common stock of the reorganized Six Flags (subject to dilution in connection with awards under the Long-Term Incentive Plan).

CONFIDENTIAL

Pre-petition loan and bond treatment under the Plan ($ millions)

|

Class |

|

Claim |

|

Recovery |

|

Treatment |

|

|

SFTP |

|

$ |

1,147 |

|

100% |

|

· Paid in full in cash through proceeds of Exit Term Loan and Rights Offering |

|

|

|

|

|

|

|

|

|

|

SFO |

|

$ |

420 |

|

29.7%-45.5%(1) |

|

· To receive approximately 22.9% of the pro forma equity · Subject to dilution by the Long-Term Incentive Plan · Each accepting claimholder shall have the right to participate in the Rights Offering for its limited pro rata share · $450 million · Approximately 69.8% of pro forma equity · Subject to dilution by the Long-Term Incentive Plan |

|

|

|

|

|

|

|

|

|

|

SFI |

|

$ |

1,346 |

|

3.0%-4.7%(1) |

|

· To receive approximately 7.3% of the pro forma equity · Subject to dilution by the Long-Term Incentive Plan |

SFTP Prepetition Credit Agreement Claims

Under the Plan, the holders of Prepetition Credit Agreement Claims against SFTP and certain of its wholly-owned domestic subsidiaries will be paid in full in cash through the proceeds of the Exit Term Loan in the principal amount of $680 million and the Rights Offering in the principal amount of $450 million.

SFO Bondholders

SFO bondholders will convert their claims against SFO into approximately 22.9% of the new common stock to be issued by reorganized SFI (subject to dilution by the Long-Term Incentive Plan). Additionally, all accepting SFO unsecured claimholders who are accredited investors shall have the right to participate in the Rights Offering to purchase its limited pro rata share of up to $450 million of new common stock, representing 69.8% of the new common stock to be issued by SFI.

SFI Bondholders

The SFI bondholders will convert their claims against SFI into approximately 7.3% of the new common stock (also shared by SFO bondholders based upon SFI guaranty of SFO unsecured bonds) to be issued by reorganized SFI (subject to dilution by the Long-Term Incentive Plan) as well as the SFO guaranty claim

Existing Equity

All existing equity interests in SFI will be cancelled under the Plan. All existing equity interests in SFI’s direct subsidiary SFO will be cancelled, and 100% of the newly-issued common stock of SFO will be issued to SFI on the date of emergence in consideration of SFI’s distribution of the new common stock in reorganized SFI to certain creditors, as described above.

Partnership Parks, Subordinated Indemnity and Existing Time Warner Loan Guarantees

The SFTP, SFO and SFI guarantees of certain obligations to Time Warner under the Partnership Parks Agreement and Existing TW Loan will be discharged and exchanged for new guarantees of such

(1) Reflects lower equity value than the Disclosure Statement due to increased term loan amount

CONFIDENTIAL

obligations. The SFTP, SFO and SFI guarantees of certain obligations to Time Warner under the Subordinated Indemnity Agreement will be reinstated.

Equity Distributions under the Plan

|

Class |

|

% of New Equity Ownership(1) |

|

SFO Bondholders |

|

· 22.9% |

|

Rights Offering |

|

· 69.8% |

|

SFI Bondholders |

|

· 7.3% |

(1) All ownership percentages shown prior to dilution by the Long-Term Incentive Plan

Postconfirmation governance

Postconfirmation Board

The postconfirmation board will be comprised of nine directors, one of whom will be the CEO of reorganized SFI. The initial directors will be selected by a majority of the Backstop Purchasers, with a majority of the members of the board being independent. The Backstop Purchasers have agreed to consider certain directors of the current board identified by the CEO of reorganized SFI for selection to the postconfirmation board. All of the directors of reorganized SFI will stand for election annually.

Long-Term Incentive Plan

As of the Effective Date, Six Flags will implement an incentive based compensation program available for management, selected employees and directors of reorganized Six Flags (the “Long-Term Incentive Plan”). The Long-Term Incentive Plan will provide compensation in the form of stock options and/or restricted stock. The aggregate amount of stock to be issued under the program is 10% of the new common stock on a fully diluted basis. As of the Effective Date, allocations to senior management will consist of 3.75% of the new common stock, in the form of restricted stock, which will vest in annual installments over a four-year period, commencing on April 1, 2009(1). In addition, 3.75% of the new common stock will be issued to senior management in the form of options with an exercise price based on a $1.335 billion enterprise value (the same valuation under the backstop of the Rights Offering). These options will only vest at the expiration of the four-year vesting period of the restricted stock mentioned above. The remaining 2.5% available for distribution under the Long-Term Incentive Plan shall be allocated in a manner determined by the postconfirmation board.

Industry overview

Theme parks and amusement parks traditionally feature themed attractions and “thrill rides” set in family-friendly environments. The market is broadly divided into destination and regional parks. Regional theme parks draw most of their visitors from local markets, whereas destination parks draw visitors from national and international locales. The worldwide theme and amusement park market was estimated to be $24.1 billion in 2007, with the U.S. market estimated at $12.0 billion.

Most theme park operators focus on either the destination or regional market, although there are exceptions. Six Flags

(1) April 1, 2009 is the effective date of the employment agreements related to senior management

CONFIDENTIAL

is one of two major pure-play regional theme park operators in North America. In 2008, Six Flags was the #1 regional theme park operator by attendance, and trailed only The Walt Disney Company (“Disney”) among all U.S.-based operators. Busch Entertainment Corp. (“Busch Entertainment”, now known as “Seaworld Parks and Entertainment” or “Seaworld”), which was a division of Anheuser-Busch InBev (“AB InBev”) until December 2009, ranked #3. Although Seaworld operates a few regional parks, it derives the majority of its revenue from destination parks and is not traditionally considered a regional theme park operator. The other pure-play regional theme park operator is Cedar Fair L.P. (“Cedar Fair”), which ranked #4 in attendance among all U.S.-based operators in 2008.(1) Disney and Universal Orlando Resort (“UO”) only operate destination parks catering to national and international tourists.

The theme and amusement park space has attracted significant investment activity in recent years. Most recently, The Blackstone Group (“Blackstone”) announced in October 2009 that it would acquire Busch Entertainment from AB InBev for $2.3 billion in cash plus up to an additional $400 million based on Blackstone’s return on investment. This transaction closed in December 2009. Apollo Global Management (“Apollo”) announced in December 2009 that it would acquire Cedar Fair for $2.4 billion in cash. The transaction has yet to close.

Partnership Parks overview

The Company currently manages and owns beneficial interests in the Partnership Parks, which consist of Six Flags Over Texas (“SFOT”), Six Flags Over Georgia and Six Flags White Water Atlanta, collectively (“SFOG”). Indirect subsidiaries of SFI are the general partners of the Partnership Parks, and separate entities indirectly owned by Time Warner own substantial limited partnership (“LP”) stakes in SFOG and SFOT. Time Warner has assigned all cash flows and voting rights associated with the LP stakes to GP Holdings Inc., a subsidiary of SFI, so long as no default under the Partnership Parks Agreements exist. Currently, the Six Flags’ ownership percentage of the LP interests in SFOG and SFOT are 29% and 52%, respectively.

As part of the Partnership Park Agreements, SFO and SFTP guarantee certain obligations of the Partnership Parks, including a fixed annual preferred distribution to LP unitholders, a minimum level of capital expenditure spending on the parks, and the purchase of puts exercisable annually by LP unitholders. The total amount of potential puts outstanding is $356 million, of which $308 million are exercisable in 2010.

Time Warner financing

To help mitigate the uncertainty of funding of potential future puts, the Acquisition Parties have received a financing commitment from Time Warner for a new $150 million delayed-draw term loan (the “New TW Loan”) to finance future puts exercised by third party holders of LP units in the entities which own the Partnership Parks. Under the terms of the financing commitment, in future years, Six Flags will be obligated to fund put amounts up to a threshold of $10 million in 2010, $12.5 million in 2011, and $15 million in any year thereafter, with proceeds from the New TW Loan funding any put payment obligations in excess of such threshold amount, up to an aggregate $150 million.

The New TW Loan provides certainty and stability to the Six Flags capital structure, particularly in an area over which it historically had no control, and is a key component of the Plan. For the first time since the acquisition of these Partnership Parks in 1998, the New TW Loan gives the Company a dedicated source of funds to meet its Partnership Park put obligations.

(1) Source: TEA / ERA 2008 Attraction Attendance Report

CONFIDENTIAL

Historical financial summary

Summary financials ($ millions)

|

|

|

2006 |

|

2007 |

|

2008 |

|

2009P |

|

2009PCA(1),(2) |

|

|||||

|

Ticket revenue |

|

$ |

522.7 |

|

$ |

524.2 |

|

$ |

534.8 |

|

$ |

486.0 |

|

$ |

486.0 |

|

|

In-Park revenue |

|

393.8 |

|

408.0 |

|

427.5 |

|

381.9 |

|

381.9 |

|

|||||

|

Sponsorship, Licensing & Other |

|

25.7 |

|

38.6 |

|

59.0 |

|

42.2 |

|

42.2 |

|

|||||

|

Total revenue |

|

$ |

942.2 |

|

$ |

970.8 |

|

$ |

1,021.3 |

|

$ |

910.2 |

|

$ |

910.2 |

|

|

Cost of sales |

|

(80.0 |

) |

(81.5 |

) |

(86.4 |

) |

(77.1 |

) |

(77.1 |

) |

|||||

|

Gross profit |

|

$ |

862.2 |

|

$ |

889.3 |

|

$ |

934.9 |

|

$ |

833.1 |

|

$ |

833.1 |

|

|

Gross margin % |

|

91.5 |

% |

91.6 |

% |

91.5 |

% |

91.5 |

% |

91.5 |

% |

|||||

|

Cash operating expenses(3),(4) |

|

(623.0 |

) |

(661.5 |

) |

(627.4 |

) |

(619.9 |

) |

(603.9 |

) |

|||||

|

As % of revenues |

|

66.1 |

% |

68.1 |

% |

61.4 |

% |

68.1 |

% |

66.3 |

% |

|||||

|

Modified EBITDA(4) |

|

$ |

239.2 |

|

$ |

227.8 |

|

$ |

307.5 |

|

$ |

213.1 |

|

$ |

229.1 |

|

|

Modified EBITDA margin |

|

25.4 |

% |

23.5 |

% |

30.1 |

% |

23.4 |

% |

25.2 |

% |

|||||

|

Min int in earnings - EBITDA |

|

(44.4 |

) |

(38.2 |

) |

(32.2 |

) |

(23.1 |

) |

(23.1 |

) |

|||||

|

Adjusted EBITDA(4) |

|

$ |

194.8 |

|

$ |

189.6 |

|

$ |

275.3 |

|

$ |

190.0 |

|

$ |

206.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Cash interest (Net) |

|

(187.6 |

) |

(196.5 |

) |

(157.5 |

) |

(82.9 |

) |

(50.0 |

) |

|||||

|

Capital expenditures (Net) |

|

(101.1 |

) |

(114.1 |

) |

(90.3 |

) |

(100.0 |

) |

(91.0 |

) |

|||||

|

PIERS cash dividends |

|

(20.8 |

) |

(20.8 |

) |

(5.2 |

) |

0.0 |

|

0.0 |

|

|||||

|

Cash paid for debt issuance costs |

|

(3.0 |

) |

(19.1 |

) |

(9.7 |

) |

0.0 |

|

0.0 |

|

|||||

|

Cash taxes |

|

(4.7 |

) |

(5.0 |

) |

(7.0 |

) |

(9.0 |

) |

(9.0 |

) |

|||||

|

Free Cash Flow(4) |

|

$ |

(122.4 |

) |

$ |

(166.0 |

) |

$ |

5.6 |

|

$ |

(1.9 |

) |

$ |

56.0 |

|

|

Cash flow from operating activities |

|

56.3 |

|

9.7 |

|

107.7 |

|

109.8 |

|

125.8 |

|

|||||

|

Cash flow from investing activities |

|

(40.0 |

) |

64.2 |

|

(93.7 |

) |

(85.9 |

) |

(76.9 |

) |

|||||

|

Cash flow from financing activities |

|

(72.4 |

) |

(70.1 |

) |

169.7 |

|

(64.5 |

) |

(64.5 |

) |

|||||

(1) Projected 2009 Cost Adjusted EBITDA of $206MM, which comprises the projected 2009 Adjusted EBITDA of $190MM and $16MM in additional cost savings projected for 2010 applied to such projected 2009 Adjusted EBITDA

(2) Projected 2009 Cost Adjusted Capital Expenditures (net) of $91MM, which comprises the projected 2009 Capital Expenditures (net) of $100MM and $9MM in additional capital expenditure reductions projected for 2010 applied to such projected 2009 Capital Expenditures (net)

(3) Excludes costs associated with the change of corporate management that occurred in late 2005 and early 2006 (approximately $13.9 million recognized as expense in 2006)

(4) As defined in the Appendix

CONFIDENTIAL

2009 Financial highlights

In the spring and early summer, several events combined to impact the Company’s operations. The swine flu virus epidemic had a significant impact on early season attendance, particularly at the parks located in Texas and Mexico. The Mexico City park was closed for two weeks during the peak of the crisis. The economic recession had a material impact on both attendance and in-park spending levels at parks throughout the country. The negative publicity from the Company’s impending bankruptcy filing as well as unusually inclement weather in the Northeast also contributed to lower attendance levels.

Attendance was approximately flat to the prior year in April; however, the factors noted above drove attendance declines through mid-July. Attendance was down by 1.1 million guests through July 19, 2009 compared to the previous year, with attendance trends stabilizing beginning in mid-July through the end of the peak operating season (Labor Day). Attendance was essentially flat compared to 2008 results during this period. However, unusually wet weather in the Northeast in October with rainfall on virtually every October weekend, which includes the popular Fright Fest product, further dampened results by another 450,000 guests compared to the prior year.

Set forth below is a comparison of YTD 2009 and 2008 actual cumulative attendance.

Cumulative attendance comparison April 2009 - November 2009

CONFIDENTIAL

2. Key investment considerations

Geographic diversity

Six Flags’ parks are located in geographically diverse markets across North America reaching 9 of the top 10 DMAs. No single park accounted for more than 13% of revenue or 18% of Modified EBITDA(1) in 2008.

High barriers to entry

High barriers to entry provide each of the Company’s parks with a significant degree of protection from competitive new theme park openings in their respective regions. While the Company’s parks benefit from limited direct theme park competition, a restricted supply of real estate appropriate for theme park development and zoning restrictions are two important barriers to entry. The high initial capital investment required to start a park and long development lead-time also contribute to protecting Six Flags from new direct theme park competition. Additionally, a significant financial commitment would be required to construct a new regional theme park comparable to one of the major Six Flags branded theme parks. The Company estimates it would require at least $300 million to construct a similar theme park, excluding the cost of land, and would take a minimum of two years to construct.

Valuable advertising platform

The Company’s high attendance levels from attractive demographic segments allow Six Flags to deliver a valuable advertising platform. With approximately 25 million guests in expected average annual attendance, Six Flags is attractive to both local and national advertisers. The Company’s annual attendance is higher than the league-wide seasonal attendance levels of several professional sports leagues, and provides advertisers an alternative, out-of-home advertising channel. Out-of-home advertising is becoming an increasingly popular type of advertising and few venues offer the geographic and population reach that Six Flags offers. As the chart below highlights, the length of stay is another significant differentiator for Six Flags, where the expected average length of stay is 8.6 hours as opposed to 2.7 hours for the NBA and NHL, and 3.1 hours for the NFL. This longer average time-of-visit translates into a broad and captive audience for up to 10 hours per visit (3x — 4x the average sports event), with a focus on families and young adults. Over 75% of Six Flags’ annual attendance resides within 100 miles of the parks, making them an ideal value for local advertisers. Additionally, the Company’s national platform and its presence in nine of the top ten DMAs in the United States appeals to national and regional accounts. Moreover, the Company continues to develop ways to leverage this captive audience and increase advertising revenue, such as Six Flags Television (SFTV) monitors in ride lines and video display boards at its restaurants.

(1) As defined in the Appendix

CONFIDENTIAL

Six Flags advertising demographics

Source: Elias Sports research,

league websites, and Nielsen (attendance in millions): 2008-2009 Season: NFL,

NBA, NHL

2007 Season NASCAR

Demographic source: 2009 ATS Survey

Sponsorship revenue opportunities

With approximately 25 million guests per year, Six Flags provides a strong platform for future sponsorship opportunities to reach a broad captive audience. As a result, Six Flags has increased sponsorship, licensing and other fees from approximately $16 million under contract at the time new management was installed in late 2005 and early 2006 to approximately $59 million for 2008. In 2009, the Company held over 40 national and regional deals and over 320 local park-specific partnerships, with brands such as Johnny Rockets, Papa John’s pizza, Coca Cola, and many others. These relationships typically include annual sponsorship fees, direct marketing opportunities and provide multiple marketing touch points for Six Flags. Additionally, the Company improves its reputation by associating itself with high quality brands.

Six Flags’ ability to rapidly identify and effectively capitalize on sponsorship opportunities is a part of the significant growth in gross revenue per capita and gross profit per capita. For example, replacing unbranded pizza in 2006 with Papa John’s, a newly-acquired national sponsor, increased gross revenue per capita spending on pizza by 93% and increased gross profit per capita on pizza by 87% by 2008. Similarly, replacing unbranded hamburgers with Johnny Rockets increased gross revenue per capita spending on hamburgers by 42% and increased gross profit per capita on hamburgers by 30% by 2008.

CONFIDENTIAL

Six Flags brand partnerships

Attractive IP portfolio

Six Flags’ attractive IP portfolio and long-term licensing contracts help increase customer satisfaction and differentiate the Company from other leisure time activities. Six Flags holds exclusive long-term licenses for theme park usage throughout the United States (excluding the Las Vegas metropolitan area), Canada, and Mexico for certain Warner Bros. and DC Comics characters.

The Company also holds the rights to use other popular characters such as The Wiggles, Scooby Doo, Yogi Bear, Thomas the Tank Engine and The Flintstones in its parks.

The Company believes the presence of well-known characters in the parks drives higher revenue, an improved guest experience and more frequent visitation. Its ability to use and market its licensed characters provides Six Flags with a competitive advantage relative to the other local entertainment options, and helps attract more families to the parks.

According to a 2009 guest satisfaction survey, guests who saw costumed characters were more likely to purchase gifts or souvenirs, play skill games and have pictures taken or purchase photos.

CONFIDENTIAL

Proportion of guests participation

Source: 2009 Guest Satisfaction Survey

In addition, guests who saw costumed characters were significantly more likely to rate “Value for the Money” and “Overall Experience” a “10” versus those not seeing characters. Guests who did not recall seeing costumed characters, instead, were significantly more likely to rate “Value for the Money” a “6 or below.”

|

Value for the Money |

|

Overall Experience |

|

|

|

|

|

|

|

|

Source: 2009 Guest Satisfaction Survey

CONFIDENTIAL

Well-invested portfolio of state of the art rides

In prior years, before the current management team joined Six Flags, the Company invested heavily in state of the art roller coasters and thrill rides, spending well above free cash flow levels and financing these investments with debt. Over time, this pattern resulted in an over levered capital structure and ultimately resulted in the current reorganization. The current management team has been much more disciplined in its capital spending and will continue this strategy. However, these historical investments have built one of the most sophisticated and technically advanced portfolios of roller coasters in the world. Six Flags’ state of the art rides consistently rank among the most popular in the world. These renowned rides have given Six Flags a reputation for great rides, and have provided management with strong products to market, helping drive attendance, in-park spending, and sponsorship revenue.

Six Flags remains committed to maintaining its portfolio of state of the art rides. The Company offers more than 800 rides, including over 120 roller coasters, has invested over $1.0 billion in its parks since 2000, and projects to invest $80 million to $100 million annually into its parks.

Top Rides in North America

|

Ride |

|

Park |

|

Rank |

|

Steel |

|

|

|

|

|

Bizarro |

|

Six Flags New England |

|

#1 |

|

Nitro |

|

Six Flags Great Adventure |

|

#3 |

|

Goliath |

|

Six Flags Over Georgia |

|

#4 |

|

X2 |

|

Six Flags Magic Mountain |

|

#13 |

|

Raging Bull |

|

Six Flags Great America |

|

#14 |

|

Mind Bender |

|

Six Flags Over Georgia |

|

#16 |

|

Kingda Ka |

|

Six Flags Great Adventure |

|

#31 |

|

Tatsu |

|

Six Flags Magic Mountain |

|

#32 |

|

Goliath |

|

Six Flags Magic Mountain |

|

#33 |

|

Shock Wave |

|

Six Flags Over Texas |

|

#34 |

|

Superman Ride of Steel |

|

Six Flags America |

|

#35 |

|

Titan |

|

Six Flags Over Texas |

|

#37 |

|

Superman Krypton |

|

Six Flags Fiesta Texas |

|

#44 |

|

Whizzer |

|

Six Flags Great America |

|

#47 |

|

|

|

|

|

|

|

Wooden |

|

|

|

|

|

El Toro |

|

Six Flags Great Adventure |

|

#3 |

|

Evel Knievel |

|

Six Flags St. Louis |

|

#13 |

|

Viper |

|

Six Flags Great America |

|

#30 |

|

Texas Giant |

|

Six Flags Over Texas |

|

#32 |

|

The Boss |

|

Six Flags St. Louis |

|

#33 |

|

Screamin’ Eagle |

|

Six Flags St. Louis |

|

#40 |

|

Terminator Salvation |

|

Six Flags Magic Mountain |

|

#43 |

|

Georgia Cyclone |

|

Six Flags Over Georgia |

|

#44 |

Source: Rankings based on Amusement Today’s 2009 Golden Ticket Awards

CONFIDENTIAL

Favorable industry characteristics

Six Flags benefits from several favorable industry characteristics. First, there is limited direct theme park competition within local markets. Second, most of the Company’s guests reside close to the parks’ locations, as 78% of attendance resides within 100 miles of the parks. Third, regional parks are typically better positioned than destination parks during a downturn and present an affordable alternative to an out-of town family vacation. Finally, a Six Flags season pass offers multiple visits for a single price, presenting a compelling value proposition.

Well-balanced capital structure

Upon emergence, Six Flags will be appropriately capitalized with lower leverage than many of its peer companies. The bankruptcy process will shed $1.7 billion of debt from the balance sheet, enabling the Company to maintain liquidity, improve Free Cash Flow(1), and foster future growth opportunities.

Total Leverage(1)

Source: Rating Agency websites, public filings and news reports

Seaworld (formerly Busch Entertainment): LCD, pro forma for December 2009

divestiture; Cedar Fair: Public filings; based on LTM EBITDA 9/30/09; debt levels pro forma for December 2009

transaction; Universal Orlando: Offering Memorandum, LTM EBITDA, debt levels

pro forma for October 2009 notes issuance

(1) Based on Projected 2009 Cost Adjusted EBITDA of $206 million, which is comprised of the projected 2009 Adjusted EBITDA of $190 million and $16 million in additional cost savings projected for 2010 applied to such projected 2009 Adjusted EBITDA

(2) Leverage calculated based on year-one average RC drawn amount of $29mm

Strong collateral coverage

The Company’s Prepetition Credit Agreement Facility is secured by substantially all assets of SFTP’s domestic wholly-owned subsidiaries as well as 100% of the stock of SFTP’s domestic wholly-owned subsidiaries and 65% of the stock of foreign subsidiaries. The real estate of most domestic parks is owned by the Company, and many of the parks are well situated in the largest markets in North America.

Collateral coverage ($billions)

|

|

|

Book Value |

|

Plan Valuation |

|

||

|

Tangible Asset Value |

|

$ |

1.55 |

(1) |

$ |

1.35 |

(2) |

|

Total Pro Forma Debt(3) |

|

0.75 |

|

0.75 |

|

||

|

Collateral Coverage |

|

2.1x |

|

1.8x |

|

||

(1) Six Flags consolidating balance sheet as of May 2009, SFTP only (excludes SFI tangible asset value)

(2) Excludes Equity Value of Partnership Parks (with a midpoint Equity Value of approximately $49.5 million per Disclosure Statement)

(3) Calculated based on year-one average RC drawn amount of $29mm

(1) As defined in the Appendix

CONFIDENTIAL

Proven management team

In late 2005 and early 2006, the new Board of Directors installed a new management team led by Mark Shapiro (CEO) and Jeffrey Speed (CFO) that effectuated the Company’s financial and operational turnaround. The management team brought strong prior experience to Six Flags. Prior to serving as President, Chief Executive Officer and a Director of Six Flags since December 2005, Mr. Shapiro had been the Executive Vice President, Programming and Production of ESPN, Inc. Mr. Speed brought a broad-based financial background and extensive experience in the media, entertainment, and theme park industries, most recently from his service as Senior Vice President and Chief Financial Officer of Euro Disney.

In addition to Mr. Shapiro and Mr. Speed, the Six Flags management team driving the Company’s recent turnaround is rounded out by a group qualified professionals whose roles and achievements are detailed below:

Mark Quenzel joined Six Flags following 15 years with ESPN, where he served as Senior Vice President of Programming and Production. He oversees all park operations, strategy, and safety for the Six Flags parks. Michael Antinoro served as the Executive Producer of ESPN Original Entertainment (EOE), the core creative group that led the ESPN brand into non-traditional sports and entertainment programming. He oversees all aspects of Six Flags’ advertising, promotions, entertainment, marketing and communications. Louis Koskovolis joined Six Flags from his position as Executive Vice President of Multi-Media Sales for ESPN and ABC Sports. He oversees the Corporate Alliances group which focuses on developing key national, regional and local sponsorships for all Six Flags’ parks and creates cross-promotional platforms. Andrew Schleimer joined Six Flags from UBS Investment Bank, where he served as Vice President in the bank’s Mergers and Acquisitions department. He oversees Six Flags’ Strategic Development and In-Park Services, a division that focuses on increasing company revenue and enhancing the park experience through agreements with branded food, beverage, equipment, service and retail partners. James Coughlin practiced law at several private law firms, most recently at the former Baer Marks & Upham firm in New York City and has served as the Company’s General Counsel since 1998.

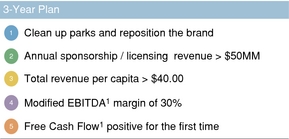

Recent operational improvements position the Company for growth

Once installed, the current management team set out five key objectives, all of which were accomplished by the end of its third year, 2008. First, the team repositioned the brand by diversifying the product offering and cleaning up and improving the parks. This repositioning resulted in key guest satisfaction scores at or above all-time highs. Second, the team developed and grew new high margin opportunities for the Company, increasing annual sponsorship and licensing revenues to over $59 million in 2008. Third, the Company achieved total revenue per capita of over $40.00, representing a 20.0% cumulative growth from 2005. Fourth, the Company improved its margins, operating at a Modified EBITDA(1) margin of over 30% in 2008, with a Modified EBITDA(1) of $307.5 million for the year ended December 31, 2008. Finally, the Company successfully became Free Cash Flow(1) positive in 2008 for the first time in the Company’s history.

2006 — 2007

The Company was able to increase total revenue per capita by focusing on improving the guest experience, customer service, and appearance and cleanliness of the parks. Management

(1) As defined in the Appendix

CONFIDENTIAL

worked to successfully build a corporate alliance team, as Six Flags partnered with well known brand names such as Papa John’s and Cold Stone Creamery. Corporate alliances and the conversion to branded concepts became a revenue and EBITDA driver for the Company.

2007 — 2008

Six Flags implemented a plan designed to broaden family offerings. The Company also launched staffing initiatives to improve recruiting, training, retention and efficiency. Six Flags built upon its corporate alliances, partnering with additional well known brand names such as Johnny Rockets and Kodak. The Company invested in IT infrastructure designed to improve systems, ticketing, point of sale and its website. This investment in IT infrastructure also generated new revenue streams with Six Flags TV and Radio.

2008

The Company implemented a more efficient and targeted marketing plan with an online focus. This program concentrated advertising spending in the early portion of the season. Six Flags also launched an attraction program with 7 coasters for 7 parks. The Company reduced operating expenses, while expanding its 2007 staffing initiatives and decreasing full time employees. Six Flags increased guest spending and total revenue per capita through additional sponsorship and international licensing opportunities. Additionally, several inefficient attractions were removed.

The table below illustrates the improvements management has been able to achieve since coming on board in late 2005 and early 2006, highlighting the operating milestones that management set out to accomplish in its three year plan:

Operating milestones ($ millions)

|

|

|

2005 |

|

2006 |

|

2007 |

|

2008 |

|

||||

|

Attendance (million) |

|

28.2 |

|

24.8 |

|

24.9 |

|

25.3 |

|

||||

|

Total Revenue per Cap |

|

$ |

33.44 |

|

$ |

37.93 |

|

$ |

38.99 |

|

$ |

40.30 |

|

|

Revenue |

|

$ |

943 |

|

$ |

942 |

|

$ |

971 |

|

$ |

1,021 |

|

|

Sponsor / License Revenue |

|

$ |

20 |

|

$ |

26 |

|

$ |

39 |

|

$ |

59 |

|

|

Modified EBITDA(1),(2) |

|

$ |

306 |

|

$ |

239 |

|

$ |

228 |

|

$ |

307 |

|

|

Modified EBITDA Margin (1),(2) |

|

32.5 |

% |

25.4 |

% |

23.5 |

% |

30.1 |

% |

||||

|

Adjusted EBITDA(1),(2) |

|

$ |

261 |

|

$ |

195 |

|

$ |

190 |

|

$ |

275 |

|

|

Capex (Net) |

|

$ |

160 |

|

$ |

101 |

|

$ |

114 |

|

$ |

90 |

|

|

Free Cash Flow(1),(2) |

|

$ |

(111 |

) |

$ |

(122 |

) |

$ |

(166 |

) |

$ |

6 |

|

|

Cash flow from operating activities |

|

165.8 |

|

56.3 |

|

9.7 |

|

107.7 |

|

||||

|

Cash flow from investing activities |

|

(37.1 |

) |

(40.0 |

) |

64.2 |

|

(93.7 |

) |

||||

|

Cash flow from financing activities |

|

(116.7 |

) |

(72.4 |

) |

(70.1 |

) |

169.7 |

|

||||

(1) As defined in the Appendix

(2) Modified EBITDA, Adjusted EBITDA and Free Cash Flow exclude costs of the change of corporate management that occurred in late 2005 and early 2006 (approximately $12.6 million and $13.9 million recognized as expense in 2005 and 2006, respectively).

CONFIDENTIAL

3. Partnership Parks overview

Partnership Parks Agreements

SFO and SFTP have guaranteed certain obligations of the parks including the following:

(i) minimum preferred return and ground lease payment to limited partners. The fixed annual distributions to LPs (including ground lease payments) grow at the rate of the Consumer Price Index. The amount of the distribution was $60.7 million in 2009. The distribution currently represents an approximate 9.7% yield to the LP investors on their original tender offer price.

(ii) minimum capital expenditure requirements. The minimum capital expenditures requirement requires the Company to fund 6% of the average Partnership Parks revenues as capital over rolling 5-year periods.

(iii) annual offer to purchase limited partnership units that are put to the Company by LP unit holders. The maximum amount of puts that can be exercised in any year is 5%, and any unused amounts accrue to subsequent years. These obligations continue until 2027 and 2028 for the Georgia and Texas parks, respectively. The aggregate potential amount of puts outstanding following the May 2009 puts is $356 million. The amount of puts exercisable in April 2010 is $308 million.

The price of a Partnership Park put is set at park valuations set forth below:

|

· |

Georgia — greater of: |

|

· |

Texas: — greater of : |

|

|

(i) 8.0x trailing 4 yr average EBITDA and |

|

|

(i) 8.5x trailing 4 yr average EBITDA and |

|

|

(ii) $250 million |

|

|

(ii) $375 million |

The level of puts has averaged approximately $3 million annually, with the notable exception of 2009, when the put amount was $66 million.

In 2027 SFOG and 2028 SFOT, the Company has a call option on all remaining units outstanding at set prices.

In addition SFI, SFO, SFTP and the domestic subsidiaries of SFTP have indemnified Time Warner pursuant to the Subordinated Indemnity Agreement (as described below) with respect to any amounts paid by Time Warner pursuant to its guarantee of obligations under the Partnership Parks Agreements.

Six Flags funds certain of these obligations via unsecured affiliate loans from the general partner of the Partnership Parks (an indirect subsidiary of SFI) to the Partnership Parks. Such loans are subordinated to the Partnership Parks’ obligation to fund the preferred return. In the event of a default by Six Flags under the Subordinated Indemnity Agreement, Time Warner is entitled to take control of the corporate parent of the general partners and thus, in effect, become the holder of the affiliate loans.

CONFIDENTIAL

Partnership Parks financing structure

Subordinated Indemnity Agreement

Time Warner guarantees all the obligations of the Six Flags entities under the Partnership Parks arrangements. Pursuant to an agreement between Time Warner and Six Flags (the “Subordinated Indemnity Agreement”), SFI, SFO, SFTP and the domestic subsidiaries of SFTP have indemnified Time Warner for any losses incurred with respect to these guarantees. In the event of a failure by Six Flags to perform under this agreement, Time Warner would be able to acquire all of Six Flags’ ownership of LP units (including the right to receive any cash flow therefrom), and replace Six Flags as the general partner of the Partnership Parks. In this situation, the parks would be permitted to continue to use the Six Flags brand to operate. A failure to perform under the agreement would also serve as a default under Time Warner’s overall license agreement with Six Flags, which could result in the revocation of Six Flags’ ability to use Time Warner’s intellectual property in its parks.

2009 Liquidity Puts

The Partnership Parks put amounts had been immaterial prior to 2009, averaging approximately $3 million per year (see diagram below). In 2009, however, the Company witnessed approximately $66 million of puts exercised by the LP investors, primarily related to the Texas partnership. A potential factor that may have contributed to the high level of puts in 2009 was a statement by the general partner of the Texas partnership, who manages the partnership that holds SFOT LP units. The general partner has a right of first refusal to purchase up to 50% of any puts exercised in any year, and historically has purchased his full share. However, in early 2009 the general partner issued a letter to the LP’s stating that he would not be purchasing his share of puts in 2009, and that he was likely to put part of his own interests. His reasoning for the decision was undisclosed. (The general partner of the Georgia partnership exercised his right to purchase 50% of the Georgia units put in 2009.) Additionally, the unprecedented level of puts in 2009 may have been driven by investors seeking additional liquidity in the midst of the credit crisis as well as general concerns about a potential Six Flags bankruptcy filing.

CONFIDENTIAL

Historic Puts since 1998 acquisition

To meet the $66 million put obligations of 2009, funding was provided as follows: i) $7 million from the general partner of SFOG to exercise his purchase right for a portion of the puts at SFOG, ii) $6 million of funding was provided from an escrow account for Time Warner’s benefit, and iii) $53 million from a Time Warner subsidiary loan (the “Existing TW Loan”). The Company has repaid approximately $23 million of the Existing TW loan through its share of the Partnership Parks’ distribution in 2009. The remaining $30 million will remain as an obligation to the Acquisition Parties and will be repaid through the Company’s portion of the annual LP distribution.

The New Time Warner Loan

To help mitigate the risks of potential future puts, the Acquisition Parties have received a financing commitment from Time Warner for the New TW Loan to finance future puts exercised by third party holders of limited partnership units in the entities which own the Partnership Parks.

The New TW Loan provides certainty and stability to the Six Flags capital structure, particularly in an area over which it historically had no control, and is a key component of the Plan. For the first time since the acquisition of these Partnership Parks in 1998, the New TW Loan gives the Company a dedicated source of funds to meet its Partnership Park put obligations, resulting in the only source of external funding the Company has ever had around this contingent obligation.

The pricing and terms of the New TW Loan are set forth below:

New Time Warner Loan

Summary of terms and conditions

|

Lender: |

|

TW-SF LLC or any other affiliate of Time Warner Inc. |

|

Borrowers: |

|

SFOG Acquisition A, Inc.; SFOG Acquisition B, LLC; SFOT Acquisition I, Inc.; and SFOT Acquisition II Inc. (joint and several borrowers) |

|

Guarantors: |

|

SFI, SFO, SFTP, and each subsidiary of SFI who are or in the future become guarantors under the Exit Facilities |

|

Commitment: |

|

$150 million; The facility amount will be permanently reduced on a dollar-for-dollar basis to the extent of each draw under the facility |

|

Availability: |

|

· Available to be drawn for 5 years after closing · Available to fund puts exercised by LP unit holders above $10 million in 2010, $12.5 million in 2011, and $15 million thereafter · Available to be drawn on May 14th of each year |

|

Interest rate: |

|

L+525 bps (spread is 1% higher than Exit Facility debt) |

|

LIBOR floor: |

|

2.5% |

|

Term: |

|

Five years from each funding |

|

Amortization: |

|

100% of SFI’s share of preferred distributions from partnership parks applied to pay down the loans |

|

Call protection: |

|

Prepayable at par |

Mandatory Prepayment Provision

The Existing TW Loan and New TW Loan each contain a mandatory prepayment provision which requires 100% of the proceeds received from Six Flags’ share of the Limited Partner preferred return distributions to be applied in the following sequence: 1) Existing TW Loan interest 2) Existing TW Loan principal 3) New TW Loan interest 4) New TW Loan principal. The Limited Partner preferred return is a fixed obligation every year that grows by the Consumer Price Index. While the Existing and New TW Loans are in place, SFI’s share of the annual distribution will be

CONFIDENTIAL

directed first to service interest and principal on the Time Warner loans before it can be used to fund expenses and capital requirements at the Partnership Parks. Consequently, Six Flags will be required to make up any cash flow shortfall at the Partnership Parks through affiliate loans from the general partners of the Partnership Parks (indirect subsidiaries of SFI) to the Partnership Parks. Once the Time Warner loans are repaid, Six Flags’ share of the distribution will become available to fund any cash flow shortfalls at the Partnership Parks, or any other obligations of SFI and its subsidiaries.

CONFIDENTIAL

4. Summary of terms and conditions

(Complete facilities Term Sheets have been posted to Intralinks for lender review)

CONFIDENTIAL

5. Form of commitment advice

Form of Commitment Advice

(Telecopy to Steve Lunau at 917-464-4197 or email to steven.c.lunau@jpmorgan.com)

|

J.P.

Morgan Securities Inc. |

|

Bank

of America Merrill Lynch |

|

Barclays

Capital |

|

Deutsche

Bank Securities |

Ladies and Gentlemen:

We refer to the Summary of Terms and Conditions for Six Flags Theme Parks Inc. (the “Borrower”) included in the Confidential Information Memorandum dated January 7, 2010. Subject only to satisfactory documentation, we are pleased to commit $ million to the Exit Revolving Credit facility and $ million to the Exit Term Loan. We understand that allocations will be made at the discretion of the Company and the Joint Bookrunners.

Our commitment is made solely on behalf of our institution and does not in any way include a commitment or other arrangement from any other non-affiliated institution. We agree that no secondary selling or offers to purchase will occur until the Joint Bookrunners declare the primary syndication to be complete.

Our decision to issue our commitment is based on our independent investigation of the financial condition, creditworthiness, affairs and the status of the Company without reliance upon any material or information furnished to us by the Joint Bookrunners or any of their affiliates, which material or information is hereby acknowledged by us to have been for informational purposes only without any representation or warranty by the Joint Bookrunners or their affiliates.

Very truly yours,

Authorized Officer:

Title:

Lender:

Telephone Number:

CONFIDENTIAL

6. Administrative questionnaire

(Administrative questionnaire has been posted separately to Intralinks)

CONFIDENTIAL

7. Business description

From the creation of the Six Flags brand in 1961 with one theme park in Arlington, Texas, to its expansion over the past 48 years, both throughout the United States and internationally, Six Flags has established its position as a leader in the amusement and theme park industries. Today, Six Flags is the largest regional theme park operator in the world. The 20 parks the Company operates had attendance of approximately 25.3 million during the 2008 season in geographically diverse markets across North America. Its theme parks offer a complete family-oriented entertainment experience along with a broad selection of state-of-the-art and traditional thrill rides, water attractions, themed areas, concerts and shows, restaurants, game venues and retail outlets. In the aggregate, during 2008 the Company’s theme parks offered more than 800 rides, including over 120 roller coasters, making it the leading provider of “thrill rides” in the industry.

From its headquarters in New York City, Six Flags operates parks throughout North America, and has entered into development agreements to extend its brand beyond North America. SFI, a publicly-traded corporation, is the ultimate parent of each of the other Six Flags entities. Six Flags conducts the majority of its business through SFO which, in turn, owns all of the capital stock of SFTP. SFTP owns, directly or through its subsidiaries, all of Six Flags’ parks other than the Partnership Parks. GP Holdings, Inc., through its subsidiaries, is the general partner of the partnerships that own portions of the Partnership Parks. The entities that own and operate both the Partnership Parks and the Company’s foreign parks were not part of the Company’s Chapter 11 filing.

Summary organizational chart

CONFIDENTIAL

Six Flags generates park revenue from three distinct sources: 1) admissions, 2) in-park food, merchandise and other revenue, and 3) sponsorship, licensing and other fees. Admissions represented 52% of Six Flags’ total revenue in 2008, while food, merchandise and other revenue represented 42% and sponsorship, licensing and other fees represented 6%.

Revenue breakdown

Ancillary lines of business

dick clark productions, inc. (“dcp”)

On June 18, 2007, Six Flags acquired an original 40% interest (subsequently reduced to 39.2%) in a venture that owns dcp for a net investment of approximately $39.7 million. The Company believes that its investment in dcp provides it with additional sponsorship and promotional opportunities. In addition, Six Flags receives an annual fee to manage dcp. Six Flags leverages the dcp library, which includes the Golden Globes, the American Music Awards, the Academy of Country Music Awards, So You Think You Can Dance, American Bandstand and Dick Clark’s New Year’s Rockin’ Eve, to provide additional product offerings in its parks. It uses this library within its parks through rewind and blooper shows on SFTV television programming, stage shows, sweepstakes and drawings for tickets to the awards shows.

Six Flags Great Escape Lodge & Indoor Waterpark (“HWP”)

Six Flags currently manages and owns a 41% interest in this hotel indoor-waterpark located in Lake George, New York, which is adjacent to the Company’s wholly-owned Great Escape theme park. HWP is a 200 room lodge featuring a 38,000 sq ft indoor water park offering entertainment, casual dining, meeting and conference centers and a day spa.

|

|

|

|

|

|

International licensing

International licensing provides Six Flags an opportunity for high-margin revenue growth that leverages its strong brand name and design, development, and operational expertise without requiring any commitment of capital. The international licensing and development deals include fees for the license and use of Six Flags’ intellectual property and for design and development services. Licensees are provided the exclusive use of marks and services in the respective territory. Throughout the term of the license they pay Six Flags a fixed fee payment. In addition, licensees are granted the on-going use of marks and services upon project opening, at which time Six Flags is entitled to royalty payments.

CONFIDENTIAL

Six Flags also provides concept, design, and development services including creation of a master plan, incorporating key aspects of the brand, creative consulting, conceptualization and attraction design.

Dubai licensing deal

In March 2008, Six Flags entered into an agreement with Tatweer Dubai LLC, a member of Dubai Holding (“Tatweer”), to create a Six Flags-branded theme park in Dubai, United Arab Emirates. Pursuant to the agreement, Six Flags is providing design and development services for the creation of the park, which will be operated and managed by Tatweer or one of its affiliates. Six Flags also granted Tatweer the exclusive right to use the Company’s brand in certain countries for certain time periods including the United Arab Emirates. As consideration for services rendered and for the exclusivity rights granted in the agreement, Six Flags will receive license and other fees over the design and development period plus an ongoing royalty fee once the park opens.

Theme Park Operations