Attached files

| file | filename |

|---|---|

| EX-23.2 - EXHIBIT 23.2 - DynaVox Inc. | a2195932zex-23_2.htm |

| EX-23.1 - EXHIBIT 23.1 - DynaVox Inc. | a2195932zex-23_1.htm |

Use these links to rapidly review the document

Table of Contents

INDEX TO FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on January 5, 2010.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

DynaVox Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

7373 (Primary Standard Industrial Classification Code Number) |

27-1507281 (I.R.S. Employer Identification No.) |

2100 Wharton Street

Suite 400

Pittsburgh, PA 15203

Telephone: (412) 381-4883

(Address, including zip code, and telephone number, including area code, of Registrant's principal executive offices)

Edward L. Donnelly, Jr.

Chief Executive Officer

DynaVox Inc.

2100 Wharton Street

Suite 400

Pittsburgh, PA 15203

Telephone: (412) 381-4883

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

Joshua Ford Bonnie Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, NY 10017-3954 Telephone: (212) 455-2000 Facsimile: (212) 455-2502 |

Jonathan A. Schaffzin Cahill Gordon & Reindel LLP 80 Pine Street New York, NY 10005 Telephone: (212) 701-3000 Facsimile: (212) 269-5420 |

|

Approximate date of commencement of the proposed sale of the securities to the public: As soon as practicable after the Registration Statement is declared effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

|

||||

| Title Of Each Class Of Securities To Be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee |

||

|---|---|---|---|---|

Class A Common Stock, par value $.01 per share |

$125,000,000 | $8,912.50 | ||

|

||||

- (1)

- Estimated

solely for the purpose of determining the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933.

- (2)

- Includes shares of Class A common stock subject to the underwriters' option to purchase additional shares of Class A common stock.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated January 5, 2010

Preliminary Prospectus

Shares

DynaVox Inc.

Class A Common Stock

This is the initial public offering of our Class A common stock. No public market currently exists for our Class A common stock. We are offering all of the shares in this offering. We expect the initial public offering price to be between $ and $ per share. We intend to apply to list our Class A common stock on the NASDAQ Global Market under the symbol "DVOX."

We intend to use a portion of the net proceeds from this offering to purchase equity interests in our business from our existing owners, including members of our senior management.

Investing in shares of our Class A common stock involves risks. See "Risk Factors" beginning on page 13 to read about factors you should consider before buying shares of our Class A common stock.

|

||||

| |

Per Share |

Total |

||

|---|---|---|---|---|

Initial public offering price |

$ | $ | ||

Underwriting discount |

$ | $ | ||

Proceeds, before expenses, to DynaVox Inc. |

$ | $ | ||

|

||||

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters have a 30-day option to purchase up to an additional shares of our Class A common stock from us at the initial public offering price less the underwriting discount, to cover over-allotments, if any.

The underwriters are offering the Class A common stock as set forth under "Underwriting." Delivery of the shares of our Class A common stock will be made on or about , 2010.

| Piper Jaffray | Jefferies & Company | |

William Blair & Company |

Wells Fargo Securities |

The date of this prospectus is , 2010

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered to you. Neither we nor the underwriters have authorized anyone to provide you with additional or different information. We and the underwriters are offering to sell, and seeking offers to buy, shares of our Class A common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our Class A common stock.

Unless the context suggests otherwise, references in this prospectus to "DynaVox," the "Company," "we," "us" and "our" refer (1) prior to the consummation of the Offering Transactions described under "Organizational Structure—Offering Transactions," to DynaVox Systems Holdings LLC and its consolidated subsidiaries and (2) after the Offering Transactions described under "Organizational Structure—Offering Transactions," to DynaVox Inc. and its consolidated subsidiaries. We refer to Vestar Capital Partners, a New York-based registered investment adviser (together with its affiliates, "Vestar"), and the other owners of DynaVox Systems Holdings LLC prior to the Offering Transactions, collectively, as our "existing owners."

Unless indicated otherwise, the information included in this prospectus assumes no exercise by the underwriters of the option to purchase up to an additional shares of Class A common stock from us and that the shares of Class A common stock to be sold in this offering are sold at $ per share of Class A common stock, which is the midpoint of the price range indicated on the front cover of this prospectus.

i

This summary highlights selected information contained elsewhere in this prospectus and does not contain all the information you should consider before investing in shares of our Class A common stock. You should read this entire prospectus carefully, including the section entitled "Risk Factors" and the financial statements and the related notes included elsewhere in this prospectus, before you decide to invest in shares of our Class A common stock.

We develop and market industry-leading software, devices and content to assist people in overcoming their speech, language or learning disabilities. Our proprietary software is the result of decades of research and development and our trademark- and copyright-protected symbol sets are more widely used than any other in the world. These assets have positioned us as a leader in two areas within the broader market for assistive technologies—speech generating technologies and special education software. Due to the magnitude and growth of the underserved non-verbal or speech impaired populations in our targeted geographies and the significant and growing portion of the student populations who are classified as having special educational requirements, we believe that there are substantial opportunities for growth within both of these areas.

We are the largest provider of speech generating technology and we believe that we sell a significantly greater number of speech generating devices than our next largest competitor each year. We believe that this area of the assistive technologies market is significantly underpenetrated and growing. We estimate that each year in our targeted geographies 350,000 additional individuals join the population of those who could use advanced speech generating technologies but that, due to a low level of awareness, only a small proportion of these individuals will actually receive such a device. Our speech generating devices are used by those who are unable to speak, such as adults with amyotrophic lateral sclerosis, or ALS, often referred to as Lou Gehrig's disease, strokes or traumatic brain injuries and children with cerebral palsy, autism or other disorders. We believe that our speech generating devices can transform the lives of users by enabling them to communicate through synthesized or digitized (recorded) speech. Our devices also allow these individuals to connect with society and control their environment in a variety of ways, including the ability to access the Internet, send text messages and control light switches, televisions and other features of their homes. Our speech generating devices are powered by our software platform that utilizes sophisticated adaptive and predictive language models and our proprietary symbol sets. These devices allow our users to rapidly and efficiently generate speech. Our portfolio of speech generating devices provides users with a broad range of features and designs and makes use of an array of adaptive technology that permits users with physical or cognitive limitations to access and control our devices. For example, our new Xpress product line offers our speech generating technology in a small, portable device that uses a high resolution dynamic capacitive touch screen for clients with some level of physical ability, while our Vmax product allows more physically restricted users to control the device with their tongue, their head or, with the use of our EyeMax accessory, their eye movements. Speech generating technologies are prescribed based on evaluations by speech language pathologists and either provided directly by institutions, such as schools or funded for eligible clients by third-party payors including the U.S. Centers for Medicare and Medicaid Services, or CMS, and private insurance programs. In our fiscal year ended July 3, 2009, sales of our speech generating technology products represented approximately 82% of our net sales.

We are a leading provider of software for special education teachers and students with complex communication and learning needs. Our software is used by children with cognitive challenges, such as those caused by autism, Down syndrome or brain injury; physical challenges, such as those caused by cerebral palsy or other neuromuscular disorders; as well as by children with learning disabilities, such as severe dyslexia. Symbol-based adapted activities and material are the preferred method of educating children with these special needs. Educators use our proprietary software as a publishing and editing

1

tool to create interactive, symbol-based educational activities and materials for these students and to adapt text-based materials to symbol-based materials for students with limited reading skills. Our Boardmaker family of products, which utilize our proprietary symbol sets, are the most widely used and recognized tools for creating symbol-based activities and materials in the industry. In calendar year 2010, we plan to introduce the next generation of our special education software, which we anticipate will be adopted by our existing customer base as well as new users. In addition to offering the key elements of functionality provided by our previous offerings, our newest software platform will include significant new content as well as online and desktop assets that provide an integrated web-based environment and the ability to collaborate and share content, or purchase our professionally-generated content, online. Funding for instructional materials for students with special needs and funding for technology in classrooms have grown in recent years and are forecasted to continue to grow. Funding comes primarily from federal sources including the American Recovery and Reinvestment Act, or ARRA, and the Individuals with Disabilities Education Act, or IDEA, but also includes funding from state and local governments as well as private schools and parents of children with special needs. In our fiscal year ended July 3, 2009, sales of our special education software products represented approximately 18% of our net sales.

In the United States, Canada and the United Kingdom, we sell our speech generating devices through a direct sales infrastructure focused on speech language pathologists. We believe that our sales force is significantly larger than that of our next largest competitor. We use strategic partnerships with third-party distributors to sell our products in other international markets that we have targeted. We sell our special education software through direct mail as well as through the Internet. We are also investing in our web-based and social media-based marketing and education efforts to build awareness for both our speech generating technologies and our special education software.

We place great importance on research and development and have a long history and demonstrated track record of innovation. We have innovated in the areas of touch screens with dynamic display, environmental control and word prediction in speech generating devices. Additionally, our Boardmaker family of products has been a leader in interactive symbol-based special education software.

We have increased our net income to $8.8 million in our fiscal year ended July 3, 2009 from $4.9 million in our fiscal year ended June 29, 2007, representing a compound annual growth rate, or CAGR, of 34%. Our net sales has similarly increased, to $91.2 million in fiscal 2009 from $66.2 million in fiscal 2007, representing a CAGR of 17%. This increase in net sales, along with improved operating efficiencies, has enabled us to grow our earnings before interest, taxes, depreciation and amortization with certain other adjustments, or Adjusted EBITDA, to $24.5 million in our fiscal year ended July 3, 2009 from $13.0 million in our fiscal year ended June 29, 2007, representing a CAGR of 37%. Our net income, net sales and Adjusted EBITDA for the thirteen week period ended October 2, 2009 were $1.7 million, $24.3 million and $5.5 million, respectively. For an explanation of Adjusted EBITDA and a reconciliation of our Adjusted EBITDA to net income, see footnote 1 under "—Summary Historical Consolidated Financial and Other Data."

Industry Overview

We currently compete in two areas within the assistive technologies market: speech generating technologies and special education software.

Speech Generating Technologies

Speech generating technologies are generally used as a proxy for verbal communication by non-verbal or substantially speech impaired adults and children. Degenerative and congenital conditions commonly found in adult and child users of speech generating technology include cerebral palsy, intellectual disabilities, ALS and autism. Other users of speech generating technology include adults who have

2

experienced a stroke or traumatic brain injury as well as adults and children with temporary speech impairments.

We currently market our products in the United States, Canada, Australia, the United Kingdom and certain other countries within the European Union. According to sources such as the Centers for Disease Control, approximately 20 million adults and children in the United States suffer from conditions that may potentially lead to speech impairment, and it is estimated that 1.1 million additional individuals are diagnosed with these conditions every year. Assuming the same level of incidence, we estimate that throughout our targeted geographies approximately 46 million individuals suffer from these conditions and approximately 2.5 million additional individuals are diagnosed with them each year. We estimate that approximately 14% of these individuals, or 350,000 additional adults and children each year, are candidates for speech generating technologies, resulting in an annual opportunity of $1.8 billion from just new cases alone.

The speech generating device segment of the assistive technology market is significantly under-penetrated for the eligible population who could benefit from this technology. We estimate that in our targeted geographies only a small proportion of those individuals who are diagnosed each year with a condition leading to speech impairment and who could use advanced speech generating technologies actually receive such a device. Furthermore, we believe that the subset of U.S. speech language pathologists who work with individuals who could benefit from advanced speech generating technologies and who recommend a device is underpenetrated. We believe a number of factors will contribute to the increased demand for speech generating technology, including:

- •

- Growing Awareness Among Speech Language Pathologists. As

more speech language pathologists learn about the benefits of speech generating technology and the availability of funding, either through formal training or professional experience, an increasing

percentage of these specialists are recommending speech generating devices.

- •

- Increasing Awareness Among the Underserved

Population. More potential users and their caregivers are learning about the benefits of speech generating technology. There is a

growing level of media coverage of speech generating devices and their users, and consumers are proactively learning about speech generating technology through web-based research and

through web- and social media-based networking.

- •

- Advances in Technology. Technological advances have made

speech generating technology more appealing and accessible to a broader range of potential users.

- •

- Increasing Number of Eligible Users. Many of the

congenital, degenerative and traumatic conditions that cause speech impairment are becoming more prevalent.

- •

- Social Trends. Speech generating technologies are continuing to garner a greater level of acceptance, including enhanced funding support from federal, state and school sources.

Special Education Software

Schools use a variety of instructional materials to meet the needs of students with speech and learning disabilities, including print-based materials and interactive software. These instructional materials are used by special education teachers and speech language pathologists to create symbol-based activities and content in order to facilitate learning and communication by students with physical, developmental, or congenital learning disabilities.

Special education software targets students in kindergarten through 12th grade, or K–12, schools. In the United States, approximately 132,000 K–12 schools serve more than 55 million students. An estimated $12.2 billion was spent on instructional materials for K–12 education in the 2008–2009 school year. An

3

estimated 6.0 million students in the United States are deemed to require special education, representing a market opportunity in excess of $1.0 billion.

We believe several factors will drive continued growth for special education software and content, including:

- •

- Rising Education Accountability Standards. Accountability

standards such as those promulgated under Elementary and Secondary Education Act, commonly referred to as No Child Left Behind, or NCLB, set objectives that schools must satisfy for their entire

student populations. As such, schools are focusing more of their efforts and resources on serving the more educationally challenged students, which requires unique approaches to learning.

- •

- Higher Funding Levels. In recent years, programs such as

IDEA have provided new and growing sources of funds specifically earmarked for the educational needs of students with learning disabilities, including those with communication challenges.

- •

- Advancing Software Technologies. As software technologies

develop towards faster, more portable and less expensive computing power, schools are allocating more funds from their budgets to support technology. Web-enabled classrooms and software

programs are also leading to increasing user appetites for pre-generated educational content available on a ready-to-use basis.

- •

- Increasing Spending on Education Globally. As countries become wealthier and more developed, classification standards for special education are becoming more inclusive. As more attention is paid internationally to students with special educational challenges, we expect that there will be increasing demand for special education software and content worldwide to meet their needs.

Our Solutions

We are focused on using technology to give people the ability to communicate and learn. We have developed a proprietary software platform that powers our speech generating devices to provide voice to those who cannot speak and is used by educators to help children with special needs. This software is the product of many years of research and development and utilizes our proprietary symbol sets and sophisticated adaptive and predictive language models to make communication more efficient.

Our Speech Generating Technology Solutions

We believe that our speech generating technologies can transform the lives of those who have significant speech, language, physical or learning challenges by enabling their communication. We believe the following competitive strengths have allowed us to achieve and maintain our position as the leading provider of speech generating technology:

- •

- Broad and Innovative Speech Generating Device

Portfolio. We believe we offer the broadest and most innovative portfolio of speech generating devices that address the needs of

individuals with severe physical or cognitive limitations.

- •

- Features that Enhance the Quality of Life for Users. We

believe our implementation of the same advances that are being made in the consumer electronics area, such as reduction in device size and offering devices with a variety of appearances and features

to suit individual preferences, is not only enhancing the quality of life for our users but also expanding the attractiveness of using a device.

- •

- Comprehensive Customer Service and Support. We believe our customer service team is the largest in the industry. We seek to make it as easy as possible for those who can benefit from our speech generating technologies to learn about our product offerings, to obtain the right device and receive the support they need to integrate that device into their lives. We do this by providing a significant portion of our customer support, including demonstrations, information,

4

documentation and support during the evaluation period and, in some cases, providing a no-charge loaner device to potential customers, prior to the actual sale.

Our Special Education Software Solutions

Our special education software allows educators to efficiently and collaboratively create interactive, symbol-based educational activities and materials for students with a variety of physical and cognitive challenges and to adapt text-based materials to symbol-based materials for students with reading difficulties. In addition, our rich collection of professionally-generated content for specific lesson plans provides a valuable, time-saving tool for teachers. We believe the following key factors enhance our market position in the special education software market:

- •

- Offer Educators a Family of Products for Creating, Adapting and Delivering

Content. We offer the Boardmaker family of products, the most widely used and recognized publishing and editing tool that allows educators to efficiently create, adapt and

deliver learning activities to suit the unique challenges of their students.

- •

- Focus on an Enhanced and Customized Learning and Communication Experience for

Children. Our software provides educators with the necessary tools to enhance the learning experience for students with special needs. Our software motivates students with

auditory feedback and support through digitized or synthesized speech.

- •

- Provide Professionally-Generated Proprietary Content

Offerings. We offer a library of high-quality proprietary professionally-generated content that is immediately accessible to educators

as an add-on purchase to our software offerings so that they can spend their time adapting materials for their students, rather than creating materials from scratch. Our selection of proprietary

content provides time-saving, ready-made educational activities, templates and communication boards for use with our Boardmaker software platform.

- •

- Host and Manage Online Community Resource for Educators. We created, host and manage the fast-growing AdaptedLearning.com website, which provides users of our special education software platform with an online community. Our AdaptedLearning.com community combines file sharing, powerful search capabilities, implementation articles, open discussion forums and community functions where educators can interact with each other on the challenges they face and find thousands of pre-made activities that others have created and posted to share. Currently, we provide access to AdaptedLearning.com for free to both users of our special education software platform and others, including non-customers.

Our Strategy for Growth

Our mission is to transform the lives of those who have significant speech, language or learning disabilities. We believe that there remains a large global opportunity for us to serve the unmet needs of individuals who could benefit from our software, devices and content. Accordingly, we believe we can further expand the market penetration of our products and increase our revenue and earnings by pursuing the following business strategies:

- •

- Continue to Expand the Scale, Reach and Sophistication of Our Direct Sales Force. We plan to continue expanding our direct sales infrastructure in order to educate more speech language pathologists about the benefits to their clients of recommending our speech generating technologies. We plan to pursue more specialized segment-focused sales strategies, to better tailor our sales efforts to the particular needs and concerns of different types of customers, such as through separate sales teams focusing on children- and adult-specific speech language pathologists, specific institutions such as schools and hospitals or key accounts.

5

- •

- Continue to Build Awareness. We believe that a majority

of non-verbal individuals and their caregivers are unaware that products such as ours exist. We plan to expand our coordinated marketing and public relations efforts to build awareness of

our speech generating technologies among both potential end users and speech language pathologists. We are also investing in our web-based and social media-based marketing and education

efforts to build awareness and increase the frequency of customer contact for both our speech generating technologies and our special education software.

- •

- Continue to Build Communities. We are expanding our

fast-growing AdaptedLearning.com user community, which allows users of our software platform and others to share user-generated content as well as interact and exchange best practices. We

believe that our sponsorship and support for the AdaptedLearning.com user community provides us with a connectedness with and deeper insight into our customers and a channel for marketing our

professionally-generated content. We also plan to continue to strengthen our relationships with groups and institutions that serve individuals who could benefit from our products.

- •

- Continue to Innovate and Maintain Our Technology Leadership

Position. We place great importance on research and development and have a long history and demonstrated track record of innovation. We

have innovated in the areas of touch screens with dynamic display, environmental control and word prediction in speech generating devices and, through our Boardmaker family of products, we have been a

leader in developing interactive symbol-based special education software. We plan to continue to develop new devices, access methods and modes of communication and to build upon our competitive

advantage by protecting our intellectual property as we continue to innovate.

- •

- Continue to Strategically Drive Our International Sales. We plan to continue to increase the revenue we generate from our existing and new international markets. We intend to strategically extend our proven direct sales model and add distributors in key markets, with a focus on those countries with broadly available funding for our products. We also intend to continue to expand our international marketing efforts.

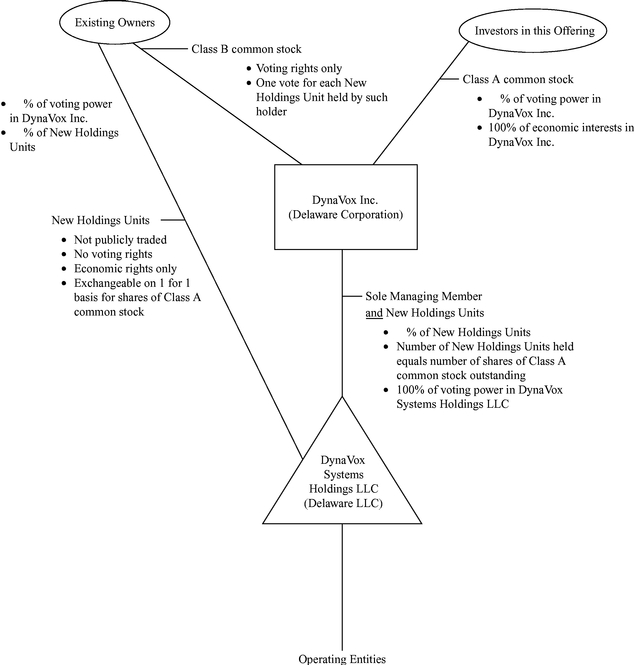

Following this offering we will be a holding company and our sole asset will be a controlling equity interest in DynaVox Systems Holdings LLC. We will operate and control all of the business and affairs and consolidate the financial results of DynaVox Systems Holdings LLC and its subsidiaries. Prior to the completion of this offering, the limited liability company agreement of DynaVox Systems Holdings LLC will be amended and restated to, among other things, modify its capital structure by replacing the different classes of interests currently held by our existing owners with a single new class of units that we refer to as "New Holdings Units." We and our existing owners will also enter into an exchange agreement under which (subject to the terms of the exchange agreement) they will have the right to exchange their New Holdings Units for shares of our Class A common stock on a one-for-one basis, subject to customary conversion rate adjustments for stock splits, stock dividends and reclassifications. See "Organizational Structure."

An investment in shares of our Class A common stock involves substantial risks and uncertainties. For example, our business could be adversely affected by the current adverse economic environment and the associated negative impact on tax revenue available to federal, state and local governments. It is also possible that the significant reforms to the healthcare system in the United States being considered by Congress could result in reductions in funding available for our speech generating technologies.

6

Some of the other more significant challenges and risks relating to an investment in our company include those associated with:

- •

- the availability and extent of funding from third-party payors for our speech generating technologies and the availability

of funding for our special education software and content;

- •

- our dependence upon, and ability to continue to attract and retain, key personnel;

- •

- our ability to continue to develop and market successful new software, devices and content and our susceptibility to new

disruptive technologies; and

- •

- our dependence on the continued support of speech language pathologists and special education teachers.

Please see "Risk Factors" for a discussion of these and other factors you should consider before making an investment in shares of our Class A common stock.

DynaVox Inc. was formed in Delaware on December 16, 2009. Our principal executive offices are located at 2100 Wharton Street, Suite 400, Pittsburgh, PA 15203 and our telephone number is (412) 381-4883.

7

Class A common stock offered by DynaVox Inc. |

shares. | |

Over-allotment option |

shares. |

|

Class A common stock outstanding after giving effect to this offering and assuming no exercise of the underwriters' option to purchase additional shares |

shares (or shares if all outstanding New Holdings Units held by our existing owners were exchanged for newly-issued shares of Class A common stock on a one-for-one basis). |

|

Class A common stock outstanding after giving effect to this offering and assuming full exercise of the underwriters' option to purchase additional shares |

shares (or shares if all outstanding New Holdings Units held by our existing owners were exchanged for newly-issued shares of Class A common stock on a one-for-one basis). |

|

Use of proceeds |

We estimate that our net proceeds from this offering, after deducting estimated underwriting discounts, will be approximately $ (or $ if the underwriters exercise in full their option to purchase additional shares of Class A common stock). |

|

|

We intend to use $ of these proceeds to purchase newly-issued New Holdings Units from DynaVox Systems Holdings LLC, as described under "Organizational Structure—Offering Transactions." We intend to cause DynaVox Systems Holdings LLC to use approximately $ of these proceeds to repay outstanding indebtedness and the remainder for general corporate purposes. We estimate that the expenses of this offering payable by us will be approximately $ , which expenses will be borne by DynaVox Systems Holdings LLC. |

|

|

We intend to use the remaining net proceeds from this offering, or $ (or $ if the underwriters exercise in full their option to purchase additional shares of Class A common stock), to purchase New Holdings Units from our existing owners, including members of our senior management, as described under "Organizational Structure—Offering Transactions." Accordingly, we will not retain any of these proceeds. See "Principal Stockholders" for information regarding the proceeds from this offering that will be paid to our directors and named executive officers. |

8

Voting rights |

Each share of our Class A common stock entitles its holder to one vote on all matters to be voted on by stockholders generally. |

|

|

Following the Offering Transactions, each existing owner of DynaVox Systems Holdings LLC will hold one or more shares of Class B common stock. The shares of Class B common stock have no economic rights but entitle the holder, without regard to the number of shares of Class B common stock held, to a number of votes on matters presented to stockholders of DynaVox Inc. that is equal to the aggregate number of New Holdings Units of DynaVox Systems Holdings LLC held by such holder. See "Description of Capital Stock—Common Stock—Class B Common Stock." |

|

|

Holders of our Class A common stock and Class B common stock vote together as a single class on all matters presented to our stockholders for their vote or approval, except as otherwise required by applicable law. |

|

Dividend policy |

We do not expect to pay dividends in the foreseeable future. |

|

Exchange rights of holders of New Holdings Units |

Prior to this offering we will enter into an exchange agreement with our existing owners so that they may (subject to the terms of the exchange agreement) exchange their New Holdings Units for shares of Class A common stock of DynaVox Inc. on a one-for-one basis, subject to customary conversion rate adjustments for stock splits, stock dividends and reclassifications. |

|

Risk factors |

See "Risk Factors" for a discussion of risks you should carefully consider before deciding to invest in our Class A common stock. |

|

Proposed NASDAQ Global Market symbol |

"DVOX" |

In this prospectus, unless otherwise indicated, the number of shares of Class A common stock outstanding and the other information based thereon does not reflect:

- •

- shares of Class A common stock issuable upon exercise of the

underwriters' option to purchase additional shares of Class A common stock from us;

- •

- shares of Class A common stock issuable upon exchange of

New Holdings Units (or, if the underwriters exercise in full their option to purchase additional shares of Class A common stock,

shares of Class A common

stock issuable upon exchange of New Holdings Units) that will be held by our existing owners immediately following this offering; or

- •

- shares of Class A common stock that may be granted under the 2010 DynaVox Inc. Stock Incentive Plan, or our "Stock Incentive Plan." See "Management—Stock Incentive Plan."

See "Pricing Sensitivity Analysis" to see how some of the information presented above would be affected by an initial public offering price per share of Class A common stock at the low-, mid- and high-points of the price range indicated on the front cover of this prospectus.

9

Summary Historical Consolidated Financial and Other Data

The following summary historical consolidated financial and other data of DynaVox Systems Holdings LLC should be read together with "Organizational Structure," "Unaudited Pro Forma Consolidated Financial Information," "Selected Consolidated Financial Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the historical financial statements and related notes included elsewhere in this prospectus. DynaVox Systems Holdings LLC will be considered our predecessor for accounting purposes, and its consolidated financial statements will be our historical financial statements following this offering.

We derived the summary historical consolidated statement of income data of DynaVox Systems Holdings LLC for each of the fiscal years ended June 29, 2007, June 27, 2008 and July 3, 2009 and the summary historical consolidated balance sheet data as of June 27, 2008 and July 3, 2009 from the audited consolidated financial statements of DynaVox Systems Holdings LLC which are included elsewhere in this prospectus, and derived the consolidated balance sheet data as of June 29, 2007 from the audited consolidated financial statements of DynaVox Systems Holdings LLC which are not included in this prospectus. The condensed consolidated statement of income data for the thirteen week periods ended September 26, 2008 and October 2, 2009, and the condensed consolidated balance sheet data as of October 2, 2009 have been derived from unaudited condensed consolidated financial statements of DynaVox Systems Holdings LLC included elsewhere in this prospectus. The unaudited condensed consolidated financial statements of DynaVox Systems Holdings LLC have been prepared on substantially the same basis as the audited consolidated financial statements and include all adjustments that we consider necessary for a fair presentation of our combined financial position and results of operations for all periods presented.

10

| |

Fiscal Year Ended | Thirteen Week Period Ended | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

June 29, 2007 |

June 27, 2008 |

July 3, 2009 |

September 26, 2008 |

October 2, 2009 |

||||||||||||||

| |

|

|

|

(unaudited) |

(unaudited) |

||||||||||||||

| |

(Amounts in thousands) |

||||||||||||||||||

Consolidated Statements of Income Data: |

|||||||||||||||||||

Net sales |

$ | 66,160 | $ | 81,438 | $ | 91,160 | $ | 19,200 | $ | 24,255 | |||||||||

Cost of sales |

19,718 | 23,336 | 24,366 | 5,277 | 6,064 | ||||||||||||||

Gross profit |

46,442 | 58,102 | 66,794 | 13,923 | 18,191 | ||||||||||||||

Operating expenses: |

|||||||||||||||||||

Selling and marketing |

21,743 | 24,721 | 28,152 | 6,595 | 8,513 | ||||||||||||||

Research and development |

4,230 | 5,622 | 6,886 | 1,372 | 2,241 | ||||||||||||||

General and administrative |

9,498 | 14,478 | 11,854 | 2,683 | 2,883 | ||||||||||||||

Amortization of certain intangibles |

535 | 463 | 468 | 116 | 420 | ||||||||||||||

Total operating expenses |

36,006 | 45,284 | 47,360 | 10,766 | 14,057 | ||||||||||||||

Income from operations |

10,436 | 12,818 | 19,434 | 3,157 | 4,134 | ||||||||||||||

Other income (expense): |

|||||||||||||||||||

Interest income |

98 | 174 | 111 | 39 | 22 | ||||||||||||||

Interest expense |

(5,582 | ) | (4,856 | ) | (8,420 | ) | (2,365 | ) | (2,010 | ) | |||||||||

Change in fair value and net gain (loss) on interest rate swap agreements |

209 | (188 | ) | (1,588 | ) | 165 | (327 | ) | |||||||||||

Other expense—net |

(83 | ) | (362 | ) | (518 | ) | (15 | ) | (61 | ) | |||||||||

Total other income (expense) |

(5,358 | ) | (5,232 | ) | (10,415 | ) | (2,176 | ) | (2,376 | ) | |||||||||

Income before income taxes |

5,078 | 7,586 | 9,019 | 981 | 1,758 | ||||||||||||||

Income taxes |

174 | 323 | 181 | 21 | 98 | ||||||||||||||

Net income |

$ | 4,904 | $ | 7,263 | $ | 8,838 | $ | 960 | $ | 1,660 | |||||||||

Consolidated Balance Sheet Data (at end of period): |

|||||||||||||||||||

Cash |

$ | 6,019 | $ | 6,240 | $ | 12,631 | $ | 7,396 | |||||||||||

Working capital |

12,362 | 11,738 | 16,858 | 15,137 | |||||||||||||||

Goodwill and intangible assets—net |

81,381 | 80,933 | 80,465 | 82,768 | |||||||||||||||

Total assets |

113,965 | 116,784 | 124,201 | 122,250 | |||||||||||||||

Total long-term debt (excluding current portion) |

53,596 | 82,795 | 79,536 | 78,066 | |||||||||||||||

Total members' equity |

44,007 | 16,325 | 24,813 | 27,509 | |||||||||||||||

Other Data: |

|||||||||||||||||||

Adjusted EBITDA(1) |

$ | 13,004 | $ | 18,749 | $ | 24,468 | $ | 3,951 | $ | 5,520 | |||||||||

- (1)

- Adjusted EBITDA represents net income before interest income, interest expense, income taxes, and depreciation and amortization and the other adjustments noted in the table below. We present Adjusted EBITDA because:

- •

- Adjusted EBITDA is used by management in managing our business as an indicator of

our operating performance;

- •

- our compliance with certain covenants in our credit agreement is measured based on

Adjusted EBITDA. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Cash Position and

Indebtedness—Financing Agreements"; and

- •

- targets for Adjusted EBITDA are among the measures we use to evaluate our management's performance for purposes of determining their compensation under our management incentive bonus plan. See Management—Executive Compensation—Compensation Discussion and Analysis."

Our management uses Adjusted EBITDA principally as a measure of our operating performance and believes that Adjusted EBITDA is useful to investors because it is frequently used by securities analysts, investors and other interested parties in their evaluation of the operating performance of companies in industries similar to ours. We also believe Adjusted EBITDA is useful to our management and investors as a measure of comparative operating performance from period to period. Our management also uses Adjusted EBITDA for planning purposes, including the preparation of our annual operating budget and financial projections.

11

Adjusted EBITDA, however, does not represent and should not be considered as an alternative to net income or cash flow from operating activities, as determined in accordance with GAAP, and our calculations thereof may not be comparable to similarly entitled measures reported by other companies. Although we use Adjusted EBITDA as a measure to assess the operating performance of our business, Adjusted EBITDA has significant limitations as an analytical tool because it excludes certain material costs. For example, it does not include interest expense or the change in fair value on our related interest rate swap agreements, which have been necessary elements of our costs. Because we use capital assets, depreciation expense is a necessary element of our costs and ability to generate revenue. In addition, the omission of the substantial amortization expense associated with our intangible assets further limits the usefulness of this measure. Adjusted EBITDA also does not include the payment of taxes, which is also a necessary element of our operations. Adjusted EBITDA also does not include expenses incurred in connection with equity-based compensation to our employees, certain costs relating to restructuring and acquisitions, debt refinancing fees, an insurance recovery and management fees that we pay to Vestar and certain other existing owners pursuant to a management agreement. Because Adjusted EBITDA does not account for these expenses, its utility as a measure of our operating performance has material limitations. Because of these limitations management does not view Adjusted EBITDA in isolation or as a primary performance measure and also uses other measures, such as net income, net sales, gross profit and income from operations, to measure operating performance. The following is a reconciliation of Adjusted EBITDA to net income for the periods presented:

| |

Fiscal Year Ended | Thirteen Week Period Ended | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

June 29, 2007 |

June 27, 2008 |

July 3, 2009 |

September 26, 2008 |

October 2, 2009 |

|||||||||||

| |

|

|

|

(unaudited) |

(unaudited) |

|||||||||||

| |

(Amounts in thousands) |

|||||||||||||||

Net income |

$ | 4,904 | $ | 7,263 | $ | 8,838 | $ | 960 | $ | 1,660 | ||||||

Income taxes |

174 | 323 | 181 | 21 | 98 | |||||||||||

Depreciation |

1,403 | 1,671 | 2,186 | 477 | 664 | |||||||||||

Amortization of certain intangibles |

535 | 463 | 468 | 116 | 475 | |||||||||||

Interest income |

(98 | ) | (174 | ) | (111 | ) | (39 | ) | (22 | ) | ||||||

Interest expense |

5,582 | 4,856 | 8,420 | 2,365 | 2,010 | |||||||||||

Change in fair value and net loss (gain) on interest rate swap agreements |

(209 | ) | 188 | 1,588 | (165 | ) | 327 | |||||||||

Other expense, net(a) |

24 | 488 | 865 | 26 | 5 | |||||||||||

Equity-based compensation |

388 | 871 | 764 | 114 | 190 | |||||||||||

Employee severance costs |

— | 2,200 | 501 | — | — | |||||||||||

Acquisition costs(b) |

— | — | 430 | — | 38 | |||||||||||

Management fee(c) |

300 | 300 | 300 | 75 | 75 | |||||||||||

Other(d) |

— | 300 | 38 | — | — | |||||||||||

Adjusted EBITDA |

$ | 13,004 | $ | 18,749 | $ | 24,468 | $ | 3,951 | $ | 5,520 | ||||||

- (a)

- Excludes

realized foreign currency gains or losses.

- (b)

- Legal,

accounting and other external costs related to the purchase of Blink Twice, Inc.

- (c)

- We

receive advisory services from Vestar and certain existing owners.

- (d)

- Executive recruiting fees and relocation costs.

12

An investment in shares of our Class A common stock involves risks. You should carefully consider the following information about these risks, together with the other information contained in this prospectus, before investing in shares of our Class A common stock.

Risks Related to Our Business

The current adverse economic environment, including the associated impact on government budgets, could adversely affect our business.

In late 2008 and early 2009, the U.S. and global economies deteriorated significantly, and although the economic, financial and credit market crises have somewhat abated, they continue to contribute to market turbulence and weakness. These factors continue to impact global economic conditions, raise heightened concerns about a prolonged global economic recession and have resulted in a significant loss of corporate earnings and consumer spending. As a result, tax revenue for federal, state and local governments has decreased substantially. In response to the reduced revenue, governments have cut funding and may continue to cut funding to public programs, including schools.

The majority of the funding for purchases of our special education software and content and a significant portion of the funding for purchases of our speech generating devices comes from the budgets of public schools. Our speech generating technology business is also dependent on funding from Medicare or Medicaid or other state or local government sources. Many state and local government agencies operate under tight budget constraints and make choices on a yearly basis of where to allocate funds. If government agencies redirect funds from special education programs, Medicaid programs or other disability programs to alternative projects, our net sales and results of operations could be adversely affected.

Changes in funding for public schools could cause the demand for our special education software and content to decrease.

We derive a significant portion of both our speech generating devices and our special education software and content revenue from public schools, which are heavily dependent on federal, state and local government funding. In addition, the school appropriations process is often slow, unpredictable and subject to many factors outside of our control. Curtailments, delays, changes in leadership, shifts in priorities or general reductions in funding could delay or reduce our revenue. Funding difficulties experienced by schools could also cause those institutions to be more resistant to price increases and could slow investments in educational products which could harm our business.

Our business may be adversely affected by changes in state educational funding as a result of changes in legislation, both at the federal and state level, changes in the state procurement process, changes in government leadership, emergence of other priorities and changes in the condition of the local, state or U.S. economy. While in the past few years the availability of state and federal funding for elementary and high school education has improved due to legislation such as No Child Left Behind, recent reductions in, and proposed elimination of, appropriations for these programs may cause some school districts to reduce spending on our products. Reductions in funding for public schools may harm our business if our customers are not able to find and obtain alternative sources of funding.

Proposed reforms to the United States healthcare system may adversely affect our business.

Congress is currently considering a number of substantial reforms to the United States healthcare system. It is unclear whether any of these proposals will ultimately become law, what form they could take or what effect they may have on our business or results of operations. It is possible that any such reform could include programs to reduce spending on healthcare-related products, which may include our speech generating technologies.

13

Healthcare legislative or administrative changes resulting in restrictive third-party payor funding practices or preferences for alternatives may decrease the demand for, or put downward pressure on the price of, our speech generating devices.

Customers for our speech generating devices typically receive funding from various third-party payors, including governmental programs (such as Medicare and Medicaid), private insurance plans and managed care plans. The ability of our customers to obtain appropriate funding for our speech generating devices from government and third-party payors is critical to our success. The availability and extent of coverage affects which products customers purchase and the prices they are willing to pay. Funding varies from country to country and can significantly impact the acceptance of new products. After we develop a promising new speech generating device, we may experience limited demand for the product unless funding approval is obtained from private and governmental third-party payors.

Legislative or administrative changes to the U.S. or international funding systems that significantly reduce funding for our products or deny coverage for our products, or adverse decisions relating to our products by administrators of such systems in coverage or funding rates, would have an adverse impact on the number of products purchased by our customers and the prices our customers are willing to pay for them, which would, in turn, adversely affect our business, financial condition and results of operations.

CMS established coverage for assistive technologies to address speech impairment in 2001 and since that time most private insurers have added such coverage as well. Payors continue to review their funding polices and can, without notice, deny coverage for our speech generating devices. Additionally, many private third-party payors base their funding policy decisions on the decision reached by governmental agencies such as Medicare or Medicaid. As a result of this, if Medicare or Medicaid alters its funding policy in an unfavorable way to us, the effects could be compounded if private insurers followed suit. CMS sets coverage policy for the Medicare program in the United States. CMS policies may alter coverage and payment related to our speech generating devices in the future. These changes may occur as the result of National Coverage Decisions issued by CMS directly or as the result of local or regional coverage decisions by contractors under contract with CMS to review and make coverage and payment decisions.

The loss of members of our senior management or other key personnel or the failure to attract and retain highly qualified personnel could compromise our ability to effectively manage our business and pursue our growth strategy.

We rely on members of our senior management to execute our existing business plans and to identify and pursue new opportunities. Our chief executive officer, Edward L. Donnelly, Jr., has been our chief executive officer since September 2007 and has been a member of the management committee of DynaVox Systems Holdings LLC since May 2004. Under the leadership of Mr. Donnelly, along with our other executive officers, Michelle L. Heying, Robert E. Cunningham and Kenneth D. Misch, we have been able to generate significant growth in our revenue while at the same time expanding our profit margins. The loss of services of one or more of our key senior managers could materially and adversely affect our business, financial condition and operating results.

Our future performance depends on the continued service of our key technical, development, sales, marketing and services personnel. We rely on our technical and development personnel for product innovation. We rely on our sales and marketing personnel to continue to expand awareness of our products and our customer base. The loss of key employees could result in significant disruptions to our business, and the integration of replacement personnel could be costly and time consuming, could cause additional disruptions to our business, and could be unsuccessful. We do not carry key person life insurance covering any of our employees.

14

Our future success also depends on our continued ability to attract and retain highly qualified technical, development, sales, services and management personnel. Competition for such personnel is intense, and we may fail to retain our key employees or attract or retain other highly qualified personnel in the future. Recently, employment dislocations among sales and marketing personnel generally, and in the healthcare area specifically, have facilitated our ability to add talented sales personnel to our workforce. To the extent employment conditions in the economy improve, we may experience difficulty in continuing to attract talented sales personnel, which in turn could adversely affect our business, financial condition and operating results.

We may not be able to develop and market successful new products.

Our future success and our ability to increase net sales and earnings depend, in part, on our ability to develop and market new software, devices and content. Our failure to develop new products could have a material adverse effect on our business, financial condition and results of operations. In addition, if any of our new products do not work as planned, our ability to market these products could be substantially impeded, resulting in lost net sales, potential damage to our reputation and delays in obtaining market acceptance of these products. We cannot assure you that we will continue to successfully develop and market new products.

New disruptive technologies may adversely affect our market position and financial results.

Our competitors or companies in related industries could develop new technologies that may reduce our market share and adversely affect our net sales and results of operations. For example, other companies are seeking to develop technologies to allow a computer to be directly controlled by a human brain. If a competitor is able to commercialize that technology before we are, our sales of speech generating devices for people with significant physical limitations, such as the EyeMax eye-tracking device, may be reduced.

We are dependent on the continued support of speech language pathologists and special education teachers.

The majority of our speech generating technologies sales are made at the recommendation of a speech language pathologist, and the majority of our special education software authoring tools and content are sold to special education teachers. We are dependent on our ability to convince speech language pathologists and special education teachers of the benefits to their clients and students of our speech generating technologies and special education software. If speech language pathologists or special education teachers were to instead favor the products of our competitors, we could lose market share, which would have an adverse effect on our results of operations.

Our products are dependent on the continued success of our proprietary symbol sets.

Our proprietary symbol sets are important components of both our speech generating technologies and our special education software. Using symbols rather than text makes communication more efficient and more broadly accessible to people with a wide range of cognitive abilities. While we believe that our proprietary symbol sets include the most widely used set of graphic symbols utilized in speech generating technology and special education software, if speech language pathologists or our clients begin to prefer an alternate symbol set (because, for example, they determine that an alternate symbol set is easier to learn or more efficient than our proprietary symbol sets) or if a superior symbol set is developed by one of our competitors, we could lose market share in both our speech generating technologies and special education software, which could adversely affect our business, financial condition and results of operations.

15

We depend upon certain third-party suppliers and licensing arrangements, making us vulnerable to supply problems and price fluctuations, which could harm our business.

We currently rely on third-party suppliers for the components of our speech generating devices. In some cases, there are relatively few alternate sources of supply for certain other components that are necessary for the hardware components of our speech generating devices.

Our reliance on these outside suppliers also subjects us to risks that could harm our business, including:

- •

- we may not be able to obtain adequate supply in a timely manner or on commercially reasonable terms;

- •

- we may have difficulty locating and qualifying alternate suppliers;

- •

- our suppliers manufacture products for a range of customers, and fluctuations in demand for the products those suppliers

manufacture for others may affect their ability to deliver components to us in a timely manner; and

- •

- our suppliers may encounter financial hardships unrelated to our demand for components, which could inhibit their ability to fulfill our orders and meet our requirements.

Identifying and qualifying additional or replacement suppliers for any of the components of our products, if required, may not be accomplished quickly and may involve additional costs. Any interruption or delay in the supply of components or materials, or our inability to obtain components or materials from alternate sources at acceptable prices in a timely manner, could impair our ability to meet the demand of our customers and cause them to cancel orders or switch to competitive products, and could therefore have a material adverse effect on our business, financial condition and results of operations.

Some of the software and other intellectual property that is incorporated into our products is owned by third parties and licensed by us. We may not be able to negotiate or renegotiate these licenses on commercially reasonable terms, or at all, and the third-party intellectual property may not be appropriately supported or maintained by the licensors. If we are unable to obtain the rights necessary to use or continue to use third-party intellectual property in our products and services it could result in increased costs, or an inability to develop new products.

If our patents and other intellectual property rights do not adequately protect our products, we may lose market share to our competitors and be unable to operate our business profitably.

Patents, trademarks, copyrights and other proprietary rights are important to our business, and our ability to compete effectively with other companies depends on the proprietary nature of our technologies. We also rely on trade secrets, know-how and continuing technological innovations to develop, maintain and strengthen our competitive position. We seek to protect these, in part, through confidentiality agreements. While we seek to obtain patent protection in the United States for patentable subject matter in our proprietary devices and also have attempted to review third-party patents and patent applications in the United States to the extent publicly available to develop an effective patent strategy, avoid infringement of third-party patents, identify licensing opportunities and monitor the patent claims of others, any pending patent applications may not result in issued patents, any current or future patents issued or licensed to us may be challenged, invalidated or circumvented and the rights granted thereunder may not provide a competitive advantage to us or prevent other companies from independently developing technology that is similar to ours or introducing competitive products. Although our proprietary symbol sets are protected by certain trademarks and copyrights, there can be no assurance that a third party could not seek to utilize our symbol sets without our authorization.

Furthermore, we may have to take legal action in the future to protect our intellectual property, or to defend ourselves against claimed infringement of the rights of others. Any legal action of that type could be costly and time-consuming to us and could divert the attention of management, and we cannot

16

assure you that such actions will be successful. The invalidation or circumvention of key copyrights, patents, trademarks or other proprietary rights which we own or unsuccessful outcomes in lawsuits to protect our intellectual property may have a material adverse effect on our business, financial condition and results of operations.

Although we have obtained and applied for some U.S. trademark registrations, and will continue to evaluate the registration of additional trademarks, as appropriate, our pending applications may not be approved by the applicable governmental authorities. Moreover, even if the applications are approved, third parties may seek to oppose or otherwise challenge these registrations. Failure to obtain trademark registrations in the United States and in other countries could limit our ability to protect our trademarks and impede our marketing efforts in those jurisdictions.

The laws of foreign countries may not protect our intellectual property rights to the same extent as the laws of the United States. If we cannot adequately protect our intellectual property rights in foreign countries, our competitors may be able to compete more directly with us, which could adversely affect our competitive position and, as a result, our business, financial condition and results of operations.

Our products could infringe on the intellectual property of others, which may cause us to engage in costly litigation and could cause us to pay substantial damages and prohibit us from selling our products.

Third parties may assert infringement or other intellectual property claims against us based on their intellectual property rights. If such claims are successful, we may have to pay substantial damages for past infringement. We might also be prohibited from selling our products or providing certain content or devices without first obtaining a license from the third party, which, if available at all, may require us to pay royalties. Moreover, we may need to redesign some of our products to avoid future infringement liability. Even if infringement claims against us are without merit, defending a lawsuit takes significant time, may be expensive and may divert management attention from other business concerns.

The market opportunities for our products and content may not be as large as we believe.

Our business strategy is to grow our sales to satisfy unmet demand for our speech generating devices among non-verbal individuals and for our special education authoring tools and content among special education teachers. Our expectations for future growth are dependent on our estimates of the number of people who can benefit from our speech generating technologies and special education software and the future growth in conditions that lead to speech and cognitive impairment, such as strokes and autism. However, these market opportunities for our products may not be as large as we believe and may not develop as expected.

We may fail to successfully execute our strategy to grow our business.

We intend to pursue a number of different strategies to grow our revenue and earnings. However, we may not be able to successfully execute these strategies. For example, while we intend to expand and diversify our revenue streams through expanding the sales of professionally-generated content for the users of our special education software platform, we have limited experience in producing and selling such content and may not be successful at doing so. While we believe our new software platform will facilitate these sales, the market for such content may not be as large as we believe or we may be unable produce content that successfully competes with user-generated content or content produced by competitors.

We may attempt to achieve our business objectives through acquisitions and strategic alliances. We compete with other companies for these opportunities, and we cannot assure you that we will be able to effect acquisitions or strategic alliances on commercially reasonable terms, or at all. Even if we enter into these transactions, we may experience, among other things:

- •

- difficulties in integrating any acquired companies and products into our existing business;

17

- •

- inability to realize the benefits we anticipate in a timely fashion, or at all;

- •

- attrition of key personnel from acquired businesses;

- •

- significant costs, charges or writedowns; or

- •

- unforeseen operating difficulties that require significant financial and managerial resources that would otherwise be available for the ongoing development and expansion of our existing operations.

Consummating these transactions could also result in the incurrence of additional debt and related interest expense, as well as unforeseen contingent liabilities, all of which could have a material adverse effect on our business, financial condition and results of operations. We may also issue additional equity in connection with these transactions which would dilute our then existing stockholders.

We depend on third-party distributors to market and sell our products internationally in a number of markets. Our business, financial condition and results of operations may be adversely affected by both our distributors' performance and our ability to maintain these relationships on terms that are favorable to us.

We depend, in part, on third-party distributors to sell our products in many jurisdictions outside the United States. In our fiscal year ended July 3, 2009 and the thirteen week period ended October 2, 2009, our net sales through third-party distributors were 8% and 4%, respectively, of our total net sales. Our international distributors operate independently of us, and we have limited control over their operations, which exposes us to certain risks. Distributors may not commit the necessary resources to market and sell our products and may also market and sell competitive products. In addition, our distributors may not comply with the laws and regulatory requirements in their local jurisdictions, which may limit their ability to market or sell our products. If current or future distributors do not perform adequately, or if we are unable to locate competent distributors in particular countries and secure their services on favorable terms, or at all, we may be unable to increase or maintain our level of net sales in these markets or enter new markets, and we may not realize our expected international growth.

Our business could be adversely affected by competition including potential new entrants.

Although we have few competitors in our specific areas of speech generating technology and special education software, many other companies compete within the broader assistive technology market and could choose to enter the areas in which we have chosen to focus. We also face the risk of new entrants who do not currently compete in any segment of the assistive technology market, whether through acquisition of a current competitor or a new startup from a company that engages in a complementary business to ours, such as producers of educational software or consumer electronics. These competitors and potential competitors may have substantially greater capital resources, larger customer bases, broader product lines, larger sales forces, greater marketing and management resources, larger research and development staffs, larger facilities than ours, as well as global distribution channels that may be more effective than ours. These competitors may develop new technologies or more effective products that would compete directly with our products. These new technologies may make it more difficult to market our products and could have an adverse effect on our business and results of operations.

Competing with these companies will require continued investment by us in research and development, marketing, customer service and support. Even with such continued investments, we may not be able to successfully compete with new entrants in the areas in which we compete.

If we fail to comply with the U.S. Federal Anti-Kickback Statute, the Health Insurance Portability and Accountability Act of 1996 (HIPAA) and similar state and foreign laws, we could be subject to criminal and civil penalties and exclusion from Medicare, Medicaid and other governmental programs.

A provision of the U.S. Social Security Act, commonly referred to as the U.S. Federal Anti-Kickback Statute, prohibits the offer, payment, solicitation or receipt of any form of remuneration in return for

18

referring, ordering, leasing, purchasing or arranging for or recommending the ordering, purchasing or leasing of items or services payable by Medicare, Medicaid or any other federal healthcare program. The Federal Anti-Kickback Statute is very broad in scope and many of its provisions have not been uniformly or definitively interpreted by existing case law or regulations. In addition, most of the states in which our products are sold in the United States have adopted laws similar to the Federal Anti-Kickback Statute, and some of these laws are even broader than the Federal Anti-Kickback Statute in that their prohibitions are not limited to items or services paid for by a federal healthcare program but, instead, apply regardless of the source of payment. Violations of the Federal Anti-Kickback Statute or such similar state laws may result in substantial civil or criminal penalties and exclusion from participation in federal or state healthcare programs. We derive a significant portion of our net sales from international operations, and many foreign governments have equivalent statutes with similar penalties.

All of our financial relationships with healthcare providers and others who provide products or services to federal healthcare program beneficiaries are potentially governed by the Federal Anti-Kickback Statute and similar state or foreign laws. We believe our operations are in material compliance with the Federal Anti-Kickback Statute and similar state or foreign laws. However, we cannot assure you that we will not be subject to investigations or litigation alleging violations of these laws, which could be time-consuming and costly to us, could divert management's attention from operating our business and could prevent healthcare providers from purchasing our products, all of which could have a material adverse effect on our business. In addition, if our arrangements were found to violate the Federal Anti-Kickback Statute or similar state or foreign laws, it could have a material adverse effect on our business and results of operations.

Federal and state laws protect the confidentiality of certain patient health information, including patient medical records, and restrict the use and disclosure of patient health information by healthcare providers. In particular, in April 2003, the U.S. Department of Health and Human Services published patient privacy rules under HIPAA and, in April 2005, published security rules for protected health information. The HIPAA privacy and security rules govern the use, disclosure and security of protected health information by "Covered Entities," which are healthcare providers that submit electronic claims, health plans and healthcare clearinghouses. Through our sales of speech generating technologies, we are a Covered Entity. We are committed to maintaining the security and privacy of patients' health information and believe that we meet the expectations of the HIPAA rules. While we believe we are and will be in compliance with all HIPAA standards, there is no guarantee that we will not be subject to enforcement actions, which can be costly and interrupt regular operations of our business.

Risks Related to Our Organizational Structure

Our only material asset after completion of this offering will be our interest in DynaVox Systems Holdings LLC, and we are accordingly dependent upon distributions from DynaVox Systems Holdings LLC to pay dividends, if any, taxes and other expenses.

DynaVox Inc. will be a holding company and will have no material assets other than its ownership of New Holdings Units. DynaVox Inc. has no independent means of generating revenue. We intend to cause DynaVox Systems Holdings LLC to make distributions to its unitholders in an amount sufficient to cover all applicable taxes at assumed tax rates and dividends, if any, declared by us. To the extent that we need funds, and DynaVox Systems Holdings LLC is restricted from making such distributions under applicable law or regulation or under the terms of our financing arrangements, or is otherwise unable to provide such funds, it could materially adversely affect our liquidity and financial condition.

19

DynaVox Inc. is controlled by our existing owners, whose interests may differ from those of our public shareholders.