Attached files

| file | filename |

|---|---|

| 8-K - Dresser-Rand Group Inc. | v170442_8-k.htm |

Pritchard Capital Partners – Energize 2010

Disclosure

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for certain forward-looking statements so long as such information is identified as forward-looking and is accompanied

by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those projected in the information.

The use of words such as “may”, “might”, “will”, “should”, “expect”, “plan”, “outlook”, “anticipate”, “believe”, “estimate",

"appear”, “project”, “intend”, “future”, “potential” or “continue”, and other similar expressions are intended to identify forward-looking statements.

All of these forward-looking statements are based on estimates and assumptions by our management that, although we believe to be reasonable, are inherently uncertain. Forward-looking statements involve

risks and uncertainties, including, but not limited to, economic, competitive, governmental and technological factors outside of our control, that may cause our business, industry, strategy or actual results to differ materially from the forward-looking

statements.

the Company’s most recent filings with the Securities and Exchange Commission, and other

factors which may not be known to us. Any forward-looking statement speaks only as of its date. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise,

except as required by law.

2

Company Overview

12%

11%

25%

MiddleEast /Africa

Europe

Latin America

41%

11%

Asia Pacific

North

America

Global Supplier of Energy Solutions

Over 90% of bookings for the twelve months ended 9/30/09 of $1.7 billion from oil and gas infrastructure spending

Compression is needed at every stage of the oil and gas production cycle – upstream, midstream and downstream

A leading provider of rotating equipment / largest installed base / industry leading alliances

Aftermarket Parts and Services

New Units

55%

45%

2008 Sales By

Business Segment

2008 Revenues By

Destination

4

Extensive Global Presence

Shanghai,PRC

Kemanan,

Terengganu, Malaysia

Cilegon, Banten, Indonesia

Naroda, India

Kongsberg, Norway

Spijkenisse,The Netherlands

Oberhausen,Germany

Peterborough

Cambridgeshire U.K.

Le Havre,France

Genoa, Italy

Campinas - SP, Brazil

Maracaibo, Edo.Zulia Venezuela

Edmonton, AlbertaCanada

Seattle, WA

Rancho Dominguez, CA

Chula Vista, CA

Tulsa, OK

Odessa, TX

Houston, TX

Baton Rouge, LA

Chesapeake, VA

Naperville, IL

Hamilton, OH

Horsham, PA

Olean, NY

Wellsville, NY

Painted Post, NY

WW Headquarters

Regional Centers

Kuala Lumpur, Malaysia

Houston, Texas

Le Havre, France

Houston, Texas, USA

Service Centers (36)

Global Operations (12)

Painted Post, New YorkBurlington, Iowa

Houston, Texas

Kuala Lumpur, Malaysia

Burlington, IA

Bielefeld,Germany

Port HarcourtNigeria

Atlantic Beach, FL

Chirchik, Uzbekistan

Luanda, Angola

Aberdeen,

Scotland, U.K.

Le Havre, France

Oberhausen, GermanyBielefeld, Germany

Kongsberg, Norway

Naroda, India

Shanghai, China

Peterborough, UK

Louisiana, MO

Jena, LA

Sarnia, Ontario

Kiefer, OK

Abu Dhabi

UAE

Baroda, India

Couva, Trinadad & Tobago

5

Most Client Alliances in Industry ~ 50

Validation of Dresser-Rand’s Value Proposition

6

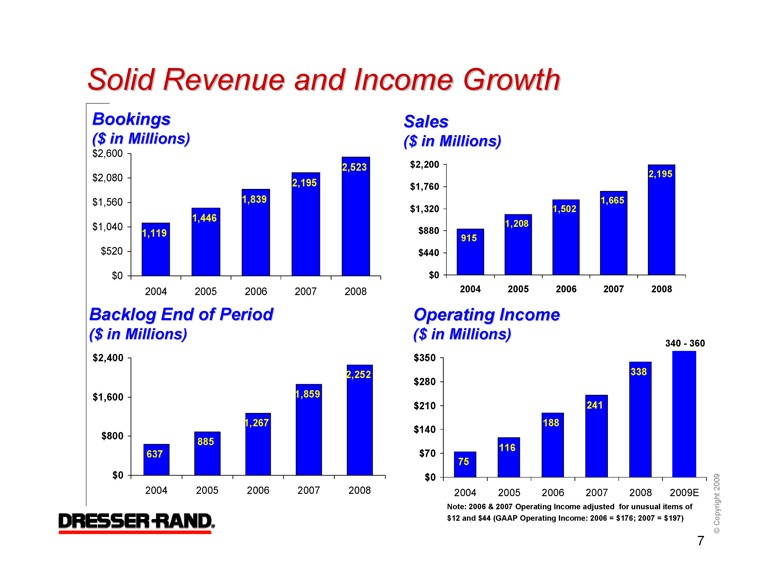

Solid Revenue and Income Growth

2008

2007

2006

2005

2004

$2,600

$2,080

$1,560

$1,040

$520

$0

2,523

2,195

1,839

1,446

1,119

2008

2007

2006

2005

2004

$2,400

$1,600

$800

$0

2,252

1,859

1,267

885

637

340 - 360

($ in Millions)

($ in Millions)

915

1,208

1,502

1,665

2,195

$0

$440

$880

$1,320

$1,760

$2,200

2004

2005

2006

2007

2008

($ in Millions)

($ in Millions)

75

116

188

241

338

$0

$70

$140

$210

$280

$350

2004

2005

2006

2007

2008

2009E

7

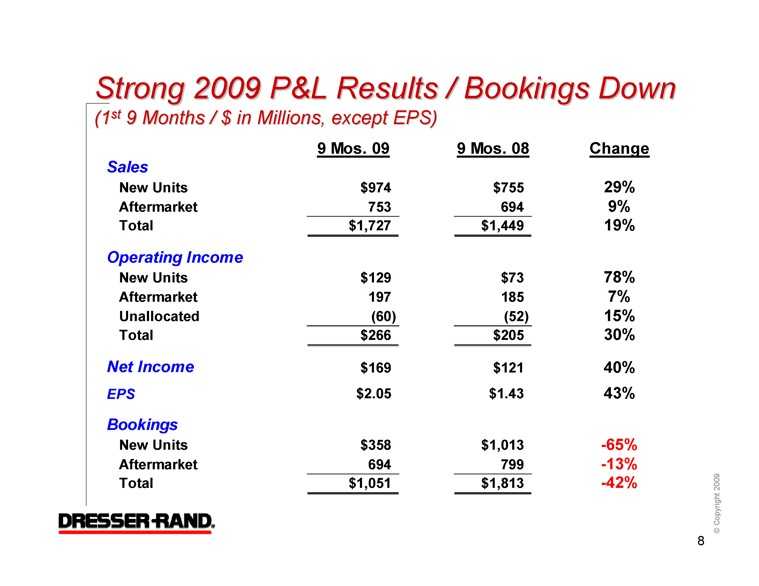

(1

9 Months / $ in Millions, except EPS)

9 Mos. 09

9 Mos. 08

Change

Sales

New Units

$974

$755

29%

Aftermarket

753

694

9%

Total

$1,727

$1,449

19%

Operating Income

New Units

$129

$73

78%

Aftermarket

197

185

7%

Unallocated

(60)

(52)

15%

Total

$266

$205

30%

Net Income

$169

$121

40%

EPS

$2.05

$1.43

43%

Bookings

New Units

$358

$1,013

-65%

Aftermarket

694

799

-13%

Total

$1,051

$1,813

-42%

8

Business Model Characteristics

~ ½ revenues tied to new build-out – cyclical

Flexible manufacturing model to effectively meet demand swings – mitigates large swings in new unit margins

~ ½ revenues tied to installed base – much less cycle sensitive

~ 75% operating income from aftermarket (installed base)

Strong value proposition

Low capital intensity

Strong Relative Performance in Both Up and Down Cycles

9

New Units - Flexible Manufacturing Model

Highly absorbed internally at cycle bottoms

Able to flex capacity to meet cycle peaks

Flexibility Through Supply Chain Management

($ in Millions)

2001

2008

08 vs. '01

Sales

$877

$2,195

2 1/2 X

Operating Income

$21

$338

16 X

- % of Sales

2.4%

15.4%

Employees

6,084

6,400

5%

Manufacturing Footprint ( Sq. Ft.)

~ 3.9 M

~ 4.0 M

Small

Change

10

New leadership team

Implemented growth strategy

~10% CAGR past 8 years

Key Initiatives:

Sales Entitlement Model

Leverage Alliances

Expand Service Centers

Added 11 since ’05 IPO

Technology Leadership

Applied Technology

’08 bookings $107

Acquisitions

Tuthill, Gimpel, Peter Brotherhood, Arrow, Enginuity, Compressor Renewal Services

DRC Captures ~ 10% of Market Opportunity

(Revenue $ in Millions)

$0

$250

$500

$750

$1,000

’90

’91

’92

’93

’94

’95

’96

’97

’98

’99

’00

’01

’02

’03

’04

’05

'06

'07

'08

11

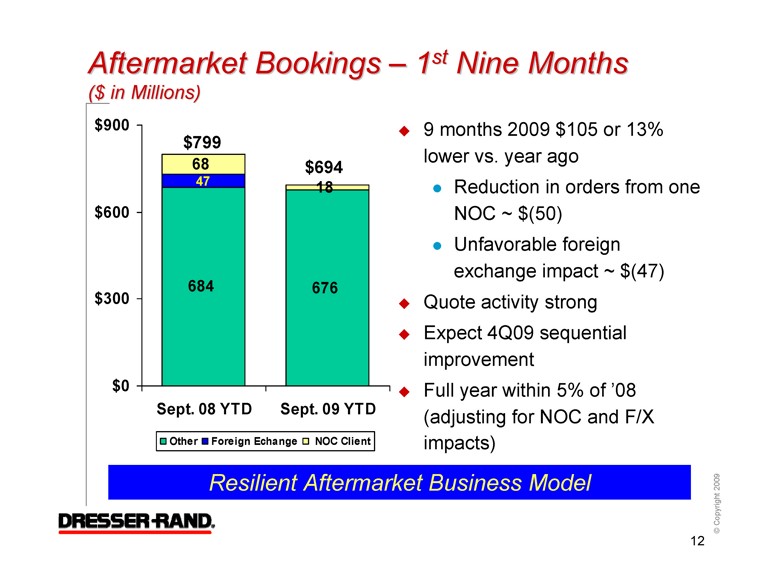

Nine Months ($ in Millions)

Resilient Aftermarket Business Model

$694

$799

9 months 2009 $105 or 13% lower vs. year ago

Reduction in orders from one NOC ~ $(50)

Unfavorable foreign exchange impact ~ $(47)

Quote activity strong

Expect 4Q09 sequential improvement

Full year within 5% of ’08 (adjusting for NOC and F/X impacts)

684

676

47

68

18

$0

$300

$600

$900

Sept. 08 YTD

Sept. 09 YTD

Other

Foreign Echange

NOC Client

12

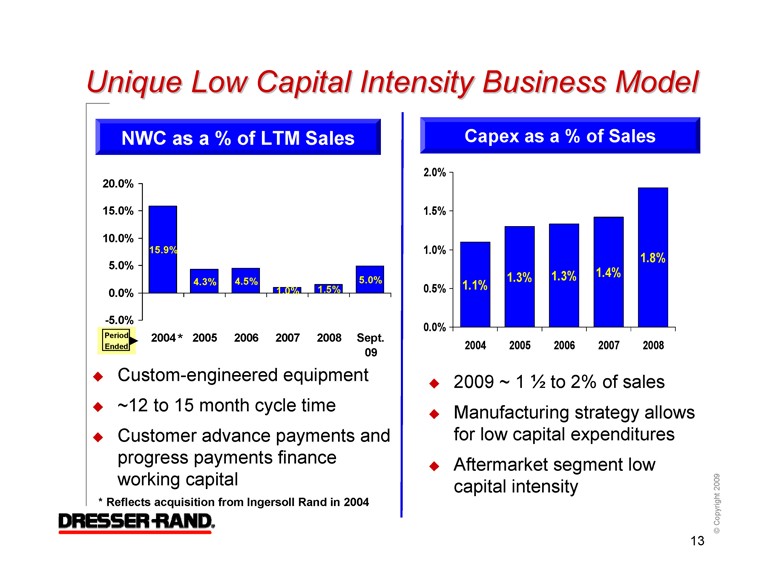

Unique Low Capital Intensity Business Model

NWC as a % of LTM Sales

09

Sept.

2008

2007

2006

2005

2004

20.0%

15.0%

10.0%

5.0%

0.0%

-5.0%

5.0%

1.5%

1.0%

4.5%

4.3%

15.9%

*

Period

Ended

* Reflects acquisition from Ingersoll Rand in 2004

Capex as a % of Sales

2009 ~ 1 ½ to 2% of sales

Manufacturing strategy allows for low capital expenditures

Aftermarket segment low capital intensity

Custom-engineered equipment

~12 to 15 month cycle time

Customer advance payments and progress payments finance working capital

1.1%

1.3%

1.3%

1.4%

1.8%

0.0%

0.5%

1.0%

1.5%

2.0%

2004

2005

2006

2007

2008

13

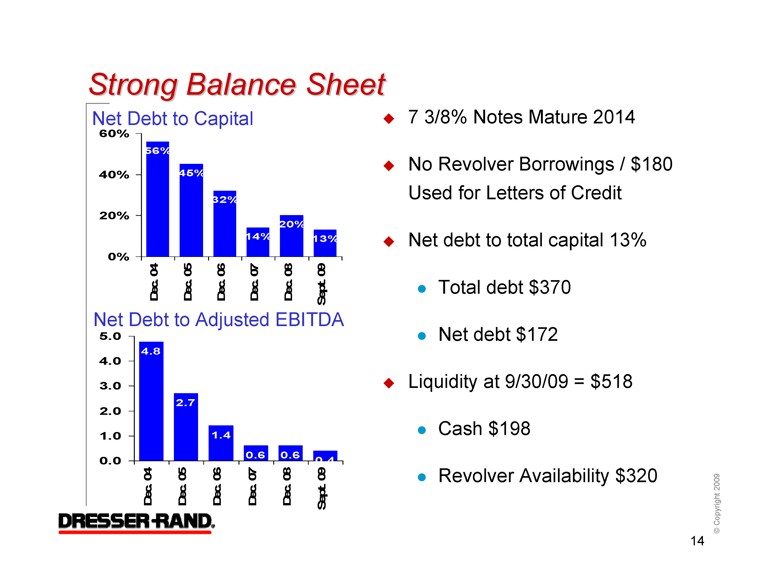

Strong Balance Sheet

Net Debt to Capital

Net Debt to Adjusted EBITDA

60%

40%

20%

0%

13%

20%

14%

32%

45%

56%

7 3/8% Notes Mature 2014

No Revolver Borrowings / $180 Used for Letters of Credit

Net debt to total capital 13%

Total debt $370

Net debt $172

Liquidity at 9/30/09 = $518

Cash $198

Revolver Availability $320

4.8

2.7

1.4

0.6

0.6

0.4

0.0

1.0

2.0

3.0

4.0

5.0

14

Outlook

Traditional Market Opportunities

Offshore production / FPSO (100+ next 5 yrs.)

Tracking ~ 60 LNG projects (more than 20 FLNG)

FLNG project

Peter Brotherhood acquisition / Samsung Techwin

Upstream

Midstream

Downstream

Pipelines & storage (growth in Asia, China, India, US)

Coal bed methane & shale opportunities

Acquisitions strengthen position (Arrow; Enginuity; Compressor Renewal Services)

Refining – 200,000 bpd ~ $50MM opportunity

Expansions e.g., Saudi Aramco Jubail & Yanbu

Process upgrades, environmental compliance, energy conservation, difficult crudes

Chemical (Asia, India & Middle East)

16

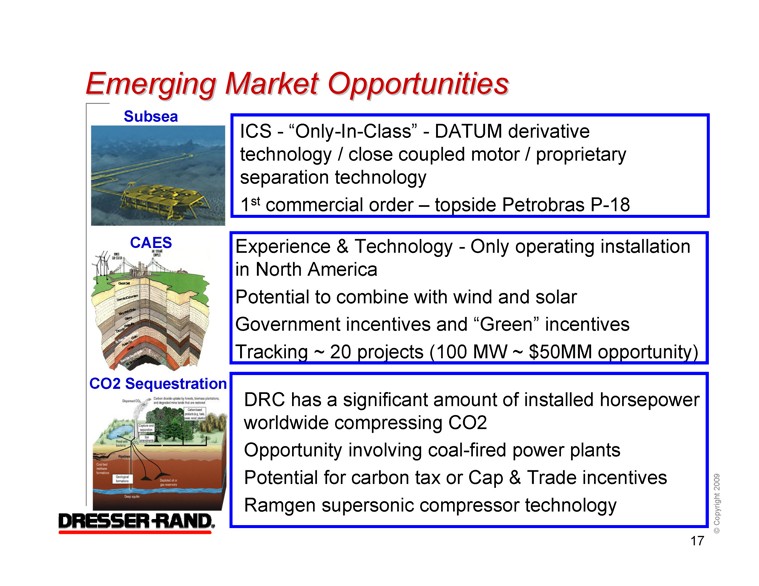

Emerging Market Opportunities

ICS - “Only-In-Class” - DATUM derivative technology / close coupled motor / proprietary separation technology

commercial order – topside Petrobras P-18

Subsea

CAES

CO2 Sequestration

Experience & Technology - Only operating installation in North America

Potential to combine with wind and solar

Government incentives and “Green” incentives

Tracking ~ 20 projects (100 MW ~ $50MM opportunity)

DRC has a significant amount of installed horsepower worldwide compressing CO2

Opportunity involving coal-fired power plants

Potential for carbon tax or Cap & Trade incentives

Ramgen supersonic compressor technology

17

2010 New Units Outlook

Project activity remains at a high level

Recovery in New Unit market appears underway

New unit backlog at 9/30/09 = $1.3 billion

Backlog scheduled to ship in 2010 = $680 million

Revenues between $800 million to $1.0 billion

Flexible manufacturing model preserving high single digit operating margin

18

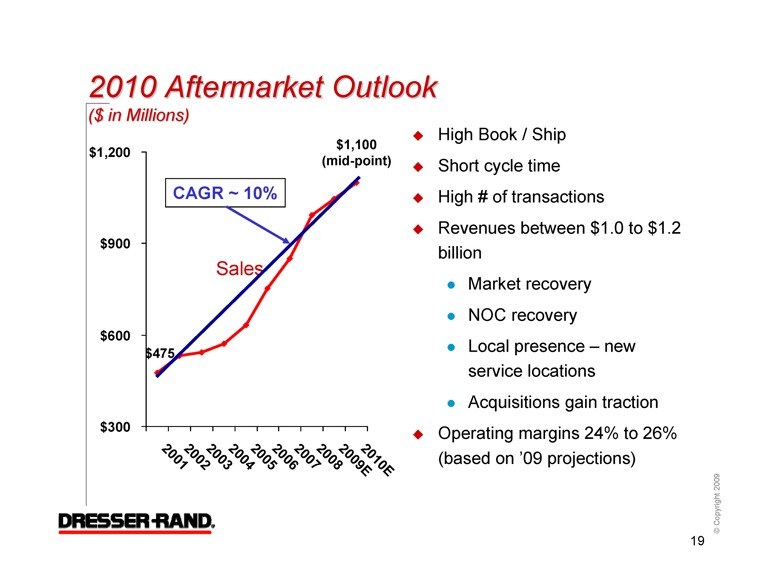

($ in Millions)

CAGR ~ 10%

Sales

$1,100

(mid-point)

$475

High Book / Ship

Short cycle time

High # of transactions

Revenues between $1.0 to $1.2 billion

Market recovery

NOC recovery

Local presence – new service locations

Acquisitions gain traction

$300

$600

$900

$1,200

19

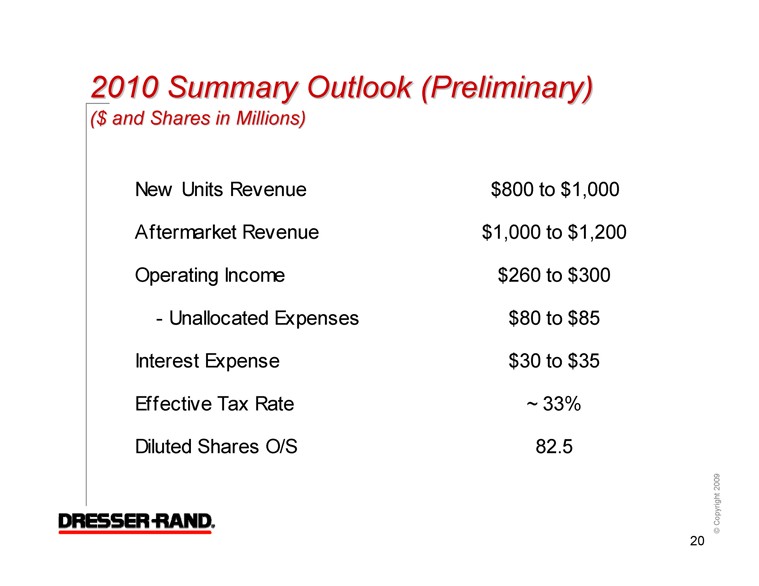

($ and Shares in Millions)

New Units Revenue

$800 to $1,000

Aftermarket Revenue

$1,000 to $1,200

Operating Income

$260 to $300

- Unallocated Expenses

$80 to $85

Interest Expense

$30 to $35

Effective Tax Rate

~ 33%

Diluted Shares O/S

82.5

20

Summary

Believe we have sustainable competitive advantages: Technology, Alliances, Installed Base, Service Network

Believe we are very well positioned

DRC Business Model Characteristics:

Steady high margin aftermarket

Flexible manufacturing model

Results:

Ability to meet significant New Unit demand swings with minimal disruption

Good performance expected even in down markets

Low capital intensity

21

www.dresser-rand.com

info@dresser-rand.com