Attached files

| file | filename |

|---|---|

| EX-4.4 - BIOCUREX INC | c58919_ex4-4.htm |

| EX-23.1 - BIOCUREX INC | c58919_ex23-1.htm |

As filed with the Securities and Exchange Commission on December 31, 2009

Registration No. 333-162345

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT No. 7

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BIOCUREX, INC.

(f/k/a Whispering Oaks International, Inc.)

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Texas |

3841 |

75-2742601 |

||

(State or other jurisdiction of incorporation) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

7080 River Road

Suite 215

Richmond, British Columbia V6X 1X5

Canada

(866) 884-8669

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Dr. Ricardo Moro-Vidal

Chief Executive Officer

7080 River Road

Suite 215

Richmond, British Columbia V6X 1X5

Canada

(866) 884-8669

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Please send copies of all communications to:

|

|

|

Joel J. Goldschmidt, Esq. |

Mark A. von Bergen, Esq. |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), check the following box. R

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

|

|

|

|

|

|

|

Large accelerated filer £ |

Accelerated filer £ |

Non-accelerated filer £ |

Smaller reporting company R |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES

THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THIS REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE

SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction

where the offer or sale is not permitted. SUBJECT TO COMPLETION, DATED DECEMBER 31, 2009 PRELIMINARY PROSPECTUS 1,200,000 Units We are offering, on a firm commitment basis, 1,200,000 units consisting of an aggregate of 84,000,000 shares of common stock and 84,000,000 redeemable common stock purchase warrants which we refer to in this prospectus as the redeemable warrants. Each unit will consist of 70 shares of our

common stock and 70 redeemable warrants. The units will not trade separately, they will not be listed on any exchange or quoted on any market and no certificates will be issued evidencing the units. The shares of common stock and the redeemable warrants comprising the units will be issued and

quoted separately on the Over-the-Counter Bulletin Board. We expect that the units will be offered at a price within a range of $5.60 to $7.60 per unit. Our common stock is currently quoted on the Bulletin Board under the symbol BOCX. We expect the redeemable warrants to be quoted on the

Bulletin Board under the symbol BOCXW. On December 30, 2009 the last sales price as quoted on the Bulletin Board was $0.115. Each redeemable warrant included in the units entitles its holder to purchase one share of our common stock at an exercise price equal to 150% of the unit offering price divided by the number of shares included in a unit. The redeemable warrants are exercisable at any time until their expiration

date, five years after the effective date of the registration statement of which this prospectus is a part. We may redeem some or all of the redeemable warrants at a price of $0.003 per warrant by giving the holders not less than 30 days’ notice at any time the common stock closes at 200% of the unit

offering price divided by the number of shares included in a unit for five consecutive trading days. INVESTING IN THESE SECURITIES INVOLVES SIGNIFICANT RISKS. WE ARE CONSIDERED TO BE IN UNSOUND FINANCIAL CONDITION. YOU SHOULD PURCHASE OUR SECURITIES ONLY IF YOU CAN AFFORD A COMPLETE LOSS OF YOUR INVESTMENT.

SEE “RISK FACTORS” BEGINNING ON PAGE 8. NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY

REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Per Unit

Total Public offering price

$

$

Underwriting discount

$

$ Proceeds to us, before expenses

$

$ We have also agreed to pay Paulson Investment Company, Inc., the representative of the underwriters of this offering, a non-accountable expense allowance equal to 3% of the total public offering price for the units offered by this prospectus and issue to Paulson a warrant to purchase 120,000 units,

identical to the units offered by this prospectus, having an exercise price per unit equal to 120% of the unit public offering price. We have also granted the underwriters a 45-day option to purchase up to an additional 180,000 units to cover over-allotments. PAULSON INVESTMENT COMPANY, INC. The date of this prospectus is , 2010

each consisting of

70 shares of common stock and 70 common stock purchase warrants

or an aggregate of

84,000,000 shares and 84,000,000 warrants

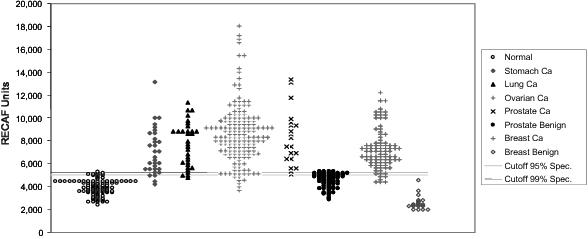

Figure 1 This chart reflects our analysis of human clinical samples of Serum-RECAF test from subjects without cancer and from patients with diagnosed cancers or benign conditions related to cancer diagnosis. See page 36. We have not sought or received FDA

or other regulatory approvals for the marketing and sale of any of our products in the United States or any other jurisdiction. The clinical samples on which the chart below is based are not related in any way to the clinical trials required to obtain

regulatory approval. Neither we nor, to our knowledge, any of our licensees have commenced conducting the clinical trial required to obtain regulatory approval for our products. In addition, some of our test results have not been independently verified

by any laboratory or other research facility. Figure 2 A proposed rendering of the POC rapid device test prototype currently being tested. See pages 38-39.

TABLE OF CONTENTS

Page

(ii

)

3

5

6

8

19

20

20

21

22

23 MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

24

31

46

52

53

54

58

60

63

63

63

64 DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION OF SECURITIES ACT LIABILITIES

64 SUITABILITY STANDARDS Notice to California investors: Each purchaser of securities in California must meet one of the following suitability standards: (1) annual gross income of at least $65,000, plus liquid net worth (exclusive of home, home furnishings and automobiles) of at least $250,000; or (2) liquid net worth (exclusive

of home, home furnishings and automobiles) of at least $500,000, regardless of annual gross income. Notice for New Jersey investors: Offers and sales in this offering in New Jersey may only be made to accredited investors as defined in Rule 501(a) of Regulation D under the Securities Act of 1933. Under Rule 501(a), to be an accredited investor, an individual must have: (1) net worth or joint net

worth with the individual’s spouse of more than $1,000,000 or (b) income of more than $200,000 in each of the two most recent years or joint income with the individual’s spouse of more than $300,000 in each of those years and a reasonable expectation of reaching the same income level in the current

year. Other standards apply to investors who are not individuals. There will be no secondary sales of the securities to persons who are not accredited investors for 90 days after the date of the offering in New Jersey by the underwriters and selected dealers. Notice to North Dakota investors: Each purchaser of securities in North Dakota must meet one of the following suitability standards: (1) a minimum annual gross income of $70,000 and a minimum net worth of $70,000 exclusive of automobile, home and home furnishings; or (2) a minimum net worth

of $250,000, exclusive of automobiles, home and home furnishings. Notice to Oregon investors: Each purchaser of securities in Oregon must meet one of the following suitability standards: (1) a minimum annual gross income of $100,000 and a minimum net worth of $100,000 exclusive of automobile, home, and home furnishings; or (2) a minimum net worth of

$350,000, exclusive of automobile, home, and home furnishings. Notice to Washington investors: Each purchaser of securities in Washington must meet one of the following suitability standards: (1) a minimum annual gross income of $70,000 and a minimum net worth of $70,000 exclusive of automobile, home and home furnishings; or (2) a minimum net worth of

$250,000, exclusive of automobiles, home and home furnishings. (i)

You should rely only on the information contained in this prospectus. Neither we nor the representative of the underwriters have authorized anyone to provide you with information different from or in addition to that contained in this prospectus. You should not rely on any information that is different or

inconsistent with the information contained in this prospectus. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus. This prospectus is not an offer to sell any securities other than the units, the shares of common stock and redeemable warrants that comprise the units and the shares of common stock issuable upon exercise of the redeemable warrants, all of which securities are offered hereby. This prospectus is not an

offer to sell securities in any circumstances in which such an offer is unlawful. We are not making an offer of these securities in any state where the offer is not permitted. No action is being taken in any jurisdiction outside the United States to permit a public offering of the securities covered by this prospectus,

or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to those

jurisdictions. FORWARD-LOOKING STATEMENTS Except for statements of historical fact, some information in this document contains “forward-looking statements” that involve substantial risks and uncertainties. You can identify these forward-looking statements by words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,”

“should,” “will,” “would” or similar words. The statements that contain these or similar words should be read carefully because these statements discuss our future expectations, contain projections of our future results of operations or of our financial position, or state other forward-looking information.

We believe that it is important to communicate our future expectations to our investors. However, there may be events in the future that we are not able to accurately predict or control. Further, we urge you to be cautious of the forward-looking statements which are contained in this registration

statement because they involve risks, uncertainties and other factors affecting our operations, market growth, service, products and licenses. The factors listed in the sections captioned “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and

“Business,” as well as other cautionary language in this registration statement and events in the future may cause our actual results and achievements, whether expressed or implied, to differ materially from the expectations we describe in our forward-looking statements. The occurrence of any of the

events described as risk factors or other future events could have a material adverse effect on our business, results of operations and financial position. Since our common stock is considered a “penny stock” we are ineligible to rely on the safe harbor for forward-looking statements provided in Section

27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”). The pronouns “we,” “our,” “us” and the like used herein refer to BioCurex, Inc., f/k/a Whispering Oaks International, Inc. We own the trademark RECAF™, when used alone or in conjunction with any other term or word. Other brand names or trademarks appearing in this prospectus are the property of their respective owners. (ii)

This summary highlights key information contained elsewhere in this prospectus and is qualified in its entirety by the more detailed information and financial statements included elsewhere in this prospectus. This summary does not contain all of the information that is important to you. You should read the

entire prospectus, including “Risk Factors,” our consolidated financial statements and the related notes thereto and condensed consolidated financial statements and the related notes thereto, and the other documents to which this prospectus refers, before making an investment decision. Overview We are a development stage company focusing on developing and commercializing products for the early detection, diagnosis and monitoring the recurrence of cancer. We have developed and evaluated in clinical trials a blood test that can detect the presence of cancer in humans and animals using a

new cancer marker named RECAF. We developed and own, royalty-free, the proprietary technology related to the RECAF marker, with patents granted in the United States, Europe and China and patents pending in other major worldwide markets. RECAF is a molecule found on most cancer cells, including breast, colon, prostate and lung cancers, but not on normal cells. RECAF can be used in blood tests to determine if a patient has cancer. The blood test can be formatted for use on automated instrumentation typically found in large clinical

and hospital laboratories or manually. It can also be formatted as a single use rapid test for point-of-care (POC) use in physicians’ offices, urgent care facilities and at the bedside. Once approved by the U.S. Food and Drug Administration (FDA), the tests could be used in general screening or in high

risk patients to determine if an individual has cancer. Unlike other notable cancer markers, such as CEA and PSA, which only detect the presence of a specific cancer type (CEA for colon cancer and PSA for prostate cancer), RECAF is found on most types of cancer and, therefore, could have much broader use than most other cancer markers in

development or currently in use. Moreover, unlike existing cancer markers, RECAF has been shown to detect early stages of breast and prostate cancers when the likelihood of cure is highest. We have granted Abbott Laboratories (Abbott) and Inverness Medical Switzerland GmbH (Inverness) semi-exclusive licenses to use the RECAF tests on blood samples processed through automated diagnostic equipment typically found only in large clinical or hospital laboratories and non-exclusive

licenses for other test formats and we have retained rights for manual tests not processed in automatic equipment, POC tests for the physicians’ office and all other single-format potential uses and all test formats used for veterinary applications. Under the respective terms of these licenses, we can grant

one additional similar semi-exclusive license for automated testing. The Abbott license has been amended to relieve them of research and development responsibilities and, to our knowledge, they have not taken any steps towards commercializing our technology. Inverness has been conducting research

and development trying to adapt our technology to their diagnostic platform. However, to our knowledge, they have not reached the stage where they are prepared to enter into clinical trials in order to obtain FDA approval or to commercialize our technology or any related products. Our principal objectives for the first twelve months after completion of this offering will be the following:

•

grant one additional semi-exclusive license for testing blood samples using automated testing equipment; • commercialize veterinary applications of RECAF testing technology not requiring regulatory approvals; • finish developing a POC rapid format test for the doctor’s office and bedside use; • conduct clinical trials and seek FDA approval for marketing of the POC rapid format test; and • commercialize manual testing formats, principally in large cities in foreign countries where further regulatory clearance is not required. 3

We cannot assure you that we can successfully achieve any of these objectives. Company History We were incorporated in Texas in December 1997. In February 2001, we acquired a U.S. patent, several foreign patents and other intellectual property related to the early detection of cancer from Lagostar Trading S.A., a Uruguayan company. In March 2001, we acquired a Canadian patent

application and proprietary technology related to RECAF technology from Curex Technologies, Inc., now known as Pacific BioSciences Research Centre, Inc. (PBRC). PBRC was incorporated in November 1996 under the Business Corporation Act of British Columbia, Canada. PBRC is owned by Dr.

Ricardo Moro-Vidal, our chief executive officer and a member of our board of directors. On October 27, 2009, we changed our legal name to BioCurex, Inc., the name under which we have conducted business since March 2001. Corporate Information Our principal executive offices are located at 7080 River Road, Suite 215, Richmond, British Columbia, Canada V6X 1X5, and our telephone number is 866-884-8669. Our website is located at www.biocurex.com. None of the information on our website is part of this prospectus. 4

Securities offered:

1,200,000 units, each of which will consist of 70 shares of our common stock and 70 redeemable warrants, or an aggregate of 84,000,000 shares and 84,000,000 redeemable warrants. The units will not trade separately, they will not be listed on any exchange or

quoted on any market and no certificates will be issued evidencing the units. The common stock and the redeemable warrants comprising the units will be issued and quoted separately.

Securities outstanding after this offering: Common stock: 157,062,205 shares based on 73,062,205 shares issued and outstanding as of December 31, 2009. Redeemable warrants:

84,000,000, each to purchase one share of our common stock at an exercise price equal to 150% of the unit offering price divided by the number of shares included in a unit. The redeemable warrants are exercisable at any time until their expiration date, five

years after the effective date of the registration statement of which this prospectus is a part. We may redeem some or all of the redeemable warrants at a price of $0.003 per warrant by giving the holders not less than 30 days’ notice at any time the common

stock closes, as quoted on the Bulletin Board, at 200% of the unit offering price divided by the number of shares included in a unit for five consecutive trading days.

Use of proceeds:

For working capital and general corporate purposes, including obtaining FDA approval for and commercializing various applications of our testing technology, sales and marketing expenses and repayment of indebtedness.

Bulletin Board symbol: Common stock:

BOCX

Proposed Bulletin Board symbol: Redeemable warrants:

BOCXW

Risk factors:

Investing in these securities involves a high degree of risk. As an investor you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section. The number of shares of common stock to be outstanding after this offering does not include any of the following:

•

approximately 17,000,000 shares of common stock underlying warrants outstanding at September 30, 2009 having a weighted average exercise price of $0.14 per share;

• approximately 13,500,000 shares of common stock issuable upon conversion in full of our amended secured convertible notes in the aggregate outstanding principal amount of $1.75 million as of December 31, 2009, assuming a conversion price of $0.13 per share, which number of shares does not

include shares issuable if the amount converted includes accrued interest and which number of shares will be reduced to approximately 3.0 million shares after this offering if the holders of the amended secured convertible notes accept a prepayment out of the net proceeds of this offering reducing

the balance due on those notes to $390,000;

5

<R>

</R>

• 84,000,000 shares of common stock underlying the redeemable warrants; • 8,400,000 shares of common stock included in the units underlying the representative’s warrant; • 8,400,000 shares of common stock underlying the warrants included in the units underlying the representative’s warrant; • 28,500,000 shares of common stock issuable upon exercise of options that we intend to grant to our senior executives and directors upon completion of this offering (see below);

• 9,857,723 shares of common stock reserved for future issuance under our Non-Qualified Stock Option Plan, of which 5,987,057 shares are issuable upon exercise of options outstanding at December 31, 2009 having an exercise price of $0.001 per share; and • 1,606,275 shares of common stock that may be issued under our Stock Bonus Plan.

On the closing date of this offering, we will grant options to our senior executives and directors. These options will have an exercise price equal to the greater of (i) the closing market price of a share of our common stock on the date of grant or (ii) the unit offering price divided by the number of

shares in a unit. As currently contemplated, these options will be granted as follows:

Grantee

Options Ricardo Moro-Vidal

15,000,000 Denis Burger

10,000,000 Phil Gold

1,000,000 Jim Walsh

1,000,000 Antonia Bold-de-Haughton

1,000,000 Gladys Chan

500,000 Except as otherwise indicated, all information in this prospectus assumes no exercise by the representative of the underwriters’ over-allotment option to purchase up to an additional 180,000 units. Statement of Operations Data:

Nine Months Ended

Years Ended

2008

2009

2007

2008 Revenue

$

1,000,000

$

—

$

50,000

$

1,000,000 General and administrative expense

770,927

607,360

1,260,865

928,845 Research and development expense

513,959

432,814

662,944

675,302 Other operating expenses

362,355

356,651

341,821

419,179 Total operating expenses

1,647,241

1,396,825

2,265,630

2,023,326 Loss from operations

(647,241

)

(1,396,825

)

(2,215,630

)

(1,023,326

) Other expense, net

(1,636,700

)

(423,001

)

(1,138,689

)

(3,090,659

) Net loss

$

(2,283,941

)

$

(1,819,826

)

$

(3,354,319

)

$

(4,113,985

) Total comprehensive loss

$

(2,255,122

)

$

(1,804,297

)

$

(3,469,380

)

$

(4,087,325

) Balance Sheet Data:

At September 30, 2009

Actual

Pro Forma, Cash

$

364,020

$

5,360,420 Working capital (deficit)

$

(996,112

)

$

4,236,511 Total assets

$

1,149,540

$

5,923,894 Total liabilities

$

2,980,684

$

1,490,637 Stockholders’ equity (deficit)

$

(1,831,144

)

$

4,433,257 6

September 30,

December 31,

As Adjusted

As

adjusted information gives effect to the following: (i) the issuance of 2,785,714

shares of common stock subscribed for on or before September 30, 2009 and

issued subsequent to that date; (ii) the issuance of an aggregate of 1,483,516

shares of common stock in October, and December 2009 to the holders of our

amended secured convertible notes in connection with the exercise of their

conversion of $200,000 principal amount of such notes; (iii) the issuance

of 300,000 shares of common stock in December 2009 to settle an account payable

for services; (iv) a rescission of the exercise of options cancelling the

issuance of 3,648,947 shares in September 2009; (v) the receipt of approximately

$6.8 million of net proceeds from this offering assuming a public offering

price of $7.00 per unit, within the range set forth on the cover of this

prospectus; and (vi) the repayment of approximately $1.8 million

of indebtedness out of the net proceeds of this offering. Subsequent to September 30, 2009, we issued an additional 4,569,230 shares. Of these shares, 2,785,714 shares were subscribed for before that date and were reflected on the balance sheet as common stock subscriptions. We had not issued those shares as of that date and, therefore, they are not

included in the number of shares outstanding at that date. In addition, 714,286, shares were issued in October 2009 in connection with the conversion of $100,000 principal amount of the amended secured convertible notes (at a conversion price of $0.14) and 769,230 shares were issued in December 2009

in connection with the conversion of another $100,000 principal amount of those notes (at a conversion price of $0.13). Finally, in December 2009, we issued 300,000 shares under our Stock Bonus Plan to settle an account payable for services. We have given pro forma effect to these issuances in order to

be consistent with the disclosure elsewhere in this prospectus. As stated in this prospectus, the number of shares outstanding both immediately before and immediately after the offering includes those 4,569,230 shares and the outstanding principal balance on the amended secured convertible notes reflects

the October and December 2009 conversions. We believe that the repayment of $1.8 million of indebtness is material. The repayment of debt is a required use of proceeds under the various debt instruments. The total amount of proceeds that will be used to repay debt represents the largest single use of proceeds constitutes the largest single use

of proceeds, approximately 26.6%, other than working capital and general corporate purposes. However, unlike working capital and general corporate purposes, the impact of the repayment of debt will be immediate as opposed to being spread out over time. Also, as a result of that repayment, we will

have significantly reduced our total indebtedness and our total liabilities significantly. 7

An investment in our securities involves a high degree of risk. You should carefully consider the risks described below and the other information in this registration statement, including our financial statements and the notes to those statements, before you purchase any of our securities. The risks and

uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us, or that we currently deem immaterial, could negatively impact our business, results of operations or financial condition in the future. If any of the following risks and uncertainties develop

into actual events, our business, results of operations or financial condition could be adversely affected. In those cases, the trading price of our securities could decline, and you may lose all or part of your investment. Risks Related to Our Business Auditors have doubt as to our ability to continue in business. In their report on our December 31, 2008 financial statements, our auditors expressed substantial doubt as to our ability to continue as a going concern. A going concern qualification could impair our ability to finance our operations through the sale of debt or equity securities. Our ability to continue

as a going concern will depend, in large part, on our ability to obtain additional financing and generate positive cash flow from operations, neither of which is certain. If we are unable to achieve these goals, our business would be jeopardized and we may not be able to continue operations. We have limited operations and a history of losses and expect to incur additional losses in the future. Historically, we have funded our operations through the private sale of securities and with private loans. To date, we have raised approximately $3.5 million in proceeds from private offerings of our common stock, and an additional $1.1 million in proceeds as the result of the exercise of privately

placed options and warrants. However, we have never earned a profit. For the nine-month period ended September 30, 2009, we reported an operating loss of $1.4 million and a net loss of $1.8 million. As of September 30, 2009, our accumulated deficit was $18.9 million and our stockholders’ deficit was

$1.8 million. We expect to incur additional losses for an indefinite period. To date, we have had limited revenues and no revenues from the sale of the products and services that we are currently focused on developing. We cannot assure that our products and services will be successfully commercialized

or that we will ever earn a profit. We recently entered into a loan modification agreement with the holders of our secured notes pursuant to which they waived defaults caused by our failure to make certain principal payments when due. We may be unable to repay the amended notes when due. Under the terms of the original secured convertible notes issued in June 2007, we were obligated to make certain principal payments on May 1, 2009, which we failed to do. As a result, these notes were characterized as short-term debt, rather than long-term debt, on our June 30, 2009 balance sheet

and our working capital deficit as of that date was $3.6 million. As of August 31, 2009, we entered into a Loan Modification Agreement with the holders of the original secured convertible notes under which they waived those defaults and we agreed to issue amended secured convertible notes in the

aggregate principal amount of $2.15 million in exchange for the original secured convertible notes. The amended secured convertible notes bear interest at the same rate as the original secured convertible notes, prime plus 2.75%, mature on December 31, 2012 and had an initial conversion price of $0.14

per share. If a default under the amended secured convertible notes should occur prior to the maturity date, the holders would be able to require us to pay the entire outstanding balance then due. We cannot assure you that we will not be in default under the amended secured convertible notes or that

we will be able to repay those notes when they mature. If we are unable to repay the principal amount of those notes when due, the holders, as secured creditors, would be able to force the sale of our assets, including the intangible assets that are at the 8

core of our business in order to repay the notes. In such case, we would no longer be able to continue operations and you could lose your entire investment. To date, we have generated limited revenues. Our future success depends on our ability to begin generating revenues on a regular and continuing basis. Since inception, we have generated aggregate revenues of only $1.5 million all of which were license fees or transfer fees related to material, technology and related services. Our future success depends on our ability to begin generating revenues on a regular and continuing basis and to properly

manage our costs. Our business strategy contemplates that we will derive revenue from licensing our technology and from sales of our products and services. Our ability to generate these revenues depends on a number of factors, some of which are outside our control. These factors include the following:

•

our ability to obtain necessary government and regulatory approvals; • our ability to successfully complete all the research and development work on the various test formats and applications of RECAF technology; • our ability to successfully commercialize the various test formats and applications of our RECAF technology; • our ability to protect our intellectual property; • the success of our sales and marketing efforts; • our ability to maintain our competitive advantages; • new developments in the area of cancer detections and the efficacy of competing technologies; • market acceptance of our products and services; and • our ability to raise additional capital as and when needed and on acceptable terms. We cannot assure you that we will be able to meet any of these challenges or that we will be able to generate any revenues. If we do not generate any revenues, you may lose your entire investment. If we are unable to raise additional capital, we may be unable to continue operating. The process to obtain regulatory approval of our products involves significant costs. In addition, the costs associated with our proposed research, development and marketing activities may be substantially higher than our estimated costs of these activities. We will probably need additional capital to

fully implement our growth strategy, which includes obtaining the necessary regulatory approvals to commercialize various applications of our RECAF technology, sales and marketing programs and continued research and development activities, in addition to our general and administrative expenses. If we

are unable to raise additional capital, we may be forced to delay or postpone the regulatory approval process and our research, development and marketing activities. Further, any capital raised through the issuance of additional equity will have a dilutive impact on other stockholders and could have a

negative effect on the market price of our common stock. We have granted semi-exclusive licenses relating to the development, sale and distribution of our products, and our dependence on these licensees exposes us to significant commercialization and development risks. In April 2005 and December 2007, we entered into a semi-exclusive license agreement with Abbott and Inverness, respectively, under which we granted each a semi-exclusive license to use RECAF tests on blood samples processed in automated equipment typically found only in large clinical and

hospital laboratories and a non-exclusive license for other test formats. Under the license agreements, we are entitled to annual minimum royalty payments, sublicense fees and royalties based on net sales. The Abbott license agreement also gives Abbott the right to grant sublicenses for these activities

and for engaging in commercial sales of our products to third parties upon payment to us of sublicense fees and also gives Abbott the right, though not the obligation, to 9

obtain the necessary regulatory approvals to exploit the RECAF technology covered by the license. To date, except for license fees and transfer related to materials, technology and related services, we have not received any payments from Abbott or Inverness as a result of their exploitation of the

licenses. The royalty payments we receive from the sale of our products under the Abbott and Inverness license agreements depend heavily on their efforts. Each of Abbott and Inverness has significant discretion in determining the efforts and resources it applies to obtaining regulatory approval and to the

development and sale of our products, and each of them likely has a significant number of other research commitments competing for its resources. Furthermore, regardless of the effort and resources they invest, Abbott and Inverness may not be effective in developing or marketing our products. In

addition, Abbott and Inverness may have corporate agendas which may not be consistent with our best interests. A disagreement between us and Abbott or Inverness could lead to lengthy and expensive dispute resolution proceedings as well as to extensive financial and operational consequences to us,

and have a material adverse effect on our business, results of operations and financial condition. If our relationship with Abbott or Inverness were to terminate, we may not be able to enter into another semi-exclusive license agreement with a company with similar resources to develop and commercialize our products and perform these functions on acceptable terms or at all. As a result, we

could experience delays in our ability to distribute and commercialize our products and increased expenses, all of which would have a material adverse affect on our business, results of operations and financial condition. Any failure to obtain or any delay in obtaining required regulatory approvals may adversely affect our ability to successfully license our products or market any products we may develop. The cancer marker RECAF tests that we have developed for human and veterinarian applications are subject to oversight by regulatory authorities in the United States and in other countries, including, without limitation, the FDA and U.S. Department of Agriculture (USDA). We believe that all of

our products are classified as Type I or II Medical Devices by the FDA. As such these medical devices do not come under the more rigorous approval guidelines as Type III Medical Devices (e.g., HIV test kits) or the arduous Phase I, II, and III clinical trial process that is required for approval of drugs.

Type I and II Medical Device approval falls under the category referred to as a 510k application and after submission of supporting data to the FDA is subject to a 90-day review process. Marketing clearance for medical devices in the veterinary market in the United States is regulated by the USDA and

that process typically takes approximately one year after submission of appropriate data. We have not initiated the approval process for our products with the FDA or with the USDA for marketing clearance in the United States. Among other requirements, FDA marketing clearance and approval of the facilities used to manufacture our cancer marker RECAF tests will be required before any of these tests may be marketed in the United States. A similar regulatory process will be required by European regulatory authorities

before our cancer tests can be marketed in Europe. As with the FDA review process, there are numerous risks associated with the review of medical devices by foreign regulatory agencies. The foreign regulatory agencies may request additional data to demonstrate the clinical safety and efficacy of a

product. We rely and will continue to rely on third parties, including Abbott and Inverness, to assist us in managing and monitoring all of our preclinical studies and clinical trials. To our knowledge, our licensees, Abbott and Inverness, have not initiated any steps toward regulatory approval of our products

for marketing clearance in the United States. If any of these parties terminate their relationship with us, the development of the products covered by those agreements could be substantially delayed. In addition, these third parties may not successfully carry out their contractual obligations, meet expected

deadlines or follow regulatory requirements, including clinical, laboratory and manufacturing guidelines. Our reliance on these third parties may result in delays in completing, or in failing to complete, these trials if they fail to perform with the speed and competency we expect. Further, if any of these

parties fail to perform their obligations under our agreements with 10

them in the manner specified in those agreements and in the trial design, the FDA may not accept the data generated by those trials, which would increase the cost of and the development time for that product candidate. If clinical testing of our product candidates is compromised for any of the above-

mentioned reasons, we will be unable to meet our anticipated development or commercialization timelines, which would have a material adverse effect on our business. Although FDA marketing clearance may not be required for certain foreign markets, we believe that FDA clearance for our RECAF cancer marker tests would add credibility when negotiating with overseas distributors. Failure to obtain FDA marketing clearance in the United States may limit our

ability to successfully market our products even where regulatory approvals are not required. Delays or rejection in obtaining FDA marketing clearance may also be encountered based upon changes in applicable law or regulatory policy during the period of regulatory review. Any failure to obtain, or any delay in obtaining, marketing clearance would adversely affect our ability to license or

market our products. Moreover, even if FDA marketing clearance is granted, such approval may include significant limitations on indicated uses for which the product could be marketed. Both before and after marketing clearance is obtained, a product and its manufacturer are subject to comprehensive regulatory oversight. Violations of regulatory requirements at any stage of the process may result in adverse consequences, including the FDA’s delay in approving or refusing to

approve a product for marketing, withdrawal of an approved product from the market and/or the imposition of criminal penalties against the manufacturer. In addition, later discovery of previously unknown problems relating to a marketed product may result in restrictions on such product or

manufacturer including withdrawal of the product from the market. We cannot assure you that we will receive the required clearances in order to be able to market any of our products. If we and our third-party suppliers do not maintain high standards of manufacturing in accordance with applicable manufacturing regulations, our development and commercialization activities could suffer significant interruptions or delays. We and any third-party suppliers on which we currently or may in the future rely must continuously adhere to applicable manufacturing regulations. In complying with these regulations, we and our third-party suppliers must expend significant time, money and effort in the areas of design and

development, testing, production, record-keeping and quality control to assure that our products meet applicable specifications and other regulatory requirements. The failure to comply with these requirements could result in an enforcement action against us, including the seizure of products and shutting

down of production. Any of these third-party suppliers and we also may be subject to audits by the FDA and other regulatory agencies. If any of our third-party suppliers or we fail to comply with applicable manufacturing regulations, our ability to develop and commercialize our products could suffer

significant interruptions. If our products do not achieve market acceptance, we will be unable to generate significant revenues from them. The commercial success of our products will depend primarily on convincing health care providers and veterinarians to adopt and use our products. To accomplish this, we, together with our licensees and any other marketing or distribution collaborators, will have to convince members of the medical

and veterinary communities of the benefits of our products through, for example, published papers, presentations at scientific conferences and additional clinical data. Medical providers and veterinarians will not use our products unless we can demonstrate that they consistently produce results comparable

or superior to existing products and have acceptable safety profiles and costs. If we are not successful in these efforts, market acceptance of our products could be limited. Even if we demonstrate the effectiveness of our products, medical practitioners may still use other products. If our products do not

achieve broad market acceptance, we will be unable to generate significant revenues from them, which would have a material adverse effect on our business, cash flows and results of operations. 11

We may not achieve or maintain a competitive position in our industry and future technological developments may result in our proprietary technologies becoming uneconomical or obsolete. The field in which we are involved is undergoing rapid and significant technological change. Our ability to successfully commercialize various applications of our cancer detection technology will depend on our ability to maintain our technological advantage. We cannot assure you that we will achieve

or maintain such a competitive position or that other technological developments will not cause our proprietary technologies to become uneconomical or obsolete. Many of our potential competitors, including large multi-national pharmaceutical companies, well-capitalized biotechnology companies, and

privately and publicly financed research facilities, have significantly greater financial resources than we do. Our revenues and profits will be adversely impacted if we cannot compete successfully with new or existing products or technologies. Our patents might not protect our technology from competitors. Certain aspects of our technologies are covered by a United States patent and a number of foreign patents. In addition, we have a number of patents pending in foreign countries. There is no assurance that the applications still pending or which may be filed in the future will result in the issuance of

additional patents. In addition, our patents expire in 2014 and 2015, and there is no assurance that we will be able to successfully renew them. Furthermore, there is no assurance as to the breadth and degree of protection the issued patents might afford us. We may not be able to prevent

misappropriation of our proprietary rights, particularly in countries where the laws may not protect such rights as fully as in the United States. Thus, any patents that we own may not provide commercially meaningful protection from competition. Disputes may arise between us and others as to the scope,

validity and ownership rights of these or other patents. Any defense of the patents could prove costly and time consuming and we cannot assure you that we will be in a position, or will deem it advisable, to carry on such a defense. Our patents may not contain claims that are sufficiently broad to

prevent others from practicing our technologies or developing competing products. Competitors may be able to use technologies in competing products that perform substantially the same as our technologies but avoid infringing our patent claims. Under these circumstances, our patents would be of little

commercial value to us. Other private and public concerns may have filed applications for, or may have been issued, patents and are expected to obtain additional patents and other proprietary rights to technology potentially useful or necessary to us. The scope and validity of any of these patents, if any,

are presently unknown. For many of the technologies we employ in our business, we rely on maintaining competitively sensitive know-how and other information as trade secrets, which may not sufficiently protect this information. Disclosure of this information could impair our competitive position. As to many technical aspects of our business, we have concluded that competitively sensitive information is either not patentable or that for competitive reasons it is not commercially advantageous to seek patent protection. In these circumstances, we seek to protect this know-how and other

proprietary information by maintaining it in confidence as a trade secret. To maintain the confidentiality of our trade secrets, we generally enter into confidentiality agreements with our employees, consultants and collaborators when their relationship with us commences. These agreements require that all

confidential information developed by the individual or made known to the individual by us during the course of the individual’s relationship with us be kept confidential and not disclosed to third parties. However, we may not obtain these agreements in all circumstances, and individuals with whom we

have these agreements may not comply with the terms of these agreements. The disclosure of our trade secrets would impair our competitive position. Adequate remedies may not exist in the event of unauthorized use or disclosure of our confidential information. Further, to the extent that our

employees, consultants or contractors use trade secret technology or know-how owned by others in their work for us, disputes may arise as to the ownership of related inventions. 12

We may incur significant liability if we infringe the patents and other proprietary rights of third parties. In the event that our technologies infringe or violate the patent or other proprietary rights of third parties, we may be prevented from pursuing product development, manufacturing or commercialization of our products that utilize such technologies. There may be patents held by others of which we

are unaware that contain claims that our products or operations infringe. In addition, given the complexities and uncertainties of patent laws, there may be patents of which we know that we may ultimately be held to infringe, particularly if the claims of the patent are determined to be broader than we

believe them to be. If a third party claims that we infringe its patents, any of the following may occur:

•

we may become liable for substantial damages for past infringement if a court decides that our technologies infringe upon a competitor’s patent; • a court may prohibit us from selling or licensing our product without a license from the patent holder, which may not be available on commercially acceptable terms or at all, or which may require us to pay substantial royalties or grant cross-licenses to our patents; and • we may have to redesign our product so that it does not infringe upon others’ patent rights, which may not be possible or could require substantial funds or time. In addition, employees, consultants, contractors and others may use the trade secret information of others in their work for us or disclose our trade secret information to others. Either of these events could lead to disputes over the ownership of inventions derived from that information or expose us

to potential damages or other penalties. If any of these events occurs, our business will likely suffer and the market price of our common stock decline. We may incur substantial costs as a result of litigation or other proceedings relating to patent and other intellectual property rights. There has been substantial litigation and other proceedings regarding patent and intellectual property rights in the biotechnology industry. We may be forced to defend claims of infringement brought by our competitors and others, and we may institute litigation against others who we believe are

infringing our intellectual property rights. The outcome of intellectual property litigation is subject to substantial uncertainties and may, for example, turn on the interpretation of claim language by the court, which may not be to our advantage, or on the testimony of experts as to technical facts upon

which experts may reasonably disagree. Our involvement in intellectual property litigation could result in significant expense to us. Some of our competitors have considerable resources available to them and a strong economic incentive to undertake substantial efforts to stop or delay us from

commercializing products. We, on the other hand, are a relatively small company with comparatively few resources available to us to engage in costly and protracted litigation. Moreover, regardless of the outcome, intellectual property litigation against or by us could significantly disrupt our development

and commercialization efforts, divert our management’s attention and quickly consume our financial resources. In addition, if third parties file patent applications or issue patents claiming technology that is also claimed by us in pending applications, we may be required to participate in interference proceedings with the U.S. Patent and Trademark Office or in other proceedings outside the United States,

including oppositions, to determine priority of invention or patentability. Interference or oppositions could adversely affect our patent rights. Even if we are successful in these proceedings, we may incur substantial costs, and the time and attention of our management and scientific personnel will be

diverted in pursuit of these proceedings. 13

If product liability lawsuits are brought against us, we might incur substantial liabilities and could be required to limit the commercialization of our products. Although we are not presently generating revenues from the sale of products, our short-term objectives include commercializing various applications of our RECAF testing technology, which may involve the sale of test kits. If our products do not function properly, we may be exposed to the risk of

product liability claims. We may even be subject to claims against us despite the fact that the injury is due to the actions of others, such as manufacturers with whom we contract to make the test kits. Any product liability litigation would consume substantial amounts of our financial and managerial

resources and might result in adverse publicity, regardless of the ultimate outcome of the litigation. We do not currently maintain clinical trial insurance or product liability insurance and we may never obtain such insurance. In any event, liability insurance is subject to deductibles and coverage limitations

and may not provide adequate coverage against potential claims or losses. A successful product liability claim brought against us could cause us to incur substantial costs and liabilities. Our future success depends on the continued availability of our chief executive officer, Dr. Ricardo Moro-Vidal, and other scientific and technical personnel. The loss of Dr. Moro-Vidal’s services or those of other technical personnel could have a significant adverse impact on our business. The success of our business depends to a great extent on the efforts and abilities of our senior executive officer, Dr. Ricardo Moro-Vidal. Dr. Moro-Vidal discovered the RECAF molecule and has done or supervised most of the research that has led to the development of our various cancer detection

tests. In addition, Dr. Moro-Vidal has most of the unpatented technical know-how that is crucial to our research and development efforts. We do not plan to obtain a key-person life insurance policy on Dr. Moro-Vidal. We have entered into a four-year employment agreement with Dr. Moro-Vidal,

terminating in December 31, 2013, which will contain confidentiality and non-compete covenants. Nevertheless, we cannot assure you that Dr. Moro-Vidal will continue to work for us or that the non-compete and confidentiality provisions of his employment agreement will be enforceable. If Dr. Moro-

Vidal terminates his employment relationship with us, it could be difficult to find a replacement with comparable skill and knowledge. In addition, the pool of individuals with relevant experience in biotechnology is limited and retaining and training personnel with the skills necessary to continue our

research and development activities would be challenging, costly and time-consuming. The loss of any of our scientific or technical personnel could significantly delay the achievement of our goals and materially and adversely affect our business, financial condition and results of operations. We depend on the continued availability of research and development services provided by PBRC. The loss of these services could adversely affect us. All of the research regarding RECAF is performed by PBRC, which is wholly-owned by Dr. Moro-Vidal. We have entered into a contract with PBRC pursuant to which PBRC will continue to perform research and development as well as diagnostic services for us. The agreement has an initial term

that expires on December 31, 2013 and we have the right to extend the agreement for two additional four-year terms. If PBRC elects to discontinue its relationship with us, we may be unable to find another firm with the same technical expertise, which could impair our ability to develop our technology

and materially and adversely affect our business, financial condition and results of operations. We may expand our operations internationally in the future, particularly in China and India, and would be subject to the political systems, economic conditions, government programs and tax structures of those countries. To the extent that we expand our operations internationally in the future, particularly in China and India, the political and economic conditions of those countries may directly affect our operations. In addition, any government programs in which we participate or any tax benefits we may derive in

those countries may not be continued at favorable levels or at all. Further, we are a 14

U.S. entity and our executive officers and assets are located in Canada. It may be difficult for us to assert legal claims in actions instituted in foreign jurisdictions. Foreign courts may refuse to hear our legal claims because they may not be the most appropriate forums in which to bring such a claim. Even

if a foreign court agrees to hear a claim, it may determine that the law of the jurisdiction in which the foreign court resides, and not Canadian or U.S. law, is applicable to the claim. Further, if Canadian or U.S. law is found to be applicable, the content of applicable Canadian or U.S. law must be proved

as a fact, which can be a time-consuming and costly process, and certain matters of procedure would still be governed by the law of the jurisdiction in which the foreign court resides. As a result of the difficulty associated with enforcing a judgment against us, you may not be able to collect any damages

awarded by either a U.S., Canadian or other foreign court. We have not yet completed the assessment of our internal controls over financial reporting required by the Sarbanes-Oxley Act of 2002 and the cost of compliance could be significant. We are in the process of completing an assessment of our disclosure controls and procedures and our internal controls over financial reporting as required by Section 404 of the Sarbanes-Oxley Act of 2002. The purpose of the assessment is to confirm that our systems, procedures and controls

regarding financial reporting and disclosure comply with the rules applicable to public companies, including (1) assuring that our systems, controls and procedures satisfy the requirements of the framework to which we have chosen to adhere and (2) developing a system of gathering and maintaining

evidence to support management’s assessment of disclosure controls and procedures and internal controls over financial reporting. In addition, our independent registered public accounting firm must provide an attestation report regarding our assessment by March 31, 2011. The costs of the assessment and

obtaining an attestation report from an independent public accounting firm regarding our assessment may be significant. Moreover, if there is a “material weakness” in our systems, controls and/or procedures, there may be additional costs to rectify those weaknesses. A finding of a “material weakness”

could also damage our reputation and, if we cannot address those weaknesses in a timely and efficient manner, could potentially subject us to administrative action by the SEC and result in the imposition of monetary penalties. Risks Related to Ownership of Our Securities and this Offering The public offering price of the securities sold in this offering may not reflect our true fair market value. The public offering price of the securities sold in this offering has been determined by negotiation between us and the representative and does not necessarily bear any direct relationship to our assets, results of operations, financial condition, book value or any other recognized criterion of value and,

therefore, might not be indicative of prices that will prevail in the trading market. We cannot assure you that the price of the securities sold in this offering will not decline immediately after the offering is completed. The market price of our common stock may decline as a result of this offering. As a result of this offering, the number of shares of our common stock outstanding will increase substantially without an immediate increase in potential net income. To the extent that the market price of our common stock reflects a multiple of discounted projected earnings per share, the share price

may decline. The market price for our common stock is volatile and the price at which you may be able to sell any of the securities purchased in this offering might be lower than the offering price. The market price of our common stock, as well as the securities of other biotechnology companies, has historically been highly volatile, and the market has from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies.

Factors such as fluctuations in our operating results, announcements of technological innovations or new products by us or our competitors, governmental regulation, developments in patent or other proprietary rights, public concern as to the safety of products developed by us or other biotechnology and

pharmaceutical companies, and general market 15

conditions may have a significant effect on the future market price of our publicly traded or quoted securities. There is, at present, only a limited market for our common stock and no market for the redeemable warrants and there is no assurance that an active trading market for either or both of these securities will develop. Trades of our common stock are subject to Rule 15g-9 promulgated by the Securities and Exchange Commission (the SEC) under the Exchange Act, which imposes certain requirements on broker/dealers who sell securities subject to the rule to persons other than established customers and accredited

investors. For transactions covered by the rule, broker/dealers must make a special suitability determination for purchasers of the securities and receive the purchaser’s written agreement to the transaction prior to sale. The SEC also has other rules that regulate broker/dealer practices in connection with

transactions in “penny stocks.” Penny stocks generally are equity securities with a price of less than $5.00 (other than securities listed on a national securities exchange, provided that current price and volume information with respect to transactions in that security is provided by the exchange or system).

The penny stock rules require a broker/dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document prepared by the SEC that provides information about penny stocks and the nature and level of risks in the penny stock market.

The broker/dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker/dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid

and offer quotations, and the broker/dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. These disclosure requirements have the

effect of reducing the level of trading activity for our common stock. As a result of the foregoing, investors may find it difficult to sell their shares. We lack analyst coverage. We do not have research analysts reviewing our performance or our securities on an ongoing basis. Therefore, we do not have an independent review of our performance or the value of our common stock relative to other public companies. You will experience immediate and substantial dilution as a result of this offering and may experience additional dilution in the future. If you purchase securities in this offering, you will experience immediate and substantial dilution insofar as the public offering price of a unit will be substantially greater than the tangible book value attributable to the shares of our common stock included in a unit after giving effect to this offering.

In the past, we have issued options and warrants to acquire shares of common stock at prices significantly below the imputed public offering price of a share of our common stock (assuming no value is attributed to the redeemable warrants included in the units). To the extent these options and warrants

are ultimately exercised, you will incur further dilution. We have broad discretion in the use of the proceeds from this offering and our use of the offering proceeds may not yield a favorable return on your investment. We expect to use proceeds from this offering for working capital and general corporate purposes including obtaining FDA approval and for commercializing various applications of our technology and sales and marketing expenses relating thereto. However, we have broad discretion over how these

proceeds will be used and could spend the proceeds in ways with which you may not agree. We may not apply the proceeds of this offering effectively or in a manner that yields a favorable or any return, and consequently, this could result in financial losses that could have a material adverse effect on

our business, cause the price of our common stock to decline or delay the development of our product candidates. 16

Future sales, or the potential sale, of a substantial number of shares of our common stock could cause the trading price of our securities to decline and could impair our ability to raise capital through subsequent equity offerings. Sales of a substantial number of shares of our common stock in the public markets, or the perception that these sales may occur, could cause the market price of our securities to decline and could materially impair our ability to raise capital through the sale of additional equity securities. After

taking into account the 84,000,000 shares included in the units offered hereby, we will have 157,062,205 shares of common stock issued and outstanding immediately after this offering based on 73,062,205 shares issued and outstanding as of December 31, 2009. In addition, we may issue up to an additional 196,500,000 shares of our common stock as follows:

•

84,000,000 shares upon exercise of the redeemable warrants; • 25,200,000 shares upon exercise of the underwriters’ over-allotment option to purchase 180,000 units (including the shares underlying the redeemable warrants included in such units); • 16,800,000 shares upon exercise of the representative’s warrant to purchase 120,000 units (including the shares underlying the warrants included in those units);

• 9,857,723 shares under our Non-Qualified Stock Option Plan, of which 5,987,057 are issuable upon exercise of options outstanding at December 31, 2009 having an exercise price of $0.001 per share;

• 28,500,000 shares upon exercise of options that we intend to grant to our senior executives and directors upon completion of this offering, which will have an exercise price equal to the result obtained by dividing the unit public offering price by the number of shares of common stock included in a

unit;

• 1,606,275 shares under our Stock Bonus Plan;

• approximately 17,000,000 shares upon exercise of warrants outstanding at September 30, 2009 having a weighted average exercise price of $0.14 per share; and

• approximately 13,500,000 shares upon conversion in full of our amended secured convertible notes in the aggregate outstanding principal amount of $1.75 million as of December 31, 2009, assuming a conversion price of $0.13 per share, which number of shares does not include shares issuable if the

amount converted includes accrued interest and which number of shares will be reduced to approximately 3.0 million shares after this offering if the holders of the amended secured convertible notes accept a prepayment out of the net proceeds of this offering reducing the balance due on those

notes to $390,000. Of the foregoing shares, approximately 137,500,000 either will be covered by the registration statement of which this prospectus is a part or are covered by another effective registration statement and, thus, upon issuance, will be freely tradable subject only to the resale restrictions set forth in Rule

144, promulgated under the Securities Act, applicable to affiliates, and subject to the further caveat that shares cannot be issued unless the applicable registration statement is effective at the time of issuance. In addition, the shares issuable upon conversion of the principal amount of the amended secured

convertible notes will be freely tradeable under Rule 144. For additional information regarding Rule 144, see page 58 of this prospectus. Finally, we intend to file a registration statement on Form S-8 as soon as practicable after completion of this offering covering the 28,500,000 shares that will be

reserved for issuance upon exercise of the options we intend to grant to our senior executives and directors upon completion of this offering. We do not anticipate paying dividends in the foreseeable future. This could make our stock less attractive to potential investors. We anticipate that we will retain all future earnings and other cash resources for the future operation and development of our business, and we do not intend to declare or pay any cash dividends in the foreseeable future. Future payment of cash dividends will be at the discretion of our board of

directors after taking into account many factors, including our operating results, financial condition and capital requirements. Corporations that pay dividends may be viewed as a better investment than corporations that do not. 17

Certain provisions of Texas law and our organizational documents could delay or discourage takeover attempts that stockholders may consider favorable. Our articles of incorporation and bylaws include provisions that are intended to enhance the likelihood of continuity and stability in the composition of our board of directors. These provisions may make it more difficult to remove directors and management or could have the effect of delaying,

deferring or preventing a future takeover or a change in control, unless the takeover or change in control is approved by our board of directors, even though the transaction might offer our stockholders an opportunity to sell their shares at a price above the current market price. In addition, we are

subject to the provisions of the Texas Business Combination Law (Articles 13.01 through 13.08 of the Texas Business Corporation Act), which generally prohibit us from engaging in any business combination with certain persons who own 20% or more of our outstanding voting stock without the approval

or our board of directors. These provisions could make it difficult for a third party to acquire us, or for members of our board of directors to be replaced, even if doing so would be beneficial to our stockholders. Any delay or prevention of a change of control transaction or changes in our board of

directors or management could deter potential acquirers or prevent the completion of a transaction in which our stockholders could receive a substantial premium over the then current market price for their shares. As a result, these provisions may adversely affect the price of our common stock. 18

Based on an assumed public offering price of $7.00 per unit, within the range set forth on the cover of this prospectus, we estimate that the net proceeds from this offering will be approximately $6.8 million after deducting the (i) underwriting discounts and commissions ($0.70 per unit, or $840,000 in

the aggregate), (ii) representative’s non-accountable expense allowance (approximately $252,000) and (iii) estimated offering expenses (approximately $500,000), or approximately $7.9 million if the underwriters’ over-allotment option is exercised in full. If the redeemable warrants are exercised, we will

receive an additional $12.6 million in gross proceeds ($14.5 million if the redeemable warrants underlying the underwriters’ over-allotment option are exercised). We have agreed to pay Paulson a warrant solicitation fee equal to 5% of the exercise price of each redeemable warrant exercised more than

one year after the date of the prospectus if Paulson solicits the exercise. We currently expect to use our net proceeds from this offering as follows:

Purpose

Amount

Percentage Develop and obtain marketing approval of our POC test format

$

1,000,000

14.7

% Repayment, in part, of our amended secured convertible notes(1)(2)

$

1,360,000

20.0

% Repayment, in part, of our 10% unsecured notes(3)

$

450,000

6.6

% Fund ongoing research and development activities relating to the RECAF marker

$

200,000

2.9

% Fund marketing expenses relating to commercializing the manual format of our serum testing technology

$

150,000

2.2

% Fund marketing expenses relating to the veterinary applications of our serum testing technology

$

100,000

1.5

% Fund working capital and other general corporate purposes, including interest on our outstanding indebtedness, accounting and legal expenses, facilities expenses and personnel expenses(2)

$

3,540,000

52.1

% TOTAL

$

6,800,000

100.0

%

(1) The amended secured convertible notes are due and payable in full on December 31, 2012 and bear interest at a floating rate of interest equal to the prime rate plus 2.75%. Based on the current prime rate of 3.25%, the amended secured notes are currently accruing interest at the rate of 6% per

annum. As of December 31, 2009, the aggregate outstanding principal balance of the amended secured convertible notes was $1.75 million. Assuming no further reductions in principal as a result of conversion or repayments, after this offering the aggregate outstanding principal balance due on these

notes will be $390,000. We may offer to repay the entire amount due on these notes as well as the notes described in the last sentence of note 3 below, in which case the amount of net proceeds allocated to working capital and general corporate purposes will be reduced by $515,000. (2) After this offering, there will remain approximately $390,000 outstanding on the amended secured convertible notes and $125,000 of unsecured notes. (3) In September 2009, we issued unsecured notes in the aggregate principal amount of $575,000. The net proceeds from the sale of the unsecured notes, after payment of all expenses relating to their issuance, were used to pay expenses relating to this offering and for working capital and general

corporate purposes. These notes bear interest at 10% per annum. Notes having an aggregate original principal amount of $450,000 are due and payable in full out of the net proceeds of this offering. The remaining notes, in an aggregate principal amount of $125,000, are due and payable on the earlier

of (a) January 31, 2013 and (b) 30 days after all amounts due with respect to the amended secured convertible notes have been paid in full or fully “cash collateralized.”

The amounts and timing of our actual expenditures will depend on numerous factors, including current global economic conditions and internal cash flows. We will have broad discretion in the 19

application of the net proceeds. Pending the uses described above, we intend to invest the net proceeds in short-term, interest-bearing, investment-grade securities. In the event the estimated net proceeds of this offering is less than $6.8 million, the amount allocated to working capital and general

corporate purposes will be reduced. We anticipate that the net proceeds from this offering together with our existing cash balances and our anticipated cash flow from operations will allow us to sufficiently manage our cash flow needs for the next twelve months. Our existing cash balances include the net proceeds from the sale of our