Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10 – K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended September 30, 2009

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 001-11703

GENCOR INDUSTRIES, INC.

| Incorporated in the | I.R.S. Employer Identification | |

| State of Delaware | No. 59-0933147 |

5201 North Orange Blossom Trail

Orlando, Florida 32810

Registrant’s Telephone Number, Including Area Code: (407) 290-6000

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

Common Stock ($.10 Par Value)

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate by check mark if the registrant is a well-known seasonal issuer, as defined in Rule 405 of the Securities Act ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15 (d) of the Act ¨ Yes x No

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer” and “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

| Large Accelerated Filer | ¨ | Accelerated Filer | ¨ | |||

| Non-Accelerated Filer | ¨ (Do not check if a smaller reporting Company) | Smaller Reporting Company | x | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

The aggregate market value of the common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of the last business day of the most recently completed second fiscal quarter was $46,101,000.

Table of Contents

Indicate the number of shares outstanding of each of the Registrant’s classes of Common Stock, as of the latest practicable date: 8,079,872 shares of Common Stock ($.10 par value) and 1,532,998 shares of Class B Stock ($.10 par value) as of December 18, 2009.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Form 10-K is incorporated by reference from the Registrant’s 2010 Proxy Statement for the Annual Meeting of the Stockholders.

Introductory Note: Caution Concerning Forward-Looking Statements

This annual report on Form 10-K (“Report”) and the Company’s other communications and statements may contain “forward-looking statements,” including statements about the Company’s beliefs, plans, objectives, goals, expectations, estimates, projections and intentions. These statements are subject to significant risks and uncertainties and are subject to change based on various factors, many of which are beyond the Company’s control. The words “may,” “could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan,” “target,” “goal,” and similar expressions are intended to identify forward-looking statements. All forward-looking statements, by their nature, are subject to risks and uncertainties. The Company’s actual future results may differ materially from those set forth in the Company’s forward-looking statements. For information concerning these factors and related matters, see “Risk Factors” in Part I, Item 1A in this Report, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 in this Report. However, other factors besides those referenced could adversely affect the Company’s results, and you should not consider any such list of factors to be a complete set of all potential risks or uncertainties. Any forward-looking statements made by the Company herein speak as of the date of this Report. The Company does not undertake to update any forward-looking statement, except as required by law.

PART I

| ITEM 1. | BUSINESS |

General

Gencor Industries, Inc. and its subsidiaries (the “Company”, “we”, “us” or “our”) is a leading manufacturer of heavy machinery used in the production of highway construction materials, synthetic fuels, and environmental control equipment. The Company’s products are manufactured in two facilities in the United States and one facility, until June 30, 2009, located in the United Kingdom. The Company’s products are sold through a combination of Company sales representatives and independent dealers and agents located throughout the world.

The Company designs, manufactures and sells machinery and related equipment used primarily for the production of asphalt and highway construction materials. The Company’s principal core products include asphalt plants, combustion systems and fluid heat transfer systems. The Company believes that its technical and design capabilities, environmentally friendly process technology, and wide range of products have enabled it to become a leading producer of equipment worldwide. The Company believes it has the largest installed base of asphalt production plants in the United States.

Because the Company’s products are sold primarily to the highway construction industry, the business is seasonal in nature. The majority of orders for the Company’s products are received between October and February, with a significant volume of shipments occurring prior to May. The principal factors driving demand for the Company’s products are the level of government funding for domestic highway construction and repair, infrastructure development in emerging economies, the need for spare parts, and a trend towards larger plants resulting from industry consolidation.

2

Table of Contents

In 1968, the Company was formed by the merger of Mechtron Corporation with General Combustion, Inc. and Genco Manufacturing, Inc. The new entity reincorporated in Delaware in 1969 and adopted the name Mechtron International Corporation in 1970. In 1985, the Company began a series of acquisitions into related fields starting with the Beverley Group Ltd. in the United Kingdom (the “UK”). Hy-Way Heat Company, Inc. and the Bituma Group were acquired in 1986. In 1987, the Company changed its name to Gencor Industries, Inc. and acquired the Davis Line Inc. and its subsidiaries in 1988.

In January 1998, the Company finalized agreements with Carbontronics, LLC (“CLLC”) pursuant to which the Company sold, designed, manufactured, and installed four synthetic fuel production plants. These plants were subsequently sold by CLLC to a limited partnership (“LP”), Carbontronics Synfuels Investors, L.P., which was the owner of the plants. The Company was paid in full for these plants in 1998. In addition to payment for the plants, the Company received a member interest of 45% in CLLC. Revenue to CLLC was based upon the production of these plants continuing to qualify for tax credits under Section 29 of the Internal Revenue Code, and the ability to economically produce and successfully market synthetic fuel produced by the plants. To the extent the LP was successful in producing fuel which qualifies for tax credits, sold the synthetic fuel, sold the tax credits to investors, and had sufficient cash flow to cover all operating expenses, then the LP remitted cash to CLLC as additional purchase price for the sale of the plants. CLLC generally distributed any cash receipts to its investors.

Also, the Company received a 25% partnership position in the General Partner (“GP”) of the LP and in Carbontronics II, LLC (“C2LLC”). C2LLC received royalty payments from the LP only if the LP had been successful in producing fuel which qualified for tax credits, sold the synthetic fuel, sold the tax credits to investors, and had sufficient cash flow to cover all other operating expenses. The remaining interests in the GP, CLLC, and C2LLC were owned by other, unrelated entities. An administrative member of the GP, not the Company, was responsible for administration of the day-to-day affairs of the GP and LP. The Company was entitled to appoint one of the three members of the GP Management Committee and had 1/3 of the voting rights thereof. As a part of the member positions in CLLC, C2LLC, and the GP (collectively “Investees”), the Company had the potential for income subject to the performance of the LP.

The tax credit legislation expired at the end of calendar year 2007. Consequently, the four synthetic fuel plants were decommissioned. The plants were sold or transferred to site owners in exchange for a release of all contracted liabilities related to the removal of plants from the sites. The administrative partner informed the Company that there were no operations in calendar 2008 and almost all of the partnership affairs were finalized in 2008. It is not possible to predict the amount of final distributions from the partnerships upon the final disposition and winding-down of operations. Futures distributions are not anticipated to be material.

The Company received $19.9 million of distributions from Investees in fiscal 2007, $15.6 million of distributions in fiscal 2008 and $48,000 of distributions in fiscal 2009. These distributions are subject to state and federal income taxes.

Products

Asphalt Plants. The Company manufactures and produces hot-mix asphalt plants used in the production of asphalt paving materials. The Company also manufactures related asphalt plant equipment including hot mix storage silos, fabric filtration systems, cold feed bins and other plant components. The Company’s H&B (Hetherington and Berner) product line is the world’s oldest asphalt plant line, first manufactured in 1894. The Company’s subsidiary, Bituma Corporation, formerly known as Boeing Construction Company, developed the continuous process for asphalt production, which has been adopted as the United States industry’s standard technology, as well as patented the Gencor counterflow technology, several adaptations of which have become the industry standard, which recaptures and burns emissions and vapors, resulting in a cleaner and more efficient process. The Company manufactures a very comprehensive range of fully mobile batch plants, as well as trommel screens.

3

Table of Contents

Combustion Systems and Industrial Incinerators. The Company manufactures combustion systems, which are large burners that can transform most solid, liquid or gaseous fuels into usable energy, or burn multiple fuels, alternately or simultaneously. Through its subsidiary General Combustion, the Company has been a significant source of combustion systems for the asphalt and aggregate drying industries since the 1950’s. The Company also manufactures soil remediation machinery, as well as combustion systems for rotary dryers, kilns, fume and liquid incinerators and fuel heaters. The Company believes maintenance and fuel costs are lower for its burners because of their superior design.

Fluid Heat Transfer Systems. The Company’s General Combustion subsidiary also manufactures the Hy-Way heat and Beverley lines of thermal fluid heat transfer systems and specialty storage tanks for a wide array of industry uses. Thermal fluid heat transfer systems are similar to boilers, but use high temperature oil instead of water. Thermal fluid heaters have been replacing steam pressure boilers as the best method of heat transfer for storage, heating and pumping viscous materials (i.e., asphalt, chemicals, heavy oils, etc.) in many industrial and petrochemical applications worldwide. The Company believes the high efficiency design of its thermal fluid heaters can outperform competitive units in many types of process applications.

Product Engineering and Development

The Company is engaged in product engineering and development efforts to expand its product lines and to further develop more energy efficient and environmentally compatible systems.

Significant developments include the use of cost effective, non-fossil fuels, biomass (bagasse, municipal solid waste, sludge and wood waste), refuse-derived fuel, coal and coal mixtures, the economical recycling of old asphalt and new designs of environmentally compatible asphalt plants. Product engineering and development activities are directed toward more efficient methods of producing asphalt and lower cost fluid heat transfer systems. In addition, efforts are also focused on developing combustion systems that operate at higher efficiency and offer a higher level of environmental compatibility. The Company also continues to evaluate opportunities in the energy field.

Sources of Supply and Manufacturing

Substantially all products sold by the Company and its subsidiaries are manufactured or assembled by the Company, except for procured raw materials and hardware. The Company purchases a large quantity of steel, raw materials and hardware used to manufacture its products from hundreds of suppliers and is not dependent on any single supplier. Periodically, the Company reviews the cost effectiveness of internal manufacturing versus outsourcing its product lines to independent third parties and currently believes it has the internal capability to produce the highest quality product at the lowest cost. This, however, may change from time to time.

Seasonality

The Company is concentrated in the asphalt-related business and subject to a seasonal slow-down during the third and fourth quarters of the calendar year. Traditionally, the Company’s customers do not purchase new equipment for shipment during the summer and fall months to avoid disrupting their peak season for highway construction and repair work. This slow-down often results in lower reported sales and earnings and/or losses during the first and fourth quarters of the Company’s fiscal year.

Competition

The markets for the Company’s products are highly competitive. Within a given product line, the industry remains fairly concentrated, with typically a small number of companies competing for the majority of a product line’s industry sales. The principal competitive factors include technology and overall product design, dependability and reliability of performance, brand recognition, pricing and after-the-sale customer support. Management believes its ability to compete depends upon its continual efforts to improve product performance and dependability, competitively price its products, and provide the best customer support and service in the industry.

4

Table of Contents

Sales and Marketing

The Company’s products and services are marketed internationally through a combination of Company employed sales representatives and independent dealers and agents.

Sales Backlog

The Company’s manufacturing processes allow for a relatively short turnaround from the order date to shipment date of usually less than ninety days. Therefore, the size of the Company’s backlog should not be viewed as an indicator of the Company’s annualized revenues or future financial results. The Company’s backlog was approximately $13 million and $9 million as of December 1, 2009 and December 1, 2008, respectively.

Financial Information about Geographic Areas Reporting Segments

The Company sold its operations in the United Kingdom in June 2009. For a geographic breakdown of revenues see the table captioned Reporting Segments in Note 1 to the Consolidated Financial Statements in Item 8.

Licenses, Patents and Trademarks

The Company holds numerous patents covering technology and applications related to various products, equipment and systems, and numerous trademarks and trade names registered with the U.S. Patent and Trademark Office and in various foreign countries. In general, the Company depends upon technological capabilities, manufacturing quality control and application know-how, rather than patents or other proprietary rights in the conduct of its business. The Company believes the expiration of any one of these patents, or a group of related patents, would not have a material adverse effect on the overall operations of the Company.

Government Regulations

The Company believes its design and manufacturing processes meet all industry and governmental agency standards that may apply to its entire line of products, including all domestic and foreign environmental, structural, electrical and safety codes. The Company’s products are designed and manufactured to comply with U.S. Environmental Protection Agency regulations. Certain state and local regulatory authorities have strong environmental impact regulations. While the Company believes that such regulations have helped, rather than restricted its marketing efforts and sales results, there is no assurance that changes to federal, state, local, or foreign laws and regulations will not have a material adverse effect on the Company’s products and earnings in the future.

Environmental Matters

The Company is subject to various federal, state, local and foreign laws and regulations relating to the protection of the environment. The Company believes it is in material compliance with all applicable environmental laws and regulations. The Company does not expect any material impact on future operating costs as a result of compliance with currently enacted environmental regulations.

Employees

As of September 30, 2009, the Company employed a total of 282 employees, all in its domestic operations. The Company has collective bargaining agreements covering production and maintenance employees at its Marquette, Iowa facility. The remaining domestic employees are not represented by a labor union or collective bargaining agreement. The Company believes that its relationship with its employees is good.

Available Information

For further discussion concerning the Company’s business, see the information included in Item 7 (Management’s Discussion and Analysis of Financial Condition and results of Operations) and Item 8 (Financial Statements and Supplementary Data) of this Report.

5

Table of Contents

The Company makes available free of charge through its web site at www.gencor.com the Company’s Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports, if applicable, filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after the material is electronically filed with or furnished to the Securities and Exchange Commission (“SEC”). The information posted on the web site is not incorporated into this Annual Report on Form 10-K.

6

Table of Contents

| ITEM 1A. | RISK FACTORS |

The following risk factors and other information included in this Annual Report on Form 10-K should be carefully considered. The risks and uncertainties described below are not the only ones the Company faces. Additional risks and uncertainties not presently known to the Company or that the Company presently deems less significant may also impair the Company’s business operations. If any of the following risks actually occur, the Company’s business operating results and financial condition could be materially adversely affected. The order of these risk factors does not reflect their relative importance or likelihood of occurrence.

The business may be adversely affected by the current economic recession.

The domestic and international economies are experiencing a significant recession. This recession has been magnified by the tightening of the credit markets. The domestic and international markets may remain depressed for an undeterminable period of time. The Company’s sales to contractors are dependent on construction and infrastructure spending and availability of credit to its customers. Changes in construction and governmental spending have had and could continue to have a material adverse effect on the Company’s results of operations.

The business is affected by the cyclical nature of the markets it serves.

The demand for the Company’s products and service is dependent on general economic conditions and more specifically, the commercial construction industry. Adverse economic conditions may cause customers to forego or delay new purchases and rely more on repairing existing equipment thus negatively impacting the Company’s sales and profits. Rising gas and oil prices, increasing steel prices and shortage of qualified workers can have adverse effects on the Company. Market conditions could limit the Company’s ability to raise selling prices to offset increases in inventory costs.

The business is affected by the level of government funding for highway construction.

Many contractors depend on funding by federal and state agencies for highway, transit and infrastructure programs. Future legislation may increase or decrease government spending, which if decreased, could have a negative affect on the Company’s financial condition or results of operations. Federal funding of infrastructure may be decreased in the future, especially since the United States is currently experiencing an economic recession.

If the Company fails to comply with requirements relating to internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act, the business could be harmed and its stock price could decline.

Rules adopted by the Securities and Exchange Commission pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require the Company to assess its internal control over financial reporting annually. The rules governing the standards that must be met for management to assess its internal control over financial reporting are complex. They require significant documentation, testing, and possible remediation of any significant deficiencies in and/or material weaknesses of internal controls in order to meet the detailed standards under these rules. The Company has evaluated its internal control over financial reporting as effective as of September 30, 2009. See Item 9A – Controls and Procedures – Management’s Report on Internal Control over Financial Reporting. Although the Company has evaluated its internal control over financial reporting as effective as of September 30, 2009, in future fiscal years, the Company may encounter unanticipated delays or problems in assessing its internal control over financial reporting as effective or in completing its assessments by the required dates. In addition, the Company cannot assure you that its independent registered public accountants will attest that internal control over financial reporting are effective in future fiscal years. If the Company cannot assess its internal control over financial reporting as effective, investor confidence and share value may be negatively impacted.

The Company may be required to reduce its profit margins on contracts on which it uses the percentage-of-completion accounting method.

The Company records revenues and profits on many of its contracts using the percentage-of-completion method of accounting. As a result, revisions made to the estimates of revenues and profits are recorded in the period in which the conditions that require such revisions become known and can be estimated. Although the Company

7

Table of Contents

believes that its profit margins are fairly stated and that adequate provisions for losses for its fixed-price contracts are recorded in the financial statements, as required under U.S. generally accepted accounting principles (GAAP), the Company cannot assure you that its contract profit margins will not decrease or its loss provisions will not increase materially in the future.

The Company may encounter difficulties with future acquisitions.

As part of its growth strategy, the Company intends to evaluate the acquisitions of other companies, assets or product lines that would complement or expand the Company’s existing businesses or broaden its customer relationships. Although the Company conducts due diligence reviews of potential acquisition candidates, it may not be able to identify all material liabilities or risks related to potential acquisition candidates. There can be no assurance that the Company will be able to locate and acquire any business, retain key personnel and customers of an acquired business or integrate any acquired business successfully. Additionally, there can be no assurance that financing for any acquisition, if necessary, will be available on acceptable terms, if at all, or that the Company will be able to accomplish its strategic objectives in connection with any acquisition. Although the Company periodically considers possible acquisitions, no specific acquisitions are probable as of the date of this Report on Form 10-K.

Demand for the Company’s products is cyclical in nature.

Orders for the Company’s products slow down during the summer and fall months since its customers generally do not purchase new equipment for shipment in their peak season for highway construction and repair work. In addition, demand for the Company’s products depends in part upon the level of capital and maintenance expenditures by the highway construction industry. The highway construction industry historically has been cyclical in nature and vulnerable to general downturns in the economy. Decreases in industry spending could have a material adverse effect upon demand for the Company’s products and negatively impact its business, financial condition, results of operations and the market price of its common stock.

The Company’s marketable securities are comprised of stocks and bonds invested through a professional investment advisor and are subject to various risks such as interest rates, markets, and credit.

Due to the level of risk associated with certain investment securities and the level of uncertainty related to changes in the value of securities, changes in these risk factors could have a material adverse impact on the Company’s results of operations.

There are and will continue to be quarterly fluctuations of the Company’s operating results.

The Company’s operating results historically have fluctuated from quarter to quarter as a result of a number of factors, including the value, timing and shipment of individual orders and the mix of products sold. Revenues from certain large contracts are recognized using the percentage of completion method of accounting. The Company recognizes product revenues upon shipment for the rest of its products. The Company’s asphalt production equipment operations are subject to seasonal fluctuation, which may lower revenues and result in possible losses in the first and fourth fiscal quarters of each year. Traditionally, asphalt producers do not purchase new equipment for shipment during the summer and fall months to avoid disruption of their activities during peak periods of highway construction.

If the Company is unable to attract and retain key personnel, its business could be adversely affected.

The success of the Company will continue to depend substantially upon the efforts, abilities and services of its management team and certain other key employees. The loss of one or more key employees could adversely affect the Company’s operations. The Company’s ability to attract and retain qualified personnel, either through direct hiring, or acquisition of other businesses employing such persons, will also be an important factor in determining its future success.

8

Table of Contents

The Company may be required to defend its intellectual property against infringement or against infringement claims of others.

The Company holds numerous patents covering technology and applications related to various products, equipment and systems, and numerous trademarks and trade names registered with the U.S. Patent and Trademark Office and in various foreign countries. There can be no assurance as to the breadth or degree of protection that existing or future patents or trademarks may afford the Company, or that any pending patent or trademark applications will result in issued patents or trademarks, or that the Company’s patents, registered trademarks or patent applications, if any, will be upheld if challenged, or that competitors will not develop similar or superior methods or products outside the protection of any patents issued, licensed or sublicensed to the Company. Although the Company believes that none of its patents, technologies, products or trademarks infringe upon the patents, technologies, products or trademarks of others, it is possible that the Company’s existing patents, trademarks or other rights may not be valid or that infringement of existing or future patents, trademarks or proprietary rights may occur. In the event that the Company’s products are deemed to infringe upon the patent or proprietary rights of others, the Company could be required to modify the design of its products, change the name of its products or obtain a license for the use of certain technologies incorporated into its products. There can be no assurance that the Company would be able to do any of the foregoing in a timely manner, upon acceptable terms and conditions, or at all, and the failure to do so could have a material adverse effect on the Company. In addition, there can be no assurance that the Company will have the financial or other resources necessary to enforce or defend a patent, registered trademark or other proprietary right, and, if the Company’s products are deemed to infringe upon the patents, trademarks or other proprietary rights of others, the Company could become liable for damages, which could also have a material adverse effect on the Company.

The Company may be subject to substantial liability for the products it produces.

The Company is engaged in a business that could expose it to possible liability claims for personal injury or property damage due to alleged design or manufacturing defects in its products. The Company believes that it meets existing professional specification standards recognized or required in the industries in which it operates, and there are no material product liability claims pending against the Company as of the date hereof. Although the Company currently maintains product liability coverage which it believes is adequate for the continued operation of its business, such insurance may prove inadequate or become difficult to obtain or unobtainable in the future on terms acceptable to the Company.

The Company is subject to extensive environmental laws and regulations, and the costs related to compliance with, or the Company’s failure to comply with, existing or future laws and regulations, could adversely affect the business and results of operations.

The Company’s operations are subject to federal, state, local and foreign laws and regulations relating to the protection of the environment. Sanctions for noncompliance may include revocation of permits, corrective action orders, significant administrative or civil penalties and criminal prosecution. The Company’s business involves environmental management and issues typically associated with historical manufacturing operations. To date, the Company’s cost of complying with environmental laws and regulations has not been material, but the fact that such laws or regulations are changed frequently makes predicting the cost or impact of such laws and regulations on the Company’s future operations uncertain.

The loss of one or more of the Company’s raw materials suppliers, or increase in prices, could cause production delays, a reduction of revenues or an increase in costs.

The principal raw materials the Company uses are steel and related products. The Company has no long-term supply agreements with any of its major suppliers. However, the Company has generally been able to obtain sufficient supplies of raw materials for its operations. Although the Company believes that such raw materials are readily available from alternate sources, an interruption in the supply of steel and related products or a substantial increase in the price of any of these raw materials could have a material adverse effect on the Company’s business, financial condition and results of operations.

9

Table of Contents

The Company is subject to significant government regulations.

The Company is subject to a variety of governmental regulations relating to the manufacturing of its products. Any failure by the Company to comply with present or future regulations could subject it to future liabilities, or the suspension of production that could have a material adverse effect on the Company’s results of operations. Such regulations could also restrict the Company’s ability to expand its facilities, or could require the Company to acquire costly equipment or to incur other expenses to comply with such regulations. Although the Company believes it has the design and manufacturing capability to meet all industry or governmental agency standards that may apply to its product lines, including all domestic and foreign environmental, structural, electrical and safety codes, there can be no assurance that governmental laws and regulations will not become more stringent over time, imposing greater compliance costs and increasing risks and penalties associated with a violation. The cost to the Company of such compliance to date has not materially affected its business, financial condition or results of operations. There can be no assurance, however, that violations will not occur in the future as a result of human error, equipment failure or other causes. The Company’s customers are also subject to extensive regulations, including those related to the workplace. The Company cannot predict the nature, scope or effect of governmental legislation, or regulatory requirements that could be imposed or how existing or future laws or regulations will be administered, or interpreted. Compliance with more stringent laws or regulations, as well as more vigorous enforcement policies of regulatory agencies, could require substantial expenditures by the Company and could adversely affect its business, financial condition and results of operations.

The Company’s management has effective voting control.

The Company’s officers and directors beneficially own an aggregate of approximately 94.6% of the outstanding shares of the Company’s $.10 par value Class B stock. The Class B stock is entitled to elect 75% (calculated to the nearest whole number, rounding five-tenths to next highest whole number) of the members of its Board of Directors. Further, approval of a majority of the Class B stock is generally required to effect a sale of the Company and certain other corporate transactions. As a result, these stockholders can elect more than a majority of the Board of Directors and exercise significant influence over most matters requiring approval by the Company’s stockholders. This concentration of control may also have the effect of delaying or preventing a change in control.

The issuance of preferred stock may impede a change of control or may be dilutive to existing stockholders.

The Company’s Certificate of Incorporation, as amended, authorizes the Company’s Board of Directors, without stockholder vote, to issue up to 300,000 shares of preferred stock in one or more series and to determine for any series the dividend, liquidation, conversion, voting or other preferences, rights and terms that are senior, and not available, to the holders of the Company’s common stock. Thus, issuances of series of preferred stock could adversely affect the relative voting power, distributions and other rights of the common stock. The issuance of preferred stock could deter or impede a merger, tender offer or other transaction that some, or a majority of the Company’s common stockholders might believe to be in their best interest or in which the Company’s common stockholders might receive a premium for their shares over the then current market price of such shares.

The Company may be required to indemnify its directors and executive officers.

The Company has authority under Section 145 of the Delaware General Corporation Law to indemnify its directors and officers to the extent provided in that statute. The Company’s Certificate of Incorporation, as amended, provides that a director shall not be personally liable to the Company for breach of fiduciary duty as a director, except to the extent such exemption from liability or limitation thereof is not permitted under the Delaware General Corporation Law. The Company’s Bylaws provide in part that it indemnify each of its directors and officers against liabilities imposed upon them (including reasonable amounts paid in settlement) and expenses incurred by them in connection with any claim made against them or any action, suit or proceeding to which they may be a party by reason of their being or having been a director or officer. The Company maintains officer’s and director’s liability insurance coverage. There can be no assurance that such insurance will be available in the future, or that if available, it will be available on terms that are acceptable to the Company. Furthermore, there can be no assurance that the insurance coverage provided will be sufficient to cover the amount of any judgment awarded against an officer or director (either individually or in the aggregate). Consequently, if such judgment exceeds the coverage under the policy, the Company may be forced to pay such difference.

10

Table of Contents

The Company enters into indemnification agreements with each of its executive officers and directors containing provisions that may require the Company, among other things, to indemnify them against certain liabilities that may arise by reason of their status or service as officers or directors (other than liabilities arising from willful misconduct of a culpable nature) and to advance their expenses incurred as a result of any proceeding against them as to which they could be indemnified. Management believes that such indemnification provisions and agreements are necessary to attract and retain qualified persons as directors and executive officers.

The Company does not expect to pay dividends for the foreseeable future.

For the foreseeable future, the Company intends to retain any earnings to finance its business requirements, and it does not anticipate paying any cash dividends on its common stock or Class B stock. Any future determination to pay dividends will be at the discretion of the Company’s Board of Directors and will be dependent upon then existing conditions, including the financial condition and results of operations, capital requirements, contractual restrictions, business prospects, and other factors that the Board of Directors considers relevant.

Competition could reduce revenue from the Company’s products and services and cause it to lose market share.

The Company currently faces strong competition in product performance, price and service. Some of the Company’s national competitors have greater financial, product development and marketing resources than the Company. If competition in the Company’s industry intensifies or if the current competitors enhance their products or lower their prices for competing products, the Company may lose sales or be required to lower the prices it charges for its products. This may reduce revenues from the Company’s products and services, lower its gross margins or cause it to lose market share.

The Company’s quarterly operating results are likely to fluctuate, which may decrease its stock price.

The Company’s quarterly revenues, expenses and operating results have varied significantly in the past and are likely to vary significantly from quarter to quarter in the future. As a result, the Company’s operating results may fall below the expectations of securities analysts and investors in some quarters, which could result in a decrease in the market price of its common stock. The reasons the Company’s quarterly results may fluctuate include:

| • | General competitive and economic conditions |

| • | Delays in, or uneven timing in, delivery of customer orders |

| • | The seasonal nature of the industry |

| • | The introduction of new products by the Company or its competitors |

| • | Product supply shortages, and |

| • | Reduced demand due to adverse weather conditions. |

Period-to-period comparisons of such items should not be relied on as indications of future performance.

The Company’s stock has been, and likely will continue to be, subject to substantial price and volume fluctuations due to a number of factors, many of which will be beyond the Company’s control.

In recent years, the stock market in general and the market for the Company’s common stock has experienced extreme price fluctuations. The market price of the Company’s common stock may be significantly affected by various factors such as:

| • | Quarterly variations in operating results |

| • | Changes in revenue growth rates as a whole or for specific geographic areas or products |

| • | Changes in earning estimates by market analysts |

| • | The announcement of new products or product enhancements by the Company or its competitors |

11

Table of Contents

| • | Speculation in the press or analyst community, and |

| • | General market conditions or market conditions specific to particular industries. |

The market price of the Company’s common stock may experience significant fluctuations in the future.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

12

Table of Contents

| ITEM 2. | PROPERTIES |

The following table lists the operating properties owned by the Company as of September 30, 2009:

| Location |

Owned Acreage |

Building Square Footage |

Principal Function | |||

| Marquette, Iowa |

72.0 | 137,000 | Offices and manufacturing | |||

| Orlando, Florida |

27.0 | 215,000 | Corporate offices and manufacturing | |||

| Billingshurst, West Sussex, England |

1.2 | 5,000 | Offices | |||

These properties are owned and pledged as security under the Company’s credit agreement with PNC Bank (see Note 4 to the Consolidated Financial Statements)

| ITEM 3. | LEGAL PROCEEDINGS |

The Company has various litigation and claims pending as of the date of this Form 10-K which have occurred in the ordinary course of business, and which may be covered in whole or in part by insurance. Management has reviewed all litigation matters arising in the ordinary course of business and, upon advice of counsel, has made provisions, not deemed material, for any estimable losses and expenses of litigation.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

There were no matters submitted during the fourth quarter of this fiscal year to a vote of security holders.

13

Table of Contents

PART II

| ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER’S PURCHASES OF EQUITY SECURITIES |

The Company’s stock has been traded on the NASDAQ Global Market under the symbol “GENC” since December 20, 2007.

Following are the high and low closing prices for the Company’s common stock for the periods indicated:

| 2009 |

HIGH | LOW | ||||

| First Quarter |

$ | 8.73 | $ | 4.81 | ||

| Second Quarter |

$ | 8.44 | $ | 5.60 | ||

| Third Quarter |

$ | 8.70 | $ | 6.25 | ||

| Fourth Quarter |

$ | 8.70 | $ | 6.05 | ||

| 2008 |

HIGH | LOW | ||||

| First Quarter |

$ | 10.50 | $ | 8.50 | ||

| Second Quarter |

$ | 20.97 | $ | 9.46 | ||

| Third Quarter |

$ | 32.88 | $ | 10.38 | ||

| Fourth Quarter |

$ | 15.80 | $ | 7.83 | ||

As of September 30, 2009, there were 294 holders of common stock of record and six holders of Class B Stock of record. The Company has not paid any dividends during the last two fiscal years and there is no intention to pay cash dividends in the foreseeable future.

EQUITY COMPENSATION PLANS

The following table includes information about the Company’s common stock that may be issued upon exercise of options, warrants and rights under all of the existing equity compensation plans and arrangements previously approved by security holders as of September 30, 2009:

| Plan |

Number of Securities to be Issued upon Exercise of Outstanding Options, Warrants and Rights (a) |

Weighted-average Exercise Price of Outstanding Options, Warrants and Rights |

Number of Securities Remaining Available for Future Issuance under Equity Compensation Plans (excluding securities reflected in column (a)) | ||||

| 1997 Stock Option Plan |

27,500 | $ | 9.32 | — | |||

| 2009 Incentive Compensation Plan |

— | — | 960,000 | ||||

14

Table of Contents

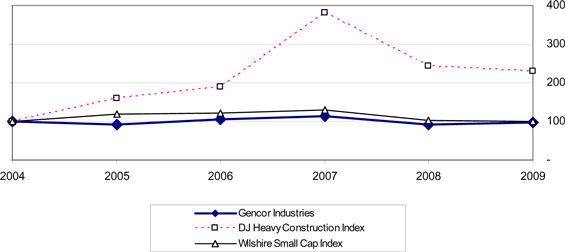

COMPARATIVE 5 YEAR CUMULATIVE RETURN GRAPH

The following graph sets forth the cumulative total stockholder return (assuming reinvestment of dividends) to the Company’s stockholders during the five-year period ended September 30, 2009, as well as the Wilshire Small Capitalization Index and the Dow Jones Heavy Construction Index. The stock performance assumes $100 was invested on October 1, 2004.

Comparison of Cumulative Total Return among Gencor Industries, Inc., the

Wilshire Small Capitalization Index and the Dow Jones Heavy Construction Index

| With Base Year of 2004: |

9/30/2004 | 9/30/2005 | 9/30/2006 | 9/30/2007 | 9/30/2008 | 9/30/2009 | ||||||

| Gencor Industries, Inc. |

100.00 | 93.14 | 105.71 | 113.14 | 92.34 | 98.29 | ||||||

| DJ Heavy Construction Index |

100.00 | 159.25 | 189.23 | 381.53 | 243.77 | 230.22 | ||||||

| Wilshire Small Cap Index |

100.00 | 119.76 | 122.72 | 130.02 | 103.2 | 99.23 | ||||||

On December 20, 2007, the Company’s stock was available for trading on the NASDAQ Global Market under the symbol “GENC”.

15

Table of Contents

| ITEM 6. | SELECTED FINANCIAL DATA |

| Years Ended September 30 | |||||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||||

| (in thousands, except per share data) | |||||||||||||||||

| Net revenue |

$ | 56,789 | $ | 88,343 | $ | 75,286 | $ | 67,107 | $ | 48,140 | |||||||

| Operating income (loss) |

$ | (4,769 | ) | $ | 6,848 | $ | 6,333 | $ | 1,359 | $ | (1,258 | ) | |||||

| Net Income (Loss) |

$ | (2,551 | ) | $ | 15,247 | $ | 18,495 | $ | 11,587 | $ | 31,307 | ||||||

| Per share data: |

|||||||||||||||||

| Basic: |

|||||||||||||||||

| Net Income (Loss) |

$ | (0.27 | ) | $ | 1.59 | $ | 1.91 | $ | 1.17 | $ | 3.50 | ||||||

| Diluted: |

|||||||||||||||||

| Net Income (Loss) |

$ | (0.27 | ) | $ | 1.59 | $ | 1.91 | $ | 1.17 | $ | 3.29 | ||||||

| Cash dividends declared per common share |

$ | — | $ | — | $ | — | $ | — | $ | — | |||||||

| Selected balance sheet data: |

|||||||||||||||||

| September 30, | |||||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||||

| Current assets |

$ | 96,950 | $ | 105,216 | $ | 96,392 | $ | 67,634 | $ | 63,745 | |||||||

| Current liabilities |

$ | 6,851 | $ | 12,807 | $ | 14,048 | $ | 11,888 | $ | 10,361 | |||||||

| Total assets |

$ | 105,601 | $ | 114,217 | $ | 104,227 | $ | 80,974 | $ | 78,010 | |||||||

| Long-term debt, less current maturities |

$ | — | $ | — | $ | — | $ | — | $ | — | |||||||

| Shareholders’ equity |

$ | 96,297 | $ | 99,015 | $ | 83,781 | $ | 63,043 | $ | 51,435 | |||||||

16

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

“Forward-Looking” Information

This Form 10-K contains certain “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which represent the Company’s expectations and beliefs, including, but not limited to, statements concerning gross margins, sales of the Company’s products and future financing plans, income from investees and litigation. These statements by their nature involve substantial risks and uncertainties, certain of which are beyond the Company’s control. Actual results may differ materially depending on a variety of important factors, including the financial condition of the Company’s customers, changes in the economic and competitive environments, the performance of the investment portfolio and the demand for the Company’s products.

For information concerning these factors and related matters, see “Risk Factors” in Part I, Item 1A in this Report. However, other factors besides those referenced could adversely affect the Company’s results, and you should not consider any such list of factors to be a complete set of all potential risks or uncertainties. Any forward-looking statements made by the Company herein speak as of the date of this Report. The Company does not undertake to update any forward-looking statement, except as required by law.

Overview

Gencor Industries, Inc., (the “Company”) is a leading manufacturer of heavy machinery used in the production of highway construction materials, synthetic fuels, and environmental control equipment. The Company’s core products include asphalt plants, combustion systems and fluid heat transfer systems. The Company’s products are manufactured in two facilities in the United States.

Because the Company’s products are sold primarily to the highway construction industry, the business is seasonal in nature. Traditionally, the Company’s customers do not purchase new equipment for shipment during the summer and fall months to avoid disrupting their peak season for highway construction and repair work. The majority of orders for the Company’s products are thus received between October and February, with a significant volume of shipments occurring prior to May. The principal factors driving demand for the Company’s products are the overall economic conditions, the level of government funding for domestic highway construction and repair, infrastructure development in emerging economies, the need for spare parts, fluctuations in the price of crude oil (liquid asphalt as well as fuel costs), and a trend towards larger plants resulting from industry consolidation.

In August 2005, the federal government passed the Safe, Accountable, Flexible and Efficient Transportation Equity Act—A Legacy for Users (“SAFETEA-LU”). This bill appropriated a multi-year guaranteed funding of $286.5 billion for federal highway, transit and safety programs that expired on September 30, 2009. On February 17, 2009, President Obama signed into law the American Recovery and Reinvestment Act of 2009, which included approximately $27.5 billion for highway and bridge construction activities. The Company believes that its customers are waiting on the states to move forward with the projects as their purchasing decisions are significantly influenced by the federal government’s legislation on federal road building funding. Any new funding will have a positive impact on the Company’s financial performance although the magnitude of that improvement cannot be determined. The reduction in sales of the Company’s larger equipment has resulted in part in an increase in sales of components, aftermarket parts, and ancillary services in fiscal 2009 as many customers are choosing to maintain versus replace or upgrade their equipment.

In January 2009, the Canadian government announced its economic action plan to stimulate economic growth which included a $12 billion two year investment in new infrastructure including roads, bridges and other infrastructure. The Company believes that certain programs associated with this funding will have a positive impact on its financial performance although the magnitude of that impact cannot be determined.

17

Table of Contents

Economic downturns like the one currently being experienced generally result in reduced purchasing within the Company’s served markets and thus have a direct impact on sales and tend to increase the pricing pressures on the Company’s products resulting in lower pricing and margins. The Company’s typical sales of asphalt plants are in the $2 to $4 million range and may require the Company’s customers obtain some sort of financing. The current state of the financial industry, the tightening of the credit markets and the higher interest rates, have had an adverse impact on the Company’s customers’ attitudes toward purchasing new equipment. On the positive side, the reduced value of the US dollar has resulted in more interest from international customers.

In addition to government funding and the overall economic conditions, fluctuations in the price of oil, which is a major component of asphalt mix, may affect the Company’s financial performance. An increase in the price of oil increases the cost of manufacturing asphalt and could therefore decrease demand for asphalt and certain of the Company’s products. The Company does not currently foresee the fluctuations in oil prices having a significant impact on its financial performance.

Steel is a major component used in manufacturing the Company’s equipment. Steel prices were at historically high levels during 2008 and the Company increased sales prices during 2008 to offset the rising steel costs. During the fourth quarter of 2008, steel prices retreated sharply from their 2008 highs and continued the downward trend through the first half of 2009. Moderate increases have occurred during the past several months and are expected to continue for the remainder of 2009. In the current economy and competitive environment, the Company does not expect to be able to raise prices to cover the increasing costs of steel and its financial results could be negatively affected.

For the long term, the Company believes the strategy of continuing to invest heavily in product engineering and development and its focus on delivering a high-quality product and superior service will strengthen the Company’s market position when demand for capital equipment rebounds. In response to the short-term outlook, the Company has taken aggressive actions to conserve cash, right size its operations and cost structure, and will continue to do so based on its forecasts. These actions included adjustments to workforce and staffing, reduced purchases of raw materials and reductions in selling, general, and administrative expenses. The Company continues to review its internal processes to identify efficiencies and cost reductions and will continue scrutinizing its relationships with external suppliers to ensure the Company is achieving the highest-quality products and services at the most competitive cost.

Results of Operations

Year ended September 30, 2009 compared with the year ended September 30, 2008

Net revenues for the years ended September 30, 2009 and 2008 were $56.8 million and $88.3 million, respectively, a $31.5 million decrease (36%) over the previous year. Domestic revenues during this period for 2009 and 2008 were $55.7 million and $85.6 million, respectively. This decrease was primarily due to the recessionary economy and tightening of credit availability which resulted in lower unit sales and decreased unit selling prices. The Company’s revenues are concentrated in the asphalt-related business and are subject to a seasonal slow-down during the third and fourth quarters of the calendar year. The Company cannot predict what impact the current recession will have on future earnings.

Gross margin for fiscal 2009 was $9.2 million versus $21.2 million in 2008 and as a percent of net revenues was 16.3% in 2009 and 23.9% for 2008. Overall, the decreases in gross profit margin were due primarily to decreases in revenues with less than a proportionate decrease in existing cost structures. Margins were positively impacted by $1.1 million reduction in LIFO reserves in 2009 but negatively affected by $.6 million increase in LIFO reserves in 2008.

Product engineering and development costs were down slightly. Selling and administrative expenses decreased $.8 million to $10.7 million during 2009 due primarily to the decreases in personnel, deferral or cancellation of discretionary expenses, and also decreases in commissions associated with decreases in revenue versus comparable periods.

18

Table of Contents

2009 had an operating loss of $4.8 million versus operating income of $6.8 million in 2008. Operating income decreased as a result of reduced revenues and related reduction in overhead absorption. The 2009 operating loss also includes a $0.6 million loss related to the sale of the UK operations.

Included in other income for the year ended September 30, 2008 was the receipt of $4.1 million in resolution of an outstanding claim against a former service provider less related legal costs of $.7 million.

During the year ended September 30, 2009, the Company transferred a net $4.0 million from its operating cash accounts to its investment portfolio. As of September 30, 2009 and 2008, the cost basis of the investment portfolio was $56.6 million and $54.7 million, respectively. For the year ended September 30, 2009, net investment interest and dividend income (“Investment Income”) was $2.2 million versus Investment Income of $1.8 million in 2008. The net realized and unrealized losses on marketable securities were $2.5 million in 2009 and $3.5 million in 2008. Total cash and investment balance at September 30, 2009 was $61.2 million compared to the September 30, 2008 cash and investment balance of $58 million.

The Company recognized income from Investees of $48,000 for the year ended September 30, 2009 and $15.6 million in the year ended September 30, 2008. See Part 1, Item 1 of this Report.

The effective income tax rate for 2009 was a benefit of 50.1% compared to an income tax rate of 37% for 2008. The change in the effective tax rate between years is mainly due to operating losses incurred during 2009 versus profit in 2008, and the effect of tax exempt interest income (see Note 6 to Consolidated Financial Statements).

Year ended September 30, 2008 compared with the year ended September 30, 2007

Net revenues for the years ended September 30, 2008 and 2007 were $88.3 million and $75.3 million, respectively, this represents a $13 million increase (17%) over the previous year. Domestic revenues during this period for 2008 and 2007 were $85.6 million and $72.4 million, respectively. Domestic revenues were higher than the prior year due to the general improvement in the road-building industry resulting in higher unit volumes. Infrastructure spending remained strong through fiscal 2008. Foreign revenues decreased by $.1 million. The backlog was $16 million at September 30, 2008 compared to a backlog of $24.5 million at September 30, 2007.

Gross margin for fiscal 2008 was $1.3 million higher than fiscal 2007 and as a percent of net revenues was 23.9% in 2008 and 26.4% of revenues for 2007. The margin for the year was adversely impacted by higher raw material costs, primarily significant increase in steel prices and high energy costs. Domestic margins were negatively affected by $.6 million and $.7 million, respectively for 2008 and 2007 due to an increase in the LIFO reserve.

Product engineering and development costs increased $.2 million due to hiring of additional engineers. Selling and administrative expenses increased $.5 million during 2008 due to higher commissions and payroll costs resulting from the higher sales volume, partially offset by lower legal costs.

Operating income was $6.8 million in 2008 compared to $4.7 million in 2007. Operating income increased as a result of increased domestic business. 2007 included a loss on sale of assets of $1.6 million.

Miscellaneous Income in 2008 includes $3.4 million from a favorable legal settlement from a former service provider.

For the year ended September 30, 2008, Investment Income was $1.8 million versus Investment Income of $0.7 million in 2007. The net realized and unrealized losses on marketable securities were $3.5 million in 2008 versus a gain of $5.3 million in 2007. Total cash and investment balance at September 30, 2008 was $58 million compared to September 30, 2007 cash and investment balance of $55 million.

The Company recognized income from Investees of $ $15.6 million in 2008 and $19.9 million in 2007 (see Part 1, Item 1 of this Report).

19

Table of Contents

The effective income tax rate for 2008 was 37% compared to 39.5% for 2007. The decrease in the effective tax rate between years is mainly due to losses in 2007 from foreign operations for which no tax benefit was recognized (see Note 6 to Consolidated Financial Statements).

Liquidity and Capital Resources

The Company generates capital resources primarily through operations. For the years ended September 30, 2008 and 2007, the Company received $15.6 million and $19.9 million, respectively, in cash distributions from Investees. During fiscal 2009, the Company received cash distributions from Investees of $48,000. The Company does not expect to receive any significant distributions from Investees in subsequent periods.

The Company has maintained a Revolving Credit and Security Agreement (“Credit Agreement”) with PNC Bank, N.A. The Credit Agreement originally established a three year revolving $20 million credit facility (“Credit Facility”) and was renewed through July 31, 2009. The Credit Facility provided for advances based on accounts receivable, inventory, and real estate. The facility included a $2 million limit on letters of credit. The interest rate at September 30, 2009, is at LIBOR plus 2.00% and subject to change based upon the fixed charge coverage ratio. The Company was required to maintain a fixed charge coverage ratio of 1.1:1. There were no required repayments as long as there were no defaults and there was adequate eligible collateral. Substantially all of the Company’s assets were pledged as security under the Credit Agreement.

The Company amended the Credit Agreement on July 23, 2009 (the “Third Amendment”). The Credit Agreement was set to expire on July 31, 2009, and rather than let it expire, the Company elected to amend the agreement and reduce the amount of the Credit Facility from $20 million to $1.5 million. The Credit Facility also includes a $1.285 million limit on letters of credit, which is reduced from the original $2 million limit. The Company elected to reduce its Credit Facility because it believed the higher amount associated with the original line was not needed. The Company is currently evaluating other options for a new revolving credit facility. Pursuant to the Third Amendment, the Company’s Credit Facility shall continue until April 30, 2010, unless terminated sooner. Under the Third Amendment, substantially all representations, warranties, covenants, rights, duties and obligations set forth in the original agreement continue to apply.

The Company had no long term debt outstanding at September 30, 2009 or 2008. At September 30, 2009, the Company had $0.9 million of letters of credit outstanding.

As of September 30, 2009, the Company had $3.7 million in cash and cash equivalents, and $57.5 million in marketable securities. The marketable securities are invested through a professional investment advisor. The securities may be liquidated at any time into cash and cash equivalents.

The Company’s backlog was at $4.2 million at September 30, 2009 versus $16.0 million at September 30, 2008. Orders have reduced significantly as a result of the recession and credit tightening during the Company’s fiscal 2009.

In terms of working capital (defined as current assets less current liabilities), the Company’s balance of $90.1 million for the year ended September 30, 2009, was $2.3 million lower than its working capital balance of $92.4 million at September 30, 2008. The reductions in accounts receivable ($1.8 million), estimated revenues in excess of customer deposits ($4.4 million), inventory ($3.8 million), accounts payable ($2.1 million) and customer deposits ($0.9 million) were all driven by the lower operating results from the recessionary economy.

Cash provided by operations during the year ended September 30, 2009 was $0.6 million. Cash used for investing activities during the year ended September 30, 2009 was $0.6 million. The Company historically operated a manufacturing facility and sales office in the United Kingdom. The revenues of the UK operations have been insignificant to the Company’s financial results. In June 2009, the Company sold its UK operations for $0.6 million (not including transaction costs of $22,000) and recognized a loss of $0.6 million. The Company retained ownership of the land and building, the brand name (“General Combustion”), and the associated intellectual property (e.g., engineering drawings).

20

Table of Contents

In terms of financing activities, there were no cash disbursements or receipts during the year ended September 30, 2009.

Critical Accounting Policies, Estimates and Assumptions

The Company believes the following discussion addresses its most critical accounting policies, which are those that are most important to the portrayal of the Company’s financial condition and results of operations and require management’s most difficult, subjective, or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain. Accounting policies, in addition to the critical accounting policies referenced below, are presented in Note 1 to the Consolidated Financial Statements, “Accounting Policies.”

Estimates and Assumptions

In preparing the Consolidated Financial Statements, the Company uses certain estimates and assumptions that may affect reported amounts and disclosures. Estimates and assumptions are used, among other places, when accounting for certain revenue (e.g. contract accounting), expense, and asset and liability valuations. The Company believes that the estimates and assumptions made in preparing the Consolidated Financial Statements are reasonable, but are inherently uncertain and unpredictable. Assumptions may be incomplete or inaccurate and unanticipated events may occur. The Company is subject to risks and uncertainties that may cause actual results to differ from estimated results.

Revenues

Revenues from contracts for the design and manufacture of certain custom equipment are recognized under the percentage-of-completion method. The percentage-of-completion method of accounting for long term contracts recognizes revenue in proportion to actual labor costs incurred as compared with total estimated labor costs expected to be incurred during the entire contract. Revenues from all other sales are recorded as the products are shipped or service is performed.

All selling, general and administrative expenses are charged to operations as incurred. Provision is made for any anticipated contract losses in the period that the loss becomes evident.

Investment in Unconsolidated Investees

As of September 30, 2009, 2008, and 2007, the Company owns a 45% interest in Carbontronics LLC and a 25% interest in Carbontronics Fuels LLC and Carbontronics II LLC. These interests were obtained as part of contracts to build four synthetic fuel production plants during 1998. The Company has no basis in these equity investments or requirement to provide future funding. Any income arising from these investments is dependent upon tax credits (adjusted for operating losses at the fuel plants) being generated as a result of synthetic fuel production, which will be recorded as received (see Part 1, Item 1 of this Report).

Inflation

The overall effects of inflation on the Company’s business during the periods discussed have not been significant. The Company monitors the prices it charges for its products and services on an ongoing basis and believes that it will be able to adjust those prices to take into account future changes in the rate of inflation.

Contractual Obligations

The following table summarizes the outstanding borrowings and long-term contractual obligations at September 30, 2009:

| Total | Less than 1 Year |

1-3 Years | 3-5 Years | More than 5 Years | |||||||||||

| Long-term debt |

$ | — | $ | — | $ | — | $ | — | $ | — | |||||

| Operating leases |

126,000 | 59,000 | 67,000 | — | — | ||||||||||

| Total |

$ | 126,000 | $ | 59,000 | $ | 67,000 | $ | — | $ | — | |||||

21

Table of Contents

The long-term debt facility matures in April 2010. The Company also has $.9 million of letters of credit outstanding. The letters of credit are typically for one year and are renewed annually.

Off-Balance Sheet Arrangements

None

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

The Company operates manufacturing facilities and sales offices principally located in the United States and, until June 2009, the United Kingdom. The Company is subject to business risks inherent in non-U.S. activities, including political and economic uncertainty, import and export limitations, and market risk related to changes in interest rates and foreign currency exchange rates. Periodically, the Company will use derivative financial instruments consisting primarily of interest rate hedge agreements to manage exposures to interest rate changes. The Company’s objective in managing its exposure to changes in interest rates on its variable rate debt is to limit their impact on earnings and cash flow and reduce its overall borrowing costs.

At September 30, 2009 and 2008 the Company had no debt outstanding. Under the Credit Agreement, substantially all of the Company’s borrowings will bear interest at variable rates based upon the prime rate or LIBOR.

The Company’s marketable securities are invested in stocks and municipal bonds through a professional investment advisor. Investment securities are exposed to various risks such as interest rate, market and credit. Due to the level of risk associated with certain investment securities and the level of uncertainty related to changes in the value of securities, it is possible that changes in these risk factors could have an adverse material impact on the Company’s results of operations or equity.

The Company’s sensitivity analysis for interest rate risk excludes accounts receivable, accounts payable and accrued liabilities because of the short-term maturity of such instruments. The analysis does not consider the effect on other variables such as changes in sales volumes or management’s actions with respect to levels of capital expenditures, future acquisitions or planned divestures, all of which could be significantly influenced by changes in interest rates.

22

Table of Contents

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

INDEX TO FINANCIAL STATEMENTS AND FINANCIAL STATEMENT SCHEDULES

All other schedules are omitted because they are not applicable or the required information is shown in the consolidated financial statements or notes thereto.

23

Table of Contents

MANAGEMENT ASSESSMENT REPORT

The management of Gencor Industries, Inc. (the “Company”) is responsible for establishing and maintaining adequate internal control over financial reporting for the Company. The Company’s internal control system is designed to provide reasonable assurance to the Company’s management and board of directors regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. There are inherent limitations in the effectiveness of all internal control systems no matter how well designed. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to the preparation and presentation of financial statements. Furthermore, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of a change in circumstances or conditions.

In order to ensure that the Company’s internal control over financial reporting is effective, management regularly assesses such controls and did so most recently as of September 30, 2009. This assessment was based on criteria for effective internal control over financial reporting described in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this assessment, management believes the Company maintained effective internal control over financial reporting as of September 30, 2009. Moore Stephen Lovelace, P. A., the Company’s independent registered public accounting firm, has issued an attestation report on the Company’s internal control over financial reporting as of September 30, 2009.

24

Table of Contents

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors of Gencor Industries, Inc.:

We have audited the accompanying consolidated balance sheets of Gencor Industries, Inc. and subsidiaries as of September 30, 2009 and 2008, and the related consolidated statements of operations, stockholders’ equity and comprehensive income (loss), and cash flows for each of the years in the three-year period ended September 30, 2009. We also have audited Gencor’s internal control over financial reporting as of September 30, 2009, based on criteria established in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). Gencor’s management is responsible for these financial statements, for maintaining effective internal control over financial reporting, and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying financial report. Our responsibility is to express an opinion on these financial statements and an opinion on the company’s internal control over financial reporting based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective internal control over financial reporting was maintained in all material respects. Our audits of the financial statements included examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our audit of internal control over financial reporting included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audits also included performing such other procedures as we considered necessary in the circumstances. We believe that our audits provide a reasonable basis for our opinions.

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.