Attached files

| file | filename |

|---|---|

| EX-31 - American Nano Silicon Technologies, Inc. | exhibit31.htm |

| EX-32 - American Nano Silicon Technologies, Inc. | exhibit32.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[ x ] ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2009

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ______

Commission File Number 000-52940

American Nano Silicon Technologies, Inc.

(Exact name of registrant as specified in its charter)

|

California |

33-0726410 | |

|

(State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer

Identification No.) | |

|

c/o American Union Securities |

||

|

100 Wall Street 15th Floor |

||

|

New York, New York |

10005 | |

|

(Address of principal executive offices) |

(Zip Code) |

(212) 232-0120

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act: None

Securities Registered Pursuant to Section 12(g) of the Act

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 406 of the Securities Act. Yes __ No X

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes __ No X

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes X No __

Indicate by check mark disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in

Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check

One)

Large accelerated filer Accelerated filer _ Non-accelerated filer Small reporting company X

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes __ No X

As of December 24, 2009, 26,578,767 shares of common stock, par value $.001 per share, were outstanding.

Documents incorporated by reference: NONE

TABLE OF CONTENTS

|

Page | ||

|

Part I | ||

|

ITEM 1 |

DESCRIPTION OF BUSINESS |

3 |

|

ITEM 1A. |

RISK FACTORS |

9 |

|

ITEM 1B. |

UNRESOLVED STAFF COMMENTS |

14 |

|

ITEM 2. |

DESCRIPTION OF PROPERTY |

14 |

|

ITEM 3. |

LEGAL PROCEEDINGS |

14 |

|

ITEM 4. |

SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

15 |

| Part II | ||

|

ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS |

15 |

|

ITEM 6. |

SELECTED FINANCIAL DATA |

15 |

|

ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS |

16 |

|

ITEM 7A |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

19 |

|

ITEM 8 |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

F-1-F-19 |

|

ITEM 9 |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

20 |

|

ITEM 9A |

CONTROLS AND PROCEDURES |

20 |

|

ITEM 9B |

OTHER INFORMATION |

21 |

|

Part III | ||

|

ITEM 10. |

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERANCE |

21 |

|

ITEM 11. |

EXECUTIVE COMPENSATION |

24 |

|

ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

25 |

|

ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE |

26 |

|

ITEM 14. |

PRINCIPAL ACCOUNTANT FEES AND SERVICES |

27 |

| Part IV | ||

|

ITEM 15. |

EXHIBITS |

27 |

|

SIGNATURES |

28 | |

2

PART I

The information in this document contains forward-looking statements which involve risks and uncertainties, including statements regarding our capital needs, business strategy and expectations. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. In some cases, you can identify

forward-looking statements by terminology such as “may,” “should,” “will,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “forecast,” “project,” or “continue,” the negative of such terms or other comparable terminology. You should not rely on forward-looking statements as predictions of future events or

results. Any or all of our forward-looking statements may turn out to be wrong. They can be affected by inaccurate assumptions, risks and uncertainties and other factors which could cause actual events or results to be materially different from those expressed or implied in the forward-looking statements.

In evaluating these statements, you should consider various factors, including the risks described under “Risk Factors” and elsewhere. These factors may cause our actual results to differ materially from any forward-looking statement. In addition, new factors emerge from time to time and it is not possible for us to predict all

factors that may cause actual results to differ materially from those contained in any forward-looking statements. We disclaim any obligation to publicly update any forward-looking statements to reflect events or circumstances after the date of this document, except as required by applicable law.

ITEMS 1. DESCRIPTION OF BUSINESS

In this document, references to the “company,” “we,” “us” and “our” refer to American Nano Silicon Technologies, Inc. and our predecessors and subsidiaries, unless the context otherwise requires.

History of the Company

Effective as of May 24, 2007, we entered into a Stock Purchase and Share Exchange Agreement (the “Exchange Agreement”) with American Nano Silicon Technologies, Inc., a Delaware corporation (“American Nano-Delaware”), the shareholders of American Nano-Delaware and Nanchong Chunfei Nano-Silicon Technologies Co. Ltd.

(“Nanchong Chunfei”), pursuant to which, among other things,

|

· |

We agreed to change our name from CorpHQ, Inc. to our current name, American Nano Silicon Technologies, Inc., |

|

· |

We agreed to amend its Articles of Incorporation to provide for a reduction of the number of authorized shares from two billion (2,000,000,000) shares of common stock without par value to two hundred million (200,000,000) shares of common stock, par value $.001 per share, |

|

· |

We agreed to reverse split the issued and outstanding shares of Old Common Stock into shares of New Common Stock in the ratio of 1,302 shares of Old Common Stock for each share of New Common Stock, |

|

· |

We agreed to buy all of the issued and outstanding shares of American Nano-Delaware in exchange for issuing 25,181,450 shares of New Common Stock to the shareholders of American Nano-Delaware, |

|

· |

Our controlling shareholders, Steven Crane and Gregg Davis, sold of all of their interest in the Company, which represented an aggregate of 558,520 shares of New Common Stock, to Huakang Zhou, a shareholder of American Nano-Delaware, |

|

· |

We agreed to transfer all of our existing business as existing prior to the Exchange Agreement together with and related assets (the “CorpHQ Business”) to South Bay Financial Solutions, Inc., an existing subsidiary of the Company (“South Bay”), |

|

· |

We agreed to sell South Bay to Mr. Crane and Mr. Davis in exchange for South Bay together with Mr. Crane and Mr. Davis assuming all of the liabilities relating to the CorpHQ Business, and |

|

· |

The existing officers and directors were required to resign and appoint in their place new officers and directors associated with American Nano-Delaware. |

3

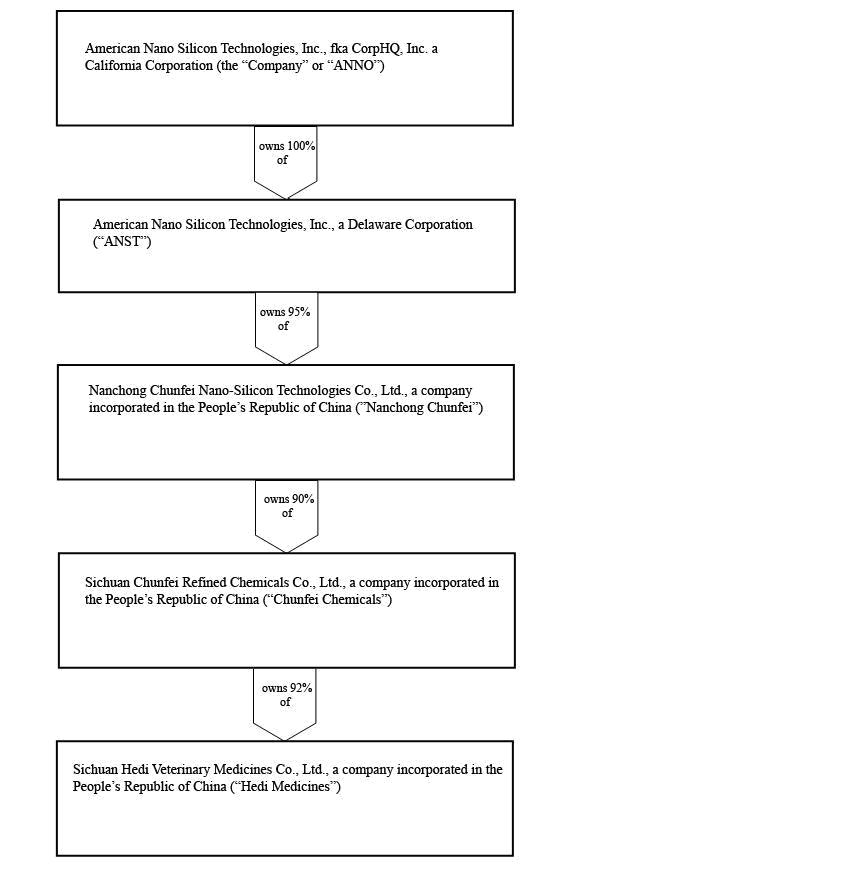

Following the acquisition of American Nano-Delaware (our wholly owned subsidiary), our new management ceased pursuing the CorpHQ Business and made the business of American Nano-Delaware the primary business of the Company. American Delaware-Nano is a holding company that directly holds one majority-owned subsidiary, Nanchong

Chunfei and, through Nanchong Chunfei, indirectly holds two additional majority-owned subsidiaries.

Below is a more detailed historical corporate background of American Nano Silicon Technologies, Inc., specifically before it merged with CorpHQ, Inc.

American Nano-Silicon Technologies, Inc. (“ANST”) was incorporated on August 8, 2006 under the laws of the State of Delaware. On August 26, 2006, ANST acquired 95% interest of Nanchong Chunfei Nano-Silicon Technologies Co., Ltd. (“Nanchong Chunfei”), a company incorporated in the People’s Republic of China (the

“PRC” or “China”) in August 2006. Nanchong Chunfei directly owns 90% of Sichuan Chunfei Refined Chemicals Co., Ltd. (“Chunfei Chemicals”), a Chinese corporation established under the laws of PRC on January 6, 2006. Chunfei Chemicals itself owns 92% of Sichuan Hedi Veterinary Medicines Co., Ltd. (“Hedi Medicines”), also a Chinese company incorporated under the law of PRC on June 27, 2002.

The Company's business is approved for:

1, Nanchong Chunfei Nano-crystalline Silicon Technology Limited’s business scope is: production and sale of household chemical products, fine chemical products, chemical raw and auxiliary materials, nano-technology development and research, and nano-crystalline silicon production and sales.

2, Sichuan Chunfei Refine Chemical Company Limited’s business scope is: production and sale of household chemical products, fine chemical products, cosmetics, chemical raw and auxiliary materials.

3, Sichuan Hedi Animal Pharmaceutical Co., Ltd’s business scope is: production and sale of animal medicine powder, feed additives.

4

Our Business

Nanchong Chunfei was organized to produce and sell fine chemical products and chemical intermediaries and Chinese herbal medicines for animal use, and to perform research and development in the fields of nano-technology and micro-nano silicon products.

Since the establishment, the Chinese Companies have been establishing management systems and corporate governance structures, hiring and training personnel, and developing business and investment plan.

Industry overview and market condition

According to statistical data collected by the Refined Chemicals’ Information Center, the annual demand for non-phosphorus auxiliary agent in the Chinese detergent and washing products industry is more than one million tons. Use of non-phosphorus agents will continue to grow as wider areas of China follow the international practice of

banning the use of phosphorus in detergents. Micro-Nano Silicon™ can perform better than market leader 4A zeolite at a similar price, currently around 3,000 Yuan/ton. The Company believes that the prospects in this 3 billion Yuan market are bright.

Sichuan, the Company's headquarter, is a major production base of the Chinese detergent industry. Provincial requirement for non-phosphorus auxiliary agent is about 200,000 tons/year, or about 20% of Chinese domestic demand. Nearby Chongqing and Chengdu cities are home to several large-scale plastic and rubber plants which

use a large amount of white carbon black, for which Micro-Nano Silicon™ can substitute in its fine reinforcing agent application.

Other emerging applications for Micro-Nano Silicon™ are as catalysts and surfactants for fine chemical production, and in nano-metric functional ceramics -- new high-tech ceramics specially designed for air purification and water treatment. Experts have predicted that by 2010, the market sales value of high-tech ceramics materials will

reach 150 billion US dollars worldwide.

The Micro-Nano Silicon product is an ultra fine crystal structured chemicals that is used in the chemical industry for phosphorus additives, as a reinforcing agent for the rubber industry, and for paint and cover agents for coatings in the paper-making industry.

The Micro-Nano Silicon product is currently the only sub-nano new material for large-scale production in China and is to be used as a substitute for current chemical agents.

Micro-Nano Silicon™ is the most effective non-phosphorus auxiliary agent available in the market today. It will compete against the most commonly used phosphorus-free auxiliary agent in synthetic detergent, 4A zeolite which is inferior to Micro-Nano Silicon™ at ion-exchange, and slow-acting at energy-saving lower wash temperatures.

Other disadvantages of 4A Zeolite are that it is insoluble in water, liable to re-deposit dirt, and tending to dull the color of clothes after washing. Micro-Nano Silicon™ addresses all these deficiencies.

Micro-Nano Silicon™ is adaptable to many uses. At present the Chinese Companies’ market research indicates that Micro-Nano Silicon™ should gain broad acceptance in the Chinese washing products industry. However, should it lose that market, the Chinese Companies expect to be able to sell Micro-Nano Silicon to the

Chinese petrochemical, plastics, rubber, paper, ceramics and other industries. The equipment and techniques of the production line are similarly adaptable, which allows the Chinese Companies to switch to producing white carbon black, alumina, calcium phosphate and other chemical products with simple modifications and variation of key inputs.

5

Our Products

Currently, the core product of our company is Micro-Nano Silicon™, so called because of its ultra-micro crystalline structure and its major ingredient, silicon. Its basic building blocks are silicon dioxide and quartz. Under the effect of a special catalyst, those materials polymerize and crystallize into the compound of

this chemical formula:

Na Na Na

| | |

O O O

| | |

Na—O—Si—O—Al—O—Si—O—Na

| |

O O

| |

Na Na

This is a three-dimensional crystal with a tetravalent and electrically neutral silicon atom. The aluminum atom is a trivalent atom sharing four oxygen atoms with one negative charge combined. The hole in the middle of the crystal can capture a positive ion. The compound can have complex reaction with ions of calcium, magnesium, iron, copper,

and manganese. Since it is ultra-white, ultra-small, phosphorus-free, with special crystalline structure and chelating and filtering performance, this unique compound lends itself to a use in washing products, as well as cosmetics and other products.

Micro-Nano Silicon™ can effectively chelate calcium and magnesium ions in water, softening it in order to improve the washing effect and to prevent damage to clothes. In this way the product actually reduces the amount of detergent required for washing a load of laundry, so it is an economical product. In addition to its

use in the detergent industry, Micro-Nano Silicon™ can also be used as a water softener for drinking water and sewage treatment.

Additionally, Micro-Nano Silicon™ can substitute for white carbon black in applications in the paper, rubber, plastics, petrochemical and ceramics industries. White carbon black commonly sells in China at a market price of 4000~8000 Yuan/ton for ordinary, and 9000~20000 Yuan/ton for ultrafine.

With good hiding power and color strength, Micro-Nano Silicon™ can also substitute for titanium dioxide (TiO2) powder in paints, inks, synthetic fibers, plastics, paper, ceramics and other products. Delivery price in the U.S. for TiO2 powder was about 1980~2200 Dollars/ton, and that in Europe was approximately 2050~2060 Euros/ton, and

the spot price in the Asia-Pacific region was about 2200~2300 Dollar/ton (CandF basis). Annual average consumption growth in China for TiO2 is expected to continue to be around 10%~15% for the near future.

Raw Materials and Our Principal Suppliers

Our Chinese subsidiaries??location offers advantages with respect to supply of raw materials and proximity to end users.

Quartz is a raw material used in the production of Micro-Nano Silicon™, and there are abundant quartz mineral resources in nearby Chinese districts such as Hechuan and Qingchuan. Another raw material, bauxite, is abundant relatively nearby in Hechuan, Chongqing, Guizhou and other places within reasonable distance for truck or railway

transportation. Similarly other raw materials such as caustic soda, calcined soda, sodium sulphate anhydrous and calcium carbonate powder are also available in large quantity, good quality and competitive cost in Sichuan province.

6

Our raw materials mainly come from Chinese domestic suppliers (detailed in the table below), and the supply of raw materials could meet our production needs and normal reserves. Our production are based on the monthly marketing plan to determine the production tasks, and then to determine the purchase of raw materials.

The raw materials and packaging materials have their rich resources and a wide range of supply channels, not a monopoly supplier. Therefore, we don’t have any independence on one or more suppliers. One major vendor provided approximately 98% of the Company’s purchases of raw materials for the year ended September 30, 2009.

Employees

As of September 30, 2009, the Company has 174 full-time staff and employees.

|

Department |

Headcount |

||

|

Management and Administrative |

39 |

||

|

Sales and Marketing |

15 |

||

|

Production |

112 |

||

|

Research and Development |

8 |

||

|

Total |

174 |

Among our eight scientific researchers, six are senior researchers. We do not have any payment obligations for any retirees and are not currently retaining any contractors. The Company purchases pension insurance, medical insurance and unemployment insurance for all full time employees in accordance with China's Labor Law. The Company's employees

are not represented by a collective bargaining unit. Management considers the Company's relationships with its employees to be satisfactory, and management believes that should the Company require additional employees at any of its facilities that it will be able to meet its needs from the locally available labor pool.

Distribution

We are currently producing and selling Micro- Nano Silicon. For the fiscal year ended September 30, 2009, we sold to a large number of regional businesses and enterprises engaged in the chemicals business. Since then, we have modified our sales method to include distributors who purchase our product for re-sale. This product is only available

to a selected group of distributors and can not be directly purchased by the general public. Chongqing Trading Company, Ltd is the most significant customer among all distributors. In the future, if we are able to raise additional capital, we expect to add more sales force to market our products beyond our regional base of customers.

7

Customers

For the fiscal year ended September 30, 2009, we sold to a large number of businesses and enterprises engaged in the chemicals business. Since then, we have modified our sales method to include distributors who purchase our product for re-sale. We do not believe we are dependent on their partnerships to maintain our sales growth. We feel

the relationships we have established in the past will enable to us to continue to market and sell our products if the relationships with our current distributors were to terminate.

Two major customers accounted for approximately 83% of the net revenue for the year ended September 30, 2009, with Chongqing Commercial Company and Chengdu Lanfeng Chemical Company individually accounting for 66% and 17%, respectively.

Marketing and Advertising

In 2008, we launched a new distribution method, by having other companies in the chemical business represent our product and re-sell it to the third parties including both institutions and individuals. From time to time, we also sponsor charitable events such as hope school projects, to increase public awareness of the benefits of our

products and spread the acceptance and influence of our brand.

Competition

Based upon our surveys and research, we believe the detergent agent, which 4A zeolite is the current industry standard in China. By the feedback we have received from our customers, we believe that the unique features of our product will enable us to challenge 4A zeolite for the leadership in the industry in the near future.

We do not face direct competition for our products in the local marketplace. This is due to the fact that our product is unique and based on patented technology. Currently, the industry standard is 4A zeolite, a phosphorus-free auxiliary agent. Although we do not face direct competition, we do have high barriers to widely spread

the acceptance of our products. We are primarily relying on the loyalty of our existing customers along with our high quality customer service to build our reputation and product acceptance.

Some inbound competitors within 4A zeolite market include:

|

· |

Tex Chemical Co. Ltd.: established in 1989 and based in Shanghai, is a exporter and producer of detergent agents including 4A zeolite and sodium percarbonate. We estimate their annual revenue to be approximately $10 million USD. |

|

· |

Xiamen Xindakang Inorganic Materials Co, Ltd.: established in 2005 and based in Fujian, is a manufacturer of 4A zeolite. We estimate their annual revenue to be approximately $8 million USD. |

|

· |

Laiyu Chemical Co. Ltd: established in 1984 and based in Shandong, is a trading company that trades on 4A zeolite as an agent. We estimate their revenue from 4A zeolite to be approximately $2 million USD. |

|

· |

Changsha Xianshanyuan Agriculture & Technology Co., Ltd: established in 2006 and based in Hunan, is a manufacturer of 4A zeolite. We estimate their revenue to be approximately $5 million USD. |

Based upon our surveys and research, we believe the detergent agent, which 4A zeolite is the current industry standard in China, is very segmented and regionalized. By the feedback we have received from our customers, we believe that the unique features of our product enable us to challenge 4A zeolite for the leadership

in the industry in the near future.

We do not face direct competition for our products in local marketplace. This is due to the fact that our product is unique and patented technology. Currently, the industry standard is 4A zeolite, a phosphorus-free auxiliary agent. Although we do not face direct competition, we do have high barriers to widely spread the acceptance

of our products. We are primarily relying on the loyalty of our existing customers along with our high quality customer service to build our reputation and product acceptance.

8

Government Regulation

Our production processes, for which we own the patents, are under the long-term protection by the China Government Laws and Regulations. Our production and operations were examined and approved by China Government's authority, and are supported and protected through its business license scope. We have also been granted

the right to import and export products, and because of China's relatively lower cost of labor, we anticipate that our products will also prove to be competitive throughout the international market.

Cost of Compliance with Environmental Laws

Management believes that our factory standards meet the requirements of the China Government and local environmental laws and other related regulations, workers security regulations, Air Protection Law, Water Resources Protection Act, Resource Conservation Recovery Act, and so on. We have all licenses required for our

production, and we have been in compliance with all applicable governmental laws and regulations.

Management believes that our products are environmentally-friendly green products, producing no pollution to the environment. So the cost of environmental protection will not cause any significant impact on our operations, production costs, and our profitability and competitiveness. However, management can give no assurance

that new or additional laws or regulations relating to the environment will not result in material costs in the future.

ITEM 1A. RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results

of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risk Related To Our Business

We need additional capital

We require substantial additional financing to implement our business plan and to cover unanticipated expenses. The timing and amount of any such capital requirements cannot be predicted at this time. There can be no assurance that any such financing will be available on acceptable terms, or at all. If financing

is not available on satisfactory terms or at all, we may be unable to expand at the rate desired or we may be required to significantly curtail or cease our business activities. If additional funds are raised through the issuance of equity or convertible debt securities, the percentage ownership of our shareholders will be reduced and such securities may have rights, preferences and privileges senior to those of the common stock. If capital is raised through a debt financing, we would likely

become subject to restrictive covenants relating to our operations and finances.

9

We face significant competition and may not be able to successfully compete

Our current and future competitors are likely to have substantially greater financial, technical and marketing resources, larger customer bases, longer operating histories, more developed infrastructures, greater brand recognition, and more established relationships in the industry than we have, each of which may allow them to gain greater

market share. As a result, our competitors may be able to develop and expand their offerings more rapidly, adapt to new or emerging technologies and changes more quickly, take advantage of acquisitions and other opportunities more readily, achieve greater economies of scale and devote greater resources to the marketing and sale of their technology and products than we can. There can be no assurance that we will successfully differentiate our current and proposed technology and products from the technologies and

products of our competitors, that the marketplace will consider our technology and products to be superior to competing technologies and products, or that we will be able to compete successfully with our competitors.

Our business is subject to factors outside our control

Our business may be affected by a variety of factors, many of which are outside our control. Factors that may affect our business include:

|

· |

The success of our research and development efforts |

|

· |

Competition |

|

· |

Our ability to attract qualified personnel |

|

· |

The amount and timing of operating costs and capital expenditures necessary to establish our business, operations, and infrastructure |

|

· |

Government regulation |

|

· |

General economic conditions as well as economic conditions specific to the nanotechnology industry |

Our ability to protect our patents and other proprietary rights is uncertain, exposing us to the possible loss of competitive advantage

Our intellectual property rights are important to our business. Currently, there are limited safeguards in place to protect our intellectual property rights, and the protective steps we intend to take may be inadequate to deter misappropriation of those rights. We have filed and intend to continue to file patent applications. If

a particular patent is not granted, the value of the invention described in the patent would be diminished. Further, even if these patents are granted, they may be difficult to enforce. Efforts to enforce our patent rights could be expensive, distracting for management, unsuccessful, cause our patents to be invalidated, and frustrate commercialization of products. Additionally, even if patents are issued, and are enforceable, others may independently develop similar, superior, or parallel technologies

to any technology developed by us, or our technology may prove to infringe upon patents or rights owned by others. Thus, the patents held by us may not afford us any meaningful competitive advantage. Our inability to maintain our intellectual property rights could have a material adverse effect on our business, financial condition and ability to implement our business plan. If we are unable to derive value from our intellectual property, the value of your investment in us will decline.

10

We maybe exposed to potential risks relating to our internal controls over financial reporting and our ability to have those controls attested to by our independent auditors

As directed by Section 404 of the Sarbanes-Oxley Act of 2002, or SOX 404, the SEC adopted rules requiring public companies to include a report of management on the company’s internal controls over financial reporting in their annual reports, including Form 10-K. We are subject to this requirement commencing with our fiscal year ending September

30, 2008 and a report of our management is included under Item 8A of this Annual Report on Form 10-K. In addition, SOX 404 requires the independent registered public accounting firm auditing a company’s financial statements to also attest to and report on the operating effectiveness of such company’s internal controls. However, this annual report does not include an attestation report because under current law, we will not be subject to these requirements until our annual report for the fiscal year

ending September 30, 2010. We can provide no assurance that we will comply with all of the requirements imposed thereby. There can be no assurance that we will receive a positive attestation from our independent auditors. In the event we identify significant deficiencies or material weaknesses in our internal controls that we cannot remediate in a timely manner or we are unable to receive a positive attestation from our independent auditors with respect to our internal controls, investors and others

may lose confidence in the reliability of our financial statements.

Risks Related to Our Company

We depend on key personnel and attracting qualified management personnel

Our success depends to a significant degree upon the management skills of Pu Fachun, our President. The loss of his services would have a material adverse effect on our company. We do not maintain key person life insurance for any of our officers or employees. Our success also depends upon our ability to attract and retain

qualified marketing and sales executives and other personnel. We compete for qualified personnel against numerous companies, including larger, more established companies with significantly greater financial resources. There can be no assurance that we will be successful in attracting or retaining such personnel, and the failure to do so could have a material adverse effect on our business.

Risks Related to Our Industry

We are facing the risk of failure to spread and widely stretch our product nationally, because our product is currently not recognized as an industry standard. The industry standard is 4A zeolite, a phosphorus-free auxiliary agent. Although we do not face direct competition, we do have high barriers to widely spread the acceptance

of our products. We are primarily rely on the loyalty of our existing customers along with our high quality customer service to build our reputation and product acceptance.

Risks Related to Doing Business in China.

Adverse changes in economic and political policies of the People's Republic of China government could have a material adverse effect on the overall economic growth of China, which could adversely affect our business.

Political Risk

All of our operations are outside the United States and are located in China, which exposes it to risks, such as exchange controls and currency restrictions, currency fluctuations and devaluations, changes in local economic conditions, changes in Chinese laws and regulations, exposure to possible expropriation or other Chinese government actions,

and unsettled political conditions. These factors may have a material adverse effect on our operations or on our business, results of operations and financial condition.

China's economy differs from the economies of most developed countries in many respects, including with respect to the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. While the People's Republic of China economy has experienced significant growth in the past 20 years,

growth has been uneven across different regions and among various economic sectors of China. The People's Republic of China government has implemented various measures to encourage economic development and guide the allocation of resources. Some of these measures benefit the overall People's Republic of China economy, but may also have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax

regulations that are applicable to us. Since early2004, the People's Republic of China government has implemented certain measures to control the pace of economic growth. Such measures may cause a decrease in the level of economic activity in China, which in turn could adversely affect our results of operations and financial condition.

11

Legal Risk

The Chinese legal and judicial system may negatively impact foreign investors.

In 1982, the National Peoples Congress amended the Constitution of China to authorize foreign investment and guarantee the "lawful rights and interests" of foreign investors in China. However, China's system of laws is not yet comprehensive. The legal and judicial systems in China are still rudimentary, and enforcement of existing laws is

inconsistent. Many judges in China lack the depth of legal training and experience that would be expected of a judge in a more developed country. Because the Chinese judiciary is relatively inexperienced in enforcing the laws that do exist, anticipation of judicial decision-making is more uncertain than would be expected in a more developed country. It may be impossible to obtain swift and equitable enforcement of laws that do exist, or to obtain enforcement of the judgment of one court by a court of another

jurisdiction. China's legal system is based on written statutes; a decision by one judge does not set a legal precedent that is required to be followed by judges in other cases. In addition, the interpretation of Chinese laws may be varied to reflect domestic political changes.

The promulgation of new laws, changes to existing laws and the preemption of local regulations by national laws may adversely affect foreign investors. However, the trend of legislation over the last 20 years has significantly enhanced the protection of foreign investment and allowed for more control by foreign parties of their investments

in Chinese enterprises. There can be no assurance that a change in leadership, social or political disruption, or unforeseen circumstances affecting China's political, economic or social life, will not affect the Chinese government's ability to continue to support and pursue these reforms. Such a shift could have a material adverse effect on the company business and prospects.

Risk Related to Our Common Stock

Our common stock price may fluctuate significantly

Because we are a developmental stage company, there are few objective metrics by which our progress may be measured. Consequently, we expect that the market price of our common stock will likely fluctuate significantly. We do not expect to generate substantial revenue from the license or sale of our nanotechnology for several years, if at

all. In the absence of product revenue as a measure of our operating performance, we anticipate that investors and market analysts will assess our performance by considering factors such as:

|

· |

announcements of developments related to our business; |

|

· |

developments in our strategic relationships with scientists within the nanotechnology field; |

|

· |

our ability to enter into or extend investigation phase, development phase, commercialization phase and other agreements with new and/or existing partners; |

|

· |

announcements regarding the status of any or all of our collaborations or products; |

|

· |

market perception and/or investor sentiment regarding nanotechnology as the next technological wave; |

|

· |

announcements regarding developments in the nanotechnology field in general; |

|

· |

the issuance of competitive patents or disallowance or loss of our patent rights; and |

|

· |

quarterly variations in our operating results. |

12

We will not have control over many of these factors but expect that our stock price may be influenced by them. As a result, our stock price may be volatile and you may lose all or part of your investment.

Our securities are very thinly traded. Accordingly, it may be difficult to sell shares of the common stock without significantly depressing the value of the stock. Unless we are successful in developing continued investor interest in our stock, sales of our stock could continue to result in major fluctuations in the price of the

stock.

We do not intend to declare dividends on our common stock

We will not distribute cash to our stockholders until and unless we can develop sufficient funds from operations to meet our ongoing needs and implement our business plan. The time frame for that is inherently unpredictable, and you should not plan on it occurring in the near future, if at all.

Our common stock is deemed to be “penny stock” as that term is defined in Rule 3a51-1 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These requirements may reduce the potential market for our common stock by reducing the number of potential investors. This may make it more

difficult for investors in our common stock to sell shares to third parties or to otherwise dispose of them. This could cause our stock price to decline. Penny stocks are stock:

|

§ |

With a price of less than $5.00 per share; |

|

§ |

That are not traded on a “recognized” national exchange; |

|

§ |

Whose prices are not quoted on the NASDAQ automated quotation system; or |

|

§ |

In issuers with net tangible assets less than $2.0 million (if the issuer has been in continuous operation for at least three years) or $10.0 million (if in continuous operation for less than three years), or with average revenues of less than $6.0 million for the last three years. |

Broker-dealers dealing in penny stocks are required to provide potential investors with a document disclosing the risks of penny stocks. Moreover, broker-dealers are required to determine whether an investment in a penny stock is a suitable investment for a prospective investor. Many brokers have decided not to trade “penny stocks”

because of the requirements of the penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited. In the event that we remain subject to the “penny stock rules” for any significant period, there may develop an adverse impact on the market, if any, for our securities. Because our securities are subject to the “penny stock rules,” investors will find it more difficult to dispose of our securities.

13

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 2. DESCRIPTION OF PROPERTIES

Production and Facilities

Our plants are located on land for which we paid $872,976 for a land use right. This gives us the exclusive use of the property until July 2051. This form of land tenure is roughly comparable to a leasehold interest under the system of land tenure. The project site is located at the Chunfei Industrial Park, Gaoping, Nanchong,

Sichuan province, in an economic development zone plentifully supplied with low-cost water, electricity, gas and communication facilities. It is near the Chengdu-to-Nanchong expressway, the Nanchong-to-Chongqing expressway and the Nanchong railway station, and enjoys very good transportation links.

The Company announced the completion of a new product line in 2008. The new Nano-Silicon product line has a designed annum output capacity of 50K tons. The new launched product line has been officially placed in the Company's daily operational activities on July, 2008.

The construction area of the Raymond mill plant is 1,500 square meters (50m×30m), enough for installation of 4 sets of Raymond mills and ancillary equipment. There is a ball milling plant of brick-concrete structure, 2,500 square meters (50m×50m), with ten underground pools for storing Ball milling slurry. The firing plant

construction area is 8,000 square meters with four sets of rotary kilns systems, and there will be a tank area of 5,000 square meters. There is a calcinations plant of 3,000 square meters, large enough for installation of six melting furnaces for water glass, adjacent to a storage area of 2,500 square meters.

The main engineering plant of the Micro-Nano Silicon™ process includes a 3,500 square meter filtration plant of brick-concrete construction and two floors – the first floor is for bauxite slug filtration plant and the second for filtration of Micro-Nano Silicon™ finished products. A cooling system is installed in the plant

ceiling.

There is a brick-concrete reaction tank and reserve tank installation 3,500 square meter total construction area as well as a flash evaporation plant of 2,160 square meters and five cooling pools of 1,000 square meters. Most raw materials are stored in two warehouses of total construction area of 8,000

square meters, while quartz can be left outside in a 4,500 square meter yard. Another two warehouses of total construction area of 8,000 square meters contain 40 kilo bags of finished product. At plant capacity of 416 daily tons, these finished goods storage facilities can handle ten days of production.

Other facilities include a 2,000 square meter machine repair plant, offices and dormitories of 15,000 square meters, and a chemical laboratory of 1500 square meters.

We have not been involved in any material litigation or claims arising from our ordinary course of business. We are not aware of any material potential litigation or claims against us which would have a material adverse effect upon our results of operations or financial condition.

14

None.

ITEM 5. MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

(a) Market Information

Our common stock is currently quoted on the OTCBB under the symbol “ANNO”. There is a limited trading market for our common stock. The following table sets forth the range of high and low bid quotations for each quarter within the last two fiscal years, and the subsequent interim period. These quotations as reported by the

OTCBB reflect inter-dealer prices without retail mark-up, mark-down, or commissions and may not necessarily represent actual transactions.

|

Period |

High |

Low |

||||||

|

Quarter Ended December 31, 2007 |

$ |

0.40 |

$ |

0.11 |

||||

|

Quarter Ended March 31, 2008 |

$ |

0.11 |

$ |

0.11 |

||||

|

Quarter Ended June 30, 2008 |

$ |

1.23 |

$ |

0.25 |

||||

|

Quarter Ended September 30, 2008 |

$ |

1.10 |

$ |

0.51 |

||||

|

Quarter Ended December 31, 2008 |

$ |

2.00 |

$ |

0.51 |

||||

|

Quarter Ended March 31, 2009 |

$ |

2.00 |

$ |

0.55 |

||||

|

Quarter Ended June 30, 2009 |

$ |

1.28 |

$ |

0.74 |

||||

|

Quarter Ended September 30, 2009 |

$ |

1.24 |

$ |

0.41 |

||||

(b) Shareholders

On December 28, 2009 there were approximately 1,190 holders of record of our common stock.

(c) Dividends

Since the Company’s incorporation, no dividends have been paid on our Common Stock. We intend to retain any earnings for use in our business activities, so it is not expected that any dividends on our common stock will

be declared and paid in the foreseeable future.

(d) Equity Compensation Plans

We do not have any equity compensation plans. We have not granted any stock options or other equity awards since our inception.

ITEM 6. SELECTED FINANCIAL DATA

Not applicable.

15

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS.

The following discussion should be read in conjunction with the financial statements and the notes thereto appearing elsewhere in this Form 10-K. The following discussion contains forward-looking statements reflecting our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements.

You are also urged to carefully review and consider our discussions regarding the various factors which affect our business, including the information provided under the caption “Risk Factors.” See the cautionary note regarding forward-looking statements at the beginning of Part I of this Form 10-K.

Results of Operations for Fiscal Year Ended September 30, 2009 Compared with the Fiscal Year Ended September 30, 2008

Our net sales totaled $15.91 million for the fiscal year ended September 30, 2009, a 457% increase compared to our net sales of $2.85 million for the fiscal year ended September 30, 2008. The growth in net sales primarily resulted from the completion of our new Nano-Silicon product line. The product line was launched and placed

in our daily operational activities in July 2008. The new launched product line has a designed annual output of 50K tons. Because of this new launched product line which materially enhanced our production capacity, we expect that we are going to realize a considerable increase of net sales in the coming year of 2010. In fiscal 2009, we produced Nano-Silicon for 30,659 tons, and sold 30,615 tons.

In addition, our new distribution method that was launched in 2008 also contributed in our increasing net sales of 2009 compare to 2008, primarily by the use of sale agents to represent our products and re-sale to the third parties. The positive feedback and awareness of our products has resulted in higher sales compared to the traditional

distribution channel.

We are currently producing and selling Micro-Nano Silicon. For the fiscal year ended September 30, 2009, we sold our products to regional businesses and enterprises engaged in chemical business. Subsequent to the year end, we have modified our sales method to include distributors who purchase our product for re-sale. Our products are

only available to a selected group of distributors and can not be directly purchased by the general public. Chongqing Commercial Company, Ltd is the most significant customer among all distributors who makes up about 66% of our total sales for the year ended September 30, 2009. In the future, if we are able to raise additional capital, we expect to add more sales force to market our products beyond our regional base of customers.

Cost of Sales

Cost of sales for the year ended September 30, 2009 was $12.29 million compared with $2.48 million for the fiscal year ended September 30, 2008. This 395% or $9.81 million increase in cost of sales was primarily caused by the increase in sales volume.

Gross Profit

Gross profit increased to $3.62 million for the fiscal year ended September 30, 2009 from that of $0.37 million of the year ended September 30, 2008. The gross profit boosted by 866% or $3.24 million, which reflects the decrease in the cost of goods sold. Our gross profit margin increased to 23% from 13% for

the same period of the previous year primarily due to the decrease of the cost of the sales as we started the new product line of micro-nano silicon for already 1 year. Once we commence full scale production, we expect our gross profit margin to be significantly higher as we are able to control over our production costs because of the production volume.

Selling Expenses and General and Administrative Expenses

Our selling, general and administrative, or SG&A, expenses include costs associated with salaries and other expenses related to research and other administrative costs. In addition, we have incurred expenses through the use of consultants and other outsourced service providers.

Our overall SG&A expenses were $367,901 or 2% of net sales for the fiscal year ended September 30, 2009 compared with $244,162 or 9% of net sales for the year ended September 30, 2008. This lower ratio of SG&A expenses to net salesoccurred because we were able to scale up our revenue production with only a modest

increase in overhead expenses.

Net Income (Loss)

Net income from continuing operation was $2.55 million for the fiscal year ended September 30, 2009 compared with the net loss of $536,743 for the fiscal year ended September 30, 2008. This is a result of the increased production and sales of our Micro-Nano

Silicon products. The loss from discontinued opertions was also contributable to the difference.

16

As of September 30, 2009, we had cash and cash equivalents of $164,876 and working capital of $893,146, as compared with cash and cash equivalents of $16,194 and working capital of $103,916 as of September 30, 2008, representing an increase in cash and cash equivalent of $148,682 or 918%. The increase was mainly attributed

to the the increase of our sales throughout the fiscal year of 2009. Also, our increased net working capital was primarily a result of the growth of our sales volume.

A year end, our long term loans consisted of the following:

|

As of September 30, |

||||||||

|

2009 |

2008 |

|||||||

|

a) Loan payable to Nanchong City Bureau of Finance |

||||||||

|

due on 9/30/2011,a fixed interest rate of 0.465% per month |

$ | 585,958 | $ | 589,110 | ||||

|

b) Individual loans from unrelated parties, fixed interest |

||||||||

|

range from 3% to 10% per month till 9/30/2008, |

- | 88,367 | ||||||

|

all with three years term, due on 9/29/2010 |

||||||||

|

c) Individual loans from unrelated parties |

||||||||

|

bear no interest, maturing in 2011 |

2,157,289 | 1,906,892 | ||||||

|

d) Individual loans from unrelated parties with a fixed interest |

||||||||

|

rate of 2% per month untill 12/31/2007, maturing on 3/30/2010 |

- | 58,911 | ||||||

|

Total |

$ | 2,743,247 | $ | 2,643,280 | ||||

17

We have engaged in related party transactions that are reasonably likely to affect our liquidity or the availability of capital resources. The Company periodically has receivables from its affiliates, owned by Mr. Fachun Pu, the majority shareholder and the president of the Company. The Company expects all outstanding amounts due from

its affiliate will be repaid and no allowance is considered necessary. The Company also periodically borrows money from its shareholders to finance the operations.

For the fiscal years ended September 30, 2009 and 2008, the details of loans to/from related parties are as follows:

|

As of September 30, |

||||||||

| 2,009 | 2,008 | |||||||

|

Receivable from Chunfei Daily Chemical |

$ | 168,599 | $ | 244,837 | ||||

|

Receivable from Chunfei Real Estate |

331,071 | 106,040 | ||||||

|

Total Other Receivable- Related Parties |

499,670 | 350,877 | ||||||

|

Loan From Chunfei Real Estate |

$ | 46,956 | $ | 47,209 | ||||

|

Loan From Zhang Qiwei (shareholder) |

- | 1,473 | ||||||

|

Loan From Pu, Fachun (shareholder) |

429,220 | 857,155 | ||||||

|

Loan From other officer and employee |

7,326 | 7,364 | ||||||

|

Total Due to Related Parties |

483,502 | 913,201 | ||||||

Cash generated from our operating activities was $2,285,575 for the fiscal year ended September 30, 2009, representing an increase of $1,721,602 or 305% compared to $563,973 for the fiscal year ended September 30, 2008. The increase in cash from operations was primarily caused by the increase in our net

income.

Cash used in investing activities totaled $1.9 million for the fiscal year ended September 30, 2009 compared to $3.1 for the fiscal year ended September 30, 2008. We invested less in the construction of our plant and equipment for the year ended September 30, 2009 than for the year ended September 30, 2008.

Cash used in financing activities totaled $213,961 in fiscal year 2009 as compared to cash provided by financing activities of $2,201,368 in 2008. This was mainly attributable to the fact that we borrowed less in fiscal year 2009 than we did in fiscal year 2008, when we were completing our factory.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements.

Critical Accounting Policies

Our consolidated financial information has been prepared in accordance with U.S. GAAP, which requires us to make judgments, estimates and assumptions that affect (1) the reported amounts of our assets and liabilities, (2) the disclosure of our contingent assets and liabilities at the end of each fiscal period and (3) the reported amounts of

revenues and expenses during each fiscal period. We continually evaluate these estimates based on our own historical experience, knowledge and assessment of current business and other conditions, our expectations regarding the future based on available information and reasonable assumptions, which together form our basis for making judgments about matters that are not readily apparent from other sources. Some of our accounting policies require a higher degree of judgment than others in their application.

When reviewing our financial statements, the following should also be considered: (1) our selection of critical accounting policies, (2) the judgment and other uncertainties affecting the application of those policies, and (3) the sensitivity of reported results to changes in conditions and assumptions. We believe the following accounting

policies involve the most significant judgment and estimates used in the preparation of our financial statements.

18

In our preparation of the financial statements for fiscal year 2009, there were two estimates made which were (a) subject to a high degree of uncertainty and (b) material to our results. These were

|

· |

our determination, described in Note 10 to the financial statements, to record a 100% allowance for our deferred tax assets. This determination was based on the uncertainty that we would realize income taxable in the U.S. in future years; and |

|

· |

our determination, to record no allowance for doubtful accounts with respect to the accounts receivable owed by our two principal customers who, as described in Note 11 to the financial statements, contributed 83% of our revenue for the year. The determination was based on the fact that the conclusions of our standard receivable testing procedures. |

We made no material changes to our critical accounting policies in connection with the preparation of financial statements for 2009.

Recent Accounting Pronouncements

In May 2009, the FASB issued guidance related to subsequent events under ASC 855-10, Subsequent Events. This guidance sets forth the period after the balance sheet date during which management or a reporting entity should evaluate events or transactions that may occur for potential recognition or disclosure, the circumstances under which

an entity should recognize events or transactions occurring after the balance sheet date, and the disclosures that an entity should make about events or transactions that occurred after the balance sheet date. It requires disclosure of the date through which an entity has evaluated subsequent events and the basis for that date, whether that date represents the date the financial statements were issued or were available to be issued. This guidance is effective for interim and annual periods ending after June 15,

2009. We have included the required disclosures in our consolidated condensed financial statements.

In June 2009, the FASB issued an amendment to ASC 810-10, Consolidation. This guidance amends ASC 810-10-15 to replace the quantitative-based risks and rewards calculation for determining which enterprise has a controlling financial interest in a VIE with a primarily qualitative approach focused on identifying which enterprise has the power

to direct the activities of a VIE that most significantly impact the entity’s economic performance. It also requires ongoing assessments of whether an enterprise is the primary beneficiary of a VIE and requires additional disclosures about an enterprise’s involvement in VIEs. This guidance is effective as of the beginning of the reporting entity’s first annual reporting period that begins after November 15, 2009 and earlier adoption is not permitted. We are currently evaluating the potential

impact, if any, of the adoption of this guidance will have on our consolidated condensed financial statements.

In June 2009, the FASB issued Accounting Standards Update No. 2009-01 which amends ASC 105, Generally Accepted Accounting Principles. This guidance states that the ASC will become the source of authoritative U.S. GAAP recognized by the FASB to be applied by nongovernmental entities. Once effective, the Codification’s content will

carry the same level of authority. Thus, the U.S. GAAP hierarchy will be modified to include only two levels of U.S. GAAP: authoritative and non-authoritative. This is effective for financial statements issued for interim and annual periods ending after September 15, 2009. We adopted ASC 105 as of September 30, 2009 and thus have incorporated the new Codification citations in place of the corresponding references to legacy accounting pronouncements.

In August 2009, the FASB issued Accounting Standards Update No. 2009-05, Measuring Liabilities at Fair Value, which amends ASC 820, Fair Value Measurements and Disclosures. This Update provides clarification that in circumstances in which a quoted price in an active market for the identical liability is not available, a reporting entity

is required to measure the fair value using one or more of the following techniques: a valuation technique that uses the quoted price of the identical liability or similar liabilities when traded as an asset, which would be considered a Level 1 input, or another valuation technique that is consistent with ASC 820. This Update is effective for the first reporting period (including interim periods) beginning after issuance. Thus, we adopted this guidance as of September 30, 2009, which did not have a material impact

on our consolidated condensed financial statements.

In September 2009, the Financial Accounting Standards Board (FASB) amended existing authoritative guidance to improve financial reporting by enterprises involved with variable interest entities and to provide more relevant and reliable information to users of financial statements. The amended guidance is effective for fiscal annual reporting

periods beginning after November 15, 2009, for interim periods within that first annual reporting period, and for interim and annual reporting periods thereafter. The Company is currently assessing the impact, if any, adoption may have on its financial statements or disclosures.

ITEM 7A QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

19

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

AMERICAN NANO SILICON TECHNOLOGIES, INC

CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2009 AND 2008

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

|

Reports of Independent Registered Public Accounting Firms |

F-2 |

|

Consolidated Balance Sheets as of September 30, 2009 and 2008 |

F-3 |

|

Consolidated Statements of Operation for years ended September 30, 2009 and 2008 |

F-4 |

|

Consolidated Statements of Changes in Stockholders’ Equity for years ended September 30, 2009 and 2008 |

F-5 |

|

Consolidated Statements of Cash Flows for years ended September 30, 2009 and 2008 |

F-6 |

|

Notes to Consolidated Financial Statements |

F7-F-19 |

F-1

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and

American Nano-Silicon Technologies, Inc.

We have audited the accompanying consolidated balance sheets of American Nano-Silicon Technologies, Inc. as of September 30, 2009 and 2008, and the related consolidated statements of operations, stockholders’ equity, and cash flows for each of the years in the two-year period ended September 30, 2009. American Nano-Silicon Technologies,

Inc.’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The company is not required to have, nor were we engaged

to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the

financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of American Nano-Silicon Technologies, Inc. as of September 30, 2009 and 2008, and the results of its operations and its cash flows for each of the years in the two-year period ended September 30, 2009 in conformity

with accounting principles generally accepted in the United States of America.

/S/Bagell Josephs, Levine & Company, LLC

Bagell Josephs, Levine & Company, LLC

Marlton, New Jersey

December 28, 2009

F-2

|

AMERICAN NANO-SILICON TECHNOLOGIES, INC. AND SUBSIDIARIES | ||||||||

|

CONSOLIDATED BALANCE SHEETS | ||||||||

|

(Expressed in US dollars) | ||||||||

|

As of September 30 |

||||||||

|

2009 |

2008 |

|||||||

|

ASSETS | ||||||||

|

Current assets: |

||||||||

|

Cash and cash equivalents |

$ | 164,876 | $ | 16,194 | ||||

|

Accounts receivable |

1,050,852 | 9,794 | ||||||

|

Inventory |

230,007 | 342,346 | ||||||

|

Advance to suppliers |

64,476 | 192,604 | ||||||

|

Other receivables |

- | 6,883 | ||||||

|

Other receivables - related parties |

499,670 | 350,877 | ||||||

|

Employee advances |

17,495 | 868 | ||||||

|

Total Current Assets |

2,027,375 | 919,566 | ||||||

|

Property, plant and equipment, net |

10,944,991 | 9,512,402 | ||||||

|

Other assets: |

||||||||

|

Land use right |

1,010,409 | 1,040,226 | ||||||

|

Total other assets |

1,010,409 | 1,040,226 | ||||||

|

Total Assets |

$ | 13,982,775 | $ | 11,472,194 | ||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

|

Current liabilities: |

||||||||

|

Accounts payable |

$ | 295,173 | $ | 452,043 | ||||

|

Advance from customers |

- | 19,367 | ||||||

|

Tax payable |

415,664 | 118,316 | ||||||

|

Accrued expenses and other payables |

423,392 | 225,924 | ||||||

|

Total Current Liabilities |

1,134,229 | 815,650 | ||||||

|

Long-term liability |

||||||||

|

Construction security deposits |

1,227,093 | 1,245,459 | ||||||

|

Long term Loan |

2,743,247 | 2,643,280 | ||||||

|

Due to related parties |

483,502 | 913,201 | ||||||

|

Total Liabilities |

5,588,071 | 5,617,590 | ||||||

|

Stockholders' Equity |

||||||||

|

Common stock, $0.0001 par value, 200,000,000 shares authorized; 26,578,767 |

||||||||

|

and 26,558,767 issued and outstanding at September 30, 2009 and September 30, 2008 |

2,658 | 2,656 | ||||||

|

Additional paid-in-capital |

4,506,941 | 4,487,743 | ||||||

|

Accumulated other comprehensive income |

801,708 | 824,006 | ||||||

|

Retained Earnings (Accumulated deficits) |

1,752,414 |

(609,468 | ) | |||||

|

Total Stockholders' Equity |

7,063,721 |

4,704,937 | ||||||

|

Noncontrolling interest |

1,330,983 | 1,149,667 | ||||||

|

Total Equity |

8,394,704 |

5,854,604 | ||||||

|

Total Liabilities and Stockholders' Equity |

$ | 13,982,775 | $ | 11,472,194 | ||||

|

|

|

|||||||

F-3

|

AMERICAN NANO-SILICON TECHNOLOGIES, INC. AND SUBSIDIARIES |

||||||||

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

||||||||

|

FOR THE YEARS ENDED AT SEPTEMBER 30, 2009 AND 2008 |

||||||||

|

(Expressed in US dollars) |

||||||||

|

For the Years Ended |

||||||||

|

September 30, |

||||||||

|

2009 |

2008 |

|||||||

|

Revenues |

$ | 15,916,813 | $ | 2,857,958 | ||||

|

Cost of Goods Sold |

12,294,361 | 2,482,943 | ||||||

|

Gross Profit |

3,622,452 | 375,015 | ||||||

|

Operating Expenses |

||||||||

|

Research and development expense |

19,074 | - | ||||||

|

Selling, general and administrative |

367,901 | 244,162 | ||||||

|

Income before other Income and (Expenses) |

3,235,478 | 130,853 | ||||||

|

Other Income and Expense |

||||||||

|

Interest income (expense) |

(32,658 | ) | (96,542 | ) | ||||

|

Other income (expense) |

(97 | ) | 1,322 | |||||

|

Total other expense |

(32,756 | ) | (95,220 | ) | ||||

|

Income Before Income Taxes |

3,202,722 | 35,633 | ||||||

|

Provision for Income Taxes |

653,610 | 63,786 | ||||||

|

Net Income (Loss) from continuing operations |

2,549,112 | (28,153 | ) | |||||

|

Discontinued Operations |

||||||||

|

Loss from discontinued operations |

- | (12,318 | ) | |||||

|

Loss on disposal |

(496,272 | ) | ||||||

|

Net income (Loss) |

2,549,112 | (536,743 | ) | |||||

|

Less: net income attributable to the noncontrolling interest |

187,230 | (21,414) | ||||||

| Net Income (Loss) attributable to American Nano | 2,361,882 | (515,329) | ||||||

|

Other comprehensive income (loss) |

||||||||

|

Foreign Currency translation adjustment |

(22,298 | ) | 349,665 | |||||

|

Comprehensive Income (Loss) |

$ | 2,339,584 | $ | (165,664 | ) | |||

|

Basic and diluted income (loss) per common share |

||||||||

|

Continuing Operations |

$ | 0.09 | $ | (0.00 | ) | |||

|

Discontinued Operations |

$ | - | $ | (0.02 | ) | |||

|

Weighted average number of common shares |

26,568,520 | 26,475,769 | ||||||

F-4

|

AMERICAN NANO-SILICON TECHNOLOGIES, INC. AND SUBSIDIARIES |

||||||||||||||||||||||||||||||||

|

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY |

||||||||||||||||||||||||||||||||

|

FOR THE YEARS ENDED SEPTEMBER 30, 2009 AND 2008 |

||||||||||||||||||||||||||||||||

|

(Expressed in US dollars) |

||||||||||||||||||||||||||||||||

|

Common Stock |

Accumulated Other |

Total |

||||||||||||||||||||||||||||||

|

par value $.0001 |

Additional |

Comprehensive |

Retained |

Noncontrolling |

Stockholders' |

|||||||||||||||||||||||||||

|

Shares |

Amount |

Paid in Capital |

Income |

Earnings |

Interest |

Equity |

||||||||||||||||||||||||||

|

Balance at September 30, 2007 |

25,740,000 | $ | 2,574 | $ | 3,979,235 | $ | 474,341 | $ | (94,139 | ) | $ | 999,751 | $ | 5,361,762 | ||||||||||||||||||

|

Comprehensive income |

||||||||||||||||||||||||||||||||

|

Net loss from continuing operations |

(6,739 | ) | (21,414 | ) | (28,153 | ) | ||||||||||||||||||||||||||

|

Net loss from discontinued operations |

(508,590 | ) | (508,590 | ) | ||||||||||||||||||||||||||||

|

Other comprehensive income, net of tax |

||||||||||||||||||||||||||||||||

|

Foreign currency translation adjustments |

349,665 | 171,330 | 520,995 | |||||||||||||||||||||||||||||

|

Acquisition of Net Asset of CorpHQ |

818,767 | 82 | 508,508 | 508,590 | ||||||||||||||||||||||||||||

|

Balance at September 30, 2008 |

26,558,767 | $ | 2,656 | $ | 4,487,743 | $ | 824,006 | $ | (609,468 | ) | $ | 1,149,667 | $ | 5,854,605 | ||||||||||||||||||

|

Comprehensive income |

||||||||||||||||||||||||||||||||

|

Stock issued for consulting service |

20,000 | 2 | 19,198 | 19,200 | ||||||||||||||||||||||||||||

|

Net income |

2,361,882 |

187,230 |

2,549,112 |

|||||||||||||||||||||||||||||

|

Other comprehensive income, net of tax |

- | |||||||||||||||||||||||||||||||

|

Foreign currency translation adjustments |

(22,298) | (5,914) | (28,213) | |||||||||||||||||||||||||||||

|

Balance at September 30, 2009 |

26,578,767 | $ | 2,658 | $ | 4,506,941 | $ | 801,708 | $ | 1,752,414 | $ | 1,330,983 | $ | 8,394,704 | |||||||||||||||||||

F-5

|

AMERICAN NANO-SILICON TECHNOLOGIES, INC. AND SUBSIDIARIES |

||||||||

|

CONSOLIDATED STATEMENTS OF CASH FLOWS |

||||||||

|

FOR THE YEARS ENDED AT SEPTEMBER 30, 2009 AND 2008 |

||||||||

|

(Expressed in US dollars) |

||||||||

|

For the Years ended |

||||||||

|

September 30, |

||||||||

|

2009 |

2008 |

|||||||

|

Cash Flows From Operating Activities: |

||||||||

|

Continuing operation |

||||||||

|

Net Income (Loss) |

$ | 2,549,112 | $ | (28,153 | ) | |||

|

Adjustments to reconcile net income (loss) to net cash |

||||||||

|

provided by operating activities: |

||||||||

|

Depreciation and amortization |

465,654 | 192,817 | ||||||

|

Stock issued for service |

19,200 | - | ||||||

|

Loss from disposal of fixed assets |

723 | |||||||

|

Changes in operating assets and liabilities: |

||||||||

|

(Increase) decrease in - |

||||||||

|

Accounts receivable and other receivable |

(1,033,044 | ) | 166,358 | |||||

|

Inventory |

110,381 | 400,957 | ||||||

|

Employee advances |

(16,612 | ) | 28,636 | |||||

|

Advances to suppliers |

126,949 | (54,363 | ) | |||||

|

Related party receivables |

(150,488 | ) | (47,905 | ) | ||||

|

Increase (decrease) in - |

||||||||

|

Accounts payable |

(154,275 | ) | 28,900 | |||||

|

Construction security deposits |

(11,706 | ) | (45,839 | ) | ||||

|

Advance from customers |

(19,241 | ) | 18,528 | |||||

|

Tax payable |

297,628 | 111,581 | ||||||

|

Accrued expenses and other payables |

102,016 | (208,267 | ) | |||||

|

Cash provided by Continuing Operating Activities |

2,285,575 | 563,973 | ||||||

|

Discontinued Operations |

||||||||

|

Net loss from Discontinued operations |

- | (508,590 | ) | |||||

|

Adjustments to reconcile net loss to net cash |

- | |||||||

|

used in discountinued operations |

- | 508,590 | ||||||

|

Cash used in Discontinued Activities |

- | - | ||||||

|

Cash provided by Operating Activities |

2,285,575 | 563,973 | ||||||

|

Cash Flows From Investing Activities: |

||||||||

|

Additions to property and equipment |

(1,923,021 | ) | (3,142,216 | ) | ||||

|

Additions to intangible assets |

- | (69,539 | ) | |||||

|

Proceeds from dsiposal of fixed assets |

- | 47,905 | ||||||

|

Cash used in investing activities |

(1,923,021 | ) | (3,163,850 | ) | ||||

|

Cash Flows From Financing Activities |

||||||||

|

Proceeds (repayment) from related party loans |

(424,324 | ) | 662,254 | |||||

|

Proceeds from loans |

210,363 | 1,539,114 | ||||||

|

Cash provided by (used in) financing activities |

(213,961 | ) | 2,201,368 | |||||

|

Effect of exchange rate changes on cash and cash equivalents |

89 | (8,997 | ) | |||||

|

Increase (decrease) in cash and cash equivalents |

148,682 | (407,506 | ) | |||||

|

Cash and Cash Equivalents - Beginning of year |

16,194 | 423,700 | ||||||

|

Cash and Cash Equivalents - End of year |

$ | 164,876 | $ | 16,194 | ||||

|

SUPPLEMENTAL CASH FLOW INFORMATION: |

||||||||

|

During the period, cash was paid for the following: |

||||||||

|

Interest expense |

$ | 32,658 | $ | - | ||||

|

Income taxes |

$ | 377,462 | $ | 63,786 | ||||

| Non Cash investing and financing activities: | ||||||||

| Stock issued for Service | $ | 19,200 | $ | - | ||||

| Net assets acquired from the reverse merger with CorpHQ | $ | - | $ | 508,590 | ||||

F-6

AMERICAN NANO-SILICON TECHNOLOGIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED SEPTEMBER 30, 2009 AND 2008

Note 1 – ORGANIZATION AND BASIS OF PRESENTATION

American Nano-Silicon Technologies, Inc. (the “Company” or “ANNO”) was originally incorporated in the State of California on September 6, 1996 as CorpHQ, Inc. (“CorpHQ”).

Initially, the Company was engaged in the business activities of providing marketing, advertising and financial consulting services until December 31, 1999. Since then, the Company explored a few business ventures and switched its business strategy to be involved in the development, acquisition and operation of minority-owned portfolio

company’s focus on consumer products and commercial technologies, as well as development of consulting and other business relationships with client companies that have demonstrated synergies with the Company’s core businesses.