Attached files

| file | filename |

|---|---|

| 10-K - FORM 10-K 9-30-09 TECHE HOLDING COMPANY - TECHE HOLDING CO | f10k_093009-0123.htm |

| EX-32 - EXHIBIT 32 - TECHE HOLDING CO | ex32.htm |

| EX-23 - EXHIBIT 23 - TECHE HOLDING CO | ex23.htm |

| EX-31 - EXHIBIT 31.1 - TECHE HOLDING CO | ex31-1.htm |

| EX-31 - EXHIBIT 31.2 - TECHE HOLDING CO | ex31-2.htm |

| EX-10 - EXHIBIT 10.9 - TECHE HOLDING CO | ex10-9.htm |

| EX-10 - EXHIBIT 10.12 - TECHE HOLDING CO | ex10-12.htm |

| EX-10 - EXHIBIT 10.11 - TECHE HOLDING CO | ex10-11.htm |

| EX-10 - EXHIBIT 10.14 - TECHE HOLDING CO | ex10-14.htm |

| EX-10 - EXHIBIT 10.10 - TECHE HOLDING CO | ex10-10.htm |

| EX-10 - EXHIBIT 10.13 - TECHE HOLDING CO | ex10-13.htm |

|

Teche Holding Company |

New Iberia |

Baton Rouge |

|

1120 Jefferson Terrace Boulevard |

142 W. St. Peter Street |

Wal-Mart Neighborhood Market |

|

New Iberia, LA 70560 |

New Iberia, LA 70560 |

9830 Old Hammond Highway |

|

PHONE (337) 560-7151 |

(337) 364-5528 |

Baton Rouge, LA 70816 |

|

FAX (337) 365-7130 |

|

(225) 926-7378 |

|

|

Lafayette |

|

|

New Iberia |

Broadmoor |

Breaux Bridge |

|

1120 Jefferson Terrace Boulevard |

5121 Johnston Street |

601 East Bridge Street |

|

New Iberia, LA 70560 |

Lafayette, LA 70503 |

Breaux Bridge, LA 70517 |

|

(337) 365-0366 |

(337) 981-1887 |

(337) 332-2149 |

|

Call Center (800) 897-0315 |

|

|

|

|

Lafayette |

Houma |

|

Franklin |

Downtown |

706 Barrow Street |

|

211 Willow Street |

1001 Johnston Street |

Houma, LA 70360 |

|

Franklin, LA 70538 |

Lafayette, LA 70501 |

(985) 868-8766 |

|

(337) 828-3212 |

(337) 232-6463 |

|

|

|

|

Houma |

|

Franklin Drive-Thru |

Lafayette |

912 Grand Caillou Road |

|

1823 Main Street |

2200 W. Pinhook Road |

Houma, LA 70363 |

|

Franklin, LA 70538 |

Lafayette, LA 70508 |

(985) 857-9990 |

|

(337) 828-4177 |

(337) 232-3419 |

|

|

|

|

Thibodaux |

|

Morgan City |

Baton Rouge |

921 Canal Boulevard |

|

1001 7th Street |

3524 S. Sherwood Forest Boulevard |

Thibodaux, LA 70301 |

|

Morgan City, LA 70380 |

Baton Rouge, LA 70816 |

(985) 446-6707 |

|

(337) 384-0653 |

(337) 293-0954 |

|

|

|

|

Opelousas |

|

Bayou Vista |

Prairieville |

428 E. Landry Street |

|

206 Arlington Street |

Wal-Mart SuperCenter |

Opelousas, LA 70570 |

|

Bayou Vista, LA 70380 |

17585 Airline Hwy. |

(337) 942-5748 |

|

(985) 395-5244 |

Prairieville, LA 70769 |

|

|

|

(225) 677-8748 |

Eunice |

|

New Iberia |

|

840 E. Laurel Avenue |

|

529 N. Lewis Street |

Baton Rouge |

Eunice, LA 70535 |

|

New Iberia, LA 70563 |

Wal-Mart SuperCenter |

(337) 457-9585 |

|

(337) 367-2516 |

2171 O’Neal Lane |

|

|

|

Baton Rouge, LA 70816 |

|

|

|

(225) 751-0264 |

www.teche.com |

|

Table of Contents |

|

|

|

|

|

President’s Message |

2 |

|

|

|

|

Selected Financial Data |

6 |

|

|

|

|

Business of the Bank - Business of the Company |

7 |

|

|

|

|

Summary of Quarterly Operating Results |

7 |

|

|

|

|

Market and Dividend Information |

8 |

|

|

|

|

Management’s Discussion and Analysis of Financial |

|

|

Condition and Results of Operations |

9 |

|

|

|

|

Management’s Report |

17 |

|

|

|

|

Report of Independent Registered Public Accounting Firm |

18 |

|

|

|

|

Consolidated Balance Sheets |

19 |

|

|

|

|

Consolidated Statements of Income |

20 |

|

|

|

|

Consolidated Statements of Stockholders’ Equity |

21 |

|

|

|

|

Consolidated Statements of Cash Flows |

22 |

|

|

|

|

Notes to Consolidated Financial Statements |

24 |

|

|

|

|

Directors and Officers |

58 |

Message from Patrick Little, Chairman and CEO

Teche achieved record earnings per share during a national recession. These results are a testament to our SmartGrowth strategy, the talents of the Teche team and the resilient economy of our region.

Results of Fiscal Year 2009

In the financial chaos of 2009, Teche Holding Company was a pillar of profitability and growth. The Company set an earnings record of $3.36 per diluted share and paid an annual cash dividend of $1.405 per share, generating an annualized yield of 4.24%.

These outstanding results emanated from our solid focus on growing the right kinds of deposits and loans, as well as our well-structured pricing and underwriting programs. For 10 years, we have honed our SmartGrowth strategy for increasing our core deposits and expanding the higher yielding loans in our portfolio. As a result, our net interest margin has increased for eight consecutive quarters to 4.01% in 2009.

Furthermore due to excellent operating results, we increased our return on average tangible equity from 8.83% to 10.49% and our return on average assets from 0.76% to 0.91% from 2008 to 2009. Tangible stockholders’ equity increased 5.4% to $68 million and tangible book value per share increased 6.5% to $32.33.

We also strengthened our capital ratios during the year by selling a block of fixed rate mortgage loans and reducing the bank’s higher cost time deposits. In addition, we decided to decline the federal “TARP” program which we felt was costly and an unnecessary source of capital for our institution. All of these actions benefited our shareholders with record returns and increased dividends. I will more fully discuss our consistent SmartGrowth deposit and loan growth, our strong asset quality and capitalization in the rest of my remarks.

The industries here (Gulf Coast) are pretty steady and it’s a much better job picture than it has been in other parts of the country.

Peter Ricchiuti, Assistant Dean

A.B. Freeman School of Business

Tulane University

ABC Good Morning America, 5/07/09

Deposit Growth

SmartGrowth (core) deposits increased 11.3% year over year to $368 million. Checking deposits, coveted by our competitors, grew to $166 million as we continued our totally free personal and business checking programs and superior customer service initiatives. Money market deposits fell to $95 million as rates declined. However, savings deposits grew to $106 million with only a marginal increase in rates this past year. Most importantly, time deposits, which are not in

our SmartGrowth deposit category, had much lower costs and balances this year. For many years, Teche has competed for growth with the highest rate payers in our markets. This year we focused on customer relationships and reduced our dependence on single account “rate shoppers.” We will continue to focus on SmartGrowth (core) deposits as a long term strategy. These deposits have the lowest cost of funds and are important to our expanding net interest margin.

Loan Growth

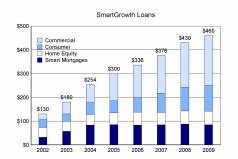

SmartGrowth loans, the highest yielding loans in the bank, grew 7.2% year over year to $460 million. These loans now comprise 77% of Teche’s total loan portfolio. In 2009, commercial and consumer loans increased 9.5% and 11.9% respectively over last year. Commercial loans increased to $210 million and consumer loans grew to $108 million. Not only did the Company grow these loans during a downturn in the national economy but Teche was also able to increase

consumer loan interest rates.

Some portions of the loan portfolio decreased such as Smart Mortgages, loans to builders for speculative home construction and closed-end home equity loans. While the Company continues to originate fixed and adjustable home loans, total balances in these categories have decreased as the Company fine-tuned its approach and sold $26 million in fixed rate loans.

Asset Quality

Teche’s strong commitment to sound underwriting standards, effective servicing and diligent collection efforts yielded high asset quality ratios compared to peers. Teche’s non-performing loans to total loans and non-performing assets to total assets were 1.21% and 1.19% respectively in the last twelve months compared to 2.88% and 2.68% average ratios of publicly traded southern banks during that same period. In addition Teche’s 0.29% net charge-offs to average loans is significantly lower than 1.31% which is the average of publicly traded southern banks over the last twelve months. Peer averages are according to Highline Financial data.

Capital Strength

Financial analysts following the banking industry this year say that “Credit and Capital” are the hallmarks of strong community banks. Teche receives top grades in both categories. As stated above Teche’s asset quality compares very favorably to other southern banks and the Company’s capital strength allowed Teche to forego the government bailout program called “TARP.” Through self-generated funds and solid funds management,

Teche kept its capital ratios at healthy levels and above capital requirements established by banking regulators. Teche’s tier 1 risk-based capital ratio was 11.51% and its total risk-based capital ratio was 12.72% at year end with 6% and 10% respectively being the federal “well-capitalized” minimum standard. Since Teche did not participate in the “TARP” program, the Company avoided the high costs associated with the program.

Non-Interest Expense

This past year we held the line on expenses, increasing our non-interest expense by only 2.1% while increasing our core non-interest income by 3.3%. Our primary non-interest expense is the compensation of our employees. Teche Federal Bank has over 300 employees working in 20 different offices in a nine parish (county) area. We have invested in the development of customer service and business development skills of our entire Teche team and that investment has reaped returns. In 2009, we opened 22,000 deposit accounts and 2,400 loan accounts, including $235 million in total loans.

Louisiana Economy

[Graphic Omitted - Map of Teche Office Locations]

My remarks would not be complete without a discussion of Louisiana’s economy. Although the national economy experienced high unemployment rates and generally negative real gross domestic product numbers since the first quarter of 2008, Louisiana was less affected by recessionary forces.

Louisiana has a solid diversified economy with a strong community banking system that funds its large and small businesses. In addition, the state has significant petrochemical manufacturing and a major oil and gas extraction industry including the Haynesville Shale gas exploration project. Even though this project is located in north Louisiana it is currently pumping additional funds throughout the state. As a result of its healthy economy, Louisiana had lower

unemployment rates than the national averages in the last 12 months.

According to the Louisiana Economic Outlook 2010-2011, published by Louisiana State University Department of Economics, the state has a projected job growth of 0.9% in 2010 and 0.9% in 2011. The Baton Rouge MSA, an expansion area of Teche, has projected job growth of 1.1% in 2010 and 1.5% in 2011. The Lafayette MSA has projected job growth of 0.5% in 2010 and 0.7% in 2011. Furthermore, the Houma MSA has projected job growth of 0.9% in 2010 and 0.8% in 2011.

We do have our challenges. Federal legislation currently under consideration including “Cap and Trade” and taxes on the extraction industry may affect our economic outlook. If these legislative initiatives are not approved, the economies of our key MSA areas may be even better than current projections. Other legislation affecting the banking industry may result in more expenses due to the cost of compliance for proposed regulations. Teche is well positioned to explore opportunities and take on future challenges.

Focused on Continuous Growth and Earnings

Although Teche has had a remarkable year especially considering the backdrop of the national economy, the Company is not resting on its laurels. Teche is continuing to closely monitor and improve credit quality, to aggressively pursue the right kinds of loans and deposits and to continue to build customer relationships. The fact that Teche has steadily grown personal and business checking accounts each year is a strong indicator of Teche’s solid strategic focus, service orientation and customer relationships.

Teamwork and Talent Matters

We owe our success to our focused and dedicated employees and our values which emphasize a tradition of quality banking, customer relationships and shareholder returns. On behalf of the Board of Directors, I want to express our appreciation to our Teche team. I am always impressed with the diligent execution of our strategy as I visit our branches and see our associates working to meet the needs of our customers. We know and serve our customers, and I believe that has helped us to avoid costly mistakes which have been rampant in our industry. We are proud of our progress this year. However, we believe that we can continually improve and grow our institution. We are working for you, our shareholders on a daily basis and we appreciate your confidence and support.

Sincerely,

Patrick Little

Chairman and President/CEO

SELECTED FINANCIAL DATA (Dollars in thousands, except per share data)

At or for the Year Ended September 30,

|

|

|

2009 |

|

2008 |

|

2007 |

|

2006 |

|

2005 |

|

|||||

|

Assets |

|

$ |

765,071 |

|

$ |

769,488 |

|

$ |

719,367 |

|

$ |

685,750 |

|

$ |

676,822 |

|

|

Loans Receivable, Net |

|

|

588,527 |

|

|

584,139 |

|

|

561,623 |

|

|

520,185 |

|

|

487,427 |

|

|

Securities-Available for Sale |

|

|

20,936 |

|

|

26,652 |

|

|

51,647 |

|

|

63,517 |

|

|

77,491 |

|

|

Securities-Held to Maturity |

|

|

75,384 |

|

|

54,291 |

|

|

31,855 |

|

|

38,743 |

|

|

34,259 |

|

|

Cash and Cash Equivalents |

|

|

23,675 |

|

|

50,112 |

|

|

21,811 |

|

|

17,528 |

|

|

32,674 |

|

|

Deposits |

|

|

585,469 |

|

|

589,228 |

|

|

555,569 |

|

|

537,549 |

|

|

516,052 |

|

|

FHLB Advances |

|

|

100,628 |

|

|

104,877 |

|

|

89,756 |

|

|

77,386 |

|

|

93,409 |

|

|

Stockholders’ Equity |

|

|

71,485 |

|

|

68,044 |

|

|

67,006 |

|

|

63,929 |

|

|

61,338 |

|

|

SUMMARY OF OPERATIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Income |

|

$ |

44,237 |

|

$ |

45,633 |

|

$ |

43,041 |

|

$ |

39,197 |

|

$ |

36,068 |

|

|

Interest Expense |

|

|

15,297 |

|

|

19,733 |

|

|

19,857 |

|

|

16,720 |

|

|

15,674 |

|

|

Net Interest Income |

|

|

28,940 |

|

|

25,900 |

|

|

23,184 |

|

|

22,477 |

|

|

20,394 |

|

|

Provision for Loan Losses |

|

|

3,026 |

|

|

825 |

|

|

605 |

|

|

210 |

|

|

950 |

|

|

Net Interest Income after |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for Loan Losses |

|

|

25,914 |

|

|

25,075 |

|

|

22,579 |

|

|

22,267 |

|

|

19,444 |

|

|

Non-Interest Income |

|

|

15,951 |

|

|

16,001 |

|

|

14,572 |

|

|

13,031 |

|

|

10,876 |

|

|

Non-Interest Expense |

|

|

31,372 |

|

|

30,740 |

|

|

27,464 |

|

|

24,364 |

|

|

22,644 |

|

|

Income Before Gains (Losses) on Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of Securities and Income Taxes |

|

|

10,493 |

|

|

10,336 |

|

|

9,687 |

|

|

10,934 |

|

|

7,676 |

|

|

Gains (Losses) on Sales of Securities |

|

|

(99 |

) |

|

(2,580 |

) |

|

164 |

|

|

34 |

|

|

26 |

|

|

Income Tax Expense |

|

|

3,258 |

|

|

2,047 |

|

|

3,170 |

|

|

3,651 |

|

|

2,503 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income |

|

$ |

7,136 |

|

$ |

5,709 |

|

$ |

6,681 |

|

$ |

7,317 |

|

$ |

5,199 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SELECTED FINANCIAL RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratio of Equity to Assets |

|

|

9.34 |

% |

|

8.84 |

% |

|

9.31 |

% |

|

9.32 |

% |

|

9.06 |

% |

|

Book Value/Common Share |

|

$ |

34.09 |

|

$ |

32.12 |

|

$ |

30.42 |

|

$ |

28.68 |

|

$ |

26.78 |

|

|

Dividends declared per Share |

|

$ |

1.41 |

|

$ |

1.37 |

|

$ |

1.26 |

|

$ |

1.10 |

|

$ |

0.94 |

|

|

Basic Income per Common Share |

|

$ |

3.38 |

|

$ |

2.65 |

|

$ |

3.01 |

|

$ |

3.22 |

|

$ |

2.34 |

|

|

Diluted Income per Common Share |

|

$ |

3.36 |

|

$ |

2.63 |

|

$ |

2.94 |

|

$ |

3.15 |

|

$ |

2.26 |

|

|

Return on Average Assets |

|

|

0.91 |

% |

|

0.76 |

% |

|

0.95 |

% |

|

1.07 |

% |

|

0.77 |

% |

|

Return on Average Equity |

|

|

9.98 |

% |

|

8.29 |

% |

|

10.24 |

% |

|

11.79 |

% |

|

8.59 |

% |

|

Net Interest Margin |

|

|

4.01 |

% |

|

3.74 |

% |

|

3.57 |

% |

|

3.53 |

% |

|

3.24 |

% |

|

Non-Interest Expense/Average Assets |

|

|

4.02 |

% |

|

4.07 |

% |

|

3.89 |

% |

|

3.54 |

% |

|

3.34 |

% |

|

Non-Interest Income/Average Assets |

|

|

2.03 |

% |

|

2.11 |

% |

|

2.06 |

% |

|

1.89 |

% |

|

1.60 |

% |

|

Non-Performing Loans/Loans (1) |

|

|

1.21 |

% |

|

1.09 |

% |

|

0.68 |

% |

|

0.74 |

% |

|

0.98 |

% |

|

Allowance for Loan Losses/Loans (1) |

|

|

1.14 |

% |

|

0.94 |

% |

|

0.90 |

% |

|

0.93 |

% |

|

1.04 |

% |

|

Dividend Payout |

|

|

41.32 |

% |

|

51.90 |

% |

|

41.66 |

% |

|

33.65 |

% |

|

40.30 |

% |

|

|

(1) |

Total loans before allowance for loan losses |

Business of the Bank

Teche Federal Bank (the "Bank") attracts savings deposits from the general public and uses such deposits to originate primarily residential mortgage loans, commercial mortgage loans and consumer loans. Additionally, the Bank invests in mortgage-backed and investment securities. (See “Management Strategy” on page 9.)

It is the Bank's intention to remain an independent community savings bank serving the local banking needs of its primary market area, which presently includes twenty offices in the Louisiana Parishes of St. Mary, Iberia, Lafayette, St. Landry, St. Martin, Terrebonne, Lafourche, East Baton Rouge and Ascension. The FDIC insures deposits at the Bank up to the maximum legal amount.

Business of the Company

Teche Holding Company (the "Company") is a Louisiana corporation organized in December 1994 at the direction of the Board of Directors of the Bank to acquire all of the capital stock that the Bank issued upon its conversion from the mutual to stock form of organization.

Summary of Quarterly Operating Results

|

|

|

2009 |

|

2008 |

|

||||||||||||||||||||

|

|

|

First |

|

Second |

|

Third |

|

Fourth |

|

First |

|

Second |

|

Third |

|

Fourth |

|

||||||||

|

|

|

(Amounts in thousands, except per share data) |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Interest Income |

|

$ |

11,214 |

|

$ |

11,013 |

|

$ |

11,130 |

|

$ |

10,880 |

|

$ |

11,361 |

|

$ |

11,391 |

|

$ |

11,465 |

|

$ |

11,417 |

|

|

Interest Expense |

|

|

4,378 |

|

|

3,950 |

|

|

3,583 |

|

|

3,386 |

|

|

5,233 |

|

|

5,082 |

|

|

4,798 |

|

|

4,620 |

|

|

Net Interest Income |

|

|

6,836 |

|

|

7,063 |

|

|

7,547 |

|

|

7,494 |

|

|

6,128 |

|

|

6,309 |

|

|

6,667 |

|

|

6,797 |

|

|

Provision for Loan Losses |

|

|

155 |

|

|

1,035 |

|

|

550 |

|

|

1,286 |

|

|

180 |

|

|

190 |

|

|

295 |

|

|

160 |

|

|

Income (Loss) Before |

|

|

2,602 |

|

|

2,482 |

|

|

2,395 |

|

|

2,915 |

|

|

2,863 |

|

|

3,223 |

|

|

(1,235 |

) |

|

2,906 |

|

|

Income Taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (Loss) |

|

|

1,764 |

|

|

1,656 |

|

|

1,733 |

|

|

1,983 |

|

|

1,883 |

|

|

2,184 |

|

|

(476 |

) |

|

2,119 |

|

|

Basic Income (Loss) |

|

|

0.83 |

|

|

0.78 |

|

|

0.82 |

|

|

0.95 |

|

|

0.85 |

|

|

1.01 |

|

|

(0.22 |

) |

|

1.00 |

|

|

per Common Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Income (Loss) |

|

|

0.83 |

|

|

0.78 |

|

|

0.81 |

|

|

0.94 |

|

|

0.84 |

|

|

1.00 |

|

|

(0.22 |

) |

|

0.99 |

|

|

per Common Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market and Dividend Information

Teche Holding Company's common stock trades on the NYSE Amex under the symbol "TSH.” The following sets forth the high and low sale prices and cash dividends declared for the common stock for the last two fiscal years.

|

Quarter ended |

Sales Price |

Period End Close |

Cash Dividend Declared |

Date Declared |

|

|

|

High |

Low |

|

|

|

|

December 31, 2007 |

$44.00 |

$37.10 |

$37.75

|

$0.335 |

November 29, 2007 |

|

March 31, 2008 |

$38.30 |

$29.50 |

$32.55 |

$0.34 |

February 26, 2008 |

|

June 30, 2008 |

$38.39 |

$31.50 |

$37.17 |

$0.345 |

May 21, 2008 |

|

September 30, 2008 |

$37.50 |

$28.90 |

$31.75 |

$0.35 |

August 27, 2008 |

|

December 31, 2008 |

$31.81 |

$22.90 |

$25.01 |

$0.35 |

November 20, 2008 |

|

March 31, 2009 |

$30.95 |

$22.40 |

$30.50 |

$0.35 |

February 19, 2009 |

|

June 30, 2009 |

$35.50 |

$28.85 |

$33.10 |

$0.35 |

May 29, 2009 |

|

September 30, 2009 |

$35.75 |

$31.09 |

$33.10 |

$0.355 |

August 27, 2009 |

According to the records of the Company's transfer agent, there were 436 registered stockholders of record at November 30, 2009. This number does not include any persons or entities that hold their stock in nominee or "street" name through various brokerage firms.

The Company's ability to pay dividends is substantially dependent upon the dividends it receives from the Bank. Under current regulations, the Bank is not permitted to pay dividends if its regulatory capital would thereby be reduced below (1) the amount then required for the liquidation account established in connection with the Bank's conversion from mutual to stock form, or (2) the regulatory capital requirements imposed by the Office of Thrift Supervision ("OTS"). Capital distributions are also subject to certain limitations based on the Bank's net income. See Notes 18 and 19 of Notes to Consolidated Financial Statements. The Bank's total capital at September 30, 2009 exceeded the amounts of its liquidation account and regulatory capital requirements.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

General

The Private Securities Litigation Reform act of 1995 contains safe harbor provisions regarding forward-looking statements. When used in this discussion, the words “believe”, “anticipates”, “contemplates”, “expects”, and similar expressions are intended to identify forward-looking statements. Such statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. Those risks and uncertainties include changes in interest rates, risk associated with the effect of opening new branches, the ability to control costs and expenses, and general economic conditions. The Company undertakes no obligation to publicly release the results of any revisions to those forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrences of unanticipated events.

The Company's consolidated results of operations are primarily dependent on the Bank's net interest income, or the difference between the interest income earned on its loan, mortgage-backed securities and investment securities portfolios, and the interest expense paid on its savings deposits and other borrowings. Net interest income is affected not only by the difference between the yields earned on interest-earning assets and the costs incurred on interest-bearing liabilities, but also by the relative amounts of such interest-earning assets and interest-bearing liabilities.

Other components of net income include: provisions for losses on loans and other assets, non-interest income (primarily, service charges on deposit accounts and other fees), and non-interest expenses (primarily, compensation and employee benefits, office occupancy expense, marketing expense and expenses associated with foreclosed real estate) and income taxes.

Earnings of the Company also are significantly affected by economic and competitive conditions, particularly changes in interest rates, government policies and regulations of regulatory authorities.

References to the "Bank" herein, unless the context requires otherwise, refer to the Company on a consolidated basis.

Overview

The Company’s net income increased $1.4 million to $7.1 million this past fiscal year primarily due to an increase in net interest income of $3.0 million offset somewhat by an increase in provision for loan losses of $2.2 million. Net income for fiscal 2008 was lower due to the Bank’s withdrawal from the AMF Ultra Short Fund which resulted in the Bank incurring a loss of $2.6 million before taxes, along with a pretax charge of $1.5 million due to the Bank’s exit and transfer out of its defined benefit pension plans during the third quarter. The Company’s assets in fiscal 2009 decreased $4.4 million to $765.1 million primarily due to decreases in interest bearing deposits and cash offset somewhat by a slight increase in loan receivables and securities.

Management Strategy

Management's strategy has been to maximize earnings and profitability through steady growth while maintaining asset quality. The Bank's lending strategy has historically focused on the origination of traditional one- to four-family mortgage loans with the primary emphasis on single-family residences in the Bank's primary market area. Additionally, management emphasizes a “SmartGrowth” strategy that focuses on the origination of consumer loans (primarily home equity and mobile home loans), Smart Mortgage loans, commercial loans and commercial real estate loans for retention in the Company’s loan portfolio. Smart Mortgage loans originated by the Bank are residential real estate loans that do not meet all of the Bank’s standard loan underwriting criteria for residential real estate loans. Consumer loans, commercial loans and commercial real estate loans generally have shorter terms to maturity and higher yields than residential real estate loans. While Smart Mortgage loans, consumer loans, commercial loans, and commercial real estate loans have greater credit risk than conforming residential real estate loans, the Company believes its SmartGrowth strategy will have a favorable impact on the Company’s net interest margin, as well as assist in interest rate risk management. SmartGrowth also emphasizes growth in core deposits (primarily transaction accounts), which include demand deposits, NOW accounts, money market deposit accounts and savings accounts.

Asset and Liability Management

Interest Rate Sensitivity Analysis. Net interest income, the primary component of the Bank's net income, is derived from the difference between the interest income on interest-earning assets and the interest expense of interest-bearing liabilities. The Bank has sought to manage its exposure to changes in interest rates by monitoring the effective maturities or re-pricing characteristics of its interest-earning assets and interest-bearing liabilities. The matching of the Bank's assets and liabilities may be analyzed by examining the extent to which its assets and liabilities are interest rate sensitive and by monitoring the expected effects of interest rate changes on its net interest income and net portfolio value.

The ability to maximize net interest income is largely dependent upon achieving a positive interest rate spread that can be sustained during fluctuations in prevailing interest rates. The Bank is exposed to interest rate risk as a result of the difference in the maturity of interest-bearing liabilities and interest-earning assets and the volatility of interest rates. Because most deposit accounts react more quickly to market interest rate movements than do traditional mortgage loans due to their shorter terms to maturity,

increases in interest rates may have an adverse effect on the Bank's earnings. Conversely, this same mismatch will generally benefit the Bank's earnings during periods of declining or stable interest rates.

The Bank attempts to manage its interest rate exposure by shortening the maturities of its interest-earning assets by emphasizing adjustable rate mortgages ("ARMs"), periodically selling loans from the portfolio of long term fixed rate mortgages, originating shorter term loans such as residential construction, consumer, home equity and commercial loans and the investment of excess liquidity in purchased loans, adjustable rate mortgage-backed securities and other securities with relatively short terms to maturity. Furthermore, the Bank works to manage the interest rates it pays on deposits while maintaining a stable deposit base and providing quality services to its customers. In recent years, the Bank has used borrowings while continuing to rely primarily upon deposits as its source of funds. At September 30, 2009, the weighted average term to re-pricing of the Bank’s ARM loan and ARM mortgage-backed securities portfolio was approximately 16 months. In contrast, at September 30, 2009, $104.8 million of the Bank's certificate accounts and $367.8 million of the Bank's regular deposit accounts (e.g. demand, NOW, money market, savings), out of $585.5 million of total deposits, were scheduled to mature or re-price within one year or sooner.

Management believes that it has adequate capital to accept a certain degree of interest rate risk. Should interest rates rise management believes the Bank's capital position will enable it to withstand the negative impact on earnings.

Rate/Volume Analysis. The table below sets forth certain information regarding changes in interest income and interest expense of the Bank for the periods indicated. For each category of interest-earning assets and interest-bearing liabilities, information is provided on changes attributable to (i) changes in volume (changes in average volume multiplied by old rate); (ii) changes in rates (changes in rate multiplied by old average volume); and (iii) the net change. The changes attributable to the combined impact of volume and rate have been allocated proportionately to the changes due to volume and the changes due to rate.

|

|

|

Year Ended September 30, |

|

||||||||||||||||||

|

|

|

2009 vs. 2008 |

|

|

|

2008 vs. 2007 |

|

||||||||||||||

|

|

|

Increase (Decrease) Due to |

|

|

|

Increase (Decrease) Due to |

|

||||||||||||||

|

|

|

Volume |

|

Rate |

|

Net |

|

|

|

Volume |

|

Rate |

|

Net |

|

||||||

|

|

|

(Dollars in thousands) |

|

||||||||||||||||||

|

Interest-Earning Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities (1) |

|

$ |

90 |

|

$ |

(115 |

) |

$ |

(25 |

) |

|

|

$ |

(522 |

) |

$ |

18 |

|

$ |

(504 |

) |

|

Loans Receivable, Net |

|

|

1,200 |

|

|

(2,290 |

) |

|

(1,090 |

) |

|

|

|

3,290 |

|

|

(189 |

) |

|

3,101 |

|

|

Other Interest-Earning Assets (2) |

|

|

304 |

|

|

(585 |

) |

|

(281 |

) |

|

|

|

817 |

|

|

(822 |

) |

|

(5 |

) |

|

Total Interest-Earning Assets |

|

|

1,594 |

|

|

(2,990 |

) |

|

(1,396 |

) |

|

|

|

3,585 |

|

|

(993 |

) |

|

2,592 |

|

|

Interest-Bearing Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

|

130 |

|

|

(4,891 |

) |

|

(4,761 |

) |

|

|

|

670 |

|

|

(1,440 |

) |

|

(770 |

) |

|

FHLB Advances |

|

|

447 |

|

|

(122 |

) |

|

325 |

|

|

|

|

854 |

|

|

(208 |

) |

|

646 |

|

|

Total Interest-Bearing Liabilities |

|

|

577 |

|

|

(5,013 |

) |

|

(4,436 |

) |

|

|

|

1,524 |

|

|

(1,648 |

) |

|

(124 |

) |

|

Net Change in Net Interest Income |

|

$ |

1,017 |

|

$ |

2,023 |

|

$ |

3,040 |

|

|

|

$ |

2,061 |

|

$ |

655 |

|

$ |

2,716 |

|

|

|

(1) |

Includes investment securities and FHLB stock. |

|

|

(2) |

Includes certificates of deposit and other interest-bearing accounts. |

Average Balance Sheet. The following table sets forth certain information relating to the Company's average balance sheet and reflects the average yield on assets and average cost of liabilities for the periods indicated. Such yields and costs are derived by dividing income or expenses by the average balance of assets or liabilities, respectively, for the periods presented. Average balances are derived from daily average balances.

|

|

|

Year Ended September 30, |

|

||||||||||||||||||||||||||

|

|

|

2009 |

|

|

|

2008 |

|

|

|

2007 |

|

||||||||||||||||||

|

|

|

Average |

|

|

|

Average |

|

|

|

Average |

|

|

|

Average |

|

|

|

Average |

|

|

|

Average |

|

||||||

|

|

|

Balance |

|

Interest |

|

Yield/Cost |

|

|

|

Balance |

|

Interest |

|

Yield/Cost |

|

|

|

Balance |

|

Interest |

|

Yield/Cost |

|

||||||

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-Earning Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities (1) |

|

$ |

86,215 |

|

$ |

3,848 |

|

4.46 |

% |

|

|

$ |

84,249 |

|

$ |

3,872 |

|

4.60 |

% |

|

|

$ |

95,651 |

|

$ |

4,376 |

|

4.57 |

% |

|

Loans Receivable (2) (3) |

|

|

606,751 |

|

|

40,190 |

|

6.62 |

% |

|

|

|

594,944 |

|

|

41,280 |

|

7.00 |

% |

|

|

|

547,740 |

|

|

38,179 |

|

6.97 |

% |

|

Other Interest-Earning Assets (4) |

|

|

29,443 |

|

|

199 |

|

0.67 |

% |

|

|

|

18,043 |

|

|

481 |

|

2.67 |

% |

|

|

|

6,731 |

|

|

486 |

|

7.22 |

% |

|

Total Interest-Earning Assets |

|

|

722,409 |

|

$ |

44,237 |

|

6.12 |

% |

|

|

|

697,236 |

|

$ |

45,633 |

|

6.60 |

% |

|

|

|

650,122 |

|

$ |

43,041 |

|

6.62 |

% |

|

Non-Interest Earning Assets |

|

|

58,778 |

|

|

|

|

|

|

|

|

|

52,589 |

|

|

|

|

|

|

|

|

|

54,423 |

|

|

|

|

|

|

|

Total Assets |

|

$ |

781,187 |

|

|

|

|

|

|

|

|

$ |

749,825 |

|

|

|

|

|

|

|

|

$ |

704,545 |

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-Bearing Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOW Accounts |

|

$ |

100,817 |

|

$ |

538 |

|

0.53 |

% |

|

|

$ |

83,515 |

|

$ |

456 |

|

0.55 |

% |

|

|

$ |

74,851 |

|

$ |

328 |

|

0.44 |

% |

|

Statement & Regular Savings Accounts |

|

|

76,214 |

|

|

664 |

|

0.87 |

% |

|

|

|

52,851 |

|

|

409 |

|

0.77 |

% |

|

|

|

52,084 |

|

|

413 |

|

0.79 |

% |

|

Money Funds Accounts |

|

|

115,721 |

|

|

1,440 |

|

1.24 |

% |

|

|

|

125,905 |

|

|

3,190 |

|

2.53 |

% |

|

|

|

89,139 |

|

|

3,183 |

|

3.52 |

% |

|

Certificates of Deposit |

|

|

240,270 |

|

|

7,882 |

|

3.28 |

% |

|

|

|

264,185 |

|

|

11,230 |

|

4.25 |

% |

|

|

|

287,292 |

|

|

12,131 |

|

4.22 |

% |

|

Total Deposits |

|

|

533,022 |

|

|

10,524 |

|

1.97 |

% |

|

|

|

526,456 |

|

|

15,285 |

|

2.90 |

% |

|

|

|

503,366 |

|

|

16,055 |

|

3.19 |

% |

|

FHLB Advances |

|

|

105,060 |

|

|

4,773 |

|

4.54 |

% |

|

|

|

95,225 |

|

|

4,448 |

|

4.67 |

% |

|

|

|

77,550 |

|

|

3,802 |

|

4.90 |

% |

|

Total Interest-Bearing Liabilities |

|

|

638,082 |

|

$ |

15,297 |

|

2.40 |

% |

|

|

|

621,681 |

|

$ |

19,733 |

|

3.17 |

% |

|

|

|

580,916 |

|

$ |

19,857 |

|

3.42 |

% |

|

Non-Interest-Bearing Liabilities |

|

|

71,626 |

|

|

|

|

|

|

|

|

|

59,311 |

|

|

|

|

|

|

|

|

|

58,396 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities |

|

|

709,708 |

|

|

|

|

|

|

|

|

|

680,992 |

|

|

|

|

|

|

|

|

|

639,312 |

|

|

|

|

|

|

|

Stockholders’ Equity |

|

|

71,479 |

|

|

|

|

|

|

|

|

|

68,833 |

|

|

|

|

|

|

|

|

|

65,233 |

|

|

|

|

|

|

|

Total Liabilities and Stockholders’ Equity |

|

$ |

781,187 |

|

|

|

|

|

|

|

|

$ |

749,825 |

|

|

|

|

|

|

|

|

$ |

704,545 |

|

|

|

|

|

|

|

Net Interest Income/Interest Rate Spread (5) |

|

|

|

|

$ |

28,940 |

|

3.72 |

% |

|

|

|

|

|

$ |

25,900 |

|

3.42 |

% |

|

|

|

|

|

$ |

23,184 |

|

3.20 |

% |

|

Net Interest Margin (6) |

|

|

|

|

|

|

|

4.01 |

% |

|

|

|

|

|

|

|

|

3.74 |

% |

|

|

|

|

|

|

|

|

3.57 |

% |

|

Interest-Earning Assets/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-Bearing Liabilities |

|

|

|

|

|

|

|

113.22 |

% |

|

|

|

|

|

|

|

|

112.15 |

% |

|

|

|

|

|

|

|

|

111.91 |

% |

|

|

(1) Includes securities and Federal Home Loan Bank (“FHLB”) stock. |

|

|

(2) Amount is net of deferred loan fees, loan discounts and premiums and loans-in-process and includes non-accruing loans. |

|

|

(3) Interest income includes loan fees of approximately $585,000 in 2009, $565,000 in 2008 and $479,000 in 2007. |

|

|

(4) Amount includes certificates of deposit and other interest-bearing deposits. |

|

|

(5) Interest rate spread represents the difference between the yield on average interest-earning assets and the cost of average interest-bearing liabilities. |

| (6) Net interest margin represents net interest income divided by average interest-earning assets. |

Changes in Financial Condition from September 30, 2008 to September 30, 2009

General. Total assets decreased $4.4 million, or 0.6% to $765.1 million at September 30, 2009 from $769.5 million at September 30, 2008, due to decreases in interest bearing deposits and cash, offset somewhat by a slight increase in loans receivable and securities.

Cash and Cash Equivalents. Cash decreased $26.4 million from $50.1 million at September 30, 2008 to $23.7 million at September 30, 2009. The decrease resulted primarily from the purchase of securities along with a small increase in loans receivable.

Securities Available-for-Sale and Held to Maturity. Securities available-for-sale decreased $5.7 million from $26.6 million at September 30, 2008 to $20.9 million at September 30, 2009 due primarily to repayments on existing mortgage-backed securities. Securities held-to-maturity increased $21.1 million from $54.3 million to $75.4 million due primarily to purchases of $34.0 million offset by repayments on existing securities. (See Note 3 of the Consolidated Financial Statements.)

Loans Receivable, Net. The Bank’s net loans receivable increased $4.4 million or 0.7% to $588.5 million from $584.1 million at September 30, 2008 due primarily to growth in the Commercial Real Estate loan portfolio and Mobile Home loan portfolio, offset by a decrease in the One-to-Four Family Conforming loan portfolio brought about by a $26.0 million sale of fixed rate conforming one-to-four family loans. (See Note 4 of the Consolidated Financial Statements for a comparative breakdown of the Bank’s loan portfolio.)

|

|

Premises and Equipment, Net. |

Premises and equipment increased $0.3 million or 1.2% due to a land purchase. |

Deposits. The Bank’s deposits decreased $3.7 million or 0.6% to $585.5 million at September 30, 2009, from $589.2 million at September 30, 2008. SmarthGrowth deposits which consist of non-interest bearing checking, interest-bearing checking, savings accounts, and money market accounts increased $37.3 million during the fiscal year. Time deposits decreased $41.1 million from $258.8 million to $217.7 million. (See Note 7 of the Consolidated Financial Statements for a comparative breakdown of the Bank’s deposit portfolio.)

Advances from FHLB. Advances from the Federal Home Loan Bank of Dallas decreased $4.3 million, or 4.1% to $100.6 million from $104.9 million at September 30, 2008. The decrease was due to principal payments on existing advances.

Stockholders’ Equity. Stockholders’ equity increased $3.5 million, or 5.1% from $68.0 million at September 30, 2008, to $71.5 million at September 30, 2009. The increase was due primarily to net income less dividends and the purchase of treasury stock.

Comparison of Operating Results for Years Ended September 30, 2009, 2008 and 2007

Analysis of Net Income

General. The Company had net income of $7.1 million, $5.7 million and $6.7 million for the years ended 2009, 2008 and 2007. The $1.4 million increase during fiscal 2009 was primarily due to a $3.0 million increase in net interest income, offset by an increase in the provision for loan losses of $2.2 million. The $972,000 decrease during fiscal 2008 was primarily due to two major items. First the Bank withdrew its investment in the AMF Ultra Short Mortgage Fund resulting in a pre-tax charge of $2.6 million, and the Bank also settled and transferred the obligations of its defined benefit pension Plans to Hartford Insurance Company resulting in a pre-tax charge of $1.5 million.

Revenue. Revenue amounted to $45.3 million, $41.8 million and $37.7 million for the years ended 2009, 2008 and 2007, respectively. The $3.5 million increase during fiscal 2009 was primarily due to a reduction in total interest expense of $4.4 million offset somewhat by a decrease in interest income on loans of $1.1 million. The $4.0 million increase during fiscal 2008 was primarily due to an increase in interest income on loans resulting from growth in the loan portfolio coupled with an increase in service charges on transaction accounts. Non-interest income remained relatively stable at $16.3 million in fiscal 2009 compared to $16.6 million in fiscal 2008.

Interest Income. Interest income amounted to $44.2 million, $45.6 million and $43.0 million for the years ended 2009, 2008 and 2007, respectively. The $1.4 million decrease during fiscal 2009 was primarily due to a decrease in interest rates offset by an increase in the average balance on earning assets. The $2.6 million increase during fiscal 2008 was primarily due to an increase in the average balance on earning assets, offset by a slight decrease in interest rates.

The average balance of loans increased during fiscal 2009 and fiscal 2008 by approximately $17.1 million, or 2.9% and $41.9 million, or 7.6%, respectively.

Interest Expense. Interest expense totaled $15.3 million, $19.7 million and $19.9 million for the years ended September 30, 2009, 2008 and 2007. The $4.4 million decrease from fiscal 2008 to fiscal 2009 was primarily due to lower interest rates offset by an increase in both deposit and FHLB advance average balances. The $124,000 decrease from fiscal 2007 to fiscal 2008 was primarily

due to lower interest rates along with good growth in lower rate deposit accounts. The average balance of deposits increased $6.6 million and $23.1 million in fiscal 2009 and 2008, respectively.

Net Interest Income. Net interest income increased $3.1 million to $28.9 million during the year ended September 30, 2009 primarily due to a decrease in interest expense on deposits and FHLB advances, offset by a decrease in interest income on loans. Net interest income increased $2.7 million to $25.9 million during the year ended September 30, 2008 primarily due to an increase in interest income on loans and to a decrease in interest expense on deposits, offset somewhat by an increase in interest expense on FHLB advances.

Provision for Loan Losses. The Bank provided $3.0 million, $825,000 and $605,000 to the allowance for loan losses for the years ended September 30, 2009, 2008 and 2007 respectively. The provision increased in fiscal 2009 due to continued loan growth along with an increase in qualitative adjustments necessary to address negative economic and credit quality trends. The provision increased in fiscal 2008 primarily due to growth in loan portfolio as well as changes to the qualitative and quantitative factors considered during the analysis of the allowance for loan losses. The allowance for loan losses was $6.8 million at September 30, 2009, $5.5 million at September 30, 2008, and $5.1 million at 2007 fiscal year end.

Management periodically estimates the likely level of losses to determine whether the allowance for loan losses is adequate to absorb probable losses inherent in the existing portfolio. Based on these estimates, an amount is charged or credited to the provision for loan losses and credited or charged to the allowance for loan losses in order to adjust the allowance to a level determined to adequately absorb probable inherent losses.

While the Bank maintains its allowance for losses at a level that it considers to be adequate to provide for existing losses, there can be no assurance that further additions will not be made to the loss allowances and that such losses will not exceed the estimated amounts. (See Note 1 to the Consolidated Financial Statements.)

Non-Interest Income. Non-interest income during the years ended September 30, 2009, 2008 and 2007 amounted to $15.9 million, $13.4 million and $14.7 million respectively. Non-interest income in fiscal 2008 and 2009 included charges for certain securities in the investment portfolio in the amount of $3.0 million and $1.0 million respectively. Non-interest income in fiscal 2009 included a gain of $559,000 on the sale of $26 million of conforming loans. (See Loans Receivable, Net) Excluding these charges, non-interest income remained relatively stable between fiscal 2008 and 2009. The increase between fiscal 2007 and 2008, excluding impairment charges, was primarily due to an increase in deposit related fees due to an increase in the number of deposit accounts.

Non-Interest Expense. Non-interest expense totaled $31.4 million; $30.7 million and $27.4 million during the years ended September 30, 2009, 2008 and 2007, respectively. The $0.6 million increase during fiscal 2009 was primarily due to an increase in deposit insurance premiums. The $3.3 million increase during fiscal 2008 was primarily due to compensation expense that included a $1.5 million charge for exiting the defined benefit pension plan.

The Bank is subject to the Louisiana Shares Tax, which amounted to an expense of $567,000, $666,000 and $535,000 in the fiscal years ended September 30, 2009, 2008 and 2007, respectively.

Gain (loss) on Sale of Securities. In the years ended September 30, 2009, 2008 and 2007, (losses) and gains on the sale of securities amounted to $(99,000), ($2,580,000) and $164,000, respectively. The loss recorded in 2009 resulted from the Company’s recording an impairment loss on an equity security for $175,000, offset by a gain on sale of equity securities of $76,000. The loss recorded in 2008 resulted from the Company’s withdrawal of a $16.1 million investment in a mortgage mutual fund that had continued to decline in value during the year as a result of the turmoil that existed in the mortgage markets in general. (See Note 3 of the Consolidated Financial Statements.)

Income Tax Expense. For the years ended September 30, 2009, 2008 and 2007, the Company incurred income tax expense of $3.3 million, $2.0 million and $3.2 million, respectively. There was an increase in the effective tax rate in 2009 due to higher pre-tax income and the benefit of tax credits were lower than in 2008. There was a decrease in the effective tax rate in 2008 due to lower pre-tax income and the benefit of certain tax credits related to tax incentives applied to the Company’s 2006 and 2007 income tax returns recorded in the 2008 financial statements. (See Note 10 of the Consolidated Financial Statements for further explanation.)

Liquidity and Capital Resources

The Bank's average liquidity ratio is based on deposits and was approximately 10.0% percent during September 2009. The Bank manages its average liquidity ratio to meet its funding needs, including: deposit outflows; disbursement of payments collected from borrowers for taxes and insurance; repayment of Federal Home Loan Bank advances and other borrowings; and loan principal disbursements. The Bank also monitors its liquidity position in accordance with its asset/liability management objectives.

In addition to funds provided from operations, the Bank's primary sources of funds are: savings deposits, principal repayments on loans and mortgage-backed securities, and matured or called investment securities. The Bank also borrows funds from the Federal Home Loan Bank of Dallas (the “FHLB”).

Scheduled loan repayments and maturing investment securities are a relatively predictable source of funds. However, savings deposit flows and prepayments on loans and mortgage-backed securities are significantly influenced by changes in market interest rates, economic conditions and competition. The Bank strives to manage the pricing of its deposits to maintain a balanced stream of cash flows commensurate with its loan commitments and other predictable funding needs.

The Bank usually maintains a portion of its cash on hand in interest-bearing demand deposits with the FHLB and other correspondent banks to meet immediate loan commitment and savings withdrawal funding requirements. When applicable, cash in excess of immediate funding needs is invested into longer-term investment and mortgage-backed securities, some of which may also qualify as liquid investments under current OTS regulations.

Funds available under existing credit facilities from the FHLB totaled $175.3 million. The Bank has total FHLB borrowings of $100.6 million, or 13.2% of the Bank’s assets. Approximately $10.6 million is due in the year ending September 30, 2010.

Management believes the Bank has sufficient resources available to meet its foreseeable funding requirements. At September 30, 2009, the Bank had outstanding loan commitments of $44.4 million, and certificates of deposit scheduled to mature within one year of $104.8 million, much of which management expects, based on past experience, will remain with the Bank upon maturity.

Regulations of the OTS require the Bank to meet or exceed three separate standards of capital adequacy. These regulations require financial institutions to have minimum tangible capital equal to 1.5 percent of total adjusted assets; minimum core capital equal to 4.0 percent of total adjusted assets; and risk-based capital equal to 8.0 percent of total risk-weighted assets. At September 30, 2009, the Bank exceeded all regulatory capital requirements. (See Note 18 to the Consolidated Financial Statements.)

Net Portfolio Value Analysis - Interest Rate Risk

The Bank is subject to interest rate risk to the degree that its interest-bearing liabilities, primarily deposits with short- and medium-term maturities, mature or re-price at different rates than our interest-earning assets. Although having liabilities that mature or re-price less frequently on average than assets will be beneficial in times of rising interest rates, such an asset/liability structure will result in lower net income during periods of declining interest rates, unless offset by other factors.

The Bank believes it is critical to manage the relationship between interest rates and the effect on its net portfolio value (“NPV”). This approach calculates the difference between the present value of expected cash flows from assets and the present value of expected cash flows from liabilities, as well as cash flows from off-balance sheet contracts. The Bank manages assets and liabilities within the context of the marketplace, regulatory limitations and within its limits on the amount of change in NPV which is acceptable given certain interest rate changes.

The OTS requires all regulated thrift institutions to calculate the estimated change in the institution’s NPV assuming instantaneous parallel shifts in the Treasury yield curve of 100 to 300 basis points either up or down in 100 basis point increments. The NPV is defined as the present value of expected cash flows from existing assets less the present value of expected cash flows from existing liabilities plus the present value of net expected cash inflows from existing off-balance sheet contracts.

The OTS provides an interest rate sensitivity report of NPV to all institutions that file with the OTS a Consolidated Maturity & Rate Schedule (“CMR”) as a part of the institution’s quarterly Thrift Financial Report. The OTS simulation model uses a discounted cash flow analysis and an option-based pricing approach to measuring the interest rate sensitivity of NPV. The OTS model estimates the economic value of each type of asset, liability, and off-balance sheet contract under the assumption that the Treasury yield curve shifts instantaneous and parallel up and down 100 to 300 basis points in 100 basis point increments. The OTS allows thrifts with under $1 billion in total assets to use the results of their interest rate sensitivity model, which is based on information provided by the institution, to estimate the sensitivity of NPV.

The OTS model utilizes an option-based pricing approach to estimate the sensitivity of mortgage loans. The most significant embedded option in these types of assets is the prepayment option of the borrowers. The OTS model uses various price indications and prepayment assumptions to estimate sensitivity of mortgage loans.

In the OTS model, the value of deposit accounts appears on the asset and liability side of the NPV analysis. In estimating the value of certificates of deposit accounts (“CD”), the liability portion of the CD is represented by the implied value when comparing the difference between the CD face rate and available wholesale CD rates. On the asset side of the NPV calculation, the value of the “customer relationship” due to the rollover of retail CD deposits represents an intangible asset in the NPV calculation.

Other deposit accounts such as NOW accounts, money market demand accounts, passbook accounts, and non-interest-bearing accounts also are included on the asset and liability side of the NPV calculation in the OTS model. These

accounts are valued at 100% of the respective account balances on the liability side. On the asset side of the analysis, the value of the “customer relationship” of the various types of deposit accounts is reflected as a deposit intangible.

The NPV sensitivity of borrowed funds is estimated by the OTS model based on a discounted cash flow approach.

The OTS uses, as a critical point, a change of plus or minus 200 basis points in order to set its “normal” institutional results and peer comparisons. A resulting change in NPV of more than 2% of the estimated market value of its assets will require the institution to deduct from its capital 50% of that excess change. The rules provide that the OTS will calculate the IRR component quarterly for each institution. The greater the change, positive or negative, in NPV, the more interest rate risk is assumed to exist with the institution. The following table lists the Bank’s latest percentage change in NPV assuming an immediate change of plus or minus 100, 200, and 300 basis points from the level of interest rates at September 30, 2009.

|

|

|

|

|

NPV as % of PV |

|

||||||||||

|

Change |

|

$ Amount |

|

$ Change(2) |

|

|

|

NPV |

|

|

|

||||

|

|

|

(Dollars in Thousands) |

|

|

|

||||||||||

|

+300 bp |

|

|

$ 95,701 |

|

$ |

-1,805 |

|

-2 |

% |

12.16 |

% |

+14 |

bp |

||

|

+200 bp |

|

|

98,413 |

|

|

906 |

|

+1 |

% |

12.35 |

% |

+33 |

bp |

||

|

+100 bp |

|

|

98,908 |

|

|

1,402 |

|

+1 |

% |

12.29 |

% |

+27 |

bp |

||

|

+50 bp |

|

|

98,246 |

|

|

740 |

|

+1 |

% |

12.16 |

% |

+14 |

bp |

||

|

0 bp |

|

|

97,507 |

|

|

|

|

|

|

12.02 |

% |

|

|

||

|

-50 bp |

|

|

94,519 |

|

|

-2,987 |

|

-3 |

% |

11.63 |

% |

-39 |

bp |

||

|

-100 bp |

|

|

91,245 |

|

|

-6,082 |

|

-6 |

% |

11.24 |

% |

-78 |

bp |

||

|

(1) |

The -200bp and -300bp scenarios are not shown due to low interest rate environment. |

|

(2) |

Represents the excess (deficiency) of the estimated NPV assuming the indicated change in interest rates minus the estimated NPV assuming no change in interest rates. |

|

(3) |

Calculated as the amount of change in the estimated NPV divided by the estimated NPV assuming no change in interest rates. |

|

(4) |

Calculated as the estimated NPV divided by average total assets. |

|

(5) |

Calculated as the excess (deficiency) of the NPV ratio assuming the indicated change in interest rates over the estimated NPV ratio assuming no change in interest rates. |

|

|

|

September 30, |

|

September 30, |

|

|

*** RISK MEASURES: +200 BP RATE SHOCK *** |

|

|

|

|

|

|

Pre-Shock NPV Ratio: NPV as % of PV of Assets |

|

12.02 |

% |

11.09 |

% |

|

Exposure Measure: Post-Shock NPV Ratio |

|

11.24 |

% |

9.94 |

% |

|

Sensitivity Measure: Decline in NPV Ratio |

|

78 |

bp |

115 |

bp |

|

*** CALCULATION OF CAPITAL COMPONENT *** |

|

|

|

|

|

|

Change in NPV as % of PV of Assets |

|

0.78 |

% |

1.15 |

% |

As the table shows, increases in interest rates would result in net decreases in the Bank’s NPV. The Bank’s NPV decreases by 0.9% if interest rates increase by 200 basis points. Certain shortcomings are inherent in the methodology used in the above table. Modeling changes in NPV requires the making of certain assumptions that may tend to oversimplify the manner in which actual yields and costs respond to changes in market interest rates. First, the models assume that the composition of the Bank’s interest sensitive assets and liabilities existing at the beginning of a period remains constant over the period being measured. Second, the models assume that a particular change in interest rates is reflected uniformly across the yield curve regardless of the duration to maturity or re-pricing of specific assets and liabilities. Accordingly, although the NPV measurements do provide an indication of the Bank’s interest rate risk exposure at a particular point in time, such measurements are not intended to provide a precise forecast of the effect of changes in market interest rates on the Bank’s net interest income.

In times of decreasing interest rates, the value of fixed-rate assets could increase in value and the lag in re-pricing of interest rate sensitive assets could be expected to have a positive effect on the Bank.

Contractual Obligations

The Company has various contractual obligations related to borrowings, deposits and operating lease payments. These obligations are outlined in Notes 6, 7 and 8 in the Consolidated Financial Statements of the Company.

Critical Accounting Policies

Certain critical accounting policies affect the more significant judgments and estimates used in the preparation of the consolidated financial statements. The Company’s most critical accounting policies are as follows:

Allowance for Loan Losses - The allowance for loan losses is a valuation allowance available for losses incurred on loans. Any losses are charged to the allowance for loan losses when the loss actually occurs or when a determination is made that a loss is probable to occur. Recoveries are credited to the allowance at the time of recovery.

Management estimates the likely level of losses to determine whether the allowance for loan losses is adequate to absorb losses inherent in the existing portfolio. Based on the estimates, an amount is charged to or recovered from the provision for loan losses and credited or debited to the allowance for loan losses in order to adjust the allowance to a level determined to be adequate to absorb such losses.

Management’s judgment as to the level of losses on existing loans involves the consideration of current and anticipated economic conditions and their potential effects on specific borrowers; an evaluation of the existing relationships among loans, known and inherent risks in the loan portfolio, and the present level of the allowance; results of examination of the loan portfolio by regulatory agencies; and management’s internal review of the loan portfolio. In determining the collectibility of certain loans, management also considers the fair value of any underlying collateral.

It should be understood that estimates of loan losses involve an exercise of judgment. During the fiscal year ending September 30, 2009, the company made changes to the allowance model. These changes included using a three year rolling average charge-off history instead of five years, switching to actual charge-off history instead of a blend with peer rates and increased the qualitative factors due to an overall negative economic environment and credit quality trends in the banks portfolio. While it is possible that in particular periods the Company may sustain losses, which are substantial relative to the allowance for loan losses, it is the judgment of management that the allowance for loan losses reflected in the consolidated balance sheets is adequate to absorb probable losses inherent in the existing loan portfolio.

Goodwill – Goodwill does not require amortization but is subject to at least an annual assessment for impairment unless interim events or circumstances make it more likely than not that an impairment loss has occurred. Impairment is defined at that amount by which the implied fair value of the goodwill is less than the goodwill’s carrying value. Impairment losses would be charged to operating expense. Goodwill is not deductible for income tax purposes.

Impact of Off-Balance Sheet Instruments

The Company has certain off-balance-sheet instruments in the form of contractual commitments to extend credit to customers. These legally binding commitments have set expiration dates and are at predetermined interest rates. The underwriting criteria for these commitments are the same as for loans in our loan portfolio. Collateral is also obtained, if necessary, based on the credit evaluation of each borrower. Although many of the commitments will expire unused, management believes that we have the necessary resources to fund these commitments. (See Note 16 in the accompanying Consolidated Financial Statements.)

MANAGEMENT’S REPORT ON INTERNAL CONTROL

OVER FINANCIAL REPORTING