Attached files

Exhibit 10.32

LEASE AGREEMENT

THIS AGREEMENT is made and entered into as of the 30 day of June, 2009, by and between EastGroup Properties, LP, a Delaware limited partnership (“Landlord”) and Leslie’s Poolmart, Inc., a Delaware corporation (“Tenant”).

WITNESSETH:

1. Premises. Landlord, in consideration of the payments to it by Tenant of the rents herein contained, while Tenant agrees to pay, and in consideration of the performance by Tenant of the covenants hereinafter provided, which Tenant agrees to fully and promptly perform, does hereby lease to Tenant approximately 30,300 square feet of space, hereinafter referred to as the “Premises,” as shown on the plan attached hereto as “Exhibit A” and incorporated herein by reference, located within Sunbelt Distribution Center II (the “Center”). The address of the Premises is 1260 LaQuinta Drive, Suite 400, Orlando, FL 32809. For purposes of calculating sums owed under this Lease, it is agreed that the Premises constitutes approximately 50% of the total leasable area within ¨ the Building, or x the Center in which it is located. Said percentage is hereinafter referred to as Tenant’s Share. If the size of the Premises, or Building/Center is for any reason adjusted, Tenant’s pro rata share shall be likewise adjusted accordingly.

2. Term. The term of this Lease shall be for a period of ninty-five (95) months beginning December 1, 2009 (the “Commencement Date”), and ending on October 31, 2017. This period (including any renewals), shall be referred to as the “Term”.

3. Rent. As “Rent” for the use and occupancy of the Premises, Tenant shall pay to Landlord, without demand, deduction or offset (except as expressly allowed in this Lease), as an independent covenant of all other covenants of this Lease, in lawful money of The United States of America, “Base Rent” as set forth in subparagraph (b) below, “Operating Expenses” (based on an initial estimated annual Operating Expense Factor of $42,723.00 described in Section 6, “Operating Expenses”), and State of Florida sales tax (“Sales Tax”) on all amounts due from Tenant to Landlord pursuant to this Lease, all sums payable in twelve (12) equal payments plus, in advance on the first day of each and every month.

With respect to rents, the parties also agree as follows:

(a) Tenant has deposited with Landlord simultaneously with Tenant’s execution of this Lease, the sum of $15,326.75 plus all applicable Sales Tax for a total of $16.322.99 which will be credited to Tenant for payment of the first month’s building operating expense and the second month’s Total Rent.

Rent Schedule: Base Rent shall be payable through the initial Term in accordance with the following schedule:

| Lease Month |

Base Rent Per SF |

Annual Base Rent* |

Monthly Base Rent * | ||||||

| 1 |

$ | 0.00 | N/A | $ | 0.00 | ||||

| 2-13 |

$ | 3.25 | $ | 98,475.00 | $ | 8,206.25 | |||

| 14 |

$ | 0.00 | N/A | $ | 0.00 | ||||

| 15-26 |

$ | 3.32 | $ | 100,596.00 | $ | 8,383.00 | |||

| 27 |

$ | 0.00 | N/A | $ | 0.00 | ||||

| 28-39 |

$ | 3.38 | $ | 102,414.00 | $ | 8,534.50 | |||

| 40 |

$ | 0.00 | N/A | $ | 0.00 | ||||

| 41-52 |

$ | 3.47 | $ | 105,141.00 | $ | 8,761.75 | |||

| 53 |

$ | 0.00 | N/A | $ | 0.00 | ||||

| 54-65 |

$ | 3.75 | $ | 113,625.00 | $ | 9,468.75 | |||

| 66-77 |

$ | 4.00 | $ | 121,200.00 | $ | 10,100.00 | |||

| 78-89 |

$ | 4.25 | $ | 128,775.00 | $ | 10,731.25 | |||

| 90-95 |

$ | 4.25 | $ | 64,387.50 | $ | 10,731.25 | |||

| * | Amounts do not include applicable Sales Tax and Operating Expenses to be paid by Tenant. |

(b) During Lease Month’s 1, 14, 27, 40, and 53 of the Term, Operating Expenses and sales taxes only will be paid.

(c) If the Commencement Date begins on a day other than the first day of the month, the second monthly installment of rent shall be adjusted and prorated so that Tenant shall only pay Rent for the actual number of days in the first month of said term, but for all other months Tenant shall pay the full monthly installment on the first day of each and every month.

(d) Rent shall be delivered by Tenant to Landlord at such place as Landlord may designate in writing and Rent shall be payable to EastGroup Properties - East Coast Lock Box- P.O.Box 534563, Atlanta, GA 30353.

(e) Tenant hereby agrees with Landlord that in the event that Rent is received after the fifth (5th) day of the month in which it is due, Tenant shall pay to Landlord a late charge equal to the lesser of (1) $200.00; or (2) five percent (5%) of the total sum due.

4. Additional Rent. In addition to Rent set forth herein, all other payments (if any) to be made by Tenant to Landlord shall be deemed to be and shall become additional rent hereunder, whether or not the same be designated as such; and shall be due and payable with the next succeeding installment of monthly Base Rent, together with Sales Tax thereon. Landlord shall have the same remedies for failure to pay the same as for a non-payment of Rents. Following the second (2nd) event of any returned check for any payment, Landlord may require that Tenant remit all payments thereafter either by Wire Transfer or Bank Official Check only. An administrative fee equal to $50.00 will be assessed for all dishonored checks.

5. Intentionally Omitted.

6. Operating Expenses. (a) Initially, the estimated “Operating Expense Factor” equals to $1.41 per square foot of the Premises, for the calendar year in which the Commencement Date occurs, to cover Tenant’s Share (see Section 1) of the projected Operating Expenses.

With respect to Operating Expenses, the parties agree to the following:

(i) The term “Operating Expenses” used in this Lease Agreement represents the total annualized cost of operating the Building/Center including, but is not limited to, Common Maintenance and Service Costs, Real Estate Taxes and Assessments, Insurance Premiums, accounting, property management fees and other reasonable costs associated with the management and operation of the Building/Center. Said term shall not include depreciation on any improvement, any capital expenses or improvements except all net expenses properly allocable for any capital improvement incurred which actually reduce or limit increases in Operating Expenses, which expenses shall be repaid in equal monthly installments together with interest at applicable rates over the useful capital life of the capital improvement not to exceed ten (10) years. Notwithstanding anything to the contrary contained herein, the Operating Expenses exclude (1) leasing costs, consulting fees, brokerage commissions, legal fees, vacancy costs, rent or other concessions, and/or refurbishment or improvement expenses which are incurred in connection with other tenants’ spaces or the enforcement and negotiation of leases; (2) to the extent not caused by the unique type and nature of Tenant’s operations and use of the Premises, the cost of compliance with laws, rules and regulations or orders of any governmental or quasi-governmental authority having jurisdiction over the Premises; (3) financing costs, debt service or ground lease payments for the Center; (4) acquisition costs or any depreciation of land and buildings of the Center or the common areas; (5) costs of repairing any portion of the Center due to defective construction; (6) costs, fees and compensation paid by or to Landlord for services in or to the Center, exceeding those charged by unaffiliated third parties on a competitive basis: (7) costs incurred because the Center or common areas violate any valid, applicable building code, regulation or law in effect and as interpreted by governmental authorities, including, without limitation, laws requiring sprinkler installation and requirements under the Americans With Disabilities Act of 1990, as may be amended, and regulations promulgated thereunder; (8) reserves maintained in connection with the Center; (9) any and all collection costs, including legal fees and/or bad debt losses or reserves therefor; (10) any otherwise permissible fees or costs to the extent in excess of prevailing and competitive rates; (11) costs incurred by Landlord to the extent that Landlord is reimbursed by insurance proceeds, governmental agencies or entities, or any tenant or other person (other than

2

reimbursement as part of Operating Expenses); (12) costs, including compensation paid to clerks, attendants or other persons, in connection with any commercial concession operated by Landlord, provided that if such costs relate to the operation of the parking areas, Landlord may include Landlord’s reasonable out-of-pocket costs thereof in Operating Expenses to the extent in excess of parking gross revenues; (13) advertising and promotional expenditures, and any acquisition or construction costs of signs in or on the Center identifying the owner of the Center; (14) costs arising from the negligence of Landlord or its contractors, agents or employees, including the payment of any claims or damages; (15) Landlord’s general corporate or partnership overhead and general administrative expenses; (16) costs arising from the presence of any hazardous materials in or about the Center, including the Premises; and (17) any costs or expenses resulting from Landlord’s violation of any agreement to which it is a party or any applicable law.

(ii) The term “Common Maintenance and Service Costs” shall include without limitation routine cleaning and maintenance of the exterior of the Premises to include periodic window cleaning; the cleaning, maintenance and sweeping of the parking lot and sidewalks; the care and maintenance of the landscaping and landscaped areas to include the retention pond areas, conduits, pumps and irrigation systems; common area lighting and other utility charges for utilities used in the common areas, if any; domestic and irrigation water, and sanitary sewer charges and assessments; rubbish collection, if any; painting; and any other costs customarily considered as common repair, maintenance and service costs.

(iii) The term “Real Estate Taxes and Assessments” shall include without limitation ad valorem and non ad valorem real and personal property taxes and assessments or any new and different taxes, and assessments levied or charged against the real property or personal property of the Center. All Sales Tax on rents and personal property taxes charged or levied against Tenant’s furniture, fixtures and equipment in the Premises shall be paid by Tenant when due.

(iv) The term “Insurance Premiums” shall include without limitation Landlord’s insurance as set forth in Section 9. In the event the cost of premiums on said fire and extended insurance increases due to the hazardous nature of the use and occupancy by Tenant of the Premises, then the entire increase in insurance cost shall be paid by Tenant in a lump sum within thirty (30) days following receipt of invoice from Landlord.

(b) On the first day of each calendar year falling after the Commencement Date throughout the Term, the Operating Expense Factor portion of the Rent set forth in Section 3 (and, as a result, the Rent) shall be adjusted to reflect Tenant’s Share of actual or estimated decreases or increases in Operating Expenses. Landlord shall provide the cost data upon which the determination of costs, and any decreases or increases, are based in a format it shall determine to be consistent with reasonable and customary business practice. In the event that actual Operating Expenses for a preceding period are less than the sum paid by Tenant under this provision, Landlord shall refund or credit such excess to the account of Tenant. If the sum collected is less than the actual Operating Expenses, Tenant shall reimburse Landlord for such variation upon invoice therefor accompanied by supporting data. The obligation to pay Tenant’s Share of Operating Expenses incurred during the Term shall survive the expiration or termination of this Lease.

(c) Tenant acknowledges that if the Building is part of a Center, the Center may include not only the Building but other buildings either already existing or to be constructed in the future. Tenant understands and agrees that, for the purposes of administering the provisions of this Section 6, so long as the Building is owned and/or managed in conjunction with other buildings, Operating Expenses and other costs reimbursable by Tenant may be paid, recorded and reported on a consolidated overall project basis, provided Tenant’s share of said costs shall be calculated by dividing the size of the Premises by the size of the overall project.

(d) Prior to the Commencement Date and each calendar year during the term, Landlord shall give Tenant written estimates (on a line item basis) of Tenant’s pro rata share of Operating Expenses for the next calendar year. Tenant shall pay such estimated amount to Landlord in equal monthly installments with Tenant’s payments of Rent hereunder. Within ninety (90) days after the end of each such calendar year, Landlord shall furnish Tenant a statement showing in reasonable detail the costs and expenses actually incurred by Landlord for the operation and maintenance of the common areas during such calendar year. Notwithstanding the foregoing, if Tenant has not received the statement described in the preceding sentence on or before December 31 of the year in which such statement is due, Landlord shall be deemed to have waived its right to collect such

3

actual amount from Tenant. Any deficiency in the payments made by Tenant shall be paid by Tenant to Landlord within thirty (30) days of receipt of demand therefor. Any surplus paid by Tenant during the preceding calendar year shall be applied against the next due monthly installments of Rent or, if at the end of the Term, shall be refunded to Tenant.

(e) Controllable Operating Expenses will not increase by more than six percent (6%) annually. Non controllable expenses are limited to Real Estate Taxes and Assessments, Building Insurance, and building common utilities and will not be capped.

(f) Tenant shall have the right to audit or inspect Landlord’s records (but not more than once in any lease year), with respect to operating expenses and real estate taxes, as well as any other additional rent payable by Tenant.

7. Construction. Tenant will be accepting the Premises as follows:

¨ “As Is”

¨ With the following improvements to be made by Landlord:

þ With improvements to be constructed in accordance with the attached Leasehold Improvement Addendum. The Commencement Date set forth herein is subject to the construction of tenant improvements, if any. Tenant acknowledges that neither Landlord nor its agents or employees have made any representations or warranties as to the suitability or fitness of the Premises for the conduct of Tenant’s business or for any other purpose, nor has Landlord or its agents or employees agreed to undertake any alterations or construct any tenant improvements to the Premises except as expressly provided in this Lease, if any.

8. Utilities. Tenant shall pay when due electric power consumed at the Premises, which shall be separately metered. Tenant shall reimburse Landlord for water and sewer charges as part of the “Operating Expense Factor” pursuant to Section 6; provided that Tenant shall receive a separate meter for water and sewer charges should another occupant of the Center be a heavy water user. Landlord reserves the right to install, at Landlord’s discretion, separate meters (or submeters) for any utility, and may further require Tenant to place service in Tenant’s name, whereupon Tenant shall pay any necessary deposits to the applicable utility company, and thereafter pay for such utilities directly. Tenant shall arrange and pay for trash collection services at the Premises.

9. Insurance. (a) Landlord shall arrange to insure the Building of which the Premises form a part against loss or damage to the Building/Center with coverage for perils as set forth under the “Causes of Loss-Special Form” or equivalent property insurance policy in an amount equal to the full insurable replacement cost of the Building/Center (excluding coverage of Tenant’s personal property and any alterations by Tenant) and such other insurance, including rent loss coverage, as Landlord may reasonably deem appropriate. Tenant, at its expense, shall keep in effect commercial general liability insurance, including blanket contractual liability insurance, covering Tenant’s use of the Property, with such coverages and limits of liability as Landlord may reasonably require, but not less than a $1,000,000 combined single limit with a $1,750,000 general aggregate limit (which general aggregate limit may be satisfied by an umbrella liability policy) for bodily injury or property damage. These policies shall name Landlord and any other associated or affiliated entity as their interests may appear and at Landlord’s request, any mortgagee(s), as additional insureds, shall be written on an “occurrence” basis and not on a “claims made” basis and shall be endorsed to provide that it is primary to and not contributory to any policies carried by Landlord and to provide that it shall not be cancelable or reduced without at least 30 days prior notice to Landlord. The insurer shall be authorized to issue such insurance, licensed to do business and admitted in the State of Florida and rated at least A VII in the most current edition of Best’s Insurance Reports. Tenant shall deliver to Landlord on or before the Commencement Date or any earlier date on which Tenant accesses the Premises, and at least 30 days prior to the date of each policy renewal, a certificate of insurance evidencing such coverage.

(b) Landlord and Tenant each waive, and release each other from and against, all claims for recovery against the other for any loss or damage to the property of such party arising out of fire or other casualty covered by a standard “Causes of Loss-Special Form” property insurance policy, even if such loss or damage shall be brought about by the fault or negligence of the other party or its employees, agents or contractors provided, however, such waiver by Landlord shall not be effective with respect to Tenant’s liability described in Sections 13 and 32 below unless such loss by Landlord is actually covered by insurance. This waiver and release is effective regardless of whether the releasing party actually maintains the insurance described above in this Section 9. Each party shall have its insurance company that issues its property coverage waive any rights of subrogation, and shall have the insurance company include an endorsement acknowledging this waiver, if necessary.

4

Tenant assumes all risk of damage of Tenant’s property within the Property, including any loss or damage caused by water leakage, fire, windstorm, explosion, theft, act of any other tenant, or other cause.

10. Use of Premises, Parking and Loading. Tenant shall use and occupy the Premises only for use as administrative office, showroom and warehouse purposes consistent with those commonly found in the 1-3 zoning in Orange County, Florida, and for no other purpose without Landlord’s prior written consent. Landlord hereby grants to Tenant, its employees, guests and invitees the right to use the off-street auto parking lot and truck loading areas on the site upon which the Building is situated. Tenant shall have the right to access the Premises 24 hours per day and 7 days per week. The auto parking lot shall be used by Tenant, its employees, guests and invitees, in common with other tenants of said Building, their employees, guests and invitees, and in common with Landlord and its employees, guests and invitees. If Landlord designates a portion of the parking lot for tenant and employee parking, Tenant and employees of Tenant shall use that portion of the lot. At all times in the absence of designated parking, Tenant, its employees and guests, shall use those parking areas closest to the Premises to the extent possible. The exterior truck loading and trailer parking areas immediate to the Premises are reserved for the exclusive use of Tenant and Tenant shall have the right to fence in such area and the gate shall be locked and controlled solely by Tenant. Tenant shall not use, block or otherwise interfere with the loading areas of other occupants in the Building or Center. At no time will outside storage be permitted at the property without the express written consent of Landlord.

11. Interruption of Utility Service. Landlord does not warrant that any utilities or public services will be free from interruption or defect. In the event of interruption of such services, the same shall not be deemed an eviction or disturbance of Tenant’s use and possession of the Premises nor render Landlord liable to Tenant for damage by abatement of Rent or otherwise.

12. Waiver of Claim; Indemnification. Tenant waives and releases all claims against Landlord, its agents, employees, and servants, in respect of, and they shall not be liable for damage to property sustained by Tenant or by any occupant of the Premises, occurring in or about the Building/Center, or the Premises resulting directly, or indirectly, from any existing or future condition, defect, matter or thing in the Premises, or the Building or any part of it, or from equipment or appurtenance therein, or from accident, or from any occurrence, act, negligence or omission of any tenant or occupant of the Building, or of any other person, specifically excluding Landlord. This paragraph shall apply also to damage caused as aforesaid or by flooding, sprinkling devices, air conditioning apparatus, water, frost, steam, excessive heat or cold, falling objects, broken glass, sewage, gas, odors or noise, or the bursting or leaking of pipes or plumbing fixtures and shall apply equally whether any such damage results from the act or circumstance, whether of a like or wholly different nature. If any damage to the Building results from any act or omission or negligence of Tenant, its agents or employees, Tenant shall, within ten (10) days following demand by Landlord, reimburse Landlord forthwith for all cost of such repairs and damages to the Building in excess of the amount, if any, paid to Landlord under insurance covering such damages. All property in the Building or in the Premises belonging to Tenant, its agents or employees, or to any occupant of the Premises, shall be there at the risk of Tenant only, and Landlord shall not be liable for damage thereto or theft, misappropriation, or loss thereof. Tenant agrees to protect, defend, hold Landlord harmless and to indemnify it against claims and liability for injuries to all persons and for the damages due to any act or omission of Tenant, its agents and employees, guests, customers and invitees (but only while such are inside the Premises), and against any expense, cost and attorney’s fees incurred in connection with any claim for such loss or damage, including costs and attorney’s fees on appeal.

13. Care of Premises. (a) Tenant shall, throughout the Term, take good care of the Premises and all fixtures, appurtenances, doors and windows, locks, walls, ceilings, flooring and mechanical and plumbing equipment located therein and expressly serving the Premises, excepting that which may be covered by applicable warranty, and, at its sole cost and expense, make all non-structural repairs thereto and perform maintenance thereon as and when needed to preserve them in good working order and condition, reasonable wear and tear from use and damage from the elements, fire or other casualty excepted. Notwithstanding the foregoing, all damage or injury to the Premises or to any other part of the Building, or to its fixtures, equipment and appurtenances, whether requiring structural or non-structural repairs, caused by or resulting from carelessness, omission, neglect or conduct of Tenant, its servants, employees or licensees, shall be repaired by Tenant at its sole expense to the satisfaction of Landlord reasonably exercised. Tenant shall also be responsible for any repairs to the Premises or to any other part of the Building, or to its fixtures, equipment and appurtenances, whether requiring structural or non-structural repairs, directly attributable to Tenant’s chemicals stored on site. Tenant shall replace or repair, as needed, all lamps, bulbs, ballasts and other lighting fixtures and apparatus. Tenant shall also repair all damage to the Building and the

5

Premises caused by the moving of Tenant’s fixtures, furniture or equipment. All the aforesaid repairs shall be of quality or class equal to the original work or construction. If Tenant fails after thirty (30) days’ notice to proceed with due diligence to make repairs required to be made by it, the same may be made by Landlord at the expense of Tenant. Tenant shall give Landlord prompt notice of any defective condition in the Premises which Landlord is required to repair or replace. Landlord shall remedy the condition with due diligence but at the expense of Tenant if repairs are necessitated by damage or injury attributable to Tenant, Tenant’s servants, agents, employees, invitees, or licensees as aforesaid. All repair work and/or modifications made to the Premises must be made by licensed and bonded contractor(s) approved by Landlord.

(b) As of the Commencement Date, the heating, ventilating and air conditioning system(s) (“HVAC”) serving the Premises shall be in good working order. Thereafter, Tenant shall be responsible for the cost of all maintenance, repair and replacement thereof. Tenant shall, within thirty (30) days of occupancy, contract with a licensed HVAC maintenance company to maintain the system in proper working order with semi-annual inspections and maintenance services. Upon execution and renewal, Tenant agrees to supply a copy of the maintenance agreement to Landlord and shall at all times during the term of the Lease keep in full force such HVAC maintenance agreement. If Tenant fails to enter into a maintenance agreement as herein provided and such failure continues for thirty (30) days after Tenant’s receipt of notice of such failure, Landlord, at Landlord’s option, may elect to enter into a service contract and Tenant shall pay the cost thereof.

(c) Landlord agrees that during the Term it will keep the exterior and structural parts of the Building in good condition and repair, and that it will make such repairs promptly as they become necessary. If Tenant becomes aware of any condition that is Landlord’s responsibility to repair, Tenant shall promptly notify Landlord of the condition. Exterior parts of the Building shall be deemed to include exterior walls, foundations, pavement, roof replacement, gutters, downspouts, and plumbing which is a part of the structure or foundation. Landlord shall make such interior replacements as are necessitated by building equipment failure and repairs and replacements necessitated by fire or perils covered by extended coverage insurance for which damage or loss insurance is carried by Landlord and for which insurance proceeds are recovered, including interior reconstruction and/or redecorating necessitated by such fire or other perils.

14. Compliance with Laws and Regulations.

(a) Tenant shall comply with all federal, state, county and city laws, ordinances, rules and regulations affecting or respecting the use or occupancy of the Premises by Tenant or the business at any time thereon transacted by Tenant, and Tenant shall comply with all reasonable and non-discriminatory rules which may be hereafter adopted by Landlord for the protection, welfare and orderly management of the Building and its tenants or occupants. Landlord shall maintain the Center in full compliance with all codes, including but not limited to the Americans With Disabilities Act, provided, however, that Tenant shall be responsible for the costs of such compliance if necessitated by the Tenant’s actions or use of the Premises.

(b) Patriot Act. Each party hereby represents, warrants and certifies that: (i) neither it nor its officers, directors, or controlling owners is acting, directly or indirectly, for or on behalf of any person, group, entity, or nation named by any Executive Order, the United States Department of Justice, or the United States Treasury Department as a terrorist, “Specifically Designated National or Blocked Person,” or other banned or blocked person, entity, nation, or transaction pursuant to any law, order, rule or regulation that is enforced or administered by the Office of Foreign Assets Control (“SDN”); (ii) neither it nor its officers, directors or controlling owners is engaged in this transaction, directly or indirectly on behalf of, or instigating or facilitating this transaction, directly or indirectly on behalf of, any such person, group, entity, or nation; and (iii) neither it nor its officers, directors or controlling owners is in violation of Presidential Executive Order 13224, the USA PATRIOT Act, (Public Law 107-56), the Bank Secrecy Act, the Money Laundering Control Act or any regulations promulgated pursuant thereto. Each party hereby agrees to defend, indemnify and hold harmless the other party from and against any and all claims, damages, losses, risks, liabilities and expenses (including reasonable attorneys’ fees and costs) arising from or related to any breach of the foregoing representations, warranties and certifications by the indemnifying party. The provisions of this Paragraph shall survive the expiration or earlier termination of this Lease.

15. Holding Over. Tenant shall have the right to hold over beyond the expiration of either the primary or extended lease term for up to three (3) months without any increase above the rent paid during the last month of the proceeding term, provided Landlord is given a prior six (6) month written notice. If Tenant does not notify Landlord of Tenant’s intention to holdover or after the three (3) month holdover period, Tenant has no right to remain in possession of all or any part of the Premises after

6

the expiration of the Term or hold over period. If Tenant nevertheless remains in possession of all or any part of the Premises after the expiration of the Term or holdover period: (a) such tenancy will be deemed to be a periodic tenancy at sufferance from month-to-month only; (b) such tenancy will not constitute a renewal or extension of this Lease for any further term; and (c) such tenancy may be terminated by Landlord upon the later of thirty (30) days’ prior written notice or the earliest date otherwise permitted by law. Such month-to-month tenancy will be subject to every other term, condition, and covenant contained in this Lease, except for rights to renew and expand. If Tenant holds over in the Premises after receipt of such termination notice, Rent following the termination date will be increased to an amount equal to 200% of the Rent for the last month of occupancy, and any other sums due under this Lease will be payable in the amount and at the times specified in this Lease. In addition to such payment of Rent and other amounts as set forth in the previous sentence, Tenant shall also be liable to Landlord for any losses sustained by Landlord or claims by third parties arising out of and in connection with the holding over of the Premises by Tenant.

16. Signs. Subject to Landlord’s approval which will not be unreasonably withheld, Tenant may have signs installed with Tenant’s name and logo on an exterior front wall facing east and the exterior side wall facing south. Tenant shall not install or locate signs in the windows and doors of the Premises or any other part of the Building or grounds without first securing Landlord’s written consent, which consent shall not be unreasonably withheld. Any signs installed by Tenant with Landlord’s permission shall be at the sole cost of Tenant and maintained by Tenant in good repair and shall be removed and any building or grounds damaged there from restored by Tenant at the expiration or earlier termination of this Lease at Tenant’s expense.

17. Quiet Enjoyment; Imposition of “Reasonableness” Standard. Tenant, upon paying the rents and keeping and performing the covenants of this Lease to be performed by Tenant, shall peacefully and quietly hold, occupy, and enjoy the Premises during the Term without any hindrance or molestation by Landlord or any persons lawfully claiming under Landlord. Wherever the consent or approval of either party is required herein, it is understood and agreed that such consent or approval may not, unless expressly stated otherwise in this Lease, be unreasonably withheld or delayed. If either party withholds any consent or approval, such party shall on written request deliver to the other party a written statement giving the reasons therefore. A party’s sole remedy if the other party unreasonably withholds or delays consent or approval shall be an action for specific performance, and such party shall not be liable for damages. Whenever this Lease specifies that either party has the right of consent, said consent shall be effective only if in writing and signed by the consenting party.

18. Waste; Disturbance. Tenant shall not commit nor suffer any waste upon the Premises nor cause nor allow any nuisance, odor, noise, vibration or other act or thing which does or may disturb any other tenant in the Building/Center containing the Premises or any other building in the Center, including without limitation the parking, loading and landscaped areas. Tenant shall conduct its business and control its employees, agents, contractors, invitees and visitors in such manner as not to create any nuisance, or interfere with, annoy or disturb any other tenant or Landlord or the operation of the Building.

19. Assignment and Subletting. Tenant shall not assign this Lease nor sublet all or any part of the Premises, except to an affiliated entity of common ownership and business (“Affiliate”), without first securing Landlord’s written consent, which consent shall not be unreasonably withheld. In the event of an assignment or subletting, the assignee and/or subtenant shall first assume in writing all of the obligations of Tenant under this Lease and Tenant shall, for the full Term, continue to be jointly and severally liable with such assignee or subtenant for the payment of rents and the performance of all obligations required of Tenant under this Lease. Tenant hereby acknowledges that the use to which the Premises are put and the compatibility of any occupant of the Premises with other tenants, and the use, creditworthiness, and ability to pay rent when due are of prime importance and significance to Landlord in the operation and maintenance of the Building in which the Premises are located. The consent by Landlord to an assignment or sublease will not be construed to relieve Tenant from obtaining Landlord’s prior written consent in writing to any further assignment or sublease. No permitted subtenant may assign or encumber its sublease or further sublease all or any portion of its subleased space, or otherwise permit the subleased space or any part of its subleased space to be used or occupied by others, without Landlord’s prior written consent in each instance. Acceptance of payments from a person or entity other than Tenant shall not constitute a consent to the assignment or subletting of the Premises. If Landlord consents to a proposed assignment or sublease, then Landlord will have the right to require Tenant to pay to Landlord a sum equal to (a) any Rent or other consideration paid to Tenant by any proposed transferee that is in excess of the Rent allocable to the transferred space then being paid by Tenant to Landlord pursuant to this Lease; (b) any other profit or gain realized by Tenant from any such sublease or assignment: and (c) Landlord’s reasonable attorneys’ fees, consultant fees, and costs incurred in connection with negotiation, review, and processing of the transfer, not to exceed

7

$1,000.00. All such sums payable will be payable to Landlord at the time the next payment of Base Rent is due. Anything to the contrary in this Lease notwithstanding, except when the assignment or subletting is proposed to an Affiliate, at any time within twenty (20) days after Landlord’s receipt of all (but not less than all) of the information and documents reasonably requested by Landlord, Landlord may, at its option by written notice to Tenant, elect to: (a) sublease the Premises or the portion thereof proposed to be sublet by Tenant upon the same terms as those offered to the proposed subtenant; (b) take an assignment of the Lease upon the same terms as those offered to the proposed assignee; or (c) terminate the Lease in its entirety or as to the portion of the Premises proposed to be assigned or sublet, with a proportionate adjustment in the Rent payable hereunder if the Lease is terminated as to less than all of the Premises. If Landlord does not exercise any of the options described in the preceding sentence, then, during the above-described twenty (20) business day period, Landlord shall either consent or deny its consent to the proposed assignment or subletting.

Landlord shall have the right to assign or transfer, in whole or in part every feature of its rights and obligations hereunder and the Premises provided such assignee or transferee recognizes and agrees to be bound by the terms of this Lease. Such assignments or transfers may be made to a corporation, trust, trust company, individual or group of individuals, and howsoever made “shall be in all things respected and recognized by Tenant.

20. Fire or Other Casualty. In the event the Premises shall be destroyed or so damaged or injured by fire or other casualty during the Term, whereby the same shall be rendered untenantable, then Landlord shall have the right to render the Premises tenantable by repairs within two hundred twenty (220) days therefrom and this Lease shall not terminate. If the Premises can not be rendered tenantable within said time, it shall be optional by either party hereto to cancel this Lease, and in the event of such cancellation, the Rent shall be paid only to the date of such fire or casualty. The cancellation herein mentioned shall be evidenced in writing. During any time that the Premises remain untenantable due to causes set forth in this paragraph, the rents due hereunder or a just and fair proportion thereof shall abate. Notwithstanding the provisions of this Section 20, if the Premises or the Building are damaged by uninsured casualty, if the proceeds of insurance are insufficient to pay for the repair of any damage to the Premises or the Building, or if all or any portion of the proceeds of insurance are retained by Landlord’s mortgagee, Landlord will have the option to repair such damage or cancel this Lease as of the date of such casualty by written notice to Tenant on or before sixty (60) days following the casualty.

21. Eminent Domain. If the whole of the Premises shall be taken by any public authority under the power of eminent domain, or if so much of the Building or grounds shall be taken by any such authority under the power of eminent domain so that Tenant cannot continue to operate its business in the Premises, then the Term shall cease as of the day possession is taken by such public authority and Rents shall be paid up to that day with proportionate refund by Landlord of any such Rents as may have been paid in advance or deposited as security. The amount awarded for any taking under the power of eminent domain shall belong entirely to and be the property of Landlord. Nothing herein shall limit Tenant’s ability to make an independent claim for damages or awards to the extent Landlord’s claims for damages are not affected.

22. No Waiver or Accord and Satisfaction.

(a) Neither the waiver by Landlord of any agreement, breach, condition, default, provision, requirement, or term contained in this Lease nor the acquiescence of Landlord to any violation of any agreement, breach, condition, default, provision, requirement, or term contained in this Lease, shall be deemed to be a waiver of any subsequent breach of the same or any other agreement, condition, provision, requirement, or term contained in this Lease, nor constitute a course of dealing regardless of the number of times Landlord may choose to make such a waiver or acquiesce to any violation of any agreement, breach, condition, default, provision, requirement, or term contained in this Lease; nor will any custom or practice that may come to exist between the parties in the administration of the terms of this Lease be construed to waive or to lessen the right of Landlord to insist upon the performance by Tenant in strict accordance with the terms of this Lease.

(b) Acceptance by Landlord of Rent or other amounts due, in whole or in part, following a breach or default will not be deemed to be a waiver of any existing or preceding breach by Tenant of any agreement, condition, provision, requirement, or term of this Lease, regardless of Landlord’s knowledge of such preceding breach at the time of acceptance of such Rent or other payment. However, payment of the full amount due, including any late fees, administrative charges and other amounts due, shall constitute a waiver of default for the failure of Tenant to pay the particular Rent or other payment so accepted. The breach or default shall nevertheless remain unwaived for purposes of Section 28(f).

8

(c) No payment by Tenant or receipt by Landlord of a lesser amount than the full amount of any installment or payment of Rent or other amount due, shall be deemed to be anything other than a payment on account of the amount due, and no endorsement or statement on any check or payment of Rent or related to it shall be deemed an accord and satisfaction. Landlord may accept such check or payment without prejudice to Landlord’s right to recover the balance of such installment or payment of Rent, or pursue any other remedies available to Landlord.

23. Notices. All notices required under this Lease to be given to Tenant shall be given to it at 3925 East Broadway, Suite 100, Phoenix, AZ 85040 Attn: Real Estate Department, or at such other place as Tenant may designate in writing. Any such notice to be given to Landlord under this Lease shall be given to it at EastGroup Properties, 2966 Commerce Park Drive, Suite 450, Orlando, FL 32819, or at such other place as Landlord may designate in writing. All notices shall be in writing, require a receipt, and shall be sent by certified mail, postage prepaid, or by telecopy facsimile transmission, or by personal delivery, or by commercial courier or overnight delivery service. Notices shall be deemed to have been given (i) in the case of mailing, when postmarked, (ii) in the case of telecopy transmission, when received as evidenced by written transmission report, or (iii) in the case of hand delivery or delivery by commercial courier, when delivered or refused.

24. Subordination. This Lease is subject and subordinate to all mortgages which may now or hereafter affect the Premises or the Building of which it forms a part, and to all renewals, modifications, consolidations, replacements and extensions thereof. Landlord will make commercially reasonable efforts to provide Tenant with a Subordination and Non-Disturbance Agreement from any mortgage holders of Landlord. The foregoing notwithstanding this clause shall be self-operative and no further instrument of subordination shall be required.

25. Fixtures and Alterations. Tenant shall not, without Landlord’s prior written consent, make additions costing in excess of $20,000.00 to the Premises or which affect the structure thereof, nor permit any annoying sound device, overload any floor, or deface the Premises. Additionally, at the end of the Term, the Tenant will (i) remove all trade fixtures and personal property and repair any damage caused by such removal at the end of the Lease Term; and (ii) remove all curbing and containment installations that are specific to the Tenant’s use at the end of the Term.

26. Redelivery of Premises. Tenant shall, on the expiration of this Lease, deliver up the Premises in good order and condition, reasonable use and ordinary wear and tear thereof and damage by fire or other unavoidable casualty, condemnation excepted. Additionally, Tenant shall promptly surrender all keys to the Premises to Landlord.

27. Examination and Exhibiting of Premises. Landlord or its duly authorized agent shall have the right to enter the Premises at all reasonable times during Tenant’s normal business hours to examine the condition of and to make repairs to the Premises or the Building. Within six (6) months prior to the date of the expiration of the Lease, Landlord or its authorized agent shall have the right to enter the Premises at all reasonable times during Tenant’s normal business hours for the purpose of exhibiting the same to prospective tenants.

28. Events of Default. Any of the following events or occurrences shall constitute a breach of this Lease by Tenant and shall constitute and “Event of Default” hereunder:

(a) The failure of Tenant to pay any Rents or other amounts due under this Lease, within five (5) days after receipt of notice of such failure, provided, however, Landlord shall not be required to give such notice more than two (2) times in any calendar year.

(b) The failure of Tenant to observe or perform any other covenant, agreement, condition or provision of the

Lease within thirty (30) days after receipt of such failure.

(c) If Tenant becomes insolvent or admits in writing its inability to pay its debts as they mature, or makes an assignment for the benefit of creditors, or applies or consents to the appointment of a trustee or receiver for Tenant or for a major part of its property.

9

(d) The appointment of a trustee or a receiver to take possession of all or substantially all of Tenant’s property, or the attachment, execution or other judicial seizure of all or substantially all of Tenant’s assets located at the Premises, unless such appointment, attachment, execution or seizure is discharged within thirty (30) calendar days after the appointment, attachment, execution or seizure.

(e) The institution of bankruptcy, reorganization, arrangement, insolvency or liquidation proceedings, or any other proceedings for relief under any bankruptcy or insolvency law or any other similar law for the relief of debtors, by or against Tenant, and if instituted against Tenant, the same are not dismissed within thirty (30) calendar days after the institution of such proceedings.

Any notice periods provided for under this Section 28 shall run concurrently with any statutory notice periods and any notice given hereunder may be given simultaneously with or incorporated into any such statutory notice.

29. Landlord’s Remedies. On the occurrence of any such Event of Default, Landlord shall, in addition to any other rights or remedies available to Landlord under this Lease and under the laws of the State of Florida, have the following rights and remedies:

(a) Re-Entry Without Termination. Landlord may re-enter the Premises without terminating this Lease, and remove all persons and property from the Premises, and relet the Premises or any part thereof for the account of Tenant, for such time (which may be for a term extending beyond the Term) and upon such terms as Landlord in Landlord’s sole discretion shall determine, and Landlord shall not be required to accept any Tenant offered by Tenant or to observe any instructions given by Tenant relative to such reletting. In the event of any such reletting, Landlord may make repairs, alterations and additions in or to the Premises and redecorate the same to the extent deemed necessary or desirable by Landlord and in connection therewith change the locks to the Premises, and Tenant shall upon demand pay the cost of putting the Premises into the condition required for redelivery as stated in Section 26 above, together with Landlord’s expenses of reletting. Landlord may collect the Rent from any such reletting and apply the same first to the payment of the expenses of re-entry, redecoration, repairs and alterations and the expenses of reletting and second to the payment of Rental herein provided to be paid by Tenant, and any excess or residue shall operate only as an offsetting credit against the amount of Rental as the same thereafter becomes due and payable hereunder. No such re-entry or repossession, repairs, alterations and additions or reletting shall be construed as an eviction or ouster of Tenant or as an election on Landlord’s part to terminate this Lease unless a written notice of such intention be given to Tenant, nor shall the same operate to release Tenant in whole or in part from any of Tenant’s obligations hereunder, and Landlord may, at any time and, from time to time, sue and recover judgment for any deficiencies from time to time remaining after the application from time to time of the proceeds of any such reletting.

(b) Acceleration. On the occurrence of any such Event of Default, Landlord may declare the entire amount of Rent and any other sums or charges which would become due and payable from Tenant to Landlord during the remainder of the Term to be due and payable immediately, in which event, Tenant agrees to pay the sum at once, together with all Rent, including any other sum theretofore due; provided, however, that such payment shall not constitute a penalty or forfeiture or liquidated damages but shall merely constitute payment in advance of the Rent for the remainder of the Term.

(c) Other Enforcement. Landlord may enforce the provisions of this Lease and may enforce and protect the rights of Landlord hereunder by a suit or suits in equity or at law for specific performance of any covenant or agreement contained herein, or for the enforcement of any other legal or equitable remedy, including recovery of all monies due or to become due from Tenant under any of the provisions of this Lease.

(d) Remedies Cumulative. The rights, privileges, elections and remedies of Landlord under this Lease shall be cumulative, and Landlord shall have the right to exercise such remedies at any time and from time to time singularly or in combination. No termination of this Lease (whether upon an Event of Default or otherwise) shall be deemed to limit or negate Landlord’s rights hereunder to indemnification from Tenant (or Tenant’s insurance carriers) for any claim or liability asserted against or imposed upon Landlord, whether before or after the termination of this Lease, which is directly or indirectly based upon death, personal injury, property damage or other matters occurring prior to the termination hereof.

10

(e) Attorneys’ Fees and Collection Charges. In the event of any legal action or proceeding is brought by either party to enforce this Lease, the non-prevailing party shall pay all expenses of the prevailing party incurred in connection with such action or proceeding, including court costs and reasonable attorneys’ fees at or before the trial level and in any appellate or bankruptcy proceeding.

30. Construction Liens. The interest of Landlord in the Premises shall not be subject in any way to any liens, including but not limited to real estate sales commission liens and construction liens for improvements to or other work performed with respect to the Premises by or on behalf of Tenant. Tenant shall have no power or authority to create any lien or permit any lien to attach to the present estate, reversion, or other estate of Landlord (or the interest of any ground Landlord) in the Premises, Building or in the Project and all mechanics, materialmen, contractors, artisans, and other parties contracting with Tenant or its representatives or privies with respect to the Premises or any part of the Premises are hereby charged with notice that they must look to Tenant to secure payment of any bill for work done or material furnished or for any other purpose during the Term. The foregoing provisions are made with express reference to Section 713.10, Florida Statutes (1995). Notwithstanding the foregoing provisions, Tenant, at its expense, shall cause any lien filed against the Premises, Building or the Project for work or materials claimed to have been furnished to Tenant to be discharged of record or properly transferred to a bond pursuant to Section 713.24, Florida Statutes (1995), within ten (10) days after notice thereof to Tenant. Further, Tenant agrees to indemnify, protect, defend, and save Landlord harmless from and against any damage or loss, including reasonable attorneys’ fees, incurred by Landlord as a result of any such lien. Tenant shall notify every contractor making improvements to the Premises that the interest of Landlord in the Premises shall not be subject to liens for improvements to or other work performed with respect to the Premises by or on behalf of Tenant. Tenant shall execute, acknowledge, and deliver without charge a short form of lease or notice in recordable form containing a confirmation that the interest of Landlord in the Premises and the Building shall not be subject to liens for improvements or other work performed with respect to the Premises by or on behalf of Tenant. If such a short form of lease or notice is executed, it shall expressly provide that it shall be of no further force or effect after the last day of the Term or on the filing by Landlord of an affidavit that the Term has expired or the Lease has been terminated or that Tenant’s right to possession of the Premises has been terminated.

31. Estoppel Certificate. Tenant and Landlord, upon request, one from the other, shall give or exchange with, one with the other, estoppel certificates which shall confirm to others that this Lease is in full force and effect, that, to the actual knowledge of such party, neither party is in default and/or such other information regarding this Lease as may be reasonably appropriate and factual.

32. Hazardous Material. To the best of Landlord’s knowledge, there are no Hazardous Material problems in the Center. Throughout the term of this Lease, Tenant shall prevent the presence, use, generation, release, discharge, storage, disposal, or transportation of any Hazardous Materials (as hereinafter defined) on, under, in, above, to, or from the Premises except for activities which are part of the ordinary course of Tenant’s business and are conducted in strict compliance with all applicable federal, state, and local laws, rules, regulations, and orders. For purposes of this provision, the term “Hazardous Materials” shall mean and refer to any wastes, materials, or other substances of any kind or character that are or become regulated as hazardous or toxic waste or substances, or which require special handling or treatment, under any applicable local, state, or federal law, rule, regulation, or order. Tenant shall protect, defend, indemnify, and hold harmless from and against (a) any loss, cost, expense, claim, or liability arising out of any investigation, monitoring, clean-up, containment, removal, storage, or restoration work (herein referred to as “Remedial Work”) required by, or incurred by Landlord or any other person or party in a reasonable belief that such Remedial Work is required by any applicable federal, state or local law, rule, regulation or order, or by any governmental agency, authority, or political subdivision having jurisdiction over the Premises and caused by the action of Tenant, and (b) any claims of third parties for loss, injury, expense, or damage arising out of the presence, release, or discharge of any Hazardous Materials on, under, in, above, to, or from the Premises by Tenant. In the event any Remedial Work is so required under any applicable federal, state, or local law, rule, regulation or order due to the action of Tenant, Tenant shall promptly perform or cause to be performed such Remedial Work in compliance with such law, rule, regulation, or order. In the event Tenant shall fail to commence the Remedial Work required of Tenant as stated previously in a timely fashion, or shall fail to prosecute diligently the Remedial Work required of Tenant as stated previously to completion, such failure shall constitute an event of default on the part of Tenant under the terms of this Lease, and Landlord, in addition to any other rights or remedies afforded it hereunder, may, but shall not be obligated to, cause the Remedial Work to be performed, and Tenant shall promptly reimburse Landlord for the cost and expense thereof upon demand.

11

33. Intentionally Omitted.

34. Landlord’s Lien. Landlord acknowledges that Tenant has previously granted to its lending institution (which, together with its successors and assigns, are collectively referred to as “Bank”), a lien on, and security interest in, all of Tenant’s assets. Landlord agrees that Bank’s (and its successor’s and assign’s) liens are, and shall be during the existence of this Lease, and without the requirement of any other written document evidencing such agreement, first and superior to any liens or claims, if any, Landlord may have against Tenant for payment of rent or otherwise. Landlord additionally agrees to execute and deliver to Bank, its successors and assigns, a form of subordination agreement reasonably requested by the Bank to confirm the agreements contained herein.

35. Miscellaneous.

(a) All approvals required of and between Landlord and Tenant under the provisions of this Agreement shall be in writing and shall not be unreasonably withheld or delayed unless otherwise expressly provided.

(b) It is understood and agreed that in the event any provision of this Lease shall be adjudged, decreed, held or ruled to be invalid, such portion shall be deemed severable, and it shall not invalidate or impair the agreement as a whole or any other provision of the agreement.

(c) This Lease and all provisions, covenants and conditions thereof shall be binding upon and inure to the benefit of the heirs, legal representatives, and successors, and assigns of the parties hereto, except that no person, firm, corporation nor court officer holding under or through Tenant in violation of any of the terms, provisions or conditions of this Lease, shall have any right, interest or equity in or to this Lease, the terms of this Lease or the Premises.

(d) Landlord shall have the right, at any time without liability to Tenant to make, at Landlord’s own expense, repairs, alterations, additions and improvements, structural or otherwise, in or to the Premises, the Building or any part thereof, and to perform any acts related to the safety, protection and preservation thereof, and during such operations to take into and through the Premises or any part of the Building all material and equipment required and to close or temporarily suspend operation of entrances, doors, corridors or other facilities, provided that Landlord shall cause as little inconvenience or annoyance to Tenant as is reasonably necessary in the circumstances, and shall not do any act which permanently reduces the size of the Premises. Landlord may do any such work during ordinary business hours and Tenant shall pay Landlord for overtime and other expenses incurred if such work is done during other hours at Tenant’s request.

(e) Radon is a naturally occurring radioactive gas that, when it has accumulated in a building in sufficient quantities may present health risks to persons who are exposed to it over time. Levels of radon that exceed federal and state guidelines have been found in buildings in Florida. Additional information regarding radon and radon testing may be obtained from your county public health unit, pursuant to Section 404.056(8), Florida Statutes.

(f) This Lease and the addenda attached hereto constitute the entire agreement between the parties and supersedes all prior agreements. No waiver, modifications, additions or addenda to this Lease shall be valid unless in writing and signed by both Landlord and Tenant.

(g) This Lease shall be governed by and construed in accordance with the laws of the State of Florida.

(h) Time is of the essence of each and every provision of this Lease.

(i) No Offer: This Lease is submitted on the understanding that it will not be considered an offer and will not bind any party in any way until both parties have duly executed the Lease.

12

(j) No Construction Against Drafting Party: Landlord and Tenant acknowledge that each of them and their counsel have had an opportunity to review this Lease and that this Lease will not be construed against Landlord merely because Landlord has prepared it. This Lease is to be construed in such a manner as to give effect to the provisions herein.

(k) No Recording of Lease: This Lease MUST NOT BE RECORDED in any official Public Records, without Landlord’s written consent, which consent may be arbitrarily withheld. Tenant’s recording this Lease or any memorandum or short form of it will be void and shall constitute a default under this Lease.

(l) Waiver of jury trial. Landlord and Tenant by this subparagraph waive trial by jury in any action, proceeding, or counterclaim brought by either of the parties to this Lease against the other on any matters whatsoever arising out of or in any way connected with this Lease and other documents related to it or arising from it, the relationship of landlord and tenant, Tenant’s use or occupancy of the premises, or any other claims (including without limitation claims for personal injury or property damage), and any emergency statutory or any other statutory remedy. Landlord and Tenant are each entering into this waiver as they desire to avoid delays in the resolution of disputes arising out of the above referenced documents and their landlord and tenant relationship.

(m) Warranty of Authority: Landlord and Tenant and the party(ies) executing this Lease on behalf of Landlord and Tenant represent and warrant that such party(ies) is/are authorized to do so by requisite action of the board of directors or partners, as the case may be.

(n) Notwithstanding anything in this Lease to the contrary, Landlord shall never be liable to Tenant for any loss of business or profits or other special, incidental, indirect or consequential damages or for punitive or special damages of any kind. None of Landlord’s officers, employees, agents, directors, shareholders, or partners shall ever have any personal liability to Tenant under or in connection with this Lease. Tenant shall look solely to Landlord’s estate and interest in the Building for the satisfaction of any right or remedy of Tenant under this Lease, or for the collection of any judgment (or other judicial process) requiring the payment of money by Landlord, and no other property or assets of Landlord or its principals shall be subject to levy, execution, or other enforcement procedure for the satisfaction of Tenant’s rights or remedies under this Lease, the relationship of Landlord and Tenant under this Lease, Tenant’s use and occupancy of the Premises, or any other liability of Landlord to Tenant of whatever kind or nature.

(o) Brokers: Landlord and Tenant respectively represent and warrant to each other that neither of them nor any of their representatives, employees or agents have consulted or negotiated with any broker or finder with regard to this Lease or the Premises except, Cushman and Wakefield of Arizona, LLC and Cushman and Wakefield of Florida, LLC, representing Tenant and EastGroup Property Services of Florida, LLC (“EastGroup”), representing Landlord. Landlord and Tenant each will indemnify the other against, and hold the other harmless from, any claims for fees or commissions from anyone with whom either of them has consulted or negotiated with regard to the Premises except the brokers named herein. Landlord will pay the fees or commissions due only to EastGroup, pursuant to a separate written agreement between Landlord and EastGroup, and EastGroup, will pay the fees or commissions due only to Cushman and Wakefield of Arizona, LLC and Cushman and Wakefield of Florida, LLC, pursuant to a separate written agreement between them. Tenant shall not be responsible for payment of any leasing commission fees to such brokers.

(p) No Easements for Air or Light: Any diminution or shutting off of light, air, or view, by any structure that may be erected on the Project or on lands adjacent to the Building will in no way affect this Lease or impose any liability on Landlord.

(q) Except for the payment of sums due under this Lease, each party hereto shall be excused for the period of any delay and shall not be deemed in default with respect to the performance of any of its obligations when prevented from so doing by a cause beyond such party’s reasonable control, including labor disputes, government regulations, fire or casualty, inability to obtain any materials or services, or Acts of God.

13

(r) Interlineation: Whenever in this Lease any printed portion has been stricken, whether or not any relative provision has been added, this Lease shall be construed as if the material so stricken was never included in this Lease and no inference shall be drawn from the stricken material which would be inconsistent in any way with the construction or interpretation which would be appropriate if such material were never contained in this Lease.

(s) Surrender. No act or thing done or omitted to be done by Landlord or Landlord’s agent during the Term of this Lease will constitute, nor will it be deemed an acceptance of surrender of the Premises, and no agreement to accept such termination or surrender will be valid unless in a writing signed by Landlord. The delivery of keys to any employee or agent of Landlord will not operate as a termination of this Lease or a surrender of the Premises unless such delivery of keys is done in connection with a written instrument executed by Landlord approving such termination or surrender.

(t) Survival of Obligations: Any obligations of Tenant accruing prior to the date of the expiration or earlier termination of this Lease, or if Tenant continues to occupy the Premises after the expiration or earlier termination of this Lease, on the date Tenant completely vacates the Premises shall survive the same, and Tenant shall promptly perform all such obligations whether or not this Lease has expired or been terminated.

36. Early Occupancy. Tenant may enter the Premises prior to the Commencement Date to complete Tenant Improvements and to install its furniture, special flooring or carpeting, trade fixtures, telephone, computers and other business equipment. Any such early entry shall be subject to the terms and conditions of the Lease, except the obligation to pay Rent, provided Tenant does not conduct its business in the Premises prior to the Commencement Date. If the Tenant completes the improvements early, Tenant will be allowed to occupy the space at no charge prior to December 1, 2009 but no earlier than November 1, 2009. If Tenant occupies the space prior to November 1, 2009, they will pay prorated rent at $3.25 per square foot plus applicable Operating Expenses and Sales Tax for that period.

37. Option to Renew. Tenant shall have two (2) - five (5) year options to renew its lease for all of the premises upon six (6) months prior written notice. The beginning rental rate for each renewal term shall be ninety five percent (95%) of the current fair market rate for the Premises and then it will increase by two and one half percent (2.5%) annually for the remainder of each renewal term. For purposes of this Lease, the fair market rate shall mean the amount of Base Rent determined by Landlord in its commercially reasonable discretion as the fair market rate for the Premises based on retail use in a building of similar size, configuration, quality, and location. If Tenant objects to Landlord’s determination of the fair market rate for the Premises, and Landlord and Tenant are unable to reach an agreement within ten (10) days after Landlord provides Tenant with written notice of its determination of fair market rate, Tenant, at its sole cost and expense, shall appoint a qualified MAI appraiser (“Tenant’s Appraisal”) for the purpose of determining the fair market rate. Tenant shall submit Tenant’s Appraisal to Landlord, together with a written summary of the methods used and data collected to make such determination within twenty (20) days after Tenant provides Landlord with Tenant’s written objection to Landlord’s determination of fair market rate. If Tenant does not make such objection and appoint such appraiser within twenty (20) days after receipt of written notice of Landlord’s determination, or deliver Tenant’s Appraisal to Landlord within such twenty (20) day period, then Landlord’s determination shall be deemed conclusive. If Landlord objects to Tenant’s Appraisal, Landlord, at Landlord’s sole cost and expense, shall appoint a qualified MAI appraiser (“Landlord’s Appraisal”) for the purpose of determining the fair market rate. Landlord shall submit Landlord’s Appraisal to Tenant, together with a written summary of the methods used and data collected within twenty (20) days after Landlord provides Tenant with Landlord’s written objection to Tenant’s determination of the fair market rate. If Landlord does not make such objection and appoint such appraiser within twenty (20) days after receipt of Tenant’s Appraisal, then Tenant’s Appraisal shall be deemed conclusive. If Landlord’s Appraisal and Tenant’s Appraisal differ by (x) less than ten percent (10%), the average of the two appraised amounts shall be the fair market rate for the Premises, or, if (y) ten percent (10%) or more. Landlord and Tenant shall promptly instruct their appraisers to jointly appoint a third MAI appraiser to determine the fair market rate for the Premises (“Third Appraisal”). Landlord and Tenant shall each pay one-half (1/2) of the expenses of the Third Appraisal. The appraisal among the three (3) that is farthest from the average of all the appraisals shall be disregarded and the average of the other two shall be the fair market rate for the Premises and binding upon Landlord and Tenant.

38. Satellite Dishes and or Antennaes. Tenant may install and maintain on roof any and all equipment and satellite dishes needed for Tenant’s communication and data transmission network. Location and installation to be approved by Landlord.

14

Under no circumstance will antennas or satellite dishes be affixed to the building in anyway or penetrate the Landlords roof. Any damage related to the installation or maintenance will be the responsibility of the Tenant.

39. Addenda/Exhibits. The additional Addenda and Exhibits (if any) listed below or attached hereto are hereby incorporated by reference and made a part of this Lease:

Exhibit “A” – Site Plan

Exhibit “B” – Space Plan

Exhibit “C” – Leasehold Improvement Addendum

Exhibit “D” – Rules and Regulations

IN WITNESS WHEREOF. Landlord and Tenant have hereunto executed this Lease as of the day and year first above written.

| Signed, sealed and delivered | LANDLORD: | |||||||

| in the presence of: | EastGroup Property Services of Florida, LLC | |||||||

| Agent for: | ||||||||

| EastGroup Properties, LP, a Delaware Limited Partnership | ||||||||

| /s/ Kristina Preston |

By: | /s/ Chris Segrest | ||||||

| Print Name: | Kristina Preston | Name: | CHRIS SEGREST | |||||

| Megan Borling | Title: | Vice President | ||||||

| Print Name: | Megan Borling | |||||||

| /s/ Kristina Preston |

By: | /s/ John Colemadi | ||||||

| Print Name: | Kristina Preston | Name: | JOHN COLEMADI | |||||

| Megan Borling | Title: | SENIOR VP | ||||||

| Print Name: | Megan Borling | |||||||

| TENANT | ||||||||

| Leslie’s Poolmart, Inc., a Delaware Corporation | ||||||||

| /s/ Kory Klecker |

By: | /s/ Steven L. Ortega | ||||||

| Print Name: | Kory Klecker | Name: | Steven L. Ortega | |||||

| Title: | EVP / CFO | |||||||

| /s/ Dave Backus |

||||||||

| Print Name: | Dave Backus | |||||||

15

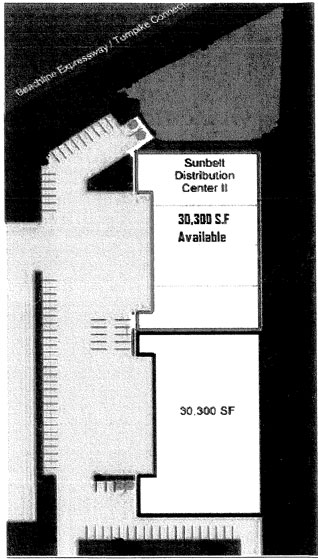

Exhibit “A”

Site Plan

16

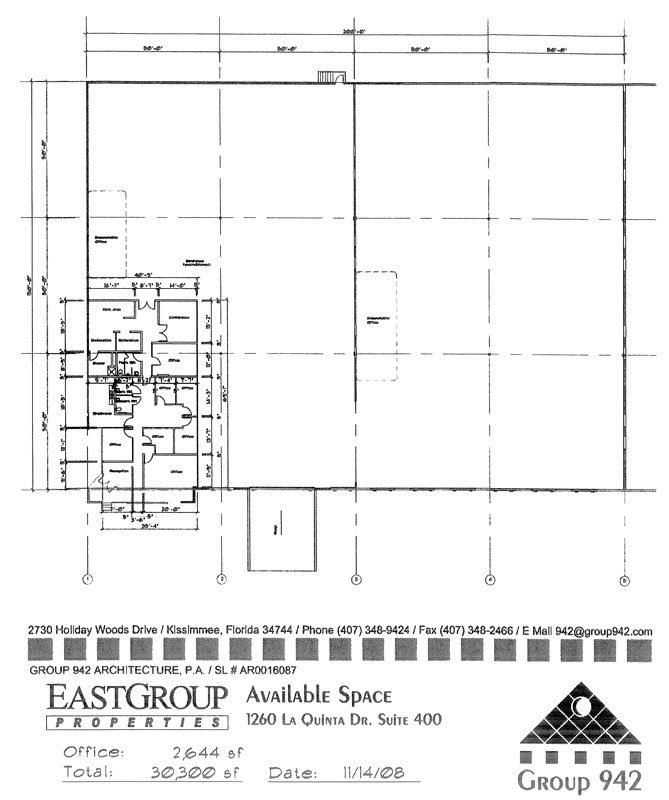

Exhibit “B”

Current Space Plan

17

Exhibit “C”

18

Leasehold Improvement Addendum

Landlord shall provide a Tenant Improvement Allowance of $150,000.00 for refurbishment and construction to be performed at 1260 LaQuinta Drive, Suite 400, Orlando, FL 32809. This Allowance is to be used by Tenant for all costs associated with refurbishment and construction in the Premises. Tenant shall be self performing this refurbishment and construction. Prior to the commencement of the refurbishment and construction the Tenant shall provide Landlord with plans and a scope of work for Landlord’s approval, which will not be unreasonably withheld. All improvements shall be governed by the provisions of paragraph 25 of the Lease. Prior to any work being performed, Tenant shall ensure that all contractors related to this work provide proper insurance coverage to Landlord. Tenant shall be responsible for complying with all Governmental rules and regulations. When refurbishment is completed the Tenant will provide to Landlord receipts indicating that all contractors have been paid in full and will also provide Landlord any applicable Lien Waivers from contractors who provide more than $5,000.00 in materials or services. Landlord shall reimburse to Tenant, on a monthly basis, the applicable portion of the Tenant Improvement Allowance after receipt of the applicable Lien Waivers and invoices for the refurbishment allowance to be reimbursed.

19

Exhibit “D”

Rules and Regulations

| • | Tenant shall faithfully observe and comply with the rules and regulations of the building as may be included in this Lease and modified or added to from time to time by the Landlord. Landlord shall not be responsible to Tenant for the nonperformance of any of said Rules and Regulations by any other tenant or occupant of the building. |

| • | No tenant shall install any radio or television antenna, loudspeaker, or other device on the roof, exterior walls of the Building, or on the property or permeter of property. No TV, radio or recorder shall be played in such a manner as to cause a nuisance to any other tenant. |

| • | The sidewalks, entry passages, corridors, and stairways shall not be obstructed by Tenant or used by it for other than those of ingress and egress. |

| • | Canvassing, soliciting, distribution of handbills or any other written material and peddling in the Center or on the site are prohibited, and each tenant shall cooperate to prevent the same. |

| • | No cargo or delivery vans, trucks or other similar vehicles shall be permitted to park in front of the Center building other than temporary delivery. These approved vehicles should park directly behind the rear of the Premises, or in designated truck court/dock area. Materials stored or placed by Tenant visible from outside the building will not be permitted. |

| • | Each tenant shall store all its trash and garbage within its premises. No material shall be placed in the trash boxes or receptacles if such material is of such nature that it may not be disposed of in the ordinary and customary manner of removing and disposing of trash and garbage without being in violation of any law or ordinance governing such disposal. |

| • | The auto parking lot shall be used in common with other tenants of the Center, their employees, guests and invitees, and in common with the Lessor and its employees, guests and invitees. All parking is free and unassigned. Tenants, their employees and guests, shall use those parking areas closest to their leased premises to the extent possible. The exterior truck loading and trailer parking areas immediate to the Premises are reserved for the exclusive use of each tenant. Tenants shall not use, block or otherwise interfere with the loading areas of other occupants in the Center. |

| • | Tenant may not store or place rubbish, pallets or other by-products of shopping or manufacturing outside the Premises. All such items must be hauled away without delay and at the sole cost and expense of Tenant. |

| • | No tenant shall use or keep in their premises or the Center, any kerosene, gasoline, or inflammable or combustible fluid or material other than limited quantities thereof reasonable necessary for the operation or maintenance of office equipment. No tenant shall use or keep or permit to be used or kept any foul or noxious gas or substance in the Premises, or permit or suffer the Premises to be occupied or used in a manner offensive or objectionable to Landlord or other occupants of the Center by reason of noise, odors or vibrations, or interfere in any way with other tenants or those having business in the Center, nor shall any animals or birds be brought or kept in the Premises or the Center. |

| • | These Rules and Regulations are in addition to, and shall not be construed to in any way modify or amend, in whole or in part, the agreements, covenants, conditions and provisions of any Lease of the Premises or the Center. The terms, covenants and conditions set forth in the Lease shall govern in the event of any inconsistency or ambiguity between the Rules and Regulations and the Lease. |

| • | Each tenant shall ensure that the doors of its Premises are closed and locked and that all water faucets and water apparatus are shut off before Tenant or Tenant’s employees leave the Premises so as to prevent waste or damage. For any default or carelessness in this regard Tenant shall make good all damages sustained by other tenants or occupants of the Center or Landlord. |

Landlord reserves the right to make such other rules and regulations as in its judgment may from time to time be needed for the safety, care and cleanliness of the Building and for the preservation of good order therein. Notice of any such amendment or modification will be provided Tenant, and Tenant will comply with them provided they are reasonable.

20