Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - PROSPECT MEDICAL HOLDINGS INC | a2195842zex-31_2.htm |

| EX-23.1 - EXHIBIT 23.1 - PROSPECT MEDICAL HOLDINGS INC | a2195842zex-23_1.htm |

| EX-21.1 - EXHIBIT 21.1 - PROSPECT MEDICAL HOLDINGS INC | a2195842zex-21_1.htm |

| EX-31.1 - EXHIBIT 31.1 - PROSPECT MEDICAL HOLDINGS INC | a2195842zex-31_1.htm |

| EX-32.2 - EXHIBIT 32.2 - PROSPECT MEDICAL HOLDINGS INC | a2195842zex-32_2.htm |

| EX-32.1 - EXHIBIT 32.1 - PROSPECT MEDICAL HOLDINGS INC | a2195842zex-32_1.htm |

| EX-10.42 - EXHIBIT 10.42 - PROSPECT MEDICAL HOLDINGS INC | a2195842zex-10_42.htm |

| EX-10.89 - EXHIBIT 10.89 - PROSPECT MEDICAL HOLDINGS INC | a2195842zex-10_89.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2009

Commission File Number 1-32203

PROSPECT MEDICAL HOLDINGS, INC.

| Delaware (State or other jurisdiction of incorporation or organization) |

33-0564370 (IRS Employer Identification No.) |

|

10780 Santa Monica Blvd., Suite 400 Los Angeles, California (Address of principal executive offices) |

90025 (Zip Code) |

(310) 943-4500

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of each exchange on which registered: | |

|---|---|---|

| Common stock, Par value $0.01 per share | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes ý No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. o Yes ý No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). o Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o Yes ý No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company ý |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes ý No

The aggregate market value of common stock held by non-affiliates of the registrant as of March 31, 2009 (the last business day of our most recently completed second fiscal quarter) was approximately $12,251,000 based upon the closing price for shares of our common stock as reported by NASDAQ (the exchange upon which our common stock was traded at the time) on such date.

As of December 11, 2009, 20,655,278 shares of the registrant's common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive proxy statement for the 2010 annual stockholders meeting, expected to be filed within 120 days of our fiscal year end, are incorporated by reference into Part III of this Form 10-K.

Table of Contents

Form 10-K

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this Annual Report on Form 10-K constitute "forward-looking statements" (rather than historical facts) as defined in the Private Securities Litigation Reform Act of 1995 or by the Securities and Exchange Commission (the"SEC") in its rules, regulations and releases, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements in this Annual Report, including under the captions "Business," "Risk Factors," and "Management's Discussion and Analysis of Financial Condition and Results of Operations," other than statements of historical fact, are forward-looking statements for purposes of these provisions, including statements of our current views with respect to our business strategy, business plan, our future financial results, and other future events. In some cases, forward-looking statements can be identified by the use of terminology such as "may," "will," "expects," "plans," "anticipates," "estimates," "potential" or "could" or the negative thereof or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements contained herein are reasonable, there can be no assurance that such expectations or any of the forward-looking statements will prove to be correct, and actual results could differ materially from those projected or assumed in the forward-looking statements.

All forward-looking statements involve inherent risks and uncertainties, and there are or will be important factors that could cause actual results to differ materially from those indicated in these statements. We believe that these factors include, but are not limited to, those factors set forth in this Annual Report under the captions "Business," "Risk Factors," and "Management's Discussion and Analysis of Financial Condition and Results of Operations," all of which you should review carefully. If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary materially from what we anticipate. Please consider our forward-looking statements in light of those risks as you read this Annual Report. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

3

Overview

We provide quality, coordinated healthcare and physician services in Southern California. We own and operate five hospitals, with a total of approximately 759 licensed beds, and currently maintain approximately 829 on-staff physicians, including specialists who cover approximately 35 medical and surgical specialties. Our hospitals are located in high density population areas within Los Angeles County and maintain leading market positions in the areas they serve. We also manage the provision of physician services through ten Medical Groups that consist of physician networks with approximately 7,200 primary care and specialty physicians. Our Medical Groups provide physician services to approximately 177,000 enrollees. Based on our enrollment, our combined Medical Groups represent one of the largest in Southern California and has contracts with nearly all the major (non-Kaiser) HMOs operating in the region. We believe the coordination of our hospitals and Medical Groups will create an efficient healthcare delivery system that positions us to drive growth and profitability.

We operate both our hospitals and Medical Groups by applying highly disciplined, data-driven management to the provision of quality care. Through this in-depth and data-driven approach to analysis and application of various operational and financial metrics, we have been able to achieve a highly-efficient cost structure which enables us to adjust our operations to provide services that generate higher margins and revenue growth. Our management's expertise in executing our operating model has enabled us to increase profitability across a diverse mix of payors and the flexibility to adapt to economic and regulatory changes. Our operating model also allows us to be well-positioned for the future, as we believe that the most cost-efficient providers will be the ones who benefit in this rapidly changing economic and regulatory environment.

We have grown through a series of strategic acquisitions:

- •

- in June 2007, we acquired the ProMed Entities, which, at the time of the acquisition, collectively had approximately

82,000 HMO enrollees;

- •

- in August 2007, we acquired Alta, which owned and operated four community-based hospitals in Los Angeles County with a

combined 339 licensed beds served by approximately 315 on-staff physicians. In connection with the Alta acquisition, Sam Lee, Alta's president, joined our board of directors and the

management team and was later appointed Chief Executive Officer in March 2008. The acquisition of Alta transformed our Company from a business exclusively providing Medical Group management services

to a business capable of providing coordinated hospital and physician management services; and

- •

- in April 2009, we increased our approximately 33% ownership stake in Brotman, a 420-bed hospital located in Culver City, California, to approximately 72%.

We have improved our operating margin and profitability through the following actions:

- •

- managing staffing levels according to patient volumes and acuity levels of care required;

- •

- optimizing resource allocation by utilizing our case management program, which assists in improving clinical care and cost

containment;

- •

- negotiating favorable payor contracts and reductions in uncompensated care and payor claims denial;

- •

- expanding and improving profitable services offered by our hospitals;

- •

- enhancing claims management functions and negotiating more favorable provider contracts for our Medical Groups;

- •

- divesting non-core assets; and

4

- •

- restructuring our senior management team and adding experienced professionals in the areas of finance, operations, claims management, business development and compliance.

We believe that our acquisitions and the successful implementation of our operating model by our management team have both strengthened our infrastructure and positioned us for continued revenue growth and profitability.

Our principal executive offices are located at 10780 Santa Monica Blvd., Suite 400, Los Angeles, CA 90025. Our telephone number is (310) 943-4500. Our web site address is www.prospectmedicalholdings.com. A copy of this filing is posted on our web site. However, our web site and the information contained on our web site or connected to our web site are not incorporated by reference into this Annual Report on Form 10-K.

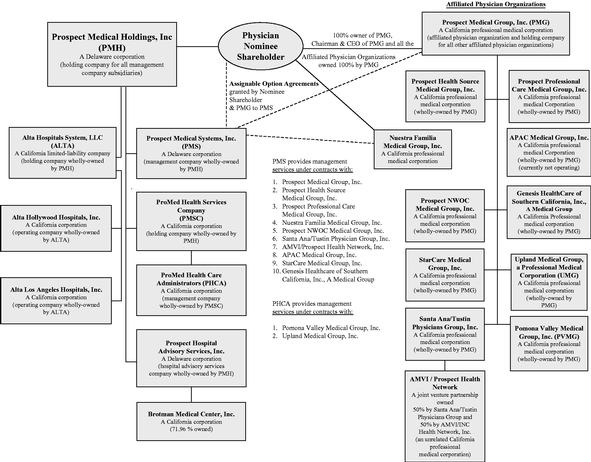

The organizational structure of our business is set forth on the next page.

ORGANIZATIONAL STRUCTURE OF OUR BUSINESS

History and Development of Our Business

Our business effectively commenced in 1996, when we began to implement our growth strategy through a series of acquisitions and affiliations. Between 1996 and 2005, PMG acquired fourteen physician organizations. These acquisitions provided us with a substantial concentration of HMO enrollees in our three Southern California service areas—North and Central Orange County, West Los Angeles and the Antelope Valley region of Los Angeles County. In 2007 we completed two major acquisitions, described below, which resulted in the addition of HMO enrollees in San Bernardino County and in the establishment of our Hospital Services segment.

5

On June 1, 2007, PMG completed the acquisition of the ProMed Entities, for consideration of $48,000,000, consisting of $41,040,000 of cash and 1,543,237 shares of PMH common stock, valued at $6,960,000, or $4.51 per share. As a result of the ProMed Acquisition, PHCA became a wholly-owned subsidiary of PMH and PVMG and UMG became wholly-owned subsidiaries of PMG. At the time of the acquisition, PVMG and UMG had approximately 80,000 HMO enrollees.

On August 8, 2007, we acquired Alta, and we repaid approximately $41,500,000 of Alta's existing debt. Total merger consideration, exclusive of the Alta debt repaid, consisting of approximately $103 million, was paid one-half ($51.3 million) in cash and one-half in stock (valued, for transaction purposes only, at $5.00 per share of our common stock). The equity portion of the merger consideration consisted of 1,887,136 shares of common stock and 1,672,880 shares of Series B Preferred Stock. The Series B Preferred Stock was non-convertible until such time as the stockholders voted to approve its convertibility. Such approval was received at our annual meeting of stockholders held on August 13, 2008. As a result, each share of Series B Preferred Stock automatically became convertible into five shares of common stock at a conversion price of $5.00 per share of common stock. Following such stockholder approval, the holders of all the outstanding shares of Series B Preferred Stock elected to convert their preferred shares into common stock.

Also on August 8, 2007, in connection with the closing of the Alta acquisition, Bank of America, N.A. (the "Lender") agented $155 million of financing for us in the form of term loans totaling $145 million and a $10 million revolving line of credit facility, $3 million of which was drawn at closing. The term loans were used to refinance approximately $41.5 million of existing Alta debt, refinance approximately $48 million of our existing debt that had previously been provided by the Lender in connection with our acquisition of ProMed, and pay the cash portion of the Alta purchase price.

On August 1, 2008, we completed the sale of all of the outstanding stock of the AV Entities for total pre-tax cash consideration of $8,000,000 and entered into a non-competition agreement in the Antelope Valley region of Los Angeles County for the benefit of the buyer.

On August 31, 2005, we initially acquired an approximately 33% ownership interest in Brotman. Although Brotman faced financial and operational challenges, we viewed the investment as having a potential benefit to our Medical Group business. Following our initial investment, Brotman continued to incur substantial losses. In September 2007, following consultation with outside advisors and our new management team, which was experienced in hospital management and turnarounds, Brotman determined that it would be in its best interest to file for bankruptcy protection, which it did in October 2007. Concurrent with the filing, we entered into an amendment to our existing consulting services agreement with Brotman, which provided for an increased level of services and responsibility by our new management team.

On April 14, 2009, Brotman emerged from bankruptcy and we acquired an approximately 39% additional ownership interest, which brought us to our current total ownership of approximately 72% of the outstanding common stock of Brotman. Pursuant to the terms of the bankruptcy plan, we made additional investments in Brotman totaling $2,500,000.

Our Strategy

Our objective is to operate as an entrepreneurial, efficient healthcare delivery system by delivering both hospital and physician services.

Enhance Operating Efficiencies

We seek to use our operating efficiencies to provide an advantage by enabling us to profitably service patients that other providers cannot serve profitably. We monitor our cost trends, operating performance and the regulatory environment in our existing markets to drive operating efficiencies, such as the optimization of staffing and utilization levels. These efficiencies allow us to strengthen our

6

financial performance while improving the services we provide to our patients, physicians and health plan partners, as well as provide us greater flexibility to adapt to regulatory changes.

Cross-Fertilize Revenues among Our Hospitals and Medical Group Networks

We seek to generate organic growth primarily through cross-fertilization between our Medical Group and Hospital Services segments. Specifically, we have undertaken the following initiatives:

- •

- utilizing our existing community hospitals to facilitate referrals to Brotman;

- •

- consolidating the back-office operations and management of our existing Medical Groups to reduce

administrative costs and enhance partnering with HMOs and physicians; and

- •

- integrating Medical Group and Hospital Services operations to:

- •

- utilize our existing hospital-physician relationships to increase enrollment at our Medical Groups;

- •

- use our existing Medical Group enrollment to drive business to our hospital facilities;

- •

- leverage our existing Medical Groups to enhance payor diversification for our hospitals; and

- •

- expand HMO contracts by offering a combined hospital-physician provider solution.

Additionally, we plan to expand our physician networks into areas where we have hospitals and seek hospital acquisition opportunities in areas where we have physician networks. The HMOs with which we contract have increasingly expressed their desires for their medical group partners to provide a combined hospital-physician solution.

Complete the Transformation of Brotman

We believe that our acquisition of a controlling stake in Brotman will allow us to use our proven operating model to drive efficiencies, as well as add new payors, improve reimbursement from existing payors and recruit new physicians to the medical staff. We will continue the implementation of our cost efficiency initiatives, which we expect will improve Brotman's operating results. We will also continue to recruit physicians for our surgical and cardiology groups as well as in primary care, which we believe will create opportunities for both inpatient and outpatient growth. In addition, we are evaluating the expansion of Brotman's emergency room services to better serve its strategic geographic location and facilitate admissions into the hospital.

Grow Through Strategic Acquisitions

We intend to continue growing through select strategic acquisitions of hospitals. We will seek hospital acquisition candidates that we believe are not currently achieving their potential in attractive service areas where our operating model can be applied. Additionally, we expect the number of potential acquisition candidates to increase given the fragmented ownership within the hospital market and the increasing number of underperforming hospitals struggling with inefficient operations and high cost structures.

Our Market

We operate our business in Southern California where we believe market dynamics will favorably impact our growth. There is a shortage of hospital beds in Los Angeles County, with fewer than 100 hospitals to serve approximately ten million people across 4,000 square miles. According to a recent report from the Hospital Association of Southern California ("HASC"), Los Angeles County averages approximately one bed per 1,000 people, well below the national average of over three beds per 1,000 people. High hospital construction costs in Southern California have prevented meaningful increases in bed supply commensurate with demand.

7

Additionally, we expect demographic trends to further increase the supply-demand imbalance for hospital services. California anticipates unprecedented growth in its senior population as the baby boom generation ages and life expectancy continues to increase. California's senior population is projected to more than double between 2000 and 2030, growing to approximately 8.8 million, according to a recent report from the California HealthCare Foundation. Because of these demographic trends and the shortage of hospital beds in our local markets, we believe we are well-positioned to benefit organically from the increased demand for our services.

Closures of competitor hospitals have further added to the hospital bed shortage. Over the past ten years, 14 hospitals in Los Angeles County have closed, mostly because of their inefficient cost structures. HASC reported recently that it expects this trend to continue. Also, the Southern California hospital market is highly fragmented, with approximately 60 different ownership entities. The fragmented and decreasing number of hospitals in our market will facilitate our acquisition strategy, as competitor hospitals become available for acquisition.

Description of Our Business—Hospital Services Segment

Overview

The hospital services sector is comprised of at least three sub-sectors that do not generally compete with each other because they largely serve three distinct patient populations:

- •

- Tertiary Care Hospitals: Tertiary care hospitals are

generally owned by the larger philanthropic organizations and for-profit hospital companies which tend to be well funded and utilize state of the art facilities to treat commercially

insured patients and higher acuity care patients.

- •

- Community Hospitals: Community hospitals are both

for-profit and not-for-profit and operate in generally older properties, use generally less state-of-the-art equipment, and are

equipped to care for patients of lower acuity. Efficient hospitals in this group are able to provide care profitably because of their significantly lower cost structures.

- •

- Public Hospitals: Public hospitals are generally owned by government entities that are set up to treat uninsured, indigent patients with a full range of acuity needs.

Both government and managed care payors are under pressure to reduce the cost of health coverage. One means of doing this is to match patients to the facility best suited to delivering the quality of care required in the most cost-efficient setting. Because of the focused, cost efficient structures of community hospitals, both patients and payors can benefit economically from utilizing community hospitals where feasible. In the managed care context, patient co-pays in many instances increase as the cost structure of the hospital increases, thereby providing an incentive to the patient, as well as the payor, to utilize focused cost efficient community hospitals. Further, government payors generally pay tertiary care hospitals higher per diem amounts for care under Medicare and Medi-Cal than the per diem amounts paid to community hospitals. Companies operating community-based hospitals are positioned to benefit from this market dynamic as focused quality, cost efficient providers.

Our Hospitals

We own and operate five hospitals in Los Angeles County, all accredited by the Joint Commission (formerly the Joint Commission on Accreditation of Healthcare Organizations), with a total of approximately 759 licensed beds served by 829 on-staff physicians at September 30, 2009. We acquired four community hospitals in Hollywood, Los Angeles, Norwalk and Van Nuys in connection with our acquisition of Alta. Our fifth hospital is Brotman Medical Center, located in Culver City. For the 12 months ended September 30, 2009, our hospital services segment generated revenues of approximately $205 million.

8

Our three community hospitals in Hollywood, Los Angeles and Norwalk offer a comprehensive range of medical and surgical services, including general acute care hospital services, pediatrics, obstetrics and gynecology, pediatric sub-acute care, general surgery, medical-surgical services, orthopedic surgery, and diagnostic, outpatient, skilled nursing and urgent care services. Our psychiatric hospital in Van Nuys provides acute inpatient and outpatient psychiatric services on a voluntary basis. Brotman offers a comprehensive range of inpatient and outpatient services, including general surgery, orthopedic, spine and neurosurgery, cardiology, diagnostic outpatient, rehabilitation, psychiatric and detox services. In addition, Brotman has an active emergency room that plays an integral part in providing emergency services to the West Los Angeles area.

The table below gives a brief overview of our hospitals and the locations they serve:

Name/Location

|

Primary Service | Number of Beds | ||

|---|---|---|---|---|

Hollywood Community Hospital |

Medical/Surgical | 100 licensed beds/100 staffed beds | ||

Los Angeles Community Hospital |

Medical/Surgical |

130 licensed beds/130 staffed beds |

||

Norwalk Community Hospital |

Medical/Surgical |

50 licensed beds/50 staffed beds |

||

Brotman Medical Center |

Medical/Surgical |

420 licensed beds/240 staffed beds |

||

Van Nuys Community Hospital |

Psychiatric |

59 licensed beds/59 staffed beds |

Selected Operating Statistics

The table below sets forth selected hospital operating statistics for the years ended September 30, 2009 and 2008.

| |

Year Ended September 30, | ||||||

|---|---|---|---|---|---|---|---|

| |

2009 | 2008 | |||||

Licensed beds as of the end of the period(1) |

759 | 339 | |||||

Admissions(2) |

18,573 | 14,206 | |||||

Adjusted admissions(3) |

20,098 | 15,058 | |||||

Emergency room visits(4) |

25,616 | 13,600 | |||||

Surgeries(5) |

4,146 | 2,935 | |||||

Patient days(6) |

124,004 | 87,463 | |||||

Acute care average length of stay in days(7) |

6.20 | 5.50 | |||||

- (1)

- Licensed beds are beds for which a hospital has obtained approval to operate from the applicable state licensing agency.

9

- (2)

- Admissions

are patients admitted to our hospitals for inpatient treatment. This statistic is used by our management, investors and other readers of our

financial statements as a measure of inpatient volume.

- (3)

- Adjusted

admissions are total admissions adjusted for outpatient volume. Adjusted admissions are computed by multiplying admissions (inpatient volume) by

the sum of gross inpatient charges and gross outpatient charges and then dividing the resulting amount by gross inpatient charges. This statistic is used by our management, investors and other readers

of our financial statements as a measure of inpatient and outpatient volume.

- (4)

- The

number of emergency room visits is an important operational measure that is used by our management, investors and other readers of our financial

statements to gauge our patient volume. Much of our inpatient volume results from a patient's initial encounter with our hospitals through an emergency room visit.

- (5)

- The

number of surgeries includes both inpatient and outpatient surgeries. This statistic is used by our management, investors and other readers of our

financial statements as one component of overall patient volume and business trends.

- (6)

- Patient

days are the total number of days that patients are admitted in our hospitals. This statistic is used by our management, investors and other readers

of our financial statements as a measure of inpatient volume.

- (7)

- Acute

care average length of stay in days represents the average number of days admitted patients stay in our hospitals. This statistic is used by our

management, investors and other readers of our financial statements as a measure of our utilization of hospital resources.

- (8)

- Operating statistics are for the period April 14, 2009 through September 30, 2009.

Our Hospital Operating Model

Our hospital operating model is physician-centric. We have found that a physician friendly environment is key to recruiting physicians. We also strive to provide convenience in scheduling and collaborative patient case management in order to assist in the treatment of the patient and in the physician's time management. We have, for example, developed an admissions process that enables the physician's office to make a hospital admission with a single telephone call to our admissions coordinator. We also provide admissions through our emergency room and urgent care centers to help better evaluate medical necessity.

Our hospital physicians are not employed by us. However, some physicians provide services in our hospitals under contracts which generally describe a term of service, provide and establish the duties and obligations of such physicians, require the maintenance of certain performance criteria and fix compensation for such services. Any licensed physician may apply to be admitted to the medical staff of any of our hospitals in accordance with established credentialing criteria.

We have also developed transfer processes with other area hospitals to receive patients that are more appropriately treated in one of our hospitals. Hospitals with which we have such transfer relationships include community hospitals that do not accept Medi-Cal patients and tertiary care hospitals with high cost structures that consider certain non-tertiary-level care patients to be unprofitable. Correspondingly, our hospitals will transfer patients to another hospital with which we have a transfer relationship when the patient's individual circumstances warrant.

10

Hospital Revenues and Reimbursement

We record gross patient service charges on a patient-by-patient basis in the period in which services are rendered. Patient accounts are billed after the patient is discharged. When a patient's account is billed, our accounting system calculates the reimbursement that we expect to receive based on the type of payor and the contractual terms of such payor. We record the difference between gross patient service charges and expected reimbursement as contractual adjustments.

At the end of each month, we estimate expected reimbursement for unbilled accounts. Estimated reimbursement amounts are calculated on a payor-specific basis and are recorded based on the best information available to us at the time regarding applicable laws, rules, regulations and contract terms. We continually review our contractual adjustment estimation process to consider and incorporate updates to laws, rules and regulations, as well as changes to managed care contract terms that result from negotiations and renewals.

Hospital revenues depend upon inpatient occupancy levels, the ancillary services and therapy programs ordered by physicians and provided to patients, the volume of outpatient procedures and the charges or negotiated payment rates for such services. Charges and reimbursement rates for inpatient services vary significantly depending on the type of service and geographic location of the hospital. Our hospitals receive revenues for patient services from a variety of sources, including the federal Medicare program, California's Medi-Cal program, managed care payors (including PPOs and HMOs), indemnity-based health insurance companies and self-pay patients. The basis for payments involving inpatients is prospectively set Diagnostic Related Group ("DRG") rates for Medicare, negotiated per diem rates for Medi-Cal and percentage of charge or negotiated rates for the other payors. The basis for payments for outpatients is prospectively set rate-per-service based on the Ambulatory Payment Classification ("APC") assigned for Medicare, a fixed rate by procedure for Medi-Cal and percentage of charges or negotiated rates for other payors. Our hospitals are also eligible for State of California Disproportionate Share payments based on a prospective payment system for hospitals that serve large populations of low-income patients.

Our hospitals receive payment for patient services from the federal government, primarily under the Medicare program, the California Medi-Cal program, managed care plans (including PPOs and HMOs), indemnity-based health insurance plans, as well as directly from patients ("self-pay"). All of our hospitals are certified as providers of Medicare and Medi-Cal services. Amounts received under the Medicare and Medi-Cal programs are generally significantly less than a hospital's customary charges for the services provided. Since a substantial portion of our revenue comes from patients under Medicare and Medi-Cal programs, our ability to operate our business successfully in the future will depend in large measure on our ability to adapt to changes in these programs.

The nation's current economic crisis may have a negative impact on reimbursement for our hospitals. A recent American Hospital Association report on the economic crisis indicates that the credit crunch is making it difficult and expensive for hospitals to finance facility and technology needs. The majority of hospitals are experiencing decreased admissions and elective procedures. In addition, rising unemployment is leading to increased uncompensated care. California budget shortfalls may result in decreases in hospital Medi-Cal reimbursement.

Medicare

Medicare is a federal program that provides medical insurance benefits to persons age 65 and over, some disabled persons, and persons with end-stage renal disease. Under the Medicare program, we are paid for inpatient and outpatient services performed by our hospitals. Payments for inpatient acute services are generally made pursuant to a prospective payment system, commonly known as "PPS." Under PPS, our hospitals are paid a predetermined amount for each hospital discharge based on the patient's diagnosis.

11

Specifically, each discharge is assigned to a diagnosis related group, commonly known as a "DRG," based upon the patient's condition and treatment during the relevant inpatient stay. Each DRG is assigned a cost weight based on its severity. The DRG weight is then applied to a national average rate to arrive at the payment. The national average rate is adjusted for labor cost by a predetermined geographic adjustment factor assigned to the geographic area in which the hospital is located. In addition to the DRG payment, hospitals may qualify for an "outlier" payment when the relevant patient's treatment costs are extraordinarily high and exceed a specified regulatory threshold.

The national average rates are adjusted by an update factor on October 1 of each year, the beginning of the federal fiscal year. The index used to adjust the DRG rates, known as the "market basket index," gives consideration to the inflation experienced by hospitals in purchasing goods and services. Under the Medicare Prescription Drug, Improvement and Modernization Act of 2003 ("MMA"), DRG payment rates were increased by the full "market basket index," for the federal fiscal years 2007, 2008 and 2009 or 3.4%, 3.3% and 3.6% respectively. The Deficit Reduction Act of 2005 imposes a 2% reduction to the market basket index beginning in the federal fiscal year 2007, and thereafter, if patient quality data is not submitted. We intend to and have complied with this data submission requirement. Future legislation may decrease the rate of increase for DRG payments, but we are not able to predict the amount of any reduction or the effect that any reduction will have on us.

In an effort to encourage hospitals to improve quality of care, the Medicare program has taken steps to reduce or withhold payments to hospitals for treatment given to patients whose conditions were caused by serious medical error. Under rules that became effective October 1, 2008, Medicare will no longer pay hospitals for the higher costs of care resulting from eight complications, including falls, objects left inside patients during surgery, pressure ulcers and three types of hospital-acquired infections. California hospitals are required to report certain adverse events to a state agency charged with publicizing the events, as well as the results of any ensuing investigation conducted by the agency. We believe that our hospital quality of care programs will address such issues, but we are unable to predict the future impact of these developments on our business.

Medi-Cal

Medi-Cal is a federal/state-funded program, administered by the California Department of Health Services (the "State") which provides medical benefits to individuals that qualify. Our hospitals participate in the Medi-Cal system and are paid a negotiated per diem rate. There can be no assurances that revisions in the Medi-Cal program will not have a material adverse effect on our results of operations.

Pursuant to the terms of the Medi-Cal contracts between the State and each of our hospitals, a significant portion of our hospital business is subject to termination of contracts and subcontracts at the election of the government. The contract between the State and Los Angeles Community Hospital and Norwalk Community Hospital was entered into on September 14, 2000 and most recently amended on September 24, 2009. The agreement may not be terminated without cause prior to December 31, 2010 and after that date it may be terminated without cause, provided that 120 days notice of termination is given. The contract between the State and Hollywood Community Hospital and Van Nuys Community Hospital was entered into on September 14, 2000 and most recently amended on May 10, 2007. The agreement may not be terminated without cause prior to July 10, 2009 and after that date it may be terminated without cause, provided that 120 days notice of termination is given. The contract between the State and Brotman was entered into on September 1, 2005 and most recently amended on June 1, 2009. The agreement may not be terminated without cause prior to July 1, 2010 and after that date it may be terminated without cause, provided that 120 days notice of termination is given. California budgetary shortfalls may result in our inability to renew Medi-Cal contracts at existing rates. Thereafter, the contracts are renewed by negotiation between the parties. We can provide no assurance whether these contracts will be renewed upon their expiration.

12

Disproportionate Share Payments

Hospitals that treat a high percentage of low-income patients may receive additional Disproportionate Share ("DSH") payment adjustment from Medicare and Medi-Cal. We receive both of these adjustments. The Medicare adjustment is based on the hospital's DSH patient percentage, which is the sum of the number of patient days for patients entitled to both Medicare Part A and Supplemental Security Income benefits, divided by the total number of Medicare Part A patient days and a second factor that is a ratio of Medi-Cal eligible days to total DRG days. For fiscal 2009, total Medicare DSH payments received were approximately $27,700,000 compared to approximately $18,000,000 for fiscal 2008. The Medi-Cal adjustment is based either on the Hospital's Medi-Cal utilization or its low income utilization percentage. Our hospitals qualify because their Medi-Cal utilization was greater than one standard deviation above 42% of the hospitals' total patient days. For fiscal 2009, total Medi-Cal DSH payments received by our hospitals were approximately $12,000,000 compared to approximately $11,300,000 for fiscal 2008.

Medicare Bad Debt Reimbursement

Under Medicare, the costs attributable to the deductible and coinsurance amounts which remain unpaid by the Medicare beneficiary can be added to the Medicare share of allowable costs as cost reports are filed. Hospitals generally receive interim pass-through payments during the cost report year which were determined by the fiscal intermediary from the prior cost report filing.

Bad debts must meet the following criteria to be allowable:

- •

- the debt must be related to covered services and derived from deductible and coinsurance amounts;

- •

- the provider must be able to establish that reasonable collection efforts were made;

- •

- the debt was actually uncollectible when claimed as worthless; and

- •

- sound business judgment established that there was no likelihood of recovery at any time in the future.

The amounts uncollectible from specific beneficiaries are to be charged off as bad debts in the accounting period in which the accounts are deemed to be worthless. In some cases, an amount previously written off as a bad debt and allocated to the program may be recovered in a subsequent accounting period. In these cases, the recoveries must be used to reduce the cost of beneficiary services for the period in which the collection is made. In determining reasonable costs for hospitals, the amount of bad debts otherwise treated allowable costs is reduced by 30%. Under this program, our hospitals incurred an aggregate of approximately $4,568,000 and $2,757,000, which are subject to the 30% reduction, for fiscal 2009 and 2008, respectively. Amounts incurred by a hospital as reimbursement for bad debts are subject to audit and recoupment by the fiscal intermediary. Bad debt reimbursement has been a focus of fiscal intermediary audit/recoupment efforts in the past.

Annual Cost Reports

Hospitals participating in the Medicare and some Medi-Cal programs are required to meet specified financial reporting requirements. Federal and state regulations require submission of annual cost reports identifying medical costs and expenses associated with the services provided by each hospital to Medicare beneficiaries and Medi-Cal recipients. Annual cost reports required under the Medicare and Medi-Cal programs are subject to routine governmental audits. These audits may result in adjustments to the amounts ultimately determined to be due to us under these reimbursement programs. Finalization of these audits often takes several years. We can appeal any final determination made in connection with an audit. DRG outlier payments and other cost report abuses have been and

13

continue to be the subject of audit and adjustment by the Centers for Medicare and Medicaid Services ("CMS").

In 2003, Congress passed legislation to enhance and support Medicare's current efforts in identifying and correcting improper payments. In section 306 of the Medicare Modernization Act ("MMA"), Congress directed the Department of Health and Human Services ("DHHS") to conduct a three-year demonstration program using Recovery Audit Contractors ("RAC") to detect and correct improper payments in the Medicare FFS program. In addition, in section 302 to the Tax Relief and Health Care Act of 2006 ("TRHCA"), Congress required DHHS to make the RAC program permanent and nationwide by no later than January 1, 2010. The RAC program does not detect or correct payments for Medicare Advantage or the Medicare prescription drug benefit.

The permanent RAC program is scheduled to begin in California in July 2009. The auditors will be auditing payments made to California healthcare providers to assure correct payment. Payments deemed incorrect will be adjusted at the time of audit. These adjustments can be appealed following the guidelines of the program. As of September 30, 2009, no audits under the RAC program were scheduled for any of our hospitals.

Our hospitals are subject to audit along with other California hospitals during this upcoming year. Our hospitals have taken steps to assure on-going coding and billing accuracy, which will also help ensure successful RAC audits.

Inpatient Psychiatric

As of September 30, 2009, we operated one 70-bed, inpatient psychiatric unit paid under the IPF PPS method at Brotman and one 59 licensed bed, inpatient psychiatric unit paid on the acute PPS method at Van Nuys. Effective for reporting periods after January 1, 2005, CMS replaced the cost-based system with a PPS for inpatient hospital services furnished in freestanding psychiatric hospitals and PPS exempt psychiatric units of general, acute care hospitals and critical access hospitals ("IPF PPS"). IPF PPS is a per diem prospective payment system with adjustments to account for certain patient and facility characteristics. IPF PPS contains an "outlier" policy for extraordinarily costly cases and an adjustment to a facility's base payment if it maintains a full-service emergency department. Under this program, Brotman received an aggregate of approximately $6,392,000 for fiscal 2009. Under the acute MS-DRG, Van Nuys received an aggregate of approximately $8,168,000 and $6,401,000 for fiscal 2009 and 2008 respectively.

Competition

All five of our hospitals are located in Los Angeles County and each hospital serves its own local community.

Within the Los Angeles Community Hospital ("LACH") service area, three urban hospitals are considered competitors of LACH. They are Mission Hospital of Huntington Park, a 127 licensed bed acute care hospital, Monterey Park Hospital, a 101 licensed bed acute care facility, and East Lost Angeles Doctors Hospital, which is licensed for 127 acute care beds and 30 skilled nursing beds.

The Norwalk Community Hospital service area has two main competitors, Coast Plaza Doctors Hospital, located in Norwalk, and Presbyterian Intercommunity Hospital, which is located in Whittier. Coast Plaza Doctors Hospital is licensed for 105 beds, of which 7 are skilled nursing beds. Presbyterian Intercommunity Hospital is licensed for 402 beds, of which 24 are licensed as skilled nursing beds.

In the surrounding service area of Hollywood Community Hospital, there are two main competitors, Olympia Medical Center, an acute care hospital licensed for 204 beds and Valley Presbyterian Hospital, a 350 acute care licensed bed hospital.

14

Brotman, located in Culver City, serves the growing Culver City market as well as parts of West Los Angeles. Its closest competitor, Century City Hospital, closed in the fall of 2008 which provided immediate benefit to Brotman as a number of registered nurses were hired from the hospital. Brotman does not have any significant competitors in its immediate vicinity. Brotman's nearest competitors are UCLA Medical Center, Cedar Sinai Medical Center and Olympia Medical Center, which are located approximately seven miles, five miles and four miles, respectively, from Brotman and all of which have capacity issues for inpatient and emergency care.

Van Nuys Community Hospital is the only psychiatric hospital in the area. There are two competing acute care facilities that offer acute psychiatric services. Mission Community Hospital in Panorama City is licensed for 60 acute psychiatric beds and Pacifica Hospital of the Valley, located in Sun Valley, is licensed for 38 acute psychiatric beds.

We believe that each of our hospitals is able to compete within its respective service areas based upon three primary factors:

- •

- Competitive Cost Structure. We have historically been

successful in increasing operating revenue and developing improved service delivery capabilities. We have been able to achieve a highly-efficient cost structure which allows us to maintain

profitability across all payors. Our cost structure enables us to service patients that many other providers cannot serve profitably. We seek to achieve efficiencies through higher margin revenue

growth and continual process improvements.

- •

- Quality of Service. Our operating model has allowed our

hospitals to develop a reputation for delivering quality care and easy access to the communities in which they serve. We have strengthened the patient care we provide by retaining and recruiting

experienced physicians. Our medical staffs typically practice at several hospitals concurrently, including some major tertiary care facilities located within the same metropolitan areas as our

hospitals.

- •

- Leverageable Platform. Our hospital operations are, over time, expected to provide synergies between our Medical Group business and our Hospital Services segment, allowing us to offer quality, coordinated, healthcare and physician services.

Description of Our Business—Medical Group Segment

Overview

Our affiliated group of Medical Groups is one of the largest providers of physician services for HMO enrollees in Southern California, managing the provision of healthcare services for approximately 135,700 commercial, 19,900 Medi-Cal and 21,800 Medicare lives. Our Medical Group network of approximately 7,200 independent physicians is concentrated in Orange, Los Angeles and San Bernardino Counties. For the fiscal year ended September 30, 2009, our Medical Groups generated revenues of $196.7 million.

Our Medical Groups are networks of independent physicians who collectively contract with HMOs under a capitated payment arrangement. Under the capitated model, an HMO pays our Medical Groups a per-member-per-month ("PMPM") rate, or a "capitation" payment, and then assigns our Medical Groups the responsibility for providing the physician services required by those patients. In certain areas, HMOs find it more efficient to outsource the responsibility of providing physician services through Medical Groups. The relationship between HMOs and Medical Groups is a well-established model in the markets we serve and is designed to motivate physicians to practice preventative medicine and reduce unnecessary procedures. Medical Groups allow independent physicians to participate in contracts with HMOs and obtain patients, while allowing HMOs to more efficiently contract for physician services and outsource certain administrative functions associated with those activities.

15

We provide the following management and administrative support services to our affiliated physician organizations:

- •

- negotiation of contracts with physicians and HMOs;

- •

- physician recruiting and credentialing;

- •

- human resources;

- •

- claims administration;

- •

- provider relations;

- •

- member services;

- •

- medical management, including utilization management and quality assurance; and

- •

- data collection and management information systems.

We employ a variety of methodologies to mitigate the financial risk associated with the capitation model, including passing a portion of our payment through to the physician in a "sub-capitated" payment, pre-negotiating contracts with other providers, requiring prior authorization for services, and other techniques to appropriately manage utilization. All of our primary care physicians and a portion of our specialist physicians receive sub-capitation payments, with capitation representing approximately 53% of our medical costs. The remaining 47% of our medical costs consist of pre-authorized procedures referred to our contracted providers at discounted fee-for-service rates and emergency room services provided by non-contracted providers.

Our Affiliated Physician Organizations

Our two management subsidiaries, PMS and PHCA, currently provide management services to ten affiliated physician organizations. Our affiliated physician organizations include PMG, the nine affiliated physician organizations that PMG owns or controls, and one affiliated physician organization that is a joint venture in which PMG owns a 50% interest.

Physician organizations, by California law, may only be owned by physicians. We have designated Arthur Lipper, M.D., the President of PMG, to be the owner of all of the capital stock of PMG. As such he indirectly controls PMG's ownership interest in each of our other affiliated physician organizations. Dr. Lipper is also the President of all of the affiliated physician organizations that PMG owns (except Nuestra Familia Medical Group, Pomona Valley Medical Group, and Upland Medical Group, where he is a Vice-President) and is one of the two general partners of our joint venture affiliated physician organization.

We control the ownership of each of our affiliated physician organizations through assignable option agreements that we have entered into through our management subsidiary, PMS, with Dr. Lipper and PMG, and with Dr. Lipper and Nuestra. See "Assignable Option Agreement," below. For financial reporting purposes, we are deemed to control PMG under U.S. Generally Accepted Accounting Principles (see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies—Consolidation of Financial Statements") and are therefore required to consolidate the financial statements of PMG with those of our management subsidiaries.

Our affiliated physician organizations consist of affiliated Medical Groups which contract with physicians (primary care and specialist) and other ancillary providers, to provide all of their physician services.

Each of our affiliated physician organizations enters into contracts with HMOs to provide physician services to enrollees of the HMOs. Most of our HMO agreements have an initial term of two years renewing automatically for successive one-year terms. Increased capitation rates under the HMO

16

agreements are usually negotiated at the end of the term of such HMO agreements, typically taking the form of new agreements or amendments for additional two-year terms.

The HMO agreements generally provide for a termination by the HMOs for cause at any time, although we have never experienced a for-cause termination. The HMO agreements generally allow either the HMOs or the affiliated physician organizations to terminate the HMO agreements without cause within a four to six month period immediately preceding the expiration of the term of the agreement.

As of September 30, 2009, our affiliated physician organizations had contracts with approximately 6,200 independent physicians.

The physicians of the affiliated physician organizations are exclusively in control of and responsible for all aspects of the practice of medicine, subject to specialist referral guidelines developed by multi-specialty medical committees composed of our contracted physicians and chaired by one of our medical directors.

Information about our ten affiliated physician organizations is listed in the tables below. Except where noted, each organization is a medical corporation owned either directly or through PMG by a single shareholder, currently, Arthur Lipper, M.D.

| |

As of September 30, 2009 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Affiliated Physician Organizations

|

Primary Care Physicians |

Specialists | Enrollees | Area of Operations | |||||||

Prospect Medical Group, Inc. |

452 | 3,337 | 28,587 | Orange, Los Angeles & Riverside Counties | |||||||

Prospect Health Source Medical Group, Inc. |

72 | 1,845 | 14,055 | West Los Angeles | |||||||

Nuestra Familia Medical Group, Inc.(1) |

75 | 915 | 3,301 | East Los Angeles | |||||||

AMVI/Prospect Health Network(2) |

276 | 1,777 | 13,134 | Orange County | |||||||

Prospect Professional Care Medical Group |

184 | 2,275 | 16,024 | East Los Angeles & North Orange County | |||||||

Prospect NWOC Medical Group, Inc. |

110 | 1,428 | 5,773 | North Orange County | |||||||

StarCare Medical Group, Inc.(3) |

157 | 1,935 | 16,443 | North Orange County | |||||||

Genesis HealthCare of Southern California |

198 | 1,745 | 12,514 | Los Angeles and North Orange County | |||||||

Pomona Valley Medical Group |

126 | 183 | 55,960 | San Bernardino County | |||||||

Upland Medical Group |

85 | 146 | 11,609 | San Bernardino Counties | |||||||

Less: Physicians counted at multiple Medical Group |

(825 | ) | (9,346 | ) | — | ||||||

Total |

910 | 6,240 | 177,400 | ||||||||

- (1)

- 55%

owned by PMG directly with Arthur Lipper, M.D. through a separate assignable option agreement.

- (2)

- 50% owned joint venture partnership with AMVI/IMC Health Network, originally formed to service Medi-Cal, Healthy Families and OneCare members under the CalOPTIMA contract. Included in the total enrollment were approximately 2,900 enrollees that we manage for our own

17

economic benefit, and approximately 10,200 enrollees in the joint venture and in AMVI Care that we manage for the economic benefit of our partner, for which we earn management fee income.

| |

As of September 30, | ||||||

|---|---|---|---|---|---|---|---|

| |

2009 | 2008 | |||||

Commercial |

135,700 | 144,700 | |||||

Medicare |

21,800 | 21,900 | |||||

Medi-Cal |

19,900 | 27,400 | |||||

Totals |

177,400 | 194,000 | |||||

Note: On August 1, 2008, we sold the AV Entities, which had total enrollees of approximately 18,000 as of the date of sale.

The Medi-Cal enrollment statistics above include both enrollees that we manage for our own economic benefit, and enrollees that we manage for the economic benefit of our partner in the AMVI/Prospect Health Network joint venture. The number of enrollees included in the above table for which we provide management services to our joint venture partner, but in which we have no beneficial ownership interest, was 10,200 and 9,100, as of September 30, 2009 and 2008, respectively.

Revenue Concentration Statistics of our Affiliated Physician Organizations

For the Fiscal Years Ended September 30, 2009 and 2008

For the fiscal year ended September 30, 2009, our affiliated physician organizations had contracts with approximately 14 HMOs, from which our revenue was primarily derived. All of the contracts between our affiliated physician organizations and the HMOs provide for the provision of medical services to the HMO enrollees by the affiliated physician organization in consideration for the prepayment of the fixed monthly capitation fee paid by the HMOs.

For the fiscal years ended September 2009 and 2008, our affiliated physician organizations recognized capitation revenue of approximately $193,543,000 and $199,322,000, respectively. During those periods, the five largest HMOs of our affiliated physician organizations, United Healthcare, Health Net of California, Blue Cross of California, Blue Shield of California and Inter Valley Health Plan, accounted for approximately 77% and 79% of total capitation revenue, respectively.

As of June 1, 2009, the latest date for which such date was compiled, our affiliated physician organizations were listed by Cattaneo & Stroud as having a combined market share (based on number of HMO enrollees served) of approximately 6.7% in Orange County (92,000 enrollees compared to 1,378,450 total enrollees in Orange County), approximately 0.4% in Los Angeles County (18,000 enrollees compared to 4,863,050 total enrollees in Los Angeles County), and approximately 8.3% in San Bernardino County (68,000 enrollees compared to 822,900 total enrollees in San Bernardino County).

Assignable Option Agreement

The assignable option agreement is an essential element of our "single shareholder model." The assignable option agreement between our management subsidiary, PMS, and PMG provides PMS the right, at will and on an unlimited basis, to designate a successor physician to purchase the capital stock of PMG for nominal consideration ($1,000) and thereby determine the ownership of PMG. The assignable option agreement terminates or expires coterminous with the management services agreement between PMS and PMG, which has a thirty-year term with successive automatic ten-year

18

renewal terms. There is no limitation on whom we may name as a successor shareholder except that any successor shareholder must be duly licensed as a physician in the State of California or otherwise be permitted by law to be a shareholder of a professional corporation.

As a result of the assignable option agreement and our control of PMS, we have control over the ownership of PMG. Because PMG is the owner of all or a significant amount of the capital stock of all of the other affiliated physician organizations, control over the ownership of PMG ensures that we can control the ownership of each of our affiliated physician organizations.

Arthur Lipper, M.D. is currently the sole shareholder, sole director and President of PMG. He is also the President of each of our other affiliated physician organizations, except for AMVI/Prospect Health Network, Nuestra Familia Medical Group, Pomona Valley Medical Group and Upland Medical Group. As such, Dr. Lipper has a fiduciary duty to protect the interests of each entity and its shareholders.

Management Services Agreements

Upon completion of every Medical Group acquisition, one of our management subsidiaries enters into a long-term management services agreement with the newly-acquired physician organization. Our management subsidiaries provide management services to our affiliated Medical Groups under management services agreements that transfer control of all non-medical components of the business of the affiliated physician organizations to our management subsidiaries to the full extent permissible under federal and state law.

Under the management services agreements, we, through our management subsidiaries, provide management functions only. Under these agreements, each affiliated physician organization delegates to us the non-physician support activities that are required by the affiliated physician organizations in the practice of medicine. The management services agreements require us to provide suitable facilities, fixtures and equipment and non-physician support personnel to each affiliated physician organization. The primary services that we provide under management services agreements include the following:

- •

- utilization management and quality assurance;

- •

- medical management;

- •

- physician contracting;

- •

- physician credentialing;

- •

- HMO contracting;

- •

- claims administration;

- •

- provider relations;

- •

- management information systems;

- •

- patient eligibility and services;

- •

- member services; and

- •

- physician recruiting.

In return for these management and administrative support services we receive a management fee. Our current standard management fee is 15% of each organization's gross revenues, which we receive from each of our affiliated physician organizations, with the exception of AMVI/Prospect Health Network (an amount equal to the sum of $5.25 per CalOPTIMA Medi-Cal enrollee per month, $3.15 per CalOPTIMA Healthy Families enrollee, and 6.5% of the premium per CalOptima OneCare enrollee per month).

19

In addition to these management fees, we receive an incentive bonus based on the net profit or loss of each wholly-owned affiliated physician organization. Generally, we are allocated a 50% residual interest in all profits after the first 8% of the profits or a 50% residual interest in the net losses, after deduction for costs to the management subsidiary and physician compensation.

From time to time, supplemental management fees have been awarded by the physician organizations to the management companies to compensate for, among other things, increased costs associated with specific initiatives for the benefit of the physician organizations.

Because of the ownership of a controlling financial interest by PMG or Dr. Lipper in all of our affiliated physician organizations, other than AMVI/Prospect Health Network, we have the ability to adjust our management fees (other than for AMVI/Prospect Health Network) should we determine that an adjustment is appropriate and warranted, based on increased costs associated with managing the affiliated physicians organizations. In the case of AMVI/Prospect Health Network, because PMG's ownership interest is a 50% interest, in the event we determine that an adjustment of the management fee for AMVI/Prospect Health Network is appropriate, an adjustment would require negotiation with the joint venture partner.

Notwithstanding our ability to control the management fee adjustment process, we are limited by laws affecting management fees of healthcare management service companies. Such laws require that our management fees reflect fair market value for the services being rendered, giving consideration however to the costs of providing the services. Such laws also limit our ability to increase our management fees more frequently than once a year.

The management services agreements with our affiliated physician organizations that are 100% owned by PMG each have a thirty-year term and renew automatically for successive ten-year terms unless either party elects to terminate them 90 days prior to the end of their term. The management services agreements with those affiliated physician organizations in which PMG has less than a 100% interest have different terms. Our contract with Nuestra Familia is for only ten years; however, because Dr. Lipper as the nominee shareholder under an assignable option agreement is a 55% shareholder, any renewal or termination must be approved by Dr. Lipper. Similarly, our joint venture with AMVI is year-to-year, but because PMG is a 50% owner of that joint venture, it cannot be terminated without approval of the board of directors, of which PMG controls the appointment of 50% of the members. The management services agreements are terminable by the unilateral action of the particular physician organization prior to their normal expiration if we materially breach our obligations under the agreements or become subject to bankruptcy-related events, and we are unable to cure a material breach within sixty days of the occurrence. All management fees of consolidated entities are eliminated in our consolidated financial statements.

Risk Management

We control the medical expense or medical risk of our affiliated physician organizations. We use sub-capitation as our primary technique to control this risk. Sub-capitation is where an organization that is paid under capitated contracts with an HMO in turn contracts with other providers on a capitated basis for a portion of the original capitated premium. Historically, approximately half of the medical costs of our affiliated physician organizations are sub-capitated.

The medical costs of our affiliated physician organizations which are not sub-capitated are controlled in various ways. For those specialties for which we cannot, or do not choose to obtain a sub-capitated contract, we negotiate discounted fee-for-service contracts. Further, by contract, our affiliated physician organizations generally do not assume responsibility for the costs of providing medical services ("medical costs") that occur outside of their service area, which has been defined as a 30-mile radius around the office of the HMO enrollee's primary care physician. All non-emergent care requires prior authorization, in order to limit unnecessary procedures and to direct the HMO enrollee

20

requiring care to the physicians contracted with our affiliated physician organizations, and to the most cost effective facility. Our affiliated physician organizations utilize board certified pulmonologists and internists, trained in intensive care to maintain appropriate utilization, reducing unnecessary consultations and facilitating the patient's treatment and discharge. We also review medical costs by Medical Group and by specialty and compare those costs to the trend of patient utilization of medical services by specialty. In those instances where the patient utilization is trending very low, we determine whether it would be less expensive for our affiliated physician organizations to pay their providers on a discounted fee-for-service basis rather than on a capitated basis.

In addition, our affiliated physician organizations' agreements with HMOs and hospitals contain risk-sharing arrangements under which the affiliated physician organizations can earn additional compensation by coordinating the provision of quality, cost-effective healthcare to enrollees, but, in certain very limited cases, they may also be required to assume a portion of any loss sustained from these arrangements. Risk-sharing arrangements are based upon the cost of hospital services or other services for which our physician organizations are not capitated. The terms of the particular risk-sharing arrangement allocate responsibility to the respective parties when the cost of services exceeds a budget, which results in a "deficit," and permit the parties to share in any amounts remaining in the budget, known as a "surplus," which occurs when actual cost is less than the budgeted amount. The amount of non-capitated and hospital costs in any period could be affected by factors beyond our control, such as changes in treatment protocols, new technologies and inflation. To the extent that such non-capitated and hospital costs are higher than anticipated, revenue paid to our affiliated physician organizations may not be sufficient to cover the risk-sharing deficits they are responsible for paying, which could reduce our revenues and profitability. It is our experience that "deficit" amounts for hospital costs are applied to offset any future "surplus" amount we would otherwise be entitled to receive. We have historically not been required to reimburse the HMOs for most hospital cost deficit amounts. Most of our contracts with HMOs specifically provide that we will not have to reimburse the HMO for hospital cost deficit amounts.

HMOs may insist on withholding negotiated amounts from the affiliated physician organizations' professional capitation payments, which the HMOs are permitted to retain, in order to cover the affiliated physician organizations' share of any risk-sharing deficits. Whenever possible, we seek to contractually reduce or eliminate our affiliated physician organizations' liability for risk-sharing deficits.

Provider Agreements

The physicians of our affiliated physician organizations are exclusively in control of, and responsible for all aspects of, the practice of medicine, and are subject to specialist referral guidelines developed by multi-specialty medical committees composed of our contracted physicians and chaired by one of our medical directors. Each affiliated physician organization enters into the following types of contracts for the provision of physician and ancillary health services:

Primary Care Physician Agreement. A primary care physician agreement provides for primary care physicians contracting with independent physician associations to be responsible for both the provision of primary care services to enrollees and for the referral of enrollees to specialists affiliated with the independent physician association, when appropriate. Primary care physicians receive monthly sub-capitation for the provision of primary care services to enrollees assigned to them.

Specialist Agreement. A specialist agreement provides for a specialty care physician contracting with the independent physician association to receive either sub-capitated payments or discounted fee-for-service payments for the provision of specialty services to those enrollees referred to them by the independent physician association's primary care physician.

21

Ancillary Provider Agreement. An ancillary provider agreement provides for ancillary service providers—generally non-physician providers such as physical therapists, laboratories, etc.—to contract with an independent physician association to receive either monthly sub-capitated, discounted fee-for service or case rate payments for the provision of service to enrollees on an as-needed basis.

Competition

The medical group industry is highly competitive and is subject to continuing changes with respect to the manner in which services are provided and how providers are selected and paid. We are subject to significant competition with respect to physicians affiliating with our physician organizations. Generally, both we and our affiliated physician organizations compete with any entity that enters into contracts with HMOs for the provision of prepaid healthcare services, including:

- •

- other companies that provide management services to healthcare providers but do not own the affiliated physician

organization;

- •

- hospitals that affiliate with one or more physician organizations;

- •

- HMOs that contract directly with physicians; and

- •

- other physician organizations.

We believe that we offer competitive services in the Southern California managed care market based upon our historical stability, our competitive compensation relative to other organizations, and our quality of service.

There is competition for patients and primary care physicians in every market in which our affiliated physician organizations operate. The number of significant competitors varies in each region. The following summary of information about our competitors and their estimated enrollment in various markets is based on an industry report updated through June 1, 2009. Enrollment numbers that follow differ from updated enrollment numbers of our affiliated entities provided elsewhere in this filing, due to differing dates of presentation.

Based on these reports, total HMO enrollment in Los Angeles County was approximately 4,863,050, of which we had approximately 18,000 enrollees, or approximately 0.4%. Our five largest competitors in Los Angeles County are Kaiser Foundation, Healthcare Partners Medical Group, Regal Medical Group, La Vida Medical Group, and Facey Medical Foundation. HMO enrollment in Orange County was estimated at approximately 1,378,450, of which Prospect had approximately 92,000 enrollees, or approximately 6.7%. Our five largest competitors in Orange County are Kaiser Foundation, St. Joseph Heritage Healthcare, Monarch Healthcare, Greater Newport Physicians Medical Group, and Bristol Park Medical Group. HMO enrollment in San Bernardino County was estimated at approximately 822,900 of which Prospect had approximately 68,000 enrollees, or approximately 8.3%. Our five largest competitors in San Bernardino County are Kaiser Foundation, Beaver Medical Group, Choice Medical Group, PrimeCare of San Bernardino and Regal Medical Group. As such, we believe that the combined enrollment of our affiliated physician organizations is the eighth largest in California.

Some of our competitors are larger than us, have greater resources and may have longer-established relationships with buyers of their services, giving them greater value in contracting with physicians and HMOs. Such competition may make it difficult to enter into affiliations with physician organizations on acceptable terms and to sustain profitable operations.

22

Health Care Regulation

General Regulatory Overview

Both our hospitals and affiliated physician organizations are subject to numerous federal and state statutes and regulations that are applicable to the management and provision of health care services and to business generally, as summarized below. The healthcare industry is required to comply with extensive government regulation at the federal, state, and local levels. Under these regulations, hospitals must meet requirements to be certified as hospitals and qualified to participate in government programs, including the Medicare and Medi-Cal programs. These requirements relate to the adequacy of medical care, equipment, personnel, operating policies and procedures, maintenance of adequate records, hospital use, rate-setting, compliance with building codes, and environmental protection laws. There are also extensive regulations governing a hospital's participation in these government programs. If we fail to comply with applicable laws and regulations, we can be subject to criminal penalties and civil sanctions, our hospitals can lose their licenses and we could lose our ability to participate in these government programs. In addition, government regulations may change. If that happens, we may have to make changes in our facilities, equipment, personnel, and services so that our hospitals remain certified as hospitals and qualified to participate in these programs. We believe that our hospitals and affiliated physician organizations are in substantial compliance with current federal, state, and local regulations and standards.

In addition to the regulations referenced above, our affiliated physician organization operations may also be affected by changes in ethical guidelines and operating standards of professional and trade associations such as the American Medical Association. Changes in existing ethical guidelines or professional organization standards, adverse judicial or administrative interpretations of such guidelines and standards, or enactment of new legislation could require us to make costly changes to our business that would reduce our profitability. Changes in health care legislation or government regulation may restrict our existing operations, limit the expansion of our business or impose additional compliance requirements and costs, any of which could have a material adverse effect on our business, financial condition, results of operations and the trading price of our stock.

Corporate Practice of Medicine and Professional Licensing