Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - BOSTON SCIENTIFIC CORP | exhibit7.htm |

| 8-K - LIVE FILING - BOSTON SCIENTIFIC CORP | htm_35609.htm |

| EX-10.4 - EX-10.4 - BOSTON SCIENTIFIC CORP | exhibit4.htm |

| EX-10.3 - EX-10.3 - BOSTON SCIENTIFIC CORP | exhibit3.htm |

| EX-10.1 - EX-10.1 - BOSTON SCIENTIFIC CORP | exhibit1.htm |

| EX-10.5 - EX-10.5 - BOSTON SCIENTIFIC CORP | exhibit5.htm |

| EX-10.6 - EX-10.6 - BOSTON SCIENTIFIC CORP | exhibit6.htm |

EXHIBIT 10.2

EXHIBIT 10.2

Performance Share Plan (“Plan”)

Performance Period January 1, 2010 — December 31, 2012

| I. | Purpose of the Program |

The purpose of the Program is to align Boston Scientific’s executive compensation program with the interests of shareholders and to reinforce the concept of pay for performance by comparing the Total Shareholder Return (“TSR”) of shares of Boston Scientific Corporation Common Stock (the “Common Stock”) to the TSR of companies included in the S&P 500 Healthcare Index over a three-year period beginning on January 1, 2010.

The Program shall be administered under the Boston Scientific Corporation 2003 Long-Term Incentive Plan (the “2003 LTIP”). Defined terms not explicitly defined in this Program document but defined in the 2003 LTIP shall have the same meaning as in the 2003 LTIP. For covered employees, the 2010 Plan is established under section 4.a.(9) of the Boston Scientific Corporation 2003 Long-Term Incentive Plan and is intended to qualify for the performance-based compensation exception under Section 162(m) of the Internal Revenue Code (“Code”).

Boston Scientific must achieve performance greater than the median TSR of the S&P 500 Healthcare Index for eligible executives to earn the target award under the Program (as set forth in Section III below).

| II. | Eligible Participants |

The Program covers members of the Executive and Operating Committees on the date that awards are granted under the Program.

The Executive Compensation and Human Resources Committee of the Board of Directors (the “Committee”) may review Program eligibility criteria for participants in the Program from time to time and may revise such criteria at any time, even within a Program year, with or without notice and within its sole discretion.

III. Performance Share Units

The performance share units granted under the Program (the “Performance Share Units”) shall vest based on the TSR of the Common Stock relative to the TSR of companies in the S&P 500 Healthcare Index. The Common Stock underlying the Performance Share Units awarded under the Program will be granted under the Boston Scientific 2003 LTIP.

The TSR for Boston Scientific and all companies in the S&P 500 Healthcare Index will be measured in three annual Performance Cycles (as defined below) over a three-year period beginning January 1, 2010 and ending on December 31, 2012 (the “Performance Period”).

The final TSR calculation for determination of Performance Share Units that will vest will be the simple average of the TSR as measured based on each of the three annual Performance Cycles.

The Performance Share Units will pay out in shares of Common Stock in a range of 0% to 260% of the target number of Performance Share Units awarded to the participant as follows:

| TSR Performance | ||||||||

| Percentile Rank | Units Vesting | |||||||

100th Percentile

|

260 | % | ||||||

95th Percentile

|

240 | % | ||||||

80th Percentile

|

150 | % | ||||||

55th Percentile

|

100 | % | ||||||

30th Percentile

|

50 | % | ||||||

Below 30th Percentile

|

0 | % | ||||||

The Performance Share Units will pay out linearly between each set of data points.

Following the end of the Performance Period, the Committee shall determine the number of shares of Common Stock earned, which determination shall be final and binding. Shares of Common Stock earned will be delivered or otherwise made available to the participant no later than March 15, 2013.

| IV. | Total Shareholder Return |

The TSR for Boston Scientific and each company in the S&P 500 Healthcare Index shall include any cash dividends paid during the Performance Period and shall be determined as follows:

Total Shareholder Return for each Performance Cycle =

(Change in Stock Price + Dividends Paid) / Beginning Stock Price

Total Shareholder Return for the three-year Performance Period =

Results of (Performance Cycle 1 + Performance Cycle 2 + Performance Cycle 3) / 3

“Beginning Stock Price” means the daily average closing price as quoted on the New York Stock Exchange or the NASDAQ Global Select Market, as applicable, of one (1) share of common stock for the two calendar months prior to the beginning of each Performance Cycle.

“Change in Stock Price” means the difference between the Beginning Stock Price and the Ending Stock Price.

“Dividends Paid” means the total of all cash dividends paid on one (1) share of stock during the applicable Performance Cycle.

“Ending Stock Price” means the daily average closing price as quoted on the New York Stock Exchange or the NASDAQ Global Select Market, as applicable, of one (1) share of common stock for the last two calendar months of the Performance Cycle.

“Performance Cycle” means the annual period commencing each January 1 and ending on December 31 during the Performance Period.

“Performance Cycle 1” is the Performance Cycle during which the Beginning Stock Price is determined as of January 1, 2010 and the Ending Stock Price is determined as of December 31, 2010.

“Performance Cycle 2” is the Performance Cycle during which the Beginning Stock Price is determined as of January 1, 2011 and the Ending Stock Price is determined as of December 31, 2011.

“Performance Cycle 3” is the Performance Cycle during which the Beginning Stock Price is determined as of January 1, 2012 and the Ending Stock Price is determined as of December 31, 2012.

Example: If the Beginning Stock Price for a company was $25.00 per share, and the company paid $2.50 in dividends over the Performance Cycle, and the Ending Stock Price was $30.00 per share (thereby making the Change in Stock Price $5.00 ($30.00 minus $25.00)), then the TSR for that company would be thirty percent (30%). The calculation is as follows: 0.30 = ($5.00 + $2.50) / $25.00

| V. | Calculation of Percentile Performance |

Following the calculation of the TSR for the Performance Period for Boston Scientific and each of the companies in the S&P 500 Healthcare Index, Boston Scientific and the companies in the S&P 500 Healthcare Index will be ranked, in order of maximum to minimum, according to their respective TSR for the Performance Period.

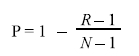

After this ranking, the percentile performance of Boston Scientific as compared to the other companies in the S&P 500 Healthcare Index shall be determined by the following formula:

“P” represents the percentile performance which will be rounded, if necessary, to the nearest whole percentile by application of regular rounding.

“N” represents the number of companies in the S&P 500 Healthcare Index, including Boston Scientific.

“R” represents Boston Scientific’s ranking versus the other companies in the S&P 500 Healthcare Index.

Example: If Boston Scientific ranked 10th out of 54 companies, the performance will be in the 83rd percentile.

This calculation is as follows: 0.83 = 1 – (10 – 1) / (54 – 1) |

||

| VI. | S&P 500 Healthcare Index |

The companies currently included in the S&P 500 Healthcare Index can be found in Appendix A attached hereto.

If two companies in the S&P 500 Healthcare Index merge, the surviving company shall remain in the S&P 500 Healthcare Index.

If a company in the S&P 500 Healthcare Index merges with, or is acquired by, a company that is not in the S&P 500 Healthcare Index, and the company in the S&P 500 Healthcare Index is the surviving company, then the surviving company shall be included in the S&P 500 Healthcare Index.

If a company in the S&P 500 Healthcare Index merges with, or is acquired by, a company that is not in the S&P 500 Healthcare Index, and the company in the S&P 500 Healthcare Index is not the surviving company or the surviving company is no longer publicly traded, then the surviving company shall not be included in the S&P 500 Healthcare Index.

Notwithstanding the foregoing, if a company in the S&P 500 Healthcare Index ceases to be listed in the Healthcare Sector under the Standard & Poor’s Global Industry Classification Standard (GICS) at anytime during the Performance Period (including after a merger, acquisition or other business transaction described above), then it shall not be included in the S&P 500 Healthcare Index.

| VII. | Payment Criteria |

A participant must be employed by Boston Scientific on December 31, 2012 to be eligible to receive the full award under the Program. Except as set forth below with respect to a Change in Control or termination of employment as a result of Retirement, death, or Disability, no Performance Share Units shall vest prior to December 31, 2012.Participants on military, sick or other bona fide leave of absence on December 31, 2012 will not be deemed to have terminated employment with Boston Scientific if such absence does not exceed 180 days or, if longer, if the participant retains the right by statute or by contract to return to employment with Boston Scientific.

If a participant’s employment with Boston Scientific terminates before the end of the Performance Period, any unvested Performance Share Units shall be forfeited on the effective date of the termination of employment, except in connection with Retirement, death, Disability or upon a Change in Control as outlined below.

Upon a Change in Control or if a participant’s employment terminates due to Retirement, death, or Disability after the end of Performance Cycle 1 (December 31, 2010) but prior to the end of the Performance Period, the Performance Share Units shall remain outstanding and shares of Common Stock shall be issued on a prorated basis in accordance with Section III but using the the date of the participant’s termination of employment (as described below). The number of prorated shares to be issued to the participant, if any, will be approved by the Committee at its next regular meeting.

The number of shares to be issued on a prorated basis shall be determined as follows: (# Performance Share Units awarded) * ((# of months worked during the Performance Period, rounded to nearest whole month) / 36). This result will be multiplied by either the Performance Cycle 1 percentile performance funding amount (as calculated according to the chart in Section III) or the average of the Performance Cycle 1 and Performance Cycle 2 percentile performance funding amount (as calculated according to the chart in Section III), depending on the date of the Change in Control or the date participant’s employment is terminated due to Retirement, death or Disability.

| VIII. | Termination, Suspension or Modification and Interpretation of the Program |

The Committee has sole authority over administration and interpretation of the Program and retains its right to exercise discretion as it sees fit. The Committee may terminate, suspend or modify and if suspended, may reinstate with or without modification all or part of the Program at any time, with or without notice to the participant. The Committee reserves the exclusive right to determine eligibility to participate in this Program and to interpret all applicable terms and conditions, including eligibility criteria.

IX. Other

This document sets forth the terms of the Program and is not intended to be a contract or employment agreement between the participant and Boston Scientific. As applicable, it is understood that both the participant and Boston Scientific have the right to terminate the participant’s employment with Boston Scientific at any time, with or without cause and with or without notice, in acknowledgement of the fact that their employment relationship is “at will.”