Attached files

| file | filename |

|---|---|

| EX-31.2 - CERTIFICATION OF CEO/CFO PURSUANT TO SECTION 302 - VALSPAR CORP | valspar095485_ex31-2.htm |

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - VALSPAR CORP | valspar095485_ex23-1.htm |

| EX-32.1 - CERTIFICATION OF CEO/CFO PURSUANT TO SECTION 906 - VALSPAR CORP | valspar095485_ex32-1.htm |

| EX-21.1 - SUBSIDIARIES OF THE REGISTRANT - VALSPAR CORP | valspar095485_ex21-1.htm |

| EX-10.19 - THE VALSPAR CORPORATION 2009 OMNIBUS EQUITY PLAN - VALSPAR CORP | valspar095485s1_ex10-19.htm |

| EX-31.1 - CERTIFICATION OF CEO PURSUANT TO SECTION 302 - VALSPAR CORP | valspar095485_ex31-1.htm |

WASHINGTON, D.C. 20549

|

|

|

|

|

|

|

FORM 10-K |

|

|

|

|

|

|

|

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

For the fiscal year ended October 30, 2009 |

|

or |

|

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

For the transition period from _______________________ to ___________________ |

|

|

|

|

Commission File Number 1-3011 |

|

|

|

|

|

|

|

|

|

|

|

|

Delaware |

|

36-2443580 |

|

(State of incorporation) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

901 3rd Avenue South |

|

|

|

Minneapolis, Minnesota |

|

55402 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (612) 851-7000

|

|

|

|

|

Title of Each Class |

|

Name of Each Exchange on which Registered |

|

|

|

|

|

Common Stock, $.50 Par Value |

|

New York Stock Exchange |

|

Common Stock Purchase Rights |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the

registrant is a well-known seasoned issuer, as defined in Rule 405 of the

Securities Act.

x

Yes o No

Indicate by check mark if the

registrant is not required to file reports pursuant to Section 13 or Section

15(d) of the Act.

o Yes x No

Indicate by check

mark whether the registrant (1) has filed all reports required to be filed by

Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file

such reports), and (2) has been subject to the filing requirements for the past

90 days.

x Yes o No

Indicate by check mark

whether the registrant has submitted electronically and posted on its corporate

Web site, if any, every Interactive Data File required to be submitted and

posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during

the preceding 12 months (or for such shorter period that the registrant was

required to submit and post such files).

o Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer o Non-accelerated filer o Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule12b-2 of the Act). o Yes x No

The aggregate market value of the voting stock held by persons other than officers, directors and more than 5% stockholders of the registrant as of May 1, 2009 was $1.9 billion based on the closing sales price of $23.38 per share as reported on the New York Stock Exchange. As of December 14, 2009, 99,513,733 shares of Common Stock, $.50 par value per share (net of 18,928,891 shares in treasury), were outstanding.

DOCUMENTS INCORPORATED IN PART BY REFERENCE

Portions of The Valspar Corporation’s definitive Proxy Statement dated January 15, 2010 (the “Proxy Statement”), to be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year ended October 30, 2009, are incorporated by reference into Part III to the extent described in this report.

The Valspar Corporation

Form 10-K

Table of Contents

|

|

|

|

BUSINESS |

OVERVIEW

The Valspar

Corporation is a leading global coatings and paints manufacturer and

distributor, based on revenues and trade publication rankings. We manufacture

and distribute a broad portfolio of coatings, paints and related products. We

operate our business in two reportable segments: Coatings and Paints. Our net

sales in 2009 from our Coatings and Paints segments were $1,582.8 million and

$1,072.4 million, respectively. Our total net sales in 2009 were $2,879.0

million.

Our Coatings segment includes a broad range of decorative and protective coatings for metal, wood and plastic, primarily for sale to original equipment manufacturing (OEM) customers. Products within our Coatings segment include primers, top coats, varnishes, inks, sprays, stains, fillers and other coatings used by customers in a wide range of manufacturing industries, including building products, appliances, furniture, transportation, agricultural and construction equipment, metal packaging and metal fabrication. We utilize a wide variety of coatings technologies to meet our customers’ coatings requirements, including electrodeposition, powder, solvent-based, waterborne and UV light-cured coatings. This segment includes our packaging product line and our three industrial product lines: coil, general industrial and wood.

Our packaging product line includes coatings for the interior and exterior of metal packaging containers, principally food containers and beverage cans. We also produce coatings for aerosol and paint cans, crowns for glass bottles, plastic packaging and bottle closures. We believe we are the world’s largest supplier of metal packaging coatings. Consolidation and globalization of our customers has occurred in this product line and we have responded by offering a wide variety of packaging coatings products throughout the world.

Our coil product line includes coatings that are applied to metal coils used to manufacture pre-engineered buildings and building components, other metal building and architectural products and appliances. We believe we are the largest supplier of coil coatings in North America. We also supply coil coatings in Asia, South America and Northern and Eastern Europe.

Our general industrial product line provides customers in a wide variety of industries with a single source for powder, liquid and electrodeposition coatings technologies. With our wide range of products and technologies, we are able to supply customers around the world. We have expanded our infrastructure to support customers in Europe, Central and South America and Asia.

Our wood product line includes decorative and protective coatings for wood furniture, building products, cabinets and floors. We believe we are one of the world’s largest suppliers of wood coatings. We have color design, manufacturing and technical service capabilities in the U.S. and Asia, which are important regions for wood furniture production.

Our Paints segment includes a wide variety of products such as paints, primers, topcoats and aerosol spray paints sold primarily through retailers and distribution networks. We sell branded and other products in our Paints segment, including Valspar, Cabot, Huarun, DeBeer and House of Kolor. We support these brands through advertising and marketing programs. This segment includes our architectural and automotive refinish product lines.

Our architectural product line comprises the largest part of our Paints segment. We offer a broad portfolio of interior and exterior paints, stains, primers, varnishes, high performance floor paints and specialty decorative products. We sell these products primarily into the do-it-yourself and professional markets through home centers, mass merchants, hardware wholesalers and independent dealers. We offer our own branded products and private label brands for customers. We continue to invest in brands, including Valspar, Cabot and Huarun. At key customers, we also offer additional marketing and customer support by providing Valspar personnel to train paint department employees and to answer paint questions in stores. In China, we sell our Huarun brand of architectural coatings through distributors and retail outlets.

Our automotive product line includes refinish paints and aerosol spray paints that are sold through automotive refinish distributors, body shops, automotive supply distributors and automotive supply retailers. Our Valspar, De Beer and House of Kolor brands are offered in many countries around the world.

In addition to the main product lines within our two segments, we manufacture and sell specialty polymers, colorants and gelcoats, and we sell furniture protection plans under the Guardsman brand. The specialty polymers and colorants are manufactured for internal use and for external sale to other coatings manufacturers. Our gelcoats and related products are sold to boat manufacturers, shower and tub manufacturers and others.

Much of our growth has occurred during the last decade. During this time we have expanded our business into international markets. A significant portion of our business growth has been accomplished through acquisitions.

1

The Valspar Corporation is a Delaware corporation and was founded in 1806. Our principal executive offices are located at 901 3rd Avenue South, Minneapolis, Minnesota 55402, and our telephone number at that address is (612) 851-7000. Our corporate website address is www.valsparglobal.com. The information on our website is not part of this filing.

PRODUCTS

Coatings Segment

The Coatings segment

includes a broad range of decorative and protective coatings for metal, wood

and plastic, primarily for sale to OEM customers in North America, South

America, Europe and Asia. Products within our Coatings segment include primers,

top coats, varnishes, inks, sprays, stains, fillers and other coatings used by

customers in a wide range of manufacturing industries, including building

products, appliances, furniture, transportation, agricultural and construction

equipment, metal packaging and metal fabrication.

We utilize a wide variety of coatings technologies to meet our customers’ coatings requirements, including electrodeposition, powder, solvent-based, waterborne and UV light-cured coatings. This broad technology capability allows us to customize products to our customers’ specifications and to provide “one stop” integrated solutions. For example, we believe that we are one of only a small number of coatings manufacturers that currently have the technological and manufacturing capabilities to be a single source coatings supplier to appliance makers.

The packaging product line includes coatings for both interior and exterior use in metal packaging containers, principally food containers and beverage cans for global customers. We also produce coatings for aerosol and paint cans, crowns for glass bottles, plastic packaging and bottle closures. We believe we are the world’s largest supplier of metal packaging coatings, producing coatings for the entire can. Consolidation and globalization of our customers has occurred in this product line, and we have responded to these trends by offering a wide variety of packaging coatings products throughout the world.

Our coil coatings are applied to pre-engineered buildings and building components, other metal building and architectural products and appliances. We believe we are the leading coil coatings manufacturer in North America, with particular strength in coil coatings for metal buildings and appliances. With our broad technology portfolio, we have a product for nearly every type of coil coatings application requirement.

Within our general industrial product line, we offer a single source for powder, liquid and electrodeposition coatings technologies to customers in a wide variety of industries, including transportation, and agricultural and construction equipment. We continue to follow our customers with manufacturing and technical service as they move into Europe, Central and South America and Asia.

Our wood product line supplies decorative and protective coatings for wood furniture, building products, cabinets and floors. We offer color design, manufacturing and technical service for customers throughout North America and Asia which serve the domestic and export markets.

Paints Segment

Our architectural

paints products comprise a broad portfolio of interior and exterior paints,

stains, primers, varnishes, high performance floor paints and specialty decorative

products, such as enamels, aerosols and faux finishes, used in both the

do-it-yourself and professional markets. The primary distribution channels for

these products are home centers, mass merchants, hardware wholesalers,

distributors and independent dealers in the U.S. and Canada. In China, the

primary distribution channel is a network of distributors and retail outlets.

Sales of our architectural products are seasonal, with the lowest levels

occurring in the first quarter of our fiscal year.

We develop highly customized merchandising and marketing support programs for our architectural paint customers, enabling them to differentiate their paint departments from their competitors’ through product and color selection assistance, point-of-purchase materials and labeling. We offer branded products under the names Valspar, Cabot, Plasti-Kote, McCloskey and, in China, Huarun and Idol. We support these brands through advertising and marketing programs.

Within the Paints segment, we also manufacture and distribute automotive refinish paints around the world under the brand names Valspar, De Beer and House of Kolor. We also supply aerosol spray paints for automotive supply distributors and large automotive supply retailers under the Plasti-Kote brand name.

All Other

In addition to our

main product lines, we manufacture and sell specialty polymers, gelcoats and

colorants, and we sell furniture protection plans under the Guardsman brand. We

manufacture specialty polymers and colorants for internal use and for external

sale to other coatings manufacturers. Our gelcoats and related products are

sold to boat manufacturers, shower and tub manufacturers and others.

COMPETITION

All aspects of

the coatings and paints business are highly competitive. We face strong

competitors in all areas of our business, some of which are larger and better

capitalized than us.

2

Competition in our Coatings segment is based on formulating products for specific customer applications, meeting customer delivery requirements and providing technical assistance to the customer in product application, price and new technology offerings. In addition, the markets for industrial coatings are becoming increasingly global as customers are looking for global coatings solutions. We can provide global coatings solutions to customers due to our position as one of the world’s largest industrial coatings manufacturers and our commitment to developing innovative technologies.

Competition in our Paints segment is based on factors such as consumer brand recognition, product quality, distribution and price. In this segment, we support our brand awareness through advertising and highly customized merchandising and marketing support programs to our customers. We offer high quality products through our distribution networks.

RAW MATERIALS

We obtain raw

materials from a number of suppliers. The raw materials are derived from

petrochemicals, minerals and metals. Historically, all of these materials have

been generally available on the open market, with pricing and availability

subject to fluctuation. The chemical industry’s economic cycle for the past

four to five years has been volatile. Early in 2009, due to weak economic

conditions, prices for many of the raw materials we purchased moderated from

the historical highs of 2008. As the year progressed, material prices began to

rise again as crude oil and other feedstock prices recovered. Current raw

material price levels are still above trend lines from the early part of this

decade. Raw material demand and price volatility are managed to minimize the

impact on our operations. Because our raw material costs average approximately

80% of our cost of goods sold, the efficient use of raw materials is a critical

cost component of the products we manufacture.

PATENTS

Our policy is

to seek patent protection for our products and manufacturing processes when

appropriate. We also license some patented technology from other sources. Our

business is not materially dependent upon licenses or similar rights or on any

single patent or group of related patents. Although we believe our patent

rights are valuable, our knowledge and trade secret information regarding our

manufacturing processes and materials have also been important in maintaining

our competitive position. As a condition of employment, except where otherwise

prohibited by law or union rules, we require each employee to sign a

confidentiality agreement relating to proprietary information.

While we make efforts to protect our trade secret information, others may independently develop or otherwise acquire substantially equivalent proprietary information or techniques or gain access to our proprietary technology or disclose this technology. Any of these factors could adversely impact the value of our proprietary trade secret information and harm our business.

SEASONALITY AND WORKING CAPITAL ITEMS

Our sales

volume is traditionally lowest during the first quarter of the fiscal year

(November, December and January), and highest in the third quarter of the

fiscal year (May, June and July), primarily due to weather and the buying cycle

in the Coatings and Paints segments. When sales are generally lowest, we build

inventory, the financing for which is provided primarily by internally

generated funds and short-term and long-term credit lines discussed in Note 5

of Notes to Consolidated Financial Statements.

SIGNIFICANT CUSTOMERS

In 2009, our

sales to Lowe’s Companies, Inc. exceeded 10% of net sales, and our ten largest

customers accounted for approximately 38% of net sales. In 2009, our five

largest customers in the Paints segment accounted for approximately 63% of our

net sales in the segment.

BACKLOG AND GOVERNMENT CONTRACTS

We have no

significant backlog of orders and generally are able to fill orders on a

current basis. No material portion of our business is subject to renegotiation

of profits or termination of contracts or subcontracts at the election of the

government.

RESEARCH AND DEVELOPMENT

Our product and

application technology is supported by underlying chemistry that has not changed

over time. Ongoing research and development efforts include reviewing our

propriety technology, including the technology we have acquired through our

acquisitions, and making formulation changes to improve our products. This has

resulted in several successful product improvements. For example, we have

recently commercialized a new coil coating product with improved hardness,

adhesion and flexibility. In our architectural line, we have introduced an

improved concrete coating. In our wood line, we have commercialized a

waterborne ultraviolet energy cured product line. Moreover, we have continued

to expand our line of polymers and we now have a full portfolio of both

water-based and conventional polymers for architectural, industrial and

packaging products.

Research and development costs for fiscal 2009 were $91.3 million or 3.2% of net sales, compared to $96.6 million or 2.8% of net sales for fiscal 2008 and $90.3 million or 2.8% of net sales for fiscal 2007. Our primary emphasis has been on developing and refining emerging technologies in our Coatings segment.

3

ENVIRONMENTAL COMPLIANCE

We undertake to

comply with applicable regulations relating to protection of the environment

and workers’ safety. Capital expenditures for this purpose were not material in

fiscal 2009, and capital expenditures for fiscal 2010 to comply with existing

laws and regulations are also not expected to be material.

EMPLOYEES

We employ

approximately 8,800 persons, approximately 500 of whom are subject to

collective bargaining agreements in the United States. We believe that our

relationship with our unionized employees is good.

FOREIGN OPERATIONS AND EXPORT SALES

Our foreign

operations are conducted primarily through majority-owned subsidiaries and, to

a limited extent, through joint ventures. Our various acquisitions and joint

ventures over the past several years have increased revenues from foreign

subsidiaries and operations, which comprised approximately 38% of our total

revenues in fiscal 2009. Sales from foreign operations as a percent of

consolidated sales decreased in 2009 compared to 2008, but we expect the

percentage to increase in the years ahead.

We have manufacturing plants in Australia, Brazil, Canada, China, France, Germany, Ireland, Malaysia, Mexico, The Netherlands, Singapore, Switzerland, Thailand, the United Kingdom and Vietnam. We also have joint ventures in China, Japan, South Africa and Vietnam and sales offices in other countries.

During fiscal 2009, export sales from the United States represented 2.2% of our business.

|

|

|

|

RISK FACTORS |

You should consider the following risk factors, in addition to the other information presented or incorporated by reference into this Annual Report on Form 10-K, in evaluating our business and your investment in us.

Deterioration of economic conditions could harm our business.

Our business may be adversely affected by changes in national or global economic conditions, including inflation, interest rates, access to and functioning of capital markets, consumer spending rates, energy availability and costs (including fuel surcharges), and the effects of governmental initiatives to manage economic conditions.

The recent volatility in financial markets and the deterioration of national and global economic conditions could impact our operations as follows:

|

|

|

|

• |

the value of our investments in debt and equity securities may decline, including our assets held in pension plans; |

|

|

|

|

• |

financial stability of our customers and suppliers may be compromised, which could result in additional bad debts for us or non-performance by suppliers; and |

|

|

|

|

• |

it may become more costly or difficult to obtain financing to fund operations or investment opportunities, or to refinance our debt in the future. |

Additionally, we utilize hedges and other derivative financial instruments to reduce our exposure to various interest rate risks, which qualify for hedge accounting for financial reporting purposes. Volatile fluctuations in market conditions could cause these instruments to become ineffective, which could require any gains or losses associated with these instruments to be reported in our earnings each period.

Fluctuations in the supply and prices of raw materials could negatively impact our financial results.

We purchase the raw materials needed to manufacture our products from a number of suppliers. The majority of our raw materials are petroleum-based derivatives and minerals and metals. Under normal market conditions, these materials are generally available on the open market. From time to time, however, the prices and availability of these raw materials may fluctuate significantly, which could impair our ability to procure necessary materials, or increase the cost of manufacturing our products. During the past four to five years, our raw material costs have been volatile. When raw material costs increase, our profit margins are reduced unless and until we are able to pass along the increases to our customers through higher prices. If raw material costs increase, and if we are unable to pass along, or are delayed in passing along, those increases to our customers, we will experience profit margin reductions.

Many of our customers are in cyclical industries, which may affect the demand for our products.

Many of our customers, especially for our industrial products, are in businesses and industries that are cyclical in nature and sensitive to changes in general economic conditions. As a result, the demand for our products by these customers depends, in part, upon general economic conditions. The challenging global economic environment has had the most severe impact on our industrial product lines. Downward economic cycles affecting the industries of our customers will reduce sales of our products. When general economic conditions deteriorate, we may suffer reductions in our sales and profitability.

4

The industries in which we operate are highly competitive and some of our competitors may be larger and may have greater financial resources than we do.

All aspects of the coatings and paints business are highly competitive. We face strong competitors in all areas of our business. Any increase in competition may cause us to lose market share or compel us to reduce prices to remain competitive, which could result in reduced margins for our products. Competitive pressures may not only impair our margins but may also impact our revenues and our growth. A number of our competitors are larger than us and may have greater financial resources than we do. Increased competition with these companies could curtail price increases or could require price reductions or increased spending on marketing and sales, any of which could adversely affect our results of operations.

Industry sources estimate that the top ten largest coatings manufacturers represent more than half of the world’s coatings sales. Our larger competitors may have more resources to finance acquisitions or internal growth in this competitive environment. Also, we buy our raw materials from large suppliers, primarily chemical companies. In many of our product lines, we then sell our finished goods to large customers, such as do-it-yourself home centers, large equipment manufacturers and can makers. Our larger competitors may have more resources or capabilities to conduct business with these large suppliers and large customers. Finally, many of our larger competitors operate businesses other than paints and coatings. These competitors may be better able to compete during industry downturns.

We have a significant amount of indebtedness.

Our total debt, including notes payable, was $880.4 million at October 30, 2009. Our level of indebtedness may have important consequences. For example, it:

|

|

|

|

• |

may require us to dedicate a material portion of our cash flow from operations to make payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, acquisitions or other general corporate purposes; |

|

|

|

|

• |

could make us less attractive to prospective or existing customers or less able to fund potential acquisitions; and |

|

|

|

|

• |

may limit our flexibility to adjust to changing business and market conditions and make us more vulnerable to a downturn in general economic conditions as compared to a competitor that may have lower indebtedness. |

Future acquisitions may not be successful.

Acquisitions have historically contributed significantly to the growth of our company. As part of our growth strategy, we intend to continue to pursue acquisitions of complementary businesses and products. If we are successful in completing such acquisitions, we may experience:

|

|

|

|

• |

difficulties in assimilating acquired companies and products into our existing business; |

|

|

|

|

• |

delays in realizing the benefits from the acquired companies or products; |

|

|

|

|

• |

diversion of our management’s time and attention from other business concerns; |

|

|

|

|

• |

difficulties due to lack of or limited prior experience in any new markets we may enter; |

|

|

|

|

• |

unforeseen claims and liabilities, including unexpected environmental exposures or product liability; |

|

|

|

|

• |

unforeseen adjustments, charges and write-offs; |

|

|

|

|

• |

problems enforcing the indemnification obligations of sellers of businesses for claims and liabilities; |

|

|

|

|

• |

unexpected losses of customers of, or suppliers to, the acquired business; |

|

|

|

|

• |

difficulty in conforming the acquired business’ standards, processes, procedures and controls with our operations; |

|

|

|

|

• |

variability in financial information arising from the implementation of purchase price accounting; |

|

|

|

|

• |

difficulties in retaining key employees of the acquired businesses; and |

|

|

|

|

• |

challenges arising from the increased scope, geographic diversity and complexity of our operations. |

Any of these factors may make it more difficult to repay our debt. In addition, an acquisition could materially impair our operating results by causing us to incur debt or requiring us to amortize acquisition expenses or the cost of acquired assets. We can give no assurance that we will continue to be able to identify, acquire and integrate successful strategic acquisitions in the future or be able to implement successfully our operating and growth strategies within our existing markets or with respect to any future product or geographic diversification efforts.

5

We derive a substantial portion of our revenues from foreign markets, which subjects us to additional business risks.

We conduct a substantial portion of our business outside of the United States. We and our joint ventures currently have production facilities, research and development facilities, and administrative and sales offices located outside the United States, including facilities and offices located in Australia, Brazil, Canada, China, Finland, France, Germany, Ireland, Malaysia, Mexico, The Netherlands, Singapore, South Africa, Switzerland, Thailand, the United Kingdom and Vietnam. In 2009, revenues from products sold outside the United States accounted for approximately 38% of our net sales.

We expect sales from international markets to continue to represent a significant portion of our net sales. Notwithstanding the benefits of geographic diversification, our business is subject to risks related to the differing legal, political, social and regulatory requirements and economic conditions of many jurisdictions. Risks inherent in international operations include the following:

|

|

|

|

• |

agreements may be difficult to enforce and receivables difficult to collect; |

|

|

|

|

• |

foreign customers may have longer payment cycles; |

|

|

|

|

• |

foreign countries may impose additional withholding taxes or otherwise tax our foreign income, or adopt other restrictions on foreign trade or investment, including currency exchange controls; |

|

|

|

|

• |

foreign operations may experience staffing difficulties and labor disputes; |

|

|

|

|

• |

transportation and other shipping costs may increase; |

|

|

|

|

• |

foreign governments may nationalize private enterprises; |

|

|

|

|

• |

unexpected adverse changes in export duties, quotas and tariffs and difficulties in obtaining export licenses; |

|

|

|

|

• |

intellectual property rights may be more difficult to enforce; |

|

|

|

|

• |

fluctuations in exchange rates may affect product demand and may adversely affect the profitability in U.S. dollars of products and services we provide in international markets where payment for our products and services is made in the local currency; |

|

|

|

|

• |

general economic conditions in the countries in which we operate could have an adverse effect on our earnings from operations in those countries; |

|

|

|

|

• |

our business and profitability in a particular country could be affected by political or economic repercussions on a domestic, country specific or global level from terrorist activities and the response to such activities; |

|

|

|

|

• |

difficulties in attracting and retaining key employees outside of the United States; |

|

|

|

|

• |

unexpected adverse changes in foreign laws or regulatory requirements may occur; and |

|

|

|

|

• |

compliance with a variety of foreign laws and regulations may be burdensome. |

We have certain key customers.

Our relationships with certain key customers are important to us. From 2007 through 2009, sales to our largest customer exceeded 10% of our total net sales. In 2009, our ten largest customers accounted for approximately 38% of our total net sales. Although we sell various types of products through various channels of distribution, we believe that the loss of a substantial portion of our sales to our largest customers could have a material adverse impact on us.

Environmental laws and regulations affect our business.

We are subject to numerous environmental laws and regulations that impose various environmental controls on us, including among other things, the discharge of pollutants into the air and water, the handling, use, treatment, storage and clean-up of hazardous and non-hazardous wastes, the investigation and remediation of soil and groundwater affected by hazardous substances, or otherwise relating to environmental protection and various health and safety matters. These laws and regulations govern actions that may have adverse environmental effects and also require compliance with certain practices when handling and disposing of hazardous wastes. These laws and regulations also impose strict, retroactive and joint and several liability for the costs of, and damages resulting from, cleaning up current sites, past spills, disposals and other releases of hazardous substances and violations of these laws and regulations can also result in fines and penalties. We are currently undertaking remedial activities at a number of our facilities and properties, and have received notices under the Comprehensive Environmental Response, Compensation and Liability Act, or CERCLA, or analogous state laws of liability or potential liability in connection with the disposal of material from our operations or former operations.

We are also subject to the risk that new environmental laws or regulations, or changes in existing laws or regulations or their interpretation, could expand our potential liability by regulating additional substances or increasing our obligations with respect to the handling, disposal or remediation of regulated substances.

In addition, our customers’ or consumers’ perceptions about the acceptability or potential environmental or health effects of certain substances could require us to invest additional amounts to develop products that exclude those substances. If we are unable to develop products that exclude those substances when and if required by our customers, we may experience reduced sales and profitability.

6

|

|

|

|

UNRESOLVED STAFF COMMENTS |

Not Applicable.

|

|

|

|

PROPERTIES |

We lease our principal offices located in Minneapolis, Minnesota. North America manufacturing operations are conducted at thirty-one locations (29 owned; 2 leased), primarily in California, Illinois, Indiana, North Carolina, Pennsylvania and Texas, including one owned manufacturing facility in both Canada and Mexico. The total combined square footage for our principal offices and manufacturing operations in North America is approximately 4,385,000, which includes 130,000 square feet at our principal offices. Asia Pacific manufacturing operations are conducted at eleven locations (8 owned; 3 leased) in Australia, China, Malaysia, Singapore, Thailand and Vietnam with a total combined square footage of approximately 1,252,000. European manufacturing operations are conducted at nine locations (8 owned; 1 leased) in France, Germany, Ireland, The Netherlands, Switzerland and the United Kingdom with a total combined square footage of approximately 929,000. In South America, we own one manufacturing facility in Brazil with square footage of approximately 400,000. In South Africa, we own one manufacturing facility with square footage of approximately 54,000.

Set forth below is a breakdown of the approximate square footage of principal facilities by region as of October 30, 2009:

|

|

|

|

|

|

|

|

|

|

|

|

|

Region |

|

Approximate |

|

Approximate |

|

Total |

|

|||

|

North America |

|

|

3,862,000 |

|

|

523,000 |

|

|

4,385,000 |

|

|

Asia Pacific |

|

|

1,144,000 |

|

|

108,000 |

|

|

1,252,000 |

|

|

Europe |

|

|

834,000 |

|

|

95,000 |

|

|

929,000 |

|

|

Other |

|

|

454,000 |

|

|

— |

|

|

454,000 |

|

|

Total |

|

|

6,294,000 |

|

|

726,000 |

|

|

7,020,000 |

|

Set forth below is a breakdown of principal facilities square footage by business segment:

|

|

|

|

|

|

|

Business Segment |

|

Approximate |

|

|

|

Coatings |

|

|

3,884,000 |

|

|

Paints |

|

|

2,259,000 |

|

|

All Other |

|

|

877,000 |

|

|

Total |

|

|

7,020,000 |

|

Management believes our manufacturing properties are well maintained, in good operating condition and adequate for the purposes for which they are being used. We had restructuring initiatives in 2009 that included plant closures, which are reflected above. See Note 15 in Notes to Consolidated Financials Statements for more information. Operating capacity varies by product line, but additional production capacity is available for most product lines by increasing the number of days and/or shifts worked.

7

|

|

|

|

LEGAL PROCEEDINGS |

Environmental Matters

We are involved in

various claims relating to environmental matters at a number of current and

former plant sites. We engage or participate in remedial and other

environmental compliance activities at certain of these sites. At other sites,

we have been named as a potentially responsible party (“PRP”) under federal and

state environmental laws for site remediation. Management analyzes each

individual site, considering the number of parties involved, the level of our

potential liability or contribution relative to the other parties, the nature

and magnitude of the hazardous wastes involved, the method and extent of

remediation, the potential insurance coverage, the estimated legal and

consulting expense with respect to each site and the time period over which any

costs would likely be incurred. Based on the above analysis, management

estimates the clean-up costs and related claims for each site. The estimates

are based in part on discussion with other PRPs, governmental agencies and

engineering firms.

We accrue appropriate reserves for potential environmental liabilities, which are reviewed and adjusted as additional information becomes available. While uncertainties exist with respect to the amounts and timing of our ultimate environmental liabilities, management believes there is not a reasonable possibility that such liabilities, individually or in the aggregate, will have a material adverse effect on our financial condition or results of operations.

Other Legal Matters

We are involved in a

variety of legal claims and proceedings relating to personal injury, product

liability, warranties, customer contracts, employment, trade practices,

environmental and other legal matters that arise in the normal course of business.

These claims and proceedings include cases where we are one of a number of

defendants in proceedings alleging that the plaintiffs suffered injuries or

contracted diseases from exposure to chemicals or other ingredients used in the

production of some of our products or waste disposal. We believe these claims

and proceedings are not out of the ordinary course for a business of the type

and size in which we are engaged. While we are unable to predict the ultimate

outcome of these claims and proceedings, management believes there is not a

reasonable possibility that the costs and liabilities of such matters,

individually or in the aggregate, will have a material adverse effect on our

financial condition or results of operations.

|

|

|

|

SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

There was no matter submitted during the fourth quarter of fiscal year 2009 to a vote of security holders.

EXECUTIVE OFFICERS OF THE REGISTRANT

The names and

ages of all of our executive officers, all of whom are approved by the Board of

Directors for re-election in February of each year, and the positions held by

them are as listed below. There are no family relationships between any of the

officers or between any officer and director.

|

|

|

|

|

|

|

Name |

|

Age |

|

Position |

|

William L. Mansfield |

|

61 |

|

Chairman since August 2007 and Chief Executive Officer since February 2005 |

|

|

|

|

|

|

|

Lori A. Walker |

|

52 |

|

Senior Vice President and Chief Financial Officer since February 2008 |

|

|

|

|

|

|

|

Gary E. Hendrickson |

|

53 |

|

President and Chief Operating Officer since February 2008 and Director since August 2009 |

|

|

|

|

|

|

|

Steven L. Erdahl |

|

57 |

|

Executive Vice President since April 2004 |

|

|

|

|

|

|

|

Rolf Engh |

|

56 |

|

Executive Vice President since July 2005, General Counsel and Secretary since April 1993 |

|

|

|

|

|

|

|

Anthony L. Blaine |

|

42 |

|

Senior Vice President – Human Resources since January 2007 |

The foregoing executive officers have served in the stated capacity for the registrant during the past five years, except for the following:

Prior to February 2008, Mr. Mansfield was President since February 2005. Prior to February 2005, Mr. Mansfield was Executive Vice President and Chief Operating Officer since April 2004.

Prior to February 2008, Ms. Walker was Vice President, Treasurer and Controller since October 2004.

Prior to February 2008, Mr. Hendrickson was Senior Vice President since July 2005. Prior to July 2005, Mr. Hendrickson was Group Vice President – Wood Coatings since April 2004.

Prior to July 2005, Mr. Engh was Senior Vice President since November 1998.

Prior to January 2007, Mr. Blaine was Vice President – Human Resources at MeadWestvaco Corporation since June 2001.

8

|

|

|

|

|

|

|

|

|

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our Common Stock is listed on the New York Stock Exchange under the trading symbol VAL. The table below sets forth the quarterly high and low market prices of the Common Stock for fiscal years 2009 and 2008 as quoted on the New York Stock Exchange.

|

|

|

|

|

|

|

|

|

|

|

|

Market Price (high/low) |

|

||||

|

For the Fiscal Year |

|

2009 |

|

2008 |

|

||

|

First Quarter |

|

$ |

21.32–14.47 |

|

$ |

26.20–17.38 |

|

|

Second Quarter |

|

$ |

24.91–15.13 |

|

$ |

23.27–18.10 |

|

|

Third Quarter |

|

$ |

25.61–21.51 |

|

$ |

22.68–17.95 |

|

|

Fourth Quarter |

|

$ |

28.60–24.80 |

|

$ |

24.95–16.02 |

|

The quarterly dividend declared December 9, 2009, to be paid on January 15, 2010 to common stockholders of record December 28, 2009, was increased to $0.16 per share. The table below sets forth the quarterly dividend paid for fiscal years 2009 and 2008.

|

|

|

|

|

|

|

|

|

|

|

|

Per Share Dividends |

|

||||

|

For the Fiscal Year |

|

2009 |

|

2008 |

|

||

|

First Quarter |

|

$ |

0.15 |

|

$ |

0.14 |

|

|

Second Quarter |

|

$ |

0.15 |

|

$ |

0.14 |

|

|

Third Quarter |

|

$ |

0.15 |

|

$ |

0.14 |

|

|

Fourth Quarter |

|

$ |

0.15 |

|

$ |

0.14 |

|

|

|

|

$ |

0.60 |

|

$ |

0.56 |

|

The number of record holders of our Common Stock at December 14, 2009 was 1,448.

ISSUER PURCHASES OF EQUITY SECURITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period |

|

Total

Number |

|

Average |

|

Total

Number of |

|

Maximum

Number |

|

||||

|

8/01/09 – 8/28/09 |

|

|

180,000 |

|

|

$ 27.30 |

|

|

180,000 |

|

|

3,820,000 |

|

|

8/29/09 – 9/25/09 |

|

|

1,135,000 |

|

|

27.16 |

|

|

1,135,000 |

|

|

2,685,000 |

|

|

9/26/09 – 10/30/09 |

|

|

685,000 |

|

|

27.21 |

|

|

685,000 |

|

|

2,000,000 |

|

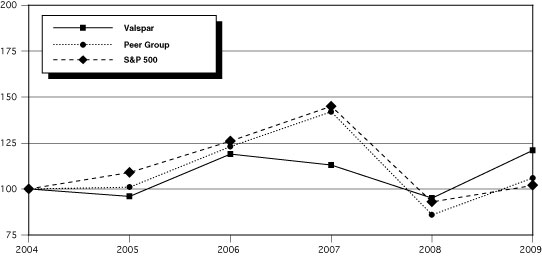

Stock Performance Graphs

The following graphs

compare our cumulative total shareholder return for the last five fiscal years

and the last ten fiscal years with the cumulative total return of the Standard

& Poor’s 500 Stock Index and a peer group of companies selected by us on a

line-of-business basis. The graphs assume the investment of $100 in our Common

Stock, the S&P 500 Index and the peer group at the end of fiscal 2004 and

fiscal 1999, respectively, and the reinvestment of all dividends.

The companies selected to form the peer group index are: Akzo Nobel N.V.; Ferro Corporation; H.B. Fuller Company; Masco Corporation; Newell Rubbermaid Inc.; PPG Industries, Inc.; RPM International Inc. and The Sherwin-Williams Company.

We included the ten-year graph because we believe the ten-year graph provides information regarding performance of our Common Stock over an extended period.

9

COMPARISON OF FIVE YEAR CUMULATIVE TOTAL RETURN

Among The Valspar Corporation, a Peer Group and the S&P 500 Index

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative Total Return |

|

||||||||||||||||

|

|

|

||||||||||||||||||

|

|

|

2004 |

|

2005 |

|

2006 |

|

2007 |

|

2008 |

|

2009 |

|

||||||

|

Valspar |

|

$ |

100 |

|

$ |

96 |

|

$ |

119 |

|

$ |

113 |

|

$ |

95 |

|

$ |

121 |

|

|

Peer Group |

|

$ |

100 |

|

$ |

101 |

|

$ |

123 |

|

$ |

142 |

|

$ |

86 |

|

$ |

106 |

|

|

S&P 500 |

|

$ |

100 |

|

$ |

109 |

|

$ |

126 |

|

$ |

145 |

|

$ |

93 |

|

$ |

102 |

|

Assumes $100 invested on October 31, 2004 in the Common Stock of The Valspar Corporation, the Peer Group and the S&P 500 Index, including reinvestment of dividends.

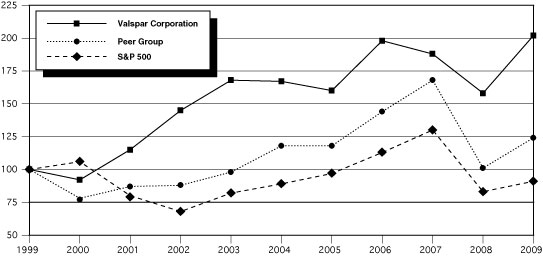

COMPARISON OF TEN YEAR CUMULATIVE TOTAL RETURN

Among The Valspar Corporation, a Peer Group and the S&P 500 Index

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative Total Return |

||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

1999 |

|

2000 |

|

2001 |

|

2002 |

|

2003 |

|

2004 |

|

2005 |

|

2006 |

|

2007 |

|

2008 |

|

2009 |

|

|||||||||||

|

Valspar |

|

$ |

100 |

|

$ |

92 |

|

$ |

115 |

|

$ |

145 |

|

$ |

168 |

|

$ |

167 |

|

$ |

160 |

|

$ |

198 |

|

$ |

188 |

|

$ |

158 |

|

$ |

202 |

|

|

Peer Group |

|

$ |

100 |

|

$ |

78 |

|

$ |

87 |

|

$ |

88 |

|

$ |

98 |

|

$ |

118 |

|

$ |

118 |

|

$ |

144 |

|

$ |

168 |

|

$ |

101 |

|

$ |

124 |

|

|

S&P 500 |

|

$ |

100 |

|

$ |

106 |

|

$ |

80 |

|

$ |

68 |

|

$ |

82 |

|

$ |

89 |

|

$ |

97 |

|

$ |

113 |

|

$ |

130 |

|

$ |

83 |

|

$ |

91 |

|

Assumes $100 invested on October 31, 1999 in the Common Stock of The Valspar Corporation, the Peer Group and the S&P 500 Index, including reinvestment of dividends.

10

|

|

|

|

SELECTED FINANCIAL DATA |

The following selected financial data has been derived from our audited Consolidated Financial Statements and should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Consolidated Financial Statements and related notes included elsewhere in this Form 10-K.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Years |

|

|||||||||||||

|

(Dollars in thousands, |

|

2009 |

|

2008 |

|

2007 |

|

2006 |

|

2005 |

|

|||||||

|

Operating Results |

|

Net Sales |

|

$ |

2,879,042 |

|

$ |

3,482,378 |

|

$ |

3,249,287 |

|

$ |

2,978,062 |

|

$ |

2,713,950 |

|

|

|

|

Cost and Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of Sales |

|

|

1,900,114 |

|

|

2,504,947 |

|

|

2,277,490 |

|

|

2,072,157 |

|

|

1,928,352 |

|

|

|

|

Operating Expense |

|

|

687,960 |

|

|

684,056 |

|

|

662,224 |

|

|

598,468 |

|

|

514,735 |

|

|

|

|

Income from Operations |

|

|

290,968 |

|

|

293,375 |

|

|

309,573 |

|

|

307,437 |

|

|

270,863 |

|

|

|

|

Interest Expense |

|

|

50,394 |

|

|

57,745 |

|

|

61,662 |

|

|

46,206 |

|

|

44,522 |

|

|

|

|

Other (Income) Expense – Net |

|

|

2,246 |

|

|

6,933 |

|

|

(11,860 |

) |

|

3,799 |

|

|

621 |

|

|

|

|

Income Before Income Taxes |

|

|

238,328 |

|

|

228,697 |

|

|

259,771 |

|

|

257,432 |

|

|

225,720 |

|

|

|

|

Net Income |

|

|

160,153 |

|

|

150,766 |

|

|

172,115 |

|

|

175,252 |

|

|

147,618 |

|

|

|

|

Net Income as a Percent of Sales |

|

|

5.6 |

% |

|

4.3 |

% |

|

5.3 |

% |

|

5.9 |

% |

|

5.4 |

% |

|

|

|

Return on Average Equity |

|

|

10.8 |

% |

|

10.6 |

% |

|

13.1 |

% |

|

15.2 |

% |

|

14.3 |

% |

|

|

|

Per Common Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income – Basic |

|

$ |

1.50 |

* |

$ |

1.39 |

* |

$ |

1.52 |

* |

$ |

1.73 |

|

$ |

1.45 |

|

|

|

|

Net Income – Diluted |

|

|

1.49 |

* |

|

1.38 |

* |

|

1.50 |

* |

|

1.71 |

|

|

1.42 |

|

|

|

|

Dividends Paid |

|

|

0.60 |

|

|

0.56 |

|

|

0.52 |

|

|

0.44 |

|

|

0.40 |

|

|

|

|

Stockholders’ Equity |

|

|

15.12 |

|

|

14.53 |

|

|

13.72 |

|

|

12.17 |

|

|

10.57 |

|

|

Financial Position |

|

Total Assets |

|

$ |

3,511,024 |

|

$ |

3,520,042 |

|

$ |

3,452,281 |

|

$ |

3,191,535 |

|

$ |

2,732,383 |

|

|

|

|

Working Capital** |

|

|

406,638 |

|

|

435,897 |

|

|

458,141 |

|

|

389,394 |

|

|

432,966 |

|

|

|

|

Property, Plant and Equipment, Net |

|

|

471,088 |

|

|

489,716 |

|

|

514,396 |

|

|

459,605 |

|

|

427,822 |

|

|

|

|

Long-Term Debt, Excluding Current Portion |

|

|

873,095 |

|

|

763,129 |

|

|

648,988 |

|

|

350,267 |

|

|

706,415 |

|

|

|

|

Stockholders’ Equity |

|

|

1,504,507 |

|

|

1,452,868 |

|

|

1,380,797 |

|

|

1,240,063 |

|

|

1,061,092 |

|

|

Other Statistics |

|

Property, Plant and Equipment Expenditures |

|

$ |

57,897 |

|

$ |

43,045 |

|

$ |

76,940 |

|

$ |

75,417 |

|

$ |

62,731 |

|

|

|

|

Depreciation and Amortization Expense |

|

|

82,862 |

|

|

80,831 |

|

|

71,811 |

|

|

68,716 |

|

|

68,395 |

|

|

|

|

Research and Development Expense |

|

|

91,303 |

|

|

96,552 |

|

|

90,322 |

|

|

82,608 |

|

|

79,286 |

|

|

|

|

Total Cash Dividends |

|

$ |

60,116 |

|

$ |

55,854 |

|

$ |

52,670 |

|

$ |

44,655 |

|

$ |

40,658 |

|

|

|

|

Average Diluted Common Shares Outstanding (000’s) |

|

|

100,921 |

|

|

100,326 |

|

|

102,617 |

|

|

102,726 |

|

|

104,150 |

|

|

|

|

Number of Stockholders at Year-End |

|

|

1,449 |

|

|

1,467 |

|

|

1,474 |

|

|

1,532 |

|

|

1,524 |

|

|

|

|

Number of Employees at Year-End |

|

|

8,788 |

|

|

9,341 |

|

|

9,946 |

|

|

9,556 |

|

|

7,540 |

|

|

|

|

Market Price Range – Common Stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High |

|

$ |

28.60 |

|

$ |

26.20 |

|

$ |

29.58 |

|

$ |

29.62 |

|

$ |

25.52 |

|

|

|

|

Low |

|

|

14.47 |

|

|

16.02 |

|

|

24.00 |

|

|

21.54 |

|

|

20.41 |

|

|

|

|

|

Reference is made to the Notes to Consolidated Financial Statements for a summary of accounting policies and additional information. |

|

|

|

|

|

Per share data has been adjusted to reflect a 2 for 1 stock split effective in September 2005. |

|

|

|

|

|

* |

Huarun Redeemable Stock accrual reduced basic and diluted net income per common share by $0.10 in 2009, $0.12 in 2008 and $0.18 in 2007. The accrual was related to the minority interest shares of Huarun Paints Holding Company Limited as further described in Note 2 in Notes to Consolidated Financial Statements. Adjusted net income per common share diluted was $1.59 for 2009, $1.50 for 2008 and $1.68 for 2007. See related reconciliation in “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Overview — Earnings per Share” for more information. In 2009 and 2008, net income per common share basic and diluted included $0.18 and $0.16 per share in restructuring charges, respectively. See Note 15 in Notes to Consolidated Financial Statements for more information. Net income per common share basic and diluted for 2008 and 2007 included gains on the sale of assets of $0.09 and $0.10, respectively. |

|

|

|

|

** |

Working Capital is defined as accounts receivable plus inventory less accounts payable. |

11

|

|

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

In response to the market conditions in fiscal year 2009 we took the following actions:

|

|

|

|

• |

Expanded our restructuring actions that started in 2008 to lower our cost structure and further increase our operational efficiency. The main focus of our actions was in our Coatings segment, which is largely comprised of product lines most directly affected by the economic slowdown. |

|

|

|

|

• |

Enhanced our liquidity by issuing $300,000,000 of unsecured, senior notes that mature on June 15, 2019 with a coupon rate of 7.25% and establishing a new $475,000,000 three-year credit facility. |

|

|

|

|

• |

Managed working capital to maximize cash flow, with a particular focus on lowering our inventory levels and minimizing accounts receivable write-offs. |

|

|

|

|

In addition, despite the difficult economic environment, we did the following: |

|

|

|

|

|

• |

Continued to invest in our brands and technologies, which enabled us to gain new business in most of our product lines. |

|

|

|

|

• |

Made aggregate pension contributions of $21,992,000 to maintain appropriate funding levels. |

|

|

|

|

• |

Increased our dividend for the 32nd consecutive year. |

Business Performance

Net sales decreased to

$2,879,042,000 from $3,482,378,000 in 2008, primarily driven by lower volume.

We were able to partially offset volume declines with new business in most of

our product lines. Despite the challenging economic climate, our earnings

increased for the year due to a combination of improved raw material cost

comparisons, previous customer price increases, improved efficiency in our

operations resulting from previously completed restructuring actions that began

in fiscal year 2008, productivity initiatives and effective control of

expenses.

Sales in our Coatings segment decreased significantly, reflecting continued weakness in industrial markets. Despite the volume declines, we reduced our cost structure, which allowed us to remain profitable in all product lines in this segment. The U.S. architectural market continued to decline in 2009, however, sales growth in our architectural product line outperformed this market. We believe this is due to increased brand awareness and a consumer shift from the professional channel to the do-it-yourself channel. Our global presence remained strong. International sales accounted for approximately 38% of consolidated net sales.

During the third quarter of 2008, we initiated a comprehensive series of actions to lower our cost structure and further increase our operational efficiency. During the first quarter of 2009, we expanded these restructuring activities. We expect the total restructuring cost to be $0.35 to $0.38 per share after tax. Restructuring activities during 2009 resulted in pre-tax charges of $28,557,000 or $0.18 per share after tax. Restructuring activities during 2008 resulted in pre-tax charges of $23,454,000 or $0.16 per share after tax. See Note 15 in Notes to Consolidated Financial Statements for more information on restructuring.

During the year, we generated $219,682,000 in free cash flow (net cash provided by operating activities less capital expenditures and dividends), an increase of $54,131,000 from 2008, and reduced our total debt, including notes payable, by $42,282,000. Our liquidity position is strong, with $187,719,000 in cash and $420,629,000 unused committed bank credit facilities providing total committed liquidity of $608,348,000 at year-end, compared to $429,932,000 at the end of 2008.

During the year, we repurchased 2,000,000 shares of our stock for $54,387,000. Our board of directors raised the dividend in fiscal year 2009 by 7.1% to $0.60 per share.

Earnings Per Share

Net income per share

available to common stockholders was $1.49 for 2009 and $1.38 for 2008. We

accrued $9,954,000 in 2009 for the Huarun Redeemable Stock (see Note 2 in Notes

to Consolidated Financial Statements for further details). This compares to an

accrual of $12,195,000 in 2008. The accrual reduced basic and diluted income

available to common stockholders by $0.10 and $0.12 per share in 2009 and 2008,

respectively. We acquired the remaining Huarun Redeemable Stock in the fourth

quarter of 2009; refer to Note 2 in Notes to Consolidated Financial Statements

for further details. The table below presents adjusted net income per common

share – diluted, which excludes a non-cash accrual relating to Huarun

Redeemable Stock. The table also presents

restructuring charges and a gain on the sale of a non-strategic specialty

product line included in net income in the respective periods.

12

|

|

|

|

|

|

|

|

|

|

|

|

|

2009 |

|

|

2008 |

|

|

Net income per common share – diluted |

|

$ |

1.49 |

|

$ |

1.38 |

|

|

Huarun redeemable stock accrual |

|

|

0.10 |

|

|

0.12 |

|

|

Adjusted net income per common share – diluted |

|

$ |

1.59 |

|

$ |

1.50 |

|

|

Restructuring charges |

|

$ |

0.18 |

|

$ |

0.16 |

|

|

Gain on sale of a non-strategic specialty product line |

|

$ |

— |

|

$ |

(0.09 |

) |

“Adjusted net income per common share – diluted” is a non-GAAP financial measure. Management discloses this measure because we believe the measure may assist investors in comparing our results of operations in the respective periods without regard to the effect on results in the 2009 and 2008 periods of the non-cash accrual related to the Huarun Redeemable Stock. As the Huarun Redeemable Stock was redeemed, acquisition accounting was applied. In addition, fiscal year 2009 and 2008 included after-tax restructuring charges of $0.18 and $0.16 per share, respectively. Fiscal year 2008 included an after-tax benefit of $0.09 per share for a gain on the sale of a non-strategic specialty product line.

OPERATIONS 2009 VS. 2008

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

|

|

2009 |

|

|

2008 |

|

|

% Change |

|

|

Coatings |

|

$ |

1,582,786,000 |

|

$ |

2,053,747,000 |

|

|

-22.9 |

% |

|

Paints |

|

|

1,072,372,000 |

|

|

1,127,073,000 |

|

|

-4.9 |

% |

|

All Other |

|

|

223,884,000 |

|

|

301,558,000 |

|

|

-25.8 |

% |

|

Consolidated Net Sales |

|

$ |

2,879,042,000 |

|

$ |

3,482,378,000 |

|

|

-17.3 |

% |

|

|

|

|

• |

Consolidated Net Sales – The sales decline for 2009 was 14.3% after excluding the negative effect of foreign currency of 3.2% and the positive effect of acquisitions of 0.2%. The decrease in core sales was primarily due to lower volume, partially offset by previous customer price increases. The challenging global economic environment negatively affected demand. Fiscal year 2009 included 52 weeks compared to 53 weeks in 2008, which negatively affected sales by 1.1%. |

|

|

|

|

• |

Coatings Segment Net Sales – The sales decrease for 2009 was 18.7% after excluding the negative impact of foreign currency of 4.4% and the positive effect of acquisitions of 0.2%. All of our product lines had reduced sales reflecting weakness in global industrial markets. Our general industrial, wood and coil product lines primarily drove the core sales decline. Fiscal year 2009 included 52 weeks compared to 53 weeks in 2008, which negatively affected sales by 1.1%. |

|

|

|

|

• |

Paints Segment Net Sales – The sales decline for 2009 was 4.0% after excluding the negative effect of foreign currency of 0.9%. Sales were down primarily due to promotional spending to build our brand in the Asia architectural product line and weak market conditions in our global automotive refinish product line, partially offset by increased sales in our domestic architectural product line. Fiscal year 2009 included 52 weeks compared to 53 weeks in 2008, which negatively affected sales by 1.3%. |

|

|

|

|

• |

All Other Net Sales – The All Other category includes resins, colorants, gelcoats and our furniture protection plan business. Sales for 2009 decreased 23.1% after excluding the negative effect of foreign currency of 2.7%. The lower sales were due to weak demand. Fiscal year 2009 included 52 weeks compared to 53 weeks in 2008, which negatively affected sales by 1.3%. |

|

|

|

|

|

|

|

|

|

|

Gross Profit |

|

|

2009 |

|

|

2008 |

|

|

Consolidated Gross Profit |

|

$ |

978,928,000 |

|

$ |

977,431,000 |

|

|

As a percent of Net Sales |

|

|

34.0 |

% |

|

28.1 |

% |

|

|

|

|

• |

Consolidated Gross Profit – The increase in gross profit as a percent of net sales was primarily due to improved raw material cost comparisons, previous customer price increases, favorable product mix and productivity gains from previously completed restructuring actions, partially offset by continuing restructuring charges and higher incentive compensation accruals. Restructuring charges of $22,280,000 or 0.8% of net sales and $15,694,000 or 0.5% of net sales were included in the 2009 and 2008 periods, respectively. |

|

|

|

|

|

|

|

|

|

|

Operating Expenses* |

|

|

2009 |

|

|

2008 |

|

|

Consolidated Operating Expenses |

|

$ |

687,960,000 |

|

$ |

684,056,000 |

|

|

As a percent of Net Sales |

|

|

23.9 |

% |

|

19.6 |

% |

|

|

|

|

* |

Includes research and development, selling and administrative costs and amortization expense. For breakout see Consolidated Statements of Income. |

|

|

|

|

• |

Consolidated Operating Expenses (dollars) – Consolidated operating expenses increased 0.6% to $687,960,000 in 2009 compared to the prior year. Operating expenses for 2009 included restructuring charges of $6,277,000 or 0.2% of net sales. Operating expenses for 2008 included restructuring charges of $7,489,000 or 0.2% of net sales and a pre-tax gain on the sale of a non-strategic specialty product line of $14,167,000 or 0.4% of net sales. The operating expense dollar increase is due to the 2008 gain on the sale of the specialty product line and higher 2009 incentive-based compensation accruals, partially offset by favorable effect of foreign currency exchange, benefits from previously completed restructuring actions and effective expense controls. |

|

|

|

|

• |

Consolidated Operating Expenses (percent of net sales) – As a percent of consolidated net sales, consolidated operating expenses increased 4.3 percentage points from last year. The increase was primarily due to lower sales volume. |

13

|

|

|

|

|

|

|

|

|

|

EBIT* |

|

|

2009 |

|

|

2008 |

|

|

Coatings |

|

$ |

185,528,000 |

|

$ |

188,267,000 |

|

|

As a percent of Net Sales |

|

|

11.7 |

% |

|

9.2 |

% |

|

Paints |

|

|

135,561,000 |

|

|

94,587,000 |

|

|

As a percent of Net Sales |

|

|

12.6 |

% |

|

8.4 |

% |

|

All Other |

|

|

(32,367,000 |

) |

|

3,588,000 |

|

|

As a percent of Net Sales |

|

|

-14.5 |

% |

|

1.2 |

% |

|

Consolidated EBIT |

|

$ |

288,722,000 |

|

$ |

286,442,000 |

|

|

As a percent of Net Sales |

|

|

10.0 |

% |

|

8.2 |

% |

|

|

|

|

* |

We evaluate the performance of operating segments and allocate resources based on profit or loss from operations before interest expense and taxes (EBIT). |

|

|

|

|

|

|

|

• |

Consolidated EBIT – EBIT for 2009 increased $2,280,000 or 0.8% from the prior year. Consolidated EBIT included restructuring charges of $28,557,000 or 1.0% of net sales and $23,454,000 or 0.7% of net sales in the 2009 and 2008 periods, respectively. In addition, fiscal year 2008 included a $14,167,000 gain, or 0.4% of net sales, on the sale of a non-strategic specialty product line. For Consolidated EBIT, as well as EBIT of the segments discussed below, foreign currency fluctuation had no material effect. |

|

|

|

|

• |

Coatings Segment EBIT – EBIT included restructuring charges of $18,237,000 or 1.2% of net sales and $12,951,000 or 0.6% of net sales in the 2009 and 2008 periods, respectively. The increase in EBIT as a percent of net sales was driven primarily by improved raw material cost comparisons, previous customer price increases and productivity gains from previously completed restructuring actions, partially offset by lower sales volume and higher 2009 restructuring charges compared to 2008. |

|

|

|

|

• |

Paints Segment EBIT – EBIT included restructuring charges of $4,429,000 or 0.4% of net sales and $7,153,000 or 0.6% of net sales in the 2009 and 2008 periods, respectively. The increase in EBIT as a percent of net sales was driven primarily by improved raw material cost comparisons, previous customer price increases and productivity gains from previously completed restructuring actions. |

|

|

|

|

• |