Attached files

| file | filename |

|---|---|

| EX-99.2 - UNAUDITED PRO FORMA - Dolat Ventures, Inc. | ex-99_2.htm |

| EX-99.1 - AUDITED FINANCIAL STATEMENTS - Dolat Ventures, Inc. | ex-99_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported)

December 15, 2009

December 15, 2009

DOLAT VENTURES, INC.

(Exact name of registrant as specified in its charter)

(Exact name of registrant as specified in its charter)

|

Nevada |

333-151570 |

Pending |

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer of Identification No.) |

545 8th Ave

Suite 401

New York, NY 10018

Suite 401

New York, NY 10018

(Address of principal executive offices)

(212) 502-6657

Registrant’s telephone number, including area code

8050 No. University Dr.

Suite 202

Tamarac, FL 33321

Suite 202

Tamarac, FL 33321

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.01 Completion of Acquisition or Disposition of Assets:

On November 17, 2009, Dolat Ventures, Inc (the “Registrant” also the “Company”) reported that it had entered into an Agreement and Plan of Acquisition (the “Agreement”) whereby the Registrant agreed to acquire 100% of the outstanding capital stock of Dove Diamonds and Mining, Inc.,

a Nevada Corporation (“Dove” also the “Subsidiary”) through a share exchange transaction (the “Acquisition”). In consideration of their shares of Dove, the Dove shareholders collectively received Twenty Million Six Hundred Twenty Two Thousand (20,622,000) restricted common shares of the Registrant. All contingencies set forth in the Agreement were satisfied, and the Acquisition became effective on December 15, 2009 (hereinafter the terms

“We,” “Us” and “Our” shall refer to the Company and Dove collectively).

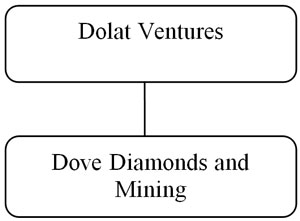

Company’s Post-acquisition Organizational Structure

Following Registrant’s acquisition of Dove, as described under Item 2.01 and as set forth in the following diagram, Dove became Registrant’s direct wholly owned subsidiary: Dolat Ventures directly holds the entire equity interest in Dove.

Registrant was a shell company, other than a business combination related shell company, as those terms are defined in Rule 12b-2 under the Exchange Act (17 CFR 240.12b-2), immediately before the Acquisition, therefore the information that would be required if the Registrant were filing a general form for registration

of securities on Form 10 under the Exchange Act reflecting all classes of the Registrant’s securities subject to the reporting requirements of Section 13 (15 U.S.C. 78m) or Section 15(d) (15 U.S.C. 78o(d)) of such Act follows.

FORWARD LOOKING STATEMENTS

The following discussion contains forward-looking statements. Forward looking statements are identified by words and phrases such as “anticipate,” “intend,” “expect,” and words and phrases of similar nature. We caution investors that forward-looking statements are only predictions based

on our current expectations about future events and are not guarantees of future performance. Our actual results, performance or achievements could differ materially from those expressed or implied by the forward-looking statements due to risks, uncertainties and assumptions that are difficult to predict. We encourage you to read all information provided in this Report and in our other filings with the SEC before deciding to invest in our stock or to maintain or change your investment. We undertake no obligation

to revise or update any forward-looking statement for any reason, except as required by law.

Our Business

Dolat Ventures, Inc. was incorporated in the state of Nevada on April 13, 2006. The Company is engaged in the business of mining and wholesale distribution of diamonds and precious gemstones. The Company is headquartered in New York, NY and as of September 30, 2009 has not begun operations. The Company

has never been subject to bankruptcy, receivership or similar proceeding; or any material reclassification, and, except for the Acquisition reported in this Current Report on Form 8-K, any merger consolidation, or purchase or sale of a significant amount of assets not in the ordinary course of business.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion is an overview of the important factors that management focuses on in evaluating Our businesses, financial condition and operating performance and should be read in conjunction with the financial statements included in this Current Report on Form 8-K. This discussion contains forward-looking

statements that involve risks and uncertainties. Actual results could differ materially from those anticipated in these forward looking statements as a result of any number of factors, including those set forth in the Company’s reports filed with the SEC on Form 10-K, 10-Q and 8-K as well as in this Current Report on Form 8-K. Given the uncertainties that surround such statements, you are cautioned not to place undue reliance on such forward-looking statements.

Overview

Dove Diamonds & Mining, Inc. was incorporated in the state of Nevada on May 19, 2009. Dove is headquartered in Brooklyn, NY and as of September 30, 2009 had not begun operations. Dove intends to acquire equipment, mining operations and mining locations, and to establish distribution channels

to sell its diamonds to wholesalers and retailers in the United States and globally. Dove has no plans to sell directly to consumers.

World diamond prices began to decline in the fourth quarter of 2008 and continued to decline throughout the first quarter of 2009. While prices have now begun to stabilize, they continue to be lower on a year-over-year basis. However, many industry professionals believe the current market is influenced

by the expectation that prices for rough Diamonds will rise again in 2010. As a result, We intend for Dove to gain a competitive advantage by entering the market at a low point, and establish itself as a major diamond wholesaler as the market begins to improve. Our long term goals include obtaining a facility to process, cut, assemble and polish rough diamonds and gems.

Current Business

Dove is currently in the early stages of acquiring diamonds, gems and precious stones from a variety of locations throughout the African continent. Primarily focused on the West African country of Sierra Leone We are in an organized search for mineral locations, suppliers and sellers of diamonds, gems and precious

stones.

Dove was incorporated May 19, 2009 with the issuance of 2,500 common shares with a par value of $.0001 per share. Dove currently has 2,500 shares issued and outstanding.

On May 19, 2009 Dove elected Shmuel Dovid Hauck to be its President and Chief Executive Officer. Shmuel Dovid Hauck was elected to the Board of Directors, May 19, 2009. Since 2003, Mr. Houck has been involved in mining diamonds, gold and other precious stones and metals in Sierra Leone. Mr. Hauck has spent

his entire professional career involved in the diamond business both on the physical mining and wholesale sides. For nearly 6 years he has operated numerous companies throughout Sierra Leone and from 2001 to 2004, he was also salesperson and manager of Forest Diamonds, a diamond wholesaler with offices worldwide.

On May19, 2009 Dove elected Shlomo Bleier to be its Secretary and Chief Operating Officer. Shlomo Bleier was also elected to the Board of Directors on May 19, 2009. Mr. Bleier has worked in the diamond industry for over 35 years and has been involved in mining operations in Brazil and Sierra Leone

for the past 10 years. In 1973, Mr. Bleier moved from Isreal to New York City where he joined the diamond industry and worked as a diamond cutter and polisher specializing in large stones; managing the process from rough to finished product. From 1993 to 1999, he worked for Simcha Diamond Ltd. in Brazil, where he successfully mined gold and diamonds. From 2000 to 2004 he was a partner in S & T Mining Group, a Sierra Leone mining operation where he served as head administrator of operations, prospecting,

surveying and mining. Since 2004 he has been active in many Diamond projects based in Sierra Leone. With nearly 10 years experience operating in Sierra Leone, Mr. Bleier has extensive experience in all aspects of mining for diamonds from initial inception to finished product. He has been a member of the Diamond Club of New York since 1980.

Neither Shmuel Dovid Hauck, nor Shlomo Bleier has been involved in any of the following proceeding during the past five years:

|

· |

any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

|

· |

any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

|

· |

being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; or |

|

· |

being found by a court of competent jurisdiction (in a civil action), the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated. |

Our business is subject to the risks inherent with a natural resource based company in its early exploration stage of development. These risks include, but are not limited to: limited capital resources; limited industry operating experience; possible delays due to weather, manpower and equipment shortage and regulatory

processing practices; possible cost overruns due to price increases in services, supplies and equipment; and the general speculative nature of exploring a raw mineral property for minerals.

Registrant’s common stock has been assigned the ticker symbol DOLV and has been approved for trading on the Over-The-Counter Bulletin Board (“OTCBB”). However, no trading market has developed.

Our administrative office is located at 545 Eighth Avenue Suite 401 New York, NY 10018.

Research and Development Activities and Costs

Our Directors and officers have not undertaken any research and development to date. The Company does not have any plans to undertake any additional research or development in the future.

Compliance with Environmental Laws

Our business is subject to extensive governmental controls and regulations which are amended from time to time. We are unable to predict what additional legislation or amendments may be proposed that might affect its business or the time at which any such proposals, if enacted, might become effective. Such

legislation or amendments, however, could require increased capital and operating expenditures and could prevent or delay certain of Our operations.

Facilities

We do not own facilities of any kind.

Employees

We do not intend to hire employees until Our business has been successfully launched and has sufficient reliable sales revenues. Our officers and Directors will provide work as necessary to bring Us to the point of earning revenues. Human resource planning will be part of an ongoing process that will include constant

evaluation of Our operations. We do not expect to hire any employees before the end of this calendar year. However, in the event that We are able to raise sufficient capital and proceed with an exploration and import program We may hire a number of employees to aid in our operations.

Results of Operations

We are currently in a start up phase and have no revenue from operations. There can be no assurance that We will generate revenues in the future, or that We will be able to operate profitably in the future, if at all.

We have never declared bankruptcy, never been in receivership, and never been involved in any legal action or proceedings. Since becoming incorporated, We have not made any significant sale of assets, nor have We been involved in any mergers or consolidations.

The accompanying financial statements have been presented assuming Dove Diamond Mining will continue as a going concern, which contemplate the realization of assets and the satisfaction of liabilities in the normal course of business. As of September 30, 2009, the Company had no operations, and only had $1,000 in cash.

These factors, among others, raise substantial doubt about Our ability to continue as a going concern. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Plan of Operation

The following discussion of Our plan of operation should be read in conjunction with Our financial statements and the notes to those statements included elsewhere in this report. In addition to the historical financial information, the following discussion contains forward-looking statements that involve risks and

uncertainties. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of certain factors.

Contractual Obligations

We do not have any material contractual obligations as of this time, and there have been no changes to Our contractual obligations during the period covered by this report.

We have no revenues, have achieved losses since inception, have no operations, have been issued a going concern opinion by Our auditors and rely upon the sale of our securities and loans from Our officers and directors to fund operations.

Our business is subject to the risks inherent with a natural resource based company in its early exploration stage of development. These risks include, but are not limited to: limited capital resources; limited industry operating experience; possible delays due to weather, manpower and equipment shortage and regulatory

processing practices; possible cost overruns due to price increases in services, supplies and equipment; and the general speculative nature of exploring a raw mineral property for minerals.

We may enter into supply contracts and establish formal relationships in the immediate future, so that it can acquire claims, initiate an exploration program, establish a base camp, and hire the personnel required for the operation of the Company and its Subsidiary. We are not looking for exclusive marketing rights

nor do We plan to enter into any agency agreements.

OFF-BALANCE SHEET ARRANGEMENTS

We have no off-balance sheet arrangements.

RISK FACTORS

Registrant is a smaller reporting company as defined by Rule 12b-2 and is not required to provide the information required by this item.

PROPERTIES

We currently own no properties.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

|

A. |

The following Table sets forth information as of November 19, 2009 regarding any person known to the Registrant to be the beneficial owner of more than five percent of any class of the Registrant’s voting securities: |

|

Title of Class |

Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership |

Percent of Class * | |||

|

Common |

Gary Tice, 6 Blue Cedar, Littleton, CO 80127

|

4,000,000

direct ownership |

60.6% |

|

|

B. |

The following table sets forth information as of November, 19, 2009 regarding ownership of each class of the Company’s equity securities by certain members of the Company’s management, including all Directors and nominees, and executive officers. |

|

Title of Class |

Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership |

Percent of Class * | |||

|

Common |

Gary Tice, 6 Blue Cedar, Littleton, CO 80127

|

4,000,000

direct ownership |

60.6% |

*Based on 6,600,000 shares outstanding

|

|

C. |

There are no arrangements, known to the Registrant, including any pledge by any person of securities of the Registrant or any of its parents, the operation of which may at a subsequent date result in a change in control of the Registrant. |

DIRECTORS AND EXECUTIVE OFFICERS

The following individuals serve as the directors and executive officers of the Registrant as of the date of this report. All directors hold office until the next annual meeting of our shareholders or until their successors have been elected and qualified. The Registrant’s executive officers are appointed by our board

of directors and hold office until their death, resignation or removal from office.

Registrant’s sole executive officer and director and his age as of the date of this Current Report on Form 8-K is as follows:

|

Name |

Age |

Position | ||

|

Gary Tice

|

59 |

President and Director |

Business Experience

The following is a brief account of the education and business experience during at least the past five years of each director, executive officer and key employee of the Company, indicating the person’s principal occupation during that period, and the name and principal business of the organization in which such

occupation and employment were carried out.

Ms. Gary Tice has acted as the Company’s president and director since October 15, 2009. Mr. Tice is a resident of Littleton, Colorado and 1972 graduate of University of California Santa Barbara, where he earned his Bachelor Degree. He

opened his first Travel agency in Littleton Colorado in 1977 and expanded the business to doing more than $15 million in gross sales. For the past five years Mr. Tice has been President and 100% owner of Tice Travel, Inc. doing business as Four Seasons Travel, Ken Caryl Travel and Cruise Innovations.

(1) filed a petition under the federal bankruptcy laws or any state insolvency law, nor had a receiver, fiscal agent or similar officer appointed by a court for the business or present of such a person, or any partnership in which he was a general partner at or within two years before the time of such filing, or any corporation

or business association of which he was an executive officer within two years before the time of such filing;

(2) was convicted in a criminal proceeding or named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses);

(3) was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from or otherwise limiting the following activities:

(i) acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, associated person of any of the foregoing, or as an investment advisor, underwriter, broker or dealer in securities, or as an affiliated person, director of

any investment company, or engaging in or continuing any conduct or practice in connection with such activity;

(ii) engaging in any type of business practice;

(iii) engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of federal or state securities laws or federal commodity laws;

Term of Office

Registrant’s directors are appointed for a one-year term to hold office until the next annual meeting of our shareholders or until removed from office in accordance with our bylaws. Registrant’s officers are appointed by our board of directors and hold

office until removed by the board.

Director Independence

Registrant’s determination of independence of directors is made using the definition of ‘‘independent director’’ contained under Rule 4200(a) (15) of the Rules of FINRA, even though such definitions do not currently apply to us because

we are not listed on NASDAQ.

EXECUTIVE COMPENSATION

The Company’s officers and directors serve without compensation. The Company currently has no compensation committee, and there have been no deliberations concerning executive compensation.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

There have been no past, present or proposed transactions in which the Registrant was or is to be a participant, and the amount involved exceeds the smaller of $120,000 or 1% of the average of the Registrant’s year end assets for the previous two completed fiscal years, and in which any related person

had or will have a direct or indirect material interest.

LEGAL PROCEEDINGS

There are no material pending legal proceedings, other than ordinary routine litigation incidental to the business, to which the Registrant or any of its subsidiaries is a party or of which any of their property is the subject, nor are there any such proceedings known to be contemplated by governmental authorities.

MARKET PRICE OF AND DIVIDENDS ON THE REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

General

Registrant’s authorized capital stock consists of 75,000,000 shares of common stock, par value $0.001 per share.

All of the shares of Registrant’s authorized capital stock, when issued for such consideration as Registrant’s Board of Directors may determine, shall be fully paid and non-assessable.

Shareholders

As of date of this Report, there were 6,600,000 shares of Registrant’s common stock issued and outstanding, held by 20 shareholders of record.

Only a limited market exists for Registrant’s securities. There is no assurance that a regular trading market will develop, or if developed, that it will be sustained. Therefore, a shareholder in all likelihood will be unable to resell his securities in the Company. Furthermore, it is unlikely that a lending institution

will accept the Company’s securities as pledged collateral for loans unless a regular trading market develops.

Trading

Dividend Policy

The Company has not declared any cash dividends. The Company does not intend to pay dividends in the foreseeable future, but rather to reinvest earnings, if any, in Our business operations.

Section 15(g) of the Securities Exchange Act of 1934

Registrant’s shares are covered by section 15(g) of the Securities Exchange Act of 1934, as amended that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of

$5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). For transactions covered by the Rule, the broker/dealer must make a special suitability determination for the purchase and have received the purchaser's written agreement to the transaction prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell our securities and also may affect your ability to sell your shares in the secondary market.

Section 15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one page summary of certain essential items. The items include the risk of investing in penny stocks in both public offerings and secondary marketing; terms important to in understanding

of the function of the penny stock market, such as “bid” and “offer” quotes, a dealers “spread” and broker/dealer compensation; the broker/dealer compensation, the broker/dealers duties to its customers, including the disclosures required by any other penny stock disclosure rules; the customers rights and remedies in causes of fraud in penny stock transactions; and, the FINRA's toll free telephone number and the central number of the North American Administrators Association,

for information on the disciplinary history of broker/dealers and their associated persons.

Securities authorized for issuance under equity compensation plans

The Registrant has no equity compensation plans.

INDEMNIFICATION OF OFFICERS AND DIRECTORS

Our officers and directors are indemnified as provided by the Nevada Revised Statutes. Under the NRS, director immunity from liability to a company or its shareholders for monetary liabilities applies automatically unless it is specifically limited by a company’s articles of incorporation. Excepted from such indemnification

are:

|

(1) |

a willful failure to deal fairly with the company or its shareholders in connection with a matter in which the director has a material conflict of interest; |

|

(2) |

a violation of criminal law (unless the director had reasonable cause to believe that his or her conduct was lawful or no reasonable cause to believe that his or her conduct was unlawful); |

|

(3) |

a transaction from which the director derived an improper personal profit; and |

|

(4) |

willful misconduct. |

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

DOLAT VENTURES, INC. | ||

|

By: |

/s/ Gary Tice | |

|

Gary Tice | ||

|

President, Chief Financial Officer

and Secretary | ||

Dated: December 17, 2009