Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended October 2, 2009

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 0-27248

LEARNING TREE INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 95-3133814 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1805 Library Street Reston, VA |

20190 | |

| (Address of principal executive offices) | (Zip Code) |

(703) 709-9119

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $.0001 par value | the NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer |

¨ |

Accelerated filer | x | |||

| Non-accelerated filer |

¨ (do not check if a smaller reporting company) |

Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the common stock, $.0001 par value, held by non-affiliates of the registrant, as of April 3, 2009 was $76,227,834. (Excludes 7,622,832 shares held by directors and officers of the registrant since such persons may be deemed to be affiliates.)

The number of shares of common stock, $.0001 par value, outstanding as of December 7, 2009, was 13,876,296 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement of the registrant to be delivered to stockholders in connection with the 2010 Annual Meeting of Stockholders are incorporated by reference into Part III, Items 10, 11, 12, 13 and 14 of this Form 10-K.

Table of Contents

LEARNING TREE INTERNATIONAL, INC. AND SUBSIDIARIES

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

2

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. You can find many (but not all) of these statements by looking for words such as “approximates,” “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “would,” “may” or other similar expressions in this Report. Our forward-looking statements relate to future events or our future performance and include, but are not limited to, statements concerning our business strategy, future commercial revenues, market growth, capital requirements, new product introductions, expansion plans and the adequacy of our funding. Other statements contained in this report that are not historical facts are also forward-looking statements.

We claim the protection of the safe harbor contained in the Private Securities Litigation Reform Act of 1995. We caution investors that any forward-looking statements presented in this Report, or that we may make orally or in writing from time to time, are based on our beliefs, assumptions made by us and information currently available to us. Such statements are based on assumptions, and the actual outcome will be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control or ability to predict. Although we believe that our assumptions are reasonable, they are not guarantees of future performance, and some will inevitably prove to be incorrect. As a result, our actual future results can be expected to differ from our expectations, and those differences may be material. Accordingly, investors should use caution in relying on forward-looking statements, which are based on known results and trends at the time they are made, to anticipate future results or trends.

Some of the risks and uncertainties that may cause our actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include those related to the following:

| • | the timely development, introduction, and customer acceptance of our courses; |

| • | efficient delivery and scheduling of our courses; |

| • | technology development and new technology introduction; |

| • | competition; |

| • | international operations, including currency fluctuations; |

| • | attracting and retaining qualified personnel; |

| • | intellectual property, including having to defend potential infringement claims; |

| • | changing economic and market conditions; and |

| • | adverse weather conditions, strikes, acts of war or terrorism and other external events. |

For further discussion of these and other factors see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors.”

This Report and all subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We do not undertake any obligation to release publicly any revisions to our forward-looking statements to reflect events or circumstances after the date of this Report.

3

Table of Contents

| Item 1. | BUSINESS |

Overview

Learning Tree International, Inc. is a leading worldwide vendor-independent provider to business and government organizations for the training and education of their managers and information technology (“IT”) professionals. Since our founding in 1974, we have provided high-quality training to nearly 2 million managers and IT professionals. In fiscal year 2009, we trained 76,552 course participants from more than 9,100 organizations worldwide, including large national and multinational companies, government organizations, and small and medium-size companies. As used in this Report (unless the context otherwise requires) “we”, “our”, and “us” refer to Learning Tree International, Inc. and its subsidiaries.

As of October 2, 2009, we offered a broad proprietary library of intensive instructor-led courses from two to five days in length, consisting of 219 different course titles representing 4,986 hours of training, including 143 IT course titles and 76 management course titles. Learning Tree courses provide education and training across a wide range of technical and management disciplines, including operating systems, databases, computer networks, computer and network security, web development, programming languages, software engineering, open source applications, project management, business skills, leadership and professional development.

We market and present our courses through locally staffed operations in the United States, the United Kingdom, France, Canada, Sweden and Japan, and generate approximately half of our revenues internationally. We coordinate, plan and deliver our courses at our own education centers, external hotel and conference facilities and customer sites worldwide. During fiscal year 2009, we presented courses in 54 countries. Additionally, in fiscal year 2009 we implemented our proprietary e-Learning platform, Learning Tree AnyWare™ (patent-pending), which allows individuals located anywhere to attend a live instructor-led class being conducted in a Learning Tree Education Center or at a customer location.

We use a well-defined systematic approach to develop and update the Learning Tree course library so as to provide training that is immediately relevant to course participants working in a broad range of applications and industries. After assessing market need, courses may be translated into French, Swedish and Japanese. Our proprietary course development process also allows us to customize our courses for delivery at our customers’ sites.

Business Strategy

Our long-term objective is to sustain and grow our position as a leading worldwide vendor-independent provider of training and education to managers and IT professionals and become the provider of choice for large national and multinational companies, small and medium-size companies and government organizations. To that end, we focus on providing our customers’ employees with the knowledge and skills they need to contribute to their employers’ key business objectives, and developing and maintaining long-term relationships with our customers and course participants.

Commitment to Quality Training. For the past 35 years, we have set the highest standards of excellence in educating and training managers and IT professionals throughout the world. We believe these standards have driven our long-term success. In fiscal year 2009, course participants rated Learning Tree instructors and courses at the highest levels in our history. These ratings reflect improvements that include our patented MagnaLearn™ instructional enhancement system and the latest up-to-date course equipment, ongoing revision and updating of our course materials, and continuing improvement of instructor skills and capabilities. Our AnyWare e-Learning platform extends the full range of Learning Tree features and standards to our remote participants, so that they enjoy the same experience and results as our in-class participants.

4

Table of Contents

High Quality Instructor Team. At October 2, 2009, we had 610 course instructors located around the world who are practicing professionals with expert subject knowledge and who average over 24 years of “hands-on, real world” experience. Learning Tree instructors teach an average of approximately 10 course events per year on an “as-needed” basis. During the rest of the year they work either as full-time employees or independent consultants for other companies. This “on-demand” structure enables us to quickly schedule additional courses anywhere in the world and to respond efficiently to our customers’ needs for management and IT skills training. In addition, because Learning Tree instructors generally spend the majority of their time working in industry settings, they provide our course participants with up-to-date, practical knowledge and skills in the latest technological and management developments, and provide us with unique access to a large pool of industry experts on management and IT trends throughout the world that is especially valuable in our decisions and development process for new course titles.

Our success depends on our ability to attract and retain highly skilled instructors. We use a highly systemized program in each of our local operating subsidiaries to identify, engage, train, coach, and evaluate our instructor team. Our instructors are highly loyal, as evidenced by our annual instructor retention rate, which exceeds 90%.

Broad Proprietary Course Library. We offer a broad, proprietary course library, which at October 2, 2009 totaled 219 instructor-led two- to five-day course titles comprising a total of 4,986 hours of classroom instruction covering a wide range of management and IT topics. Based on their sophistication and quality, all Learning Tree courses are recommended for one to two semester hours of college credit by the American Council on Education. We are a trusted continuing professional education (CPE) provider of the International Information Systems Security Certification Consortium (ISC)2. In addition, we are on the National Association of State Boards of Accountancy National Registry of CPE sponsors and are a Registered Education Provider of the Project Management Institute (PMI).

The following table itemizes the number of Learning Tree course titles by curriculum at October 2, 2009:

| Curriculum |

Number of Course Titles |

Total Hours of Training | ||

| Windows Systems and Exchange |

19 | 468 | ||

| Networking, Cisco Networks and PC Support |

17 | 438 | ||

| ITIL Certification |

17 | 408 | ||

| Visual Studio and .NET Development |

16 | 378 | ||

| Project Management |

18 | 372 | ||

| SQL Server |

16 | 372 | ||

| Security |

12 | 306 | ||

| Business Analysis |

14 | 282 | ||

| Web Development and XML |

13 | 282 | ||

| SharePoint, Access and Office |

12 | 276 | ||

| Communication and Time Management |

16 | 270 | ||

| RDBMS, and Oracle Databases |

10 | 270 | ||

| Java, C++ and Perl Programming |

11 | 264 | ||

| Software Engineering |

11 | 252 | ||

| UNIX and Linux |

7 | 162 | ||

| Management and Leadership |

8 | 150 | ||

| Apple Macintosh Systems and Support |

2 | 36 | ||

| Total |

219 | 4,986 | ||

As a leading vendor-independent provider of IT training, we design our courses to provide participants an unbiased perspective of software and hardware products and the ability to compare and integrate multiple platforms and technologies from various vendors in a single course. Drawing from the expertise of our

5

Table of Contents

international team of instructors, each course incorporates multiple points of view concerning IT applications used throughout the world. Our IT courses are designed to be highly interactive; most involve “hands-on” training on networked state-of-the-art workstations so that participants can practice and assimilate the skills being taught. Participants spend a significant portion of each hands-on course working on computer-based exercises and participating in group workshops and class interactions. Participants receive extensive printed course materials that facilitate learning and serve as a post-course reference tool.

Our management courses, while including core concepts and theory, focus heavily on providing practical skills, tools, and techniques that participants can apply immediately upon returning to their jobs. Participants work extensively in group exercises that provide the opportunity for them to practice applying the key concepts in real-world situations. These real-world scenarios are primarily delivered through RealityPlus™ , our proprietary performance-based management training platform. RealityPlus™ courses bring the real world to life in the classroom through the use of computer-based and rich-media simulations, supplemented with substantial amounts of hands-on exercises and group activities, facilitated by experts in their respective fields. RealityPlus™ prepares participants to apply the skills and knowledge they learn in our simulated projects, problems, and situations to the real-life management tasks they will perform in the workplace.

At October 2, 2009, we offered 143 titles in our IT curriculum, representing 65.3% of our entire course library, compared to 131 titles, or 70.8% at the end of fiscal year 2008. At the same date, we offered 76 titles in our management curriculum, representing 34.7% of our entire course library, compared to 54 titles, or 29.2% at the end of fiscal year 2008. Our spending on course development was $7.4 million in fiscal year 2009, $9.7 million in fiscal year 2008 and $8.6 million in fiscal year 2007.

To assist participants in their long-term professional development, we offer 25 Learning Tree Professional Certification programs, in which participants earn their certification by successfully completing four Learning Tree courses in a particular field, and demonstrating mastery by passing the examination for each course. Each Professional Certification Program is designed to teach all of the skills necessary to master a specific job function.

Over our 35-year history, we have developed and implemented a well-defined, systematic approach to rapidly develop, customize and update courses in the Learning Tree library and to translate our course content into multiple languages. Courses are organized into curricula that reflect general topics or disciplines. We continuously update and expand our course curriculum structure and course content and add new course titles to keep pace with the introduction of new technologies and to reflect the evolving training needs of our customers. To identify potential new courses for development, we incorporate feedback from the worldwide Learning Tree instructor team, course participants and customers, and from the development groups of leading IT vendors. In fiscal year 2009, we developed 50 new titles and retired 16 titles. We may or may not develop more titles than we retire in any period, and there can be no assurance that we will develop courses that keep pace with the introduction of new hardware, software and networking technologies or the need for key business skills training. We expect course development costs to vary in the future, primarily depending on the number of new titles we introduce in any period, as well as the overall size of the total course library we must maintain.

International Infrastructure and Logistics Capability. We meet customer demand for scheduling flexibility by delivering course events frequently and at multiple locations throughout the world. Our sophisticated infrastructure and logistics capability allow us to coordinate, plan and deliver Learning Tree courses at our education centers and external hotel and conference facilities worldwide. We also present standard or customized courses on demand at customer facilities whenever and wherever desired, with quality standards that are identical to those for courses presented in Learning Tree Education Centers. By using our team of 610 instructors, our course development and customization processes, our team of customer support specialists, our logistics team and our thousands of classroom computer workstations, we can rapidly and effectively deliver any Learning Tree course to any location in the world.

6

Table of Contents

In fiscal year 2009, we presented 6,082 course events at Learning Tree Education Centers and at third-party and customer sites in a total of 54 countries. We currently operate wholly-owned subsidiaries in the United States (since 1974), France (since 1977), the United Kingdom (since 1978), Canada (since 1985), Sweden (since 1986) and Japan (since 1989). Each subsidiary is staffed by local personnel responsible for the sale and delivery of courses in its local country as well as in other designated countries. Our international operations produced approximately half of our revenues in fiscal year 2009. See Note 9 of “Notes to Consolidated Financial Statements” for certain financial data regarding operating segments and geographic regions. See Item 1A, “Risk Factors” for a description of the risks associated with our international operations.

On an on-going basis, we evaluate the advisability of expansion or contraction of our operations both within cities and countries with existing Learning Tree Education Centers and in new cities or countries.

Long-Term Relationships with Global Customer Base. We have built long-standing relationships with our customer base of large national and multinational companies, small and medium-sized companies and government organizations throughout the world, and seek to build continuing relationships both with these employers and with the individual employees who participate in our courses. Our customers operate in a wide range of sectors, including finance, computer, communications, electronics, systems integration, aerospace, government and military, manufacturing, and energy. Every one of our 100 largest clients five years ago in fiscal year 2004 was still one of our clients five years later in fiscal year 2009. In fiscal year 2009, we provided training to 76,552 course participants and over 179 of our corporate and government customers purchased more than $100,000 of Learning Tree training. No customer accounted for 10% or more of our revenues in fiscal years 2009 or 2008.

In fiscal year 2009, we continued our efforts to develop enterprise-wide relationships with many of our large customers. These relationships take various forms, but generally involve a modest discount to our list price in exchange for becoming a preferred supplier, which enables us to provide training services to the individual employees with lower sales and administrative costs.

Backlog. Our sales backlog at November 27, 2009 was $27.0 million. This compares to a sales backlog of $31.5 million at November 28, 2008.

Multi-Tiered Sales and Marketing Organization. We employ a multi-tiered sales and marketing organization that integrates direct mail, electronic marketing, telemarketing and field sales to market and sell our course offerings to existing customers and to attract new customers.

As we have since our inception, we maintain a strong brand image for providing high-quality training for managers and IT professionals through the prominent use of our trademarks in our marketing and course materials. We market our courses primarily through direct mail and electronic mail to our proprietary database of approximately 2.8 million technology professionals and managers who have attended, inquired about, or sent a staff member to Learning Tree courses, and we also use direct mail to reach other managers and IT professionals on rented mailing lists. We also utilize targeted, personalized e-mails through our automated e-mail marketing system to advise prospective course participants of upcoming events. In addition, we use rented e-mail address lists to augment our own database. We also market our products and services over the Internet on our website (www.learningtree.com). (Information contained on our website is not part of this Annual Report on Form 10-K.)

We have a telemarketing sales team that consisted of approximately 101 telemarketers and related support staff at October 2, 2009. Our telemarketers call customer leads generated from direct mailings, e-mail marketing, website inquiries and other sales and marketing programs. In addition, our sales team follows up on customer inquiries, and works to identify key personnel at customers with the potential to become major customers. We use our proprietary automated POSTTM techniques to identify regions of our database that are profitable to mail, email and/or call, and those that are not.

7

Table of Contents

At October 2, 2009, we employed a field sales team of 57 direct field sales representatives and related support staff. Our direct sales force primarily focuses on selling training that is delivered on-site for our customers at their locations.

To remain successful, we must continue to expand our business with both existing and new customers. To encourage repeat purchases from existing customers, we offer three different multiple-course discount programs—Learning Tree “Training Passports”, Learning Tree 10-Day Passes, and Learning Tree “Training Vouchers”—and also provide Professional Certification Programs described earlier. We believe that in addition to generating revenues directly, these programs foster long-term relationships with participants and encourage participants to recommend Learning Tree courses to their colleagues.

Learning Tree Training Passports permit an individual Passport holder to attend up to a specified number of courses, generally three or four, during a one- to two-year period. List prices for Passports are significantly discounted from the list price of the equivalent number of individual courses. Learning Tree 10-Day Passes permit an individual Pass holder to attend up to 10 days of training during a twelve-month period and are priced slightly lower than the Passports. The Learning Tree Training Voucher program allows corporate customers to buy blocks of three or more Vouchers at a fixed discounted price, for future courses to be taken by any person in the customer organization over a six to twelve month period.

Markets and Competition

Instructor-Led Training. The management and IT training markets include outside third-party providers, as well as in-house training conducted by organizations for their own employees. Third-party providers of IT training include “vendor-dependent providers”, who deliver courses developed by the vendors of software and hardware technologies and who depend heavily on those vendors to market their courses. The IT training market also includes “vendor-independent providers”, such as us, who independently develop, market and deliver proprietary courses. In addition, third-party providers of management training include non-profit associations, as well as “for-profit providers”, who provide training largely as a professional development service, and both for-profit and not-for-profit “academic providers”, who offer courses that lead to accredited undergraduate or graduate degrees.

We are a for-profit vendor-independent provider of management education and IT training. Some competitors offer course titles and programs similar to ours at lower prices. In addition, some competitors have greater financial or other resources than we do.

Our main IT training competitors are vendor-dependent and include the IT hardware and software vendors themselves. Many hardware and software vendors supply training, sometimes bundled in the prices of their products. Other vendor-dependent providers are Authorized Technical Education Centers and Certified Technical Education Centers that deliver these vendors’ proprietary courses. Vendor-dependent providers may have, or claim, greater knowledge of upcoming developments in their products, and their certifications are widely recognized. We differentiate ourselves from vendor-dependent providers by maintaining a vendor-independent posture and providing cross-platform training solutions. By being vendor-independent, we can address both the strengths and the weaknesses of a product and teach IT professionals how to integrate one product with those of other vendors in a multi-vendor configuration. We leverage the expertise of Learning Tree instructors and authors, to ensure that we offer a level of expertise that matches or exceeds that of vendor-dependent providers while also providing a vendor-independent platform that provides meaningful product comparisons.

Our principal management education competitors include for-profit and not-for-profit post-secondary educational providers, as well as not-for-profit management associations and training companies who focus—as do we—on providing continuing professional development programs to government and commercial organizations and the employees of those organizations. We believe we differentiate ourselves from these competitors by adopting and implementing a more practical, results-oriented approach to management education than is typical in this market, as well as through our focus on performance-based learning, our patented

8

Table of Contents

MagnaLearn™ Instructional Enhancement Technology, and our RealityPlus™ simulation-centric educational methodology.

We believe that the majority of third-party providers—whether in management or IT—are smaller organizations that often provide training as one of several services or product lines. We differentiate ourselves from these providers based on our experience over more than three decades, the breadth and quality of our proprietary course library, our worldwide delivery capability, and the size, quality and experience of our instructor force.

Internal training departments generally provide companies with the most control over the method and content of training, enabling them to tailor programs to their specific needs. However, we believe that internal trainers find it difficult to keep pace with new technologies, lack the hands-on experience needed to teach the latest technological developments and lack the capacity to meet demand for training, and therefore most organizations must supplement their internal training resources with externally supplied training. This is particularly critical when dealing with new or emerging technologies. Additionally, internal training departments may not operate consistently on a worldwide basis, where we offer consistent management and IT courses, processes and quality around the globe.

Our customers are widely diversified across industries and geographies, with varying fiscal years including many whose fiscal years coincide with the U.S. Government September 30 budget year, many who are on the calendar year, and many whose fiscal years coincide with the UK and Canadian governments’ March 31 budget year. We also see seasonal variations in our business as a result of other factors, including summer vacations, especially in Europe. For a discussion of the seasonal effects on our business, see Item 1A “Risk Factors” and Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

E-Learning and Blended Learning. Management and IT training are primarily delivered by classroom instructors, video, and technology-based training, including Internet-based e-learning and printed means. Based upon extensive research and use of pilot programs as well as our experience, we believe that instructor-led training will continue to fill the largest portion of the market because it provides the greatest foundation and ability for participants to learn, practice and receive feedback on their mastery of new knowledge and skills. Course participants value the personalized interaction and problem solving with their instructor and fellow participants, and the opportunity to get expert advice on the application of the course material to their own projects. Furthermore, instructor-led classroom training insulates course participants from workplace interruptions and accelerates their learning of new technologies. However, the use of technology-based IT training formats, such as Internet-based e-learning, appears to have gained some acceptance in the IT and management training and education market.

As noted last year, we have continued to investigate alternate, technology-based training formats and how they might effectively be integrated into our training programs. Based on extensive testing of alternate delivery formats and training program structures, we developed Learning Tree AnyWare™, our proprietary e-learning platform that integrates participants in remote locations into live class events in another location. Remote attendees use an ordinary Internet connection to connect to our patent-pending classroom interface. Once logged in, remote AnyWare class participants see and hear their instructor and classmates in real time, and view the instructor’s annotations on the two in-class MagnaLearn™ projection screens in real-time. They are able to participate in discussions, ask questions, work in breakout sessions, and complete the same hands-on exercises as their in-class counterparts. They gain the full benefit of our proprietary courseware, and achieve the same level of knowledge and skill transfer as in-class participants. Early customer feedback is that AnyWare is highly differentiated and significantly more effective in promoting job-related learning than other forms of e-Learning. Through AnyWare, we effectively apply technology to leverage the strengths of our classroom offerings.

9

Table of Contents

Employees

Our executive officers have extensive experience in the training and education industry with an average of nearly 16 years of experience with us and nearly 19 years of relevant industry experience.

On October 2, 2009, we had a total of 427 full-time equivalent employees, of whom 183 were employed outside the United States. We also utilized the services of 610 expert instructors to teach our courses on an “as-needed” basis. We consider our relations with our employees and our instructors to be good.

Intellectual Property Rights

Our course development process and course titles are proprietary, and we rely on a combination of copyright, trademark and trade secret laws, customer licensing agreements, employee and third-party nondisclosure agreements and other methods to protect those proprietary rights.

“LEARNING TREE”, “LEARNING TREE INTERNATIONAL”, the Learning Tree “Tree Design” logo, “LEARNING TREE INTERNATIONAL” and Design, “LEARNING TREE PROFESSIONAL CERTIFICATION” and Design, “LEARNING TREE ANYWARE BE THERE WITH ANYWARE” and Design, “LEARNING TREE ANYWARE”, “EDUCATION IS OUR BUSINESS”, “EDUCATION YOU CAN TRUST”, “WE BRING EDUCATION TO LIFE”, “PRODUCTIVITY THROUGH EDUCATION”, “REALITYPLUS” Design, “REALITYPLUS MANAGEMENT EDUCATION FOR THE REAL WORLD”, “TRAINING PASSPORT”, “TRAINING ADVANTAGE”, “ALUMNI GOLD”, “TRAINING YOU CAN TRUST”, “WE BRING LEARNING TO LIFE”, “WWW.LEARNINGTREE.COM”, “MAGNALEARN”, “VENDOR INDEPENDENT TRAINING YOU CAN TRUST”, “LEARNING TREE UNIVERSITY CONSORTIUM” and Design, “ON-SITE COURSES” and Design, “800-LRN-TREE”, and “800-THE-TREE” are among our trademarks and service marks. In addition to the trademarks and service marks, this Annual Report on Form 10-K also contains trademarks and trade names of other companies.

We own the copyright to all course materials we develop. Our copyrighted course materials are a significant differentiator of our services from those of our competitors.

Our MagnaLearn Instructional Enhancement System is covered by various United States and international patents. MagnaLearn™ gives Learning Tree instructors greater flexibility to customize and pace course presentations by allowing them to annotate, highlight and manipulate course materials on two independent projection screens, in real time. The system also provides automated feedback to our course development resources, allowing constant improvement of courses and the ability to consistently update courses immediately on a world-wide basis.

We have applied for patents related to our recently introduced AnyWare e-Learning platform.

We cannot be certain that our means of protecting our proprietary rights will be adequate or that our competitors will not independently develop similar course titles or delivery methods. If substantial unauthorized use of our products were to occur, our business and results of operations could be materially adversely impacted. We may also have to defend against claims that our current or future courses infringe on the proprietary rights of others. Defending and prosecuting these claims could have a material adverse effect on our operating results.

Regulatory Environment

We are paid directly by the employers of Learning Tree course participants and do not receive funding from any government student-aid or loan programs. As a result, we do not depend on government appropriations for programs and are generally exempt from the governmental regulation of public education providers. In contrast, providers of education to the public must comply with many laws and regulations of Federal, state and international governments. However, our results of operations could be affected by current or future licensing or regulatory requirements.

10

Table of Contents

Available Information

We make available on our website (www.learningtree.com), free of charge, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after such material is electronically filed or furnished to the Securities and Exchange Commission. (Information contained on our website is not part of this Annual Report on Form 10-K.) Our Annual Report on Form 10-K may also be obtained free of charge by written request to the Chief Financial Officer, Learning Tree International, Inc., 1805 Library Street, Reston, VA 20190.

| Item 1A. | RISK FACTORS |

You should carefully consider the following discussion of various risks and uncertainties, keeping in mind that they are not the only ones that affect us. Additional risks that we do not presently consider material, or of which we are not currently aware, may also have an adverse impact on us.

Common Stock Price Fluctuations

Historically, our common stock price has fluctuated, and we expect fluctuations to continue in the future.

General Factors. We believe some of the reasons for past fluctuations in the price of our stock related to factors such as:

| • | announcements of developments related to our business; |

| • | announcements concerning new products or enhancements by us or our competitors; |

| • | developments in our relationships with our customers; |

| • | market perceptions of new means of delivering training, such as the Internet; |

| • | variations in our revenues, gross margins, earnings or other financial results; |

| • | fluctuations in general conditions in the economy, our market, and the markets served by our customers; and |

| • | introductions of new technologies both by our customers and technology vendors. |

In addition, prices in the stock market, particularly for technology-related stocks, have been volatile in recent years. In some cases, the fluctuations have been unrelated to the operating performance of the affected companies. As a result, the price of our common stock could fluctuate in the future without regard to our operating performance.

Future Sales of Our Common Stock. Sales of our common stock by our founders, officers, directors and employees could adversely and unpredictably affect the price of shares of our common stock. Additionally, the price could be affected even by the potential for sales by these persons. In addition to the 13,876,296 shares outstanding as of December 7, 2009, as of that date we are authorized to issue up to a total of 1,173,053 shares of common stock under our existing Stock Option and Equity Incentive Plan. We cannot predict the effect that any future sales of our common stock, or the potential for those sales, will have on our share price.

11

Table of Contents

Fluctuations in Operating Results

Historically, our operating results have fluctuated, and we expect fluctuations to continue in the future.

Fluctuations in our historical operating results have resulted from many factors, some of which are beyond our control. In the future, these or other factors could have a material adverse impact on our operating results and cause our stock price to decrease. For example:

Timing of Course Development, and Sales and Marketing Expenditures. We try to adjust our expenditures for course development and sales and marketing to maintain our long-term profitability, including our assessment of the potential to influence future customer demand, market conditions, and other factors. This may mean accepting reduced margins in poor economic periods, as we must commit to much of our spending before our attendees enroll in our courses. If revenues fall short of our expectations, we may not be able to adjust our expenditures quickly enough to compensate for lower than anticipated revenues. This could compound the impact of any revenue shortfall and further affect our operating results and the price of our common stock.

Course Scheduling and Marketing Activities. The timing and content of our courses and our marketing activities can affect the number of participants who attend our courses. Some of the activities that can contribute to fluctuations in our operating results include:

| • | the frequency of our course events; |

| • | the number of weeks during which our courses can be conducted in a quarter; |

| • | the timing, timely delivery, frequency and size of, and the response to, our direct mail marketing and advertising campaigns; |

| • | the timing of introduction of new course titles; |

| • | the average length of courses, based on the current mix of course titles, which affects the average revenue per attendee; and |

| • | the mix between course events held at customer locations and course events held in our education centers and hotels due to differing gross profit margins. |

Seasonal Factors. Our quarterly revenues and income fluctuate due to the seasonal spending patterns of our customers, which are affected by factors such as:

| • | cyclic or one-time budgetary considerations; |

| • | factors specific to their business or industry; and |

| • | weather, holiday and vacation considerations. |

Use of Accounting Estimates. The preparation of our financial statements in conformity with Generally Accepted Accounting Principles requires us to make estimates and assumptions in calculating our financial results. As one example, we currently offer our customers a multiple-course sales discount referred to as a Training Passport, which allows an individual passport holder to attend up to a specified number of Learning Tree courses over a one to two-year period for a fixed price. For a Training Passport, the amount of revenue we recognize for each attendance in one of our courses is based upon the selling price of the Training Passport, the list price of the course taken, the average list price of all courses taken, and our estimate of the average number of courses a Passport holder will actually attend. After expiration of a Training Passport, we record the difference, if any, between the revenue previously recognized and the Training Passport selling price. For example, if a Passport holder attends more courses than we had estimated, we would make a negative adjustment to revenues at the expiration of that Passport. We base our estimate of the average number of course events that a Training Passport holder will attend on historical trends. However, these historical trends may not accurately predict the actual number of course events that a Training Passport holder will attend in the future. If average Training Passport attendance rates were to increase, for example, we would have to make negative adjustments to

12

Table of Contents

our revenue, which could be significant. For a summary of some of our key accounting estimates, please see our “Critical Accounting Estimates and Policies” in Management’s Discussion and Analysis.

Changing Regulation of Corporate Governance and Public Disclosure. Changing laws, regulations and standards relating to corporate governance and public disclosure can result in uncertainty regarding compliance matters and higher costs incurred with ongoing revisions to disclosure and governance practices. As a result, our efforts to comply with evolving laws, regulations and standards have resulted in, and are likely to continue to result in, increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities. If our efforts to comply with new or changed laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to practice, our reputation may be harmed.

Introductions and Adoption of New Technology. Our customers tend to increase their training at times when new technology is being introduced. During periods when fewer new technologies are being introduced, demand for our training courses may decrease, which could have a material adverse effect on our operating results and stock price.

Other Factors. Other factors that may affect our operating results include:

| • | competitive forces within our current and anticipated future markets; |

| • | our ability to attract customers and meet their expectations; |

| • | currency fluctuations and other risks inherent in international operations; |

| • | general economic conditions; |

| • | differences in the timing of our spending on the marketing of our courses, as well as the timing of our spending on the development of our courses and other areas; and |

| • | excess capacity and/or unused space in our education centers and/or administrative office facilities, and our ability to sublease or find other uses for it. |

All or any of these and similar factors could cause our operating results to differ substantially from the expectations of public market analysts and investors, which would likely have a material adverse impact on our stock price.

Risks Associated with Technology Changes

If we do not adequately anticipate or respond to changes in technology, it could have a material adverse effect on our operating results and stock price.

Changes in technology can affect our business in at least two principal ways. First, we must anticipate and keep pace with the introduction of new hardware, software and other information technologies and develop courses that effectively train customers in the technologies they use now and will use in the future. Second, we must adapt to changes in the technologies by which we can deliver training to our customers’ employees. As a result of technology developments, we may have to make substantial and unanticipated expenditures to develop new course titles, buy new equipment, or invest in further course development software and processes to deliver our courses. Further, we may not adequately anticipate or respond successfully to technology changes for many reasons, including misjudging the impact of technology changes, as well as financial, technological or other constraints. A lack of adequate response on our part to changes in information technology platforms, customer preferences or software technology could have a material adverse impact on our operating results and stock price.

13

Table of Contents

Competition

If our customers decide that they prefer training offered by new or existing competitors, it could have a material adverse effect on our operating results and stock price.

The IT and management training markets are highly fragmented, with low barriers to entry. No single competitor holds a dominant market share. We face intense competition from both established entities and new entries in the market. Our primary competitors include:

| • | internal training departments within our current and potential customers; |

| • | computer hardware and software vendors and their Authorized Training and Education Center partners; |

| • | independent education and training companies; |

| • | academic providers; and |

| • | software systems integrators. |

Some of our competitors offer course titles and programs similar to ours at lower prices. In addition, some competitors have greater financial and other resources than us. Additionally, hardware and software vendors, as well as software systems integrators, may combine IT education and training with sales of their products or other services, which could allow them to offer training at lower prices than we do. Furthermore, future consolidation of IT vendors or training companies could have a material impact on our future operations.

The risk of outsourcing of corporate IT administration and software development overseas to countries or firms not currently served by us could have a material adverse impact on our future operations.

Although instructor-led classroom training continues to dominate the worldwide IT and management training markets, technology-based education and training formats, such as Internet-based distance learning, have gained some acceptance. Accordingly, our future results may also depend on the extent to which the market will continue to accept instructor-led IT and management training and on our ability to develop and market instructor-led courses that compete effectively against technology-based courses offered by our competitors.

Risks Associated with International Operations

Approximately half of our annual revenue is generated by courses conducted outside the United States. Therefore, if we do not adequately anticipate and respond to the risks inherent in international operations, it could have a material adverse effect on our operating results and stock price.

Foreign Currency Fluctuations. Our consolidated financial statements are prepared in U.S. Dollars, while the operations of our foreign subsidiaries are conducted in their respective local currencies. Consequently, changes in exchange rates can unpredictably and adversely affect our consolidated operating results and could result in exchange losses. We do not hedge against the risks associated with fluctuations in exchange rates. Even if we were to use hedging techniques in the future, we might not be able to eliminate or reduce the effects of currency fluctuations. Thus, exchange rate fluctuations could have a material adverse impact on our operating results and stock price.

Other Risks Associated with International Operations. Additionally, our results of operations may be adversely affected by other international risks, such as:

| • | difficulties in translating our courses into foreign languages; |

| • | international political and economic conditions; |

| • | changes in government regulation in various countries; |

| • | trade barriers; |

| • | difficulty in staffing our foreign offices, and in training and retaining foreign instructors; |

14

Table of Contents

| • | adverse income tax and transfer pricing consequences; and |

| • | potential costs associated with expansion into new territories. |

We expect that international revenues will continue to be a significant portion of our total revenues. A lack of anticipation and response to the risks associated with international operations could have a material adverse effect on our operating results and stock price.

Dependence on Key Personnel

If we are unable to recruit and retain qualified personnel, it could have a material adverse effect on our operating results and stock price.

Our success depends in large part on the continued services of our executive officers, our senior managers and other key personnel. The loss of these people, especially without advance notice, could have a material adverse impact on our results of operations. It is also very important that we attract and retain highly skilled personnel, including course instructors, to accommodate growth, new course titles and to replace personnel who leave. Competition for qualified personnel can be intense, especially in information technology industries and/or in certain geographic areas, and there are a limited number of people with the requisite knowledge and experience. Under these conditions, we could be unable to recruit, train and retain instructors and employees. If we cannot attract and retain qualified personnel, it could have a material adverse impact on our operating results and stock price.

Risks Associated with Intellectual Property

If substantial unauthorized use of our courses occurs or if we must defend against infringement claims, it could have a material adverse effect on our operating results and stock price.

Our success depends in part on our ability to protect our intellectual property and confidential information. Our course development process and course titles are proprietary and we rely primarily on a combination of statutory and common law copyright, trademark and trade secret laws, customer licensing agreements, employee and third-party nondisclosure agreements and other methods to protect those proprietary rights. Our course materials generally do not include any mechanisms to prohibit or prevent unauthorized use. As a result, someone could copy or otherwise obtain and use our course materials without authorization, either for educational use or to develop competing courses. In addition, we operate in countries that do not provide protection of proprietary rights to the same extent as the United States. Finally, our intellectual property rights will not prevent competitors from independently developing similar course titles or delivery methods. If substantial unauthorized use of our products were to occur, our results of operations and price of our common stock could be materially adversely impacted.

We may also have to defend against claims that our current or future courses infringe on the proprietary rights of others. If such a claim succeeded, we might have to change or eliminate courses, and could be required to pay damages or royalties. In addition, litigation over intellectual property rights, whether brought by us or by someone else, could be time-consuming and expensive, even if we were ultimately to succeed. Accordingly, defending and prosecuting these claims could have a material adverse effect on our operating results and stock price.

Risks Associated with Laws and Regulations

Laws and regulations can affect our operations and may limit our ability to operate in certain states.

Providers of educational programs to the public must comply with many laws and regulations of Federal, state and international governments. Generally, we are exempt from this type of regulation because we contract with the employer of the participants in our courses, and we do not participate in any Federal or state student aid

15

Table of Contents

or loan programs. However, state laws and regulations targeting educational providers could affect our operations in the future and could limit our ability to obtain authorization to operate in certain states. If we were found in violation of a state’s current or future licensing or regulatory requirements, we could be subject to civil or criminal sanctions, including monetary penalties, and we could also be barred from providing educational services in that state. In addition, laws and regulatory decisions in many areas other than education could also adversely affect our operations. Complying with current or future legal requirements could have a material adverse effect on our operating results and stock price.

We are subject to tax audits by state, federal and foreign jurisdictions. Such audits are to be expected and may result in adjustments as a result of the accretion of tax jurisdiction interpretations and changes in operational practices. Any such audits may result in additional taxes being assessed or in the refund of taxes previously paid. Such changes could have a material adverse effect on our operating results and stock price.

Control by Management

Senior personnel, especially our founders, own a majority of our outstanding shares and may therefore have significant influence over our policies and affairs and may be in a position to determine the outcome of corporate actions.

As of December 7, 2009, our executive officers and directors collectively beneficially own approximately 55.2% of our outstanding shares of common stock. As of that date, Mr. Garen, our Chairman of the Board of Directors, beneficially owned approximately 24.4% of our outstanding shares of common stock. Dr. Collins, our Vice Chairman of the Board of Directors, beneficially owned approximately 30.2% of our outstanding shares of common stock as of December 7, 2009. Consequently, senior personnel, and Mr. Garen and Dr. Collins in particular, have significant influence over, and may control, our policies and affairs and may be in a position to determine the outcome of corporate actions requiring stockholder approval. These may include, for example, the election of directors, the adoption of amendments to our corporate documents and the approval of mergers and sales of our assets.

Risks Associated with Possible Acquisitions and Other Strategic Transactions

If we cannot successfully implement any future acquisitions or other strategic transactions, it could have a material adverse effect on our operating results and stock price.

On occasion, we evaluate business opportunities and other strategic transactions that appear to fit within our overall business strategy. We could decide to pursue one or more of these opportunities by acquisition or internal development. Acquisitions and other strategic transactions involve many risks, including:

| • | the difficulty of integrating acquired technologies, operations and personnel with our existing operations; |

| • | the difficulty of developing and marketing new products and services; |

| • | the diversion of our management’s attention as a result of evaluating, negotiating and integrating acquisitions or new business ventures; |

| • | our exposure to unforeseen liabilities of acquired companies; and |

| • | the loss of key employees of an acquired operation. |

In addition, an acquisition or other strategic transactions could adversely impact cash flows and/or operating results, and dilute shareholder interests, for many reasons, including:

| • | charges to our income to reflect the amortization of acquired intangible assets; |

| • | write-offs for the impairment of the carrying value of goodwill or other intangible assets; |

16

Table of Contents

| • | interest costs and debt service requirements for any debt incurred in connection with an acquisition or new business venture; and |

| • | any issuance of securities in connection with an acquisition or other strategic transactions that dilutes or lessens the rights of our current common stockholders. |

We have had no significant experience in executing and implementing acquisitions. Although we have implemented other strategic transactions, those ventures have not always been successful, and we may not succeed in the future. The risks associated with acquisitions and other strategic transactions could have a material adverse impact on our operating results and stock price.

Risks Associated with Changing Economic Conditions

General domestic and international economic conditions could have a material adverse effect on our operating results and common stock price. As a result of the current economic downturn and macro-economic challenges currently affecting the economy of the United States and other parts of the world, some of our customers may choose to delay or postpone purchases of courses from us until the economy and their businesses strengthen.

Domestic and/or International Economic Downturns. A significant part of our revenues comes from Fortune 1000-level companies, their international equivalents, and government organizations. During weak economic conditions, our growth rate generally slows, and in downturns as severe as that of the past year, sales diminish. If the domestic and/or international economy were to continue to weaken, the demand for our services could decline, which could have a material adverse effect on our operating results and stock price.

Industry-Specific Slowdowns. Our customers generally operate in the finance, computer, communications, electronics, systems integration, aerospace, government and military, manufacturing, and energy sectors. If one or more of these industries experiences a slowdown, it could have a material adverse effect on our operating results and stock price.

Globalization Issues. Our operations are concentrated in Europe and North America, which have traditionally been the centers of IT development and implementation. In recent years, there has been increasing IT activity in other parts of the world, such as China and India. If this trend adversely affects IT jobs in regions in which we have our principal operations, it could have a material adverse effect on our operating results and stock price.

Anti-Takeover Provisions

Certain provisions of our Restated Certificate of Incorporation, our Bylaws and Delaware law could adversely impact the interests of our stockholders.

Certain provisions of our Restated Certificate of Incorporation, our Bylaws and Delaware law could, together or separately, discourage, delay or prevent a third party from acquiring us, even if doing so might benefit our stockholders. These provisions may also affect the price investors would receive for their shares of our common stock. Some examples of these provisions in our Restated Certificate of Incorporation and Bylaws are:

| • | the division of our board of directors into three classes; |

| • | the right of our board of directors to issue preferred stock with rights and privileges that are senior to the common stock, without prior stockholder approval; |

| • | certain limitations of the rights of stockholders to call a special meeting of stockholders; and |

| • | the prohibition of stockholder actions by written consent. |

17

Table of Contents

Natural Disasters, External Strikes, Acts of War or Terrorism and Other External Events

Since our founding in 1974, various natural disasters, external labor disruptions, acts of war or terrorism and other adverse external factors have from time to time impaired our ability to conduct our business, resulted in the loss of revenue or otherwise affected our operating results. When these or other external events occur in the future, they could have a material adverse effect on our operating results and stock price.

Natural Disasters. Natural disasters can affect our business. For example, severe weather has at times prevented our course participants from traveling to our courses. In these situations, we try to transfer the course participants to later courses, but we may still lose some potential revenue. Similarly, both weather and floods have also disrupted the printing and transportation of the catalogs we use in our direct mail campaigns. The resulting delays in our mailings may reduce or delay the revenue we realize from courses listed in those catalogs.

External Strikes. We have had to react to postal, transportation, and other strikes in the countries where we operate. Postal strikes delay or reduce the delivery of our direct mail marketing materials, which may result in reduced enrollments in upcoming course events. Transportation strikes can make it difficult for our course participants or our instructors to reach course facilities. Although we try to employ strategies to mitigate the impact of external strikes, these alternative means are rarely completely effective and generally increase our costs, which could adversely affect our operating results.

Acts of War or Terrorism. Threats or acts of war or terrorism can adversely affect our business. The terrorist attacks in the United States on September 11, 2001, the declaration of war by the United States against terrorism, and continuing hostilities in the Middle East have created significant instability and uncertainty in the world. These and future events may have a material adverse effect on world financial markets, including financial markets in the United States. In addition, threats or acts of war or terrorism can cause course participants to be reluctant regarding or prevented from traveling to our course facilities, thereby resulting in lower attendance rates. Additionally, our direct mail marketing materials may be delayed or disrupted from reaching our customers; and suppliers and service providers may be unable to provide required services or materials. These impacts could happen after we have committed to all the costs of our course, so that we would be unable to quickly adjust our cost structure to reflect the changes in revenues caused by these events, which could materially and adversely affect our operating results and stock price.

Other External Factors. Other factors outside our control can affect our operations, including those related to our suppliers and service providers. For example, disruptions of telephone networks can prevent customers from enrolling in our courses; disruptions in transportation services can prevent customers from reaching our facilities, and power outages can prevent us from delivering courses. Similarly, if commodities (for example, the paper used in the printing of our catalogs) that we or our customers need become scarce or more expensive, our operating results may be adversely affected.

| Item 1B. | UNRESOLVED STAFF COMMENTS |

None.

| Item 2. | PROPERTIES |

Our headquarters are located at 1805 Library Street, Reston, VA 20190.

We own a 38,500 square foot office facility in Reston, VA, which is occupied by the sales, administrative and operations groups of our U.S. subsidiary. We lease all of our other offices and education center classroom facilities. The leases expire at various dates over the next 10 years. We also present our courses at rented hotel and conference facilities and customer sites. We typically provide all of the software, hardware and networking systems required for use in our courses.

We believe that our facilities are adequate and suitable for our needs. In general, at current attendee levels, we have some excess capacity at most of our education centers. We have been seeking to deal with excess capacity by reducing the size of some of our facilities and by renting excess classrooms.

18

Table of Contents

We present our classroom courses at Learning Tree Education Centers in Atlanta, Chicago, Los Angeles, New York City, the Washington, D.C. area (three locations), Ottawa, Toronto, London, Paris, Stockholm, and Tokyo as well as in other rented facilities in those and other cities worldwide as well as at our clients’ facilities.

The following table contains certain information regarding Learning Tree Education Centers and offices at October 2, 2009:

| Location (Metropolitan Area) |

Function(s) |

Number of Classrooms |

Total Area in Square Feet |

||||

| Atlanta, GA |

Education Center | 9 | 16,903 | ||||

| Chicago, IL |

Education Center | 5 | 11,017 | ||||

| Los Angeles, CA |

Education Center & Office | 5 | 34,374 | ||||

| New York, NY |

Education Center | 19 | 41,724 | ||||

| Washington, DC area |

Education Centers (3 sites) | 37 | 87,958 | ||||

| Reston, VA |

Offices (3 sites) | — | 45,959 | (a) | |||

| Powell, OH |

Office | — | 400 | ||||

| Kennett Square, PA |

Office | — | 440 | ||||

| Paris, France |

Education Center & Office | 19 | 36,813 | ||||

| London, England |

Education Center | 34 | 56,481 | (b) | |||

| Leatherhead, England |

Office | — | 23,209 | (c) | |||

| Ottawa, Canada |

Education Center & Office | 6 | 20,006 | ||||

| Toronto, Canada |

Education Center | 10 | 17,207 | ||||

| Stockholm, Sweden |

Education Center & Office | 12 | 27,790 | ||||

| Tokyo, Japan |

Education Center & Office | 2 | 3,096 | ||||

| 158 | 423,377 | ||||||

| (a) | Includes a 38,500 square foot office facility, which we own; all other facilities are leased. |

| (b) | Excludes 55,519 square feet that we sublease to various subtenants. Subleases end at various dates prior to the end of our prime lease. See Note 4 of “Notes to Consolidated Financial Statements” for details on subleases. Some subtenants may opt for early termination based on their sublease agreements. |

| (c) | Excludes 7,000 square feet that we sublease to a single subtenant. Sublease ends co-terminus with our prime lease which ends in December 2010. |

| Item 3. | LEGAL PROCEEDINGS |

We are not involved in any pending or threatened legal proceedings, other than routine legal proceedings and claims incidental to our business, that we believe could reasonably be expected to have a material adverse effect on our financial condition or results of operations.

Beginning in 1996, we sold Training Passports and Vouchers to the United States Government under terms similar to those sold to our commercial customers. We have previously disclosed the existence of a claim by the U.S. Government relating to the expiration and prepayment terms of our passport and voucher programs for periods prior to fiscal year 2009. The Government has asserted that the expiration and prepayment terms of those programs in prior years violated the terms of our GSA contract, and that our acceptance of payment under these terms violates the civil False Claims Act, 31 U.S.C. 3729. We do not agree, but in continuing discussions with the Government have offered to settle the dispute by making a cash payment to the Government. In the fourth quarter of fiscal year 2009, we accrued $4.2 million for the estimated cost of such a settlement. Although the positions of the parties are close, there can be no assurance that agreement on a settlement of the matter will be reached, and the ultimate payment could be more or less than the amount reserved. In particular, in the event that the Government were to file suit on this matter, under certain legal theories the Government could seek an award of up to treble damages and other penalties.

| Item 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

No matters were submitted to a vote of security holders during the fourth quarter of fiscal year 2009 through the solicitation of proxies or otherwise.

19

Table of Contents

| Item 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Price Range of Common Stock

Our Common Stock trades on the NASDAQ Stock Market under the symbol “LTRE.” The following table sets forth, for the periods indicated, the range of high and low sales prices for our Common Stock on the NASDAQ Stock Market:

| High | Low | |||||

| Fiscal Year 2008 |

||||||

| First Quarter |

$ | 27.19 | $ | 17.96 | ||

| Second Quarter |

22.96 | 12.43 | ||||

| Third Quarter |

18.12 | 14.02 | ||||

| Fourth Quarter |

17.29 | 10.50 | ||||

| Fiscal Year 2009 |

||||||

| First Quarter |

$ | 12.78 | $ | 7.52 | ||

| Second Quarter |

10.25 | 6.20 | ||||

| Third Quarter |

11.09 | 8.10 | ||||

| Fourth Quarter |

11.58 | 9.63 | ||||

On December 4, 2009, the number of holders of our Common Stock was approximately 1,416, consisting of 54 record holders and approximately 1,362 stockholders whose stock is held by a bank, broker or other nominee.

Dividends

To date, we have not paid any cash dividends on our Common Stock and have no current plans to do so in the foreseeable future. The declaration and payment of dividends are subject to the discretion of our Board of Directors and to compliance with applicable laws. Any determination as to the payment of dividends in the future will depend upon, among other things, general business conditions, the effect such payment would have on our financial condition and other factors that our Board of Directors may in the future consider to be relevant.

Sales of Unregistered Securities.

During fiscal year 2009, we did not make any unregistered sales of our securities.

Purchases of Equity Securities

The following table summarizes information regarding shares purchased during the three months ended October 2, 2009.

| Period |

Total Number of Shares Purchased |

Average Price Paid per Share | |||

| July 4, 2009 – July 31, 2009 |

117,310 | $ | 10.33 | ||

| August 1, 2009 – August 31, 2009 |

151,117 | $ | 11.06 | ||

| September 1, 2009 – October 2, 2009 |

114,071 | $ | 11.18 | ||

| Total |

382,498 | $ | 10.87 | ||

20

Table of Contents

All Common Stock repurchases were made in open-market transactions and not pursuant to any publicly announced plans. We may choose to make additional purchases of our Common Stock in the future, but have no commitment to do so.

Securities Authorized for Issuance under Equity Compensation Plans

| Plan Category |

Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights |

Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights |

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plan (Excluding Securities Reflected in the first Column) | ||||

| Equity compensation plan approved by security holders |

391,949 | $ | 13.32 | 781,104 | |||

| Equity compensation plan not approved by security holders |

— | — | — | ||||

| Total |

391,949 | $ | 13.32 | 781,104 | |||

For a description of the other material features of our equity compensation plan, see Note 6 of “Notes to Consolidated Financial Statements.”

21

Table of Contents

COMPANY STOCK PERFORMANCE

The information contained below shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), whether made before or after the date hereof and irrespective of any general incorporation language in any such filing (except to the extent that we specifically incorporate this information by reference) and shall not otherwise be deemed “soliciting material” or “filed” with the Securities and Exchange Commission or subject to Regulation 14A or 14C, or to the liabilities of Section 18 of the Exchange Act (except to the extent that we specifically incorporate this information by reference).

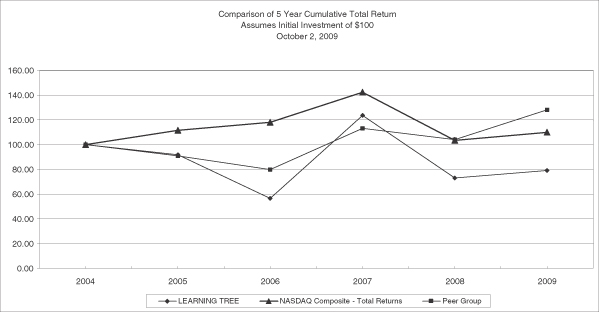

The following graph compares the cumulative total stockholder return on our Common Stock from October 1, 2004 to October 2, 2009 with the cumulative total return on the NASDAQ Stock Market Composite Index and an appropriate “peer group” index (assuming the investment of $100 in our Common Stock and in each of the indexes on October 1, 2004.)

| Fiscal Year Ended | ||||||||||||||||||

| October 1, 2004 |

September 30, 2005 |

September 29, 2006 |

September 28, 2007 |

October 3, 2008 |

October 2, 2009 | |||||||||||||

| Learning Tree International, Inc. |

||||||||||||||||||

| Common Stock |

$ | 100 | $ | 94 | $ | 58 | $ | 126 | $ | 88 | $ | 81 | ||||||

| NASDAQ Stock Exchange |

||||||||||||||||||

| Composite Index |

$ | 100 | $ | 114 | $ | 121 | $ | 146 | $ | 114 | $ | 117 | ||||||

| Peer Group Index (1) |

$ | 100 | $ | 94 | $ | 83 | $ | 117 | $ | 113 | $ | 137 | ||||||

| Peer Group + Learning Tree International, Inc |

$ | 100 | $ | 94 | $ | 82 | $ | 117 | $ | 112 | $ | 136 | ||||||

Data and graph provided by Zacks Investment Research, Inc. Copyright© 2009, NASDAQ, Inc. All rights reserved. Used with permission.

| (1) | Peer Group index includes: Apollo Group, Inc.; Skillsoft Public Limited Company; DeVry, Inc.; and, ITT Education Services, Inc. The returns of each issuer within the Peer Group Index have been weighted according to such issuer’s respective stock market capitalization at the beginning of the period presented. |

22

Table of Contents

| Item 6. | SELECTED FINANCIAL DATA |

The following selected consolidated financial data is qualified in its entirety by reference to, and should be read in conjunction with, the audited consolidated financial statements and notes thereto and other financial data included elsewhere in this Annual Report on Form 10-K. The statement of operations data set forth below for the years ended September 28, 2007, October 3, 2008 and October 2, 2009, and the balance sheet data as of October 3, 2008 and October 2, 2009, are derived from our consolidated financial statements, which are included elsewhere herein. The statement of operations data set forth below for the years ended September 30, 2005 and September 29, 2006, and the balance sheet data as of September 30, 2005, September 29, 2006 and September 28, 2007, are derived from our audited financial statements that are not included in this annual report on Form 10-K. These historical results are not necessarily indicative of the results to be expected in the future. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

We follow a 52- or 53-week fiscal year. Our year-end and quarter-end dates are on the Friday nearest the end of the calendar quarter. Accordingly, our fiscal year 2007 ended on September 28, 2007, fiscal year 2008 ended on October 3, 2008 and fiscal year 2009 ended on October 2, 2009. Fiscal years 2005 through 2007 each consisted of 52 weeks, fiscal year 2008 consisted of 53 weeks and fiscal year 2009 consisted of 52 weeks.

| Fiscal Year Ended (dollars in thousands, except per share data) | |||||||||||||||||

| September 30, 2005 |

September 29, 2006 |

September 28, 2007 |

October 3, 2008 |

October 2, 2009 | |||||||||||||

| SELECTED STATEMENT OF OPERATIONS DATA: |

|||||||||||||||||

| Revenues |

$ | 151,558 | $ | 154,049 | $ | 167,193 | $ | 181,278 | $ | 132,559 | |||||||

| Cost of revenues |

75,966 | 76,164 | 72,936 | 76,807 | 59,243 | ||||||||||||

| Gross profit |