Attached files

| file | filename |

|---|---|

| EX-32.2 - COMPOSITE TECHNOLOGY CORP | v168261_ex32-2.htm |

| EX-23.1 - COMPOSITE TECHNOLOGY CORP | v168261_ex23-1.htm |

| EX-31.1 - COMPOSITE TECHNOLOGY CORP | v168261_ex31-1.htm |

| EX-31.2 - COMPOSITE TECHNOLOGY CORP | v168261_ex31-2.htm |

| EX-32.1 - COMPOSITE TECHNOLOGY CORP | v168261_ex32-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

10-K

(Mark

one)

x ANNUAL REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the

fiscal year ended September 30, 2009

¨ TRANSITION REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the

transition period from ______________ to _____________

Commission

File Number: 0-10999

COMPOSITE

TECHNOLOGY CORPORATION

(Exact

name of registrant as specified in its charter)

|

Nevada

|

59-2025386

|

|

(State

or other jurisdiction

|

(I.R.S.

Employer

|

|

of

incorporation or organization)

|

Identification

No.)

|

2026

McGaw Avenue, Irvine, California 92614

(Address

of principal executive offices) (Zip Code)

(949)

428-8500

(Registrant's

telephone number, including area code)

Securities

registered under Section 12(b) of the Act: None

Securities

registered under Section 12(g) of the Act: Common Stock:

$0.001

par value

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes ¨ No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate

by check mark whether the registrant has (1) filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes x No ¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes ¨ No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (ss.229.405 of this chapter) is not contained herein, and will

not be contained, to the best of registrant's knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of

the Exchange Act:

|

Large

accelerated filer ¨

|

Accelerated

filer x

|

|

|

Non-accelerated filer ¨ (Do not check if a smaller reporting company)

|

Smaller

reporting company ¨

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act). Yes ¨ No x

The

aggregate market value of the registrant's common stock held by non-affiliates

of the registrant on March 31, 2009, the last business day of the registrant's

most recently completed second fiscal quarter was $50,414,923 (based on the

closing sales price of the registrant's common stock on that date). Shares of

the registrant's common stock held by each officer and director and each person

who owns more than 5% or more of the outstanding common stock of the registrant

have been excluded in that such persons may be deemed to be affiliates. This

determination of affiliate status is not necessarily a conclusive determination

for other purposes.

Indicate

by check mark whether the registrant has filed all documents and reports

required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act

of 1934 subsequent to the distribution of securities under a plan confirmed by a

court. Yes x No ¨

As of

November 30, 2009 there were 288,108,370 shares of Common Stock issued and

outstanding.

COMPOSITE

TECHNOLOGY CORPORATION

TABLE OF

CONTENTS

|

Part

I

|

||

|

Item

1

|

Business

|

1

|

|

Item

1A

|

Risk

Factors

|

11

|

|

Item

1B

|

Unresolved

Staff Comments

|

18

|

|

Item

2

|

Properties

|

18

|

|

Item

3

|

Legal

Proceedings

|

18

|

|

Item

4

|

Submission

of Matters to a Vote of Security Holders

|

21

|

|

Part

II

|

||

|

Item

5

|

Market

for Registrant’s Common Equity, Related Shareholder Matters and Issuer

Purchases of Equity Securities

|

21

|

|

Item

6

|

Selected

Financial Data

|

23

|

|

Item

7

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operation

|

23

|

|

Item

7A

|

Quantitative

and Qualitative Disclosures About Market Risk

|

35

|

|

Item

8

|

Financial

Statements and Supplementary Data

|

35

|

|

Item

9

|

Changes

in and Disagreements With Accountants on Accounting and Financial

Disclosure

|

71

|

|

Item

9A

|

Controls

and Procedures

|

71

|

|

Item

9B

|

Other

Information

|

73

|

|

Part

III

|

||

|

Item

10

|

Directors

and Executive Officers of the Registrant

|

74

|

|

Item

11

|

Executive

Compensation

|

74

|

|

Item

12

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Shareholder Matters

|

74

|

|

Item

13

|

Certain

Relationships and Related Transactions, and Director

Independence

|

74

|

|

Item

14

|

Principal

Accounting Fees and Services

|

74

|

|

Part

IV

|

||

|

Item

15

|

Index

to Exhibits, Financial Statement Schedules

|

74

|

|

Signatures

|

76

|

|

|

Index

to Exhibits

|

77

|

CAUTION

REGARDING FORWARD-LOOKING INFORMATION

In

addition to historical information, this Annual Report on Form 10-K contains

forward-looking statements that involve risks and uncertainties that could cause

our actual results to differ materially. Factors that might cause or contribute

to such differences include, but are not limited to, risks related to the

following: uncertain cash flows, the need to collect accounts receivable, our

need for additional capital, demand for our products, decrease in energy demand

and corresponding decrease in energy prices, costs related to restructuring our

corporate structure, competition, our need to protect and maintain intellectual

property, litigation, raw material costs and unavailability, changing government

regulations, the loss of significant customers or suppliers, the limited market

for our common stock, the volatility of our stock price, issues related to the

sale of DeWind and residual liabilities associated with DeWind and its

discontinued operations and other factors referenced in this and previous

filings. When used in this report, the words "expects," "anticipates,"

"intends," "plans," "believes," "seeks," "estimates" and similar expressions are

generally intended to identify forward-looking statements. You should not place

undue reliance on these forward-looking statements, which reflect our opinions

only as of the date of this Annual Report. We undertake no obligation to

publicly release any revisions to the forward-looking statements after the date

of this document. You should carefully review the risk factors described in this

report and other documents we will file from time to time with the Securities

and Exchange Commission, including our Quarterly Reports on Form 10-Q filed by

us in our 2009 fiscal year, which ran from October 1, 2008 to September 30,

2009.

As used

in this Form 10-K, unless the context requires otherwise, "we", "us," the

"Company" or "CTC" means Composite Technology Corporation and its

subsidiaries.

PART

I

Item

1 - BUSINESS

I.

Overview

Composite

Technology Corporation (“CTC” or the “Company”) develops, produces, and markets

innovative energy efficient and renewable energy products for the electrical

utility industry. CTC’s products incorporate advanced composite materials

and innovative design solutions that result in energy efficient conductors for

electrical transmission systems. The Company’s products benefit from proprietary

and patented technologies which create products that we believe have substantial

economic benefits over similar, more traditional products. The Company was

incorporated in Florida on February 26, 1980 as El Dorado Gold &

Exploration, Inc. and reincorporated in Nevada on June 27, 2001 and renamed

Composite Technology Corporation. Our fiscal year begins on October 1 and

ends the following year on September 30. We maintain our principal

corporate offices at 2026 McGaw Avenue, Irvine, California 92614. Our

telephone number at that address is (949) 428-8500. We maintain a website

at www.compositetechcorp.com.

On our website, we also publish information relating to CTC’s corporate

governance and responsibility. The content on any web site referred to in

this filing is not incorporated by reference into this filing unless expressly

noted otherwise.

During

fiscal 2009, the Company operated under two operating segments. (1) The cable

segment operated as CTC Cable and (2) the wind turbine segment operated as

DeWind. Our primary products consist of ACCC®

conductor for electricity sold under the CTC Cable segment (“Cable”) and the

DeWind wind powered electricity-generating turbines sold under the DeWind

segment (“Wind”). In September 2009, the Company sold substantially

all of its operating assets and liabilities of DeWind to Daewoo Shipbuilding and

Marine Engineering Co. Ltd. (DSME) for a gross amount of $49.5

million. The operations of DeWind as well as residual assets and

liabilities of DeWind are being accounted for as discontinued

operations.

The CTC

Cable segment sells ACCC®

conductor, an advanced composite core overhead electrical transmission

conductor, and manufactures and sells ACCC® core,

the composite core component of the ACCC®

conductor, along with hardware connector accessories specifically designed for

ACCC®

applications. We sell ACCC®

conductor and core directly to customers and through various distribution

agreements both internationally and in North America. We also sell

ACCC®

conductor connecting hardware and assist with engineering design services.

ACCC®

conductor has been available for commercial sale since June, 2005. We have

marketed ACCC®

conductor as the most energy efficient, highest performance and overall cost

efficient alternative to traditional ACSR (Aluminum Conductor Steel Reinforced),

newer variant ACSS (Aluminum Conductor Support Steel), new technology ACCR

(Aluminum Conductor Composite Reinforced), AAAC (All Aluminum Alloy Conductor),

and AAC (All Aluminum Conductor). Our revenues from our CTC cable products

for the 2009, 2008 and 2007 fiscal years were $19.6 million, $32.7 million, and

$16.0 million respectively.

The

DeWind segment produced wind turbines for electricity production and intended to

develop wind farms incorporating these turbines. The DeWind segment

represents the successor operations of the EU Energy, Ltd., which was acquired

in July 2006. In November, 2008 after the realization that the worldwide

economic and banking crises were severe and were resulting in a significant

delay or elimination of financing for our customers’ wind farms, the Company

made a decision to seek strategic investment partners or to divest its ownership

stake in DeWind. In September, 2009 the Company sold substantially

all of DeWind’s assets and operating liabilities to DSME. Under

the terms of the transaction, described in greater detail below, the Company is

prohibited from developing, marketing, or selling competing wind turbine

technology for five years except that the Company retained the rights to develop

and sell wind farm projects.

The

divestiture of DeWind was a decision driven by the worldwide banking and credit

crisis. DeWind had focused its sales and marketing efforts into the

North American and South American markets to take advantage of its innovative

D8.2 technology. Following the June 2008 cash investment by Credit

Suisse and the signing of turbine contracts in September and early October,

DeWind began to invest a significant amount of cash into its supply chain to

fulfill orders. In October 2008, DeWind’s largest customer defaulted

on a progress payment, which was the result of that customer losing their

project financing, a consequence of the continuing worldwide banking and credit

crisis that began in late 2008. Other customers that could have

absorbed the delivery of some or all of the turbines under order were similarly

unable to obtain project financing during the credit crisis. By

November 2008, the Company’s management developed a contingency plan in case

wind project financing in North and South America continued to be unavailable

for our customers. That plan was to engage RBS Securities to find a

strategic investor or to sell DeWind outright while reducing the investment in

the supply chain to a minimum, while still maintaining the viability of DeWind

to fulfill the remaining DeWind sales contracts.

II. Our

Strategy

Our

strategy is to penetrate the electrical utility markets with our more energy

efficient and economically advantageous products that provide solutions to

long-standing problems endemic in most electrical transmission and generation

systems. We incorporate our composite materials technology knowledge

to invent products and improve existing energy products that provide novel

solutions in the energy industry. We focus on development of

profitable products that, once adopted, will have substantial technical,

efficiency, and economic advantages over existing energy

products.

1

Our

approach:

|

|

·

|

We carefully choose the

businesses we are in, focusing primarily on the electrical utility

industry and identifying opportunities that we feel are underserved or

which have a large, underserved market opportunity where we believe that

our products, properly introduced, will have a strategic and durable

advantage to produce long-term profitable

growth.

|

|

|

·

|

We strive to develop and modify

technologies, to protect our developed technologies, and to introduce

these new technologies into markets with mature technologies that

represent significant potential improvements and

opportunities.

|

|

|

·

|

We use operational disciplines

and process methodologies, tools, and resources to execute more

effectively to provide our customers with reliable and quality

products.

|

|

|

·

|

We seek relationships with

industry leaders when necessary to achieve our strategic goals and

emphasize initial sales to industry leaders so that we can best leverage

our sales and marketing

efforts.

|

|

|

·

|

We seek to capitalize on the

expected transmission grid enhancements including the “Smart Grid” as well

as increased U.S. and other capital spending on mission critical

electrical grid

improvements.

|

|

|

·

|

We market our products as

cost-effective solutions that promote energy efficiency and which reduce

greenhouse gas emissions through reduced transmission power losses and

related reduction in power generation from fossil-fuel power

plants.

|

Our

strengths are derived from our ability to identify and address problems inherent

in existing electrical utilities, which the industry considers normal operating

constraints. We then develop and market products that are designed to

be innovative and economically superior solutions to the underlying problems and

to provide a superior return on investments in transmission and generation

assets. We protect our competitive advantages through a worldwide

intellectual property strategy on our products.

III. Industry

Background

The

transmission grid consists of multiple transmission lines that connect and

interconnect power produced at power plants that are transmitted via high

voltage transmission lines to substations near population centers where they are

stepped down in voltage and delivered through distribution systems to

customers. Each transmission corridor contains at least one

transmission circuit consisting of three wires in standard three phase AC

transmission systems. In the less common DC transmission systems

there are two wires per circuit. Typically, a transmission corridor

from a very large production facility may have multiple circuits on the same

towers and each circuit may have “bundled” conductors of between 2-4 wires per

bundle per phase. The industry term for three single

transmission conductors for a mile is a “circuit mile.” The Company

converts circuit miles or circuit kilometers to linear miles or kilometers as

key metrics for production and sales results.

Bare

overhead transmission conductors have been in use since the beginning of the

electricity age and form the backbone of the electrical grid. Overhead

transmission conductors are the primary method used in the grid to connect power

generation plants to population centers, since generation plants are often many

miles away from the eventual consumers.

The

transmission of electricity from power production to the consumer can be thought

of as a grid of electrical “energy pipelines” in the sky. In the

developed world, under the demand conditions contemplated decades earlier, the

grids were engineered to handle a relatively low level of power transmission and

therefore smaller “pipes” were engineered as compared to today’s

requirements. For example, in the U.S. most of the transmission grid

was designed and erected in the 1950s, with expectations of a significantly

lower population and per capita electricity consumption. Existing electrical

transmission grids use bare overhead conductors as these “pipes”, which have

been in existence for over 100 years and predominantly use the industry standard

known as ACSR. ACSR consists of a steel wire core stranded with

aluminum wire. The steel serves as the strength component required

for the high tension between the support structures while the aluminum is the

primary electricity conducting material.

The use

of steel wire as a strength component has three primary

drawbacks: steel is heavy, it is subject to corrosion over time,

limiting its life, and like all metals it exhibits thermal expansion, that

causes line sag as it heats. Under electrical power load the steel strength

component in standard ACSR conductor heats and stretches which results in the

ACSR drooping closer to the ground, called “sag” in the electrical transmission

industry. Grid and safety regulations require minimum ground

clearances for conductors. The worldwide transmission grids were

designed to overcome the weight and sag drawbacks by placing the conductor under

high tension thereby requiring expensive heavy duty tall tower structures spaced

close enough together in order to hang ACSR at such heights so as to allow for

the expected operational power loads. The heavy duty tower structures are

engineered for the combined weight of the ACSR steel core and the aluminum wire

it supports, while the close proximity of the towers allows a pre-engineered

amount of conductor sag to allow for high power load conditions. In a

typical transmission grid project, the cost of siting, constructing and

maintaining tower structures can be as much as 80% of the total cost of the

project, depending on the size and strength of the towers and remoteness of the

tower sites, which often require helicopters to bring materials to the tower

site.

Total

Cost of Ownership:

Historically

the industry approach to the total cost of ownership for a transmission line

consisted of:

|

|

i.

|

capital

costs for the tower structures and the ACSR conductor;

and

|

|

|

ii.

|

routine

maintenance for the conductor and tower

structures.

|

2

With the

advent of products such as ACCC®

conductor this conventional wisdom is beginning to change. Twenty

years ago, very little thought was given to the concept of power losses in the

lines, called “line losses” in the power industry. There were no

commercial alternatives to ACSR and most of the transmission line infrastructure

had been engineered decades before the rapid increase in electricity consumption

over the past twenty years. Line losses were an acceptable cost of

business for the electrical energy in the U.S.

Resistance

in transmission and distribution conductors, transformers, and other electrical

infrastructure cause line losses through heat losses. According to

the U.S. Department of Energy (U.S. DOE) Office of Electricity Delivery &

Energy Reliability, the line losses from distribution and transmission increased

from 5% of generated power in 1970 to 9.5% in 2001 (http://sites.energetics.com/gridworks/grid.html

pg 2). On average, using 2001 data, a power plant generating 100 Megawatts of

power will deliver just over 90 megawatts to a consumer, with the rest of the

power lost through heat from the transmission and distribution conductors and

the transformers.

The

Company views the additional power generation required to offset line losses of

the transmission corridor to be a cost of ownership that was previously never

considered by the transmission line operator. We believe that more

efficient conductors such as ACCC®

conductor will reduce the total cost of ownership by reducing the line losses if

compared to existing transmission conductor alternatives.

Line

losses cost consumers in two ways:

Economically,

the losses are passed through to the consumer through higher rates since it

requires the utility or power generating company to produce more power to

deliver the required megawatts. The total retail value of grid losses

for 2008, based on U.S. DOE Information Administration data, are estimated at

over $30 billion. According to the November 2003 U.S. Climate Change

Technology Program report, 60% of the losses are from transmission and

distribution lines resulting in an estimate of $18 billion in economic losses

due to U.S. transmission and distribution conductor line

losses. Incremental to this cost would be the value, or cost, of the

monetization of the greenhouse gas emissions mentioned below.

Environmentally,

the line losses represent additional greenhouse gas emissions. In

2007, based on U.S. DOE Information Administration data, over 2.5 billion metric

tons of CO2 was emitted in the U.S. from conventional power

plants. Based on the information in the sources cited above,

approximately 5.7% or 142 million metric tons of pollution is caused by line

losses, the annual equivalent of approximately 26 million

automobiles.

Over the

past several years, an intense media focus on climate change has raised the

awareness of the need to reduce greenhouse gas emissions. Information is readily

available on the Internet for U.S. based studies by the U.S. Department of

Energy, the California Air Resources Board, and Stanford University’s Precourt

Institute for Energy Efficiency, and internationally by McKinsey & Company’s

landmark “Pathway to a Low Carbon Economy” study which focuses on cost-effective

methods towards global greenhouse gas reductions. Both the Precourt

and McKinsey studies use an “abatement cost curve” or “marginal abatement curve”

which provides the cost effectiveness of different greenhouse gas solutions and

graphs the greenhouse gas reduction against the total cost of ownership.

Although none of these studies segregate transmission and distribution grid

improvements under a separate heading, each study has “other utility efficiency”

categories and each is considered to be a significantly cost-effective method of

greenhouse gas reductions, listed as a “negative cost” for CO2

remediation.

Recently,

much public attention has been given to the “Smart Grid”, which consists of a

system of monitoring sensors, and grid management tools to optimize the existing

grid. CTC Cable sees this as beneficial since it highlights the need

for an improved transmission grid, however compared to reconductoring

constrained transmission lines, provides a much lower return on invested

capital.

IV. Our Solutions and

Competitive Advantages

The state

of the transmission grids around the world and the issues faced by grid managers

can be divided into two general categories:

|

|

·

|

The

existing grid is aged and capacity constrained due to the greater demand

for electricity by consumers and a lack of historical investment in the

grid.

|

|

|

·

|

New

markets in developing countries and new sources of renewable energy, such

as solar or wind energy require investment in new transmission

lines.

|

We

believe that our ACCC®

conductor solution provides a superior total economic return over all other

existing bare overhead transmission conductors. The total cost of

ownership over the life cycle of either a new transmission line or for

replacement of existing transmission lines is significantly reduced as compared

to the total cost of ownership of ACSR or other conductor products after

factoring in the following costs and benefits:

Capital

Costs:

|

|

·

|

Lower

capital costs for tower structures due to fewer or lighter weight tower

structures (approximately 80% of typical transmission project

cost)

|

|

|

·

|

Higher

per foot (or meter) capital cost of the more energy efficient ACCC®

conductor vs. ACSR (approximately 20% of typical transmission project

cost)

|

Net

capital costs have been lower for most ACCC®

conductor installations to date.

3

Recurring

Benefits:

|

|

·

|

Decreased

power production costs resulting from decreased line losses of

approximately 33% vs. ACSR, due to the higher aluminum content of

ACCC®

conductor, which has more

conductivity

|

|

|

·

|

Increased

transmission revenues at peak demand periods since ACCC®

conductor can transmit more electricity capacity and operate at higher

peak operating temperatures which provides utilities with better grid

management capabilities

|

|

|

·

|

Reduced

“congestion costs”, defined in the industry as the requirement to purchase

more expensive power due to transmission line constraints which prevent

the delivery of less expensive, or possibly less pollutive power to the

consumer

|

|

|

·

|

Reduced

system “brownouts” or “rolling blackouts”, which in turn cause

unquantifiable general economic losses to utility

customers

|

|

|

·

|

Currently

unquantifiable economic savings and significant environmental benefits due

to avoided greenhouse gas emissions by otherwise greater required fossil

fuel power generation to supply the lost

power.

|

Product

History:

Our

conductor product was conceived in response to the California energy crisis

during the early to mid 2000's and increased public awareness that the crisis

was not due to a shortage of power generation, which was the conventional wisdom

at the time, but rather due, in part, to constraints in certain

transmission corridors. In 2001, the Company founders surmised that a more

efficient and effective transmission conductor solution would be to redesign the

transmission conductors themselves, by replacing the heavy steel wire strength

“core” used in traditional “bare overhead” conductors with a light weight

composite core using existing carbon and glass composite

technologies. The idea was the creation of a conductor that has

a greater aluminum cross section for the same diameter conductor that would have

the same weight and would require fewer or smaller towers, thus reducing the

overall cost of installation.

In very

simple terms, analogous to the concept that a larger water pipe will deliver

more water at lower pressure, than a smaller water pipe; the aluminum on a

conductor functions as the “electricity pipe.” Under identical

operating conditions, a conductor with a greater aluminum cross-section will

therefore conduct more electricity, at a lower temperature, at less resistance,

and with lower power losses through heat, than a conductor with a smaller

aluminum cross-section.

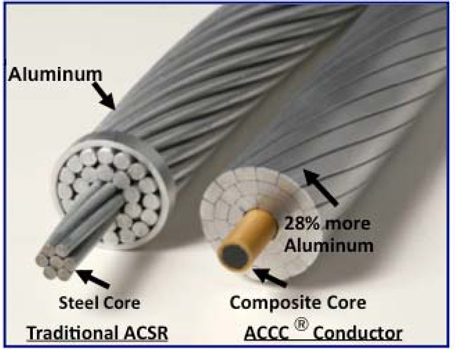

Cutaway of ACCC® conductor compared with a

traditional ACSR Conductor:

We have

replaced the steel core of traditional ACSR conductor with a lighter, stronger

composite core to create ACCC®

conductor. By taking out the weight of the steel and using annealed

aluminum, for the same size diameter and weight conductor as ACSR we are able to

increase the conductive cross section allowing approximately 28% more

aluminum. In effect, for the same weight and size, ACCC®

conductor functions as a larger “electricity pipe” which will allow for easy

replacement on existing tower structures or, for new construction provides for a

larger “electricity pipe” on smaller, fewer, and cheaper tower

structures.

The

source of the benefit is our proprietary ACCC®

composite core, which forms the strength component of ACCC®

conductor. The ACCC® core

consists of aerospace grade carbon fiber and industrial glass fibers, infused

with a proprietary resin mixture, and pulled through a heated die in a

proprietary pultrusion process. We manufacture our ACCC® core in

our ISO 9001:2008 certified plant in Irvine, California on internally designed

and constructed machinery that is easily duplicated and scalable into additional

locations. The ACCC® core is

then shipped to an outsourced licensed contract manufacturer where it is

stranded with trapezoidal aluminum wire around the

core.

We sell

ACCC®

conductor either as a completed conductor ready for installation on the grid or

as ACCC® core to

licensed aluminum stranding manufacturers, which then strand the ACCC® core and

sell the finished ACCC®

conductor to their customers. As part of our product offering, we

also design and manufacture the hardware required to connect ACCC®

conductor to the tower structures and for splicing lines together. We

deliberately designed ACCC® hardware

to be installed in a manner consistent with ACSR. While ACCC®

conductor does require attention to certain differences in handling than ACSR,

ACCC®

conductor installations do not require special tools and are installed in the

same amount of time on the same transmission tower structures.

Other

than as disclosed in our patents, patent applications, and marketing materials,

we consider our manufacturing process, the components used and material

mixtures, types of materials, and methodologies to be trade secrets and part of

our overall strategy to develop and protect our intellectual property rights to

maintain a competitive advantage against competing products.

The

intellectual property used in our ACCC®

conductor has been developed internally and is aggressively protected through

our intellectual property strategy, which has achieved several issued patents

and have filings in over 70 countries. We continue to aggressively

defend our intellectual property rights, which we believe is a key competitive

advantage.

4

V. Conductor

Market

The

market for transmission infrastructure is massive. According to the

2008 World Energy Outlook published by the International Energy Agency (IEA),

the worldwide demand for electricity is expected to grow at an annual rate of

3.2% between 2006 and 2015 decreasing to a 2% growth rate from 2016 to 2030 with

most of the growth occurring outside the 30 “developed” countries comprising the

OECD, consisting of North America, Western Europe, Australia, South Korea, and

Japan. Demand within the OECD is expected to increase an average 1.1%

while the developing world economies are expected to grow by 3.8% per

year. Transmission infrastructure required to support this growth is

projected to be $2.1 trillion between 2007 and 2030 of which $1.4 trillion is in

developing countries and $700 billion in the OECD. Distribution

infrastructure required over the same time frame is expected to total $2.7

trillion. The expected annual average spending for transmission and

distribution infrastructure combined averages over $300 billion per year between

2007 and 2015, approximately one-third of which is transmission. The

largest growth market is China, which alone is expected to spend nearly $68

billion per year on transmission and distribution projects on average for the

next eight years according to the IEA. A recent announcement by the

Chinese Central Government accelerated the planned electrical transmission

infrastructure spending to a level of $161 billion in 2009 and

2010.

According

to the Department of Energy’s 2009 Annual Energy Outlook reference case, the

U.S. electricity demand is expected to grow 19% between 2009 and 2030 on a grid

that is already overloaded. The 2002 DOE National Transmission Grid Study

identifies 157,800 miles of transmission line and cites that “the U.S.

Electricity Transmission system is under stress and identified key transmission

bottlenecks.” The North American Electric Reliability Corporation (NERC) 2009

Long-Term Reliability Assessment indicates that approximately 260,000 megawatts

of new renewable capacity is projected to come on line by 2018 and that there

will need to be more than double the average number of transmission miles

constructed over the next five years than what was constructed over any previous

five year period since 1990, primarily for integration of renewable energy

resources, reliability, and congestion. It further cites that the number one

emerging issue is transmission siting of new transmission lines.

Factoring

in the push towards renewable energy and the increased focus on reducing

greenhouse gas emissions, the markets could expand beyond what this data

indicates. The McKinsey study “Pathway to a Low Carbon Economy”

indicates that the global “business as usual” (BAU) analysis projects greenhouse

gas emissions from electricity production worldwide will increase 26% from 2005

to 2020 to 16.2 gigatons per year and projects an abatement potential of 3.4

gigatons of CO2, or 21% of the BAU level for the power industry by

2020. The capital investment between 2011 and 2020 for such abatement

is estimated to be 148 billion Euros ($220 billion) (Source: Pathway to a Low Carbon Economy,

pages 155-158, McKinsey & Co.).

Our

ACCC® products

serve both transmission and distribution markets. Our analysis, based

on market figures provided by the International Energy Associations’ 2008 World

Energy Outlook indicates a worldwide market for transmission and distribution

conductors of $45 billion per year. We see China as the largest

market with over 30% of the spending, followed by the United States at 11% and

Europe at 10%. With the exception of the United States, a regulatory body such

as a state grid entity or a state utility controls most individual country or

regional markets worldwide. Technical approvals of the regulatory

body are required prior to obtaining the right to sell product within the

region. Examples of this would be the state grids of China, Poland,

or Mexico. In the United States, most independent utilities have

their own technical requirements, resulting in a much more fragmented market in

the United States. In the U.S., we are currently tracking and

managing over 1,800 transmission projects with projected costs in excess of $185

billion of which we believe $20-25 billion could be for bare overhead

transmission conductor installed over the next 5-7 years.

Within

each market, bare overhead conductor is sold in one of three general

ways:

“Green

field” – the term for construction of a new transmission corridor or the

addition of another circuit pathway to an existing corridor. ACCC®

conductor is an excellent solution for green field construction in most cases,

where both the increase in efficiency and the reduction in the number of towers

required is cost effective versus the use of a conventional

conductor.

“Retrofit”

– where additional capacity is required for an existing transmission line and

where such additional transmission capacity can be obtained by installing a

larger sized conductor. When using a conventional conductor, this

usually requires upgrading the tower structures so that one can handle the

increased weight and tension required when using a larger conductor with greater

aluminum content. One can usually install our ACCC®

conductor on the same tower system to provide the increased capacity as well as

greater efficiency; or in certain instances where peak demand is all that is

needed, by installing a same size conductor that has higher temperature, low sag

characteristics such as ACCC®

conductor.

“Replacement”

– occurs when a conductor has aged and requires replacement of the same type and

size conductor. Due to the higher price per linear meter vs. ACSR,

ACCC®

conductor typically is not a solution for replacement installations, unless one

wanted increased energy efficiency or some of the aging towers would otherwise

require weight load de-rating. We believe that ACCC®

conductor would provide a cost effective solution to expensive tower

upgrades.

We are

focusing our efforts on green field and retrofit applications.

VI.

Competition

The

competition for ACCC®

conductor depends somewhat on the application of the conductor. In

general, we believe that ACSR is our primary competition. Thus far in

this document, we have focused the description of our products and product

advantages by comparing ACCC®

conductor to ACSR conductor since it is the industry standard and represents the

greatest opportunity for market penetration. ACSR is made using

100-year-old technology and is usually sold by weight as a commodity product by

a multitude of conductor manufacturers including General Cable, Southwire, and

Alcan Cable in the U.S.

5

During

our analysis, we also compared ACCC®

conductor with other conductor product innovations. We compete with

the following products either on a high temperature, low sag (HTLS) basis or on

an energy efficiency of transmission basis:

|

|

·

|

ACSS, or Aluminum Conductor

Support Steel, is an annealed aluminum conductor using a similar design as

ACSR but which uses a higher strength steel alloy as its

core. ACSS can operate at a higher temperature than ACSR and

has similar weight to ACSR. ACCC® conductor is superior to ACSS

both on the basis of reduced high temperature sag, as well as the

efficiency of transmission. Although ACSS is less expensive

than ACCC® conductor on a price per linear

meter, on most projects our ACCC® conductor is less expensive

considering capital cost of the total project and in line loss savings due

to the increased efficiency.

|

|

|

·

|

GAP conductor, is a modified

version of ACSR using higher strength, heat resistant steel, a proprietary

“grease material” barrier between the steel core and the heat resistant

aluminum alloy that serves as the primary conductor. GAP is

marketed as HTLS and provides no efficiency

gain.

|

|

|

·

|

ACCR, or Aluminum Conductor

Composite Reinforced, is a composite conductor composed of

aluminum-zirconium alloy stranded wire around a metal-ceramic matrix

composite wire core and is manufactured by 3M

Corporation. We do not consider ACCR in its current state

to be a competitive product with ACCC® conductor, since it is prone to

brittle fracture and is therefore difficult to handle and

install. Furthermore, it does not have the amount of reduced

sag that our ACCC®

conductor has and it

has less performance per price point. ACCR has been on the market for a

number of years, marketed by 3M, with more resources than we have had, yet

appears to have a more limited commercial installation base to date as

compared to the installation base of ACCC®

conductor.

|

|

|

|

|

|

·

|

AAAC, or All Aluminum Alloy

Conductors, and AAC, or All Aluminum Conductors, are designed to eliminate

the strength component and make the entire conductor from aluminum using

alloying elements for AAAC to render the aluminum stronger and increase

its operating temperature. Both conductors are very soft and

cannot be operated at the same temperatures as conventional ACSR since

they have high levels of thermal sag which requires shorter spans between

towers, resulting in a more expensive total system installation

cost. Both conductors have very limited maximum operating

temperature ranges, which limits capacity significantly. AAAC and AAC

conductors have gained commercial adoption in Europe, however, our

ACCC® conductor of the same diameter

has approximately the same conductivity and allows a much higher capacity

and can be easily retrofitted on such

systems.

|

|

|

·

|

Superconductors

and underground cables. We do not consider superconductors or

underground cables to be competitive products to ACCC®

conductor. Buried cables cost several times a comparable total

installation cost and are typically not used for transmission lines due to

the requirement for high voltage insulation, maintenance and cooling

issues. Superconductors are even more expensive to install, in

the multiple millions of dollars per mile and consequently have had very

limited government sponsored short trial installations of less than two

miles in extremely congested city areas where there is a lack of conduit

space underground.

|

We

believe ACCC®

conductor has two disadvantages compared to the competition. First, our

ACCC®

conductor is still a relatively new product that incorporates technology that,

while well proven in aerospace and other applications, still has limited

installations in the utility markets even though it has been in commercial

application for almost four years. At present, over 8,500 kilometers

of ACCC®

conductor have been installed worldwide, which has definitely proven its

effectiveness in transmission and distribution systems. Nevertheless, the ACSR

product we typically replace has been in existence for 100 years, is familiar to

utility management and utility engineers and has been proven to work, and its

limitations are well understood in all types of installations. Our

product deployment is increasing, even though it does not yet have this legacy

in the utility markets. Second, our product is more expensive when

compared by the meter or foot than the ACSR conductor for the same diameter

sized conductor. While we believe and have demonstrated that

installation of our product results in capital cost savings of the overall

project, since less tower construction or other upgrading costs should more than

offset the higher cost per meter or foot of conductor, the sale is still

challenging to convince traditional utility buyers, who are not accustomed to

analyzing costs of a total system when thinking about the actual cost of a unit

of conductor. We also believe and have demonstrated that there are

additional yearly cost savings from the increased efficiency of electrical

transmission due to lower line losses. However, it is also

challenging for the typical decision maker to incorporate that into their

analysis, since that falls in a different department and is usually considered a

normal line loss cost that is built into the rate base.

VII. ACCC® Conductor

Marketing

Marketing

Message:

Our

ACCC®

conductor marketing message consists of three primary benefits: 1) energy

efficiency seen through reduced line losses and decreased greenhouse gas

generation emissions, 2) increased power transmission capacity due to higher

operating temperature thresholds, and 3) return on investment through lower

capital costs, improved line losses, and once monetized, value in greenhouse gas

reductions. This message fits the main issues facing a utility, which

include finding a solution for problems of a constrained existing transmission

grid, improving the energy efficiency to decrease line losses, and mitigating

the increasing risks of the increasingly pollution sensitive public

. Our message further provides a comparison with other conductors to

illustrate these advantages as well as state the benefits of the total cost of

ownership over the life cycle of the transmission or distribution

line.

6

Marketing

Approach and Strategy:

Our

approach is to demonstrate to utilities the financial benefits of ACCC®

conductor through a lowest total cost of ownership approach while providing

assurances that the mission critical application of electricity transmission

through a product that provides as much, if not more, reliability as the

existing ACSR conductors. We are also pushing the environmentally

friendly benefits of ACCC®

conductor due to lower line losses.

Conductors

are currently considered and sold to the industry as commodity items with little

or no distinction between the products offered from one manufacturer to the

next. To communicate the value proposition of the ACCC®

conductor solution effectively, we must speak to and educate various

participants in the decision making process regarding ACCC®

conductor's ability to solve line problems. In this respect, CTC Cable focuses

its sales and marketing message on selling solutions instead of simply one

component of a solution. This approach is necessary to promote a

dramatically improved product into a mature conservative

environment. To help illustrate and quantify this solution-based

message, CTC Cable has created sales and engineering

tools. Principally, the tool known as the Conductor Comparison

Program (CCP), performs electrical throughput, structural calculations and

financial cost benefit analysis on ACCC®

conductors and compares them to other available conductors. This analysis of

ACCC®

conductors, when viewed in terms of “cost per delivered kilowatt” presents a

compelling value proposition under most operating conditions.

Our total

cost of ownership message consists of four general concepts consisting of costs

and revenue benefits including:

|

|

a.

|

Capital

costs including towers, conductor, and

installation

|

|

|

b.

|

Recurring

maintenance costs

|

|

|

c.

|

Transmission

Revenues and grid management

benefits

|

|

|

d.

|

Line

losses including greenhouse gas emission

reductions

|

Capital

Costs: Our capital costs are lower due to the lower number of towers

required, and that the required towers require less tension than ACSR towers

despite a higher per mile cost of ACCC® conductor

than ACSR. The cost of new transmission corridors vary widely,

depending on terrain, land acquisition costs and permitting costs, but according

to the National Council on Electricity Policy publications (source data:

American Transmission Company, 10-Year Transmission Assessment, September, 2003)

is typically over $900,000 for a single circuit 345kV “Greenfield” line and can

exceed $1 million per mile for higher voltages. New construction

often takes years to obtain the necessary permits and environmental studies

prior to breaking ground on a project. By comparison, it is

considerably less expensive and takes a much shorter amount of time to replace

or “reconductor” existing transmission corridors. The cost and time

to market to reconductor a transmission corridor is dependent on the number of

tower replacements or retrofits to existing towers but the same source cites a

2003 cost of $400,000 for a 69kV to 138kV upgrade cost using ACSR due to

materials costs, installation charges and tower upgrades. By

comparison, assuming little or no tower upgrades ACCC®

conductor cost per corridor mile would typically be $150,000 - $200,000 per

circuit replaced, or about half the cost, assuming a minimum number of tower

enhancements or modifications.

Recurring

Maintenance: We show that the lack of corrosive steel core, as

compared to ACSR, and the lower number of towers with lower tension will result

in an overall lower maintenance cost of ACCC®

conductor.

Transmission

Revenues: ACCC®

conductor has a higher operating temperature than ACSR which allows for greater

capacity at peak demand times, therefore it can operate at times where an ACSR

line would be subject to “rolling blackouts” or brownouts. For

developing countries and even developed countries, the reliability of the

transmission grid often causes power reductions or interruptions to industrial

and commercial businesses, which can cause significant decreases in economic

activity. The higher peak demand ability, as shown by real world

customers of ACCC® in the

U.S, who routinely use their ACCC® line as

an emergency power shunt to reroute power to ensure better grid

reliability. The temperature limitations of a similar ACSR line would

result in a reduction or elimination of this ability for the transmission

corridor.

Line

losses: ACCC® shows

superior performance on line losses as compared to an identically sized ACSR

conductor and as described above.

Addressing Risk: To

overcome the risk averse, conservative barriers to the adoption of a new

conductor by the market, we provide through a third-party insurance company a

three-year Original Equipment Manufacturer Warranty (parts and labor) on all

ACCC®

conductor products currently produced by CTC Cable, and all of its stranding

sources sold worldwide. The warranty covers the repair or replacement of the

ACCC®

conductor and connectors, plus a limited labor expense reimbursement. We also

provide through the same third-party insurance company the option to extend the

warranty period to five, seven or ten years. The program covers

ACCC®

conductor for the following: (1) sag and creep; (2) wind generated Aeolian

vibration; (3) composite core failure; (4) breakage; (5) corrosion rust; and (6)

unwinding. We believe that the program makes our products more attractive

because it reduces much of the risk and uncertainty of adopting the new

product.

We have

reviewed the top markets worldwide and during 2009 we focused on expanding our

market penetration worldwide. We have penetrated seven worldwide

markets in the U.S., China, Mexico, Chile, South Africa, Indonesia, and several

European countries with commercial sales in each of these areas. In China, we

have operated with a multi-year distribution agreement that is ending at the

close of 2009. A new form of agreement is being negotiated for 2010

and beyond. In the U.S. market, we have spent the past five years

working through and completing the technical sales requirements necessary to

allow our conductor to be considered for larger scale

installations. In addition, we now have nearly four years of

commercial installations and six years of trial installations. In

Europe, we have made sales to Poland, Spain, Portugal and Belgium with

additional proposals and quotes outstanding in, France, Germany, the

Scandinavian countries, and the UK. We are also beginning to

penetrate the Latin and South American markets with orders from Mexico and Chile

with quotes and tenders in Brazil and Argentina. We are currently

qualified to sell and market conductor into the U.S. and China, parts of Europe,

as well as India, Indonesia, Mexico, Canada, Chile, South Africa, Saudi Arabia,

Bahrain, and the UAE. We are technically certified to sell ACCC®

conductor in approximately 65% of the estimated worldwide transmission

markets.

7

VIII.

Sales

We have

made several important commercial sales in the United States, Europe, China,

South America, and South Africa. Our U.S. sales are made both

as finished ACCC®

conductor sold directly to the customer and as ACCC® core

sales directly to our stranding source who in turn sells ACCC®

conductor to the end user customer.

We sell

our conductor in the U.S. and internationally through a direct sales force

headquartered in Irvine, California, and through regional sales representative

organizations, agencies and through distribution agreements with our conductor

aluminum stranders. Our international sales strategy is to obtain

product certification from local regulatory bodies and then to enter into

strategic manufacturing and distribution agreements in those areas with

well-known transmission conductor suppliers and manufacturers. We

expect to make initial sales into those geographies as finished ACCC®

conductor sales and then to transition those sales to selling ACCC® core to

our stranding and distribution relationships. We believe this

strategy has several advantages to the product acceptance of ACCC®

conductor within these geographies:

|

|

·

|

By allowing ACCC® conductor to be stranded within

a local market, the total value content of the ACCC® conductor will allow the product

to be sold as a local product, rather than as a product imported from the

U.S.

|

|

|

·

|

Sales of primarily

ACCC® core will result in a higher per

unit product margin, but a lower per unit revenue

level.

|

|

|

·

|

By eliminating the necessity of

stranding of ACCC® core with aluminum, the sales

order to cash cycle will decrease, and the working capital required to

purchase aluminum will be eliminated resulting in a more efficient and

accelerated cash flow.

|

|

|

·

|

ACCC® conductor sales will be made

using the existing relationships within those markets, resulting in a more

effective and lower cost

sale.

|

As of

September 30, 2009, we had agreements with six stranding manufacturers: General

Cable in La Malbaie, Canada; Lamifil, NV in Belgium; Midal Cable in Bahrain; Far

East Composite Cable Co. in Jiangsu, China, PT KMI Wire and Cable Tbk and PT GT

Kabel Indonesia Tbk. We are currently negotiating for additional stranding

contractors to serve the South American, Australian, Asian, and North American

markets.

In

January, 2007 we announced a three year manufacturing and distribution agreement

with Far East Composite Cable Co., a subsidiary of Jiangsu New Far East Cable

Company, where they agreed to the purchase of a minimum of 600 kilometers of

ACCC®

conductor per quarter for year one with increases to 900 kilometers and 1,200

kilometers per quarter in years two and three. Although they did

purchase the minimum amounts in the first years, to date in 2009, Jiangsu has

not purchased the minimum quantity of ACCC® core

required under the agreement. Far East Composite Cable Co. did qualify in

September 2007 to become certified to strand ACCC® core at

their plant in Jiangsu, China. This agreement will terminate in December

2009 but are in the process of renegotiating our contract with Far East

Composite Cable Co.

Our

agreements with Lamifil and Midal have been primarily stranding manufacturing

agreements resulting in these companies stranding ACCC® core

with aluminum on a contract basis for shipments to our

customers. We recently expanded the relationship with Lamifil

to include the distribution of ACCC®

conductor as well. We are also in discussion with other potential

stranding and distribution parties in geographies we see as having significant

market potential, including South America, Asia, and Eastern

Europe.

Customers

Our

customers purchase stranded ACCC®

conductors and ACCC® hardware

and consist of electric utilities, engineering companies, our stranding

manufacturers and our distributors. During the 2009 fiscal year, our

consolidated revenue was derived from a broadening mix of domestic and

international customers. The breakout of revenue by geography for

2009 is as follows; China 53.6%, North America 27.6%, Middle East 7.4%, Latin

America 4.7%, Europe 4.5%, and other markets totaling 2.2%. For the year ended September 30, 2009,

53.6% and 16.8% of our CTC Cable revenue were derived from two customers, Far

East Composite Cable Co., and Allteck Line Contractors Inc., a Canadian

corporation, respectively.

Backlog:

We

believe our backlog of firm orders for 2009 is $9.2 million of which $0.2

million is with a customer in China. Our backlog in 2008 was $11.8

million of which $5.4 million was with the customer in China.

IX.

Manufacturing

We

produce the composite core component of the ACCC®

conductor through CTC Cable Corporation in Irvine, for sale to conductor

manufacturers that strand and distribute the finished conductor in their

particular markets. The manufacture of the core uses a proprietary continuous

process, which allows numerous glass and carbon filaments to be pre-tensioned,

impregnated with high performance resin systems, and then rapidly cured as the

product emerges through a heated die. The proprietary resin formulations we use

are highly resistant to temperature, impact, tensile and bending stresses, as

well as to harsh environmental conditions encountered in the

field. Primarily for quality control reasons, core manufacture is

carried out at our facilities in Irvine, California. The production facilities

in Irvine were certified under ISO 9001:2000 in November, 2006, and re-certified

in November 2007 and November 2008 per the annual audit. In October

2009 the facilities were certified ISO 9001:2008. We have formulated plans to

increase capacity ahead of commercial orders to manufacture our product to meet

delivery times and these plans include new core production facilities at some

point of time in the future but no earlier than 2010 as presently

envisioned.

8

We

currently have 18 pultruder machines in production, capable of producing

approximately 18,000 km of ACCC® core per

year representing potential revenues of between $100 million and $250 million,

depending on the size of the ACCC®

conductor and whether the final product is ACCC® core or

the stranded higher value ACCC®

conductor. We currently have sufficient capacity with our existing

machinery to handle our anticipated production needs for the next year, but we

have prepared plans to open additional ACCC® core

manufacturing plants outside of California to allow for additional expansion and

to mitigate the risk of overreliance on one plant. We are also considering

vertical integration or entering into a strategic relationship to provide for an

uninterrupted supply of ACCC®

conductor through an investment in an aluminum stranding facility. We also

produce parts for and license the production of the special connecting hardware

accessories required to install ACCC®

conductor and to ensure that the connecting hardware supply will match conductor

sales requirement.

The

principal raw materials in the production of the patented ACCC® core are

glass and aerospace grade carbon fibers, combined with specific polymer

resins. Our conductor stranding manufacturers use similar aluminum

rod materials typical in the production of bare overhead

conductor. Connecting hardware accessories require primarily

high-grade aluminum tube and special steel alloys. The prices for

these raw materials are subject to market variations. We can acquire glass and

resins from several sources and we have two qualified suppliers for carbon

fiber.

Over the

past year, due to the reduced demand by aerospace customers of our carbon fiber,

we have seen a per unit price reduction by our carbon vendors even with

consistent purchase volume. However, should the aerospace industry

recover and begin to purchase additional quantities of this material, our costs

may increase.

X. DeWind Discontinued

Operations

The

DeWind segment sold wind turbines that produce electricity and intended to

develop wind farms incorporating these turbines. The DeWind segment

represents the successor operations of the EU Energy, Ltd., acquisition

completed in July 2006. DeWind sold wind turbines in the U.S.,

Europe, and South America directly to utilities and wind farm developers as a

turnkey wind turbine unit.

The

divestiture of DeWind was a decision driven by the worldwide banking and credit

crisis. DeWind had focused its sales and marketing efforts into the

North American and South American markets to take advantage of its innovative

D8.2 technology. Following the June 2008 cash investment by Credit

Suisse and the signing of turbine contracts in September and early October of

that year, DeWind began to invest a significant amount of cash into its supply

chain.

At the

beginning of the fiscal year, in October, 2008 DeWind had orders in excess of

$150 million from customers with established track records of success in wind

farm project completion and had received initial payments on the largest of

these orders, which included orders for 60 units of the new D8.2

turbine. DeWind began to make advance payments for parts and to

increase its commitments for turbine parts in anticipation of the fulfillment of

these orders. In October, 2008, this customer defaulted on scheduled

payments required under their turbine purchase agreement. The payment

default was due to the loss of financing for their wind project caused by the

worldwide credit contraction. Further, with the collapse of several wind

industry financing institutions, notably Lehman Brothers which had previously

been heavily involved in the organization of “tax equity” funding in the U.S.,

it was apparent that there had been a fundamental change in the ability for

small and medium sized wind projects to be funded.

In

November 2008, after the realization that the worldwide economic and banking

crises were long lasting and were causing a significant delay or cancellation of

financing for wind farms, the Company determined that unless the business

environment reverted back to pre-credit crisis levels, the Company did not have

the financial resources to continue to fund DeWind without significant amounts

of additional capital. Therefore the Company’s Board of Directors

approved a contingency plan to seek strategic investment partners or divest its

ownership stake in DeWind. In December, 2008 the Company engaged the

services of RBS Securities, who had substantial industry knowledge of the wind

industry and who had assisted in other significant wind industry M&A

activities. Between February 2009 and June 2009, the Company had

circulated investment memoranda and due diligence materials to over 150 separate

interested parties concluding with on site discussions and bids from multiple

parties. In June 2009, the Company signed a Bridge Loan agreement for

$5 million in order to provide sufficient cash to continue its operations

through the conclusion of the DeWind asset sale. In August, 2009 the

Company completed negotiations with the winning bidder, Daewoo Shipbuilding and

Marine Engineering (DSME), and signed an Asset Purchase Agreement on August 9,

2009 valued at $49.5 million in cash. The transaction closed on

September 4, 2009 and the Company received approximately $32.3 million in cash

with $17.2 million in cash escrowed to cover certain contingent

liabilities. Of the escrowed cash, $5.5 million is expected to be

released within one year after the achievement of certain milestones and $11.7

million expected to be released over longer time periods.

Under the

terms of the transaction disclosed on forms 8-K filed on August 14, 2009 and

September 11, 2009, DeWind sold substantially all of its operating assets

including all inventories, receivables, fixed assets, wind farm project assets

and intangible assets including all intellectual property and DSME assumed

substantially all operating liabilities of DeWind including supply chain and

operating expense account payables and accrued liabilities, warranty related

liabilities for U.S. turbine installations, and deferred

revenues. All former DeWind employees were also transferred to DSME

employment. DSME did not acquire any cash balances of DeWind;

acquired only the long-term assets of one of the European subsidiaries, leaving

all other assets and liabilities of that entity intact; and did not acquire

certain assets and liabilities of the US DeWind subsidiary tied to one turbine

supply contract. As part of the transaction, the Company is

prohibited from developing, marketing, or selling competing wind turbine

technology for five years except that the Company retained the rights to develop

and sell wind farm projects.

9

The

divestiture of DeWind provided a significant amount of cash to the Company’s

balance sheet, and reduced cash spending for DeWind operating expenses and

working capital requirements. However, the Company remains exposed to

and may need to continue to expend resources in order to defend its legal

positions including litigation previously filed, or expected to be filed by FKI

and claims made or assigned by the receiver of subsidiaries filed for insolvency

in 2008 as well as certain former suppliers of DeWind.

All of

the remaining assets and liabilities of the remaining portions of DeWind,

subsequently renamed Stribog, have been classified as net liabilities of

discontinued operations. All operations of DeWind have been

classified as discontinued operations.

XI. Intellectual

Property

We are

aggressively pursuing patent protection for all aspects of our CTC Cable

conductor composite materials, products, and processing.

In

connection with our ACCC®

conductor business, CTC Cable Corporation currently has nine issued U.S. patents

and eight pending U.S. patent applications, three of which are

continuation-in-part applications, one of which is a pending U.S. application

claiming priority to a PCT international application. Of the nine issued U.S.

patents, two, U.S. Patent Numbers 7,368,162 and 7,211,319, are the subjects of

pending litigation and are currently undergoing reexamination procedures with

the U.S. Patent and Trademark Office. In addition, three PCT international

applications have entered the national phase and are currently pending in over

70 strategic countries world-wide. Of these pending applications, twenty-one

applications have been granted. These patent applications cover subjects

including composite materials as applied to electrical transmission conductors

and related structural apparatus and accessories, manufacturing processing

techniques, cross sectional composite core designs for electrical transmission

cables and methods and designs for splicing composite core reinforced cables.

CTC Cable Corporation plans to continue filing and supplementing these patent

applications with new information as it is developed. The issued, pending

patents, and provisional U.S. applications, if issued, have patent terms that

will end within the period of 2023 to 2029, depending on the filing dates of

each of the applications. Based on available information and after prior art

searches by our patent strategists, we believe that the pending and issued

patent applications provide the basis for us to, over time, be issued a number

of separate and distinct patents. If CTC Cable Corporation continues to be

successful in being granted patent protection consistent with the disclosures in

these applications, we anticipate that we could have a strong position in the

field of composite-based electrical conductors.

Our

business and competitive position are dependent upon our ability to protect our

proprietary technologies. Despite our efforts to protect our proprietary rights,

unauthorized parties may attempt to obtain and use information that we regard as

proprietary.

There can

be no assurance that others will not independently develop substantially

equivalent proprietary information and techniques or otherwise gain access to

our proprietary information, that such information will not be disclosed or that

we can effectively protect our rights to unpatented trade secrets or other

proprietary information.

There can

be no assurance that others will not obtain patents or other legal rights that

would prevent us from commercializing our technologies in the United States or

other jurisdictions.

From time

to time, we may encounter disputes over rights and obligations concerning

intellectual property. For instance, we are currently engaged in a legal dispute

with Mercury Cable & Energy, LLC. in which Mercury has alleged that our

patents are not valid. Also, the efforts we have taken to protect our

proprietary rights may not be sufficient or effective. Any significant

impairment of our intellectual property rights could harm our business, our

reputation, or our ability to compete. Also, protecting our intellectual

property rights could be costly and time consuming.

XII. Research and

Development

We have

spent considerable funds on research and development of our proprietary,

patented, and patents pending ACCC®

conductor and related component technologies. We continue to invest

in the further development of this product with a view to accelerating and

lowering the cost of production, using less expensive and more readily available

material sources, as well as enhancing the product's properties and

characteristics. We also anticipate the need to continue spending significant

funds to protect the ACCC®

conductor technologies worldwide

We spent

$2,703,000, $4,519,000, and $4,187,000 on research and development activities in

fiscal years 2009, 2008 and 2007, respectively.

XIII. Governmental

Regulation

We are

not aware of any specific government regulations governing the design and

specifications of bare overhead conductors in the United States or in Europe

that restrict our ability to sell our products. We do not believe the

manufacture of ACCC®

conductor is subject to any specific government regulations other than those

regulations that traditionally apply to manufacturing activities such as the

Occupational Safety and Health Act of 1970 or similar occupational safety

regulations in our other manufacturing locations.

Our

intended operations are generally subject to various governmental laws and

regulations relating to the protection of the environment. These environmental

laws and regulations, which have become increasingly stringent, are implemented

principally by the Environmental Protection Agency in the United States and

comparable European and U.S. state agencies, and govern the management of

hazardous wastes, the discharge of pollutants into the air and into surface and

underground waters, and the manufacture and disposal of certain substances. We

believe that we comply completely with any such laws or

regulations.

10

A

majority of the international markets require government or type registration

approvals from leading companies or public or semi-private bodies or

associations for our ACCC®