Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - RANCHO SANTA MONICA DEVELOPMENTS INC. | exh311.htm |

| EX-32.1 - EXHIBIT 32.1 - RANCHO SANTA MONICA DEVELOPMENTS INC. | exh321.htm |

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

[ X ] Quarterly Report Pursuant To Section 13 Or 15(d) Of The Securities Exchange Act Of 1934

For the quarterly period ended August 31, 2009

[ ] Transition Report Under Section 13 Or 15(d) Of The Securities Exchange Act Of 1934 For the transition period ________ to ________

COMMISSION FILE NUMBER 000-51376

RANCHO SANTA MONICA DEVELOPMENTS INC.

(Exact name of small business issuer as specified in its

charter)

| NEVADA | 83-0414306 |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

802-610 Granville Street

Vancouver, BC, Canada

V6C-3T3

(Address of principal executive offices)

(604) 689-5661

Issuer's telephone number

Not Applicable

(Former name, former address and

former fiscal year, if changed since last report)

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ X ] No [ ]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o | Smaller reporting company x |

| (Do not check if a smaller | |||

| reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [ X ]

As of November 30, 2009, the registrant had 8,918,426 shares of Common Stock outstanding.

PART I - FINANCIAL INFORMATION

ITEM 1.

FINANCIAL STATEMENTS.

Certain statements contained in this Form 10-Q constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). These statements, identified by words such as “plan”, "anticipate," "believe," "estimate," "should," "expect" and similar expressions, include our expectations and objectives regarding our future financial position, operating results and business strategy. These statements reflect the current views of management with respect to future events and are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry results, to be materially different from those described in the forward-looking statements. Such risks and uncertainties include those set forth under the caption "Management's Discussion and Analysis or Plan of Operation" and elsewhere in this Form 10-Q. We do not intend to update the forward-looking information to reflect actual results or changes in the factors affecting such forward-looking information. We advise you to carefully review the reports and documents we file from time to time with the Securities and Exchange Commission (“SEC”), particularly our quarterly reports on Form 10-Q and our current reports on Form 8-K. As used in this interim report, the terms "we", "us", "our", and “our company” mean Rancho Santa Monica Developments, Inc., unless otherwise indicated. All dollar amounts in this Quarterly Report are in U.S. dollars unless otherwise stated.

| RANCHO SANTA MONICA DEVELOPMENTS, INC. | ||||||

| Consolidated Balance Sheets | ||||||

| (Unaudited) | ||||||

| ASSETS | ||||||

| August 31, | November 30, | |||||

| 2009 | 2008 | |||||

| (Restated) | ||||||

|

|

||||||

|

CURRENT ASSETS |

||||||

|

Cash |

$ | 25,694 | $ | 4,217 | ||

|

Accounts receivable, net |

16,545 | - | ||||

|

Total Current Assets |

42,239 | 4,217 | ||||

|

|

||||||

|

PROPERTY AND EQUIPMENT, NET |

317,346 | 296,414 | ||||

|

|

||||||

|

TOTAL ASSETS |

$ | 359,585 | $ | 300,631 | ||

|

|

||||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) |

||||||

|

|

||||||

|

CURRENT LIABILITIES |

||||||

|

Accounts payable and accrued liabilities |

$ | 35,375 | $ | 19,250 | ||

|

Due to related parties |

187,084 | 103,757 | ||||

|

Convertible debt, net |

112,500 | 63,125 | ||||

|

Notes payable |

50,000 | 50,000 | ||||

|

Total Current Liabilities |

384,959 | 236,132 | ||||

|

Commitments and contingencies |

- | - | ||||

|

|

||||||

|

STOCKHOLDERS' EQUITY (DEFICIT) |

||||||

|

Preferred stock; 100,000,000 shares authorized at $0.0001 par value, no shares issued or outstanding |

- | - | ||||

|

Common stock; 100,000,000 shares authorized at $0.0001 par value, 8,918,426 and 7,846,999 shares issued and outstanding, respectively |

892 | 785 | ||||

|

Additional paid-in capital |

896,813 | 371,920 | ||||

|

Accumulated deficit |

(923,079 | ) | (308,206 | ) | ||

|

Total Stockholders' Equity (Deficit) |

(25,374 | ) | 64,499 | |||

|

|

||||||

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) |

$ | 359,585 | $ | 300,631 | ||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

| RANCHO SANTA MONICA DEVELOPMENTS,

INC. Consolidated Statements of Operations (Unaudited) |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

|

For the Nine Months Ended |

| ||||||

|

|

|

August 31, |

|

|

August 31, |

| ||||||

|

|

|

2009 |

|

|

2008 |

|

|

2009 |

|

|

2008 |

|

|

|

|

|

|

|

(Restated) |

|

|

|

|

|

(Restated) |

|

|

REVENUES |

|

|

|

|

|

|

|

|

|

|

|

|

|

Hotel revenue, net |

$ |

13,887 |

|

$ |

11,992 |

|

$ |

96,646 |

|

$ |

60,939 |

|

|

Hosting revenue, net |

|

132,376 |

|

|

- |

|

|

501,468 |

|

|

- |

|

|

Total Revenue |

|

146,263 |

|

|

11,992 |

|

|

598,114 |

|

|

60,939 |

|

|

OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

104,398 |

|

|

34,736 |

|

|

580,538 |

|

|

79,148 |

|

|

Web hosting fees |

|

82,181 |

|

|

- |

|

|

82,181 |

|

|

- |

|

|

Impairment loss |

|

477,847 |

|

|

- |

|

|

477,847 |

|

|

- |

|

|

Depreciation expense |

|

1,924 |

|

|

1,924 |

|

|

5,770 |

|

|

5,978 |

|

|

Total Operating Expenses |

|

666,350 |

|

|

36,660 |

|

|

1,146,336 |

|

|

85,126 |

|

|

LOSS FROM OPERATIONS |

|

(520,087 |

) |

|

(24,668 |

) |

|

(548,222 |

) |

|

(24,187 |

) |

|

OTHER EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

(6,753 |

) |

|

(1,500 |

) |

|

(64,003 |

) |

|

(4,500 |

) |

|

Foreign currency loss |

|

(2,296 |

) |

|

- |

|

|

(2,648 |

) |

|

- |

|

|

Total Other Expense |

|

(9,049 |

) |

|

(1,500 |

) |

|

(66,651 |

) |

|

(4,500 |

) |

|

LOSS BEFORE INCOME TAXES |

|

(529,136 |

) |

|

(26,168 |

) |

|

(614,873 |

) |

|

(28,687 |

) |

|

PROVISION FOR INCOME TAXES |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

NET LOSS |

$ |

(529,136 |

) |

$ |

(26,168 |

) |

$ |

(614,873 |

) |

$ |

(28,687 |

) |

|

LOSS PER SHARE - BASIC AND DILUTED |

$ |

(0.06 |

) |

$ |

(0.00 |

) |

$ |

(0.07 |

) |

$ |

(0.00 |

) |

|

WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING - BASIC AND DILUTED |

|

8,865,427 |

|

|

7,846,999 |

|

|

8,853,447 |

|

|

7,813,908 |

|

The accompanying notes are an integral part of these unaudited consolidated financial statements

| RANCHO SANTA MONICA

DEVELOPMENTS, INC. Consolidated Statements of Stockholders' Equity (Deficit) (Unaudited) |

|||||||||||||||

| Additional | |||||||||||||||

| Common Stock | Paid-In | Accumulated | |||||||||||||

| Shares | Amount | Capital | Deficit | Total | |||||||||||

| Balance, November 30, 2008 (Restated) | 7,846,999 | 785 | 371,920 | (308,206 | ) | 64,499 | |||||||||

| Stock issued to purchase subsidiary | 1,000,000 | 100 | 499,900 | - | 500,000 | ||||||||||

| Shares issued for cash | 71,427 | 7 | 24,993 | - | 25,000 | ||||||||||

| Net loss | - | - | - | (614,873 | ) | (614,873 | ) | ||||||||

| Balance, August 31, 2009 | 8,918,426 | $ | 892 | $ | 896,813 | $ | (923,079 | ) | $ | (25,374 | ) | ||||

| The accompanying notes are an integral part of these unaudited consolidated financial statements. | |||||||||||||||

RANCHO SANTA MONICA DEVELOPMENTS, INC.

Consolidated

Statements of Cash Flows

(Unaudited)

| For the Nine Months Ended | ||||||

| August 31, | ||||||

| 2009 | 2008 | |||||

| (Restated) | ||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||

| Net loss | $ | (614,873 | ) | $ | (28,687 | ) |

| Adjustments to reconcile net loss to net cash used by operating activities: | ||||||

| Impairment loss | 477,847 | - | ||||

| Depreciation and amortization | 5,770 | 5,978 | ||||

| Amortization of embedded conversion feature | 49,375 | - | ||||

| Changes in operating assets and liabilities: | ||||||

| Accounts receivable | (16,545 | ) | - | |||

| Accounts payable and accrued expenses | 16,125 | 21,504 | ||||

| Cash Used In Operating Activities | (82,301 | ) | (1,205 | ) | ||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||

| Cash received from acquisition of subsidiary | 22,153 | - | ||||

| Purchase of property and equipment | (26,702 | ) | (140,500 | ) | ||

| Cash Used In Investing Activities | (4,549 | ) | (140,500 | ) | ||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||

| Advances from related parties | 83,327 | - | ||||

| Payments to related parties | - | (8,991 | ) | |||

| Proceeds from notes payable | - | 112,500 | ||||

| Proceeds from the sale of common stock | 25,000 | 41,000 | ||||

| Cash Provided by Financing Activities | 108,327 | 144,509 | ||||

| NET CHANGE IN CASH | 21,477 | 2,804 | ||||

| CASH AT BEGINNING OF PERIOD | 4,217 | 493 | ||||

| CASH AT END OF PERIOD | $ | 25,694 | $ | 3,297 | ||

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION CASH PAID FOR: | ||||||

| Interest | $ | 3 | $ | - | ||

| Income taxes | $ | - | $ | - | ||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

RANCHO SANTA MONICA DEVELOPMENTS, INC.

Notes to the

Consolidated Financial Statements

(Unaudited)

NOTE 1 – SIGNFICANT ACCOUNTING POLICIES

The accompanying unaudited interim consolidated financial statements of Rancho Santa Monica Developments, Inc. (“the Company”) have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules of the Securities and Exchange Commission and should be read in conjunction with the audited consolidated financial statements and notes thereto contained in the Company's latest Annual Report filed with the SEC on Form 10-K for the year ended November 30, 2008, as restated herein (see Note 8). In the opinion of management, all adjustments, consisting of normal recurring adjustments and restatement adjustments (see Note 8), necessary for a fair presentation of financial position and the results of operations for the interim periods presented have been reflected herein. The results of operations for interim periods are not necessarily indicative of the results to be expected for the full year. Notes to the unaudited interim consolidated financial statements that would substantially duplicate the disclosures contained in the audited financial statements for the most recent fiscal year as reported in the Form 10-K have been omitted.

Principles of Consolidation

The consolidated financial statements include the accounts of the Company and its wholly-owned subsidiary, AptHost Communications USA Ltd (“Apthost”). All significant intercompany transactions and balances have been eliminated in consolidation.

Certain reclassifications have been made to amounts in prior periods to conform to the current period presentation. All reclassifications have been applied consistently to the periods presented.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Accounts Receivable

Accounts receivable consist primarily of trade receivables, net of a valuation allowance for doubtful accounts totaling $0 at August 31, 2009. The Company regularly reviews outstanding receivables and provides for estimated losses through an allowance for doubtful accounts. In evaluating the level of established reserves, the Company makes judgments regarding its customers' ability to make required payments, economic events and other factors. When the Company determines that a customer may not be able to make required payments, the Company increases the allowance through a charge to income in the period in which that determination is made.

Foreign exchange and currency translation

For the periods presented, the Company maintained cash accounts in Canadian and U.S. dollars, and incurred certain expenses denominated in Canadian dollars. The Company's functional and reporting currency is the U.S. dollar. Transactions denominated in foreign currencies are translated into U.S. dollars at exchange rates in effect on the date of the transactions. Assets and liabilities are translated using exchange rates at the end of each period. Exchange gains or losses on transactions are included in earnings.

RANCHO SANTA MONICA DEVELOPMENTS, INC.

Notes to the

Consolidated Financial Statements

(Unaudited)

Impairment of Goodwill and Indefinite-Lived Intangible Assets

The Company periodically reviews the carrying value of intangible assets not subject to amortization, including goodwill, to determine whether impairment may exist. Goodwill and certain intangible assets are assessed annually for impairment using fair value measurement techniques. Specifically, goodwill impairment is determined using a two-step process. The first step of the goodwill impairment test is used to identify potential impairment by comparing the fair value of a reporting unit with its carrying amount, including goodwill. The estimates of fair value of a reporting unit, generally the Company’s operating segments, are determined using various valuation techniques with the primary technique being a discounted cash flow analysis. A discounted cash flow analysis requires one to make various judgmental assumptions including assumptions about future cash flows, growth rates, and discount rates. The assumptions about future cash flows and growth rates are based on the Company’s budget and long-term plans. Discount rate assumptions are based on an assessment of the risk inherent in the respective reporting units. If the fair value of a reporting unit exceeds its carrying amount, goodwill of the reporting unit is considered not impaired and the second step of the impairment test is unnecessary. If the carrying amount of a reporting unit exceeds its fair value, the second step of the goodwill impairment test is performed to measure the amount of impairment loss, if any. The second step of the goodwill impairment test compares the implied fair value of the reporting unit’s goodwill with the carrying amount of that goodwill. If the carrying amount of the reporting unit’s goodwill exceeds the implied fair value of that goodwill, an impairment loss is recognized in an amount equal to that excess. The implied fair value of goodwill is determined in the same manner as the amount of goodwill recognized in a business combination. That is, the fair value of the reporting unit is allocated to all of the assets and liabilities of that unit (including any unrecognized intangible assets) as if the reporting unit had been acquired in a business combination and the fair value of the reporting unit was the purchase price paid to acquire the reporting unit.

The impairment test for other intangible assets not subject to amortization consists of a comparison of the fair value of the intangible asset with its carrying value. If the carrying value of the intangible asset exceeds its fair value, an impairment loss is recognized in an amount equal to that excess. The estimates of fair value of intangible assets not subject to amortization are determined using various discounted cash flow valuation methodologies. Significant assumptions are inherent in this process, including estimates of discount rates. Discount rate assumptions are based on an assessment of the risk inherent in the respective intangible assets.

Recent Accounting Pronouncements

In May 2009, the FASB issued FAS 165 (ASC 855-10), “Subsequent Events”. This pronouncement establishes standards for accounting for and disclosing subsequent events (events which occur after the balance sheet date but before financial statements are issued or are available to be issued). FAS 165 (ASC 855-10) requires an entity to disclose the date subsequent events were evaluated and whether that evaluation took place on the date financial statements were issued or were available to be issued. It is effective for interim and annual periods ending after June 15, 2009. The adoption of FAS 165 (ASC 855-10) did not have a material impact on the Company’s financial condition or results of operation.

In June 2009, the FASB issued SFAS No. 168 (ASC 105-10), The FASB Accounting Standards Codification and the Hierarchy of Generally Accepted Accounting Principles (“SFAS 168” or ASC 105-10). SFAS 168 (ASC 105-10) establishes the Codification as the sole source of authoritative accounting principles recognized by the FASB to be applied by all nongovernmental entities in the preparation of financial statements in conformity with GAAP. SFAS 168 (ASC 105-10) was prospectively effective for financial statements issued for fiscal years ending on or after September 15, 2009, and interim periods within those fiscal years. The adoption of SFAS 168 (ASC 105-10) on July 1, 2009 did not impact the Company’s results of operations or financial condition. The Codification did not change GAAP; however, it did change the way GAAP is organized and presented. As a result, these changes impact how companies reference GAAP in their financial statements and in their significant accounting policies. The Company implemented the Codification in this Report by providing references to the Codification topics alongside references to the corresponding standards.

RANCHO SANTA MONICA DEVELOPMENTS, INC.

Notes to the

Consolidated Financial Statements

(Unaudited)

In addition to the pronouncement noted above, there were

various other accounting standards and interpretations issued recently, none of

which are expected to a have a material impact on our consolidated financial

position, operations or cash flows.

NOTE 2 – GOING CONCERN

The accompanying unaudited consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which contemplates continuation of the Company as a going concern. The Company currently has a working capital deficit of $342,720, a stockholders’ deficit of $25,374 and an accumulated deficit of $923,079 as of August 31, 2009. In addition, the Company has generated net losses of $614,873 during the nine months ending August 31, 2009. These conditions raise substantial doubt as to the Company’s ability to continue as a going concern.

In order to continue as a going concern, the Company intends to continue to develop its specialized web hosting technology. Until profitability is reached, the Company will need, among other things, additional capital resources. Management’s plan is to obtain such resources for the Company by obtaining capital from management and significant shareholders sufficient to meet its minimum operating expenses and seeking equity and/or debt financing. However, management cannot provide any assurances that the Company will be successful in accomplishing any of its plans.

The financial statements do not include any adjustments to

reflect the possible future effects on the recoverability and classification of

assets or the amounts and classification of liabilities that may result from the

possible inability of the Company to continue as a going concern.

NOTE

3 – SIGNIFICANT EVENTS

In December 2008, the Company acquired AptHost Communications USA Ltd (“Apthost”), by acquiring all of the outstanding capital stock of Apthost, valued at $250,000, by issuing 500,000 common shares (the shares had a quoted market price of $0.50 per share on the date of acquisition). In May 2009, the Company issued additional consideration for the purchase of Apthost whereby the Company issued 500,000 shares of common stock, valued at $250,000 to the former shareholders of AptHost. The total consideration of the 1,000,000 shares of the Company’s common stock issued for the purchase of Apthost was valued at $500,000. In addition to the 1,000,000 shares that were issued to the former shareholders of Apthost, the former shareholders of Apthost also signed non-compete agreements with the Company. The 1,000,000 shares issued as consideration are subject to a two year lock-up period.

The acquisition was accounted for in accordance with the provisions of Statement of Financial Standards No. 141 (ASC 805), “Business Combinations.” The total purchase price, net of cash received of $22,153 was preliminarily allocated to goodwill based on the estimated fair values. No other tangible or intangible assets were recorded. The preliminary allocation of the purchase price was based upon valuation data as of December 1, 2008. During August 2009, the Company determined that the goodwill and any intangible assets acquired in the Apthost transaction were impaired and recorded an impairment loss of $477,847.

RANCHO SANTA MONICA DEVELOPMENTS, INC.

Notes to the

Consolidated Financial Statements

(Unaudited)

Apthost’s results of operations have been included in the consolidated financial statements since the date of acquisition.

Due to the sale of Apthost on December 4, 2009 (see footnote 7) the Company is unable to provide proforma information for prior periods.

NOTE 4 – RELATED PARTY TRANSACTIONS

During the nine months ended August 31, 2009, non-interest bearing due on demand advances were made to the Company by officers totaling $83,327. These advances were made to assist in funding operations. As of August 31, 2009 and November 30, 2008, total advances were $187,084 and $103,757, respectively.

NOTE 5 – DEBT

As of November 30, 2008, the Company had notes payable of $50,000 and convertible notes payable of $112,500 (a beneficial conversion feature totaling $112,500 was recognized at inception of the convertible debt that has been fully amortized as interest expense as of August 31, 2009). During the nine months ended August 31, 2009, no payments were made on these notes. All of the notes and convertible notes are currently past due and in default. All loans are collateralized by the assets of the company.

NOTE 6 – EQUITY

The Company is authorized to issue up to 100,000,000 shares of Preferred Stock, $0.0001 par value per share.

The Company is authorized to issue up to 100,000,000 shares of Common Stock, $0.0001 par value per share, of which no shares are currently reserved for future contractual issuances.

On December 1, 2008, the Company issued 1,000,000 shares of restricted common stock for all the outstanding shares of Apthost, valued at $500,000.

On August 5, 2009, the Company issued 71,427 shares of restricted common stock for net proceeds of $25,000.

NOTE 6 – SEGMENT INFORMATION

We have two

reporting segments:

•

Rancho Santa Monica Development - separately owns and operates property (the “Solidaridad Property”) in Tulum, Mexico. The hotel has been open since February 7, 2007. Rancho also manages the adjoining 11 hotel suites and receives income from the supply of management services.

•

AptHost Communications USA Ltd - a wholly-owned subsidiary that provides domain registration and web hosting services worldwide.

The accounting policies of the segments are the same as those described in the summary of significant accounting policies. The Company evaluates the financial performance of its segments based on profit or loss from operations before income taxes, not including nonrecurring gains and losses and foreign exchange gains and losses. The Company's reportable segments are strategic business units that are in different industries and require different marketing strategies.

RANCHO SANTA MONICA DEVELOPMENTS, INC.

Notes to the

Consolidated Financial Statements

(Unaudited)

Consolidated revenues from external customers, operating income (loss), identifiable assets, depreciation, amortization and impairment expense, and capital expenditures were as follows:

| For the Three Months Ended | For the Nine Months Ended | |||||||||||

| August 31, | August 31, | |||||||||||

| 2009 | 2008 | 2009 | 2008 | |||||||||

| REVENUES: | ||||||||||||

| Rancho Santa Monica Development | $ | 13,887 | $ | 11,992 | $ | 96,646 | $ | 60,939 | ||||

| AptHost Communications USA Ltd | 132,376 | - | 501,468 | - | ||||||||

| Total Revenue | $ | 146,263 | $ | 11,992 | $ | 598,114 | $ | 60,939 | ||||

INCOME (LOSS) FROM |

||||||||||||

| OPERATIONS: | ||||||||||||

| Rancho Santa Monica Development | $ | 2,051 | $ | (24,668 | ) | $ | (2,930 | ) | $ | (24,187 | ) | |

| AptHost Communications USA Ltd | (522,138 | ) | - | (545,292 | ) | - | ||||||

|

Total Loss from Operations |

(520,087 | ) | (24,668 | ) | (548,222 | ) | (24,187 | ) | ||||

OTHER EXPENSE |

(9,049 | ) | (1,500 | ) | (66,651 | ) | (4,500 | ) | ||||

NET LOSS |

$ | (529,136 | ) | $ | (26,168 | ) | $ | (614,873 | ) | $ | (28,687 | ) |

| August 31, | November 30, | |||||||||||

| 2009 | 2008 | |||||||||||

| INDENTIFIABLE ASSETS: | ||||||||||||

| Rancho Santa Monica Development | $ | 350,608 | $ | 300,631 | ||||||||

| AptHost Communications USA Ltd | 8,977 | - | ||||||||||

| Total Identifiable Assets | $ | 359,585 | $ | 300,631 | ||||||||

| For the Three Months Ended | For the Nine Months Ended | |||||||||||

| August 31, | August 31, | |||||||||||

| 2009 | 2008 | 2009 | 2008 | |||||||||

| DEPRECIATION, AMORTIZATION | ||||||||||||

| AND IMPAIRMENT: | ||||||||||||

| Rancho Santa Monica Development | $ | 1,924 | $ | 1,924 | $ | 5,770 | $ | 5,978 | ||||

| AptHost Communications USA Ltd | 477,847 | - | 477,847 | - | ||||||||

| Total Depreciation, Amortization and Impairment | $ | 479,771 | $ | 1,924 | $ | 483,617 | $ | 5,978 | ||||

CAPITAL EXPENDITURES: |

||||||||||||

| Rancho Santa Monica Development | $ | 26,702 | $ | - | $ | 26,702 | $ | 140,500 | ||||

| AptHost Communications USA Ltd | - | - | - | - | ||||||||

| Total Capital Expenditures | $ | 26,702 | $ | - | $ | 26,702 | $ | 140,500 | ||||

RANCHO SANTA MONICA DEVELOPMENTS, INC.

Notes to the

Consolidated Financial Statements

(Unaudited)

NOTE 7 – SUBSEQUENT EVENTS

The Company evaluated subsequent events through November 30, 2009, which is the date the financial statements were issued and there were no other significant subsequent events to report.

Effective December 4, 2009 the Company, entered into an agreement to sell all of the assets, including but not limited to all intellectual property, domain names and contracts, of AptHost Communications USA Ltd (“Apthost”) to Hostgator.com LLC in exchange for $100,000.

NOTE 8 – RESTATEMENT

The Company has restated the Statements of Operations for the three and nine month periods ended August 31, 2008 for the correction to the weighted average number of common shares outstanding - basic and diluted. The August 31, 2008 financial statements erroneously reported 7,866,999 outstanding shares at August 31, 2008 versus 7,846,999 shares that were actually outstanding. The August 31, 2008 financial statements erroneously reported 7,866,999 and 7,854,499 weighted average number of common shares outstanding versus 7,846,999 and 7,813,908 weighted average number of common shares that were outstanding for the three and nine months ended August 31, 2008, respectively. There was no effect on loss per share as a result of this error.

The Company has restated the Statement of Cash Flows for the nine month period ended August 31, 2008 to properly present the $8,991 Due to related parties as cash flows from financing activities versus cash flows from operating activities as originally reported. As a result for the nine months ended August 31, 2008, net cash used in operating activities decreased from $10,196 to $1,205 and net cash provided by financing activities decreased from $153,500 to $144,509.

The Company has restated the Balance Sheet as of November 30, 2008 for errors in applying the Company’s common stock par value to its common stock transactions. The resulting correction decreases common stock by $7,082 to $785 and increases additional paid-in capital of $364,838 to $371,920 at November 30, 2008.

NOTE 9 – COMMITMENTS AND CONTINGENCIES

We commenced an action on February 3rd, 2009 against the principals of AptHost and its affiliated companies for breach of contract, intentional interference with business, fraudulent conveyance, and both preliminary and permanent injunctive relief. On May 8, 2009 US Nevada Southern District Court case 0902-224 was dismissed with prejudice. The parties entered into a settlement agreement whereby the sellers received 1,000,000 shares in RSDV and the buyers were fully entitled to ownership of AptHost.

ITEM 2.

MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION.

Cautionary Statement Regarding Forward-Looking Statements

This quarterly report contains forward-looking statements as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors" that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our unaudited interim financial statements are stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles. The following discussion should be read in conjunction with our unaudited interim financial statements and the related notes that appear elsewhere in this quarterly report.

In this quarterly report, unless otherwise specified, all references to "common shares" refer to common shares in the capital of our company and the terms "we", "us" and "our" mean Rancho Santa Monica Developments, Inc. and its wholly owned subsidiaries.

Corporate Background

Our company currently owns and operates a specialized web hosting company, AptHost Communications USA Inc. (“AptHost”) (www.apthost.com). Our client base exceeds 3,000 clients and estimated annual sales are over $500,000 with an average of two hundred new signups a month. To service our growing client base, we have over 150 dedicated servers and 33 Virtual Private Servers, Reseller, and Semi-Dedicated Servers. We primarily host clients who require FFMPEG codex, a computer program that can record, convert and stream digital audio and video in numerous formats.

In addition to our AptHost operation, we own a resort property in Tulum, Mexico. The resort, named Hotel ParaYso, is an ocean front property hotel located on the Caribbean beaches of Tulum, Quintana Roo, Mexico. Our Company, in addition to the management of its resort property, has constructed certain facilities and provides management services for apartment units constructed on adjoining property.

Recent Corporate Developments

We experienced the following significant developments during the nine months ended August 31, 2009:

| 1. |

On May 8, 2009, entered into a settlement agreement with the shareholders of AptHost whereby we issued an additional 500,000 shares of common stock (for cumulative sum of 1,000,000 shares) in Rancho to the former shareholders of AptHost. |

| 2. |

On May 8, 2009 Cody McLain was appointed as President and Director of AptHost and Joshuee Shang Ortiz as an Officer and Director of AptHost. |

| 3. |

On May 8, 2009 US Nevada Southern District Court case 0902-224 was dismissed with prejudice. |

AptHost Communications USA Inc. (www.apthost.com)

Summary

Founded in 2000 and based in Seattle, WA, AptHost provides domain registration and web hosting services worldwide. This segment of our company currently has sales totaling over $60,000 per month and hosts 3,000+ clients and services 18,000+ domains. AptHost.com plans to focus on the following markets:

| (1) |

FFMPEG Hosting for Shared, Reseller, VPS, Semi-Dedicated and Dedicated Servers |

| (2) |

Management Service for Dedicated Servers |

| (3) |

Domain registration and management |

| (4) |

Digital streaming solutions |

| (5) |

Security products |

Our company was one of the first companies in the world to bring shared FFMPEG hosting to the web hosting market. AptHost’s customer base includes personal use consumers as well as business customers. Our business clients span all types of businesses, including start-ups.

Mission

The mission of AptHost.com provides a complete hosting solution designed to meet the growing demands of the video hosting market. It aims to service a wide range of clients and to make FFMPEG video hosting affordable for anyone in need of a high quality video website.

AptHost.com has established a reputation for quality service at an affordable price and plans to enhance its image in the industry as a top solution provider. The company is also a developer of advanced software applications that cater to the various market niches that offer vertical growth opportunities. Below are a few of the opportunities our company has already identified as targets to expand services to sub-markets within the web hosting industry:

- Social Media/Video Sharing

- Tomacat Hosting

- Joomla Hosting

- Managed Hosting Automation Tools

Products and Services

AptHost.com currently provides Shared, Reseller, Virtual Private Servers, Semi-Dedicated and Dedicated Hosting solutions. The company currently hosts approximately 18,000 domains on its shared servers alone. Additionally, the company hosts and manages over 150 dedicated servers which have an unknown number of domains.

AptHost feels that the FFMPEG market segment has largely been over looked by the larger hosting companies because of the amount of "specialty support" required by this segment. AptHost.com has overcome this by developing proprietary software that enables us to provide faster support with less staff. We have, through this software, managed to keep our staffing levels down and maintain higher quality of support at the same time.

With current staff, hardware and facilities, the company can do the following:

- Provide shared hosting for over 3,000 clients

- Provide VPS Hosting for 150+ clients

- Design and build database driven web solutions

- Provide Managed Dedicated Server solutions to 500+ customers

- Offer domain registration services

- Offer SSL certificates

Results of Operations

Revenue for the three months ended August 31, 2009 of $146,263 was an increase of 1,120% over the same period ended August 31, 2008 of $11,992 due to the acquisition of AptHost which contributed $132,376 in revenue during the three month period ended August 31, 2009. During the nine months ended August 31, 2009 revenue increased by $537,175 or 881% over the nine month period ended August 31, 2008 again due to the acquisition of AptHost. During this nine month period, AptHost contributed $501,468 in revenue.

During the three and nine months ended August 31, 2009 the Company saw total operating expenses increase by $151,843 or 414% and $583,363 or 685% over the same periods ended August 31, 2008, respectively. These increases are primarily related to the acquisition and operation of AptHost. The Company also spent approximately $30,000 in litigation costs related to a malicious code embedded by terminated employees. General and administrative expenses declined as a percentage of revenue over the last two fiscal quarters. The Company attributes this to the finalization of the acquisition of Apthost and expects this trend to continue as management and employees are able to focus on building each segment of the business.

Interest expense increased over the three and nine month periods ended August 31, 2009, as compared to the same periods ended August 31, 2008, by $5,253 or 350% and $59,503 or 1,322%, respectively, due to amortization of debt discount related to the beneficial conversion feature of our convertible debt.

Since the acquisition of AptHost, the Company has gone through a litigation process involving the discovery of malicious code on its servers and network. The code has since been removed and involved employees that are no longer with the company. AptHost has since moved to a new datacenter to fulfill its customer needs for better service and uptime. As a result, the Company can now report its services have been expanded to offer 24/7 online support and an upgrade of its Hosting Services with the addition of using The Planet Internet Services to provide web hosting services. Due to these improvements, the company expects an upward trend in both sales and customer base, even without significant advertising increases. In other words, even if the status quo is maintained, with no advertising injection, we do still expect a positive upwards trend.

Liquidity and Capital Resources

We anticipate spending approximately $250,000 in the next 12 months in pursuing our plan of operations. Currently, we have cash of $25,694 which is insufficient to allow us to meet our current commitments and to complete our plan of operation. We will require substantial additional financing in order to implement our long term business strategy and plan of operation. It is anticipated that any additional financing will likely be in the form of equity financing as substantial debt financing is not expected to be available at this stage of our business. AptHost plans to devote $200,000 to the development and advertising budget for the 2010 fiscal year. The company primarily needs capital to fund three areas of controlled growth in the company:

- Increased personnel to handle increased sales and service.

- Increase advertising for the purpose of branding and increase sales.

- Research and development to bring new products to the market.

Our actual expenditures and business plan may differ from the one stated above. Our Board of Directors may decide not to pursue this plan. In addition, we may modify the plan based on available financing.

As of August 31, 2009 we had cash on hand of $25,694. Since inception, we have issued common stock to raise money for operations and for property acquisitions.

We anticipate continuing to rely on equity sales of our common stock in order to continue to fund our business operations. Issuances of additional shares will result in dilution to our existing stockholders. There is no assurance that we will achieve any additional sales of our equity securities or arrange for debt or other financing for to fund our planned business activities.

Cash flow from operations. For the nine months ended August 31, 2009, cash flow used in operations was $82,301, compared to cash flow used in operations of $1,205 during the same period in 2008. Our net loss of $137,026 for the nine months ended August 31, 2009 included non-cash expenses of $55,145, including depreciation and amortization of $5,770 and amortization of debt discount of $49,375.

Cash flow from investing activities. Our investing activities used cash of $4,549 during the nine month period ended August 31, 2009, as a result of cash received from the purchase of Apthost of $22,153, offset by the purchase of property and equipment of $26,702. This is compared to cash used by investing activities during the same period in the prior year in the amount of $140,500, as a result of the purchase of property and equipment.

Cash flow from financing activities. During the nine months ended August 31, 2009, our financing activities provided cash of $108,327 compared to cash provided of $144,509 during the same period in 2008. During the nine month period ended August 31, 2009, we received proceeds from the issuance of stock of $25,000 and from related party advances of $83,327. During the 2008 period, we received net proceeds from the issuance of debt of $112,500 and from sale of stock of $41,000. We made net payments of $8,991 on advances from related parties during the nine month period ended August 31, 2008.

Monthly New Sign Ups

A result of the litigation and the discovery of the malicious code on our servers and network, there was a decrease in new signups. The code has since been removed and the employees involved are no longer with the company. We expect to reestablish a positive trend of new signups in the months to come.

Market Analysis

Industry analysts predict that the future of out-sourced web hosting is positive. Research by top ranked industry analysts International Data Corporation, Forrester Research and Ing Barings, indicates that custom hosting solutions such as dedicated, co-located, and managed services are the key growth areas of the future. Furthermore, research by Deutsche Bank states that managed services carry 45% margins and are considered the most important future source for web host providers.

AptHost.com is already providing a wide selection of hosting services but what sets us apart are the specialty features we provide with them. Management feels that FFMPEG Hosting is going to see growth as more and more scripts become available that allow people with little or no experience to publish sites. Combined with our custom built automation processes, clients will be able to have a site setup and offering videos in a matter of minutes. These sites can have individual themes that cater to special interests and will all have the ability to earn money from advertising.

With this opportunity, people are publishing social media sites. Below are articles describing the current market conditions and helps demonstrate the potential growth within the industry.

By Georg Szalai/The Hollywood Reporter NEW YORK The global entertainment and media industry will expand at a 6.4 percent compound annual growth rate over five years to hit $2 trillion in 2011, according to PricewaterhouseCoopers’ “Global Entertainment and Media Outlook: 2007-2011.”

One estimate likely to cause a stir includes the prediction that U.S. spending on Internet advertising and access will surpass spending on newspaper publishing in 2009.Globally, PwC expects Internet advertising and access spending to grow from an estimated $177 billion in 2006 to $332 billion in 2011, making for a 13.5 percent compound annual growth rate.Source - http://bussola.wordpress.com/2007/06/22/global-media-outlook-2-tril-by-2011/

“There are 94 million Internet users in Japan (representing 73.8% of the population), according to Internet World Stats in June 2008. This was up 99.7% compared to 2000.” (Internet World Stats, August 2008) (source - http://www.etcnewmedia.com/review/default.asp?SectionID=11&CountryID=65)

Customers and Target Markets

The company's customer base includes all consumers and all small- to medium-sized businesses, including start-ups. They are mainly focused on developing video sharing and social media sites, with the potential to branch out into live streaming and eventually have their own online TV station.

Target Market Segment Strategy

AptHost’s primary market niche was pursued due to its rapid growth potential. As a recently new market, it has shown potential opportunities to grow business within the FFMPEG market as well as significant opportunity to grow the company vertically into related markets.

Our secondary market is VPS and dedicated servers. This is a natural fit for us as many of our clients will outgrow their shared plans quickly due high demand for bandwidth and other server resources for their sites. Our company anticipated this need and has secured sufficient VPS and dedicated server capacity to accommodate this need seamlessly for our clients. Although it is our secondary market, it is fast growing with expected margins in the 40% to 60% range.

The third market for us is managed services. This market is, as is our secondary market, a derivative of the current strengths of the company. As clients move from shared to dedicated servers, most will not have the in house expertise to manage their own servers. AptHost offers 3 management plans to match the needs of each client.

Competition - Web hosting operations

Competition comes from established hosts currently offering similar hosting solutions and by new companies attempting to gain market share.

Key competitors are detailed as follows:

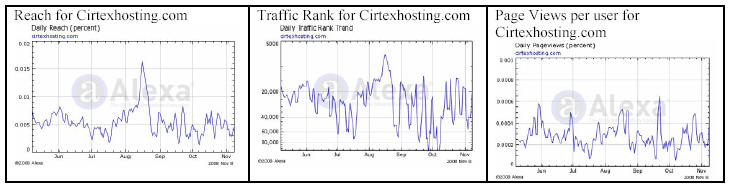

Cirtex & HostV - An established company located in New York, NY. The owner of Cirtex started offering FFMPEG before us by a few months but only to VPS and dedicated server clients. They offer a shared platform as well. They have recently launched a second site called HostV that handles only Dedicated and VPS clients.

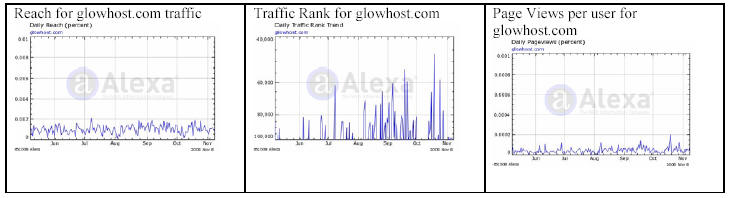

Glowhost - Entered the FFMPEG market in October of 2007. Similar to AptHost, they also offer a full selection of hosting platforms and are becoming known for supporting FFMPEG.

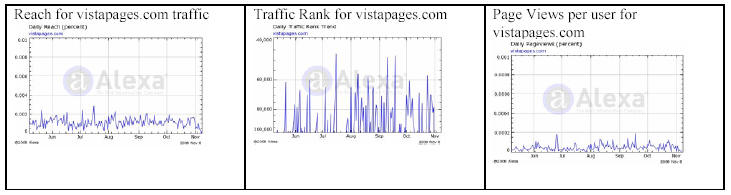

Vistapages - A Canadian owned and operated company, Vistapages has similar roots to AptHost.com, focusing on the Canadian market.

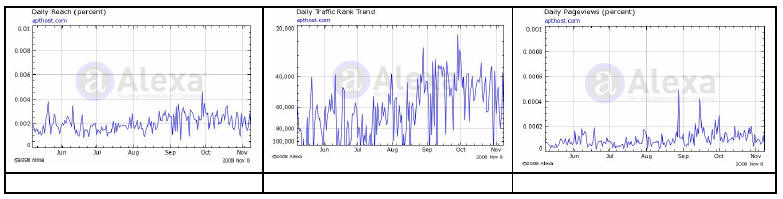

AptHost.com In order to compare AptHost with its competitors, below is our company’s Alexa ranking for reach, traffic, and page views.

Sales Strategy

AptHost markets to a diverse base of customers. We aim to provide end to end services and support combined with competitive pricing. Our main focus is a value product, the combination of quality and affordability. As a provider of a complete solution, we are positioned to form a longstanding partnership with our clients through our ability to tailor our service to meet our customer’s evolving needs.

Positioning

AptHost has been involved in the development of FFMPEG hosting in a shared server environment. We have added to our hosting service free script installation and quality support on the varied scripts clients desire for their sites. We intend to increase our position in the FFMPEG market through the continued development of software and support for the creation and maintenance of websites, the additional development of products and scripts, and the ability to support customers long term through vertical integration of related services.

Promotion

Affiliate programs have become a popular way to get others to promote products. Our affiliate program will be strengthened with larger payouts to entice affiliates to send traffic to apthost.com. Word of mouth has always been a powerful way to promote our business and we will continue employ the talents of professionals to promote through word of mouth advertising on industry related forums, blogs and review sites where they are respected members.

Pricing

Our products and services are priced to initially attract the lower end, beginner users within the market with incentives to move the client into higher revenue, longer term agreements. Since moving to this pricing structure on our shared plans, we have seen an increase in monthly revenue and new signups. We carry similar incentives on all our plans, but we have seen the most success with signing up customers on basic plans first and then selling add on services as they see everything AptHost can offer their companies.

On the dedicated server plans, we moved to a price-match model the retail pricing of our main dedicated server vendor. This is with the intent that when our clients compare pricing, ours compares favorably. It has been a successful strategy to have the same aggressive pricing as one of the most well-advertised, dedicated server providers on the Internet.

Glossary of terms

- FFmpeg hosting is a term that is used to refer to any "assortment of software which is available, which helps in recording, converting and streaming a digital video or an audio"[1], and to those domain registrars and web hosting companies which provide the above assortment of software to video hosting services.

- Virtual private server, also known as Virtual Dedicated Server (VDS), a type of web hosting based on the concept of partitions on mainframes and advanced resource scheduling to divide a computer into many virtually isolated servers. It is a server that runs inside another server. Each VDS acts like a dedicated server but shares the same hardware.

- Dedicated hosting service, dedicated server, or Managed hosting service are types of Internet hosting where the client leases an entire server not shared with anyone. This is more flexible than shared hosting, as organizations have full control over the server(s), including choice of operating system, hardware, etc. Server administration can usually be provided by the hosting company as an add-on service. In some cases a dedicated server can offer less overhead and a larger return on investment.

- Apache Tomcat is the servlet container that is used in the official Reference Implementation for the Java Servlet and JavaServer Pages technologies.

- Joomla is an Open Source Content Management Systems on the planet. It is used all over the world for everything from simple websites to complex corporate applications. Joomla is easy to install, simple to manage, and reliable.

- Social Media describes the online tools and platforms that people use to share opinions, insights, experiences, and perspectives with each other. Social media can take many different forms, including text, images, audio, and video. Popular social mediums include blogs, message boards, podcasts, wikis, and vlogs.

Hotel ParaYso Resort, Tulum, Quintana Roo, Mexico

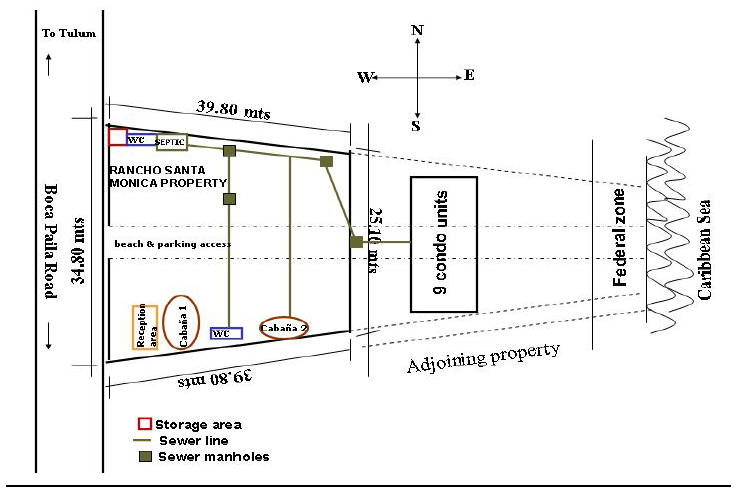

Our company separately owns and operates property (the “Solidaridad Property”) in Tulum, Mexico as noted in Figure 1. The property consists of two developable pods where an additional 15 hotel units can be built. The hotel has been open since February 7, 2007. We also manage the adjoining 11 hotel suites and receive income from the supply of management services. In November 29, 2005, the Company entered into an agreement with Monica Galan-Rios for the purchase of certain lands located in Solidaridad, Mexico consisting of approximately 1,220 square meters, See Figure 1 below.

Location of Hotel ParaYso Resort, Tulum, Quintana Roo, Mexico

The property consists of the Western half of the fraction of Lot #10 located at Km 8, Carretara a Tulum-Boca Paila Ejido Jose Maria Pino Suarez Municipality of Solidaridad, Quintana Roo, Mexico in the city of Tulum, Mexico. See Figure 1 below. Solidaridad is one of the eight municipalities that make up the Mexican state of Quintana Roo. Quintana Roo is located on the eastern part of the Yucatán Peninsula. It borders the Mexican states of Yucatán and Campeche to the north and west, the Caribbean Sea to the east, and the nation of Belize to the south.

Figure 1

Property

Location

Competition - Hotel operations

There are a number of hotels with which the Company will be forced to compete with in the downtown Financial District in order to obtain sufficient occupancy and room rental rates. Competition from other real estate developers and real estate services companies may adversely affect our ability to:

| 1. |

Attract purchasers |

| 2. |

Sell undeveloped rural land |

The presence of competing real estate development companies in Mexico may impact on our ability to raise additional capital in order to fund our property acquisitions or property developments in Mexico if investors are of the view that investments in competitors are more attractive. Competition could also reduce the availability of properties of merit or increase the cost of acquiring the properties.

OFF-BALANCE SHEET ARRANGEMENTS

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

RISKS AND UNCERTAINTIES

Going Concern and Liquidity.

The Company currently has a working capital deficit of $342,720, a stockholders’ deficit of $25,374 and an accumulated deficit of $923,079 as of August 31, 2009. In addition, the Company has generated net losses of $614,873 during the nine months ending August 31, 2009. These conditions raise substantial doubt as to the Company’s ability to continue as a going concern.

In order to continue as a going concern, the Company intends to continue to develop its specialized web hosting technology. Until profitability is reached, the Company will need, among other things, additional capital resources. Management’s plan is to obtain such resources for the Company by obtaining capital from management and significant shareholders sufficient to meet its minimum operating expenses and seeking equity and/or debt financing. However, management cannot provide any assurances that the Company will be successful in accomplishing any of its plans.

Our operating results may be adversely impacted by worldwide political and economic uncertainties and specific conditions in the markets we address. As a result, the market price of our common stock decline.

Recently general worldwide economic conditions have experienced a deterioration due to credit conditions resulting from the recent financial crisis affecting the banking system and financial markets and other factors, slower economic activity, concerns about inflation and deflation, volatility in energy costs, decreased consumer confidence, reduced corporate profits and capital spending, the ongoing effects of the war in Iraq and Afghanistan, recent international conflicts and terrorist and military activity, and the impact of natural disasters and public health emergencies. These conditions make it extremely difficult for both us and our customers to accurately forecast and plan future business activities, and they could cause U.S. and foreign businesses to slow spending on our services, which could delay and lengthen our new customer sales cycle and cause existing customers to do one or more of the following:

- Cancel or reduce planned expenditures for our services;

- Seek to lower their costs by renegotiating their contracts with us;

- Move their hosting services in-house; or

- Switch to lower-priced solutions provided by us or our competitors.

Customer collections are our primary source of cash. We have historically grown through a combination of an increase in new customers and revenue growth from our existing customers. We have experienced a decrease in revenue from our existing customer base, and if the current market conditions continue to deteriorate we may experience continued or more substantial decrease in revenue from our customer base, including through reductions in their commitments to us, and/or longer new customer sales cycles. If these events were to occur, we could experience a decrease in revenues and reduction in operating margins. Furthermore, during challenging economic times our customers may face issues gaining timely access to sufficient credit, which could result in an impairment of their ability to make timely payments to us. We have experienced an increase in our allowance for doubtful accounts already. If our customers’ ability to pay is further challenged, we may be required to further increase our allowance for doubtful accounts. We cannot predict the timing, strength or duration of any economic slowdown or subsequent economic recovery. If the economy or markets in which we operate do not continue at their present levels or continue to deteriorate, we may record additional charges related to the impairment of goodwill and other long-lived assets, and our business, financial condition and results of operations could be materially and adversely affected.

Finally, like many other stocks, our stock price decreased during the onset of the economic downturn. Although our stock price has recently increased, if investors have concerns that our business, financial condition and results of operations will be negatively impacted by a continued worldwide economic downturn, our stock price could decrease again.

If we are unable to manage our growth effectively our financial results could suffer and our stock price could decline.

The growth of our business and our service offerings has strained our operating and financial resources. Further, we intend to continue to expand our overall business, customer base, headcount, and operations. Creating a global organization and managing a geographically dispersed workforce requires substantial management effort and significant additional investment in our operating and financial system capabilities and controls. If our information systems are unable to support the demands placed on them by our growth, we may be forced to implement new systems which would be disruptive to our business. We may be unable to manage our expenses effectively in the future due to the expenses associated with these expansions, which may negatively impact our gross margins or operating expenses. If we fail to improve our operational systems or to expand our customer service capabilities to keep pace with the growth of our business, we could experience customer dissatisfaction, cost inefficiencies, and lost revenue opportunities, which may materially and adversely affect our operating results.

Our physical infrastructure is concentrated in very few facilities and any failure in our physical infrastructure or services could lead to significant costs and disruptions and could reduce our revenues, harm our business reputation and have a material adverse effect on our financial results.

Our network and power supplies and data centers are subject to various points of failure, and a problem with our generators, uninterruptible power supply, or UPS, routers, switches, or other equipment, whether or not within our control, could result in service interruptions for some or all of our customers or equipment damage. Because our hosting services do not require geographic proximity of our data centers to our customers, our hosting infrastructure is consolidated into a few large facilities. Accordingly, any failure or downtime in one of our data center facilities could affect a significant percentage of our customers. While data backup services are included in our hosting services, the majority of our customers do not elect to pay the additional fees required to store their backup data offsite in a separate facility. The total destruction or severe impairment of any of our data center facilities could result in significant downtime of our services and the loss of vast amounts of customer data. Since our ability to attract and retain customers depends on our ability to provide customers with highly reliable service, even minor interruptions in our service could harm our reputation. The services we provide are subject to failure resulting from numerous factors, including:

- Human error or accidents (such as an airplane crash into one of our facilities, some of which are located near major airports);

- Power loss;

- Equipment failure;

- Internet connectivity downtime;

- Improper building maintenance by the landlords of the buildings in which our facilities are located;

- Physical or electronic security breaches;

- Fire, earthquake, hurricane, tornado, flood, and other natural disasters;

- Water damage;

- Terrorism;

- Sabotage and vandalism; and

- Failure by us or our vendors to provide adequate service to our equipment.

Additionally, in connection with the expansion or consolidation of our existing data center facilities from time to time, there is an increased risk that service interruptions may occur as a result of server relocation or other unforeseen construction-related issues.

We have experienced interruptions in service in the past, due to such things as power outages, power equipment failures, cooling equipment failures, routing problems, hard drive failures, database corruption, system failures, software failures, and other computer failures.

Any future interruptions could:

- Cause our customers to seek damages for losses incurred;

- Require us to replace existing equipment or add redundant facilities;

- Damage our reputation as a reliable provider of hosting services;

- Cause existing customers to cancel or elect to not renew their contracts; or

- Make it more difficult for us to attract new customers.

Any of these events could materially increase our expenses or reduce our revenues, which would have a material adverse effect on our operating results.

If we are unable to maintain a high level of customer service, customer satisfaction and demand for our services could suffer.

We believe that our success depends on our ability to provide customers with quality service that not only meets our stated commitments, but meets and then exceeds customer service expectations. If we are unable to provide customers with quality customer support in a variety of areas, we could face customer dissatisfaction, decreased overall demand for our services, and loss of revenues. In addition, our inability to meet customer service expectations may damage our reputation and could consequently limit our ability to retain existing customers and attract new customers, which would adversely affect our ability to generate revenue and negatively impact our operating results.

We may not be able to continue to add new customers and increase sales to our existing customers, which could adversely affect our operating results.

Our growth is dependent on our ability to continue to attract new customers while retaining and expanding our service offerings to existing customers. Growth in the demand for our services may be inhibited and we may be unable to sustain growth in our customer base, for a number of reasons, such as:

- Our inability to market our services in a cost-effective manner to new customers;

- The inability of our customers to differentiate our services from those of our competitors or our inability to effectively communicate such distinctions;

- Our inability to successfully communicate to businesses the benefits of hosting;

- The decision of businesses to host their Internet sites and web infrastructure internally or in colocation facilities as an alternative to the use of our hosting services;

- Our inability to penetrate international markets;

- Our inability to expand our sales to existing customers;

- Our inability to strengthen awareness of our brand; and

- Reliability, quality or compatibility problems with our services.

A substantial amount of our past revenue growth was derived from purchases of service upgrades by existing customers. Our costs associated with increasing revenues from existing customers are generally lower than costs associated with generating revenues from new customers. Therefore, a reduction in the rate of revenue increase or a rate of revenue decrease from our existing customers, even if offset by an increase in revenues from new customers, could reduce our operating margins.

Any failure by us to continue attracting new customers or grow our revenues from existing customers for a prolonged period of time could have a material adverse effect on our operating results.

Our existing customers could elect to reduce or terminate the services they purchase from us because we do not have long-term contracts with our customers, which could adversely affect our operating results.

Our customer contracts for our services typically have initial terms of one to two years, which unless terminated, may be renewed or automatically extended on a month-to-month basis. Our customers have no obligation to renew their services after their initial contract periods expire. Moreover, our customers could cancel their service agreements before they expire. Our costs associated with maintaining revenue from existing customers are generally much lower than costs associated with generating revenue from new customers. Therefore, a reduction in revenue from our existing customers, even if offset by an increase in revenue from new customers, could reduce our operating margins. Any failure by us to continue to retain our existing customers could have a material adverse effect on our operating results.

If we fail to hire and retain qualified employees and management personnel, our growth strategy and our operating results could be harmed.

Our growth strategy depends on our ability to identify, hire, train, and retain IT professionals, technical engineers, operations employees, and sales and senior management personnel who maintain relationships with our customers and who can provide the technical, strategic, and marketing skills required for our company to grow. There is a shortage of qualified personnel in these fields, specifically in the San Antonio, Texas area, where we are headquartered and a majority of our employees are located, and we compete with other companies for this limited pool of potential employees. There is no assurance that we will be able to recruit or retain qualified personnel, and this failure could cause our operations and financial results to be negatively impacted.

Our success and future growth also depends to a significant degree on the skills and continued services of our management team, especially Graham Alexander, our Chairman, and Cody McLain, our Chief Executive Officer and President.

Our operating results may fluctuate significantly, which could make our future results difficult to predict and could cause our operating results to fall below investor or analyst expectations.

Our operating results may fluctuate due to a variety of factors, including many of the risks described in this section, which are outside of our control. As a result, comparing our operating results on a period-to-period basis may not be meaningful. You should not rely on our operating results for any prior periods as an indication of our future operating performance. Fluctuations in our revenue can lead to even greater fluctuations in our operating results. Our budgeted expense levels depend in part on our expectations of long-term future revenue. Given relatively fixed operating costs related to our personnel and facilities, any substantial adjustment to our expenses to account for lower than expected levels of revenue will be difficult and take time. Consequently, if our revenue does not meet projected levels, our operating expenses would be high relative to our revenue, which would negatively affect our operating performance.

Increased Internet bandwidth costs and network failures may adversely affect our operating results.

Our success depends in part upon the capacity, reliability, and performance of our network infrastructure, including the capacity leased from our Internet bandwidth suppliers. We depend on these companies to provide uninterrupted and error-free service through their telecommunications networks. Some of these providers are also our competitors.

We exercise little control over these providers, which increases our vulnerability to problems with the services they provide. We have experienced and expect to continue to experience interruptions or delays in network service. Any failure on our part or the part of our third-party suppliers to achieve or maintain high data transmission capacity, reliability or performance could significantly reduce customer demand for our services and damage our business.

As our customer base grows and their usage of telecommunications capacity increases, we will continue to need to make additional investments in our capacity to maintain adequate data transmission speeds, the availability of which may be limited or the cost of which may be on terms unacceptable to us. If adequate capacity is not available to us as our customers’ usage increases, our network may be unable to achieve or maintain sufficiently high data transmission capacity, reliability or performance. In addition, our business would suffer if our network suppliers increased the prices for their services and we were unable to pass along the increased costs to our customers.

Many of our current and potential competitors have substantially greater financial, technical and marketing resources, larger customer bases, longer operating histories, greater brand recognition, and more established relationships in the industry than we do. As a result, some of these competitors may be able to:

- Develop superior products or services, gain greater market acceptance, and expand their service offerings more efficiently or more rapidly;

- Adapt to new or emerging technologies and changes in customer requirements more quickly;

- Bundle hosting services with other services they provide at reduced prices;

- Take advantage of acquisition and other opportunities more readily;

- Adopt more aggressive pricing policies and devote greater resources to the promotion, marketing, and sales of their services; and

- Devote greater resources to the research and development of their products and services.

Our acquisitions may divert our management’s attention, result in dilution to our stockholders and consume resources that are necessary to sustain our business.

We have made acquisitions and, if appropriate opportunities present themselves, we may make additional acquisitions or investments or enter into joint ventures or strategic alliances with other companies. Risks commonly encountered in such transactions include:

- The difficulty of assimilating the operations and personnel of the combined companies;

- The risk that we may not be able to integrate the acquired services or technologies with our current services, products, and technologies;

- The potential disruption of our ongoing business;

- The diversion of management attention from our existing business;

- The inability of management to maximize our financial and strategic position through the successful integration of the acquired businesses;

- Difficulty in maintaining controls, procedures, and policies;

- The impairment of relationships with employees, suppliers, and customers as a result of any integration;

- The loss of an acquired base of customers and accompanying revenue; and

- The assumption of leased facilities, other long-term commitments or liabilities that could have a material adverse impact on our profitability and cash flow.

As a result of these potential problems and risks, businesses that we may acquire or invest in may not produce the revenue, earnings, or business synergies that we anticipated. In addition, there can be no assurance that any potential transaction will be successfully identified and completed or that, if completed, the acquired business or investment will generate sufficient revenue to offset the associated costs or other potential harmful effects on our business.

We have and will continue to incur significant increased costs as a result of operating as a public company, and our management will be required to devote substantial time to new compliance initiatives.

As a public company, we have and will continue to incur significant legal, accounting, and other expenses that we did not incur as a private company. In addition, the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, as well as rules subsequently implemented by the Securities and Exchange Commission, or the SEC, have imposed various requirements on public companies, including requiring changes in corporate governance practices. Our management and other personnel will need to devote a substantial amount of time to these new compliance initiatives. Moreover, these rules and regulations will increase our legal and financial compliance costs and will make some activities more time-consuming and costly. For example, these new rules and regulations to make it more difficult and more expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced policy limits and coverage or incur substantial costs to maintain the same or similar coverage. These rules and regulations could also make it more difficult for us to attract and retain qualified persons to serve on our board of directors, our board committees or as executive officers.

In order to respond to additional regulations applicable to public companies, such as Section 404 of the Sarbanes-Oxley Act, we have hired a number of finance and accounting personnel. We use independent contractors to fill certain positions and provide certain accounting functions. In the future, we may be required to hire additional full-time accounting employees to fill these and other related finance and accounting positions. Some of these positions require candidates with public company experience, and we may be unable to locate and hire such individuals as quickly as needed, if at all. In addition, new employees will require time and training to learn our business and operating processes and procedures. If our finance and accounting organization is unable for any reason to respond adequately to the increased demands resulting from being a public company, the quality and timeliness of our financial reporting may suffer and we could experience internal control weaknesses. Any consequences resulting from inaccuracies or delays in our reported financial statements could have an adverse effect on the trading price of our common stock as well as an adverse effect on our business, operating results, and financial condition.

Property Ownership Risk of Tulum Hotel ParaYso Property