Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SCHAWK INC | f8k_120809.htm |

EXHIBIT

99.1

INVESTOR

PRESENTATION

DECEMBER 8, 2009

DECEMBER 8, 2009

©

2009 Schawk, Inc. All Rights Reserved

2

FORWARD LOOKING STATEMENTS

CERTAIN

STATEMENTS IN THIS PRESENTATION ARE FORWARD-LOOKING STATEMENTS WITHIN THE

MEANING OF

SECTION 21E OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED, AND ARE SUBJECT TO THE SAFE HARBOR

CREATED THEREBY. THESE STATEMENTS ARE MADE BASED UPON CURRENT EXPECTATIONS AND BELIEFS THAT ARE

SUBJECT TO RISK AND UNCERTAINTY. ACTUAL RESULTS MIGHT DIFFER MATERIALLY FROM THOSE CONTAINED IN THE

FORWARD-LOOKING STATEMENTS BECAUSE OF FACTORS, SUCH AS, AMONG OTHER THINGS, UNANTICIPATED

DIFFICULTIES ASSOCIATED WITH ADDITIONAL ACCOUNTING ISSUES, IF ANY, WHICH MAY CAUSE OUR INVESTORS TO

LOSE CONFIDENCE IN OUR REPORTED FINANCIAL INFORMATION AND MAY HAVE A NEGATIVE IMPACT ON THE TRADING

PRICE OF OUR STOCK; OUR ABILITY TO REMEDY KNOWN INTERNAL CONTROL DEFICIENCIES AND WEAKNESSES AND THE

DISCOVERY OF FUTURE CONTROL DEFICIENCIES OR WEAKNESSES, WHICH MAY REQUIRE SUBSTANTIAL COSTS AND

RESOURCES TO RECTIFY; HIGHER THAN EXPECTED COSTS, OR UNANTICIPATED DIFFICULTIES ASSOCIATED WITH,

INTEGRATING ACQUIRED OPERATIONS; HIGHER THAN EXPECTED COSTS ASSOCIATED WITH COMPLIANCE WITH LEGAL

AND REGULATORY REQUIREMENTS; THE STRENGTH OF THE UNITED STATES ECONOMY IN GENERAL AND,

SPECIFICALLY, MARKET CONDITIONS FOR THE CONSUMER PRODUCTS INDUSTRY; THE LEVEL OF DEMAND FOR

SCHAWK'S SERVICES; CHANGES IN OR WEAK CONSUMER CONFIDENCE AND CONSUMER SPENDING; UNFAVORABLE

FOREIGN EXCHANGE RATE FLUCTUATIONS; LOSS OF KEY MANAGEMENT AND OPERATIONAL PERSONNEL; OUR ABILITY

TO IMPLEMENT OUR GROWTH STRATEGY, REBRANDING INITIATIVES AND COST REDUCTION PLANS AND TO REALIZE

ANTICIPATED COST SAVINGS; THE ABILITY OF THE COMPANY TO COMPLY WITH THE FINANCIAL COVENANTS CONTAINED

IN ITS DEBT AGREEMENTS AND OBTAIN WAIVERS OR AMENDMENTS IN THE EVENT OF NON-COMPLIANCE WITH SUCH

COVENANTS; THE ABILITY OF THE COMPANY TO RENEW OR REPLACE ITS REVOLVING CREDIT FACILITY WHEN IT

TERMINATES IN JANUARY 2010; THE STABILITY OF STATE, FEDERAL AND FOREIGN TAX LAWS; OUR CONTINUED ABILITY

TO IDENTIFY AND EXPLOIT INDUSTRY TRENDS AND EXPLOIT TECHNOLOGICAL ADVANCES IN THE IMAGING INDUSTRY;

OUR ABILITY TO IMPLEMENT RESTRUCTURING PLANS; THE STABILITY OF POLITICAL CONDITIONS IN FOREIGN

COUNTRIES IN WHICH WE HAVE PRODUCTION CAPABILITIES; TERRORIST ATTACKS AND THE U.S. RESPONSE TO SUCH

ATTACKS; AS WELL AS OTHER FACTORS DETAILED IN SCHAWK, INC.’S FILINGS WITH THE SECURITIES AND EXCHANGE

COMMISSION.

SECTION 21E OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED, AND ARE SUBJECT TO THE SAFE HARBOR

CREATED THEREBY. THESE STATEMENTS ARE MADE BASED UPON CURRENT EXPECTATIONS AND BELIEFS THAT ARE

SUBJECT TO RISK AND UNCERTAINTY. ACTUAL RESULTS MIGHT DIFFER MATERIALLY FROM THOSE CONTAINED IN THE

FORWARD-LOOKING STATEMENTS BECAUSE OF FACTORS, SUCH AS, AMONG OTHER THINGS, UNANTICIPATED

DIFFICULTIES ASSOCIATED WITH ADDITIONAL ACCOUNTING ISSUES, IF ANY, WHICH MAY CAUSE OUR INVESTORS TO

LOSE CONFIDENCE IN OUR REPORTED FINANCIAL INFORMATION AND MAY HAVE A NEGATIVE IMPACT ON THE TRADING

PRICE OF OUR STOCK; OUR ABILITY TO REMEDY KNOWN INTERNAL CONTROL DEFICIENCIES AND WEAKNESSES AND THE

DISCOVERY OF FUTURE CONTROL DEFICIENCIES OR WEAKNESSES, WHICH MAY REQUIRE SUBSTANTIAL COSTS AND

RESOURCES TO RECTIFY; HIGHER THAN EXPECTED COSTS, OR UNANTICIPATED DIFFICULTIES ASSOCIATED WITH,

INTEGRATING ACQUIRED OPERATIONS; HIGHER THAN EXPECTED COSTS ASSOCIATED WITH COMPLIANCE WITH LEGAL

AND REGULATORY REQUIREMENTS; THE STRENGTH OF THE UNITED STATES ECONOMY IN GENERAL AND,

SPECIFICALLY, MARKET CONDITIONS FOR THE CONSUMER PRODUCTS INDUSTRY; THE LEVEL OF DEMAND FOR

SCHAWK'S SERVICES; CHANGES IN OR WEAK CONSUMER CONFIDENCE AND CONSUMER SPENDING; UNFAVORABLE

FOREIGN EXCHANGE RATE FLUCTUATIONS; LOSS OF KEY MANAGEMENT AND OPERATIONAL PERSONNEL; OUR ABILITY

TO IMPLEMENT OUR GROWTH STRATEGY, REBRANDING INITIATIVES AND COST REDUCTION PLANS AND TO REALIZE

ANTICIPATED COST SAVINGS; THE ABILITY OF THE COMPANY TO COMPLY WITH THE FINANCIAL COVENANTS CONTAINED

IN ITS DEBT AGREEMENTS AND OBTAIN WAIVERS OR AMENDMENTS IN THE EVENT OF NON-COMPLIANCE WITH SUCH

COVENANTS; THE ABILITY OF THE COMPANY TO RENEW OR REPLACE ITS REVOLVING CREDIT FACILITY WHEN IT

TERMINATES IN JANUARY 2010; THE STABILITY OF STATE, FEDERAL AND FOREIGN TAX LAWS; OUR CONTINUED ABILITY

TO IDENTIFY AND EXPLOIT INDUSTRY TRENDS AND EXPLOIT TECHNOLOGICAL ADVANCES IN THE IMAGING INDUSTRY;

OUR ABILITY TO IMPLEMENT RESTRUCTURING PLANS; THE STABILITY OF POLITICAL CONDITIONS IN FOREIGN

COUNTRIES IN WHICH WE HAVE PRODUCTION CAPABILITIES; TERRORIST ATTACKS AND THE U.S. RESPONSE TO SUCH

ATTACKS; AS WELL AS OTHER FACTORS DETAILED IN SCHAWK, INC.’S FILINGS WITH THE SECURITIES AND EXCHANGE

COMMISSION.

SCHAWK,

INC. ASSUMES NO OBLIGATION TO UPDATE THE INFORMATION CONTAINED IN THIS

PRESENTATION, WHICH

SPEAKS ONLY AS OF ITS DATE.

SPEAKS ONLY AS OF ITS DATE.

©

2009 Schawk, Inc. All Rights Reserved

3

NON-GAAP & OTHER FINANCIAL INFORMATION

ALL

HISTORICAL FINANCIAL INFORMATION PRESENTED HEREIN SHOULD BE READ IN CONJUNCTION

WITH THE MORE

DETAILED INFORMATION INCLUDED IN OUR ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER

31, 2008 AND OUR QUARTERLY REPORTS ON FORM 10-Q FOR THE QUARTERLY PERIODS ENDED MARCH 31, JUNE 30 AND

SEPTEMBER 30, 2009 AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION.

DETAILED INFORMATION INCLUDED IN OUR ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER

31, 2008 AND OUR QUARTERLY REPORTS ON FORM 10-Q FOR THE QUARTERLY PERIODS ENDED MARCH 31, JUNE 30 AND

SEPTEMBER 30, 2009 AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION.

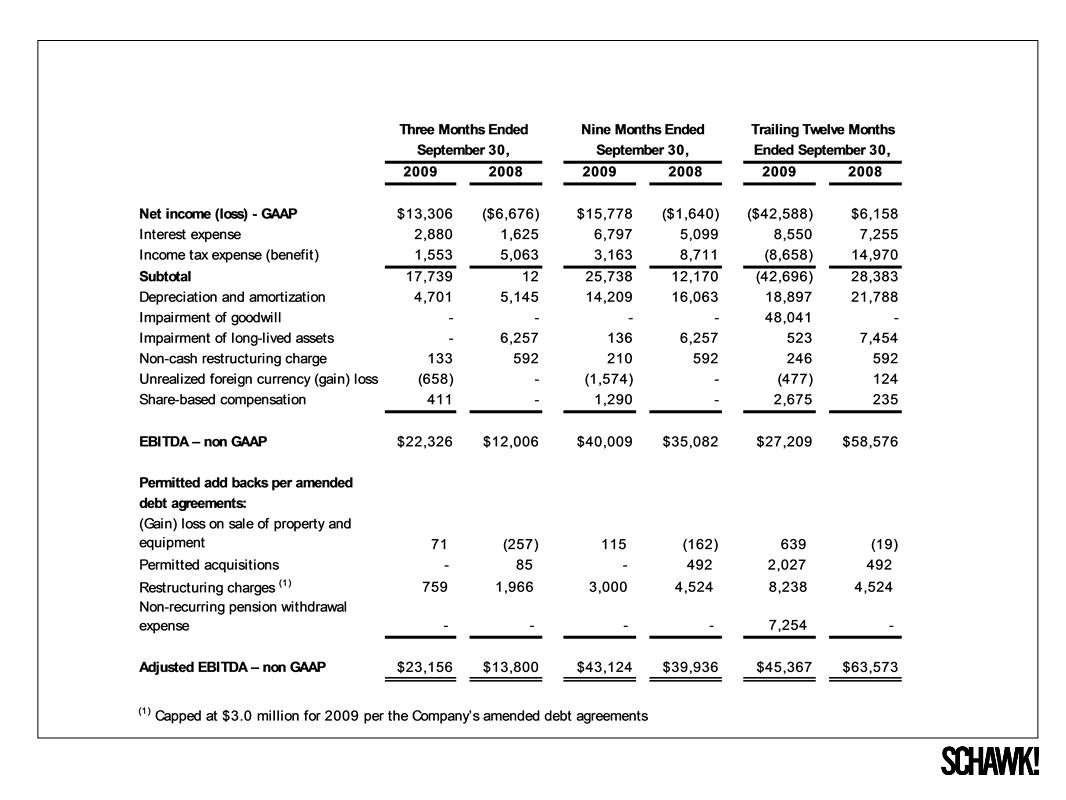

THIS

PRESENTATION CONTAINS CERTAIN NON-GAAP FINANCIAL MEASURES INCLUDED UNDER THE

SLIDES ENTITLED

“ADJUSTED EBITDA (UNAUDITED)” AND “RECONCILIATION OF NON-GAAP TO GAAP (UNAUDITED)” WHICH ARE RECONCILED

TO THE CLOSEST GAAP MEASURES.

“ADJUSTED EBITDA (UNAUDITED)” AND “RECONCILIATION OF NON-GAAP TO GAAP (UNAUDITED)” WHICH ARE RECONCILED

TO THE CLOSEST GAAP MEASURES.

IN

ADDITION, EBITDA, AS SHOWN IN THIS PRESENTATION, IS DEFINED AS EARNINGS BEFORE

INTEREST, INCOME TAXES,

DEPRECIATION AND AMORTIZATION, AND OTHER CERTAIN NON-CASH ITEMS. ADJUSTED EBITDA, AS DEFINED IN THE

COVENANTS UNDER THE COMPANY’S CURRENT DEBT AGREEMENTS, IS EBITDA AS ADJUSTED TO EXCLUDE CERTAIN

ITEMS, INCLUDING ITEMS THAT ARE GENERALLY CONSIDERED NON-OPERATING. BOTH MEASURES ARE IMPORTANT

INDICATORS OF PERFORMANCE UNDER THE COMPANY’S CURRENT DEBT AGREEMENTS AND PROVIDE MANAGEMENT

WITH A CONSISTENT MEASUREMENT TOOL FOR EVALUATING THE OPERATING ACTIVITIES OF THE COMPANY FROM

PERIOD TO PERIOD. MANAGEMENT ALSO BELIEVES THAT THE PRESENTATION OF THESE MEASURES PROVIDES

INVESTORS WITH GREATER TRANSPARENCY AND SUPPLEMENTAL DATA RELATING TO THE COMPANY’S FINANCIAL

CONDITION AND RESULTS OF OPERATIONS AND PROVIDES MORE CONSISTENT INSIGHT INTO THE PERFORMANCE OF

THE COMPANY’S CORE OPERATIONS FROM PERIOD TO PERIOD. THESE MEASURES DO NOT REPRESENT CASH FLOWS

FROM OPERATIONS AS DEFINED BY GENERALLY ACCEPTED ACCOUNTING PRINCIPLES, SHOULD NOT BE CONSIDERED AS

AN ALTERNATIVE TO NET INCOME OR CASH FLOW FROM OPERATIONS AS AN INDICATOR OF OUR OPERATING

PERFORMANCE, AND ARE NOT INDICATIVE OF CASH AVAILABLE TO FUND ALL CASH FLOW NEEDS. THESE MEASURES

ALSO MAY BE INCONSISTENT WITH SIMILAR MEASURES PRESENTED BY OTHER COMPANIES.

DEPRECIATION AND AMORTIZATION, AND OTHER CERTAIN NON-CASH ITEMS. ADJUSTED EBITDA, AS DEFINED IN THE

COVENANTS UNDER THE COMPANY’S CURRENT DEBT AGREEMENTS, IS EBITDA AS ADJUSTED TO EXCLUDE CERTAIN

ITEMS, INCLUDING ITEMS THAT ARE GENERALLY CONSIDERED NON-OPERATING. BOTH MEASURES ARE IMPORTANT

INDICATORS OF PERFORMANCE UNDER THE COMPANY’S CURRENT DEBT AGREEMENTS AND PROVIDE MANAGEMENT

WITH A CONSISTENT MEASUREMENT TOOL FOR EVALUATING THE OPERATING ACTIVITIES OF THE COMPANY FROM

PERIOD TO PERIOD. MANAGEMENT ALSO BELIEVES THAT THE PRESENTATION OF THESE MEASURES PROVIDES

INVESTORS WITH GREATER TRANSPARENCY AND SUPPLEMENTAL DATA RELATING TO THE COMPANY’S FINANCIAL

CONDITION AND RESULTS OF OPERATIONS AND PROVIDES MORE CONSISTENT INSIGHT INTO THE PERFORMANCE OF

THE COMPANY’S CORE OPERATIONS FROM PERIOD TO PERIOD. THESE MEASURES DO NOT REPRESENT CASH FLOWS

FROM OPERATIONS AS DEFINED BY GENERALLY ACCEPTED ACCOUNTING PRINCIPLES, SHOULD NOT BE CONSIDERED AS

AN ALTERNATIVE TO NET INCOME OR CASH FLOW FROM OPERATIONS AS AN INDICATOR OF OUR OPERATING

PERFORMANCE, AND ARE NOT INDICATIVE OF CASH AVAILABLE TO FUND ALL CASH FLOW NEEDS. THESE MEASURES

ALSO MAY BE INCONSISTENT WITH SIMILAR MEASURES PRESENTED BY OTHER COMPANIES.

©

2009 Schawk, Inc. All Rights Reserved

4

q ONE OF THE WORLD’S

LARGEST INDEPENDENT SUPPLIERS OF

BRAND POINT MANAGEMENT SOLUTIONS

BRAND POINT MANAGEMENT SOLUTIONS

q FOUNDED IN 1953 -

PUBLIC SINCE 1995 (NYSE:SGK)

q $494.2 MILLION IN

REVENUE FOR 2008

q GLOBAL PRESENCE WITH

OVER 3,000 EMPLOYEES IN 14

COUNTRIES ACROSS 4 CONTINENTS

COUNTRIES ACROSS 4 CONTINENTS

q 154 LOCATIONS,

INCLUDING 106 ON-SITE CUSTOMER

LOCATIONS (WE ARE THE ONLY COMPANY IN OUR INDUSTRY

WITH A SIGNIFICANT PRESENCE IN ASIA)

LOCATIONS (WE ARE THE ONLY COMPANY IN OUR INDUSTRY

WITH A SIGNIFICANT PRESENCE IN ASIA)

q 23 OF THE FORTUNE

100 COMPANIES AND 63 OF THE FORTUNE

500 ARE SCHAWK CLIENT-PARTNERS

500 ARE SCHAWK CLIENT-PARTNERS

WHO

WE ARE

©

2009 Schawk, Inc. All Rights Reserved

5

q SCHAWK IS A LEADER

IN THE BRAND POINT MANAGEMENT

CATEGORY, ENABLING COMPANIES OF ALL SIZES TO CONNECT

THEIR BRANDS WITH CONSUMERS TO CREATE DEEPER BRAND

AFFINITY

CATEGORY, ENABLING COMPANIES OF ALL SIZES TO CONNECT

THEIR BRANDS WITH CONSUMERS TO CREATE DEEPER BRAND

AFFINITY

q WITH A GLOBAL

FOOTPRINT OF 48 OFFICES, SCHAWK HELPS

COMPANIES CREATE COMPELLING AND CONSISTENT BRAND

EXPERIENCES BY PROVIDING INTEGRATED STRATEGIC,

CREATIVE AND IMPLEMENTATION SERVICES ACROSS BRAND

TOUCH POINTS

COMPANIES CREATE COMPELLING AND CONSISTENT BRAND

EXPERIENCES BY PROVIDING INTEGRATED STRATEGIC,

CREATIVE AND IMPLEMENTATION SERVICES ACROSS BRAND

TOUCH POINTS

WHO

WE ARE

©

2009 Schawk, Inc. All Rights Reserved

6

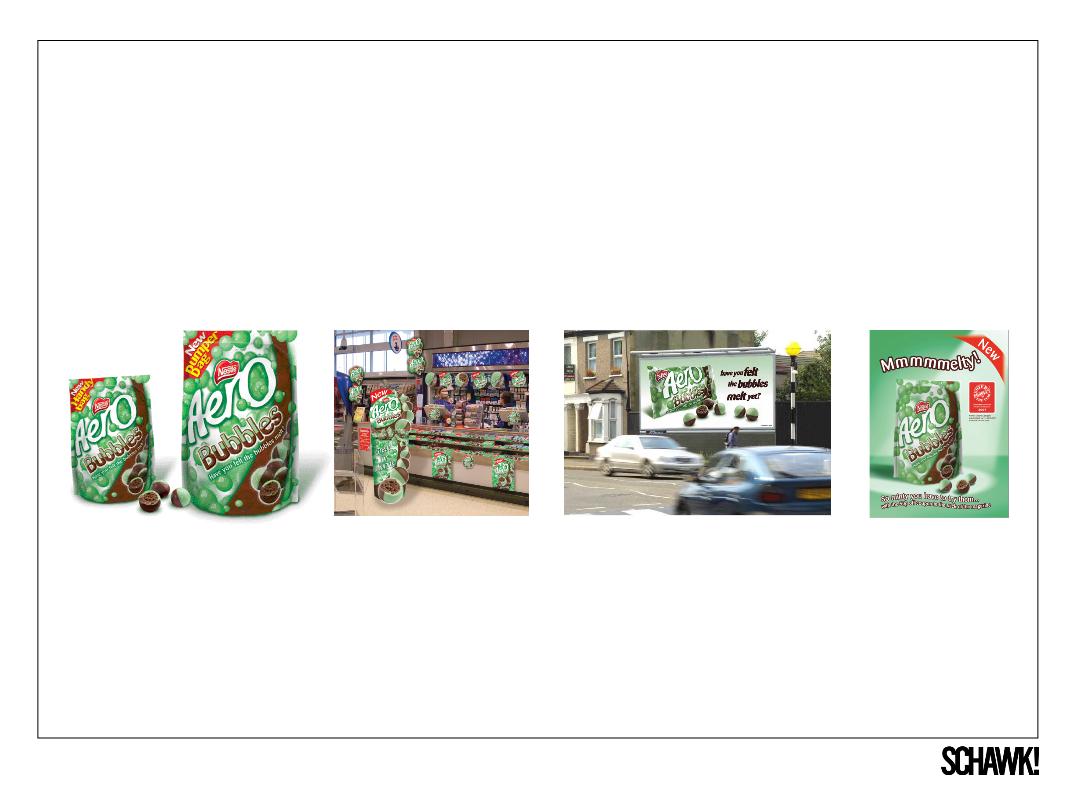

ON THE SHELF

IN THE STORE

ON THE

GO

GO

AT HOME

WHAT

WE DO

©

2009 Schawk, Inc. All Rights Reserved

7

RETAIL

CPG

PHARMA

ADVERTISING

PRIMARY

INDUSTRIES SERVED

©

2009 Schawk, Inc. All Rights Reserved

8

ENTERTAINMENT

TECHNOLOGY

FASHION/COSMETICS

PRIMARY

INDUSTRIES SERVED

©

2009 Schawk, Inc. All Rights Reserved

9

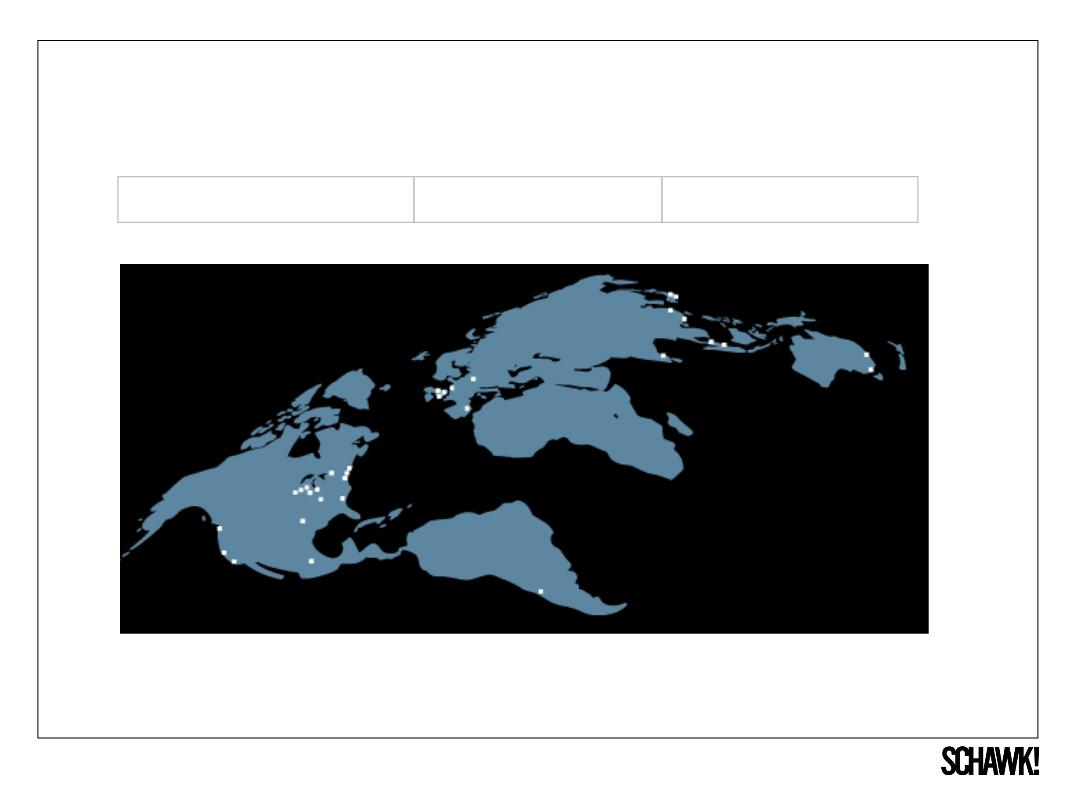

OPERATING

FACILITIES

©

2009 Schawk, Inc. All Rights Reserved

10

NORTH

AMERICA

EUROPE

ASIA

PACIFIC

CLIENT

ON-SITES

(74)* (25)

(7)

(7)

USA

(26)

CANADA

(4)

MEXICO

(1)

UK

(6)

BELGIUM

(1)

SPAIN

(1)

NETHERLANDS

(1)

(1)

AUSTRALIA

(2)

CHINA

(2)

SINGAPORE

(1)

JAPAN

(1)

INDIA

(1)

MALAYSIA

(1)

OFFICES

UNIQUE

GLOBAL REACH

*SOME

COMPANIES HAVE MULTIPLE ON-SITE LOCATIONS

©

2009 Schawk, Inc. All Rights Reserved

11

MARKET

DYNAMICS:

§ MAJORITY OF MARKET

PARTICIPANTS

ARE SINGLE LOCATION, NICHE FIRMS

WITH REVENUES OF LESS THAN $20M

ARE SINGLE LOCATION, NICHE FIRMS

WITH REVENUES OF LESS THAN $20M

§ INCREASING FOCUS ON

POS MARKETING

STRATEGIES

STRATEGIES

§ IMAGE CHANGES AND AD

SPENDING

DRIVE GROWTH

DRIVE GROWTH

§ INCREASINGLY

TECHNOLOGY INTENSIVE

§ CLIENTS REDUCING

MARKETING STAFF

AND OUTSOURCING FUNCTION

AND OUTSOURCING FUNCTION

§ CLIENTS INCREASINGLY

SEEKING

GLOBAL SOLUTIONS WITH LOCAL

KNOWLEDGE AND DELIVERY

CAPABILITIES

GLOBAL SOLUTIONS WITH LOCAL

KNOWLEDGE AND DELIVERY

CAPABILITIES

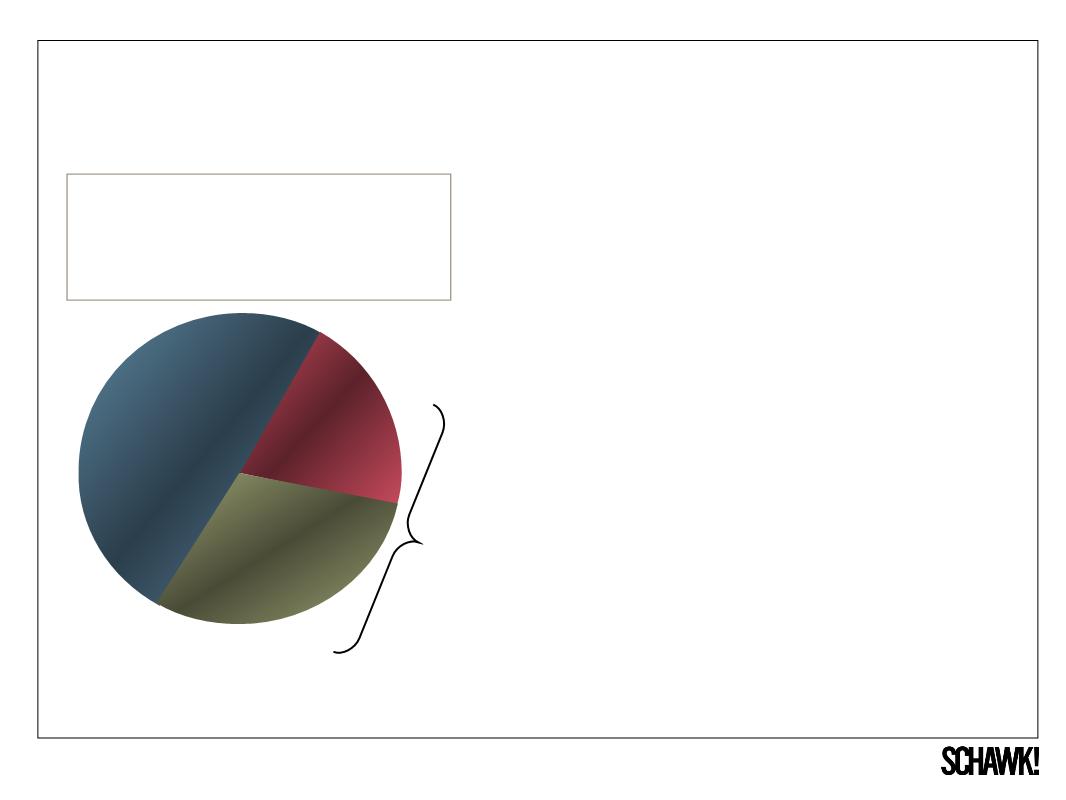

SERVING

A $30

BILLION

BILLION

GLOBAL

MARKET

SCHAWK'S

FOCUS

PUBLISHING

&

OTHER

OTHER

$15.0

PACKAGING

$6.0

$6.0

ADVERTISING

$9.0

SOURCE:

COMPANY ESTIMATE

LEADER IN FRAGMENTED MARKET

©

2009 Schawk, Inc. All Rights Reserved

12

q CLIENTS REMAIN

CAUTIOUS DUE TO THE ECONOMIC

ENVIRONMENT. SCHAWK WORKS TO DEVELOP REVENUE

GROWTH AND APPROPRIATE COST ACTIONS TO IMPROVE

EFFECTIVENESS AND WORLD CLASS SERVICE DELIVERY

CAPABILITIES

ENVIRONMENT. SCHAWK WORKS TO DEVELOP REVENUE

GROWTH AND APPROPRIATE COST ACTIONS TO IMPROVE

EFFECTIVENESS AND WORLD CLASS SERVICE DELIVERY

CAPABILITIES

q STRONG, MOTIVATED

MANAGEMENT FOCUSED ON

CAPITALIZING ON OPPORTUNITIES WITH NEW AND EXISTING

CLIENTS

CAPITALIZING ON OPPORTUNITIES WITH NEW AND EXISTING

CLIENTS

q CONFIDENCE IN THE

ABILITY TO ACHIEVE REAL COST &

OPERATING SYNERGIES

OPERATING SYNERGIES

q STRONGER

INFRASTRUCTURE SHOULD HELP DRIVE TOP AND

BOTTOM LINE GROWTH

BOTTOM LINE GROWTH

q FOCUS ON

BEST-PRACTICE SOLUTIONS THAT DELIVER

AGAINST

CLIENT NEEDS

CLIENT NEEDS

q FOCUS ON INFORMATION

TECHNOLOGY AND INFRASTRUCTURE

IMPROVEMENTS

IMPROVEMENTS

2010

FOCUS

©

2009 Schawk, Inc. All Rights Reserved

13

PACKAGE-GOOD

PLAYERS PLAN NEW-PRODUCT SURGE FOR 2010

AFTER

HUNKERING DOWN IN '09, COMPANIES SHOW SIGNS OF GOING ON OFFENSE

BY

JACK NEFF

PUBLISHED:

DECEMBER 07, 2009

q “PACKAGE-GOODS

MARKETERS ARE PROMISING BIGGER, BETTER AND MORE PLENTIFUL

INNOVATION AND NEW PRODUCTS IN 2010 THAN 2009…”

INNOVATION AND NEW PRODUCTS IN 2010 THAN 2009…”

q “TITANS PROCTER

& GAMBLE CO., RECKITT BENCKISER, KIMBERLY-CLARK CORP., ENERGIZER

HOLDINGS AND UNILEVER HAVE ALL SAID OR SIGNALED THAT THEY EXPECT TO STEP UP NEW-

PRODUCT ACTIVITY AND BY EXTENSION MARKETING SUPPORT IN 2010.”

HOLDINGS AND UNILEVER HAVE ALL SAID OR SIGNALED THAT THEY EXPECT TO STEP UP NEW-

PRODUCT ACTIVITY AND BY EXTENSION MARKETING SUPPORT IN 2010.”

q “SIGNS OF A 2010

NEW-PRODUCT SURGE INCLUDE A REBOUND IN CONCEPT TESTING AND A

PICKUP IN NEW PACKAGING ORDERS.”

PICKUP IN NEW PACKAGING ORDERS.”

q “P&G HAS BEEN

PERHAPS THE MOST FORTHRIGHT IN PROMISING MORE INNOVATION FOR 2010,

…SAYING THE FISCAL YEAR STARTED JULY 1 COULD BE ITS BIGGEST IN A DECADE.”

…SAYING THE FISCAL YEAR STARTED JULY 1 COULD BE ITS BIGGEST IN A DECADE.”

q “U.S. -BASED

CONSUMER-PACKAGE GOODS MARKETERS GENERALLY ARE RELATIVELY FLUSH WITH

CASH, FACING LOWER COMMODITY COSTS AND INCREASED MARGIN FLEXIBILITY THANKS TO THE

EFFECTS OF A WEAKER DOLLAR.”

CASH, FACING LOWER COMMODITY COSTS AND INCREASED MARGIN FLEXIBILITY THANKS TO THE

EFFECTS OF A WEAKER DOLLAR.”

q “…P&G CEO BOB

MCDONALD STAKING HIS REPUTATION ON A VOW TO TAKE BACK MARKET SHARE,

SHOULD MAKE FOR MORE VIGOROUS INDUSTRY NEW-PRODUCT COMPETITION THIS YEAR...”

SHOULD MAKE FOR MORE VIGOROUS INDUSTRY NEW-PRODUCT COMPETITION THIS YEAR...”

ADVERTISING AGE INDICATES CPG COMPANIES

WILL RETURN TO INNOVATION IN 2010

©

2009 Schawk, Inc. All Rights Reserved

14

LEADER

IN

FRAGMENTED

MARKET

UNIQUE

CLIENT

RELATIONSHIPS

COMPRE-

HENSIVE

HENSIVE

SERVICE

OFFERING

OFFERING

PLATFORM

POSITIONED

FOR GROWTH

FOR GROWTH

STRONG

CASH

FLOW

GENERATOR

UNMATCHED

GLOBAL

CAPABILITIES

HIGHLIGHTS

©

2009 Schawk, Inc. All Rights Reserved

15

SCHAWK!

THIRD QUARTER 2009

FINANCIAL REVIEW

THIRD QUARTER 2009

FINANCIAL REVIEW

©

2009 Schawk, Inc. All Rights Reserved

16

q CONTINUED COST

REDUCTIONS ($35+ MILLION

ANNUALIZED

SAVINGS FOR SIX QUARTERS ENDED SEPT 2009) AND Q3 2009

AND Q2 2009 SEQUENTIAL INCREASES IN REVENUE,

CONTRIBUTED TO BEST QUARTERLY RESULTS (EPS AND

“ADJUSTED EBITDA” FOR Q2 2009 AND Q3 2009), SINCE FY 2007

SAVINGS FOR SIX QUARTERS ENDED SEPT 2009) AND Q3 2009

AND Q2 2009 SEQUENTIAL INCREASES IN REVENUE,

CONTRIBUTED TO BEST QUARTERLY RESULTS (EPS AND

“ADJUSTED EBITDA” FOR Q2 2009 AND Q3 2009), SINCE FY 2007

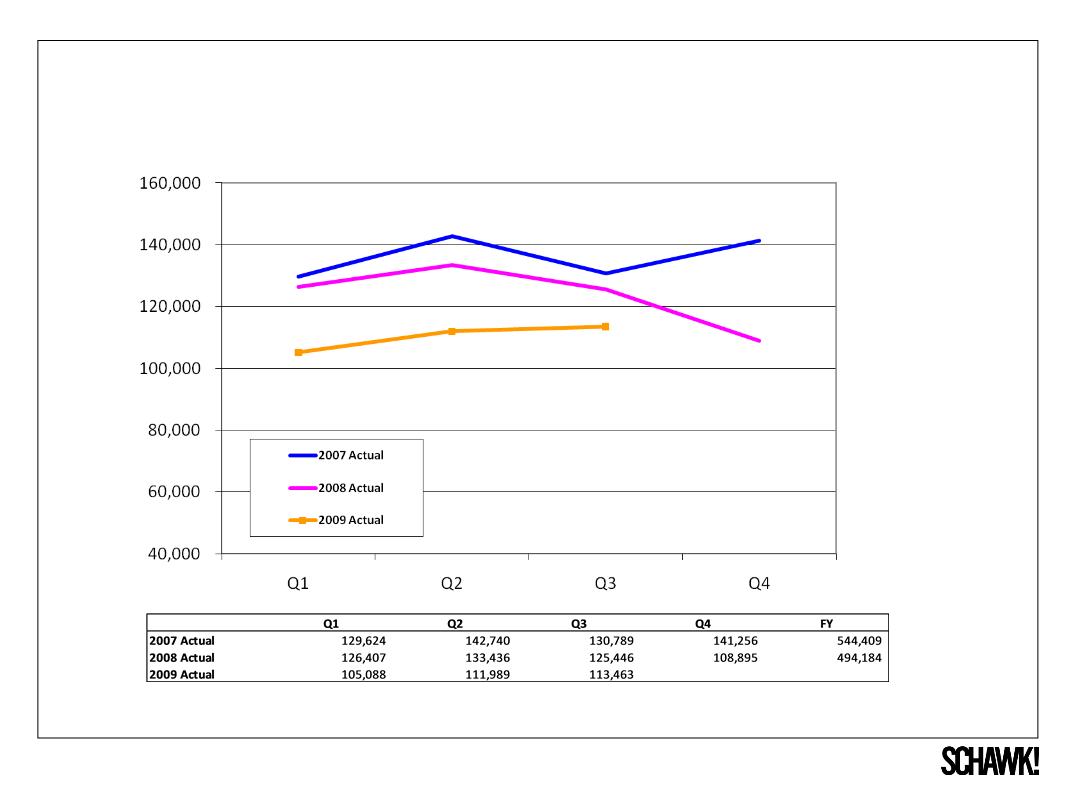

q BELIEF IS THAT Q4

2008 AND Q1 2009 WERE THE “LOW REVENUE

POINTS” IN THE RECESSION CYCLE FROM A REVENUE

PERSPECTIVE

POINTS” IN THE RECESSION CYCLE FROM A REVENUE

PERSPECTIVE

q CLIENT SPENDING DOWN

IN 2009 AND 2008, VERSUS 2007 LEVELS

AS PRODUCT INNOVATION IS DOWN DRAMATICALLY AT

PACKAGING CLIENTS

AS PRODUCT INNOVATION IS DOWN DRAMATICALLY AT

PACKAGING CLIENTS

q Q3 2009 IS 6TH STRAIGHT QUARTER OF

SIGNIFICANT COST

REDUCTIONS

REDUCTIONS

2009

SUMMARY TO DATE

©

2009 Schawk, Inc. All Rights Reserved

17

Q3

2009 HIGHLIGHTS

q $22.3 MILLION 3RD

QUARTER DEBT PAYDOWN

§ $9.2 MILLION CASH

FROM INDEMNITY SETTLEMENT

($5 MILLION OPERATING INCOME)

($5 MILLION OPERATING INCOME)

q $55.5 MILLION NET

DEBT REDUCTION IN SIX

MONTHS ENDED SEPTEMBER 30, 2009

MONTHS ENDED SEPTEMBER 30, 2009

§ $45.1 MILLION NET

DEBT REDUCTION SINCE

DECEMBER 2008

DECEMBER 2008

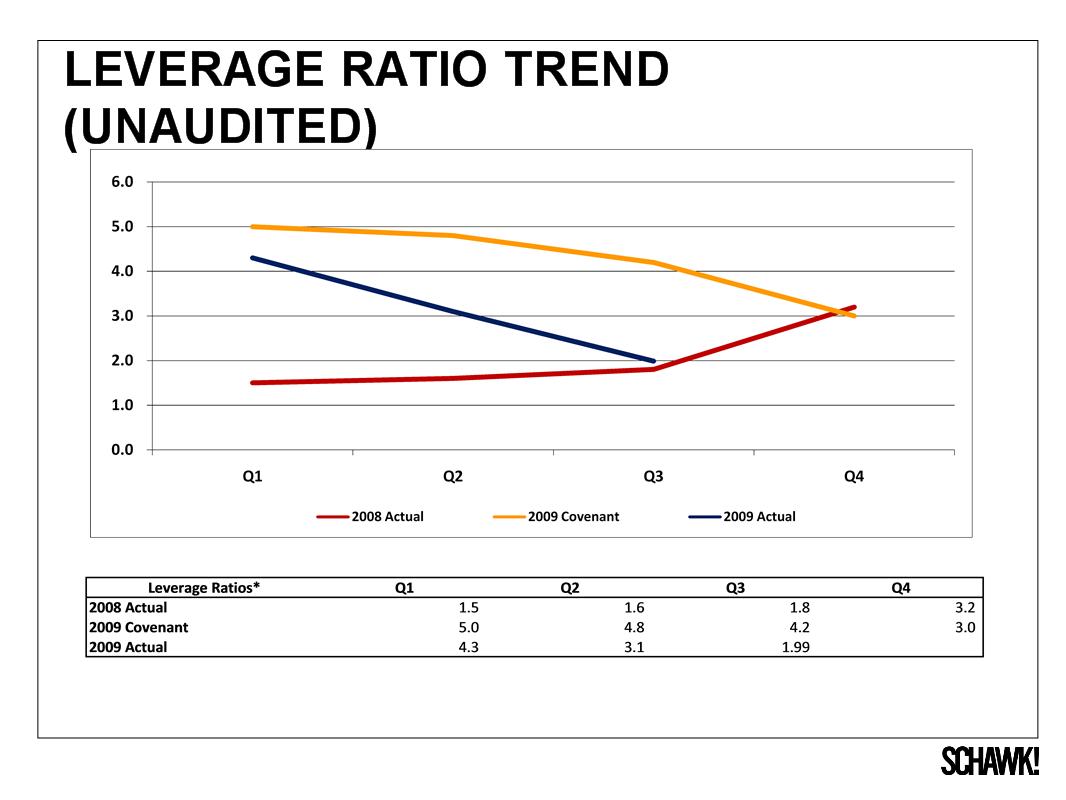

q LEVERAGE RATIO OF

1.99X AT SEPTEMBER 30,

2009

2009

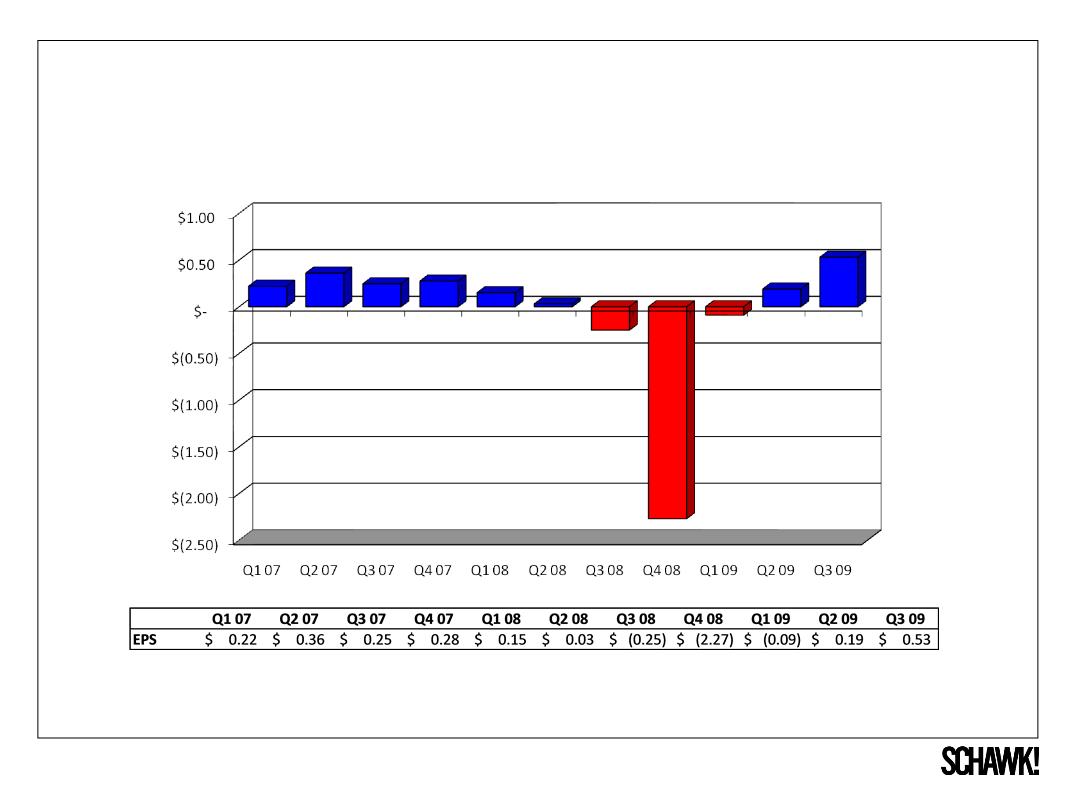

q BEST EPS QUARTER

SINCE Q2 2007, EXCLUDING

INCOME FROM THE Q3 2009 INDEMNITY

SETTLEMENT

INCOME FROM THE Q3 2009 INDEMNITY

SETTLEMENT

q 2ND STRAIGHT QUARTER OF

SEQUENTIAL

REVENUE INCREASES

REVENUE INCREASES

©

2009 Schawk, Inc. All Rights Reserved

18

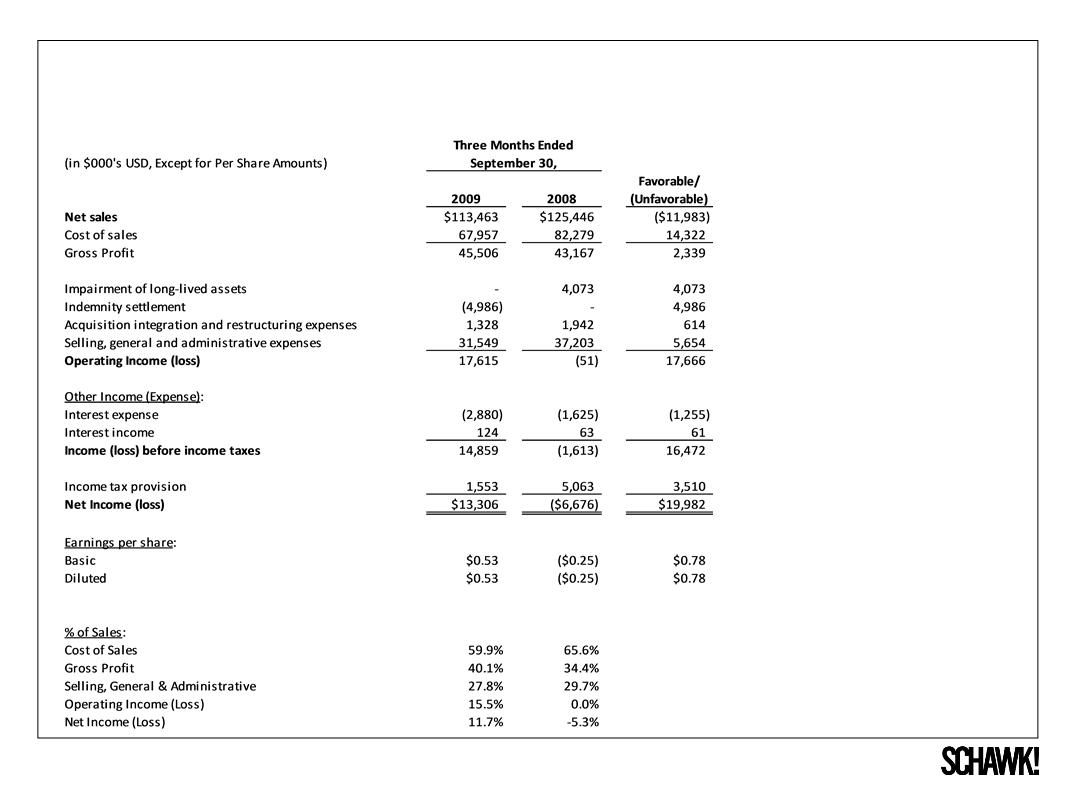

Q3

2009 INCOME STATEMENT

(UNAUDITED)

(UNAUDITED)

©

2009 Schawk, Inc. All Rights Reserved

19

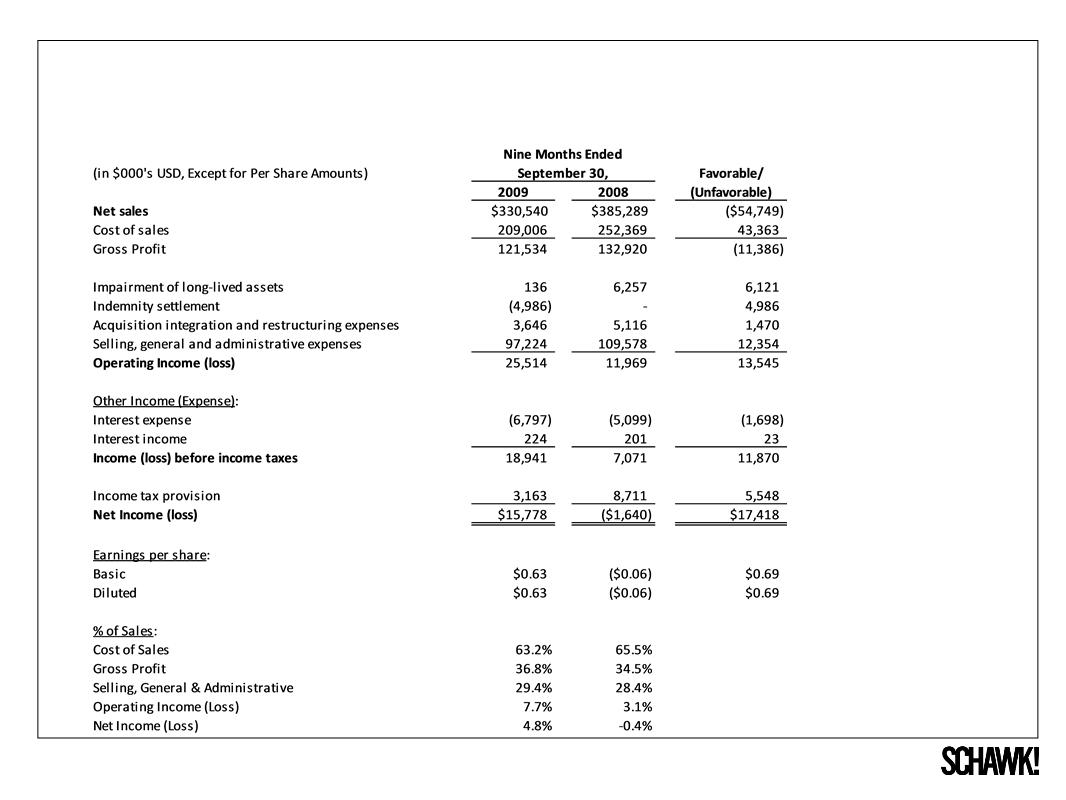

SEPT

YTD 2009 INCOME STATEMENT

(UNAUDITED)

(UNAUDITED)

©

2009 Schawk, Inc. All Rights Reserved

20

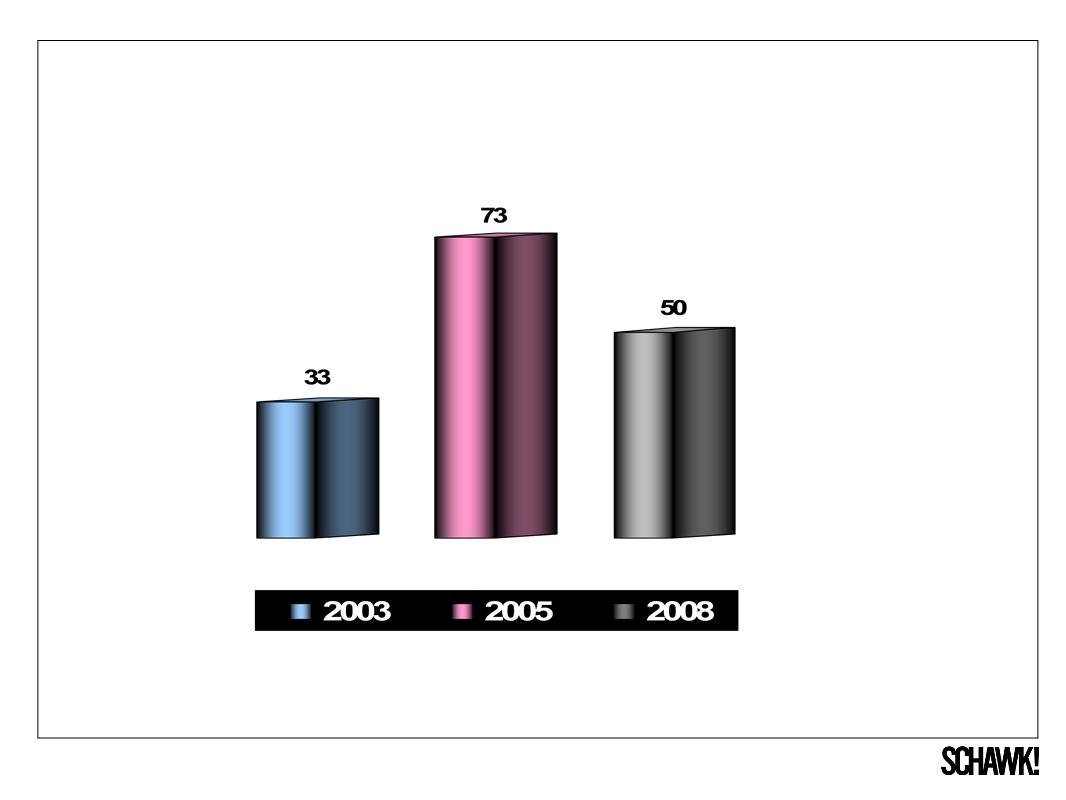

QUARTERLY SALES TREND 2007-2009

($000’s

USD, Unaudited)

©

2009 Schawk, Inc. All Rights Reserved

21

ADJUSTED

EBITDA (UNAUDITED)

($000’s

USD)

©

2009 Schawk, Inc. All Rights Reserved

22

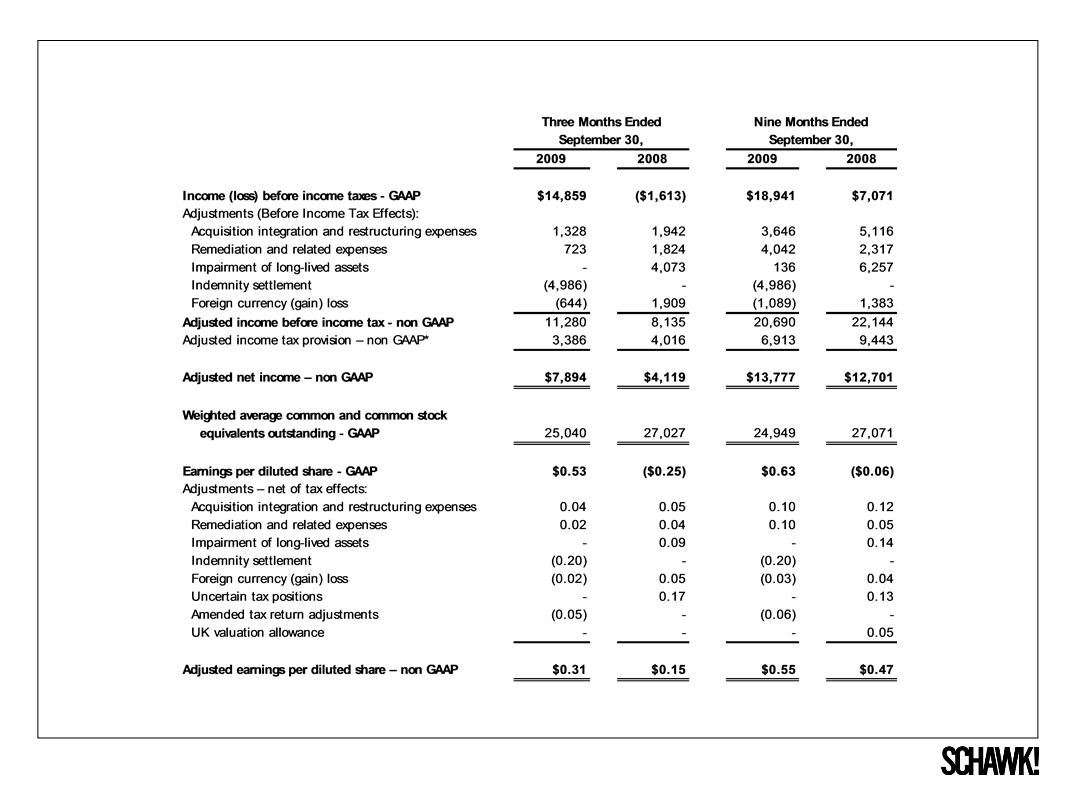

RECONCILIATION

OF NON-GAAP TO GAAP (UNAUDITED)

($000’s

USD, Except for Per Share Amounts)

* Please

see the Company’s 2009 third-quarter earnings release for a full reconciliation

of this measure.

©

2009 Schawk, Inc. All Rights Reserved

23

* THE LEVERAGE RATIOS ARE

CALCULATED CONSISTENT WITH THE TERMS OF THE COMPANY’S DEBT AGREEMENTS IN PLACE

FOR THE RESPECTIVE TIME PERIOD SHOWN.

©

2009 Schawk, Inc. All Rights Reserved

24

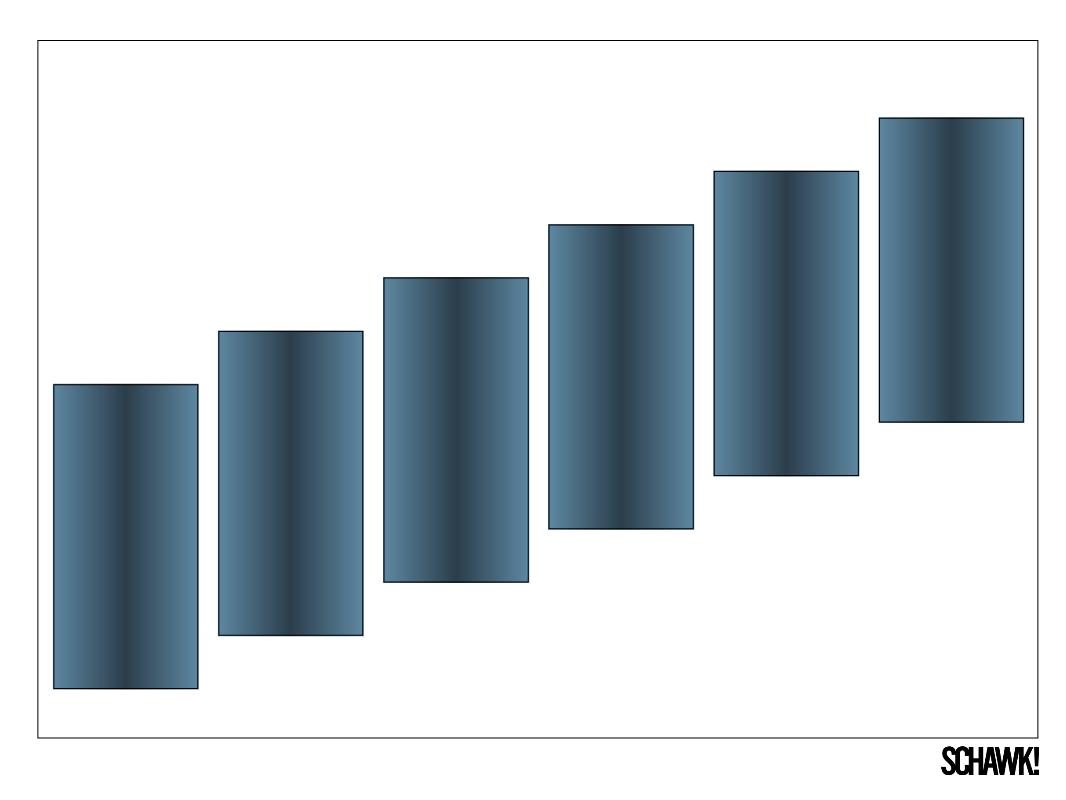

(1) Q4

2008 DILUTED EPS INCLUDES CHARGES OF $1.98 FOR NON-CASH ASSET IMPAIRMENTS, AS

WELL

AS A PENSION WITHDRAWAL LIABILITY

AS A PENSION WITHDRAWAL LIABILITY

(2) Q3

2009 DILUTED EPS IS $0.33 PER SHARE, EXCLUDING INDEMNITY SETTLEMENT GAIN OF

$0.20

(1)

(2)

DILUTED QUARTERLY EPS

(UNAUDITED)

PREVIOUS 11 QTRS

(UNAUDITED)

PREVIOUS 11 QTRS

INVESTOR

PRESENTATION

DECEMBER 8, 2009

DECEMBER 8, 2009