Attached files

| file | filename |

|---|---|

| EX-10.3 - EXHIBIT 10.3 - V Media Corp | dvmg_8k-ex10x3.htm |

| EX-10.4 - EXHIBIT 10.4 - V Media Corp | dvmg_8k-ex10x4.htm |

| EX-16.1 - EXHIBIT 16.1 - V Media Corp | dvmg_8k-ex16x1.htm |

| EX-10.6 - EXHIBIT 10.6 - V Media Corp | dvmg_8k-ex10x6.htm |

| EX-10.5 - EXHIBIT 10.5 - V Media Corp | dvmg_8k-ex10x5.htm |

| EX-10.2 - EXHIBIT 10.2 - V Media Corp | dvmg_8k-ex10x2.htm |

| EX-10.1 - EXHIBIT 10.1 - V Media Corp | dvmg_8k-ex10x1.htm |

| EX-10.7 - EXHIBIT 10.7 - V Media Corp | dvmg_8k-ex10x7.htm |

| EX-10.13 - EXHIBIT 10.13 - V Media Corp | dvmg_8k-ex10x13.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of

Report: December 8, 2009

Golden

Key International, Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

000-53027

|

33-0944402

|

|

(State

or Other Jurisdiction

of

Incorporation)

|

(Commission

File Number)

|

(IRS

Employer

Identification

No.)

|

Dalian

Vastitude Media Group

8th

Floor, Golden Name Commercial Tower

68

Renmin Road, Zhongshan District, Dalian, P.R. China

(ADDRESS

OF PRINCIPAL EXECUTIVE OFFICES)

116001

(Zip

Code)

86-0411-82728168

(Registrant's telephone number,

including area code)

N/A

(Former

Name or Former Address if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

|

|

o

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

|

|

|

o

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

|

o

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

|

|

|

o

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

|

Item

1.01 Entry into a Material Definitive

Agreement

On December 8, 2009, Golden Key

International, Inc. (the “Company”) acquired all of the outstanding capital

stock of Hongkong Fortune-Rich Investment Co., Limited, a Hong Kong

corporation (“Fortune-Rich”), through China New Media Corp., a Delaware

corporation (the “Merger Sub”) wholly owned by the

Company. Fortune-Rich is a holding company whose only asset, held

through a subsidiary, is 100% of the registered capital of Dalian Guo-Heng

Management and Consultation Co., Ltd. (“Dalian Guo-Heng”), a limited liability

company organized under the laws of the People’s Republic of China.

Substantially all of Fortune-Rich's operations are conducted in China through

Dalian Guo-Heng, and through contractual arrangements with several of Dalian

Guo-Heng’s consolidated affiliated entities in China, including Dalian Vastitude

Media Group Co., Ltd. (“V-Media”) and its subsidiaries. V-Media is a

fast-growing outdoor advertising company with dominant operation in Dalian, the

commercial center of Northeastern China.

In connection with the acquisition, the

following transactions took place:

|

§

|

The

Merger Sub issued 10 shares of the common stock of the Merger Sub which

constituted no more than 10% ownership interest in the Merger Sub and

1,000,000 shares of Series A Preferred Stock of the Company to the

shareholders of Fortune-Rich, in exchange for all the shares of the

capital stock of Fortune-Rich (the “Share Exchange” or “Merger”). The 10

shares of the common stock of the Merger Sub were converted into

approximately 26,397,933 shares of the common stock of the Company so that

upon completion of the Merger, the shareholders of Fortune-Rich own

approximately 96% of the common stock of the

Company.

|

|

§

|

Robert

Blair resigned as the Company’s Chief Executive Officer, Secretary and

Treasurer on December 8, 2009.

|

|

§

|

Guojun

Wang, Chairman of V-Media, was elected to serve on our Board of Directors

as Chairman and as Chief Executive Officer of the

Company.

|

|

§

|

Ming

Ma, President of V-Media, was appointed as President of the

Company.

|

|

§

|

Hongwen

Liu, Chief Financial Officer of V-Media, was appointed as Chief Financial

Officer of the Company.

|

|

§

|

As

part of the Merger, pursuant to a stock purchase agreement (the “Stock

Purchase Agreement”), the Company transferred all of the outstanding

capital of its subsidiary, Deep Rooted, Inc. (“Deep Rooted”) to certain of

its shareholders in exchange for the cancellation of 9,760,000 shares of

the Company’s common stock (the “Split Off Transaction”). Deep

Rooted was engaged in the business of internet travel

planning. To date, Deep Rooted’s activities were limited to

capital formation, organization, set-up of a website and development of

its business plan and target customer market. Following the

Merger and the Split-Off Transaction, the Company discontinued its former

business and is now engaged in the outdoor advertising

business.

|

|

§

|

As

part of the Merger, the Company’s name was changed from “Golden Key

International, Inc.” to the Merger Sub’s name “China New Media Corp..” The

Company is communicating with FINRA for the name change and trading symbol

change on the OTC Bulletin Board.

|

As a

result of these transactions, persons affiliated with V-Media now own securities

that in the aggregate represent approximately 96% of the equity in the

Company.

1

New

Management

Upon the

completion of the Merger, the new executive officers and directors of the

Company will be:

|

Name

|

Age

|

Positions with the

Company

|

|

Guojun

Wang

|

45

|

Chairman

& CEO

|

|

Ming

Ma

|

43

|

President

|

|

Hongwen

Liu

|

42

|

Chief

Financial Officer

|

|

Wei

Wang

|

40

|

Chief

Operation Officer

|

|

Feng

Wan

|

32

|

Chief

Technology Officer

|

All directors hold office until the

next annual meeting of our shareholders and until their successors have been

elected and qualify. Officers serve at the pleasure of the Board of

Directors.

Guojun Wang, 45, Founder and

Chairman of V-Media, Director and General Manager of Dalian V-Media Engineering

& Design Co. Ltd. Before Mr. Wang founded V-Media in September 2000, he had

served as President of Dalian Pacific Advertisement Co., Ltd. for 11 years. With

his 20 years of experience in China media and advertising industry and his

success in building and managing one of the largest regional outdoor media

companies in China, Mr. Wang was elected Vice Chairman of China Advertising

Association of Commerce in 2007. He graduated from Dalian University

of Technology in 1986.

Ming Ma, 43, President and

Board of Director of V-Media, Mr. Wang’s wife. She has been in charge of

V-Media’s daily operation since its inception in September 2000. Prior to that,

she had served as Sales Manager in Dalian Pacific Advertisement Co. Ltd. Ms. Ma

graduated from Dalian Institute of Finance trade union in 1991.

Hongwen Liu, 42, Chief

Financial Officer of V-Media. He joined the Company as Chief Financial Officer

in December 2003. Prior to that, he served as Deputy Director of

Dalian Da-xin Accounting Firm for nine years. Mr. Liu graduated from the

Computer-Based Accounting Department of Dalian Radio and Television University

in July 1991.

Wei Wang, 40, Chief Operation

Officer of V-Media. He joined the Company as Chief Operation Officer in

September 2009. Prior to that, he had served as Assistant President of Sinorail

Bohai Train Ferry Logistics Co., Ltd. for 3 years. Prior to that, he served as

CEO of China International Shipping Network Corp for 2 years. Mr.Wang graduated

from Liaoning University in 1991.

Feng Wan, 32 , Chief

Technology Officer of V-Media. He joined the Company in 2001. Mr. Wan also

serves as General Manager of Dalian Vastitude Network Technology Co., Ltd. He

graduated from the Central Party School majored in Law in 2000.

2

Form

10 Disclosure

Prior to

closing of the Share Exchange, the Company was a “shell company” as such term is

defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended

(the “Exchange Act”). Accordingly, as required by SEC rules, set forth below is

the information that would be required if the Company were filing a general form

for registration of securities on Form 10 under the Exchange

Act.

Please

note that the information provided below relates to the combined Company after

the Share Exchange, unless otherwise specifically indicated.

Security Ownership of

Certain Beneficial Owners and Management

Upon

completion of the Merger, there were 27,500,000 shares of the Company’s common

stock issued and outstanding. In addition, there were 1,000,000

shares of Series A Preferred Stock issued and outstanding. The

holders of the Series A Preferred Stock have an aggregate voting power of 40% of

the combined voting power of all of the Company’s shares of Common Stock and

Preferred Stock as long as the Company is in existence .

The

following table sets forth information known to us with respect to the

beneficial ownership of our common stock as of December 8, 2009 by the

following:

|

·

|

each

shareholder who beneficially owns more than 5% of our

common;

|

|

·

|

each

of our named executive officers;

|

|

·

|

Each

of our directors; and

|

|

·

|

Executive

officers and directors as a group.

|

Beneficial ownership is determined in

accordance with the rules of the SEC, which deem a person to beneficially own

any shares the person has or shares voting or dispositive power over and any

additional shares obtainable within 60 days through the exercise of options,

warrants or other purchase rights. Shares of our common stock subject to

options, warrants or other rights to purchase that are currently exercisable or

are exercisable within 60 days of December 8, 2009 (including shares subject to

restrictions that lapse within 60 days of December 8, 2009) are deemed

outstanding for purposes of computing the percentage ownership of the person

holding such shares, options, warrants or other rights, but are not deemed

outstanding for purposes of computing the percentage ownership of any other

person. Unless otherwise indicated, each person possesses sole voting and

investment power with respect to the shares identified as beneficially

owned.

|

Name and

Address of Beneficial Owner(1)

|

Amount

and Nature

of

Beneficial

Ownership

|

Percentage

of Class

|

||||||

|

Guojun

Wang

|

6,850,000 | (5) | 24.91 | % | ||||

|

Ming

Ma

|

2,757,600 | (5) | 10.03 | % | ||||

|

Robert

Blair(2)

|

0 |

--

|

||||||

|

Hongwen

Liu

|

0 |

--

|

||||||

|

Wei

Wang

|

30,000 |

Less

than one percent

|

||||||

|

Feng

Wan

|

10,000 |

Less

than one percent

|

||||||

|

All such directors

and executive officers as a group (6

persons)

|

9,647,600 | (3) | 35.08 | % | ||||

|

Five

Percent Shareholders (other than directors and named executive

officers)

|

||||||||

|

Chuk Chung Fuk (3)

|

7,150,000 | (5) | 26 | % | ||||

|

China Reinv Partners, L.P. (4)

|

5,497,933 | 19.99 | % | |||||

(1) All

shares are owned of record and beneficially. Except as otherwise noted, each

shareholder’s address is c/o Dalian Vastitude Media Group, 8th

Floor, Golden Name Commercial Tower, 68 Renmin Road, Zhongshan District, Dalian,

P.R. China.

(2) The

address of this stockholder is c/o Golden Key International, Inc. 119 11th

Street, Fort Macleod, Alberta, Canada T0L 0Z0.

(3) The address of this stockholder is

Room 1105, 11/F., Tower 1, Lippo Center, No. 89 Queensway, Admiralty,

Hong Kong.

(4) The

address of this stockholder is c/o Oded Har-Even, Zysman Aharoni Gayer

& Co./Sullivan & Worcester LLP, 1290 Avenue of the Americas,

29th Floor, New York, NY 10023

U.S.A.

(5)

Mr. Guojin Wang, Ms. Ming Ma and Mr. Chuk Chung

Fuk have entered into an agreement dated November 26, 2009 pursuant to which Mr.

Wang and Ms. Ma may purchase shares of the common stock of the merged company

from Mr. Chuk for a nominal price if V-Media achieves certain revenue

thresholds.

3

INFORMATION

REGARDING THE ACQUIRED COMPANIES

Dalian Guo-Heng Management

and Consultation Co., Ltd.

Dalian Guo-Heng was incorporated as a limited liability

company on November 6, 2009 under PRC law. It is currently 100% owned by

Fortune-Rich. Due to certain restrictions and qualification

requirements under PRC law that apply to foreign investment in China’s

advertising industry, our advertising business is currently conducted through

contractual arrangements among us, our subsidiary and our consolidated

affiliated entities in China, principally V-Media and its subsidiaries. V-Media

and several of its subsidiaries hold the requisite licenses to provide

advertising services in China. These contractual arrangements enable us

to:

|

§

|

exercise

effective control over V-Media and its

subsidiaries;

|

|

§

|

receive

a substantial portion of the economic benefits from V-Media and its

subsidiaries; and

|

|

§

|

have

an exclusive option to purchase all or part of the equity interests in

V-Media and all or part of the equity interests in V-Media’s subsidiaries

that are owned by V-Media or its nominee holders, as well as all or part

of the assets of V-Media, in each case when and to the extent permitted by

PRC law.

|

Dalian Vastitude Media Group

Co., Ltd.

We are a

fast-growing advertising provider in China. Through Nine years of development,

we have become one of the largest outdoor advertising companies in China with

dominant position in Dalian, the commercial center of Northeastern China. We own

and operate an outdoor advertising network which consists of over 600 bus

shelters furnished with billboards and displays, including 130

taxi shelters with displays and 13 large-size billboards, including 3

large-size LED displays at the major traffic conjunctions. We also furnished

more than 400 buses with advertising posters and 28 metro trains throughout

Dalian Metro Lines. We provide comprehensive adverting service from art design

to advertising publishing, from daily maintenance to technical

upgrading.

As of

June 30, 2009, more than 200 advertisers purchased advertising on our network.

We have a stable and expanding advertising client base, which includes major

banks, utility companies and consumer product companies. Some of our largest

advertising clients in terms of revenue include leading international brand name

advertisers such as Coca-Cola, Pepsi, UPS, HSBC, Sony, Canon, HP and

leading domestic brand name advertisers such as China Mobile, Pin-an Insurance,

China Unicom, CITIC Bank, and China Merchant Bank, which together accounted for

approximately one third of our revenue in the fiscal year 2009. In addition, we

believe that low installation and maintenance costs for operating our network

allow us to grow our business rapidly and efficiently.

Since we

commenced our current business operations in September 2000, we have experienced

significant growth in our network and in our financial results. In

the fiscal year ended June 30, 2009, we have generated RMB 57.5 million (USD 8.4

million) in revenue and RMB 19.3 million (USD 2.8 million) of net profit

attributable to the Company, which represent over 58% and 272% increase over the

fiscal year 2008 results, respectively.

4

Our

Industry

The

advertising market in China is one of the largest and fastest growing in the

world. According to the research of Outdoor Advertising Association of America

(“OAAA”), China has become the second largest outdoor advertising market in the

world. China’s overall advertising spending has kept double digit annual growth

in the last decade; from USD 6.5 billion (RMB 53.8 billion) in 1998 to USD 20.32

billion (RMB 138.79 billion) in 2008, according to Zenith Optimedia. We believe

the growth of China’s advertising industry is being driven by a number of

factors, including high and sustained levels of economic growth, a growing

consumer class, as well as relatively low levels of advertising spending per

capita and as a percentage of gross domestic product. Our sector of the

advertising industry in China, which is referred to as outdoor advertising, is

characterized by its newness, ability to target desirable and segmented consumer

audiences and its high recall rates.

Our

Strategies, Risks and Uncertainties

In order

to enhance our position as one of the largest outdoor advertising networks in

China, we intend to expand our network, promote our brand name, create

increasingly segmented network channels and explore new digital media

opportunities. Our ability to realize our business objectives and execute our

strategies is subject to risks and uncertainties, including the

following:

|

§

|

our

limited operating history for our current operations and the short history

of outdoor advertising sector that make it difficult for you to evaluate

the viability and prospects of our

business;

|

|

§

|

competition

from present and future competitors in China’s growing advertising market;

and

|

|

§

|

the possibility that the PRC

government could determine that the agreements that establish our

operating structure do not comply with PRC government restrictions on

foreign investment in the advertising industry, which could potentially

subject us to severe

penalties.

|

These

risks and uncertainties, along with others, are also described in the Risk

Factors section of this Current Report on Form 8-K.

5

MANAGEMENT’S DISCUSSION AND

ANALYSIS

OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

You

should read the following discussion and analysis of our financial condition and

results of operations in conjunction with our consolidated financial statements

and the related notes included elsewhere in this document. The following

discussion contains forward-looking statements. Dalian Vastitude Media Group

Co., Ltd. is referred to herein as “we”, “us”, “our”, or the “Company.” The

words or phrases “would be,” “will allow,” “expect to”, “intends to,” “will

likely result,” “are expected to,” “will continue,” “is anticipated,”

“estimate,” or similar expressions are intended to identify forward-looking

statements. Such statements include, among others, those statements concerning

our expected financial performance, our corporate strategy and operational

plans. Actual results could differ materially from those projected in the

forward-looking statements as a result of a number of risks and uncertainties,

including, among others: (a) those risks and uncertainties related to general

economic conditions in China, including regulatory factors that may affect such

economic conditions; (b) whether we are able to manage our planned growth

efficiently and operate profitable operations, including whether our management

will be able to identify, hire, train, retain, motivate and manage required

personnel or that management will be able to successfully manage and exploit

existing and potential market opportunities; (c) whether we are able to generate

sufficient revenues or obtain financing to sustain and grow our operations; and

(d) whether we are able to successfully fulfill our primary requirements for

cash which are explained below under “Liquidity and Capital Resources”. Unless

otherwise required by applicable law, we do not undertake, and we specifically

disclaim any obligation, to update any forward-looking statements to reflect

occurrences, developments, unanticipated events or any other circumstances after

the date of such statement unless required by law. For additional information

regarding these risks and uncertainties, see “Risk Factors”. Our consolidated

financial statements have been prepared in accordance with U.S. GAAP. In

addition, our consolidated financial statements and the financial data included

in this document reflect the Merger and have been prepared as if our current

corporate structure had been in place throughout the relevant

periods.

Overview

We are a fast-growing outdoor media

company in China, and we operate one of the largest outdoor advertising networks

in northeast China with strong market presence in Dalian and Shenyang, the two

most popular commercial cities in Northeast China. We provide clients with

advertising opportunities through our diverse media platform which includes

three major proprietary channels, (1) Street Fixture and Display Network, which

includes bus and taxi shelters; (2) Mobile advertisement displayed on mass city

transit systems, which includes displays on city buses and metro-trains; (3)

Billboard displays along the city’s streets and highways.

We have experienced sustainable

business growth in the recent years. The size of our network has grown

significantly over the years since the commercial launch of our advertising

network. The number of bus and taxi shelters on which we operate and

carry our advertisements increased from 509 as of June 30, 2007 to 604 as

of June 30, 2009. For the same period, the number of buses that carry

our mobile advertisements increased from 330 to 337; the number of mobile

displays through Dalian metro-trains increased from 16 to 28. We also added 3

mega-screen (100 M2 to 500 M2,) (approximately 1,076.4 square feet to

5,382 square feet) LED billboards in downtown business districts, which

tripled our advertising space and time slots in our outdoor billboard network.

The number of our clients has increased from 562 to 1102 during these two

years.

6

In March 2009, we set up a new joint

venture in which we maintain a controlling equity position, Dalian Vastitude

Network Technology Co., Ltd., which specializes in providing technical support

and development to our multi-media platform and outdoor advertising customers.

In April 2007, we established Shenyang Vastitude Media Co., Ltd. In July 2009,

we launched our innovated “City Navigator” Networks, one of the most

advanced outdoor advertising platforms in China.

During the fiscal year ended June 30,

2009, we generated net revenues of US$ 8.4 million and achieved a net income

attributable to V-Media of US$ 2.83 million, which represents a growth of 57.85%

and 271.87% compared to the previous fiscal year, respectively. This dramatic

increase is attributed to the full usage of existing advertisement channels and

the increase of number and variety of advertising channels. For the three months

ended September 30, 2009, our net revenues increased to US$ 3.17 million from

US$2.10 million for the same three-month period ended September 30, 2008 and our

net income increased to US$ 0.91 million from US$0.82 million for the same

period ended September 30, 2008.

Factors

Affecting Our Results of Operations

The increase in our operating results

in the last two years is attributable to a number of factors, including the

substantial expansion of our outdoor media network in Dalian and Shenyang, the

two largest cities in Northeast China, and our technical innovation and

large-scale media system upgrading. We expect our business to

continue to be driven by the following factors:

Increasing domestic spending in outdoor

advertising

The demand for our advertising time

slots is directly related to the outdoor advertising spending in northeast

China. The increase in advertising spending is largely determined by the

economic conditions in our region. According to the “Statistical Communiqué of

the PRC on 2008 National Economic and Social Development” released by National

Bureau of Statistics of China on Feb. 26, 2009, China’s economy has experienced

rapid growth in the last five years. The annual growth rate has been in the

range of 9% to 13%. The domestic retail sales have been growing even faster than

any other sectors, with an average annual growth rate of 15.5% in the last 5

years. The latest government’s economic stimulus plan is aimed at

building a domestic consumer-driven economy, which, we believe, is going to

generate more demand for outdoor advertising. We expect the outdoor advertising

spending in our regional market will maintain its double-digit growth in the

years to come.

Expansion of Our Market Presence by Launching City Navigator ®

Networks in Other Major Commercial Cities

We believe our proprietary multi-media

advertising system – City Navigator ®

Network is one of the most advanced outdoor advertising platforms available in

China. This system combines the latest LED displaying technology, internet and

WI-FI technology, and has proven to be very effective in our competition to get

access to top tier cities such as Shanghai and Beijing.

7

By using wireless access technology,

our LED displays at bus and taxi shelters are able to display real time programs

at the control of our computer terminal. It consists of a Wi-Fi receiver,

large-screen LED display, and web-based touch-screen kiosk which provide the

public with information on all aspects of the city life, including travel,

traffic, restaurants, shopping, hotels, business, medical and education, all at

the touch of the screen. In addition, every City Navigator is

equipped with Bluetooth, wireless access and printing technology. Users can

either print the information or send the information to their cell phones or

computers. As City Navigator®

Network adopts Wi-Fi technology, users do not need to stand before a City

Navigator to receive its information. They can enjoy its service from any area

covered by its Wi-Fi signals. We intend to aggressively expand our

media platform by launching City Navigator ®

Networks in our target cities, such as, Tianjin, Qingdao and Shanghai, to create

our own cross-region advertising network and enhance our advertising

distribution capacity.

Promotion of Our Brand Name to Attract a Wider Client Base and Increase

Revenues

We plan to promote our brand name,

国域无疆TM,

through both our own media channels and public channels in North China. We

believe that the enhancement of public awareness to our brand name will help to

broaden our client base, especially in the new marketplace such as Shenyang and

Tianjin. As we expand our advertising client base and promote public’s awareness

to our brand, demand for time slots and advertising space on our network will

continue to grow.

Upgrade of Our Outdoor Billboard Network with New Digital Display

Technology

We intend to capitalize recent advances

in digital display technology, especially mega-screen LED displays, to meet

major institutional clients’ needs. Because the LED displays can be linked

through centralized computer systems to instantaneously change static

advertisements, and it is highly visible even during bright daylight, it

improves the advertising effectiveness and efficiency markedly. We

plan to build more mega-screen (100 M2 to

500 M2)

(approximately 1,076.4 square feet to 5,382 square feet) LED displays at premier

locations in our marketplace.

As we continue to expand our network, we expect to face a number of challenges.

We have expanded our network rapidly, and we, as well as our competitors, have

occupied many of the most desirable locations in Dalian. In order to continue

expanding our network in a manner that is attractive to potential advertising

clients, we must continue to identify and occupy desirable locations and to

provide effective channels for advertisers. In addition, we must react to

continuing technological innovations in the use of wireless and broadband

technology in our network, and changes in the regulatory environment, such as

the regulations allowing 100% foreign ownership of PRC advertising companies and

new regulations governing cross-border investment by PRC persons.

We

believe that our business model and success in our regional market give us a

considerable advantage over our competitors. Our future growth will

depend primarily on the following factors:

|

§

|

Overall

economic growth in China, which we expect to contribute to an increase in

advertising spending in major urban areas in China where consumer spending

is concentrated;

|

|

§

|

Our

ability to expand our network into new locations and additional

cities;

|

8

|

§

|

Our

ability to expand our sales force and engage in increased sales and

marketing efforts;

|

|

§

|

Our

ability to expand our client base through promotion of our

services;

|

|

§

|

Our

ability to expand our new systems including large-screen LED display

network and City Navigator®

Networks which commenced operation in the third quarter of

2009.

|

Corporate

Structure and Contractual Arrangements

Substantially

all of our operations are conducted in China through Dalian Guo-Heng, our

wholly-owned subsidiary in China, and through our contractual arrangements with

several of our consolidated affiliated entities in China, including V-Media and

its subsidiaries.

PRC

regulations require any foreign entities that invest directly in the advertising

services industry to have at least two years of direct operations in the

advertising industry outside of China. Since December 10, 2005, foreign

investors have been allowed to own directly 100% of PRC companies operating an

advertising business if the foreign entity has at least three years of direct

operations in the advertising business outside of China or less than 100% if the

foreign investor has at least two years of direct operations in the advertising

industry outside of China. We do not currently directly operate an advertising

business outside of China and cannot qualify under PRC regulations any earlier

than two or three years after we commence any such operations outside of China

or until we acquire a company that has directly operated an advertising business

outside of China for the required period of time. Accordingly, since we

have not been involved in the direct operation of an advertising business

outside of China, our domestic PRC subsidiary, Dalian Guo-Heng, which

is considered foreign-invested, is currently ineligible to apply for the

required advertising services licenses in China. Our advertising business is

currently provided through contractual arrangements with our consolidated

affiliated entities in China, including V-Media and its

subsidiaries. V- Media is owned by 9 PRC citizens. V-

Media and several of its subsidiaries hold the requisite licenses to provide

advertising services in China.

V-Media

and its subsidiaries directly operate our advertising network, enter into

display placement agreements and sell advertising time and space to our clients.

We have been and are expected to continue to be dependent on V-Media and its

subsidiaries to operate our advertising business until we qualify for direct

ownership of an advertising business in China under PRC laws and regulations and

acquire V-Media and its subsidiaries as our direct, wholly-owned subsidiaries,

as described below. Dalian Guo-Heng has entered into contractual arrangements

with V-Media and its subsidiaries and shareholders, pursuant to

which:

|

§

|

we

are able to exert effective control over V-Media and its

subsidiaries;

|

|

§

|

a

substantial portion of the economic benefits of V-Media and its

subsidiaries will be transferred to us;

and

|

|

§

|

Dalian

Guo-Heng or its designee has an exclusive option to purchase all or part

of the equity interests in V-Media , all or part of the equity interests

in V-Media ’s subsidiaries that are owned by V-Media or its

nominee holders, or all or part of the assets of V-Media, in each case

when and to the extent permitted by PRC

law.

|

9

In

connection with its entry into the World Trade Organization, China is required

to relax restrictions on foreign investment in the advertising industry in

China. Accordingly, since December 10, 2005, foreign investors have been

allowed to own 100% of PRC companies operating an advertising business if the

foreign entity has at least three years of direct operations in the

advertising business outside of China. We do not currently directly operate an

advertising business outside of China and cannot qualify for 100% ownership of a

PRC advertising company under PRC regulations any earlier than three years after

we commence any such operations or until we acquire a company which has directly

operated an advertising business for the required period of time. We do not

currently know how or when we will be able to qualify under these regulations.

Even if we do qualify in the future, it may be burdensome or not cost effective

for us to meet the required criteria for direct ownership. If and when we

qualify for direct ownership, we intend to explore the commercial feasibility of

changing our current structure, including possibly direct ownership

of V-Media and its subsidiaries, taking into consideration relevant

cost, market, competitive and other factors. In the event we take such steps, we

cannot assure you that we will be able to identity or acquire a qualified

foreign company for a possible future restructuring or that any restructuring we

may undertake to facilitate direct ownership will be successful.

|

●

|

Agreements

that Transfer Economic Benefits to

Us

|

Pursuant to our contractual

arrangements with V-Media and its subsidiaries, Dalian Guo-Heng provides

management and consulting

services to V- Media and its subsidiaries in exchange for service fees. The service fees shall equal to 100% of the

residual return of V-Media and its subsidiaries which can be waived by Guo-Heng from

time to time in its sole discretion.

|

●

|

Agreements

that Provide Effective Control over V-Media and Its

Subsidiaries

|

We have

entered into the following agreements with V- Media and its subsidiaries that

provide us with effective control over V- Media and its

subsidiaries:

|

§

|

an

exclusive service agreement, pursuant to which V-Media and its

Subsidiaries irrevocably entrust to Guo-Heng the right of management and

operation of V-Media and its subsidiaries and the responsibilities and

authorities of their shareholders and directors of Media and its

subsidiaries;

|

|

§

|

a

voting rights proxy agreement, pursuant to which the shareholder of

V-Media and its subsidiaries have granted the personnel designated by

Dalian Guo-Heng the right to appoint directors and senior management of

V-Media and its subsidiaries and to exercise all of their other voting

rights as shareholders of V-Media and its subsidiaries, as the case may

be, as provided under the articles of association of each such

entity;

|

|

§

|

a

call option agreement, pursuant to

which:

|

|

§

|

neither

V- Media nor any of its subsidiaries may enter into any transaction that

could materially affect its assets, liabilities, equity or operations

without the prior written consent of Dalian

Guo-Heng;

|

10

|

§

|

neither

V- Media nor any of its subsidiaries will distribute any dividends without

the prior written consent of Dalian Guo-Heng

and

|

|

§

|

Dalian

Guo-Heng or its designee has an exclusive option to purchase all or part

of the equity interests in V-Media, all or part of the equity interests in

V-Media’s subsidiaries owned by V-Media or its nominee holders, or all or

part of the assets of V-Media, in each case when and to the extent

permitted by PRC law. In case of Guo-Heng exercising the call option in

its sole discretion upon the occurrence of the situation in which such

call option exercise become feasible under the relevant laws in PRC, any

additional consideration paid other than the $1.00 which may be

required under the laws of China to effect such purchase to comply with

such legal formalities shall be either cancelled or returned to the

company immediately with no additional compensation to the owners;

and

|

|

§

|

an

equity pledge agreement pursuant to which each of shareholders of V-Media

has pledged his or its equity interest in V-Media and its subsidiaries, as

the case may be, to Dalian Guo-Heng to secure their obligations under the

relevant contractual control agreements, including but not limited to, the

obligations of V-Media and its subsidiaries under the exclusive services

agreement, the call option agreement, the voting rights proxy agreement

described above, and each of them has agreed not to transfer, sell,

pledge, dispose of or create any encumbrance on their equity interest in

V-Media or its subsidiaries without the prior written consent of Dalian

Guo-Heng.

|

See

“Related Party Transactions” for further information on our contractual

arrangements with these parties.

In the

opinion of Deheng Law Firm, our PRC legal counsel:

|

§

|

the

ownership structures of Dalian Guo-Heng, V- Media and its subsidiaries,

both currently and after giving effect to this merger, are in compliance

with existing PRC laws and

regulations;

|

|

§

|

the

contractual arrangements among Dalian Guo-Heng, V- Media and its

subsidiaries governed by PRC law are valid, binding and enforceable, and

will not result in any violation of PRC laws or regulations currently in

effect; and

|

|

§

|

the

business operations of Dalian Guo-Heng and V- Media and their

respective subsidiaries, as described in this Form 8-K, are in compliance

with existing PRC laws and regulations in all material

respects.

|

However,

in spite of the above, there are substantial uncertainties regarding the

interpretation and application of current and future PRC laws and regulations.

Accordingly, there can be no assurance that the PRC regulatory authorities, in

particular the SAIC which regulates advertising companies, will not in the

future take a view that is contrary to the above opinion of our PRC legal

counsel. If the PRC government finds that the agreements that establish the

structure for operating our PRC advertising business do not comply with PRC

government restrictions on foreign investment in advertising businesses, we

could be subject to severe penalties. See “Risk Factors — If the PRC

government finds that the agreements that establish the structure for operating

our China business do not comply with PRC governmental restrictions on foreign

investment in the advertising industry, we could be subject to severe

penalties”, “— Our business operations may be affected by legislative or

regulatory changes” and “— The PRC legal system embodies uncertainties

which could limit the legal protections available to you and us”.

11

Subsidiaries

of V- Media

The

following table sets forth information concerning V- Media’s

subsidiaries:

|

VMedia_Group’s

Ownership

Percentage

|

Region

of Operations

|

Primary

Business

|

||||

|

Shenyang

Vastitude Media Co., Ltd

|

100% |

Shenyang

|

Advertising

company

|

|||

|

Tianjin

Vastitude AD Media Co., Ltd

|

100% |

Tianjin

|

Advertising

company

|

|||

|

Dalian

Vastitude Network Technology Co., Ltd

|

60% |

Dalian

|

Computer

exploitation, technical service, domestic advertisement

|

|||

|

Dalian

Vastitude Engineering&Design Co., Ltd

|

83% |

Dalian

|

Engineering,

design, Construction

|

|||

|

Dalian

Vastitude &Modern Transit Media Co., Ltd

|

70% |

Dalian

|

Advertising company

|

Intellectual

Property

Mr. Guojun Wang, our CEO and largest

shareholder of V-Media, is the owner of 26 patents in outdoor advertising

display field. His innovations on billboards, bus and taxi shelters, newsstands,

and other street furniture have been vastly used in our outdoor display

networks.

Marketing

We market

our advertising services directly to advertisers and to advertising agencies. As

of June 30, 2009, we had 33 dedicated sales and marketing personnel. As we only

commenced our current business operations in September 2000, many of our sales

and marketing personnel have only worked for us for a short period of time. We

depend on our marketing staff to explain our service offerings to our existing

and potential clients and to cover a large number of clients in a wide variety

of industries. We will need to further increase the size of our sales and

marketing staff if our business continues to grow. We may not be able to hire,

retain, integrate or motivate our current or new marketing personnel which would

cause short-term disruptions of our operations, restrict our sales efforts and

negatively affect our advertising service revenue.

Competition

We compete with some of the largest

advertising companies in China that operate outdoor advertising networks such as

JCDecaux China, Clear Media, CBS Outdoor (China) and TOM OMG. We compete for

advertising clients primarily on the basis of network size and coverage,

location, price, the range of services that we offer and our brand name. We also

compete for overall advertising spending with other alternative advertising

media companies, such as Internet, street furniture, billboard, frame and public

transport advertising companies, and with traditional advertising media, such as

newspapers, television, magazines and radio.

Employees

V-Media

currently has 120 full-time employees as of June 30, 2009, including 21 in

manufacturing, 7 in research and development, 59 in administration and financial

department, and 33 in sales, purchasing and marketing.

Properties

Our principal executive offices are

located at 8th

Floor, Golden Name Commercial Tower, 68 Renmin Road, Zhongshan District,

Dalian, P.R. China, 116001. This office consists of approximately 8,987.94

square inches which we leased from Mr. Guojun Wang and Ms. Ming

Ma for $1 a year. The agreement will be renewed every

year.

12

Results of

Operations

Operation Results for the Three Months

Ended September 30, 2009 and 2008

The

following table sets forth information from our statements of operations for the

three months ended September 30, 2009 and 2008, in dollars and as a percentage

of revenues:

|

REVENUES

|

3

Months Ended September 30

|

|||||||||||||||

|

2009

|

2008

|

Difference

|

%

Change

|

|||||||||||||

|

Dalian

District

|

||||||||||||||||

|

Street Fixture and Display network

|

$ | 1,165,232 | $ | 1,265,543 | $ | (100,311 | ) | -7.93 | % | |||||||

|

City Transit system Display network

|

693,826 | 406,510 | 287,316 | 70.68 | % | |||||||||||

|

Outdoor

Billboards

|

792,789 | 157,147 | 635,642 | 404.49 | % | |||||||||||

|

City

Navigator

|

109,746 | - | 109,746 | 100.00 | % | |||||||||||

|

Other service income (a)

|

347,744 | 251,798 | 95,946 | 38.10 | % | |||||||||||

|

Subtotal

for Dalian District

|

$ | 3,109,337 | $ | 2,080,998 | $ | 1,028,339 | 49.42 | % | ||||||||

|

Shenyang

Distict

|

||||||||||||||||

|

Street Fixture and Display network

|

$ | 48,236 | $ | 19,122 | $ | 29,114 | 152.25 | % | ||||||||

|

Outdoor

Billboards

|

9,761 | 4,468 | 5,293 | 118.46 | % | |||||||||||

|

Subtotal

for Shenyang District

|

$ | 57,997 | $ | 23,590 | $ | 34,407 | 145.85 | % | ||||||||

|

Total

Revenues

|

$ | 3,167,334 | $ | 2,104,588 | $ | 1,062,746 | 50.50 | % | ||||||||

(a) Other service income generated by

Construction & Design service provided by V-Media Engineering & Design

Company and technique service provided by V-Media Network Technology Company to

outside customers.

Revenues

During

the three months ended September 30, 2009 we had revenues of $ 3,167,334 as

compared to revenues of $2,104,588 during the three months ended September 30,

2008, an increase of $1,062,746, or 50.5%. The increase was a result of our

increased and expanded sale to the existing and new customers in 2009.. We

expand the scope of the advertising network rapidly. We have landed

some more desirable locations in Dalian, created new advertising media platforms

and continued our efforts to expand our client base.

13

|

COST

OF REVENUE

|

3

Months Ended September 30

|

|||||||||||||||

|

2009

|

2008

|

Difference

|

%

Change

|

|||||||||||||

|

Dalian

District

|

||||||||||||||||

|

Street Fixture and Display network

|

$ | 417,300 | $ | 498,426 | $ | (81,126 | ) | -16.28 | % | |||||||

|

City Transit system Display network

|

274,621 | 181,513 | 93,108 | 51.30 | % | |||||||||||

|

Outdoor Billboards

|

317,007 | 67,395 | 249,612 | 370.37 | % | |||||||||||

|

City Navigator

|

52,013 | - | 52,013 | 100.00 | % | |||||||||||

|

Other service cost (b)

|

105,661 | 107,987 | (2,326 | ) | -2.15 | % | ||||||||||

|

Subtotal for Dalian District

|

$ | 1,166,602 | $ | 855,321 | $ | 311,281 | 36.39 | % | ||||||||

|

Shenyang

District

|

||||||||||||||||

|

Street Fixture and Display network

|

$ | 21,928 | $ | 6,649 | $ | 15,279 | 229.79 | % | ||||||||

|

Outdoor Billboards

|

4,437 | 1,554 | 2,883 | 185.52 | % | |||||||||||

|

Subtotal for Shenyang District

|

$ | 26,365 | $ | 8,203 | $ | 18,162 | 221.41 | % | ||||||||

|

Total Cost of Revenue

|

$ | 1,192,967 | $ | 863,524 | $ | 329,443 | 38.15 | % | ||||||||

(b) Other service cost attribute to

V-Media Engineering & Design Company and by V-Media Network Technology

Company when they provide Construction & Design service and technique

service to outside customers, respectively.

Cost

of Revenue

During

the 3 months ended September 30, 2009, our cost of revenue was $1,192,967, as

compared to cost of revenue of $863,524 during the 3 months ended September 30,

2008, an increase of $329,443, or 38.15%. The percentage of our increase in cost

of revenue was slightly less than that of the increase in revenue. As we become

more experienced in our operation, we have been able to cut more costs and

remain competitive. In addition, since the launch of our City Navigator and

large-screen LED, we are able to generate higher profit margin on these new

products due to lower maintenance costs.

Selling,

General and Administrative Expenses

Selling,

general and administrative expenses, totaled $581,270 during the three months

ended September 30, 2009 as compared to $340,991 for the three months ended

September 30, 2008. The increase in selling, general and administrative expense

was mainly attribute to increase in our payroll, depreciation expenses,

administrative costs and various fees associated with our efforts to go public

in the U.S. capital market

Interest

expense

Interest

expense increased from $65,236 during the three months ended September 30, 2008

to $69,359 for the three month ended September 30, 2009. The increased interest

expense resulted from the sizable increase in our loans during third quarter

2009.

Net

Income attributable to the Company

As a

result of the factors described above, we had net income attributable to the

Company in

the amount of $907,565 for the three months ended September 30, 2009, as

compared with $818,408during the three months ended September 30, 2008. The

increase in net income was mainly attributed to our increase in revenue and our

efforts to control the costs

Comprehensive

Income

Our

business operates primarily in Chinese Renminbi (“RMB”), but we report our

results in U.S. Dollars. The conversion of our accounts from RMB to U.S. Dollars

results in translation adjustments. As a result of a currency translation

adjustment gain, our comprehensive income was $820,560 during

the three months ended September 30, 2008, as compared with $910,912 during the

three months ended September 30, 2009. The increase is due to significant

currency exchange fluctuation of Chinese RMB to US Dollar for the

periods.

14

Liquidity

and Capital Resources

Presently,

our principal sources of liquidity were generated from our operations and

through bank loans. As of September 30, 2009, although we had a

negative working capital of $4,641,618, as compared to a negative working

capital of $3,974,320 as of June 30, 2009, we were still able to generate

$907,565 of net income attributable to the Company and our operating have

produced a positive cash flow of $1,282,307 for the three months ended September

30, 2009, as compared to a negative cash flow of 708,820 for the same period

ended September 30, 2008. Based on our current operating plan, we

believe that our existing resources, including cash generated from operations as

well as the bank loans, will be sufficient to meet our working capital

requirement for our current operations. In order to fully implement our business

plan and continue our growth, however, we will require additional capital either

from our shareholders or from outside sources.

Operating

Activities

Cash

provided by operating activities totaled $1,282,307 for the three months ended

September 30, 2009 as compared to $708,820 used inoperating activities for the

three months ended September 30, 2008. Increase in our cash provided by

operations is due to decrease in our advance to suppliers, increase in accounts

payable and advance from customers.

Investing

Activities

Cash used

in investing activities was $ 1,851,921 for the three months ended September 30,

2009 as compared to $340,883 used for the three months ended September 30, 2008.

Increase of cash used in investing activities is mainly because we have invested

heavily in our infrastructure related to our newly launched City

Navigator,

Financing

Activities

Cash

provided by financing activities totaled $557,136 for the three months ended

September 30, 2009 as compared to $1,076,520 provided for the three months ended

September 30, 2008. Decrease in cash provided by financing activities is because

we did not receive any new capital contributions from our shareholders for this

period.

15

Operation

Results of the Fiscal Year Ended June 30, 2008 and 2009

Revenues

We

generate revenues from the sale of outdoor advertising on our advertising

network. The following table sets the revenues generated from each of our

advertising categories for the periods indicated.

|

REVENUES

|

For

the year ended June 30

|

|||||||||||||||

|

2009

|

2008

|

Difference

|

%

Change

|

|||||||||||||

|

Dalian

District

|

||||||||||||||||

|

Street Fixture and Display network

|

$ | 4,353,014 | $ | 2,478,201 | $ | 1,874,813 | 75.65 | % | ||||||||

|

City Transit system Display network

|

1,836,678 | 1,418,440 | 418,238 | 29.49 | % | |||||||||||

|

Outdoor Billboards

|

1,564,299 | 568,722 | 995,577 | 175.06 | % | |||||||||||

|

Other service income (a)

|

472,619 | 867,660 | (395,041 | ) | -45.53 | % | ||||||||||

|

Subtotal for Dalian District

|

$ | 8,226,610 | $ | 5,333,023 | $ | 2,893,587 | 54.26 | % | ||||||||

|

Shenyang

District

|

||||||||||||||||

|

Street Fixture and Display network

|

$ | 159,471 | $ | - | $ | 159,471 | 100.00 | % | ||||||||

|

Outdoor Billboards

|

32,270 | - | 32,270 | 100.00 | % | |||||||||||

|

Subtotal for Shenyang District

|

$ | 191,741 | $ | - | $ | 191,741 | 100.00 | % | ||||||||

|

Total

Revenues

|

$ | 8,418,351 | $ | 5,333,023 | $ | 3,085,328 | 57.85 | % | ||||||||

(a)

Other service income generated by Construction & Design service provided by

V-Media Engineering & Design Company and technique service provided by

V-Media Network Technology Company to outside customers.

During

the year ended June 30, 2009, we had revenues of $8,418,351, as compared

with $5,333,023 during the year ended June 30, 2008, an increase of

approximately $3,085,328, or 57.85% due to our increased and expanded sale to

the existing and new customers in 2009. Our advertising network has been

expanded quickly. We obtained more desirable locations in Dalian for

advertisements, created new media platforms and continued our efforts to expand

our client base.

16

Cost

of Revenue

|

COST

OF REVENUE

|

For

the year ended June 30

|

|||||||||||||||

|

2009

|

2008

|

Difference

|

%

Change

|

|||||||||||||

|

Dalian

District

|

||||||||||||||||

|

Street Fixture and Display network

|

$ | 1,663,837 | $ | 1,640,933 | $ | 22,904 | 1.40 | % | ||||||||

|

City Transit system Display network

|

793,751 | 779,942 | 13,809 | 1.77 | % | |||||||||||

|

Outdoor Billboards

|

536,828 | 360,449 | 176,379 | 48.93 | % | |||||||||||

|

Other service cost (b)

|

335,676 | 434,931 | (99,255 | ) | -22.82 | % | ||||||||||

|

Subtotal for Dalian District

|

$ | 3,330,092 | $ | 3,216,255 | $ | 113,837 | 3.54 | % | ||||||||

|

Shenyang

District

|

||||||||||||||||

|

Street Fixture and Display network

|

$ | 100,516 | $ | - | $ | 100,516 | 100.00 | % | ||||||||

|

Outdoor Billboards

|

23,486 | - | 23,486 | 100.00 | % | |||||||||||

|

Subtotal for Shenyang District

|

$ | 124,002 | $ | - | $ | 124,002 | 100.00 | % | ||||||||

|

Total Cost of Revenue

|

$ | 3,454,094 | $ | 3,216,255 | $ | 237,839 | 7.39 | % | ||||||||

During

the year ended June 30, 2009, we had cost of revenue of $3,454,094, as compared

with cost of revenue of $3,216,255, an increase of approximately $237,839, or

7.39%, reflecting the increase in revenues. The gross profit rose to $4,964,257,

or a 134.52% increase during the year ended June 30, 2009 compared with the year

ended June 30, 2008. The major reasons for the dramatic increase of

gross profit from 2008 to 2009 are as following: 1) Increased usage of

advertising space as we have been able to secure more popular locations and have

raised more brand awareness among our customers; 2) we are also able to realize

more profits on some of our new advertising channels, such as large-screen LED

billboards, due to lower maintenance costs and higher fee charged.

Selling,

General and Administrative Expenses

Our operating expenses were

$1,363,966 during the year ended June 30, 2009, compared with $1,174,148 during

the year ended June 30, 2008, an increase of $189,818, or approximately 16.17%.

Reflect the increased salary expense, depreciation expense and other

administrative expense.

Interest

Expense

Interest

expense increased from $235,182 during the year ended June 30, 2008 to $260,943

for the year ended June 30, 2009. The increase interest expense resulted from

the increase in our loans during 2009, as we borrowed to fund the rapid growth

in our sales and to invest in our infrastructure.

Net

Income attributable to the Company

As a

result of the factors described above, we had net income attributable to

the Company in the amount of $2,830,224 during the year ended June 30,

2009, compared with $761,078 during the year ended June 30, 2008. The increase

in net income was mainly attributed to our increase in revenue and our efforts

to control the costs.

Also, as

a result of a currency translation adjustment gain, our comprehensive income was

$2,837,667 during the year ended June 30 , 2009, compared with $770,190 during

the year ended June 30 , 2008. The change is due to the significant currency

exchange fluctuation.

17

Liquidity

and Capital Resources

Presently,

our principal sources of liquidity were generated from our operations and

through bank loans. As of June 30, 2009, although we had a negative

working capital of $3,974,320, as compared to a negative working capital of

$3,654,572 as of June 30, 2008, we were still able to generate $2,830,224 of net

income attributable to the Company and our operating have produced a positive

cash flow of $1,423,288 for the year ended June 30, 2009, as compared to only

$210,178 cash generated for the year ended June 30, 2008. Based on

our current operating plan, we believe that our existing resources, including

cash generated from operations as well as the bank loans, will be sufficient to

meet our working capital requirement for our current operations. In order to

fully implement our business plan and continue our growth, however, we will

require additional capital either from our shareholders or from outside

sources.

Operating

Activities

For the

year ended June 30, 2009, our operations generated cash in the total amount of

$1,423,288, as opposed to $210,178 used in operating activities for the year

ended June 30, 2008. This increase was mainly composed of the significant

increase in our net income and increased collections on our accounts

receivable.

Investing

Activities

Cash used

in investing activities was $4,056,536 for the year ended June 30, 2009 as

compared to only $532,779 for the year ended June 30, 2008. We have invested

heavily in building our infrastructures, including spending on purchase and

installation of our new products, City Navigator and Mega-screen

LEDs.

Financing

Activities

For the

year ended June 30, 2009, we have financed a total amount of $2,636,426 through

the bank loans and capital contributions, as compared to $386,091

provided by financing activities for the year ended June 30, 2008. Increase in

cash provided by financing activities is due to the increased short term loans

and long term bank loans.

Off-Balance

Sheet Arrangements

Neither

Fortune-Rich, Dalian Guo-Heng, nor V-Media or its subsidiaries has

any off-balance sheet arrangements that have or are reasonably likely to have a

current or future effect on their financial condition or results of

operations.

18

China’s

Advertising Market

The

advertising market in China is one of the largest and fastest growing

advertising markets in the world and has the following

characteristics:

|

§

|

Largest Market in Asia

Excluding Japan. Advertising spending in China totaled

$7.7 billion in 2003 according to ZenithOptimedia’s December 2004

Advertising Expenditure

Forecasts report, making it the largest advertising market in Asia

excluding Japan.

|

|

§

|

High Growth Rate.

According to ZenithOptimedia, advertising spending in China grew 20.8%

between 2002 and 2003 compared to the average worldwide growth rate of

3.0%, making it one of the fastest growing advertising markets in the

world during that period.

|

|

§

|

Urban Concentration of

Advertising Spending. Advertising spending in China is highly

concentrated in China’s more economically developed regions and

increasingly concentrated in urban areas. For example, Beijing, Shanghai

and Guangdong province (Guangdong province includes the major cities of

Guangzhou and Shenzhen), together accounted for 49.3% of total advertising

spending in China in 2003, according to the State Administration for

Industry and Commerce.

|

|

§

|

Importance of New Alternative

Advertising Media. Alternative advertising media, which is a term

we use to refer to media other than traditional broadcast and print media,

account for a larger percentage of total advertising spending in China

compared to Europe, the United States and other countries in

Asia.

|

|

§

|

Fragmented Industry.

The advertising industry in China is highly fragmented and is not

dominated by a small number of advertising companies. According to the

China Advertising Association, there were approximately 66,400 advertising

companies in China in 2003.

|

Market Size and

Composition. According to ZenithOptimedia statistics, China’s advertising

market in terms of advertising spending is expected to remain the largest in

Asia excluding Japan through at least 2007. The following table sets forth

historical and estimated future advertising spending in the countries and

regions described and for the years indicated:

| 2001 | 2002 | 2003 | 2004E | 2005E | 2006E | 2007E | ||||||||||||||||||||||

| (In billions of U.S. dollars) | ||||||||||||||||||||||||||||

| China | 5.1 | 6.3 | 7.7 | 9.0 | 10.5 | 12.2 | 14.2 | |||||||||||||||||||||

|

South

Korea

|

5.6 | 6.5 | 6.8 | 6.4 | 6.3 | 6.6 | 6.9 | |||||||||||||||||||||

|

India

|

1.8 | 1.9 | 2.1 | 2.7 | 2.9 | 3.1 | 3.3 | |||||||||||||||||||||

| Taiwan | 1.9 | 1.9 | 2.1 | 2.2 | 2.3 | 2.4 | 2.5 | |||||||||||||||||||||

| Hong Kong | 1.9 | 1.9 | 2.0 | 2.1 | 2.3 | 2.4 | 2.5 | |||||||||||||||||||||

| Other Asia (1) (excluding Japan) | 4.9 | 5.7 | 6.4 | 8.0 | 9.2 | 10.7 | 12.4 | |||||||||||||||||||||

| Total Asia (excluding Japan) | 21.2 | 24.2 | 27.0 | 30.5 | 33.5 | 37.4 | 41.8 | |||||||||||||||||||||

| Japan | 38.9 | 36.3 | 36.2 | 38.0 | 39.2 | 40.3 | 41.5 | |||||||||||||||||||||

| Total Asia | 60.1 | 60.4 | 63.2 | 68.5 | 72.6 | 77.7 | 83.3 | |||||||||||||||||||||

| United States | 147.2 | 149.8 | 152.3 | 161.5 | 168.2 | 177.0 | 186.2 | |||||||||||||||||||||

(1) Other Asia includes Indonesia,

Malaysia, Philippines, Singapore, Thailand and Vietnam.

Source: Advertising

Expenditure Forecasts, ZenithOptimedia, December 2004.

19

The

advertising industry is generally divided into television, newspaper, magazine,

radio and other types of advertising media. Other advertising media includes

Internet, outdoor, billboard, out-of-home, bus-stop display and other outdoor

advertising media. Other advertising media account for a larger percentage of

total advertising spending in China than in Europe, the United States or other

countries in the Asia Pacific region. The following table sets forth the

percentage breakdown of advertising spending by medium in the countries and

regions described below for 2003:

| Country/Region: | Television | Newspaper | Magazine | Radio | Other | |||||||||||||||

| China | 40.2 | % | 38.3 | % | 3.8 | % | 4.0 | % | 13.5 | % | ||||||||||

| Asia (1) | 44.7 | % | 30.4 | % | 7.9 | % | 4.4 | % | 12.6 | % | ||||||||||

|

United

States

|

33.9 | % | 30.4 | % | 14.3 | % | 12.9 | % | 8.6 | % | ||||||||||

| Europe (2) | 33.3 | % | 32.3 | % | 19.6 | % | 5.6 | % | 9.3 | % | ||||||||||

|

(1)

|

Asia includes China, Hong

Kong, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South

Korea, Thailand and Vietnam.

|

|

(2)

|

Europe includes Austria,

Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany,

Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Netherlands, Norway,

Poland, Portugal, Spain, Sweden, Switerland, and the United

Kingdom.

|

| Source: Advertising Expenditure Forecasts, ZenithOptimedia, December 2004. |

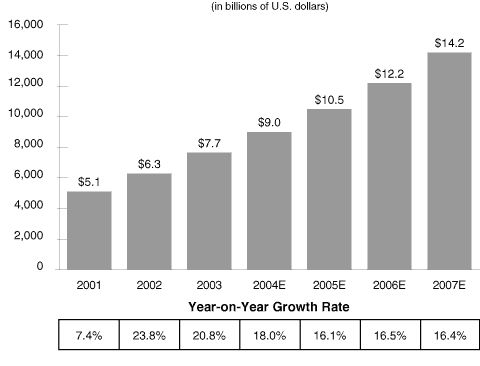

Growth. We

believe advertising spending in China has considerable growth potential over the

next few years. According to ZenithOptimedia, advertising spending in China is

expected to increase to $14.2 billion in 2007 from $7.7 billion in

2003, a compound annual growth rate of 16.3% from 2004 to 2007, a much faster

rate compared to 6.8%, 4.9% and 4.8%, respectively, for Asia, the United States

and Europe. However, we cannot provide any assurance that we or our business

will benefit from growth that occurs in China’s advertising industry. The

following table sets forth the historical and prospective growth in advertising

spending in China for the periods indicated.

|

Source:

|

Advertising

Expenditure Forecasts, ZenithOptimedia, December

2004.

|

20

The

growth of China’s advertising industry is being driven by a number of factors

including:

|

§

|

High and Sustained Levels of

Economic Growth. China’s economy has grown and continues to grow

rapidly compared to the growth experienced by other developed economies.

China’s GDP grew by 8.9%, 8.1% and 11.1% in 2001, 2002 and 2003,

respectively, and is projected to grow by 13.2%, 10.7%, 10.0% and 9.8% in

2004, 2005, 2006 and 2007 according to

ZenithOptimedia.

|

|

§

|

Growing Consumer Class.

We believe the emergence and ongoing expansion of a consumer class

concentrated in major cities in China will encourage companies to spend

increasing amounts on advertising for new products and services

particularly in major urban areas.

|

|

§

|

Relatively Low Levels of

Advertising Spending in China Per Capita and as a Percentage of

GDP. Advertising spending per capita and as a percentage of GDP in

China remains very low relative to other countries and regions, indicating

that there is significant growth potential in China’s advertising industry

as its consumer markets continue to develop and income levels

increase.

|

The

following table sets forth advertising spending per capita and as a percentage

of GDP for the countries and regions indicated for 2003:

| Advertising Spending | ||||||||

| Country/Region |

Per

Capita

|

As

a

Percentage

of

GDP

|

||||||

|

(in

U.S. dollars,

except

percentages)

|

||||||||

| China | $ | 6 | 0.5 | % | ||||

| Hong Kong | $ | 282 | 1.3 | % | ||||

| South Korea | $ | 142 | 1.1 | % | ||||

| Japan | $ | 284 | 0.8 | % | ||||

| Asia (1) Weighted Average | $ | 21 | 0.8 | % | ||||

| United Kingdom | $ | 288 | 1.0 | % | ||||

| United States | $ | 518 | 1.4 | % | ||||

|

(1)

|

Asia includes China, Hong Kong,

India, Indonesia, Japan, Malaysia, Philippines, Singaport, South Korea,

Taiwan, Thailand, and Vietnam.

|

Source: Advertising

Expenditure Forecasts, ZenithOptimedia, December 2004

Rapid

Urbanization and Concentration of Advertising Spending. While the total

size of China’s advertising market is expected to increase by a compound annual

growth rate of 16.3% from 2004 to 2007, we expect that advertising spending in

certain regions and urban areas will increase at a faster rate compared to the

national average. This is due to:

|

§

|

Rapid urbanization.

According to the National Bureau of Statistics of China, China’s

urban population increased from 17.9% in 1978 to 29.0% in 1995, to 40.5%,

or 523 million people, in 2003. China’s Academy of Social Sciences

estimates that China’s urban population will reach 610 million people

by 2010.

|

|

§

|

Faster growth of consumer

spending in urban areas. Rapid urbanization, in turn, will result

in faster growth of consumer spending in urban areas, which already

accounts for a disproportionately larger amount of consumer spending.

According to the National Bureau of Statistics, in 2004, 77.4% of retail

sales for consumer goods took place in urban areas. Retail sales in urban

areas grew by 14.4% compared to growth in rural areas of 9.9% relative to

the same period in 2003.

|

The

impact of these trends is particularly notable in certain regions and urban

centers. For example, Beijing, Shanghai and Guangdong province (Guangdong

includes the major cities of Guangzhou and Shenzhen) together accounted for

49.3% of total advertising spending in China in 2003, according to the State

Administration for Industry and Commerce, while accounting for only 8.6% of the

population in 2003.

Outdoor

Advertising Networks in China

The rapid

development of outdoor advertising networks is a relatively recent development

in China. This form of advertising allows advertisers to effectively reach

increasingly mobile and urbanized target audiences. We believe that this form of

advertising appeals to advertisers for several reasons:

Provides an

Alternative and Supplement to Other Advertising Media. We believe

technological innovations and changing consumer habits have eroded the market

appeal of more traditional advertising media. For instance, total television

advertising spending as a percentage of all advertising spending in China has

decreased from 45.4% in 1999 to 40.2% in 2003 according to

ZenithOptimedia.

21

We

believe that the primary reasons for this include:

|

§

|

the

prevalence of digital-video recording and other technologies that enable

consumers to avoid watching television

advertising;

|

|

§

|

the

overall lack of high quality entertainment options for television viewers

in China leading to low viewer rates by desired consumer

groups;

|

|

§

|

changes

in consumer demographics and behavior, including the tendency of consumers

to spend greater periods of time out of home in professional and

commercial settings; and

|

|

§

|

technological

innovations in recent years that have provided advertisers with new means

to reach consumers in a wider range of locations, including the Internet

and, in our case, the development of outdoor advertising

displays.

|

Effective

Audience Reach and Attractive

Medium Welcomed by Consumers. Our outdoor advertising

networks are usually installed in venues such as bus shelters, taxi shelters and

Metro lines which occupy popular locations of the city which have a large

concentration of population. It has unlimited viewing exposure to the public and

our state-of-the-art display technology makes our displays very attractive to

watch and provides vast amount of information to the commuters.

Cost Effective.

Placed in public areas in populous urban centers where large numbers of

people congregate, outdoor advertising can reach consumers at a lower cost than

most mass media advertising such as traditional television.

We

believe that as we apply new display technologies, improve the existing display

network and expand into new market, we will continue to experience significant

growth in terms of market share of total advertising spending in the

region.

An

investment in our common stock or other securities involves a number of