Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DELTA AIR LINES, INC. | t66799_8k.htm |

Exhibit 99.1

Delta Air Lines

Hank Halter

Chief Financial Officer

Next Generation Equity Research 2009 U.S. Airline Conference

December 9, 2009

Safe Harbor

This presentation contains various projections and other forward-looking statements which represent Delta’s estimates or expectations regarding future events. All forward-looking statements involve a number of assumptions, risks and uncertainties, many of which are beyond Delta’s control, that could cause

the actual results to differ materially from the projected results. Factors which could cause such differences include, without limitation, business, economic, competitive, industry, regulatory, market and financial uncertainties and contingencies, as well as the “Risk Factors” discussed in Delta’s Form 10-Q filed with the SEC on October 27, 2009. Caution should be taken not to place undue reliance on Delta’s forward-looking statements, which represent Delta’s views only as of the

date of this presentation, and which Delta has no current intention to update.

In this presentation, we will discuss certain non-GAAP financial measures. You can find the reconciliations of those measures to comparable GAAP measures on our website at delta.com.

1

2

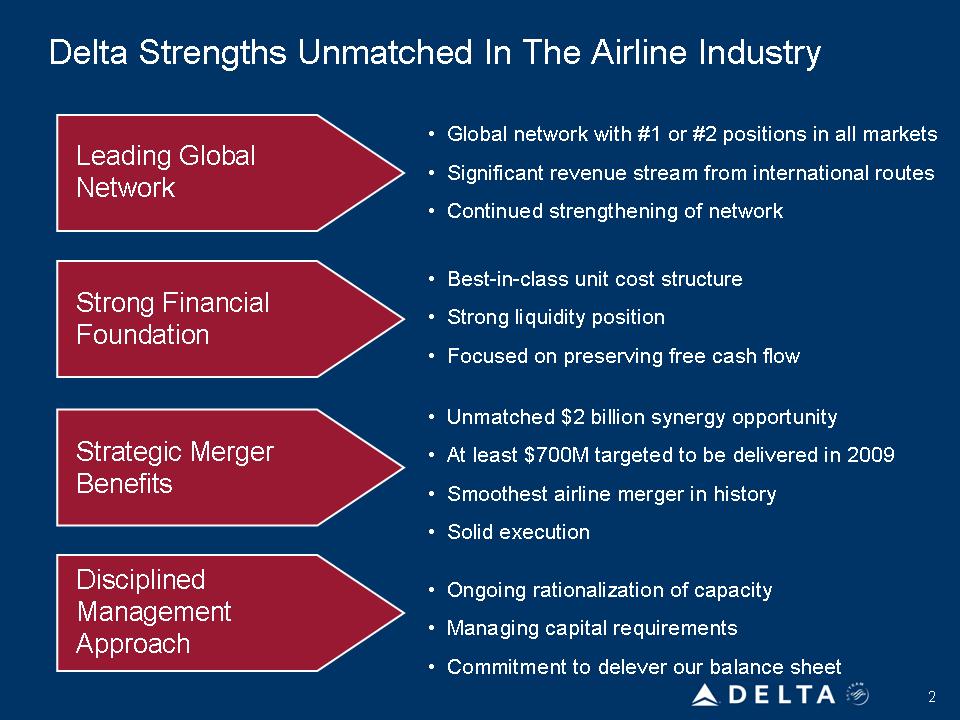

• Unmatched $2 billion synergy opportunity

• At least $700M targeted to be delivered in 2009

• Smoothest airline merger in history

• Solid execution

• Global network with #1 or #2 positions in all markets

• Significant revenue stream from international routes

• Continued strengthening of network

Strategic Merger

Benefits

Leading Global

Network

Delta Strengths Unmatched In The Airline Industry

• Ongoing rationalization of capacity

• Managing capital requirements

• Commitment to delever our balance sheet

Disciplined

Management

Approach

Strong Financial

Foundation

• Best-in-class unit cost structure

• Strong liquidity position

• Focused on preserving free cash flow

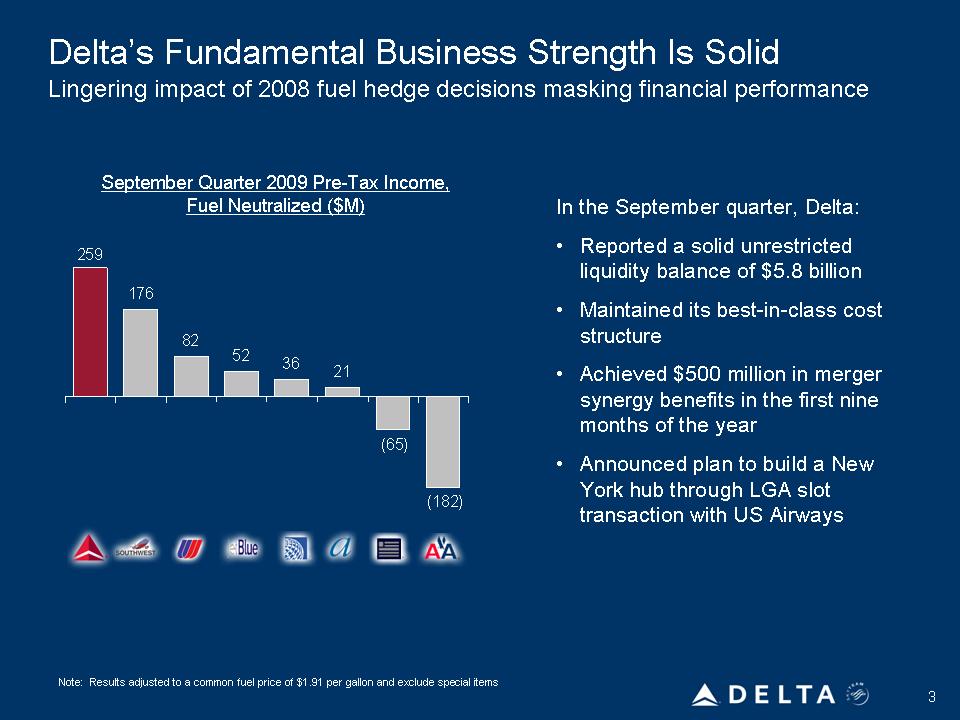

Delta’s Fundamental Business Strength Is Solid

Lingering impact of 2008 fuel hedge decisions masking financial performance September Quarter 2009 Pre-Tax Income, Fuel Neutralized ($M)

176

82

52 36 21

(65)

(182)

In the September quarter, Delta:

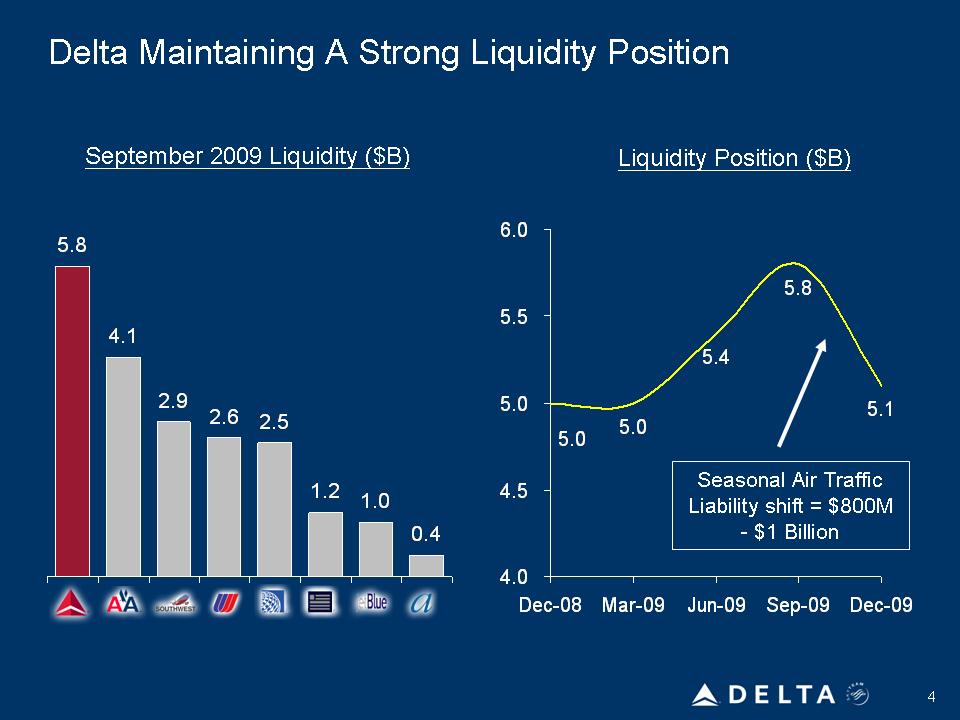

• Reported a solid unrestricted liquidity balance of $5.8 billion

• Maintained its best-in-class cost structure

• Achieved $500 million in merger synergy benefits in the first nine months of the year

• Announced plan to build a New York hub through LGA slot transaction with US Airways

Note: Results adjusted to a common fuel price of $1.91 per gallon and exclude special items

Delta Maintaining A Strong Liquidity Position

September 2009 Liquidity ($B)

6.0

5.5

4.1

2.9 5.0

2.6 2.5

1.2 1.0 4.5

0.4

4.0

Liquidity Position ($B)

5.1

5.8

5.4

5.0

5.0

Seasonal Air Traffic

Liability shift = $800M

-$1 Billion

Dec-08 Mar-09 Jun-09 Sep-09 Dec-09

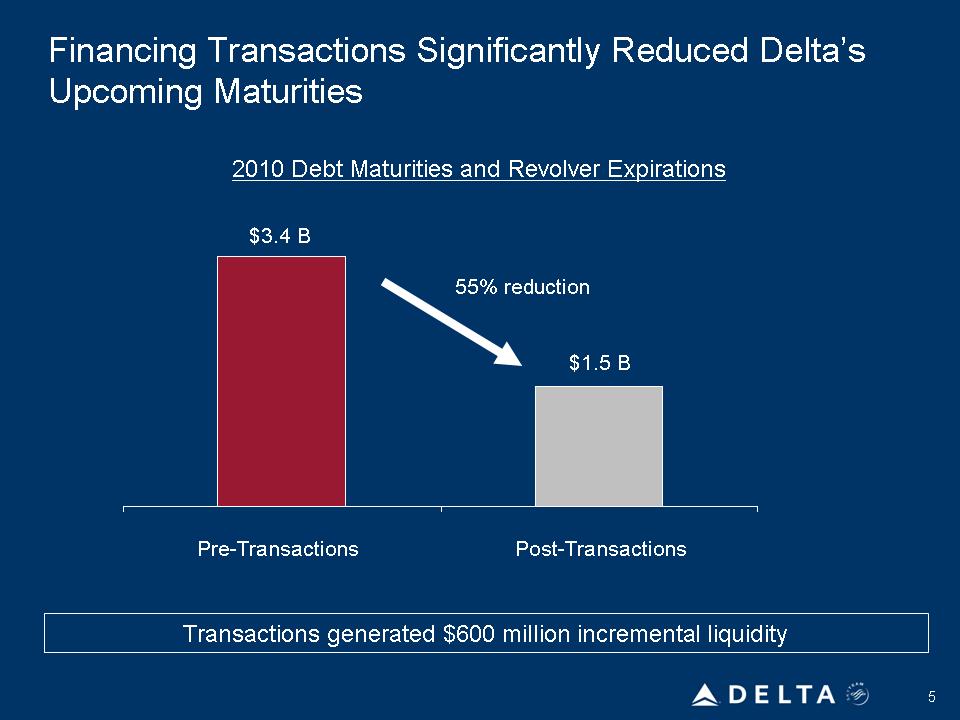

Financing Transactions Significantly Reduced Delta’s

Upcoming Maturities

2010 Debt Maturities and Revolver Expirations

$3.4 B

55% reduction

$1.5 B

Pre-Transactions Post-Transactions

5

Transactions generated $600 million incremental liquidity

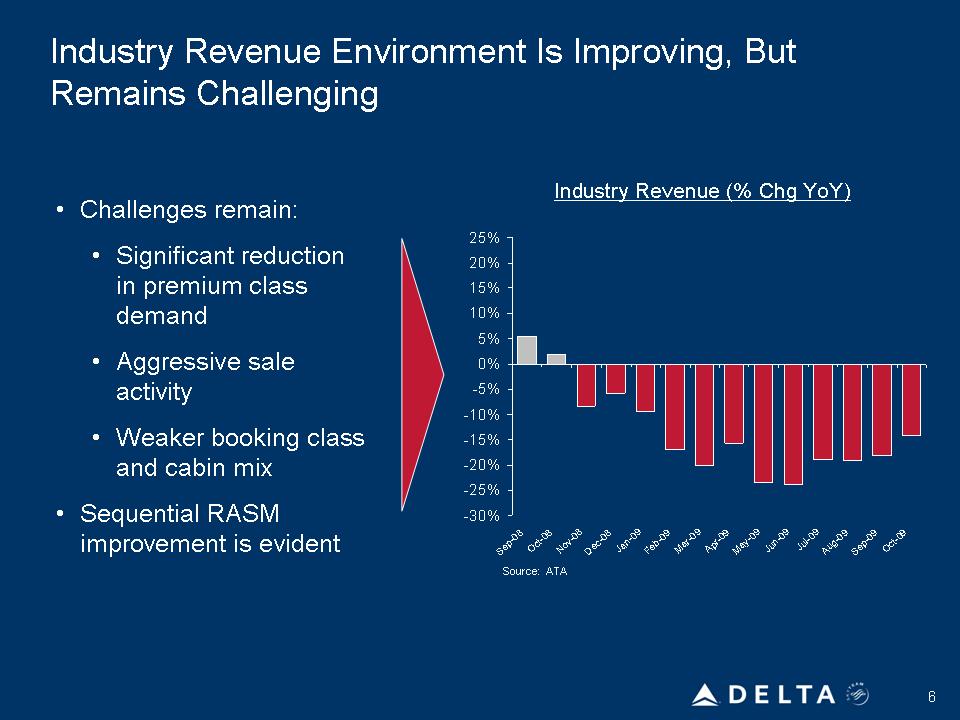

Industry Revenue Environment Is Improving, But

Remains Challenging

• Challenges remain:

• Significant reduction in premium class demand

• Aggressive sale activity

• Weaker booking class and cabin mix

• Sequential RASM improvement is evident

Industry Revenue (% Chg YoY)

25%

20%

15%

10%

5%

0%

-5%

-10%

-15%

-20%

-25%

-30%

Source: ATA

6

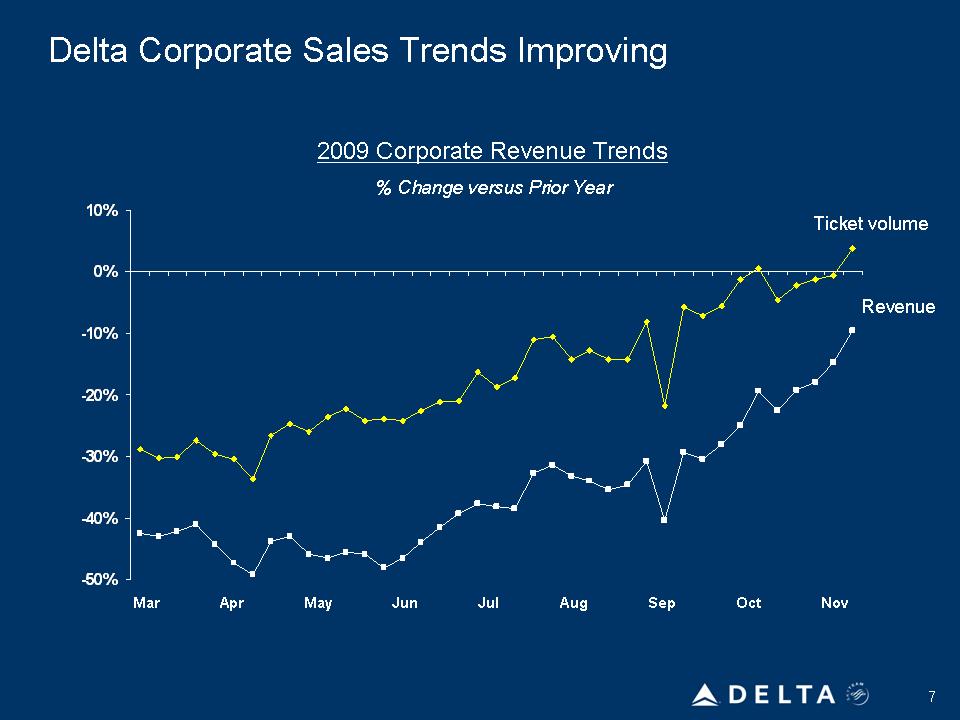

Delta Corporate Sales Trends Improving

2009 Corporate Revenue Trends

% Change versus Prior Year

Ticket volume

Revenue

10%

0%

-10%

-20%

-30%

-40%

-50%

Mar Apr May Jun Jul Aug Sep Oct Nov

7

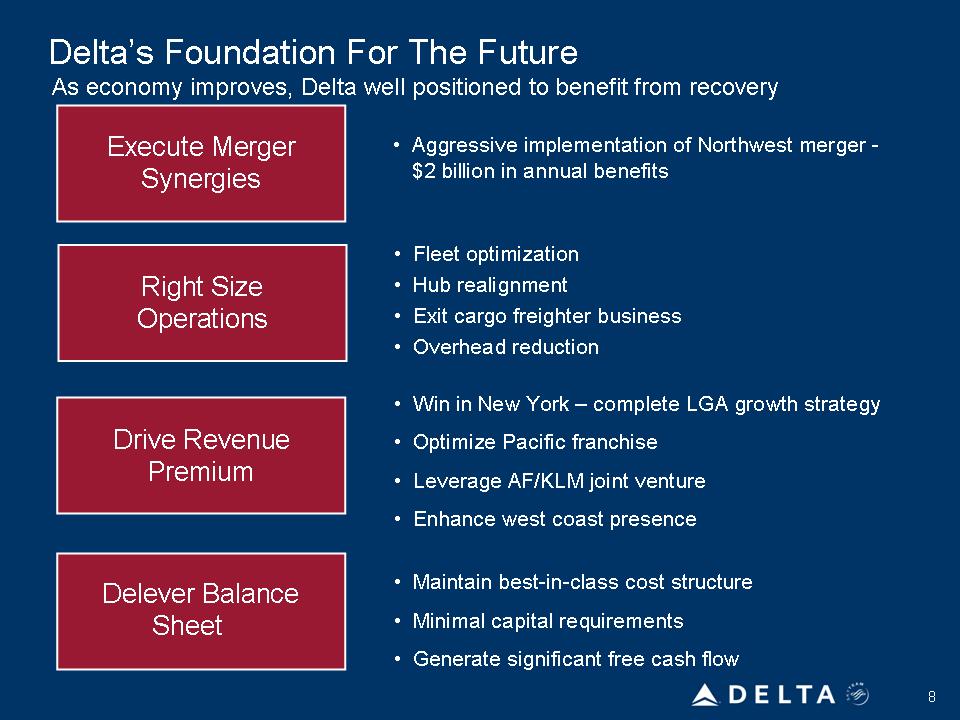

Delta’s Foundation For The Future

As economy improves, Delta well positioned to benefit from recovery

Drive Revenue

Premium

Execute Merger

Synergies

Delever Balance

Sheet

Right Size

Operations

• Aggressive implementation of Northwest merger $2 billion in annual benefits

• Fleet optimization

• Hub realignment

• Exit cargo freighter business

• Overhead reduction

• Win in New York – complete LGA growth strategy

• Optimize Pacific franchise

• Leverage AF/KLM joint venture

• Enhance west coast presence

• Maintain best-in-class cost structure

• Minimal capital requirements

• Generate significant free cash flow

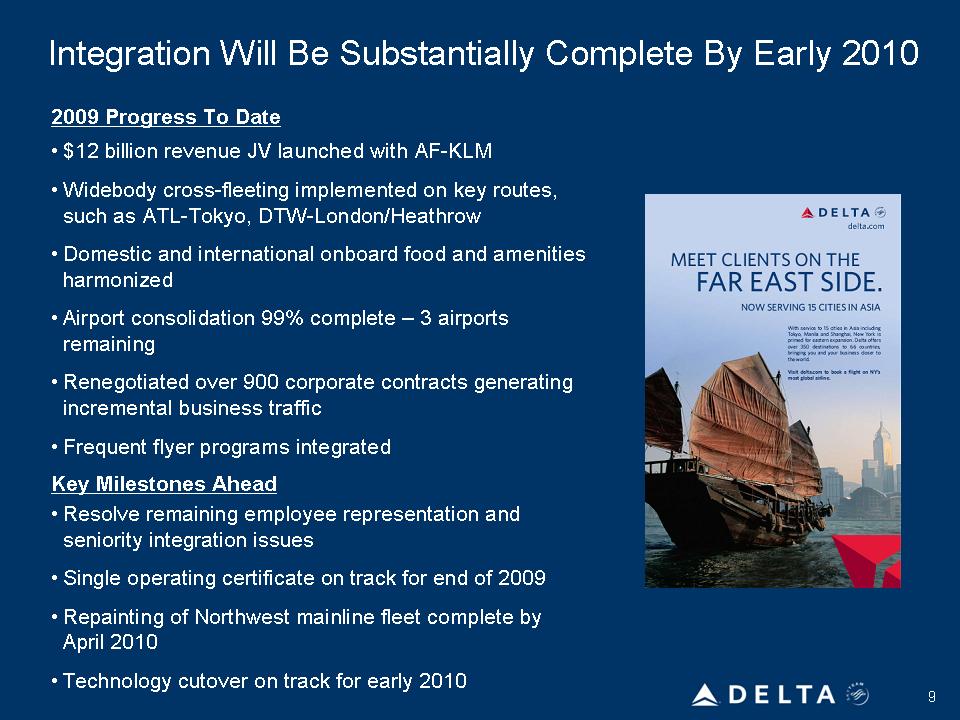

Integration Will Be Substantially Complete By Early 2010

2009 Progress To Date

• $12 billion revenue JV launched with AF-KLM

• Widebody cross-fleeting implemented on key routes, such as ATL-Tokyo, DTW-London/Heathrow

• Domestic and international onboard food and amenities harmonized

• Airport consolidation 99% complete – 3 airports remaining

• Renegotiated over 900 corporate contracts generating incremental business traffic

• Frequent flyer programs integrated

Key Milestones Ahead

• Resolve remaining employee representation and seniority integration issues

• Single operating certificate on track for end of 2009

• Repainting of Northwest mainline fleet complete by April 2010

• Technology cutover on track for early 2010

9

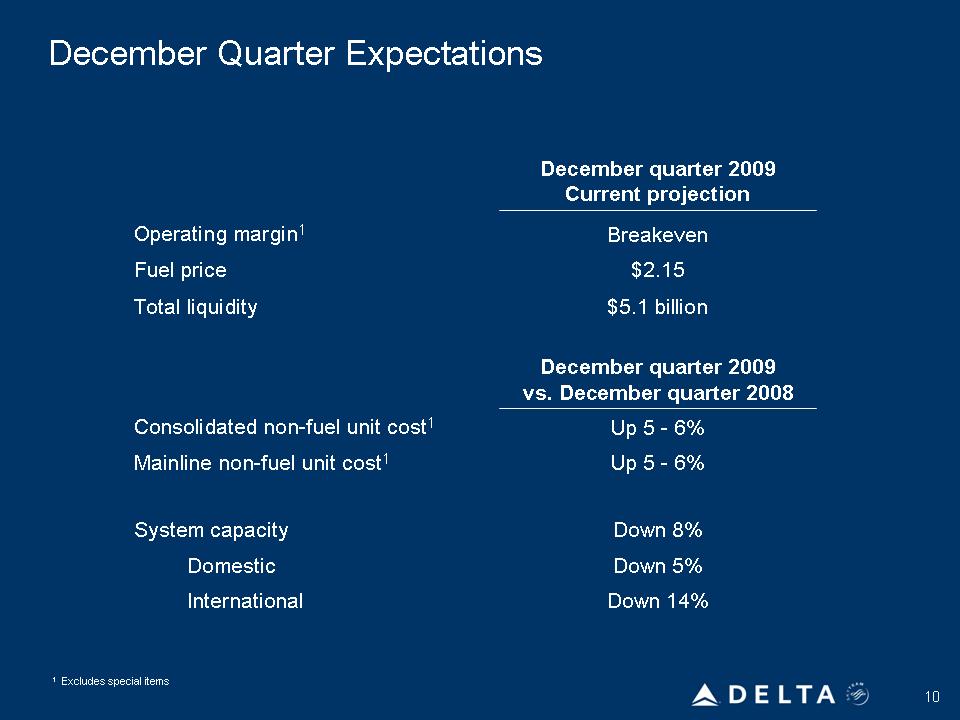

December Quarter Expectations

Operating margin1

Fuel price

Total liquidity

Consolidated non-fuel unit cost1

Mainline non-fuel unit cost1

System capacity

Domestic

International

December quarter 2009

Current projection

Breakeven

$2.15

$5.1 billion

December quarter 2009

vs. December quarter 2008

Up 5 -6%

Up 5 -6%

Down 8%

Down 5%

Down 14%

1 Excludes special items

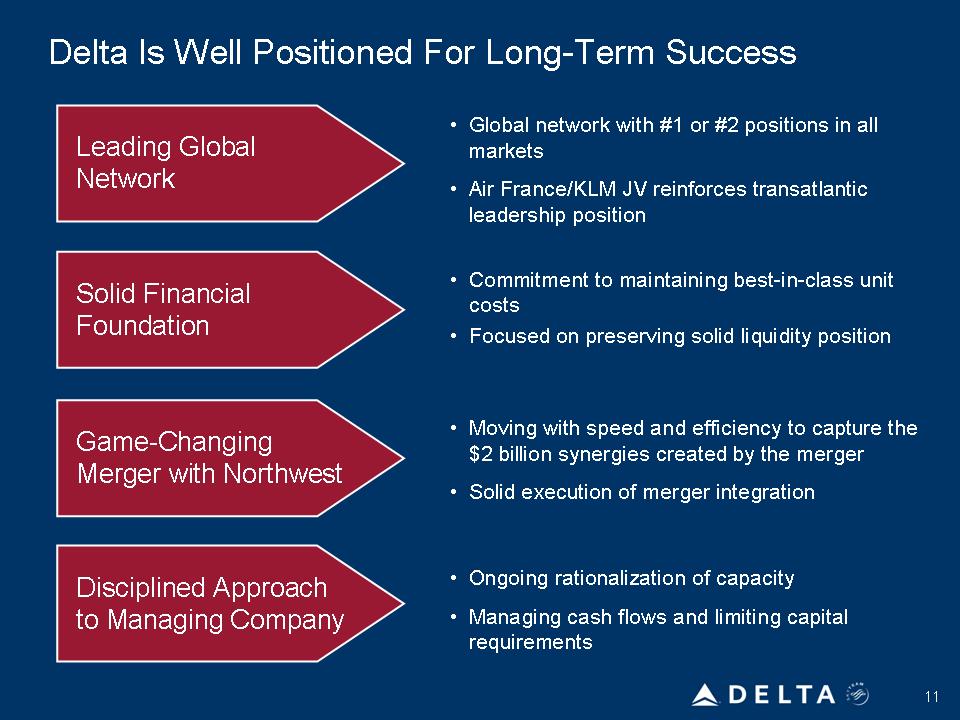

Delta Is Well Positioned For Long-Term Success

Game-Changing

Merger with Northwest

Leading Global

Network

Disciplined Approach

to Managing Company

Solid Financial

Foundation

• Global network with #1 or #2 positions in all markets

• Air France/KLM JV reinforces transatlantic leadership position

• Commitment to maintaining best-in-class unit costs

• Focused on preserving solid liquidity position

• Moving with speed and efficiency to capture the $2 billion synergies created by the merger

• Solid execution of merger integration

• Ongoing rationalization of capacity

• Managing cash flows and limiting capital requirements

11