Attached files

| file | filename |

|---|---|

| 8-K - COURTESY COPY OF CURRENT REPORT ON FORM 8-K - PEPCO HOLDINGS LLC | dec8-phi8k.pdf |

| EX-99 - COURTESY COPY OF WELLS FARGO PRESENTATION - PEPCO HOLDINGS LLC | ex-99.pdf |

| 8-K - CURRENT REPORT ON FORM 8-K - PEPCO HOLDINGS LLC | dec8-phi8k.htm |

WELLS

FARGO • UTILITY

SYMPOSIUM • DECEMBER 9,

2009

Joseph

M. Rigby

President,

Chairman & Chief Executive Officer

Some of

the statements contained in today’s presentations are forward-looking statements

within the meaning of Section 21E of

the Securities Exchange Act of 1934 and are subject to the safe harbor created by the Private Securities Litigation Reform Act of

1995. These statements include all financial projections and any declarations regarding management’s intents, beliefs or current

expectations. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,”

“plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of such terms or other comparable

terminology. Any forward-looking statements are not guarantees of future performance, and actual results could differ materially

from those indicated by the forward-looking statements. Forward-looking statements involve estimates, assumptions, known and

unknown risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to be

materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-

looking statements. Each forward-looking statement speaks only as of the date of the particular statement, and we undertake no

obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or

otherwise. A number of factors could cause actual results or outcomes to differ materially from those indicated by the forward-

looking statements contained in this presentation. These factors include, but are not limited to, prevailing governmental policies

and regulatory actions affecting the energy industry, including with respect to allowed rates of return, industry and rate structure,

acquisition and disposal of assets and facilities, operation and construction of plant facilities, recovery of purchased power

expenses, and present or prospective wholesale and retail competition; changes in and compliance with environmental and safety

laws and policies; weather conditions; population growth rates and demographic patterns; competition for retail and wholesale

customers; general economic conditions, including potential negative impacts resulting from an economic downturn; growth in

demand, sales and capacity to fulfill demand; changes in tax rates or policies or in rates of inflation; rules and changes in

accounting standards or practices; changes in project costs; unanticipated changes in operating expenses and capital

expenditures; the ability to obtain funding in the capital markets on favorable terms; restrictions imposed by Federal and/or state

regulatory commissions, PJM and other regional transmission organizations (NY ISO, ISO New England), the North American

Electric Reliability Council and other applicable electric reliability organizations; legal and administrative proceedings (whether civil

or criminal) and settlements that affect our business and profitability; pace of entry into new markets; volatility in market demand

and prices for energy, capacity and fuel; interest rate fluctuations and credit market concerns; and effects of geopolitical events,

including the threat of domestic terrorism. Readers are referred to the most recent reports filed with the Securities and Exchange

Commission.

the Securities Exchange Act of 1934 and are subject to the safe harbor created by the Private Securities Litigation Reform Act of

1995. These statements include all financial projections and any declarations regarding management’s intents, beliefs or current

expectations. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,”

“plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of such terms or other comparable

terminology. Any forward-looking statements are not guarantees of future performance, and actual results could differ materially

from those indicated by the forward-looking statements. Forward-looking statements involve estimates, assumptions, known and

unknown risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to be

materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-

looking statements. Each forward-looking statement speaks only as of the date of the particular statement, and we undertake no

obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or

otherwise. A number of factors could cause actual results or outcomes to differ materially from those indicated by the forward-

looking statements contained in this presentation. These factors include, but are not limited to, prevailing governmental policies

and regulatory actions affecting the energy industry, including with respect to allowed rates of return, industry and rate structure,

acquisition and disposal of assets and facilities, operation and construction of plant facilities, recovery of purchased power

expenses, and present or prospective wholesale and retail competition; changes in and compliance with environmental and safety

laws and policies; weather conditions; population growth rates and demographic patterns; competition for retail and wholesale

customers; general economic conditions, including potential negative impacts resulting from an economic downturn; growth in

demand, sales and capacity to fulfill demand; changes in tax rates or policies or in rates of inflation; rules and changes in

accounting standards or practices; changes in project costs; unanticipated changes in operating expenses and capital

expenditures; the ability to obtain funding in the capital markets on favorable terms; restrictions imposed by Federal and/or state

regulatory commissions, PJM and other regional transmission organizations (NY ISO, ISO New England), the North American

Electric Reliability Council and other applicable electric reliability organizations; legal and administrative proceedings (whether civil

or criminal) and settlements that affect our business and profitability; pace of entry into new markets; volatility in market demand

and prices for energy, capacity and fuel; interest rate fluctuations and credit market concerns; and effects of geopolitical events,

including the threat of domestic terrorism. Readers are referred to the most recent reports filed with the Securities and Exchange

Commission.

1

Safe

Harbor Statement

Combined Service Territory

Transmission

& Distribution

Competitive

Energy / Other

2009

- 2013

Forecast

Business

Mix*

70

- 75%

25

- 30%

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

Business

Mix

*

Percentages based on projected operating income.

PHI

Investments

2

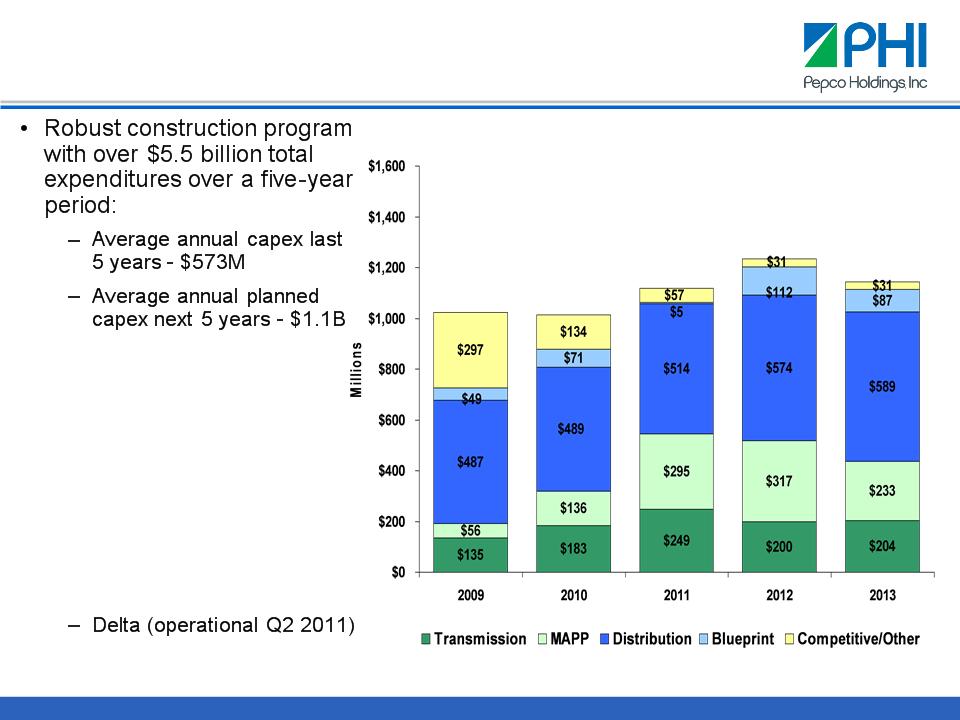

Planned

Construction Expenditures

3

$1,024

$1,013

$1,120

$1,234

$1,144

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

Construction

Expenditures

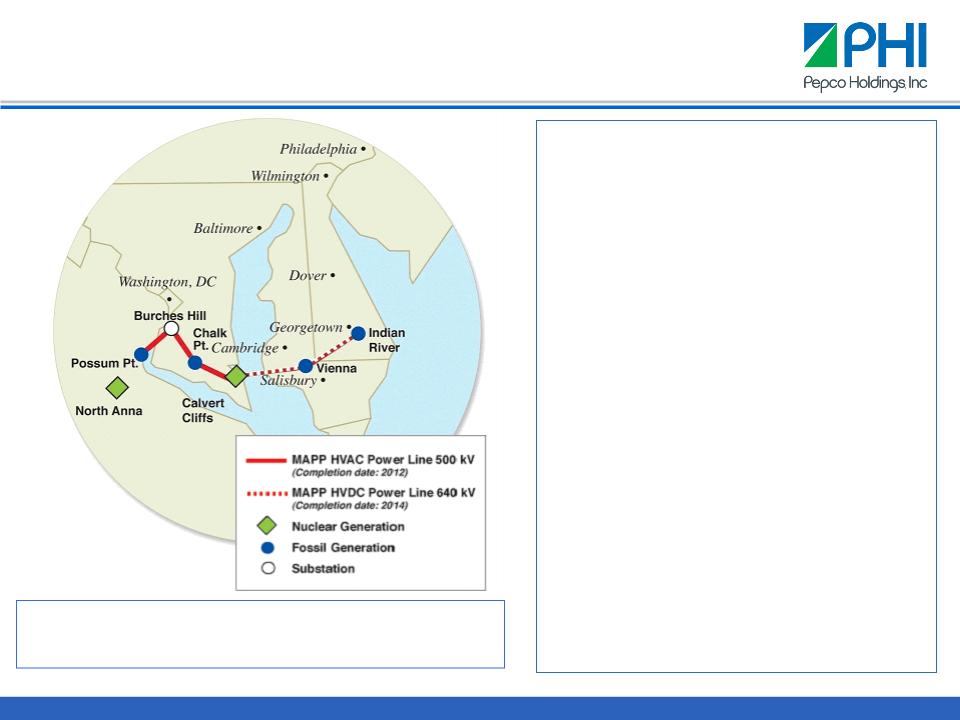

• Two major Power

Delivery

initiatives:

initiatives:

– Mid-Atlantic

Power

Pathway

Pathway

– Blueprint for the

Future

• Conectiv

Energy

construction projects:

construction projects:

– Cumberland

(operational

Q2 2009)

Q2 2009)

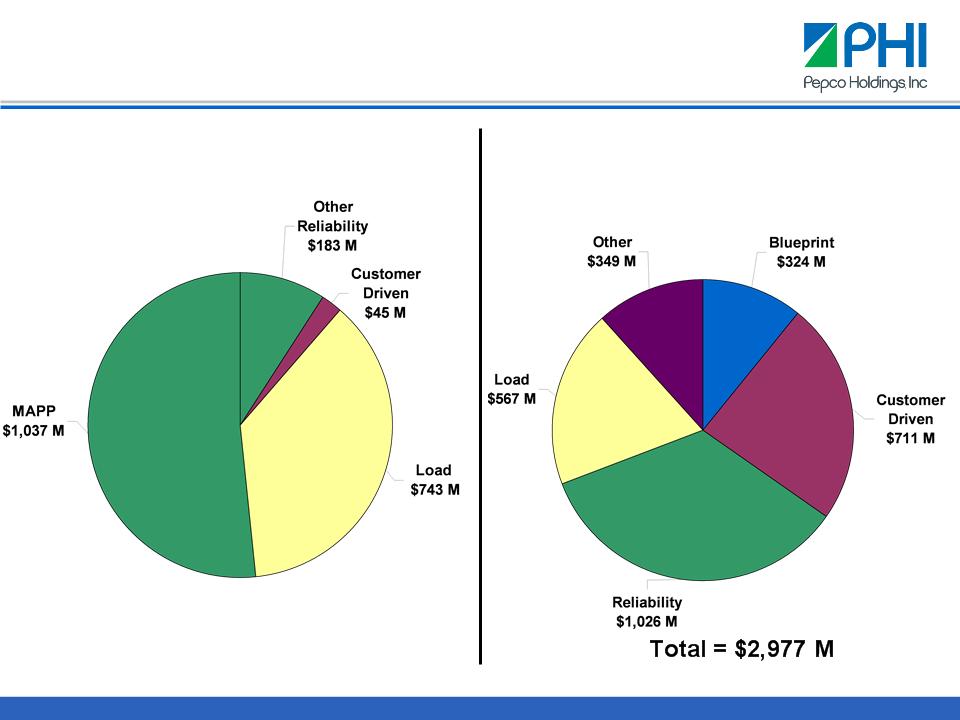

Total

= $2,008 M

Note:

See Safe Harbor statement at beginning of today’s presentation.

4

Transmission

Distribution

Power

Delivery -

Construction Forecast 2009-2013

Construction Forecast 2009-2013

5

Capital

Allocation/Resource Planning

Capital

Allocation

• Detailed planning

process over a 5 year period

• Beyond customer

growth and reliability driven construction, projects compete for

funding

funding

• A risk adjusted cost

of capital specific to the line of business used to assess

returns; post project completion analysis performed to measure results

returns; post project completion analysis performed to measure results

• Evaluation process

entails assigning total value to each project and ranking on a

discretionary/non-discretionary basis involving assessment of specific financial and

non-financial factors

discretionary/non-discretionary basis involving assessment of specific financial and

non-financial factors

Resource

Planning

• Capital allocation

process establishes the required resource plan and determines

the following criteria:

the following criteria:

– Quantity and type of

skilled crafts necessary to complete the work

– Construction

schedule

– Allocation of work

to internal/external resources

• Currently

using

– Cash from

operations

– Proceeds from 2008

financing

• Traditional First

Mortgage Bonds

• Equity

• In

progress

– Federal Grant

Awards

• Under

consideration

– Federal Loan

Guarantee (MAPP Project)

– Continued review of

capital expenditure reductions/deferrals

– Utility Debt (public

and private placement)

– Sale of selected

assets

– Mandatory

Convertible/Hybrids

– Short-term debt

capacity

– Small equity

issuance

6

While a challenging environment, we have adequate

access to the market to finance our plans

access to the market to finance our plans

Capital

Funding Sources

Capital

Allocation Factors

• Transmission

investment earns an

11.3% Return on Equity

11.3% Return on Equity

• Rates adjusted

through a formula

rate process

rate process

• Option to apply for

additional

incentives

incentives

• Incentive filing

approvals:

– MAPP project (as

well as eight

other RTEP projects) was

approved for a 150 basis point

adder raising Return on Equity to

12.8%

other RTEP projects) was

approved for a 150 basis point

adder raising Return on Equity to

12.8%

• MAPP also

awarded:

– Full forward year

CWIP allowed in

rate base

rate base

– 100% recovery of

prudently

incurred costs in case of project

cancellation

incurred costs in case of project

cancellation

7

- Cost of project - $1.2 billion

- In-service date - 2014

- Construction currently expected to begin the latter half of 2010

- Total length - 150 miles (~ 30 miles on new right of way)

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

Mid-Atlantic

Power Pathway (MAPP)

· Capital

Allocation Factors

– Public Service

Commission pre-approval

– DOE federal stimulus

funds

· Delaware

– AMI deployment

approved

– Establishment of

regulatory asset approved

– Meter installation

has begun

· District

of Columbia

– Legislation adopted

in June approving AMI

deployment, subject to PSC agreeing to the

sufficiency of federal grants

deployment, subject to PSC agreeing to the

sufficiency of federal grants

– Legislation provides

for cost recovery, and a return

on costs, by the creation of a regulatory asset

on costs, by the creation of a regulatory asset

· Maryland

– AMI system

requirements established

– PSC proceedings

underway for cost recovery

determination

determination

· DOE

awarded $168 million in federal stimulus

funds for Smart Grid projects in October 2009

funds for Smart Grid projects in October 2009

8

• Cost

of project (2008 - 2014) - $422 million

• Full

meter deployment expected by 2014,

contingent upon regulatory approvals

contingent upon regulatory approvals

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

Blueprint

for the Future - Smart Grid

While we operate in a challenging environment, we stay

focused

on customer needs, value creation and efficient financing

on customer needs, value creation and efficient financing

9

Summary

• PHI employs a

comprehensive and deliberate capital

allocation model

allocation model

• We appropriately

address service and reliability

requirements

requirements

• We work to ensure a

clear path for the recovery of

regulated investments

regulated investments

• We work to minimize

our cost of capital while maintaining

a strong credit focus

a strong credit focus