Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - JPMORGAN CHASE & CO | d8k.htm |

Exhibit 99.1

Exhibit 99.1

Jamie Dimon

Chairman and Chief Executive Officer

December 8, 2009

Goldman Sachs US Financial Services Conference

Agenda

Part I — Firm and line of business update

Part II — Key investor topics

Credit update

Loan demand

Fortress balance sheet

Consumer and small business support efforts

Part III

Comments on the environment

Outlook

| 1 |

|

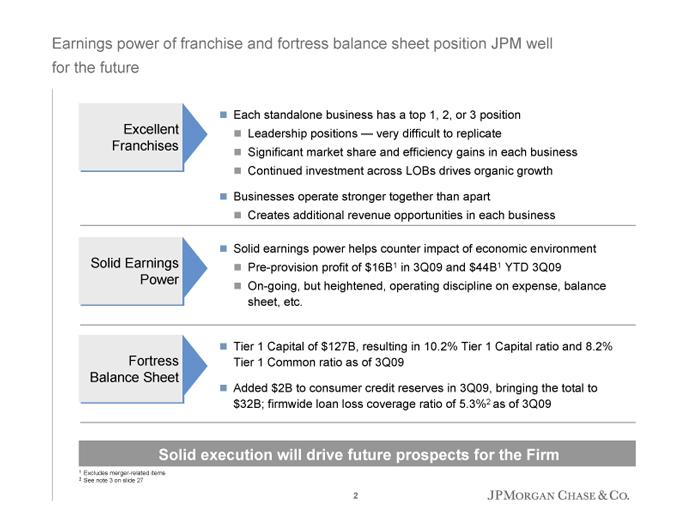

Earnings power of franchise and fortress balance sheet position JPM well for the future

Excellent

Franchises

Each standalone business has a top 1, 2, or 3 position

Leadership positions — very difficult to replicate

Significant market share and efficiency gains in each business

Continued investment across LOBs drives organic growth

Businesses operate stronger together than apart

Creates additional revenue opportunities in each business

Solid Earnings

Power

Solid earnings power helps counter impact of economic environment

Pre-provision profit of $16B1 in 3Q09 and $44B1 YTD 3Q09

On-going, but heightened, operating discipline on expense, balance sheet, etc.

Fortress

Balance Sheet

Tier 1 Capital of $127B, resulting in 10.2% Tier 1 Capital ratio and 8.2% Tier 1 Common ratio as of 3Q09

Added $2B to consumer credit reserves in 3Q09, bringing the total to $32B; firmwide loan loss coverage ratio of 5.3%2 as of 3Q09

Solid execution will drive future prospects for the Firm

| 1 |

|

Excludes merger-related items |

| 2 |

|

See note 3 on slide 27 |

| 2 |

|

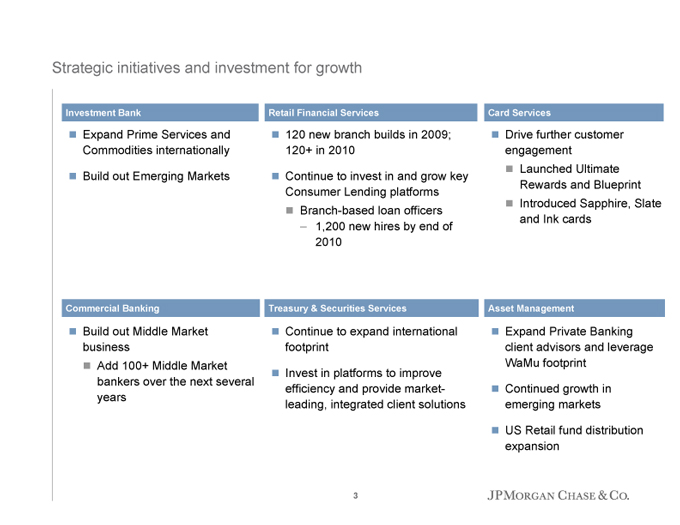

Strategic initiatives and investment for growth

Investment Bank

Expand Prime Services and Commodities internationally

Build out Emerging Markets

Retail Financial Services

120 new branch builds in 2009; 120+ in 2010

Continue to invest in and grow key Consumer Lending platforms

Branch-based loan officers

– 1,200 new hires by end of 2010

Card Services

Drive further customer engagement

Launched Ultimate Rewards and Blueprint

Introduced Sapphire, Slate and Ink cards

Commercial Banking

Build out Middle Market business

Add 100+ Middle Market bankers over the next several years

Treasury & Securities Services

Continue to expand international footprint

Invest in platforms to improve efficiency and provide market-leading, integrated client solutions

Asset Management

Expand Private Banking client advisors and leverage WaMu footprint

Continued growth in emerging markets

US Retail fund distribution expansion

| 3 |

|

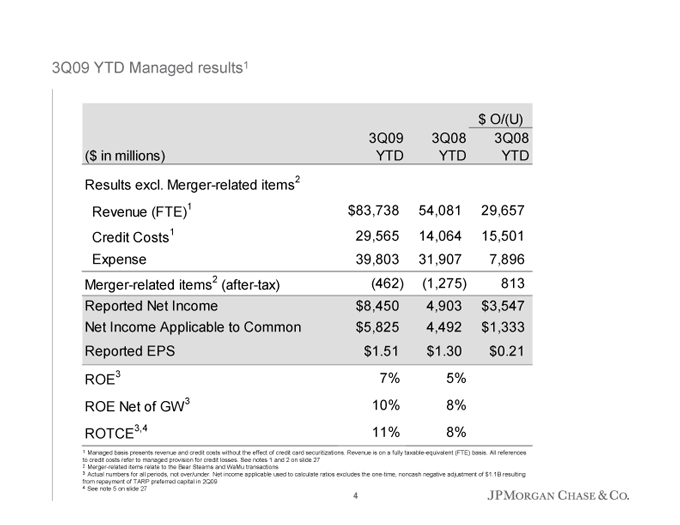

3Q09 YTD Managed results1

$ O/(U)

3Q09 3Q08 3Q08

($ in millions) YTD YTD YTD

Results excl. Merger-related items2

Revenue (FTE)1 $83,738 54,081 29,657

Credit Costs1 29,565 14,064 15,501

Expense 39,803 31,907 7,896

Merger-related items2 (after-tax)(462)(1,275) 813

Reported Net Income $8,450 4,903 $3,547

Net Income Applicable to Common $5,825 4,492 $1,333

Reported EPS $1.51 $1.30 $0.21

ROE3 7% 5%

ROE Net of GW 3 10% 8%

ROTCE3,4 11% 8%

1 Managed basis presents revenue and credit costs without the effect of credit card securitizations. Revenue is on a fully taxable-equivalent (FTE) basis. All references to credit costs refer to managed provision for credit losses. See notes 1 and 2 on slide 27

| 2 |

|

Merger-related items relate to the Bear Stearns and WaMu transactions |

3 Actual numbers for all periods, not over/under. Net income applicable used to calculate ratios excludes the one-time, noncash negative adjustment of $1.1B resulting from repayment of TARP preferred capital in 2Q09

| 4 |

|

See note 5 on slide 27 |

| 4 |

|

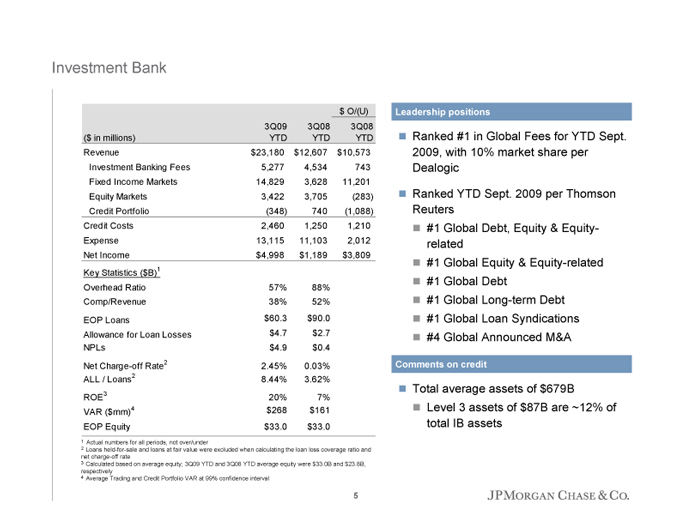

Investment Bank

$ O/(U)

3Q09 3Q08 3Q08

($ in millions) YTD YTD YTD

Revenue $23,180 $12,607 $10,573

Investment Banking Fees 5,277 4,534 743

Fixed Income Markets 14,829 3,628 11,201

Equity Markets 3,422 3,705(283)

Credit Portfolio(348) 740(1,088)

Credit Costs 2,460 1,250 1,210

Expense 13,115 11,103 2,012

Net Income $4,998 $1,189 $3,809

Key Statistics ($B)1

Overhead Ratio 57% 88%

Comp/Revenue 38% 52%

EOP Loans $60.3 $90.0

Allowance for Loan Losses $4.7 $2.7

NPLs $4.9 $0.4

Net Charge-off Rate2 2.45% 0.03%

ALL / Loans2 8.44% 3.62%

ROE3 20% 7%

VAR ($mm)4 $268 $161

EOP Equity $33.0 $33.0

Leadership positions

Ranked #1 in Global Fees for YTD Sept. 2009, with 10% market share per Dealogic

Ranked YTD Sept. 2009 per Thomson Reuters

#1 Global Debt, Equity & Equity-related

#1 Global Equity & Equity-related

#1 Global Debt

#1 Global Long-term Debt

#1 Global Loan Syndications

#4 Global Announced M&A

Comments on credit

Total average assets of $679B

Level 3 assets of $87B are ~12% of total IB assets

1 Actual numbers for all periods, not over/under

2 Loans held-for-sale and loans at fair value were excluded when calculating the loan loss coverage ratio and net charge-off rate

3 Calculated based on average equity; 3Q09 YTD and 3Q08 YTD average equity were $33.0B and $23.8B, respectively

4 Average Trading and Credit Portfolio VAR at 99% confidence interval

5

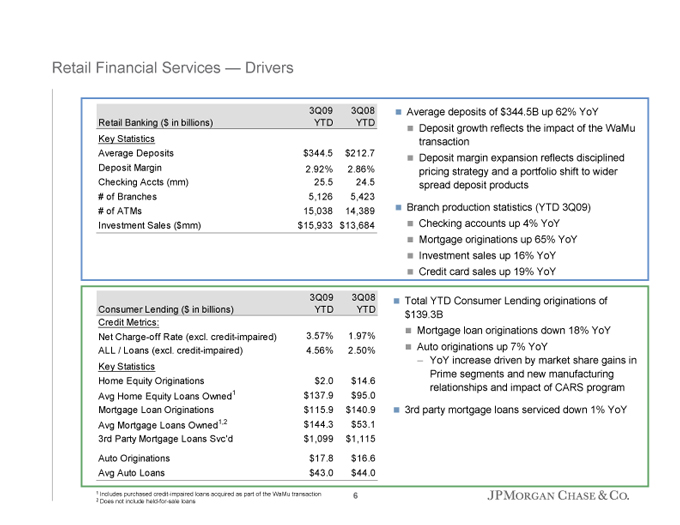

Retail Financial Services — Drivers

3Q09 3Q08

Retail Banking ($ in billions) YTD YTD

Key Statistics

Average Deposits $344.5 $212.7

Deposit Margin 2.92% 2.86%

Checking Accts (mm) 25.5 24.5

# of Branches 5,126 5,423

# of ATMs 15,038 14,389

Investment Sales ($mm) $15,933 $13,684

Average deposits of $344.5B up 62% YoY

Deposit growth reflects the impact of the WaMu transaction

Deposit margin expansion reflects disciplined pricing strategy and a portfolio shift to wider spread deposit products

Branch production statistics (YTD 3Q09)

Checking accounts up 4% YoY

Mortgage originations up 65% YoY

Investment sales up 16% YoY

Credit card sales up 19% YoY

3Q09 3Q08

Consumer Lending ($ in billions) YTD YTD

Credit Metrics:

Net Charge-off Rate (excl. credit-impaired) 3.57% 1.97%

ALL / Loans (excl. credit-impaired) 4.56% 2.50%

Key Statistics

Home Equity Originations $2.0 $14.6

Avg Home Equity Loans Owned1 $137.9 $95.0

Mortgage Loan Originations $115.9 $140.9

Avg Mortgage Loans Owned1,2 $144.3 $53.1

3rd Party Mortgage Loans Svc’d $1,099 $1,115

Auto Originations $17.8 $16.6

Avg Auto Loans $43.0 $44.0

Total YTD Consumer Lending originations of $139.3B

Mortgage loan originations down 18% YoY

Auto originations up 7% YoY

– YoY increase driven by market share gains in Prime segments and new manufacturing relationships and impact of CARS program

3rd party mortgage loans serviced down 1% YoY

1 Includes purchased credit-impaired loans acquired as part of the WaMu transaction

2 Does not include held-for-sale loans

6

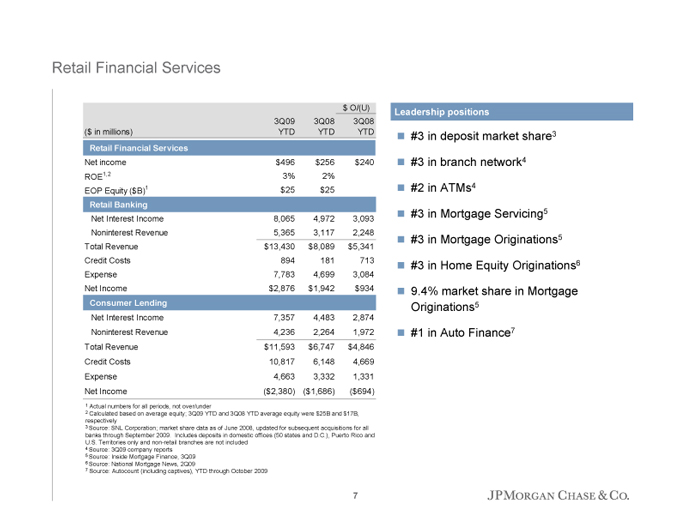

Retail Financial Services

$ O/(U)

3Q09 3Q08 3Q08

($ in millions) YTD YTD YTD

Retail Financial Services

Net income $496 $256 $240

ROE1,2 3% 2%

EOP Equity ($B)1 $25 $25

Retail Banking

Net Interest Income 8,065 4,972 3,093

Noninterest Revenue 5,365 3,117 2,248

Total Revenue $13,430 $8,089 $5,341

Credit Costs 894 181 713

Expense 7,783 4,699 3,084

Net Income $2,876 $1,942 $934

Consumer Lending

Net Interest Income 7,357 4,483 2,874

Noninterest Revenue 4,236 2,264 1,972

Total Revenue $11,593 $6,747 $4,846

Credit Costs 10,817 6,148 4,669

Expense 4,663 3,332 1,331

Net Income($2,380)($1,686)($694)

Leadership positions

#3 in deposit market share3

#3 in branch network4

#2 in ATMs4

#3 in Mortgage Servicing5

#3 in Mortgage Originations5

#3 in Home Equity Originations6

9.4% market share in Mortgage Originations5

#1 in Auto Finance7

| 1 |

|

Actual numbers for all periods, not over/under |

| 2 |

|

Calculated based on average equity; 3Q09 YTD and 3Q08 YTD average equity were $25B and $17B, respectively |

3 Source: SNL Corporation; market share data as of June 2008, updated for subsequent acquisitions for all banks through September 2009. Includes deposits in domestic offices (50 states and D.C.), Puerto Rico and U.S. Territories only and non-retail branches are not included

| 4 |

|

Source: 3Q09 company reports |

| 5 |

|

Source: Inside Mortgage Finance, 3Q09 |

| 6 |

|

Source: National Mortgage News, 2Q09 |

| 7 |

|

Source: Autocount (including captives), YTD through October 2009 |

| 7 |

|

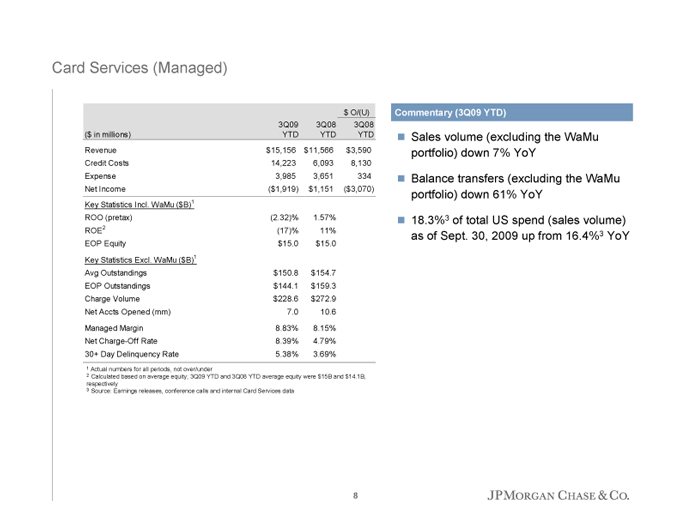

Card Services (Managed)

$ O/(U)

3Q09 3Q08 3Q08

($ in millions) YTD YTD YTD

Revenue $15,156 $11,566 $3,590

Credit Costs 14,223 6,093 8,130

Expense 3,985 3,651 334

Net Income($1,919) $1,151($3,070)

Key Statistics Incl. WaMu ($B)1

ROO (pretax)(2.32)% 1.57%

ROE2(17)% 11%

EOP Equity $15.0 $15.0

Key Statistics Excl. WaMu ($B)1

Avg Outstandings $150.8 $154.7

EOP Outstandings $144.1 $159.3

Charge Volume $228.6 $272.9

Net Accts Opened (mm) 7.0 10.6

Managed Margin 8.83% 8.15%

Net Charge-Off Rate 8.39% 4.79%

30+ Day Delinquency Rate 5.38% 3.69%

Commentary (3Q09 YTD)

Sales volume (excluding the WaMu portfolio) down 7% YoY

Balance transfers (excluding the WaMu portfolio) down 61% YoY

18.3%3 of total US spend (sales volume) as of Sept. 30, 2009 up from 16.4%3 YoY

| 1 |

|

Actual numbers for all periods, not over/under |

| 2 |

|

Calculated based on average equity; 3Q09 YTD and 3Q08 YTD average equity were $15B and $14.1B, respectively |

| 3 |

|

Source: Earnings releases, conference calls and internal Card Services data |

| 8 |

|

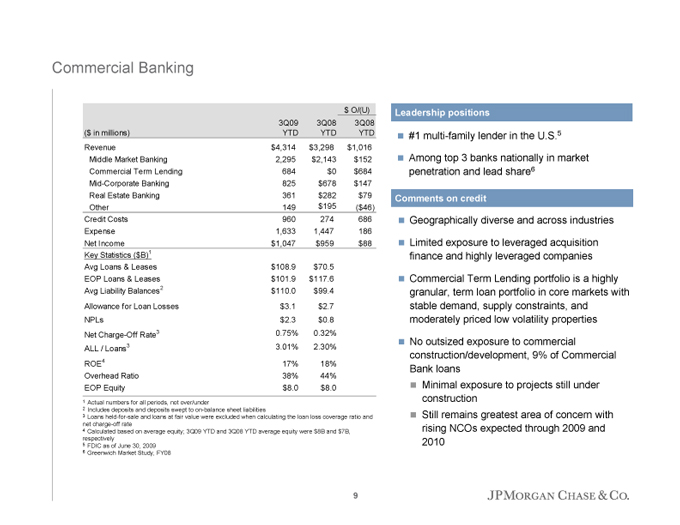

Commercial Banking

$ O/(U)

3Q09 3Q08 3Q08

($ in millions) YTD YTD YTD

Revenue $4,314 $3,298 $1,016

Middle Market Banking 2,295 $2,143 $152

Commercial Term Lending 684 $0 $684

Mid-Corporate Banking 825 $678 $147

Real Estate Banking 361 $282 $79

Other 149 $195($46)

Credit Costs 960 274 686

Expense 1,633 1,447 186

Net Income $1,047 $959 $88

Key Statistics ($B)1

Avg Loans & Leases $108.9 $70.5

EOP Loans & Leases $101.9 $117.6

Avg Liability Balances2 $110.0 $99.4

Allowance for Loan Losses $3.1 $2.7

NPLs $2.3 $0.8

Net Charge-Off Rate3 0.75% 0.32%

ALL / Loans3 3.01% 2.30%

ROE4 17% 18%

Overhead Ratio 38% 44%

EOP Equity $8.0 $8.0

Leadership positions

#1 multi-family lender in the U.S.5

Among top 3 banks nationally in market penetration and lead share6

Comments on credit

Geographically diverse and across industries

Limited exposure to leveraged acquisition finance and highly leveraged companies

Commercial Term Lending portfolio is a highly granular, term loan portfolio in core markets with stable demand, supply constraints, and moderately priced low volatility properties

No outsized exposure to commercial construction/development, 9% of Commercial Bank loans

Minimal exposure to projects still under construction

Still remains greatest area of concern with rising NCOs expected through 2009 and 2010

| 1 |

|

Actual numbers for all periods, not over/under |

| 2 |

|

Includes deposits and deposits swept to on-balance sheet liabilities |

3 Loans held-for-sale and loans at fair value were excluded when calculating the loan loss coverage ratio and net charge-off rate

| 4 |

|

Calculated based on average equity; 3Q09 YTD and 3Q08 YTD average equity were $8B and $7B, respectively |

| 5 |

|

FDIC as of June 30, 2009 |

| 6 |

|

Greenwich Market Study, FY08 |

9

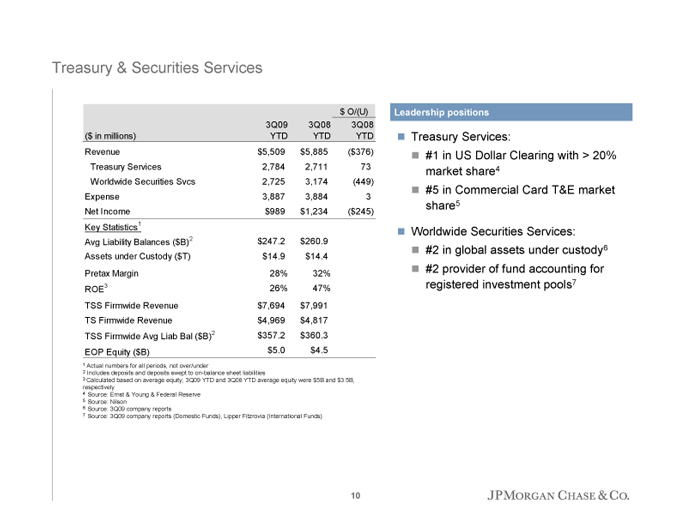

Treasury & Securities Services

$ O/(U)

3Q09 3Q08 3Q08

($ in millions) YTD YTD YTD

Revenue $5,509 $5,885($376)

Treasury Services 2,784 2,711 73

Worldwide Securities Svcs 2,725 3,174(449)

Expense 3,887 3,884 3

Net Income $989 $1,234($245)

Key Statistics1

Avg Liability Balances ($B)2 $247.2 $260.9

Assets under Custody ($T) $14.9 $14.4

Pretax Margin 28% 32%

ROE3 26% 47%

TSS Firmwide Revenue $7,694 $7,991

TS Firmwide Revenue $4,969 $4,817

TSS Firmwide Avg Liab Bal ($B)2 $357.2 $360.3

EOP Equity ($B) $5.0 $4.5

Leadership positions

Treasury Services:

#1 in US Dollar Clearing with > 20% market share4

#5 in Commercial Card T&E market share5

Worldwide Securities Services:

#2 in global assets under custody6

#2 provider of fund accounting for registered investment pools7

| 1 |

|

Actual numbers for all periods, not over/under |

| 2 |

|

Includes deposits and deposits swept to on-balance sheet liabilities |

| 3 |

|

Calculated based on average equity; 3Q09 YTD and 3Q08 YTD average equity were $5B and $3.5B, respectively |

| 4 |

|

Source: Ernst & Young & Federal Reserve |

| 5 |

|

Source: Nilson |

| 6 |

|

Source: 3Q09 company reports |

| 7 |

|

Source: 3Q09 company reports (Domestic Funds), Lipper Fitzrovia (International Funds) |

10

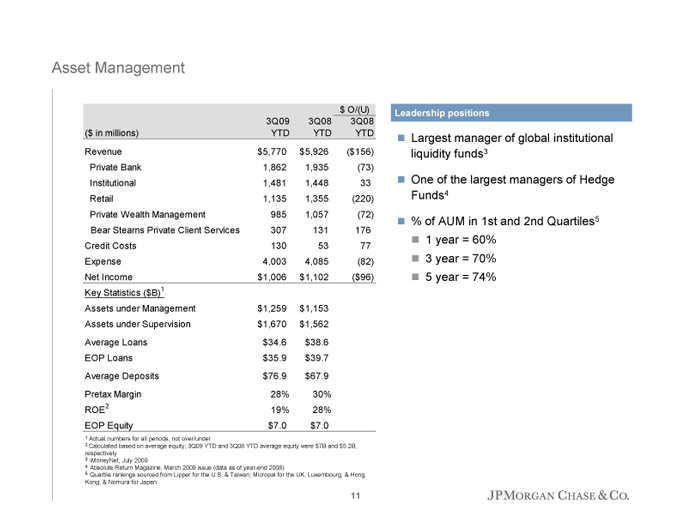

Asset Management

$ O/(U)

3Q09 3Q08 3Q08

($ in millions) YTD YTD YTD

Revenue $5,770 $5,926($156)

Private Bank 1,862 1,935(73)

Institutional 1,481 1,448 33

Retail 1,135 1,355(220)

Private Wealth Management 985 1,057(72)

Bear Stearns Private Client Services 307 131 176

Credit Costs 130 53 77

Expense 4,003 4,085(82)

Net Income $1,006 $1,102($96)

Key Statistics ($B)1

Assets under Management $1,259 $1,153

Assets under Supervision $1,670 $1,562

Average Loans $34.6 $38.6

EOP Loans $35.9 $39.7

Average Deposits $76.9 $67.9

Pretax Margin 28% 30%

ROE2 19% 28%

EOP Equity $7.0 $7.0

Leadership positions

Largest manager of global institutional liquidity funds3

One of the largest managers of Hedge Funds4

% of AUM in 1st and 2nd Quartiles5

1 year = 60%

3 year = 70%

5 year = 74%

| 1 |

|

Actual numbers for all periods, not over/under |

| 2 |

|

Calculated based on average equity; 3Q09 YTD and 3Q08 YTD average equity were $7B and $5.2B, respectively |

| 3 |

|

iMoneyNet, July 2009 |

| 4 |

|

Absolute Return Magazine, March 2009 issue (data as of year-end 2008) |

5 Quartile rankings sourced from Lipper for the U.S. & Taiwan; Micropal for the UK, Luxembourg, & Hong Kong; & Nomura for Japan

11

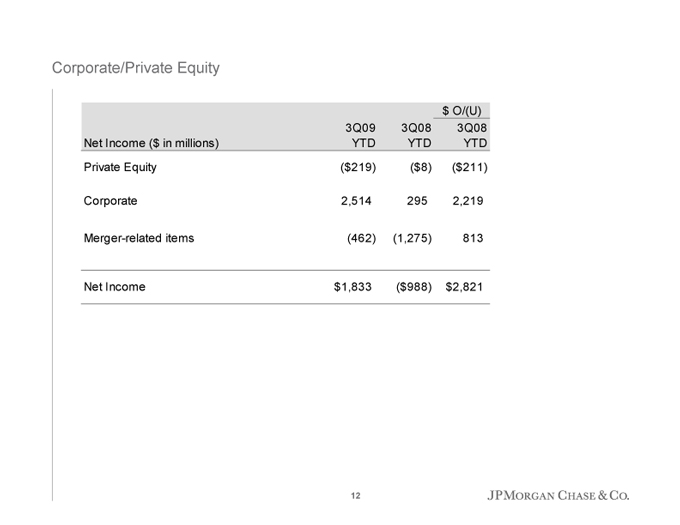

Corporate/Private Equity

$ O/(U)

3Q09 3Q08 3Q08

Net Income ($ in millions) YTD YTD YTD

Private Equity ($219) ($8) ($211)

Corporate 2,514 295 2,219

Merger-related items (462) (1,275) 813

Net Income $1,833 ($988) $2,821

12

Agenda

Page

Key Investor Topics 13

Appendix 23

13

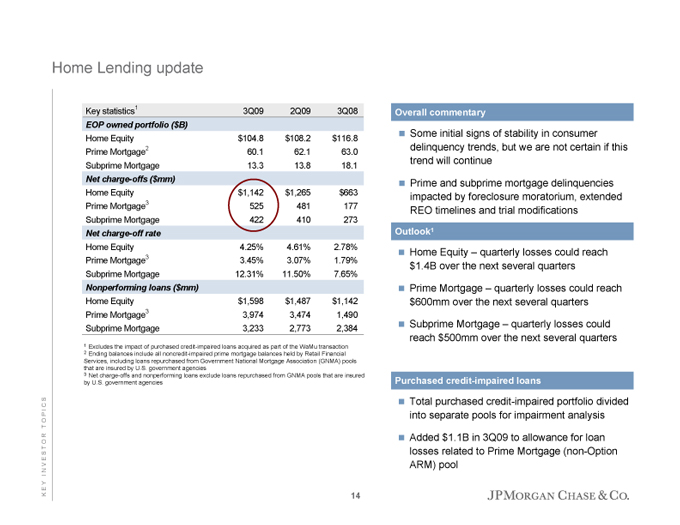

Home Lending update

KEY INVESTOR TOPICS

Key statistics1 3Q09 2Q09 3Q08

EOP owned portfolio ($B)

Home Equity $104.8 $108.2 $116.8

Prime Mortgage2 60.1 62.1 63.0

Subprime Mortgage 13.3 13.8 18.1

Net charge-offs ($mm)

Home Equity $1,142 $1,265 $663

Prime Mortgage3 525 481 177

Subprime Mortgage 422 410 273

Net charge-off rate

Home Equity 4.25% 4.61% 2.78%

Prime Mortgage3 3.45% 3.07% 1.79%

Subprime Mortgage 12.31% 11.50% 7.65%

Nonperforming loans ($mm)

Home Equity $1,598 $1,487 $1,142

Prime Mortgage3 3,974 3,474 1,490

Subprime Mortgage 3,233 2,773 2,384

Overall commentary

Some initial signs of stability in consumer delinquency trends, but we are not certain if this trend will continue

Prime and subprime mortgage delinquencies impacted by foreclosure moratorium, extended REO timelines and trial modifications

Outlook1

Home Equity – quarterly losses could reach $1.4B over the next several quarters

Prime Mortgage – quarterly losses could reach $600mm over the next several quarters

Subprime Mortgage – quarterly losses could reach $500mm over the next several quarters

Purchased credit-impaired loans

Total purchased credit-impaired portfolio divided into separate pools for impairment analysis

Added $1.1B in 3Q09 to allowance for loan losses related to Prime Mortgage (non-Option ARM) pool

1 Excludes the impact of purchased credit-impaired loans acquired as part of the WaMu transaction

2 Ending balances include all noncredit-impaired prime mortgage balances held by Retail Financial Services, including loans repurchased from Government National Mortgage Association (GNMA) pools that are insured by U.S. government agencies

3 Net charge-offs and nonperforming loans exclude loans repurchased from GNMA pools that are insured by U.S. government agencies

14

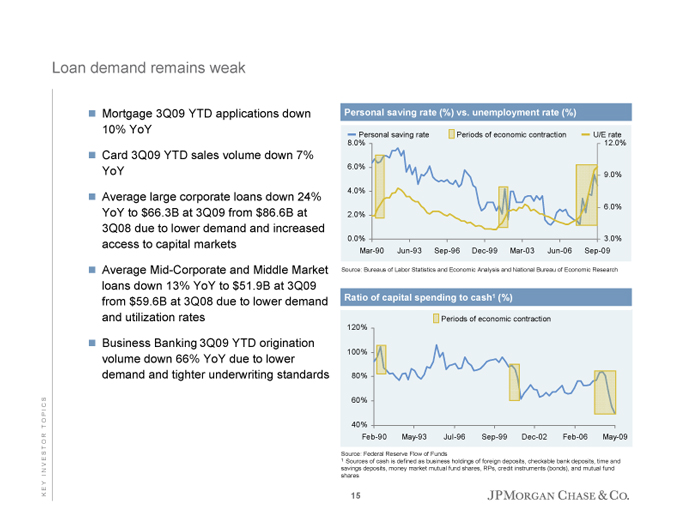

Loan demand remains weak

Mortgage 3Q09 YTD applications down 10% YoY

Card 3Q09 YTD sales volume down 7% YoY

Average large corporate loans down 24% YoY to $66.3B at 3Q09 from $86.6B at 3Q08 due to lower demand and increased access to capital markets

Average Mid-Corporate and Middle Market loans down 13% YoY to $51.9B at 3Q09 from $59.6B at 3Q08 due to lower demand and utilization rates

Business Banking 3Q09 YTD origination volume down 66% YoY due to lower demand and tighter underwriting standards

K E Y I N V E S T O R T O P I C S

Personal saving rate (%) vs. unemployment rate (%)

Personal saving rate Periods of economic contraction U/E rate

| 8.0% |

|

12.0% |

6.0%

9.0%

4.0%

6.0%

2.0%

| 0.0% |

|

3.0% |

Mar-90 Jun-93 Sep-96 Dec-99 Mar-03 Jun-06 Sep-09

Source: Bureaus of Labor Statistics and Economic Analysis and National Bureau of Economic Research

Ratio of capital spending to cash 1 (%)

Periods of economic contraction

120%

100%

80%

60%

40%

Feb-90 May-93 Jul-96 Sep-99 Dec-02 Feb-06 May-09

Source: Federal Reserve Flow of Funds

1 Sources of cash is defined as business holdings of foreign deposits, checkable bank deposits, time and savings deposits, money market mutual fund shares, RPs, credit instruments (bonds), and mutual fund shares

15

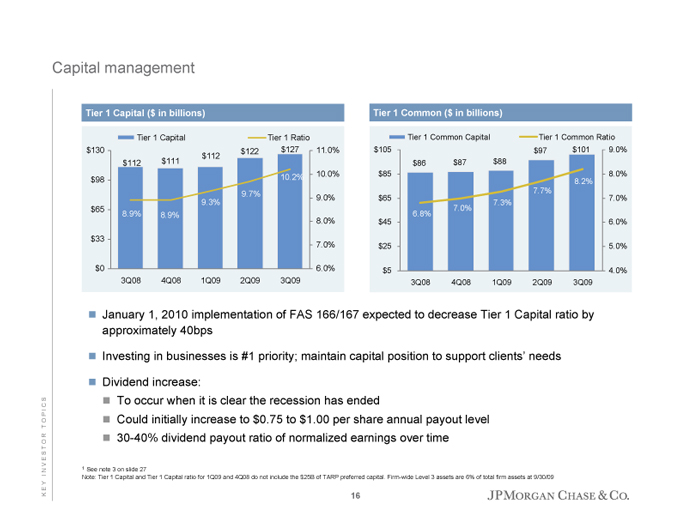

Capital management

Tier 1 Capital ($ in billions)

$130 $122 $127 11.0%

$112 $111 $112

$98 10.2% 10.0%

| 9.7% |

|

9.0% |

9.3%

$65 8.9% 8.9%

8.0%

$33

7.0%

$0 6.0%

3Q08 4Q08 1Q09 2Q09 3Q09

Tier 1 Common ($ in billions)

Tier 1 Common Capital Tier 1 Common Ratio

$105 $97 $101 9.0%

$86 $87 $88

$85 8.0%

8.2%

7.7%

$65 7.0%

7.3%

7.0%

6.8%

$45 6.0%

$25 5.0%

$5 4.0%

3Q08 4Q08 1Q09 2Q09 3Q09

January 1, 2010 implementation of FAS 166/167 expected to decrease Tier 1 Capital ratio by approximately 40bps

Investing in businesses is #1 priority; maintain capital position to support clients’ needs

Dividend increase:

To occur when it is clear the recession has ended

Could initially increase to $0.75 to $1.00 per share annual payout level

30-40% dividend payout ratio of normalized earnings over time

KEY INVESTOR TOPICS

1 See note 3 on slide 27

Note: Tier 1 Capital and Tier 1 Capital ratio for 1Q09 and 4Q08 do not include the $25B of TARP preferred capital. Firm-wide Level 3 assets are 6% of total firm assets at 9/30/09

16

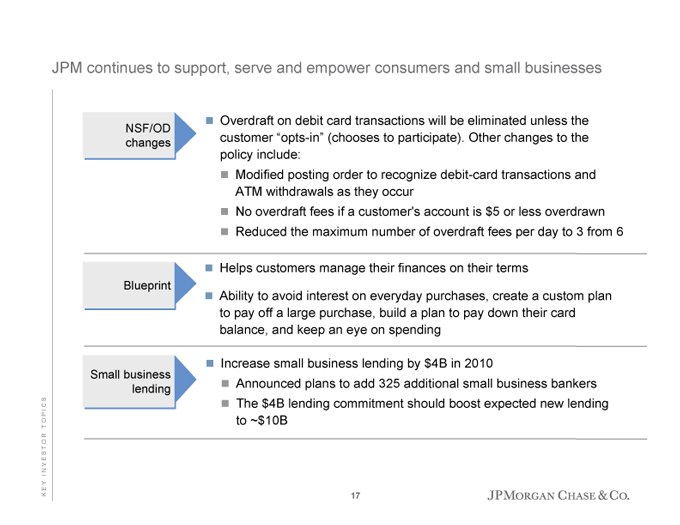

JPM continues to support, serve and empower consumers and small businesses

Overdraft on debit card transactions will be eliminated unless the NSF/OD changes customer “opts-in” (chooses to participate). Other changes to the policy include:

Modified posting order to recognize debit-card transactions and ATM withdrawals as they occur

No overdraft fees if a customer’s account is $5 or less overdrawn

Reduced the maximum number of overdraft fees per day to 3 from 6

Blueprint

Helps customers manage their finances on their terms

Ability to avoid interest on everyday purchases, create a custom plan to pay off a large purchase, build a plan to pay down their card balance, and keep an eye on spending

Small business lending

Increase small business lending by $4B in 2010

Announced plans to add 325 additional small business bankers

The $4B lending commitment should boost expected new lending to ~$10B

K E Y I N V E S T O R T O P I C S

17

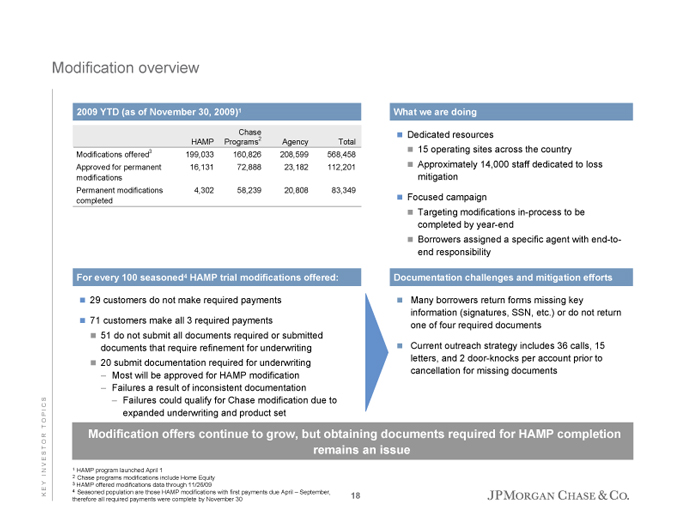

Modification overview

2009 YTD (as of November 30, 2009)1

Chase

HAMP Programs2 Agency Total

Modifications offered3 199,033 160,826 208,599 568,458

Approved for permanent 16,131 72,888 23,182 112,201

modifications

Permanent modifications 4,302 58,239 20,808 83,349

completed

For every 100 seasoned4 HAMP trial modifications offered:

29 customers do not make required payments

71 customers make all 3 required payments

51 do not submit all documents required or submitted documents that require refinement for underwriting

20 submit documentation required for underwriting

– Most will be approved for HAMP modification

– Failures a result of inconsistent documentation

– Failures could qualify for Chase modification due to expanded underwriting and product set

What we are doing

Dedicated resources

15 operating sites across the country

Approximately 14,000 staff dedicated to loss mitigation

Focused campaign

Targeting modifications in-process to be completed by year-end

Borrowers assigned a specific agent with end-to-end responsibility

Documentation challenges and mitigation efforts

Many borrowers return forms missing key information (signatures, SSN, etc.) or do not return one of four required documents

Current outreach strategy includes 36 calls, 15 letters, and 2 door-knocks per account prior to cancellation for missing documents

Modification offers continue to grow, but obtaining documents required for HAMP completion remains an issue

1 HAMP program launched April 1

2 Chase programs modifications include Home Equity

3 HAMP offered modifications data through 11/26/09

4 Seasoned population are those HAMP modifications with first payments due April – September, therefore all required payments were complete by November 30

18

KEY INVESTOR TOPICS

Comments on regulatory reform

OTC derivatives

Consumer Financial Protection Agency

Incentive compensation

Risk, leverage and capital requirements

Resolution authority

KEY INVESTOR TOPICS

19

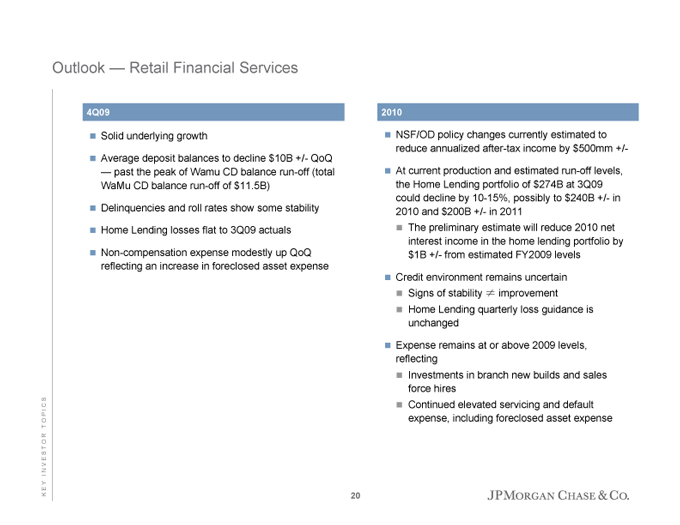

Outlook — Retail Financial Services

4Q09

Solid underlying growth

Average deposit balances to decline $10B +/- QoQ — past the peak of Wamu CD balance run-off (total WaMu CD balance run-off of $11.5B)

Delinquencies and roll rates show some stability

Home Lending losses flat to 3Q09 actuals

Non-compensation expense modestly up QoQ reflecting an increase in foreclosed asset expense

2010

NSF/OD policy changes currently estimated to reduce annualized after-tax income by $500mm +/-

At current production and estimated run-off levels, the Home Lending portfolio of $274B at 3Q09 could decline by 10-15%, possibly to $240B +/- in 2010 and $200B +/- in 2011

The preliminary estimate will reduce 2010 net interest income in the home lending portfolio by

$1B +/- from estimated FY2009 levels

Credit environment remains uncertain

Signs of stability ≠ improvement

Home Lending quarterly loss guidance is unchanged

Expense remains at or above 2009 levels, reflecting

Investments in branch new builds and sales force hires

Continued elevated servicing and default expense, including foreclosed asset expense

KEY INVESTORTOPICS

20

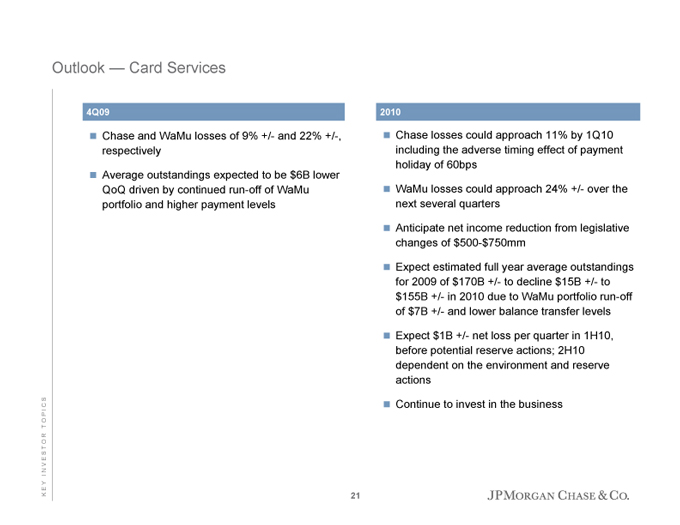

Outlook — Card Services

4Q09

Chase and WaMu losses of 9% +/- and 22% +/-, respectively

Average outstandings expected to be $6B lower QoQ driven by continued run-off of WaMu portfolio and higher payment levels

2010

Chase losses could approach 11% by 1Q10 including the adverse timing effect of payment holiday of 60bps

WaMu losses could approach 24% +/- over the next several quarters

Anticipate net income reduction from legislative changes of $500-$750mm

Expect estimated full year average outstandings for 2009 of $170B +/- to decline $15B +/- to $155B +/- in 2010 due to WaMu portfolio run-off of $7B +/- and lower balance transfer levels

Expect $1B +/- net loss per quarter in 1H10, before potential reserve actions; 2H10 dependent on the environment and reserve actions

Continue to invest in the business

KEY INVESTORTOPICS

21

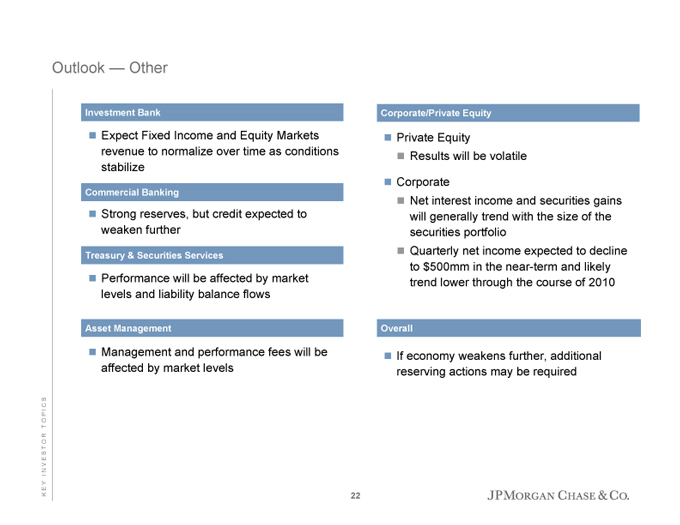

Outlook — Other

Investment Bank

Expect Fixed Income and Equity Markets revenue to normalize over time as conditions stabilize

Commercial Banking

Strong reserves, but credit expected to weaken further

Treasury & Securities Services

Performance will be affected by market levels and liability balance flows

Asset Management

Management and performance fees will be affected by market levels

Corporate/Private Equity

Private Equity

Results will be volatile

Corporate

Net interest income and securities gains will generally trend with the size of the securities portfolio

Quarterly net income expected to decline to $500mm in the near-term and likely trend lower through the course of 2010

Overall

If economy weakens further, additional reserving actions may be required

K E Y I N V E S T O R T O P I C S

22

Agenda

Page

Key Investor Topics 13

Appendix 23

23

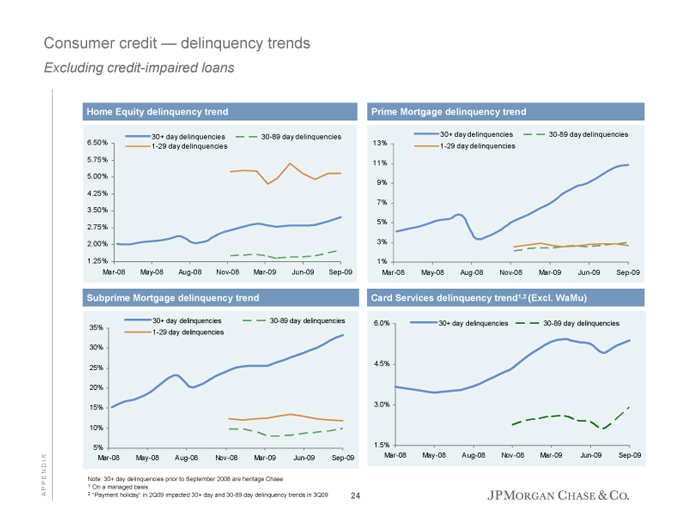

Consumer credit — delinquency trends

Excluding credit-impaired loans

Home Equity delinquency trend

30+ day delinquencies 30-89 day delinquencies

| 6.50% |

|

1-29 day delinquencies |

5.75%

5.00%

4.25%

3.50%

2.75%

2.00%

1.25%

Mar-08 May-08 Aug-08 Nov-08 Mar-09 Jun-09 Sep-09

Prime Mortgage delinquency trend

30+ day delinquencies 30-89 day delinquencies

13% 1-29 day delinquencies

11%

9%

7%

5%

3%

1%

Mar-08 May-08 Aug-08 Nov-08 Mar-09 Jun-09 Sep-09

Subprime Mortgage delinquency trend

30+ day delinquencies 30-89 day delinquencies

35% 1-29 day delinquencies

30%

25%

20%

15%

10%

5%

Mar-08 May-08 Aug-08 Nov-08 Mar-09 Jun-09 Sep-09

Card Services delinquency trend1,2 (Excl. WaMu)

| 6.0% |

|

30+ day delinquencies 30-89 day delinquencies |

4.5%

3.0%

1.5%

Mar-08 May-08 Aug-08 Nov-08 Mar-09 Jun-09 Sep-09

Note: 30+ day delinquencies prior to September 2008 are heritage Chase

| 1 |

|

On a managed basis |

| 2 |

|

“Payment holiday” in 2Q09 impacted 30+ day and 30-89 day delinquency trends in 3Q09 24 |

A P P E N D I X

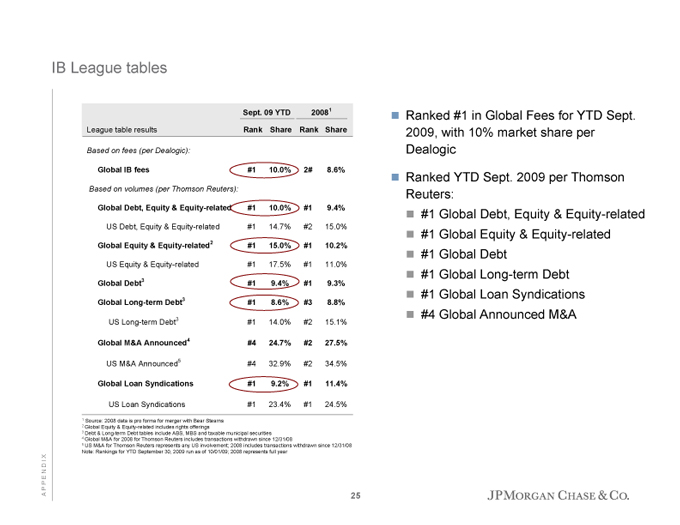

IB League tables

Sept. 09 YTD 20081

League table results Rank Share Rank Share

Based on fees (per Dealogic):

Global IB fees #1 10.0% 2# 8.6%

Based on volumes (per Thomson Reuters):

Global Debt, Equity & Equity-related #1 10.0% #1 9.4%

US Debt, Equity & Equity-related #1 14.7% #2 15.0%

Global Equity & Equity-related2 #1 15.0% #1 10.2%

US Equity & Equity-related #1 17.5% #1 11.0%

Global Debt3 #1 9.4% #1 9.3%

Global Long-term Debt3 #1 8.6% #3 8.8%

US Long-term Debt3 #1 14.0% #2 15.1%

Global M&A Announced4 #4 24.7% #2 27.5%

US M&A Announced5 #4 32.9% #2 34.5%

Global Loan Syndications #1 9.2% #1 11.4%

US Loan Syndications #1 23.4% #1 24.5%

Ranked #1 in Global Fees for YTD Sept. 2009, with 10% market share per Dealogic

Ranked YTD Sept. 2009 per Thomson Reuters:

#1 Global Debt, Equity & Equity-related

#1 Global Equity & Equity-related

#1 Global Debt

#1 Global Long-term Debt

#1 Global Loan Syndications

#4 Global Announced M&A

| 1 |

|

Source: 2008 data is pro forma for merger with Bear Stearns |

| 2 |

|

Global Equity & Equity-related includes rights offerings |

| 3 |

|

Debt & Long-term Debt tables include ABS, MBS and taxable municipal securities |

| 4 |

|

Global M&A for 2008 for Thomson Reuters includes transactions withdrawn since 12/31/08 |

5 US M&A for Thomson Reuters represents any US involvement; 2008 includes transactions withdrawn since 12/31/08 Note: Rankings for YTD September 30, 2009 run as of 10/01/09; 2008 represents full year

25

A P P E N D I X

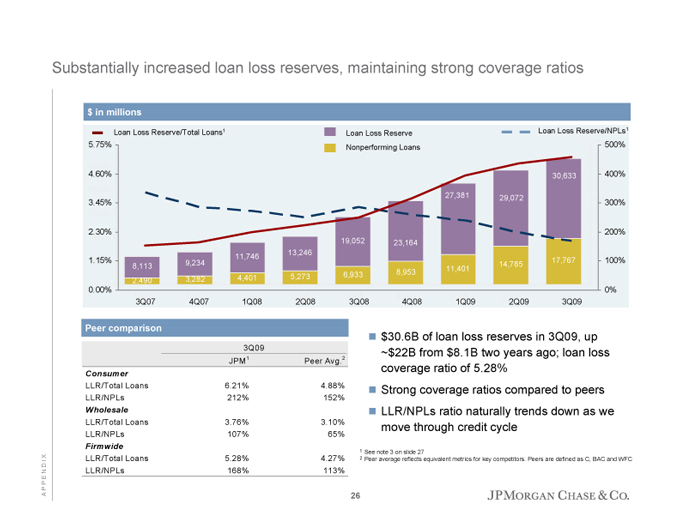

Substantially increased loan loss reserves, maintaining strong coverage ratios

$ in millions

Loan Loss Reserve/Total Loans1 Loan Loss Reserve Loan Loss Reserve/NPLs1

5.75% Nonperforming Loans 500%

| 4.60% |

|

30,633 400% |

27,381 29,072 3%

| 3.45% |

|

300% |

| 2.30% |

|

200% |

19,052 23,164

11,746 13,246

| 1.15% |

|

8,113 9,234 14,785 17,767 100% |

11,401

2,490 3,282 4,401 5,273 6,933 8,953 0%

0.00%

3Q07 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09

Peer comparison

3Q09

JPM 1 Peer Avg.2

Consumer

LLR/Total Loans 6.21% 4.88%

LLR/NPLs 212% 152%

Wholesale

LLR/Total Loans 3.76% 3.10%

LLR/NPLs 107% 65%

Firmwide

LLR/Total Loans 5.28% 4.27%

LLR/NPLs 168% 113%

$30.6B of loan loss reserves in 3Q09, up

~$22B from $8.1B two years ago; loan loss coverage ratio of 5.28%

Strong coverage ratios compared to peers

LLR/NPLs ratio naturally trends down as we move through credit cycle

| 1 |

|

See note 3 on slide 27 |

| 2 |

|

Peer average reflects equivalent metrics for key competitors. Peers are defined as C, BAC and WFC |

A P P E N D I X

26

Notes on non-GAAP financial measures and forward-looking statements

This presentation includes non-GAAP financial measures.

1.Financial results are presented on a managed basis, as such basis is described in the firm’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2009, June 30, 2009 and September 30, 2009 and its Annual Report on Form 10-K for the year ended December 31, 2008.

2.All non-GAAP financial measures included in this presentation are provided to assist readers in understanding certain trend information.

Additional information concerning such non-GAAP financial measures can be found in the above-referenced filings, to which reference is hereby made.

3.The ratio for the allowance for loan losses to end-of-period loans excludes the following: loans accounted for at fair value and loans held-for-sale; purchased credit-impaired loans; the allowance for loan losses related to purchased credit-impaired loans; and, loans from the Washington Mutual Master Trust, which were consolidated on the firm’s balance sheet at fair value during the second quarter of 2009. Additionally, Consumer Lending net charge-off rates exclude the impact of purchased credit-impaired loans. The allowance related to the purchased credit-impaired portfolio was $1.1 billion at September 30, 2009.

4.Tier 1 Common Capital (“Tier 1 Common”) is calculated, for all purposes, as Tier 1 Capital less qualifying perpetual preferred stock, qualifying trust preferred securities, and qualifying minority interest in subsidiaries.

5.Tangible Common Equity (“TCE”) is calculated, for all purposes, as common stockholders equity (i.e., total stockholders’ equity less preferred stock) less identifiable intangible assets (other than MSRs) and goodwill, net of related deferred tax liabilities. The TCE measures used in this presentation are not necessarily comparable to similarly titled measures provided by other firms due to differences in calculation methodologies.

Forward looking statements

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are based upon the current beliefs and expectations of JPMorgan Chase’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. Factors that could cause JPMorgan Chase’s actual results to differ materially from those described in the forward-looking statements can be found in JPMorgan Chase’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2009, June 30, 2009 and September 30, 2009 and its Annual Report on Form 10-K for the year ended December 31, 2008, each of which has been filed with the Securities and Exchange Commission and is available on JPMorgan Chase’s website (www.jpmorganchase.com) and on the Securities and Exchange Commission’s website (www.sec.gov). JPMorgan Chase does not undertake to update the forward-looking statements to reflect the impact of circumstances or events that may arise after the date of the forward-looking statements.

27

A P P E N D I X