Attached files

| file | filename |

|---|---|

| EX-31.1 - Eatware, Inc. | v168132_ex31-1.htm |

| EX-32.2 - Eatware, Inc. | v168132_ex32-2.htm |

| EX-31.2 - Eatware, Inc. | v168132_ex31-2.htm |

| EX-32.1 - Eatware, Inc. | v168132_ex32-1.htm |

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

10-K/A

|

þ

|

ANNUAL REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

|

|

SECURITIES

EXCHANGE ACT OF 1934

|

|

|

For

the fiscal year ended March 31, 2009

|

|

|

or

|

|

|

o

|

TRANSITION REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

Commission

file number 333-139910

China

Shoe Holdings, Inc.

(Exact

name of registrant as specified in its charter )

|

Nevada

|

20-2234410

|

|

(State

or other jurisdiction of

|

(I.R.S.

Employer

|

|

incorporation

or organization)

|

Identification

No.)

|

23/F,

Westin Center, 26 Hung To Road

Kwun

Tong, Kowloon, Hong Kong

(Address

of principal executive offices)

+852

2295-1818

( Registrant’s telephone number, including area

code

)

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act: Common Stock, $.001 Par Value

Per Share

Indicate

by check mark whether the registrant is a well-known seasoned issuer as defined

in Rule 405 of the Securities Act. Yes ¨

No þ

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes ¨

No þ

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes þ

No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, or a non-accelerated filer. See definition of

“accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange

Act. (Check one):

Large

accelerated filer ¨ Accelerated

filer ¨ Non-accelerated

filer ¨ Smaller

Reporting Company þ

Indicate

by check mark whether the registrant is a shell company (as defined by Rule

12b-2 of the Exchange Act) Yes ¨

No þ

As of

June 15, 2009, the aggregate market value of the issued and outstanding common

stock held by non-affiliates of the registrant, based upon the closing price of

the common stock as quoted on the National Association of Securities Dealers

Inc. OTC Bulletin Board of $0.01 was approximately

$4,694,456. For purposes of the above statement only, all

directors, executive officers and 10% shareholders are assumed to be

affiliates. This determination of affiliate status is not necessarily

a conclusive determination for any other purpose.

Number of

shares of common stock outstanding as of June 15, 2009 was

1,990,759,517.

DOCUMENTS INCORPORATED BY

REFERENCE – None

CHINA

SHOE HOLDINGS, INC.

FORM

10-K

FOR

THE FISCAL YEAR ENDED MARCH 31, 2009

INDEX

|

Page

|

|||

|

PART

I

|

|||

|

Item

1

|

Business

|

4

|

|

|

Item

1A

|

Risk

Factors

|

12

|

|

|

Item

1B

|

Unresolved

Staff Comments

|

18

|

|

|

Item

2

|

Properties

|

18

|

|

|

Item

3

|

Legal

Proceedings

|

19

|

|

|

Item

4

|

Submission

of Matters to a Vote of Security Holders

|

19

|

|

|

PART

II

|

|||

|

Item

5

|

Market

for Registrant’s Common Equity, Related Shareholder Matters and Issuer

Purchases of Equity Securities

|

20

|

|

|

Item

6

|

Selected

Financial Data

|

21

|

|

|

Item

7

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

22

|

|

|

Item

7A

|

Quantitative

and Qualitative Disclosures About Market Risk

|

27

|

|

|

Item

8

|

Financial

Statements and Supplementary Data

|

28

|

|

|

Item

9

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

29

|

|

|

Item

9A

|

Controls

and Procedures

|

29

|

|

|

Item

9B

|

Other

Information

|

29

|

|

|

PART

III

|

|||

|

Item

10

|

Directors,

Executive Officers, and Corporate Governance

|

30

|

|

|

Item

11

|

Executive

Compensation

|

31

|

|

|

Item

12

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

34

|

|

|

Item

13

|

Certain

Relationships and Related Transactions and Director

Independence

|

35

|

|

|

Item

14

|

Principal

Accounting Fees and Services

|

35

|

|

|

PART

IV

|

|||

|

Item

15

|

Exhibits

and Financial Statement Schedules

|

36

|

|

|

Signatures

|

37

|

STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

In this

annual report, references to "China Shoe Holdings, Inc.," "China Shoe," "Extra

Ease Limited," “Eatware Intellectual Properties Limited,” "the Company," "we,"

"us," and "our" refer to China Shoe Holdings, Inc. and its wholly owned

subsidiaries, Extra Ease Limited Eatware Intellectual Properties

Limited.

Except

for the historical information contained herein, some of the statements in this

Report contain forward-looking statements that involve risks and uncertainties.

These statements are found in the sections entitled "Business," "Management's

Discussion and Analysis of Financial Condition and Results of Operation,"

and "Risk Factors." They include statements concerning: our business strategy;

expectations of market and customer response; liquidity and capital

expenditures; future sources of revenues; expansion of our proposed product

line; and trends in industry activity generally. In some cases, you can identify

forward-looking statements by words such as "may," "will," "should," "expect,"

"plan," "could," "anticipate," "intend," "believe," "estimate," "predict,"

"potential," "goal," or "continue" or similar terminology. These statements are

only predictions and involve known and unknown risks, uncertainties and other

factors, including, but not limited to, the risks outlined under "Risk Factors,"

that may cause our or our industry's actual results, levels of activity,

performance or achievements to be materially different from any future results,

levels of activity, performance or achievements expressed or implied by such

forward-looking statements. For example, assumptions that could cause

actual results to vary materially from future results include, but are not

limited to: our ability to successfully develop and market our products to

customers; our ability to generate customer demand for our products in our

target markets; the development of our target markets and market opportunities;

our ability to manufacture suitable products at competitive cost; market pricing

for our products and for competing products; the extent of increasing

competition; technological developments in our target markets and the

development of alternate, competing technologies in them; and sales of shares by

existing shareholders. Although we believe that the expectations reflected in

the forward looking statements are reasonable, we cannot guarantee future

results, levels of activity, performance or achievements. Unless we are required

to do so under federal securities laws or other applicable laws, we do not

intend to update or revise any forward-looking statements.

PART

I

ITEM

1. BUSINESS

Introduction

CHSH was

incorporated in the State of Nevada on January 24, 2005 as Indigo Technologies,

Inc. On June 6, 2007, the Company changed its name to China Shoe Holdings,

Inc. Prior to the transaction under the Exchange Agreement, CHSH was engaged,

through its subsidiaries, in the manufacturing of ladies fashion footwear for

shoe retailers in Japan and China. The Company also produced various types of

shoe soles for the domestic market in the PRC. The Company’s manufacturing plant

was located in Jiading Township, a suburb of Shanghai in the People's Republic

of China. However, the Company faced a worsening operating environment during

the third quarter of 2008 as the global financial crisis cut demand and a rising

currency eroded profits.

As a

result, on March 31, 2009 (the “Closing Date”), China Shoe Holdings, Inc.

(“CHSH” or the “Company”) entered into a Share Exchange Agreement (the “Exchange

Agreement”) by and among (1) Extra Ease Limited (“Extra Ease”), (2) Eatware

Intellectual Properties Limited (“EWIP”), (3) China Shoe Holdings, Inc., a

Nevada corporation (the “Company”), and (4) the Shareholders of Extra Ease and

EWIP (collectively “the Shareholders”).

Pursuant

to the Exchange Agreement, the Company agreed to acquire (the “Acquisition”),

subject to the satisfaction of the conditions to closing as outlined in the

Agreement, all of the issued and outstanding shares of common stock of Extra

Ease and EWIP. As consideration, the Company shall issue a total of

1,871,313,946 shares of its common stock, of which (i) 121,313,946 shares shall

be issued to the shareholder of Extra Ease or its designee/designees (the “Extra

Ease Exchange Shares”) in exchange for 10,000 shares of Extra Ease, representing

100% of the issued and outstanding common stock of Extra Ease, and (ii)

1,750,000,000 shares shall be issued to the shareholders of EWIP or their

designee/designees (the “EWIP Exchange shares”) in exchange for 50,000 shares of

EWIP, representing 100% of the issued and outstanding common stock of

EWIP. Immediately following completion of the share exchange

transaction, the Company shall have a total of 1,990,759,517 shares of its

common stock issued and outstanding.

As a

result, the Company acquired the business and operations of Extra Ease and EWIP,

and the Company’s principal business activities, moving forward, shall continue

to be conducted through these two companies and their subsidiaries, as further

described below. As a result, in connection with the Exchange Agreement, the

Company sold off the existing business operations of CHSH by way of a

Subsidiary Stock Purchase Agreement dated March 31, 2009, thereby selling the

business and assets of its subsidiaries to a third party. Moving forward, the

Company shall engage in the business as described in the “Business” section

below.

In

connection with the acquisition of Extra Ease and EWIP, the Company intends to

change its name to EATware Inc. The Company has also changed its fiscal year-end

from December 31 to March 31.

Overview

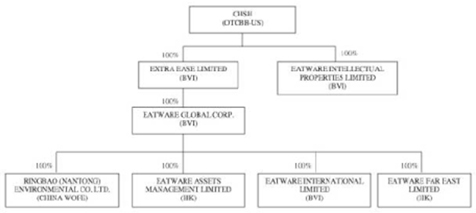

We

conduct our operations through our wholly owned subsidiaries, EWIP and

Extra Ease and its subsidiaries – EGC, Eatware Asset Management Ltd.,

Eatware Far East Ltd., Eatware International Ltd., and Rongbao (Nantong)

Environmental Co. Ltd. (collectively referred to as “EGC”). Extra Ease, EGC and

EWIP are collectively referred to as “Eatware” or the “Group”. We

primarily engage in the marketing and trading of environmentally safe food

packaging products and additives. Our objective is to establish ourselves as a

leading brand of high quality bio-based food packaging

products. We are also looking into opportunities of licensing our

technology, intellectual properties and trademarks to licensed factories for

producing Eatware products and collect royalty for additional income

source.

4

Our

Corporate Structure

Our

Intellectual Properties

Prior to

Eatware products launching to the market, we have performed extensive research

on pulp technology. Throughout the process, EWIP has involved experts both from

the industry and the universities. Management believes that Eatware’s

technological application in this area is far advanced of its competitors. Our

research and development strategy is to create innovative, value-added products

and market opportunities and thus enhance Eatware’s market

position.

The

patented technology combined with the unique additive serve as a high barrier to

entry for the Company’s competitors.

|

Invention

|

An Apparatus And A Method Of

Producing Pulp-Moulded Products

(Compression Chamber Forming)

|

A Method To Reduce Water

Content During Cold Press

|

A Kind Of Food Container Box

Hasp Structure

|

A Mould Cavity Device To Reduce

Residual Moisture Of Pulp-Moulded

Products During Compression

|

|||||

|

China

|

-

|

Patent

No.: ZL 200520040420.9

(Issued

on 27 Sept 06)

|

App

No. 200520047096.3

(filed

on 1 Dec 05)

(Process

time : 48 months)

|

App

No. 200610140169.2

(filed

on 10 Oct 06)

(Process

time : 48 months)

|

|||||

|

Korea

|

-

|

Patent

No.: 10-0877008

(Issued

on 24 Dec 08)

|

-

|

-

|

|||||

|

Malaysia

|

App

No. PI20056021

(filed

on 20 Dec 05)

(Process

time : 48 months)

|

App

No. PI20060276

(filed

on 23 Jan 06)

(Process

time : 48 months)

|

-

|

-

|

|||||

|

Singapore

|

App

No. 200508402-5

(filed

on 27 Dec 05)

(Process

time : 48 months)

|

App

No. 200602007-7

(filed

on 27 Mar 06)

(Process

time : 48 months)

|

-

|

-

|

|||||

|

Taiwan

|

-

|

Patent

No. : M296135

(Issued

on 21 Aug 06)

|

-

|

||||||

|

UK

|

App

No. GB0415853.1

(filed

on 15 July 04)

|

-

|

-

|

-

|

5

EWIP has

been working extensively with copyrights and trademarks to protect against

infringement of its properties. The below table outlines Eatware’s

copyrights and trademarks:

|

TRADEMARK/COPYRIGHT

|

|||||||||||||

|

|

|

|

|

|||||||||

|

COUNTRY

|

Canada

|

File

no.: 1255299

(class

16 & 21)

Filed

on 26 Apr 05

|

-

|

-

|

File

no.:1255302

(class

1)

Filed

on 26 Apr 05

|

||||||||

|

China

|

®

4601212 (class 16)

Reg.

date : 21 August 08

®

4601214 (class 21)

Reg.

date : 21 August 08

|

-

|

File

no.: ZC5014116SL

(class

35)

Filed

on 1 March 06

|

-

|

®

4601213 (class 1)

Reg.

date :

21

August 08

|

||||||||

|

European

Union

|

®

005050976

(class

16,21,35)

Reg.

date : 20 July 07

|

-

|

-

|

-

|

-

|

||||||||

|

Hong

Kong

|

®

300305225

(class

16 & 21)

Reg.

date : 21 Oct 04

|

-

|

®

300569160

(class

16 & 21 & 35)

EATWARE/Eatware/

eatware

Reg.

date : 21 Jan 06

|

®

300569142

(class

16 & 21 & 35)

Reg.

date : 21 Jan 06

|

®

300305216 (class 1)

Reg.

date 21 Oct 04

|

||||||||

|

Japan

|

®

4968375 (class 16 & 21)

Reg.

date : 7 Jul 06

|

-

|

-

|

-

|

-

|

||||||||

|

Malaysia

|

®

06000078 (class 16)

Reg.

date : 4 Jan 06

®

06000079 (class 21)

Reg.

date : 4 Jan 06

|

-

|

File

no: 6008434 (class 35)

Filed

on 19 May 06

|

® 06008435

(class 35)

Reg.

date : 21 Nov 05

|

-

|

||||||||

|

Singapore

|

® T06/00623D

(class 16)

®

T06/00624B (class 21)

Reg.

date: 9 Jan 06

|

-

|

®

T06/09579B (class 35)

Reg.

date: 19 May 06

|

-

|

-

|

||||||||

|

Taiwan

|

®

01198302 (class 16)

Reg.

date: 1 Mar 06

®

01204663 (class 21)

Reg.

date: 16 Apr 06

|

-

|

®

01249531 (class 35)

Reg.

date: 1 Feb 07

|

®

01249530 (class 35)

Reg.

date: 1 Feb 07

|

®

01203450 (class 1)

Reg.

date: 16 Apr 06

|

||||||||

|

UK

|

®

2395326 (class 16 & 21)

Reg.

date: 7 May 05

|

-

|

-

|

-

|

®2397473

(class 1)

Reg.

date: 7 May 05

|

||||||||

|

US

|

®

3308510 (class 16)

Reg.

date : 9 Oct 07

|

®

3364588

Reg.

date : 8 Jan 08 (class 16, 21)

|

®3364587

Reg.

date : 8 Jan 08

(class

16, 21)

|

-

|

®3481399

Reg.

date : 5 Aug 08

(class

16, 21)

|

||||||||

6

EWIP

relies on a combination of trade secrets, confidentiality agreements, patent,

trademark, copyright, licenses, unfair competition and other intellectual

property laws to protect its intellectual property and other proprietary

rights.

EWIP has

engaged with B.I. Appraisals Limited (“B.I. Appraisals”) for an opinion of

valuation of its Intellectual Property in the technology to produce

environmentally preferable food packaging products. B.I.

Appraisals and the management have been conducting asset valuations and

consultancy works in the Greater China and the Asia Pacific regions for various

purposes for over 25 years. In their report dated December

23, 2008, B.I. Appraisals has estimated that the market value of EWIP

Intangible Asset as at November 30, 2008, was reasonably represented by the

amount of US$127,000,000.00 (US Dollars One Hundred and Twenty-seven Million

only).

Our

Products

Eatware

products are 100% organic, chemical-free biodegradable foodservice packaging

product. Features of the products include being oil, water, heat

resistant, microwave and oven safe. EWIP also invented what management believes

to be the world’s first 100% organic additive - Eatplus ® , comprised of a modified

starch. While other food packaging competitive products can take over 200 years

to decompose and have contributed to massive landfills across the globe, Eatware

products are designed to decompose in the soil within 180 days and can disperse

in water within two weeks. Eatplus ® enhances the products making

them sturdy, yet 100% biodegradable.

In

contrast, traditional foodservice disposables, wraps, and paperboard are

currently manufactured from a variety of materials, including paper and plastic.

Management believes that none of these materials fully addresses three of the

principal challenges facing the foodservice industry; namely performance, price,

and environmental impact. Management believes that Eatware products address the

combination of these challenges better than traditional alternatives and

therefore will be able to achieve a significant share of the foodservice

disposable packaging market.

Eatware

products can be categorized into five types: (1) plates; (2) bowls; (3) trays;

(4) lunch boxes; and (5) mini containers. To date, EWIP’s technology has been

used to produce limited commercial quantities of plates, bowls, and hinged-lid

containers intended for use by all segments of the foodservice disposable

packaging market, including quick-service restaurants, food and facilities

management companies, Governments, universities/colleges, and retail operations.

These products were developed using detailed environmental assessments and

carefully selected raw materials and processes to minimize the harmful impact on

the environment without sacrificing competitive price or

performance.

The

Company markets and sells bio-based tableware for the food service packaging

industry that is:

|

¨

|

100%

decomposable, biodegradable and

compostable;

|

|

¨

|

100%

water-resistant;

|

|

¨

|

100%

oil-resistant to over 400ºF;

|

|

¨

|

100%

heat-resistant to over 400ºF;

|

|

¨

|

100%

microwave-safe to over 400ºF;

|

|

¨

|

100%

freezer-safe;

|

|

¨

|

100%

steamer-safe;

|

|

¨

|

100%

made of natural materials – absolutely no chemicals/petroleum are

added;

|

|

¨

|

Made

from bamboo, sugarcane, rice or

cornstarches;

|

|

¨

|

Decomposable

in a landfill within 90 days;

|

|

¨

|

Decomposable

in a compost pile within 2 days;

|

Industry

Based on

industry studies, management believes that the annual spending on foodservice

disposable packaging is approximately $12 billion in the U.S. and will reach

14.4 billion in year 2009. (

source: http://www.allbusiness.com/specialty-businesses/860475-1.html )

The Company believes that of the foodservice disposables purchased in the U.S.

by quick-service restaurants and other institutions, approximately 45% are made

of coated or plastic laminated paper and 55% are made of non-paper materials

such as plastic, polystyrene or foil.

In

addition to the U.S., management believes the market opportunity for Eatware

products are particularly strong in Europe and parts of Asia due to heightened

environmental concerns and government regulations.

7

The

Current Market for Environmentally-Friendly Tableware

According

to the U.S. Environmental Protection Agency (“EPA”), approximately 60 billion

disposable cups, 20 billion disposable eating utensils and 25 billion disposable

plates are used and sent to landfills and incinerators each year in the United

States. Single-use disposable "Expanded Polystyrene" (“EPS”) food and drink

containers (lunch boxes, cups and bowls) are discarded by consumers around the

world by the hundreds of millions each and every single day. This is extremely

detrimental to the environment. EPS products are being viewed by cities and

countries around the world as the main culprit for causing so called "White

Pollution" since EPS is totally non-biodegradable and non-recyclable, according

to the California Integrated Waste management Board, Statewide Waste

Characterization Study: Results and Final Report , pub.

#340-00-009, Sacramento, Calif., December 1999, prepared by Cascadia Consulting

Group. It takes over 200 years before EPS begins to only partly degrade in water

or in the earth. Not only that, but EPS also releases significant toxic

by-products.

Most

widely-used food serviceware is made from crude oil (Styrofoam, etc.) and, like

all conventional plastics, polystyrene foam is non-renewable, non-biodegradable

and virtually non-recyclable. Polystyrene foam food serviceware ends up in

landfills, waterways or the ocean. It breaks down into smaller and smaller

pieces which are often mistaken for food and ingested by marine animals, birds

and fish. Medical evidence also suggests that chemicals in polystyrene foam are

carcinogenic and may leach into food or drink. Polystyrene is produced from

styrene, which is also a known human neurotoxin and a known animal

carcinogen.

As a

result, many municipalities have enacted efforts, regulations and laws to curb

or ban the use of EPS products, such as polystyrene. In fact, over 100 cities in

the US have banned polystyrene in some empirical form ( source:

http://earth911.com/blog/2008/06/23/stroyfoam-bans-here-to-stay/

). In Oakland, CA, for instance, recently banned the use of polystyrene foam

(such as Styrofoam) disposable food service ware for all food vendors ( source: Ordiance No.

07-004http://www.ci.emeryville.ca.us/community/environment/pdf/foodware_ordinance.pdf

)

In our

disposable society, though, it is difficult to ban disposable products

altogether. Fast food restaurants, households with young children,

hospitals, school cafeterias and other facilities concerned with the spread of

food-borne disease attest to the need for disposable food containers.

Add to this the additional energy, water and detergents needed to

wash permanent-ware and it becomes clear that a disposable eco-friendly

alternative is needed around the world. The dilemma, of course, is in

choosing a disposable container that is effective, cost efficient, and minimizes

damage to the environment. Management believes that Eatware products fulfill

this need.

The

Company believes that no other competitive product currently exists in the

market that can equal its environmentally friendly product line’s full list of

benefits. A strong opportunity exists, then, for segment dominance by

Eatware products since the market is just beginning to adopt eco-friendly

foodware. The Company forecasts multiple niche markets that could readily

transition to using the Company’s products, including: catering, government,

academic, hospitality, airline, military and restaurants. Major

opportunities also exist to capture significant portions of the fresh and frozen

food packaging industries.

Environmental

Compliance

Eatware

products have received numerous awards and certifications throughout the

years:

|

Eatware

Management System Certifications

|

||

|

1

|

Quality

Management System ISO9001:2000

|

|

|

2

|

Environmental

Management System ISO14001:2004

|

|

|

3

|

Food

Safety Management System HACCP

|

|

|

Eatware

Product Awards

|

||

|

1

|

***US

Green Seal***

|

|

|

2

|

***China

Environmental Label***

|

|

|

3

|

Hong

Kong Eco-Products Award

|

|

|

4

|

Hong

Kong Q-Mark Product

|

|

|

5

|

Hong

Kong Green Label

|

|

|

6

|

China

Quality Safety Mark

|

|

|

7

|

US

People’s Choice Award – Best New Technology

|

|

|

Eatware

Product Compliance Testing

|

||

8

|

1

|

HKEPD

Testing Guideline on the Degradability and Food Safety of Container and

Bags

|

|

|

HS

1004 Pesticides Residues Test

|

||

|

HS

1005 Coliform Bacteria Test

|

||

|

HS

1006 Moulds and Yeasts Test

|

||

|

HS

2001 Biodegradability Test

|

||

|

HS

3001 Static Loading Test

|

||

|

HS

3003 Low Temperature Resistance Test

|

||

|

HS

3004 Water and Oil Proof Tests at Raised Temperature

|

||

|

HS

3006 Acid Resistance Test

|

|

2

|

US

FDA 21 CFR 176.170

|

|

|

Components

of Paper and Paperboard in Contact with Aqueous and Fatty

Foods

|

||

|

3

|

US

FDA 21 CFR 178.3800

|

|

|

Preservatives

for Fiber

|

||

|

4

|

US

FDA Bacteriological Analytical Manual Chapter 18

|

|

|

Yeasts,

Molds and Mycotoxins

|

||

|

5

|

French

Law 94-647

|

|

|

Packaging

Materials Pollutants Analysis

|

||

|

6

|

EU

Council Directive 94/62/EC; French Law 98-638

|

|

|

Recyclability,

Composting and Biodegradability

|

||

|

7

|

The

European Standard EN13432

|

|

|

Requirements

for Resins Recoverable through Composting and

Biodegradation

|

||

|

8

|

ASTM

D6866-08

|

|

|

Biobased

content

|

||

|

9

|

Canada

Consumer Packaging and Labelling Act (R.S., 1985,

c.C-38)

|

|

|

Packaging,

Labelling, Sale, Importation and

Advertising

|

In

addition to international certifications, Eatware products have also been

awarded Eco Products Award by the Centre of Environmental Technology Ltd, the

Chinese and Hong Kong General Chamber of Commerce in 1999, the Best New

Technology Award by Los Angeles Western Foodservice & Hospitality Expo 2006

and recently the Hong Kong Q-Mark Product Scheme in May 2008 for its remarkable

biodegradable nature and quality. Governmental authorities worldwide recognize

Eatware® as a strong advocator of environmental preservation providing the most

bio-based foodware solutions.

Customers

The

Company’s current customer base is comprised of professional medium size

corporations, with years of experiences in their market segments and with

established network within the food and packaging industries, for faster

penetration. The Company continues to search internationally for more industry

players, to expand its network, as it increases its licensed manufacturing base

for production capacity.

Suppliers

Our

principal suppliers include:

|

NAME

|

AMOUNT (HK$)

04/01/07 – 03/31/08

|

AMOUNT (HK$)

04/01/08 – 03/31/09

|

||||||

|

Tian

Yao Puikei (Haimen) Environmental Product Co. Ltd.

|

4,147,608.14

|

8,524,140.49

|

||||||

|

Tian

Yao (Nantong) Environment Protection

|

3,432,151.22

|

4,787,552.78

|

||||||

|

Glory

Team Industrial Ltd, Shanghai

|

0.0

|

76,287.90

|

||||||

9

Competition

Competition

among food and beverage container manufacturers in the foodservice industry is

intense and many of these competitors have greater financial and marketing

resources at their disposal than the Company does, and many have established

supply, production and distribution relationships and channels.

A number

of the competitors have introduced or are attempting to develop biodegradable

starch-based materials, plastics, or other materials that may be positioned as

potential environmentally superior packaging alternatives. It is expected that

many existing packaging manufacturers may actively seek to develop competitive

alternatives to the Company’s patented manufacturing process and

products.

There are

at least five companies involved in the production of water- and oil-stopping

additives that compete against us, namely: 3M, Dupont, Proman, Michelin and

Aquashield.

To the

best of our knowledge, our principal competitors within the PRC are the

following companies:

|

¨

|

Shandong

Teanhe Green PAK Science and

Technology

|

|

¨

|

China

National Aero-Technology

|

|

¨

|

Zuangzhou

Xin Yan Environmental Protection

Products

|

For

countries outside PRC, there are also competing products from companies such as:

Earthcycle, Biosphere, Cereplast, Earthshell, Novamont, Enviropak, Biobag,

International Paper, NatureWorks, Eatitworlda and Earthsmart. Management

believes that its low-cost manufacturing and technological advantage of EWIP’s

patented additive, EATplus (as described in the section titled “Our Business”),

gives the Company a strong competitive advantage over competitors. The main

advantage, though, is that Eatware product line is a proven technology that has

been manufactured, distributed and marketed for years in Asia.

Some of

our competitive strengths include:

|

¨

|

Premium Quality: We are committed

to ensure the quality of our products. Every single piece of product is

carefully examined before delivering to our

customers.

|

|

¨

|

Highest Hygienic

Standard: Our productions

from licensees are designed to meet the highest food safety requirements

to ensure Eatware products arefree of chemicals, microbiologicals and

allergens.

|

|

¨

|

Extensive Product

Range: Our licensees are

capable of full customized solutions, developments and production. We can

tailor our products to meet client needs in terms of thickness, shape or

size.

|

The

Company believes that its patents and proprietary manufacturing process give it

a competitive advantage in its area of specialization.

Our

Distribution Method

Sales and Marketing. Our

internal sales and marketing team is responsible for monitoring international

sales, which includes coordinating and distributing orders from

distributors.

Distribution Network. We

have established a wide distribution network which allows us to maintain our

competitiveness in the industry. Eatware products are exported through

distributors to various countries, including Bioplanet USA (formerly known as

Global Food Trade, LLC) of USA, BSS (Hong Kong) Corporation Ltd. of Hong Kong

and Singapore, Biopack Pty Ltd. of Australia and New Zealand, and Meitav Chef of

Israel.

10

As of

March 31st, 2009 we had 16 distributors and 2 sales representatives in various

countries throughout the world as follows:

|

Country

|

No. of Distributors

|

|

|

Australia

& New Zealand

|

1

|

|

|

Canada

|

1

|

|

|

France

|

1

|

|

|

Benelux

|

1

|

|

|

Hong

Kong & Singapore

|

1

|

|

|

Korea

|

1

|

|

|

Mexico

|

1

|

|

|

Sweden

|

1

|

|

|

United

Kingdom

|

1

|

|

|

United

States

|

6

|

|

|

Israel

|

1

|

|

|

Sales

Representative (Italy)

|

1

|

|

|

Sales

Representatives (US)

|

1

|

|

|

Total

|

18

|

The

Company primarily serves three customer groups: (1) foodservice (2) consumer and

(3) produce (growers/packers). The Company has maintained strong relationships

with leading foodservice customers and emphasis on innovation and customer

service.

The

Company mainly markets and sells its product line to foodservice distributors

through its in-house direct sales force. Foodservice distributors

sell the products they purchase to various operators including catering

services, the government, academic institutions, hospitality companies,

airlines, the military and restaurants. The company’s sales team works closely

with these customers to develop unique product offerings and promotional

programs.

Compared

to polystyrene products, Eatware products are equally leak-proof, versatile,

sturdy and convenient. However, the biodegradability of Eatware’s starch-based

products could lessen the burden of disposable serviceware on the environment.

Although consumers are generally more environmentally conscious, pricing is

still the key factors for commercial customers and distributors. In the last few

years, the general manufacturing costs for “green” biodegradable products have

become much more competitive compared to traditional methods. Besides promoting

the biodegradability of Eatware products, the Company emphasizes on building

cost advantage by developing economies of scale. The Company expects the costs

of Eatware products would be very competitive to traditional polystyrene

products when more licensed manufacturers are in full operation. It is the

Company’s strategic plan to aggressively expand in order to meet the targeted

price points.

11

ITEM 1A. RISK FACTORS

You

should carefully consider the risks described below as well as other information

provided to you in this document, including information in the section of this

document entitled “Information Regarding Forward Looking Statements.” The risks

and uncertainties described below are not the only ones facing us. Additional

risks and uncertainties not presently known to us or that we currently believes

are immaterial may also impair our business operations. If any of the following

risks actually occur, the Company’s businesses, financial condition or results

of operations could be materially adversely affected, the value of the common

stock could decline, and you may lose all or part of your

investment.

RISKS

RELATED TO OUR BUSINESS

We

are dependent on our Executive Directors and Executive Officers. Any

loss in their services without suitable replacement may adversely affect our

operations.

Our

success to date has been largely due to the contribution of our Chairman and

Chief Financial Officer, Jonathan W. L. So. Mr. So is the founder of our

Company, and has spearheaded our expansion and growth. He is

responsible for our operations, marketing, public relations, strategic planning

and development of new products and markets. Our continued success is

dependent, to a large extent, on our ability to retain his services. The

continued success of our business is also dependent on our key management and

operational personnel such as Mr. Wu, Man-Shing, our Chief Executive

Officer and Mr. Megret, Laurent, our Chief Operating Officer. We

rely on their experience in the food packaging industry, product development,

sales and marketing and on their relationships with our customers and

suppliers.

The loss

of the services of any of our executive directors or executive officers without

suitable replacement or the inability to attract and retain qualified personnel

will adversely affect our operations and hence, our revenue and

profits.

We

have not yet fully evaluated all of the Eatware products and it is possible that

some of the products may not perform as well as conventional

products.

Although

we believe that our licensed Eatware manufacturer can engineer and manufacture

Eatware product to meet many of the critical performance requirements for

specific applications, individual products may not perform as well as

conventional foodservice disposables; for example, some consumers may prefer

clear cups and clear lids on take-home containers which are not available with

our technology. We are still developing many of our Eatware

product and we have not yet evaluated the performance of all of

them. If we fail to develop Eatware product that perform comparably

to conventional foodservice disposables, this could cause consumers to prefer

our competitors' products.

Established

manufacturers in the foodservice disposables industry could improve their

ability to recycle their existing products or develop new environmentally

preferable disposable foodservice containers, which could render our technology

obsolete and could negatively impact our ability to compete.

Competition

among existing food and beverage container manufacturers in the foodservice

industry is intense. Virtually all of the key participants in the

industry have substantially greater financial and marketing resources at their

disposal than we do, and many have well-established supply, production and

distribution relationships and channels. Companies producing competitive

products utilizing competitive materials may reduce their

prices or engage in advertising or

marketing campaigns designed to protect their respective

market shares

and impede market acceptance of our

Eatware product line. In addition, several paper and

plastic disposable packaging manufacturers and

converters and others have made efforts

to increase the recycling of these

products. Increased recycling of paper and plastic products could

lessen their harmful environmental impact, one major basis upon which the

Company intends to compete. A number of companies

have introduced or are attempting to develop biodegradable starch-based

materials, plastics, or other materials that may be positioned as potential

environmentally superior packaging alternatives. We expect that many existing

packaging manufacturers may actively seek competitive alternatives to our

products and processes. The development of competitive, environmentally

attractive, disposable foodservice packaging, whether or not based on our

products and technology, could render our technology obsolete and could impair

our ability to compete, which would have an adverse effect on our business,

financial condition and results of operations.

Our

anticipated international revenues are subject to risks inherent in

international business activities.

We expect

sales of our products and services in foreign countries to account for a

material portion of our revenues. These sales are subject to risks inherent in

international business activities, including:

|

¨

|

Any

adverse change in the political or

economic environments in these

countries;

|

|

¨

|

Economic

instability;

|

12

|

¨

|

Any

adverse change in tax, tariff and trade or other

regulations;

|

|

¨

|

The

absence or significant lack of legal protection for intellectual property

rights;

|

|

¨

|

Exposure

to exchange rate risk for revenues which are denominated in currencies

other than U.S. dollars; and

|

|

¨

|

Difficulties

in managing joint venture businesses spread over various

jurisdictions.

|

Our revenues could

be substantially less than we expect if these risks affect

our ability to successfully sell

our products in the international

market.

Our

products may be perceived poorly by customers and/or environmental groups, which

could have an adverse affect on our business.

Our

success depends substantially on our ability to design and develop foodservice

disposables that are not as harmful to the environment as conventional

disposable foodservice containers made from paper, plastic and polystyrene.

Extra Ease uses a cradle to grave approach in its environmental assessment of

Eatware products and in the development of associated environmental claims. We

have received support for the Eatware concept from a number of environmental

groups. Although we believe that Eatware products offer several

environmental advantages over conventional packaging products, our products may

also possess characteristics that consumers or some environmental groups could

perceive as negative for the environment. Whether, on balance, Eatware products

are better for the environment than conventional packaging products is a

somewhat subjective judgment. Environmental groups, regulators,

customers or consumers may not agree that present and future Eatware products

have an environmental advantage over conventional packaging.

Third parties

may infringe upon our patents, new products that we

develop may not be covered by our

patents and we could suffer an adverse determination in a

patent infringement proceeding, which could allow our competitors to duplicate

our products without having incurred the research and

development costs we

have incurred and therefore allow

them to produce and market those products more

profitably

Our

ability to compete effectively with

conventional packaging will depend, in part, on

our ability to protect our proprietary rights to our

technology. Although the Company endeavors to protect our licensed

technology through, among other things, U.S. and foreign patents, the duration

of these patents is limited and the patents and patent applications licensed to

us may not be sufficient to protect our technology. We also rely on

trade secrets and proprietary know-how that we try to protect in part by

confidentiality agreements with employees and consultants. These agreements have

limited terms and these agreements may be breached, we may not have adequate

remedies for any breach and our competitors may learn our trade secrets or

independently develop them. It is necessary for us to litigate from

time to time to enforce patents issued or licensed to us, to protect our trade

secrets or know-how and to determine the enforceability, scope and validity of

the proprietary rights of others

We

believe that we own or have the rights to use all of the technology that we

expect to incorporate into Eatware products, but an adverse determination in

litigation or infringement proceedings to which we are or may become a party

could subject us to significant liabilities and costs to third parties or

require us to seek licenses from third parties. Although patent and

intellectual property disputes are often settled through licensing or similar

arrangements, costs associated with those arrangements could be substantial and

could include ongoing royalties. Furthermore, we may not obtain the

necessary licenses on satisfactory terms or at all. We

could incur substantial costs attempting to

enforce our licensed patents against third party infringement, or

the unauthorized use of

our trade secrets and proprietary know-how or

in defending ourselves against claims of infringement by others. Accordingly, if

we suffered an adverse determination in a judicial or administrative proceeding

or failed to obtain necessary licenses, it would prevent us from manufacturing

or licensing others to manufacture some of our products.

Our

Failure to produce products profitably on a commercial scale would adversely

affect our ability to compete with conventional disposable foodservice

packagers.

Production

volumes of Eatware products to date have been low relative to the intended

capacity of the various manufacturing lines, and, until production volumes

approach design capacity levels, actual costs and profitability will not be

certain. Since the actual cost of manufacturing Eatware products on a commercial

scale has not been fully demonstrated, they may not be manufactured at a

competitive cost. As we begin to commercially produce Eatware products, we may

encounter unexpected difficulties that cause production costs to exceed current

estimates. The failure to manufacture Eatware products at commercially

competitive costs would make it difficult to compete with other foodservice

disposable manufacturers.

Unavailability

of raw materials used to manufacture our products, increases in the price of the

raw materials, or the necessity of finding alternative raw materials to use in

our products could delay the introduction and market acceptance of our

products.

13

Although

we believe that sufficient quantities of all raw materials used in Eatware

products are generally available, if any raw materials become unavailable, it

could delay the commercial introduction and hinder market acceptance of Eatware

products. In addition, we may

become significant consumers of certain

key raw materials such as starch, and if such consumption is

substantial in relation to

the available resources, raw

material prices may increase which in turn may increase

the cost of Eatware products and impair our profitability. In

addition, we may need to seek alternative sources of raw materials or modify our

product formulations if the cost or availability of the raw materials that we

currently use become prohibitive.

Our

operations are subject to regulation by the U.S. Food and Drug

Administration.

The

manufacture, sale and use of Eatware products are subject to regulation by the

U.S. Food and Drug Administration (the "FDA"). The FDA's regulations

are concerned with substances used in food packaging materials, not with

specific finished food packaging

products. Thus, food and beverage

containers are in compliance with FDA regulations if the components

used in the food and beverage containers: (i)

are approved by the FDA as indirect food

additives for their intended uses and comply with

the applicable FDA indirect food

additive regulations; or (ii) are

generally recognized as safe for their intended uses and are of

suitable purity for those intended uses. the

Company believes that Eatware plates, bowls and

hinged-lid containers and all other current and prototype Eatware

products are in compliance with all requirements of the FDA and do not require

additional FDA approval. However, the FDA may not agree with these

conclusions, which could have a material adverse affect on our business

operations.

RISKS

RELATED TO DOING BUSINESS IN CHINA

Our

operations in the PRC are subject to the laws and regulations of the

PRC.

As the

manufacturing of our products by licensees is mainly carried out in the PRC, we

are subject to and have to operate within the framework of the PRC legal system.

Any changes in the laws or policies of the PRC or the implementation thereof,

for example in areas such as foreign exchange controls, tariffs, trade barriers,

taxes, export licence requirements and environmental protection, may have a

material impact on our operations and financial performance.

The

corporate affairs of our subsidiary in the PRC are governed by its articles of

association and the corporate and foreign investment laws and regulations of the

PRC. The principles of the PRC laws relating to matters such as the fiduciary

duties of directors and other corporate governance matters and foreign

investment laws in the PRC are relatively new. Hence, the enforcement of

investors or shareholders' rights under the articles of association of a PRC

company and the interpretation of the relevant laws relating to corporate

governance matters remain largely untested in the PRC.

Introduction

of new laws or changes to existing laws by the PRC government may adversely

affect our business.

The laws

of the PRC govern our businesses and operations that are located in the PRC. The

PRC legal system is a codified system of written laws, regulations, circulars,

administrative directives and internal guidelines. The PRC government is still

in the process of developing its legal system to encourage foreign investment

and to align itself with global practices and standards. As the PRC economy is

undergoing development at a faster rate than the changes to its legal system,

some degree of uncertainty exists in connection with whether and how existing

laws and regulations apply to certain events and circumstances. Some of the laws

and regulations and the interpretation, implementation and enforcement of such

laws and regulations are also at an experimental stage and are subject to policy

changes. Hence, precedents on the interpretation, implementation and enforcement

of certain PRC laws are limited and court decisions in the PRC do not have

binding effect on lower courts. Accordingly, the outcome of dispute resolutions

and litigation may not be as consistent or predictable as in other more

developed jurisdictions and it may be difficult to obtain swift and equitable

enforcement of the laws in the PRC, or to obtain enforcement of a judgment by a

court or another jurisdiction.

In

particular, on 8 August 2006, six PRC regulatory bodies (including MOFCOM and

the China Security and Regulatory Commission (“CSRC”)) jointly promulgated the

new “Regulations on Foreign Investors Merging with or Acquiring Domestic

Enterprises”, which took effect on 8 September 2006 (“2006 M&A Rules”). The

2006 M&A Rules regulate, inter alia , the

acquisition of PRC domestic companies by foreign investors.

On 21

September 2006, the CSRC promulgated the “Guidelines on Domestic Enterprises

Indirectly Issuing or Listing and Trading their Stocks on Overseas Stock

Exchanges” (the “CSRC Guidelines”).

Under the

2006 M&A Rules and the CSRC Guidelines, the listing of overseas special

purpose vehicles (“SPV”) which are controlled by PRC entities or individuals are

subject to the prior approval of the CSRC.

The 2006

M&A Rules and the CSRC Guidelines do not provide any express requirement for

an SPV to retroactively obtain CSRC approval where the restructuring steps had

been completed prior to 8 September 2006.

John Y.

Lo, 9/F, Hutchison House, Central, Hong Kong, telephone number

(852) 2848-4848, the Legal Adviser to our Company on PRC Law, is of the

opinion that our Group has obtained all the necessary governmental approvals

from PRC authorities for the Restructuring Exercise prior to 8 September 2006,

the requirement to obtain CSRC approval is not applicable to our Company and it

is not necessary for the Company to comply retroactively with the requirement of

obtaining the prior approval of the CSRC for a listing on OTC-BB.

14

There is

no assurance that these PRC authorities will not issue further directives,

regulations, clarifications or implementation rules requiring us to obtain

further approvals in relation to our proposed listing on the

OTC-BB.

PRC

foreign exchange control may limit our ability to utilise our cash effectively

and affect our ability to receive dividends and other payments from our PRC

subsidiaries.

Our PRC

subsidiary, which is a foreign investment entity (“FIEs”), is subject to the PRC

rules and regulations on currency conversion. In the PRC, the State

Administration of Foreign Exchange (“SAFE”) regulates the conversion of the RMB

into foreign currencies. Currently, foreign investment enterprises (including

wholly foreign-owned enterprises) are required to apply to the SAFE for “Foreign

Exchange Registration Certificates for FIEs”. With such registration

certification (which have to be renewed annually), FIEs are allowed to open

foreign currency accounts including the “current account” and “capital account”.

Currently, transactions within the scope of the "current account" (for example,

remittance of foreign currencies for payment of dividends) can be effected

without requiring the approval of the SAFE. However, conversion of currency in

the “capital account” (for example, for capital items such as direct

investments, loans and securities) still requires the approval of the SAFE. Our

PRC operating subsidiary Rixiang has obtained the "Foreign Exchange

Registration Certificates for FIEs", which is subject to annual

review.

Our

subsidiaries, operations and significant assets are located outside the

U.S. Shareholders may not be accorded the same rights and protection

that would be accorded under the Securities Act. In addition, it could be

difficult to enforce a U.S judgment against our Directors and

officers.

Our

subsidiaries, operations and assets are located in the PRC, British Virgin

Islands and Hong Kong. Our subsidiaries are therefore subject to the relevant

laws in the PRC, British Virgin Islands and Hong Kong. The Companies Act may

provide shareholders with certain rights and protection which may not have

corresponding or similar provisions under the laws of the PRC, British Virgin

Islands and Hong Kong. As such, investors in our Shares may or may not be

accorded the same level of shareholder rights and protection that would be

accorded under the Securities Act. In addition, some of our Executive Directors,

as at the Latest Practicable Date, are non-residents of the U.S. and the

assets of these persons are mainly located outside the U.S. As such, there may

be difficulty for Shareholders to effect service of process in the U.S., or to

enforce a judgment obtained in PRC, British Virgin Islands and Hong Kong against

any of these persons.

We

are subject to the PRC's environmental laws and regulations.

Our

production facilities in the PRC will be subject to environmental laws and

regulations imposed by the PRC authorities, inter alia , in respect of

air protection, waste management and water protection. In the event stricter

rules are imposed on air protection, waste management and water protection by

the PRC authorities, we may have to incur higher costs to comply with such

rules. Accordingly, our financial performance may be adversely affected. In

addition, we require licence for the discharge of pollutants for our operations,

which is subject to annual review and renewal. In the event that we fail to

renew our licence with the relevant authority, our operations and financial

performance will be adversely affected.

Changes in

China’s political or

economic situation could harm us and our operating results.

Economic

reforms adopted by the Chinese government have had a positive effect on the

economic development of the country, but the government could change these

economic reforms or any of the legal systems at any time. This could

either benefit or damage our operations and profitability. Some of

the things that could have this effect are:

|

¨

|

Level

of government involvement in the

economy;

|

|

¨

|

Control

of foreign exchange;

|

|

¨

|

Methods

of allocating resources;

|

|

¨

|

Balance

of payments position;

|

|

¨

|

International

trade restrictions; and

|

|

¨

|

International

conflict.

|

The

Chinese economy differs from the economies of most countries belonging to the

Organization for Economic Cooperation and Development, or OECD, in many

ways. As a result of these differences, we may not develop in the

same way or at the same rate as might be expected if the Chinese economy were

similar to those of the OECD member countries.

15

Our business is

largely subject to the uncertain legal environment in China and your legal

protection could be limited.

The

Chinese legal system is a civil law system based on written

statutes. Unlike common law systems, it is a system in which

precedents set in earlier legal cases are not generally used. The

overall effect of legislation enacted over the past 20 years has been to enhance

the protections afforded to foreign invested enterprises in

China. However, these laws, regulations and legal requirements are

relatively recent and are evolving rapidly, and their interpretation and

enforcement involve uncertainties. These uncertainties could limit

the legal protections available to foreign investors, such as the right of

foreign invested enterprises to hold licenses and permits such as requisite

business licenses. In addition, some of our executive officers and

our directors are residents of China and not of the U.S., and substantially

all the assets of these persons are located outside the U.S. As a

result, it could be difficult for investors to effect service of process in the

U.S., or to enforce a judgment obtained in the U.S. against our Chinese

operations and subsidiaries.

The

Chinese government exerts substantial influence over the manner in which we must

conduct our business activities.

China

only recently has permitted provincial and local economic autonomy and private

economic activities. The Chinese government has exercised and continues to

exercise substantial control over virtually every sector of the Chinese economy

through regulation and state ownership. Our ability to operate in China may be

harmed by changes in its laws and regulations, including those relating to

taxation, import and export tariffs, environmental regulations, land use rights,

property and other matters. We believe that our operations in China are in

material compliance with all applicable legal and regulatory requirements.

However, the central or local governments of the jurisdictions in which we

operate may impose new, stricter regulations or interpretations of existing

regulations that would require additional expenditures and efforts on our part

to ensure our compliance with such regulations or interpretations.

Accordingly,

government actions in the future including any decision not to continue to

support recent economic reforms and to return to a more centrally planned

economy or regional or local variations in the implementation of economic

policies, could have a significant effect on economic conditions in China or

particular regions thereof, and could require us to divest ourselves of any

interest we then hold in Chinese properties or joint ventures.

The

PRC's legal and judicial system may not adequately protect our business and

operations and the rights of foreign investors.

The PRC

legal and judicial system may negatively impact foreign investors. In 1982, the

National People's Congress amended the Constitution of China to authorize

foreign investment and guarantee the "lawful rights and interests" of foreign

investors in the PRC. However, the PRC's system of laws is not yet

comprehensive. The legal and judicial systems in the PRC are still rudimentary,

and enforcement of existing laws is inconsistent. Many judges in the PRC lack

the depth of legal training and experience that would be expected of a judge in

a more developed country. Because the PRC judiciary is relatively inexperienced

in enforcing the laws that do exist, anticipation of judicial decision-making is

more uncertain than would be expected in a more developed country. It may be

impossible to obtain swift and equitable enforcement of laws that do exist, or

to obtain enforcement of the judgment of one court by a court of another

jurisdiction. The PRC's legal system is based on the civil law regime, that is,

it is based on written statutes; a decision by one judge does not set a legal

precedent that is required to be followed by judges in other cases. In addition,

the interpretation of Chinese laws may be varied to reflect domestic political

changes.

The

promulgation of new laws, changes to existing laws and the pre-emption of local

regulations by national laws may adversely affect foreign investors. However,

the trend of legislation over the last 20 years has significantly enhanced the

protection of foreign investment and allowed for more control by foreign parties

of their investments in Chinese enterprises. There can be no assurance that a

change in leadership, social or political disruption, or unforeseen

circumstances affecting the PRC's political, economic or social life, will not

affect the PRC government's ability to continue to support and pursue these

reforms. Such a shift could have a material adverse effect on our business

and prospects.

The

practical effect of the PRC legal system on our business operations in the PRC

can be viewed from two separate but intertwined considerations. First, as a

matter of substantive law, the Foreign Invested Enterprise laws provide

significant protection from government interference. In addition, these laws

guarantee the full enjoyment of the benefits of corporate Articles and contracts

to Foreign Invested Enterprise participants. These laws, however, do impose

standards concerning corporate formation and governance, which are

qualitatively different from the general corporation laws of the United States.

Similarly, the PRC accounting laws mandate accounting practices, which are not

consistent with U.S. generally accepted accounting principles. PRC's

accounting laws require that an annual "statutory audit" be performed in

accordance with PRC accounting standards and that the books of account of

Foreign Invested Enterprises are maintained in accordance with Chinese

accounting laws. Article 14 of the People's Republic of China Wholly

Foreign-Owned Enterprise Law requires a wholly foreign-owned enterprise to

submit certain periodic fiscal reports and statements to designated financial

and tax authorities, at the risk of business license revocation. While the

enforcement of substantive rights may appear less clear than United States

procedures, the Foreign Invested Enterprises and Wholly Foreign-Owned

Enterprises are Chinese registered companies, which enjoy the same status as

other Chinese registered companies in business-to-business dispute resolution.

Any award rendered by an arbitration tribunal is enforceable in accordance with

the United Nations Convention on the Recognition and Enforcement of Foreign

Arbitral Awards (1958). Therefore, as a practical matter, although no assurances

can be given, the Chinese legal infrastructure, while different in operation

from its United States counterpart, should not present any significant

impediment to the operation of Foreign Invested Enterprises

Capital

outflow policies in the PRC may hamper our ability to remit income to the United

States.

The PRC

has adopted currency and capital transfer regulations. These regulations may

require that we comply with complex regulations for the movement of capital and

as a result we may not be able to remit all income earned and proceeds received

in connection with our operations or from the sale of our operating subsidiary

to the U.S. or to our stockholders.

16

Future

inflation in China may inhibit our ability to conduct business in

China.

In recent

years, the Chinese economy has experienced periods of rapid expansion and highly

fluctuating rates of inflation. During the past ten years, the rate of inflation

in China has been as high as 20.7% and lows as -2.2%. These factors have led to

the adoption by the Chinese government, from time to time, of various corrective

measures designed to restrict the availability of credit or regulate growth and

contain inflation. High inflation may in the future cause the Chinese government

to impose controls on credit and/or prices, or to take other action, which could

inhibit economic activity in China, and thereby harm the market for our

products.

Any

recurrence of severe acute respiratory syndrome, or SARS, or another widespread

public health problem, could harm our operations.

A renewed

outbreak of SARS or another widespread public health problem in China, where our

operations are conducted, could have a negative effect on our

operations.

Our

operations may be impacted by a number of health-related factors, including the

following:

|

¨

|

Quarantines

or closures of some of our offices which would severely disrupt our

operations,

|

|

¨

|

The

sickness or death of our key officers and employees,

and

|

|

¨

|

A

general slowdown in the Chinese

economy.

|

Any of

the foregoing events or other unforeseen consequences of public health problems

could damage our operations.

Restrictions

on currency exchange may limit our ability to receive and use our revenues

effectively.

The

majority of our revenues will be settled in Renminbi and U.S. dollars, and any

future restrictions on currency exchanged may limit our ability to use revenue

generated in Renminbi to fund any future business activities outside China or to

make dividend or other payments in the U.S. dollars. Although the Chinese

government introduced regulations in 1996 to allow greater convertibility of the

Renminbi for current account transactions, significant restrictions still

remain, including primarily the restriction that foreign-invested enterprises

may only buy, sell or remit foreign currencies after providing valid commercial

documents, at those banks in China authorized to conduct foreign exchange

business. In addition, conversion of Renminbi for capital account items,

including direct investment and loans, is subject to governmental approval in

China, and companies are required to open and maintain separate foreign exchange

accounts for capital account items. We cannot be certain that the Chinese

regulatory authorities will not impose more stringent restrictions on the

convertibility of the Renminbi.

The

value of our securities will be affected by the foreign exchange rate between

U.S. dollars and Renminbi.

The value

of our common stock will be affected by the foreign exchange rate between U.S.

dollars and Renminbi, and between those currencies and other currencies in which

our sales may be denominated. For example, to the extent that we need to convert

U.S. dollars into Renminbi for our operational needs and should the

Renminbi appreciate against the U.S. dollar at that time, our financial

position, the business of the company, and the price of our common stock may be

harmed. Conversely, if we decide to convert our Renminbi into U.S. dollars for

the purpose of declaring dividends on our common stock or for other business

purposes and the U.S. dollar appreciates against the Renminbi, the U.S. dollar

equivalent of our earnings from our subsidiaries in China would be

reduced.

Because our funds are held in banks

which do not provide

insurance, the failure of any bank in which we deposit our funds could affect

our ability to continue in business.

Banks and

other financial institutions in the PRC do not provide insurance for funds held

on deposit. As a result, in the event of a bank failure, we may not have access

to funds on deposit. Depending upon the amount of money we maintain in a bank

that fails, our inability to have access to our cash could impair our

operations, and, if we are not able to access funds to pay our suppliers,

employees and other creditors, we may be unable to continue in

business.

Imposition

of trade barriers and taxes may reduce our ability to do business

internationally, and the resulting loss of revenue could harm our

profitability.

We may

experience barriers to conducting business and trade in our targeted emerging

markets in the form of delayed customs clearances, customs duties and tariffs.

In addition, we may be subject to repatriation taxes levied upon the exchange of

income from local currency into foreign currency, substantial taxes of

profits, revenues, assets and payroll, as well as value-added tax. The

markets in which we plan to operate may impose onerous and unpredictable duties,

tariffs and taxes on our business and products, and there can be no assurance

that this will not reduce the level of sales that we achieve in such markets,

which would reduce our revenues and profits.

17

Failure

to comply with the United States Foreign Corrupt Practices Act could subject us

to penalties and other adverse consequences.

We are

subject to the United States Foreign Corrupt Practices Act, which generally

prohibits United States companies from engaging in bribery or other prohibited

payments to foreign officials for the purpose of obtaining or retaining

business. Foreign companies, including some that may compete with us, are not

subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft