Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - International Coal Group, Inc. | frm8-k.htm |

UBS

Boston Coal Conference

December 1, 2009

December 1, 2009

Ben

Hatfield

President

& Chief Executive Officer

Forward-Looking

Statement

n Statements in this

press release that are not historical facts are forward-looking statements

within the “safe harbor” provision of the Private

Securities Litigation Reform Act of 1995 and may involve a number of risks and uncertainties. We have used the words “anticipate,” “believe,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project” and similar terms and phrases, including references to assumptions, to

identify forward-looking statements. These forward-looking statements are made based on expectations and beliefs concerning future events

affecting us and are subject to various risks, uncertainties and factors relating to our operations and business environment, all of which are difficult

to predict and many of which are beyond our control, that could cause our actual results to differ materially from those matters expressed in or

implied by these forward-looking statements. The following factors are among those that may cause actual results to differ materially from our

forward-looking statements: market demand for coal, electricity and steel; availability of qualified workers; future economic or capital market

conditions; weather conditions or catastrophic weather-related damage; our production capabilities; consummation of financing, acquisition or

disposition transactions and the effect thereof on our business; a significant number of conversions of our convertible senior notes prior to maturity;

our plans and objectives for future operations and expansion or consolidation; our relationships with, and other conditions affecting, our customers;

availability and costs of key supplies or commodities, such as diesel fuel, steel, explosives and tires; availability and costs of capital equipment;

prices of fuels which compete with or impact coal usage, such as oil and natural gas; timing of reductions or increases in customer coal

inventories; long-term coal supply arrangements; reductions and/or deferrals of purchases by major customers; risks in or related to coal mining

operations, including risks related to third-party suppliers and carriers operating at our mines or complexes; unexpected maintenance and

equipment failure; environmental, safety and other laws and regulations, including those directly affecting our coal mining and production, and

those affecting our customers’ coal usage; ability to obtain and maintain all necessary governmental permits and authorizations; competition

among coal and other energy producers in the United States and internationally; railroad, barge, trucking and other transportation availability,

performance and costs; employee benefit costs and labor relations issues; replacement of our reserves; our assumptions concerning economically

recoverable coal reserve estimates; availability and costs of credit, surety bonds and letters of credit; title defects or loss of leasehold interests in

our properties which could result in unanticipated costs or inability to mine these properties; future legislation and changes in regulations or

governmental policies or changes in interpretations thereof, including with respect to safety enhancements and environmental initiatives relating to

global warming; impairment of the value of our long-lived and deferred tax assets; our liquidity, including the ability to adhere to financial

covenants related to our borrowing arrangements, results of operations and financial condition; adequacy and sufficiency of our internal controls;

and legal and administrative proceedings, settlements, investigations and claims and the availability of related insurance coverage.

Securities Litigation Reform Act of 1995 and may involve a number of risks and uncertainties. We have used the words “anticipate,” “believe,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project” and similar terms and phrases, including references to assumptions, to

identify forward-looking statements. These forward-looking statements are made based on expectations and beliefs concerning future events

affecting us and are subject to various risks, uncertainties and factors relating to our operations and business environment, all of which are difficult

to predict and many of which are beyond our control, that could cause our actual results to differ materially from those matters expressed in or

implied by these forward-looking statements. The following factors are among those that may cause actual results to differ materially from our

forward-looking statements: market demand for coal, electricity and steel; availability of qualified workers; future economic or capital market

conditions; weather conditions or catastrophic weather-related damage; our production capabilities; consummation of financing, acquisition or

disposition transactions and the effect thereof on our business; a significant number of conversions of our convertible senior notes prior to maturity;

our plans and objectives for future operations and expansion or consolidation; our relationships with, and other conditions affecting, our customers;

availability and costs of key supplies or commodities, such as diesel fuel, steel, explosives and tires; availability and costs of capital equipment;

prices of fuels which compete with or impact coal usage, such as oil and natural gas; timing of reductions or increases in customer coal

inventories; long-term coal supply arrangements; reductions and/or deferrals of purchases by major customers; risks in or related to coal mining

operations, including risks related to third-party suppliers and carriers operating at our mines or complexes; unexpected maintenance and

equipment failure; environmental, safety and other laws and regulations, including those directly affecting our coal mining and production, and

those affecting our customers’ coal usage; ability to obtain and maintain all necessary governmental permits and authorizations; competition

among coal and other energy producers in the United States and internationally; railroad, barge, trucking and other transportation availability,

performance and costs; employee benefit costs and labor relations issues; replacement of our reserves; our assumptions concerning economically

recoverable coal reserve estimates; availability and costs of credit, surety bonds and letters of credit; title defects or loss of leasehold interests in

our properties which could result in unanticipated costs or inability to mine these properties; future legislation and changes in regulations or

governmental policies or changes in interpretations thereof, including with respect to safety enhancements and environmental initiatives relating to

global warming; impairment of the value of our long-lived and deferred tax assets; our liquidity, including the ability to adhere to financial

covenants related to our borrowing arrangements, results of operations and financial condition; adequacy and sufficiency of our internal controls;

and legal and administrative proceedings, settlements, investigations and claims and the availability of related insurance coverage.

n You should keep in

mind that any forward-looking statement made by us in this presentation or

elsewhere speaks only as of the date on which the

statements

were made. See also the “Risk Factors” in our 2008 Annual Report on Form 10-K

and in subsequent filings on Form 10-Q, all of which

are currently available on our website at www.intlcoal.com. New risks and uncertainties arise from time to time, and it is impossible for us to predict

these events or how they may affect us or our anticipated results. We have no duty to, and do not intend to, update or revise the forward-looking

statements in this presentation , except as may be required by law. In light of these risks and uncertainties, you should keep in mind that any

forward-looking statement made in this presentation might not occur. All data presented herein is as of December 1, 2009 unless otherwise noted.

are currently available on our website at www.intlcoal.com. New risks and uncertainties arise from time to time, and it is impossible for us to predict

these events or how they may affect us or our anticipated results. We have no duty to, and do not intend to, update or revise the forward-looking

statements in this presentation , except as may be required by law. In light of these risks and uncertainties, you should keep in mind that any

forward-looking statement made in this presentation might not occur. All data presented herein is as of December 1, 2009 unless otherwise noted.

UBS Boston

Conference, December 1, 2009

2

Highlights

of ICG

n Strong operating

presence in 3 of 4 largest US coal-producing

regions - Central Appalachia, Northern Appalachia, & IL Basin

regions - Central Appalachia, Northern Appalachia, & IL Basin

n Extensive coal

reserve holdings with 63% ownership position

n Favorable contracted

sales position

n Metallurgical sales

projected to double in 2010

n Planned production

growth is primarily from permitted

underground mines with less exposure to environmental issues

underground mines with less exposure to environmental issues

n 100% union-free

workforce

n Solid balance sheet

with minimal long-term legacy liabilities

Summary

Statistics

Market

capitalization1: $700.0 million

Coal

reserves: 1.0

billion tons

Reserve

life: Approximately

58 yrs

Employees: 2,600

2009 tons

sold2: 17.3 to

17.5 million

2009 tons

produced2: 16.4 to

16.6 million

1Market capitalization

is based on 155.2 million shares outstanding and a stock price of $4.51 as of

November 25, 2009.

2Management’s estimate

as of October 28, 2009

UBS Boston

Conference, December 1, 2009

3

§ 13 active mining

complexes - 8 in Central Appalachia, 4 in

Northern Appalachia, and 1 in Illinois Basin

Northern Appalachia, and 1 in Illinois Basin

Operating

Strength

and Diversity

and Diversity

ICG

Illinois

Illinois

Kentucky

Beckley

Virginia

MD

East

Kentucky

Flint

Ridge

Hazard

Knott

County

Raven

Eastern

Buckhannon

Sentinel

Tygart

Valley #1

Vindex

Current

Operations

Future

Operations

Powell

Mountain

Pennsylvania

Indiana

Ohio

UBS Boston

Conference, December 1, 2009

4

High-Caliber

Reserve Base

(As of September 30, 2009)

(As of September 30, 2009)

37%

Leased

96

million tons met

273

million tons steam

63%

Owned

232

million tons met

399

million tons steam

Geographic

Distribution of

Reserves

Reserves

Reserve

Ownership

Reserves

by Method

11%

Surface

89%

Underground

37%

IL

Basin

37%

NAPP

26%

CAPP

§ ICG controls 1.0

billion tons of high-quality reserves that are

primarily high-BTU, low-sulfur steam and metallurgical coal

primarily high-BTU, low-sulfur steam and metallurgical coal

§ Largest reserve

ownership position among publicly traded peers

§ ~200 million

permitted tons; 162 million underground

UBS Boston

Conference, December 1, 2009

5

Large

Met Quality

Reserve Position*

(As of September 30, 2009)

Reserve Position*

(As of September 30, 2009)

52%

Met

Quality

328

million tons

48%

Steam

Quality

301

million tons

76%

Hi Vol

250

million tons

8%

Mid Vol

26

million tons

16%

Low Vol

52

million tons

n CAPP/NAPP reserves

of 629 million tons are 52%

metallurgical-grade quality

metallurgical-grade quality

UBS Boston

Conference, December 1, 2009

6

2009

Production Profile

(As

of September 30, 2009)

24%

NAPP

62%

CAPP

14%

ILB

Production

by State

Production

by Region

Production

by Method

53%

Surface

47%

Underground

42%

KY

40%

WV

14%

IL

4%

MD

UBS Boston

Conference, December 1, 2009

7

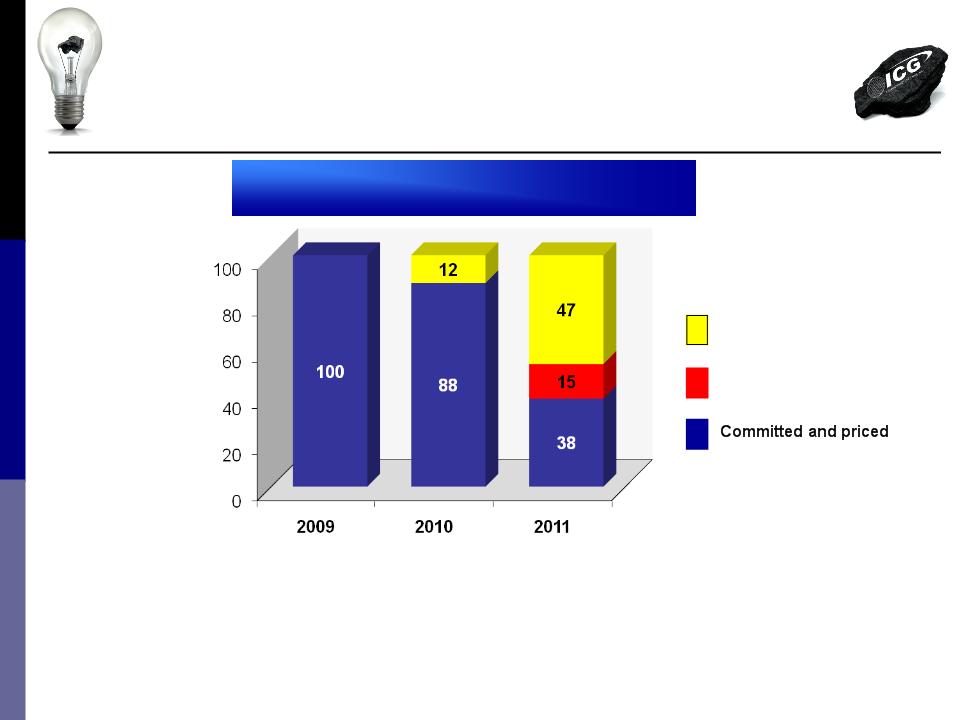

Projected

Sales 17.3

- 17.5 16.5 -

17.5 16.5 -

18.0

(tons in millions)

(tons in millions)

Projected

Price Per Ton $59.25-$59.50 $61.00-$62.50 $65.00-$70.00

Committed

Tonnage1

1 Management’s

estimate as of November 30, 2009

Favorable

Sales Position

%

of

Sales

Sales

UBS Boston

Conference, December 1, 2009

8

Uncommitted

Committed

and not priced

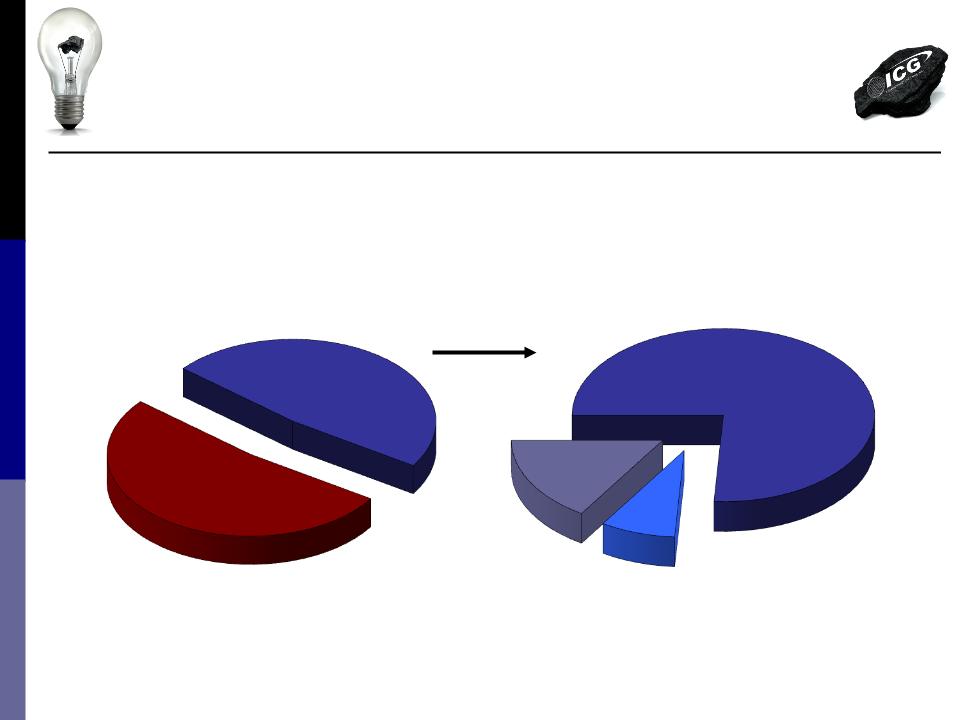

Projecting

Doubling of

Metallurgical Sales

Metallurgical Sales

Future

met growth opportunities

n Tygart

project

– Premium high

volatile met

– 3.5 mm TPY longwall

mine

projected at 40% met

projected at 40% met

n Vindex

Bakerstown project

– Premium low volatile

met

– 0.9 mm TPY CM deep

mine

n These

mines and other permitted

sources could increase annual

met sales to plus 5 mm tons by

2014-15

sources could increase annual

met sales to plus 5 mm tons by

2014-15

UBS Boston

Conference, December 1, 2009

Met

Sales Growth 2006-10

9

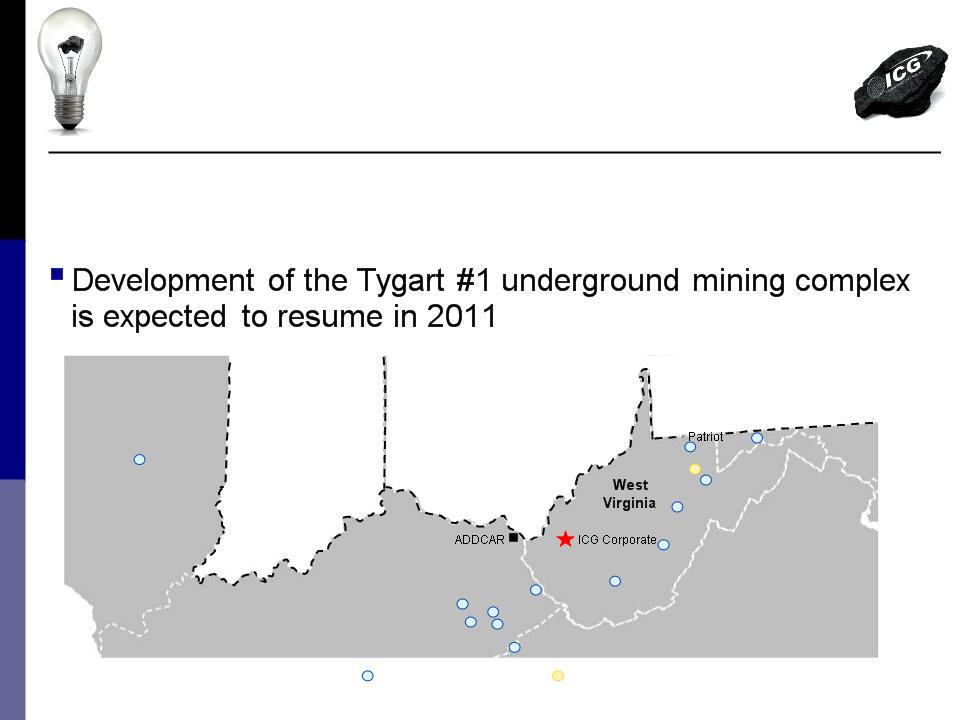

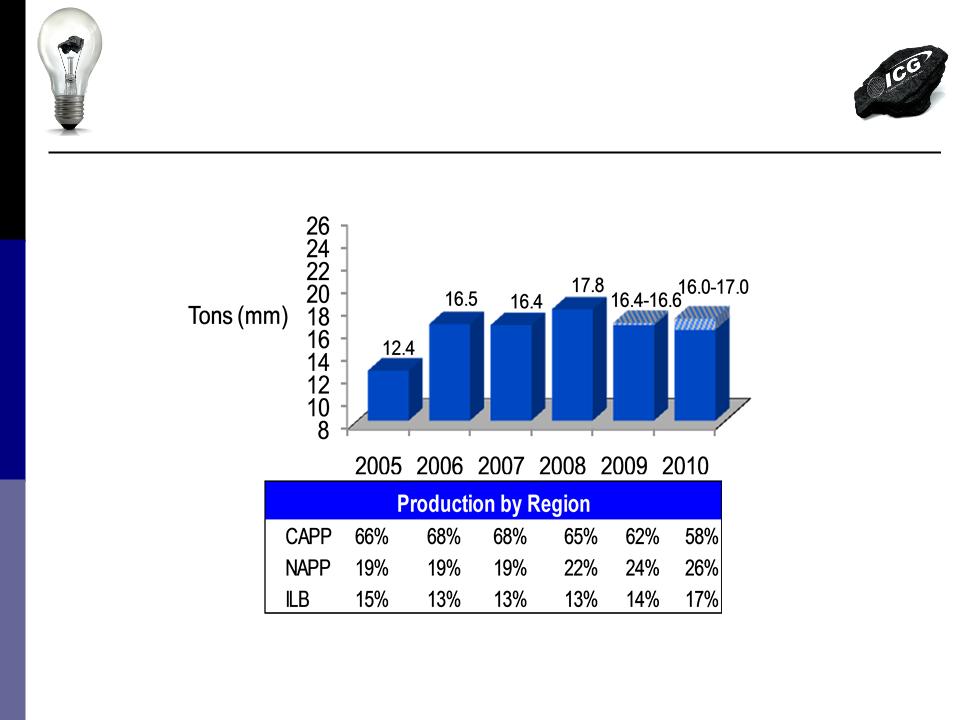

Production

Growth Is Primarily

from Underground Mines

from Underground Mines

n Nearly all ICG

growth is comprised of new or expanding

underground mining operations (versus surface mines)

underground mining operations (versus surface mines)

– Major new

development is Tygart #1 complex in Northern App

– Other deep mine

growth planned at Beckley, Illinois, & Raven

n Surface portion of

ICG production steadily decreasing

– Dropped from 65% in

2007 to 53% in 2009

– Projected to

decrease to 31% by 2015

n Although still

subject to development risks, underground

mines have become less controversial (and less likely to be

delayed by anti-mining activists) than surface mines

mines have become less controversial (and less likely to be

delayed by anti-mining activists) than surface mines

UBS Boston

Conference, December 1, 2009

10

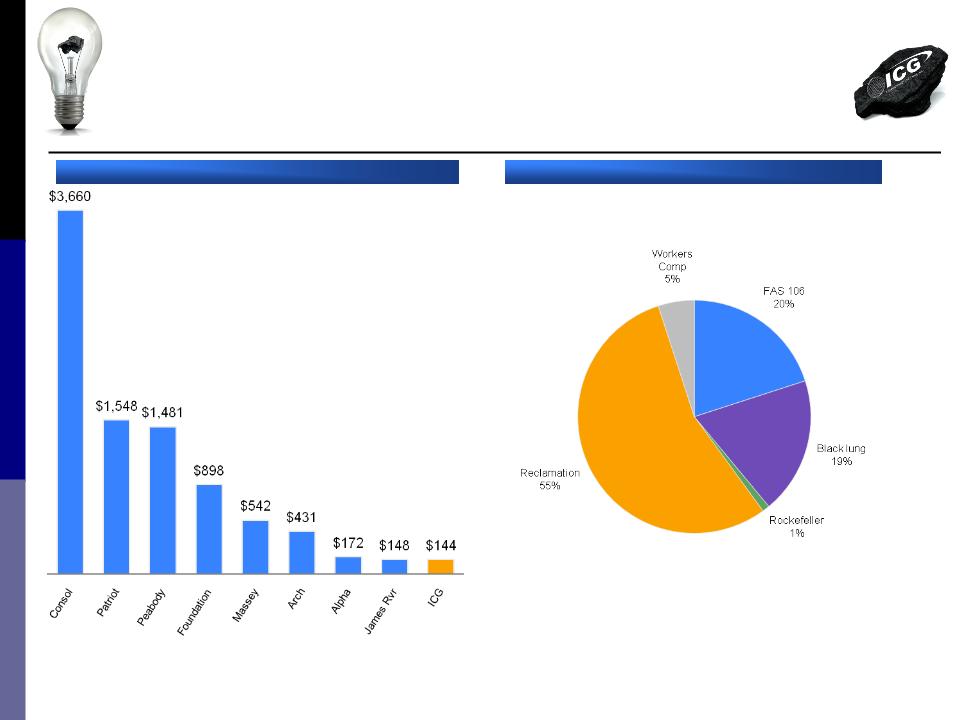

ICG

Legacy Liabilities

Total: $144

million

Total

Legacy Liabilities1

1 Source:

company Annual Reports as of December 31, 2008. Legacy

liabilities include post retirement benefits, black lung liabilities,

reclamation

liabilities, workers compensation and Coal Act liabilities

liabilities, workers compensation and Coal Act liabilities

($ in

millions)

Lowest

Legacy Liabilities

Among

Peer Group

UBS Boston

Conference, December 1, 2009

11

Coal

Market Update

UBS Boston

Conference, December 1, 2009

12

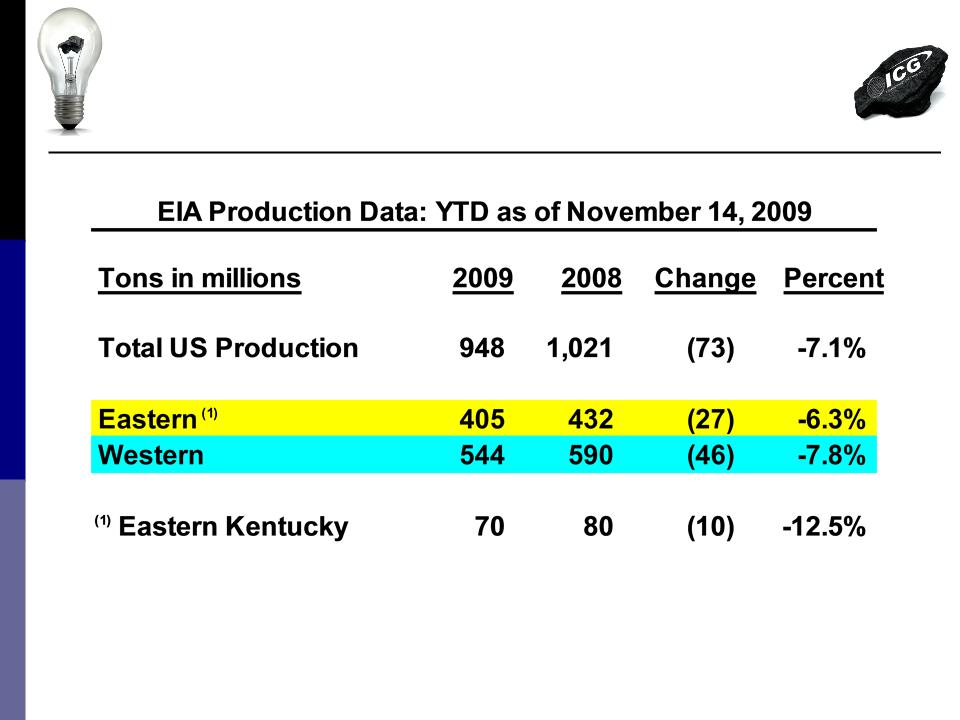

Current Market Conditions

n Market has recently

improved, but remains somewhat fragile

– Rising natural gas

prices are subject to retreat in response to mild weather

or bloated storage reports

or bloated storage reports

– Further, thermal

coal production cuts may be needed to achieve balance

n However, several

positive signals are developing

– Steel capacity

utilization has been improving each week since late April

– Coal exports are

increasing, especially for metallurgical coals

– US economic

indicators, while mixed, are generally showing improvement

n Coal output expected

to remain subdued until utility stockpiles

drop

drop

– However, shipment

execution should improve as winter demand arrives

– Expect domestic coal

inventory levels to fall sharply as dramatic production

cuts become visible in the face of winter demand and rising exports

cuts become visible in the face of winter demand and rising exports

n Overall, we believe

worst of market weakness is behind us

UBS Boston

Conference, December 1, 2009

13

Producers

Reacted

Quickly in 2009

Quickly in 2009

UBS Boston

Conference, December 1, 2009

14

Recent

Thermal Spot Pricing Suggests

Early Signs of Recovery

Early Signs of Recovery

UBS Boston

Conference, December 1, 2009

Prompt

Month Coal Pricing Per ICAP-United, Inc.

15

Forward

Curve Predicts

Meaningful Price Opportunity

Meaningful Price Opportunity

UBS Boston

Conference, December 1, 2009

16

Favorable

Trends for

Met Coal Demand

Met Coal Demand

n Steel capacity

utilization has been recovering:

– U. S. has rebounded

to 65% from 40% in Q1 2009

– Steel sectors in

China, Eastern Europe, & India are near 100%

n Resilient economic

growth in Asia is expected to drive

increased met coal consumption

increased met coal consumption

– Projected GDP growth

in China is 8-10% for 2010 and 2011

– Infrastructure

constraints in Australia expected to position Eastern

US producers favorably to service rising global demand

US producers favorably to service rising global demand

n Recent Australian

spot sales in the $165 range represent a

28% increase from the $129 March settlements

28% increase from the $129 March settlements

n Industry consensus

suggests that met market recovery will

come sooner and stronger than the thermal market rebound

come sooner and stronger than the thermal market rebound

UBS Boston

Conference, December 1, 2009

17

Summary

UBS Boston

Conference, December 1, 2009

18

Near-Term

Strategy

n Maintain flexibility

to match production with changing

markets

markets

– ICG has idled or

reduced 4.2 million annual tons of higher-cost

production since January 2009

production since January 2009

n Capitalize on

improving metallurgical coal market

n Continue to

strengthen liquidity and maximize cash

n Protect profit

margin by managing costs

n Be cautious on

entering coal contracts beyond 2010 as

pricing environment is expected to improve beginning

mid-year

pricing environment is expected to improve beginning

mid-year

UBS Boston

Conference, December 1, 2009

19

Conclusion

n Well-positioned for

the current economic outlook

– Essentially all of

2009 coal is committed at substantially higher prices than

in prior years, solid contract base for 2010

in prior years, solid contract base for 2010

– Maturing of new

mines, lower labor turnover and reduced commodity prices

are expected to help cost performance

are expected to help cost performance

– Met production

expected to double in 2010 (versus 2009)

n Favorable operating

cash flow expected in 2009 and 2010

– Capital spending

reflects a measured and cautious outlook

– Key focus on

strengthening liquidity

n As the market

rebalances in 2010 and global stimulus

efforts take hold, increasing demand for low-cost electricity

and steel products should bode well for coal

efforts take hold, increasing demand for low-cost electricity

and steel products should bode well for coal

UBS Boston

Conference, December 1, 2009

20

Questions?

UBS Boston

Conference, December 1, 2009

21

Appendices

UBS Boston

Conference, December 1, 2009

22

Production

and Operating

Statistics

Statistics

UBS Boston

Conference, December 1, 2009

23

Adjusting

Production

Growth To Match Demand

Growth To Match Demand

1 Management’s estimate

as of October 28, 2009

UBS Boston

Conference, December 1, 2009

24

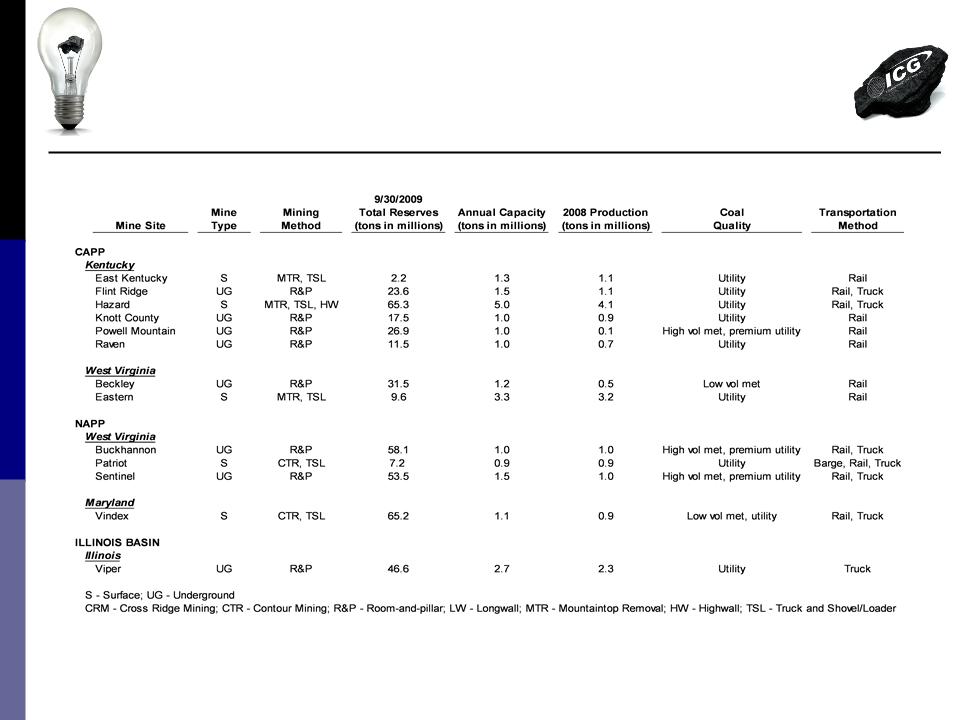

Summary

of Active

Mining Operations

Mining Operations

UBS Boston

Conference, December 1, 2009

25

Peer

Group

Cost

and Margin Comparisons

UBS Boston

Conference, December 1, 2009

26

Peer

Group Cost Per Ton

Appalachian Production (2007 - 3Q09)

Appalachian Production (2007 - 3Q09)

UBS Boston

Conference, December 1, 2009

27

Peer

Group Cost Per Ton

Illinois Basin Production (2007 - 3Q09)

Illinois Basin Production (2007 - 3Q09)

UBS Boston

Conference, December 1, 2009

28

Peer

Group Margin Comparison

Margin Per Ton in Dollars (2007 - 3Q09)

Margin Per Ton in Dollars (2007 - 3Q09)

UBS Boston

Conference, December 1, 2009

29

Recap

of ICG Capital

Investment

Strategy

2005-2009

UBS Boston

Conference, December 1, 2009

30

ICG

Capital Investment Focus

n Capital investment

strategy during 2005-2009 has focused

on two key areas:

on two key areas:

1. Development capital

for construction of new mining complexes to

boost production for targeted markets

boost production for targeted markets

2. Maintenance capital

designed to “catch up” for years of under-

investment and upgrade the aged equipment fleet inherited from

the Horizon and Anker bankruptcies

investment and upgrade the aged equipment fleet inherited from

the Horizon and Anker bankruptcies

UBS Boston

Conference, December 1, 2009

31

Substantial

Success Achieved in

Launching Expansion Projects

Launching Expansion Projects

|

Major

Expansion Projects

|

2005

|

2006

|

2007

|

2008

|

2009

Est |

|

• Flint

Ridge Complex

|

|

|

|

|

|

|

• Raven

Complex

|

|

|

|

|

|

|

• Vindex

Barton/Buffalo Expansion

|

|

|

|

|

|

|

• New

Sentinel Clarion Mine

|

|

|

|

|

|

|

• Beckley

Complex

|

|

|

|

|

|

|

• Hazard

Shovel Spread

|

|

|

|

|

|

|

• Tygart

#1 Complex (Ongoing)

|

|

|

|

|

|

|

• Other

Substantial Exp Projects

|

|

|

|

|

|

|

Total

Project Capex

(millions)

|

$35.6

|

$92.2

|

$123.3

|

$94.9

|

$8.0

|

Total

of $354.0 million invested in expansion projects during 2005-2009

UBS Boston

Conference, December 1, 2009

32

Maintenance

Capital “Catch-Up”

Spending Has Leveled Off

Spending Has Leveled Off

|

($

in millions)

|

2005

|

2006

|

2007

|

2008

|

2009

Est

|

|

Total Capital

Expenditures

|

$116.8

|

$197.0

|

$181.3

|

$171.6

|

$94.5

|

|

|

|

|

|

|

|

|

Less Project

Capex

|

$35.6

|

$92.2

|

$123.3

|

$94.9

|

$8.0

|

|

|

|

|

|

|

|

|

=

Non-Project Capital

(Basic

Maintenance Capex)

|

$81.2

|

$104.8

|

$58.0

|

$76.7

|

$86.5

|

|

|

|

|

|

|

|

|

Coal

Production (tons, millions)

|

12.4

|

16.5

|

16.4

|

17.8

|

16.5

|

|

|

|

|

|

|

|

|

Maintenance

Capex/Ton

|

$6.55

|

$6.35

|

$3.54

|

$4.31

|

$5.24(1)

|

UBS Boston

Conference, December 1, 2009

33

Note

: (1) Idled capacity due to market-driven production cuts essentially inflated

2009 maintenance capex per ton

Equipment

Fleet Now

Significantly Stronger

Significantly Stronger

UBS Boston

Conference, December 1, 2009

34

Miscellaneous

Coal Reserves

&

Sales Statistics Slides

UBS Boston

Conference, December 1, 2009

35

Substantial

Permitted Reserves

(September 30, 2009)

(September 30, 2009)

Permitted

199

million tons

Non-permitted

801

million tons

NAPP

116

million tons

CAPP

64

million tons

ILL

19

million tons

n ICG’s permitted

reserves include 162 million tons

underground and 37 million tons surface

underground and 37 million tons surface

Permitted

Reserves

Permitted

Reserves by

Geographic

Basin

UBS Boston

Conference, December 1, 2009

36

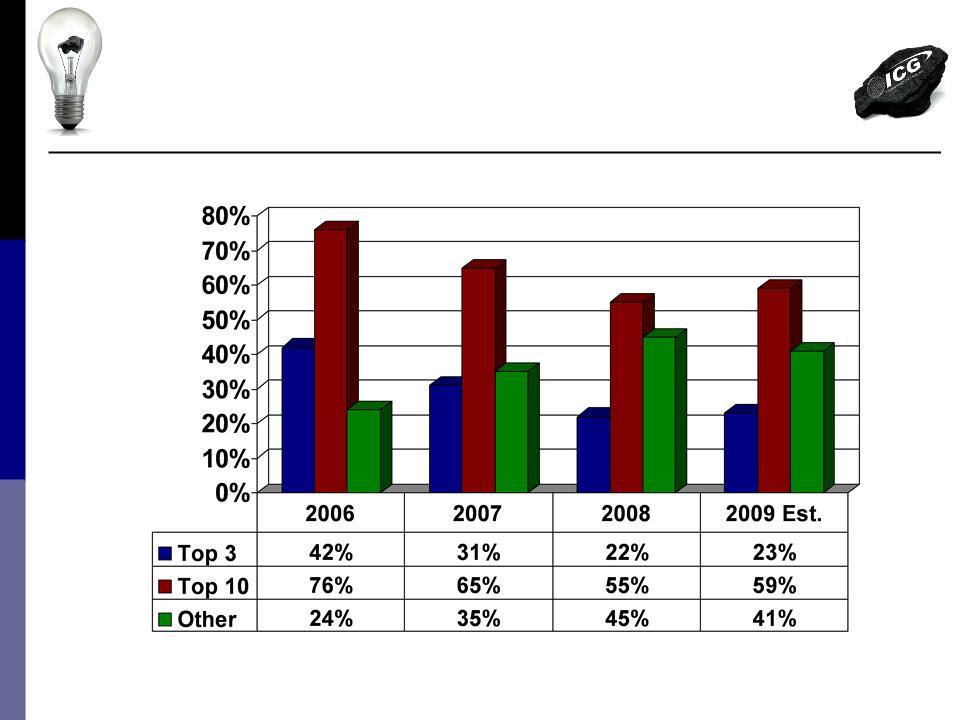

More

Diversified

Customer Base

Customer Base

UBS Boston

Conference, December 1, 2009

37