Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CHOICE HOTELS INTERNATIONAL INC /DE | d8k.htm |

Investor Presentation December 2009 Exhibit 99.1 |

2 DISCLAIMER Certain matters discussed throughout all of this presentation constitute forward-looking statements

within the meaning of the federal securities law. Generally, our use of words such as

“expect,” “estimate,” “believe,” “anticipate,”

“will,” “forecast,” “plan,” “project,” “assume” or similar words of futurity identify statements that are forward-looking and that we intend to be included within the Safe Harbor protections provided by

Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934. Such

forward-looking statements are based on management’s current beliefs, assumptions and

expectations regarding future events, which in turn are based on information currently

available to management. Such statements may relate to projections for the company’s revenue, earnings and other financial and operational measures, company debt levels, payment of stock

dividends, and future operations. We caution you not to place undue reliance on any

forward-looking statements, which are made as of the date of this presentation.

Forward-looking statements do not guarantee future performance and involve known and

unknown risks, uncertainties and other factors. Several factors could cause actual results,

performance or achievements of the company to differ materially from those expressed in or

contemplated by the forward-looking statements. Such risks include, but are not limited to, changes to general, domestic and foreign economic conditions; operating risks common in the lodging and

franchising industries; changes to the desirability of our brands as viewed by hotel operators

and customers; changes to the terms or termination of our contracts with franchisees; our

ability to keep pace with improvements in technology utilized for reservations systems and

other operating systems; fluctuations in the supply and demand for hotels rooms; and our ability

to manage effectively our indebtedness. These and other risk factors are discussed in detail in

the Risk Factors section of the company’s Form 10-K for the year ended December 31, 2008, filed with the Securities and Exchange Commission on March 2, 2009. We undertake no obligation to publicly update or

revise any forward-looking statement, whether as a result of new information, future events

or otherwise. |

3 CHOICE HOTELS OVERVIEW Leading gainer of US hotel market share* – 9.5% share of branded US hotels (+190 basis points over trailing 5 years)* – 2nd largest U.S. hotelier* 65+ year-old company with well-known, diversified brands suitable for various stages of hotel life cycle Core competencies and services drive demand for our brands and deliver business for our franchisees Global pipeline of 860 hotels under construction, awaiting conversion or approved for development Source: Choice Internal Data, September 30, 2009. Pipeline data as of September 30, 2009 * Based on number of hotels as of September 30, 2009 (Smith Travel Research) Fee-for-service business model Predictable, profitable, long-term growth in a variety of lodging and economic environments Cumulative free cash flows of more than $1 billion since 1997 – >99% returned to shareholders through share repurchases and dividends Capital “light” model generates strong returns on invested capital Long-term franchise contracts and scale represent barriers to entry Strong, Growing, Global Hotel Franchising Business Highly Attractive Business Model With Strong Financial Returns |

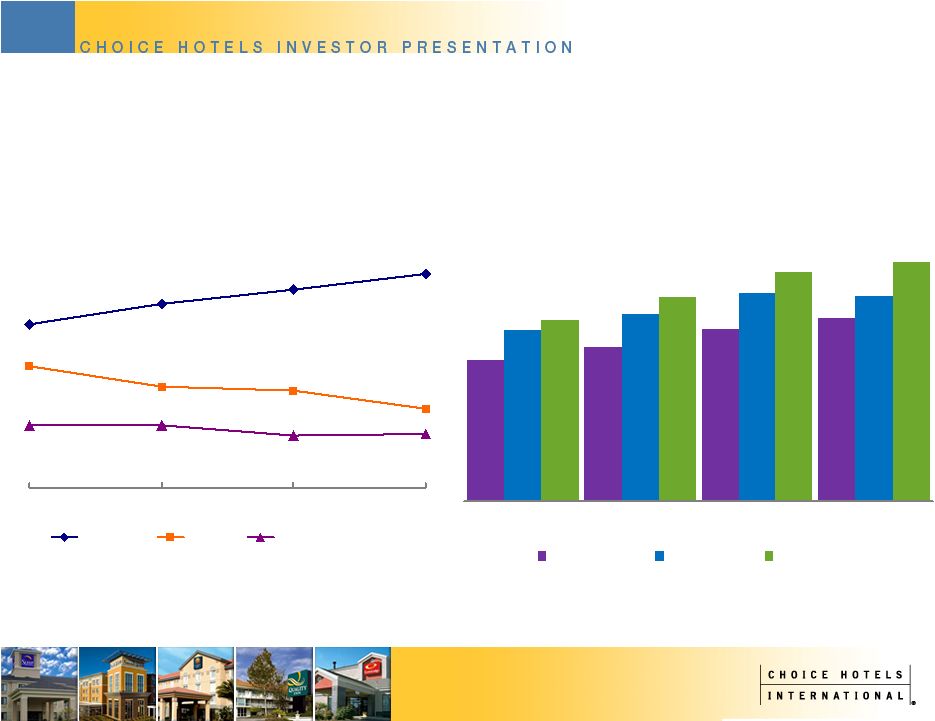

4 0 2 4 6 8 10 12 14 Wyndham Choice IHG Hilton Marriott Best Western Accor Carlson Starwood Hyatt 2004 2005 2006 2007 2008 2009 ONE OF THE LARGEST HOTELIERS Source: Smith Travel Research, September 30, 2009. Market Share 11.5% 9.5% 6.0% 5.9%

5.5% 3.9% 1.9% 1.2% 0.9% 0.6% 5 yr. bps (04-09) -60 190 80 150

100 -60 -50 10 10 -80 Leading Gainer of Market Share (% of Hotels Open in U.S.) |

5 * Excludes cost of land Conversion $45,000+ $105,000+ $50 $70 $100+ Targeted Average Daily Rate $85 FAMILY OF WELL KNOWN AND DIVERSIFIED BRANDS New Construction Source: Choice Internal Data, April 2009 |

6 Source: Smith Travel Research, Choice Internal Data, September 30, 2009 WELL POSITIONED FOR LONG-TERM NEW CONSTRUCTION HOTEL GROWTH IN LIMITED SERVICE SEGMENT Domestic Hotels 1,712 1,457 747 615 464 1,672 601 389 Holiday Inn Express Hampton Inn / Inn & Suites La Quinta Inn/Inn & Suites Fairfield Inn Country Inn & Suites |

7 Source: Smith Travel Research, Choice Internal Data, September 30, 2009 SIGNIFICANT GROWTH OPPORTUNITIES REMAIN IN LARGE CONVERSION MARKET Chart does not include 17,000+ independent hotels in budget, economy and mid-scale

segments Best Western Holiday Inn Express Motel 6 La Quinta Inn/ La Quinta Inn & Suites Hampton Inn / Hampton Inn & Suites Fairfield Inn Red Roof Inn Knights Inn Days Inn Holiday Inn / Holiday Inn Select Americas Best Value Inn Travelodge Howard Johnson Microtel Super 8 Ramada/ Ramada Limited Domestic Hotels 2,041 1,896 1,712 1,678 1,672 731 747 615 547 366 297 167 309 350 752 795 958 341 963 374 |

8 DOMESTIC PIPELINE OF 744 HOTELS 194 134 130 65 29 34 31 44 37 43 Mid-scale Extended Stay Economy Upscale Source: Choice Internal Data, September 30, 2009 New Construction Conversion 3 |

9 1,116 properties Over 35 countries and territories on 5 continents Large global “pure hotel franchising” business Track record of consistent, conservative, profitable growth Significant long-term growth opportunity in underrepresented regions/countries 116 hotels under construction, awaiting conversion or approved for development Source: Choice Internal Data, September 30, 2009 STRONG PRESENCE IN MAJOR TRAVEL MARKETS OUTSIDE OF THE U.S. 279 hotels Canada 262 hotels Australia, New Zealand & Papa New Guinea 1 hotel Singapore 3 hotels China 58 hotels Japan 1 hotel Malaysia 29 hotels India 53 hotels Brazil 13 hotels Central America 18 hotels Mexico 1 hotel Lebanon 237 hotels Continental Europe, UK & Ireland 161 hotels Scandinavia |

10 SERVICES LIFECYCLE IMPROVES BRANDS AND PROPERTY PERFORMANCE FRANCHISED FRANCHISED PROPERTIES PROPERTIES RETURN ON RETURN ON INVESTMENT INVESTMENT Brand Planning and Management • Targeted, differentiated programs, amenities and services for each brand Brand Performance • Revenue and guest service consulting • Inventory and rate management • Local sales and marketing • Independent third-party quality assurance Training • On-site • Regional • Web-based • GM Certification Opening Services • Ensure hotels open successfully and meet or exceed brand standards Portfolio Management • Repositioning • Relicensing • Termination Procurement Services • Value-engineered prototypes and design packages • Negotiated vendor relationships |

11 MARKETING LEVERAGES SIZE, SCALE AND DISTRIBUTION $300-plus million in annual marketing and reservation system fees Leverage expertise in on-line, targeted interactive marketing to influence

guest hotel stay decisions Multi and single brand advertising campaigns Focus on driving guests to Choice central channels Facilitate “one-stop” shopping Strong and growing loyalty program Growing brand awareness Source: Choice Internal Data, September 2009 |

12 STRONG AND GROWING AIDED BRAND AWARENESS 98 77 43 87 72 99 90 62 89 82 95 57 29 20 40 14 14 Comfort Inn Comfort Suites Sleep Inn Quality Clarion Econo Lodge Rodeway Inn MainStay Suburban Cambria Suites Choice Hotels 2001 2008 Source: Percentage of survey respondents. Millward Brown, December 2008 |

13 8.3% 10.0% 12.2% 15.3% 16.2% 17.9% 20.3% 24.6% 21.8% 2001 2002 2003 2004 2005 2006 2007 2008 2009 YTD 08/31/09 STRONG, GROWING LOYALTY PROGRAM Comprehensive loyalty rewards program More than 9 million members worldwide as of November 2009 – contribute 24.6% of domestic gross room revenues More than 1.75 million members added in 2009 Delivers incremental business to all Choice brand hotels Important selling point for franchise sales Source: Choice Internal Data, November 2009. Choice Privileges Revenue as Percent of Domestic Gross Room Revenues |

14 LARGE AND GROWING CENTRAL RESERVATIONS SYSTEM (“CRS”) DELIVERY PUTS “HEADS IN BEDS” All Hotel Direct Reservation Choice Central Reservation Contribution 1/3 Domestic Franchise System Gross Room Revenue Source Domestic Choice CRS Net Room Revenue $1,161 $1,638 $1,000 $1,200 $1,400 $1,600 $1,800 2005 2006 2007 2008 $ in Millions Source: Choice Internal Data, December 2008 |

15 Central Channel ADR Source: Choice Internal Data, December, 2008 47% 62% 23% 35% 15% 18% 2005 2006 2007 2008 Internet Voice Travel Agent (GDS) Domestic Choice CRS Net Channel Share $73.72 $66.11 $77.78 $71.59 $84.03 $73.35 2005 2006 2007 2008 Systemwide Call Center choicehotels.com SIGNIFICANT AVERAGE DAILY RATE PREMIUM ON CENTRAL RESERVATIONS BOOKINGS |

16 MANAGING DIFFERENTLY IN LODGING DOWNTURN Leverage brand preference and conversion opportunity during lodging down cycle to drive market share Reallocate resources and deliver tools to position franchisees to capture larger share of shrinking travel demand Implement contingency plans at all levels of the organization Delay non-mission critical operating and capital spending Ensure adequate liquidity |

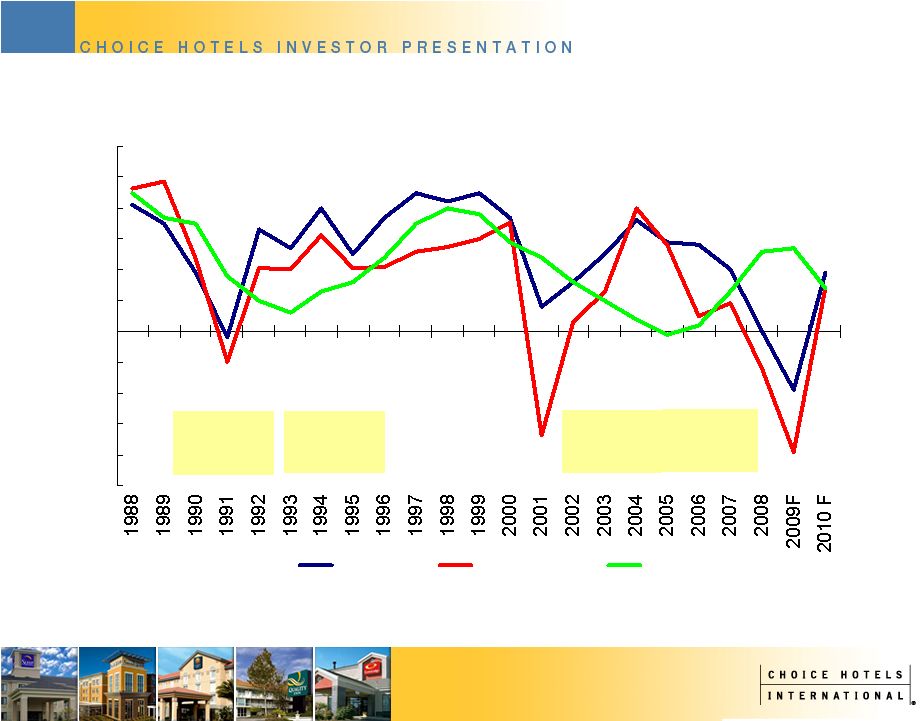

17 LODGING DOWNCYCLE TRENDS -5.0 -4.0 -3.0 -2.0 -1.0 0.0 1.0 2.0 3.0 4.0 5.0 6.0 GDP Demand Supply 1990 +2.0% 1991 - 2.5% 1992 +2.5% 2001 -7.0% 2002 -2.7% 2003 +0.3% Financial Markets/ Housing Crisis IND. REVPAR IND. REVPAR 1990 +1.7% 1991 - 2.7% 1992 +1.4% CHH REVPAR CHH REVPAR 2001 -2.4% 2002 -3.8% 2003 -0.8% Each recession - supply grew faster than demand and the economy (GDP) 9/11 recession Gulf war recession Source: Bureau of Economic Analysis, Blue Chip Economic Indicators, Smith Travel

Research, Choice Internal Data, May, 2009 |

18 184 174 116 63 128 182 237 288 327 261 109 134 124 184 241 342 370 402 432 443 437 355 318 298 300 304 470 552 639 720 770 698 464 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 09/30/09 TTM New Construction Conversion Total Source: Choice Internal Data, September 30, 2009 CONVERSION BRAND FRANCHISE SALES OPPORTUNITY IN SOFT NEW CONSTRUCTION ENVIRONMENT |

19 153 188 158 146 190 254 332 147 403 312 378 5.0% 6.0% 4.9% 4.4% 5.5% 7.0% 8.7% 3.2% 7.0% 9.3% 9.6% 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 9/30/09 TTM Relicensing Contracts Relicensings as % of the prior year's ending system size Source: Choice Internal Data, September 30, 2009 RELICENSING ACTIVITY SIMILAR TO NEW CONSTRUCTION BRAND SALES |

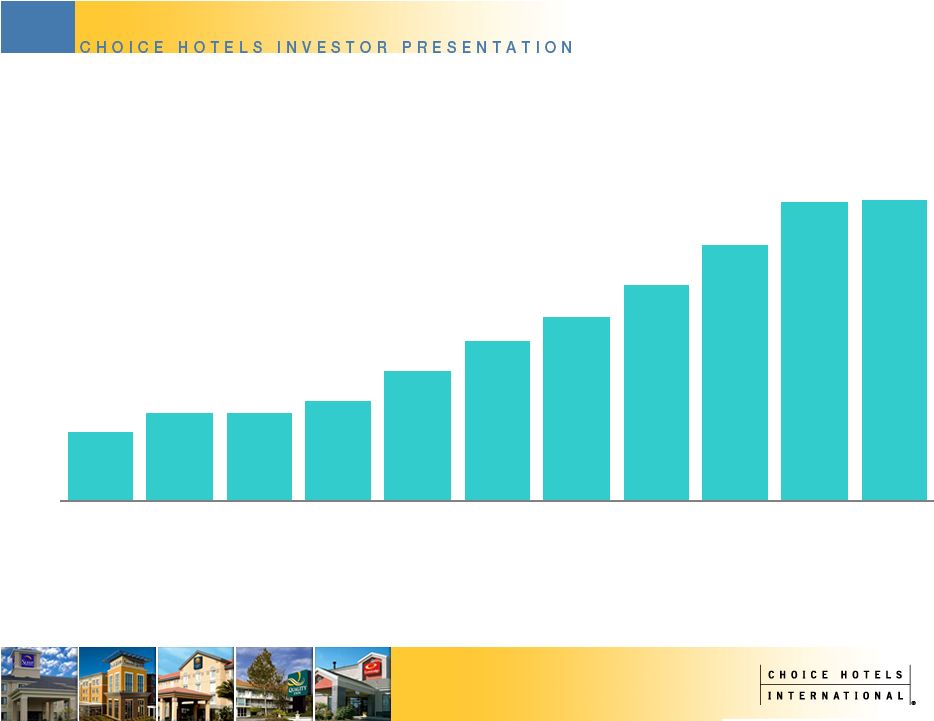

20 STRONG, STEADY FRANCHISE SYSTEM GROWTH 3,123 3,244 3,327 3,482 3,636 3,834 4,048 4,211 4,445 4,716 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 258 266 271 282 310 329 339 354 374 294 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 Domestic Hotels On-Line Domestic Rooms On-Line (in thousands) Source: Choice Internal Data, December 2008 CAGR = 4.5% CAGR = 5.3% CAGR = 4.0% CAGR = 4.9% |

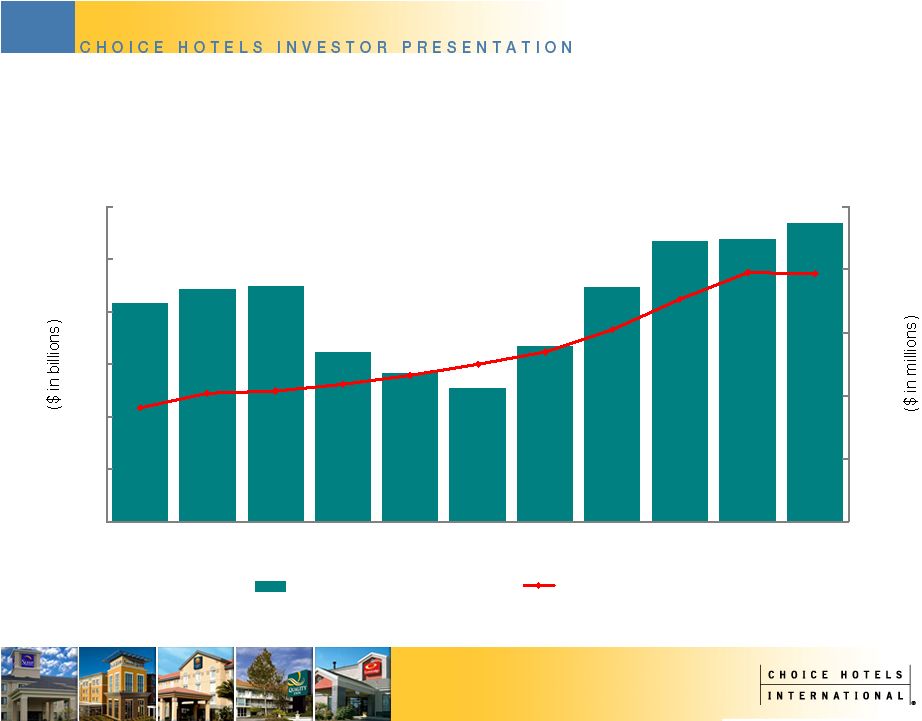

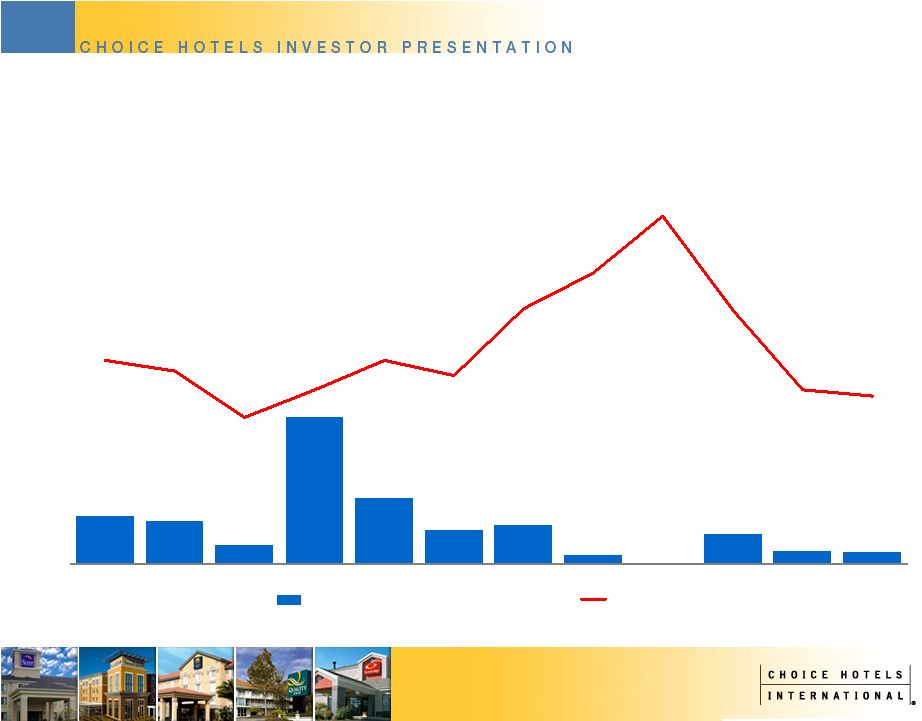

21 FRANCHISING REVENUE STREAM LESS VOLATILE THAN REVPAR -6% -4% -2% 0% 2% 4% 6% 8% 10% 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 $0 $50 $100 $150 $200 $250 $300 $350 CHH RevPAR STR Chain Scale (Supply Weighted) Industry RevPAR Franchising Revenue Source: Smith Travel Research, Choice Internal Data, December 2008 ($ in millions) |

22 ADJUSTED EBITDA LESS VOLATILE THAN INDUSTRY PROFITABILITY 0 5 10 15 20 25 30 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 0 50 100 150 200 250 Industry Profits Adjusted EBITDA Source: Smith Travel Research, Choice Internal Data, December 2008

|

23 CAPITAL “LIGHT” MODEL GENERATES STRONG RETURNS ON INVESTED CAPITAL 19.5% 78.5% 15.2% 16.1% 14.7% 27.6% 36.7% 49.7% 62.9% 68.8% 59.5% 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 Source: Choice Internal Data, December 2008 |

24 TRACK RECORD OF STRONG EARNINGS PER SHARE GROWTH $0.40 $0.51 $0.51 $0.58 $0.76 $0.93 $1.07 $1.26 $1.49 $1.74 $1.75 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 Source: Choice Internal Data, December 2008, Per Share Amounts Retroactively Adjusted

For 2005 Stock Split Adjusted Diluted Earnings Per Share Note: See appendix for reconciliation of adjusted diluted earnings per share to diluted

earnings per share. To improve comparability certain employee severance amounts included in the determination of adjusted diluted earnings per share in this

presentation for 2008 and 2007 differ from amounts reported in exhibit 8 of our February 10, 2009 earnings announcement. |

25 - 2.1 7.9 7.2 24.0 10.8 5.7 6.4 4.9 3.2 1.6 2.2 9.8 x 10.2 x 14.8 x 20.3 x 17.0 x 14.9 x 11.0 x 11.9 x 10.2 x 8.6 x 11.3 x 11.9 x 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 9/30/2009 Millions of Shares Repurchased Avg. TEV/EBITDA Source: Capital IQ, Choice Internal Data, September 30, 2009. Share amounts for 2005 and

prior years retroactively adjusted for 2005 two-for-one stock split Remaining authority on current authorization – 3.9 million shares as of September 30, 2009 OPPORTUNISTIC SHARE REPURCHASES KEY PART OF CAPITAL ALLOCATION STRATEGY |

26 CREDIT STRENGTHS Solid investment grade company – Moody’s Baa3 – Standard & Poor’s BBB Strong liquidity position – $350 million committed revolver matures June 2011 with $58 million available as of September 30, 2009 – No debt maturities until 2011 Substantial financial flexibility Minimal contingent liability exposure Source: Choice Internal Data, September 30, 2009. |

27 ROYALTY FEE “LEVERS” Domestic Royalty Impact Estimated Impact on Full Year Royalties 1 Estimated Impact on Full Year Diluted EPS 2,3 RevPAR Improvement 1% = $2.0 million $0.02 5% = $9.9 million $0.10 New Franchise Growth 1% (49 units) = $2.0 million $0.02 5% (245 units) = $9.9 million $0.10 Improvement in Royalty Rate 1 bps increase = $0.5 million $0.005 5 bps increase = $2.3 million $0.02 (1) Based on current annual RevPAR forecast at September 30, 2009 (2) Assumes outstanding diluted shares of 60.4 million (3) Assumed tax rate of 37.2% Source: Choice Internal Data, September 2009 |

28 STRATEGIC AGENDA FOR CHOICE’S BRANDS, GROWTH AND SHAREHOLDERS Continue core brand market share, unit growth and brand performance improvements Continue shareholder-friendly capital allocation policies Leverage financial capacity/strength to expand scale of emerging brands Evaluate opportunities to enter new segments Continue international expansion |

29 Appendix Reconciliation of Non-GAAP Financial Measurements to GAAP |

30 DISCLAIMER Adjusted franchising margins, adjusted earnings before interest, taxes depreciation and amortization (EBITDA), adjusted net income, adjusted diluted earnings per share (EPS),

franchising revenues, net operating profit after tax (NOPAT), return

on average invested capital (ROIC) and free cash flows are non-GAAP

financial measurements. These financial measurements are presented as supplemental disclosures because they are used by management in reviewing and analyzing the company’s performance. This

information should not be considered as an alternative to any measure of

performance as promulgated under accounting principles generally accepted in the United States (GAAP), such as operating income, net income, diluted earnings per share, total

revenues or net cash provided by operating activities. The calculation of

these non- GAAP measures may be different from the calculation by other

companies and therefore comparability may be limited. The company has

included the following appendix which reconcile these measures to the

comparable GAAP measurement. |

31 FRANCHISING REVENUES AND ADJUSTED FRANCHISING MARGINS Source: Choice Internal Data, December 2008 ($ amounts in thousands) Year Ended Year Ended Year Ended Year Ended Year Ended Year Ended December 31, December 31, December 31, December 31, December 31, December 31, 2008 2007 2006 2005 2004 2003 Total Revenues 641,680 $ 615,494 $ 539,903 $ 472,098 $ 428,208 $ 385,866 $ Adjustments: Marketing and Reservation (336,477) (316,827) (273,267) (237,822) (220,732) (195,219) Product Sales - - - - - - Hotel Operations (4,936) (4,692) (4,505) (4,293) (3,729) (3,565) Franchising Revenues 300,267 $ 293,975 $ 262,131 $ 229,983 $ 203,747 $ 187,082 $ Operating Income 174,596 $ 185,199 $ 166,625 $ 143,750 $ 124,983 $ 113,946 $ Adjustments Hotel Operations (1,502) (1,451) (1,311) (1,068) (725) (842) Acceleration of Management Succession Plan 6,605 - - - - - Executive Termination Benefits - 3,690 - - - - Loan Reserves Related to Impaired Notes

Receivable 7,555 - - - - - Product Sales - - - - - - Impairment of Friendly Investment - - - - - - Net 187,254 $ 187,438 $ 165,314 $ 142,682 $ 124,258 $ 113,104 $ Adjusted Franchising Margin 62.4% 63.8% 63.1% 62.0% 61.0% 60.5% Note: To improve comparability certain employee severance amounts included in the

determination of adjusted franchising margins in this presentation for 2008 and 2007 differ from amounts reported in exhibit 8 of our February 10, 2009 earnings

announcement. |

32 FRANCHISING REVENUES AND ADJUSTED FRANCHISING MARGINS (CONTINUED) Source: Choice Internal Data, December 2008 ($ amounts in thousands) Year Ended Year Ended Year Ended Year Ended Year Ended Year Ended December 31, December 31, December 31, December 31, December 31, December 31, 2002 2001 2000 1999 1998 1997 Total Revenues 365,562 $ 341,428 $ 352,841 $

324,203 $

165,474 $

175,416 $ Adjustments: Marketing and Reservation (190,145) (168,170) (185,367) (162,603) - - Product

Sales - - - (3,871) (20,748) (23,806) Hotel Operations (3,331) (3,215) (1,249) - (1,098) (17,303) Franchising Revenues 172,086 $ 170,043 $ 166,225 $

157,729 $

143,628 $

134,307 $ Operating Income 104,700 $ 73,577 $ 92,427 $

94,170 $

85,151 $

77,068 $

Adjustments Hotel Operations (385) (714) (640) - 35 (1,679) Acceleration of Management Succession

Plan - - - - - - Executive

Termination Benefits - - - - - - Loan Reserves

Related to Impaired Notes Receivable - - - - - - Product

Sales - - - 12 (1,216) (1,037) Impairment of Friendly Investment

- 22,713 - - - - Net 104,315 $ 95,576 $ 91,787 $

94,182 $

83,970 $

74,352 $

Adjusted Franchising Margin 60.6% 56.2% 55.2% 59.7% 58.5% 55.4% |

33 RETURN ON INVESTED CAPITAL Source: Choice Internal Data, December 2008 (a) Operating income and tax rate for the year ended December 31, 2001 have been

adjusted to exclude the effect of a $22.7 million impairment charge related

to the write-off of the company’s investment in Friendly Hotels. Year

Ended Year Ended Year Ended Year Ended Year Ended Year Ended ($ in millions) December 31, December 31, December 31, December 31, December 31, December 31, 1997 1998 1999 2000 2001 2002 Operating Income (a) $77.1 $85.2 $94.2 $92.4 $96.3 $104.7 Tax Rate(a) 41.7% 41.7% 39.5% 39.0% 35.0% 36.5% After-Tax Operating Income 45.0 49.7 57.0 56.4 62.6 66.5 + Depreciation & Amortization 9.2 6.7 7.7 11.6 12.5 11.3 - Maintenance CAPEX 9.2 6.7 7.7 11.6 12.5 11.3 Net Op. Profit After-tax (NOPAT) $45.0 $49.7 $57.0 $56.4 $62.6 $66.5 Total Assets 386.4 398.2 464.7 484.1 321.2 316.8 - Current Liabilities 68.2 64.7 88.7 93.8 71.2 84.3 Invested Capital 318.2 333.6 375.9 390.3 250.0 232.5 Return on Average Invested Capital 17.8% 15.2% 16.1% 14.7% 19.5% 27.6% |

34 RETURN ON INVESTED CAPITAL (CONTINUED) Source: Choice Internal Data, December 2008 Year Ended Year Ended Year Ended Year Ended Year Ended Year Ended ($ in millions) December 31, December 31, December 31, December 31, December 31, December 31, 2003 2004 2005 2006 2007 2008 Operating Income (a) $113.9 $125.0 $143.8 $166.6 $185.2 $174.6 Tax Rate(a) 36.1% 35.1% 33.0% 27.4% 36.0% 36.3% After-Tax Operating Income 72.8 81.1 96.3 121.0 118.5 111.2 + Depreciation & Amortization 11.2 9.9 9.1 9.7 8.6 8.2 - Maintenance CAPEX 11.2 9.9 9.1 9.7 8.6 8.2 Net Op. Profit After-tax (NOPAT) $72.8 $81.1 $96.3 $121.0 $118.5 $111.2 Total Assets 267.3 263.4 265.3 303.3 328.4 328.2 - Current Liabilities 102.2 102.1 120.3 139.8 147.5 135.1 Invested Capital 165.1 161.3 145.0 163.5 180.9 193.1 Return on Average Invested Capital 36.7% 49.7% 62.9% 78.5% 68.8% 59.5% |

35 FREE CASH FLOWS Source: Choice Internal Data, December 2008 Year Ended Year Ended Year Ended Year Ended Year Ended December 31, December 31, December 31, December 31, December 31, ($ in thousands) 2008 2007 2006 2005 2004 Net Cash Provided by Operating Activities 104,399 $

145,666 $ 153,680 $ 133,588 $ 108,908 $ Net Cash Provided (Used) by Investing Activities (20,265) (21,284) (17,244) (24,531) (14,544) Free Cash Flows 84,134 $

124,382 $ 136,436 $ 109,057 $ 94,364 $ |

36 FREE CASH FLOWS (continued) Source: Choice Internal Data, December 2008 Year Ended Year Ended Year Ended Year Ended Year Ended Year Ended December 31, December 31, December 31, December 31, December 31, December 31, ($ in thousands) 2003 2002 2001 2000 1999 1998 Net Cash Provided by Operating Activities 115,304 $ 99,018 $ 101,712 $ 53,879 $ 65,040 $ 38,952 $ Net Cash Provided (Used) by Investing Activities 27,784 (14,683) 87,738 (16,617) (36,031) (9,056) Free Cash Flows 143,088 $ 84,335 $ 189,450 $ 37,262 $ 29,009 $ 29,896 $ |

37 ADJUSTED EBITDA Source: Choice Internal Data, December 2008 Year Ended Year Ended Year Ended Year Ended Year Ended Year Ended ($ in thousands) December 31, December 31, December 31, December 31, December 31, December 31, 2008 2007 2006 2005 2004 2003 Operating Income 174,596 $ 185,199 $ 166,625 $ 143,750 $ 124,983 $ 113,946 $ Adjustments Acceleration of Management Succession Plan 6,605 - - - - - Executive Termination Benefits - 3,690 - - - - Loan Reserves Related to Impaired Notes Receivable 7,555 - - - - - Product Sales - - - - - - Impairment of Friendly investment - - - - - - Depreciation and Amortization 8,184 8,637 9,705 9,051 9,947 11,225 Adjusted EBITDA 196,940 $ 197,526 $ 176,330 $ 152,801 $ 134,930 $ 125,171 $ Note: To improve comparability certain employee severance amounts included in the

determination of adjusted EBITDA in this presentation for 2008 and 2007

differ from amounts reported in exhibit 8 of our February 10, 2009 earnings announcement. |

38 ADJUSTED EBITDA (CONTINUED) Source: Choice Internal Data, December 2008 Year Ended Year Ended Year Ended Year Ended Year Ended Year Ended ($ in thousands) December 31, December 31, December 31, December 31, December 31, December 31, 2002 2001 2000 1999 1998 1997 Operating Income 104,700 $ 73,577 $ 92,427 $ 94,170 $ 85,151 $ 77,068 $ Adjustments Acceleration of Management Succession Plan - - - - - - Executive Termination Benefits - - - - - - Loan Reserves Related to Impaired Notes Receivable - - - - - - Product Sales - - - 12 (1,216) (1,037) Impairment of Friendly investment - 22,713 - - - - Depreciation and Amortization 11,251 12,452 11,623 7,687 6,710 9,173 Adjusted EBITDA 115,951 $ 108,742 $ 104,050 $ 101,869 $ 90,645 $ 85,204 $ |

39 ADJUSTED DILUTED EARNINGS PER SHARE Source: Choice Internal Data, December 2008 Note: To improve comparability certain employee severance amounts included in the determination of adjusted

diluted earnings per share in this presentation for 2008 and 2007 differ from amounts reported

in exhibit 8 of our February 10, 2009 earnings announcement. Year Ended Year Ended Year Ended Year Ended Year Ended December 31, December 31, December 31, December 31, December 31, (In thousands, except per share amounts) 2008 2007 2006 2005 2004 Net Income 100,211 $

111,301 $

112,787 $

87,565 $

74,345 $

Adjustments: Loss(Gain) on Extinguishment of Debt, Net of Taxes - - 217 - 433 Acceleration of Management Sucession Plan, Net of Taxes 4,135 - - - - Executive Termination Benefits, Net of Taxes - 2,310 - - - Loan Reserves Related to Impaired Notes Receivable, Net of Taxes 4,729 - - - - Resolution of Provisions for Income Tax Contingencies - - (12,791) (4,855) (1,182) Income Tax Expense Incurred Due to Foreign Earnings Repatriation - - - 1,192 - Loss(Gain) on Sunburst Note Transactions, Net of Taxes - - - - - Impairment of and Equity Losses in Friendly Hotels PLC Investment, Net of Taxes - - - - - Adjusted Net Income 109,075 $

113,611 $

100,213 $

83,902 $

73,596 $

Weighted Average Shares

Outstanding-Diluted 62,521 65,331 67,050 66,336 69,000 Diluted Earnings Per Share 1.60 $

1.70

$

1.68

$

1.32

$

1.08

$

Adjustments: Loss(Gain) on Extinguishment of Debt, Net of Taxes - - - - 0.01 Acceleration of Management Sucession Plan, Net of Taxes 0.07 - - - - Executive Termination Benefits, Net of Taxes - 0.04 - - - Loan Reserves Related to Impaired Notes Receivable, Net of Taxes 0.08 - - - - Resolution of Provisions for Income Tax Contingencies - - (0.19) (0.08) (0.02) Income Tax Expense Incurred Due to Foreign Earnings Repatriation - - - 0.02 - Loss(Gain) on Sunburst Note Transactions, Net of Taxes - - - - - Impairment of and Equity Losses in Friendly Hotels PLC Investment, Net of Taxes - - - - - Adjusted Diluted Earnings Per Share (EPS) 1.75 $

1.74

$

1.49

$

1.26

$

1.07

$

|

40 ADJUSTED DILUTED EARNINGS PER SHARE (CONTINUED) Source: Choice Internal Data, December 2008 Year Ended Year Ended Year Ended Year Ended Year Ended Year Ended December 31, December 31, December 31, December 31, December 31, December 31, (In thousands, except per share amounts) 2003 2002 2001 2000 1999 1998 Net Income 71,863 $

60,844 $

14,327 $

42,445 $

57,155 $

55,305 $

Adjustments: Loss(Gain) on Extinguishment of Debt, Net of Taxes - - - - - (7,232) Acceleration of

Management Sucession Plan, Net of Taxes - - - - - - Executive Termination Benefits, Net of Taxes - - - - - - Loan Reserves Related to Impaired Notes Receivable, Net of Taxes - - - - - - Resolution of Provisions for Income Tax Contingencies - - - - - - Income Tax Expense Incurred Due to Foreign Earnings Repatriation - - - - - - Loss(Gain) on Sunburst Note Transactions, Net of Taxes (3,383) -

- 4,721 - - Impairment of and Equity Losses in Friendly Hotels PLC Investment, Net of Taxes - - 37,166 7,532 - - Adjusted Net Income 68,480 $

60,844 $

51,493 $

54,698 $

57,155 $

48,073 $

Weighted Average Shares

Outstanding-Diluted 73,349 80,114 89,144 106,506 111,334 119,096 Diluted Earnings Per Share

0.98 $

0.76 $

0.16 $

0.40 $

0.51 $

0.46 $

Adjustments: Loss(Gain) on Extinguishment of Debt, Net of Taxes - - - - - (0.06) Acceleration of Management Sucession Plan, Net of Taxes - - - - - - Executive Termination Benefits, Net of Taxes - - - - - - Loan Reserves Related to Impaired Notes Receivable, Net of Taxes - - - - - - Resolution of Provisions for Income Tax Contingencies - - - - - - Income Tax Expense Incurred Due to Foreign Earnings Repatriation - - - - - - Loss(Gain) on Sunburst Note Transactions, Net of Taxes (0.05) - - 0.04 - - Impairment of and Equity Losses in Friendly Hotels PLC Investment, Net of Taxes - - 0.42 0.07 - - Adjusted Diluted Earnings Per Share (EPS) 0.93 $

0.76 $

0.58 $

0.51 $

0.51 $

0.40 $

|