Attached files

| file | filename |

|---|---|

| EX-10.4 - OTS STIPULATION AND CONSENT - WATERSTONE FINANCIAL INC | form104otsstipulation.htm |

| EX-10.2 - FDIC/DFI STIPULATION AND CONSENT - WATERSTONE FINANCIAL INC | form102fdicstipulation.htm |

| EX-10.1 - FDIC/DFI CONSENT ORDER - WATERSTONE FINANCIAL INC | form101fdicconsentorder.htm |

| EX-10.3 - OTS ORDER TO C & D - WATERSTONE FINANCIAL INC | form103otscease.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

Form

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of

Report (Date of Earliest Event

Reported): November

27, 2009

Waterstone Financial,

Inc.

(Exact name of registrant as

specified in its charter)

|

Federally Chartered

Corporation

|

000-51507

|

20-3598485

|

||

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification

No.)

|

||

|

11200 W Plank Ct, Wauwatosa,

Wisconsin

|

53226

|

|||

|

(Address of principal executive

offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area

code: 414-761-1000

| Not Applicable |

| Former name or former address, if changed since last report |

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provision:

[ ]

Written communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

[ ]

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.

14a-12)

[ ]

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

[ ]

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240. 13e-4(c))

Item

1.01 Entry into a Material Definitive Agreement.

On

November 25, 2009, pursuant to a Stipulation and Consent to the Issuance of a

Consent Order (“Stipulations”), WaterStone Bank agreed to the issuance of a

Consent Order (“Orders”) to be issued jointly by the Federal Deposit Insurance

Corporation (“FDIC”) and the Wisconsin Department of Financial Institutions

(“WDFI”), the Bank’s primary banking regulators. At the same time,

pursuant to a Stipulation and Consent to Issuance of Order to Cease and Desist

(“Stipulations”), Waterstone Financial, Inc. agreed to the issuance of on Order

to Cease and Desist (“Orders”) to be issued by the Office of Thrift Supervision

(“OTS”), the Company’s thrift holding company regulator.

The

Orders formalize a prior informal agreement entered into by the Bank, the FDIC

and the WDFI in 2008. The Bank and its federal and state regulators

have been working in concert for the past two years to minimize the effects that

the current economic recession is having on the Bank and its

borrowers. The Orders require, among other things, that the Bank

maintain minimum Tier 1 capital of 8.5% of total average assets and minimum

total risk-based capital of 12.0% of risk-weighted assets. Failure to

comply with the Orders could result in additional enforcement actions by the

FDIC, the WDFI or the OTS. Compliance with the Orders may have

adverse effects on the operations and financial condition of the Company and the

Bank.

The

foregoing description of the Orders is qualified in its entirety by reference

thereto, copies of which are attached to this Current Report on Form 8-K as

Exhibits 10.1 and 10.3 and are incorporated herein by

reference. Also, the Stipulations are attached to this Current Report

on Form 8-K as Exhibits 10.2 and 10.4 and are incorporated herein by

reference.

On

November 27, 2009, the Company issued a press release announcing, among other

things, the issuance of the Orders. A copy of the press release is

attached hereto as Exhibit 99.1 and incorporated herein by

reference.

(d)

Exhibits

Exhibit

No. Description

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Waterstone Financial, Inc.

November

27,

2009 By: Richard

C. Larson

Name: Richard C. Larson

Title: Chief Financial Officer

Waterstone

Financial, Inc. Announces Consent Order with Regulators.

WAUWATOSA,

WI – 11/27/2009– Waterstone Financial, Inc. (NASDAQ: WSBF), holding company of

WaterStone Bank, SSB, announced today that the bank has agreed to the issuance

of a Consent Order to be jointly issued by federal and state banking

regulators which formalizes our commitment to provide the communities we serve

with a well-managed bank supported by strong capital reserves and competitively

priced deposit and loan products. This Consent Order formalizes a

prior informal agreement entered into by the Bank, the FDIC and the WDFI in

2008. The Bank and its federal and state regulators have been working

in concert for the past two years to minimize the effects that the current

economic recession is having on the Bank and its borrowers.

Over the

past 24 months, WaterStone Bank has been working aggressively to manage the

problem loans in our portfolio by devoting significant human, technical and

financial resources to address them. In addition, over the past three

years, we have strengthened our loan origination and credit administration

practices to better ensure that our loan portfolio consists of well-underwritten

loans to qualified applicants. During 2009, we have focused our

strategic plan on, and succeeded in, preserving capital, improving our

liquidity, managing the problem loans in our portfolio, managing costs, and

maintaining a strong, profitable customer base. Our achievements are

outlined in detail by the following points:

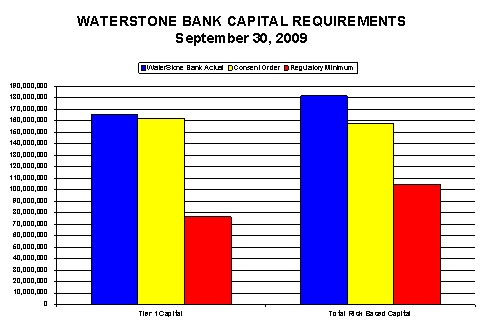

1) The

Bank has capital reserves of $165,000,000 as of September 30, 2009, resulting in

a tier-one capital ratio of 8.69%, and capital reserves plus allowance for loan

and lease losses of $182,000,000, resulting in a total risk-based capital ratio

of 13.86%, both well in excess of the levels that the FDIC considers to be “well

capitalized”. The following chart compares the Bank’s capital levels

to various regulatory measures.

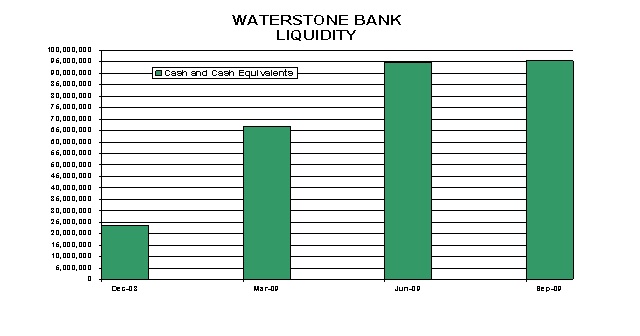

2) We

have enhanced our liquidity by increasing our cash and cash equivalents from $24

million on December 31, 2008 to $95 million on September 30, 2009. A

chart depicting the improvement in our liquidity position from December 31, 2008

to September 30, 2009, follows.

- 5

-

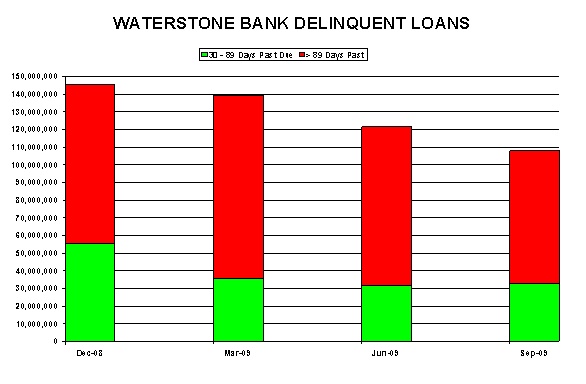

3) Our

non-performing loans (90 days or more past due) have declined by 6% during the

six months ended September 30, 2009. Our delinquent loans as a

percentage of total loans have decreased from 9.36% on December 31, 2008 to

7.41% on September 30, 2009. More significantly, our performing

delinquent loans, or those loans that are 30-89 days past due, have declined by

40.5% from December 31, 2008 through September 30, 2009. A chart

detailing these improvements is shown below.

4) While

the Bank has incurred losses resulting from problem loans, our adjusted pre-tax

operating income (our income before taxes, loan losses, FDIC insurance premiums

and expenses related to real estate acquired in foreclosure) continues to

improve. For the period of January 1, 2009 through September 30,

2009, our operating profits were $18,000,000, an increase of 35% over the same

period in 2008 and an increase of 67% over the same period in

2007. The trend in improving operating results reflects the strength

of our current lending, deposit gathering and expense control

practices.

The

Consent Order to be issued jointly by the FDIC and the Wisconsin Department

of Financial Institutions has three primary requirements. WaterStone

Bank has agreed to: (a) perform a management study to confirm our

belief that the bank is a well managed institution; (b) maintain our tier-one

capital and our total risk-based capital ratios at or above 8.5% and 12%

respectively (“tier-one capital” and “total risk-based capital” are regulatory

capital measures; as of September 30, 2009, our tier-one capital ratio of 8.69%

and total risk-based capital ratio of 13.86% qualify us as “well capitalized”

under FDIC regulation, the highest regulatory classification); and (c) continue

to aggressively manage our bad loans and real estate acquired in foreclosure and

enhance our credit administration practices.

Doug

Gordon, WaterStone Bank CEO stated, “With our capital strength, strong

liquidity, and deposits insured to the maximum level provided by the FDIC, we

will continue to offer a full array of competitively priced deposit products,

loans to all qualified applicants, and the high level of customer service the

communities we serve are accustomed to.”

- 6

-