Attached files

| file | filename |

|---|---|

| 8-K - 8-K - UNITED WISCONSIN GRAIN PRODUCERS LLC | a09-00019_18k.htm |

Exhibit 99.1

Inside this issue:

Commodities Manager

2

Plant Manager

2

Corn Procurement &

Feed Sales

3

CFO

4

Board News/Robert Miller – President

Harvest this year is a little like our year in the ethanol industry. We have had some challenges through the year but we are thankful for good weather now that will hopefully allow us to get our grain in from the field. We at United Wisconsin Grain Producers LLC (UWGP) are also thankful for the continued demand for ethanol placing upward pressure on prices and margins in spite of economic conditions and overall fuel supplies.

As you know, we have began the process of preparing documents to propose reclassification of our membership units in an effort to terminate our reporting obligations with the Securities and Exchange Commission (SEC). You, as members of UWGP, will receive a proxy statement explaining the proposed amendments to UWGP’s Operating Agreement needed to effect this reclassification. This information is currently being prepared. We expect to hold a member meeting to vote on the proposals, which we anticipate may be sometime in the month of January. However, much of the timing is dictated by the SEC’s review of this process. We will continue to keep you informed.

We have wrapped up our two major capital projects and brought them on-line. The corn oil extraction system was completed and began production in July of this year. We are currently shipping approximately four trucks per week and generating approximately $200,000 per month in revenue from this system. The installation of the system was done very nicely and will add approximately four cents per gallon of ethanol produced to our bottom line. The regenerative thermal oxidizer (RTO) was also completed in July and brought on-line at our recent scheduled shutdown in October. Dan Groh talks more about this project in his report in this newsletter. Both projects were completed within the budgeted amounts and are operating as good as or better than we anticipated.

All of us at UWGP wish you a safe and successful harvest season!

Jeff Robertson – CEO

We are approaching the end of 2009, which has been a challenging year for our industry. UWGP weathered the tough times of the past year reasonably well. We are generally satisfied with the results we have generated this year. We still stack up well when compared to our peers and this is gratifying even if it not as financially rewarding as we have become used too.

This very trying time has been a real test for the organization. Our success thus far is a real testament to the highly capable people who have staked their futures on our teams’ ability to be among the best in the industry, and to our Board who have guided us and given us the latitude and the tools to make the best use of our staffs’ talents.

As we approach 2010 we are optimistic that margins will be better than in 2009. We have done several things to improve our results from operations such as the capital projects for the oil extraction system, which has been online for a few months now, and our new regenerative thermal oxidizer (RTO), which came online in October. We have also given attention to the administrative side of the business. We have identified two major ways to reduce costs. The first is the assumption of marketing duties for our ethanol. We will be one of only a handful of ethanol facilities in the country to manage this function in house. We have been considering this for nearly two years and effective January 1, 2010 United Wisconsin Grain Producers LLC (UWGP) will be in the ethanol production and the ethanol marketing business. Another major cost reduction is the proposed termination of our reporting obligations with the SEC. This is something that, like the marketing of ethanol ourselves, we have considered for quite some time and planned for very carefully. As it stands today we expect that we may be in a position to call a special meeting of the membership to vote on this proposal in December or in January.

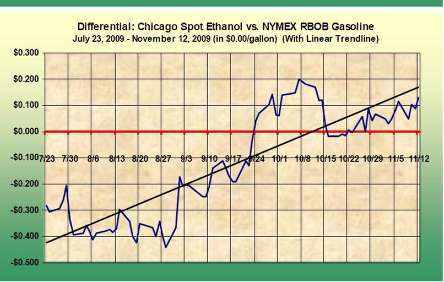

Looking at the industry today, we are encouraged that ethanol margins are improving steadily even as more of the previously idled production capacity has come back on line. At the mid-year point, nearly a third of the industry’s capacity was idle. Today that has been reduced to just 10% of capacity being idle. Stronger margins have encouraged the increase in production, and still prices are strong and have been higher than the price of regular unleaded gasoline for the past two months. Obviously there has been real issues with the corn harvest this year, but it is getting done and the crop is very large and this should be reflected in the prices we will pay for corn during the next several months.

In summary I am encouraged by what I see shaping up for 2010. I hope you all have a very happy Thanksgiving, and to the farmers working hard to get this crop in the bin, above all else please have a safe harvest.

Dan Wegner – Commodities Manager

Hello everyone, as the autumn season brings about changes in our weather, so too does it bring about some changes for United Wisconsin Grain Producers LLC (UWGP) and the way we will be conducting some of our business functions. UWGP has decided to begin marketing our ethanol “in-house”, and not renew our ethanol marketing contract with Noble Americas. As you know, when we started ethanol production back in 2005, we marketed our production through Renewable Products Marketing Group (RPMG). The “pooling” concept worked well for the first couple years because of a few advantages it provided at the time. In 2005, the ethanol industry was very young, with only a fraction of the players we have today. The pool provided a level of comfort for participants bringing freight advantages, production safety nets, and a means for getting our product to the end users who quite frankly were not happy about having to buy and blend ethanol. In a short period of time, the ethanol industry expanded very rapidly, doubling, and then tripling the production capacity of the industry. As this growth came online, the size of the pool grew, and so did our costs of doing business within the pool. About two years ago, we made the decision to depart RPMG, and signed a new marketing agreement with Noble Americas. This new agreement allowed UWGP to take more control over when and how our ethanol was marketed, and provided better means for managing our market risks. At the same time, we also were able to improve our ethanol netbacks to the plant. Over the course of the last two years the ethanol industry has continued to mature, helped by the Renewable Fuels Standard (RFS) and the petroleum industry’s willingness to blend this product. Our working relationship with Noble allowed me to get very involved in all aspects of marketing our ethanol, and has provided a solid foundation of both knowledge and confidence that will facilitate UWGP marketing its own production. Although marketing our own ethanol will be a large undertaking on our own, it will not be the first commodity we have successfully brought in house. We have marketed all our distillers dried grains with solubles (DDGS) in-state truck sales from day one, and in September 2007 we took over our wet distiller’s grain marketing from Cenex Harvest States (CHS), leaving only our DDGS rail marketing to an outside service. Given the fact that UWGP relies so little on marketing companies, makes us unique in the industry, and should provide additional revenue for our members.

In order to better facilitate this transition, we will also be making some internal responsibility changes to increase our efficiency. Kathy Becker, who has been our commodities assistant with many responsibilities, will be moving upstairs to assist Barb Bontrager and focus more on accounting responsibilities. Nola Burckhardt who has been upstairs in our administrative office will be moving downstairs to join the commodities group. Her new responsibilities will include truck scale operation, ethanol logistics, and other support functions for the commodities group. Terry Olson, who markets our wet feed, and provides many other support functions in our company, will also begin to focus a larger percentage of his time to corn procurement, along with feed sales. Everyone at UWGP is excited about the new challenges that lie ahead, and look forward to working hard to increase earnings for our members.

Eric Kuntz — Plant Manager

In the past, you’ve seen articles about specific equipment, processes or procedures here at the plant. Although there might be a few items distinct to our operation, most ethanol plants have things similar. So what makes United Wisconsin Grain Producers LLC (UWGP) unique? What makes us different from the other ethanol plants around? It’s our people.

Look around at your work. Somewhere is there a statement that says “People Make the Difference” or the like? Do you believe it? Do you think it’s sincere? At UWGP, from the very beginning, it was obvious that people would be held in high regard; and that philosophy starts at the top.

As an engineer, I’ve worked with statistics some, but thankfully not a lot. But here’s a few statistics about our work force. When most original employees were hired back in March of 2005, there ended up being 34 of us. Of those 34, 68% (23 people) still work here. That’s pretty amazing for a start up company. Additionally, six more employees have been here over 3 years. We’ve added a few positions through the years to better fill vacation openings, to better service our customers or to take over responsibilities that originally were done by outside groups. So currently UWGP has 38 full time employees. We’ve been an operating facility for just over 4-1/2 years and 76% of the people have been here over 3 years. Of the 38, only four of us (yes, I was one) relocated for the job. Everyone else came from the surrounding communities – Friesland, Cambria, Markesan, Dalton, Neshkoro, Waupun, Fairwater, Brandon, Pardeeville, Lodi, Rio, Columbus, Fox Lake and Randolph.

We have a well trained, dedicated staff here at the plant. Departments work extremely well together and people genuinely seem to enjoy the time spent at work. Personally, I am still very grateful for the opportunities UWGP has given me, and I’m proud to represent your company. And I’m confident if you ask any of the other employees, they’ll say the same.

Terry Olson — Corn Procurement & Feed Sales

What a difference a week makes!! November is here and it brought sunshine, warmer temperatures and renewed hope that harvest will get completed this year. Beans are 75% completed and corn is doing some drying in the field and is 35% completed. Granted we are still behind versus the average, however, the sun and warm temperatures make everything better.

According to the Data Transmission Network (DTN), the corn market is poised to extend its short term uptrend due to continued noncommercial buying. Technically, the market seems to be growing more bullish, meaning a test of the October high of $4.13½ is possible and possibly a move all the way back to near $4.50. However, the underlying fundamentals continue to grow more bearish, as indicated by the strengthening carry in the futures spreads. In conclusion, the short term trend for corn is up but the longer term trend is sideways and underlying fundamentals continue to grow more bearish.

The quality of the corn crop this year has been less than ideal. High moisture, mold, low test weights and higher amounts of foreign material (FM) are very prevalent. This will create storage problems if the corn is not monitored throughout the storage period. To minimize storage losses you will need to make sure that the corn is cooled and that the bins are cored to get the fines out of the middle of the bin. This is going to be very important so that corn quality is maintained.

Molds have been another topic that we have heard about this year. We have tested some ears that have been brought in and what we have seen is that the pink or red mold is showing vomitoxin. At this point we are going to continue to test our corn grind and our distillers dried grains with solubles (DDGS), as we have in the past, and see if the toxins are actually in the corn or if the molds are not going to be an issue in producing toxins. We have always been proactive on the mold and toxin issue to assure our DDGS customers of the quality of our product. We will continue to be proactive so as to provide a good product for your feeding operations. Please let us know if you have any concerns regarding toxins in the DDGS and we will answer all of your questions.

Lastly, as mentioned in Dan’s article, there are some restructuring moves being made in our office. I look forward to my new role in corn procurement and working with our producers more in depth on corn procurement. I invite anyone to call and talk with us about your corn marketing plans. I look forward to working with you in the future.

Dan Groh — Maintenance Manager

Well once again, another summer has come and gone. We now find ourselves digging out our winter clothing and hunkering down for the season Wisconsin is famous for: cold wet snow, freezing rain, ice, and wind chill, otherwise known as winter.

This has been a very satisfying year here at United Wisconsin Grain Producers LLC (UWGP). We have implemented some significant equipment changes which will go a long way in making the plant more efficient, reliable, and profitable. Recently we have completed our semi-annual plant shutdown where we brought our new “Regenerative Thermal Oxidizer” (RTO) online. This system will take over emission control duties which were previously handled by our boiler. The RTO system dramatically simplifies our emission control system for our dryers by separating the steam generation from the dryer operation. The RTO can now simply do its job of incinerating volatile organic compounds (VOC’s) without having to also pull double duty as our steam generation. From a maintenance perspective this will allow the dryers and boiler to operate independently of each other and will allow not only better destruction efficiency, but also much greater flexibility in plant, and maintenance operations.

With the RTO now handling emissions from the dryers, our boiler also needed to undergo some significant modifications to convert it to a fresh air fired boiler. Since we have removed all of the dryer exhaust from the boiler it was necessary to modify the burner to operate strictly on fresh air. Typically this is how a boiler would normally operate, so really it was a matter of removing all of the Thermal Oxidizer functions and modifying the burner and air flows so that it could run as efficiently as possible.

If you pay close attention as you visit or drive by the plant you may notice that the vapor plume is now coming from a different stack. What you are seeing is the water vapor driven off in the dryers. This of course used to come out of the boiler stack, but is now coming out of the RTO stack. When the weather gets even colder you will notice a white cloud rising on the north side of our property. Not to worry, this is also water vapor coming from the cooling towers. This water vapor becomes much more prevalent in the winter, for the same reason that you can see your breath in the winter. The cooling tower uses fans and the evaporative cooling concept to pull the heat out of the water so the result is warm moist air being released.

Often, I am asked about different things that people see while visiting us or just driving by. I am always willing and eager to answer questions about our plant. UWGP continues to be one of the jewels of the ethanol industry. We take great pride in how our facility looks and runs. Everyone here is committed to being a steward of our community and environment. And after roughly 4.5 years of operation our level of enthusiasm has not diminished. It is a great pleasure being a part of this organization and I look forward to many more years of success.

This newsletter contains historical information, as well as forward-looking statements that involve known and unknown risks and relate to future events, our future financial performance, or our expected future operations and actions. These forward-looking statements are only our predictions based upon current information and involve numerous assumptions, risks and uncertainties. Our actual results or actions may differ materially from these forward-looking statements for many reasons, including the reasons described in our filings with the Securities and Exchange Commission. We caution you not to put undue reliance on any forward-looking statements, which speak only as of the date of this newsletter. We qualify all of our forward-looking statements by these cautionary statements.

Barb Bontrager — CFO

Our 3rd quarter Securities and Exchange Commission (SEC) report (10Q) was filed timely on November 13, 2009. This report along with all of our previous SEC reports are available from a link on our website www.uwgp.com -> Click on Company Information -> Click on Financial Information -> Click on the large green button “click here” -> on the next page, click on the [html] link in red to the left of the report you want to view. The most recent filing is on top with the “10Q” being our quarterly reports and the “10K” our annual reports.

Included in our $4 million year-to-date loss as of September 30, 2009 is our recorded hedge account loss of $5.7 million. This is the loss we would incur if we liquidated our positions on the 30 th of September. This is not, in fact, what will happen. We use these futures positions on corn and ethanol to lock in our margins (the spread between ethanol prices and corn prices) in future months. Unforeseen increased demand for ethanol in the nearby months has caused ethanol prices to trend upward since late in August of this year, outpacing the relative cost of corn thereby increasing the margin. Having secured these positions and margin prior to the recent increase we have actually reduced our ability to benefit from the immediate high price of ethanol as compared to the price of corn. This also has contributed to the immediate loss in our hedge account which we will recapture either in the form of future gain(s) in our hedge account (if markets trend lower) or in the actual sale price of our ethanol as we produce it (if markets trend the same or higher). The good news is overall margins in the ethanol industry are definitely better right now and appear to be better in the future than what we have been able to capture over the past several months.

|

|

Nine Months Ended 9/30/09 |

Nine Months Ended 9/30/08 |

Variance |

% Variance |

|

Gallons of Ethanol Produced |

40,354,954 |

40,954,858 |

(599,904) |

(1.5%) |

|

Bushel of Corn Ground |

13,902,594 |

14,309,940 |

(407,346) |

(2.8%) |

|

Yield—Gallons denatured

|

2.90 |

2.86 |

0.04 |

1.4% |

|

Average Ethanol Price (net back) per gallon |

$ 1.58 |

$ 2.22 |

$ (0.64) |

(28.8%) |

|

Average Corn price per bushel |

$ 3.94 |

$ 5.07 |

$ (1.13) |

(22.3%) |

|

Total Revenues |

$ 73,698,325 |

$ 108,302,919 |

$ (34,604,594) |

|

|

Gross Profit (Loss) |

$ (2,224,107) |

$ 15,559,934 |

$ (17,784,041) |

|

|

Net Income (Loss) |

$ (4,075,015) |

$ 12,386,090 |

$ (16,461,105) |

|