Attached files

Table of Contents

As filed with the Securities and Exchange Commission on November 25, 2009.

Registration No. 333-162473

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 2

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MONARCH FINANCIAL HOLDINGS, INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

| Virginia | 6022 | 20-4985388 | ||

| (State or other jurisdiction of incorporation) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1101 Executive Blvd.

Chesapeake, Virginia 23320

(757) 389-5111

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

William F. Rountree, Jr.

President and Chief Executive Officer

Monarch Financial Holdings, Inc.

1101 Executive Blvd.

Chesapeake, Virginia 23320

(757) 389-5112

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of Communications to:

| John M. Paris, Jr., Esq. | George P. Whitley, Esq. | |

| R. Willson Hulcher, Jr., Esq. | Scott H. Richter, Esq. | |

| Williams Mullen | LeClairRyan, A Professional Corporation | |

| 222 Central Park Avenue, Suite 1700 | 951 East Byrd Street | |

| Virginia Beach, Virginia 23462 | Richmond, Virginia 23219 | |

| (757) 473-5308 | (804) 783-2003 |

Approximate date of commencement of proposed sale to the public: As soon as practicable following the effectiveness of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Table of Contents

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company)

|

Smaller reporting company | x | |||

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to Be Registered | Amount to Be Registered |

Proposed Offering Price Per Share (1) |

Proposed Offering Price (1) |

Amount of Registration Fee | ||||

| % Series B Noncumulative Convertible Perpetual Preferred Stock, par value $5.00 per share |

800,000 | $25.00 | $20,000,000 | $1,116.00 | ||||

| Common Stock, par value $5.00 per share |

(2) | N/A (2) | N/A (2) | N/A (2) | ||||

| (1) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457 under the Securities Act of 1933, as amended. |

| (2) | Includes an indeterminate number of shares of Common Stock issuable upon conversion of the % Series B Noncumulative Convertible Perpetual Preferred Stock. The registrant will receive no consideration for the issuance of these shares of Common Stock upon conversion of the preferred stock. Therefore, pursuant to Rule 457(i), no filing fee is required with respect to these shares of Common Stock registered hereby. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 25, 2009

PRELIMINARY PROSPECTUS

700,000 Shares

% Series B

Noncumulative Convertible Perpetual Preferred Stock

We are offering 700,000 shares of our % Series B Noncumulative Convertible Perpetual Preferred Stock, which we refer to in this prospectus as the “Series B Preferred Stock.” The annual dividend on each share of our Series B Preferred Stock is $ and is payable quarterly in cash, when, as and if declared, on the last day of March, June, September and December, commencing December 31, 2009. If our board of directors does not declare a dividend or we fail to pay a dividend declared by our board for any quarterly dividend period, you will not be entitled to receive any dividend for that quarterly dividend period and the undeclared or unpaid dividend will not accumulate.

Each share of our Series B Preferred Stock will be convertible at your option at any time, unless previously redeemed, into shares of our Common Stock, reflecting an initial conversion price of $ per share of Common Stock, which may be adjusted as described in this prospectus. The shares of Series B Preferred Stock are also convertible at our option, in whole or in part, into shares of our Common Stock at the conversion price, if the closing price of our Common Stock equals or exceeds 130% of the conversion price for at least 20 trading days within any period of 30 consecutive trading days. Cash will be paid in lieu of issuing any fractional share interest.

The Series B Preferred Stock is also redeemable by us, in whole or in part, at any time on and after the third anniversary of the issue date for the liquidation amount of $25.00 per share of Series B Preferred Stock, plus any declared and unpaid dividends.

All shares of our Common Stock issued upon conversion of the Series B Preferred Stock will be freely tradable without restriction under the Securities Act of 1933, as amended, except for shares purchased by our “affiliates.”

We have filed an application for quotation of the Series B Preferred Stock on the NASDAQ Capital Market under the symbol “MNRKP.” Our Common Stock is currently quoted and traded on the NASDAQ Capital Market under the symbol “MNRK.” On November 24, 2009, the last reported sale price of our Common Stock was $6.74 per share.

Investing in our Series B Preferred Stock involves risks. See “Risk Factors” beginning on page 11 to read about factors you should consider before making your investment decision.

| Per Share |

Total | |||||

| Price to public |

$ | 25.00 | $ | 17,500,000 | ||

| Underwriting discount (1) |

$ | 1.50 | $ | 1,018,750 | ||

| Proceeds, before expenses, to us (1) |

$ | 23.50 | $ | 16,481,250 | ||

| (1) | Scott & Stringfellow, LLC has agreed that the underwriting discount will be $0.875 per share for shares purchased by our directors, executive officers and others. The total underwriting discount and commissions and total proceeds assume the purchase of 50,000 shares by such persons. |

We have granted Scott & Stringfellow, LLC, the underwriter for this offering, an option to purchase up to 100,000 additional shares of our Series B Preferred Stock from us at the public offering price, less the underwriting discount and commission, within 30 days from the date of the underwriting agreement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful and complete. Any representation to the contrary is a criminal offense.

These securities are not savings accounts, deposits or other obligations of any bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation, the Deposit Insurance Fund or any other governmental agency.

The underwriter expects to deliver the shares of Series B Preferred Stock to purchasers on or about , 2009, subject to customary closing conditions.

Scott & Stringfellow

The date of this prospectus is , 2009

Table of Contents

Table of Contents

| Page | ||

| ii | ||

| 1 | ||

| 10 | ||

| 11 | ||

| 25 | ||

| 26 | ||

| Ratio of Earnings to Fixed Charges and Preferred Dividends and Distributions |

26 | |

| 27 | ||

| 28 | ||

| 29 | ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

30 | |

| 67 | ||

| 69 | ||

| 81 | ||

| 86 | ||

| 89 | ||

| 90 | ||

| 101 | ||

| 112 | ||

| 121 | ||

| 126 | ||

| 129 | ||

| 129 | ||

| 129 | ||

| F-1 |

i

Table of Contents

It is important for you to read and consider all of the information contained in this prospectus before making your investment decision. You should rely only on the information contained in this prospectus and any related free writing prospectus that we file with the Securities and Exchange Commission, or the SEC. We have not, and the underwriter has not, authorized any other person to provide you with additional or different information. If anyone provides you with additional or different information, you should not rely on it. We are not, and the underwriter is not, making an offer to sell our Series B Preferred Stock in any jurisdiction in which the offer or sale is not permitted. You should assume that the information contained in this prospectus is accurate only as of the date on the front cover page of this prospectus, regardless of the time of delivery of this prospectus or any sale of our Series B Preferred Stock. Our business, financial condition and results of operations may have changed since that time.

In this prospectus we rely on and refer to information and statistics regarding the banking industry and banking markets in Virginia and North Carolina. We obtained this market data from independent publications or other publicly available information. Although we believe these sources are reliable, we have not independently verified and do not guarantee the accuracy and completeness of this information. In addition, the sources of the demographic information that we have included in our discussion of our market area in this prospectus include United States Census Bureau, Environmental Systems Research Institute, Inc., economic development authorities and chamber of commerce materials.

No action is being taken in any jurisdiction outside the United States to permit a public offering of our Series B Preferred Stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to those jurisdictions.

In this prospectus, we frequently use the terms “we”, “our”, “us” and the “Company” to refer to Monarch Financial Holdings, Inc., Monarch Bank and other subsidiaries which we own as a combined entity, except where it is clear that the terms mean only Monarch Financial Holdings, Inc. To understand the offering fully and for a more complete description of the offering you should read this entire document carefully, including particularly the “Risk Factors” section beginning on page 11.

ii

Table of Contents

This summary highlights information contained elsewhere in this prospectus. Because this is a summary, it may not contain all of the information that may be important to you. Therefore, you should read this entire prospectus carefully before making a decision to invest in our Series B Preferred Stock, including the risks discussed under the “Risk Factors” section and our financial statements and related notes.

The Company

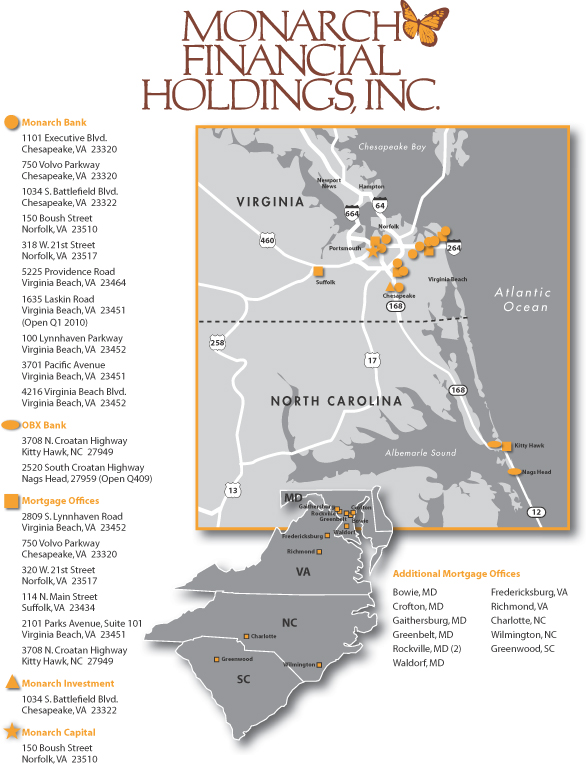

Monarch Financial Holdings, Inc. is a Virginia-chartered bank holding company headquartered in Chesapeake, Virginia engaged in commercial and retail banking, investment and insurance sales, and mortgage origination and brokerage. We conduct our operations through our wholly-owned subsidiary, Monarch Bank, and its two wholly-owned subsidiaries, Monarch Investment, LLC and Monarch Capital, LLC. We also do business in some markets as OBX Bank, Monarch Mortgage and under various names via joint ventures with other partners.

Monarch Bank serves the needs of local businesses, professionals, corporate executives and individuals in the South Hampton Roads area of Southeastern Virginia and the Outer Banks region of Northeastern North Carolina. We operate eight banking offices, five residential mortgage offices and one investment services office in the cities of Chesapeake, Norfolk, Suffolk and Virginia Beach, Virginia. Our ninth full-service banking office operates under the name “OBX Bank” in the Outer Banks region of Northeastern North Carolina in the town of Kitty Hawk. We also operate twelve additional residential mortgage offices outside of our primary market areas.

Monarch Mortgage, a division of Monarch Bank, was formed in May 2007 when we hired a group of approximately 70 experienced mortgage professionals to staff the division. At that time our employment of these individuals increased the size of our mortgage group from approximately 10 to approximately 80 mortgage professionals. Monarch Mortgage is a residential mortgage lender with offices in Virginia, Maryland, North Carolina and South Carolina. We sell 99% of the mortgages we originate on a loan by loan basis to a large number of national banks, mortgage companies, and directly to certain governmental agencies. By maintaining correspondent and broker relationships with a number of companies, and by monitoring the financial condition of those companies, we believe we can limit the risk of our correspondents not purchasing loans we originate. We originate and sell primarily long-term fixed rate mortgage loans and all loans we originate are considered prime loans. We do not securitize pools of loans.

Mortgage originations and sales have become a major source of revenue and net income for the company since the formation of Monarch Mortgage in 2007, with significant growth in both 2008 and 2009 due to a low interest rate environment coupled with recent government stimulus to the mortgage marketplace. We currently manage our interest rate risks by locking in the interest rate for each mortgage loan with our correspondents and borrowers at the same time.

We offer a wide range of commercial and consumer credit, deposit, mortgage, cash management and private banking services. Through our subsidiaries, we provide full-service investment services through licensed representatives as well as title insurance and commercial mortgage brokerage. We are a community oriented, locally owned and operated financial services company.

Monarch Bank was incorporated on May 1, 1998, and opened for business on April 14, 1999. To better serve our clients and more efficiently manage our business operations, in June 2006 we reorganized as a bank

1

Table of Contents

holding company with Monarch Bank becoming the banking subsidiary of Monarch Financial Holdings, Inc. We have grown through de novo expansion, acquisition and the hiring of seasoned banking professionals in our target markets. While we have grown rapidly over the past five years, our strategy has been to do so profitably and without compromising our asset quality. Our growth highlights over the last five years include:

| • | increasing our total assets from $226.9 million as of December 31, 2004 to $651.7 million as of September 30, 2009; |

| • | increasing our total loans held for investment from $177.1 million as of December 31, 2004 to $512.8 million as of September 30, 2009; |

| • | increasing our total deposits from $171.4 million as of December 31, 2004 to $540.1 million as of September 30, 2009. |

Over the past two years our markets have experienced a slowdown in the development, construction, and sale of residential properties, as well as declines in real estate values. The decline in sales has created diminished cash flows for many of our borrowers, and at times left some borrowers unable to properly service their loan obligations. The rise in unemployment has also affected the ability of consumers to properly service their debt obligations. Management has been aggressive during this period in the recognition, provisioning and charging off of non-performing loans, and this has had an impact on the net income of our commercial and other banking segment. During 2008, our commercial and other banking segment experienced a decline in net income before income taxes and noncontrolling interests primarily due to higher provision for loan loss expense related to the general decline in market conditions. However, growth in our mortgage banking operations during 2008 helped offset the decline in our commercial and other banking segment. For the nine months ended September 30, 2009, the impact of adverse conditions on our commercial and other banking segment moderated, with improvements noted in both segments when compared to the first nine months of 2008.

Net Income before income taxes

and noncontrolling interest

| For the Nine Months Ended September 30, |

For the Year Ended December 31, |

|||||||||||||||

| 2009 | 2008 | 2008 | 2007 | |||||||||||||

| Commercial and Other Banking |

$ | 5,565,204 | $ | 4,148,133 | $ | 1,890,990 | $ | 4,978,893 | ||||||||

| Mortgage Banking Operations |

1,776,256 | 1,649,987 | 1,799,724 | (1,149,772 | ) | |||||||||||

| Intersegment Eliminations |

(1,706,913 | ) | (1,544,622 | ) | (1,772,101 | ) | 1,026,944 | |||||||||

| Total |

$ | 5,634,547 | $ | 4,253,498 | $ | 1,918,613 | $ | 4,856,065 | ||||||||

2

Table of Contents

Management Team

Our senior management team consists of 14 officers who have 370 years of combined experience, with an average of 26 years experience each in the financial services industry. The table below identifies our key senior managers.

| Name |

Position |

Years of Experience | ||

| William F. Rountree, Jr. |

President & Chief Executive Officer | 42 | ||

| Brad E. Schwartz |

Executive Vice President – Chief Operating/Financial Officer Chief Executive Officer, Monarch Bank |

25 | ||

| E. Neal Crawford |

President – Monarch Bank | 24 | ||

| E. Ted Yoder |

President – Monarch Mortgage | 16 | ||

| James K. Ferber |

President – Real Estate & Construction Group | 27 | ||

| Barry A. Mathias |

Market President – Chesapeake | 38 | ||

| David W. McGlaughon |

Market President – OBX Bank | 29 | ||

| Donald F. Price |

Market President – Norfolk | 32 | ||

| W. Craig Reilly |

Market President – Virginia Beach | 11 | ||

| Barbara N. Lane |

Executive Vice President – Operations | 39 | ||

| Andrew N. Lock |

Executive Vice President – Chief Credit Officer | 17 | ||

| William T. Morrison |

Executive Vice President – Chief Operating Officer, Monarch Mortgage | 23 | ||

| Nancy B. Porter |

Executive Vice President – Sales and Marketing | 19 | ||

| Lynette P. Harris |

Senior Vice President – Chief Financial Officer, Monarch Bank | 28 |

Mr. Rountree turned 65 in July 2009. As part of our management transition plan, Mr. Rountree retained the title of President and Chief Executive Officer of Monarch Financial Holdings, Inc., and stepped down as Chief Executive Officer and President of Monarch Bank in May 2009. At that time Mr. Brad E. Schwartz was named Chief Executive Officer of Monarch Bank and Mr. E. Neal Crawford was named President of Monarch Bank. Previous to that time Mr. Schwartz served as Executive Vice President and Chief Operating and Financial Officer of Monarch Financial Holdings, Inc. and Monarch Bank, and Mr. Crawford served as Market President-Norfolk for Monarch Bank. Mr. Crawford, Mr. Rountree, and Mr. Schwartz all currently serve as members of the board of directors of Monarch Financial Holdings, Inc. and Monarch Bank. The transition plan is expected to continue and it is expected that Mr. Rountree will step down as Chief Executive Officer in 2010 but will continue to serve as part of Monarch’s executive management team for at least the next three years.

We utilize a “Market President” approach to deliver products and services in each of our primary markets. We hire experienced bankers to serve in these leadership roles, and each Market President is responsible for building a strong team of bankers in their respective markets, developing and managing an advisory board of directors, managing sales and service delivery, and integrating our other lines of business in their communities. We believe this approach allows us to expand into new markets with fewer banking office locations and achieve profitability earlier than by utilizing the traditional banking model of opening a banking office and then looking for bankers to staff the location.

Our Market Areas

We operate in the Virginia Beach-Norfolk-Newport News, VA-NC Metropolitan Statistical Area (“MSA”), more commonly known as Greater Hampton Roads. The Greater Hampton Roads area includes the cities of Virginia Beach, Norfolk, Newport News, Chesapeake, Hampton, Portsmouth and Suffolk, and is the 2nd largest MSA in Virginia and the 5th largest MSA in the Southeast with a population of approximately 1.7 million people

3

Table of Contents

as of July 2009. The Greater Hampton Roads has a diversified economy that includes military, tourism, government, education, shipping, healthcare and professional services which has resulted in lower unemployment rates when compared to the overall United States.

As of September 2009, the unemployment rate for the Greater Hampton Roads area was 6.7% compared to 9.8% for the U.S. As of September 2008, the unemployment rate for the Greater Hampton Roads area was 4.3%. The labor pool in Hampton Roads has grown in the past year, with 788 thousand working and 35 thousand unemployed in September 2008 compared to 775 thousand working and 56 thousand unemployed in September 2009. The September 2009 numbers are preliminary estimates of the U.S. Bureau of Labor Statistics.

Our primary market areas are South Hampton Roads, which includes the cities of Virginia Beach, Norfolk, Chesapeake, Portsmouth and Suffolk, Virginia, and the Outer Banks region of Northeastern North Carolina, which is comprised of Currituck and Dare counties. We believe the economic conditions encountered in South Hampton Roads, including the level of home purchases and sales, are consistent with those encountered in Greater Hampton Roads as a whole.

South Hampton Roads, with a population of over one million people as of July 2009, has experienced steady growth in recent years and is one of the largest metropolitan areas in Virginia. The area has a significant military base presence with all of the U.S. armed forces represented in the area. The most notable military base is Naval Station Norfolk, the largest naval installation in the world. Norfolk is also the home of the Port of Hampton Roads, the third largest volume port on the East Coast in terms of general cargo. The presence of the military and port provide stability to the market and help the area weather market downturns in other sectors of the local economy. The area’s economy is also supported by a diverse private sector, including a strong manufacturing base and other significant employers. Leading private sector employers include Stihl, Inc. (chain saws), Sumitomo Machinery Corporation of America (industrial motor drives), Canon Virginia, Inc. (copiers, laser printers and suppliers), Dollar Tree Stores, Inc. (retail), Norfolk Southern Corporation (transportation), and Mitsubishi Corporation (various manufacturing operations). We currently concentrate our operations and have banking offices in Chesapeake, Virginia Beach and Norfolk, Virginia.

The Outer Banks region primarily consists of Currituck and Dare counties on North Carolina’s northeast coast and is a natural extension of our South Hampton Roads market. Currituck County is a part of the Virginia Beach-Norfolk-Newport News, VA-NC MSA. We operate a banking office under the name “OBX Bank” in the town of Kitty Hawk with a second OBX Bank office opening in December 2009 in Nags Head, North Carolina.

Business Strategy

Our overall strategic goal is to continue building the area’s top community-based financial services company. We plan to continue to grow both our core banking business as well as our non-interest income lines of business. Specifically, we plan to:

Continue to Penetrate the Greater Hampton Roads Market

Most of our offices are located in the cities of Chesapeake, Virginia Beach and Norfolk, Virginia, and we are continuously looking for additional banking locations in these existing markets that will help support our loan and deposit growth goals. In October 2009, we announced our intention to open our fifth banking office in Virginia Beach, which we expect to open in the first quarter of 2010. Logical extensions of our footprint include the cities of Suffolk, Portsmouth, Newport News and Hampton, Virginia and other markets adjacent to Greater Hampton Roads. We believe our Market President approach to market delivery positions us to successfully expand into new markets. Successful expansion into new markets means we must locate, attract and retain the best talent in our businesses. We will not enter a new market without the right person in the Market President leadership role. This approach may delay our market expansion, but it is our experience that with the right

4

Table of Contents

leadership we are able to attract complementary banking professionals and grow loans and deposits more quickly, thus minimizing the short term dilutive effects of de novo branching on our overall profitability.

We believe the Greater Hampton Roads banking market is experiencing a significant amount of market disruption created by the acquisition of Wachovia by Wells Fargo, which held the largest deposit market share at June 30, 2009 representing 19.4% of deposits in the MSA. Other area banks have also been impacted negatively by the recent financial markets downturn. These disruptions create an opportunity for us to acquire both seasoned banking professionals and new clients that are seeking to join a stable and growing franchise in the Greater Hampton Roads marketplace. In August 2009, we announced the hiring of four seasoned banking professionals from regional and local bank competitors in our market. These professionals all have significant client relationships and loan and deposit books of business that we expect to be a source of future growth. The hiring of seasoned bankers and banking teams in our existing and contiguous markets will continue to be a strategy for us as we grow our market share.

Expand OBX Bank

In May 2007, we opened our first full-service banking office in Kitty Hawk, North Carolina under the name “OBX Bank, a Monarch Bank division.” While there have been a number of banks entering this growing market over the past 10 years, most of the banks have out-of-market headquarters and decision-making. Consistent with our strategy, we identified our Market President and developed a local advisory board of directors that have significant experience and deep local ties that we believe will provide us with a competitive advantage in the Outer Banks market. We are also building strong support among local businesses, professionals and consumers, as well as reaching targeted non-residents with residential construction and mortgage loans. We plan to open our second OBX Bank office in the town of Nags Head, North Carolina during December 2009.

Grow Core Deposits

Growing low cost core deposits has been and will continue to be vital to funding our loan growth and preserving our net interest margin. In recent years, we have been successful in growing overall deposits in our target markets. From 2003 to 2008, we opened one banking center per year, increasing our deposit market share penetration in Greater Hampton Roads from 0.98% in 2003 to 2.54% in 2009. Total deposits were $540.1 million at September 30, 2009, an increase of $41.4 million or 8.3% over September 30, 2008. We generate core deposits by offering our clients technology on par with our large bank competitors, including remote deposit capture, sophisticated online internet-based cash management system, and the use of our internal core deposit generating sweep services that allow businesses to earn interest on their excess funds. Our Private Banking Group drives core deposit generation by tailoring the packaging and sales of these services to meet the needs of our retail and commercial clients. At June 30, 2009, we were ranked 9th in deposit market share with 2.54% of the deposits in the Greater Hampton Roads market.

The top four banks in our market control 60.0% of the total deposits in the Greater Hampton Roads market as of June 30, 2009, providing us with ample opportunity to continue to grow our market share.

Grow Non-Interest Income Lines of Business

Our strategy involves building and maintaining sustainable revenue and net income sources incremental to our bank’s spread income (the difference between asset yields and funding costs). Through our subsidiaries and joint ventures, our goal is to provide a full array of products and services, including residential mortgage, investment advisory, title insurance and commercial mortgage brokerage to our clients to meet their financial needs. These ancillary products drive non-interest income, adding diversity to our revenue base and increasing our overall profitability. Over the past several years, we have successfully grown our non-interest income lines of

5

Table of Contents

businesses, increasing our non-interest income to operating revenue to 59.6% for the year ended December 31, 2008 compared to 28.0% for the year ended December 31, 2004. We expect that, in the absence of non-organic growth, we will continue to earn non-interest income attributable to our mortgage banking operations at current levels until interest rates rise to rates that discourage residential sales and refinancing by existing homeowners. We operate the following companies that generate non-interest income:

| • | Monarch Mortgage – a division of Monarch Bank formed in 2007, Monarch Mortgage and our affiliate mortgage companies (Coastal Home Mortgage, LLC and Home Mortgage Solutions, LLC) underwrite permanent residential mortgage loans to be sold in the secondary market. Monarch Mortgage is headquartered in Virginia Beach, Virginia and operates seventeen additional offices in Chesapeake, Norfolk, Virginia Beach, Suffolk, Richmond, and Fredericksburg, Virginia; Rockville, Bowie, Crofton, Gaithersburg, Waldorf, and Green Belt, Maryland; Kitty Hawk, Charlotte, and Wilmington, North Carolina; and Greenwood, South Carolina. We have been successful in hiring seasoned mortgage originators since opening and continue to evaluate expansion opportunities to hire individual loan officers, entire production groups and offices within our current mortgage market areas. |

| • | Monarch Investment, LLC – a wholly-owned subsidiary of Monarch Bank formed in 2003, delivers retail and commercial investment and insurance services to our clients. |

| • | Monarch Capital, LLC – a wholly-owned subsidiary of Monarch Bank formed in 2004, provides structured financing and commercial mortgage brokerage services in the placement of primarily long-term, fixed-rate, non-recourse debt for the commercial, hospitality, and multi-family housing markets. |

| • | Real Estate Security Agency, LLC – a majority-owned joint venture formed in 2007, offers residential and commercial title and settlement services to our banking and mortgage clients. |

Maintain Financial Discipline

We are committed to being a high performing financial services company and will continue to expand our banking office network and grow our loan portfolio, but will only do so in a disciplined manner. We will expand only when we have the appropriate local banking officers retained and will not reduce our credit standards or pricing to generate new loans. Our focus on credit risk management has enabled us to successfully grow our balance sheet while generally maintaining strong asset quality through our conservative underwriting practices despite the recent adverse economic climate. We believe that maintaining our financial discipline will generate strong long-term stockholder value.

Our principal executive offices are located at 1101 Executive Boulevard, Chesapeake, Virginia 23320, and our telephone number is (757) 389-5112. Our primary internet address is www.monarchbank.com. The information contained on our web site is not part of this prospectus.

Participation in the Capital Purchase Program

On December 19, 2008 we issued $14.7 million of our Fixed Rate Cumulative Perpetual Preferred Stock, Series A (“Series A Preferred Stock”) to the United States Department of the Treasury (the “Treasury”) pursuant to the Treasury’s Capital Purchase Program (the “CPP”), together with a warrant to purchase up to 264,706 shares of our Common Stock at an initial exercise price of $8.33 per share (the “Warrant”). If this offering and any other qualified equity offerings that we may make prior to December 31, 2009 result in aggregate gross proceeds of at least $14.7 million, the number of shares of our Common Stock underlying the Warrant then held by the Treasury will be reduced by 50% to 132,353 shares.

6

Table of Contents

The Offering

| Issuer |

Monarch Financial Holdings, Inc. |

| Securities Offered |

700,000 shares of Series B Preferred Stock (800,000 shares if the underwriter exercises its over-allotment option in full). |

| Offering Price per Share |

$25.00 |

| Liquidation Preference |

$25.00 per share of Series B Preferred Stock, plus an amount equal to the sum of all declared, accrued and unpaid dividends. |

| Maturity |

Perpetual. |

| Dividends |

% per annum, which is equivalent to $ per annum per share. Dividends are payable quarterly, when, as and if declared, on the last day of March, June, September and December of each year, commencing December 31, 2009. |

In order for the Series B Preferred Stock to qualify for Tier 1 capital treatment, dividends are noncumulative and are payable if, when and as authorized and declared by our board of directors. If for any reason the board of directors does not authorize full cash dividends for a dividend period, we will have no obligation to pay any dividends for that period, whether or not our board of directors authorizes and declares dividends on the Series B Preferred Stock for any subsequent dividend period.

Notwithstanding the foregoing, holders of the Series B Preferred Stock have a priority on the receipt of dividends relative to the holders of our junior securities, including the Common Stock. If we have not declared and paid or set aside for full payment of the quarterly dividends on the Series B Preferred Stock for a particular dividend period, we may not declare or pay dividends on, or redeem or purchase, shares of securities junior to the Series B Preferred Stock during the next succeeding dividend period.

| Conversion by Holder |

Each share of Series B Preferred Stock will be convertible at the option of the holder into shares of our Common Stock (which reflects an initial conversion price of $ per share of Common Stock), subject to certain adjustments. See “Description of the Series B Preferred Stock – Optional Conversion Right.” |

| Conversion by Us |

We may, at our option, at any time or from time to time cause some or all of the Series B Preferred Stock to be converted into shares of our Common Stock at the then applicable conversion rate. We may exercise our conversion right if, for 20 trading days within any period of 30 consecutive trading days, the closing price of our Common Stock exceeds 130% of the then applicable conversion price of the Series B Preferred Stock. See “Description of the Series B Preferred Stock – Mandatory Conversion at Our Option.” |

7

Table of Contents

| Redemption |

Subject to prior approval by the Federal Reserve, the Series B Preferred Stock is redeemable at our option at any time, in whole or in part, on and after the third anniversary of the issue date, at $25.00 per share, plus declared and unpaid dividends, if any, for the prior and the then current dividend periods. |

| Ranking |

The Series B Preferred Stock will be, with respect to dividends and upon liquidation, dissolution or winding-up: (i) junior to all our existing and future debt obligations; (ii) junior to each class of capital stock or series of preferred stock, the terms of which expressly provide that it ranks senior to the Series B Preferred Stock; (iii) on a parity with the Series A Preferred Stock, and any future class of capital stock or preferred stock expressly state that such class ranks on parity with the Series B Preferred Stock; and (iv) senior to all classes of our Common Stock or series of preferred stock, the terms of which do not expressly provide that it ranks senior to or on a parity with the Series B Preferred Stock. |

As of the consummation of this offering, the Series B Preferred Stock will not rank junior to any of our securities; will rank on a parity with the Series A Preferred Stock; and will rank senior to our trust preferred securities and Common Stock. “Description of the Series B Preferred Stock – Ranking.”

| Voting |

Except as required by law and our articles of incorporation, which will include the terms of the Series B Preferred Stock, the holders of Series B Preferred Stock will have no voting rights. |

| Use of Proceeds |

We expect to receive net proceeds from this offering of approximately $16.2 million, after deducting underwriting discounts and commissions and other estimated expenses (or approximately $18.6 million if the underwriter exercises its over-allotment option in full). We intend to use the proceeds of the offering for general corporate purposes, including funding organic growth and opportunistic acquisitions that meet our investment criteria, and, including, if approved, the redemption of our Series A Preferred Stock and Warrant issued to the Treasury through the CPP. See “Use of Proceeds.” |

| Tax Consequences |

Material U.S. federal tax considerations relevant to the purchase, ownership and disposition of our Series B Preferred Stock and Common Stock issued upon its conversion are described in “Material Federal U.S. Income Tax Considerations.” Prospective investors are advised to consult with their own tax advisors regarding the tax consequences of acquiring, holding or disposing of our Series B Preferred Stock and Common Stock issued upon its conversion in light of current tax laws, their particular personal investment circumstances and the application of state, local and other tax laws. |

8

Table of Contents

| Shares Outstanding After this Offering (1) |

5,792,914 shares of Common Stock. |

14,700 shares of Series A Preferred Stock.

700,000 shares of Series B Preferred Stock (800,000 shares if the underwriter exercises its over-allotment option in full).

| Risk Factors |

Before investing, you should carefully review the information contained under “Risk Factors” beginning at page 11 for a discussion of the risks related to an investment in our Series B Preferred Stock. |

| Proposed NASDAQ Symbol |

We have filed an application for quotation of the Series B Preferred Stock on the NASDAQ Capital Market under the symbol “MNRKP.” |

| (1) | The number of shares of Common Stock outstanding excludes 301,437 shares of Common Stock issuable upon exercise of outstanding stock options as of September 30, 2009, with a weighted average exercise price of $7.78 per share, and the Warrant for 264,706 shares of Common Stock with an initial exercise price of $8.33 per share held by the Treasury. |

9

Table of Contents

The following consolidated summary sets forth our selected financial data for the periods and at the dates indicated. The selected financial data have been derived from our audited financial statements for each of the five years that ended December 31, 2008, 2007, 2006, 2005 and 2004 and from our unaudited financial statements for the nine months ended September 30, 2009 and 2008. You should read the detailed information and the financial statements included elsewhere in the prospectus. The operating data for the nine months ended September 30, 2009 are not necessarily indicative of the results that might be expected for the full year.

| At or For the Nine Months Ended September 30, |

At or For the Years Ended December 31, | |||||||||||||||||||||||||||

| 2009 | 2008 | 2008 | 2007 | 2006 | 2005 | 2004 | ||||||||||||||||||||||

| (in thousands, except ratios and per share amounts) | ||||||||||||||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||||||||||

| Assets |

$ | 651,744 | $ | 594,835 | $ | 597,198 | $ | 503,164 | $ | 407,720 | $ | 331,174 | $ | 226,858 | ||||||||||||||

| Loans, held for investment (HFI), net of unearned income |

512,784 | 496,061 | 496,666 | 415,177 | 318,028 | 260,581 | 177,141 | |||||||||||||||||||||

| Deposits |

540,092 | 498,704 | 496,086 | 389,704 | 314,113 | 273,073 | 171,376 | |||||||||||||||||||||

| Total common stockholders’ equity |

48,346 | 46,294 | 45,077 | 36,548 | 34,009 | 29,796 | 21,103 | |||||||||||||||||||||

| Total shareholders’ equity |

63,046 | 46,294 | 59,777 | 36,548 | 34,009 | 29,796 | 21,103 | |||||||||||||||||||||

| Average shares outstanding, basic (1) |

5,650,780 | 5,088,633 | 5,213,096 | 4,814,738 | 4,759,448 | 4,388,720 | 3,943,054 | |||||||||||||||||||||

| Average shares outstanding, diluted (1) |

5,704,082 | 5,250,089 | 5,292,232 | 5,019,221 | 5,026,364 | 4,583,951 | 4,112,396 | |||||||||||||||||||||

| Results of Operations: |

||||||||||||||||||||||||||||

| Interest income |

$ | 24,047 | $ | 23,435 | $ | 29,258 | $ | 30,752 | $ | 25,110 | $ | 15,527 | $ | 9,392 | ||||||||||||||

| Interest expense |

8,220 | 11,129 | 14,716 | 14,487 | 10,861 | 5,507 | 3,232 | |||||||||||||||||||||

| Net interest income |

15,827 | 12,306 | 14,542 | 16,265 | 14,249 | 10,020 | 6,160 | |||||||||||||||||||||

| Provision for loan losses |

4,085 | 1,245 | 5,014 | 976 | 559 | 915 | 305 | |||||||||||||||||||||

| Net interest income after provision for loan losses |

11,742 | 11,061 | 9,528 | 15,289 | 13,690 | 9,105 | 5,855 | |||||||||||||||||||||

| Non-interest income |

26,526 | 14,641 | 21,469 | 8,379 | 3,615 | 3,161 | 2,412 | |||||||||||||||||||||

| Securities gains (losses) |

— | 10 | (56 | ) | — | (29 | ) | (11 | ) | (16 | ) | |||||||||||||||||

| Non-interest expenses |

32,633 | 21,459 | 29,023 | 18,812 | 11,870 | 9,088 | 7,113 | |||||||||||||||||||||

| Income before income taxes |

5,635 | 4,253 | 1,918 | 4,856 | 5,406 | 3,167 | 1,138 | |||||||||||||||||||||

| Income tax expense |

1,834 | 1,328 | 505 | 1,533 | 1,786 | 1,065 | 374 | |||||||||||||||||||||

| Net income |

3,801 | 2,925 | 1,413 | 3,323 | 3,620 | 2,102 | 764 | |||||||||||||||||||||

| Net income attributable to noncontrolling interests |

(168 | ) | (258 | ) | (281 | ) | (165 | ) | 6 | — | (7 | ) | ||||||||||||||||

| Net income attributable to Monarch Financial Holdings, Inc. |

3,633 | 2,667 | 1,132 | 3,158 | 3,626 | 2,102 | 757 | |||||||||||||||||||||

| Amortization of warrants |

29 | — | — | — | — | — | — | |||||||||||||||||||||

| Dividend on preferred stock |

558 | — | 25 | — | — | — | — | |||||||||||||||||||||

| Net income available to common shareholders |

3,046 | 2,667 | 1,107 | 3,158 | 3,626 | 2,102 | 757 | |||||||||||||||||||||

| Per Share Data: |

||||||||||||||||||||||||||||

| Net income, basic |

$ | 0.54 | $ | 0.52 | $ | 0.21 | $ | 0.66 | $ | 0.76 | $ | 0.48 | $ | 0.19 | ||||||||||||||

| Net income, diluted |

0.53 | 0.51 | 0.21 | 0.63 | 0.72 | 0.46 | 0.18 | |||||||||||||||||||||

| Book value at period end |

8.35 | 8.14 | 7.86 | 7.57 | 7.02 | 6.31 | 5.33 | |||||||||||||||||||||

| Tangible book value at period end |

8.06 | 7.82 | 7.55 | 7.17 | 7.02 | 6.30 | 5.33 | |||||||||||||||||||||

| Asset Quality Ratios: |

||||||||||||||||||||||||||||

| Non-performing assets to total assets |

1.34 | % | 0.89 | % | 1.35 | % | 0.08 | % | 0.02 | % | 0.00 | % | 0.00 | % | ||||||||||||||

| Non-performing loans to period end loans |

1.47 | % | 0.98 | % | 1.49 | % | 0.10 | % | 0.03 | % | 0.00 | % | 0.00 | % | ||||||||||||||

| Net charge-offs to average loans |

0.50 | % | 0.05 | % | 0.20 | % | 0.06 | % | 0.00 | % | 0.01 | % | 0.00 | % | ||||||||||||||

| Allowance for loan losses to period-end loans, HFI |

1.83 | % | 1.00 | % | 1.59 | % | 0.95 | % | 1.01 | % | 1.02 | % | 1.01 | % | ||||||||||||||

| Allowance for loan losses to nonperforming loans |

124.22 | % | 101.92 | % | 107.19 | % | 958.07 | % | 3267.68 | % | N/A | N/A | ||||||||||||||||

| Selected Ratios: |

||||||||||||||||||||||||||||

| Return on average assets |

0.75 | % | 0.65 | % | 0.20 | % | 0.76 | % | 1.05 | % | 0.82 | % | 0.39 | % | ||||||||||||||

| Return on average equity |

7.84 | % | 8.79 | % | 2.66 | % | 8.86 | % | 11.38 | % | 8.14 | % | 3.68 | % | ||||||||||||||

| Efficiency (2) |

76.80 | % | 79.10 | % | 80.20 | % | 76.33 | % | 66.55 | % | 69.01 | % | 83.13 | % | ||||||||||||||

| Noninterest income to operating revenue (3) |

62.63 | % | 54.35 | % | 59.55 | % | 34.00 | % | 20.10 | % | 23.92 | % | 28.00 | % | ||||||||||||||

| Net interest margin |

3.52 | % | 3.21 | % | 3.00 | % | 4.25 | % | 4.43 | % | 4.15 | % | 3.35 | % | ||||||||||||||

| Equity to assets |

9.67 | % | 7.78 | % | 10.01 | % | 7.26 | % | 8.34 | % | 9.00 | % | 9.30 | % | ||||||||||||||

| Tangible common shareholders’ equity to tangible assets |

7.18 | % | 7.50 | % | 7.27 | % | 6.90 | % | 8.34 | % | 9.00 | % | 9.30 | % | ||||||||||||||

| Tier 1 risk-based capital |

12.64 | % | 11.09 | % | 13.53 | % | 9.22 | % | 12.18 | % | 9.86 | % | 9.92 | % | ||||||||||||||

| Total risk-based capital |

13.89 | % | 12.11 | % | 14.79 | % | 10.05 | % | 13.07 | % | 10.74 | % | 10.76 | % | ||||||||||||||

| Leverage |

11.17 | % | 9.42 | % | 11.76 | % | 9.56 | % | 12.21 | % | 9.96 | % | 10.28 | % | ||||||||||||||

| (1) | Amounts have been adjusted to reflect a 6 for 5 stock split in 2003, a 6 for 5 stock split in 2004, an 11 for 10 stock dividend in 2005, a 5 for 4 stock split in 2006, and a 6 for 5 stock split in 2007. |

| (2) | The efficiency ratio is a key performance indicator in our industry. We monitor this ratio in tandem with other key indicators for signals of potential trends that should be considered when making decisions regarding strategies related to such areas as asset liability management, business line development, and growth and expansion planning. The ratio is computed by dividing non-interest expense by the sum of net interest income on a tax equivalent basis and non-interest income, net of any securities gains or losses. It is a measure of the relationship between operating expenses and earnings. |

| (3) | Operating revenue is defined as net interest income plus noninterest income. |

10

Table of Contents

An investment in our Series B Preferred Stock involves risk, and you should not invest in our stock unless you can afford to lose some or all of your investment. You should carefully read the risks described below before you decide to buy any of our Series B Preferred Stock. Our business, prospects, financial condition and results of operations could be harmed by any of the following risks.

Risk Factors Related to this Offering

Our Series B Preferred Stock is subordinated to our obligations to our creditors and will rank junior to all of our and our subsidiaries’ liabilities in the event of a bankruptcy, liquidation or winding-up of our assets.

The Series B Preferred Stock is subordinated to our obligations to our creditors, including our depositors. If we are in default to these creditors, you may not receive principal and interest payments on the Series B Preferred Stock. In the event of bankruptcy, liquidation or winding-up, our assets will be available to pay the liquidation preference of our Series B Preferred Stock only after all of our liabilities have been paid. In addition, our Series B Preferred Stock will effectively rank junior to all existing and future liabilities of our subsidiaries and the capital stock of our subsidiaries held by third parties. The rights of holders of our Series B Preferred Stock to participate in the assets of our subsidiaries upon any liquidation or reorganization of any subsidiary will rank junior to the prior claims of that subsidiary’s creditors and minority equity holders. In the event of bankruptcy, liquidation or winding-up, there may not be sufficient assets remaining, after paying our and our subsidiaries’ liabilities, to pay amounts due on any or all of our Series B Preferred Stock then outstanding. The Series B Preferred Stock ranks equally in seniority to the Series A Preferred Stock, which has a liquidation value of $14.7 million. The Series B Preferred Stock will not rank junior to any of our securities, however the terms of our outstanding junior subordinated debt securities relating to certain issuances of trust preferred securities prohibit us from making a liquidation payment on the Series B Preferred Stock if we are in default or have given notice of our election to defer interest payments on the junior subordinated debt securities.

We may not have sufficient cash flow to make payments on the Series B Preferred Stock and our other debt.

Our ability to pay dividends on the Series A Preferred Stock and the Series B Preferred Stock, principal and interest on our debt and to fund our planned capital expenditures, depends on our future operating performance. Our future operating performance is subject to a number of risks and uncertainties that are often beyond our control, including general economic conditions and financial, competitive, and regulatory factors. For a discussion of some of these risks and uncertainties, please see “— Risk Factors Relating to Our Company.” Consequently, we cannot assure you that we will have sufficient cash flow to meet our liquidity needs, including making payments on our indebtedness.

If our cash flow and capital resources are insufficient to allow us to make scheduled payments on the Series B Preferred Stock or our other debt, we may have to sell assets, seek additional capital or restructure or refinance our debt. If we cannot make scheduled payments on our debt, we could be forced into receivership or liquidation and you could lose all or part of your investment in the Series B Preferred Stock.

You may not receive dividends on our Series B Preferred Stock or our Common Stock.

Dividends on the Series B Preferred Stock are noncumulative. If our board of directors fails to declare a dividend or we fail to pay a dividend declared by our board of directors on the Series B Preferred Stock for a dividend period, then the holders of the Series B Preferred Stock will have no right to receive a dividend related to that dividend period, and we will have no obligation to pay a dividend for the related dividend period or to pay any interest, whether or not dividends on the Series B Preferred Stock are declared for any future dividend period. See “Description of the Series B Preferred Stock – Dividend Rights.”

Holders of our Series B Preferred Stock and our Common Stock are only entitled to receive such dividends as our board of directors may declare out of funds legally available for such payments. Furthermore, our

11

Table of Contents

Common Stockholders are subject to the prior dividend rights of any holders of our preferred stock or depositary shares representing such preferred stock then outstanding. As of September 30, 2009, there were 14,700 shares of our Series A Preferred Stock, with a liquidation amount of $1,000 per share, issued and outstanding. Under the terms of the Series A Preferred Stock, our ability to declare and pay dividends on or repurchase our Common Stock will be subject to restrictions in the event we fail to declare and pay (or set aside for payment) full dividends on the Series A Preferred Stock.

We have never declared a cash dividend on our Common Stock in the past and we may not do so in the future. Our ability to declare and pay cash dividends will be dependent upon, among other things, restrictions imposed by the reserve and capital requirements of Virginia and federal banking regulations, our income and financial condition, tax considerations and general business conditions. Furthermore, as long as the Series A Preferred Stock is outstanding, dividend payments and repurchases or redemptions relating to certain equity securities, including our Common Stock, are prohibited until all accrued and unpaid dividends are paid on such preferred stock, subject to certain limited exceptions. In addition, prior to December 19, 2011, unless we have redeemed all of the Series A Preferred Stock or the Treasury has transferred all of the Series A Preferred Stock to third parties, the consent of the Treasury will be required for us to, among other things, pay a Common Stock dividend. Under the terms of our Series A Preferred Stock, our ability to declare or pay dividends on or repurchase our Common Stock or other equity or capital securities will be subject to restrictions in the event that we fail to declare and pay (or set aside for payment) full dividends on the Series A Preferred Stock. This could adversely affect the market price of our Common Stock. Also, we are a bank holding company and our ability to declare and pay dividends is dependent on certain federal regulatory considerations, including the guidelines of the Board of Governors of the Federal Reserve System, or Federal Reserve, regarding capital adequacy and dividends.

In addition, the terms of our outstanding junior subordinated debt securities relating to certain issuances of trust preferred securities prohibit us from declaring or paying any dividends or distributions on our capital stock, including our Series B Preferred Stock and our Common Stock, or purchasing, acquiring, or making a liquidation payment on such stock, if we are in default or have given notice of our election to defer interest payments.

We are a holding company and depend on our subsidiaries for dividends, distributions and other payments.

We are a legal entity separate and distinct from our banking and other subsidiaries. Our principal source of cash flow, including cash flow to pay dividends to our stockholders and principal and interest on our outstanding debt, is dividends from our banking subsidiary, Monarch Bank. There are statutory and regulatory limitations on the payment of dividends by Monarch Bank to us, as well as by us to our stockholders. Regulations of both the Federal Reserve and the Virginia State Corporation Commission affect the ability of Monarch Bank to pay dividends and other distributions to us and to make loans to us. If Monarch Bank is unable to make dividend payments to us and sufficient capital is not otherwise available, we may not be able to make dividend payments to holders of our Series B Preferred Stock or our Common Stock.

In addition, our right to participate in any distribution of assets of any of our subsidiaries upon the subsidiary’s liquidation or otherwise, and thus your ability as a holder of our Series B Preferred Stock or our Common Stock to benefit indirectly from such distribution, will be subject to the prior claims of creditors of that subsidiary, except to the extent that any of our claims as a creditor of such subsidiary may be recognized. As a result, shares of our Common Stock are effectively subordinated to all existing and future liabilities and obligations of our subsidiaries.

Periods of rising interest rates will adversely affect the market price of the Series B Preferred Stock.

As of the date of this prospectus, interest rates are at historically low levels. In periods of rising interest rates, holders of fixed dividend securities like the Series B Preferred Stock should expect to see the market price of the fixed rate security go down.

12

Table of Contents

There is currently no established public market for the Series B Preferred Stock, which could limit their market price or the ability to sell them for an amount equal to or higher than their initial offering price.

There is no established public trading market for the Series B Preferred Stock. We intend to have the Series B Preferred Stock quoted on the NASDAQ Capital Market as soon as practicable after the completion of the offering. However, we cannot assure you that an active trading market for the Series B Preferred Stock will develop or be sustained after the completion of the offering. If a trading market does not develop or is not maintained, holders of the Series B Preferred Stock may experience difficulty in reselling, or an inability to sell, the Series B Preferred Stock. If a market for the Series B Preferred Stock develops, any such market may be discontinued at any time. If a public trading market develops for the Series B Preferred Stock, future trading prices of the Series B Preferred Stock will depend on many factors, including, among other things, the price of our Common Stock into which the Series B Preferred Stock is convertible, prevailing interest rates, our operating results and the market for similar securities. Depending on the price of our Common Stock into which the Series B Preferred Stock is convertible, prevailing interest rates, the market for similar securities and other factors, including our financial condition, the Series B Preferred Stock may trade at a discount from their principal amount.

The market for our Common Stock is limited and historically has experienced significant price and volume fluctuations, which may make it difficult for you to resell the Series B Preferred Stock or the shares of Common Stock into which the Series B Preferred Stock is convertible.

The Series B Preferred Stock will be convertible into shares of our Common Stock. Our Common Stock is currently listed on the NASDAQ Capital Market under the symbol “MNRK.” The volume of trading activity in our stock is relatively limited. Even if a more active market develops, there can be no assurance that such market will continue, or that you will be able to sell your shares at or above the offering price.

Further, the market for our Common Stock historically has experienced and may continue to experience significant price and volume fluctuations similar to those experienced by the broader stock market in recent years. Generally, the fluctuations experienced by the broader stock market have affected the market prices of securities issued by many companies for reasons unrelated to their operating performance and may adversely affect the price of our Common Stock. In addition, our announcements of our quarterly operating results, changes in general conditions in the economy or the financial markets and other developments affecting us, our affiliates or our competitors could cause the market price of our Common Stock to fluctuate substantially. The trading price of the Series B Preferred Stock is expected to be affected significantly by the price of our Common Stock.

You may suffer dilution of the Common Stock issuable upon conversion of your Series B Preferred Stock.

The number of shares of our Common Stock issuable upon conversion of your Series B Preferred Stock is subject to adjustment only for stock splits and combinations, stock dividends and certain other specified transactions. See “Description of the Series B Preferred Stock—Conversion Rights.” The number of shares of our Common Stock issuable upon conversion of your Series B Preferred Stock is not subject to adjustment for other events, including the following:

| • | the issuance of shares of our Common Stock for cash or in connection with acquisitions or other transactions, including in exchange for other of our outstanding securities; |

| • | the issuance of any shares of our Common Stock pursuant to any present or future plan providing for the reinvestment of dividends or interest payable on our securities and the investment of additional optional amounts in shares of our Common Stock under any plan; |

| • | the issuance of any shares of our Common Stock or options or rights to purchase those shares pursuant to any present or future employee, director or consultant benefit plan or program of or assumed by us or any of our subsidiaries; or |

13

Table of Contents

| • | the issuance of any shares of our Common Stock pursuant to any option, warrant, right or exercisable, exchangeable or convertible security outstanding as of the date the Series B Preferred Stock were first issued. |

The terms of the Series B Preferred Stock do not restrict our ability to offer shares of our Common Stock in the future or to engage in other transactions that could dilute our Common Stock. We have no obligation to consider the interests of the holders of the Series B Preferred Stock in engaging in any such offering or transaction. If we issue additional shares of our Common Stock, that issuance may materially and adversely affect the price of our Common Stock and, because of the relationship of the number of shares of our Common Stock you are to receive on conversion to the price of our Common Stock, such other events may adversely affect the trading price of the Series B Preferred Stock.

If you hold Series B Preferred Stock, you are not entitled to any rights with respect to our Common Stock, but you are subject to all changes made with respect to our Common Stock.

If you hold Series B Preferred Stock, you are not entitled to any rights with respect to our Common Stock (including, without limitation, voting rights and rights to receive any dividends or other distributions on our Common Stock), but you are subject to all changes affecting the Common Stock. You will only be entitled to rights on the Common Stock if and when we deliver shares of Common Stock to you in exchange for your Series B Preferred Stock. For example, if an amendment is proposed to our articles of incorporation or bylaws requiring stockholder approval and the record date for determining the stockholders of record entitled to vote on the amendment occurs prior to delivery to you of the shares of Common Stock, you will not be entitled to vote on the amendment, although you will nevertheless be subject to any changes in the powers, preferences or special rights of our Common Stock.

The trading volume in our Common Stock is lower than that of other large financial services companies.

Subject to certain conditions, the Series B Preferred Stock will be convertible into shares of our Common Stock. Although our Common Stock is traded on the NASDAQ Capital Market, the trading volume in our Common Stock is lower than that of other larger financial services companies. A public trading market having the desired characteristics of depth, liquidity and orderliness depends on the presence in the marketplace of willing buyers and sellers of our Common Stock at any given time. This presence depends on the individual decisions of investors and general economic and market conditions over which we have no control. Given the lower trading volume of our Common Stock, significant sales of our Common Stock, or the expectation of these sales, could cause our stock price to fall.

Risk Factors Relating to Our Company

Changes in interest rates may impact our net interest margin and profitability.

Our profitability depends in substantial part on our net interest margin, which is the difference between the rates we receive on loans and investments and the rates we pay for deposits and other sources of funds. Our net interest margin depends on many factors that are partly or completely outside of our control, including competition, monetary and fiscal policies, and economic conditions generally. Our net interest margin is positively impacted when the Federal Reserve lowers rates and negatively impacted when it increases rates, due to our large portfolio of floating rate loans with floor or minimum rates established above the floating rate equivalent. We anticipate that our profitability will continue to hold in the current rate environment by our ability to control the costs of deposits and other borrowings which are used to fund our loans. We try to minimize our exposure to interest rate risk, but we are unable to completely eliminate this risk.

Our profitability depends significantly on economic conditions in our market area.

Our success depends to a large degree on the general economic conditions in Greater Hampton Roads, Virginia. Our market has experienced a downturn in which we have seen falling home prices, rising foreclosures,

14

Table of Contents

reduced economic activity, increased unemployment and an increased level of commercial and consumer delinquencies. The economic climate has created diminished cash flows for many of our borrowers, and at times left some borrowers unable to properly service their loan obligations. The rise in unemployment has also affected the ability of consumers to properly service their debt obligations. Management has been aggressive during this period in the recognition, provisioning and charging off of non-performing loans, and this has had an impact on the net income of our commercial and other banking segment. If economic conditions in our market do not improve or deteriorate further, we could experience any of the following consequences, each of which could further adversely affect our business:

| • | demand for our products and services could decline; |

| • | loan delinquencies may continue to increase; and |

| • | problem assets and foreclosures may continue to increase. |

We could experience further adverse consequences in the event of a prolonged economic downturn in our market due to our exposure to commercial loans across various lines of business. A prolonged economic downturn could impact collateral values or cash flows of the borrowing businesses, and as a result our primary source of repayment could be insufficient to service the debt. In addition, adverse consequences to us in the event of a prolonged economic downturn in our market could be compounded by the fact that many of our commercial and real estate loans are secured by real estate located in our market area. A further significant decline in real estate values in our market would mean that the collateral for many of our loans would provide less security. As a result, we would be more likely to suffer losses on defaulted loans because our ability to fully recover on defaulted loans by selling the real estate collateral would be diminished. In addition, a number of our loans are dependent on successful completion of real estate projects and demand for homes, both of which could be affected adversely by a decline in the real estate markets.

Future economic conditions in our market will depend on factors outside of our control such as political and market conditions, broad trends in industry and finance, legislative and regulatory changes, changes in government, military and fiscal policies and inflation. Adverse changes in economic conditions in our market would likely impair our ability to collect loans and could otherwise have a negative effect on our financial condition.

If we experience greater loan losses than anticipated, it will have an adverse effect on our net income and our ability to fund our growth strategy.

While the risk of nonpayment of loans is inherent in banking, if we experience greater nonpayment levels than we anticipate, our earnings and overall financial condition, as well as the value of our Common Stock, could be adversely affected. We cannot assure you that our monitoring, procedures and policies will reduce certain lending risks or that our allowance for loan losses will be adequate to cover actual losses. In addition, as a result of the growth in our loan portfolio, loan losses may be greater than management’s estimates of the appropriate level for the allowance. Loan losses can cause insolvency and failure of a financial institution and, in such an event, our stockholders could lose their entire investment. In addition, future provisions for loan losses could materially and adversely affect our profitability. Any loan losses will reduce the loan loss allowance. A reduction in the loan loss allowance will be restored by an increase in our provision for loan losses. This would reduce our earnings, which could have an adverse effect on our stock price.

Our profitability depends on our ability to manage our balance sheet to minimize the effects of interest rate fluctuation on our net interest margin.

Our results of operations depend on the stability of our net interest margin, which is the difference between the rates we receive on loans and investments and the rates we pay for deposits and other sources of funds. Interest rates, because they are influenced by, among other things, expectations about future events, including the level of economic activity, federal monetary and fiscal policy and geo-political stability, are not predictable or

15

Table of Contents

controllable. In addition, the interest rates we can earn on our loan and investment portfolios and the interest rates we pay on our deposits are heavily influenced by competitive factors. Community banks are often at a competitive disadvantage in managing their cost of funds compared to the large regional, super-regional or national banks that have access to the national and international capital markets. These factors influence our ability to maintain a stable net interest margin.

Our long-term goal is to maintain a neutral position in terms of the volume of assets and liabilities that mature or re-price during any period so that we may reasonably predict our net interest margin; however, interest rate fluctuations, loan prepayments, loan production and deposit flows are constantly changing and influence our ability to maintain this neutral position. Generally speaking, our earnings will be more sensitive to fluctuations in interest rates the greater the variance in the volume of assets and liabilities that mature or re-price in any period. The extent and duration of the sensitivity will depend on the cumulative variance over time, the velocity and direction of interest rates, and whether we are more asset sensitive or liability sensitive. Accordingly, we may not be successful in maintaining this neutral position and, as a result, our net interest margin may suffer, which will negatively impact our earnings. Based on our asset and liability position at September 30, 2009, a rise or decline in interest rates would have limited impact on our net interest income in the short term.

We rely heavily on our management team and the unexpected loss of any of those personnel could adversely affect our operations; we depend on our ability to attract and retain key personnel.

We are a client-focused and relationship-driven organization. We expect our future growth to be driven in a large part by the relationships maintained with our clients by our executive and senior lending officers. We have entered into an employment agreement with Mr. Rountree, President and Chief Executive Officer, Mr. Schwartz, Executive Vice President and Chief Operating and Financial Officer of the Company and Chief Executive Officer of Monarch Bank, E. Neal Crawford, Jr., Executive Vice President of the Company and President of Monarch Bank, and Edward O. Yoder, President of Monarch Mortgage. The existence of such agreements, however, does not necessarily ensure that we will be able to continue to retain their services. The other members of management do not currently have employment agreements to retain their services. The unexpected loss of key employees could have a material adverse effect on our business and possibly result in reduced revenues and earnings. Mr. Rountree has been treated for the past 18 years for various types of cancer, and he continues treatment and monitoring.

Also, our anticipated growth and success, in large part, will be due to the services provided by our mortgage banking officers and the employees of our residential mortgage division. The loss of services of one or more of these persons could have a material adverse effect on our operations, and our business could suffer. With the exception of Mr. Yoder, our mortgage loan originators are not a party to any employment agreement with us, and they could terminate their employment with us at any time and for any reason.

The implementation of our business strategy will also require us to continue to attract, hire, motivate and retain skilled personnel to develop new client relationships as well as new financial products and services. Many experienced banking professionals employed by our competitors are covered by agreements not to compete or solicit their existing clients if they were to leave their current employment. These agreements make the recruitment of these professionals more difficult. The market for these people is competitive, and we cannot assure you that we will be successful in attracting, hiring, motivating or retaining them.

Revenue from our mortgage banking operations are sensitive to changes in economic conditions, decreased economic activity, a slowdown in the housing market, higher interest rates or new legislation and may adversely impact our profits.

Our mortgage banking division, Monarch Mortgage, has provided a significant portion of our consolidated revenue and maintaining our revenue stream in this segment is dependent upon our ability to originate loans and sell them to investors. For the nine months ended September 30, 2009, our mortgage banking operations

16

Table of Contents

produced approximately $1.8 million in net income before taxes and non-controlling interest. Mortgage loan production levels are sensitive to changes in economic conditions and can suffer from decreased economic activity, a slowdown in the housing market or higher interest rates. Generally, any sustained period of decreased economic activity or higher interest rates could adversely affect Monarch Mortgage’s mortgage originations and, consequently, reduce its income from mortgage lending activities. In addition, new legislation, including proposed legislation that would require Monarch Mortgage to retain five percent of the credit risk of securitized exposures, could adversely affect its operations.

Deteriorating economic conditions may also cause home buyers to default on their mortgages. In certain of these cases where Monarch Mortgage has originated loans and sold them to investors, it may be required to repurchase loans or provide a financial settlement to investors if it is proven that the borrower failed to provide full and accurate information on or related to their loan application or for which appraisals have not been acceptable or when the loan was not underwritten in accordance with the loan program specified by the loan investor. Such repurchases or settlements would also adversely affect our net income.

Periods of rising interest rates will adversely affect our income from our mortgage division.

In periods of rising interest rates, consumer demand for new mortgages and re-financings decreases, which in turn adversely impacts our mortgage banking division. Currently, as a result of government actions and other economic factors related to the economic downturn and disruptions in the credit market, interest rates are at historically low levels. It is unknown how long interest rates will remain at these historically low levels and to the extent that market interest rates increase in the future, we will likely experience reductions in our mortgage banking income. Because interest rates depend on factors outside of our control, we cannot eliminate the interest rate risk associated with our mortgage operations.

Our concentration in loans secured by real estate may increase our credit losses, which would negatively affect our financial results.