Attached files

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

x ANNUAL REPORT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the

fiscal year ended August 31,

2009

o TRANSITION REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the

transition period from ___________ to ___________.

Commission

file number 000-51755

CHINA

RUNJI CEMENT INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

98-0533824

|

|

|

(State

or Other Jurisdiction of Incorporation of Organization)

|

(I.R.S.

Employer Identification No.)

|

|

|

Xian

Zhong Town, Han Shan County

Chao

Hu City, Anhui Province

People’s

Republic of China 23181

|

86-565-4219871

|

|

|

(Address

of principal executive offices) (ZIP Code)

|

(Registrant’s

telephone number, including area

code)

|

|

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section12 (g) of the Act: Common Stock, $0.0001 par

value

|

Yes o

No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act.

Yes x

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for shorter period that the registrant as required to

file such reports), and (2) has been subject to such filing requirements for the

past 90 days.

Yes x

No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

Nooor any amendment to

this Form 10-K.

Yes x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, or a non-accelerated filer. See definition of “accelerated

filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check

one):

Large

accelerated filer o

Accelerated filer o

Non-accelerated filer o

Smaller reporting company x

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act).

Yes o

No x

Aggregate

market value of the voting stock of the registrant held by non-affiliates of the

registrant as of February 28, 2009 (computed by reference to the closing

price of $0.40 per share as of the last business day of the most recently

completed second fiscal quarter): $2,116,026

TABLE

OF CONTENTS

|

Page(s)

|

||

|

PART

I

|

||

|

Item 1.

|

Business

|

3

|

|

Item 1A.

|

Risk

Factors

|

8

|

|

Item 1B.

|

Unresolved

Staff Comments

|

15

|

|

Item 2.

|

Properties

|

15

|

|

Item 3.

|

Legal

Proceedings

|

15

|

|

Item 4.

|

Submission

of Matters to a Vote of Security Holders

|

15

|

|

PART

II

|

||

|

Item 5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

16

|

|

Item 6.

|

Selected

Financial Data

|

17

|

|

Item 7.

|

Management's

Discussion and Analysis of Financial Condition and Results of

Operations

|

17

|

|

Item 7A.

|

Quantitative

and Qualitative Disclosures about Market Risk

|

18

|

|

Item 8.

|

Financial

Statements and Supplementary Data

|

21

- 34

|

|

Item 9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

35

|

|

Item 9A.

|

Controls

and Procedures

|

35

|

|

Item 9A(T).

|

Controls

and Procedures

|

35

|

|

Item 9B.

|

Other

Information

|

35

|

|

PART

III

|

||

|

Item 10.

|

Directors,

Executive Officers and Corporate Governance

|

36

|

|

Item 11.

|

Executive

Compensation

|

38

|

|

Item 12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

39

|

|

Item 13.

|

Certain

Relationships, Related Transactions and Director

Independence

|

40

|

|

Item 14.

|

Principal

Accounting Fees and Services

|

40

|

|

PART

IV

|

||

|

Item 15.

|

Exhibits,

Financial Statement Schedules

|

41

|

|

|

||

|

Signatures

|

42

|

- 2

-

PART

I

Item

1. Business

Forward-looking

Statements

This

annual report contains forward-looking statements. These statements relate to

future events or our future financial performance. In some cases, you can

identify forward-looking statements by terminology such as "may", "will",

"should", "expects", "plans", "anticipates", "believes", "estimates",

"predicts", "potential" or "continue" or the negative of these terms or other

comparable terminology. These statements are only predictions and involve known

and unknown risks, uncertainties and other factors that may cause our or our

industry's actual results, levels of activity, performance or achievements to be

materially different from any future results, levels of activity, performance or

achievements expressed or implied by these forward-looking

statements.

Although

we believe that the expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee future results, levels of activity, performance

or achievements. Except as required by applicable laws, including the securities

laws of the United States, we do not intend to update any of the forward-looking

statements so as to conform these statements to actual results.

As used

in this annual report, the terms "we", "us", "our", “the Company”, and "China

Runji" mean China Runji Cement Inc. and all of our subsidiaries, unless

otherwise indicated.

All

dollar amounts refer to US dollars unless otherwise indicated.

Overview

China

Runji was incorporated as FitMedia Inc., a Delaware company, on August 30, 2004.

FitMedia was a development stage company that planned to sell prenatal yoga DVDs

through small retail stores and others and it also planned to sell its fitness

DVDs through its Internet site www.fitmedia.net. It

completed its prenatal yoga DVD for sale and began marketing it in January

2007.

In

October 2007, the management of FitMedia determined that it was in the best

interests of the stockholders of FitMedia to agree to a share exchange with

Anhui Province Runji Cement Co., Limited, a Chinese company that is engaged in

the business of distributing cement across many provinces in mainland

China. As part of the share exchange and reverse merger, FitMedia

ceased engaging in the health and fitness business.

On

October 9, 2007, FitMedia entered into a Share Exchange Agreement

(the “Exchange Agreement”) by and among FitMedia, Timothy Crottey, the President

and majority shareholder of FitMedia (“Crottey”), Shouren Zhao, a citizen and

resident of the People’s Republic of China and owner of 100% of the share

capital of Ren Ji Cement Investment Company Limited (“Zhao”); Ren Ji Cement

Investment Company., Ltd., a British Virgin Islands corporation (“Renji

Investment”) and owner of 100% of the share capital of Ren Ji Cement Company

Limited; Ren Ji Cement Company Limited, a corporation organized and existing

under the laws of the Hong Kong SAR of the People’s Republic of China (“HK

Renji”) and owner of 100% of the share capital of Anhui Province Runji Cement

Co., Ltd.; and Anhui Province Runji Cement Co., Ltd., a corporation organized

under the laws of the People’s Republic of China (“Anhui Runji”). For

purposes of the Exchange Agreement, Zhao was referred to as the “Ren

Shareholder,” and Renji Investment, HK Renji and Anhui Runji were referred to as

the “Renji Subsidiaries.” Upon closing of the share exchange

transaction (the “Share Exchange”) contemplated under the Exchange Agreement on

November 1, 2007, the Ren Shareholder transferred all of his share capital in

Renji Investment to FitMedia in exchange for an

aggregate of 55,000,000 shares of common stock of the FitMedia, thus causing the

Renji Subsidiaries to become direct and indirect wholly-owned subsidiaries of

FitMedia.

On

October 9, 2007, FitMedia entered into a Stock Purchase Agreement (the “Stock

Purchase Agreement”) by and among FitMedia, Crottey, and the Ren Shareholder,

pursuant to which the Ren Shareholder, as Purchaser, at closing on November 1,

2007, acquired 18,500,000 shares (the “Stock Purchase”) of common stock of

FitMedia from Crottey for $540,000.

In

addition, pursuant to the terms and conditions of the Exchange

Agreement:

|

§

|

Demand

and piggy-back registration rights were granted to the Ren Shareholder

with respect to shares of the Company’s restricted common stock to be

acquired by him at closing in a Regulation S

offering.

|

|

§

|

On

the Closing Date, the current officers of FitMedia resigned from such

positions and the persons chosen by Anhui Runji were appointed as the

officers of FitMedia, notably Shouren Zhao, as Chairman, CEO and President

and Yichun Jiang as CFO.

|

|

§

|

On

the Closing Date, Crottey resigned from his position as a director

effective upon the expiration of the ten day notice period required by

Rule 14f-1, at which time additional persons designated by Anhui Runji

were appointed as directors of FitMedia, notably Liming Bi and Xuanjun

Yang.

|

|

§

|

On

the Closing Date, FitMedia paid and satisfied all of its “liabilities” as

such term is defined by U.S. GAAP as of the

closing.

|

|

§

|

As

of the Closing, the parties consummated the transactions contemplated by

the Stock Purchase Agreement.

|

On

January 8, 2008, FitMedia changed its name to China Runji Cement Inc. and

increased its authorized common stock from 80,000,000 shares to 200,000,000

shares.

As a

result of the closing of the Share Exchange, China Runji became the owner of a

leading cement production and distribution company in mainland China through its

ownership of Anhui Runji. Using cost effective production techniques, while

building a strong brand image, Anhui Runji is a strong competitor in the central

China cement market.

Anhui

Runji is a producer and distributor of cement, primarily in An Hui Province of

central China and neighboring locations, which was founded in December

2003. Its initial capital was 60,000,000 RMB and there were two

founding shareholders who owned such capital in a ratio of 60 to

40%. Anhui Runji is located in Xianzong Town,

Hanshan County, An Hui Province, where the factory occupies an area of 418

mu, and its limestone mine comprises an area of 1,000 mu. The Anhui

Runji factory, limestone reserve and storing mine together comprise an area of

approximately 50,000 square meters.

- 3

-

Anhui

Province Runji Cement Co., Limited (www.chinarunji.com),

a private company located in Anhui Province in China, was established in

December 2003 with registered capital of 60 million RMB. The Company

started production in October 2005 and specializes in cement production and

sales. The main cement varieties produced are ordinary silicate cement P.O52.5,

P.O42.5, P.O32.5 and P.C32.5. At present, the Company has one cement production

line and one cement clinker production line. The production capacity of

each line amounts to 2,500 tons per day and one million tons per

year.

The

Company obtained its production license in 2005. Presently, the Company mainly

focuses production on Runji Brand cement P.II52.5, P.O42.5, P.O32.5 P.C32.5 as

well as cement clinker. P.II52.5 is a high grade, high strength

cement that is made for Anhui and Jiangsu Provinces and the region north of

the Changjiang River and is used in large infrastructure projects. The

cement clinker is the semi-finished ingredient of cement, which is able to be

processed into different categories of cement products.

The

Company produces cement through the advanced dry production process, an energy

efficient and environmentally friendly cement production technique, as only 60%

of the total output in the region is produced by dry process. The Company has a

rigorous quality control system and received ISO9001 quality system

certification and international accreditation in March 2006. In

addition, our Company passed the national GB/T 19001-2000 standard

authentication. The Company’s pollution control exceeds the national

standard and received “green building material” certification in

2007.

The

Company has an abundant supply of high quality raw materials. The Company has

obtained a 30 year mining right for 87 million tons of limestone reserve, which

can supply two cement clinker production lines with a daily output of 2,500

tons for 40 years.

Presently,

the Company is one of the largest cement producers and distributors in the north

Changjiang region of Anhui, with a 10% market share within a 100 mile radius of

its facility. The Company is the only producer of P.II52.5 cement (the highest

quality cement) in the north Changjiang region of Anhui and

Jiangsu Provinces, with 70% market share within a 100 miles radius of its

facility. Annual production capacity of the Company is two million tons cement

and cement clinker. The Company’s main market of cement is in Hefei (Anhui

Province), with total sales of 900,000 tons, representing 90% of our total

annual cement production and an additional 10% is sold in Chaohu and its

surrounding areas, Moreover, the Company’s main cement clinker market is in

Chaohu with total sales of 950,000 tons in the area, representing 95% of our

total annual cement clinker production, and an additional 5% is sold in

Hefei.

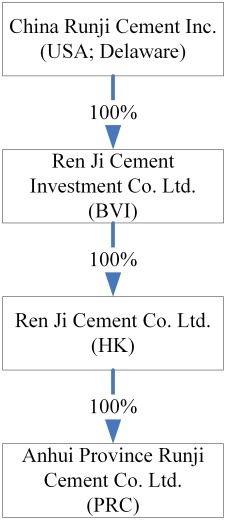

Organizational

Structure

Our

current organizational structure is summarized by the illustration

below:

- 4

-

|

§

|

We

plan to raise adequate capital over the next five years for expansion and

growth.

|

|

§

|

We

have invested over USD$50 million to build up one cement production line

with daily production of 2,500 tons and one cement clinker production line

with daily production of 2,500 tons. The newly invested cement clinker

production line was put into production in October

2008.

|

|

§

|

We

have invested USD$10 million to establish a waste heat power generator

system to convert waste heat into electricity, which was put into

production on October 25, 2009 and is expected to save about USD$4.6

million per year in electricity costs. The completion of the generator

system should significantly improve our margins and reduce reliance

on outside power sources.

|

Growth

Strategy

The

Company’s vision is to be the leading producer of cement and cement products in

An Hui Province as well as surrounding provinces and cities. Management intends

to grow the Company’s business by pursuing the following

strategies:

|

§

|

Grow

capacity and capabilities in line with market demand

increases

|

|

§

|

Enhance

leading-edge technology through continuous innovation, research and

study

|

|

§

|

Continue

to improve operational

efficiencies

|

|

§

|

Build

a strong market reputation to foster and capture future growth in

China

|

Sales

by Product Category

The

Company distributes a number of products, including the types of cement listed

below. The sales of these types of cement for the last three years in U.S.

Dollars are as follows:

|

2007

|

2008

|

2009

|

||||||||||

|

P.II52.5

|

1,405,919 | 2,339,838 | 3,298,498 | |||||||||

|

P.O42.5

|

22,685,425 | 30,232,786 | 25,071,088 | |||||||||

|

P.O32.5

|

1,868,453 | 1,746,419 | 1,207,460 | |||||||||

|

P.C32.5

|

2,608,391 | 3,186,918 | 1,554,558 | |||||||||

|

Cement

Clinker

|

2,104,286 | 2,959,771 | 24,506,290 | |||||||||

A brief

explanation of each type of cement and its uses follows:

P.II52.5

– high strength and good adaptability. Mainly used on large projects where

superior intensity is needed, such as large span bridges and beams.

P.O42.5 –

high strength and hardens quickly. Mainly used in normal concrete projects, such

as high-rise buildings, roadways, viaducts and airplane runways.

P.O32.5 –

has low heat of hydration and good durability. Mainly used in commercial and

industrial buildings and low intensity concrete projects.

P.C32.5

–has low heat of hydration and high mineral content. Mainly used in commercial

and industrial buildings and low intensity concrete projects.

The

Market for Cement

The

World Market for Cement

Cement

production is a global industry. Estimates indicate that global cement

production is increasing approximately 3% every year. At present,

worldwide cement production is approximately 2.2 billion tons, with China

accounting for up to 44% of that total.

According

to cement sales figures, China is currently the largest producer of cement with

India and America being the second and third largest producers. Since the huge

demand for cement in America cannot be totally met by cement produced

domestically, the U.S. also imports cement from Canada, China, Thailand and

other countries. This trend is expected to continue for the next few

years.

At

present, apart from focusing on the question in the cement industry of

environmental impact and sustainable urban development, the emerging market also

been receiving much attention. People often think the emerging market consists

of the Middle East, North Africa, Asia, Latin America and eastern

Europe.

- 5

-

The

China Market for Cement

There are

5,000 cement companies in China with annual turnover of 5 million RMB or more.

Total production is 1.6 billion tons per year, of which only 470 million tons of

cement per year is made from the Modern Dry Process. National trends

of conserving energy, handling waste gas and pollution treatment, will result in

growth in the cement industry.

The rapid

increase in Chinese economic statistics will provide an increase in demand for

cement. Economic growth rates of 9% will bring at least a 10% growth

rate in the demand for cement. This is supported by previous

government pronouncements concerning an emphasis on building China’s

infrastructure during the financial crisis that began in 2008 and is still being

felt throughout the world.

China’s

fixed asset investment (“FAI”) increased 26% in 2007, and is expected to

continue growing at 20%-25% annually in the next three years according

to China’s “11th Five Year” plan (2006 – 2010). On October 28, 2009, the Chinese

central government announced that the government has invested RMB 717 billion as

of August and a total of RMB 908 billion will be invested by the year end of

2009. In November 2009, The National Development and Reform Commission (“NDRC”)

announced that Chinese domestic banks newly increased bank loans of RMB 8,670

billion in first three quarters. A large part of newly increased investments and

bank loans will be invested in transportation and infrastructural facilities

with high demand for cement.

NDRC

required the elimination of 280 million tons of old technique cement production

capacities (wet production technique) during the “11th Five Year” period.

According to analysts, a 25% - 35% cement price hike is anticipated by

2010, driven by aggressive increase in FAI and elimination of old

capacities.

In China,

the average person uses only 8 tons of cement per year, which is lower than the

consumption of 14 tons for developed countries.

Restrictions

on cement production in developed countries caused a huge export demand in

China, with increasing prices and profits in the international

market.

The

An Hui Province Market for Cement

Anhui is

located in the Yangtze River Delta region, where the construction industry is

the most developed and demand for cement is most concentrated. Anhui is

rich in natural resources such as limestone mineral reserves and coal reserves,

which are important in cement production. Also, the Chanjiang River is

located in Anhui Province, and its waters are very essential to the production

of cement.

At

present, the economic conditions are growing rapidly in Anhui Province,

with economic growth of 14% in 2007, surpassing the national

average. As a result, there is a strong demand for

cement. There are many large projects in the basic facilities area

and in real estate development. Both require a significant amount of

cement.

Anhui Province’s

cement production reached 44 million tons in 2006, ranked the ninth in

China. In Anhui Province, there are 170 cement businesses, with annual

output of 40 million tons. However, 85% of the cement businesses lag

behind Anhui Runji in terms of output and quality. The businesses

that use advanced techniques in cement production are in demand. By 2010, about

12 million tons of old capacity will be eliminated in Anhui, adding additional

growth potential for dry production capacity.

Huge

infrastructure spending in Anhui is boosting cement demand, e.g. Hefei

Xinqiao International Airport – 4 billion RMB; 675 hectare of area, expected

completion by 2010; major highway expansion - 3 billion RMB to expand 60

miles of highway from four lanes to six lanes, expected

completion by 2010; Anhui plans to invest 83 billion RMB in transportation and

infrastructure construction during the “11th Five Year” period (2006 -

2010).

Our

Suppliers

We rely

on third party suppliers of the raw materials to manufacture our

products. The main components of our products include electricity,

coal, coal ash, iron powder, and limestone. Our primary suppliers of

each are:

|

Raw Material

|

Suppliers

|

|

|

Electricity

|

Anhui

Electricity Hanshan Power-Supply Co., Ltd.

|

|

|

Coal

|

Wuhu

New Energy Commercial & Trading Co., Ltd.

|

|

|

Coal

|

JiangsuYutai

Trading Co., Ltd.

|

|

|

Coal

ash

|

Caohu

Huaxiang Building Material Co., Ltd.

|

|

|

Iron

Powder

|

Anhui

Hongde Trading Co.,

Ltd

|

We

believe we are not dependent on any of these suppliers and will be able to

replace them, if necessary, without material difficulties.

- 6

-

Our

competition in An Hui Province uses antiquated technology and is not competitive

with that of Anhui Runji.

Our

Competitive Advantage

Limestone

is the most basic ingredient in cement production. We have a huge limestone

reserve, which is of high grade. Our

reserves are approximately 87 million tons of limestone,

which can supply two cement production lines with daily output of 2,500 tons for

40 years. Our limestone reserve is located just 300-500 meters from the

production site, significantly reducing transportation cost. All of this is

adequate for our long term supply. In addition, the limestone contains over 53%

calcium oxide, which enables production of superior quality, such as the

high grade P.II 52.5 cement, which is superior to that of other

companies.

Anhui Province

has a very favorable climate for investment such as in the cement

industry. Local governments offer tax incentives on resource usage,

which favors industries such as cement.

We have a

favorable location that is less than 100 kilometers away from the provincial

capitals of Hefei and Nanjing. Other cities such as Wuhu, Ma’anshan,

and Chaohu are between 20 – 70 kilometers away and also provide a good

marketplace. Our close proximity to the Changjiang River affords

us low cost shipping to many locations.

Our main

competitors within the Hefei market are Anhui Chaodong Cement Stock Co., Ltd,

Anhui Chaohu Tiepeng Cement Factory and Lujiang Dajiang Cement Co.,

Ltd. Additionally, there are 10 cement grinding companies with an

annual production of 10 – 50 tons who compete with us.

We

utilize the advanced modern dry cement production process, which enables high

quality production, consumes less energy and is more environmental friendly

compared with the traditional wet production process. The production

equipment is partially imported from Germany. We also use Siemens DCS

(Distributed Computer Control System) auto control system for measuring

ingredients and controlling production flow. Our advanced cement techniques lead

to low costs and consistent high quality. Our products have a 100% passing

rate.

The

cement industry is a polluting and heavy energy-consumption industry. The old

cement production technique (wet production) consumes two times more energy,

emits two times more waste gas and sulfur dioxide and releases three times

more dust than the new cement dry production. We have installed highly efficient

dust collectors, noise reducing equipment and waste water treatment equipment

that complies with the most rigorous Chinese environmental regulations. We are

able to constrain emission at 30mg per cubic meter, much lower than the national

average of 50mg per cubic meter.

Competitive

Advantages and Strategy

Cement

The

Company believes that its product formulations, price points, lower costs,

relationships, infrastructure, proven quality, and reputation represent

substantial competitive advantages. The Company is currently able to maintain a

substantially lower cost structure than competitors based in An Hui Province and

neighboring locations of China. Furthermore, the Company believes its

competitive advantage in China is protected by significant knowledge of

government regulations, business practices, and strong relationships. We

are the only producer of PII52.5 cement (the highest quality cement) in the

north Changjiang region of Anhui and Jiangsu Provinces, with a 70% market

share within a 100 mile radius of its facility.

In

comparison to Chinese competitors, the Company believes it possesses superior

technological expertise, products, marketing knowledge, and governmental

relationships.

Intellectual

Property

Our

Company logo “Runji” was registered May 21, 2007 in Xianzong town, Hanshan

County, Anhui Province.

Customers

For the

twelve month period from September 1, 2008 through August 31, 2009, the Company

achieved revenues of $55,637,894. That revenue was in part generated from the

following representative customers:

|

Name of

Customer

|

Products

Sold

|

Sales

for the Period

by

Customer

(USD$)

|

% of Sales

for the

Period

|

||||

|

Anhui

Tianfu Concrete Co., Ltd.

|

PO42.5,

PII52.5

|

5,550,439

|

9.98%

|

||||

|

Hefei

Ruirui Industrial & Trading Co., Ltd

|

PO42.5,

PII52.5

|

5,192,913

|

9.33%

|

||||

|

Hefei

Changhong Concrete Co., Ltd.

|

PO42.5,

PII52.5

|

4,706,880

|

8.46%

|

||||

|

Hefei

Tonggong Industrial & Trading Co., Ltd.

|

PO42.5,

PII52.5

|

3,951,486

|

7.10%

|

||||

|

Hefei

Shuanglong Concrete Co., Ltd.

|

PO42.5,

PII52.5

|

3,822,769

|

6.87%

|

Our major

construction project is the Heifei Binghu Century City commercial apartment

project, which will use approximately 200,000 tons of our

cement. Another important project is Anhui Economic Technological

Development Area Jingdongfang factory project, which will use 15,000 tons of our

cement.

- 7

-

Employees

Anhui

Runji has a staff of approximately 337 employees in the following ten

departments: Manufacture Control Department, Raw Material Plant,

Burning Plant, Ready Product Plant, Machine Repairing Plant, Electronic

Department, Laboratory, Financial Department, Supply and Marketing Department,

and the General Administrative Offices. Included in the

337 employees are 33 senior managers, one general manager, three deputy

general managers and one chief financial officer, and 304

workers. Anhui Runji believes it is in compliance with local

prevailing wage, contractor licensing and insurance regulations, and has good

relations with its employees.

Government

Regulations

Our

business is regulated in various ways as follows:

|

1.

|

Cement

Industry Development Policy enacted by the National Development and Reform

Commission on October 17, 2006.

|

|

2.

|

Notification

regarding rate of tax refund enacted by the Ministry of Finance, National

Development and Reform Commission, Department of Commerce, General

Administration of Customs and State Administration of Taxation on

September 14, 2006.

|

|

3.

|

National

Resource Integration Management Methodology enacted by the National

Development and Reform Commission, Ministry of Finance and

State Administration of Taxation on September 7,

2006.

|

|

4.

|

Cement

industry special legislation enacted by the National Development and

Reform Commission on October 17,

2006.

|

|

5.

|

Several

policy opinions for the cement industry unanimously enacted by the

National Development and Reform Commission, Ministry of Finance, Ministry

of Land and Resources, Ministry of Construction, Department of Commerce,

People's Bank of China, General Administration of Quality Supervision, and

National and State Environmental Protection Administration on April 13,

2006.

|

|

6.

|

Notification

regarding energy-saving and pollution emission comprehensive working plan

enacted by the China National Council in June 3,

2007.

|

|

7.

|

Anhui

Province Bulk Cement “Eleventh-Five” Development Plan enacted by Anhui

Provincial Government in July 9,

2007.

|

|

8.

|

Anhui

Province Industrial Economy “Eleventh-Five” Development Plan enacted by

Anhui Provincial Government in August 13,

2007.

|

|

9.

|

Standardization

Implement Policy enacted by the National Development and Reform Commission

on January 23, 2008.

|

|

10.

|

Anhui

Province Bulk Cement and Premix Concrete Development Policy (Protocol)

published by Anhui Provincial Government in October 27, 2008 and under

asking for public comments.

|

Item

1A. Risk Factors

The

Company’s future revenues will be derived from the production and distribution

of cement products and operating a cement business. There are numerous risks,

known and unknown, that may prevent the Company from achieving its goals

including, but not limited to, those described below. Additional unknown risks

may also impair the Company’s financial performance and business operations. The

Company’s business, financial condition and/or results of operations may be

materially adversely affected by the nature and impact of these risks. In such

case, the market value of the Company’s securities could be detrimentally

affected, and investors may lose part or all of their investment. Please refer

to the information contained under “Business” in this report for further details

pertaining to the Company’s business and financial condition.

- 8

-

Risks

Related To Our Company

Unanticipated

problems in expanding the Company’s cement business may harm the Company’s

business and viability.

The

Company’s future cash flow depends on its ability to timely expand its cement

business. If the Company’s operations are disrupted and/or the economic

integrity of its distribution operation is threatened for unexpected reasons

(including, but not limited to, technical difficulties, poor weather conditions,

and business interruptions due to terrorism or otherwise), the Company’s

business may experience a substantial setback. Moreover, the

occurrence of significant unforeseen conditions or events may require the

Company to reexamine its business model. Any change to the Company’s business

model may adversely affect its business.

If

the Company does not obtain financing when needed, its business will

fail.

As of

August 31, 2009, the Company had cash and cash equivalents on hand in the amount

of approximately $752,952. The Company predicts that it will need approximately

$30 million to implement its business plan and meet its capital expenditure

needs over the next three years. The Company currently does not have any

arrangements for additional financing and it may not be able to obtain financing

when required. Obtaining additional financing would be subject to a number of

factors, including the market prices for the Company’s products, production

costs, availability of credit, prevailing interest rates and the market prices

for the Company’s common stock.

The

Company’s ability to operate at a profit is partially dependent on market prices

of cement. If cement prices drop too far, the Company will be unable

to maintain profitability.

The

Company’s results of operations and financial condition will be affected by the

selling prices for cement. Prices are subject to and determined by market forces

over which the Company has no control. The Company’s revenues will be heavily

dependent on the market prices for cement in many markets in China.

The

success of the Company’s business depends upon the continuing contributions of

its Chief Executive Officer and other key personnel and its ability to attract

other employees to expand the business, whereas the loss of key individuals or

the Company’s inability to attract new employees could have a negative impact on

the Company’s business.

The

Company relies heavily on the services of Mr. Shouren Zhao, the President and

Chief Executive Officer, and the services of Xiangfei Zeng, the Chief Financial

Officer, as well as several other senior management personnel. Loss of the

services of any of such individuals would adversely impact other Company’s

operations. In addition, the Company believes that its technical personnel

represent a significant asset and provide the Company with a competitive

advantage over many of the Company’s competitors. The Company believes that its

future success will depend upon its ability to retain these key employees and

its ability to attract and retain other skilled financial, engineering,

technical and managerial personnel. In addition, as a result of a failure to

retain qualified personnel the Company may be unable to meet its

responsibilities as a public reporting company under the rules and regulations

of the SEC. None of the Company’s key personnel are party to any employment

agreements. The Company does not currently maintain any “key man” life insurance

with respect to any of such individuals.

We

experienced low productivity and high production costs in the past, when we were

delayed in our production of cement, which delay caused us to experience low

profitability.

Our

recent past suggests that delays in producing cement can lead to low

productivity and high production costs, which result in low

profitability. We have plans to bring on one new clinker line by late

2009, and if we do not implement this growth with an organized and optimal

expansion plan, we could continue to experience low profitability.

We

have been forced to cease production for periods of time in order to install,

maintain and adjust equipment, which resulted in high production costs and low

profitability.

In the

past, we have had to cease production for periods of time in order to install,

maintain and adjust equipment, which resulted in high production costs and low

profitability. In the future, we will be challenged to keep our

equipment in working order so that we do not suffer a decrease in

profitability.

Future

sales of the Company’s equity securities will dilute existing

stockholders.

To fully

execute its long-term business plan, the Company may need to raise additional

equity capital in the future. Such additional equity capital, when

and if it is raised, would result in dilution to the Company’s existing

stockholders.

Subject

to its receipt of the additional capital required, the Company plans to grow

very rapidly, which will place strains on management and other

resources.

The

Company plans to grow rapidly and significantly expand its operations. This

growth will place a significant strain on management systems and resources,

particularly since the Company has approximately 319 employees. The Company

will not be able to implement its business strategy in a rapidly evolving market

without an effective planning and management processes. The Company has a short

operating history and has not implemented sophisticated managerial, operational

and financial systems and controls. The Company is required to manage

multiple relationships with various strategic partners, and other third parties.

These requirements will be strained in the event of rapid growth or in the

number of third party relationships, and the Company’s systems, procedures or

controls may not be adequate to support the Company’s operations and management

may be unable to manage growth effectively. To manage the expected growth of the

Company’s operations and personnel, the Company will be required to

significantly improve or replace existing managerial, financial and operational

systems, procedures and controls, and to expand, train and manage its growing

employee base. The Company will be required to expand its finance,

administrative and operations staff. The Company may be unable to complete in a

timely manner the improvements to its systems, procedures and controls necessary

to support future operations, management may be unable to hire, train, retain,

motivate and manage required personnel and management may be unable to

successfully identify, manage and exploit existing and potential market

opportunities.

- 9

-

Risks

Related to the Cement Business

The

economics of the cement industry, which require deliveries within a limited

geographic radius of the plant, make deliveries outside of a localized area

difficult and unprofitable.

The

economics of the cement industry requires delivery of cement within a narrow

geographic radius of the plant for the delivered price of cement to be

affordable. Unless a company is willing to build additional plants

closer to other markets, its potential to sell to projects within those markets

and earn a profit is limited. Expansion opportunities are costly and

limited, as is growth of our business.

Price

competition in the cement market in China is intense, particularly in the

production of low standard grade cement, all of which makes it difficult for a

producer of high standard grade cement such as our Company to compete on quality

alone.

Low grade

producers of cement in China compete fiercely on price grounds

alone. We are a high quality manufacturer of a variety of cements and

we cannot always compete on price with the low quality

manufacturer. The tendency of low quality manufacturers to under

price the competition makes it difficult for us to bid and win certain

jobs.

We

are reliant on sales to the construction industry, which is the largest consumer

of our cement. The construction industry has experienced swings in

building patterns that are tied to the macroeconomic cycles in the Chinese

economy. We are at the mercy of these swings in the economy as

well.

Cement is

used in the construction industry, most notably in private and government

building projects. Such building projects depend on the state of the

economy, which in recent years has fluctuated. Our revenues fluctuate

accordingly and it is difficult to manage our business profitably under these

conditions.

We

are subject to regulation in the environmental area because of the dust that is

discharged in the production and use of cement. The National and State

Environmental Protection Administration imposes regulation and charges on cement

manufacturers, which is an expensive cost to our business.

Environmental

regulation, primarily in the area of dust creation in the manufacture of cement

imposes significant costs on our operations. We also spend

considerable funds on abatement of environmental issues and in research and

development. The regulatory authorities can be arbitrary in their

decisions and make the manufacture of cement a more costly and uncertain

business.

Risks

Related to Doing Business in the PRC

The

Company faces the risk that changes in the policies of the PRC government could

have a significant impact upon the business the Company may be able to conduct

in the PRC and the profitability of such business.

The PRC’s

economy is in a transition from a planned economy to a market oriented economy

subject to five-year and annual plans adopted by the government that set

national economic development goals. Policies of the PRC government can have

significant effects on the economic conditions of the PRC. The PRC government

has confirmed that economic development will follow the model of a market

economy. Under this direction, the Company believes that the PRC will continue

to strengthen its economic and trading relationships with foreign countries and

business development in the PRC will follow market forces. While the Company

believes that this trend will continue, there can be no assurance that this will

be the case. A change in policies by the PRC government could adversely

affect the Company’s interests by, among other factors: changes in laws,

regulations or the interpretation thereof, confiscatory taxation, restrictions

on currency conversion, imports or sources of supplies, or the

expropriation or nationalization of private enterprises. Although the PRC

government has been pursuing economic reform policies for more than two decades,

there is no assurance that the government will continue to pursue such policies

or that such policies may not be significantly altered, especially in the event

of a change in leadership, social or political disruption, or other

circumstances affecting the PRC's political, economic and social

life.

The

PRC laws and regulations governing the Company’s current business operations are

sometimes vague and uncertain. Any changes in such PRC laws and regulations may

have a material and adverse effect on the Company’s business.

There are

substantial uncertainties regarding the interpretation and application of PRC

laws and regulations, including but not limited to the laws and regulations

governing the Company’s business, or the enforcement and performance of the

Company’s arrangements with customers in the event of the imposition of

statutory liens, death, bankruptcy and criminal proceedings. The Company and any

future subsidiaries are considered foreign persons or foreign funded enterprises

under PRC laws, and as a result, the Company is required to comply with PRC laws

and regulations. These laws and regulations are sometimes vague and may be

subject to future changes, and their official interpretation and enforcement may

involve substantial uncertainty. The effectiveness of newly enacted laws,

regulations or amendments may be delayed, resulting in detrimental reliance by

foreign investors. New laws and regulations that affect existing and proposed

future businesses may also be applied retroactively. The Company cannot predict

what effect the interpretation of existing or new PRC laws or regulations

may have on the Company’s businesses.

A

slowdown or other adverse developments in the PRC economy may materially and

adversely affect the Company’s customers, demand for the Company’s products and

the Company’s business.

All of

the Company’s operations are conducted in the PRC and all of its revenue is

generated from sales in the PRC. Although the PRC economy has grown

significantly in recent years, the Company cannot assure investors that such

growth will continue. A slowdown in overall economic growth, an economic

downturn or recession or other adverse economic developments in the PRC could

materially reduce the demand for our products and materially and adversely

affect the Company’s business.

- 10

-

Inflation

in the PRC could negatively affect our profitability and growth.

While the

PRC economy has experienced rapid growth, such growth has been uneven among

various sectors of the economy and in different geographical areas of the

country. Rapid economic growth can lead to growth in the money supply and rising

inflation. If prices for the Company’s products rise at a rate that is

insufficient to compensate for the rise in the costs of supplies, it may have an

adverse effect on profitability. In order to control inflation in the past, the

PRC government has imposed controls on bank credits, limits on loans for fixed

assets and restrictions on state bank lending. Such an austere policy can lead

to a slowing of economic growth. In October 2004, the People’s Bank of China,

the PRC’s central bank, raised interest rates for the first time in nearly a

decade and indicated in a statement that the measure was prompted by

inflationary concerns in the Chinese economy. Repeated rises in interest rates

by the central bank would likely slow economic activity in China which

could, in turn, materially increase the Company’s costs and also reduce demand

for the Company’s products.

Governmental

control of currency conversion may affect the value of an investment in the

Company.

The PRC

government imposes controls on the convertibility of Renminbi into foreign

currencies and, in certain cases, the remittance of currency out of the PRC. The

Company receives all of its revenues in Renminbi, which is currently not a

freely convertible currency. Shortages in the availability of foreign currency

may restrict the Company’s ability to remit sufficient foreign currency to pay

dividends, or otherwise satisfy foreign currency dominated obligations. Under

existing PRC foreign exchange regulations, payments of current account items,

including profit distributions, interest payments and expenditures from the

transaction, can be made in foreign currencies without prior approval from the

PRC State Administration of Foreign Exchange by complying with certain

procedural requirements. However, approval from appropriate governmental

authorities is required where Renminbi is to be converted into foreign currency

and remitted out of China to pay capital expenses such as the repayment of bank

loans denominated in foreign currencies.

The PRC

government may also at its discretion restrict access in the future to foreign

currencies for current account transactions. If the foreign exchange control

system prevents the Company from obtaining sufficient foreign currency to

satisfy its currency demands, the Company may not be able to pay certain of its

expenses as they come due.

The

fluctuation of the Renminbi may materially and adversely affect investments in

the Company.

The value

of the Renminbi against the U.S. dollar and other currencies may fluctuate and

is affected by, among other things, changes in the PRC’s political and economic

conditions. As the Company relies principally on revenues earned in the PRC, any

significant revaluation of the Renminbi may materially and adversely affect the

Company’s cash flows, revenues and financial condition. For example, to the

extent that the Company needs to convert U.S. dollars it receives from an

offering of its securities into Renminbi for the Company’s operations,

appreciation of the Renminbi against the U.S. dollar could have a material

adverse effect on the Company’s business, financial condition and results of

operations. Conversely, if the Company decides to convert its Renminbi into U.S.

dollars for the purpose of making payments for dividends on its common stock or

for other business purposes and the U.S. dollar appreciates against the

Renminbi, the U.S. dollar equivalent of the Renminbi that the Company converts

would be reduced. In addition, the depreciation of significant U.S. dollar

denominated assets could result in a charge to the Company’s income statement

and a reduction in the value of these assets.

On July

21, 2005, the PRC government changed its decade-old policy of pegging the value

of the Renminbi to the U.S. dollar. Under the new policy, the Renminbi is

permitted to fluctuate within a narrow and managed band against a basket of

certain foreign currencies. This change in policy has resulted in an

approximately 3.2% appreciation of the Renminbi against the U.S. dollar as of

May 15, 2006. While the international reaction to the Renminbi revaluation has

generally been positive, there remains significant international pressure on the

PRC government to adopt an even more flexible currency policy, which could

result in a further and more significant appreciation of the Renminbi against

the U.S. dollar.

Recent PRC State

Administration of Foreign Exchange (“SAFE”) Regulations regarding offshore

financing activities by PRC residents have undergone a number of changes that

may increase the administrative burden the Company faces. The failure by the

Company’s stockholders who are PRC residents to make any required applications

and filings pursuant to such regulations may prevent the Company from being able to

distribute profits and could expose the Company and its PRC resident

stockholders to liability under PRC law.

SAFE

issued a public notice (the “October Notice”) effective November 1, 2005, which

requires registration with SAFE by the PRC resident stockholders of any foreign

holding company of a PRC entity. Without registration, the PRC entity cannot

remit any of its profits out of the PRC as dividends or otherwise; however, it

is uncertain how the October Notice will be interpreted or implemented regarding

specific documentation requirements for a foreign holding company formed prior

to the effective date of the October Notice, such as in the Company’s case.

While the Company’s PRC counsel advised it that only the PRC resident

stockholders who receive the ownership of the foreign holding company in

exchange for ownership in the PRC operating company are subject to the October

Notice, there can be no assurance that SAFE will not require the Company’s other

PRC resident stockholders to make disclosure. In addition, the October Notice

requires that any monies remitted to PRC residents outside of the PRC be

returned within 180 days; however, there is no indication of what the penalty

will be for failure to comply or if stockholder non-compliance will be

considered to be a violation of the October Notice by the Company or otherwise

affect the Company.

In the

event that the proper procedures are not followed under the SAFE October Notice,

the Company could lose the ability to remit monies outside of the PRC and would

therefore be unable to pay dividends or make other distributions. The Company’s

PRC resident stockholders could be subject to fines, other sanctions and even

criminal liabilities under the PRC Foreign Exchange Administrative Regulations

promulgated January 29, 1996, as amended.

Any

recurrence of severe acute respiratory syndrome, or SARS, or another widespread

public health problem, could adversely affect the Company’s

operations.

A renewed

outbreak of SARS or another widespread public health problem such as bird flu in

the PRC, where most of the Company’s revenue is derived, could have an adverse

effect on the Company’s operations. The Company’s operations may be impacted by

a number of health-related factors, including quarantines or closures of some of

its offices that would adversely disrupt the Company’s operations. Any of the

foregoing events or other unforeseen consequences of public health problems

could adversely affect the Company’s operations.

- 11

-

Because

the Company’s principal assets are located outside of the United States and all

of the Company’s directors and officers reside outside of the United States, it

may be difficult for investors to enforce their rights based on U.S. federal

securities laws against the Company and the Company’s officers and directors in

the U.S. or to enforce U.S. court judgment against the Company or them in the

PRC.

All of

the Company’s directors and officers reside outside of the United States. In

addition, Anhui Runji is located in the PRC and substantially all of its assets

are located outside of the United States; it may therefore be difficult or

impossible for investors in the United States to enforce their legal rights

based on the civil liability provisions of the U.S. federal securities laws

against the Company in the courts of either the U.S. or the PRC and, even if

civil judgments are obtained in U.S. courts, to enforce such judgments in PRC

courts. Further, it is unclear if extradition treaties now in effect between the

United States and the PRC would permit effective enforcement against the Company

or its officers and directors of criminal penalties, under the U.S. federal

securities laws or otherwise.

Risks

Relating to the Company’s Share Exchange with Anhui Runji

The

Company’s Chairman and President, Shouren Zhao, beneficially owns 51.6% of the

Company’s outstanding common stock, which gives him control over certain major

decisions on which the Company’s stockholders may vote, which may discourage an

acquisition of the Company.

As a

result of the Share Exchange, most of management of the Company do not

beneficially own any of the Company’s outstanding common stock at this point in

time, and one of the Company’s officers and directors beneficially owns 51.6% of

the Company’s outstanding shares. The interests of this director may differ from

the interests of other stockholders. As a result, this officer and director will

have the right and ability to control virtually all corporate actions requiring

stockholder approval, irrespective of how the Company’s other stockholders may

vote, including the following actions:

|

§

|

Electing

or defeating the election of

directors;

|

|

§

|

Amending

or preventing amendment of the Company’s Certificate of Incorporation or

By-laws;

|

|

§

|

Effecting

or preventing a merger, sale of assets or other corporate transaction;

and

|

|

§

|

Controlling

the outcome of any other matter submitted to the stockholders for

vote.

|

The

Company’s stock ownership profile may discourage a potential acquirer from

seeking to acquire shares of the Company’s common stock or otherwise attempting

to obtain control of the Company, which in turn could reduce the Company’s stock

price or prevent the Company’s stockholders from realizing a premium over the

Company’s stock price.

As

a result of the Share Exchange, Anhui Runji has become an indirect wholly-owned

subsidiary of a company that is subject to the reporting requirements of U.S.

federal securities laws, which can be expensive.

As a

result of the Share Exchange, Anhui Runji has become an indirect wholly-owned

subsidiary of a company that is a public reporting company and, accordingly, is

subject to the information and reporting requirements of the Exchange Act and

other federal securities laws, including compliance with the Sarbanes-Oxley Act.

The costs of preparing and filing annual and quarterly reports, proxy statements

and other information with the SEC (including reporting of the Share Exchange)

and furnishing audited reports to stockholders will cause the Company’s expenses

to be higher than they would be if Anhui Runji had remained privately-held and

did not consummate the Share Exchange.

In

addition, it may be time consuming, difficult and costly for the Company to

develop and implement the internal controls and reporting procedures required by

the Sarbanes-Oxley Act. The Company may need to hire additional financial

reporting, internal controls and other finance personnel in order to develop and

implement appropriate internal controls and reporting procedures. If the Company

is unable to comply with the internal controls requirements of the

Sarbanes-Oxley Act, the Company may not be able to obtain the independent

accountant certifications required by the Sarbanes-Oxley Act.

Public

company compliance may make it more difficult to attract and retain officers and

directors.

The

Sarbanes-Oxley Act and new rules subsequently implemented by the SEC have

required changes in corporate governance practices of public companies. As a

public entity, the Company expects these new rules and regulations to increase

compliance costs in 2008 and beyond and to make certain activities more time

consuming and costly. As a public entity, the Company also expects that these

new rules and regulations may make it more difficult and expensive for the

Company to obtain director and officer liability insurance in the future and it

may be required to accept reduced policy limits and coverage or incur

substantially higher costs to obtain the same or similar coverage. As a result,

it may be more difficult for the Company to attract and retain qualified persons

to serve as directors or as executive officers.

Because

Anhui Runji became public by means of a share exchange, the Company may not be

able to attract the attention of major brokerage firms.

There may

be risks associated with Anhui Runji’s becoming public through a share exchange.

Specifically, securities analysts of major brokerage firms may not provide

coverage of the Company since there is no incentive to brokerage firms to

recommend the purchase of the company’s common stock. No assurance can be given

that brokerage firms will, in the future, want to conduct any secondary

offerings on behalf of the company.

- 12

-

Risks

Relating to the Common Stock

The

Company’s stock price may be volatile.

The

market price of the Company’s common stock is likely to be highly volatile and

could fluctuate widely in price in response to various factors, many of which

are beyond the Company’s control, including the following:

|

§

|

Additions

or departures of key personnel;

|

|

§

|

Limited

“public float” following the Share Exchange, in the hands of a small

number of persons whose sales or lack of sales could result in positive or

negative pricing pressure on the market price for the common

stock;

|

|

§

|

Sales

of the common stock

|

|

§

|

The

Company’s ability to execute its business

plan;

|

|

§

|

Operating

results that fall below

expectations;

|

|

§

|

Loss

of any strategic relationship;

|

|

§

|

Industry

developments;

|

|

§

|

Economic

and other external factors; and

|

|

§

|

Period-to-period

fluctuations in the Company’s financial

results.

|

In

addition, the securities markets have from time to time experienced significant

price and volume fluctuations that are unrelated to the operating performance of

particular companies. These market fluctuations may also materially and

adversely affect the market price of the Company’s common stock.

There

is currently no liquid trading market for the Company’s common stock and the

Company cannot ensure that one will ever develop or be sustained.

There is

currently no liquid trading market for the Company’s common stock. The Company

cannot predict how liquid the market for the Company’s common stock might

become. The Company’s common stock is currently approved for quotation on the

OTC Bulletin Board trading under the symbol CRJI. The Company cannot ensure that

it will be able to satisfy the initial listing standards on a higher exchange,

or that its common stock will be accepted for listing on any such exchange.

Should the Company fail to satisfy the initial listing standards of such

exchanges, or its common stock be otherwise rejected for listing and remain on

the OTC Bulletin Board or be suspended from the OTC Bulletin Board, the trading

price of the Company’s common stock could suffer, the trading market for the

Company’s common stock may be less liquid and the Company’s common stock price

may be subject to increased volatility.

The

Company’s common stock may be deemed a “penny stock”, which would make it more

difficult for investors to sell their shares.

The

Company’s common stock is subject to the “penny stock” rules adopted under

section 15(g) of the Exchange Act. The penny stock rules apply to companies

whose common stock is not listed on the NASDAQ Stock Market or other national

securities exchange and trades at less than $5.00 per share or that have

tangible net worth of less than $5,000,000 ($2,000,000 if the company has been

operating for three or more years). These rules require, among other things,

that brokers who trade penny stock to persons other than “established customers”

complete certain documentation, make suitability inquiries of investors and

provide investors with certain information concerning trading in the security,

including a risk disclosure document and quote information under certain

circumstances. Many brokers have decided not to trade penny stocks because of

the requirements of the penny stock rules and, as a result, the number of

broker-dealers willing to act as market makers in such securities is

limited. If the Company remains subject to the penny stock rules for any

significant period, it could have an adverse effect on the market, if any, for

the Company’s securities. If the Company’s securities are subject to the penny

stock rules, investors will find it more difficult to dispose of the Company’s

securities.

Furthermore,

for companies whose securities are quoted on the OTC Bulletin Board, it is more

difficult (1) to obtain accurate quotations, (2) to obtain coverage for

significant news events because major wire services generally do not publish

press releases about such companies, and (3) to obtain needed

capital.

Offers

or availability for sale of a substantial number of shares of the Company’s

common stock may cause the price of the Company’s common stock to

decline.

If the

Company’s stockholders sell substantial amounts of common stock in the public

market, or upon the expiration of any statutory holding period, under Rule 144,

it could create a circumstance commonly referred to as an “overhang” and in

anticipation of which the market price of the Company’s common stock could fall.

The existence of an overhang, whether or not sales have occurred or are

occurring, also could make more difficult the Company’s ability to raise

additional financing through the sale of equity or equity-related securities in

the future at a time and price that the Company deems reasonable or appropriate.

Additional shares of common stock will be freely tradable upon the earlier of:

(i) effectiveness of the registration statement the Company is required to file;

and (ii) the date on which such shares may be sold without registration pursuant

to Rule 144 under the Securities Act.

Provisions

of the Company’s Certificate of Incorporation and Delaware law could deter a

change of control, which could discourage or delay offers to acquire the

Company.

Provisions

of the Company’s Certificate of Incorporation and Delaware law may make it more

difficult for someone to acquire control of the Company or for the Company’s

stockholders to remove existing management, and might discourage a third party

from offering to acquire the Company, even if a change in control or in

management would be beneficial to stockholders. For example, the Company’s

Certificate of Incorporation allows the Company to issue shares of preferred

stock without any vote or further action by stockholders.

- 13

-

Volatility

in the Company’s common stock price may subject the Company to securities

litigation.

The

market for the Company’s common stock is characterized by significant price

volatility when compared to seasoned issuers, and the Company expects that its

share price will continue to be more volatile than a seasoned issuer for the

indefinite future. In the past, plaintiffs have often initiated securities class

action litigation against a company following periods of volatility in the

market price of its securities. The Company may, in the future, be the target of

similar litigation. Securities litigation could result in substantial costs and

liabilities and could divert management’s attention and resources.

The

elimination of monetary liability against the Company’s directors, officers and

employees under the Company’s Articles of Incorporation and

Delaware law, and the existence of indemnification rights to the

Company’s directors, officers and employees may result in substantial

expenditures by the Company and may discourage lawsuits against the Company’s

directors, officers and employees.

The

Company’s Certificate of Incorporation contains a provision that provides for

indemnification of directors and officers against any and all expenses,

including amounts paid upon judgments, counsel fees and amounts paid in

settlement by any such person in any proceeding that they are made a party to by

reason of being or having been directors or officers of the Company, except in

relation to matters as to which any such director or officer shall be adjudged

to be liable for his own negligence or misconduct in the performance of his

duties. Such indemnification shall be in addition to any other rights

to which those indemnified may be entitled under any law, by law, agreement,

vote of shareholder or otherwise. The Company may also have

contractual indemnification obligations under its employment agreements with its

executive officers. The foregoing indemnification obligations could result in

the Company incurring substantial expenditures to cover the cost of settlement

or damage awards against directors and officers, which the Company may be unable

to recoup. These provisions and resultant costs may also discourage the Company

from bringing a lawsuit against directors and officers for breaches of their

fiduciary duties and may similarly discourage the filing of derivative

litigation by the Company’s stockholders against the Company’s directors and

officers even though such actions, if successful, might otherwise benefit the

Company and its stockholders.

- 14

-

Item

1B. Unresolved Staff

Comments

None.

Item

2. Properties

Our

headquarters are located in Xianzong town, Hanshan County, Anhui Province, with

our plant and facilities occupying 51,989.87m2. Our

company holds a property ownership certificate for this parcel.

We know

of no material, active or pending legal proceedings against us, our subsidiaries

or our property, nor are we involved as a plaintiff in any material proceedings

or pending litigation. There are no proceedings in which any of our directors,

officers or affiliates, or any registered or beneficial shareholders are an

adverse party or have a material interest adverse to us.

Item

4. Submission of

Matters to a Vote of Security Holders

None.

- 15

-

|

Market

for Company’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

Market

Information

There is

a limited public market for our common shares. Our common shares are quoted for

trading on the OTC Bulletin Board under the symbol “CRJI.” The market for our

stock is highly volatile. We cannot assure you that there will be a market in

the future for our common stock. OTC Bulletin Board securities are not listed

and traded on the floor of an organized national or regional stock exchange.

Instead, OTC Bulletin Board securities transactions are conducted through a

telephone and computer network connecting dealers in stocks. OTC Bulletin Board

stocks are traditionally smaller companies that do not meet the financial and

other listing requirements of a regional or national stock

exchange.

Our

common shares became eligible for quotation on the OTC Bulletin Board on July 6,

2006, but no trades were made until November 2006.

The

following table shows the high and low prices of our common shares on the OTC

Bulletin Board. The following quotations reflect inter-dealer prices, without

retail mark-up, mark-down or commission and may not necessarily represent actual

transactions:

|

Hi

|

Low

|

|||||||

|

Sept

1, 2007 – Nov 30, 2007

|

$

|

0.70

|

$

|

0.30

|

||||

|

Dec

1, 2007 – Feb 29, 2008

|

$

|

1.01

|

$

|

0.20

|

||||

|

Mar

1, 2008 – May 31, 2008

|

$

|

2.10

|

$

|

0.40

|

||||

|

June

1, 2008 – Aug 31, 2008

|

$

|

2.00

|

$

|

0.65

|

||||

|

Sept

1, 2008 – Nov 30, 2008

|

$

|

1.01

|

$

|

0.21

|

||||

|

Dec

1, 2008 – Feb 28, 2009

|

$

|

1.00

|

$

|

0.21

|

||||

|

Mar

1, 2009 – May 31, 2009

|

$

|

0.58

|

$

|

0.20

|

||||

|

June

1, 2009 – Aug 31, 2009

|

$

|

0.58

|

$

|

0.29

|

||||

From

September 1 to November 20, 2009, the highest and lowest prices of our common

shares on the OTC Bulletin Board were $0.55 per share and $0.25 per share. On

November 24, 2009, the closing price of our common stock on the OTC Bulletin

Board on the last day it traded before the filing of this Annual Report was

$0.30 per share.

We have

never paid any cash dividends and currently do not intend to pay any dividends

for the foreseeable future.

Holders

As of August 31,

2009, there were 129 holders of record of our common stock.

Dividends

Holders

of our common stock are entitled to dividends if declared by the Board of

Directors out of funds legally available therefore. As of August 31, 2009, no

cash dividends have been declared.

We do not

intend to issue any cash or stock dividends in the near future. We intend to

retain earnings, if any, to finance the development and expansion of our

business. Our future dividend policy will be subject to the discretion of the

Board of Directors and will be contingent upon future earnings, if any, our

financial condition, capital requirements, general business conditions and other

factors.

As of