Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PACIFIC OFFICE PROPERTIES TRUST, INC. | form8k.htm |

| EX-99.1 - EXH 99.1 EARNINGS RELEASE - PACIFIC OFFICE PROPERTIES TRUST, INC. | exh99_1.htm |

Pacific

Office Properties Trust, Inc.

Supplemental

Operating and Financial Information

For the

three months ended September 30, 2009

Pacific

Office Properties Trust, Inc.

2

Pacific

Office Properties Trust, Inc.

Corporate

Profile

Pacific

Office Properties Trust, Inc. (“The Company”) is a real estate investment trust

that acquires, owns, and operates office properties in the western U.S.,

focusing initially on the long-term growth sub-markets of Honolulu, San Diego,

Los Angeles, and Phoenix. The Company is externally managed by Pacific Office

Management, Inc., an affiliate of The Shidler Group. The Company

acquires, often in partnership with institutional co-investors, value-added

office buildings whose potential can be maximized through improvements,

repositioning, and superior leasing and management. The Company continues in the

tradition of The Shidler Group’s proven institutional joint-venture strategy,

which focuses on acquiring opportunistic and value-added commercial real estate

in partnership with institutional co-investors. More

information can be found on Pacific Office at www.pacificofficeproperties.com.

Investor

Information

|

Board

of Directors

|

Management

|

|||

|

Jay

H. Shidler

Chairman

of the Board,

Chair

of Investment Committee

Paul

M. Higbee

Director,

Chair of Audit Committee

Robert

L. Denton

Director

Thomas

R. Hislop

Director

|

Michael

W. Brennan

Director,

Chair of Compensation Committee

Clay

W. Hamlin

Director,

Chair of Nominating Committee

|

Pacific

Office Properties Trust, Inc.

|

Pacific

Office Management, Inc.

|

|

|

Jay

H. Shidler

President

and Chief Executive Officer

|

Jay

H. Shidler

President

and Chief Executive Officer

|

James

R. Ingebritsen

Executive

Vice President, Capital Markets/Operations

|

||

|

Lawrence

J. Taff

Chief

Financial Officer

|

Lawrence

J. Taff

Chief

Financial Officer

|

Tamara

G. Edwards

Corporate

Secretary

|

||

|

Matthew J. Root

Chief

Investment Officer

|

||||

Company

Information

|

Corporate

Headquarters

233

Wilshire Blvd.

Suite

310

Santa

Monica, CA 90401

(t)

(310) 395-2083

(f)

(310) 395-2741

|

Trading

Symbol

PCE

Stock

Exchange Listing

NYSE

Amex

|

Inquiries

For

investor relations or media inquiries, contact:

|

|

|

Stacey

Feit, CFA

Vice

President

Financial

Relations Board

sfeit@mww.com

(t)

(213) 486-6549

(f)

(213) 233-3499

|

Lawrence

J. Taff

Chief

Financial Officer

ltaff@pacificofficeproperties.com

(t)

(808) 544-1219

|

||

3

Note Regarding

Forward-Looking Statements

This

Supplemental Operating and Financial Information contains forward-looking

statements within the meaning of Section 21E of the Exchange Act, which include

information relating to future events, future financial performance, strategies,

expectations, risks and uncertainties. From time to time, we also

provide forward-looking statements in other materials we release to the public

as well as oral forward-looking statements. These forward-looking

statements include, without limitation, statements regarding: projections,

predictions, expectations, estimates or forecasts as to our business, financial

and operational results and future economic performance; statements regarding

strategic transactions such as mergers or acquisitions or a possible dissolution

of the Company; and statements of management’s goals and objectives and other

similar expressions.

We cannot

guarantee that any forward-looking statement will be realized, although we

believe we have been prudent in our plans and

assumptions. Achievement of future results is subject to risks,

uncertainties and potentially inaccurate assumptions. Should known or

unknown risks or uncertainties materialize, or should underlying assumptions

prove inaccurate, actual results could differ materially from past results and

those anticipated, estimated or projected. These factors include the

risks and uncertainties described in “Risk Factors” in our Annual Report on Form

10-K and our Quarterly Report on Form 10-Q. You should bear this in mind as you

consider forward-looking statements.

We

undertake no obligation to publicly update forward-looking statements, whether

as a result of new information, future events or otherwise. You are

advised, however, to consult any further disclosures we make on related subjects

in our other public filings made with the Securities and Exchange

Commission.

4

Pacific

Office Properties Trust, Inc.

| Common Stock and Unit Data |

For

the three months ended

|

|||||||||||||||||||

|

September 30, 2009

|

June 30, 2009

|

March 31, 2009

|

December 31, 2008

|

September 30, 2008

|

||||||||||||||||

|

High

Closing Price

|

$ | 4.38 | $ | 5.00 | $ | 5.50 | $ | 6.65 | $ | 7.32 | ||||||||||

|

Low

Closing Price

|

$ | 3.50 | $ | 3.65 | $ | 4.30 | $ | 2.52 | $ | 6.10 | ||||||||||

|

Average

Closing Price

|

$ | 3.85 | $ | 4.39 | $ | 4.89 | $ | 4.75 | $ | 6.55 | ||||||||||

|

Closing

Price, at end of quarter

|

$ | 4.34 | $ | 3.72 | $ | 5.00 | $ | 4.44 | $ | 6.65 | ||||||||||

|

Closing

common shares and common units outstanding (in thousands)

|

18,150 | 17,361 | 17,330 | 17,330 | 17,330 | |||||||||||||||

|

Preferred

units - as-converted basis (in thousands)

|

32,598 | 32,598 | 32,598 | 32,598 | 32,598 | |||||||||||||||

|

Total

common shares and units outstanding - as-converted basis (in

thousands)

|

50,747 | 49,958 | 49,928 | 49,928 | 49,928 | |||||||||||||||

|

Total

dividends per share, annualized

|

$ | 0.20 | $ | 0.20 | $ | 0.20 | $ | 0.20 | $ | 0.20 | ||||||||||

|

Annual

Dividend Yield – On Closing Price

|

4.61 | % | 5.38 | % | 4.00 | % | 4.50 | % | 3.01 | % | ||||||||||

Highlights of Current Period Performance

Financial

Results

Funds

from Operations, or FFO, totaled $0.8 million, or $0.05 per common share/common

unit – basic and diluted, for the third quarter of 2009. Net loss

attributable to stockholders totaled $1.24 million, or $0.40 loss per basic and

diluted share, for the third quarter of 2009.

Financing and Capital

Activity

|

Ø

|

On

September 10, 2009, our Board of Directors declared a cash dividend of

$0.05 per share of our common stock for the third quarter of 2009. The

dividend was paid on October 15, 2009 to holders of record of common stock

on September 30, 2009. Commensurate with our declaration of a quarterly

cash dividend, we paid distributions to holders of record of Common Units

at September 30, 2009 in the amount of $0.05 per Common Unit, on October

15, 2009. In addition, we paid 2% distributions, or $.125 per unit, to

holders of record of Preferred Units at September 30, 2009, on October 15,

2009.

|

|

Ø

|

As

of September 30, 2009, the Company’s current total market capitalization

is $644.7 million, including approximately $220.2 million in equity on a

fully diluted basis, based on our closing price on the NYSE

Amex.

|

5

Pacific

Office Properties Trust, Inc.

Financial and Portfolio

Highlights

(unaudited

and in thousands, except property portfolio data, share price data and

percentages)

|

September

30, 2009

|

June

30, 2009

|

March

31, 2009

|

December

31, 2008

|

September

30, 2008

|

||||||||||||||

|

Property Portfolio

|

||||||||||||||||||

|

Number of

|

||||||||||||||||||

|

Consolidated

Properties

|

8 | 8 | 8 | 8 | 8 | |||||||||||||

|

Unconsolidated

Joint Venture Properties

|

15 | 15 | 15 | 15 | 15 | |||||||||||||

| 23 | 23 | 23 | 23 | 23 | ||||||||||||||

|

Square Footage

|

||||||||||||||||||

|

Consolidated

Properties

|

2,265,339 | 2,265,339 | 2,265,339 | 2,265,339 | 2,265,339 | |||||||||||||

|

Unconsolidated

Joint Venture Properties

|

2,060,855 | 2,060,855 | 2,060,855 | 2,065,052 | 2,065,052 | |||||||||||||

| 4,326,194 | 4,326,194 | 4,326,194 | 4,330,391 | 4,330,391 | ||||||||||||||

|

Capitalization Summary

|

||||||||||||||||||

|

Common

Shares

|

3,851 | 3,061 | 3,031 | 3,031 | 3,031 | |||||||||||||

|

Common

Units

|

14,299 | 14,299 | 14,299 | 14,299 | 14,299 | |||||||||||||

| 18,150 | 17,360 | 17,330 | 17,330 | 17,330 | ||||||||||||||

|

Convertible

Preferred Units as converted to Common Units

|

||||||||||||||||||

|

(4,545,300

Preferred Units converted at a 7.1717x conversion ratio)

|

32,598 | 32,598 | 32,598 | 32,598 | 32,598 | |||||||||||||

| 50,748 | 49,958 | 49,928 | 49,928 | 49,928 | ||||||||||||||

|

Valuation

|

||||||||||||||||||

|

Closing

Common Share Price

|

$ | 4.34 | $ | 3.72 | $ | 5.00 | $ | 4.44 | $ | 6.65 | ||||||||

|

Market

Value of Common Shares

|

$ | 16,713 | $ | 11,387 | $ | 15,155 | $ | 13,457 | $ | 20,156 | ||||||||

|

Market

Value of Common Shares and Equivalents (as converted)

|

$ | 203,533 | $ | 174,457 | $ | 234,485 | $ | 208,223 | $ | 311,865 | ||||||||

|

Total

Equity Market Capitalization

|

$ | 220,246 | $ | 185,844 | $ | 249,640 | $ | 221,680 | $ | 332,021 | ||||||||

|

Total

Consolidated Debt

|

$ | 424,451 | $ | 424,280 | $ | 423,856 | $ | 423,884 | $ | 420,888 | ||||||||

|

Total

Market Capitalization

|

$ | 644,697 | $ | 610,124 | $ | 673,496 | $ | 645,564 | $ | 752,909 | ||||||||

|

Total

Consolidated Debt to Total Market Capitalization

|

65.84 | % | 69.54 | % | 62.93 | % | 65.66 | % | 55.90 | % | ||||||||

6

Pacific

Office Properties Trust, Inc.

Financial and Portfolio

Highlights, continued

(unaudited

and in thousands, except share/unit data, ratios and percentages)

|

For

the three months ended

|

||||||||||||||||||||

|

September

30, 2009

|

June

30, 2009

|

March

31, 2009

|

December

31, 2008

|

September

30, 2008

|

||||||||||||||||

|

Income Items

|

||||||||||||||||||||

|

Total

Revenues

|

$ | 17,744 | $ | 18,019 | $ | 18,770 | $ | 19,848 | $ | 18,591 | ||||||||||

|

Equity

in Net Earnings (Loss) of Unconsolidated Joint Ventures

|

$ | 189 | $ | 163 | $ | 54 | $ | (63 | ) | $ | 185 | |||||||||

|

Net

Loss Attributable to Stockholders

|

$ | (1,241 | ) | $ | (1,116 | ) | $ | (1,056 | ) | $ | (1,163 | ) | $ | (1,188 | ) | |||||

|

FFO(1)

|

$ | 862 | $ | 1,240 | $ | 1,164 | $ | 764 | $ | 493 | ||||||||||

|

FFO

(per common share/common unit)

(1)

|

$ | 0.05 | $ | 0.07 | $ | 0.07 | $ | 0.04 | $ | 0.03 | ||||||||||

|

AFFO(1)

|

$ | 1,821 | $ | 1,952 | $ | 2,164 | $ | 1,201 | $ | 838 | ||||||||||

|

AFFO

(per common share/common unit)

(1)

|

$ | 0.10 | $ | 0.11 | $ | 0.12 | $ | 0.07 | $ | 0.05 | ||||||||||

|

EBITDA(1)

|

$ | 8,811 | $ | 9,144 | $ | 8,978 | $ | 9,030 | $ | 8,417 | ||||||||||

|

Ratios

|

||||||||||||||||||||

|

FFO

Payout Ratio (per common share/common unit)

(2)

|

105.3 | % | 70.0 | % | 74.4 | % | 113.4 | % | 175.8 | % | ||||||||||

|

AFFO

Payout Ratio (per common share/common unit)

(3)

|

49.8 | % | 44.5 | % | 40.0 | % | 72.1 | % | 61.6 | % | ||||||||||

|

Interest

Coverage Ratio

(4)

|

1.19 | x | 1.25 | x | 1.24 | x | 1.17 | x | 1.14 | x | ||||||||||

1 A

description of these non-GAAP measures and reconciliations is provided on pages

10 through 13.

2

Calculated as dividends for the respective quarters accrued to common

stockholders and unitholders divided by Funds from Operations

(FFO).

3

Calculated as dividends for the respective quarters accrued to common

stockholders and unitholders divided by Adjusted Funds from Operations

(AFFO).

4

Calculated as EBITDA divided by total interest expense.

7

Pacific

Office Properties Trust, Inc.

Consolidated Balance

Sheets

(unaudited

and in thousands)

|

September

30, 2009

|

June

30, 2009

|

March

31, 2009

|

December

31, 2008

|

September

30, 2008

|

||||||||||||||||

|

ASSETS

|

||||||||||||||||||||

|

Investments

in real estate

|

$ | 417,873 | $ | 416,211 | $ | 414,435 | $ | 413,914 | $ | 414,164 | ||||||||||

|

Less:

accumulated depreciation

|

(32,442 | ) | (28,646 | ) | (24,859 | ) | (21,257 | ) | (17,350 | ) | ||||||||||

|

Investments

in real estate, net

|

385,431 | 387,565 | 389,576 | 392,657 | 396,814 | |||||||||||||||

|

Cash

and cash equivalents

|

3,405 | 6,881 | 6,537 | 4,463 | 6,158 | |||||||||||||||

|

Restricted

cash

|

5,444 | 5,055 | 5,266 | 7,267 | 5,996 | |||||||||||||||

|

Rents

and other receivables, net

|

6,004 | 5,729 | 5,387 | 6,342 | 4,343 | |||||||||||||||

|

Intangible

assets, net

|

35,079 | 36,875 | 38,925 | 41,379 | 44,096 | |||||||||||||||

|

Other

assets, net

|

5,822 | 5,080 | 5,383 | 4,680 | 5,254 | |||||||||||||||

|

Goodwill

|

62,019 | 62,019 | 62,019 | 61,519 | 59,388 | |||||||||||||||

|

Investment

in unconsolidated joint ventures

|

10,016 | 10,376 | 11,149 | 11,590 | 11,847 | |||||||||||||||

| $ | 513,220 | $ | 519,580 | $ | 524,242 | $ | 529,897 | $ | 533,896 | |||||||||||

|

LIABILITIES

AND EQUITY

|

||||||||||||||||||||

|

Mortgage

and other collateralized loans, net

|

$ | 403,347 | $ | 400,504 | $ | 400,080 | $ | 400,108 | $ | 397,112 | ||||||||||

|

Unsecured

notes payable to related parties

|

21,104 | 23,776 | 23,776 | 23,776 | 23,776 | |||||||||||||||

|

Accounts

payable and other liabilities

|

20,257 | 21,692 | 18,970 | 17,088 | 14,758 | |||||||||||||||

|

Acquired

below market leases, net

|

9,997 | 10,578 | 11,186 | 11,817 | 12,283 | |||||||||||||||

| 454,705 | 456,550 | 454,012 | 452,789 | 447,929 | ||||||||||||||||

|

Non-controlling

interests

|

130,679 | 121,810 | 140,117 | 133,250 | 152,757 | |||||||||||||||

|

Equity:

|

||||||||||||||||||||

|

Preferred

Stock (including Proportionate Voting Preferred Stock)

|

- | - | - | - | - | |||||||||||||||

|

Common

Stock

|

185 | 185 | 185 | 185 | 185 | |||||||||||||||

|

Class

B Common Stock

|

- | - | - | - | - | |||||||||||||||

|

Additional

paid-in capital

|

- | - | - | - | - | |||||||||||||||

|

Retained

deficit

|

(72,349 | ) | (58,965 | ) | (70,072 | ) | (56,327 | ) | (66,975 | ) | ||||||||||

|

Total

equity

|

(72,164 | ) | (58,780 | ) | (69,887 | ) | (56,142 | ) | (66,790 | ) | ||||||||||

|

Total

liabilities and equity

|

$ | 513,220 | $ | 519,580 | $ | 524,242 | $ | 529,897 | $ | 533,896 | ||||||||||

8

Pacific

Office Properties Trust, Inc.

Consolidated Statements of

Operations

(unaudited

and in thousands, except share and per share data)

|

For

the three months ended

|

||||||||||||||||||||

|

September

30, 2009

|

June

30, 2009

|

March

31, 2009

|

December

31, 2008

|

September

30, 2008

|

||||||||||||||||

|

Revenue:

|

||||||||||||||||||||

|

Rental

|

$ | 10,486 | $ | 10,607 | $ | 10,906 | $ | 11,046 | $ | 10,899 | ||||||||||

|

Tenant

reimbursements

|

5,163 | 5,299 | 5,722 | 6,635 | 5,583 | |||||||||||||||

|

Parking

|

2,012 | 2,011 | 2,057 | 2,035 | 1,981 | |||||||||||||||

|

Other

|

83 | 102 | 85 | 132 | 136 | |||||||||||||||

|

Total

revenue

|

17,744 | 18,019 | 18,770 | 19,848 | 18,599 | |||||||||||||||

|

Expenses:

|

||||||||||||||||||||

|

Rental

property operating

|

9,781 | 9,660 | 9,915 | 11,302 | 11,067 | |||||||||||||||

|

General

and administrative

|

351 | 497 | 1,149 | 740 | 429 | |||||||||||||||

|

Depreciation

and amortization

|

6,913 | 7,030 | 6,527 | 6,792 | 6,740 | |||||||||||||||

|

Interest

|

6,823 | 6,806 | 6,719 | 7,110 | 6,769 | |||||||||||||||

|

Loss

on extinguishment of debt

|

171 | - | - | - | - | |||||||||||||||

|

Total

expenses

|

24,039 | 23,993 | 24,310 | 25,944 | 25,005 | |||||||||||||||

|

Loss

before equity in net earnings (loss) of unconsolidated joint

ventures

|

(6,295 | ) | (5,974 | ) | (5,540 | ) | (6,096 | ) | (6,406 | ) | ||||||||||

|

Equity

in net earnings (loss) of unconsolidated joint ventures

|

189 | 163 | 54 | (63 | ) | 185 | ||||||||||||||

|

Non-operating

income

|

2 | 1 | 3 | 2 | - | |||||||||||||||

|

Net

loss

|

(6,104 | ) | (5,810 | ) | (5,483 | ) | (6,157 | ) | (6,221 | ) | ||||||||||

|

Less:

net loss attributable to non-controlling interests

|

4,863 | 4,694 | 4,427 | 4,994 | 5,033 | |||||||||||||||

|

Net

loss attributable to common stockholders

|

$ | (1,241 | ) | $ | (1,116 | ) | $ | (1,056 | ) | $ | (1,163 | ) | $ | (1,188 | ) | |||||

|

Net

loss per common share - basic and diluted

|

$ | (0.40 | ) | $ | (0.37 | ) | $ | (0.35 | ) | $ | (0.38 | ) | $ | (0.39 | ) | |||||

|

Weighted

average number of common shares outstanding - basic and

diluted

|

3,112,888 | 3,034,122 | 3,031,125 | 3,031,125 | 3,031,125 | |||||||||||||||

9

Pacific

Office Properties Trust, Inc.

Funds From Operations and

Adjusted Funds From Operations

(unaudited

and in thousands, except share and per share data)

|

For

the three months ended

|

||||||||||||||||||||

|

September

30, 2009

|

June

30, 2009

|

March

31, 2009

|

December

31, 2008

|

September

30, 2008

|

||||||||||||||||

|

Funds

From Operations (FFO)

(1):

|

||||||||||||||||||||

|

Net

loss attributable to common stockholders

|

$ | (1,241 | ) | $ | (1,116 | ) | $ | (1,056 | ) | $ | (1,163 | ) | $ | (1,188 | ) | |||||

|

Depreciation

and amortization of real estate assets

|

6,913 | 7,030 | 6,527 | 6,792 | 6,740 | |||||||||||||||

|

Depreciation

and amortization of real estate assets – unconsolidated joint

ventures

|

621 | 588 | 688 | 697 | 542 | |||||||||||||||

|

Distributions

to preferred unitholders

|

(568 | ) | (568 | ) | (568 | ) | (568 | ) | (568 | ) | ||||||||||

|

Net

loss attributable to non-controlling interests

|

(4,863 | ) | (4,694 | ) | (4,427 | ) | (4,994 | ) | (5,033 | ) | ||||||||||

|

FFO

|

$ | 862 | $ | 1,240 | $ | 1,164 | $ | 764 | $ | 493 | ||||||||||

|

Adjusted

Funds From Operations (AFFO)(2):

|

||||||||||||||||||||

|

FFO

|

$ | 862 | $ | 1,240 | $ | 1,164 | $ | 764 | $ | 493 | ||||||||||

|

Straight-line

rent adjustments, net

|

281 | 84 | 226 | (147 | ) | (23 | ) | |||||||||||||

|

Amortization

of interest rate contracts, loan premiums and prepaid

financings

|

368 | 435 | 411 | 426 | 254 | |||||||||||||||

|

Recurring

capital expenditures, tenant improvements and leasing

commissions

|

(193 | ) | (299 | ) | (114 | ) | (319 | ) | (352 | ) | ||||||||||

|

Non-cash

compensation expense

|

50 | 49 | 40 | 40 | 40 | |||||||||||||||

|

Interest

expense deferred on unsecured notes payable

|

453 | 443 | 437 | 437 | 426 | |||||||||||||||

|

AFFO

|

$ | 1,821 | $ | 1,952 | $ | 2,164 | $ | 1,201 | $ | 838 | ||||||||||

|

Weighted

average number of common shares and common share equivalents

outstanding - basic and diluted

|

17,412 | 17,333 | 17,330 | 17,330 | 17,330 | |||||||||||||||

|

FFO

per common share/common unit – basic and diluted

|

$ | 0.05 | $ | 0.07 | $ | 0.07 | $ | 0.04 | $ | 0.03 | ||||||||||

|

AFFO

per common share/common unit – basic and diluted

|

$ | 0.10 | $ | 0.11 | $ | 0.12 | $ | 0.07 | $ | 0.05 | ||||||||||

10

Pacific

Office Properties Trust, Inc.

Funds From Operations and

Adjusted Funds From Operations (continued)

|

|

(unaudited

and in thousands, except share and per share

data)

|

|

|

|

1

|

Funds

from Operations, or FFO, is a widely recognized measure of REIT

performance. We calculate FFO as defined by the National Association of

Real Estate Investment Trusts, or NAREIT. FFO represents net income (loss)

attributable to stockholders (as computed in accordance with accounting

principles generally accepted in the United States of America, or GAAP),

excluding gains (or losses) from dispositions of property, extraordinary

items, real estate-related depreciation and amortization (including

capitalized leasing expenses, tenant allowances or improvements and

excluding amortization of deferred financing costs) and after adjustments

for unconsolidated partnerships and joint ventures. Management uses FFO as

a supplemental performance measure because, in excluding real

estate-related depreciation and amortization, gains (or losses) from

property dispositions and extraordinary items, it provides a performance

measure that, when compared year over year, captures trends in occupancy

rates, rental rates and operating costs. We also believe that, as a widely

recognized measure of the performance of REITs, FFO will be used by

investors as a basis to compare our operating performance with that of

other REITs.

|

However,

because FFO excludes depreciation and amortization and captures neither the

changes in the value of our properties that result from use or market conditions

nor the level of capital expenditures and leasing commissions necessary to

maintain the operating performance of our properties, all of which have real

economic effect and could materially impact our results from operations, the

utility of FFO as a measure of our performance is limited. Other Equity REITs

may not calculate FFO in accordance with the NAREIT definition and, accordingly,

our FFO may not be comparable to such other Equity REITs' FFO. As a result, FFO

should be considered only as a supplement to net income (loss) as a measure of

our performance. FFO should not be used as a measure of our liquidity, nor is it

indicative of funds available to fund our cash needs, including our ability to

pay dividends or make distributions. FFO also should not be used as a supplement

to or substitute for cash flow from operating activities (computed in accordance

with GAAP).

The

weighted average number of common shares and common share equivalents

outstanding – basic and diluted includes common unit limited partnership

interests in our Operating Partnership.

Our

outstanding preferred unit interests in our Operating Partnership are

convertible into common unit limited partnership interests in our Operating

Partnership, but no earlier than the later of March 19, 2010 and the date an

underwritten public equity offering of our common stock in an amount equal to or

greater than $75 million is consummated, which is a contingent event and not yet

probable as of September 30, 2009. These common unit interests will become

exchangeable for shares of our common stock one year after such conversion. Our

outstanding preferred unit interests at September 30, 2009 represent 32,597,528

common share equivalents, on an as-if converted basis, and any impact related to

these outstanding limited partnership interests have not been included in our

calculation of diluted earnings per share or FFO per share, including our

calculation of the weighted average number of common and common equivalent

shares outstanding, in accordance with GAAP. Assuming the full

conversion of our outstanding preferred unit interests at September 30, 2009,

June 30, 2009, March 31, 2009, December 31, 2008 and September 30, 2008, our FFO

per share/unit, on a fully diluted basis, would have been $0.03, $0.04, $0.03,

$0.03 and $0.02, respectively.

11

Pacific

Office Properties Trust, Inc.

|

2

|

AFFO

is a non-GAAP financial measure we believe is a useful supplemental

measure of our performance. We compute AFFO by subtracting from

FFO the straight-line rent adjustments and recurring capital expenditures,

tenant improvements and leasing commissions, and then adding the

amortization of interest rate contracts, loan premium and prepaid

financing costs, non-cash compensation expense, and interest expense

deferred on unsecured notes. AFFO is not intended to represent

cash flow for the period, and it only provides an additional perspective

on our ability to fund cash needs and make distributions to shareholders

by adjusting the effect of the non-cash items included in FFO, as well as

recurring capital expenditures and leasing costs. We believe

that net income or loss is the most directly comparable GAAP financial

measure to AFFO. We also believe that AFFO provides useful

information to the investment community about the Company’s financial

position as compared to other REITs since AFFO is a widely reported

measure used by other REITs. However, other REITs may use

different methodologies for calculating AFFO and, accordingly, our AFFO

may not be comparable to other REITs. Assuming the full conversion of our

outstanding preferred unit interests at September 30, 2009, June 30, 2009,

March 31, 2009, December 31, 2008 and September 30, 2008, our AFFO per

share/unit, on a fully diluted basis, would have been $0.05, $0.05, $0.05,

$0.04 and $0.03, respectively.

|

|

3

|

Note

that, unlike many REITs, AFFO has often been higher than FFO for Pacific

Office Properties Trust, Inc. due to the addition of the noncash impact of

straightlining ground lease rent expense for AFFO. Beginning

with the period ended September 30, 2009; the Company will deduct the

distributions on its preferred unit interests from both its FFO and AFFO

calculations. Prior periods will be presented utilizing this

new calculation for comparative

purposes.

|

12

Pacific

Office Properties Trust, Inc.

Earnings Before Interest,

Taxes and Depreciation and Amortization (EBITDA)

(unaudited

and in thousands)

| For the Three Months Ended | ||||||||||||||||||||

|

September 30, 2009

|

June 30, 2009

|

March 31, 2009

|

December 31, 2008

|

September 30, 2008

|

||||||||||||||||

|

Reconciliation

of net loss to earnings before interest taxes and depreciation and

amortization (EBITDA) (1):

|

||||||||||||||||||||

|

Net

loss attributable to common stockholders

|

$ | (1,241 | ) | $ | (1,116 | ) | $ | (1,056 | ) | $ | (1,163 | ) | $ | (1,188 | ) | |||||

|

Interest

expense

|

6,823 | 6,806 | 6,719 | 7,110 | 6,769 | |||||||||||||||

|

Interest

expense – unconsolidated joint ventures

|

558 | 530 | 527 | 588 | 587 | |||||||||||||||

|

Depreciation

and amortization of real estate assets

|

6,913 | 7,030 | 6,527 | 6,792 | 6,740 | |||||||||||||||

|

Depreciation

and amortization of real estate assets – unconsolidated joint

ventures

|

621 | 588 | 688 | 697 | 542 | |||||||||||||||

|

Net

loss attributable to non-controlling interests

|

(4,863 | ) | (4,694 | ) | (4,427 | ) | (4,994 | ) | (5,033 | ) | ||||||||||

|

EBITDA

|

$ | 8,811 | $ | 9,144 | $ | 8,978 | $ | 9,030 | $ | 8,417 | ||||||||||

|

|

|

1

|

Management

believes that earnings before interest expense, depreciation and

amortization, and net loss attributable to non-controlling interests

(EBITDA) is a useful supplemental measure of our

performance. We believe that EBITDA provides useful information

to the investment community about the Company’s financial position before

the impact of investing and financing transactions and facilitates

comparisons with other REITs. Accordingly, EBITDA should not be

considered as an alternative to cash flows from operating activities (as

computed in accordance with GAAP) as a measure of

liquidity. EBITDA should not be considered as an alternative to

net income (loss) as an indicator of our operating

performance. Other REITs may use different methodologies for

calculating EBITDA and accordingly, our EBITDA may not be comparable to

other REITs.

|

13

Pacific

Office Properties Trust, Inc.

Condensed Combined Balance

Sheets - Unconsolidated Joint Ventures(1)

(unaudited

and in thousands)

|

September

30, 2009

|

June

30, 2009

|

March

31, 2009

|

December

31, 2008

|

September

30, 2008

|

||||||||||||||||

|

ASSETS

|

||||||||||||||||||||

|

Investment

in real estate

|

$ | 354,899 | $ | 354,896 | $ | 353,516 | $ | 353,180 | $ | 346,602 | ||||||||||

|

Less:

accumulated depreciation

|

(26,142 | ) | (24,215 | ) | (20,619 | ) | (17,427 | ) | (14,893 | ) | ||||||||||

|

Investment

in real estate, net

|

328,757 | 330,681 | 332,897 | 335,753 | 331,709 | |||||||||||||||

|

Cash

and cash equivalents, including restricted cash

|

18,202 | 17,638 | 19,986 | 17,800 | 21,634 | |||||||||||||||

|

Rents

and other receivables, net

|

7,081 | 6,238 | 6,024 | 5,285 | 3,169 | |||||||||||||||

|

Intangible

assets, net

|

28,214 | 29,943 | 30,325 | 32,879 | 45,700 | |||||||||||||||

|

Other

assets

|

4,744 | 5,299 | 5,708 | 5,604 | 7,081 | |||||||||||||||

|

Total

assets

|

$ | 386,998 | $ | 389,799 | $ | 394,940 | $ | 397,321 | $ | 409,293 | ||||||||||

|

LIABILITIES

AND MEMBERS’ EQUITY

|

||||||||||||||||||||

|

Mortgage

and other secured loans

|

$ | 318,091 | $ | 318,134 | $ | 318,177 | $ | 314,324 | $ | 310,071 | ||||||||||

|

Accounts

payable and other liabilities

|

7,958 | 7,334 | 9,320 | 11,380 | 15,363 | |||||||||||||||

|

Acquired

below market leases, net

|

5,146 | 5,659 | 6,183 | 6,737 | 11,991 | |||||||||||||||

|

Total

liabilities

|

331,195 | 331,127 | 333,680 | 332,441 | 337,425 | |||||||||||||||

|

Members'

equity

|

55,803 | 58,672 | 61,260 | 64,880 | 71,868 | |||||||||||||||

|

Total

liabilities and members' equity

|

$ | 386,998 | $ | 389,799 | $ | 394,940 | $ | 397,321 | $ | 409,293 | ||||||||||

|

|

1We own

managing interests in six joint ventures, consisting of 15 office

properties, including 29 office buildings, comprising approximately 2.06

million leasable square feet. Our ownership interest

percentages in these joint ventures range from approximately 7.50% to

32.17%. In exchange for our managing ownership interest and

related equity investment in these joint ventures, we are entitled to

preferential allocations of earnings and cash flows from each respective

joint venture. We are also entitled to incentive interests in

excess of our ownership percentages ranging from approximately 21.41% to

36.00%, subject to returns on invested

capital.

|

14

Condensed Combined

Statements of Operations - Unconsolidated Joint Ventures

(unaudited

and in thousands)

|

For

the three months ended

|

||||||||||||||||||||

|

September 30, 2009

|

June 30, 2009

|

March 31, 2009

|

December 31, 2008

|

September 30, 2008

|

||||||||||||||||

|

Revenue:

|

||||||||||||||||||||

|

Rental

|

$ | 9,513 | $ | 9,433 | $ | 9,309 | $ | 9,208 | $ | 9,793 | ||||||||||

|

Tenant

reimbursements

|

1,689 | 1,581 | 1,651 | 1,625 | 1,731 | |||||||||||||||

|

Parking

|

390 | 379 | 401 | 370 | 391 | |||||||||||||||

|

Interest

and other

|

81 | 67 | 113 | 129 | 21 | |||||||||||||||

|

Total

revenue

|

11,673 | 11,460 | 11,474 | 11,332 | 11,936 | |||||||||||||||

|

Expenses:

|

||||||||||||||||||||

|

Rental

property operating

|

4,768 | 4,934 | 4,765 | 5,159 | 5,112 | |||||||||||||||

|

Depreciation

and amortization

|

4,486 | 4,211 | 4,745 | 5,065 | 4,472 | |||||||||||||||

|

Interest

|

3,972 | 3,967 | 3,938 | 4,760 | 4,355 | |||||||||||||||

|

Total

expenses

|

13,226 | 13,112 | 13,448 | 14,984 | 13,939 | |||||||||||||||

|

Net

loss

|

$ | (1,553 | ) | $ | (1,652 | ) | $ | (1,974 | ) | $ | (3,652 | ) | $ | (2,003 | ) | |||||

|

Equity

in net income (loss) of unconsolidated joint ventures

|

$ | 189 | $ | 163 | $ | 54 | $ | (63 | ) | $ | 185 | |||||||||

15

Pacific

Office Properties Trust, Inc.

Debt Analysis(1)

(unaudited

and in thousands)

|

September 30, 2009

|

June 30, 2009

|

March 31, 2009

|

December 31, 2008

|

September 30, 2008

|

||||||||||||||||

|

Debt

Outstanding

|

||||||||||||||||||||

|

Consolidated Debt

|

||||||||||||||||||||

|

Mortgage

Loans

|

$ | 405,422 | $ | 402,675 | $ | 402,347 | $ | 402,471 | $ | 399,571 | ||||||||||

|

Unsecured

Loans

|

21,104 | 23,776 | 23,776 | 23,776 | 23,776 | |||||||||||||||

|

Total

Consolidated Debt

|

$ | 426,526 | $ | 426,451 | $ | 426,123 | $ | 426,247 | $ | 423,347 | ||||||||||

|

Company portion

of Unconsolidated Joint Venture Debt(2)

|

||||||||||||||||||||

|

Mortgage

Loans

|

$ | 39,795 | $ | 39,804 | $ | 39,145 | $ | 39,171 | $ | 39,187 | ||||||||||

|

Unsecured

Loans

|

1,367 | 1,367 | 1,367 | 1,367 | 1,367 | |||||||||||||||

|

Total

Company portion of Unconsolidated Joint Venture

Debt

|

$ | 41,162 | $ | 41,171 | $ | 40,512 | $ | 40,538 | $ | 40,554 | ||||||||||

|

Debt

Structure

|

||||||||||||||||||||

|

Consolidated Debt

|

||||||||||||||||||||

|

Fixed

Rate Mortgage Loans

|

$ | 372,558 | $ | 372,658 | $ | 372,735 | $ | 372,859 | $ | 372,959 | ||||||||||

|

Fixed

Rate Unsecured Loans

|

21,104 | 23,776 | 23,776 | 23,776 | 23,776 | |||||||||||||||

|

Total

Fixed Rate Debt

|

393,662 | 396,434 | 396,511 | 396,635 | 396,735 | |||||||||||||||

|

Variable

Rate Loans (3)

(subject to interest rate protection)

|

32,864 | 30,017 | 29,612 | 29,612 | 26,612 | |||||||||||||||

|

Total

Consolidated Debt

|

$ | 426,526 | $ | 426,451 | $ | 426,123 | $ | 426,247 | $ | 423,347 | ||||||||||

|

Company portion of Unconsolidated Joint Venture

Debt

|

||||||||||||||||||||

|

Fixed

Rate Mortgage Loans

|

$ | 29,037 | $ | 29,046 | $ | 29,070 | $ | 29,096 | $ | 29,112 | ||||||||||

|

Fixed

Rate Unsecured Loans

|

1,367 | 1,367 | 1,367 | 1,367 | 1,367 | |||||||||||||||

|

Total

Fixed Rate Debt

|

30,404 | 30,413 | 30,437 | 30,463 | 30,479 | |||||||||||||||

|

Variable

Rate Loans (subject to interest rate protection)

|

10,758 | 10,758 | 10,075 | 10,075 | 10,075 | |||||||||||||||

|

Total

Company portion of Unconsolidated Joint Venture Debt

|

$ | 41,162 | $ | 41,171 | $ | 40,512 | $ | 40,538 | $ | 40,554 | ||||||||||

|

1

|

Amounts

included herein represent the outstanding principal balances as of the

respective dates presented and, accordingly, do not include any amounts

attributable to discounts or premiums on our outstanding debt obligations,

which are not material. The amounts of mortgage and other

collateralized loans reflected in our consolidated balance sheets

represent the outstanding principal balances of those loans, adjusted for

applicable discounts or premiums, in accordance with GAAP for the

respective dates presented.

|

2

Company portion of Unconsolidated Joint Venture Debt is derived based on the

outstanding principal balances of mortgage and unsecured loans of our

unconsolidated joint ventures multiplied by our ownership interest percentage in

each respective unconsolidated joint venture as of the respective dates

presented. Primarily the entire Company portion of Joint Venture Debt

is non-recourse to the Company, except for approximately $1.50 million at

September 30, 2009 attributable to Palomar Heights Corporate Center and Scripps

Ranch Center.

3Variable

rate loans include amount borrowed under the revolving credit facility at a

fluctuating interest rate equal to the effective rate of interest paid by First

Hawaiian Bank on a time certificate of deposit, plus one

percent.

16

Pacific

Office Properties Trust, Inc.

Equity

Analysis

(unaudited

and in thousands, except share/unit price, ratios and percentages)

|

September

30, 2009

|

June

30, 2009

|

March

31, 2009

|

December

31, 2008

|

September

30, 2008

|

||||||||||||||||

|

Common

Equity

|

||||||||||||||||||||

|

Common

Shares

|

3,851 | 3,061 | 3,031 | 3,031 | 3,031 | |||||||||||||||

|

Common

Units(1)

|

14,299 | 14,299 | 14,299 | 14,299 | 14,299 | |||||||||||||||

| 18,150 | 17,360 | 17,330 | 17,330 | 17,330 | ||||||||||||||||

|

Common

Share Price

|

$ | 4.34 | $ | 3.72 | $ | 5.00 | $ | 4.44 | $ | 6.65 | ||||||||||

|

Market

Value of Common Shares/Common Units

|

$ | 78,771 | $ | 64,579 | $ | 86,650 | $ | 76,945 | $ | 115,245 | ||||||||||

|

Convertible

Preferred Equity

|

||||||||||||||||||||

|

Convertible

Preferred Units(2)

|

4,545 | 4,545 | 4,545 | 4,545 | 4,545 | |||||||||||||||

|

Conversion

Ratio

|

7.1717 | x | 7.1717 | x | 7.1717 | x | 7.1717 | x | 7.1717 | x | ||||||||||

|

Common

Shares Issued (assuming full conversion)

|

32,598 | 32,598 | 32,598 | 32,598 | 32,598 | |||||||||||||||

|

Market

Value of Convertible Preferred Units (as converted)

|

$ | 141,475 | $ | 121,265 | $ | 162,990 | $ | 144,735 | $ | 216,777 | ||||||||||

|

Capitalization

|

||||||||||||||||||||

|

Market

Value of Common Shares/Common Units

|

$ | 78,771 | $ | 64,579 | $ | 86,650 | $ | 76,945 | $ | 115,244 | ||||||||||

|

Market

Value of Convertible Preferred Units (as converted)

|

141,475 | 121,265 | 162,990 | 144,735 | 216,777 | |||||||||||||||

| 220,246 | 185,844 | 249,640 | 221,680 | 332,021 | ||||||||||||||||

|

Total

Consolidated Debt

|

424,451 | 424,280 | 423,856 | 423,884 | 420,888 | |||||||||||||||

|

Total

Market Capitalization

|

$ | 644,697 | $ | 610,124 | $ | 673,496 | $ | 645,564 | $ | 752,909 | ||||||||||

1

Common Units are exchangeable on a one-for-one basis for shares of our common

stock, but no earlier than March 19, 2010.

2 Each

Convertible Preferred Unit is convertible into 7.1717 Common Units, but no

earlier than the later of March 19, 2010, and the date an underwritten public

offering (of at least $75 million) by us of our common stock is

consummated. Upon conversion of the Preferred Units to Common Units,

the Common Units are exchangeable on a one-for-one basis for shares of our

common stock, but no earlier than one year after the date of their conversion

from a Preferred Unit to a Common Unit.

17

Pacific

Office Properties Trust, Inc.

(as of

September 30, 2009)

Consolidated Debt

Summary

(unaudited

and in thousands, except for percentages)

|

Property/Loan

|

Maturity

Date

|

Interest

Rate

|

Outstanding

Principal Balance at

September

30, 2009

|

%

of Total Consolidated Debt

|

|||||

|

Fixed

Rate Secured Debt:

|

|||||||||

|

Clifford

Center

(1)

|

8/15/2011

|

6.00%

|

$ 3,567

|

0.84%

|

|||||

|

Davies

Pacific Center

|

11/11/2016

|

5.86%

|

95,000

|

22.27%

|

|||||

|

First

Insurance Center

|

1/1/2016

|

5.74%

|

38,000

|

8.91%

|

|||||

|

First

Insurance Center

|

1/6/2016

|

5.40%

|

14,000

|

3.28%

|

|||||

|

Pacific

Business News Building

|

4/6/2010

|

6.98%

|

11,691

|

2.74%

|

|||||

|

Pan

Am Building

|

8/11/2016

|

6.17%

|

60,000

|

14.06%

|

|||||

|

Waterfront

Plaza

|

9/11/2016

|

6.37%

|

100,000

|

23.45%

|

|||||

|

Waterfront

Plaza

|

9/11/2016

|

6.37%

|

11,000

|

2.58%

|

|||||

|

City

Square

|

9/1/2010

|

5.58%

|

27,500

|

6.45%

|

|||||

|

Sorrento

Technology Center

|

1/11/2016

|

5.75%

|

11,800

|

2.77%

|

|||||

|

Subtotal

Fixed Rate Secured Debt

|

372,558

|

87.35%

|

|||||||

|

|

|||||||||

|

Fixed

Rate Unsecured Debt:

|

|||||||||

|

Unsecured

notes payable to related parties

|

Varying

dates from

3/19/2013

to 8/31/2013

|

7.00%

|

21,104

|

4.95%

|

|||||

|

Floating

Rate Secured Debt :

|

|||||||||

|

City

Square (2)

|

9/1/2010

|

LIBOR

+ 2.35%

|

27,017

|

6.33%

|

|||||

|

Revolving

line of credit(3)

|

9/2/2011

|

1.85%

|

5,847

|

1.37%

|

|||||

|

Subtotal

Floating Rate Secured Debt

|

32,864

|

7.70%

|

|||||||

|

Total

Consolidated Debt

|

426,526

|

100.00%

|

|||||||

|

Less

Unamortized Debt Discount

|

(2,075)

|

||||||||

|

Total

Consolidated Debt, Net of Unamortized Debt Discount

|

$ 424,451

|

||||||||

1 The

initial maturity date is August 15, 2011. The Company has the option

to extend the maturity date to August 15, 2014.

2

Maximum loan amount to be advanced is $28.5 million. In addition, the

Company has an interest rate cap on this loan for the notional amount of $28.5

million, which effectively limits the LIBOR rate on this loan to

7.45%. The interest rate cap expires on September 1,

2010.

18

Pacific

Office Properties Trust, Inc.

(as of

September 30, 2009)

Consolidated Debt

Maturities

(unaudited

and in thousands)

|

Property/Loan

|

2009

|

2010

|

2011

|

2012

|

2013

|

Thereafter

|

Total

|

|||||||||||||||||||||

|

Fixed

Rate Secured Debt:

|

||||||||||||||||||||||||||||

|

Clifford

Center(1)

|

$ | 66 | (2) | $ | 275 | (2) | $ | 292 | (2) | $ | 310 | (2) | $ | 329 | (2) | $ | 2,295 | $ | 3,567 | |||||||||

|

Davies

Pacific Center

|

- | - | - | - | - | 95,000 | 95,000 | |||||||||||||||||||||

|

First

Insurance Center

|

- | - | - | - | - | 52,000 | 52,000 | |||||||||||||||||||||

|

Pacific

Business News Building

|

38 | (2) | 11,653 | - | - | - | - | 11,691 | ||||||||||||||||||||

|

Pan

Am Building

|

- | - | - | - | - | 60,000 | 60,000 | |||||||||||||||||||||

|

Waterfront

Plaza

|

- | - | - | - | - | 111,000 | 111,000 | |||||||||||||||||||||

|

City

Square

|

- | 27,500 | - | - | - | - | 27,500 | |||||||||||||||||||||

|

Sorrento

Technology Center

|

- | - | - | - | - | 11,800 | 11,800 | |||||||||||||||||||||

|

Fixed

Rate Unsecured Debt:

|

||||||||||||||||||||||||||||

|

Unsecured

notes payable to related parties

|

- | - | - | - | 21,104 | - | 21,104 | |||||||||||||||||||||

|

Floating

Rate Secured Debt:

|

||||||||||||||||||||||||||||

|

City

Square

|

- | 27,017 | - | - | - | - | 27,017 | |||||||||||||||||||||

|

Revolving

line of credit

|

- | - | 5,847 | - | - | - | 5,847 | |||||||||||||||||||||

|

Total

|

$ | 104 | $ | 66,445 | $ | 6,139 | $ | 310 | $ | 21,433 | $ | 332,095 | $ | 426,526 | ||||||||||||||

1 The

initial maturity date is August 15, 2011. The Company has the option

to extend the maturity date to August 15, 2014. Accordingly, the

related debt maturity reflected herein is scheduled using an amortization

schedule based on the extended maturity date, as if the Company had exercised

its option to extend the original maturity date.

19

Pacific

Office Properties Trust, Inc.

(as of

September 30, 2009)

Unconsolidated Joint Venture

Debt Summary

(unaudited

and in thousands, except for percentages)

|

Property/Loan

|

Maturity

Date

|

Interest

Rate

|

Ownership

Interest %

|

Outstanding

Principal Balance at

September

30, 2009

|

Company

Portion of Outstanding Principal Balance at September 30,

2009

|

%

of Total Company Portion of Outstanding Principal

Balance

|

|||||||||||||

|

Fixed

Rate Secured Debt:

|

|||||||||||||||||||

|

Seville

Plaza - Note A

|

1/1/2011

|

6.05 | % | 7.50 | % | $ | 21,650 | $ | 1,624 | 3.95 | % | ||||||||

|

Seville

Plaza - Note B

|

1/1/2011

|

9.19 | % | 7.50 | % | 3,000 | 225 | 0.55 | % | ||||||||||

|

SoCal

II Joint Venture

|

1/6/2012

|

5.75 | % | 10.00 | % | 133,500 | 13,350 | 32.42 | % | ||||||||||

|

Bank

of Hawaii Waikiki Center

|

3/11/2017

|

5.99 | % | 17.50 | % | 26,900 | 4,708 | 11.44 | % | ||||||||||

|

POP

San Diego – Palomar Heights Plaza

|

4/30/2011

|

6.25 | % | 32.17 | % | 10,796 | 3,473 | 8.44 | % | ||||||||||

|

POP

San Diego – Palomar Heights Plaza

|

4/1/2014

|

5.58 | % | 32.17 | % | 1,888 | 607 | 1.47 | % | ||||||||||

|

POP

San Diego – Palomar Heights Corporate Center

|

4/1/2014

|

5.58 | % | 32.17 | % | 10,526 | 3,386 | 8.23 | % | ||||||||||

|

POP

San Diego – Scripps Ranch Center

|

12/1/2014

|

5.44 | % | 32.17 | % | 5,174 | 1,664 | 4.04 | % | ||||||||||

|

Subtotal

Fixed Rate Secured Debt

|

213,434 | 29,037 | 70.54 | % | |||||||||||||||

|

Fixed

Rate Unsecured Debt:

|

|||||||||||||||||||

|

POP

San Diego Mezzanine Loan

|

4/30/2011

|

12.00 | % | 32.17 | % | 4,250 | 1,367 | 3.32 | % | ||||||||||

|

Floating

Rate Secured Debt :

|

|||||||||||||||||||

|

US

Bank Center

|

5/9/2010(1)

|

LIBOR

+ 1.53%(2)

|

7.50 | % | 56,800 | 4,260 | 10.35 | % | |||||||||||

|

SoCal

II Joint Venture - Senior Loan

|

1/1/2010(1)

|

LIBOR

+ 2.95%(2)

|

10.00 | % | 16,500 | 1,650 | 4.01 | % | |||||||||||

|

Black

Canyon Corporate Center - Note A

|

2/9/2010(1)

|

LIBOR

+ 1.65%(2)

|

17.50 | % | 27,700 | 4,848 | 11.78 | % | |||||||||||

|

Subtotal

Floating Rate Secured Debt

|

101,000 | 10,758 | 26.14 | % | |||||||||||||||

|

Total

Unconsolidated Joint Venture Debt

|

$ | 318,684 | $ | 41,162 | 100.00 | % | |||||||||||||

1 The

initial maturity dates for the floating rate secured debt attributable to US

Bank Center, SoCal II Joint Venture – Senior Loan and Black Canyon Corporate

Center – Note A are May 9, 2010, January 1, 2010, and February 9, 2010,

respectively. The joint ventures have the option to, and expect to, extend the

maturity dates of their floating rate secured debt to May 9, 2011, January 1,

2012, and February 9, 2012, respectively, subject to nominal fees and

requirements.

2

Interest rate cap agreements are in place on floating rate secured debt

attributable to US Bank Center, SoCal II Joint Venture – Senior Loan and Black

Canyon Corporate Center – Note A in the notional amounts of $56.8 million, which

effectively limits the LIBOR rate on this loan to 4.98%, $16.5 million, which

effectively limits the LIBOR rate on this loan to 6.25%, and $23.8 million,

which effectively limits the LIBOR rate on this loan to 6.00%,

respectively.

20

Pacific

Office Properties Trust, Inc.

(as of

September 30, 2009)

Company Portion of

Unconsolidated Joint Venture Debt Maturities (1)

(unaudited

and in thousands)

|

Property/Loan

|

2009

|

2010

|

2011

|

2012

|

2013

|

Thereafter

|

Total

|

|||||||||||||||||||||

|

Fixed

Rate Secured Debt:

|

||||||||||||||||||||||||||||

|

Seville

Plaza – Notes A&B

|

$ | - | $ | - | $ | 1,849 | $ | - | $ | - | $ | - | $ | 1,849 | ||||||||||||||

|

SoCal

II Joint Venture

|

- | - | - | 13,350 | - | - | 13,350 | |||||||||||||||||||||

|

Bank

of Hawaii Waikiki Center

|

- | - | - | - | - | 4,708 | 4,708 | |||||||||||||||||||||

|

POP

San Diego – Palomar Heights Plaza

|

- | - | 3,473 | - | - | - | 3,473 | |||||||||||||||||||||

|

POP

San Diego – Palomar Heights Plaza

|

- | - | - | - | - | 607 | 607 | |||||||||||||||||||||

|

POP

San Diego – Palomar Heights Corporate Center

|

- | - | - | - | - | 3,386 | 3,386 | |||||||||||||||||||||

|

POP

San Diego – Scripps Ranch Center

|

- | - | - | - | - | 1,664 | 1,664 | |||||||||||||||||||||

|

Fixed

Rate Unsecured Debt:

|

||||||||||||||||||||||||||||

|

POP

San Diego Mezzanine Loan

|

- | - | 1,367 | - | - | - | 1,367 | |||||||||||||||||||||

|

Floating

Rate Secured Debt:

|

||||||||||||||||||||||||||||

|

US

Bank Center(2)

|

- | - | 4,260 | - | - | - | 4,260 | |||||||||||||||||||||

|

SoCal

II Joint Venture - Senior Loan(2)

|

- | - | - | 1,650 | - | - | 1,650 | |||||||||||||||||||||

|

Black

Canyon Corporate Center- Note A(2)

|

- | - | - | 4,848 | - | - | 4,848 | |||||||||||||||||||||

|

Total

|

$ | - | $ | - | $ | 10,949 | $ | 19,848 | $ | - | $ | 10,365 | $ | 41,162 | ||||||||||||||

|

1

Company portion of Unconsolidated Joint Venture Debt Maturities amounts

were derived based on the outstanding principal balances of mortgage and

unsecured loans of our unconsolidated joint ventures multiplied by our

ownership interest percentage in each respective unconsolidated joint

venture.

|

2 The

initial maturity dates for the floating rate secured debt attributable to US

Bank Center, SoCal II Joint Venture – Senior Loan and Black Canyon Corporate

Center – Note A are May 9, 2010, January 1, 2010, and February 9, 2009,

respectively. The joint ventures have the option to, and expect to, extend the

maturity dates of their floating rate secured debt to May 9, 2011, January 1,

2012, and February 9, 2012, respectively, subject to nominal fees and

requirements. Accordingly, the unconsolidated joint venture debt maturities

herein are scheduled using the expected maturity date, as if the Company had

exercised all available options to extend the maturity

date.

21

Pacific

Office Properties Trust, Inc.

(as of

September 30, 2009)

Portfolio

Leasing Statistics

Portfolio

Summary

Through

our Operating Partnership, we own whole interests in eight office properties,

and managing ownership interests in six joint ventures holding fifteen office properties,

comprising approximately 4.3 million square feet of leasable area in Honolulu,

Southern California and Phoenix metropolitan areas (the “Property

Portfolio”). As of September 30, 2009, the portion of our Property

Portfolio, which was effectively owned by us (representing the leasable square

feet of our consolidated properties and our respective ownership interests in

the leasable square feet of our unconsolidated joint venture properties) (the

“Effective Portfolio”) comprised approximately 2.5 million leasable square

feet. Our property statistics as of September 30, 2009, were as

follows:

|

Property

|

Effective

|

|||||||||||||||

|

Number

of

|

Portfolio

|

Portfolio

|

||||||||||||||

|

|

Properties

|

Buildings

|

Square

Feet

|

Square

Feet

|

||||||||||||

|

Consolidated

properties

|

8 | 11 | 2,265,339 | 2,265,339 | ||||||||||||

|

Unconsolidated

joint ventures properties

|

15 | 29 | 2,060,855 | 261,397 | ||||||||||||

|

Total

|

23 | 40 | 4,326,194 | 2,526,736 | ||||||||||||

22

Pacific

Office Properties Trust, Inc.

(as of

September 30, 2009)

Portfolio Leasing

Summary

|

Submarket

|

Market

Rentable Square Feet

|

Effective

Market Rentable Square Feet

|

Percent

Leased

|

Annualized

Rent per Square Foot(1)

|

|||||||||||||

|

Honolulu, Hawaii

|

|||||||||||||||||

|

Waterfront

Plaza

|

Downtown

(CBD)

|

534,475 | 534,475 | 92.80 | % | $ | 36.10 | ||||||||||

|

Davies

Pacific Center

|

Downtown

(CBD)

|

353,224 | 353,224 | 89.89 | % | 34.76 | |||||||||||

|

Pan

Am Building

|

Kapiolani

|

209,889 | 209,889 | 92.65 | % | 38.52 | |||||||||||

|

First

Insurance Center

|

Kapiolani/Ward

|

202,992 | 202,992 | 98.22 | % | 34.60 | |||||||||||

|

Pacific

Business News Building

|

Kapiolani

|

90,559 | 90,559 | 74.18 | % | 32.29 | |||||||||||

|

Clifford

Center

|

Downtown

(CBD)

|

72,415 | 72,415 | 72.54 | % | 30.88 | |||||||||||

|

Bank

of Hawaii Waikiki Center

|

Waikiki

|

152,288 | 26,650 | 86.47 | % | 52.85 | |||||||||||

|

Subtotal

|

1,615,842 | 1,490,204 | 90.28 | % | $ | 37.12 | |||||||||||

|

Phoenix, Arizona

|

|||||||||||||||||

|

City

Square

|

(CBD)/North

Central

|

738,422 | 738,422 | 71.81 | % | $ | 20.63 | ||||||||||

|

U.S.

Bank Center

|

(CBD)/South

Central

|

372,676 | 27,951 | 79.21 | % | 22.20 | |||||||||||

|

Black

Canyon Corporate Center

|

Deer

Valley/Airport

|

218,694 | 38,271 | 64.66 | % | 17.59 | |||||||||||

|

Subtotal

|

1,329,792 | 804,644 | 72.71 | % | $ | 20.66 | |||||||||||

|

San Diego, California

|

|||||||||||||||||

|

Sorrento

Technology Center

|

Sorrento

Mesa

|

63,363 | 63,363 | 100.00 | % | $ | 24.47 | ||||||||||

|

Seville

Plaza

|

Kearny

Mesa

|

138,576 | 10,393 | 86.52 | % | 27.18 | |||||||||||

|

Scripps

Ranch Center

|

Scripps

Ranch

|

47,248 | 15,198 | 96.96 | % | 21.21 | |||||||||||

|

Torrey

Hills Corporate Center

|

Del

Mar Heights

|

24,066 | 7,742 | 100.00 | % | 41.06 | |||||||||||

|

Palomar

Heights Corporate Center

|

Carlsbad

|

64,812 | 20,848 | 90.31 | % | 28.84 | |||||||||||

|

Palomar

Heights Plaza

|

Carlsbad

|

45,538 | 14,648 | 91.70 | % | 27.06 | |||||||||||

|

Via

Frontera Business Park

|

Rancho

Bernardo

|

78,819 | 7,882 | 100.00 | % | 15.92 | |||||||||||

|

Poway

Flex

|

Poway

|

112,000 | 11,200 | 100.00 | % | 9.36 | |||||||||||

|

Carlsbad

Corporate Center

|

Carlsbad

|

121,528 | 12,153 | 85.86 | % | 17.60 | |||||||||||

|

Subtotal

|

695,950 | 163,427 | 93.19 | % | $ | 21.15 | |||||||||||

|

Orange County, California

|

|||||||||||||||||

|

South

Coast Executive Center

|

Costa

Mesa

|

61,025 | 6,102 | 49.05 | % | $ | 26.53 | ||||||||||

|

Savi

Tech Center

|

Yorba

Linda

|

372,327 | 37,233 | 96.98 | % | 19.02 | |||||||||||

|

Yorba

Linda Business Park

|

Yorba

Linda

|

166,042 | 16,604 | 93.88 | % | 11.50 | |||||||||||

|

Subtotal

|

599,394 | 59,939 | 91.24 | % | $ | 17.29 | |||||||||||

|

Los Angeles, California

|

|||||||||||||||||

|

Gateway

Corporate Center

|

San

Gabriel Valley

|

85,216 | 8,522 | 88.51 | % | $ | 26.55 | ||||||||||

|

Total

Portfolio

|

4,326,194 | 2,526,736 | 85.45 | % | $ | 26.71 | |||||||||||

1

Annualized Rent per Square Foot represents annualized gross rent divided by

occupied square feet excluding leases signed but not commenced as of September

30, 2009. The gross rent amount used in the calculation of Annualized

Rent per Square Foot was derived using monthly base rental revenue and tenant

reimbursements as of September 30, 2009.

23

Pacific

Office Properties Trust, Inc.

(for the

three months ended, September 30, 2009)

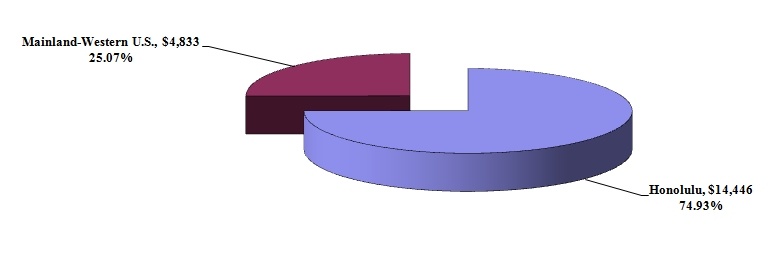

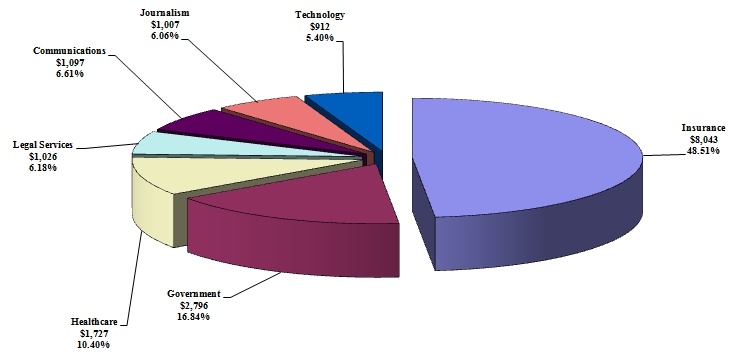

Total Revenue (1)

(unaudited

and in thousands, except percentages)

|

1

Total revenue amounts used herein are comprised of rental revenue, tenant

reimbursements, parking, interest and other revenue of the Company and of

the Company’s unconsolidated joint ventures multiplied by the Company’s

ownership interest in each respective joint venture for the three months

ended September 30, 2009.

|

24

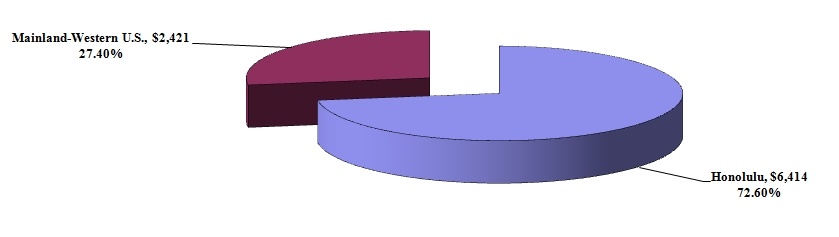

Pacific

Office Properties Trust, Inc.

(for the

three months ended, September 30, 2009)

Total Net Operating Income

(1)

(unaudited

and in thousands, except percentages)

|

1

Total net operating income amounts used herein were derived

using the combined rental revenue, tenant reimbursements, parking,

interest and other revenue less operating expenses of the Company and of

the Company’s unconsolidated joint ventures multiplied by the Company’s

ownership interest in each respective joint venture for the three months

ended September 30, 2009.

|

25

Pacific

Office Properties Trust, Inc.

(as of,

and for the three months ended, September 30,

2009)

Leasing Activity

Reconciliation

|

Total

|

Consolidated

|

Unconsolidated

Joint

|

||||||||||

|

Property

Portfolio

|

Properties

|

Venture

Properties

|

||||||||||

|

Occupancy

(as of September 30, 2009)

|

||||||||||||

|

%

Leased

|

85.45 | % | 84.79 | % | 86.17 | % | ||||||

|

%

Occupied

|

83.83 | % | 82.14 | % | 85.69 | % | ||||||

|

Cash

Rent Growth

|

||||||||||||

|

Expiring

Rate

|

$ | 22.42 | $ | 26.23 | $ | 14.66 | ||||||

|

New/Renewal

Rate

|

$ | 25.96 | $ | 31.87 | $ | 13.96 | ||||||

|

Increase

|

15.83 | % | 21.51 | % | -4.82 | % | ||||||

|

Gross

New Leasing Activity

|

||||||||||||

|

Rentable

square feet

|

85,211 | 75,828 | 9,383 | |||||||||

|

Number

of leases

|

38 | 33 | 5 | |||||||||

|

Gross

Renewal Leasing Activity

|

||||||||||||

|

Rentable

square feet

|

70,847 | 31,208 | 39,639 | |||||||||

|

Number

of leases

|

22 | 11 | 11 | |||||||||

|

Average

Lease Term in Months

|

||||||||||||

|

New

leases

|

84 | 90 | 31 | |||||||||

|

Renewal

leases

|

34 | 41 | 28 | |||||||||

|

Blended

|

61 | 76 | 29 | |||||||||

|

Weighted

Average Tenant Improvements per square foot

|

||||||||||||

|

New

leases

|

$ | 35.89 | $ | 40.25 | $ | 0.64 | ||||||

|

Renewal

leases

|

$ | 0.63 | $ | 1.41 | $ | 0.01 | ||||||

|

Blended

|

$ | 19.88 | $ | 28.93 | $ | 0.13 | ||||||

26

Pacific

Office Properties Trust, Inc.

(as of

September 30, 2009)

Top Tenants by Rental

Revenue – Consolidated Properties

(unaudited

and in thousands, except square feet)

|

Tenant

|

Lease

Expiration

|

Market

Rentable

Square

Feet

|

Annualized

Rental

Revenue(1)

|

Property

|

Industry

|

||||||

|

First

Insurance Company of Hawaii Ltd.

|

02/28/18

|

109,755 | $ | 3,974 |

First

Insurance Center

|

Insurance

|

|||||

|

Hawaii

Insurance Consultants, Ltd

|

12/31/12

|

79,159 | 3,231 |

Waterfront

Plaza

|

Insurance

|

||||||

|

AZ

Dept of Economic Security

|

12/31/12

|

104,059 | 1,975 |

City

Square

|

Government

|

||||||

|

Straub

Clinic & Hospital

|

01/31/13

|

55,986 | 1,727 |

First

Insurance Center

|

Healthcare

|

||||||

|

AT&T

Corp.

|

06/30/10

|

26,160 | 1,097 |

Waterfront

Plaza

|

Communications

|

||||||

|

McCorriston,

Miho, Miller, Mukai, LLP

|

12/31/11

|

35,828 | 1,025 |

Waterfront

Plaza

|

Legal

Services

|

||||||

|

Oahu

Publications, Inc.

|

01/31/13

|

25,691 | 1,007 |

Waterfront

Plaza

|

Journalism

|

||||||

|

Fujitsu

Transaction Solutions, Inc.

|

12/31/10

|

37,886 | 912 |

Sorrento

Technology Center

|

Technology

|

||||||

|

Royal

State Financial Corp.

|

10/31/11

|

22,119 | 839 |

Pan

Am Building

|

Insurance

|

||||||

|

AZ

DES- Social Security

|

05/31/14

|

39,524 | 821 |

City

Square

|

Government

|

||||||

|

Total

Annualized Rental Revenue for Top Ten Tenants – Consolidated

Properties

|

$ | 16,608 | |||||||||

|

Total

Annualized Rental Revenue – Consolidated Properties(2)

|

$ | 57,456 | |||||||||

1

Annualized Rental Revenue represents monthly base rental revenue and tenant

reimbursements as of September 30, 2009, on an annualized

basis.

2 Total

Annualized Rental Revenue – Consolidated Properties was derived based on

annualizing the rental revenues and tenant reimbursements of the Company for the

three months ended September 30, 2009.

27

Pacific

Office Properties Trust, Inc.

(as of

September 30, 2009)

|

1

Rental Revenue amounts used herein were derived using base rental revenue

and tenant reimbursements of the Company for the three months ended

September 30, 2009.

|

28

Pacific

Office Properties Trust, Inc.

(as of

September 30, 2009)

Top Tenants by Rental

Revenue – Unconsolidated Joint Venture Properties

(unaudited

and in thousands, except square feet and percentages)

|

Tenant

|

Lease

Expiration

|

Market

Rentable

Square

Feet

|

Ownership

Interest %

|

Annualized

Rental Revenue(1)

|

Property

|

Industry

|

|||||||||

|

CareFusion

Corp.

|

02/28/15

|

130,000 | 10.00 | % | $ | 2,679 |

Savi

Tech Center

|

Healthcare

|

|||||||

|

Nobel

Biocare USA, Inc.

|

10/31/17

|

122,361 | 10.00 | % | 2,345 |

Savi

Tech Center

|

Healthcare

|

||||||||

|

Bank

of Hawaii

|

01/31/38

|

6,971 | 17.50 | % | 1,912 |

Bank

of Hawaii Waikiki Center

|

Financial

Services

|

||||||||

|

High-Tech

Institute, Inc.

|

04/04/18

|

92,974 | 17.50 | % | 1,541 |

Black

Canyon Corporate Center

|

Education

|

||||||||

|

JTB

Hawaii, Inc.

|

12/31/12

|

35,623 | 17.50 | % | 1,261 |

Bank

of Hawaii Waikiki Center

|

Tourism

|

||||||||

|

Valley

Metro Rail, Inc.

|

06/30/16

|

57,007 | 7.50 | % | 1,256 |

U.S.

Bank Center

|

Transportation

|

||||||||

|

Jacobs

Engineering Group, Inc.

|

10/31/11

|

53,717 | 7.50 | % | 1,168 |

U.S.

Bank Center

|

Engineering

|

||||||||

|

General

Atomics Aeronautical Systems Inc

|

05/31/15

|

112,000 | 10.00 | % | 1,048 |

Poway

Flex

|

Aerospace

|

||||||||

|

Ashley

Furniture Homestore

|

09/30/16

|

61,541 | 10.00 | % | 966 |

Savi

Tech Center

|

Retail

|

||||||||

|

Paychex

North America, Inc.

|

06/30/12

|

48,427 | 17.50 | % | 946 |

Black

Canyon Corporate Center

|

Business

Services

|

||||||||

|

Total

Annualized Rental Revenue for Top Ten Tenants –

Unconsolidated

Joint Venture Properties

|

$ | 15,122 | |||||||||||||

|

Total

Annualized Rental Revenue – Unconsolidated Joint Venture Properties(2)

|

$ | 39,402 | |||||||||||||

1 Annualized Rental Revenue represents

monthly aggregate base rental revenue and tenant reimbursements per property as

of September 30, 2009, on an annualized basis.

2 Total

Annualized Rental Revenue – Unconsolidated Joint Venture Properties was derived

based on annualizing the rental revenues and tenant reimbursements of the

Company’s unconsolidated joint venture properties for the three months ended

September 30, 2009.

29

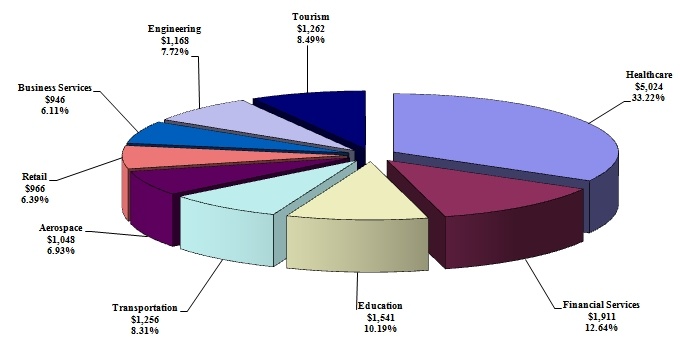

Pacific

Office Properties Trust, Inc.

(as of

September 30, 2009)

Top Tenant Industry

Diversification by Rental Revenue – Unconsolidated Joint Venture

Properties(1)

(unaudited

and in thousands, except percentages)

|

1

Rental Revenue amounts used herein were derived using base rental revenue

and tenant reimbursements of the Company’s unconsolidated joint ventures

for the three months ended September 30,

2009.

|

30

Pacific

Office Properties Trust, Inc.

(as of

September 30, 2009)

Lease Expirations –

Consolidated Properties(1)

|

Year

of Lease Expiration

|

Number

of Leases Expiring

|

Market

Rentable Square Feet

|

Expiring

Square Feet as a % of Total

|

Annualized Rent(1)(2)

|

Annualized

Rent as a % of Total

|

Annualized Rent Per Leased

Square Foot(3)

|

Annualized

Rent at Expiration

|

Annualized Rent per Square Foot

at Expiration(4)

|

||||||||||||||||||||||||

|

2009

|

77 | 102,930 | 4.54 | % | $ | 3,025,884 | 5.27 | % | $ | 29.40 | $ | 2,985,012 | $ | 29.00 | ||||||||||||||||||

|

2010

|

134 | 321,870 | 14.21 | % | 10,516,104 | 18.30 | % | 32.67 | 10,594,536 | 32.92 | ||||||||||||||||||||||

|

2011

|

156 | 329,670 | 14.55 | % | 10,044,708 | 17.48 | % | 30.47 | 10,349,088 | 31.39 | ||||||||||||||||||||||

|

2012

|

129 | 402,635 | 17.77 | % | 12,340,608 | 21.48 | % | 30.65 | 12,703,632 | 31.55 | ||||||||||||||||||||||

|

2013

|

86 | 265,739 | 11.73 | % | 8,032,944 | 13.98 | % | 30.23 | 7,757,220 | 29.19 | ||||||||||||||||||||||

|

2014

|

52 | 152,844 | 6.75 | % | 4,620,024 | 8.04 | % | 30.23 | 4,906,692 | 32.10 | ||||||||||||||||||||||

|

2015

|

18 | 68,662 | 3.03 | % | 1,709,484 | 2.98 | % | 24.90 | 1,822,392 | 26.54 | ||||||||||||||||||||||

|

2016

|

18 | 47,859 | 2.11 | % | 1,705,416 | 2.97 | % | 35.63 | 1,925,892 | 40.24 | ||||||||||||||||||||||

|

2017

|

5 | 20,733 | 0.92 | % | 580,666 | 1.01 | % | 28.01 | 672,120 | 32.42 | ||||||||||||||||||||||

|

2018

|

17 | 125,992 | 5.56 | % | 4,570,932 | 7.95 | % | 36.28 | 5,332,176 | 42.32 | ||||||||||||||||||||||

|

Thereafter

|