Attached files

| file | filename |

|---|---|

| EX-31.2 - CHINA ELECTRIC MOTOR, INC. | v167370_ex31-2.htm |

| EX-31.1 - CHINA ELECTRIC MOTOR, INC. | v167370_ex31-1.htm |

| EX-10.1 - CHINA ELECTRIC MOTOR, INC. | v167370_ex10-1.htm |

| EX-32.1 - CHINA ELECTRIC MOTOR, INC. | v167370_ex32-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form 10-Q

|

x

|

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

|

For

the Quarterly Period Ended September 30, 2009

OR

|

o

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

|

For

the transition period

from to

Commission

File No.: 000-53017

CHINA

ELECTRIC MOTOR, INC.

(Exact

name of Registrant as specified in its charter)

|

Delaware

|

26-1357787

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(I.R.S.

Employer

Identification

Number)

|

Sunna

Motor Industry Park, Jian’an, Fuyong Hi-Tech Park, Baoan District, Shenzhen,

Guangdong,

People’s

Republic of China

(ADDRESS

OF PRINCIPAL EXECUTIVE OFFICES)(ZIP CODE)

86-0755-8149969

(COMPANY’S

TELEPHONE NUMBER, INCLUDING AREA CODE)

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant

was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes x

No o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such

files). Yes o

No o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer or a smaller reporting

company. See definitions of “large accelerated filer,” “accelerated

filer” and “smaller reporting company” as defined in Rule 12b-2 of the Exchange

Act.

|

Large

accelerated filer o

|

Accelerated

filer o

|

|

Non-accelerated

filer x

|

Smaller

reporting company o

|

Indicate

by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act). Yes o

No x

The

registrant had 14,083,030 shares of common stock, par value $0.0001 per share,

outstanding as of November 20, 2009 (taking into account the reverse stock

split, as described below).

EXPLANATORY

NOTE

On

October 8, 2009, the Company’s Board of Directors and stockholders approved an

amendment to its Certificate of Incorporation to effect a 1-for-1.53846153846154

reverse stock split of all of its issued and outstanding shares of common stock

(the “Reverse Stock Split”). To effect the Reverse Stock Split, the Company will

file the amendment to the Certificate of Incorporation with the Secretary of the

State of Delaware, which will not be done sooner than 20 days after the Company

mails a definitive information statement on Schedule 14C to the Company’s

stockholders. The Reverse Stock Split will occur immediately prior to the

closing of the public offering that the Company proposes to complete in

accordance with the registration statement on Form S-1 as filed with the SEC

(File No. 333-162459). The par value and number of authorized shares

of the Company’s common stock will remain unchanged. All references to number of

shares and per share amounts included in this Form 10-Q gives effect to the

Reverse Stock Split. The number of shares and per share amounts included in the

consolidated financial statements and the accompanying notes have been adjusted

to reflect the Reverse Stock Split retroactively. Unless otherwise indicated,

all outstanding shares and earnings per share information contained in this

report gives effect to the Reverse Stock Split.

CHINA

ELECTRIC MOTOR, INC.

FORM 10-Q

For

the Quarterly Period Ended September 30, 2009

INDEX

|

Page

|

||||

|

Part I

|

Financial

Information

|

|||

|

Item

1.

|

Financial

Statements

|

2

|

||

|

(a)

|

Consolidated

Balance Sheets as of September 30, 2009 (Unaudited) and December 31,

2008

|

2

|

||

|

(b)

|

Consolidated

Statements of Operations for the Three and Nine Months Ended September 30,

2009 and 2008 (Unaudited)

|

3

|

||

|

(c)

|

Consolidated

Statements of Cash Flows for the Nine Months Ended September 30, 2009 and

2008 (Unaudited)

|

4

|

||

|

(d)

|

Consolidated

Statements of Changes in Stockholders’ Equity and Comprehensive Income for

the Nine Months Ended September 30, 2009 (Unaudited)

|

5

|

||

|

(e)

|

Notes

to Financial Statements (Unaudited)

|

6

|

||

|

Item

2.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

23

|

||

|

Item

3.

|

Quantitative

and Qualitative Disclosures About Market Risk

|

31

|

||

|

Item

4.

|

Controls

and Procedures

|

32

|

||

|

Part II

|

Other

Information

|

|||

|

Item

1.

|

Legal

Proceedings

|

32

|

||

|

Item

1A.

|

Risk

Factors

|

32

|

||

|

Item

2.

|

Unregistered

Sale of Equity Securities and Use of Proceeds

|

32

|

||

|

Item

3.

|

Default

Upon Senior Securities

|

32

|

||

|

Item

4.

|

Submission

of Matters to a Vote of Security Holders

|

32

|

||

|

Item

5.

|

Other

Information

|

32

|

||

|

Item

6.

|

Exhibits

|

32

|

||

|

Signatures

|

33

|

|||

1

Part I.

Financial Information

Item

1. Financial Statements

China

Electric Motor, Inc. and Subsidiaries

Consolidated

Balance Sheets

(In US

Dollars)

|

September 30,

|

December 31,

|

|||||||

|

2009

|

2008

|

|||||||

|

ASSETS:

|

(Unaudited)

|

|||||||

|

Current

Assets:

|

||||||||

|

Cash

and cash equivalents

|

$ | 6,459,094 | $ | 2,655,808 | ||||

|

Accounts

receivable, net (Note 3)

|

7,828,010 | 5,239,785 | ||||||

|

Inventories

(Note 4)

|

7,241,415 | 7,293,544 | ||||||

|

Other

receivables and prepaid expense

|

90,265 | 15,103 | ||||||

|

Total

current assets

|

21,618,784 | 15,204,240 | ||||||

|

Property

and equipment, net (Note 5)

|

8,066,874 | 2,770,782 | ||||||

|

Total

Assets

|

$ | 29,685,658 | $ | 17,975,022 | ||||

|

LIABILITIES

AND STOCKHOLDERS' EQUITY

|

||||||||

|

Current

Liabilities:

|

||||||||

|

Accounts

payable-trade

|

$ | 2,068,268 | $ | 2,309,026 | ||||

|

Accrued

merger costs

|

244,000 | - | ||||||

|

Short-term

note payable (Note 16)

|

333,557 | - | ||||||

|

Accrued

liabilities and other payable

|

150,000 | 240,130 | ||||||

|

Various

taxes payable (Note 8)

|

33,156 | 39,972 | ||||||

|

Wages

payable

|

358,043 | 295,367 | ||||||

|

Corporate

tax payable (Note 8)

|

849,864 | 469,435 | ||||||

|

Due

to director (Note 6)

|

1,569,720 | 1,339,337 | ||||||

|

Total

Current Liabilities

|

5,606,608 | 4,693,267 | ||||||

|

Commitments

and Contingencies (Note 9)

|

- | - | ||||||

|

Stockholders'

Equity:

|

||||||||

|

Preferred

stock, $0.0001 par value, 10,000,000 shares authorized, none

issued

|

- | - | ||||||

|

Common

stock, $0.0001 par value, 100,000,000 shares authorized,

13,314,042

|

||||||||

|

shares

and 10,679,260 shares issued and outstanding at September 30, 2009

and

|

||||||||

|

December

31, 2008, respectively. (Notes 1 and 13)

|

1,331 | 1,068 | ||||||

|

Additional

paid-in capital

|

2,755,481 | 158,271 | ||||||

|

Accumulated

other comprehensive income

|

952,119 | 1,089,032 | ||||||

|

Statutory

surplus reserve fund (Note 7)

|

1,177,075 | 1,177,075 | ||||||

|

Retained

earnings (unrestricted)

|

19,193,044 | 10,856,309 | ||||||

|

Total

Stockholders' Equity

|

24,079,050 | 13,281,755 | ||||||

|

Total

Liabilities and Stockholders' Equity

|

$ | 29,685,658 | $ | 17,975,022 | ||||

The

accompanying notes are an integral part of these consolidated financial

statements.

2

China

Electric Motor, Inc. and Subsidiaries

Consolidated

Statements of Operations

(In

US Dollars)

(Unaudited)

|

For the Three Months Ended

|

For the Nine Months Ended

|

|||||||||||||||

|

September 30,

|

September 30,

|

|||||||||||||||

|

2009

|

2008

|

2009

|

2008

|

|||||||||||||

|

Sales

|

$ | 22,081,199 | $ | 14,163,197 | $ | 63,293,729 | $ | 39,049,862 | ||||||||

|

Cost

of Goods Sold

|

(15,598,052 | ) | (10,205,436 | ) | (45,460,910 | ) | (28,102,994 | ) | ||||||||

|

Gross

Profit

|

6,483,147 | 3,957,761 | 17,832,819 | 10,946,868 | ||||||||||||

|

Operating

Costs and Expenses:

|

||||||||||||||||

|

Selling

expenses

|

1,128,845 | 708,782 | 3,169,799 | 2,010,820 | ||||||||||||

|

Bad

debts recovery

|

(3,246 | ) | - | (3,246 | ) | - | ||||||||||

|

Merger

costs

|

- | - | 938,152 | - | ||||||||||||

|

Research

and development

|

476,124 | 275,479 | 1,264,119 | 703,201 | ||||||||||||

|

Depreciation

(Note 5)

|

5,187 | 5,577 | 15,991 | 17,209 | ||||||||||||

|

General

and administrative

|

807,849 | 296,206 | 1,682,738 | 835,909 | ||||||||||||

|

Total

operating costs and expenses

|

2,414,759 | 1,286,044 | 7,067,553 | 3,567,139 | ||||||||||||

|

Income

From Operations

|

4,068,388 | 2,671,717 | 10,765,266 | 7,379,729 | ||||||||||||

|

Other

income (expense)

|

||||||||||||||||

|

Interest

income

|

6,989 | 449 | 19,869 | 2,156 | ||||||||||||

|

Imputed

interest (Notes 6 and 16)

|

(35,648 | ) | (3,778 | ) | (69,680 | ) | (13,227 | ) | ||||||||

|

Sundry

income (expense), net

|

2,966 | (30 | ) | 2,856 | (2,867 | ) | ||||||||||

|

Total

other income (expense)

|

(25,693 | ) | (3,359 | ) | (46,955 | ) | (13,938 | ) | ||||||||

|

Income

before income taxes

|

4,042,695 | 2,668,358 | 10,718,311 | 7,365,791 | ||||||||||||

|

Provision

for income taxes (Note 8)

|

(849,552 | ) | (481,608 | ) | (2,381,576 | ) | (1,329,169 | ) | ||||||||

|

Net

income

|

$ | 3,193,143 | $ | 2,186,750 | $ | 8,336,735 | $ | 6,036,622 | ||||||||

|

Basic

earnings per share

|

$ | 0.25 | $ | 0.20 | $ | 0.71 | $ | 0.57 | ||||||||

|

Weighted

average shares outstanding-basic

|

12,926,571 | 10,679,260 | 11,788,790 | 10,679,260 | ||||||||||||

|

Diluted

earnings per share

|

$ | 0.24 | $ | 0.20 | $ | 0.69 | $ | 0.57 | ||||||||

|

Weighted

average shares outstanding-diluted

|

13,553,465 | 10,679,260 | 12,128,645 | 10,679,260 | ||||||||||||

The

accompanying notes are an integral part of these consolidated financial

statements.

3

China

Electric Motor, Inc. and Subsidiaries

Consolidated

Statements of Cash Flows

(In

US Dollars)

(Unaudited)

|

For the Nine Months Ended

|

||||||||

|

September 30,

|

||||||||

|

2009

|

2008

|

|||||||

|

Cash

Flows From Operating Activities:

|

||||||||

|

Net

income

|

$ | 8,336,735 | $ | 6,036,622 | ||||

|

Adjustments

to reconcile net income to net cash provided by operating

activities:

|

||||||||

|

Shares

issued for legal service

|

148,720 | - | ||||||

|

Imputed

interest expense

|

69,680 | 13,227 | ||||||

|

Bad

debt recovery

|

(3,246 | ) | - | |||||

|

Depreciation

|

479,417 | 381,144 | ||||||

|

Changes

in operating assets and liabilities:

|

||||||||

|

(Increase)

decrease in -

|

||||||||

|

Accounts

receivable – trade

|

(2,584,979 | ) | (2,555,544 | ) | ||||

|

Inventories

|

52,129 | (1,311,501 | ) | |||||

|

Prepaid

expenses and other receivables

|

(75,162 | ) | 284 | |||||

|

Increase

(decrease) in -

|

||||||||

|

Accounts

payable

|

(240,758 | ) | 1,234,214 | |||||

|

Accrued

merger costs

|

244,000 | - | ||||||

|

Accrued

liabilities and other payable

|

(90,130 | ) | 6,612 | |||||

|

Various

taxes payable

|

(6,816 | ) | (75,642 | ) | ||||

|

Wages

payable

|

62,676 | 86,907 | ||||||

|

Corporate

tax payable

|

380,429 | 363,089 | ||||||

|

Net

cash provided by operating activities

|

6,772,695 | 4,179,412 | ||||||

|

Cash

Flows From Investing Activities:

|

||||||||

|

Purchases

of property and equipment

|

(5,772,362 | ) | (406,871 | ) | ||||

|

Net

cash used in investing activities

|

(5,772,362 | ) | (406,871 | ) | ||||

|

Cash

Flows From Financing Activities:

|

||||||||

|

Proceeds

from (repayment of) short-term loans

|

333,557 | (164,520 | ) | |||||

|

Net

proceeds from sale of common shares

|

2,379,073 | - | ||||||

|

Dividends

paid

|

- | (2,088,600 | ) | |||||

|

Increase

(decrease) due to related parties

|

230,383 | (150,390 | ) | |||||

|

Net

cash provided by (used in) financing activities

|

2,943,013 | (2,403,510 | ) | |||||

|

Effect

of exchange rate changes on cash and cash equivalents

|

(140,060 | ) | 468,142 | |||||

|

Increase

in cash and cash equivalents

|

3,803,286 | 1,837,173 | ||||||

|

Cash

and cash equivalents, beginning of period

|

2,655,808 | 1,588,778 | ||||||

|

Cash

and cash equivalents, end of period

|

$ | 6,459,094 | $ | 3,425,951 | ||||

|

Supplemental

disclosure information:

|

||||||||

|

Income

taxes paid

|

$ | 380,429 | $ | 981,179 | ||||

|

Interest

expense paid

|

$ | - | $ | - | ||||

The

accompanying notes are an integral part of these consolidated financial

statements.

4

China

Electric Motor, Inc. and Subsidiaries

Consolidated

Statements of Changes in Stockholders’ Equity and Comprehensive

Income

For the

Nine Months Ended September 30, 2009

(In US

Dollars)

(Unaudited)

|

Accumulated

|

||||||||||||||||||||||||||||||||

|

Additional

|

Other

|

Statutory

|

Retained

|

Total

|

||||||||||||||||||||||||||||

|

Common Stock

|

Paid-in

|

Comprehensive

|

Reserve

|

Earnings

|

Stockholders'

|

Comprehensive

|

||||||||||||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Income

|

Fund

|

(Unrestricted)

|

Equity

|

Income

|

|||||||||||||||||||||||||

|

Balance

at December 31, 2008

|

10,679,260 | $ | 1,068 | $ | 158,271 | $ | 1,089,032 | $ | 1,177,075 | $ | 10,856,309 | $ | 13,281,755 | $ | ||||||||||||||||||

|

Reverse

merger adjustment

|

1,352,003 | 135 | (135 | ) | - | - | - | - | ||||||||||||||||||||||||

|

Shares

issued for legal service

|

- | - | 148,720 | - | - | - | 148,720 | |||||||||||||||||||||||||

|

Sale

of common shares

|

1,282,779 | 128 | 2,378,945 | - | - | - | 2,379,073 | |||||||||||||||||||||||||

|

Imputed

interest

|

- | - | 69,680 | - | - | - | 69,680 | |||||||||||||||||||||||||

|

Net

income

|

- | - | - | - | - | 8,336,735 | 8,336,735 | $ | 8,336,775 | |||||||||||||||||||||||

|

Foreign

currency translation

|

- | - | - | (136,913 | ) | - | - | (136,913 | ) | (136,913 | ) | |||||||||||||||||||||

|

Comprehensive

income

|

- | - | - | - | - | - | - | $ | 8,199,822 | |||||||||||||||||||||||

|

Balance

September 30, 2009

|

13,314,042 | $ | 1,331 | $ | 2,755,481 | $ | 952,119 | $ | 1,177,075 | $ | 19,193,044 | $ | 24,079,050 | |||||||||||||||||||

The

accompanying notes are an integral part of these consolidated financial

statements.

5

China Electric

Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three months and nine months ended September 30,

2009 and 2008 are unaudited)

NOTE

1 – DESCRIPTION OF BUSINESS AND ORGANIZATION

China

Electric Motor, Inc. (“China Electric”, formerly SRKP 21, Inc.) was incorporated

in the State of Delaware on October 11, 2007. China Electric was originally

organized as a “blank check” shell company to investigate and acquire a target

company or business seeking the perceived advantages of being a publicly held

corporation. On May 6, 2009, China Electric (i) closed a share exchange

transaction pursuant to which SRKP 21 became the 100% parent of Attainment

Holdings Limited (“Attainment”), (ii) assumed the operations of Attainment and

its subsidiaries, including Luck Loyal International Investment Limited ("Luck

Loyal") and Shenzhen YuePengCheng Motor Co., Ltd (“YuePengCheng”), and (iii)

changed its name from SRKP 21, Inc. to China Electric Motor, Inc.

Attainment

is a holding company incorporated in the British Virgin Islands (“BVI”) on July

28, 2008. Attainment had 50,000 capital shares authorized with $1.00

par value and one share issued and outstanding. The sole shareholder

of Attainment was Excel Profit Global Group Limited (“Excel Profit”), which in

turn solely owned by Mr. To Chau Sum, a Hong Kong citizen.

Luck

Loyal is a holding company incorporated in Hong Kong (“HK”) on October 15,

2004. Luck Loyal had 10,000 shares authorized with one Hong Kong

Dollar (“HKD”) par value and one share issued and outstanding. The

sole shareholder of Luck Loyal is Attainment.

YuePengCheng

was incorporated in the City of Shenzhen of the People’s Republic of China

(“PRC”) on November 19, 1999. YuePengCheng mainly engages in

production, marketing, sales and research and development of specialized

micro-motor products for the domestic and international market.

Shenzhen

YuePengDa Development Enterprises (“YuePengDa”), a company owned by the son of

Ms. Jianrong Li, a director of YuePengCheng and Luck Loyal (the “Director”), and

Taiwan Qiling Shashi Enterprises (“Qiling”), a company owned by a relative of

the Director, were the original owners of YuePengCheng and held 75% and 25% of

the total interest of YuePengCheng, respectively.

In

November 2007, the Director caused Luck Loyal to enter into an ownership

transfer agreement with Qiling. Pursuant to the agreement, Qiling transferred

its 25% interest in YuePengCheng to Luck Loyal at a price of Chinese Renminbi

(“RMB”) 2.5 million. In September 2008, in order to implement a capital

restructuring program, the Director had Luck Loyal acquire the remaining 75%

ownership of YuePengCheng from YuePengDa under an ownership transfer agreement.

Pursuant to the agreement, Luck Loyal paid YuePengDa RMB 7.5 million for the

ownership transfer. Thereafter, Luck Loyal became the sole owner of

YuePengCheng. Since these transactions were effected by parties under

common control, the Company accounted for them as similar to a pooling of

interest transaction, with a retroactive reduction in additional paid-in capital

for the payments to the former owner, and the recording of a corresponding

liability.

The

Director agreed to convert the debts owed to her of RMB 7.5 million and RMB 2.5

million (approximately $1.3 million) into shares of the Company’s common stock

on the effective date of the public offering, with the conversion price to be

equal to the per share price of the shares sold in the Company’s public

offering.

For

accounting purpose, this transaction is being accounted as business combination

of entities under common control and the historical financial statements include

the operations of YuePengCheng for all periods presented.

China

Electric and its subsidiaries – Attainment, Luck Loyal and YuePengCheng are

collectively referred throughout as the “Company.”

6

China Electric

Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three months and nine months ended September 30,

2009 and 2008 are unaudited)

NOTE

1 – DESCRIPTION OF BUSINESS AND ORGANIZATION (continued)

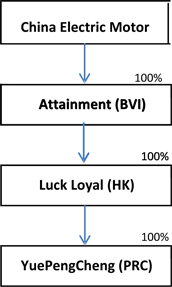

To

summarize the paragraphs above, the organization and ownership structure of the

Company is currently as follows:

Share

Exchange

On March

3, 2009, China Electric Motor, Inc. (the “Company”) (formerly known as “SRKP 21,

Inc.”) entered into a Share Exchange Agreement with Attainment Holdings, Excel

Profit as the sole shareholder of Attainment Holdings, and as to certain

portions of the agreement, certain designees. Pursuant to the Share

Exchange Agreement, as it was amended on May 6, 2009 (the “Exchange Agreement”),

SRKP 21 agreed to issue an aggregate of 10,679,260 shares of its common stock in

exchange for all of the issued and outstanding securities of Attainment Holdings

(the “Share Exchange”). The Share Exchange closed on May 6, 2009. The

10,679,260 shares of common stock issued to the stock holders of Attainment in

conjunction with the share exchange transaction have been presented as

outstanding for all periods.

Upon the

closing of the Share Exchange, the Company issued an aggregate of 10,679,260

shares of its common stock to Excel Profit and the designees in exchange for all

of the issued and outstanding securities of Attainment Holdings. Prior to

the closing of the Share Exchange, the stockholders of the Company canceled an

aggregate of 3,260,659 shares held by them such that there were 1,352,003 shares

of common stock outstanding immediately prior to the Share Exchange. The

Company’s stockholders also canceled an aggregate of 3,985,768 warrants to

purchase shares of common stock such that the stockholders held an aggregate of

626,894 warrants immediately after the Share Exchange. Immediately after

the closing of the Share Exchange, the Company had 12,031,263 outstanding shares

of common stock, no shares of Preferred Stock, no options, and warrants to

purchase 626,894 shares of common stock.

For

accounting purposes, this transaction is being accounted for as a reverse

merger. The transaction has been treated as a recapitalization of Attainment

Holdings and its subsidiaries, with China Electric Motor (the legal

acquirer of Attainment and its subsidiaries including YuePengCheng) considered

the accounting acquiree and YuePengCheng , the only operating company, and whose

management took control of China Electric Motor (the legal acquiree of

YuePengCheng) is considered the accounting acquirer. The Company did

not recognize goodwill or any intangible assets in connection with the

transaction. The 10,679,260 shares of common stock issued to the

shareholder of Attainment and its designees in conjunction with the share

exchange transaction have been presented as outstanding for all periods. The

10,679,260 shares of common stock issued to the stockholders of Attainment in

conjunction with the share exchange transaction have been presented as

outstanding for all periods. The historical consolidated financial statements

include the operations of the accounting acquirer for all periods

presented.

On

October 8, 2009, the Company’s Board of Directors authorized a 1-for-1.5384615

reverse stock split of the Company's outstanding shares of common stock (the

“Reverse Stock Split”). References to shares in the consolidated financial

statements and the accompanying notes, including, but not limited to, the number

of shares and per share amounts, have been adjusted to reflect the Reverse Stock

Split on a retroactive basis.

7

China Electric

Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three months and nine months ended September 30,

2009 and 2008 are unaudited)

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

|

a.

|

Basis

of Preparation

|

The

interim consolidated financial statements are unaudited and have been prepared

by the Company in accordance with U.S. GAAP for interim financial information

and the instructions to Form 10-Q and Article 10 of Regulation SX. Accordingly,

they do not include all of the information and footnotes required by generally

accepted accounting principles for complete financial statements. These interim

consolidated financial statements should be read in conjunction with the

consolidated financial statements of the Company for the year ended December 31,

2008 and notes thereto contained in the Registration Statement on Form

S-1/A of the Company as filed with the United States Securities and Exchange

Commission (the “SEC”) on October 19, 2009. Interim results are not necessarily

indicative of the results for the full year.

The

parent only financial statements reflect nominal assets and operations

consistent with the disclosure that all assets and operations are conducted in

China, and that the only significant transactions at the parent level are

capital transactions, intercompany transactions, and equity accounting

transactions to account for the parent’s 100% ownership of its operations in

China. See the Registration Statement on Form S-1/A of the Company as filed with

the United States Securities and Exchange Commission (the “SEC”) on October 19,

2009 for further information.

In the

opinion of the management, the interim consolidated financial statements reflect

all adjustments of a normal recurring nature necessary for a fair statement of

the results for interim periods.

|

b.

|

Basis

of Consolidation

|

The

consolidated financial statements include the accounts of the Company and its

subsidiaries. Intercompany transactions have been eliminated in

consolidation.

|

c.

|

Use

of Estimates

|

The

preparation of financial statements in conformity with generally accepted

accounting principles requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities, disclosure of contingent

assets and liabilities at the date of the financial statements, and the reported

amounts of revenues and expenses during the reporting year. Because of the use

of estimates inherent in the financial reporting process, actual results could

differ from those estimates.

|

d.

|

Fair

Values of Financial Instruments

|

US GAAP

requires certain disclosures about the fair value of financial instruments. The

Company defines fair value, using the required three-level valuation hierarchy

for disclosures of fair value measurement the enhanced disclosures requirements

for fair value measures. Current assets and current liabilities qualified as

financial instruments and management believes their carrying amounts are a

reasonable estimate of fair value because of the short period of time between

the origination of such instruments and their expected realization and if

applicable, their current interest rate is equivalent to interest rates

currently available. The three levels are defined as

follows:

|

·

|

Level

1 — inputs to the valuation methodology are quoted prices (unadjusted) for

identical assets or liabilities in active markets.

|

|

|

·

|

Level

2 — inputs to the valuation methodology include quoted prices for similar

assets and liabilities in active markets, and inputs that are observable

for the assets or liability, either directly or indirectly, for

substantially the full term of the financial

instruments.

|

|

|

·

|

Level

3 — inputs to the valuation methodology are unobservable and significant

to the fair value.

|

As of the

balance sheet date, the estimated fair values of the financial instruments were

not materially different from their carrying values as presented due to the

short maturities of these instruments and that the interest rates on the

borrowings approximate those that would have been available for loans of similar

remaining maturity and risk profile at respective period-ends. Determining which

category an asset or liability falls within the hierarchy requires significant

judgment. The Company evaluates the hierarchy disclosures each

quarter.

8

China

Electric Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three months and nine months ended September 30,

2009 and 2008 are unaudited)

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

|

e.

|

Cash

and Cash Equivalents

|

Cash and

cash equivalents include cash on hand, demand deposits with banks and liquid

investments with an original maturity of three months or less.

|

f.

|

Accounts

Receivable

|

Accounts

receivables are recognized and carried at original invoiced amount less an

allowance for uncollectible accounts, as needed.

The

Company uses an aging method to estimate the valuation allowance for anticipated

uncollectible receivable balances. Under the aging method, bad debts percentages

determined by management based on historical experience as well as current

economic climate are applied to customers’ balances categorized by the number of

months the underlying invoices have remained outstanding. The valuation

allowance balance is adjusted to the amount computed as a result of the aging

method. When facts subsequently become available to indicate that the amount

provided as the allowance was incorrect, an adjustment, classified as a change

in estimate, is made.

|

g.

|

Inventories

|

Inventories

are stated at the lower of cost, as determined on a weighted average basis, or

market. Costs of inventories include purchase and related costs incurred in

bringing the products to their present location and condition. Market value is

determined by reference to selling prices after the balance sheet date or to

management’s estimates based on prevailing market conditions. The management

writes down the inventories to market value if it is below cost. The management

also regularly evaluates the composition of its inventories to identify

slow-moving and obsolete inventories to determine if valuation allowance is

required.

|

h.

|

Property

and Equipment

|

Property

and equipment are initially recognized and recorded at cost. Gains or losses on

disposals are reflected as gain or loss in the period of disposal. The cost of

improvements that extend the life of plant and equipment are capitalized. These

capitalized costs may include structural improvements, equipment and fixtures.

All ordinary repairs and maintenance costs are expensed as

incurred.

Depreciation

for financial reporting purposes is provided using the straight-line method over

the estimated useful lives of the assets at cost less 5% for salvage

value:

|

Building

|

46

years

|

|

Machinery

and Equipment

|

5

~ 25 years

|

|

Office

and Other Equipment

|

5

~ 10 years

|

|

i.

|

Impairment

of Long-Lived Assets

|

The

Company accounts for impairment of plant and equipment and amortizable

intangible assets in accordance with the standard of “Accounting for Impairment

of Long-Lived Assets and Long-Lived Assets to be Disposed Of”, which requires

the Company to evaluate a long-lived asset for recoverability when there is

event or circumstance that indicate the carrying value of the asset may not be

recoverable. An impairment loss is recognized when the carrying amount of a

long-lived asset or asset group is not recoverable (when carrying amount exceeds

the gross, undiscounted cash flows from use and disposition) and is measured as

the excess of the carrying amount over the asset’s (or asset group’s) fair

value.

|

j.

|

Comprehensive

Income

|

The

Company reports Comprehensive Income, its components, and accumulated balances

in its financial statements. Accumulated other comprehensive income represents

the accumulated balance of foreign currency translation adjustments. No other

items of comprehensive income are present.

9

China Electric

Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three months and nine months ended September 30,

2009 and 2008 are unaudited)

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

|

k.

|

Revenue

Recognition

|

The

Company generates revenues from the sales of micro-motor

products. The Company recognizes revenue net of value added tax (VAT)

when the earnings process is complete, as evidenced by an agreement with the

customer, transfer of title, acceptance of ownership and assumption of risk of

loss by the customer, as well as predetermined fixed pricing, persuasive

evidence of an arrangement exists, and collection of the relevant receivable is

probable. The Company includes shipping charges billed to customers in net

revenue, and includes the related shipping costs in cost of sales. No return

allowance is made as products returns are insignificant based on historical

experience.

The

Company does not provide different policies in terms warranties, credits,

discounts, rebates, price protection, or similar privileges among customers.

Orders are placed by both the distributors and OEMs and the products are

delivered to the customers within 30-45 days of order, the Company does not

provide price protection or right of return to the customers. The price of the

products are predetermined and fixed based on contractual agreements, therefore

the customers would be responsible for any loss if the customers are faced with

sales price reductions and rapid technology obsolescence in the industry. The

Company does not allow any discounts, credits, rebates or similar

privileges.

The

Company warrants the products sold to all customers for up to 1 year from the

date the products leave the Company’s factory, under which the Company will pay

for labor and parts, or offer a new or similar unit in exchange for a

non-performing unit due to defects in material or workmanship. The

customers may also return products for a variety of reasons, such as damage to

goods in transit, cosmetic imperfections and mechanical failures, if within the

warranty period. There is no allowance for warranty on the products sales as

historical costs incurred for warranty replacements and repairs have been

insignificant.

|

l.

|

Research

and Development Costs

|

Research

and development costs are expensed to operations as incurred. The Company spent

$476,124 and $275,479 in the three months ended September 30, 2009 and 2008,

respectively, and $1,264,119 and $703,201 in the nine months ended September 30,

2009 and 2008, respectively, on direct research and development

efforts.

|

m.

|

Income

Taxes

|

The

Company accounts for income taxes in accordance with the US Generally Accepted

Accounting Principles (GAAP) which requires the asset and liability approach for

financial accounting and reporting for income taxes and allows recognition and

measurement of deferred tax assets based upon the likelihood of realization of

tax benefits in future years. Under the asset and liability approach, deferred

taxes are provided for the net tax effects of temporary differences between the

carrying amounts of assets and liabilities for financial reporting purposes and

the amounts used for income tax purposes. A valuation allowance is provided for

deferred tax assets if it is more likely than not these items will either expire

before the Company is able to realize their benefits, or that future

deductibility is uncertain.

The

Company follows the requirements of US GAAP in Accounting for Uncertainty in

Income Taxes, which requires a comprehensive model for how a company should

recognize, measure, present and disclose in its financial statements uncertain

tax positions that the company has taken or expects to take on a tax return

(including a decision whether to file or not file to file a return in a

particular jurisdiction).

|

n.

|

Advertising

Costs

|

The

Company expenses advertising costs as incurred. The Company incurred

$133,510 and $97,606 in the three months ended September 30, 2009 and 2008,

respectively, and $417,020 and $276,909 in the nine months ended September 30,

2009 and 2008, respectively, on advertising expenses.

10

China Electric

Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three months and nine months ended September 30,

2009 and 2008 are unaudited)

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

|

o.

|

Foreign

Currency Translation

|

The

functional currency of Attainment and Luck Loyal is the Hong Kong Dollar

(“HKD”). They maintain their financial statements using the functional currency.

Monetary assets and liabilities denominated in currencies other than the

functional currency are translated into the functional currency at rates of

exchange prevailing at the balance sheet dates. Transactions denominated in

currencies other than the functional currency are translated into the functional

currency at the exchange rates prevailing at the dates of the transaction.

Exchange gains or losses arising from foreign currency transactions are included

in the determination of net income (loss) for the respective

periods.

The

functional currency of YuePengCheng is the Renminbi (“RMB”), the PRC’s currency.

It maintains its financial statements using its own functional currency.

Monetary assets and liabilities denominated in currencies other than the

functional currency are translated into the functional currency at rates of

exchange prevailing at the balance sheet dates. Transactions denominated in

currencies other than the functional currency are translated into the functional

currency at the exchange rates prevailing at the dates of the transaction.

Exchange gains or losses arising from foreign currency transactions are included

in the determination of net income (loss) for the respective

periods.

For

financial reporting purposes, the financial statements of Attainment and Luck

Loyal, which are prepared in HKD, are translated into the Company’s reporting

currency, United States Dollars (“USD”); the financial statements of

YuePengCheng, which are prepared in RMB, are translated into the Company’s

reporting currency, USD. Balance sheet accounts are translated using the closing

exchange rate in effect at the balance sheet date and income and expense

accounts are translated using the average exchange rate prevailing during the

reporting period. Adjustments resulting from the translation, if any, are

included in accumulated other comprehensive income (loss) in stockholder’s

equity.

The

exchange rates used for foreign currency translation were as follows (USD$1 =

RMB):

|

Period Covered

|

Balance Sheet Date Rates

|

Average Rates

|

||||||

|

Nine

Months Ended September 30, 2009

|

6.81756

|

6.82174

|

||||||

|

Nine

Months Ended September 30, 2008

|

6.83527

|

6.97496

|

||||||

The

exchange rates used for foreign currency translation were as follows (USD$1 =

HKD):

|

Period Covered

|

Balance Sheet Date Rates

|

Average Rates

|

||||||

|

Nine

Months Ended September 30, 2009

|

7.75013

|

7.75193

|

||||||

|

Nine

Months Ended September 30, 2008

|

7.76908

|

7.79838

|

||||||

|

p.

|

Recently

Issued Accounting Pronouncements

|

In

June 2009, the Financial Accounting Standards Board (FASB) issued a

standard that established the FASB Accounting Standards Codification (ASC) and amended the

hierarchy of generally accepted accounting principles (ASC) and amended the

hierarchy of generally accepted accounting principles (GAAP) such that the ASC

became the single source of authoritative nongovernmental U.S. GAAP. The ASC did

not change current U.S. GAAP, but was intended to simplify user access to all

authoritative U.S. GAAP by providing all the authoritative literature related to

a particular topic in one place. All previously existing accounting standard

documents were superseded and all other accounting literature not included in

the ASC is considered non-authoritative. New accounting standards issued

subsequent to June 30, 2009 are communicated by the FASB through Accounting

Standards Updates (ASUs). The Company adopted the ASC on July 1, 2009. This

standard did not have an impact on the Company’s consolidated results of

operations or financial condition. However, throughout the notes to the

consolidated financial statements references that were previously made to

various former authoritative U.S. GAAP pronouncements have been changed to

coincide with the appropriate section of the ASC.

11

China Electric

Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three months and nine months ended September 30,

2009 and 2008 are unaudited)

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

|

q.

|

Recently

issued accounting pronouncements

(continued)

|

In

September 2006, the FASB issued an accounting standard codified in ASC 820,

Fair Value Measurements and

Disclosures. This standard established a single definition of fair value

and a framework for measuring fair value, set out a fair value hierarchy to be

used to classify the source of information used in fair value measurements, and

required disclosures of assets and liabilities measured at fair value based on

their level in the hierarchy. This standard applies under other accounting

standards that require or permit fair value measurements. One of the amendments

deferred the effective date for one year relative to nonfinancial assets and

liabilities that are measured at fair value, but are recognized or disclosed at

fair value on a nonrecurring basis. This deferral applied to such items as

nonfinancial assets and liabilities initially measured at fair value in a

business combination (but not measured at fair value in subsequent periods) or

nonfinancial long-lived asset groups measured at fair value for an impairment

assessment. The adoption of the fair value measurement standard did not

have a material impact on the Company’s consolidated results of operations or

financial condition.

In

December 2007, the FASB issued and, in April 2009, amended a new

business combinations standard codified within ASC 805, which changed the

accounting for business acquisitions. Accounting for business combinations under

this standard requires the acquiring entity in a business combination to

recognize all (and only) the assets acquired and liabilities assumed in the

transaction and establishes the acquisition-date fair value as the measurement

objective for all assets acquired and liabilities assumed in a business

combination. Certain provisions of this standard impact the determination of

acquisition-date fair value of consideration paid in a business combination

(including contingent consideration); exclude transaction costs from acquisition

accounting; and change accounting practices for acquisition-related

restructuring costs, in-process research and development, indemnification

assets, and tax benefits. The Company adopted the standard for business

combinations for its business combination during the period ended June 30,

2009.

In

April 2009, the FASB issued an accounting standard which provides guidance

on (1) estimating the fair value of an asset or liability when the volume

and level of activity for the asset or liability have significantly declined and

(2) identifying transactions that are not orderly. The standard also

amended certain disclosure provisions for fair value measurements and

disclosures in ASC 820 to require, among other things, disclosures in interim

periods of the inputs and valuation techniques used to measure fair value as

well as disclosure of the hierarchy of the source of underlying fair value

information on a disaggregated basis by specific major category of investment.

The standard was effective prospectively beginning April 1, 2009. The

adoption of this standard did not have a material impact on the Company’s

consolidated results of operations or financial condition.

In

April 2009, the FASB issued an accounting standard which modifies the

requirements for recognizing other-than-temporarily impaired debt securities and

changes the existing impairment model for such securities. The standard also

requires additional disclosures for both annual and interim periods with respect

to both debt and equity securities. Under the standard, impairment of debt

securities will be considered other-than-temporary if an entity (1) intends

to sell the security, (2) more likely than not will be required to sell the

security before recovering its cost, or (3) does not expect to recover the

security’s entire amortized cost basis (even if the entity does not intend to

sell). The standard further indicates that, depending on which of the above

factor(s) causes the impairment to be considered other-than-temporary,

(1) the entire shortfall of the security’s fair value versus its amortized

cost basis or (2) only the credit loss portion would be recognized in

earnings while the remaining shortfall (if any) would be recorded in other

comprehensive income. The standard requires entities to initially apply its

provisions to previously other-than-temporarily impaired debt securities

existing as of the date of initial adoption by making a cumulative-effect

adjustment to the opening balance of retained earnings in the period of

adoption. The cumulative-effect adjustment potentially reclassifies the

noncredit portion of a previously other-than-temporarily impaired debt security

held as of the date of initial adoption from retained earnings to accumulated

other comprehensive income. The adoption of this standard did not have a

material impact on the Company’s consolidated results of operations or financial

condition.

In

April 2009, the FASB issued an accounting standard regarding interim

disclosures about fair value of financial instruments. The standard essentially

expands the disclosure about fair value of financial instruments that were

previously required only annually to also be required for interim period

reporting. In addition, the standard requires certain additional disclosures

regarding the methods and significant assumptions used to estimate the fair

value of financial instruments. The adoption of this standard did not have a

material impact on the Company’s consolidated results of operations or financial

condition.

12

China

Electric Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three months and nine months ended September 30,

2009 and 2008 are unaudited)

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

|

q.

|

Recently

issued accounting pronouncements

(continued)

|

In

May 2009, the FASB issued a new accounting standard regarding subsequent

events. This standard incorporates into authoritative accounting literature

certain guidance that already existed within generally accepted auditing

standards, with the requirements concerning recognition and disclosure of

subsequent events remaining essentially unchanged. This guidance addresses

events which occur after the balance sheet date but before the issuance of

financial statements. Under the new standard, as under previous practice, an

entity must record the effects of subsequent events that provide evidence about

conditions that existed at the balance sheet date and must disclose but not

record the effects of subsequent events which provide evidence about conditions

that did not exist at the balance sheet date. This standard added an additional

required disclosure relative to the date through which subsequent events have

been evaluated and whether that is the date on which the financial statements

were issued. For the Company,

this standard was effective beginning April 1, 2009.

In

June 2009, the FASB issued a new standard regarding the accounting for

transfers of financial assets amending the existing guidance on transfers of

financial assets to, among other things, eliminate the qualifying

special-purpose entity concept, include a new unit of account definition that

must be met for transfers of portions of financial assets to be eligible for

sale accounting, clarify and change the derecognition criteria for a transfer to

be accounted for as a sale, and require significant additional disclosure. The

standard is effective for new transfers of financial assets beginning

January 1, 2010. The Company is currently evaluating the impact of this

standard, but does not expect it to have a material impact on the Company’s

consolidated results of operations or financial condition.

In

June 2009, the FASB issued an accounting standard that revised the

consolidation guidance for variable-interest entities. The modifications include

the elimination of the exemption for qualifying special purpose entities, a new

approach for determining who should consolidate a variable-interest entity, and

changes to when it is necessary to reassess who should consolidate a

variable-interest entity. The standard is effective January 1, 2010. The

Company is currently evaluating the impact of this standard, but does not expect

it to have a material impact on the Company’s consolidated results of operations

or financial condition.

In

August 2009, the FASB issued ASU No. 2009-05, Measuring Liabilities at Fair

Value, which provides additional guidance on how companies should measure

liabilities at fair value under ASC 820. The ASU clarifies that the quoted price

for an identical liability should be used. However, if such information is not

available, a entity may use, the quoted price of an identical liability when

traded as an asset, quoted prices for similar liabilities or similar liabilities

traded as assets, or another valuation technique (such as the market or income

approach). The ASU also indicates that the fair value of a liability is not

adjusted to reflect the impact of contractual restrictions that prevent its

transfer and indicates circumstances in which quoted prices for an identical

liability or quoted price for an identical liability traded as an asset may be

considered level 1 fair value. This ASU is effective October 1, 2009. The

Company is currently evaluating the impact of this standard, but does not expect

it to have a material impact on the Company’s consolidated results of operations

or financial condition.

13

China Electric

Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three months and nine months ended September 30,

2009 and 2008 are unaudited)

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

|

q.

|

Recently

issued accounting pronouncements

(continued)

|

In

October 2009, the FASB issued ASU No. 2009-13, Multiple-Deliverable Revenue

Arrangements—a consensus of the FASB Emerging Issues Task Force, that

provides amendments to the criteria for separating consideration in

multiple-deliverable arrangements. As a result of these amendments,

multiple-deliverable revenue arrangements will be separated in more

circumstances than under existing U.S. GAAP. The ASU does this by establishing a

selling price hierarchy for determining the selling price of a deliverable. The

selling price used for each deliverable will be based on vendor-specific

objective evidence if available, third-party evidence if vendor-specific

objective evidence is not available, or estimated selling price if neither

vendor-specific objective evidence nor third-party evidence is available. A

vendor will be required to determine its best estimate of selling price in a

manner that is consistent with that used to determine the price to sell the

deliverable on a standalone basis. This ASU also eliminates the residual method

of allocation and will require that arrangement consideration be allocated at

the inception of the arrangement to all deliverables using the relative selling

price method, which allocates any discount in the overall arrangement

proportionally to each deliverable based on its relative selling price. Expanded

disclosures of qualitative and quantitative information regarding application of

the multiple-deliverable revenue arrangement guidance are also required under

the ASU. The ASU does not apply to arrangements for which industry specific

allocation and measurement guidance exists, such as long-term construction

contracts and software transactions. The ASU is effective beginning

January 1, 2011. The Company is currently evaluating the impact of this

standard on the Company’s consolidated results of operations and financial

condition.

In

October 2009, the FASB issued ASU No. 2009-14, Certain Revenue Arrangements That

Include Software Elements—a consensus of the FASB Emerging Issues Task

Force, that reduces the types of transactions that fall within the

current scope of software revenue recognition guidance. Existing software

revenue recognition guidance requires that its provisions be applied to an

entire arrangement when the sale of any products or services containing or

utilizing software when the software is considered more than incidental to the

product or service. As a result of the amendments included in ASU

No. 2009-14, many tangible products and services that rely on software will

be accounted for under the multiple-element arrangements revenue recognition

guidance rather than under the software revenue recognition guidance. Under the

ASU, the following components would be excluded from the scope of software

revenue recognition guidance: the tangible element of the product,

software products bundled with tangible products where the software components

and non-software components function together to deliver the product’s essential

functionality, and undelivered components that relate to software that is

essential to the tangible product’s functionality. The ASU also provides

guidance on how to allocate transaction consideration when an arrangement

contains both deliverables within the scope of software revenue guidance

(software deliverables) and deliverables not within the scope of that guidance

(non-software deliverables). The ASU is effective beginning January 1,

2011. The Company is currently evaluating the impact of this standard on the

Company’s consolidated results of operations and financial

condition.

14

China

Electric Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three months and nine months ended September 30,

2009 and 2008 are unaudited)

NOTE

3 – ACCOUNTS RECEIVABLE

Accounts

receivable consists of the following:

|

September 30,

|

December 31,

|

|||||||

|

2009

|

2008

|

|||||||

|

Accounts

receivable-trade

|

$ | 7,828,010 | $ | 5,243,033 | ||||

|

Allowance

for doubtful accounts

|

- | (3,248 | ) | |||||

|

Accounts

receivable-trade, net

|

$ | 7,828,010 | $ | 5,239,785 | ||||

The

change in the allowance for doubtful accounts between the reporting periods, as

of September 30, 2009 and December 31, 2008, is as follows:

|

September 30,

|

December 31,

|

|||||||

|

2009

|

2008

|

|||||||

|

Beginning

|

$ | (3,248 | ) | $ | (3,036 | ) | ||

|

(Provision)/reversal

during the period

|

3,246 | - | ||||||

|

Effect

of exchange rate changes

|

2 | (212 | ) | |||||

|

Ending

|

$ | - | $ | (3,248 | ) | |||

There

were no bad debts written off for the three months and nine months ended

September 30, 2009 and 2008 as there were no accounts receivable outstanding in

excess of 60 days at September 30, 2009 and 2008. The aging of the accounts

receivable is as follows:

|

September

30,

|

||||||||

|

2009

|

2008

|

|||||||

|

1-60

days

|

$ | 7,828,010 | $ | 5,200,667 | ||||

NOTE

4 – INVENTORY

Inventory

includes raw materials, work-in-process (“WIP”), and finished goods. Finished

goods contain direct material, direct labor and manufacturing overhead and do

not contain general and administrative costs.

Inventory

consists of the following:

|

September 30,

|

December 31,

|

|||||||

|

2009

|

2008

|

|||||||

|

Raw

materials

|

$ | 1,955,017 | $ | 2,524,124 | ||||

|

Finished

goods

|

2,385,642 | 2,544,534 | ||||||

|

Work-in-process

|

2,900,756 | 2,224,886 | ||||||

|

Total

|

$ | 7,241,415 | $ | 7,293,544 | ||||

15

China Electric

Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three months and nine months ended September 30,

2009 and 2008 are unaudited)

NOTE

5 – PROPERTY AND EQUIPMENT

Property

and Equipment consist of the following:

|

September 30,

|

December 31,

|

|||||||

|

2009

|

2008

|

|||||||

|

Building

|

$ | 3,717,781 | $ | - | ||||

|

Machinery

and equipment

|

6,369,548 | 4,314,429 | ||||||

|

Electronic,

office and other equipment

|

185,803 | 182,963 | ||||||

|

Accumulated

depreciation

|

(2,206,258 | ) | (1,726,610 | ) | ||||

|

Property

and equipment, net

|

$ | 8,066,874 | $ | 2,770,782 | ||||

Depreciation

expense for the three months and nine months ended September 30, 2009 and 2008

is as follows:

|

Three months ended September 30,

|

Nine months ended September 30,

|

|||||||||||||||

|

2009

|

2008

|

2009

|

2008

|

|||||||||||||

|

Cost

of goods sold

|

$ | 168,825 | $ | 124,785 | $ | 463,426 | $ | 363,935 | ||||||||

|

Operating

expenses

|

5,187 | 5,577 | 15,991 | 17,209 | ||||||||||||

|

Total

|

$ | 174,012 | $ | 130,362 | $ | 479,417 | $ | 381,144 | ||||||||

NOTE

6 – DUE TO DIRECTOR

Due to

director consists of the following:

|

September 30,

|

December 31,

|

|||||||

|

2009

|

2008

|

|||||||

|

Due

to director - Li, Jianrong: Luck Loyal loans

|

1,440,288 | 1,339,337 | ||||||

|

Due

to director - Li, Jianrong: Working capital loans

|

129,432 | - | ||||||

|

Total

|

$ | 1,569,720 | $ | 1,339,337 | ||||

In

November 2007, Luck Loyal acquired a 25% ownership interest in YuePengCheng from

Qiling; and in September 2008 acquired the remaining 75% ownership interest in

YuePengCheng from YuePengDa. Pursuant to the agreements, Luck Loyal paid Qiling

and YuePengDa RMB 2.5 million and RMB 7.5 million, respectively. These amounts

were contributed by a director of Luck Loyal, Ms. Li, Jianrong, in 2007 and

2008.

On March

25, 2009, Ms. Li, Jianrong entered into an agreement to convert the debt

outstanding as of the close of the share exchange (approximately $1.3 million)

into corresponding equity of China Electric Motor, Inc. at the time of China

Electric Motor, Inc.’s anticipated public offering of its common stock based on

the per share offering price.

The other

amounts that are due to Ms. Li, Jianrong consist of unsecured loans for working

capital with no fixed repayment date.

The

Company recorded the imputed interests with respect to these loans as a charge

to operations, and as a credit to additional paid-in capital. The

calculations are performed monthly at annual rates in the range of 5.25% - 7.14%

with the reference to the average short term loan rate announced by People's

Bank of China. A summary of the imputed interest is as follows:

|

Three months ended September 30,

|

Nine months ended September 30,

|

|||||||||||||||

|

2009

|

2008

|

2009

|

2008

|

|||||||||||||

|

Imputed

interest

|

$ | 28,468 | $ | 3,778 | $ | 62,500 | $ | 13,227 | ||||||||

16

China Electric

Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three months and nine months ended September 30,

2009 and 2008 are unaudited)

NOTE

7 – STATUTORY RESERVES

As

stipulated by the relevant laws and regulations for enterprises operating in

PRC, the Company is required to make annual appropriations to a statutory

surplus reserve fund. Specifically, the Company is required to allocate 10% of

its profits after taxes, as determined in accordance with the PRC accounting

standards applicable to the Company, to a statutory surplus reserve until such

reserve reaches 50% of the registered capital of the Company.

NOTE

8 – INCOME TAX AND VARIOUS TAXES

Income Tax

The

Company is registered and entitled as a “Hi-Tech Corporation” in the

PRC. The Company has tax advantages granted by the local government

for corporate income taxes and sales taxes. The Company is

entitled to have a 50% reduction on the normal tax rate of 15% commencing year

2005 for the following three consecutive years. The Company’s tax

advantages were abolished after the Enterprise Income Tax Law that took effect

on January 1, 2008. The Company’s prior tax rate of 15% was changed to a rate of

18% in 2008.

The tax

authority of the PRC Government conducts periodic and ad hoc tax filing reviews

on business enterprises operating in the PRC after those enterprises had

completed their relevant tax filings, hence the Company’s tax filings may not be

finalized. It is therefore uncertain as to whether the PRC tax

authority may take different views about the Company’s tax filings which may

lead to additional tax liabilities.

|

Three months ended September 30,

|

Nine months ended September 30,

|

|||||||||||||||

|

Current income tax expense:

|

2009

|

2008

|

2009

|

2008

|

||||||||||||

|

PRC

Enterprises Income Tax

|

$ | 849,552 | $ | 481,608 | $ | 2,381,576 | $ | 1,329,169 | ||||||||

A

reconciliation between the income tax computed at the PRC statutory rate and

provision for income tax is as follows:

|

Three months ended September 30,

|

Nine months ended September 30,

|

|||||||||||||||

|

2009

|

2008

|

2009

|

2008

|

|||||||||||||

|

Preferential

PRC income tax rate

|

20 | % | 18 | % | 20 | % | 18 | % | ||||||||

Effective

January 1, 2008, the new "Law of the People's Republic of China on Enterprise

Income Tax" was implemented. The new law requires that:

|

|

(i)

|

For

all resident enterprises, domestic or foreign, the Enterprise Income Tax

rate is unified 25%.

|

|

|

(ii)

|

Enterprises

that are categorized as the "High Tech Enterprise" will have a reduced tax

rate of 15%.

|

|

|

(iii)

|

From

January 1, 2008 onwards, enterprises that enjoyed a preferential tax rate

before, will need to adopt the new law within the next five years.

Specifically, enterprises with a current preferential tax rate of 15% for

2007, the tax rate will be 18%, 20%, 22%, 24%, and 25% for the years ended

December 31 2008, 2009, 2010, 2011, and 2012,

respectively.

|

Accounting for Uncertainty

in Income Taxes

The

Company follows the requirements of US GAAP in Accounting for Uncertainty in

Income Taxes, as per ASC codification 740. The standard clarifies the accounting

for uncertainty in income taxes recognized in an enterprise’s financial

statements and prescribes a recognition threshold and measurement process for

financial statement recognition and measurement of a tax position taken or

expected to be taken in a tax return. The standard also provides guidance on

derecognition, classification, interest and penalties, accounting in interim

periods, disclosure and transition.

Based on

the Company’s evaluation, the Company has concluded that there are no

significant uncertain tax positions requiring recognition in its financial

statements.

The

Company may from time to time be assessed interest or penalties by major tax

jurisdictions. In the event it receives an assessment for interest and/or

penalties, it will be classified in the financial statements as tax

expense.

17

China Electric

Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three months and nine months ended September 30,

2009 and 2008 are unaudited)

NOTE

8 – INCOME TAX AND VARIOUS TAXES (continued)

Various

Taxes

The

Company is subject to pay various taxes such as Value added tax (VAT), City

development tax, and Education tax to the local government tax authorities. The

Value added tax (VAT) collected on sales is netted against taxes paid for

purchases of cost of goods sold to determine the amounts payable or refundable.

The city development tax and education tax are expensed as general and

administrative expense.

NOTE

9 – COMMITMENTS AND CONTINGENCIES

The

Company leased its factory premises and staff quarters for approximately

$300,000 per year. This lease was terminated effective September 30,

2009.

On

September 24, 2009, the Company purchased a factory building covered under its

factory lease from the lessor, and the lessor terminated the existing lease

agreement without penalties.

The

Company signed a new lease agreement for the remaining buildings from the lessor

for approximately $176,000 per year.

Rent

expense was $76,731 and $76,625 for the three months ended September 30, 2009

and 2008, respectively, and $230,128 and $225,072 for the nine months ended

September 30, 2009 and 2008, respectively.

NOTE

10 – OPERATING RISK

Country

Risk

The

Company has significant investments in the PRC. The operating results of the

Company may be adversely affected by changes in the political and social

conditions in the PRC and by changes in Chinese government policies with respect

to laws and regulations, anti-inflationary measures, currency conversion and

remittance abroad, and rates and methods of taxation, among other things. The

Company can give no assurance that those changes in political and other

conditions will not result in have a material adverse effect upon the Company’s

business and financial condition.

Concentration of Credit

Risk

A

significant portion of the Company’s cash is maintained at various financial

institutions in the PRC which do not provide insurance for amounts on

deposit. The Company has not experienced any losses in such accounts

and believes it is not exposed to significant credit risk in this

area.

The

Company operates principally in the PRC and grants credit to its customers in

this geographic region. Although the PRC is economically stable, it is always

possible that unanticipated events in foreign countries could disrupt the

Company’s operations.

For the

nine months ended September 30, 2009, two customers accounted for 10% and 10% of

total sales, respectively. At September 30, 2009, these two customers accounted

for 13%, and 21% of accounts receivable, respectively.

For the

nine months ended September 30, 2008, two customers accounted for 11% and 10% of

total sales, respectively. At September 30, 2008, these two customers accounted

for 11%, and 9% of accounts receivable, respectively.

For the

year ended December 31, 2008, three customers accounted for 11%, 10% and 10% of

total sales, respectively. At December 31, 2008, these three customers accounted

for 11%, 9%, and 10% of accounts receivable, respectively.

Supply

Risk

The

suppliers for the Company's key raw materials are located in

China. For the nine months ended September 30, 2009, three suppliers

accounted for 13%, 12% and 10% of the Company's total purchases,

respectively. At September 30, 2009, these suppliers accounted for

14%, 14% and 0% of accounts payable, respectively.

For the

nine months ended September 30, 2008, one supplier accounted for 24% of the

Company's total purchases. At September 30, 2008, this supplier

accounted for 10% of accounts payable.

18

China Electric

Motor, Inc. and Subsidiaries