Attached files

| file | filename |

|---|---|

| 8-K - WEB.COM GROUP, INC. | v166974_8k.htm |

2009 Sidoti Conference

NYC

November 20, 2009

David Brown, Chairman and CEO

Kevin Carney, Chief Financial Officer

2

Safe-Harbor Statement

This presentation includes certain "forward-looking statements" including, without limitation, statements regarding Web.com’s expectations

about its future financial performance and market

position, that are subject to risks, uncertainties and other factors that could cause actual

results or outcomes to differ materially from those contemplated by the forward-looking statements. These forward-looking statements

include, but are not limited

to, plans, objectives, expectations and intentions and other statements contained in this presentation that are not

historical facts. These statements are sometimes identified by words such as “believe”, “growing”, “emerge”

or words of similar meaning.

These statements are based on our current beliefs or expectations, and there are a number of important factors that could cause the actual

results or outcomes to differ materially from those indicated by these

forward-looking statements, including, without limitation, our ability to

integrate acquired businesses, our ability to maintain our sales efficiency, our ability to maintain our existing, and develop new, strategic

relationships, the number of our

net subscriber additions and our monthly customer turnover. These and other risk factors are set forth

under the caption "Risk Factors" in Web.com’s Quarterly Report on Form 10-Q for the

quarter ended September 30, 2009, as filed with the

Securities and Exchange Commission, which is available on a website maintained by the Securities and Exchange Commission

at www.sec.gov. Web.com expressly disclaims any obligation or undertaking

to release publicly any updates or revisions to any forward-

looking statements contained herein as a result of new information, future events or otherwise.

3

Company Overview

Leader in online marketing for small businesses

Over 272,000 paid subscribers (as of September 30,

2009

)

Solid financial profile:

~$109 million Last 12-Month (LTM) Revenue

~18% LTM non-GAAP operating margin

~$16 million LTM free cash flow

Founded in 1997 with headquarters in Jacksonville, FL

4

Investment Highlights

Addressing a large, underserved market opportunity

Growing contribution from suite of online marketing solutions

Increasingly viewed as partner of choice by SMB-focused vendors

Strong franchise:

Significant critical mass

Large customer base

History of profitability and cash flow

Strong balance sheet

Improving business metrics and stabilizing overall financial

performance during 2009

Positioning company for enhanced, long-term growth

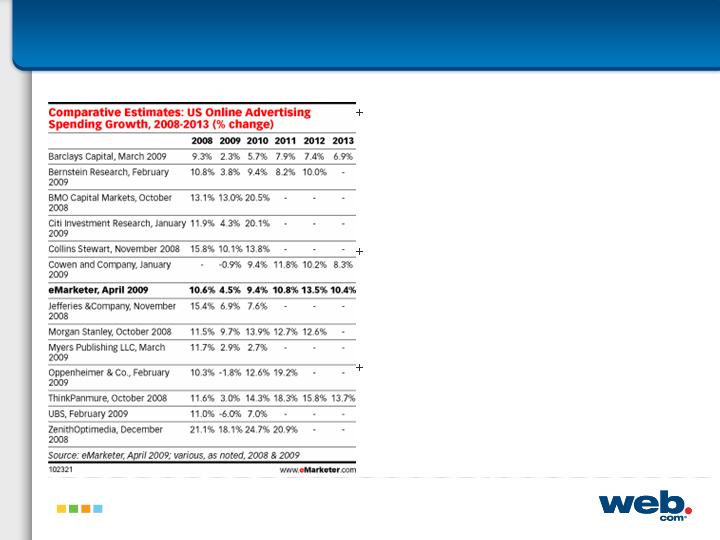

US Online Channel Continues to Expand;

Offline to Online Trend Expanding

5

While online ad spending grows,

traditional media (magazines, YP,

newspapers, TV, radio and direct

marketing) spending is primarily down

Website development, SEM, SEO,

eCommerce, mobile and video

advertising are up

Local search is expected to eclipse top-

line search growth through 2013;

Indications point to more local

businesses building websites, buying

search, adding content and actively

managing

their online presence (Kelsey,

March ‘09)

6

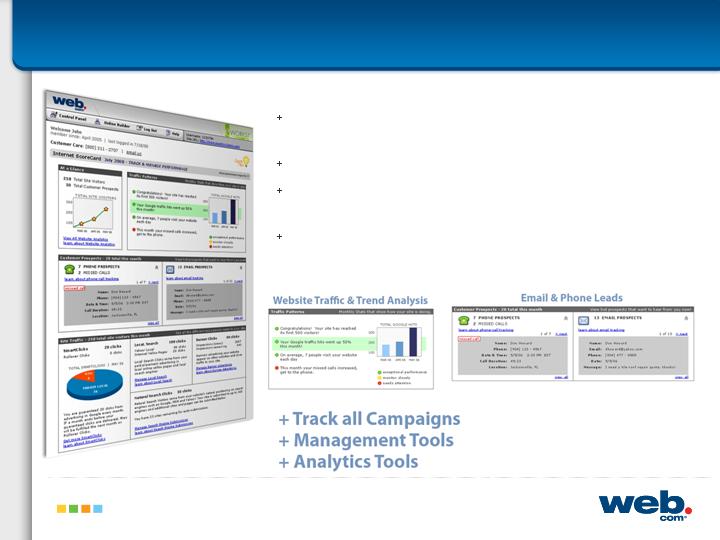

Small Businesses Need Help Navigating the Online World

They’re focused on running their business; limited time;

lack of expertise

Require online marketing experts to help them succeed

Web.com offers complete solutions and customer

support to ensure success

SMBs willing to pay for value delivered; measure

success one lead, call or email at a time

Customer Value Proposition:

A Complete Online Marketing Solution

7

Typical Website Company

Typical Website Company

8

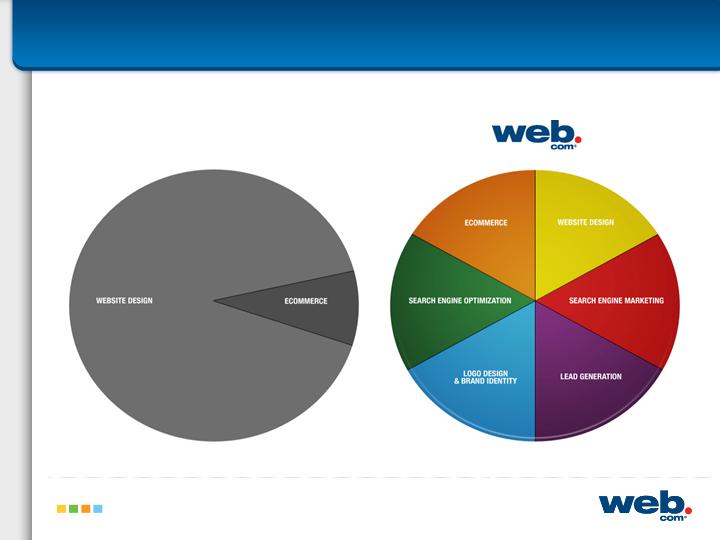

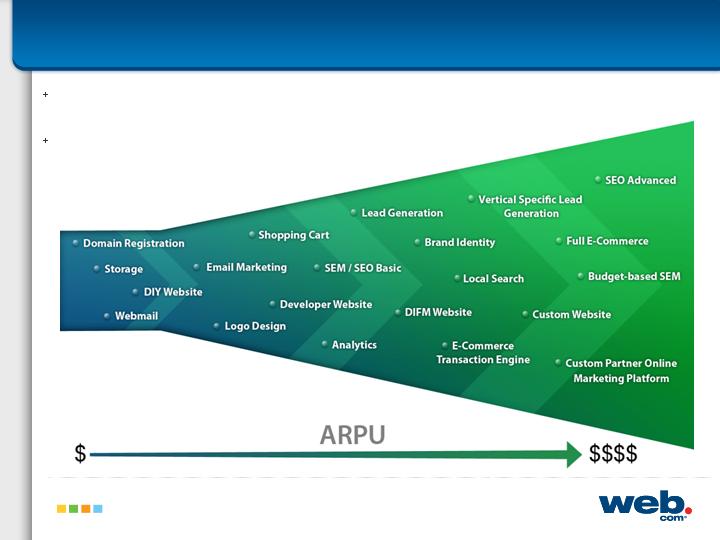

Evolution of Web.com

200x

2009

Web.com started in ‘97 with basic websites and hosting and has evolved into a full

service provider of online marketing solutions

Solutions are sold directly to SMB’s as well as through partnerships

9

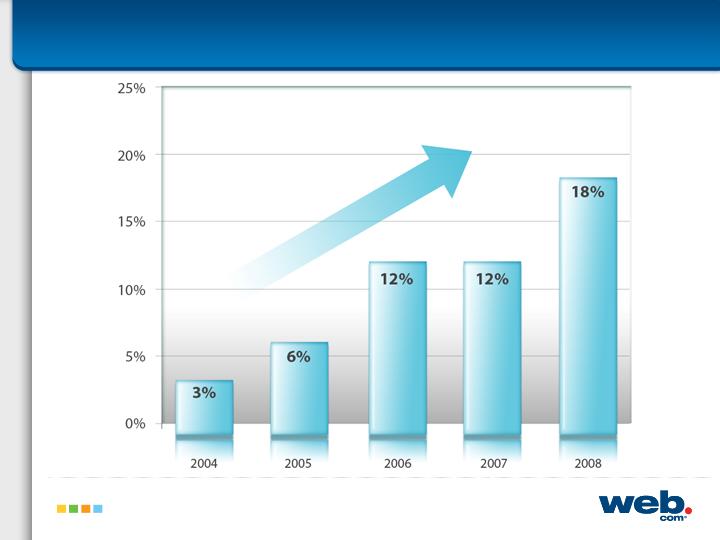

Growing Contribution of Online Marketing Solutions

OF TOTAL

REVENUE

%

Increasing SMB online marketing

offerings a significant driver of long-term

growth strategy

Over 30% of total revenue derived from

diverse suite of online marketing tools;

up from less than 1% in 2002

Solutions complementary to web

presence; increases value to customer;

SEM, SEO, eCommerce, etc

Solid Cactus acquisition adds further

critical mass within eCommerce

10

Pursuing the SMB e-Commerce Market Opportunity

~$1 billion in e-commerce

transactions facilitated annually

eCommerce is a growing area of

interest for SMBs and Web.com

Web.com has built a complete

platform and service delivery

infrastructure to fullly serve

customers eCommerce needs

11

Web.com: The Partner of Choice

90+%

50+%

50+ partners ensures stability and highly-diversified revenue generation

Supports multi-channel acquisition strategy: online marketing, affiliate

marketing, direct to brand, outbound/inbound sales, enterprise, cross/sell

and upsell to existing customer base

Within 10 years, Web.com’s partnership strategy has resulted in largest

partner accounting for negligible percentage of Web.com’s overall business

(down from 90%)

12

Significant Accomplishments in a Difficult Environment

Integrated major acquisition

Delivering strong profitability and cash flow

Using strong financial position to enhance shareholder value

Executing company’s first share repurchase program

Acquiring complementary solutions

Maintaining and growing large subscriber base

Expanding distribution network and signing key partners

Advancing leadership position in online marketing for small

businesses

Positioning Web.com for Long-term Growth

13

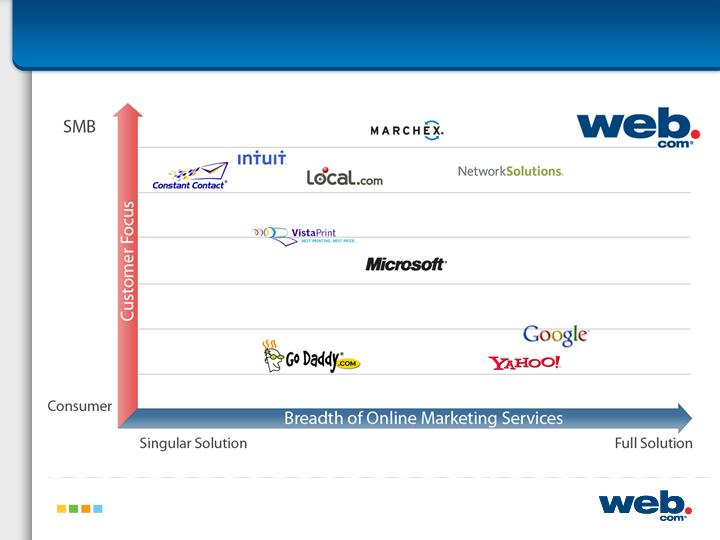

SMB Online Marketing Universe

14

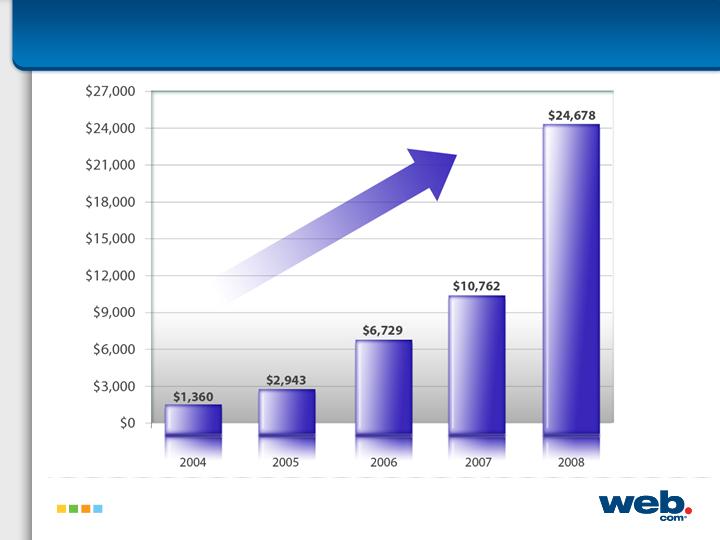

Annual Revenue

15

Annual Non-GAAP Operating Margin

Non-GAAP operating margin excludes the effect of stock-based compensation,

amortization of intangibles, non-recurring

restructuring charges and revenue eliminated in purchase accounting. During Q4’08, Web.com had a negative GAAP Operating

Margin of 346% due to a $103 million goodwill and asset impairment charge, and a

non-GAAP 22% operating margin in Q4’08.

*2007 Non-GAAP Operating Margin impacted by merger-related expenses

*

Adjusted EBITDA

Adjusted EBITDA excludes depreciation expense, amortization of intangibles, income tax, interest expense, interest income,

and stock-based compensation, because management believes that excluding such items helps investors better understand

the Company's operating activities.

17

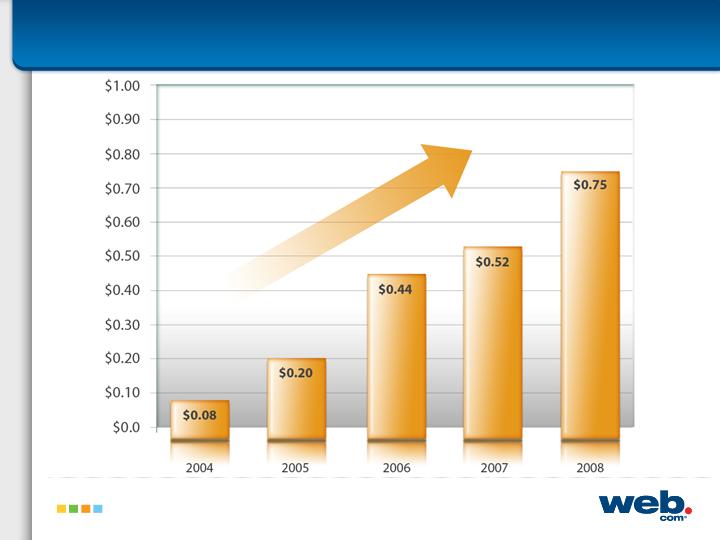

Non-GAAP EPS

Non-GAAP Net Income and Non-GAAP Net Income Per Share. The Company excludes from non-GAAP net income and non-

GAAP net

income per share amortization of intangibles, income tax expense, fair value adjustment to deferred revenue and

stock based compensation, and includes cash income tax expense, because management believes that excluding such

measures helps investors

better understand the Company’s operating activities.

18

Web.com Investment Highlights

Massive number of small businesses moving online

Web.com has a strong market position

Offers complete solution for any SMB online marketing

needs

Increasing stability and positioned for enhanced growth

when economy improves

Proven ability to generate significant cash flow and

profitability during healthy and challenging economic

environments

2009 Sidoti Conference

NYC

November 20, 2009

David Brown, Chairman and CEO

Kevin Carney, Chief Financial Officer