Attached files

| file | filename |

|---|---|

| 8-K - CSC 8K FORM 11182009 - COMPUTER SCIENCES CORP | form8k.htm |

*

November 18,

2009

INVESTOR

CONFERENCE

CONFERENCE

*

Forward-Looking

Statement

All

written or oral statements made by CSC at this meeting or in

these presentation materials that do not directly and exclusively

relate to historical facts constitute “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. These statements represent CSC’s expectations and

beliefs, and no assurance can be given that the results described

in such statements will be achieved. These statements are

subject to risks, uncertainties, and other factors, many outside of

CSC’s control, that could cause actual results to differ materially

from the results described in such statements. For a description

of these factors, please see CSC’s most recent Annual Report on

Form 10-K and Quarterly Reports on Form 10-Q.

these presentation materials that do not directly and exclusively

relate to historical facts constitute “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. These statements represent CSC’s expectations and

beliefs, and no assurance can be given that the results described

in such statements will be achieved. These statements are

subject to risks, uncertainties, and other factors, many outside of

CSC’s control, that could cause actual results to differ materially

from the results described in such statements. For a description

of these factors, please see CSC’s most recent Annual Report on

Form 10-K and Quarterly Reports on Form 10-Q.

*

This

presentation includes certain non-GAAP financial measures, such as

operating income, operating costs, and free cash flow. These non-GAAP

financial measures are not meant to be considered in isolation or as a

substitute for results prepared in accordance with accounting principles

generally accepted in the United States (GAAP). A reconciliation of non-

GAAP financial measures included in this presentation to the most

directly comparable financial measure calculated and presented in

accordance with GAAP is set forth elsewhere in this presentation and on

our web site at www.csc.com. CSC management believes that these

non-GAAP financial measures provide useful information to investors

regarding the Company's financial condition and results of operations as

they provide another measure of the Company's profitability and ability

to service its debt, and are considered important measures by financial

analysts covering CSC and its peers.

operating income, operating costs, and free cash flow. These non-GAAP

financial measures are not meant to be considered in isolation or as a

substitute for results prepared in accordance with accounting principles

generally accepted in the United States (GAAP). A reconciliation of non-

GAAP financial measures included in this presentation to the most

directly comparable financial measure calculated and presented in

accordance with GAAP is set forth elsewhere in this presentation and on

our web site at www.csc.com. CSC management believes that these

non-GAAP financial measures provide useful information to investors

regarding the Company's financial condition and results of operations as

they provide another measure of the Company's profitability and ability

to service its debt, and are considered important measures by financial

analysts covering CSC and its peers.

Non-GAAP

Measures

*

Company

and

Strategic Overview

Strategic Overview

Mike

Laphen

Chairman

and

Chief Executive Officer

Chief Executive Officer

November 18,

2009

CSC

INVESTOR CONFERENCE

*

Welcome

to CSC’s Investor Conference

$16B

global IT services powerhouse

Ranking

153 on the Fortune 500

Operating in more

than 90 countries

2,500

world-class customers

92,000

employees worldwide

50-year

track record of client service excellence

NYSE:

CSC

CSC

Today

*

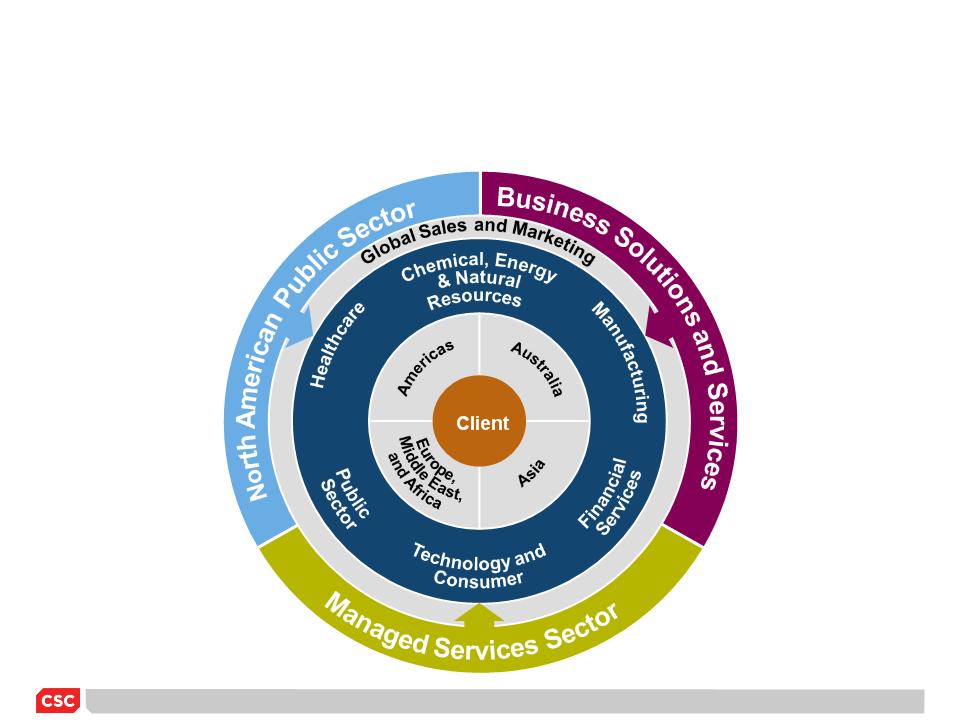

CSC:

A Global Technology and Business Services Company

Business Solutions

and

Services (BSS)

Services (BSS)

North

American Public Sector

(NPS)

(NPS)

Government

Managed

Services

Sector (MSS)

Sector (MSS)

Commercial

$16.7B*

Revenue

Operating in Three

Lines of Business

25%

31%

23%

21%

Globally Balanced

Workforce

7%

6%

15%

17%

15%

40%

Across

Six Vertical Industry Groups

Public

Sector

Financial

Services

Manufacturing

Technology

and

Consumer

Consumer

Chemical, Energy

&

Natural

Resources

EMEA

Americas

Commercial

Commercial

Asia/Pacific

NPS

*Ended

FY09

41%

23%

36%

*

Growing

New Business Momentum

DOE

Hanford

TSA

ITIP

Positioned to

deliver growth as markets recover

*

Improved

Financial Performance

|

Solid

Financial Performance

|

Measure

|

FY08

|

FY09

|

FY10

Guidance |

|

ü Increased New

Business Bookings

|

TCV

|

$15.6B

|

$16.2B

|

$17 to

$18B

|

|

ü Held Revenue

through global crisis

|

Revenue

|

$16.5B

|

$16.7B

|

$16.0 -

$16.5B

|

|

ü Improved

Margin performance

|

OI

Margin

|

7.98%

|

8.25%

|

8.5% -

8.75%

|

|

ü Grew EPS

faster than Revenue

|

EPS

|

$3.20

|

$4.07*

|

$4.80 -

$5.00

|

|

ü Improved Cash

Performance

|

Cash (NI

%)

|

32%

|

92%

|

90% -

100%

|

Positioned to

deliver sustainable, profitable growth as markets recover

*Non-GAAP EPS

normalized for IRS tax settlement benefit and goodwill impairment

charge

*

Global

Product

Companies

Companies

CSC

Local

Providers

Providers

Regional

Providers

Providers

Market

Dynamics: We Like Our Competitive Market Position

Global

Scale and Reach

• Full-service

offerings

• Mission-critical

delivery

• Product

independent

• Extensive

partner

ecosystem

ecosystem

• Locally intimate —

globally leveraged

• Delivery to the

world from around the world

• Global

cross-fertilization between public sector and

commercial businesses

commercial businesses

*

CSC’s

Strategic Directions

*

Major

Market Trends Provide Opportunities for Growth

Solutions to Cut Costs, Improve Efficiency, and Ensure Sustainability

Solutions to Cut Costs, Improve Efficiency, and Ensure Sustainability

Cybersecurity

and

Identity Management

Identity Management

Critical

Infrastructure Improvement

(Transportation, Utilities, Smart Grids)

(Transportation, Utilities, Smart Grids)

Health

IT Solutions for Commercial and

Government Reform Initiatives

Government Reform Initiatives

IT

Infrastructure Evolution

(Remote, Virtual, Mobile, Cloud)

(Remote, Virtual, Mobile, Cloud)

Sourcing

Solutions That Conserve Cash

and Drive Profitability Improvement

and Drive Profitability Improvement

Solutions

to Help Address

Regulatory Compliance

Regulatory Compliance

Industry

Relevance

Relevance

*

Organic

Revenue Growth and Operating Margin Goals

|

$19

- $21B

|

Annual

Revenue Growth

|

Operating

Margin Goals

|

|

BSS

|

7% - 10%

annual growth

|

Mid-teens

|

|

NPS

|

6% - 8% annual

growth

|

High single

digit

|

|

MSS

|

5% - 7% annual

growth

|

Low double

digit

|

|

FY13

|

6% - 8% annual

growth

|

≥

10%

|

NPS

MSS

BSS

FY10

$16.0

- $16.5B*

Project 6% -

8% organic revenue growth (CAGR) and low double-digit operating

margins

*FY10

guidance

*

Summary

• Excellent market

position

• Elevated financial

performance

• Positioned for

top-line growth

• Focused strategic

direction

• Creating shareholder

value

Solid case for

investment

*

|

Revenue

|

6% - 8% CAGR,

organic

2% - 3% additional from acquisition |

|

Margin

|

25 - 50 BPS

improvement, YoY

|

|

EPS

|

Growth at a

rate in excess of revenue

|

|

FCF

|

In line with

EPS growth and

In excess of

90% of Net Income

|

Investment

Case

• CSC is an

attractive, undervalued stock for investors seeking

– Fortune 200 company

with investment grade credit

– Leading technology

in all aspects of the IT services sector

– An expansive global

footprint across both public sector and

commercial markets

commercial markets

– A marquee set of

commercial and public sector clients who

provide long-term revenues and cash flows

provide long-term revenues and cash flows

• Three-Year Financial

Performance Objectives

*

Financial

Performance

Performance

Mike

Mancuso

Chief

Financial Officer

November 18,

2009

CSC

INVESTOR CONFERENCE

*

The

Past…

Financial

Accomplishments

Accomplishments

*

*

History

of Solid Performance

Most Recent 3 Years

Most Recent 3 Years

|

|

FY07

|

FY08

|

FY09

|

Improvement

|

|

Revenue

|

$14.9B

|

$16.5B

|

$16.7B

|

6%

CAGR

|

|

OI

Margin

|

8%

|

8%

|

8.3%

|

30

bps

|

|

EPS

|

$2.21

|

$3.20

|

$4.071

|

36%

CAGR

|

|

DSO

|

94

|

90

|

84

|

10-day

improvement

|

|

FCF2

|

$672M

|

$175M

|

$1,021M

|

Reached 90% of

NI

|

1 Non-GAAP EPS accounts

for net favorable tax audit settlements and a goodwill impairment

charge

2 Free Cash Flow is a

non-GAAP measure

*

The

Present…

Solid

Financial

Performance

Performance

*

*

*Non-GAAP EPS

accounts for net favorable tax audit settlements and a goodwill impairment

charge

FY

2010 ― YTD Solid Financial Performance

|

|

1st

Half

FY10 Actual |

FY10

Guidance |

FY09

Actual |

|

Bookings

|

$8.1B

|

$17 -

$18B

|

$16.2B

|

|

Revenue

|

$7.9B

|

$16 -

$16.5B

|

$16.7B

|

|

Margin

|

7.6%

|

8.5% -

8.8%

|

8.3%

|

|

EPS

|

$2.26

|

$4.80 -

$5.00

|

$4.07*

|

|

FCF

|

$(33)M

|

90% - 100% of

NI

|

$1,021M

|

*

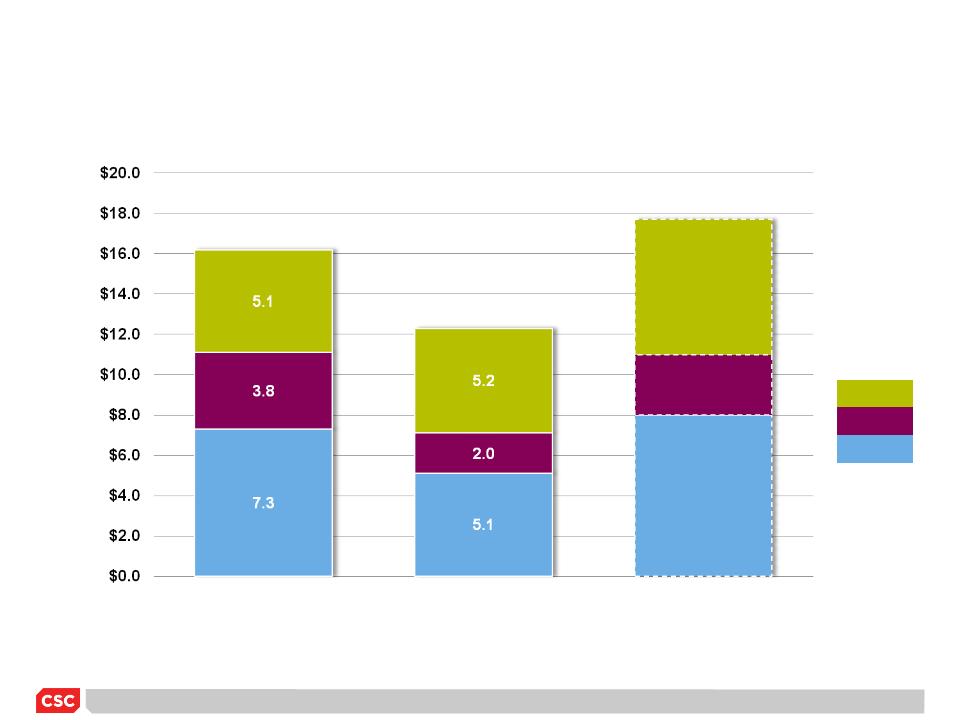

New

Business Bookings Comparison

TCV

($B)

($B)

|

MSS

|

|

BSS

|

|

NPS

|

$17

- $18

FY09

FY10

Guidance

Guidance

$12.3*

$16.2

YTD

November

FY10

*Includes Zurich

Financial Services: down-selected for negotiations

*

The

Future…

Positioned

for Growth

for Growth

*

*

Financial

Performance Plan

Three-Year Planning Period FY11 - FY13

Three-Year Planning Period FY11 - FY13

Deliver

top-line

growth

6% - 8%

(excluding

acquisitions)

growth

6% - 8%

(excluding

acquisitions)

Achieve

10% OI margin

by FY13

(25 - 50 bps

improvement

annually)

10% OI margin

by FY13

(25 - 50 bps

improvement

annually)

Grow

EPS at a

rate in excess

of top-line

growth

rate in excess

of top-line

growth

Sustain

cash

performance at

> 90% of

net income

performance at

> 90% of

net income

*

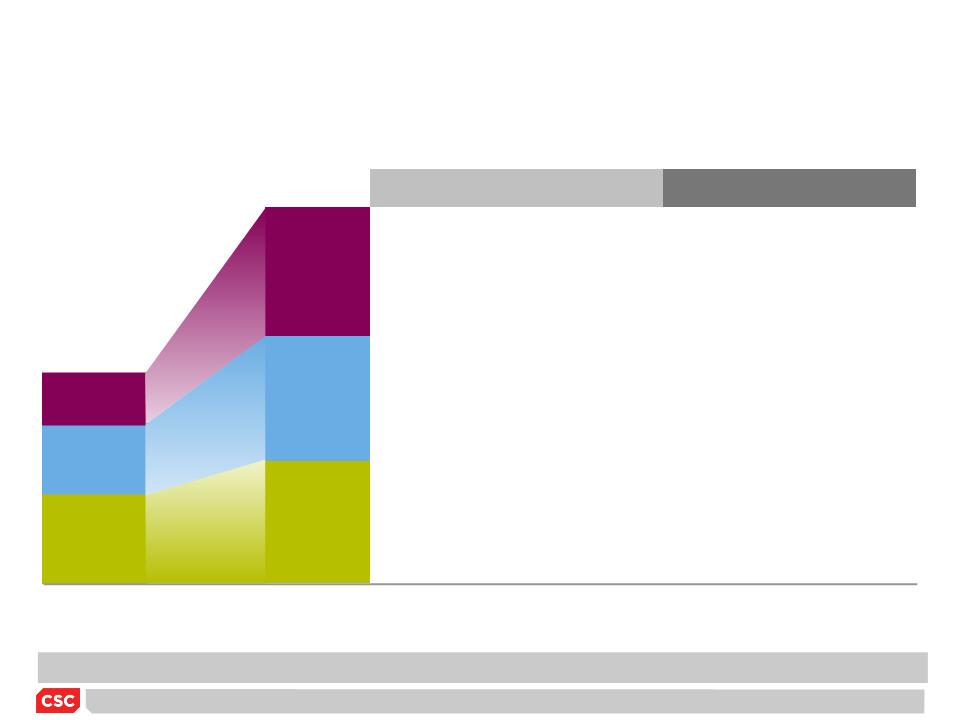

NPS

Targeted

Revenue Growth

|

$19

- $21B

|

FY11

- FY13

|

Strategic

Growth Vectors

|

|

BSS

|

7% -

10%

|

• Healthcare

reform

• Regulatory

compliance

• Information

security/management

|

|

NPS

|

6% -

8%

|

• Cybersecurity

• Healthcare

reform

• International

public sector

|

|

MSS

|

5% -

7%

|

• Applications

management

• Cybersecurity

• Virtualization

• Trusted Cloud

Computing

|

|

CSC

FY13

|

|

|

Today

$16

- $16.5B*

Positioned to

deliver growth as markets recover

*FY10

guidance

BSS

MSS

*

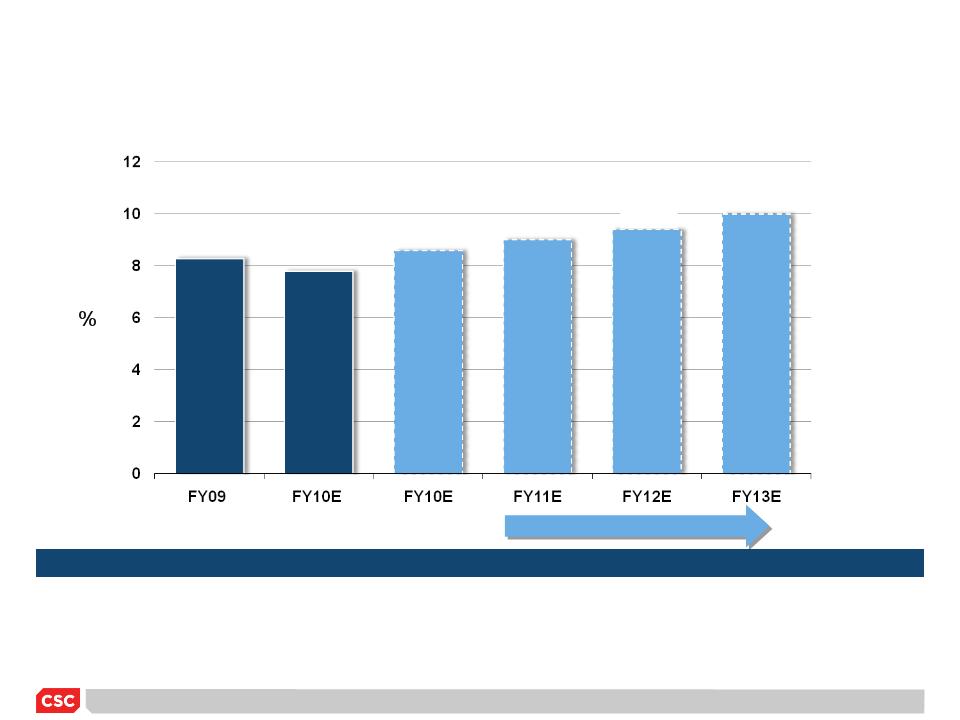

Operating

Income Margin

(25 - 50 bps Improvement Annually)

(25 - 50 bps Improvement Annually)

8.3%

8.6%1

7.6%

Actual

YTD

9.1%

10.1%

9.6%

|

Major

Margin Drivers

|

|

|

• Benefit cost

containment

|

• Work migration

to lower cost centers

|

|

• Lower

depreciation/amortization

|

• Continuous

improved execution

|

|

• Healthier

client base

|

• Portfolio

mix

|

High

End of Guidance

1FY10E margin represents

mid-point of guidance

*

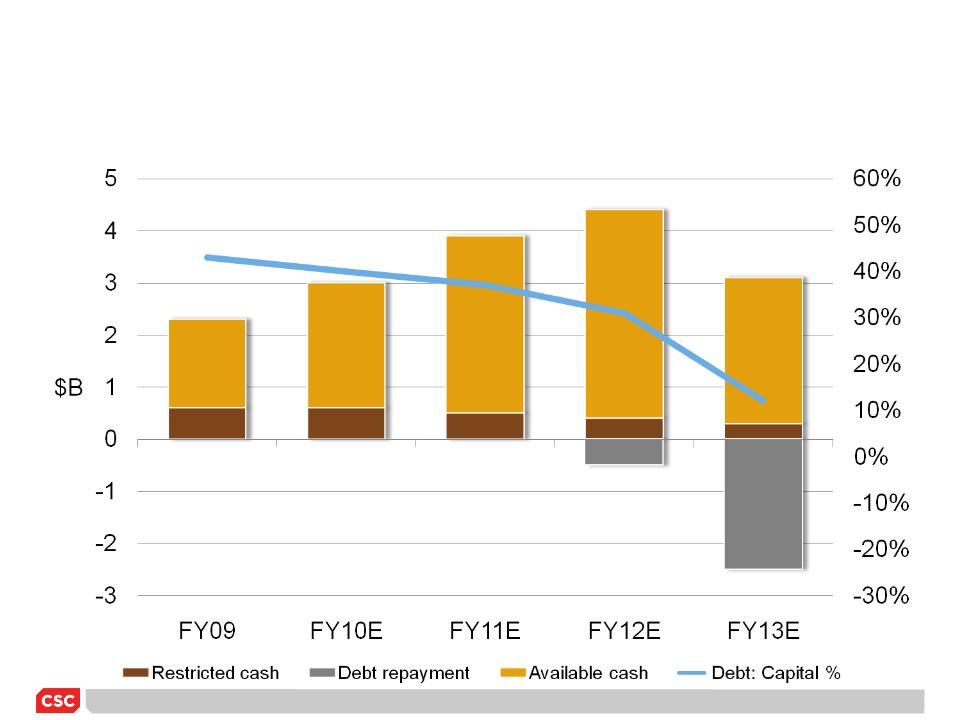

Cash

Profile

*

90%

- 100% of

Net

Income

91.5%

Free

Cash Flow

Cash

Flow Drivers

• Lower

pension

contributions

contributions

• Reduced

capital

expenditures

expenditures

• DSO

improvements

FY10

Guidance

Guidance

>

90% of NI

FY09

Actual

CSC

FY13E

*

For

Our Stakeholders, We Will…

lence

Excel

Improve

shareholder

value

value

*

Supplemental

Information

Information

CSC

INVESTOR CONFERENCE

*

Non-GAAP

Measures and Other Definitions

• Operating

Cost: Equal to the sum of

(1) cost of services, (2) business units

SG&A, (3) depreciation and amortization

SG&A, (3) depreciation and amortization

• Operating

Income: Revenue minus

operating cost

• Operating

Income Margin: Operating Income as

a percentage of revenue

• DSO:

Total

receivables at quarter end divided by revenue per day. Revenue per

day equals total revenues for the last quarter divided by the number of days in the

fiscal quarter. Total receivables includes unbilled receivables but excludes tax

receivables

day equals total revenues for the last quarter divided by the number of days in the

fiscal quarter. Total receivables includes unbilled receivables but excludes tax

receivables

• Free

Cash Flow: Equal to the sum of

(1) operating cash flows, (2) investing cash

flows, excluding business acquisitions and dispositions, purchase, or sale of

available for sale securities, and (3) capital lease payments

flows, excluding business acquisitions and dispositions, purchase, or sale of

available for sale securities, and (3) capital lease payments

*

Non-GAAP

Reconciliation

|

$M

(Except per

share amounts)

|

FY09

|

FY08

|

|

Total

revenue

|

$16,740

|

$16,500

|

|

Operating

income (OI)

|

$ 1,382

|

$ 1,316

|

|

OI

margin

|

8.25%

|

7.98%

|

|

Goodwill

impairment

|

($19)

|

-

|

|

Other

(income)/expense

|

$23

|

($

48)

|

|

Special

items

|

-

|

($156)

|

|

Tax

rate

|

(17.5)%

|

40.7%

|

|

GAAP

EPS

|

$7.31

|

$3.20

|

|

Tax

benefit/goodwill

|

(3.24)

|

-

|

|

Special

items

|

|

.64

|

|

Non-GAAP

EPS

|

$4.07

|

$3.84

|

*

Non-GAAP

Reconciliation (Cont’d)

|

$M

|

|

Fiscal

Year Ended

|

||

|

April

3, 2009

|

March

28, 2008

|

March

30, 2007

|

||

|

Operating

Income

|

|

$ 1,381.8

|

$ 1,316.4

|

$ 1,187.2

|

|

Minority

Interest Expense

|

|

(8.4)

|

(14.3)

|

(14.8)

|

|

Equity

Earnings

|

|

15.4

|

12.7

|

13.1

|

|

Corporate

G&A

|

|

(177.9)

|

(141.2)

|

(136.0)

|

|

Interest

Expense

|

|

(260.5)

|

(185.4)

|

(217.9)

|

|

Interest

Income

|

|

41.0

|

37.1

|

49.5

|

|

Special

Items

|

|

-

|

(155.8)

|

(316.1)

|

|

Goodwill

Impairment

|

|

(18.9)

|

-

|

-

|

|

Other

(Expense)/Income

|

|

(23.4)

|

48.4

|

41.3

|

|

Income Before

Taxes

|

|

949.1

|

917.9

|

606.3

|

|

Tax (Benefit)

/ Expense on Income

|

|

(166.1)

|

373.3

|

209.0

|

|

Net

Income

|

|

$ 1,115.2

|

$ 544.6

|

$ 397.3

|

|

Operating

Income Margin

|

|

8.25%

|

7.98%

|

7.99%

|

*

Non-GAAP

Reconciliation (Cont’d)

1) Unaudited financial

results

2) Audited financial

results

3) Capital lease

payments and proceeds from the sale of property and equipment

(included in investing activities) are included in the calculation of free cash flow.

(included in investing activities) are included in the calculation of free cash flow.

|

$M

|

Six

Months

Ended1 |

Fiscal Year

Ended2

|

||

|

October

2,

2009

|

April

3,

2009

|

March

28,

2008

|

March

30,

2007

|

|

|

Free Cash

Flow

|

(33)

|

1,020.6

|

175.2

|

671.5

|

|

Net Cash Used

in Investing Activities

|

286

|

1,038.0

|

2,718.7

|

872.7

|

|

Proceeds from

preferred stock

redemption |

|

|

|

126.5

|

|

Acquisitions,

Net of Cash Acquired

|

(5)

|

(100.3)

|

(1,591.1)

|

(134.3)

|

|

Business

dispositions

|

12

|

|

|

2.8

|

|

Capital Lease

Payments3

|

15

|

28.1

|

40.1

|

39.4

|

|

Net Cash

Provided by Operating

Activities |

$

275

|

$

1,986.4

|

$1,342.9

|

$1,578.6

|

*

Thank

You

CSC

INVESTOR CONFERENCE