Attached files

| file | filename |

|---|---|

| 8-K - LINCOLN NATIONAL CORPORATION FORM 8-K - LINCOLN NATIONAL CORP | lincoln8k.htm |

Exhibit 99.1

Dennis

R. Glass

President and Chief

Executive Officer

Lincoln

Financial Group

©2009 Lincoln

National Corporation

2009

Conference for

Investors and Bankers

Investors and Bankers

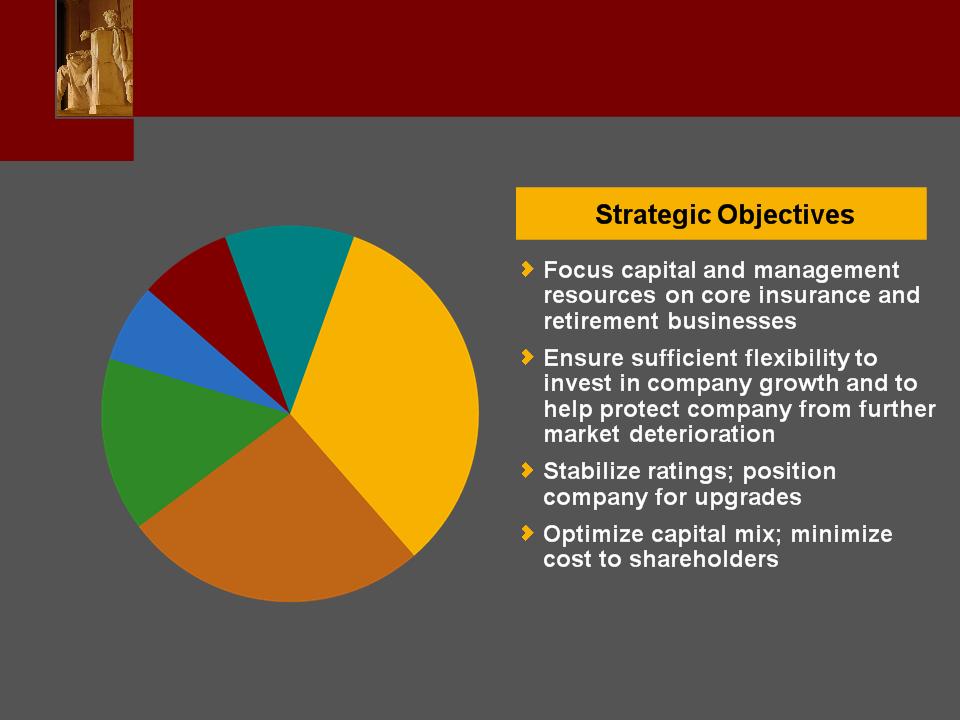

Strategic

Overview

2

Equity

and

Debt

$1,190

Capital

Purchase

Program

$950

Dividend,

Expense

Cuts $650

Cuts $650

LNUK

$300

Reinsurance

$240

Delaware

Investments

Investments

$400

Actions

Taken Over Past 12 Months to Focus on

Core Businesses and Support Franchise

Core Businesses and Support Franchise

3

Despite

the weakened macro-

economy, demand characteristics for

Lincoln products are strong

economy, demand characteristics for

Lincoln products are strong

Increased

risk aversion and consumer

demand for guarantees and advice

demand for guarantees and advice

Continued

shift in consumer

demographics toward retirees

demographics toward retirees

Rising

taxes at both the state and

federal levels

federal levels

DC,

individual

annuities,

individual life,

and Group

Protection

will likely

experience

tailwinds from

consumer

trends

individual

annuities,

individual life,

and Group

Protection

will likely

experience

tailwinds from

consumer

trends

Source:

McKinsey Consumer Financial Health Survey (March 2009); 2009 Retirement Consumer

Survey

Considerable

Tailwinds from Consumer Trends

Post-Crisis and Demographics

Post-Crisis and Demographics

4

Individual

Life

Variable

Annuity

Group

large case

Top

20+ player

No

participation

Top

10 player

Top

11-20 player

Fixed

Annuity

Based

on sales rankings from

industry sources1 (data compiled

by McKinsey & Co.)

industry sources1 (data compiled

by McKinsey & Co.)

Asset

Management

Group

<500 lives2

DC

401(k)

DC

403(b)

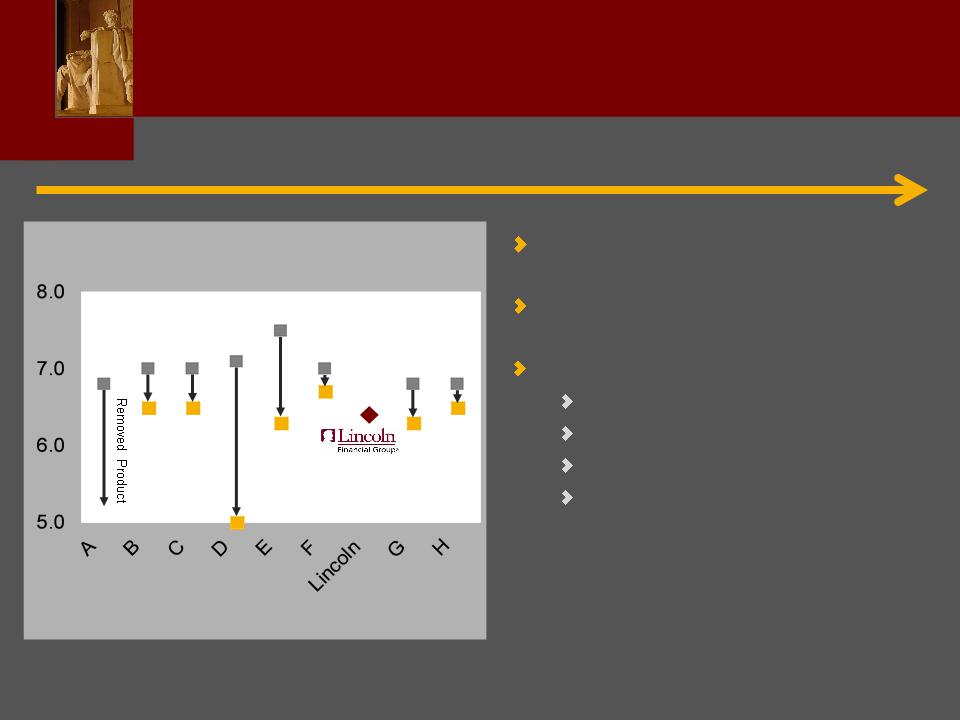

Competitors

1 Metrics

used to calculate rankings: Individual Life - New Sales; VA/FA - Sales; Group -

Premiums; DC / Asset management - Total AUM

2

Approximates; actual rankings are not available for <500 lives

Source:

Pensions and Investments, Plan Sponsors, Limra, Institutional Investor, AM Best,

Conning, Bloomberg

LNC

C

D

A

B

E

H

F

G

I

Lincoln

One of Four Competitors with

Significant Market Position in Core Businesses

Significant Market Position in Core Businesses

5

Lincoln’s

share of volume and ranking for key strategic partners

Variable

Annuities

Share

of

partner volume

partner volume

(Percent)

Rank

within

partner

partner

Major

Wire / Bank

Major

Wire / Bank

10

Major

Wire / Bank

Top

MGA

Top

MGA

Top

MGA

Top

Regional

Top

Independent BD

Top

Independent BD

Major

Wire / Bank

33

23

26

30

14

15

25

4

3

4

4

1

5

7

1

1

2

3

2

1

2

Strategic

partner

partner

Life

(incl. MoneyGuard1)

1 MoneyGuard

is included as normalized sales in share of LFD volume (15% of gross

premium)

Share

of

partner volume

partner volume

(Percent)

Rank

within

partner

partner

10

29

9

9

7

5

Top

Partner Status with Key Distribution Firms

6

Life

Insurance

Insurance

49%

Individual

Annuities

28%

Defined

Contribution

12%

Group

Protection

11%

1 Based on

LFG after-tax third quarter of 2009 YTD income from operations, excluding Other

Operations.

Earnings1

2010

Focus

Clearly

Focused on Four Core Insurance

and Retirement Businesses

and Retirement Businesses

Mark

Konen

President

Insurance Solutions

and

Retirement Solutions

Retirement Solutions

Will

Fuller

President

Lincoln

Financial Distributors

©2009 Lincoln

National Corporation

2009

Conference for

Investors and Bankers

Investors and Bankers

Life

Insurance and

Individual Annuities

Individual Annuities

2

Product

Innovation and

Responsiveness

Responsiveness

Securing

Financial Futures

Financial Futures

Operational

Effectiveness

Comprehensive

Risk Management

Risk Management

Distribution

Depth

and Breadth

and Breadth

Cornerstones

of Our Success

3

Scale

Fuels Market Leadership

Compelling

-

And

competitive products, along with a distribution

organization that is both a differentiator and a value

creator for Lincoln

organization that is both a differentiator and a value

creator for Lincoln

Comprehensive

-

Suite

of solutions and a multi-channel, multi-product

distribution model

distribution model

Consistent

-

Approach

to product development, risk management and

our deep distribution relationships and wholesaler

execution

our deep distribution relationships and wholesaler

execution

4

1 Source:

LIMRA, based on YTD sales as of June 30, 2009, except Life/LTC ranking which is

based on FY 2008 sales

2 As of

September 30, 2009

|

UL

|

#

1

|

Life-LTC

|

#

1

|

|

VUL

|

#

4

|

Term

|

#

16

|

Life

Insurance Overview

Leveraging

scale to drive value

#3

life insurance provider in 20091

$532

billion of life insurance in-force2

Multi-channel

distribution

Comprehensive

product suite1

Industry

leading underwriting

Consistent,

stable market presence year

after year

after year

5

1 Based on

YTD sales as of September 30, 2009, specialty represents COLI/BOLI

Key

Takeaways:

Driving

sales through multiple channels

Leveraging

presence in MGA to increase MoneyGuard sales

Lincoln

ranked top 1, 2 or 3 Life

carrier in many key distribution

firms

carrier in many key distribution

firms

Expanded

distribution

relationships

relationships

Increased

advisor base by 11%

Sales

by Channel1

2009

Channel Highlights

Leveraging

Scale and Footprint to Grow

Life Insurance Sales Across Key Partners

Life Insurance Sales Across Key Partners

6

Key

Takeaways:

Increasing

market share

Shift

to term life and lower face amount UL policies

Significant

increase in number of policies sold (UL +26%, Term +107%)3

COLI

/ BOLI

VUL

UL

Term

$415

$530

1 As of

September 30, 2009; 2 Source: LIMRA, based on YTD sales as of June 30, 2009; 3

YTD 3Q09 versus YTD 3Q08

2008

2009

YTD

Sales by Product1

($

in millions)

Market

Share2

Increasing

Market Share in a Changing

Sales Environment

Sales Environment

7

Secondary

Guarantee

UL Product Management

UL Product Management

Changing

competitive landscape

New

products earn 12 - 15% returns without

capital solution

capital solution

Pricing

and compensation changes

Focus

on less capital-intensive “cells”

Leverage

underwriting expertise

Manage

interest rate risk

Liability

structure Æ

long investment strategy

Pricing

assumes very low lapses

8

2005

2006

2007

2008

2009

YTD2

YTD2

MoneyGuard

Sales

(in

PAP, millions)

3Q08

YTD MoneyGuard Sales

1 Source:

LIMRA, based on sales

2 As of

September 30, 2009

MoneyGuard

Product

meets consumer preference for flexible

benefits solutions

benefits solutions

Simplified

story and product processes (fall 2006)

70%

market share in 20081

YTD

3Q 2009 sales up 18%

Product

and distribution

enhancements create

new opportunities

enhancements create

new opportunities

9

Life

Insurance

2010 Focus

2010 Focus

Maintain

product leadership

Build

on core distribution strength

Explore

opportunities with financial advisors

who do not currently sell life insurance

who do not currently sell life insurance

10

|

Variable

Annuities

|

# 7

|

|

Fixed

Annuities

|

#

13

|

|

Indexed

Annuities

|

# 4

|

1 Source:

MARC and LIMRA, based on YTD sales as of June 30, 2009

2 As of

September 30, 2009

Product

mix + continuity in the market = diversified risk

Individual

Annuities Overview

Leveraging

scale, traditionally conservative

approach to drive value

approach to drive value

#

5 overall annuity provider1

$72

billion in account values2

Multi-channel

distribution

Comprehensive

product suite1

Multiple

income solutions

11

1 Based on

YTD sales as of September 30, 2009, VA includes fixed portion

Key

Takeaways:

Leverage

distribution strength and product mix

Expand

distribution relationships

Increase

wholesaler productivity

Sales

by Channel1

Sales

by Product1

VA

Indexed

Fixed

Leveraging

Scale and Footprint to Grow

Annuity Sales Across Key Partners

Annuity Sales Across Key Partners

12

Key

Takeaways:

Increasing

wholesaler productivity

Broad

product portfolio to meet shifting demand

Distribution

relationships drive long-term value

1 Variable

includes fixed portion

Variable1

Indexed/Fixed

$7.9

YTD

Sales by Product

($

in billions)

YTD

Total Net Flows

($

in billions)

$9.4

Resilient

Business Model in a Changing

Sales Environment

Sales Environment

13

Move

toward more conservative products & guarantees

Lincoln

objective - be a consistent

market participant

market participant

Stayed

at conservative end of the

spectrum of guarantees

spectrum of guarantees

Product

Guarantees1, May

2008

1 Calculated

as initial withdrawal as a percentage of principal, buying at 60 and holding to

65

Source:

Variable Annuity Internal Competitive Intelligence

àOctober

2009

Recent

actions taken:

Tightened

investment restrictions

Increased

rider fees

Reduced

roll-up period

Removed

“double” from Lincoln

Lifetime Advantage

Lifetime Advantage

Industry

Redesign of VA Living Benefits

14

Writing

business consistently through market

cycles improves risk profile

cycles improves risk profile

Did

not add roll-up to GMWB until early 2008

No

significant change in policyholder behavior

during crisis

during crisis

Conservative

death benefit guarantees

Hedge

Program covers all VA guarantees

Assets

cover liabilities

|

9/30/09

GMWB Exposure (Net

Amount at Risk1/Account

Value)

|

|||||||

|

2003

|

2004

|

2005

|

2006

|

2007

|

2008

|

2009

|

Total

|

|

1.5%

|

5.3%

|

16.6%

|

21.6%

|

25.4%

|

8.1%

|

0.3%

|

11.6%

|

1 Net amount

at risk is calculated as the guaranteed amount minus account value, floored at

zero

Inforce

VA Risk Profile

15

VA

FA

Combined

1Q

09

VA

FA

Combined

2Q

09

VA

FA

Combined

3Q

09

1 Represents

un-levered returns based on pricing assumptions and capital markets conditions

during the quarter

New

Business Profitability

Strong

Indexed/Fixed returns in early 2009 help

balance VA returns

balance VA returns

VA

product changes (removing “double”) would

push Q3 VA return to 15%

push Q3 VA return to 15%

Reduced

“tail” risk on new GMWB design

16

Individual

Annuities

2010 Focus

2010 Focus

Maintain

product leadership

Build

on core distribution strengths

Simplify

and enhance advisor experience

Explore

new opportunities for annuities

Bob

Dineen

President and Chief

Executive Officer

Lincoln

Financial Network

©2009 Lincoln

National Corporation

2009

Conference for

Investors and Bankers

Investors and Bankers

The

Retail Model &

Consumer Behavior

Consumer Behavior

2

Lincoln

Financial Network Overview

LFN

Positioned for Growth

Investment

in Recruiting Platform

Trend

in the Industry towards Independence

3

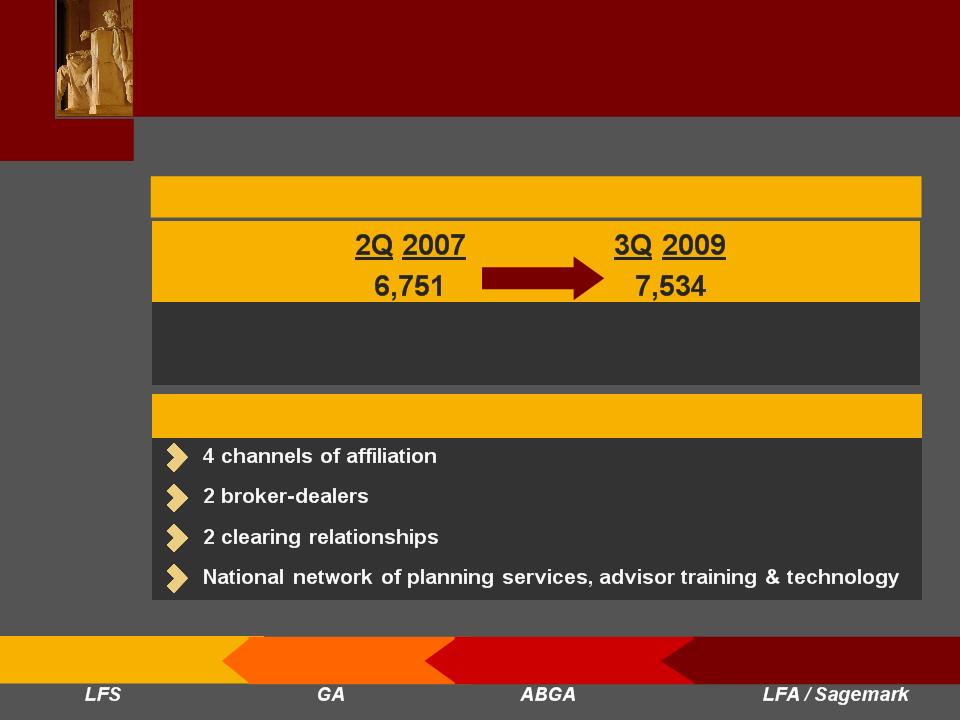

|

2007:

First year of new national recruiting effort

|

|

Successfully

recruiting experienced, productive

advisors

|

Independent

Full

Service Support

|

A

National Support Network for Advisors and their Clients

|

Growth

of Advisor Population

LFN

Offers a Unique Value Proposition

For Planners and Producers

For Planners and Producers

4

* Defined

as distribution revenues, less producer compensation and fully allocated

expenses

** Reflects

LFN percentage of total LFG production, YTD as of September 30,

2009

LFN

Internal P&L*

26%

life insurance PAP**

~$100

million

~50%

in-force life

insurance block

insurance block

11%

annuity deposits**

~$1

billion

Bottom

Line Operating Results and

Significant Contributions to the Corporation

Significant Contributions to the Corporation

5

|

Pre-Crisis

February 2008 |

Post-Crisis

April 2009 |

|

20%

of

retirees say that they

are less financially secure than they thought they would be* |

49%

of

retirees say that they

are less financially secure than they thought they would be* |

|

53%

of

retirees are risk-

averse* (call themselves extremely or somewhat conservative) |

70%

of

retirees are risk-

averse* (call themselves extremely or somewhat conservative) |

Post-crisis,

72% of pre-retirees

are concerned about

taxes in retirement**

taxes in retirement**

* Society of

Actuaries, LIMRA, InFRE study: What a Difference a Year Makes, April 2009 **

McKinsey Consumer Financial Health Survey, March, 2009

Consumer

Sentiment Shift Post-Crisis…

6

* U.S. Census

Bureau

The

Need for Advice

Opportunity for Lincoln and the Industry

Opportunity for Lincoln and the Industry

Of

79 million baby boomers …

…

only 20% have a clear plan for their retirement*

Consumers

are more risk-averse

$3

trillion “on the sidelines” in minimal interest accounts

Implications:

muted recovery plus low interest rates will

suppress individual wealth building

suppress individual wealth building

Advisors

can build trust in this environment by

understanding new desire for downside protection and

income guarantees

understanding new desire for downside protection and

income guarantees

Taxes

are expected to become more of a top-of-

mind issue as marginal tax rates increase and

Congress pursues estate tax legislation

mind issue as marginal tax rates increase and

Congress pursues estate tax legislation

Will

Fuller

President and Chief

Executive Officer

Lincoln

Financial Distributors

©2009 Lincoln

National Corporation

2009

Conference for

Investors and Bankers

Investors and Bankers

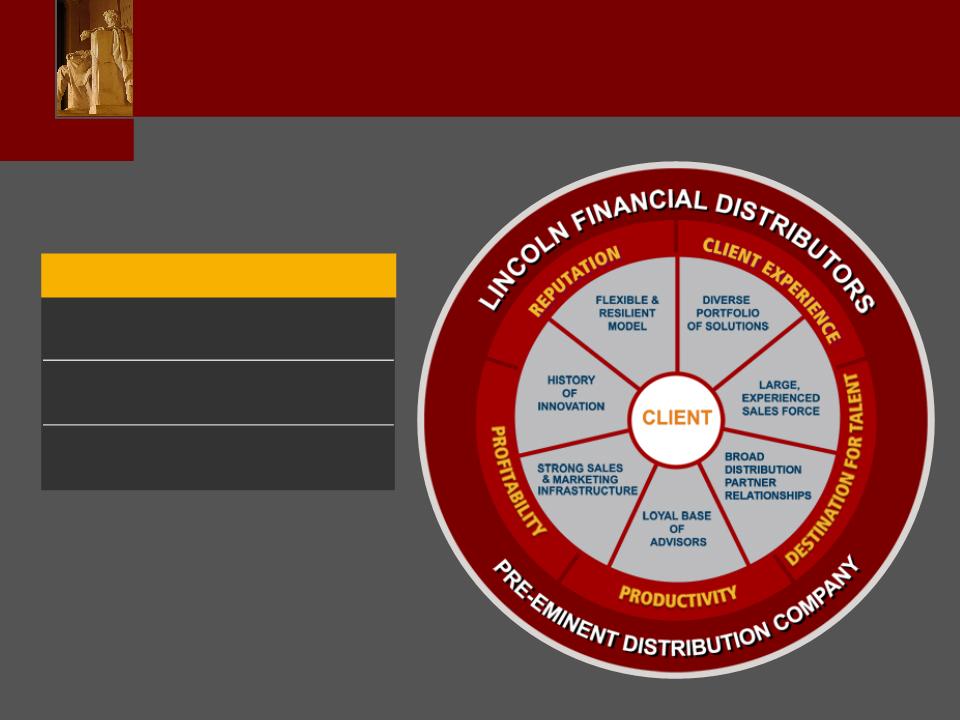

Executing and

Evolving

the LFD Model

the LFD Model

8

Goal

is to Build on LFD’s Strengths and Position in

the Industry to Increase Our Contribution to Lincoln

the Industry to Increase Our Contribution to Lincoln

Annuities 288

Life

Insurance 223

Defined

Contribution 44

LFD

Sales Force

9

Client

needs

and preferences

and preferences

Distribution

partnerships

partnerships

Execution

ACT

III

Execute

in the

Current

Environment

Current

Environment

Adjust

to

Market

Realities

Market

Realities

Align

to enterprise

structure

structure

Contain

/ reduce

expenses

expenses

Right-size

sales force

for market opportunity

for market opportunity

Align

sales structure

with consumer

demand

with consumer

demand

Protect

and strengthen distribution

relationships

relationships

26

new or expanded distribution

relationships

relationships

Base

of active advisors up 6%

Achieve

Sales Targets

Gross

sales

Diverse

mix of sales

Net

flows

Focus

on wholesaler productivity

discipline

discipline

Focus

on talent retention and

recruiting

recruiting

2009

was a Transitional Year - Focused on

Executing Through the Financial Crisis

Executing Through the Financial Crisis

ACT

I

ACT

II

10

Grow

Sales in core products

Annuities

Life

Insurance

Defined

Contribution

Pursue

natural cross-sell

synergies

synergies

Increase

wholesaler

productivity

productivity

Core

Focus

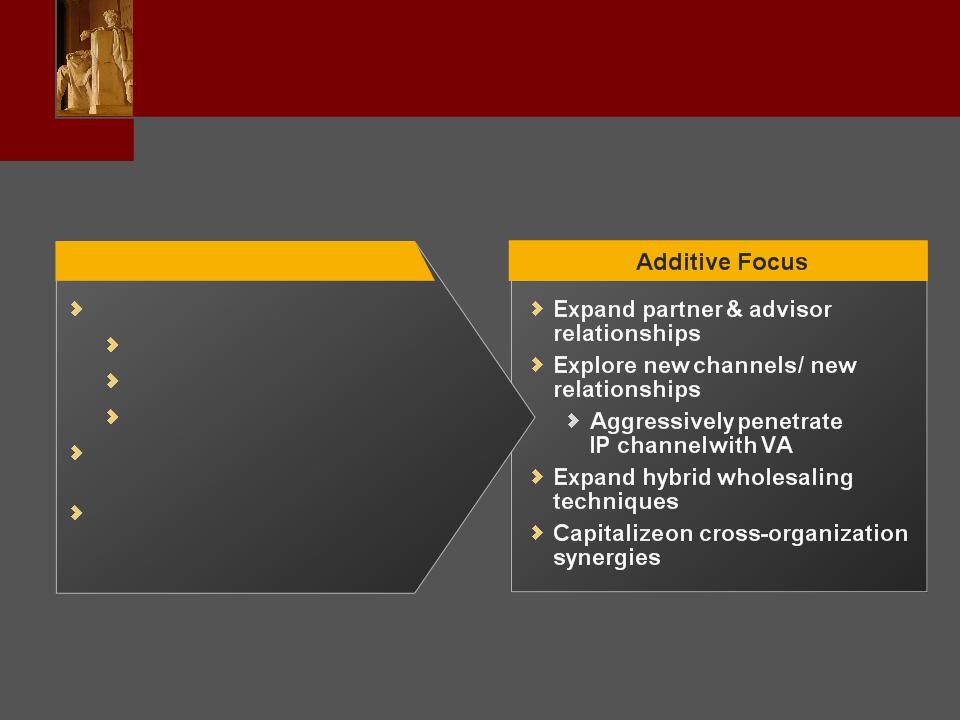

Drive

Execution and Growth: Focus on

Core Strengths and Additive Opportunities

Core Strengths and Additive Opportunities

11

|

Financial

Institutions |

|

General

Agents |

|

Lincoln

Financial Network |

Preeminent

Execution

Focus

What

We Will Do

To

Benefit Our Clients

Driving

Growth and Profitability in 2010 and Beyond

with A Client Centric Approach to Distribution

with A Client Centric Approach to Distribution

Establish

a “360°view” of

distribution relationships with

shared goals

distribution relationships with

shared goals

Improve

client experience with formalized

“Voice of the Customer” process

“Voice of the Customer” process

Implement

firm-wide core skills &

productivity initiative

productivity initiative

Recruit

& retain THE BEST industry talent

Continue

to drive a diverse mix

of business

of business

Leverage

cross-organization synergies

and promote cross-product sales

and promote cross-product sales

Maintain

fiscal discipline

Essential

Partner

Program

Partner

Program

Client

Experience

Experience

Reputation

Sales

Force

Productivity

Productivity

Productivity

Talent

Maximize

Distribution

Value to LFG

Distribution

Value to LFG

Profitability

©2009 Lincoln

National Corporation

Mark

Konen

President

Insurance Solutions

and

Retirement Solutions

Retirement Solutions

2009

Conference for

Investors and Bankers

Investors and Bankers

Defined

Contribution and

Group Protection

Group Protection

2

Small

Case Market

(Director

Program)

Large

Case Market

(Alliance

Program)

Multi-Fund

and

Other

Sales3

AUM3

1 Source:

LIMRA, as of June 30, 2009

2 Source:

LIMRA, YTD as of June 30, 2009

3 YTD as of

September 30, 2009

$3.8

billion

$34.3

billion

Defined

Contribution Overview

Focus

on 403(b) consolidation

#6

in 403(b) plan assets1

Top

3 in Healthcare and top 10 in K-12, based on

contributions2

contributions2

Focus

401(k) efforts on top strategic partners

3

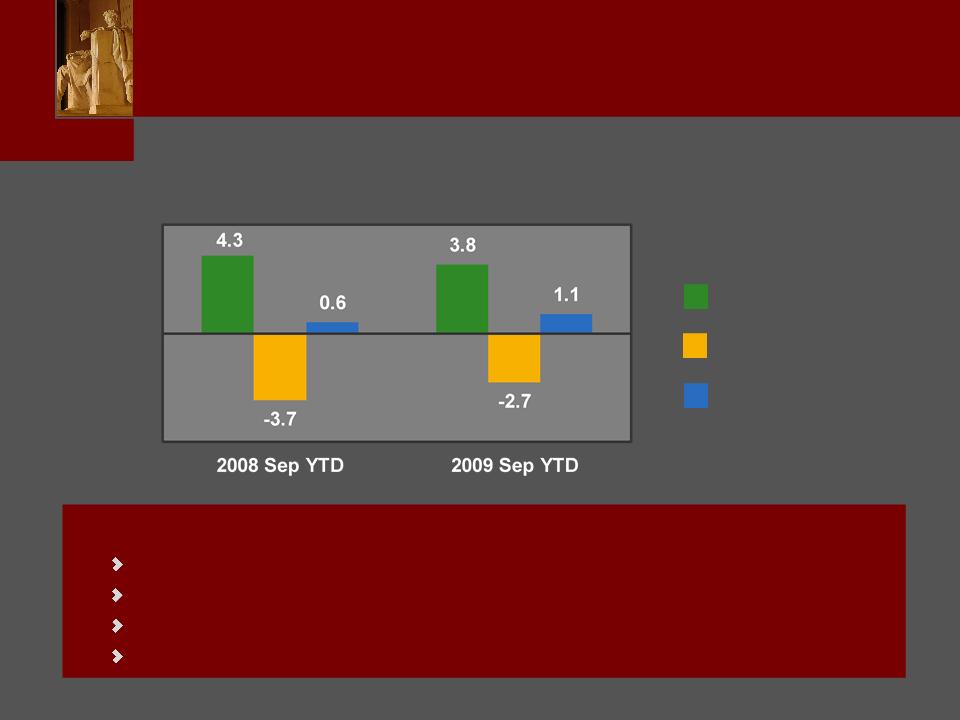

Deposits

Outflows

Net

Flows

Production

Results

($ billions)

($ billions)

Key

Takeaways:

Market

“frozen” throughout much of 2009

Solid

production despite economic pressures

Improved

lapse experience driving increase in net flows

Total

DC participants up 5% over last year

Defined

Contribution

Increasing Net Flows

Increasing Net Flows

4

|

|

Mid-Large

403(b)

and Corporate |

Micro-Small

401(k)

|

|

Distribution

Force

|

Plan

Sponsor-Focused

10

external and

6 internal wholesalers 21

account

executives Participant

Focused

300

Retirement

Consultants and Advisors |

16

external and

8 internal wholesalers Leverage

LFD

strategic relationships |

|

Participants

|

1.2

million

|

0.2

million

|

|

AUM1

|

$28.5

billion

|

$5.8

billion

|

1 As of

September 30, 2009

Defined

Contribution

Distribution Depth and Breadth

Distribution Depth and Breadth

5

2010

Focus - Leveraging Participant

Relationships

Relationships

Untapped

Opportunity

Over

a million DC participants

Need

for retirement planning guidance

Maximize

participant lifecycle with Lincoln

Differentiated

service models depending on

client needs

client needs

High-Touch

model with Retirement Consultants and

Advisors

Advisors

Efficient-Touch

model with Phone Team and Web

6

2010

Focus - Continued

Strengthen

core service offering

Attract

new assets and maintain existing plans

Key

investments

UNIFIER

enhancements

Website

upgrades

Focus

on key Strategic Partners and TPAs in

small 401(k) space

small 401(k) space

Leverage

LFD relationships

Increase

wholesaler productivity

7

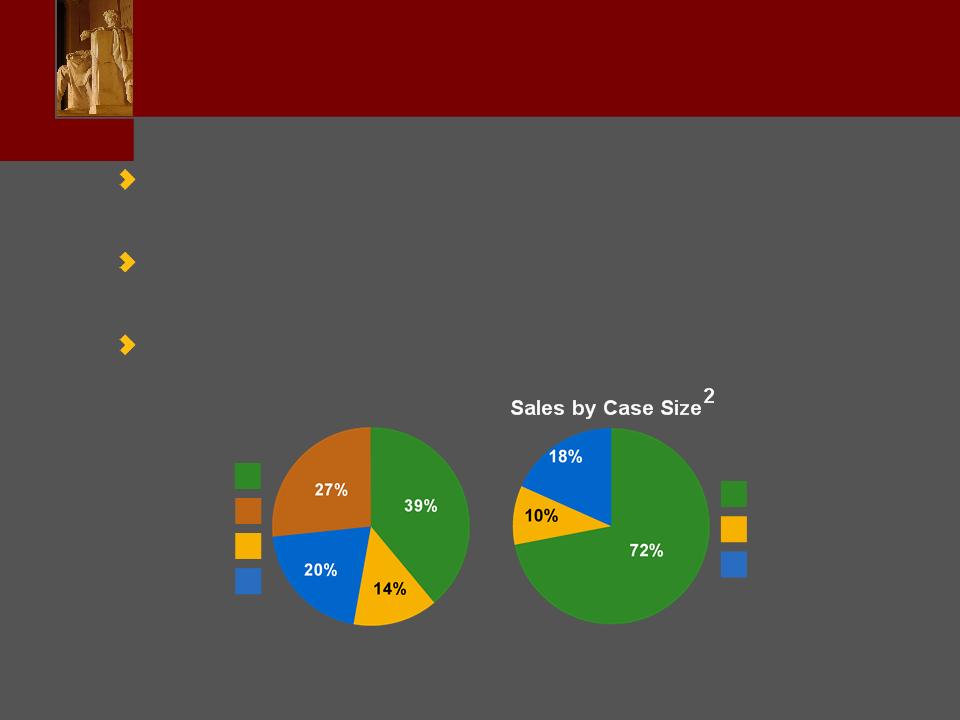

Less

than 500 Lives

501-1000

Lives

1000+

Lives

Sales

by Product2

Short-Term

Disability

Dental

Group

Life/AD&D

Long-Term

Disability

1 Source:

LIMRA, YTD as of June 30, 2009

2 Based on

YTD annualized sales as of September 30, 2009

$194

million

Group

Protection Overview

Leveraging

service expertise and distribution

strengths in core market of under 500 lives

strengths in core market of under 500 lives

#3

Group LTD and #7 Life carrier by new

contracts issued1

contracts issued1

Voluntary

sales ~38% of total new sales2

8

1 As of

September 30, 2009

2 YTD as of

September 30, 2009 compared to YTD September 30, 2008

Group

Protection

Distribution Depth and Breadth

Distribution Depth and Breadth

Distribution

model

2

Regional VP’s

12

Regional Directors

122

sales reps (wholesalers)1

Focus

on rep productivity

Number

of reps down slightly from 2008

Cautious

due to economic environment

Upgraded

talent

Rep

productivity up 7% versus last year2

Poised

for growth

9

8%

CAGR

Gaining

momentum with a strong pipeline

Year-over-year

third quarter 2009 sales up 17%

+4%

Group

Protection

Sales Growth

Sales Growth

10

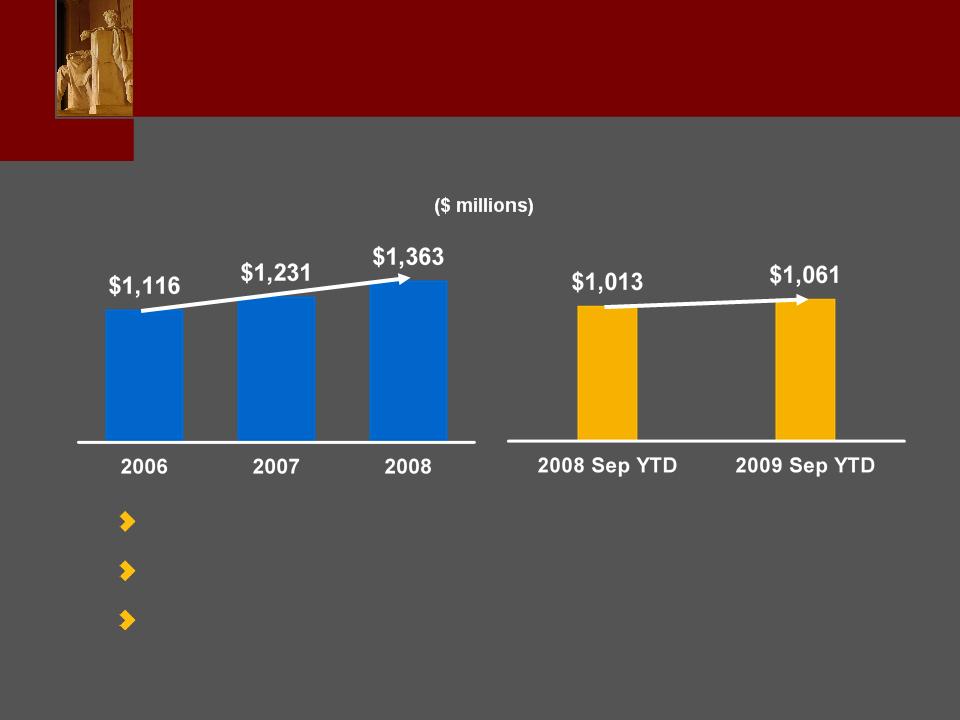

Net

Earned Premium

Solid

growth in spite of difficult environment

Case

lapses consistent with recent history

Unemployment

and wage actions depressing

inforce premium growth

inforce premium growth

11%

CAGR

+5%

Group

Protection

Non-Medical Premium Growth

Non-Medical Premium Growth

11

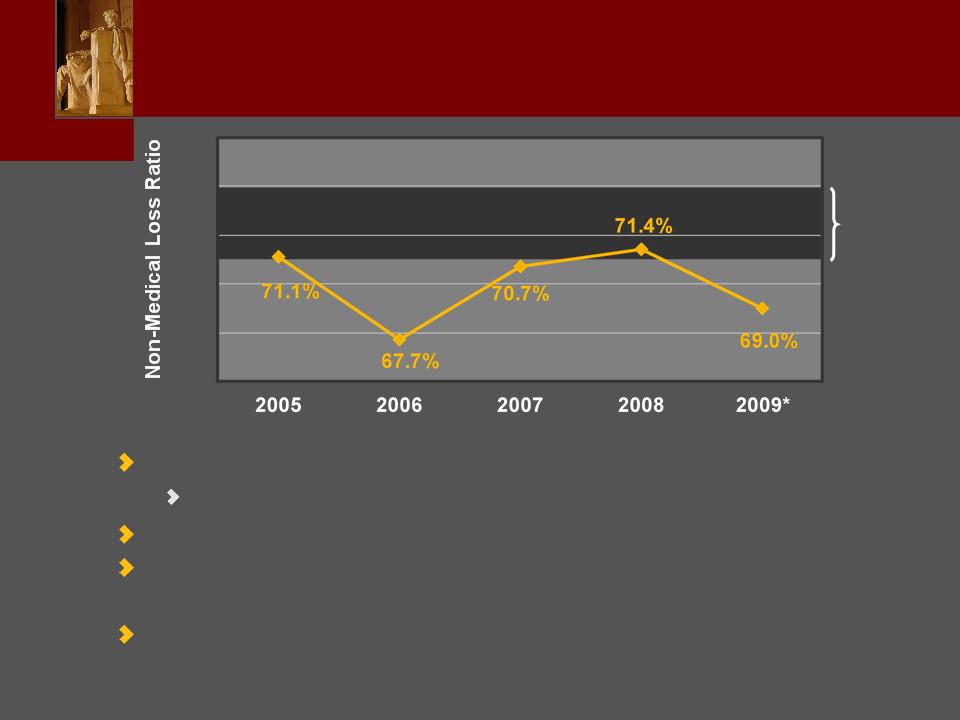

74%

71%

68%

Historic

Guidance

Guidance

Actual

Consistently

strong loss ratios over several years

Disciplined

risk selection and claims management expertise

Recent

disability loss ratios extremely good

Expect

near-term loss ratios to continue to trend

favorably to historic guidance

favorably to historic guidance

Significant

investments in claims management

infrastructure

infrastructure

* YTD as of

September 30, 2009

Group

Protection

Strong, Consistent Loss Ratios

Strong, Consistent Loss Ratios

12

1

Source: Eastbridge

Consulting Group, Inc., An

Update on the Voluntary Industry, May 2008

2 Best’s

Review, July 2009

2010

Focus - The Voluntary Opportunity

Compelling

Industry Opportunity

Continued

trend of employers shifting costs to employees

79%

of employers with 101-500 lives offer at least one

voluntary product1

voluntary product1

2008

industry sales of $5.2 billion and growing2

Compelling

LFG Opportunity

Proven

success and momentum with YTD sales of

$73 million up 18% versus last year

$73 million up 18% versus last year

Attractive

profit characteristics

2010

Initiatives

Expand

penetration with brokers

Position

for entry with classic worksite brokers

New

product offerings (e.g. accident)

Expanded

online enrollment

13

2010

Focus - Continued

Expansion

of field force

Increase

rep base to capitalize on opportunities

Continue

to increase rep productivity

Complete

reengineering of claims system and

processes

processes

Increased

efficiency and effectiveness

Enhanced

ability to manage claims

14

Product

Innovation and

Responsiveness

Responsiveness

Securing

Financial Futures

Financial Futures

Operational

Effectiveness

Comprehensive

Risk Management

Risk Management

Distribution

Depth

and Breadth

and Breadth

Cornerstones

of Our Success

©2009 Lincoln

National Corporation

Fred

Crawford

Chief

Financial Officer

2009

Conference for

Investors and Bankers

Investors and Bankers

Financial

Overview

Earnings and Capital

Earnings and Capital

2

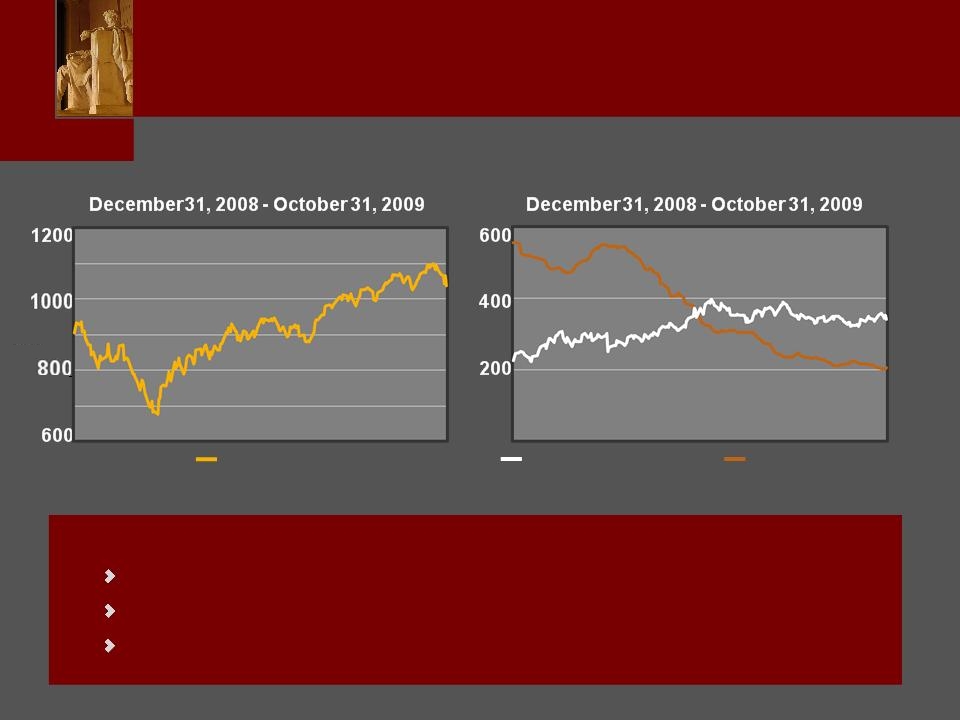

S&P

500

Equity

Markets

Market

Dynamics:

Account

values recovering - variable fees, NAR, DAC, statutory results

Rates

rising & spreads tightening - portfolio yields flat and hedge

volatility

Unrealized

gains/losses recover - some trading account profits generated

Interest

Rates & Spreads

Barclays

Credit

OAS

OAS

10yr

Treasury Rates

0

2009

Market Recovery

3

$228

$263

Life

Insurance

Group

Protection

Annuities

Defined

Contrib.

Avg.

diluted shares

257.8 262.4 310.0

1 See

appendix at the end of this presentation for a definition and reconciliation of

income from operations to net income and a schedule of notable

items

3Q

Income From Continuing Operations

Adjusted for Notable Items1

Adjusted for Notable Items1

($

in millions)

Earnings

Drivers

UK

and Delaware moved to

Discontinued Operations

Discontinued Operations

Insurance

Solutions:

Reinsurance

impact

Alternative

investments

Strong

group loss ratios

Retirement

Solutions:

Positive

and balanced flows

Market

impact on account values

EPS

impact from capital actions

$217

Third

Quarter Results

Sequential Growth in Account Values and Earnings

Sequential Growth in Account Values and Earnings

4

Life

36%

36%

Dental

10%

10%

Disability

44%

44%

Group

Net Earned Premium $1.6b

Medical

10%

10%

UL

43%

VUL

14%

UL

SG

23%

23%

MG

7%

Life

GAAP Reserves $42b

Whole

Life

10%

10%

Term

3%

Return

on Capital1

Life

Segment 9%

Stable

returns with building

in-force and account vales

in-force and account vales

Reinsurance

transactions impact

on earnings and capital

on earnings and capital

Alternative

investment income

expected to recover

expected to recover

Group

Segment 16%

Favorable

loss ratios below 70%

Steady

but lower growth in

premium expected near-term

premium expected near-term

1 Reflects

YTD reported un-leveraged returns excluding goodwill.

Note: Life

Insurance GAAP reserves as of September 30, 2009. Group Protection net earned

premium represents trailing 12 months.

Insurance

and Protection Businesses

Stable and Building Returns

Stable and Building Returns

5

Current

Reserve Financing

$1.8b

LOC facility through 2012

$400mm

long-term financing

$800mm

of reserves held

Statutory

Reserves

$25b

of UL reserves

$6b

of Whole Life & Term reserves

$2.5b

of UL reserves

$500mm

of Term reserves

Strategy:

Term-out

a portion of LOC needs in next few years

Plans

to execute on a $300mm term solution in 2009

Absorb

natural growth in reserves through statutory earnings

Required

Reserves Subject

to

Capital Financing

Life

Reserve Management

Executing on a Prudent Long-Term Plan Over 3 Years

Executing on a Prudent Long-Term Plan Over 3 Years

6

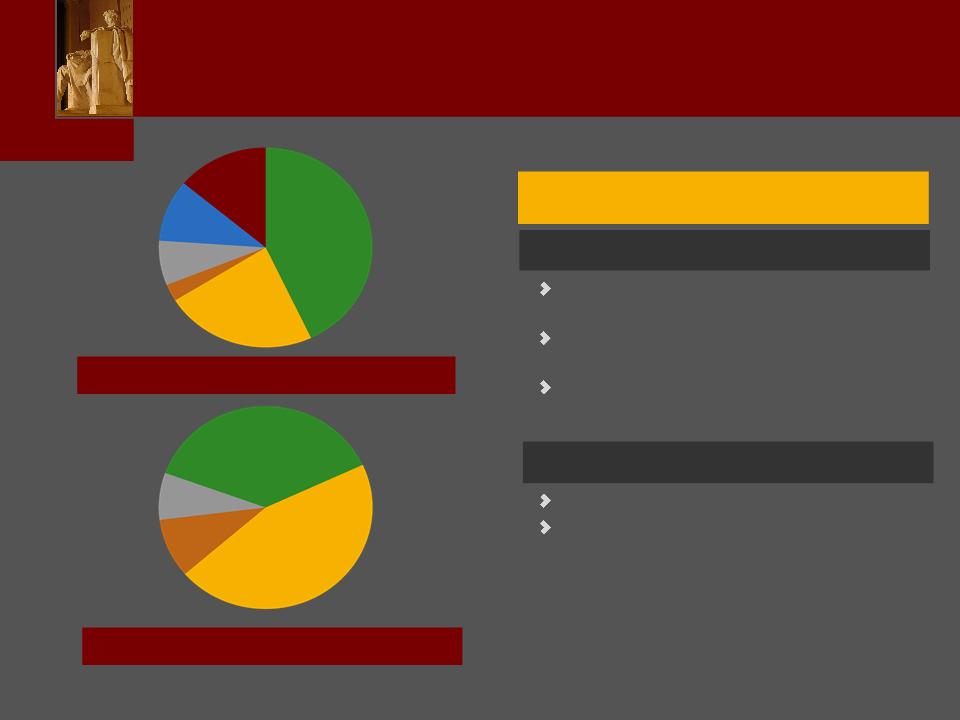

Retirement

AUM = $105 billion

DC

Mutual

Funds

DC

Fixed

Annuities

DC

Variable

Annuities1

Variable

Annuities1

Individual

Fixed Annuities

Individual

Variable

Annuities

14%

18%

6%

9%

49%

4%

Fixed

Portion of Individual

Variable Annuities

Variable Annuities

1 Includes

fixed portion of VA

2 Reflects

year-to-date reported un-leveraged returns excluding goodwill.

Return

on Capital2

Individual

Annuities 10%

Average

account values recovering

Liquidity

fully invested in 3Q

Death

benefit reserve and DAC

amortization elevated

amortization elevated

Defined

Contribution 13%

Average

account values recovering

Plans

to invest in the platform

Retirement

Returns

Diverse Portfolio Driving Balanced Returns

Diverse Portfolio Driving Balanced Returns

7

55%

Account

Value

Value

Step

Up <1%

36%

Individual

VA AUM1 = $56

billion

Hi-Water

Mark

8%

Return

of

Premium

Individual

VA Death Benefits

LB

NAR3 $6.5b $3.1b

DB

NAR3 $14.8b $7.3b

Hedge

Target $3.7b $1.1b

Hedge

Assets $4.3b $1.2b

GAAP

Reserves $3.2b $1.2b

Statutory

Reserves2 $1.1b $.8b

12/31/08 9/30/09

16%

46%

38%

No

Guarantee

Guaranteed

Income

Benefit

Income

Benefit

Guaranteed

Withdrawal

Benefit

Withdrawal

Benefit

1 Includes

fixed portion of VA

2 Statutory

reserves excludes adoption of VACARVM

3 Net amount

at risk is calculated as the guaranteed amount minus account value, floored at

zero

Reserve

Metrics

Individual

Variable Annuities

Proven Risk Management and Full Economic Hedge

Proven Risk Management and Full Economic Hedge

8

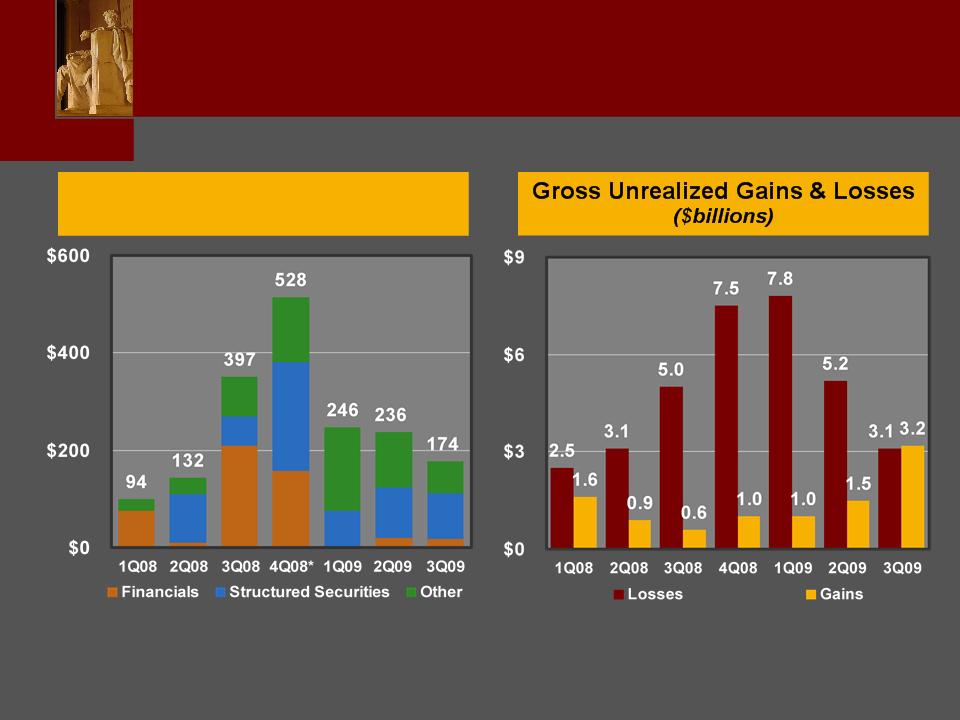

Realized

Losses

($millions)

All data

shown for available-for-sale securities. All

realized loss data presented on a pre-DAC and tax basis; excludes losses on

derivatives; includes losses

on sold securities.

on sold securities.

* Excludes

the impairment on Bank of America common stock securities of $131 million,

pre-tax, held at the holding company and does not impact insurance

subsidiary capital.

subsidiary capital.

Note: 2009

reflects the adoption of FASB Staff Position No. FAS 115-2 and

124-2.

General

Account Investment Results

Unrealized Loss Conditions Improving

Unrealized Loss Conditions Improving

9

1 Represents

statutory results of Lincoln National Life Insurance Company, Lincoln Life &

Annuity of New York, and First-Penn Pacific Life Insurance Company;

The reporting of RBC measures is not intended for the purpose of ranking any insurance company or for use in connection with any marketing, advertising or

promotional activities.

The reporting of RBC measures is not intended for the purpose of ranking any insurance company or for use in connection with any marketing, advertising or

promotional activities.

Potential

Headwinds

- asset impairments, ratings migration, and

adoption of VACARVM

adoption of VACARVM

Potential

Tailwinds

- statutory earnings, securitization, and potential net

impact of various NAIC actions

impact of various NAIC actions

Est.

Total

Adjusted Capital & RBC1

($billions)

Risk

Based Capital Ratio1

Insurance

Company Capitalization

Capital Positioned to Withstand Stressed Markets

Capital Positioned to Withstand Stressed Markets

10

$900mm

of liquid

investments1

investments1

CP:

$150mm issued under

A2/P2 program1

A2/P2 program1

Next

maturity of $250mm due

March 2010

March 2010

Delaware

sale on track with

$400mm in proceeds

$400mm in proceeds

Expect

to push some capital

down into subsidiaries

down into subsidiaries

Considering

refinancing

alternatives to pre-fund 2010

maturity

alternatives to pre-fund 2010

maturity

Holding

Company

Year-end

Outlook

Strategy:

Target

12-18 months of cash flow held at the holding company

Ladder

maturities and pre-fund when markets are favorable

1 As of

September 30, 2009

Financial

Flexibility

Excess Holding Company Liquidity and Ready Capital

Excess Holding Company Liquidity and Ready Capital

Appendix

12

Income

(loss) from operations and ROE, as used in the earnings release, are non-GAAP

financial measures and

are not substitutes for net income (loss) and ROE, calculated using GAAP measures. Income (loss) from

operations represents after-tax results excluding, as applicable, realized gains and losses associated with the

following: sale or disposal of securities; impairments of securities; change in the fair value of embedded

derivatives within certain reinsurance arrangements and the change in the fair value of related trading securities;

change in the guaranteed living benefits embedded derivative reserves within our variable annuities net of the

change in the fair value of the derivatives we own to hedge the changes in the embedded derivative reserves,

the net of which is referred to as GLB net derivatives results; net difference between the benefit ratio reserves on

our guaranteed death benefit riders within our variable annuities and the change in the fair value of the

derivatives excluding our expected cost of the hedging instruments; and changes in the fair value of the

embedded derivative liabilities related to index call options we may purchase in the future to hedge contract

holder index allocations applicable to future reset periods for our indexed annuity products, income (loss) from

the initial adoption of changes in accounting standards, income (loss) from reserve changes (net of related

amortization) on business sold through reinsurance, losses on early retirement of debt, including subordinated

debt, losses from the impairment of intangible assets and income (loss) from discontinued operations.

are not substitutes for net income (loss) and ROE, calculated using GAAP measures. Income (loss) from

operations represents after-tax results excluding, as applicable, realized gains and losses associated with the

following: sale or disposal of securities; impairments of securities; change in the fair value of embedded

derivatives within certain reinsurance arrangements and the change in the fair value of related trading securities;

change in the guaranteed living benefits embedded derivative reserves within our variable annuities net of the

change in the fair value of the derivatives we own to hedge the changes in the embedded derivative reserves,

the net of which is referred to as GLB net derivatives results; net difference between the benefit ratio reserves on

our guaranteed death benefit riders within our variable annuities and the change in the fair value of the

derivatives excluding our expected cost of the hedging instruments; and changes in the fair value of the

embedded derivative liabilities related to index call options we may purchase in the future to hedge contract

holder index allocations applicable to future reset periods for our indexed annuity products, income (loss) from

the initial adoption of changes in accounting standards, income (loss) from reserve changes (net of related

amortization) on business sold through reinsurance, losses on early retirement of debt, including subordinated

debt, losses from the impairment of intangible assets and income (loss) from discontinued operations.

The

earnings used to calculate ROE, as used in the earnings release, are income

(loss) from operations.

Income (loss) from operations is an internal measure used by the company in the management of its operations.

Management believes that this performance measure explains the results of the company's ongoing businesses

in a manner that allows for a better understanding of the underlying trends in the company's current business

because the excluded items are unpredictable and not necessarily indicative of current operating fundamentals

or future performance of the business segments, and, in most instances, decisions regarding these items do not

necessarily relate to the operations of the individual segments.

Income (loss) from operations is an internal measure used by the company in the management of its operations.

Management believes that this performance measure explains the results of the company's ongoing businesses

in a manner that allows for a better understanding of the underlying trends in the company's current business

because the excluded items are unpredictable and not necessarily indicative of current operating fundamentals

or future performance of the business segments, and, in most instances, decisions regarding these items do not

necessarily relate to the operations of the individual segments.

Definition

of Income From Operations

13

Net

Income (Loss Available to Common Stockholders)

Less:

Preferred

stock dividends and accretion of discount

Minority

adjustment

Net

Income

Less:

Excluded

realized gain (loss)

Income

from reserve changes (net of related

amortization) on business sold through reinsurance

amortization) on business sold through reinsurance

Gain

on early extinguishment of debt

Impairment

of intangibles

Income

(loss) from discontinued operations

Income

from Operations

Earnings

per share (diluted)

Net

Income (Loss)

Income

from Operations

($

in millions, except per share data)

$(161.4)

(161.4)

(215.9)

0.4

0.6

(153.8)

$

207.3

$(0.62)

$

0.79

2Q

09

3Q

09

$(579.0)

(0.1)

(578.9)

(188.4)

0.4

41.8

(603.5)

7.7

$

163.1

$(2.27)

$

0.63

1Q

09

$137.0

(16.3)

153.3

(196.0)

0.4

1.4

72.0

$275.5

$0.44

$0.84

Net

Income to Income from Operations

Reconciliation

Reconciliation

14

Reported

DAC

Unlocking

Tax-related

items

Expenses

Other

(net)

Total*

Alternative

Investments**

($

in millions)

74

74

* Excludes

alternative investment income

** Reflects

actual income or (loss) on alternative investment portfolio

Retirement

Solutions

Annuities

Insurance

Solutions

Defined

Contrib.

Contrib.

Life

Insurance

Insurance

Group

Protection

Protection

Other

Operations

Operations

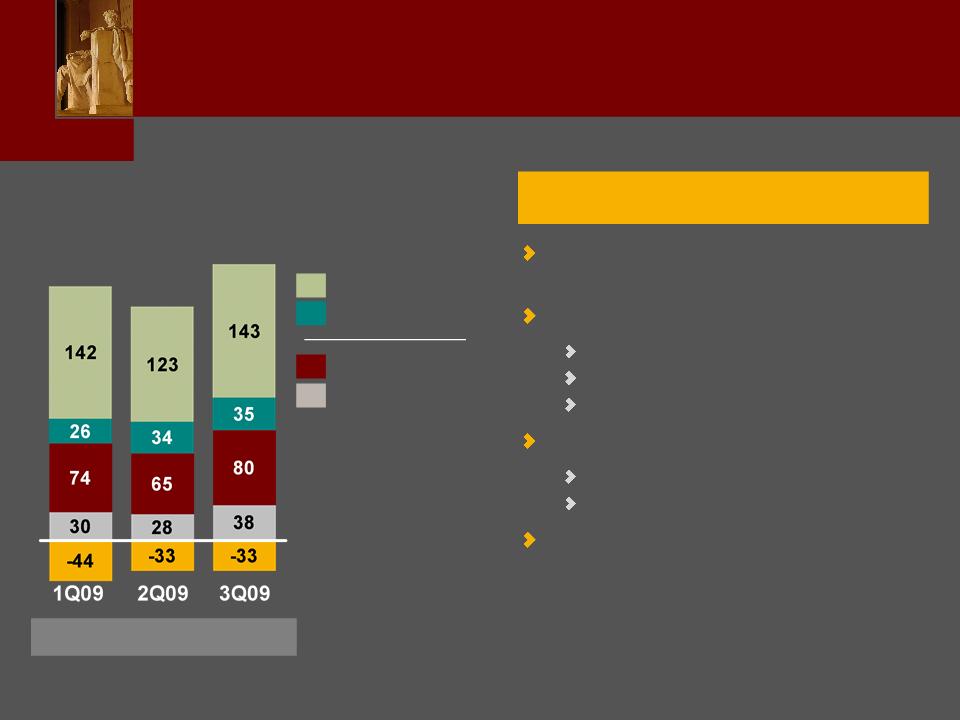

30

30

142

142

(2)

26

26

(108)

(64)

(44)

1Q

2009 Income From Operations

Schedule of Notable Items

Schedule of Notable Items

15

Reported

DAC

Unlocking

Tax-related

items

Expenses

Mortality

Other

(net)

Total*

Alternative

Investments**

($

in millions)

65

65

(5)

Retirement

Solutions

Annuities

Insurance

Solutions

Defined

Contrib.

Contrib.

Life

Insurance

Insurance

Group

Protection

Protection

Other

Operations

Operations

28

28

(3)

133

2

5

3

123

(20)

34

34

(1)

(52)

(19)

(33)

* Excludes

alternative investment income

** Reflects

actual income or (loss) on alternative investment portfolio

2Q

2009 Income From Operations

Schedule of Notable Items

Schedule of Notable Items

16

Reported

DAC

Unlocking

Tax-related

items

Other

Total*

Alternative

Investments**

($

in millions)

95

11

3

1

80

2

Retirement

Solutions

Annuities

Insurance

Solutions

Defined

Contrib.

Contrib.

Life

Insurance

Insurance

Group

Protection

Protection

Other

Operations

Operations

43

5

38

1

137

(12)

6

143

(5)

35

35

(33)

(33)

1

* Excludes

alternative investment income

** Reflects

actual income or (loss) on alternative investment portfolio

3Q

2009 Income From Operations

Schedule of Notable Items

Schedule of Notable Items