Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32.1.2 - SKYLYFT Media Group, Inc. | skylyft093009qex321.htm |

| EX-31 - EXHIBIT 31.2.2 - SKYLYFT Media Group, Inc. | skylyft093009qex312.htm |

| EX-31 - EXHIBIT 31.1.2 - SKYLYFT Media Group, Inc. | skylyft093009qex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended September 30, 2009

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from _______ to ________

Commission File Number:

SKYLYFT MEDIA NETWORK, INC.

(Exact name of small business issuer as specified in its charter)

California, United States

(State or other jurisdiction of incorporation or organization)

03-0533701

(IRS Employer Identification Number)

100 East Verdugo Avenue, Burbank, California 91502

(Address of principal executive offices)

(818) 605 0957

(Issuer’s telephone number)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Check whether the issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act. Yes [ ] No [X] State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: As of September 30, 2009, 26,436,527 shares of common stock.

Transitional Small Business Disclosure Format (Check one): Yes [ ] No [X]

1

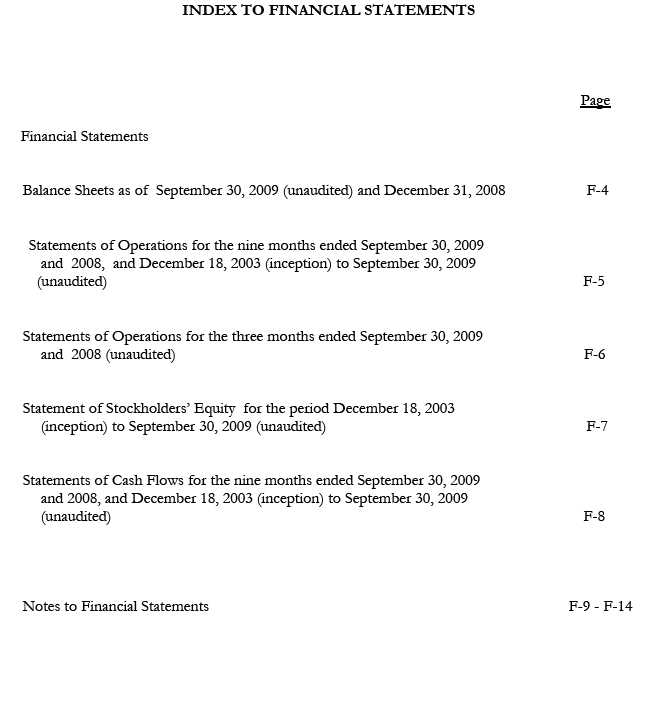

| PART I – FINANCIAL INFORMATION | ||

| Item 1. | Financial Statements | |

| Page | ||

| Balance Sheets | 4 | |

| Statements of Operations | 5-6 | |

| Statements of Stockholder's Equity | 7 | |

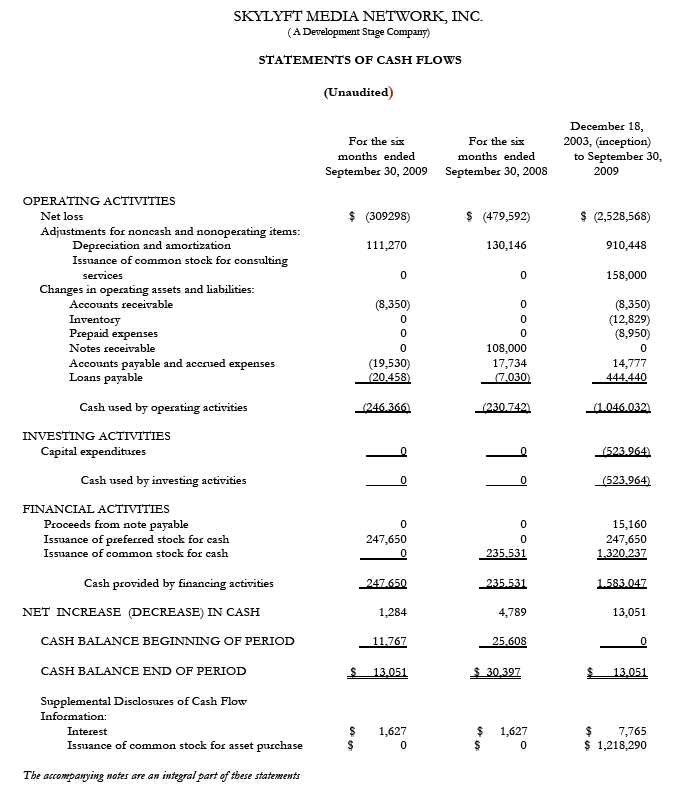

| Statement of Cash Flow | 8 | |

| Notes to the Financial Statements | 9-14 | |

2

3

F-4

F-5

F-6

F-7

F-8

SKYLYFT MEDIA NETWORK, INC.

( A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS

September 30, 2009

NOTE A – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

1. Nature of Operations/ Basis of Presentation

Nature of Operations

SKYLYFT Media Network, Inc. (the “Company”), was incorporated in December 2003 in the state of Delaware and conducts operations in California. The Company manufactures a patent pending, grand format, media rotation system, called the “SkyBanr Remote Controlled Mini-Lift.” The SkyBanr Mini-Lift system creates advertising revenues from unused ceiling space capacity in retail malls, airports, convention centers, movie theatres, sporting arenas and other public venues with high-ceiling areas. The Company also provides online internet services to a small base of retail customers.

Basis of Presentation and Accounting Estimates

The accompanying interim unaudited financial statements have been prepared in accordance with Form 10-Q instructions and in the opinion of management contain all adjustments (consisting of only normal recurring adjustments) necessary to present fairly the financial position as of September 30, 2009, and the results of operations for the nine months ended September 30, 2009 and 2008, and December 18, 2003 (inception) to September 30, 2009 and cash flows for the nine months ended September 30, 2009 and 2008 and December 18, 2003 (inception) to September 30, 2009. These results have been determined on the basis of generally accepted accounting principles and practices in the United States and applied consistently as those used in the preparation of the Company's 2009 Annual Report on Form 10-K.

The preparation of financial statements in conformity with generally accepted accounting principles in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

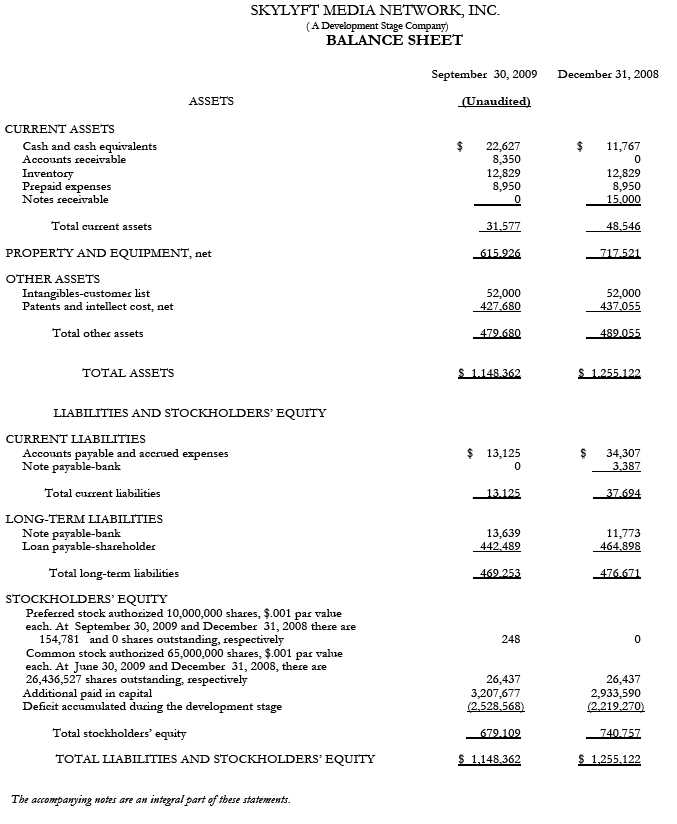

2. Inventories

Inventories, consisting of raw materials, are stated at the lower of cost (first-in, first-out) or market as of September 30, 2009 and December 31, 2008.

F-9

SKYLYFT MEDIA NETWORK, INC.

( A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS

September 30, 2009

NOTE A – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

3. Cash Equivalents

Investments having an original maturity of 90 days or less that are readily convertible into cash are considered cash equivalents. As of September 30, 2009 and December 31, 2008, the Company had no cash equivalents.

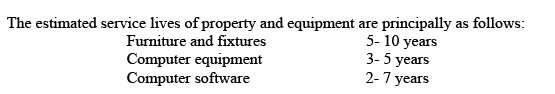

4. Property and Equipment

Property and equipment are stated at cost and are depreciated principally on methods and at rates designed to amortize their costs over their estimated useful lives.

Intangible Asset:

Patents and intellect costs are amortized over a straight-line method for forty years, the legal life of the patent. (See Note-F) The customer list will be annually tested for impairment. There was no impairment recorded for the year 2008 on the customer list. (See Note-G) Repairs and maintenance are expensed as incurred. Expenditures that increase the value or productive capacity of assets are capitalized.

5. Notes Receivable

As of September 30, 2009, we did not have any notes receivable.

6. Revenue Recognition

Sales are recorded when products are shipped to customers. Provisions for discounts and rebates to customers, estimated returns and allowances, and other adjustments are provided for in the same period the related sales are recorded. In instances where products are configured to customer requirements, revenue is recorded upon the successful completion of the Company’s final test procedures.

F-10

SKYLYFT MEDIA NETWORK, INC.

( A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS (continued)

September 30, 2009

NOTE A – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

7. Advertising Cost

Advertising cost are expensed as incurred. Advertising expense totaled $ 3,811 and $ 33,296 for the nine months ended September 30, 2009 and 2008.

8. Recently Enacted Accounting Standards

In February 2007, FASB issued SFAS 159, “ The Fair Value Option for Financial Assets and Financial Liabilities”. SFAS No. 159 amends SFAS No. 115, “ Accounting for Certain Investments in Debt and Equity Securities”. SFAS No. 159 permits entities to choose to measure financial instruments and certain other items at fair value. The objective of SFAS No. 159 is to improve financial reporting by providing entities with the opportunity to mitigate volatility in reported earnings caused by measuring related assets and liabilities differently without having to apply complex hedge accounting provision. SFAS No. 159 is expected to expand the use of fair value measurement, which is consistent with the Board’s long-term measurement objectives for accounting for financial instruments. SFAS No. 159 applies to all entities, including not-for-profit organizations. Most of the provisions of SFAS No. 159 apply to entities that elect the fair value option. However, the amendment to SFAS No. 115 applies to all entities with available-for-sale and trading securities. Some requirements apply differently to entities that do not report net income. This statement is effective as of the beginning of each reporting entity’s first fiscal year that begins after November 15, 2007. The Company has not yet determined the effect of SFAS No. 159 on its financial position, operations or cash flows.

In March 2008, the FASB issued Statement of Financial Accounting Standards No. 161, “Disclosures about Derivative Instruments and Hedging Activities” (“SFAS No. 161”). SFAS No. 161 is intended to improve financial reporting about derivative instruments and hedging activities by requiring enhanced disclosures to enable investors to better understand their effects on an entity’s financial position, financial performance, and cash flows. The provisions of SFAS No. 161 are effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008, with early application encouraged. The Company does not expect the provisions of SFAS No. 161 to have a material impact on the financial statements.

F-11

SKYLYFT MEDIA NETWORK, INC.

( A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS (continued)

September 30, 2009

9. Research and Development

Expenditures for research activities relating to product development and improvement are charged to expense as incurred. Such expenditures amounted to $10,000 in 2003 for the issuance of 10,000,000 shares of common stock at par value of $.001. (See Note-G) For the nine months ended September 30, 2009, an aggregate of $273 was expensed.

NOTE B—GOING CONCERN

The Company is a development stage Company and has not commenced planned principal operations. The Company had no significant revenues and has incurred losses of $2,528,568 for the period December 18, 2003 (inception) to September 30, 2009. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

There can be no assurance that sufficient funds required during the next year or thereafter will be generated from operations or that funds will be available from external sources such as debt or equity financings or other potential sources. The lack of additional capital resulting from the inability to generate cash flow from operations or to raise capital from external sources would force the Company to substantially curtail or cease operations and would, therefore, have a material adverse effect on its business. Furthermore, there can be no assurance that any such required funds, if available, will be available on attractive terms or that they will not have a significant dilutive effect on the Company’s existing stockholders.

The accompanying financial statements do not include any adjustments related to the recoverability of classification of asset-carrying amounts or the amounts and classification of liabilities that may result should the Company be unable to continue as a going concern.

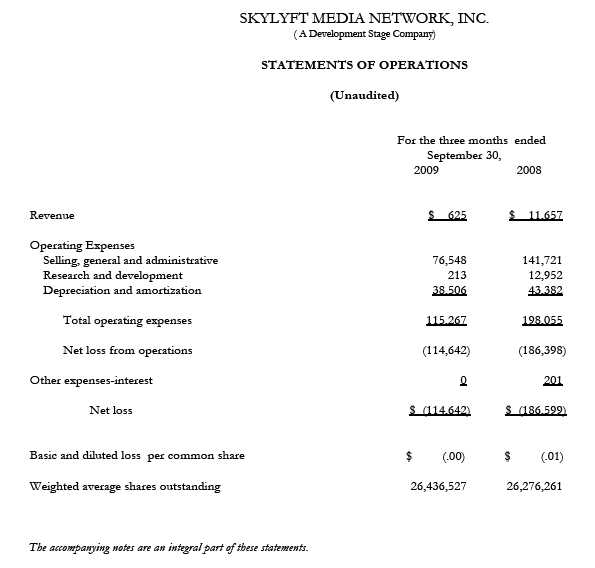

NOTE C--LOSS PER SHARE

The computation of loss per share is based on the weighted average number of common shares outstanding during the period presented. Diluted loss per common share is the same as basic loss per common share as there are no potentially dilutive securities outstanding (options and warrants).

F-12

SKYLYFT MEDIA NETWORK, INC.

( A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS (continued)

September 30, 2009

NOTE D - INCOME TAXES

The Company accounts for income taxes using the asset and liability method described in SFAS No. 109, “Accounting For Income Taxes”, the objective of which is to establish deferred tax assets and liabilities for the temporary differences between the financial reporting and the tax basis of the Company’s assets and liabilities at the enacted tax rates expected to be in effect when such amounts are realized or settled. A valuation allowance related to deferred tax assets is recorded when it is more likely than not that some portion or all of the deferred tax assets will not be realized.

NOTE E – LONG-TERM DEBT

On March 24, 2006 the Company entered into a revolving line of credit with Bank of America, N.A. in the principal amount of $15,160 with interest only payments at an annual rate of 14%. Effective April 14, 2009, an amortized payment amount of $376.38 became payable on a monthly basis at an annual interest rate of 9.75%. The current portion due in the year 2009 totals $3,387 and the long-term portion totals $11,773.

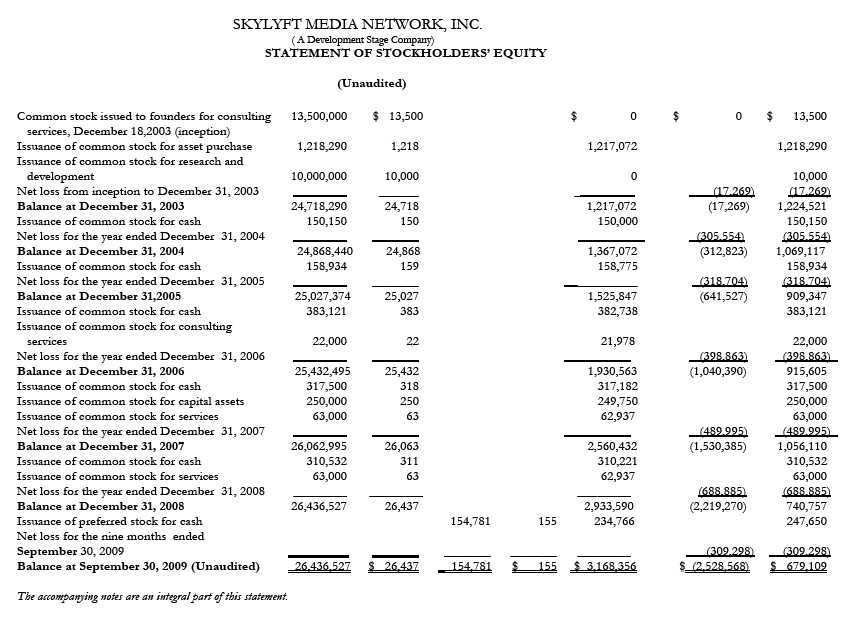

NOTE F – RELATED PARTY TRANSACTIONS

The Company was formed on December 18, 2003 as a Delaware corporation. On December 18, 2003 the Company issued 13,500,000 shares of common stock valued at $13,500 for founders shares and 1,218,290 shares of common stock for asset purchases valued at an aggregate of $718,290 including the purchase of the Intellectual property and mini-lift patent from the founders of the Company at a value of $500,000. Also on December 18, 2003, the Company purchased other assets from the Founders of the Company at a value of $500,000 resulting in a shareholders loan balance of $ 442,489 as of September 30, 2009. The shareholder loan is payable on demand; however, the shareholder has indicated that he will not demand payment of the loan within the current year. There are no employment contracts as of September 30, 2009.

F-13

SKYLYFT MEDIA NETWORK, INC.

( A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS (continued)

September 30, 2009

NOTE G – COMMON STOCK ISSUANCES

In December 2003, the Company issued 10,000,000 shares of common stock for consulting services and research and development.

During the year ended December 31, 2004, the Company sold an aggregate of 150,150 shares of common stock in consideration for $150,150 or $1.00 per share through a private placement to approximately 28 individuals.

During the year ended December 31, 2005, the Company sold an aggregate of 158,934 shares of common stock in consideration for $158,934 or $1.00 per share through a private placement to approximately 24 individuals.

During the year ended December 31, 2006, the Company sold an aggregate of 383,121 shares of common stock in consideration for $383,121 or $1.00 per share through a private placement to approximately 68 individuals and also issued 22,000 shares of common stock for services valued at $22,000 or $1.00 per share.

During the year ended December 31, 2007, the Company sold an aggregate of 317,500 shares of common stock in consideration for $317,500 or $1.00 per share through a private placement to approximately 38 individuals and also issued 63,000 shares of common stock for services valued at $63,000 or $1.00 per share. On October 1, 2007, the Company issued 250,000 shares of common stock in consideration for $250,000 or $1.00 per share for computer equipment, furniture and a customer list.

During the year ended December 31, 2008, the Company sold an aggregate of 310,532 shares of common stock in consideration for $310,532 or $1.00 per share through a private placement to approximately 11 individuals and also issued 63,000 shares of common stock for services valued at $63,000 or $1.00 per share.

During the nine months ended September 30, 2008, the Company sold an aggregate of 154,781 shares of preferred stock in consideration for $ 247,650 or $1.60 per share through a private placement to several individuals.

NOTE H - COMMITMENTS AND CONTINGENCIES

Lease agreements

The Company entered into a standard sub-lease agreement with Juanita Maloof on July 14, 2003 for a term of three years ending on August 31, 2006 at a monthly rental fee of $2,350. The Company exercised their option to extend the lease for as follows: Monthly Base Rent September 1, 2006 $2,568 September 1, 2007 $2,645 September 1, 2008 $2,724 September 1, 2009 $2,806

F-14

Item 2. Management’s Discussion and Analysis or Plan of Operations

The following discussion includes the operations of the Company for each of the periods discussed. This discussion and analysis should be read in conjunction with the Company's financial statements and the related notes thereto, which are included elsewhere in this document.

Any statements contained herein that are not statements of historical fact may be deemed forward-looking statements. Without limiting the foregoing, the words “believes,” “anticipates,” “plans,” “expects” and similar expressions are intended to identify forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. Skylyft Media Network, Inc. (the “Company” and sometimes “we,” “us,” “our” and derivatives of such words) undertakes no obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Overview

SKYLYFT Media Network, Inc. (the “Company”), was incorporated in December 2003 in the state of Delaware and conducts operations in California. The Company manufactures a patent pending, grand format, media rotation system, called the “SkyBanr Remote Controlled Mini-Lift.” The SkyBanr Mini-Lift system creates advertising revenues from unused ceiling space capacity in retail malls, airports, convention centers, movie theatres, sporting arenas and other public venues with high-ceiling areas. As of October 2007, the company also provides online internet services to a small base of retail customers.

Results of Operations

Nine months ended September 30, 2009 compared to the nine months ended September 30, 2008 Revenues: Total revenues were $ 31,028 and $ 11,657 for the nine months ended September 30, 2009, and 2008, respectively. Increase in sales is due primarily to purchase of an internet service provider.

General and Administrative:

Total general and administrative expenses were $ 227,156 and $ 141,721 for the nine months ended September 30, 2009, and 2008, respectively, and are fairly consistent with the level of activity within the Company.

15

Net Loss:

Net loss for the nine months ended September 30, 2009 was $ (309,298), compared to a net loss of $ (186,599) for the same period in 2008, which is equivalent to ($0.00) for both of the respective periods, based on the weighted average number of basic and diluted shares outstanding. The primary difference is due to the cost of sales and to a focus on preparing a Private placement memorandum and the 211 due diligence documents for the market makers and preparing a system to raise the appropriate funds so the company will be able execute their business plan and also to start trading in the market in accordance with being a fully public trading company to the SEC.

Liquidity and Capital Resources

The Company had cash and cash equivalents of $ 22,627 and $ 30,397 as of September 30, 2009 and December 31, 2008, respectively.

The Company's operating activities used $ 246,366 and $ 230,742 in the nine months ended September 30, 2009 and 2008, respectively. The difference is mainly attributable to cost of Sales and preparing and implementing a system to raise the appropriate funds so the company will be able execute it’s business plan and also to start trading in the market in accordance with being a fully public trading company to the SEC.

Cash used by financing activities was $ 247,650 and $ 235,531 for the nine months ended September 30, 2009 and 2008. The increase is from the additional issuance of common stock for cash.

Significant Accounting Policies

Our financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses. Note A of the Notes to Financial Statements describes the significant accounting policies used in the preparation of the financial statements. Certain of these significant accounting policies are considered to be critical accounting policies, as defined below.

A critical accounting policy is defined as one that is both material to the presentation of our financial statements and requires management to make difficult, subjective or complex judgments that could have a material effect on our financial condition and results of operations. Specifically, critical accounting estimates have the following attributes: 1) we are required to make assumptions about matters that are highly uncertain at the time of the estimate; and 2) different estimates we could reasonably have used, or changes in the estimate that are reasonably likely to occur, would have a material effect on our financial condition or results of operations.

16

Estimates and assumptions about future events and their effects cannot be determined with certainty. We base our estimates on historical experience and on various other assumptions believed to be applicable and reasonable under the circumstances. These estimates may change as new events occur, as additional information is obtained and as our operating environment changes. These changes have historically been minor and have been included in the financial statements as soon as they became known. Based on a critical assessment of our accounting policies and the underlying judgments and uncertainties affecting the application of those policies, management believes that our financial statements are fairly stated in accordance with accounting principles generally accepted in the United States, and present a meaningful presentation of our financial condition and results of operations. We believe the following critical accounting policies reflect our more significant estimates and assumptions used in the preparation of our financial statements:

Stock-Based Compensation

SFAS No. 123 prescribes accounting and reporting standards for all stock-based compensation plans, including employee stock options, restricted stock, employee stock purchase plans and stock appreciation rights. SFAS No. 123 requires compensation expense to be recorded (i) using the new fair value method or (ii) using the existing accounting rules prescribed by Accounting Principles Board Opinion No. 25, “Accounting for stock issued to employees” (APB 25) and related interpretations with proforma disclosure of what net income and earnings per share would have been had the Company adopted the new fair value method. The Company has chosen to account for stock-based compensation using Accounting Principles Board Opinion No. 25, "Accounting for Stock Issued to Employees" and has adopted the disclosure only provisions of SFAS 123. Accordingly, compensation cost for stock options is measured as the excess, if any, of the quoted market price of the Company's stock at the date of the grant over the amount an employee is required to pay for the stock.

17

The Company accounts for stock-based compensation issued to non-employees and consultants in accordance with the provisions of SFAS 123 and the Emerging Issues Task Force consensus in Issue No. 96-18 ("EITF 96-18"), "Accounting for Equity Instruments that are Issued to Other Than Employees for Acquiring or in Conjunction with Selling, Goods or Services". Valuation of shares for services is based on the estimated fair market value of the services performed.

Off-Balance Sheet Arrangements

As of September 30, 2009 and during the quarter then ended, we had no off-balance sheet arrangements reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

Item 3. Controls and Procedures

Our Chief Executive Officer and Chief Financial Officer have concluded, based on an evaluation conducted as of September 30, 2009, that our disclosure controls and procedures have functioned effectively so as to provide those officers the information necessary whether: This quarterly report on Form 10-Q contains any untrue statement of a material fact or omits to state a material fact necessary to make the statements made, in light of the circumstances under which those statements were made, not misleading with respect to the period covered by this quarterly report on Form 10-Q, and the financial statements, and other financial information included in this quarterly report on Form 10-Q, fairly present in all material respects our financial condition, results of operations and cash flows as of, and for, the periods presented in this quarterly report on Form 10-Q.

There have been no significant changes in our internal controls or in other factors since the date of the Chief Executive Officer’s and Chief Financial Officer’s evaluation that could significantly affect these internal controls, including any corrective actions with regard to significant deficiencies and material weaknesses.

18

PART II – OTHER INFORMATION

Item 1. Legal Proceedings

To the knowledge of the officers and directors of the Company, neither the Company nor any of its officers or directors is a party to any material legal proceeding or litigation and such persons know of no material legal proceeding or litigation contemplated or threatened. There are no judgments against the Company or its officers or directors. None of the officers or directors has been convicted of a felony or misdemeanor relating to securities or performance in corporate office.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

During the nine months ended September 30, 2009, the Company sold an aggregate of 154,781 shares of preferred stock in consideration for $247,650 or $1.60 per share through a private placement to several individuals.

Item 3. Defaults Upon Senior Securities

There were no material defaults with respect to any of our indebtedness during the third quarter of 2009.

Item 4. Submission of Matters to a Vote of Security Holders

Item 5. Other Information

The functions of the Audit and Compensation Committee are: (i) to recommend the engagement of the Company's independent auditors and review with them the plan, scope and results of their audit for each year; (ii) to consider and review other matters relating to the financial and accounting affairs of the Company; and (iii) to review and recommend to the Board of Directors all compensation packages, including the number and terms of stock options, offered to officers and executive employees of the Company. The Company’s entire board of directors serves as the Company's Audit Committee and Compensation Committee.

Item 6. Exhibits and Reports on Form 8-K

| (a) Exhibits | |

| Exhibit 31.1.2 | Certification of the Chief Executive Officer of Skylyft Media Network, Inc. |

pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

Exhibit 31.2.2 Certification of the Chief Financial Officer of Skylyft Media Network, Inc. pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

19

Exhibit 32.1.2 Certification of the Chief Executive Officer and Chief Financial Officer of Skylyft Media Network, Inc. pursuant to Section 906 of the Sarbanes Oxley Act of 2002

| (b) | Reports on Form 8-K |

| During the third fiscal quarter of 2009, we have not filed Form 8-Ks. |

Signatures

In accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Skylyft Media Network, Inc. /s/ Richard Yanke

Richard Yanke, Chief Executive Officer Date: November 12, 2009

20