Attached files

| file | filename |

|---|---|

| EX-2.1 - EXHIBIT 2.1 - Hirschfeld Industries, Inc. | a2195060zex-2_1.htm |

| EX-23.4 - EXHIBIT 23.4 - Hirschfeld Industries, Inc. | a2195060zex-23_4.htm |

| EX-23.9 - EXHIBIT 23.9 - Hirschfeld Industries, Inc. | a2195060zex-23_9.htm |

| EX-23.2 - EXHIBIT 23.2 - Hirschfeld Industries, Inc. | a2195060zex-23_2.htm |

| EX-23.6 - EXHIBIT 23.6 - Hirschfeld Industries, Inc. | a2195060zex-23_6.htm |

| EX-23.1 - EXHIBIT 23.1 - Hirschfeld Industries, Inc. | a2195060zex-23_1.htm |

| EX-23.5 - EXHIBIT 23.5 - Hirschfeld Industries, Inc. | a2195060zex-23_5.htm |

| EX-23.7 - EXHIBIT 23.7 - Hirschfeld Industries, Inc. | a2195060zex-23_7.htm |

| EX-23.8 - EXHIBIT 23.8 - Hirschfeld Industries, Inc. | a2195060zex-23_8.htm |

| EX-10.5 - EX-10.5 - Hirschfeld Industries, Inc. | a2195060zex-10_5.htm |

| EX-23.11 - EXHIBIT 23.11 - Hirschfeld Industries, Inc. | a2195060zex-23_11.htm |

| EX-23.10 - EXHIBIT 23.10 - Hirschfeld Industries, Inc. | a2195060zex-23_10.htm |

Use these links to rapidly review the document

Table of contents

Index to consolidated financial statements

As filed with the Securities and Exchange Commission on November 16, 2009

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Hirschfeld Industries, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

3440 (Primary Standard Industrial Classification Code Number) |

80-0494070 (I.R.S. Employer Identification Number) |

112 West 29th Street

San Angelo, Texas 76903

Telephone: (325) 486-4201

(Address, including zip code and telephone number, including

area code, of registrant's principal executive offices)

Dennis C. Hirschfeld

Hirschfeld Industries, Inc.

112 West 29th Street

San Angelo, Texas 76903

Telephone: (325) 486-4201

(Name, address, including zip code and telephone number, including

area code, of agent for service)

| Copies to: | ||

Ronald J. Lieberman Gregory J. Schmitt Hunton & Williams LLP Bank of America Plaza, Suite 4100 600 Peachtree Street, N.E. Atlanta, Georgia 30308-2216 Telephone: (404) 888-4000 Fax: (404) 602-9055 |

Alan F. Denenberg Davis Polk & Wardwell LLP 1600 El Camino Real Menlo Park, California 94025 Telephone: (650) 752-2000 Fax: (650) 752-2111 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||

| Title of each class of securities to be registered |

Proposed maximum aggregate offering price(1) |

Amount of registration fee |

||

|---|---|---|---|---|

Common Stock, par value $0.01 per share |

$150,000,000.00 | $8,370.00 | ||

|

||||

- (1)

- Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated November 16, 2009

Prospectus

shares

Common stock

This is an initial public offering of shares of common stock by Hirschfeld Industries, Inc. We are selling shares of common stock. The selling stockholders included in this prospectus are selling an additional shares of common stock. We will not receive any proceeds from the sale of shares of common stock by the selling stockholders. The estimated initial public offering price of our common stock is between $ and $ per share.

Prior to this offering, there has been no market for our common stock. We intend to list our common stock on the New York Stock Exchange under the symbol "HSFD."

| |

Per share |

Total |

|||||

|---|---|---|---|---|---|---|---|

Public offering price |

$ | $ | |||||

Underwriting discount |

$ |

$ |

|||||

Proceeds to us, before expenses |

$ |

$ |

|||||

Proceeds to selling stockholders, before expenses |

$ |

$ |

|||||

The selling stockholders have granted the underwriters an option for a period of 30 days to purchase up to an additional shares of common stock from them at the initial public offering price, less underwriting discounts, to cover over-allotments, if any.

Investing in our common stock involves a high degree of risk. See "Risk factors" beginning on page 14.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| J.P. Morgan | Baird | |

Jefferies & Company |

BB&T Capital Markets |

, 2009

You should rely only on the information contained in this prospectus. Neither we, the selling stockholders nor the underwriters have authorized anyone to provide you with information different from that contained in this prospectus. We and the selling stockholders are offering to sell, and seeking offers to buy, common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock.

No action is being taken in any jurisdiction outside the United States to permit a public offering of the common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to that jurisdiction.

Trademarks and trade names used in this prospectus are the property of their respective owners. We have utilized the ® symbol in "Business—Intellectual property" in this prospectus for each brand to indicate registered marks.

Market data and other statistical information used throughout this prospectus are based upon independent industry publications, government publications and other published information from third-party sources that we believe are reliable. None of the publications, reports or other published industry sources referred to in this prospectus were commissioned by us or prepared at our request and, except as we deemed necessary, we have not sought or obtained the consent from any of these sources to include their data in this prospectus.

i

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing in our common stock. You should read this entire prospectus carefully, including the risks of investing in our common stock discussed under "Risk factors" and our consolidated financial statements and the related notes included elsewhere in this prospectus, before deciding to invest in our common stock.

Unless otherwise specified and as the context requires, references to "Hirschfeld," "our company," "we," "us" and "our" refer to (i) Hirschfeld, Inc., a Texas corporation, and its consolidated subsidiaries for periods prior to April 27, 2006, (ii) Hirschfeld Holdings LP, a Texas limited partnership, and its consolidated subsidiaries for periods from April 27, 2006 until the completion of our reorganization, which will occur immediately prior to completion of this offering, and (iii) Hirschfeld Industries, Inc., a Delaware corporation, and its consolidated subsidiaries as of and after the completion of our reorganization. We refer to Insight Equity Holdings LLC as "Insight Equity" or our "equity sponsor" and, together with members of the Hirschfeld family and others who hold interests in Hirschfeld Holdings LP, in each case either directly or through intermediaries, as our "existing owners."

Our company

We are a leading integrated provider of highly-engineered steel components for infrastructure applications. With strategically located operations in the high-growth southwestern and southeastern regions of the United States, we serve a wide range of attractive markets, including bridge, renewable, nuclear and traditional energy, and general industrial and commercial construction.

We provide safety-critical, highly-engineered structural steel components that must be manufactured to precise specifications and meet stringent quality standards. Our products typically are critical elements in the project completion timeline and often account for a substantial portion of the total materials cost of a project. We are one of only a select group of companies that maintains the substantial scale, project management capabilities, fabrication expertise and quality control required to provide coordinated manufacturing and delivery of complex steel components to project sites in an efficient and timely manner.

Our long-standing relationships extend beyond our customer base of leading infrastructure contractors to our diverse end-user base, which includes government entities, utilities, energy exploration companies and power producers, as well as hospitality and entertainment venue developers. These customers and end users depend on our ability to consistently and reliably meet stringent quality, traceability, time and performance criteria required for successful execution of highly complex projects.

Our products include plate girders, box girders, trusses, engineered beams, mill-rolled shapes and other formations of highly-engineered structural steel. Our services include the cutting and welding of steel plates, the application of multiple protective coating systems on the processed steel plates and the transportation of the finished product to customer project sites for erection. With a history that dates back to 1919, we believe we have established ourselves as a leader with a strong brand name in the markets we serve. Our facilities are strategically

1

positioned in areas of the United States with high population growth and expanding infrastructure requirements. The transportation costs and logistics associated with our products generally require production facilities to be located in relative close proximity to project sites.

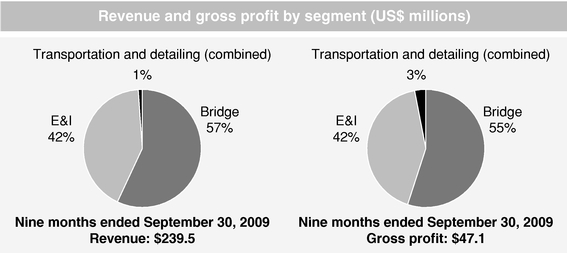

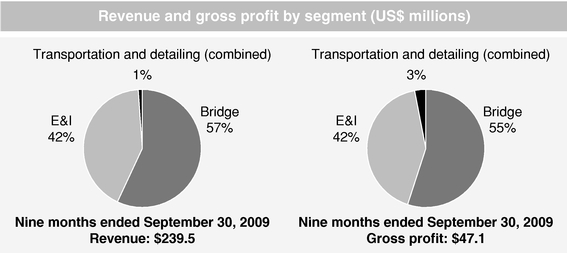

For the nine months ended September 30, 2009, our revenue was $239.5 million and our operating income was $30.7 million, compared to revenue of $201.0 million and operating income of $35.0 million for the equivalent period in 2008.

We operate in the following four segments and own a 50% stake in a wind tower fabrication joint venture:

- •

- bridge;

- •

- energy and infrastructure (E&I);

- •

- transportation; and

- •

- detailing.

Bridge segment

Based on our understanding of available steel bridge projects in our core southeastern and southwestern markets during 2007 and 2008, we believe we are the largest bridge fabricator in these regions. Our bridge segment specializes in large, custom designed and complex projects. Our operations are conducted in five modern, rail-served facilities and our extensive capabilities allow us to fabricate plate girders and box girders for most major types of highway and railroad bridge designs. These facilities incorporate engineering design technology, automated production and proprietary production management systems, which result in low operating costs, high throughput and flexible production capacity.

Energy and infrastructure segment

In our energy and infrastructure, or E&I, segment, we are also a leading provider of highly-engineered structural steel components in our core regions, specializing in complex and time-sensitive projects such as:

- •

- coal- and natural gas-fired power generation plants;

- •

- nuclear-related facilities;

2

- •

- drilling components for oil production in deep-sea environments;

- •

- large aircraft hangars;

- •

- government and military projects; and

- •

- large-scale sports, entertainment and hospitality facilities.

Our E&I segment operates three modern rail-served production facilities incorporating engineering design technology, automated production and proprietary production management systems. Over the past several years, we have refined our target markets to leverage our technical expertise and operational scale to secure higher-margin projects.

Transportation and detailing segments

Transportation services. The scale, weight and complexity of our products require specialized transportation and product handling, and our customers require reliability and tightly coordinated delivery to project sites. We manage a specialized fleet of hauling equipment consisting of approximately 60 tractors and 300 trailers which, among other functions, transport our bridge and E&I products to project sites throughout the United States. Our transportation services division also carries third-party goods and equipment.

Detailing services. Consteel Technical Services Limited, or Consteel, our United Kingdom-based wholly-owned subsidiary, provides us with the detailing design conversion technology to translate engineering specifications into detailed shop drawings. In addition to supporting our operations, Consteel provides third-party customers in the United Kingdom and continental Europe with detailing, 3-D modeling and laser surveying services.

Martifer-Hirschfeld Energy Systems

In June 2009, we entered into a joint venture agreement with Martifer Energy Systems, or Martifer, a division of a leading, publicly-traded European manufacturer of components for the renewable energy sector, to fabricate wind towers. The joint venture is completing construction of a 200,000 square foot manufacturing facility in San Angelo, Texas, with planned capacity to manufacture approximately 200 wind towers annually. Martifer-Hirschfeld Energy Systems will combine our expertise in steel infrastructure manufacturing and Martifer's expertise in producing towers, coverings and gearboxes for wind turbines. Phase I construction of the joint venture's new wind tower facility is underway and is expected to be completed in the first quarter of 2010. Expansion flexibility has been designed into the facility to ensure that capacity can be added based on market conditions. In addition, we are undertaking product development intended to expand our offerings in the wind tower market to include such products as turbine covers and base plates.

Industry

We sell our highly-engineered, fabricated structural steel components and services in the North American bridge, energy and infrastructure markets to both public and private entities. According to the World Steel Association, United States steel demand is expected to be approximately 60 million metric tons in 2009 and increase to 72 million metric tons in 2010.

We primarily compete in markets that have a large number of deficient bridges and are located in areas of high population growth. According to the U.S. Census Bureau, the eleven states we consider our core bridge markets are projected to experience a population growth

3

rate of 47.6% between 2000 and 2030, compared to 21.5% for the remaining states within the United States. We believe that population growth in our targeted regions will result in significant growth in new bridge construction in our core markets. In addition, as of December 31, 2008, the Federal Highway Administration, or FHWA, considered 151,394 bridges, or approximately 25.2% of the total bridge count in the United States, to be structurally deficient or functionally obsolete. Furthermore, according to the FHWA, as of December 31, 2008, there were 43,897 bridges deemed to be deficient within our eleven core bridge market states. We believe continued U.S. government focus on deficient bridges will drive increased spending on bridge replacement and repair projects.

Our E&I segment serves the $675 billion non-residential construction market, providing highly-engineered structural steel products that are used in a variety of private and public infrastructure construction environments, including industrial and power generation facilities, hospitals, universities, large aircraft hangars, ports and offices, as well as large-scale sports, entertainment and hospitality facilities.

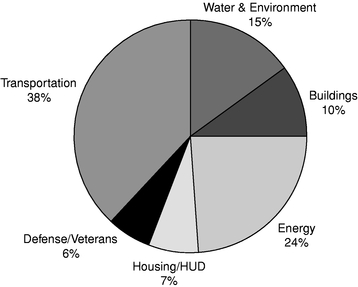

According to the U.S. Census Bureau, seasonally-adjusted annual spending in the private and public non-residential construction markets totaled approximately $357.9 billion and $318.3 billion, respectively, as of September 2009, and public non-residential construction spending in the United States continued to grow during 2009 and was up by 6.1% on a year-over-year basis as of September 2009. In addition, a substantial portion of the American Recovery and Reinvestment Act of 2009, or the ARRA, economic stimulus package has been allocated to construction spending for transportation, infrastructure, energy-related projects and government buildings, including buildings for the U.S. Department of Defense, the U.S. General Services Administration and the U.S. Department of Veterans Affairs.

Our E&I segment serves the energy infrastructure market by supplying our steel components to the power generation industry, including the oil, coal and natural gas, nuclear, wind and solar segments. According to the Energy Information Administration, or the EIA, U.S. electricity demand is projected to increase 23% from 2008 to 2030, creating the need for over 200 gigawatts of new generating capacity. To meet this anticipated demand, the Edison Electric Institute projects that domestic utilities will expend over $80 billion annually through 2011 for investment in power generation and transmission capacity. Additionally, according to the Edison Foundation, assuming no changes in a national carbon policy, it will be necessary for domestic utilities to expend $697 billion and $298 billion through 2030 for investment in power generation and transmission capacity, respectively.

Due to increasing demand for cost-efficient power, significant investment in the United States continues to be made in coal power plants. According to the U.S. Department of Energy's National Energy Technology Laboratory, which is devoted to fossil energy technology, as of October 2009, 25 coal power plants were under construction in the United States and 58 coal power plants were near construction, permitted or in their early stages of development.

Natural gas power plants also continue to be an important component of future power generation development in the United States given the significant domestic supplies of natural gas and that natural gas is cleaner burning as compared to coal. Furthermore, nuclear energy has received increased attention due to its relatively lower greenhouse gas emissions, predictable high operating rates and improved safety record. According to the World Nuclear Association, or the WNA, as of September 2009, there were proposals for the construction of

4

over 20 new nuclear reactors in the United States, with applications for construction submitted to the U.S. Nuclear Regulatory Commission, or the NRC, for the first 17. Finally, according to the American Wind Energy Association, or the AWEA, the new wind projects installed in 2008 represent an investment of $17 billion, marking the largest capital investment in the United States electricity sector that year.

Our competitive strengths

Market leadership positions in key geographic regions

Based on our understanding of available steel bridge projects in our core southeastern and southwestern markets during 2007 and 2008, we believe we are the largest bridge fabricator in these regions. In our E&I segment, we are one of the leading providers in our core regions of highly-engineered structural steel components used in a variety of complex private and public infrastructure projects.

High barriers to entry

We are a seasoned fabricator of infrastructure components with over 90 years of experience. Over the years, we believe we have built an excellent reputation for quality, reliability and breadth of capabilities gaining all available endorsements of the American Institute of Steel Construction, or the AISC, and certain critical nuclear safety certifications from the American Society of Mechanical Engineers, or the ASME, that we consider to be very valuable. Our established operations require significant capital, surety bonding and licensing requirements, and must be located in relative close proximity to project sites, all of which we believe make it difficult for competitors to enter our markets.

Well-positioned to capitalize on significant fundamental growth trends in our markets

We are a significant participant in the expansion and redevelopment of the U.S. transportation and energy infrastructure systems, for both government-funded and private enterprises. Expansion in U.S. transportation infrastructure spending, driven by a potential new, multi-year, federally funded highway bill, as well as investments funded under the ARRA, is expected to continue in our primary geographic markets. Anticipated investments in the production of energy, including from alternative sources such as nuclear, wind and solar power, should require significant steel infrastructure inputs.

High quality and diverse customer base

We maintain long-term relationships with some of the largest and most highly regarded infrastructure and structural contractors, architects and engineers in the United States serving a broad range of growing end markets.

Modern manufacturing capabilities

We specialize in fabricating highly-engineered steel infrastructure components that must be manufactured to exacting specifications while meeting stringent safety, quality and traceability standards.

Sophisticated project management capabilities

We employ proprietary project management technology integrating traceability features such as bar coding and laser stenciling. This technology allows us to fabricate complex structures

5

that can involve more than 200,000 separately-traced pieces that meet the stringent security, quality and delivery requirements of our customers.

Effective procurement and working capital management

We are seasoned raw materials purchasers with a track record of operating profitably throughout economic cycles. We carefully manage working capital to maximize cash flow while coordinating reliable delivery of inventory and finished product in accordance with our customers' construction schedules.

Strong financial position

We believe our strong balance sheet allows us to operate from a position of strength and gain market share in our target markets. Our strong financial condition is a critical advantage in the working-capital-intensive markets we serve.

Experienced, highly qualified management team

We have assembled a highly qualified management team. Our top three executives have approximately 85 years of combined experience in the infrastructure and structural components industry.

Our business strategy

Maximize profitability by leveraging our expertise in large, complex projects

We direct our resources towards projects that require our highly-engineered fabrication capabilities and allow us to exploit our technology, processing and delivery advantages. Our modern production facilities are capable of fabricating a broad range of large, custom-designed steel components for the markets we serve. We maintain strict profit margin hurdle rates when entering bids for projects and in developing pricing and procurement strategies for the projects we supply. Our high throughput and efficient fabrication processes enable us to minimize lead times and bid on higher margin projects requiring short lead times and coordinated delivery capabilities.

Further penetrate the bridge, nuclear, traditional and renewable energy markets

We are committed to continue diversifying our business through increased participation in the high-growth transportation, energy and government infrastructure markets.

Transportation market

We believe we are strategically located to take advantage of new bridge construction activity that is driven by high population growth and the replacement of the substantial number of bridges that have been deemed structurally deficient or functionally obsolete by the FHWA in our served markets. We believe our market leadership and scale position us to gain market share in our target markets.

Energy markets

We expect increasing government regulation of greenhouse gas emissions and other federal and state energy policies to drive investment in nuclear power generation and the development of other energy sources. We are able to serve the full nuclear value chain from uranium enrichment to nuclear power generation, nuclear waste disposal and downstream nuclear component manufacturing. The development of nuclear power generation and nuclear

6

waste disposal facilities are steel-intensive activities and we expect that the development of the U.S. nuclear energy industry, if it occurs, will be a long-term growth catalyst for our products.

Our infrastructure steel products are important elements in the construction of offshore oil derricks, coal- and natural gas-fired power plants and natural gas distribution terminals. We expect significant public and private investment in the maintenance and expansion of U.S. energy infrastructure as industry participants move to exploit domestic sources of energy to satisfy continued growth in the demand for energy.

Our Martifer-Hirschfeld joint venture intends to capitalize on the growing demand for wind towers. Our geographic footprint straddles the most active wind corridors in the United States in areas with abundant land for development and supportive regulatory environments. In addition to wind towers, we are investing in the development of related metal components.

Government infrastructure market

We have seen an increase in bidding opportunities related to projects planned by the federal government. These are typically large, complex projects to develop blast- and seismic-resistant buildings to house offices for government agencies and military hospitals. We are tracking these opportunities closely and bidding where project requirements play to our strengths.

Enhance profitability and efficiency through investment in advanced fabrication technology

We believe our modern facilities and advanced project management capabilities provide us with a competitive advantage. We plan to further develop this advantage by investing in advanced equipment and processes that will increase throughput and production capacity to support our growth objectives while reducing conversion costs. We are also evaluating virtual assembly technology, among others, that we believe will accelerate our production process while ensuring a high level of quality for fit and structural integrity.

Expand product offerings and geographical reach through acquisitions

We consider ourselves to be a disciplined and selective acquiror, with a successful track record of acquiring and integrating strategic assets and investing in strategic partnerships. We regularly evaluate acquisition and investment opportunities to grow our business. Our strong financial position provides us with the flexibility to consider a broad range of opportunities and provides potential partners with confidence in our ability to complete transactions. We believe our leadership position and reputation in the markets we serve make us an attractive partner.

Summary risk factors

An investment in our common stock involves a high degree of risk, including, but not limited to, the following:

- •

- any decrease in the level of governmental funding of infrastructure projects will adversely affect our business;

- •

- delays in infrastructure projects could adversely affect our business;

- •

- demand for our products, particularly in our E&I segment, is influenced by general economic conditions in the markets in

which we sell our products;

- •

- the industries in which we operate are highly competitive;

7

- •

- due to the nature of our fixed-price sales contracts, we may not be able to accurately incorporate our variable costs into

the pricing charged to our customers, which may result in lower margins or losses; and

- •

- increases in prices and reduced availability of key raw materials such as steel will increase our operating costs and may reduce our profitability.

For more information about these and other risks, please read "Risk factors." You should consider carefully these risk factors together with all of the other information included in this prospectus before you invest in our common stock.

Our history and organizational structure

Our heritage dates back to 1919 with the founding of Carolina Steel Corporation, or Carolina Steel. In 1946, L. W. Hirschfeld founded Hirschfeld, Inc., a Texas corporation, in San Angelo, Texas, as a regional supplier of steel and light fabrication services, which focused primarily on the oil services industry. Since our founding, we have diversified into bridge fabrication, energy and industrial infrastructure building components, transportation and detailing services and wind tower production. We have grown both organically and through selective acquisitions, strategic partnerships and joint ventures, including our acquisition of Carolina Steel and our Martifer-Hirschfeld joint venture. In connection with the investment by Insight Equity in our company in 2006, we reorganized our corporate structure and began operating our business through Hirschfeld Holdings LP, a Texas limited partnership.

Reorganization

Prior to this offering, we conducted our business through Hirschfeld Holdings LP and its operating subsidiaries. Hirschfeld Industries, Inc. holds no material assets and does not engage in any operations. Prior to the consummation of this offering, the following transactions will occur:

- •

- Hirschfeld Holdings LP will contribute to us, Hirschfeld Industries, Inc., all of the equity interests in

its operating subsidiaries in exchange for shares of our common stock; and

- •

- Hirschfeld Holdings LP will distribute to its limited partners, including the selling stockholders, all or a portion of the common stock that Hirschfeld Holdings LP received from us in consideration of the contribution of its operating subsidiaries.

As a result of these transactions, the direct and indirect holders of outstanding limited partnership interests of Hirschfeld Holdings LP will receive an aggregate of shares of our common stock. The reorganization will not affect our operations, which we will continue to conduct through our operating subsidiaries. See "Use of proceeds," "Business—Our history and organizational structure—Reorganization," "Principal and selling stockholders," and "Certain relationships and related party transactions" for additional information.

Our principal executive offices are located at 112 West 29th Street, San Angelo, Texas 76903. The telephone number for our principal executive offices is (325) 486-4201. Our website address is www.hirschfeld.com. Our website address is provided for informational purposes only. The information on our website is not a part of this prospectus.

8

| Common stock offered by Hirschfeld | shares | |

Common stock offered by the selling stockholders |

shares |

|

Total common stock offered hereby |

shares |

|

Common stock to be outstanding after this offering |

shares |

|

Over-allotment option |

The selling stockholders have granted the underwriters an option for a period of 30 days to purchase up to an additional shares of common stock from them at the initial public offering price less underwriting discounts to cover over-allotments, if any. |

|

Use of proceeds |

We intend to use the proceeds we receive from this offering as follows: |

|

|

• $ million to repay outstanding balances under our revolving line of credit and term loan under our Second Amended and Restated Loan and Security Agreement, or our Senior Credit Facility, with a group of lenders for whom Bank of America, N.A., acts as agent. Our Senior Credit Facility revolving line of credit had an outstanding balance of $5.9 million as of September 30, 2009. Our Senior Credit Facility term loan had an outstanding balance of $3.0 million as of September 30, 2009; |

|

|

• $ million to repay outstanding balances under our term loan under our Loan and Security Agreement, or our Second Lien Credit Facility, with a group of lenders for whom LBC Credit Partners II, L.P., acts as agent. Our Second Lien Credit Facility had an outstanding balance of $25.0 million as of September 30, 2009; |

|

|

• $ million to repay outstanding balances under our industrial development revenue bonds, or our Bonds; and |

|

|

• the remainder for general corporate purposes, including potential strategic acquisitions, investments in technology and equipment, and working capital. |

9

| We cannot voluntarily repay our Second Lien Credit Facility prior to June 11, 2010 without consent from the lenders and we are currently in discussions with the lenders regarding such consent. We will not receive any of the proceeds from sales of common stock by the selling stockholders. Pending the uses described herein, we intend to invest the net proceeds of this offering in short-term, interest-bearing, investment-grade securities. See "Use of proceeds" for more information regarding our use of the proceeds from this offering. | ||

Proposed trading symbol |

We intend to apply to have our common stock listed on the New York Stock Exchange, or NYSE, under the trading symbol "HSFD." |

|

Certain relationships and related transactions |

Please read "Certain relationships and related party transactions" for a discussion of business relationships between us and related parties, including as it relates to our reorganization. |

Unless otherwise noted, the information in this prospectus assumes:

- •

- no exercise of the underwriters' over-allotment option;

- •

- an initial public offering price of $ per share (which is the mid-point of the range set forth

on the front cover of this prospectus); and

- •

- the completion of our reorganization, as described under "Business—Our history and organizational structure—Reorganization."

Furthermore, unless otherwise noted, the number of shares of our common stock to be outstanding after this offering excludes shares reserved for future issuance under our 2009 Omnibus Incentive Plan. See "Management—Benefit plans—2009 Omnibus Incentive Plan."

Certain figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

10

Summary historical consolidated financial data

The following tables summarize our historical consolidated financial and operating data as of the dates and for the periods indicated. The summary historical consolidated financial data as of September 30, 2009 and for the nine months ended September 30, 2009 and 2008 are derived from our unaudited condensed consolidated financial statements included elsewhere in this prospectus. The summary historical consolidated financial data for the years ended December 31, 2008 and 2007, for the period April 27, 2006 through December 31, 2006 and for the period January 1, 2006 through April 26, 2006 are derived from our audited consolidated financial statements included elsewhere in this prospectus. Results for the nine months ended September 30, 2009 are not necessarily indicative of results to be expected for the full year.

Hirschfeld Holdings LP was formed to acquire substantially all of the operating assets of Hirschfeld, Inc. on April 27, 2006. The summary historical consolidated financial data for the periods prior to April 27, 2006 are considered to be those of our predecessor company.

The following information is qualified by reference to and should be read in conjunction with "Capitalization," "Selected consolidated financial data" and "Management's discussion and analysis of financial condition and results of operations" and our consolidated financial statements and the related notes thereto included elsewhere in this prospectus. Our historical financial data may not be indicative of our results of future operations.

11

| |

Successor | Predecessor | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

(Unaudited) Nine months ended September 30, |

Years ended December 31, |

|

|

|||||||||||||||

| |

Period from April 27, 2006 to December 31, 2006 |

Period from January 1, 2006 to April 26, 2006 |

|||||||||||||||||

| (in thousands, except per share data) |

|||||||||||||||||||

| 2009 |

2008 |

2008 |

2007 |

||||||||||||||||

Statement of operations data: |

|||||||||||||||||||

Revenue |

$ | 239,535 | $ | 200,968 | $ | 282,699 | $ | 222,677 | $ | 141,017 | $ | 59,683 | |||||||

Cost of revenue |

192,405 | 155,244 | 221,801 | 167,330 | 113,545 | 51,638 | |||||||||||||

Gross profit |

47,130 | 45,724 | 60,898 | 55,347 | 27,472 | 8,045 | |||||||||||||

Selling, general and administrative |

14,093 | 9,769 | 13,976 | 15,460 | 7,399 | 3,209 | |||||||||||||

Restructuring expense |

2,307 | 962 | 962 | — | 489 | — | |||||||||||||

Gain on contract settlement |

— | — | — | (7,074 | ) | — | — | ||||||||||||

Operating income |

30,730 | 34,993 | 45,960 | 46,961 | 19,584 | 4,836 | |||||||||||||

Interest expense |

3,234 | 2,614 | 4,396 | 4,012 | 2,923 | 2,731 | |||||||||||||

Other (income) expense, net |

(158 | ) | 19 | 201 | 171 | 138 | (695 | ) | |||||||||||

Income from continuing operations before income taxes |

27,654 | 32,360 | 41,363 | 42,778 | 16,523 | 2,800 | |||||||||||||

Provision for income taxes(1) |

141 | 259 | 340 | 77 | 36 | 996 | |||||||||||||

Equity in loss of nonconsolidated affiliate |

52 | — | — | — | — | — | |||||||||||||

Income from continuing operations |

27,461 | 32,101 | 41,023 | 42,701 | 16,487 | 1,804 | |||||||||||||

Loss from discontinued operations |

9 | 7 | 41 | 138 | 64 | 71 | |||||||||||||

Net income |

27,452 | 32,094 | 40,982 | 42,563 | 16,423 | $ | 1,733 | ||||||||||||

Pro forma tax expense(1) |

9,781 | 11,503 | 14,692 | 15,015 | 5,944 | ||||||||||||||

Pro forma net income after taxes |

$ | 17,671 | $ | 20,591 | $ | 26,290 | $ | 27,548 | $ | 10,479 | |||||||||

Pro forma earnings per share: |

|||||||||||||||||||

Basic(2) |

|||||||||||||||||||

Diluted(2) |

|||||||||||||||||||

Other financial data: |

|||||||||||||||||||

Adjusted EBITDA(3) |

34,772 | 37,161 | 48,797 | 49,344 | 20,226 | 5,683 | |||||||||||||

Capital expenditures |

3,707 | 2,727 | 4,970 | 7,244 | 4,025 | 162 | |||||||||||||

| |

(Unaudited) As of September 30, 2009 |

|

|

|

|

||||||||||||||

| |

Actual |

Pro forma as adjusted(4) |

|

|

|

|

|||||||||||||

| |

|

|

|

|

|||||||||||||||

Balance sheet data: |

|||||||||||||||||||

Cash and cash equivalents |

$ | 384 | |||||||||||||||||

Total assets |

157,501 | ||||||||||||||||||

Total debt including current portion |

40,525 | ||||||||||||||||||

Total partners' capital |

$ | 68,538 | |||||||||||||||||

(1) Income taxes for the periods subsequent to April 26, 2006 relate primarily to entity-level franchise taxes and income taxes related to our foreign corporate subsidiary since, as a partnership entity, such taxes on income from our operations are generally liabilities of the individual partners. For comparative purposes, we have estimated pro forma tax expense as if we had filed federal and state income tax returns for the periods after April 27, 2006.

(2) Pro forma basic and diluted earnings per share assume weighted average number of shares of and , respectively.

(3) Our definition of Adjusted EBITDA is the same as the definition in our Senior Credit Facility and is the one we use in evaluating our performance and compliance with our financial covenants under that agreement. Adjusted EBITDA represents (i) net income (loss) before gains or losses on the sale of assets other than in the ordinary course of business, the deduction of interest expense, income taxes (benefit) and depreciation and amortization expense plus or minus (ii) any non-cash losses or gains which have been subtracted or added in calculating net income related to the ownership interest in Martifer-Hirschfeld Energy Systems plus or minus (iii) any other non-cash charges or gains included in the calculation of net income plus (iv) transaction fees and expenses in an aggregate amount not to exceed $3.0 million related to debt refinancing plus (v) Martifer-Hirschfeld Energy Systems cash distributions. We have included Adjusted EBITDA in this prospectus to provide investors with a supplemental measure of our operating performance and offer insight into our compliance with our financial covenants. We believe Adjusted EBITDA is an important measure of operating performance because it eliminates items that we

12

believe have less bearing on our operating performance and highlights trends in our business that may not otherwise be apparent when relying solely on generally accepted accounting principles in the United States of America, or GAAP, financial measures.

Adjusted EBITDA is not a presentation made in accordance with GAAP. When evaluating our results, you should not consider Adjusted EBITDA in isolation of, or as a substitute for, measures of our financial performance as determined in accordance with GAAP, such as net income. Adjusted EBITDA has material limitations as a performance measure because it excludes items that are necessary elements of our costs and operations. Because other companies may calculate Adjusted EBITDA differently than we do, Adjusted EBITDA, as presented in this prospectus, may not be comparable to similarly-titled measures reported by other companies.

The following table reconciles net income to Adjusted EBITDA for the periods presented:

| |

Successor | Predecessor | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

(Unaudited) Nine months ended September 30, |

Years ended December 31, |

|

|

|||||||||||||||

| |

Period from April 27, 2006 to December 31, 2006 |

Period from January 1, 2006 to April 26, 2006 |

|||||||||||||||||

| (in thousands) |

2009 |

2008 |

2008 |

2007 |

|||||||||||||||

Adjusted EBITDA reconciliation: |

|||||||||||||||||||

Net income |

$ | 27,452 | $ | 32,094 | $ | 40,982 | $ | 42,563 | $ | 16,423 | $ | 1,733 | |||||||

Income taxes |

141 | 259 | 340 | 77 | 36 | 996 | |||||||||||||

Interest expense |

3,234 | 2,614 | 4,396 | 4,012 | 2,923 | 2,731 | |||||||||||||

Goodwill write-off |

1,520 | — | — | — | — | — | |||||||||||||

Depreciation and amortization |

2,462 | 2,189 | 3,075 | 2,438 | 1,001 | 818 | |||||||||||||

Equity in loss of nonconsolidated affiliate |

52 | — | — | — | — | — | |||||||||||||

Less: Gains (losses) on sale of assets |

89 | (5 | ) | (4 | ) | (254 | ) | 157 | 595 | ||||||||||

Adjusted EBITDA |

$ | 34,772 | $ | 37,161 | $ | 48,797 | $ | 49,344 | $ | 20,226 | $ | 5,683 | |||||||

(4) Pro forma as adjusted balance sheet data reflects the completion of our reorganization, the sale of shares of our common stock offered by us in this offering at an assumed initial offering price of $ per share (the mid-point of the range set forth on the cover page of this prospectus), after deducting underwriting discounts and estimated offering expenses payable by us, and the application of the net proceeds therefrom as described in "Use of proceeds."

13

An investment in our common stock involves a high degree of risk. In addition to the other information in this prospectus, you should carefully consider the following risk factors in evaluating us and our business before making a decision to invest in our common stock. The risks and uncertainties described below are the most significant factors of which we are aware. If any of the following risks, as well as other risks that we currently think are immaterial which later become material, actually occur, our business, financial condition, results of operations and cash flow could be materially and adversely affected. In that event, the trading price of our common stock could decline significantly and you may lose part or all of your investment. In connection with the forward-looking cautionary statements that appear in this prospectus, you should also carefully review the cautionary statements referred to under "Forward-looking statements."

Risks related to our business

Any decrease in the level of governmental funding of infrastructure projects will adversely affect our business.

A substantial portion of our operations, particularly in our bridge segment, are heavily dependent on federal, state and local government funding of infrastructure projects, which, in turn, is dependent on, among other things:

- •

- the need for new or replacement infrastructure;

- •

- the priorities placed on various projects by governmental agencies;

- •

- federal, state and local government spending levels, including budgetary constraints related to capital projects and the

ability to obtain financing;

- •

- the issuance of environmental approvals, right-of-way permits and other required approvals and

permits; and

- •

- population growth and economic expansion.

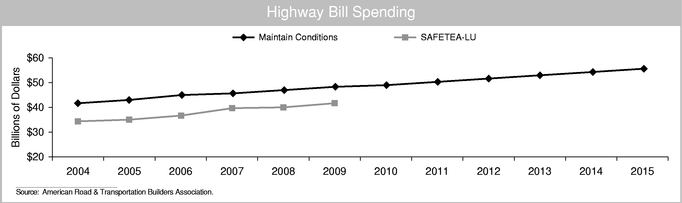

As a result, any reduction in governmental funding of infrastructure projects for whatever reason, including an economic slowdown, could have a material adverse effect on our business, financial condition and results of operations. Our expectation that the U.S. government will either further extend the Safe, Accountable, Flexible, Efficient Transportation Equity Act: A Legacy for Users, or SAFETEA-LU, or pass new legislation that will provide funding for highways may not prove accurate, and funding could cease or be reduced which would materially and adversely affect our business and financial performance.

Delays in infrastructure projects could adversely affect our business.

Governmental agencies and private parties with infrastructure projects generally announce the projects well in advance of the bidding and construction process. The timing of the start of our projects is generally subject to an extended bidding process and the completion of that bidding process is not within our control. It is not unusual for projects to be delayed and rescheduled. Projects may be delayed and rescheduled for a number of reasons, including changes in project priorities, difficulties in complying with environmental and other governmental laws, the need for additional time to acquire rights-of-way or property rights or deteriorating economic

14

conditions. Delays in infrastructure projects may occur with inadequate notice to allow us to replace those projects in our manufacturing schedules. The timing of our projects is uncertain and, as a result, our business, financial condition and results of operations may be adversely affected by unplanned downtime.

Demand for our products, particularly in our E&I segment, is influenced by general economic conditions in the markets in which we sell our products. We are currently experiencing a severe downturn in our E&I market.

Activity in our E&I market is closely tied to overall changes in the economy. Economic growth and cycles have a direct impact on the amount of construction that takes place, and consequently on the demand for our products in our E&I market. Because of such cycles, the pricing and other terms and conditions for the sale of our products, and the general demand for our products may be unfavorable for extended periods of time. The United States and other economies around the world have recently suffered a severe downturn which has negatively impacted our business. We are not certain when this downturn will end, whether it already has ended or, if it does end, whether the economy will quickly lapse back into another downturn. In particular, we believe the recent economic downturn has had a substantial negative effect on backlog in our E&I segment. Backlog in our E&I segment was $60.2 million at September 30, 2009, a decrease of $64.9 million, or 51.9%, from $125.1 million at December 31, 2008. In our experience, there has been a lag between the start of an economic downturn and the time the effects of such downturn are evident in declining backlog in our E&I segment. Accordingly, backlog in our E&I segment could continue to decline, and we may not see any increase in backlog for a significant period of time following the end of the current downturn.

The industries in which we operate are highly competitive.

We face significant competitive pressures in each of the markets we serve. We believe we generally compete on price, time to completion, quality and service. Depending on the market, our competitors include regional, national and international steel infrastructure component providers, some of whom may have greater financial, manufacturing, marketing and technical resources than we do, or greater penetration in or familiarity with a particular geographic market than we have. Furthermore, new competitors may overcome the barriers to entry that exist in our markets and effectively compete with us. To remain competitive, we will need to invest continuously in manufacturing, product development and customer service and we may be unable to do so successfully or at all. We may also need to reduce our prices, particularly with respect to customers in industries that are experiencing downturns, which would reduce our margins and could result in losses. We may not be able to maintain our competitive position in each of the markets that we serve. An unexpected reduction in our share of a market could result from pricing or product strategies pursued by competitors, unanticipated product or manufacturing difficulties, or a failure to successfully win bids. We cannot easily reduce our fixed costs even if competition reduces our margins or there is less demand for our products. We may also suffer unexpected challenges and significant costs if we endeavor to convert a facility from producing one segment of products to another, thereby hindering our ability to cost-effectively manage our capacity based on changes in demand. Any loss in our market share within the markets we serve could have a material adverse effect on our business, financial condition and results of operations.

15

We may not be able to accurately incorporate our variable costs into the pricing charged to our customers under our fixed-price sales contracts, which may result in lower margins or losses.

Our sales contracts are generally fixed-price contracts and normally result from our competitive bid on a project compared to the bids submitted by other suppliers. These contracts can extend over many months and possibly years. Our products are fabricated according to customer specifications. When bidding on a project, we estimate our costs, including projected increases in the costs of labor, materials and services, and our centralized purchasing function carefully monitors supply and demand trends and indicators for raw materials. Despite these monitoring efforts and the resulting estimates, the actual costs to us on a fixed-price contract could vary from the estimated amounts due to changes in a variety of factors that include, but are not limited to:

- •

- engineering design changes;

- •

- changes in the costs of raw materials such as steel;

- •

- difficulties in obtaining required permits or approvals;

- •

- changes in laws or regulations;

- •

- changes in labor conditions, including the cost, availability and productivity of labor;

- •

- project modifications creating unanticipated costs;

- •

- our failure to properly estimate amounts;

- •

- failure to perform by, or disruption with respect to, our suppliers or subcontractors, including erection services;

- •

- general economic conditions; and

- •

- delays, including those caused by weather conditions and other factors.

If we incorrectly estimate our costs for any particular contract, we could incur a significant loss in connection with such contract.

Increases in prices and reduced availability of key inputs such as steel will increase our operating costs and may reduce our profitability.

Steel is the main raw material used by us in the fabrication of bridge, energy, infrastructure and wind tower components, with the cost of steel constituting approximately 59.8% and 62.2% of the cost of manufacturing our products in 2008 and the first nine months of 2009, respectively. The markets for the inputs that we use in our manufacturing processes, including steel, can be very volatile. Any significant fluctuation in steel prices or other input prices and any interruption in the supply chain when procuring supplies could negatively impact our financial performance. The following factors may increase our costs and reduce the availability of steel and other inputs for us:

- •

- increased demand, which occurs when other industries purchase greater quantities of these inputs at times when we require more steel and other inputs for manufacturing, which can result in lower inventory levels at suppliers, higher prices and lengthen the time it takes to receive the inputs from suppliers;

16

- •

- increased freight costs, due to heightened demand for freight services and volatility in fuel prices;

- •

- lower production levels of inputs, due to reduced production capacities or shortages of materials needed to produce inputs

(such as coke and scrap steel for the production of steel), which could result in reduced supplies of inputs, higher costs for us and increased lead times to acquire them;

- •

- increased cost of scrap steel, coke, iron ore, energy and other inputs;

- •

- fluctuations in foreign exchange rates, such as the decline in the value of the U.S. dollar, can impact the relative cost

or availability of inputs; and

- •

- international trade disputes, import duties and quotas, since we may import some steel for our manufacturing facilities.

We generally purchase steel on the spot market and, other than fixed price arrangements that we sometimes enter into with respect to large projects in our E&I segment, we typically do not enter into any long-term contractual arrangements with any suppliers, nor do we deploy sophisticated hedging techniques to manage the cost of steel. The methodology for including steel costs in our contract estimates is to base pricing on current (or expected) levels, with some hedging techniques, such as price locks and cushions in bids, to protect against adverse price movement; however, increases in the selling prices of our products may not fully recover additional steel, materials and input costs and generally lag increases in our costs. There can be a significant lag between the time of our bid when we estimate the price of steel for purposes of submitting a binding bid to a potential customer and the time we actually purchase the steel for the project. We are subject to increased exposure to changes in steel pricing during this period. We generally cannot pass increased material costs, including increased steel costs and other raw material costs to our customers after a bid has been submitted. If we experience such increased costs that have not been factored into our bid price, our operating income would be adversely affected and a particular project may be unprofitable. Additionally, decreased availability of steel or other materials could affect our ability to produce manufactured products in a timely manner. If we cannot obtain the necessary raw materials for our manufactured products at reasonable prices or at all, our revenues, operating income and cash flows will be adversely affected.

Increased demand for substitutes for steel, such as concrete, in the development of bridges, energy and other infrastructure projects could reduce the demand for fabricated steel products.

While steel is widely used in the development of bridges, energy and other infrastructure projects, other materials could be developed that are more cost-effective, safer or provide other favorable attributes that reduce the demand for steel. Bridges are predominantly fabricated using either steel or concrete materials. Concrete-fabricated bridges have a larger market share than steel-fabricated bridges and such share could increase. If the relative share of steel for bridges and other infrastructure projects is reduced, demand for our products would decrease, which would have a material adverse effect on our business, results of operations and financial condition.

17

We compete with foreign-fabricated steel imported into the United States and these imports can increase the supply of fabricated steel in our markets and materially harm our business.

We compete with foreign-fabricated steel that is imported into the United States. Imported fabricated steel is often offered at lower prices than the prices we currently charge for our products. These products may be produced at facilities with lower cost structures than ours and we may not be successful in managing our costs to remain competitive with foreign-fabricated steel. While steel bridges funded from SAFETEA-LU must be constructed with steel that is fabricated in the United States, that may not always be the case in the future. An increase in the supply of foreign-fabricated steel could dramatically reduce prices for these products and we may not be able to successfully compete. Any loss in our market share within the markets we serve or any reduction in our margins could have a material adverse effect on our business, financial condition and results of operations.

We may sub-fabricate steel in foreign markets and we may not achieve the quality or cost benefits we expect.

We are considering sub-fabricating our products in foreign markets and have explored specific new opportunities to do so in China. We may include sub-fabricated products in current bids for new work. If we are successful obtaining new projects that include sub-fabricated products, we may not be able to effectively oversee and manage the sub-fabrication operations to address the additional risks associated with implementing this strategy. Specifically, we may not achieve the cost benefits we expect from sub-fabricated products and we may not be able to ensure the quality of those products. Our failure to achieve cost efficiencies through sub-fabrication in foreign markets and our failure to ensure the quality of those products, could materially harm our reputation and business prospects.

Our operations function at a fixed capacity, which may prevent us from being able to produce sufficient products to meet demand at any given time or efficiently consolidate our operations during periods of reduced demand.

Our manufacturing operations have a fixed capacity. If there should be an unexpected increase in the demand for our products, we may not be able to increase our production in a sufficient manner to match the increase in demand. If our fixed capacity prevents us from meeting unexpected increases in demand, we could miss opportunities to increase sales of our products, which could negatively impact our results of operations, and our reputation could be harmed. Furthermore, if demand for our products drops, we may not be able to efficiently consolidate operations and we could have substantial excess capacity that would severely harm our operating results.

Our backlog is subject to unexpected reduction due to project adjustments and cancellations and is, therefore, not necessarily indicative of our future revenues or earnings.

Our backlog consists of uncompleted projects for which we have signed contracts or commitments from customers, including those based on legally binding agreements without the scope being defined. Our backlog often includes expected revenue based on engineering and design specifications that may not be final and could be revised over time. Our backlog also often includes, directly or indirectly, expected revenues for government contracts that may not specify actual dollar amounts of work to be performed. For these contracts, our backlog is based on an estimate of work to be performed, which is based on our knowledge of customers' stated intentions or our historic experience, and our estimates could be wrong.

18

Further, our backlog may include many projects for which financing has not been secured, and, given current market conditions, may or may not ultimately become available.

Because of changes in project scope and schedule, we cannot predict with certainty when or if our backlog will become revenue and we generally have no or limited recourse if a project fails to proceed. In addition, even if a project proceeds as scheduled, it is possible that the customer may default and fail to pay amounts owed to us. As backlog represents anticipated revenue only, we may not maintain our past profit margins with respect to current backlog and could suffer losses on those projects. If we experience significant delays, cancellations, suspensions, scope adjustments or payment defaults with respect to contracts reflected in our backlog, there could be a material adverse effect on our business, financial condition and results of operations.

Our ability to comply with regulatory requirements is critical to our future success and changes in regulatory standards could require us to alter operations, incur significant expense and slow our production.

As a manufacturer of fabricated steel products, we are subject to the numerous requirements of a number of federal, state and local or foreign regulatory authorities, as well as industry standard-setting authorities, such as the AISC. Moreover, our quality assurance program has been developed and implemented to satisfy regulations promulgated by the NRC in order to permit us to fabricate steel for nuclear facilities. Any changes in the standards and requirements imposed by any of these authorities, or our failure to maintain compliance with existing standards, could have a material adverse effect on our operations, as we may be required to significantly alter our operations or make significant additional capital expenditures in order to maintain compliance with such standards and requirements, if we are able to do so at all.

Our operations are also subject to regulation of health and safety matters by the Occupational Safety and Health Administration, as well as state and local jurisdictions. We may fail to employ appropriate precautions to protect our employees and others from workplace injuries and harmful exposure to materials handled and managed at our facilities. In addition, accidents may occur on project sites on which we are engaged. For example, on November 10, 2009, one of our steel erection subcontractors on the Kaufman Performing Arts Center project in Kansas City, Missouri had an accident when the manlift its employees were using to assist in steel erection toppled over. One person was killed and another was seriously injured. The investigation is in its early stages and fault has not yet been determined. We may become subject to claims that exceed our insurance limits or are outside the scope of our insurance coverage. Claims may be asserted against us for work-related illnesses or injury which could distract management and result in significant penalties. The further adoption of or changes in occupational and health safety regulations in the United States or in foreign jurisdictions in which we may operate could also increase our operating costs. We are unable to predict the ultimate cost of compliance with these health and safety laws and regulations.

We require a number of licenses and regulatory certifications to operate, and if we cannot maintain such licenses and certifications, our business could suffer.

We are subject to licensure requirements and hold licenses in each state in the United States in which we operate and in certain local jurisdictions within such states. The loss, revocation, or the failure to comply with the terms of any license or the limitation on any of our primary

19

services thereunder in any jurisdiction in which we conduct operations could prevent us from conducting further operations in such jurisdiction and could have a material adverse effect on our operations.

We also are required to meet specifications of various public and private organizations, such as the NQA-1, 10 CFR 50, Appendix B, or NQA-1, safety standard of the ASME, which permits us to fabricate steel for nuclear facilities, as well as standards set by the AISC, the U.S. Department of Transportation, various state departments of transportation, or DOTs, the American Association of State Highway and Transportation Officials, or AASHTO, the American Bureau of Shipping, or ABS, and other building and transportation codes established by public and private organizations. Our NQA-1 certification, for example, is subjected to frequent audit. If we cannot maintain such certifications, it could cause a disruption of our operations, which could have a material adverse effect on our business, financial condition and results of operations, as well as harm our reputation with our customers.

We are subject to various environmental laws, regulations and permits that impose current and future liabilities, costs and obligations.

Our operations are subject to various international, foreign, federal, state and local environmental laws and regulations relating to the environment and human health and safety, including those governing discharges to air, soil and water, as well as greenhouse gas emissions, the remediation of contamination, and the generation, use, transportation, handling, storage and disposal of solid and hazardous materials. These environmental laws and regulations include, among others, the following federal statutes: the Clean Air Act, the Clean Water Act, the Resource Conservation and Recovery Act, and the Comprehensive Environmental Response, Compensation, and Liability Act, as well as amendments thereto and analogous international, foreign, state and local environmental laws. Pursuant to such environmental laws and regulations, we are required to obtain permits from governmental authorities that are subject to expiration, modification and revocation.

We cannot assure you that we have been or will be at all times in compliance with such environmental laws, regulations and permits. Compliance with these environmental requirements is a significant consideration for us because we use hazardous materials and generate hazardous wastes in our manufacturing processes and operations. We have in the past received notices of violation from governmental authorities related to our failure to comply with such environmental requirements. Additionally, certain of our facilities have been in operation for many years and, over time, we and other predecessor operators of these facilities have generated, used, handled, stored and disposed of hazardous materials and regulated wastes.

If we violate or fail to comply with the aforementioned environmental laws, regulations or permits, we could be fined or otherwise sanctioned by governmental regulators. Any such fines or sanctions could distract our management, harm our liquidity and require us to cease or limit production at one or more of our facilities, thereby harming our business. Compliance with these environmental requirements also may impose substantial capital expenditures and operating costs. Moreover, they could restrict our ability to expand our facilities or could require us to acquire costly equipment, or to incur other significant expenses in order to comply with them. In addition, these environmental laws, regulations and permits and the enforcement thereof change frequently and have tended to become more stringent over time.

20

As a result, we cannot assure you that the costs of complying with current and future environmental laws and regulations and the permits issued thereunder will not adversely affect our business, results of operations, reputation and financial condition.

Under certain environmental laws, we could be held responsible for any and all liabilities and consequences arising out of past or future releases of hazardous materials, human exposure to such substances and other impacts on the environment. In addition to potentially significant remediation costs, such matters can give rise to litigation with governmental authorities or other third parties. These environmental laws impose liability for contamination relating to our past and present facilities and third-party waste disposal sites and any such facilities that were owned, operated or used by our predecessors, regardless of whether we knew of or caused the contamination or even if we and our predecessors fully complied with applicable environmental laws in effect at the time. Contaminants have been detected in soil and groundwater at some such properties, and additional contamination at these or other current or former properties or offsite disposal facilities used by us or our predecessors may be discovered in the future. Our liabilities or remediation costs arising from releases of or exposure to hazardous materials could have an adverse effect on our business, results of operations, reputation and financial condition.

We face credit risk exposure associated with our accounts receivable and our customers could default on their payments to us.

We are exposed to risk that a customer will be unable to pay to us amounts in full when due. Furthermore, our customers may seek to delay payments to us beyond the invoice due date which could harm our liquidity. Our projects can extend over several years and involve significant investment so that our exposure to any one customer can be substantial. If we fail to adequately assess the creditworthiness of our customers, or if our customers suffer unexpected economic challenges, the risk of non-payment and cash flow problems will be increased, which could adversely impact our business, financial condition and results of operations. One customer represented 15.4% of accounts receivable as of September 30, 2009.

We concentrate on large and complex projects and, consequently, we may receive a significant amount of our revenue during any particular period from a small group of customers.

We focus on large and complex projects and, consequently, we can be dependent on a small number of customers during any particular period for a significant amount of our revenue. This customer concentration exposes us to increased credit risk, risk of cancellation or delay of a project and potential high volatility of our revenues. For example, during the nine months ended September 30, 2009, one customer represented 11.7% of our consolidated revenues. If any significant customer ceases payments to us, cancels or delays a project or otherwise ceases doing business with us, our business and financial condition could be materially adversely affected.

Our manufacturing business is capital-intensive and we may not have sufficient capital to operate.

The property and machinery needed to produce our products are very expensive, including the cost of our steel inventory that we purchase for specific projects. Therefore, we require large amounts of cash and working capital to fund our operations. While we believe that our cash on hand, along with our projected internal cash flows and our available financing resources,

21

will generate the cash we need to support our anticipated operating and capital needs, we could be wrong. Our ability to generate sufficient cash flow depends on future performance, which will be subject to general economic conditions, industry cycles and financial, business and other factors affecting our operations, many of which are beyond our control. Any required financing may not be available on terms acceptable to us. If we are unable to generate sufficient cash to operate our business, we may be required, among other things, to further reduce or delay planned capital or operating expenditures, close facilities and sell assets at times and at prices that are not favorable to us, if we are able to do so at all.

We depend on our bonding capacity, and any reduction in our bonding capacity could adversely impact our ability to bid on and perform work for significant projects.

In connection with our business, performance bonds are often required for public and many large private construction projects in order to provide our customers an additional measure of security for our performance. Our ability to obtain performance bonds depends upon our capitalization, working capital, past performance, management expertise and external factors, including the capacity of the overall surety market. Surety companies consider such factors in light of the amount of our contract backlog that we have currently bonded and their current underwriting standards, which may change from time to time. The capacity of the surety market is subject to market-based fluctuations driven primarily by the level of surety industry losses and the degree of surety market consolidation. When the surety market capacity shrinks, it results in higher premiums and increased difficulty obtaining bonding, in particular for larger, more complex projects. Fluctuations in surety market capacity can negatively impact our ability to grow our business. We are dependent on one surety company for our bonding and that company is under no obligation to continue to provide us with bonding. Our access to bonding could cease at any time. If we are unable to continue to obtain bonding from that company for any reason, including a decision by that company to alter its underwriting standards or materially increase its pricing or as a result of a change in the financial health of that company, we may not be able to find a replacement provider on acceptable terms or at all. In the event we were to lose our ability to obtain bonding in sufficient amounts and on terms acceptable to us, our business and prospects would be severely damaged.

We depend on the recruitment and retention of qualified personnel, and our failure to attract and retain such personnel could affect our business.