Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Diversified Restaurant Holdings, Inc. | c92687exv32w2.htm |

| EX-31.2 - EXHIBIT 31.2 - Diversified Restaurant Holdings, Inc. | c92687exv31w2.htm |

| EX-32.1 - EXHIBIT 32.1 - Diversified Restaurant Holdings, Inc. | c92687exv32w1.htm |

| EX-31.1 - EXHIBIT 31.1 - Diversified Restaurant Holdings, Inc. | c92687exv31w1.htm |

Table of Contents

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2009

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from

Commission File No. 000-53577

DIVERSIFIED RESTAURANT HOLDINGS, INC.

(Exact name of small business issuer as specified in its charter)

| Nevada | 03-0606420 | |

| (State or other jurisdiction of incorporation or formation) |

(I.R.S. employer identification number) |

21751 W. Eleven Mile Road, Suite 208

Southfield, Michigan 48076.

(Address of principal executive offices)

Southfield, Michigan 48076.

(Address of principal executive offices)

Issuer’s telephone number: (248) 223-9160

Issuer’s facsimile number: (248) 223-9165

Issuer’s facsimile number: (248) 223-9165

No change

(Former name, former address and former

fiscal year, if changed since last report)

(Former name, former address and former

fiscal year, if changed since last report)

Copies to:

Michael T. Raymond

Dickinson Wright, PLLC

301 East Liberty, Suite 500

Ann Arbor, Michigan 48104-2266

(734) 623-1663

www.dickinson-wright.com

Michael T. Raymond

Dickinson Wright, PLLC

301 East Liberty, Suite 500

Ann Arbor, Michigan 48104-2266

(734) 623-1663

www.dickinson-wright.com

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by

Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for

such shorter period that the registrant was required to file such reports), and (2) has been

subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the

Exchange Act). Yes o No þ

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Indicate by check mark whether the registrant has filed all documents and reports required to be

filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the

distribution of securities under a plan confirmed by a court.

Yes o No o

Yes o No o

APPLICABLE ONLY TO CORPORATE ISSUERS

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of

the latest practicable date: 18,070,000 shares of $.0001 par value common stock outstanding as of

November 10, 2009.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one):

| Large Accelerated Filer o | Accelerated Filer o | Non-Accelerated Filer o (Do not check if a smaller reporting company) | Smaller reporting company þ |

INTERIM FINANCIAL STATEMENTS INDEX

| Page | ||||||||

| 1 | ||||||||

| 1 | ||||||||

| 2 | ||||||||

| 3 | ||||||||

| 4 | ||||||||

| 21 | ||||||||

| 27 | ||||||||

| 27 | ||||||||

| 28 | ||||||||

| 28 | ||||||||

| 28 | ||||||||

| 28 | ||||||||

| 28 | ||||||||

| 28 | ||||||||

| 28 | ||||||||

| 29 | ||||||||

| Exhibit 31.1 | ||||||||

| Exhibit 31.2 | ||||||||

| Exhibit 32.1 | ||||||||

| Exhibit 32.2 | ||||||||

i

Table of Contents

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| September 30 | December 31 | |||||||

| 2009 | 2008 | |||||||

| Unaudited | Audited | |||||||

ASSETS |

||||||||

Current assets |

||||||||

Cash and cash equivalents |

$ | 334,286 | $ | 133,865 | ||||

Accounts receivable — related party |

236,979 | 192,889 | ||||||

Inventory |

148,090 | 157,882 | ||||||

Prepaid insurance |

81,403 | 52,440 | ||||||

Accounts receivable — other |

(1,630 | ) | 192,000 | |||||

Other assets |

31,780 | 20,000 | ||||||

Total current assets |

830,908 | 749,076 | ||||||

Property and equipment |

8,102,685 | 7,817,254 | ||||||

Intangible assets, net (Note 3) |

403,571 | 406,982 | ||||||

Deferred income taxes |

277,937 | 599,957 | ||||||

Total assets |

$ | 9,615,101 | $ | 9,573,269 | ||||

LIABILITIES AND STOCKHOLDERS’ EQUITY |

||||||||

Current liabilities |

||||||||

Current portion of long-term debt |

$ | 1,633,575 | $ | 1,454,867 | ||||

Accounts payable |

324,218 | 660,353 | ||||||

Accrued liabilities |

374,365 | 305,302 | ||||||

Accrued rent |

224,244 | 113,909 | ||||||

Deferred rent |

489,909 | 530,944 | ||||||

Total current liabilities |

3,046,311 | 3,065,375 | ||||||

Other liabilities — interest rate swap |

186,735 | 253,792 | ||||||

Long-term debt, less current portion (Notes 3 and 4) |

4,805,455 | 5,025,227 | ||||||

Total liabilities |

8,038,501 | 8,344,394 | ||||||

Commitments and contingencies (Notes 3, 4, 7, and 8) |

||||||||

Stockholders’ equity (Note 5) |

||||||||

Common stock — $0.0001 par value; 100,000,000 shares

authorized, 18,070,000 shares issued and outstanding |

1,807 | 1,807 | ||||||

Additional paid-in capital |

1,783,134 | 1,758,899 | ||||||

Accumulated deficit |

(208,341 | ) | (531,831 | ) | ||||

Total stockholders’ equity |

1,576,600 | 1,228,875 | ||||||

Total liabilities and stockholders’ equity |

$ | 9,615,101 | $ | 9,573,269 | ||||

The accompanying notes are an integral part of these interim consolidated financial statements.

1

Table of Contents

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS UNAUDITED

| Three Months Ended September 30 | Nine Months Ended September 30 | |||||||||||||||

| 2009 | 2008 | 2009 | 2008 | |||||||||||||

Revenue |

||||||||||||||||

Food and beverage sales |

$ | 4,560,261 | $ | 2,937,982 | $ | 13,001,047 | $ | 6,288,808 | ||||||||

Management and advertising fees |

426,332 | 428,173 | 1,324,137 | 1,377,944 | ||||||||||||

Total revenue |

4,986,593 | 3,366,155 | 14,325,184 | 7,666,752 | ||||||||||||

Operating expenses |

||||||||||||||||

Compensation costs |

1,476,823 | 1,185,333 | 4,327,716 | 2,723,774 | ||||||||||||

Food and beverage costs |

1,397,913 | 850,110 | 4,028,315 | 1,876,929 | ||||||||||||

General and administrative |

1,221,449 | 1,176,548 | 3,480,356 | 2,303,170 | ||||||||||||

Occupancy |

289,244 | 220,611 | 839,446 | 483,256 | ||||||||||||

Depreciation and amortization |

157,293 | 225,246 | 862,137 | 515,734 | ||||||||||||

Total operating expenses |

4,542,722 | 3,657,848 | 13,537,970 | 7,902,863 | ||||||||||||

Income from operations |

443,871 | (291,693 | ) | 787,214 | (236,111 | ) | ||||||||||

Interest expense |

118,740 | 97,408 | 334,632 | 181,866 | ||||||||||||

Other expense (income), net |

16,148 | 3,691 | (74,366 | ) | 20,656 | |||||||||||

Income (loss) before income taxes |

308,983 | (392,792 | ) | 526,948 | (438,633 | ) | ||||||||||

Income tax (provision) benefit |

(135,024 | ) | 53,852 | (203,453 | ) | 68,564 | ||||||||||

Net income (loss) |

$ | 173,959 | $ | (338,940 | ) | $ | 323,495 | $ | (370,069 | ) | ||||||

Basic earnings (loss) per share — as reported |

$ | 0.010 | $ | (0.019 | ) | $ | 0.018 | $ | (0.020 | ) | ||||||

Fully diluted earnings (loss) per share — as reported |

$ | 0.006 | $ | (0.019 | ) | $ | 0.011 | $ | (0.020 | ) | ||||||

Weighted average number of shares

outstanding (Note 1) |

||||||||||||||||

Basic |

18,070,000 | 18,022,826 | 18,070,000 | 17,895,219 | ||||||||||||

Diluted |

29,020,000 | 28,972,826 | 29,020,000 | 28,805,255 | ||||||||||||

The accompanying notes are an integral part of these interim consolidated financial statements.

2

Table of Contents

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS UNAUDITED

| Nine Months Ended September 30 | ||||||||

| 2009 | 2008 | |||||||

Cash flows from operating activities |

||||||||

Net income (loss) |

$ | 323,495 | $ | (370,069 | ) | |||

Adjustments to reconcile net income (loss) to

net cash provided by operating activities |

||||||||

Depreciation and amortization |

862,137 | 515,734 | ||||||

Loss on disposal of property and equipment |

2,903 | — | ||||||

Share-based compensation |

24,234 | 24,234 | ||||||

Deferred income tax benefit |

322,020 | (69,551 | ) | |||||

Changes in operating assets and liabilities that

provided (used) cash |

||||||||

Accounts receivable — related party |

(44,090 | ) | 16,289 | |||||

Accounts payable |

(336,135 | ) | 225,211 | |||||

Inventory |

9,792 | (75,332 | ) | |||||

Prepaid insurance |

(28,963 | ) | 2,886 | |||||

Accounts receivable — other |

193,630 | (141,994 | ) | |||||

Intangible assets |

(1,210 | ) | (124,020 | ) | ||||

Other assets |

(11,780 | ) | (12,000 | ) | ||||

Accrued liabilities |

2,006 | 199,348 | ||||||

Accrued rent |

110,334 | 58,965 | ||||||

Deferred rent |

(41,035 | ) | 75,977 | |||||

Net cash provided by operating activities |

1,387,338 | 325,678 | ||||||

Cash flows used in investing activities |

||||||||

Purchases of property and equipment |

(287,073 | ) | (4,222,970 | ) | ||||

Cash from financing activities |

||||||||

Proceeds from issuance of notes payable — related party |

13,125 | 204,800 | ||||||

Proceeds from issuance of long term debt |

— | 3,680,296 | ||||||

Repayment of notes payable — related party |

(75,858 | ) | (338,989 | ) | ||||

Repayments of long-term debt |

(837,111 | ) | 734,998 | |||||

Net cash (used in) provided by financing activities |

(899,844 | ) | 4,281,105 | |||||

Net increase in cash and cash equivalents |

200,421 | 383,813 | ||||||

Cash and cash equivalents, beginning of period |

133,865 | 275,728 | ||||||

Cash and cash equivalents, end of period |

$ | 334,286 | $ | 659,541 | ||||

Supplemental schedule of non-cash investing and financing

activities: |

||||||||

Capital expenditures funded by capital lease borrowings |

$ | 858,779 | $ | — | ||||

The accompanying notes are an integral part of these interim consolidated financial statements.

3

Table of Contents

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

NOTES

TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

| 1. | BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES | |

| Nature of Business | ||

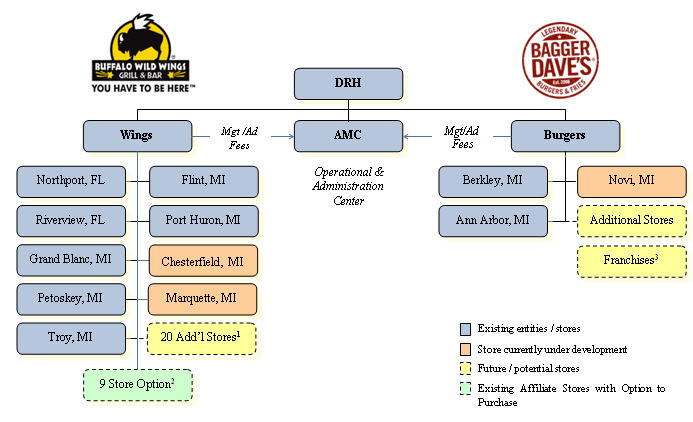

| Diversified Restaurant Holdings, Inc. (DRH) was formed September 25, 2006. DRH and its three wholly-owned subsidiaries AMC Group, Inc, (AMC), AMC Wings, Inc. (WINGS), and AMC Burgers, Inc. (BURGERS) (collectively, the “Company”), develop, own, and operate, as well as render management and marketing services for, Buffalo Wild Wings restaurants located throughout Michigan and Florida and the Company’s own restaurant concept, Bagger Dave’s Legendary Burgers and Fries (Bagger Dave’s), as detailed below. | ||

| The following organizational chart outlines the corporate structure of the Company and its subsidiaries, all of which are wholly-owned by the Company. A brief textual description of the entities follows the organizational chart. DRH is incorporated in the State of Nevada. All other entities are incorporated in the State of Michigan. |

| 1 | – | Wings is under contract with Buffalo Wild Wings, Inc to open 20 additional stores by 2017 |

| 2 | – | Wings has the option to purchase nine existing affiliate BBW restaurants currently managed by AMC |

| 3 | – | Burgers plans to franchise the Bagger Dave’s concept through Bagger Dave’s Franchising Corp. |

4

Table of Contents

DIVERSIFIED

RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

NOTES

TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

| AMC, formed on March 28, 2007, serves as the operational and administrative center for the Company. AMC renders management and marketing services to WINGS and BURGERS and their subsidiaries and nine Buffalo Wild Wings restaurants affiliated with the Company through common ownership and management control but not required to be consolidated for financial reporting purposes. Services rendered by AMC include marketing, restaurant operations, restaurant management consultation, the hiring and training of management and staff, and other management services reasonably required in the ordinary course of restaurant operations. |

| WINGS was formed on March 12, 2007 to hold Buffalo Wild Wings restaurants developed by the Company. WINGS, through its subsidiaries, holds seven Buffalo Wild Wings restaurants currently in operation. Each of WINGS’ subsidiaries is named for the location of the restaurant it holds. The subsidiaries that hold restaurants currently in operation are: |

| Date of | ||

| Subsidiary | Restaurant Opening | |

AMC North Port, Inc.

|

August 2007 | |

AMC Riverview, Inc.

|

August 2007 | |

AMC Grand Blanc, Inc.

|

March 2008 | |

AMC Troy, Inc.

|

July 2008 | |

AMC Petoskey, Inc.

|

August, 2008 | |

AMC Flint, Inc.

|

December 2008 | |

AMC Port Huron, Inc.

|

June 2009 |

| The Company has also executed franchise agreements with Buffalo Wild Wings International, Inc. to open two more restaurants in 2010, one in Chesterfield Township, Michigan and the other in Marquette, Michigan. These restaurants will be held by AMC Chesterfield, Inc. and AMC Marquette, Inc., respectively. The Company is economically dependent on retaining its franchise rights with Buffalo Wild Wings, Inc. Each of the franchise agreements has a specific expiration date ranging from September 28, 2026 through October 20, 2029, depending on the date that each was executed and its initial term. The franchise agreements are renewable at the option of the franchisor and are generally renewable if the franchisee has complied with the franchise agreement. The Company is in compliance with the terms of these agreements at September 30, 2009. The Company is under contract with Buffalo Wild Wings, International, Inc. to open 20 additional stores by 2017. The Company also holds an option to purchase the nine (9) affiliated restaurants that are currently managed by AMC. The Company plans to exercise this option in 2010. |

| BURGERS was formed on March 12, 2007 to own the Company’s Bagger Dave’s restaurants, a new fast casual dining concept developed by the Company. BURGERS’ subsidiaries Ann Arbor Burgers, Inc. and Berkley Burgers, Inc. own restaurants currently in operation in Ann Arbor, Michigan and Berkley, Michigan, respectively. BURGERS also has a wholly-owned subsidiary named Bagger Dave’s Franchising Corporation that was formed to act as the franchisor for the Bagger Dave’s Legendary Burgers and Fries concept. Our Board has authorized, and the Company has taken, action to secure our rights to franchise Bagger Dave’s restaurants in Indiana, Michigan, Ohio and Illinois. We are currently authorized to sell Bagger Dave’s franchises in Indiana, Michigan and Ohio, and our application in Illinois is under review. We have not yet franchised any Bagger Dave’s restaurants. |

5

Table of Contents

DIVERSIFIED

RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

NOTES

TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

| We follow accounting standards set by the Financial Accounting Standards Board, commonly referred to as the “FASB.” The FASB sets generally accepted accounting principles (GAAP) that we follow to ensure we consistently report our financial condition, results of operations and cash flows. References to GAAP issued by the FASB in these footnotes are to the FASB Accounting Standards Codification,™ sometimes referred to as the Codification or ASC. The FASB finalized the Codification effective for periods ending on or after September 15, 2009. Prior FASB standards like FASB Statement No. 13, Accounting for Leases, are no longer being issued by the FASB. For further discussion of the Codification, see “FASB Codification Discussion” in Management’s Discussion and Analysis of Financial Condition and Results of Operations (commonly referred to as MD&A) elsewhere in this report. | ||

| Principles of Consolidation |

| The consolidated financial statements include the accounts of DRH and its wholly owned subsidiaries AMC, WINGS and its subsidiaries, and BURGERS and its subsidiaries. |

| All significant intercompany accounts and transactions have been eliminated upon consolidation. | ||

| Segment Reporting |

| The Company has determined that it does not have any separately reportable business segments at September 30, 2009 and December 31, 2008. | ||

| Cash and Cash Equivalents |

| Cash and cash equivalents consist of cash on hand and demand deposits in banks. The Company considers all highly liquid investments purchased with original maturities of three months or less to be cash equivalents. The Company, at times throughout the year, may in the ordinary course of business maintain cash balances in excess of federally insured limits. Management does not believe the Company is exposed to any unusual risks on such deposits. | ||

| Revenue Recognition |

| Management and advertising fees are calculated by applying a percentage as stipulated in a management services agreement to managed restaurant revenues. Revenues derived from management and advertising fees are recognized in the period in which they are earned, which is the period in which the management services are rendered. Revenues from food and beverages sales are recognized and generally collected at the point-of-sale. | ||

| Accounts Receivable — Related Party |

| Accounts receivable are stated at the amount management expects to collect from outstanding balances. Balances that are outstanding after management has used reasonable collection efforts are written off with a corresponding charge to bad debt expense. The balances at September 30, 2009 and December 31, 2008 relate principally to management and advertising fees charged to and intercompany transactions with the related Buffalo Wild Wings restaurants that are managed by AMC and arise in the ordinary course of business (see Note 4). Management does not believe any allowances for doubtful accounts are necessary at September 30, 2009 or December 31, 2008. | ||

| Accounting for Gift Cards |

| The Company records the actual dollar amount of gift card liabilities at period end. The liability is included in accrued liabilities in the consolidated balance sheets. As of September 30, 2009, the Company’s gift card liability was approximately $30,275, compared to approximately $68,456 at December 31, 2008. Florida law prohibits gift card expiration dates, expiration periods and any post-sale charges or fees. Michigan law states that gift cards cannot expire and any post-sale fees cannot be assessed until five (5) years after the date of gift card purchase by consumer. At this time, there is no breakage for the Company to record. |

6

Table of Contents

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

NOTES

TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

| Lease Accounting | |||

| Certain operating leases provide for minimum annual payments that increase over the life of the lease. The aggregate minimum annual payments are expensed on a straight-line basis beginning when we take possession of the property and extending over the term of the related lease. The amount by which straight-line rent exceeds actual lease payment requirements in the early years of the lease is accrued as deferred rent and reduced in later years when the actual cash payment requirements exceed the straight-line expense. The Company also accounts, in its straight-line computation, for the effect of any “rental holidays” or “tenant incentives”. | ||

| Inventory |

| Inventory, which consists mainly of food and beverage products, is valued at the lower of cost determined on the first-in, first-out basis, or market. | ||

| Prepaid Expenses and Other Assets |

| Prepaid expenses consist principally of prepaid insurance and are recognized ratably as operating expense over the period covered by the unexpired premium. Other assets consist principally of franchise fees, trademarks and loan fees, which are deferred and amortized to operating expense on a straight line basis over the term of the related underlying agreements, which are as follows: |

| Franchise fees | 15 years | |||

| Trademarks | 15 years | |||

| Loan fees | 2 to 7 years (loan term) |

| Liquor licenses are deemed to have an indefinite life. Management annually reviews these assets to determine whether carrying values have been impaired. During the period ended September 30, 2009, no impairments relating to intangible assets with finite or infinite lives were recognized. | ||

| Property and Equipment |

| Property and equipment are stated at cost. Major improvements and renewals are capitalized, while ordinary maintenance and repairs are expensed. Management annually reviews these assets to determine whether carrying values have been impaired. |

| The Company capitalizes as restaurant construction-in-progress costs incurred in connection with the design, build out and furnishing of its owned restaurants. Such costs consist principally of leasehold improvements, directly related costs such as architectural and design fees, construction period interest (when applicable) and equipment, furniture and fixtures not yet placed in service. | ||

| Depreciation and Amortization |

| Depreciation on non-restaurant equipment, furniture and fixtures is computed using the straight-line method over the estimated useful lives of the related assets which range from five to seven years. Depreciation on restaurant equipment, furniture and fixtures is computed on the straight-line method over the estimated useful lives of the related assets, which range from five to seven years. Restaurant leasehold improvements are amortized over the shorter of the lease term or the useful life of the related improvement. Restaurant construction-in-progress is not amortized or depreciated until the related assets are placed into service. In the current quarter, the Company determined that certain assets that were being depreciated as equipment were actually part of leasehold improvements. Depreciation has been updated to reflect this re-classification. |

7

Table of Contents

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

NOTES

TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

| Advertising |

| Advertising expenses are recognized in the period in which they are incurred. Advertising expense was $146,511 for the three months ended September 30, 2009 and was $303,912 for the three months ended September 30, 2008. Advertising expense was $406,912 for the nine months ended September 30, 2009 and was $465,549 for the nine months ended September 30, 2008. | ||

| Income Taxes |

| Deferred income tax assets and liabilities are computed for differences between the financial statement and tax bases of assets and liabilities that will result in taxable or deductible amounts in the future, based on enacted tax laws and rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized. Income tax expense is the tax payable or refundable for the period plus or minus the change during the period in deferred tax assets and liabilities. | ||

| Earnings (Loss) Per Share |

| Earnings (loss) per share are calculated under the provisions of FASB ASC 260, Earnings per Share. ASC 260 requires a dual presentation of “basic” and “diluted” earnings per share on the face of the income statement. “Diluted” reflects the potential dilution of all common stock equivalents except in cases where the effect would be anti-dilutive. | ||

| Concentration Risks |

| Approximately 9% and 18% of the Company’s revenues during the nine month period ended September 30, 2009 and 2008, respectively, are generated from the management of Buffalo Wild Wings restaurants located in Michigan and Florida, which are related under common ownership and management control (see Note 4). Approximately 83% and 63% of food and beverage sales came from restaurants located in Michigan during the nine month period ended September 30, 2009 and 2008, respectively. | ||

| Use of Estimates |

| The preparation of consolidated financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates. | ||

| Financial Instrument |

| The Company utilizes interest rate swap agreements with a bank to fix interest rates on a portion of the Company’s portfolio of variable rate debt which reduces exposure to interest rate fluctuations. The Company does not use any other types of derivative financial instruments to hedge such exposures, nor does it use derivatives for speculative purposes. |

| The Company records the fair value of their interest rate swaps on the balance sheet in other assets or other liabilities depending on the fair value of the swaps. The terms of the agreements match those of the underlying debt and therefore are classified as non-current. Fair value adjustments are recorded each period in other income or other expense on the statement of operations. The notional value of interest rate swap agreements in place at September 30, 2009 was approximately $2,588,000. The expiration dates of these agreements are consistent with debt instruments as described in Note 5. |

8

Table of Contents

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

NOTES

TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

| Recent Accounting Pronouncements |

| In September 2006, the Financial Accounting Standards Board (FASB) issued SFAS No. 157, Fair Value Measurements. This Statement replaces multiple existing definitions of fair value with a single definition, establishes a consistent framework for measuring fair value, and expands financial statement disclosures regarding fair value measurements. This Statement applies only to fair value measurements that are already required or permitted by other accounting standards and does not require any new fair value measurements. SFAS 157 is effective for fiscal years beginning subsequent to November 15, 2007. The Company adopted SFAS No. 157 on January 1, 2008, which did not have a material effect on the consolidated financial statements. |

| In December 2007, the FASB issued SFAS No. 141(R), Business Combinations (“SFAS 141(R)”), which retains the fundamental requirements in Statement 141 that the acquisition method of accounting (which Statement 141 called the purchase method) be used for all business combinations and for an acquirer to be identified for each business combination. SFAS No. 141(R) requires an acquirer to recognize the assets acquired, the liabilities assumed, and any non-controlling interest in the acquiree at the acquisition date, measured at their fair values as of that date, with limited exceptions. SFAS No. 141(R) retains the guidance in Statement 141 for identifying and recognizing intangible assets separately from goodwill and applies prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008. An entity may not apply it before that date. The Company is currently evaluating the requirements of SFAS No. 141(R) and cannot determine the impact future acquisitions may have on its consolidated financial statements. |

| In March 2008, the FASB issued Statement of Financial Accounting Standards (“SFAS”) No. 161, Disclosures about Derivative Investments and Hedging Activities, an amendment of FASB Statement No. 133, which requires additional disclosures about the objectives of the derivative instruments and hedging activities, the method of accounting for such instruments under SFAS No. 133 and its related interpretations, and a tabular disclosure of the effects of such instruments and related hedged items on the Company’s financial position, financial performance, and cash flows. SFAS No. 161 is effective for the Company beginning January 1, 2009. The Company is currently assessing the potential impact, if any, that adoption of SFAS No. 161 may have on the Company’s consolidated financial statements. |

| In May 2009, the FASB issued SFAS No. 165, “Subsequent Events” (SFAS 165). SFAS 165 provides general standards of accounting for and disclosure of events that occur after the balance sheet date but before financial statements are issued or are available to be issued. In addition, SFAS 165 requires the disclosure of the date through which an entity has evaluated subsequent events and the basis for that date. |

| 2. | PROPERTY AND EQUIPMENT, NET |

| Property and equipment are comprised of the following assets: |

| September 30 | December 31 | |||||||

| 2009 | 2008 | |||||||

Equipment |

$ | 3,017,403 | $ | 2,613,488 | ||||

Furniture and fixtures |

831,313 | 767,979 | ||||||

Leasehold improvements |

6,088,762 | 5,401,301 | ||||||

Restaurant construction-in-progress |

13,467 | 27,410 | ||||||

Total |

9,950,945 | 8,810,178 | ||||||

Less accumulated depreciation |

1,848,260 | 992,924 | ||||||

Property and equipment, net |

$ | 8,102,685 | $ | 7,817,254 | ||||

9

Table of Contents

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

NOTES

TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

| 3. | INTANGIBLES |

| Intangible assets are comprised of the following: |

| September 30 | December 31 | |||||||

| 2009 | 2008 | |||||||

Amortized Intangibles |

||||||||

Franchise Fees |

$ | 131,250 | $ | 131,250 | ||||

Trademark |

2,500 | 2,500 | ||||||

Loan Fees |

15,691 | 15,691 | ||||||

Total |

149,441 | 149,441 | ||||||

Less accumulated amortization |

10,230 | 5,609 | ||||||

Amortized Intangibles, net |

139,211 | 143,832 | ||||||

Unamortized Intangibles |

||||||||

Liquor Licenses |

264,360 | 263,150 | ||||||

Total Intangibles, net |

$ | 403,571 | $ | 406,982 | ||||

| Amortization expense for the nine months ended September 30, 2009 and 2008 was $4,621 and $3,301, respectively. Based on the current intangible assets and their estimated useful lives, amortization expense for fiscal 2009, 2010, 2011, 2012 and 2013 is projected to total approximately $6,000 per year. |

| 4. | RELATED PARTY TRANSACTIONS |

| Fees for monthly accounting and financial statement compilation services are paid to an entity owned by a Director and stockholder of the Company. Fees paid during the three months ended September 30, 2009 and 2008 were $23,760 and $17,244, respectively. Fees paid during the nine months ended September 30, 2009 and 2008 were $63,636 and $43,675, respectively. |

| Management and advertising fees are earned from restaurants affiliated with the Company through common ownership and management control. Fees earned during the three months ended September 30, 2009 and 2008 totaled $426,332 and $428,173, respectively. Fees earned during the nine months ended September 30, 2009 and 2008 were $1,324,137 and $1,377,944, respectively. Accounts receivable arising from such billed fees were $112,387 and $140,034 at September 30, 2009 and December 31, 2008, respectively. Accounts receivable from related parties also includes amounts due from properties under common ownership and control that are included in the Company’s Michigan Business Tax filing, representing tax benefits realized by these related parties from offsetting state income tax that would be due on an individual basis with tax losses from the Company (see Note 7). This amounts to $118,567 as of September 30, 2009. The remainder of accounts receivable — related party, at September 30, 2009 consists of amounts due to DRH from managed restaurants for other fees paid on their behalf. |

| The Company is a guarantor of debt of nine entities that are affiliated through common ownership and management control. Under the terms of the guarantees, the Company’s maximum liability is equal to the unpaid principal and any unpaid interest. There are currently no separate agreements that provide recourse for the Company to recover any amounts from third parties should the Company be required to pay any amounts or otherwise perform under the guarantees, and there are no assets held either as collateral or by third parties, that, under the guarantees, the Company could liquidate to recover all or a portion of any amounts required to be paid under the guarantees. The event or circumstance that would require the Company to perform under the guarantee is an “event of default”. An “event of default” is defined in the related note agreements principally as a) default of any liability, obligation, or covenant with a bank, including failure to pay, b) failure to maintain adequate collateral security value, or c) default of any material liability or obligation to another party. As of September 30, 2009, the carrying amount of the underlying debt obligations of the related entities was, in aggregate, approximately $3,119,000 and the Company’s guarantee extends for the full term of the debt agreements, the last of which expires in 2019. |

10

Table of Contents

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

NOTES

TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

| This amount is also the maximum potential amount of future payments the Company could be required to make under the guarantees. As noted above, the Company and the related entities for which it has provided the guarantees operate under common ownership and management control and, in accordance with FASB ASC 460, Guarantees, the initial recognition and measurement provisions of ASC 460 do not apply. At September 30, 2009, payments on the debt obligations were current. |

| Long term debt (Note 5) contains two promissory notes in the amount of $100,000 each, along with accrued interest, due to two of DRH’s stockholders. The notes bear interest at a rate of 3.2% per annum and are being repaid over a two-year period that commenced January 2009 in monthly installments of approximately $4,444 each. |

| Long term debt (Note 5) also includes two notes in the amount of $95,000 each and one note in the amount of $142,500 to three of DRH’s stockholders. The notes bear interest at 5.26% and are due, along with accumulated interest, on November 1, 2009. At maturity, the note holders, at their option, may elect to use all or part of the principal and interest due, at that time, to exercise the private placement warrants previously issued to them in November 2006 (Note 6). |

| See financial statement Note 8 for related party lease transactions. |

| 5. | LONG TERM DEBT | |

| Long-term debt consists of the following obligations: |

| September 30 | December 31 | |||||||

| 2009 | 2008 | |||||||

Note payable to a bank secured by the

property and equipment of AMC Grand Blanc,

Inc. as well as corporate and personal

guarantees of DRH, certain stockholders, and

various related parties. The agreement

calls for interest only payments through

February 2009 with monthly principal and

interest payments of approximately $15,000

for the period beginning March 2009 through

maturity in February 2011. Interest is

charged based on the one month London

InterBank Offered Rate (“LIBOR”) plus 2.5%

(effective annual rate of approximately

2.75% at September 30, 2009). |

$ | 249,877 | $ | 349,915 | ||||

Note payable to a bank secured by the

property and equipment of AMC Grand Blanc,

Inc. as well as corporate and personal

guarantees of DRH, certain stockholders, and

various related parties. Scheduled monthly

principal and interest payments are

approximately $11,800 through maturity in

February 2015. Interest is charged based on

a swap arrangement designed to yield a fixed

annual rate of approximately 6.05%. |

659,767 | 735,829 | ||||||

Note payable to a bank secured by the

property and equipment of AMC Petoskey, Inc.

as well as corporate and personal guarantees

of DRH, certain stockholders, and various

related parties. The agreement calls for

interest only payments through February 2009

with monthly principal and interest payments

of approximately $14,800 for the period

beginning March 2009 through maturity in

February 2011. Interest is charged based on

the one month LIBOR rate plus 2.5%

(effective annual rate of approximately

2.75% at September 30, 2009). |

244,690 | 345,445 | ||||||

11

Table of Contents

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

NOTES

TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

| September 30 | December 31 | |||||||

| 2009 | 2008 | |||||||

Note payable to a bank secured by the

property and equipment of AMC Petoskey, Inc.

as well as corporate and personal guarantees

of DRH, certain stockholders, and various

related parties. The agreement calls for

payments of principal and interest of

approximately $12,200 for the period

beginning July 2008 through maturity in

September 2015. Interest is charged based

on a swap arrangement designed to yield a

fixed annual rate of approximately 6.98%. |

686,359 | 757,153 | ||||||

Note payable to a bank secured by the

property and equipment of Berkley Burgers,

Inc. as well as corporate and personal

guarantees of DRH, certain stockholders, and

various related parties. Scheduled monthly

principal and interest payments are

approximately $6,900 including annual

interest charged based on a swap arrangement

designed to yield a fixed annual rate of

approximately 6.95%. The note matures in

November 2014. |

375,271 | 417,051 | ||||||

Note payable to a bank secured by the

property and equipment of AMC Troy, Inc. as

well as corporate and personal guarantees of

DRH, certain stockholders, and various

related parties. The agreement calls for

monthly payments of principal and interest

of approximately $15,600 for the period

beginning July 2008 through maturity in

September 2015. Interest is charged based

on a swap arrangement designed to yield a

fixed annual rate of approximately 7.28%. |

866,504 | 955,417 | ||||||

Note payable to a bank secured by the

property and equipment of AMC Troy, Inc. as

well as corporate and personal guarantees of

DRH, certain stockholders, and various

related parties. The agreement calls for a

line of credit up to $476,348, and interest

only payments through February 2009 with

monthly principal and interest payments of

approximately $8,600 for the period

beginning March 2009 through maturity in

February 2014. Interest is charged based on

the one month LIBOR plus 2.75% (effective

annual rate of approximately 3.00% at

September 30, 2009). |

420,774 | 476,348 | ||||||

Note payable to a bank secured by the

property and equipment of AMC North Port,

Inc. as well as corporate and personal

guarantees of DRH, certain stockholders, and

various related parties. Scheduled monthly

principal and interest payments are

approximately $12,400 with annual interest

charged at 9.15%. The note matures in

November 2014. |

625,782 | 696,707 | ||||||

Note payable to a bank secured by the

property and equipment of AMC Riverview,

Inc. as well as corporate and personal

guarantees of DRH, certain stockholders, and

various related parties. Scheduled monthly

principal and interest payments are

approximately $12,200 with annual interest

charged at 8.67%. The note matures in

November 2014. |

633,022 | 704,449 | ||||||

12

Table of Contents

DIVERSIFIED

RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

| September 30 | December 31 | |||||||

| 2009 | 2008 | |||||||

Note payable to a bank secured by generally all

assets of Ann Arbor Burgers, Inc. as well as

personal guarantees of certain stockholders,

and various related parties. Scheduled monthly

principal and interest payments are

approximately $7,669. Interest is charged at a

fixed annual rate of approximately 7.50%. The

note matures in December 2015. |

458,051 | 500,000 | ||||||

Obligation under capital lease (see note 9) |

739,849 | — | ||||||

Notes payable — related parties (see note 4) |

479,084 | 541,780 | ||||||

Total long-term debt |

$ | 6,439,030 | $ | 6,480,094 | ||||

Less current portion |

1,633,575 | 1,454,867 | ||||||

Long-term debt, net of current portion |

$ | 4,805,455 | $ | 5,025,227 | ||||

| Scheduled principal maturities of long-term debt for each of the five years succeeding December 31, 2008 and thereafter are summarized as follows: |

| Year | Amount | |||

2009 |

$ | 1,633,575 | ||

2010 |

1,168,091 | |||

2011 |

1,031,830 | |||

2012 |

1,024,835 | |||

2013 |

882,534 | |||

Thereafter |

698,165 | |||

Total |

$ | 6,439,030 | ||

| Interest expense was $118,740 and $97,408 (including related party interest expense of $5,555 in 2009 and $3,000 in 2008 — see Note 4) in the three months ended September 30, 2009 and 2008, respectively. Interest expense was $334,632 and $181,866 for the nine months ended September 30, 2009 and 2008, respectively (including related party interest expense of $17,272 in 2009 and $7,600 in 2008). | ||

| The above agreements contain various customary financial covenants generally based on the performance of the specific borrowing entity and other related entities. The more significant covenants consist of a minimum global debt service ratio, maximum global funded indebtedness to EBITDA ratio and a Corporate Fixed Charge Coverage Ratio. |

| 6. | CAPITAL STOCK (INCLUDING PURCHASE WARRANTS AND OPTIONS) | |

| On July 30, 2007, DRH granted options for the purchase of 150,000 shares of common stock to the directors of the Company. These options vest ratably over a three year period and expire nine years from issuance. Once vested, the options can be exercised at a price of $2.50 per share. Stock option expense of $8,077 and $8,078, as determined using the Black-Scholes model, was recognized during the three months ended September 30, 2009 and 2008, respectively, and stock option expense of $24,234 and $24,234 was recognized during the nine months ended September 30, 2009 and 2008, respectively, as compensation cost in the consolidated statements of operations and as additional paid-in capital on the consolidated statement of stockholders’ equity to reflect the fair value of shares vested as of September 30, 2009. The fair value of |

13

Table of Contents

DIVERSIFIED

RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

| unvested shares, as determined using the Black-Scholes model, is $26,985 as of September 30, 2009. The fair value of the unvested shares will be amortized ratably over the remaining vesting term. The valuation methodology used an assumed term based upon the stated term of three years, a risk-free rate of return represented by the U.S. Treasury Bond rate and volatility factor of 0 based on the concept of minimum value as defined in FASB ASC 718, Compensation—Stock Compensation. A dividend yield of 0% was used because the Company has never paid a dividend and does not anticipate paying dividends in the reasonably foreseeable future. | ||

| On November 30, 2006, pursuant to a private placement, DRH issued warrants to purchase 800,000 common shares at a purchase price of $1 per share. These warrants vest over a three year period from the issuance date and expire three years after issuance. The fair value of these warrants, which totaled approximately $145,000 as determined using the Black-Scholes model, was recognized as an offering cost in 2006. The valuation methodology used an assumed term based upon the stated term of three years, a risk-free rate of return represented by the U.S. Treasury Bond rate and volatility factor of 0 based on the concept of minimum value as defined in FASB ASC 718, Compensation—Stock Compensation. A dividend yield of 0% was used because the Company has never paid a dividend and does not anticipate paying dividends in the reasonably foreseeable future. | ||

| In the third quarter of 2008, the Company issued 140,000 common shares in exchange for approximately $735,000 raised in connection with its initial public offering. | ||

| At September 30, 2009, 950,000 shares of authorized common stock are reserved for issuance to provide for the exercise of the Company’s stock purchase warrants and stock options. No such warrants or options have been exercised as of September 30, 2009. | ||

| The Company has authorized 10,000,000 shares of preferred stock at a par value of $0.0001. No preferred shares are issued or outstanding as of September 30, 2009. Any preferences, rights, voting powers, restrictions, dividend limitations, qualifications, and terms and conditions of redemption shall be set forth and adopted by a board of directors’ resolution prior to issuance of any series of preferred stock. |

| 7. | INCOME TAXES | |

| The (provision) benefit for income taxes consists of the following components for the three and nine months ended September 30, 2009 and 2008: |

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30 | September 30 | September 30 | September 30 | |||||||||||||

| 2009 | 2008 | 2009 | 2008 | |||||||||||||

Federal |

||||||||||||||||

Current |

$ | — | $ | 507 | $ | — | $ | (987 | ) | |||||||

Deferred |

(73,816 | ) | 53,345 | (178,943 | ) | 69,551 | ||||||||||

State |

||||||||||||||||

Current |

— | — | — | — | ||||||||||||

Deferred |

(61,208 | ) | — | (24,510 | ) | — | ||||||||||

Income Tax

(Provision) Benefit |

$ | (135,024 | ) | $ | 53,852 | $ | (203,453 | ) | $ | 68,564 | ||||||

| The (provision) benefit for income taxes is different from that which would be obtained by applying the statutory federal income tax rate to loss before income taxes. The items causing this difference are as follows: |

14

Table of Contents

DIVERSIFIED

RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

| September 30 | December 31 | |||||||

| 2009 | 2008 | |||||||

Income tax (provision) benefit at federal statutory rate |

$ | (159,397 | ) | $ | 291,114 | |||

State income tax (provision) benefit |

(24,511 | ) | 158,938 | |||||

Permanent differences |

(23,450 | ) | (20,967 | ) | ||||

Tax credits |

68,750 | 59,920 | ||||||

Other |

(64,845 | ) | 31,772 | |||||

Income tax (provision) benefit |

$ | (203,453 | ) | $ | 520,777 | |||

| Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. The Company expects the deferred tax assets to be fully realizable within the next several years. Significant components of the Company’s deferred income tax liabilities and assets are summarized as follows: |

| September 30 | December 31 | |||||||

| 2009 | 2008 | |||||||

Deferred tax assets: |

||||||||

Net operating loss carry forwards |

$ | 958,931 | $ | 1,028,689 | ||||

Deferred rent expense |

73,621 | 38,699 | ||||||

Start-up costs |

91,884 | 77,292 | ||||||

Tax credit carry-forwards |

139,616 | 69,260 | ||||||

Swap loss recognized for book |

63,490 | 86,289 | ||||||

Other — including state deferred tax assets |

189,380 | 270,244 | ||||||

Total deferred assets |

1,516,922 | 1,570,473 | ||||||

Deferred tax liabilities: |

||||||||

Other — including state deferred tax assets |

132,006 | 87,188 | ||||||

Tax depreciation in excess of book |

1,106,979 | 883,328 | ||||||

Total deferred tax liabilities: |

1,238,985 | 970,516 | ||||||

Net deferred income tax assets |

$ | 277,937 | $ | 599,957 | ||||

| If deemed necessary by management, the Company establishes valuation allowances in accordance with the provisions of FASB ASC 740, Income Taxes. Management continually reviews realizability of deferred tax assets and the Company recognizes these benefits only as reassessment indicates that it is more likely than not that such tax benefits will be realized. | ||

| The Company expects to use net operating loss and general business tax credit carry-forwards before their 20 year expiration. This belief is based upon the Company’s option to purchase the nine affiliated restaurants currently managed by DRH. Net operating loss carry-forwards of $286,555 and $2,533,830 will expire in 2029 and 2028, respectively. General business tax credits of $68,750, $58,116 and $11,144 will expire in 2029, 2028 and 2027, respectively. |

15

Table of Contents

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

| On January 1, 2007, the Company adopted the provisions of FASB ASC 740 regarding the accounting for uncertainty in income taxes. There was no impact on the Company’s consolidated financial statements upon adoption. |

| The Company classifies all interest and penalties as income tax expense. There are no accrued interest amounts or penalties related to uncertain tax positions as of September 30, 2009. |

| In July 2007, the State of Michigan signed into law the Michigan Business Tax Act (“MBTA”), replacing the Michigan Single Business Tax with a business income tax and a modified gross receipts tax. This new tax took effect January 1, 2008, and, because the MBTA is based or derived from income-based measures, the provisions of FASB ASC 740, Income Taxes, apply as of the enactment date. The law, as amended, established a deduction to the business income tax base if temporary differences associated with certain assets results in a net deferred tax liability as of December 31, 2007 (the year of enactment of this new tax). This deduction has a carry-forward period to at least tax year 2029. This benefit amounts to $33,762. |

| The Company is a member of a unitary group with other parties related by common ownership according to the provisions of the Michigan Business Tax Act. This group will file a single tax return for all members. An allocation of the current and deferred MBT incurred by the unitary group has been made based on an estimate of MBT attributable to the Company and has been reflected as state income tax expense in the accompanying consolidated financial statements consistent with the provisions of ASC 740. |

| The Company files income tax returns in the United States federal jurisdiction and various state jurisdictions. |

| 8. | OPERATING LEASES (INCLUDING RELATED PARTY) |

| The Company leases its current office facilities under a lease which expires April 30, 2010. The agreement requires rent to be paid in monthly installments of $3,835. |

| The Company renegotiated its lease for AMC Northport, Inc. Effective March 1, 2009, the base rent is approximately $6,129, reduced from approximately $12,267, through February, 2011. For consideration of the above rent modification, Diversified Restaurant Holdings, Inc. agrees to guarantee the rent for a period of five years beginning March 1, 2009. The lease contains two (2) five-year options to extend. |

| The Company renegotiated its lease for AMC Riverview, Inc. Effective April 1, 2009; the base rent has been reduced to approximately $9,600 from approximately $12,800 through March, 2010. The lease contains two (2) five-year options to extend. |

| Berkley Burgers, Inc. has signed a lease for restaurant space from an entity related through common ownership. The 15-year lease commenced in February 2008 and requires monthly payments of approximately $6,300. This lease contains three (3) five-year options to extend. |

| AMC Grand Blanc, Inc. lease payments commenced March 2008 and require monthly payments of approximately $10,300. The 10-year lease expires in 2018. This lease contains two (2) five-year options to extend. |

| AMC Troy, Inc. and Ann Arbor Burgers, Inc. lease payments commenced in August 2008. Both leases have ten year terms expiring in 2018 and monthly payments of approximately $13,750 and $6,890, respectively. Each lease contains two (2) five-year options to extend. |

| AMC Petoskey, Inc.’s lease commenced in August 2008 under a 10 year term expiring in 2018. Monthly lease payments of approximately $9,000 began in February 2009. This lease contains two (2) five-year options to extend. |

16

Table of Contents

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

| AMC Flint, Inc.’s lease commenced in December 2008 under a 10 year term expiring in 2018. The lease requires monthly payments of approximately $4,800. This lease contains three (3) five-year options to extend. |

| AMC Port Huron, Inc.’s lease commenced in June 2009 under a 10 year term expiring in 2019. The lease requires monthly payments of approximately $6,500. This lease contains three (3) five-year options to extend. |

| Troy Burgers, Inc. signed a lease for restaurant space in Novi, MI; the site of the third Bagger Dave’s restaurant. The lease is not expected to commence until the first quarter of 2010. The lease term is 10 years with two (2) five-year options to extend. Monthly lease payments will be approximately $7,000 per month. |

| Total rent expense was $289,244 and $220,611 for the three months ended September 30, 2009 and 2008, respectively. Rent expense was $839,446 and $483,256 for the nine months ended September 30, 2009 and 2008, respectively. Of these amounts, $20,872 and $20,872 for the three months ended September 30, 2009 and 2008, respectively, were paid to a related party. For the nine months ended September 30, 2009 and 2008, $62,616 and $55,659, respectively, were paid to a related party. |

| Scheduled future minimum lease payments for each of the five years and thereafter for non-cancelable operating leases with initial or remaining lease terms in excess of one year at September 30, 2009 are summarized as follows: |

| Year | Amount | |||

2009 |

$ | 839,174 | ||

2010 |

925,113 | |||

2011 |

953,115 | |||

2012 |

997,349 | |||

2013 |

1,046,209 | |||

Thereafter |

5,352,119 | |||

Total |

$ | 10,113,079 | ||

| 9. | CAPITAL LEASES |

| In January 2009, the Company entered into an agreement to sell and immediately lease back various equipment and furniture at its Flint location. The lease requires 48 monthly payments of approximately $10,854, including applicable taxes, with an option to purchase the assets under lease for $100 at the conclusion of the lease. This transaction is reflected in the consolidated financial statements as a capital lease with the assets recorded at their purchase price of $427,953 and depreciated as purchased furniture and equipment, and the lease obligation is included in long term debt at its present value. |

| In May 2009, the Company entered into an agreement to sell and immediately lease back various equipment and furniture at its Port Huron location. The lease requires 48 monthly payments of approximately $10,778, excluding applicable taxes, with an option to purchase the assets under lease for $100 at the conclusion of the lease. This transaction is reflected in the consolidated financial statements as a capital lease with the assets recorded at their purchase price of $430,877 plus $31,041 of sales tax paid upfront and depreciated as purchased furniture and equipment, and the lease obligation is included in long term debt at its present value. |

17

Table of Contents

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

| The following is a schedule by years of future minimum lease payments under the capital lease together with the present value of the net minimum lease payments as of the date of the lease: |

| Year | Amount | |||

2009 |

$ | 236,735 | ||

2010 |

259,585 | |||

2011 |

259,585 | |||

2012 |

259,585 | |||

2013 |

53,890 | |||

Total minimum lease payments |

1,069,380 | |||

Less amount representing interest |

179,512 | |||

Present value of minimum lease payments |

$ | 889,868 | ||

| 10. | COMMITMENTS AND CONTINGENCIES |

| The Company has management service agreements in place with nine Buffalo Wild Wings restaurants located in Michigan and Florida. These management service agreements contain an option that allows WINGS to purchase each restaurant for a price equal to a factor of twice the average earnings before interest, taxes, depreciation, and amortization of the restaurant for the previous three fiscal years. This option may be exercised by the subsidiary up to and including thirty days following the two-year anniversary date of the Company’s initial public offering completed by the Company. The two year anniversary will occur on August 1, 2010. The Company plans to exercise the option early and purchase the nine restaurants on February 1, 2010. Such exercise has always been part of the Company’s strategic plan. |

| The Company assumed from a related entity an “Area Development Agreement” with Buffalo Wild Wings, Inc. in which the Company undertakes to open 23 Buffalo Wild Wings restaurants within their designated “development territory”, as defined by the agreement, by October 1, 2016. On December 12, 2008, this agreement was amended adding 9 additional restaurants and extending the date of fulfillment to March 1, 2017. Failure to develop restaurants in accordance with the schedule detailed in the agreement could lead to potential penalties of $50,000 for each undeveloped restaurant, payment of the initial franchise fees for each undeveloped restaurant and loss of rights to development territory. As of September 30, 2009, of the 32 restaurants required to be opened, ten of these restaurants had been opened for business, seven of which are Company owned. |

| The Company is required to pay Buffalo Wild Wings, Inc. royalties (5% of net sales) and advertising fund contributions (3% of net sales) for the term of the individual franchise agreements. The Company incurred $207,072 and $132,514 in royalty expense in the three months ended September 30, 2009 and 2008 respectively. Royalty expense was $582,453 and $272,863 for the nine months ended September 30, 2009 and 2008, respectively. Advertising fund contribution expenses were $125,221 and $76,945 in the three months ended September 30, 2009 and 2008, respectively. For the nine months ended September 30, 2009 and 2008, the advertising fund contribution expenses were $347,550 and $159,222, respectively. |

| The Company is required by its various Buffalo Wild Wings, Inc. franchise agreements to modernize the restaurants during the term of the agreement. The individual agreements generally require improvements between the fifth year and the tenth year to meet the most current design model that Buffalo Wild Wings, Inc. has approved. The modernization costs can range from approximately $50,000 to approximately $500,000 depending on the individual restaurant’s needs. |

| The Company is subject to ordinary, routine, legal proceedings, as well as demands, claims and threatened litigation, which arise in the ordinary course of its business. The ultimate outcome of any litigation is uncertain. While unfavorable outcomes could have adverse effects on the Company’s business, results of operations and financial condition, management believes that the Company is adequately insured and does not believe that any pending or threatened proceedings would adversely impact the Company’s results of operations, cash flows or financial condition. |

18

Table of Contents

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

| AMC Group, Inc., a wholly owned subsidiary of DRH, became a guarantor to an operating lease at one of our Affiliated restaurants. The guarantee began April 1, 2009 and continues for four years. The amount guaranteed is $115,733 in year 1, $136,533 in year 2 and $147,200 in years 3 and 4. |

| 11. | SUPPLEMENTAL CASH FLOWS INFORMATION |

| Other Cash Flows Information |

| Cash paid for interest was $118,740 and $97,408 during the three months ended September 30, 2009 and 2008, respectively. For the nine months ended September 30, 2009 and 2008, cash paid for interest was $334,632 and $181,866, respectively. |

| Supplemental Schedule of Non-Cash Investing and Financing Activities |

| Capital expenditures of $858,779 were funded by capital lease borrowings during the nine months ended September 30, 2009. |

| 12. | FAIR VALUE OF FINANCIAL INSTRUMENTS |

| As of September 30, 2009 and December 31, 2008, our financial instruments consisted of cash equivalents, accounts receivable, accounts payable and debt. The fair value of cash equivalents, accounts receivable, accounts payable and short term debt approximate their carrying value, due to their short-term nature. Also, the fair value of Notes Payable — Related Parties approximates the carrying value due to their short term maturities. As of September 30, 2009, our total debt, less related party debt, was approximately $6.0 million and had a fair value of approximately $6.2 million. As of December 31, 2008, our total debt was approximately $5.9 million and had a fair value of approximately $5.2 million. The Company estimates the fair value of its fixed-rate debt using discounted cash flow analysis based on the Company’s incremental borrowing rate. |

| There was no impact for adoption of FASB ASC 820, Fair Value Measurements and Disclosures, to the consolidated financial statements as of September 30, 2009. ASC 820 requires fair value measurement to be classified and disclosed in one of the following three categories: |

| • | Level 1: Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities. |

| • | Level 2: Quoted prices in markets that are not active or inputs which are observable, either directly or indirectly, for substantially the full term of the asset or liability. |

| • | Level 3: Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (i.e., supported by little or no market activity). |

| Interest rate swaps held by the Company for risk management purposes are not actively traded. The Company measures the fair value using broker quotes which are generally based on market observable inputs including yield curves and the value associated with counterparty credit risk. The interest rate swaps discussed in Notes 1 and 5 fall into the Level 2 category under the guidance of ASC 820. The fair market value of the interest rate swaps as of September 30, 2009 was a liability of $186,735, which is recorded in other liabilities on the consolidated balance sheet. The fair value of the interest rate swaps at December 31, 2008 was a liability of $253,792. Unrealized loss associated with interest rate swap positions in existence at September 30, 2009, which are reflected in the statement of operations, totaled $11,286 for the three months ended September 30, 2009 and are included in other income/loss. For the nine months ended September 30, 2009, the unrealized gain associated with interest rate swap positions was $67,057. |

19

Table of Contents

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

| 13. | SUBSEQUENT EVENTS |

| Subsequent to September 30, 2009, the Buffalo Wild Wings Franchise Agreements were executed for AMC Marquette, Inc. and AMC Chesterfield, Inc. for the right to open Buffalo Wild Wings restaurants in Marquette, Michigan and Chesterfield Township, Michigan. Both companies are wholly-owned subsidiaries of AMC Wings, Inc. The Company plans to open these stores mid-year during 2010. |

| Subsequent to September 30, 2009, Jay Alan Dusenberry, Company Treasurer and member of the Board of Directors, exercised options on 6,000 shares of common stock in the Company. The option price paid was $2.50 per share. |

| The Company evaluated subsequent events for potential recognition and/or disclosure through November 16, 2009, the date the consolidated financial statements were issued. |

* * * * *

20

Table of Contents

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion and analysis of our financial condition and results of operations should

be read in conjunction with our consolidated financial statements and related notes included in

Item 1 of Part 1 of this Quarterly Report and the audited consolidated financial statements and

related notes and Management’s Discussion and Analysis of Financial Condition and Results from

Operations contained in our Form 10-K for the fiscal year ended December 31, 2008. This discussion

and analysis contains certain statements that are not historical facts, including, among others,

those relating to our anticipated financial performance for 2009 and our expected store openings.

Such statements are forward-looking and involve risks and uncertainties. Our actual results could

differ materially from those anticipated in these forward-looking statements as a result of certain

factors including, but not limited to, those discussed in this Form 10-Q under the heading

“Cautionary Statement for Forward-Looking Statements”.

CRITICAL ACCOUNTING POLICIES AND USE OF ESTIMATES

In the ordinary course of business, we have made a number of estimates and assumptions in the

preparation of our financial statements in conformity with accounting principles generally accepted

in the United States of America. Actual results could differ significantly from those estimates

under different assumptions and conditions. We frequently reevaluate these significant factors and

make adjustments where facts and circumstances dictate.

The Company believes the following accounting policies represent critical accounting policies.

Critical accounting policies are those that are both most important to the portrayal of a company’s

financial condition and results and require management’s most difficult, subjective or complex

judgments, often as a result of the need to make estimates about the effect of matters that are

inherently uncertain and may change in subsequent periods. We discuss our significant accounting

policies in Note 1 to the Company’s consolidated financial statements, including those policies

that do not require management to make difficult, subjective or complex judgments or estimates.

FASB Codification Discussion

We follow accounting standards set by the Financial Accounting Standards Board, commonly referred

to as the “FASB.” The FASB sets generally accepted accounting principles (GAAP) that we follow to

ensure we consistently report our financial condition, results of operations and cash flows. Over

the years, the FASB and other designated GAAP-setting bodies have issued standards in the form of

FASB Statements, Interpretations, FASB Staff Positions, EITF consensuses, AICPA Statements of

Position, etc. One standard that applies to our business is FASB Statement No. 13, Accounting for

Leases. That standard, originally issued in 1976, has been interpreted and amended many times over

the years.

The FASB recognized the complexity of its standard-setting process and embarked on a revised

process in 2004 that culminated in the release on July 1, 2009, of the FASB Accounting Standards

Codification,™ sometimes referred to as the Codification or ASC. To the Company, this means

instead of following the leasing rules in Statement 13, we will follow the guidance in Topic 840,

Leases. The Codification does not change how the Company accounts for its transactions or the

nature of related disclosures made. However, when referring to guidance issued by the FASB, the

Company refers to topics in the ASC rather than Statement 13, etc. The above change was made

effective by the FASB for periods ending on or after September 15, 2009. We have updated

references to GAAP in this quarterly report on form 10-Q to reflect the guidance in the

Codification.

Property and Equipment

We record all property and equipment at cost less accumulated depreciation and we select useful

lives that reflect the actual economic lives of the underlying assets. We amortize leasehold

improvements over the shorter of the useful life of the asset or the related lease term. We

calculate depreciation using the straight-line method for consolidated financial statement

purposes. We capitalize improvements and expense repairs and maintenance costs as incurred. We

are often required to exercise judgment in our decision whether to capitalize an asset or expense

an expenditure that is for maintenance and repairs. Our judgments may produce materially different

amounts of repair and maintenance or depreciation expense if different assumptions were used.

21

Table of Contents

We perform an asset impairment analysis on an annual basis of property and equipment related to our

restaurant locations. We also perform these tests when we experience a “triggering” event such as

a major change in a location’s operating environment, or other event that might impact our ability

to recover our asset investment. This process requires the use of estimates and assumptions which

are subject to a high degree of judgment. Our analysis indicated that we did not need to record

any impairment charges during the three months ended September 30, 2009 or the nine months ended

September 30, 2009 and thus none were recorded. If these assumptions or circumstances change in

the future, we may be required to record impairment charges for these assets.

Deferred Tax Assets

The Company records deferred tax assets for the value of benefits expected to be realized from the

utilization of state and federal net operating loss carry-forwards. We periodically review these

assets for realizability based upon expected taxable income in the applicable taxing jurisdictions.

To the extent we believe some portion of the benefit may not be realizable, an estimate of the

unrealized portion is made and an allowance is recorded. At September 30, 2009, we had no

valuation allowance as we believe we will generate sufficient taxable income in the future to

realize the benefits of our deferred tax assets. This belief is based upon the Company’s option to

purchase the nine affiliated restaurants currently managed by DRH. Realization of these deferred

tax assets is dependent upon generating sufficient taxable income prior to expiration of any net

operating loss carry-forwards. Although realization is not assured, management believes it is more

likely than not that the remaining recorded deferred tax assets will be realized. If the ultimate

realization of these deferred tax assets is significantly different from our expectations, the

value of its deferred tax assets could be materially overstated.

LIQUIDITY AND CAPITAL RESOURCES

Our current consolidated cash flow from operations for the nine months ended September 30, 2009 was

$1,387,338 compared to $325,678 for the nine months ended September 30, 2008. We anticipate that

new restaurant construction will be funded by debt financing, which

we had planned to be provided by our

existing lenders or another lending institution. These new restaurants include:

| • | Novi, Michigan — Bagger Dave’s — construction to begin in the fourth quarter 2009 and restaurant opening to occur in the first quarter 2010. The estimated cost of construction and equipment is approximately $650,000. We anticipate borrowing 50% of the necessary funds and paying the remaining balance through cash from operations. |

| • | Marquette, Michigan — Buffalo Wild Wings — construction expected to begin in the second quarter 2010 with an estimated opening in the third quarter 2010. The estimated cost of construction is approximately $1,037,000. We anticipate borrowing 50-70% of the necessary funds and paying the remaining balance through cash from operations. |

| • | Chesterfield, Michigan — Buffalo Wild Wings — construction expected to begin in the second quarter 2010 with an estimated opening in the third quarter 2010. The estimated cost of construction is approximately $950,000. We anticipate borrowing 50-70% of the necessary funds and paying the remaining balance through cash from operations. |

At this time, we have not obtained the debt financing that we planned to secure due to the severe

tightening of the credit markets. We are pursuing alternatives to traditional debt financing,

including equipment leasing and mezzanine debt financing. There are no assurances that we will be

successful in our efforts to obtain adequate financing for new store

openings. Management believes

that emphasis on prime locations is now more critical than ever to create stronger store openings

and earlier positive cash flows to decrease our dependency on

third-party financing.

OFF BALANCE SHEET ARRANGEMENTS

An off balance sheet arrangement exists between TMA Enterprises of Novi, Inc., which is a Buffalo

Wild Wings unit managed by AMC Group, Inc., and AMC Group, Inc., one of our wholly owned

subsidiaries. On April 5, 2007, TMA Enterprise of Novi, Inc. entered into a loan for $719,950.

That loan was used to refinance the existing debt of $369,950 and it provided an additional

$350,000 to help finance a five year remodel of that restaurant. The principal outstanding at

September 30, 2009 is $524,011. AMC Group, Inc. is a guarantor of this debt.

22

Table of Contents

An off balance sheet arrangement exists between TMA Enterprises of Ferndale, LLC, which is a

Buffalo Wild Wings unit managed by AMC Group, Inc. and Diversified Restaurant Holdings, Inc. (DRH),

AMC Burgers, Inc., AMC Wings, Inc., AMC Grand Blanc Inc. and AMC Petoskey, Inc. (the last four

being wholly owned subsidiaries of DRH). On August 10, 2007, TMA Enterprises of Ferndale, LLC

entered into a loan for $720,404. That loan was used to refinance the existing debt of $704,419

and it provided $15,985 additional cash for operations. The outstanding principal as of September

30, 2009 is $544,518. Diversified Restaurant Holdings, Inc. (DRH), AMC Burgers, Inc., AMC Wings,

Inc., AMC Grand Blanc Inc. and AMC Petoskey, Inc. are guarantors of this debt.

An off balance sheet arrangement exists between Flyer Enterprises, Inc., a Buffalo Wild Wings unit

managed by AMC Group, Inc. and Diversified Restaurant Holdings, Inc. (DRH), AMC Wings, Inc., AMC

Group, Inc., AMC Grand Blanc, Inc., AMC Troy, Inc. and AMC Petoskey, Inc. (the last five being

wholly owned subsidiaries of DRH). On February 12, 2008, Flyer Enterprises, Inc. entered into a