Attached files

| file | filename |

|---|---|

| EX-32.1 - Plainfield Enterprises LLC | d1030038_ex32-1.htm |

| EX-10.2 - Plainfield Enterprises LLC | d1030038_ex10-2.htm |

| EX-31.1 - Plainfield Enterprises LLC | d1030038_ex31-1.htm |

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

________________

FORM

10-K

[X] ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF

1934

For the Fiscal Year Ended July 31,

2009

OR

[ ] TRANSITION REPORT PURSUANT TO

SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

For

the transition period

from to

________________

Commission

File Number 000-53407

PLAINFIELD

ENTERPRISES LLC

(Exact name of Registrant as specified

in its charter)

|

Delaware

|

26-0787260

|

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(I.R.S.

Employer

Identification

No.)

|

|

|

100

West Putnam Avenue, Greenwich, CT 06830

(Address

of principal executive offices and Zip

Code)

|

||

Registrant's

telephone number, including area code: (203) 302–1700

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act: Class A Unit

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes o No ý

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate

by check mark whether the registrant: (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes ý No o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit

and post such files). Yes o No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of "large accelerated filer", "accelerated filer" and "smaller

reporting company" in Rule 12b-2 of the Exchange Act. (Check

one):

Large

accelerated filer o Accelerated

filer o

Non-Accelerated filer o Smaller reporting

company ý

(Do not

check if a smaller reporting company)

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes o No ý

As of

November 13, 2009, none of the Registrant's voting or non-voting common

equity was held by non-affiliates.

Documents

Incorporated by Reference: None

Forward

Looking Statements May Prove Inaccurate

Certain

statements in this Form 10-K contain or may contain information that is

forward-looking. When used in this report, the words "expect," "intend,"

"anticipate," "should," "believe," "plan," "estimate," "may," "seek," and

similar expressions are generally intended to identify forward-looking

statements. Actual results may differ materially from those described in the

forward-looking statements and will be affected by a variety of risks and

factors including, but not limited to, the following:

|

|

·

|

the

inability of regulated entities and certain members of the Board of

Managers, officers, key employees and other affiliates of Plainfield

Enterprises LLC, or the Company, to obtain and maintain gaming licenses or

permits in jurisdictions where the Company's current or planned business

or an entity in which the Company invests requires such licenses or

permits;

|

|

|

·

|

the

limitation, conditioning, revocation or suspension of any such gaming

licenses or permits;

|

|

|

·

|

revocation of

licenses or permits by regulatory authorities with respect to any member

of the Company's Board of Managers, officer, or key employee required to

be found suitable;

|

|

|

·

|

loss

or retirement of members of the Company's Board of Managers, officers, or

key employees;

|

|

|

·

|

increased

competition in existing markets or the opening of new gaming jurisdictions

(including on Native American

lands);

|

|

|

·

|

the

inability to maintain and improve existing gaming

facilities;

|

|

|

·

|

the

inability of the Company to maintain possession of the existing casino

facility in Henderson, Nevada;

|

|

|

·

|

the

inability to consummate planned acquisitions of gaming

opportunities;

|

|

|

·

|

the

costs and delays associated with constructing and opening new gaming

facilities;

|

|

|

·

|

the

inability to retain key leases;

|

|

|

·

|

a

decline in the public acceptance or popularity of

gaming;

|

|

|

·

|

increases

in or new taxes or fees imposed on gaming revenues or gaming

devices;

|

|

|

·

|

significant

increases in fuel or transportation

prices;

|

|

|

·

|

adverse

economic conditions in key markets;

and

|

|

|

·

|

severe

or unusual weather in such key

markets.

|

In

addition, any financings consummated by Casino MonteLago Holding, LLC, which we

refer to as MonteLago, or its subsidiaries may substantially increase the

leverage and other fixed charge obligations of those entities. The level of

indebtedness and other fixed charge obligations of MonteLago and its

subsidiaries could have important consequences, including but not limited to the

following:

|

|

·

|

a

substantial portion of MonteLago's and its subsidiaries' cash flow from

operations could be dedicated to debt service and other fixed charge

obligations and thus not be available for other

purposes;

|

|

|

·

|

MonteLago's

and its subsidiaries' ability to obtain additional financing in the future

for working capital, capital expenditures or acquisitions may be limited;

and

|

|

|

·

|

MonteLago's

and its subsidiaries' level of indebtedness could limit their flexibility

in reacting to changes in the gaming industry, their respective

jurisdictions and economic conditions

generally.

|

i

|

TABLE OF CONTENTS

|

||

|

Page

|

||

|

PART

I

|

||

|

Item

1.

|

Business

|

1

|

|

Item

2.

|

Properties

|

12

|

|

Item

3.

|

Legal

Proceedings

|

12

|

|

Item

4.

|

Submission

of Matters to a Vote of Security Holders

|

13

|

|

PART

II

|

||

|

Item

5.

|

Market

for Registrant's Common Equity, Related Stockholder Matters

and Issuer Purchases of Equity

Securities

|

13

|

|

Item

6.

|

Selected

Financial Data

|

14

|

|

Item

7.

|

Management's

Discussion and Analysis of Financial Condition and

Results of Operations

|

14

|

|

Item

8.

|

Financial

Statements and Supplementary Data

|

17

|

|

Item

9.

|

Changes

in and Disagreements with Accountants on Accounting

and Financial Disclosure

|

17

|

|

Item

9A(T).

|

Controls

and Procedures

|

17

|

|

Item

9B.

|

Other

Information

|

17

|

|

PART

III

|

||

|

Item

10.

|

Directors,

Executive Officers, and Corporate Governance

|

18

|

|

Item

11.

|

Executive

Compensation

|

21

|

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management

and Related Stockholder Matters

|

21

|

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

22

|

|

Item

14.

|

Principal

Accountants' Fees and Services

|

23

|

|

PART

IV

|

||

|

Item

15.

|

Exhibits,

Financial Statement Schedules

|

24

|

ii

PART

I

Item

1. Business.

THE

COMPANY

Overview

of the Company

Plainfield

Enterprises LLC, a Delaware limited liability company, and its wholly-owned

subsidiaries, Plainfield AcquisitionCo LLC, a Delaware limited liability

company, or AcquisitionCo, and Plainfield Enterprises Inc., a Delaware

corporation, or BlockerCo, which we refer to collectively as the Company, were

formed on August 22, August 22, and September 11, 2007, respectively, at the

direction of Plainfield Direct Inc., or the Plainfield Fund, which is an

affiliate of Plainfield Asset Management LLC, or Plainfield, for the purpose of

participating in various activities relating to the gaming industry including

holding equity in gaming industry related businesses.

The

Company had no revenue generating business prior to the acquisition through

AcquisitionCo of a $1,562,500 unsecured exchangeable note, or the MonteLago

Note, receivable from Casino MonteLago Holding, LLC, or MonteLago, which we

refer to as the MonteLago Transaction, on July 1, 2008. MonteLago

owns a 100% equity interest in CIRI Lakeside Gaming Investors, LLC, or CIRI

Lakeside Gaming, which operates Casino MonteLago, or the Casino, located at Lake

Las Vegas in Henderson, Nevada. On November 20, 2008, the Company was

granted a Nevada gaming license, and as a result, the MonteLago Note

automatically converted into a 33.33% equity interest in MonteLago, or the

MonteLago Equity, on that date. The Company's current business consists

primarily of its ownership of the MonteLago Equity.

Plainfield

is an investment management firm formed on February 14, 2005, and is based in

Greenwich, Connecticut. Plainfield is registered with the United States

Securities and Exchange Commission, or the SEC, as an investment adviser under

the Investment Advisers Act of 1940 and serves as the investment manager to the

Plainfield Fund and to other pooled investment vehicles inside and outside of

the United States. Plainfield manages approximately $3.7 billion of investment

capital for institutions and high net worth individuals based in the United

States and abroad. Plainfield's principal address is at 100 West Putnam Avenue,

Greenwich, CT 06830. Max Holmes is the sole managing member of

Plainfield.

Ownership

of the Company

The

Company currently has two issued and outstanding classes of limited liability

company interests. The Company has one issued and outstanding Class A

unit, or the Class A Interest, representing all of its voting equity interests,

which is held by HBJ Plainfield LLC, a Delaware limited liability company, or

HBJ, and 9,999 issued and outstanding Class B units, or the Class B Interests,

representing all of its non-voting equity interests, which are held by

Plainfield Enterprises Holdings LLC, a Delaware limited liability company, or

Plainfield Holdings, that is a wholly-owned subsidiary of the Plainfield

Fund. HBJ is owned by Alan Ginsberg, who also serves as HBJ's

President, Secretary and Treasurer. The Company does not currently

intend to issue any additional Class A or Class B Interests.

All

matters of the Company that are subject to the vote of its member, or the

Member, including the appointment and removal of members of the Company's board

of managers, or the Board of Managers, are controlled by HBJ, the sole managing

member of the Company. Alan Ginsberg, the sole HBJ Principal, and a

member of the Board of Managers, is also the Company's Operating Manager, who is

responsible for the Company's day-to-day management and operations. The

remaining members of the Board of Managers include Max Holmes, Joseph

Bencivenga, Ronald Johnson, and Marc Sole. The Class B Interests

issued to Plainfield Holdings allow Plainfield Holdings and its sole member, the

Plainfield Fund, to invest in the Company without having any voting power or

power to control the operations or affairs of the Company, except as otherwise

required by law. If Plainfield Holdings or its sole member had any of

the power to control the operations or affairs of the Company afforded to the

holder of the Class A Interest, they and their respective constituent equity

holders would generally be required to be licensed or found suitable under the

gaming laws and regulations of the State of Nevada. In connection

with the formation of the Company, HBJ and Plainfield Holdings have executed the

Amended and Restated Limited Liability Company Agreement of the Company, dated

September 2, 2008, which we refer to as the Company Operating

Agreement.

1

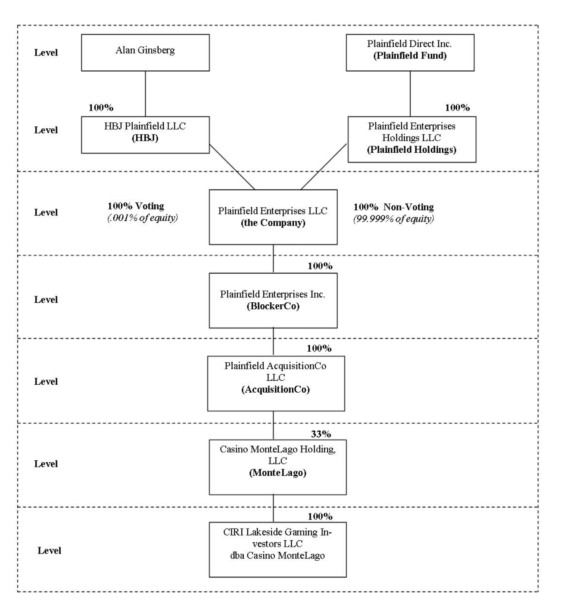

The

diagram below depicts the general ownership of the Company and its parents and

subsidiaries.

HBJ is

managed by Alan Ginsberg and the Company is managed by a Board of Managers

consisting of Alan Ginsberg as Operating Manager, Max Holmes, Joseph Bencivenga,

Ronald Johnson, and Marc Sole. BlockerCo is a holding company that

has elected to be taxed as a corporation. Because BlockerCo is a

separately taxed, non-flow through entity, BlockerCo is taxed on its share

of the income relating to the Company's business rather than the investors in

the Plainfield Fund.

2

Business

Developments

Recent

Events

On

September 4, 2009, CIRI Lakeside Gaming entered into a Conditional Covenant Not

to Execute, or the Conditional Agreement, with Village Hospitality, LLC, or

Village Hospitality, the landlord of CIRI Lakeside Gaming's leased premises

located at 1600 Lake Las Vegas Parkway, Henderson, Nevada 89011, which we refer

to as the Property. Pursuant to the terms of the Conditional

Agreement, Village Hospitality agreed to provide CIRI Lakeside Gaming 65 days

prior written notice before removing CIRI Lakeside Gaming from the

Property. The terms of the Conditional Agreement also provided that

Village Hospitality may remove CIRI Lakeside Gaming from the Property five days

after giving written notice following the occurrence of certain events of

default set forth in the Conditional Agreement. The Conditional

Agreement further provided that CIRI Lakeside Gaming must surrender the Property

no later than September 8, 2010, subject to the specific terms and conditions of

the Conditional Agreement. If CIRI Lakeside Gaming is unable to

remain on the Property and/or realize sufficient proceeds on the disposition of

its assets, the Company may not be able to recover all or a significant portion

of the carrying value of its investment in MonteLago.

The

MonteLago Transaction

The

purpose of the MonteLago Transaction was, first, to finance MonteLago's

acquisition of all of the issued and outstanding membership interests of CIRI

Lakeside Gaming, and second, for the Company to pursue a long-term investment in

the continued growth and development of gaming in the Lake Las Vegas

area.

On May 3,

2007, MonteLago and Plainfield Gaming Inc., or Plainfield Gaming, entered into a

loan agreement, amended and restated as of June 20, 2007, or the Loan

Agreement. Pursuant to the terms and conditions of the Loan

Agreement, Plainfield Gaming loaned, in exchange for the MonteLago Note, an

aggregate amount of $1,562,500, or the Company Loan, to MonteLago to enable

MonteLago to acquire all of the issued and outstanding membership interests of

CIRI Lakeside Gaming, which then owned and operated the Casino.

On

September 22, 2007, upon CIRI Lakeside Gaming's receipt of regulatory approval

from the Nevada Gaming Commission, or the Nevada Commission, MonteLago acquired

all of the issued and outstanding membership interests of CIRI Lakeside

Gaming.

On July

1, 2008, the Company, indirectly through AcquisitionCo, acquired the MonteLago

Note from MonteLago, for the purchase price of $1,484,475. The

MonteLago Note was unsecured and non-interest bearing and was converted into

33.33% of the equity interests of MonteLago upon the Company's receipt of a

Nevada gaming license.

On

November 20, 2008, the Company was granted a Nevada gaming

license. As a result, the Company, through its subsidiaries,

exchanged (cancelled) the MonteLago Note for the cancellation of the Company

Loan and the MonteLago Note automatically converted into the MonteLago Equity on

that date.

Upon

completion of the MonteLago Transaction, the Company, indirectly through

AcquisitionCo, owned 33.334% of the equity interests of MonteLago, and the

remaining 66.666% of the equity interests of MonteLago are owned by the

following:

|

The

Finley Family Trust

|

20.276%

|

||

|

Steve

Szapor

|

13.665%

|

||

|

Steve

Rittvo

|

12.335%

|

||

|

Jess

M. Ravich

|

11.660%

|

||

|

Peter

Cleary

|

1.400%

|

||

|

Ernest

D'Ambrosio

|

3.000%

|

||

|

Scott

Fisher

|

4.330%

|

Employees

The

Company currently has no employees. The Company currently has five

managers on the Board of Managers: Alan Ginsberg, Max Holmes, Joseph Bencivenga,

Ronald Johnson, and Marc Sole. Alan Ginsberg serves as Operating Manager with

responsibility for the Company's day-to-day management and operations. Given the

Company's structure as a holding company to hold, indirectly through

wholly-owned subsidiaries, the MonteLago Equity, Mr. Ginsberg does not intend to

devote a significant amount of his professional time to the operation of the

Company. None of the members of the Board of Managers, including Mr. Ginsberg,

receive any compensation from the Company for their services.

3

Environmental

Issues

The

Company has no physical assets.

CASINO

MONTELAGO HOLDING, LLC

MonteLago

was organized on April 12, 2007, and entered into a Purchase and Sale Agreement

dated April 18, 2007, as amended and restated as of May 16, 2007, with Cook

Inlet Region, Inc., an Alaskan corporation, or CIRI, for the acquisition of 100%

of the membership interests, gaming assets and leasehold improvements of CIRI

Lakeside Gaming, the non-restricted gaming licensee operating the Casino at Lake

Las Vegas. Today, MonteLago, through its subsidiary, CIRI Lakeside

Gaming, leases the premises on which the Casino is located and operates the

Casino.

The

Casino is located adjacent to the Ritz-Carlton Hotel at Lake Las Vegas in

Henderson, Nevada, and since its opening in April 2003, the Casino had been

managed by an unrelated third party management company. Prior to the

approval of the sale between CIRI and MonteLago, CIRI cancelled the management

agreement with the management company. MonteLago installed a

full-time on-site General Manager and has a Board of Managers and Advisory

Committee comprised of senior principals of various equity holders to manage

MonteLago.

On July

17, 2008, Lake at Las Vegas Joint Venture, LLC, the master developer of the Lake

Las Vegas Resort, and several of its subsidiaries, or the Lake Las Vegas Group,

filed a voluntary petition for bankruptcy protection with the United States

Bankruptcy Court for the District of Nevada in Las Vegas under Chapter 11 of the

Bankruptcy Code. On February 25, 2009, CIRI Lakeside Gaming received

a notice to vacate the Property pursuant to Nevada Revised Statutes Section

40.255(1)(C), which we refer to as the Eviction Notice, from German American

Capital Corporation, or the Lender. The Eviction Notice was delivered

in connection with a trustee sale that was effected as part of the bankruptcy

proceedings pertaining to the Property. Both CIRI Lakeside Gaming and

Village Hospitality filed pleadings with the district court in Clark County,

Nevada. The primary issue surrounding the dispute was the existence

or non-existence of a written consent made by Village Hospitality to the lease

agreement made by and between CIRI Lakeside Gaming and the prior owners of the

Property. Village Hospitality argued that no written consent existed

and that the lease agreement was not valid. CIRI Lakeside Gaming

argued that it was advised by the prior owners of the Property that the prior

owners had received the written consent. However, a copy of the

written consent has not been produced. On July 15, 2009, the district

court in Clark County, Nevada ruled that a temporary writ of restitution be

issued against CIRI Lakeside Gaming and in favor of Village

Hospitality. The district court's ruling provided for the potential

eviction and removal of CIRI Lakeside Gaming from the Property.

On

September 4, 2009, CIRI Lakeside Gaming entered into the Conditional Agreement

with Village Hospitality. Pursuant to the terms of the Conditional

Agreement, Village Hospitality agreed to provide CIRI Lakeside Gaming 65 days

prior written notice before removing CIRI Lakeside Gaming from the

Property. The terms of the Conditional Agreement also provided that

Village Hospitality may remove CIRI Lakeside Gaming from the Property five days

after giving written notice following the occurrence of certain events of

default set forth in the Conditional Agreement. The Conditional

Agreement further provided that CIRI Lakeside Gaming must surrender the Property

no later than September 8, 2010, subject to the specific terms and conditions of

the Conditional Agreement. If CIRI Lakeside Gaming is unable to

remain on the Property and/or realize sufficient proceeds on the disposition of

its assets, the Company may not be able to recover all or a significant portion

of the carrying value of its investment in MonteLago.

Management

of MonteLago

The

Company and MonteLago executed the MonteLago Operating Agreement dated as of May

3, 2007, or the MonteLago Operating Agreement. Under the terms of the

MonteLago Operating Agreement, MonteLago is managed by the board of managers of

MonteLago, comprised of Johan Finley and Peter Cleary, which we refer to as the

MonteLago Board. Representatives from various equity holders also

form an Advisory Committee, which makes recommendations to the MonteLago

Board. Riccardo Ingrassia, formerly the General Manager of the Hyatt

Casino at Lake Las Vegas prior to its closing, currently serves as General

Manager of the Casino.

4

Other

than powers expressly delegated to the General Manager in its management of the

Casino, the MonteLago Board has all power to control and manage the business and

affairs of MonteLago. Each Manager of the MonteLago Board has one

vote and actions of the MonteLago Board generally require a majority vote of the

Managers, except that if there are only two members of the MonteLago Board at

any time then a vote of the MonteLago Board at that time must be

unanimous. Certain actions by the MonteLago Board, however, are

subject to ratification by Members of MonteLago who own in the aggregate at

least a majority of the equity interests of MonteLago, including:

|

|

·

|

any

amendment to the MonteLago Operating Agreement or to MonteLago's

certificate of formation,

|

|

|

·

|

any

merger or combination of MonteLago with or into another entity other than

when MonteLago is the surviving entity or where MonteLago is converted

into another form of legal entity pursuant to the MonteLago Operating

Agreement,

|

|

|

·

|

any

sale or exchange of all or substantially all of the assets of MonteLago or

any of its affiliates or

subsidiaries,

|

|

|

·

|

the

dissolution of MonteLago, change in its form, or the formation of any

subsidiaries or joint ventures,

|

|

|

·

|

the

compromising, arbitrating, adjusting and litigating of certain claims

against MonteLago or any of its affiliates or

subsidiaries,

|

|

|

·

|

the

approval of the annual operating budget and capital expenditure budget for

MonteLago or any of its affiliates or subsidiaries and the approval of any

deviation from said budgets,

|

|

|

·

|

any

public offering of securities pursuant to the Securities Act of 1933, as

amended, or the Securities Act,

|

|

|

·

|

the

approval of certain contracts or agreements to which MonteLago or any of

its affiliates or subsidiaries are a

party,

|

|

|

·

|

the

approval of certain transactions regarding borrowing of money, obtaining

of credit, issuance of notes, debentures, securities, equity or other

interests of or in MonteLago and securing of the obligations undertaken in

connection therewith and entering into of leases for real or personal

property, and

|

|

|

·

|

the

creation and appointment or elimination of an Advisory Committee to

MonteLago.

|

Managers

are required to be licensed or found suitable by the relevant Nevada gaming

authorities in order to engage in the management of a gaming casino in Nevada,

including MonteLago. For further information about licensing and

suitability requirements, see "Item 1. Business – Regulatory Matters – Nevada

Regulation and Licensing" below.

Other

than through representation on the Board of Managers, the Members and various

equity holders of MonteLago do not have the right to take part in or interfere

in any manner with the management of MonteLago. The Members have

voting rights generally limited to those required by law and those specifically

set forth in the MonteLago Operating Agreement. Except as permitted

by the MonteLago Board and the relevant gaming authorities, the Members are

generally prohibited from transferring all or any part of their interests in

MonteLago.

Business

and Marketing Strategy

MonteLago

aims to target the locals geographic gaming market, focusing on residents living

in close proximity to the Casino. MonteLago management believes that

the Casino also benefits from the Neighborhood Casino Act, which limits

competition within defined areas. For more information on the

Neighborhood Casino Act, see "Item 1. Business – Casino MonteLago Holding, LLC –

Competition – The Neighborhood Casino Act" below.

Strong Management

Team. The day-to-day operations of MonteLago are managed

by Riccardo Ingrassia, who has had significant gaming industry

experience. Mr. Ingrassia previously served as the Casino General

Manager of the casino at the Hyatt Regency Lake Las Vegas. Mr.

Ingrassia not only has a thorough understanding of the local operating

environment at Lake Las Vegas, table games and slot machines, but he also has

extensive contacts within the casino gaming industry and with casino

customers. As General Manager, Mr. Ingrassia reports to the MonteLago

Board comprised of MonteLago principals. Mr. Ingrassia is assisted in

his management functions by a team of departmental managers with extensive

experience in their respective fields of expertise. In addition, Members of the

MonteLago Board and Advisory Committee of MonteLago have significant experience

in the gaming industry.

5

Targeted Customer

Base. MonteLago's operating strategy aims to attract and

retain customers primarily from the locals geographic market through innovative,

frequent and high-profile promotional programs, and focused marketing

efforts. MonteLago's primary customers are located within a five-mile

radius of the Casino, and MonteLago focuses its marketing efforts on those

patrons. In addition, MonteLago is broadening its marketing strategy

to include overnight visitors staying at the hotels and condominium units in

Lake Las Vegas.

High-Value Customer

Experience. In order to provide what MonteLago's management

believes is a high-value gaming experience that will attract repeat local

customers, MonteLago focuses on slot and video poker machine play and offers a

wide variety of high quality slot and video poker games. MonteLago

management is also committed to providing a high-value entertainment experience

through food and beverage and other entertainment amenities.

Creative Marketing and Promotional

Programs. MonteLago management believes that promotions

and promotional events are one of the primary factors to success in the locals

gaming market. MonteLago employs a marketing strategy that utilizes

what they believe are innovative, frequent and high-profile promotional programs

in order to attract and retain customers and establish a high level of name

recognition for the Casino. In addition to aggressive direct

marketing efforts, MonteLago markets its own promotional events in close

conjunction with the Lake Las Vegas Village, and has established and promotes an

efficient and competitive local player loyalty rewards program at the

Casino. Furthermore, MonteLago management intends to pursue strategic

alliances with other entities to induce incremental casino play at the

Casino.

The

Casino

Following

the sale of the Hyatt Hotel at Lake Las Vegas to Loews Hotels, the Casino is the

only casino remaining in Lake Las Vegas. The Casino is located

adjacent to the Ritz-Carlton Hotel at Lake Las Vegas. The Casino

opened in April 2003 and has a Tuscan theme. The Casino's facilities

consist of approximately 40,000 square feet of casino space, approximately 424

slot/video poker machines, 10 table games, a sports book, a restaurant and snack

bar, two bars, and an indoor/outdoor entertainment venue. The Casino

benefits indirectly from the marketing efforts of Lake Las Vegas' two hotels –

the Ritz Carlton and the Loews Lake Las Vegas Resort, as well as traffic from

the residents of nearby timeshares and visitors to golf courses near Lake Las

Vegas.

Las

Vegas Locals Gaming Market

Henderson

is part of the greater Las Vegas metropolitan area in Clark County,

Nevada. The greater Las Vegas area is one of the fastest growing

areas within the United States. According to the Nevada State Demographer,

between 1997 and 2007 Clark County's population grew approximately 67%,

approximately six times the United States population growth of approximately 11%

over the same period of time. According to Clark County demographers, county

population growth slowed somewhat to approximately 4% between 2006 and 2007 but

still remained above the national average, and has remained relatively unchanged

in 2008. MonteLago's management believes that the growth in Clark County's

population has been driven, in part, by the popularity of casino gaming and

Nevada's favorable climate and tax structure and low unemployment.

MonteLago

competes primarily in the Las Vegas locals gaming market, which is defined as

the Clark County gaming market excluding the Las Vegas Strip, downtown Las Vegas

and Laughlin. According to the 2008 Clark County Residents Study by the Las

Vegas Convention and Visitors Authority, approximately two-thirds of the local

adult population participates in casino gaming at least occasionally (less than

once per month to more than twice per week). In conjunction with the growth of

the Clark County population, gaming revenues for the locals gaming market has

experienced steady near double digit increases annually until recently.

According to the Nevada Commission, total revenue from non-restricted gaming

operations in the Las Vegas locals gaming market grew from approximately $1.7

billion in 2002 to approximately $2.8 billion in 2007, representing an annual

growth rate of 9.7% and between 2006 and 2007 of 3.0%. However, in

2008, total revenue from non-restricted gaming operations in the Las Vegas

locals gaming market declined by 9.36% to $2.51 billion. For the year ended

July 31, 2009, total revenue for the Las Vegas locals gaming market was

approximately $2.36 billion.

The

specific geographic market for the Casino is the residents of Lake Las Vegas and

its surrounding area within a three to five mile range, guests staying at one of

Lake Las Vegas' three resorts – the Ritz Carlton, the Loews Lake Las Vegas

Resort, and MonteLago Village Resort, and daily visitors to Lake Las Vegas and

Lake Mead. As of November 13, 2009, Lake Las Vegas is an

3,592-acre, upscale development situated on a privately owned 320-acre lake with

10 miles of shoreline, and is located approximately 17 miles from Las

Vegas. The Lake Las Vegas area also has three resorts, 19 distinct

neighborhoods, golf courses, spas, and full-service marinas with watercraft

rentals and yacht cruises.

Competition

The

gaming industry is a highly fragmented and competitive industry. The

gaming industry includes land-based casinos, in certain locations dockside

casinos and riverboat casinos, casinos located on Native American reservations

and other forms of legalized gaming. MonteLago management believes

that the primary competition to the Casino comes from other casinos that cater

to the Clark County locals market. In addition, to

6

a lesser

extent, the Casino faces competition from casinos located on the Las Vegas Strip

and in downtown Las Vegas. The competition among companies in the

gaming industry is intense and many of MonteLago's competitors have

significantly greater resources than MonteLago. Certain states have

legalized casino gaming and other states may legalize gaming in the

future. Legalized casino gaming in these states and on Native

American reservations near MonteLago or changes to gaming laws in states

surrounding Nevada could increase competition in the Las Vegas market and could

adversely affect its operations. MonteLago also competes to a lesser

extent with gaming facilities in other jurisdictions, state-sponsored lotteries,

on-and-off track pari-mutuel wagering, internet gaming, card clubs, riverboat

casinos and other forms of legalized gambling.

Las

Vegas Locals Gaming Market

The Clark

County locals gaming market has led to a highly competitive market to attract

business of local residents. In addition to established casinos and

resorts, MonteLago faces competition from smaller casinos, supermarkets, bars

and convenience stores that offer limited forms of gaming.

The

closest casino competitor to the Casino is the Fiesta, which is approximately

eight miles from the Casino. Other competitors (each more than 10

miles from the Casino) include Sunset Station, Green Valley Ranch, and Boulder

Station, all of which are owned by Station Casinos Inc., Sam's Town, which is

owned by Boyd Gaming, and the Eastside Cannery, which is owned by Cannery Casino

Resorts. Together, these five casinos account for 12,852 slots, 219

table games and 2,270 hotel rooms.

There are

also a number of casinos that service population centers in and around downtown

Henderson. These properties offer minimum amenities and target a

lower-middle class demographic. These facilities include the Eldorado

Casino and Jokers Wild, owned by Boyd Gaming, the Peppermill's Rainbow Club

Casino, and the Emerald Island Casino.

Las

Vegas Strip and Downtown Las Vegas Gaming Market

The Las

Vegas Strip is the location of numerous casino resorts, including the largest

and newest mega-casinos that Las Vegas has to offer. In addition, the

downtown Las Vegas area includes approximately 15 casinos on or near Fremont

Street in old Las Vegas. Casinos located on the Las Vegas Strip or in

downtown Las Vegas are typically tourist destinations and generally do not

target the locals gaming market.

The

Neighborhood Casino Act

In 1997,

the Nevada Legislature passed Senate Bill No. 208, or the Neighborhood Casino

Act, enacting laws which possibly create significant barriers to new competition

near the Casino and other neighborhoods by limiting future casino development in

certain areas of Clark County, Nevada. These laws have been

subsequently amended several times by the Nevada Legislature. With

certain specified exemptions, the Neighborhood Casino Act limits non-restricted

gaming to certain designated gaming enterprise districts, and imposes

potentially burdensome requirements on applicants proposing to have new

locations designated as gaming enterprise districts by the applicable county,

city or town body with jurisdiction.

Operations

For the

year ended December 31, 2008, MonteLago derived approximately 99% of its

revenues from three sources: slot and video gaming machines (69%), food and

beverage (17%), and table games (13%).

REGULATORY

MATTERS

CIRI

Lakeside Gaming's operations are subject to extensive regulation under laws,

rules and supervisory procedures imposed by Nevada law and by the City of

Henderson. If additional gaming regulations are adopted by the State of Nevada

or the City of Henderson, those regulations could impose restrictions or costs

that could have a significant adverse effect on those operations. From time to

time, various proposals have been introduced in the Nevada legislature or by

initiative petitions that, if enacted, could adversely affect the tax,

regulatory, operational or other aspects of the gaming industry and those

operations. MonteLago does not know whether or when such legislation

will be enacted or whether such initiative proposals may be implemented. Gaming

companies are currently subject to significant state and local taxes and fees in

addition to normal federal and state corporate income taxes, and such taxes and

fees are subject to increase at any time. Any material increase in these taxes

or fees could adversely affect MonteLago's gaming operation.

7

Some

jurisdictions, including Nevada, empower their regulators to investigate

participation by licensees in gaming outside their jurisdiction and require

access to periodic reports respecting those gaming activities. Violations of

laws in one jurisdiction could result in disciplinary action in other

jurisdictions.

Under

provisions of gaming laws of the State of Nevada, and under the organizational

documents of MonteLago, its securities are subject to restrictions on ownership

and proposed transfers of ownership interests. The restrictions may require a

holder of those securities to dispose of the securities under certain

circumstances or, if the holder refuses, or is unable to dispose of the

securities, the issuer may be required to repurchase the

securities.

Since the

Company was approved by the Nevada Gaming Authorities (defined below) to acquire

the equity interests in MonteLago, the Company became subject to extensive

regulation by the various gaming authorities. See, "Item 1. Business –

Regulatory Matters – Nevada Regulation and Licensing" below.

Nevada

Regulation and Licensing

The

ownership and operation of casino gaming facilities in Nevada, including the

Casino, are subject to the gaming laws and regulations of the State of Nevada,

including the Nevada Gaming Control Act, or the Nevada Act, and regulations

promulgated thereunder, as well as local regulations imposed by the City of

Henderson. MonteLago's gaming operations are subject to the licensing

and regulatory control of the Nevada Commission, the Nevada State Gaming Control

Board, or the Nevada Board, and the City of Henderson, which we collectively

refer to as the Nevada Gaming Authorities. The laws, regulations and

supervisory procedures of the Nevada Gaming Authorities are based upon

declarations of public policy that seek to (i) prevent unsavory or unsuitable

persons from having any direct or indirect involvement with gaming at any time

or in any capacity, (ii) establish and maintain responsible accounting practices

and procedures, (iii) maintain effective control over the financial practices of

licensees, including establishing minimum procedures for internal fiscal affairs

and the safeguarding of assets and revenues, providing reliable recordkeeping

and requiring the filing of periodic reports with the Nevada Gaming Authorities,

(iv) prevent cheating and fraudulent practices and (v) provide a source of state

and local revenues through taxation and licensing fees. Changes in such laws,

regulations and procedures could have an adverse effect on all Nevada gaming

operations, including the Casino.

CIRI

Lakeside Gaming is licensed by the Nevada Gaming Authorities as a corporate

licensee, or a Corporate Licensee, under the terms of the Nevada Act and is,

therefore, the holder of the non-restricted (casino) gaming license that

authorizes its gaming operations to be conducted under Nevada

law. The gaming license held by CIRI Lakeside Gaming requires

periodic payments of fees and taxes and is not

transferable. Corporate Licensees are required periodically to submit

detailed financial and operating reports to the Nevada Commission and furnish

any other information that the Nevada Commission may request. No person may

become a member of, or receive any percentage of the profits from a Corporate

Licensee without first obtaining licenses and approvals from the Nevada Gaming

Authorities. MonteLago has been found suitable by the Nevada

Commission as the sole owner of the membership interests of CIRI Lakeside

Gaming, and all of the present Members of MonteLago have obtained the approvals

necessary to own their respective interests in the Casino. MonteLago

and its affiliated entities have obtained from the Nevada Gaming Authorities the

various registrations, approvals, permits and licenses required in order to

engage in the Casino's present gaming activities.

Prior to

acquiring the MonteLago Equity, the Company and its affiliated entities and

controlling persons obtained certain approvals from the Nevada Gaming

Authorities. These approvals included the following:

|

|

·

|

the

Company was registered by the Nevada Commission as a publicly traded

corporation as that term is defined by the Nevada Act and was found

suitable to own all of the stock of

BlockerCo;

|

|

|

·

|

HBJ,

BlockerCo and AcquisitionCo were registered as holding or intermediary

companies under the Nevada Act, and were found suitable in such

capacities;

|

|

|

·

|

HBJ's

sole equity holder and Manager were investigated and found suitable as

Member and Manager of HBJ and as Operating Manager of the Company;

and

|

|

|

·

|

The

other four individuals who serve as members of the Board of Managers or

officers of the Company and its subsidiaries were investigated and found

suitable in such capacities.

|

The

Nevada Gaming Authorities required the Company, HBJ, BlockerCo and

AcquisitionCo, and each of their respective members and managers, to be found

suitable in connection with the MonteLago Transaction. Investigations

for findings of suitability require the same level of review and scrutiny as do

investigations for licensing. While the direct and indirect holders

of Class B Interests of the Company were not mandatorily

8

required

under the Nevada Act to be found suitable in connection with the Company's

acquisition of the MonteLago Equity, they will remain subject to the

discretionary authority of the Nevada Commission and may be required to file

applications for findings of suitability, be investigated, and have their

suitability determined by the Nevada Commission. It is customary

practice of the City of Henderson to defer to the Nevada Commission with respect

to the background and suitability investigation of gaming applications except

for those by on-site managers of liquor and gaming operations.

The

Company had applied to be registered by the Nevada Commission as a "publicly

traded corporation" as that term is defined in the Nevada

Act. Following the effectiveness of the Company's registration

statement on Form 10-12G, as amended, initially filed with the SEC on October

31, 2008 (File No. 000-53407), and after obtaining all required approvals from

the Nevada Commission, the Company was deemed a "publicly traded corporation"

under the Nevada Act, even though it is not currently anticipated that any

membership interests or any other securities of the Company will be listed for

trading or trade with any frequency.

The

Company, HBJ, BlockerCo and AcquisitionCo also applied for and obtained various

registrations, licenses, findings of suitability, approvals and permits required

from the Nevada Gaming Authorities to acquire the MonteLago

Equity. In connection with the Company's, HBJ's and AcquisitionCo's

applications, Alan Ginsberg, the sole Member and Manager of HBJ, applied for and

received the required approvals and findings of suitability in these capacities,

and each of Max Holmes, Joseph Bencivenga, Ronald Johnson, and Marc Sole

additionally applied for and received approval as members of the Board of

Managers of the Company and for various positions within BlockerCo and

AcquisitionCo.

No person

may become a stockholder or member of, or receive any percentage of the profits

of, an intermediary or holding company or a Corporate Licensee without first

being investigated by and obtaining licenses and related findings of suitability

or approvals from the Nevada Gaming Authorities. The Nevada Gaming Authorities

may investigate any individual who has a material relationship to or material

involvement with the Company or its affiliates to determine whether the

individual is suitable or should be licensed as a business associate of a

Corporate Licensee or any holding or intermediary company. As stated above,

certain of the officers, managers and key employees of MonteLago, the Company,

HBJ, BlockerCo and AcquisitionCo have been required to file applications with

the Nevada Gaming Authorities and were required to be found suitable by the

Nevada Gaming Authorities in connection with the Company's acquisition of the

MonteLago Equity. A finding of suitability is comparable to

licensing, and both require submission of detailed personal and financial

information followed by a thorough investigation. An applicant for

licensing or an applicant for a finding of suitability must pay or must cause to

be paid all the costs of the investigation. Changes in licensed

positions must be reported to the Nevada Gaming Authorities and, in addition to

their authority to deny an application for a finding of suitability or

licensing, the Nevada Gaming Authorities have the authority to disapprove

changes in a corporate position.

If the

Nevada Commission were to find an officer, manager or key employee of CIRI

Lakeside Gaming, MonteLago, the Company, HBJ, BlockerCo or AcquisitionCo

unsuitable to continue having a relationship with any of these entities, the

companies involved would have to sever all relationships with such

person. The Nevada Commission may deny an application for any cause

which they deem reasonable. Determinations of suitability or of questions

pertaining to licensing are subject to very limited judicial review in

Nevada.

If it

were determined that the Nevada Act was violated by CIRI Lakeside Gaming,

MonteLago, the Company, HBJ, BlockerCo or AcquisitionCo, the gaming licenses and

approvals they hold could be limited, conditioned, suspended or revoked, subject

to compliance with certain statutory and regulatory procedures. In

addition, any such violation and the persons involved could be subject to

substantial fines for each separate violation of the Nevada Act or of the

regulations of the Nevada Commission, at the discretion of the Nevada

Commission. Furthermore, the Nevada Commission could appoint a supervisor to

operate the Casino and, under specified circumstances, earnings generated during

the supervisor's appointment (except for the reasonable rental value of the

premises) could be forfeited to the State of Nevada. Limitation,

conditioning or suspension of any gaming license or the appointment of a

supervisor could (and revocation of any gaming license would) impact MonteLago's

revenues and cause the Company to suffer financial loss.

On

November 20, 2008, the Nevada Commission issued an order of registration of the

Company, or the Order of Registration, which was immediately

effective. The Order of Registration prohibits (1) HBJ, Plainfield

Holdings, or their respective affiliates from selling, assigning, transferring,

pledging or otherwise disposing of Class A or Class B Interests or any other

security convertible into or exchangeable for Class A or Class B Interests,

without the prior approval of the Nevada Commission, and (2) the Company from

declaring cash dividends or distributions on any class of membership unit of the

Company beneficially owned in whole or in part by HBJ or Plainfield Holdings or

their respective affiliates, without the prior approval of the Nevada

Commission. The Order of Registration sets forth a description of the

Company and its affiliates and intermediary companies and the various approvals

obtained by those entities, together with any conditions and limitations

pertaining to such approvals.

9

The

Company, HBJ, BlockerCo and AcquisitionCo are subject to detailed financial and

operating reporting requirements to the Nevada Gaming Authorities on an ongoing

basis. Substantially all material loans, leases, sales of securities

and similar financing transactions by the Company, HBJ, BlockerCo and

AcquisitionCo must be reported to, and in some cases approved by, the Nevada

Commission.

Regardless

of the amount of interest held, any beneficial holder of securities issued by

the Company may be required to file an application, be investigated and have

that person's suitability as a beneficial holder of voting securities determined

if the Nevada Commission has reason to believe that the ownership would

otherwise be inconsistent with the declared policies of the State of

Nevada. If the beneficial holder of such voting securities who must

be found suitable is a corporation, partnership, limited partnership, limited

liability company or trust, it must submit detailed business and financial

information, including a list of its beneficial owners. The applicant

must pay all costs of the investigation incurred by the Nevada Gaming

Authorities in conducting any investigation.

The

Nevada Act requires any person who individually, or in association with others,

acquires, directly or indirectly, beneficial ownership of more than 5% of the

voting securities of a publicly traded corporation registered with the Nevada

Commission to report the acquisition to the Nevada Commission, and such person

may be required to be found suitable. The Nevada Act requires that

each person who, individually or in association with others, acquires, directly

or indirectly, beneficial ownership of more than 10% of the voting securities of

a publicly traded corporation registered with the Nevada Commission to apply to

the Nevada Commission for a finding of suitability within 30 days after the

Chairman of the Nevada Board mails written notice to the person requiring such

filing. Under certain circumstances, an "institutional investor," as

defined in the Nevada Act, which acquires more than 10%, but not more than 15%,

of the voting securities of a registered publicly traded corporation may apply

to the Nevada Commission for a waiver of a finding of suitability if the

institutional investor holds the voting securities for investment purposes

only. Also under certain circumstances, an institutional investor

that has obtained a waiver may hold up to 19% of the voting securities of such

company for a limited period of time and maintain the waiver. An

institutional investor will not be deemed to hold voting securities for

investment purposes unless the voting securities were acquired and are held in

the ordinary course of business as an institutional investor and not for the

purpose of causing, directly or indirectly, the election of a majority of the

members of the board of directors of the registered publicly traded corporation,

a change in the corporate charter, bylaws, management, policies or operations of

the registered publicly traded corporation, or any of its gaming affiliates, or

any other action which the Nevada Commission finds to be inconsistent with

holding such a company's voting securities for investment purposes

only.

Activities

which are not deemed to be inconsistent with holding voting securities for

investment purposes only include:

|

|

·

|

voting

on all matters voted on by stockholders or interest

holders;

|

|

|

·

|

making

financial and other inquiries of management of the types normally made by

securities analysts for informational purposes and not to cause a change

in management, policies or operations;

and

|

|

|

·

|

other

activities that the Nevada Commission may determine to be consistent with

such investment intent.

|

Any

person who fails or refuses to apply for a finding of suitability or a license

within 30 days after being ordered to do so by the Nevada Commission or the

Chairman of the Nevada Board may be found unsuitable. The same restrictions

apply to a record owner of equity securities if the record owner, after request,

fails to identify the beneficial owner. Any person found unsuitable

and who holds, directly or indirectly, any beneficial ownership of the equity

securities of a publicly traded corporation registered with the Nevada

Commission beyond such period of time as may be prescribed by the Nevada

Commission may be guilty of a criminal offense. The Company is subject to

disciplinary action if, after it receives notice that a person is unsuitable to

be a member or hold a voting security or other equity security issued by the

Company or to have any other relationship with the Company, the

Company:

|

|

·

|

pays

that person any dividend or interest with respect to voting securities of

the Company,

|

|

|

·

|

allows

that person to exercise, directly or indirectly, any voting right

conferred through securities held by that

person,

|

|

|

·

|

pays

remuneration in any form to that person for services rendered or

otherwise, or

|

10

|

|

·

|

fails

to pursue all lawful efforts to require such unsuitable person to

relinquish his or her voting securities, including, if necessary, the

immediate purchase of said voting securities for cash at fair market

value.

|

The

Nevada Commission may, in its discretion, require the holder of any debt or

non-voting security of a registered publicly traded corporation to file

applications, be investigated, and be found suitable to own the debt or

non-voting security of such corporation. If the Nevada Commission determines

that a person is unsuitable to own such security, then pursuant to the Nevada

Act, the registered publicly traded corporation can be sanctioned, including by

revocation of its approvals, if without the prior approval of the Nevada

Commission, it:

|

|

·

|

pays

to the unsuitable person any dividend, interest, or any distribution

whatsoever,

|

|

|

·

|

recognizes

any voting right by such unsuitable person in connection with such

securities,

|

|

|

·

|

pays

the unsuitable person remuneration in any form,

or

|

|

|

·

|

makes

any payment to the unsuitable person by way of principal, redemption,

conversion, exchange, liquidation or similar

transactions.

|

The

Company may not make a public offering of its securities without the prior

approval of the Nevada Commission if the proceeds from such offering are

intended to be used to construct, acquire or finance gaming facilities in

Nevada, or to retire or extend obligations incurred for such

purposes.

The

Nevada Act provides that changes in control of the Company through merger,

consolidation, stock or asset acquisitions, management or consulting agreements,

or any act or conduct by a person whereby the person obtains control, may not

occur without the prior approval of the Nevada Commission. Entities

and persons seeking to acquire control of a registered publicly traded

corporation must satisfy the Nevada Commission with respect to a variety of

stringent standards prior to assuming control of such corporation. The Nevada

Commission may also require controlling stockholders, members, partners,

officers, directors and other persons having an ownership interest in or a

material relationship or involvement with the entity proposing to acquire

control to be investigated and licensed as part of the approval process relating

to the transaction.

Any

person who is licensed, required to be licensed, registered, required to be

registered, or under common control with such persons, and who proposes to

become involved or is involved in a gaming venture outside of Nevada, which we

refer to as Foreign Gaming, is required to deposit certain funds with the Nevada

Board in order to pay the expenses of investigation of the Nevada Board with

respect to their participation in such Foreign Gaming. Thereafter, such persons

are required to comply with certain reporting requirements imposed by the Nevada

Act. A licensee is also subject to disciplinary action by the Nevada Commission

if it knowingly violates any laws of the foreign jurisdiction pertaining to the

Foreign Gaming operation, fails to conduct the Foreign Gaming operation in

accordance with the standards of honesty and integrity required of Nevada gaming

operations, engages in activities or enters into associations that are harmful

to the State of Nevada or its ability to collect gaming taxes and fees, or

employs, contracts with, or associates with, a person in a Foreign Gaming

operation who has been denied a license or finding of suitability in Nevada for

the reason of personal unsuitability.

Internal

Revenue Service Regulations

The

Internal Revenue Service requires operators of casinos located in the United

States to file information returns for certain United States citizens, including

names and addresses of winners, for keno, bingo and slot machine winnings in

excess of stipulated amounts. The Internal Revenue Service also requires

operators to withhold taxes on some keno, bingo and slot machine winnings of

nonresident aliens. Management of MonteLago is unable to predict the

extent to which these requirements, if extended, might impede or otherwise

adversely affect operations of, and/or income from, the other

games.

Regulations

adopted by the Financial Crimes Enforcement Network of the Treasury Department,

or FinCEN, require the reporting of currency transactions in excess of $10,000

occurring within a gaming day, including identification of the patron by name

and social security number. This reporting obligation began in May

1985. In addition, for periods after March 25, 2003, federal

regulations require operators of casinos in the United States to report certain

"suspicious transactions" to FinCEN. These regulations may have

resulted in the loss of gaming revenues to jurisdictions outside the United

States which are exempt from the ambit of these regulations. Casinos

are also required to comply with certain reporting requirements of the Nevada

Commission and the Nevada Board.

11

Other

Laws and Regulations

The sale

of alcoholic beverages at MonteLago Casino is subject to licensing, control and

regulation by applicable local regulatory agencies. All licenses are revocable

and are not transferable. The agencies involved have full power to limit,

condition, suspend or revoke any license, and any disciplinary action could, and

revocation would, have a material adverse effect upon MonteLago's

operations.

MonteLago

is subject to extensive state and local regulations and, on a periodic basis,

must obtain various licenses and permits, including those required to sell

alcoholic beverages. Management of MonteLago believes that it has obtained all

required licenses and permits and that its business is conducted in substantial

compliance with applicable laws.

Environmental

Matters

As is the

case with any owner or operator of real property, MonteLago is subject to a

variety of federal, state and local governmental regulations relating to the

use, storage, discharge, emission and disposal of hazardous materials. Federal,

state and local environmental laws and regulations also impose liability on

potentially responsible parties, including the owners or operators of real

property, to clean up, or contribute to the cost of cleaning up, sites at which

hazardous wastes or materials were disposed of or released. MonteLago does not

have environmental liability insurance to cover such events.

MonteLago

management believes that its operation and property are in compliance in all

material respects with all applicable environmental laws. Based upon

their experience to date, MonteLago management believes that the future cost of

compliance with and liability under existing environmental laws will not have a

material adverse effect on its financial condition or results of

operations.

Employees

As of

November 13, 2009, MonteLago had approximately 182

employees. Approximately 131 are full time and three are part

time. There are also 47 extra board employees. As of that date, the

gaming department had 84 employees; the food and beverage department had 50

employees; and administration had 48 employees. No employees are

currently represented by organized labor. MonteLago's management

recognizes that its employees are its greatest assets and are critical to its

success. MonteLago's management has sought to foster a productive

work culture, and employees are offered competitive salaries and benefits. The

Company currently has no employees.

Reports

to Security Holders

The

Company is required to file annual, quarterly and other current reports and

information with the SEC. You may read and copy any materials filed

by the Company with the SEC at its Public Reference Room at 100 F Street, N.E.,

Washington, D.C. 20549. You may obtain information on the operation of the

Public Reference Room by calling the SEC at 1-800-SEC-0330. The Company's

filings are also available to the public from commercial document retrieval

services and at the World Wide Web site maintained by the SEC at

http://www.sec.gov.

Item

2. Properties.

Neither

the Company nor any of its consolidated subsidiaries owns real

property.

Item

3. Legal Proceedings.

On July

17, 2008, the Lake Las Vegas Group filed a voluntary petition for bankruptcy

protection with the United States Bankruptcy Court for the District of Nevada in

Las Vegas under Chapter 11 of the Bankruptcy Code. On February 25,

2009, CIRI Lakeside Gaming received the Eviction Notice from the

Lender. The Eviction Notice was delivered in connection with a

trustee sale that was effected as part of the bankruptcy proceedings pertaining

to CIRI Lakeside Gaming's leased premises located at the

Property. Both CIRI Lakeside Gaming and Village Hospitality filed

pleadings with the district court in Clark County, Nevada. The

primary issue surrounding the dispute was the existence or non-existence of a

written consent made by Village Hospitality to the lease agreement made by and

between CIRI Lakeside Gaming and the prior owners of the

Property. Village Hospitality argued that no written consent existed

and that the lease agreement was not valid. CIRI Lakeside Gaming

argued that it was advised by the prior owners of the Property that the prior

owners had received the written consent. However, a copy of the

written consent has not been produced. On July 15, 2009, the district

court in Clark County, Nevada ruled that a temporary writ of restitution be

issued against CIRI Lakeside Gaming and in favor of Village

Hospitality. The district court's ruling provided for the potential

eviction and removal of CIRI Lakeside Gaming from the Property.

12

On

September 4, 2009, CIRI Lakeside Gaming entered into the Conditional Agreement

with Village Hospitality. Pursuant to the terms of the Conditional

Agreement, Village Hospitality agreed to provide CIRI Lakeside Gaming 65 days

prior written notice before removing CIRI Lakeside Gaming from the

Property. The terms of the Conditional Agreement also provided that

Village Hospitality may remove CIRI Lakeside Gaming from the Property five days

after giving written notice following the occurrence of certain events of

default set forth in the Conditional Agreement. The Conditional

Agreement further provided that CIRI Lakeside Gaming must surrender the Property

no later than September 8, 2010, subject to the specific terms and conditions of

the Conditional Agreement. If CIRI Lakeside Gaming is unable to

remain on the Property and / or realize sufficient proceeds on the disposition

of its assets, the Company may not be able to recover all or a significant

portion of the carrying value of its investment in MonteLago.

Item

4. Submission of Matters to a Vote of Security Holders.

No

matters were submitted to a vote of the Company's security holders during the

quarter ended July 31, 2009.

PART

II

Item

5. Market for Registrant's Common Equity, Related Stockholder Matters

and Issuer Purchases of Equity Securities.

On

January 4, 2008, in connection with the execution of the Limited Liability

Company Agreement of the Company, dated January 4, 2008, or the Original Company

Operating Agreement, the Company issued the Class A Interest to HBJ without

registration under the Securities Act in reliance on the exemption provided by

Section 4(2) of the Securities Act in exchange for a cash capital contribution

of $0.01. The Company also issued 9,999 Class B Interests to

Plainfield Holdings without registration under the Securities Act in reliance on

the exemption provided by Section 4(2) of the Securities Act in exchange for a

capital contribution of $10.00. The Class A and Class B

Interests were issued in reliance on the respective agreements of the

subscribers that the interests were being acquired for investment with no

intention to resell the units without registration under the Securities

Act. Other than the above issuances of the Class A and Class B

Interests, the Company has not, since the date of its formation, issued any

other securities.

No

established public trading market exists for the Company's membership interests,

and there are no plans, proposals, arrangements or understandings with any

person with regard to the development of a trading market in any of the

Company's membership interests.

There are

no outstanding options or warrants to purchase, or securities convertible into,

the Company's membership interests. The Company's currently

outstanding Class A Interest is "restricted," which means that they were

originally sold in offerings that were not subject to a registration statement

filed with the SEC. Accordingly, resale of the Company's membership

interests are, absent the availability of another exemption from registration

under the Securities Act or registration under the Securities Act, subject to

the provisions of Rule 144 under the Securities Act. In general,

under Rule 144, a person or persons whose membership interests are aggregated

and who has beneficially owned restricted securities for at least six months

following the payment in full of the purchase price for the securities is

entitled to sell in the public market within any three-month period a number of

membership units that does not exceed the greater of:

|

|

·

|

1%

of the then outstanding membership units of the class of membership units

to be sold, or

|

|

|

·

|

if

applicable, the average weekly trading volume of the class of membership

units to be sold on all national securities exchanges and/or reported

through the automated quotation system of a registered securities

association during the four calendar weeks preceding the date on which

notice of sale is filed with the

SEC.

|

Sales

under Rule 144 are subject to restrictions relating to the manner of sale,

notice and availability of current public information about the Company. The

Company has not agreed with any security holder to register any of its

membership interests for sale by any security holder. The Company does not

currently propose to publicly offer any membership interests or other securities

representing an equity interest in the Company.

The only

classes of equity securities of the Company currently outstanding are its Class

A Interest and its Class B Interests. As of November 13, 2009,

HBJ was the only holder of record of the Company's sole Class A Interest and

Plainfield Holdings was the only holder of record of the Company's Class B

Interests. It is currently contemplated HBJ and Plainfield Holdings

will remain the only holders of record of the Company's Class A and Class B

Interests, respectively.

13

The

Company does not pay, and does not expect to pay in the foreseeable future, any

dividends or other distributions with respect to its membership Interests. In

addition, the payment of dividends to affiliates of the Company may be limited

by or subject to the approval of the Nevada Gaming Authorities. See "Item 1.

Business – Regulatory Matters – Nevada Regulation and Licensing."

The

Company does not have any equity compensation plans and does not expect to

authorize securities for issuance pursuant to any equity compensation plan in

the foreseeable future.

Item

6. Selected Financial Data.

Not

applicable.

Item

7. Management's Discussion and Analysis of Financial Condition and

Results of Operations.

Overview

The

following management's discussion and analysis of the Company's financial

condition and results of operations should be read in conjunction with the

audited financial statements and the notes thereto included in Part II, Item 8

of this annual report on Form 10-K.

The

Company and its subsidiaries were formed as legal entities in 2007 for the

primary purpose of holding equity in one or more entities related to the gaming

industry, and to exercise the rights, and manage the distributions received, in

connection with those holdings. On November 20, 2008,

the Company was granted a Nevada gaming license. As a result, the

MonteLago Note (the Company's only investment) automatically converted into the

MonteLago Equity on that date.

Results

of Operations

During

the year ended July 31, 2009, and for the period from August 22, 2007

(inception) through July 31, 2008, the Company incurred unrealized losses of

$918,000 and $332,500, respectively, on the MonteLago investment as a result of

declines in the estimated fair value of the Company's only

investment. These declines in estimated fair value were driven by

declining economic conditions, operating losses experienced by the Casino,

uncertainty as to CIRI Lakeside Gaming's ability to continue to occupy the

Property (Note 4), and/or the Company's ability to receive distributions from

MonteLago based on proceeds from the potential future sale of the Casino's

assets.

Professional,