Attached files

| file | filename |

|---|---|

| EX-31.2 - ADVANCED MEDICAL INSTITUTE INC. | v166069_ex31-2.htm |

| EX-32.1 - ADVANCED MEDICAL INSTITUTE INC. | v166069_ex32-1.htm |

| EX-31.1 - ADVANCED MEDICAL INSTITUTE INC. | v166069_ex31-1.htm |

| EX-32.2 - ADVANCED MEDICAL INSTITUTE INC. | v166069_ex32-2.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

|

x

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

fiscal year ended June 30,

2009

or

|

o

|

TRANSITION

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

transition period from _____________ to ________________

Commission

file number 000-29531

ADVANCED

MEDICAL INSTITUTE INC.

(Exact

name of registrant as specified in its charter)

|

NEVADA

|

88-0409144

|

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(I.R.S.

Employer Identification No.)

|

|

|

Level

4, 80 William Street

East

Sydney, NSW Australia

|

2011

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

|

Registrant’s

telephone number, including area code: (61)

2-9640-5253

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act:

$0.001 Common

Stock

(Title of

class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes o No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Exchange

Act. Yes o No x

Indicate

by check mark whether the registrant (1) has filed all reports required by

Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes x

No o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes o

No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§229.405 of this chapter) is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer or a smaller reporting company. See

definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

Large

Accelerated Filer ¨

|

Accelerated

Filer ¨

|

Non-Accelerated

Filer ¨ (Do

not check if a smaller reporting company)

|

Smaller

Reporting Company x

|

Indicate by check mark whether the

registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes o No x

The

aggregate market value of the voting stock held by non-affiliates of the

Registrant as of December 31, 2008 was $2,954,521.

The

number of shares outstanding of the registrant’s common stock at $.001 par value

as of November 13, 2009 was 53,507,450.

DOCUMENTS

INCORPORATED BY REFERENCE

None.

ADVANCED

MEDICAL INSTITUTE INC.

Annual

Report on Form 10-K for the Year Ended June 30, 2009

|

Part I

|

Page

|

|

|

Item

1. Description of Business

|

3

|

|

|

Item

1A. Risk Factors

|

8

|

|

|

Item

1B. Unresolved Staff Comments

|

17

|

|

|

Item

2. Properties

|

17

|

|

|

Item

3. Legal Proceedings

|

19

|

|

|

Item

4. Submission of Matters to Vote of Security

Holders

|

19

|

|

|

Part II

|

Page

|

|

|

Item

5. Market for Registrant's Common Equity, Related

Stockholder Matters and Issuer Purchases of Equity

Securities

|

20

|

|

|

Item

6. Selected Financial Data

|

20

|

|

|

Item

7. Management’s Discussion and Analysis of Financial Condition

and Results of Operations

|

20

|

|

|

Item

7A. Quantitative and Qualitative Disclosures about Market

Risk

|

31

|

|

|

Item

8. Financial Statements and Supplementary Data

|

F-1

|

|

|

Item

9. Changes in and Disagreements With Accountants on Accounting

and Financial Disclosure

|

31

|

|

|

Item

9A(T). Controls and Procedures

|

32

|

|

|

Item

9B. Other Information

|

33

|

|

|

Part III

|

Page

|

|

|

Item

10. Directors, Executive Officers and Corporate

Governance

|

33

|

|

|

Item

11. Executive Compensation

|

36

|

|

|

Item

12. Security Ownership of Certain Beneficial Owners and

Management and Related Stockholder Matters

|

38

|

|

|

Item

13. Certain Relationships and Related Transactions, and

Director Independence

|

39

|

|

|

Item

14. Principal Accounting Fees and Services

|

39

|

|

|

Part IV

|

Page

|

|

|

Item

15. Exhibits, Financial Statement Schedules

|

40

|

|

|

Signatures

|

|

41

|

2

PART

I

This

report contains certain forward-looking statements and information relating to

Advanced Medical Institute, Inc. (“AMI” or the “Company”)) that are based on the

beliefs and assumptions made by AMI's management, as well as on information

currently available to the management. When used in this document, the words

"anticipate", "believe", "estimate", and "expect" and similar expressions, are

intended to identify forward-looking statements. Such statements reflect the

current views of AMI with respect to future events and are subject to certain

risks, uncertainties and assumptions. Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove incorrect,

actual results may vary materially from those described herein as anticipated,

believed, estimated or expected. Certain of these risks and uncertainties are

discussed in this report under the caption "Risk Factors" in Item 1A. AMI does

not intend to update these forward-looking statements.

|

Item

1.

|

Description

of Business.

|

History

We were

originally incorporated under the name of Hawksdale Financial Visions, Inc. on

December 6, 1996 under the laws of the State of Nevada. We were

involved in the business of timeshares, but became dormant on March 31, 1997,

and until January 28, 2005, we were a “blank check” company with nominal assets.

On October 15, 2004, we changed our name to “Advanced Medical Institute

Inc.”

On March

21, 2005, we completed a Share Exchange Agreement with Advanced Medical

Institute Pty Limited, a privately owned Australian company (“AMI Australia”),

whereby AMI Australia became our wholly owned subsidiary.

On

November 17, 2005 we entered a Share Exchange Agreement with PE Patent Holdco

Pty Limited, a privately owned Australian company (“PE Patent Holdco”), whereby

PE Patent Holdco became our wholly-owned subsidiary.

On

September 8, 2006, we entered a Share Exchange Agreement with Worldwide PE

Patent Holdco Pty Limited (ACN 117 157 727), a privately owned Australian

company (“Worldwide PE”), whereby Worldwide PE became our wholly owned

subsidiary.

Business

Overview

AMI is a

service provider company, which arranges for patients with sexual dysfunction

and prostate problems in Australia, New Zealand and the United Kingdom to be

provided with medical services, pharmaceuticals and associated clinical support

services.

For the

year ended June 30, 2009, AMI’s revenues were approximately $53.4

million.

Principal Products and

Services

AMI

provides a variety of treatment programs to its customers, via its call center

and clinics, for the treatment of sexual dysfunction and prostate problems. A

patient is diagnosed by telephone or in person at a clinic, in either case, by a

licensed physician, who sends a prescription directly to a compounding pharmacy

under contract with AMI to prepare the formulation. The prescription

is delivered to the patient, or the patient may pick up the prescription at the

clinic. The patient pays for treatments for a specified treatment

period, during which the formulations may be varied to best suit the patient’s

needs.

3

Our

physicians prescribe varying combinations or dosages of medications for erectile

dysfunction (predominantly phentalomine, apomorphine or a combination of them),

premature ejaculation (predominantly clomipramine) and prostate problems

(mixture of medicinal herbs). Our compound formulations have not been

subject to any clinical trial, but may lawfully be prescribed on an individual

prescription (“off-label”) basis in each country in which we

operate.

The

effectiveness of AMI’s treatment programs depend highly on the delivery

system. These include:

(a) injections,

nasal spray, lozenges, tablets and gels for the treatment of erectile

dysfunction;

(b) injections,

nasal spray, lozenges and gels for the treatment of premature

ejaculation;

(c) topical

gels for the treatment of female sexual arousal dysfunction; and

(d) an

oral elixir for the treatment of prostate problems.

New Products and

Services

Since 2003, AMI’s subsidiary,

Intelligent Medical Technologies Pty Limited (“IMT”) has been developing an

ultrasonic nebulizer which will deliver drugs to the lungs. The

group’s intention is to use this delivery system to administer its compound

formulations. In order to utilize this delivery system IMT needs to

obtain regulatory approval of the nebulizer as a medical device. IMT

has been working on this process for the last four years, however IMT has not

yet completed such process.

Sales and

Marketing

For the

year ended June 30, 2009, the Company spent $22.4 million on advertising,

including commercials (radio, television and newspapers) and billboards. We

maintain a website, http://www.amiaustralia.com.au/, where a potential patient

can submit medical history and information concerning the problem for which

treatment is sought, prefatory to being contacted by AMI.

AMI’s

erectile dysfunction treatment programs predominantly focus on men aged 40 and

over, whereas AMI’s premature ejaculation treatment programs are targeted at men

aged 18 and over.

Distribution

AMI currently operates a centralized

call center and 20 clinics throughout Australia and New Zealand. AMI

has recently established two clinics in the United Kingdom to service UK

patients. AMI’s products and services are only available by prescription and are

sold on an “off-label” basis. AMI Australia’s treatment programs are

generally available in the same manner through its medical clinics and its

over-the-phone sales and marketing program.

4

Intellectual

Property

The Company’s intellectual property

consists of an Australian innovation patent for AMI’s premature ejaculation

treatment programs (Australian Innovation Patent No 2005100183, which is due to

expire on July 9, 2012), an Australian standard patent application (Australian

standard patent application No. 2004222783), a New Zealand patent for its

premature ejaculation treatment programs (New Zealand patent 544484), an Indian

patent for its premature ejaculation treatment programs (patent

00283/KOL-NP/2006) and patent applications for its premature ejaculation

treatment programs in most industrialized countries. The innovation

patent, titled “Treatment of Premature Ejaculation” relates to various methods

of treatment delivery via nasal (mucosal) inhalation and topical application of

certain formulations which are used in AMI’s treatment programs for premature

ejaculation. The patents and associated formulations are integral to

AMI’s premature ejaculation treatment programs. AMI’s nasal spray

erectile dysfunction treatment programs are not patent

protected. This technology was developed by AMI and its founder, Dr

Jack Vaisman.

AMI’s

wholly-owned subsidiary, IMT, was granted the exclusive worldwide right and

license from Sheiman Ultrasonic Research Foundation Pty Limited to exploit and

sub-license certain inventions, patents and other intellectual property in

relation to certain ultrasonic nebulizer technology (including Australian Patent

No’s 693064 and 753817, European Patent No’s 0 705 145 and 1 071 479 and US

Patent No’s 5,908,158 and 6,379,616) within the field of the treatment of sexual

dysfunction in men and women (including impotence, premature ejaculation and the

treatment of female sexual arousal disorders). The patents relating

to the initial concepts underpinning the technology expire in October 2013, with

the remaining patents relating to extensions of the device expiring around

2023.

IMT applied for seven provisional

worldwide patents in July 2005 and February 2006. In September 2006,

IMT filed an international (PCT) patent application relating to its Nebuliser

device based on aspects of these provisional applications. The international

examination of the PCT application was successful, resulting in a clear

International Preliminary Report on Patentability. This PCT application

has now entered the National Phase in the following jurisdictions: Australia,

Canada, China, Europe, India, Japan, New Zealand and the United States, and

these national phase patent applications are currently awaiting examination in

the respective patent offices. Further, several Australian design

applications, and a United States design patent application have been made

for IMT’s device, the subject of the international (PCT) patent

application. The Australian Design applications are now registered, and

the United States Design patent application is currently under

examination.

AMI

applied for a broad based provisional patent relating to the technology

underpinning its topical gels on July 29, 2008. This application has

yet to be examined and is at an early stage.

Research and

Development

AMI is continuously researching and

developing new methods of treatment in relation to the treatment of sexual

dysfunction in men and women, including impotence, premature ejaculation,

reduced male libido and female sexual arousal disorders.

AMI’s Chief Executive Officer, Dr Jack

Vaisman, spends 25-35% of his time each year researching treatment

methods. In addition, the Company has engaged Dr Jim Rowe (a leading

Australian chemist) to assist the Company to research treatment options, and the

Company has also engaged various other personnel and consultants to assist the

Company in its research programs, either on a part time or project specific

basis, including research assistants, patent attorneys and legal

advisors.

5

Competition

We

compete with rival treatments such as Viagra, Cialis and Levitra in the erectile

dysfunction field. AMI does not currently have any major competitors

in the premature ejaculation market in Australia and New Zealand (its

competitors are individual doctors providing other pharmaceutical treatments on

an individual prescription or “off-label” basis, as well as individual doctors

and psychologists providing counseling services to patients).

AMI’s

delivery methods have the following advantages over the oral delivery methods of

its competitors:

|

|

·

|

Elimination

of gastric and hepatic drug degradation by avoiding metabolism and

gastro-internal tract;

|

|

|

·

|

Faster

entrance into the bloodstream; and

|

|

|

·

|

Fewer

side effects due to the potential reduced dosage of the

drug.

|

Competition

is intense in the erectile dysfunction segment of our business and includes many

competitors that have greater revenue, more customers and higher levels of brand

recognition than the Company. The Company has smaller competitors in the

premature ejaculation segment of our business that have similar business models

to the Company’s business. The efficacy, safety, patients’ and

customers’ ease of use and cost effectiveness of our products are important

factors for success in our principal businesses. Many of our

competitors have substantially greater financial and other resources, larger

research and development staff and more experience in the regulatory approval

process. Moreover, potential competitors have or may have

intellectual property or other rights that conflict with patents, license

agreements and other intellectual property rights covering our

technologies.

6

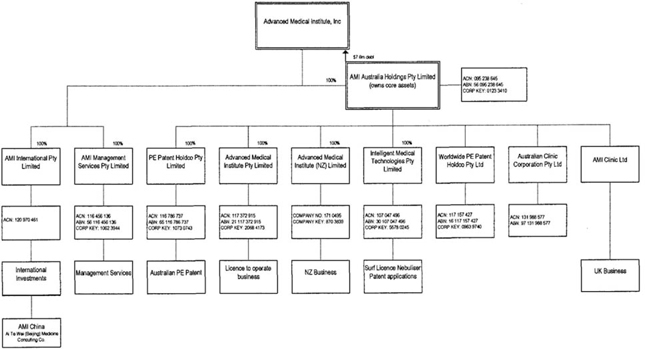

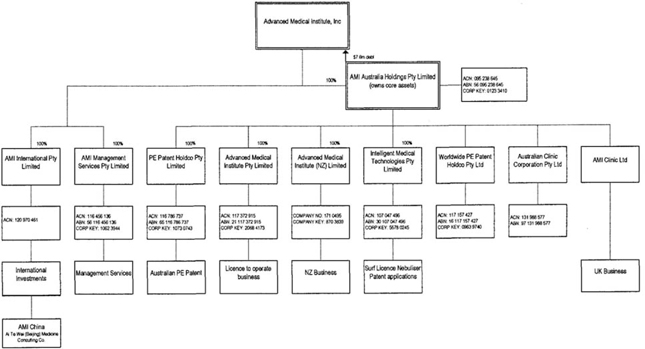

Significant Subsidiaries of

the Company and AMI Australia

The Company’s subsidiaries are AMI

Australia, AMI International Pty Limited and AMI Management Services Pty

Limited.

AMI Australia’s subsidiaries are

Advanced Medical Institute Pty Limited, PE Patent Holdco, Worldwide PE, Advanced

Medical Institute (NZ) Limited, IMT and AMI Clinic Limited.

On June 30, 2009, AMI discontinued

operations of AMI China.

AMI International Pty Limited was

established to hold the Group’s shareholdings in the Chinese company established

to conduct operations in that jurisdiction.

AMI Management Services Pty Limited

provides treasury and management services to AMI Australia and its

subsidiaries.

Advanced Medical Institute (NZ) Limited

conducts the group’s business in New Zealand.

AMI

Clinic Limited conducts the group’s business in UK.

Ai Te Wei (Beijing) Medicine Consulting

Company conducts the group’s business in China.

7

During September 2006, AMI commenced a

not-for-profit division of the Company, AMI-SCI, which provides treatment

options to men who have sustained a spinal cord injury. Details regarding this

unit’s services and operations are located at rocketlaunch.com.au.

Employees

As of

June 30, 2009, AMI had a total staff of approximately 256 people, of which 184

are full-time and 72 are part-time, working in the areas of sales and marketing,

customer support, product development and back office functions. None of the

Company’s employees or staff are members of a union or labor

organization.

Governmental

Regulation

The core government regulations

affecting the business relate to pharmaceutical prescription related

regulations, doctor related regulations and advertising related

regulations. As set out above, each of our treatments is provided on

an individual prescription (“off-label”) basis. Our treatments are

not available from retail pharmacies on an over the counter basis and our

treatments are not marketed under a brand name. It is illegal to mass

produce our medications, and our medications must be prepared in a regulated

facility to a specified standard.

Telephone consultation by doctors is

legal in Australia and the United Kingdom but is illegal in other

markets. Telephone consultation is a core component of our

business.

Our advertisements and marketing is

direct to consumers and therefore required to comply with consumer based

legislation. This legislation prohibits false and misleading

statements from being made in our advertising (amongst other things). Government

regulation also restricts the manner in which our advertising may be undertaken

due to our treatments containing prescription based medications.

Reports to Security

Holders

Annual reports. We deliver

annual reports containing audited financial statements to security

holders.

Periodic reports and other

information. We file annual and quarterly reports, current reports, proxy

statements, and information statements with the SEC.

Availability of Filings. You

may read and copy any materials we file with the SEC at the SEC’s Public

Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain

information on the operation of the Public Reference Room by calling the SEC at

1-800-SEC-0330. Additionally, the SEC maintains an Internet site (http://www.sec.gov)

that contains reports and proxy and information statements and other information

regarding issuers that file electronically with the SEC.

|

Item 1A.

|

Risk

Factors.

|

In

addition to the other information in this Annual Report, the following factors

should be considered carefully in evaluating the Company’s business and

prospects. THE FOLLOWING MATTERS MAY HAVE A MATERIAL ADVERSE EFFECT

ON THE BUSINESS, FINANCIAL CONDITION, LIQUIDITY, RESULTS OF OPERATIONS OR

PROSPECTS, FINANCIAL OR OTHERWISE, OF THE COMPANY. REFERENCE TO THIS CAUTIONARY

STATEMENT IN THE CONTEXT OF A FORWARD-LOOKING STATEMENT OR STATEMENTS SHALL BE

DEEMED TO BE A STATEMENT THAT ANY ONE OR MORE OF THE FOLLOWING FACTORS MAY CAUSE

ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE IN SUCH FORWARD-LOOKING STATEMENT

OR STATEMENTS. We are subject to, among others, the following

risks:

8

Risks Related to our

Business

Our

business may be adversely affected by competition in the market for the

treatment of sexual dysfunction.

Our

business is operating in a competitive market in the erectile dysfunction (“ED”)

segment, and our competitors have significantly greater resources. It

is likely that new competitors will emerge in the short to medium term which may

have an adverse impact on our business.

While we

do not have any significant current known competitors to our premature

ejaculation (“PE”) business in Australia, New Zealand or the United Kingdom it

is likely that competitors will emerge in the short to medium term which may

have an adverse impact on our business. There are various PE

treatments under development internationally which may enter the Australian

market in the short to medium term and which could impact on our ability to

expand our PE business internationally.

An

inability to respond quickly and effectively to new trends could adversely

impact our competitive position.

Any

failure to maintain the level of our technological capabilities or to respond

effectively to technological changes could adversely affect our ability to

retain existing business and secure new business. We will need to

constantly seek out new products and develop new solutions to maintain in our

portfolio. If we are unable to keep current with new trends, our

competitors’ services, technologies or products may render us noncompetitive and

our services and products obsolete.

Potential

impact of current litigation

We may be

adversely affected as a result of current matters in litigation due to legal

costs being incurred or judgments being given against us.

We may be

subject to adverse publicity, costs orders and damages if we lose the legal

actions we are currently involved in.

Increases

in staffing costs could adversely affect our business.

Our

business is labor intensive and we are highly dependent on the provision of

services by highly qualified personnel. These resources are scarce

and we may face competition for these services which could result in increased

expenses for the business. These labor expenses constitute a

significant component of our overall cost of doing business and increases in

these expenses may adversely impact our business.

Increases

in advertising expenses and/or decreases in the effectiveness of our advertising

could result in higher expenses with no corresponding increase in

revenue.

Our

current business model is significantly reliant upon advertising and changes to

the costs associated with that advertising or a decrease in the effectiveness of

that advertising could have a significant adverse impact on the revenue and/or

profitability of our business.

9

Increases

in cost for pharmaceutical compounds and other chemicals could adversely affect

our business.

We

arrange for patients to be provided with medications. Significant

increases in the price of medications or other chemicals used to make the

medications could increase the overall expense of doing business and reduce its

profitability.

We

are subject to risks associated with joint ventures and third party

agreements.

Development

of IMT’s technology is also dependent on contractual arrangements with various

consultants. In addition, AMI Australia has third party contractor

agreements with its doctors and compounding pharmacies. We may incur

significant costs if issues or disputes arise in relation to those arrangements

and joint ventures and our future operation, growth and expansion is dependent

on the success of those arrangements.

We

may be subject to product liability claims which could negatively impact our

profitability.

We

arrange for our patients to be treated with pharmaceutical products, which

involve risks such as product contamination or spoilage, product tampering and

other adulteration of pharmaceutical products. We may be subject to

liability if the consumption of any of our products causes injury, illness or

death. A significant product liability judgment against us may

negatively impact our profitability for a period of time depending on product

availability, competitive reaction and consumer attitudes. Even if a

product liability claim is unsuccessful or is not fully pursued, any negative

publicity surrounding such assertion that products provided through our

treatment programs caused illness or injury could adversely affect our

reputation with existing and potential customers and including irreparable harm

to our corporate and brand image.

We

have limited business liability insurance coverage.

We have

limited business liability insurance coverage for our operations. Any

loss due to business disruption, litigation or natural disaster may exceed or

may be excluded from the insurance coverage we have and could result in

substantial expenses and a diversion of resources. We do not have

liability insurance to cover any operations outside of Australia, New Zealand or

the United Kingdom and likely would need to put such insurance in place in the

event that we commence operations outside these geographic

areas.

We

have and may in the future experience negative results from our plans for

expansion.

We may,

in the future, acquire new Australian clinic facilities and may expand our

business beyond Australia, New Zealand, China and the United

Kingdom. Entering into any expansion transaction entails many risks,

any of which could have a negative impact on our business, including: (a)

diversion of management’s attention from other business concerns; (b) failure to

integrate the acquired company with our existing business; (c) additional

operating expenses not offset by additional revenue; and (d) dilution of our

stock as a result of issuing equity securities. Any expansion

globally also entails additional risks relating to operating our business in

environments with different legal and regulatory systems and business customs

than those in Australia, New Zealand and the United Kingdom, incurring

additional costs in locating and retaining those professionals with expertise in

these area. There is also the likelihood that significant start up

costs will be incurred and that it may take time to achieve successful market

penetration in new markets. We may discover that global operations

are less profitable than existing operations and that losses may be

incurred. There is a risk that our operations in those and other

international areas will continue to be unprofitable.

10

We

may be unable to implement our acquisition or expansion strategy and as a

result, we may be less successful in the future.

We may

not be able to identify and acquire companies meeting our acquisition criteria

on terms acceptable to us. Additionally, financing, if needed, to

complete acquisitions may not always be available on satisfactory

terms. Further, our acquisition strategy presents a number of risks

to us, including adverse effects on our earnings after each acquisition,

diversion of management’s attention from our core business, failure to retain

key acquired personnel and other risks from unanticipated events or liabilities

arising after each acquisition. Some or all of these risks could have

a material adverse effect on our business, financial condition and results of

operations.

We

may be adversely affected should certain patents expire or if our intellectual

property becomes widely available.

We are

currently exploiting or planning to exploit patented technology in our existing

businesses and intend to continue to exploit such technology if we expand

further internationally. Our ability to do business in a similar

manner may be adversely affected by the expiration of those patents and if our

competitors utilize such technology to compete with our businesses.

Some of

our patent applications have yet to be approved by the relevant regulatory

body. The inability to obtain patent protection for our technology or

misappropriation of our intellectual property could adversely affect our

competitive position.

Our

success depends on our medication formulations and internally developed

know-how, and related intellectual properties. Management regards

this intellectual property as proprietary and has and will continue to attempt

to protect such intellectual property by seeking patents, copyrights or

trademarks (as appropriate), and by invoking trade secret laws and entering into

confidentiality and nondisclosure agreements with third

parties. Despite these precautions, it may be possible for a third

party to obtain, misappropriate and use our services or intellectual

property.

We may

need to resort to litigation in the future to enforce or to protect our

intellectual property rights. In addition, our intellectual property

and patents may be claimed to conflict with or infringe upon the patent,

trademark or other proprietary rights of third parties. If this

occurred, we would need to defend ourselves against such challenges, and such

defenses could result in substantial costs and the diversion of resources which

could materially harm our business.

Our

products may infringe upon the intellectual property rights of others, which

could cause damages that may increase our costs and negatively affect our

profitability.

Third

parties may in the future assert against us misappropriation claims or claims

that we have infringed a patent, copyright, trademark or other proprietary right

belonging to them. Any claim, even if not meritorious, could result

in the expenditure of significant financial and managerial resources and could

negatively affect our profitability.

11

Our

ongoing research and development activities are, and the production and

marketing of our pharmaceutical products and services and medical devices

derived therefrom will be, subject to regulation by numerous governmental

authorities in Australia and elsewhere, principally the Therapeutics Goods

Administration, or “TGA” and the functional equivalent bodies in the United

States, Europe, Asia and elsewhere.

Under our

current business model, our medical formulations are able to be provided through

a compounding pharmacy in Australia on an individual prescription

basis. We may need to make variations to our business model to

commence operations in certain jurisdictions outside Australia, New Zealand and

the United Kingdom and there may be other jurisdictions where we would need to

fully comply with clinical trial requirements.

Our

nebulizer medical device is currently undergoing an extensive regulatory

approval process mandated by the TGA prior to marketing and use in Australia

and, to the extent that our nebulizer is marketed internationally, it will

likely have to go through additional regulatory approval by foreign regulatory

agencies. This review process can take considerable time and require

substantial expense. We must obtain regulatory approval from the respective

agencies in countries outside of Australia. We can make no guarantees

that such approvals will be granted.

Delays in

obtaining regulatory approvals would adversely affect the development and

commercialization of our nebulizer device. We cannot be certain that

we will be able to obtain the clearances and approvals necessary for

manufacturing and marketing our nebulizer device.

We

may have future capital needs for which we will need to access additional

financing. Additional financing could dilute our current

stockholders’ equity interests.

We

currently anticipate that our available funds and resources, including sales,

will be sufficient to meet our anticipated needs for working capital and capital

expenditures for the next twelve months within Australia and New

Zealand. We also anticipate that we have sufficient funds to continue

to operate in the United Kingdom on the present scale, however there is a

risk that our budgets may be incorrect and that such finance may prove

inadequate or that we may decide to expand more quickly and into other markets

and that we may need to raise additional funds in the future in order to fund

more research and development and more rapid expansion and to develop new or

enhanced products.

If

additional funds are raised through the issuance of equity or debt securities,

our current stockholders may experience dilution and any such securities may

have rights, preferences or privileges senior to those of the rights of our

common stock.

There can

be no assurance that additional financing will be available on terms favorable

to us, or at all. If adequate funds are not available or not

available on acceptable terms, we may not be able to fund our expansion, promote

our brand name as we desire, take advantage of unanticipated acquisition

opportunities, develop or enhance products or respond to competitive

pressures. Any such inability could have a material adverse effect on

our business, results of operations and financial condition.

12

We

may not be able to retain our key management or contractors.

We are

highly dependent on the services of Dr. Jacov (Jack) Vaisman, Mr. Dilip Shrestha

and Mr. Forhad (Tony) Khan, as well as the other principal members of our

management and scientific staff and the services of Doyle Corporate Pty Limited

and its principal Mr. Richard Doyle. The loss of one or more of such

persons could substantially impair ongoing operations. Our success

depends in large part upon our ability to attract and retain highly qualified

personnel. We compete in our hiring efforts with other pharmaceutical

and medical treatment companies and we may have to pay higher salaries to

attract and retain personnel.

Much of

our intellectual property has been devised and developed by Dr. Vaisman and the

loss or impairment of his services could significantly affect our ability to

fully exploit our intellectual property or affect our ability to develop new

intellectual property.

Risks related to our common

stock

Our

stock price is highly volatile.

Our stock

price has fluctuated significantly. There is a significant risk that

the market price of our common stock could decrease in the future in response to

any of the following factors, some of which are beyond our control:

|

|

·

|

variations

in our quarterly operating results;

|

|

|

·

|

general

economic slowdowns;

|

|

|

·

|

changes

in market valuations of similar

companies;

|

|

|

·

|

sales

of large blocks of our common

stock;

|

|

|

·

|

announcements

by us or our competitors of significant contracts, acquisitions, strategic

partnerships, joint ventures or capital commitments;

and

|

|

|

·

|

fluctuations

in stock market prices and volumes, which are particularly common among

highly volatile securities of internationally-based

companies.

|

Our

common stock is subject to the “penny stock” rules.

Our

common stock is subject to the United States Securities and Exchange

Commission’s penny stock rules, broker-dealers may experience difficulty in

completing customer transactions and trading activity in our securities may be

adversely affected.

Due to

the fact that we have net tangible assets of USD5,000,000 or less and our common

stock has a market price per share of less than USD5.00, transactions in our

common stock may be subject to the “penny stock” rules promulgated under the

Securities Exchange Act of 1934. Under these rules, broker-dealers

who recommend such securities to persons other than institutional accredited

investors:

|

|

·

|

must

make a special written suitability determination for the

purchaser;

|

|

|

·

|

must

receive the purchaser’s written agreement to a transaction prior to

sale;

|

|

|

·

|

must

provide the purchaser with risk disclosure documents which identify

certain risks associated with investing in “penny stocks” and which

describe the market for these “penny stocks” as well as a purchaser’s

legal remedies; and

|

|

|

·

|

must

obtain a signed and dated acknowledgment from the purchaser demonstrating

that the purchaser has actually received the required risk disclosure

document before a transaction in a “penny stock” can be

completed.

|

13

If our

common stock becomes subject to these rules, broker-dealers may find it

difficult to effectuate customer transactions and trading activity in our

securities may be adversely affected. As a result, the market price

of our securities may be depressed, and you may find it more difficult to sell

our securities.

Efforts

to comply with recently enacted changes in securities laws and regulations have

required substantial financial and personnel resources and we still may fail to

comply.

As

directed by the Sarbanes-Oxley Act of 2002, the Securities and Exchange

Commission adopted rules requiring public companies to include a report of

management on our internal controls over financial reporting in their annual

reports on Form 10-K. In addition, the public accounting firm

auditing our financial statements must attest to and report on management’s

assessment of the effectiveness of our internal controls over financial

reporting.

The

formal process of evaluating our internal controls over financial reporting,

which has required the devotion of substantial financial and personnel

resources, is not complete. Given the status of our efforts, coupled

with the fact that guidance from regulatory authorities in the area of internal

controls continues to evolve, uncertainty exists regarding our ability to comply

by applicable deadlines.

Risks associated with doing

business in Australia and other foreign countries

We

are subject to the risks associated with doing business in Australia and

Asia.

As most

of our current operations are conducted in Australia, New Zealand and Asia we

are subject to special considerations and significant risks not typically

associated with companies operating in North America and Western

Europe. These include risks associated with, among others, the

political, economic and legal environments and foreign currency

exchange. Our results may be adversely affected by changes in the

political and social conditions in Australia, New Zealand and Asia, and by

changes in governmental policies with respect to laws and regulations,

anti-inflationary measures, currency conversion and remittance abroad, and rates

and methods of taxation, among other things.

We

are subject to risks associated with the domicile, place of incorporation and

place of residence of AMI Australia and our directors and officers.

AMI

Australia is incorporated in Australia. All of our executive officers

and directors are non-residents of the United States. Therefore, it

may be more difficult for an investor, or any other person or entity, to enforce

a U.S. court judgment based upon the civil liability provisions of the U.S.

federal securities laws in an Australian court against us or any of those

persons or to effect service of process upon these persons in the United States

than it would be if these persons were resident in the United

States.

Additionally,

it may be difficult for an investor, or any other person or entity, to enforce

civil liabilities under U.S. federal securities laws in original actions

instituted in Australia. It may be difficult to enforce a judgment in

the United States against us and most of our officers and directors or to assert

U.S. securities laws claims in Australia or serve process on most of our

officers and directors.

14

We

may experience an impact of the United States Foreign Corrupt Practices Act on

our Business.

We are

subject to the United States Foreign Corrupt Practices Act, which generally

prohibits United States companies from engaging in bribery or other prohibited

payments to foreign officials for the purpose of obtaining or retaining

business. Foreign companies, including some that may compete with us,

are not subject to these prohibitions. Compliance with the Foreign

Corrupt Practices Act could adversely impact our competitive position and

failure to comply could subject us to penalties and other adverse

consequences. We have attempted to implement safeguards to prevent

and discourage non-compliant conduct by our employees and agents. We

can make no assurance, however, that our employees or other agents will not

engage in such conduct for which we might be held responsible. If our

employees or other agents are found to have engaged in such practices, we could

suffer severe penalties and other consequences that may have a material adverse

affect on our business, financial condition and results of

operations.

We

may experience an impact due to Australian, New Zealand or United Kingdom

regulation of the pharmaceutical and/or medical services industry.

We may

suffer an adverse impact to our business if the manner in which our services are

provided is required to change due to changes in the relevant regulatory regimes

applicable to those services. This could render our current business

model unlawful or render it uneconomic, adversely impacting our profitability

and prospects. The Australian government is in the process of

undertaking a review of the impotency industry in Australia and a committee of

the Australian federal parliament is scheduled to release a report containing

recommendations relating to the ongoing regulation of this industry in November

or December 2009. This report may recommend changes to the current

regulation of this industry and the Company’s business.

We

may experience a risk of revenue reduction due to a saturation of the Australian

Market.

Australia

is a country with a population of approximately 22 million

people. There are a limited number of people who are candidates for

our treatments. We are subject to increased risks or over saturation

of market share as we continue to treat more patients in the Australian

market.

Effects

of international sales.

We intend

to market our current and future services internationally. A number

of risks are inherent in international transactions. In order for us

to market our services in the U.S., Europe, Canada, Asia and certain other

foreign jurisdictions, we may have to obtain required regulatory approvals or

clearances and otherwise comply with extensive regulations regarding safety,

manufacturing processes and quality and advertising rules and

regulations. There can be no assurance that we will be able to obtain

or maintain regulatory approvals or clearances in such countries or that it will

not be required to incur significant costs in obtaining or maintaining its

foreign regulatory approvals or clearances.

Fluctuations

in currency exchange rates may adversely affect the demand for our services by

increasing the price of our services in the currency of the countries in which

the services are marketed.

Our

consolidated financial statements are presented in Australian and U.S.

dollars. Fluctuations in the rates of exchange between U.S. dollar

and other foreign currencies may negatively impact our financial condition and

results of operations. As we expand our presence into international

markets, we expect the percentage of both our revenues and expenditures

denominated in non-Australian dollars to increase. For the

foreseeable future, we expect our expenditures to be predominantly denominated

in Australian dollars, resulting primarily from our activities in Australia, and

expect capital expenditures to be denominated in Australian

dollars. Our expansion into the United Kingdom will also expose us to

currency fluctuations relating to UK Pounds.

15

We

are subject to a risk that our current patent applications may not be

granted.

We have

pending certain patents relating to the treatment of premature

ejaculation. We can make no guarantee that these patents will be

granted and, if the patents are rejected, the intellectual property underlying

these patents will then reside within the public domain and we would not have

any patent protection from competition using its intellectual

property. While the Company believes that formulation secrets not

contained in the patent applications will create a barrier to entry, there can

be no guarantee that such a barrier will prove sufficient. In the

event that such competition was to arise, it could adversely affect our market

share, pricing power, profitability and prospects as a going

concern.

We

are subject to risks associated with our method of patient consultation. We may

experience risks due to dispensing medication through prescriptions written by

our doctors after our over-the-phone consultations.

We retain

doctors to consult with patients over the phone and to write prescriptions on

the basis of these telephone consultations. Telephone diagnosis and

prescription is widely considered, in many countries including Australia,

appropriate for some ailments but not for others. Telephone diagnosis

and prescription written as a result of such consultation may be deemed

unsuitable either in general or for those treatments that we provide and as a

result, we have assumed this risk in its current business model. If

over-the-phone diagnosis and prescriptions were prohibited, we could be subject

to a substantial increase in costs due to the need for full-time physicians at

each clinic and, further, could result in lost sales as a result of potential

customers being unable or unwilling to see a doctor in

person. Furthermore, such a requirement could significantly impair

our future profitability and prospects as a going concern.

Our

current business model may not be profitable in international

markets.

We have

limited experience in operating outside of Australia and New Zealand, and

failure to achieve our overseas expansion strategy may have an adverse effect on

our business growth in the future. Our future growth depends, to a

considerable extent, on our ability to expand our customer base in both the

domestic and overseas markets. We have limited experience with

foreign regulatory environments and market practices, and cannot guarantee that

we will be able to penetrate any overseas market. In connection with

our initial efforts to expand overseas, we may encounter many obstacles,

including cultural and linguistic differences, difficulties in keeping abreast

of market, business and technical developments in foreign jurisdictions, and

political and social disturbances. Failure in the development of

overseas markets may have an adverse effect on our business growth in the

future.

We

may not achieve the widespread brand recognition necessary to succeed outside of

Australia.

We

believe it is imperative to our long term success that we obtain significant

market share for our services before other competitors enter the

market. Therefore, we must quickly establish recognition of our

brand. This will require us to must make substantial expenditures on

product development, strategic relationships and marketing initiatives in new

markets. In addition, we must devote significant resources to ensure

that our customers are provided with a high quality product and a high level of

customer service. Many of our potential competitors may have

substantially greater financial, marketing and other resources and potentially

greater access to content and distribution channels than us. We

cannot be certain that we will have sufficient resources to achieve the early

and widespread brand recognition we believe necessary to realize commercial

acceptance of our services.

16

Regulations

in international markets relating to advertising could adversely affect our

business.

Our

business model is dependent upon advertising and marketing. Our

current model may not be able to be enacted internationally due to regulatory

requirements in the relevant jurisdictions. In certain countries

(including Australia), advertisers, advertising agencies and companies that

engage in advertising activities are liable for the accuracy of the content of

advertisements and they have to ensure that the advertised products, activities

and services are in full compliance with applicable law. We do not

plan to do business in countries in which the advertising of our services and/or

pharmaceuticals in the manner we advertise in Australia would be

illegal. If we are found to be in breach of advertising law

requirements, we could be subject to liability and penalties under the respected

laws of such country. These penalties may include fines, confiscation

of profits, order to cease the dissemination of the advertisement and orders to

publish an advertisement correcting the misleading information. Any

such action by any relevant regulatory body, whether or not it is ultimately

successful, could distract management attention and have a material adverse

effect on our business and financial condition or results of

operations.

Regulations

in international markets relating to pharmaceuticals could adversely affect our

business.

Our

business model is dependant upon the distribution of pharmaceutical

prescriptions. Our current model may not be enacted

internationally. In certain countries, we may be subject to state or

national laws governing the distribution and compounding of

pharmaceuticals. We may be required to expend substantial unforeseen

resources to comply with such regulations. Failure to comply with

such regulations could cause a significant disruption in our business

domestically and internationally as it could distract management attention and

have a material adverse effect on our business and financial condition or

results of operations.

Inability

to hire experienced and capable employees or executives in non-Australian

markets could adversely affect our business in such markets.

We rely

heavily on the performance of our officers and key employees in

Australia. Any international expansion will be dependent on our

ability to retain and motivate qualified personnel in those markets, especially

in management. If we do not succeed in attracting new qualified

employees, our business could suffer significantly. Competition for

qualified personnel is intense in certain markets, and we may be unable

identify, attract, hire, train, assimilate, or retain a sufficient number of

highly skilled managerial, marketing and technical personnel necessary to

implement our business plan outside of Australia.

|

Item

1B.

|

Unresolved

Staff Comments.

|

|

|

Not

applicable.

|

|

Item

2.

|

Properties.

|

As of

June 30, 2009, AMI had leasehold interests in 19 Australian properties and one

New Zealand property, being the 20 clinics used to operate the business in New

Zealand and Australia. There are no encumbrances over AMI’s interest

in these properties. All of these properties are rented and none of

these properties are owned. AMI’s principal executive office is

located at Level 4, Terrace Tower, 80 William Street, East Sydney,New South

Wales, Australia. AMI’s principal executive office houses AMI’s

corporate head office, its centralized call center and some of AMI’s licensed

doctors, nursing staff and sales and administration staff.

17

AMI’s

clinics and sales offices are located at:

New

South Wales

AMI

Direct, East Sydney, Sydney, New South Wales

Bondi

Junction, Sydney, New South Wales

Dubbo,

Regional New South Wales

Hurstville,

Sydney, New South Wales

Newcastle,

Regional New South Wales

Parramatta,

Sydney, New South Wales

Sydney

City, Sydney, New South Wales

Wollongong,

Regional New South Wales

Queensland

Bundall,

Gold Coast, Queensland

Cairns,

Regional Queensland

Kallangur,

Queensland

Townsville,

Regional Queensland

Upper Mt

Gravatt, South Brisbane, Queensland

South

Australia

Adelaide,

South Australia

Victoria

St Kilda,

Melbourne, Victoria

Mitcham,

Melbourne, Victoria

Dandenong,

Melbourne, Victoria

Western

Australia

Perth,

Western Australia (2 clinics)

New

Zealand

Auckland,

North Island, New Zealand

United

Kingdom

London,

England

Twickenham,

England

In

addition, the Company presently utilizes office space of our registered agent

representative in the State of Nevada at 6767 Tropicana Avenue, Suite 207, Las

Vegas, Nevada 89103 as our US registered office.

18

|

Item 3.

|

Legal

Proceedings.

|

As of

June 30, 2009, there was no litigation pending or threatened by or against the

Company or any of its direct or indirect subsidiaries other than AMI Australia.

AMI Australia currently is involved in the following litigation and

administrative matters:

On

October 25, 2006, Bade Medical Institute Pty Limited, Mr. David Wade, Mr. Buddy

Beani and others (collectively “Bade”) applied for Trade Mark No. 114322021 in

respect of the words “AMI Nasal Spray.” AMI Australia lodged an objection to the

registration of that application with IP Australia on June 21, 2007 and that

application was subsequently refused. On December 13, 2007, AMI

Australia commenced proceedings in the Federal Court of Australia Sydney

Registry against Bade alleging Bade was infringing upon AMI Australia’s

trademarks and other intellectual property rights. On December 19, 2007, Bade

consented to orders that Bade transfer ownership of certain domain names and

telephone numbers to AMI Australia and consented to orders that Bade would not

use certain names which contained the word AMI. Bade appear to have

ceased operation since the orders were obtained and has transferred the required

names to AMI Australia. AMI subsequently applied for final orders and damages

against Bade and final hearing of this matter concluded on September 2,

2009. The court has indicated that judgment will be released

shortly.

On June

12, 2009, AMI Australia obtained an interlocutory injunction from the Supreme

Court of New South Wales preventing Fairfax Media Publications Limited

(“Fairfax”) from publishing information which AMI Australia alleges was

disclosed to Fairfax in breach of a duty of confidence owed to AMI

Australia. Final hearing of this matter commenced on October 26, 2009

but was unable to be concluded by October 28, 2009, the final scheduled date for

the hearing of the matter. Final hearing of the matter is now

scheduled for February 24 and 25, 2010 and AMI Australia’s interlocutory

injunction has been extended until that date.

|

Item 4.

|

Submission

of Matters to Vote of Security

Holders.

|

Not

applicable.

19

PART

II

|

Item

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters

and Issuer Purchases of Equity

Securities.

|

Our

Common Stock is listed on the OTC Bulletin Board under the symbol

“AVMD.OB”. The following sets forth, for the periods indicated, the

high and low bid price for our Common Stock as reported for the prior two fiscal

years. The quotations set forth below may reflect inter-dealer

prices, without retail mark-up, mark-down or commissions and may not necessarily

represent actual transactions.

|

Quarter Ending:

|

High

|

Low

|

||||||

|

September

30, 2007

|

$ | 0.20 | $ | 0.10 | ||||

|

December

31, 2007

|

$ | 0.40 | $ | 0.10 | ||||

|

March

31, 2008

|

$ | 0.39 | $ | 0.15 | ||||

|

June

30, 2008

|

$ | 0.35 | $ | 0.15 | ||||

|

September

30, 2008

|

$ | 0.35 | $ | 0.17 | ||||

|

December

31, 2008

|

$ | 0.17 | $ | 0.07 | ||||

|

March

31, 2009

|

$ | 0.07 | $ | 0.02 | ||||

|

June

30, 2009

|

$ | 0.19 | $ | 0.04 | ||||

As of

November 11, 2009 there were 328 shareholders of record of our common

stock.

We have

not paid any stock dividends or cash dividends to date and have no plans to pay

any stock or cash dividends in the immediate future.

We do not

have any equity compensation plans.

|

Item 6.

|

Selected

Financial Data.

|

Not

applicable.

|

Item 7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operation.

|

Special Note on Forward-Looking

Statements. Some of the statements contained in this annual report on

Form 10-K that are not historical facts are “forward-looking statements” which

can be identified by the use of terminology such as “estimates,” “projects,”

“plans,” “believes,” “expects,” “anticipates,” “intends,” or the negative or

other variations, or by discussions of strategy that involve risks and

uncertainties. We urge you to be cautious of the forward-looking statements,

that such statements, which are contained in this annual report Form 10-K,

reflect our current beliefs with respect to future events and involve known and

unknown risks, uncertainties and other factors affecting operations, market

growth, services, products and licenses. No assurances can be given regarding

the achievement of future results, as actual results may differ materially as a

result of the risks we face, and actual events may differ from the assumptions

underlying the statements that have been made regarding anticipated events.

Factors that may cause actual results, performance or achievements, or industry

results, to differ materially from those contemplated by such forward-looking

statements include without limitation:

20

|

|

·

|

Our

ability to attract and retain management, and to integrate and maintain

technical information and management information

systems;

|

|

|

·

|

Our

ability to raise capital when needed and on acceptable terms and

conditions;

|

|

|

·

|

The

intensity of competition; and

|

|

|

·

|

General

economic conditions.

|

All

written and oral forward-looking statements made in connection with this annual

report on Form 10-K that are attributable to us or persons acting on our behalf

are expressly qualified in their entirety by these cautionary statements. Given

the uncertainties that surround such statements, you are cautioned not to place

undue reliance on such forward-looking statements.

Information

regarding market and industry statistics contained in this report is included

based on information available to us that we believe is accurate. It is

generally based on academic and other publications that are not produced for

purposes of securities offerings or economic analysis. We have not reviewed or

included data from all sources, and we cannot assure you of the accuracy or

completeness of the data included in this report. Forecasts and other

forward-looking information obtained from these sources are subject to the same

qualifications and the additional uncertainties accompanying any estimates of

future market size, revenue and market acceptance of products and services. We

have no obligation to update forward-looking information to reflect actual

results or changes in assumptions or other factors that could affect those

statements. See “Risk Factors” for a more detailed discussion of uncertainties

and risks that may have an impact on future results.

Overview

Overall, the Company was disappointed

with its financial and operating performance in the year ended June 30,

2009.

On the positive side, total gross

revenue in the year ended June 30, 2009 was $53,351,946 compared to $51,847,992

in the year ended June 30, 2008, an increase of $1,503,954 or 2.9%.

Revenue in the Company’s premature

ejaculation (“PE”) treatment programs has increased by $5,766,406 or 24.0% to

$29,800,571 and revenue in the Company’s erectile dysfunction (“ED”) treatment

programs has decreased by $3,711,921 or 15.3% to $20,590,812 in the year ended

June 30, 2009, compared to the year ended June 30, 2008.

The Company also generated $955,353 in

revenue from its prostate programs in the year ended June 30, 2009, compared to

$3,566,629 in the year ended June 30, 2008, a decrease of 73.2%.

21

Revenue in our Australian operations

was $41,801,703 in the year ended June 30, 2009, compared to $50,572,311 during

the year ended June 30, 2008, a decrease of $8,770,608 or 17.3%. This

decrease was primarily attributable to an increase in the average program length

and the depreciation in the Australian dollar against the US dollar during the

12 months. Revenue in Australian dollars was A$58,370,389 in the year

ended June 30, 2009, compared to A$57,603,350 in the year ended June 30, 2008,

an increase of $767,039 or 1.3%.

Revenue in our UK operations was

$10,575,461 in the year ended June 30, 2009 compared to $Nil during the year

ended June 30, 2008. Our UK operation started its business activities

in September 2008.

As set out above, the Company’s

Australian revenue increased slightly during the year ended June 30, 2009, with

a substantial increase in revenue in its premature ejaculation market segment

and a substantial decrease in its erectile dysfunction and prostate market

segments. The decrease in the Company’s prostate market segment is

due to AMI Australia substantially decreasing its focus and advertising on that

market segment. At the same time, the Company achieved more than

$10.5 million in revenue in the United Kingdom from a standing

start.

Less positively, the Company incurred

substantial losses during the year ended June 30, 2009. Fortunately,

more than half of these losses were due to non-cash amortization and impairment

charges which have not affected the cash position of the Company. In

addition, a further significant portion of these losses are due to translation

of the Company’s results from Australian dollars to US

dollars. Notwithstanding these non-cash related impacts, management

was disappointed with the performance of the Company during 2009.

Cost of revenue increased to

$12,957,681 in the year ended June 30, 2009 compared to $11,597,159 in the year

ended June 30, 2008. This increase is primarily attributable to an

increase in the medication cost incurred by AMI Australia and the Company’s UK

operation as well as start up costs associated with the Company’s UK

operations. As a percentage of revenue, cost of revenue was 24.3% in

the year ended June 30, 2009 compared to 22.4% in the year ended June 30,

2008.

Gross profit was $40,394,265 in the

year ended June 30, 2009 compared to $40,250,833 in the year ended June 30,

2008. As a percentage of revenue, gross profit decreased to 75.7% in

the year ended June 30, 2009 from 77.6% in the year ended June 30,

2008. Once again, the 1.9% decrease in the gross profit percentage is

primarily attributable to the high percentage of cost of revenue in our UK

operation

Selling, general and administrative

expenses were $46,616,853 in the year ended June 30, 2009 compared to

$36,801,510 in the year ended June 30, 2008. As a percentage of

revenue, selling, general and administrative expenses increased to 87.4% in the

year ended June 30, 2009 from 71.0% in the year ended June 30,

2008. The increase in the year ended June 30, 2009 is primarily

attributable to the establishment of the Company’s UK operations as well as the

expenditure on ineffective advertising in Australia in January and February

2009.

Net income (loss) before income tax was

($12,105,376) in the year ended June 30, 2009 compared to $2,252,458 in the year

ended June 30, 2008. The decrease is primarily attributable to the

impairment on patents that were held by Worldwide PE Patent Holdco Pty Limited

amounting to $5,279,462 (a non-cash item), the increase in selling, general and

administrative expenses and the establishment of the UK operation.

Net income (loss) was ($9,344,989) in

the year ended June 30, 2009 compared to $994,779 in the year ended June 30,

2008. This decrease is mainly attributable to the impairment on the

patent and formulation rights owned by Worldwide PE Patent Holdco Pty Limited,

the increase in selling, general and administrative expenses and the

establishment of the UK operations.

22

The Company was disappointed with the

operating performance of its Australian operations and has taken steps to

address unnecessary expenditures. The Company believes that the

operating performance of its Australian operations since the end of the

financial year has substantially improved.

The Company expended substantial funds

during 2009 in endeavouring to establish its operations in the United

Kingdom. The Company is pleased to have generated substantial revenue

from its United Kingdom operations in its initial year of operations and is

hopeful that it will generate a profit from those operations during

2010.

As of June 30, 2009, the Company had

total liabilities of $29,668,233 and a positive net worth of

$18,110,615. As of June 30, 2008, the Company had total liabilities

of $21,887,563 and a positive net worth of $33,474,159.

As at June 30, 2009 our total current

assets were $26,670,960, our total current liabilities were $25,222,649 and our

net current assets were $1,448,311.

The Company’s aggregate cash balances

as at June 30, 2009 were $295,245, a substantial decrease on last

year. The core reason for this decrease is the substantial

expenditure incurred by the Company in establishing its UK

operations. The Company also substantially increased its third party

borrowings in order to undertake this expansion.

Economic conditions were difficult for

the Company over the past 12 months. This is partly due to the global

financial crisis but is also due to some ineffective advertising earlier this

year as well as the costs associated with establishing the Company’s UK

operations.

Management has taken steps to address

operating performance and the business has improved since July

2009. As a result of these changes in operating performance, we

forecast that we will be able to generate sufficient funds from our business in

order to fund our operations in the ordinary course during the next 12

months.

The Company intends to focus its

activities over the next 12 months on its profitable Australian operations as

well as its new United Kingdom operations.

The core factors for the Company’s

success over the next 12 months will be to ensure that the Company’s new United

Kingdom operations are successfully established as well as ensuring that its

core Australian operations continue to operate profitably.

Critical

Accounting Policies

The

accounting and reporting policies of the Company conform to accounting

principles generally accepted in the United States of America. The

following are descriptions of the more significant policies:

Basis of

Accounting

The

accompanying financial statements are prepared on an accrual

basis.

23

Principles of

Consolidation

The

consolidated financial statements include the accounts of the Company and its

wholly owned subsidiaries, AMI Australia Holdings Pty Limited, AMI Management

Services Pty Limited (“AMI MS”) and AMI International Pty Limited (“AMI

International”) and their direct and indirect wholly-owned subsidiaries:

Advanced Medical Institute Pty Ltd, PE Patent Holdco Pty Limited (“PE”),

Advanced Medical Institute (NZ) Limited (“AMI NZ”), Intelligent Medical

Technologies Pty Ltd (“IMT”), Ai Te Wei (Beijing) Medicine Consulting Company,

AMI Japan Kabushiki Gaisya (75% owned) and AMI Clinic Limited (“AMI

UK”). All significant intercompany accounts and transactions have

been eliminated upon consolidation.

Cash

Equivalents

For

purposes of the statement of cash flows, the Company considers all highly liquid

investments with maturities of three months or less to be cash

equivalents.

Use of

Estimates

The

preparation of financial statements in conformity with generally accepted

accounting principles requires management to make estimates and assumptions that

affect certain reported amounts and disclosures. Accordingly, actual

results could differ from those estimates.

Revenue

Recognition

Sales are

reported as deferred income when the sales contracts are executed and the term

of the contract exceeds three months. Up to three months of

medication is delivered to the patient upon the signing of a

contract. Generally the terms of the treatment contracts are up to

one year, but they can be for longer periods of time. The deferred

income arising from the contracts that exceed three months is then amortized, on

a straight line basis, into income during the approximated composite remaining

medication delivery period. This approximated composite is an

estimate that may vary from period to period.

Income

Tax

Income

taxes have been provided based upon the tax laws and rates in the countries in

which operations are conducted and income is earned. The income tax

rates imposed by the taxing authorities vary. Taxable income may vary

from pre-tax income for financial accounting purposes. There is no

expected relationship between the provision for income taxes and income before

income taxes because the countries have different taxation rules, which vary not

only to nominal rates but also in terms of available deductions, credits and

other benefits. Deferred tax assets and liabilities are recognized

for the anticipated future tax effects of temporary differences between the

financial statement basis and the tax basis of the Company’s assets and

liabilities using the applicable tax rates in effect at year end as prescribed

by SFAS 109 (ASC 740) “Accounting for Income

Taxes.”

Inventories

Inventories