Attached files

| file | filename |

|---|---|

| 8-K - KeyOn Communications Holdings Inc. | i00424_keyon-8k.htm |

KEYON COMMUNICATIONS HOLDINGS, INC.

Consolidation

Opportunities in the Rural Markets and

KeyOn Corporate Overview

November 12, 2009

This presentation includes forward-looking statements within the meaning of the Securities Act of 1933, as amended and the Securities Exchange Act of 1934, as amended. Forward-looking statements give our current expectations or forecasts of future events. Words such as “expect,” “may,” “anticipate,” “intend,” “would,” “will,” “plan,” “believe,” “estimate,” “should,” “could,” “might,” “potential,” “predict,” or the negative and plural of those terms, and similar expressions, identify forward-looking statements. Forward-looking statements in this presentation include express or implied statements concerning our future revenues, prior and potential acquisitions, expenditures, capital or other funding requirements, the adequacy of our current cash and working capital balances to fund our present and planned operations and financing needs, expansion of and demand for our product and services offerings, the growth of our business and operations as well as future economic and other conditions both generally and in our specific geographic and product and service markets. These statements are based on our estimates, projections, beliefs and assumptions, and relate only to events, as of the date the forward-looking statements are made, are not guarantees of future performance and are subject to risks and uncertainties. The occurrence of the events described, and the achievement of the expected results, depend on many events, some or all of which are not predictable or within our control. We caution that these risk factors are not necessarily all of the factors that could cause our actual future results, performance and achievements to differ materially from those expressed in forward-looking statements made by or on behalf of us in this presentation. Other unknown or unpredictable factors could also harm our results. Except as required by law, we undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, even if experience or future changes make it clear that any projected results or events expressed or implied therein will not be realized. We qualify all of our forward-looking statements by these cautionary statements.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

1

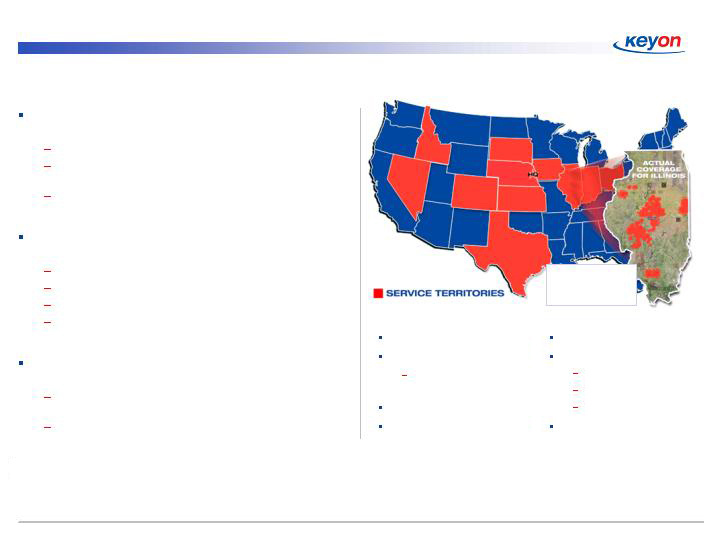

KeyOn Company Overview

Solely focused on delivering wireless broadband to

rural and underserved markets for over 7 years

KeyOn is the leader in the industry

Network currently covers 11 states, ~50,000 square miles

and over 2.3 million people

The average population of our existing markets is 4,604

people(2)

Existing scalable base of operations with systems

designed for the provision of broadband services

382 towers and 44 Hub sites

Existing distribution channels and database of customers

Cost-effective Internet termination agreements

Currently deploying state-of-the-art OSS: CRM/billing with

trouble ticket/inventory

Founded by telecom entrepreneurs to help bridge the

“digital divide”

Management has operated/built: paging, regional cellular,

undersea fiber optic cable networks

Growth through acquisitions and organic deployments

KeyOn Communications is the largest US rural wireless broadband company(1) with a strong history of delivering broadband to rural communities

Company Profile

Founded: 2002

Subscribers: ≈ 15,000

Residential and

Commercial Subscribers

Ticker: OTCBB: KEYO

Shares Outstanding: 20.6M

Market Cap: $46M

Headquarters – Omaha, NE

Services

High Speed Broadband

Voice (VoIP)

Video (Satellite)

+EBITDA since Q4-08(3)

(2) Excludes Company’s initial market launch in Las Vegas, NV.

(3) “EBITDA” is a measurement used by KeyOn Communications to monitor business performance and is not a recognized measure under GAAP (generally

accepted accounting principles). Accordingly,

investors are cautioned in using or relying upon this measure as an alternative to recognized GAAP

measures. EBITDA” is defined as earnings or loss from operations adjusted for depreciation, amortization, goodwill impairment and non-cash

stock based

compensation expenses. EBITDA should not be construed as an alternative to operating loss as defined by GAAP

(1) Broadband Wireless Exchange Magazine Website (www.bbwexchange.com/wireless_isp/)

Illinois Map is

Indicative of In-

State Coverage

2

KeyOn’s Experienced Management Team

Jonathan Snyder - President and Chief Executive Officer, Director, Founder

Private equity with Clarity Partners and Pacific Capital Group

Founding shareholder and management of Global Crossing

Investment banking at Bear, Stearns & Co. Inc.

Robert Handell - Chief Operating Officer, Executive VP, Director, Founder

President, Edison Source, an Edison International Company

EVP and COO, BellSouth MobileComm

VP, Sales, Marketing and Customer Service, Bell Atlantic Mobile Systems

Jason Lazar - Vice President, Corporate Development & General Counsel, Founder

Initial member of ITU Ventures

Practiced complex civil litigation and corporate law in NY and NJ

Holds JD from Cardozo School of Law

Annette Eggert, CPA - Chief Financial Officer

Director Finance/Controller, Interpublic Group of Companies

Controller and other senior finance positions, Connectivity Solutions, a sub of CommScope

Rory Erchul - Vice President Marketing and Sales

VP Marketing & Customer Care, Allegiance Communications

Director of Marketing, CableOne

The core leadership team at KeyOn possesses nearly 100 years of telecommunications experience

3

Significant Market Opportunity Exists in Rural America

The difference in broadband penetration results from the high cost of deploying broadband services over

existing copper and cable plants outside of urban markets

DSL & cable plant is expensive to upgrade for broadband services especially in sparsely populated ex-

urban and rural markets

In these areas, wireless has been shown to have significant cost advantages in the deployment of

broadband services and in many cases, better pricing and service levels

On the whole, 36% of dial-up and non-online users cite either price or lack of availability as reasons for not

having broadband

80%

70%

60%

50%

40%

30%

20%

10%

0%

67%

63%

59%

55%

50%

47%

46%

45%

42%

38%

31%

25%

2006

2007

2008

2009

Rural

Non-rural

U.S. Total

In the past year while broadband penetration in the entire US grew at an annual rate of 15%, rural penetration still significantly lags that of urban/suburban by 21%(1)

(1) ”Home Broadband Adoption 2009”, Pew Internet & American Life Project,

Pew Research Center, June 2009, p.14 – Report

publishes results for the 12 month period from May through April.

Home Broadband Adoption

4

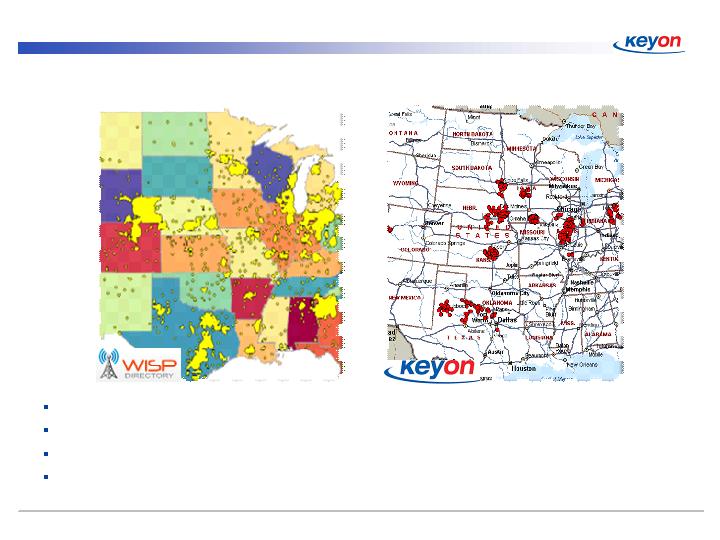

Consolidation of the Rural Wireless Broadband Market - RURAL UNIFi

Wireless broadband industry is extremely fragmented

KeyOn is ideally positioned to integrate wireless broadband companies in contiguous areas.

Previously acquired and integrated four acquisitions

Management experience, internal systems and billing platform ensure smooth integration

5

Fragmentation of Industry Creates Opportunity

Rural markets have been successfully served by wireless operators, but it is an

extremely fragmented marketplace much like the cable and paging industries before it

There are hundreds of small, “mom and pop” operators located near KeyOn’s current footprint

Operators typically use standards-based wireless gear

Many operators are capital constrained and cannot finance their growth beyond the start-up stage

Consolidation by operators can bring scale to the industry driving down unit economics while rapidly

growing revenues

6

Proven Track Record of Acquisitions

Date Completed

Purchase

Price

(000s)

Target

# of

Subs

Price Per

Sub ($)

October 22, 2007

$675

MicroLnk, LLC

1,388

$486

January 31, 2007

$3,800

SpeedNet Services

6,792

$559

June 1, 2006

$913

Freemont Broadband (Pocatello

market

1,161

$786

June 30, 2005

$450

SIRIS

1,130

$398

KeyOn has grown its base of 10,471 acquired subscribers to approximately 15,000

7

SCALABLE ACQUISITION PROCESS

EFFICIENT PROCESS:

Proprietary deal flow

Due diligence/site visits

Asset purchases

Deal structuring

Efficient integration plan

Highly experienced and

seasoned deal team

PRICING STRATEGY:

Existing valuations

methodologies dependent

on financials

Targets are cash flow

neutral to marginally cash

flow positive

Price paid is close to or

below the replacement

cost of assets

Proven process to evaluate

IRR and NPV of each

transaction

SYNERGIES THROUGH INTEGRATION:

Centralized scalable platform to

extract synergies

Expense savings realized in area of

management, network and customer

support and G&A

Network Operating Center in Omaha

enables remote monitoring and

diagnostics

Centralized customer service

Adaptable billing platform

Scale economies in purchasing CPE

and internet termination/access loops

RURAL UNIFi - KeyOn’s Acquisition Process and Integration

8

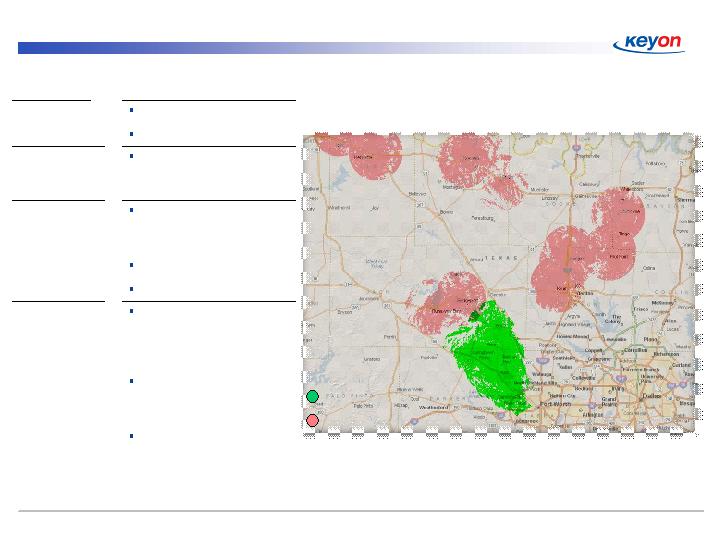

Target #1 (SkyWi Communications)

Status

Executed LOI/APA

Expected close Q4 ‘09

Location

Based in Texas with

network contiguous to

KeyOn’s existing networks

Business

Description

Provide wireless broadband

to areas Northwest of Ft.

Worth

Markets lack competition

ARPU = $50+

Transaction

Benefits to

KeyOn

Asset purchase with

assumption of certain

liabilities (tower leases;

internet termination)

Purchase price affords

upgrade for added network

capacity

Proximity to existing KeyOn

networks permits significant

OPEX efficiencies

Pending Transactions

Target #1

Current KeyOn

9

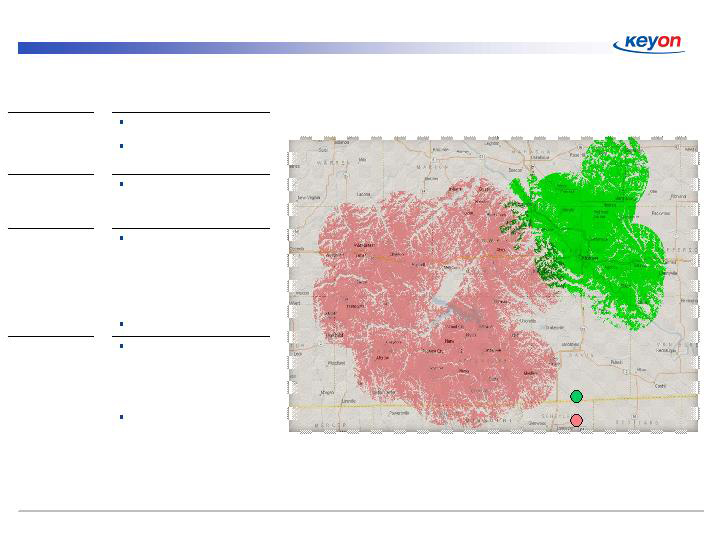

Target #2

Status

Executed LOI

Negotiating Asset

Purchase Agreement

Location

Based in South Central

Iowa contiguous to

existing networks

Business

Description

Wireless broadband

customers include

residential, business and

critical community

facilities

ARPU = $60+

Transaction

Benefits to

KeyOn

Asset purchase with

assumption of certain

liabilities (tower leases;

internet termination)

Combining networks

results in significant

monthly savings on

internet termination

Pending Transactions

Target #2

Current KeyOn

10

Growing Pipeline of Acquisitions

Acquisition Pipeline Overview

Targeted Geographic

Area

Active Targets Currently

in Discussion

Total Subscriber Base of

Active Targets

Pre-Acquisition Financials

Types of Targets

Individual Target Size

Midwestern States

30

40,000

300 – 5,000 subscribers

EBITDA Positive to Neutral

Boot-strapped Entrepreneurs

Rural Cooperative Subsidiaries

Divisions of Telcos and other Operating

Businesses

Entities Financed by Earlier RUS

Programs or Regional Financing Sources

11

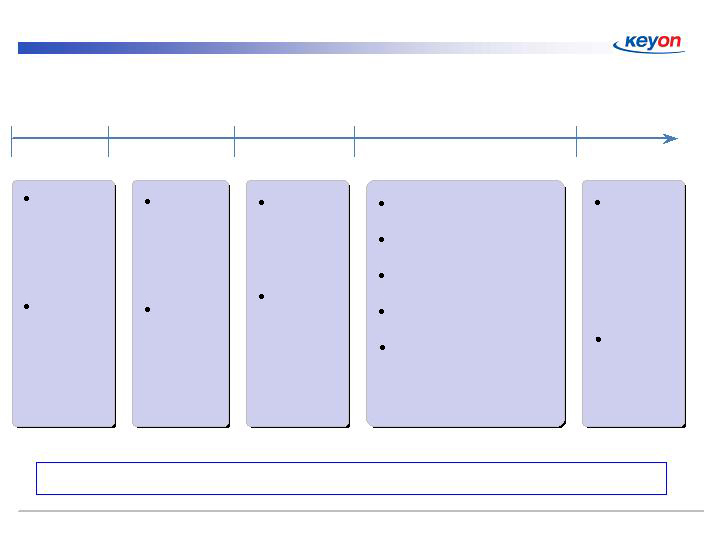

KeyOn Corporate Update

Enhanced

investor

relations

presence with

hiring of

Liviakis

Financial

Announced

Q1-09 results –

EBITDA + for

2nd

consecutive

quarter

Restructured

term debt

Extended term

for 6 years;

principal

reduction of

$450,000

Engaged

Interactive

Broadband

Consulting

Group for

application

preparation

Update on

Broadband

Stimulus

Process –

KeyOn’s first

conference call

Continued

work on

federal

stimulus

applications

Filed for $150 million of

Stimulus funds

Converted $1.5 million of short-

term secured debt into stock

Raised a total of $2.1 million

since May 2009

Rural UNIFi Program

announced

Announced Q2-09 results –

EBIDTA+ for 3rd consecutive

quarter

Partnership

with Google

announced –

roll-out of

Google Apps

to current and

future

subscriber

base

Pipeline of

acquisitions

developed for

Rural UNIFi

MAY

2009

JUN

JUL

AUG - SEPT

NOV

12

Update on ARRA Efforts

Round 1 application submissions were due August 20, 2009

2,200 total applications ($4B + loans available)

1,130 last-mile infrastructure applications (BIP & BTOP)

400 BIP only last-mile infrastructure applications ($1.5B available)

Approximately 307 WiMAX wireless applications (lowest cost per household passed)

September 28, 2009 Incumbent challenge period commences for 30 days

October 5, 2009 NTIA announces initial mapping grants

October 27, 2009 NTIA/RUS announces that the date to commence award announcements has been

delayed by approximately one month

November 10, 2009 NTIA/RUS announce that future awards will be streamlined from two round to

one

KeyOn has applied for a combination of $150 million of grants and loans to quickly deploy next

generation broadband services

13

Questions and Answer

Jonathan Snyder, KeyOn’s CEO will now take questions from the call

participants

Due to the limited time, we ask that you limit your questions to just

one. If you’d like to follow up with KeyOn offline, please email

us at

john@liviakis.com. Thank you for your understanding.

Thank you for joining today’s call

14