Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - KITE REALTY GROUP TRUST | form8k_111209.htm |

EXHIBIT

99.1

Kite Realty

Group Trust

Investor

Presentation

Information

as of September 30, 2009

2

|

§ Stable

Operating Portfolio

|

§ 55

Operating Properties in 9 states

§ 91.2%

leased

§ Diverse

tenant base

§ Strong

demographics

|

|

§ Increased

Leasing Productivity

|

§ 400,000

square feet of productivity in Q2 and Q3

§ Targeting

another 200,000 square feet for Q4

§ Strengthened

leasing team and revised compensation structure

§ Bud

Moll as new EVP of Leasing

|

|

§ Proven

Access to Capital

|

§ Equity

Offerings in October 2008 and May 2009

§ Over

$200 million of property refinancings and extensions since 3Q

2008

§ Property

sales

|

|

§ Mitigating

Development Exposure

|

§ Only

two developments under construction

§ Significant

pre-leasing

§ Rent

commencements throughout 2010

§ Anticipated

shadow pipeline costs reduced by over $100

million

|

Information as of

September 30, 2009

COMPANY

OVERVIEW

3

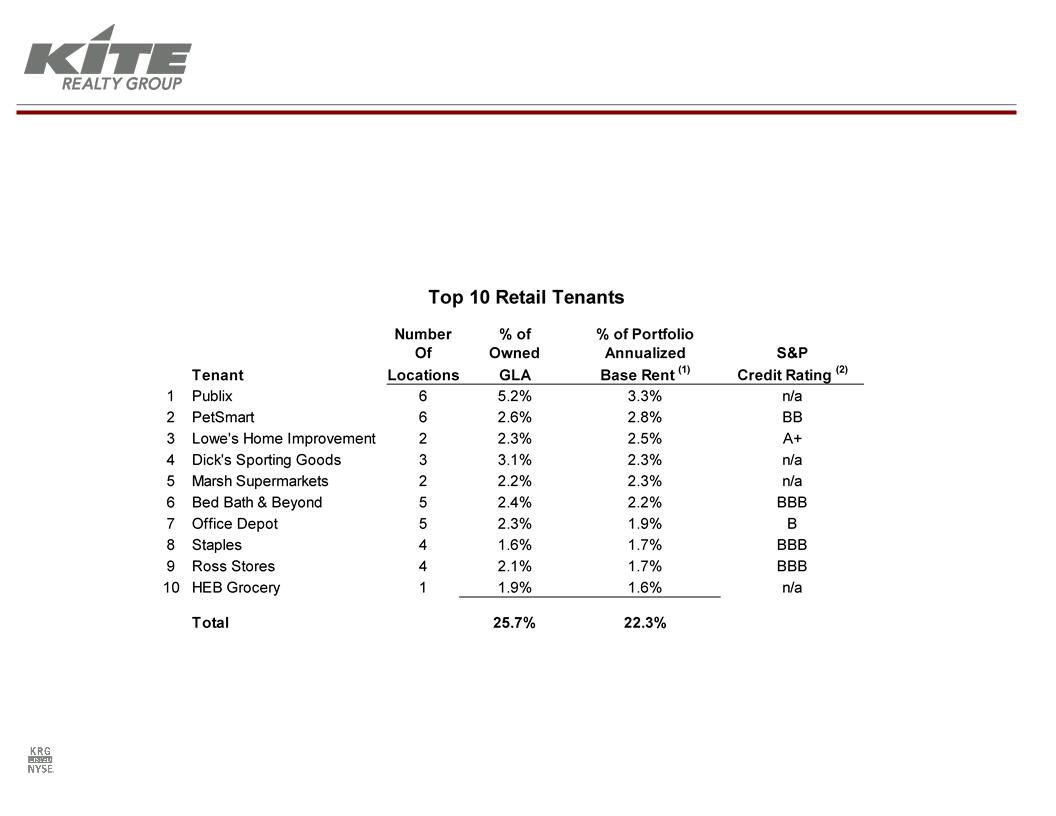

(1) Annualized

base rent represents the monthly contractual rent for September 2009 for each

applicable tenant multiplied by 12.

(2) S&P

credit ratings for parent company as of

11/5/2009.

§ Largest

single retail tenant comprises only 3.3% of total annualized base

rent

§ Top

10 retail tenants account for only 22.3% of total annualized base

rent

Information as of

September 30, 2009

DIVERSE

TENANT BASE

4

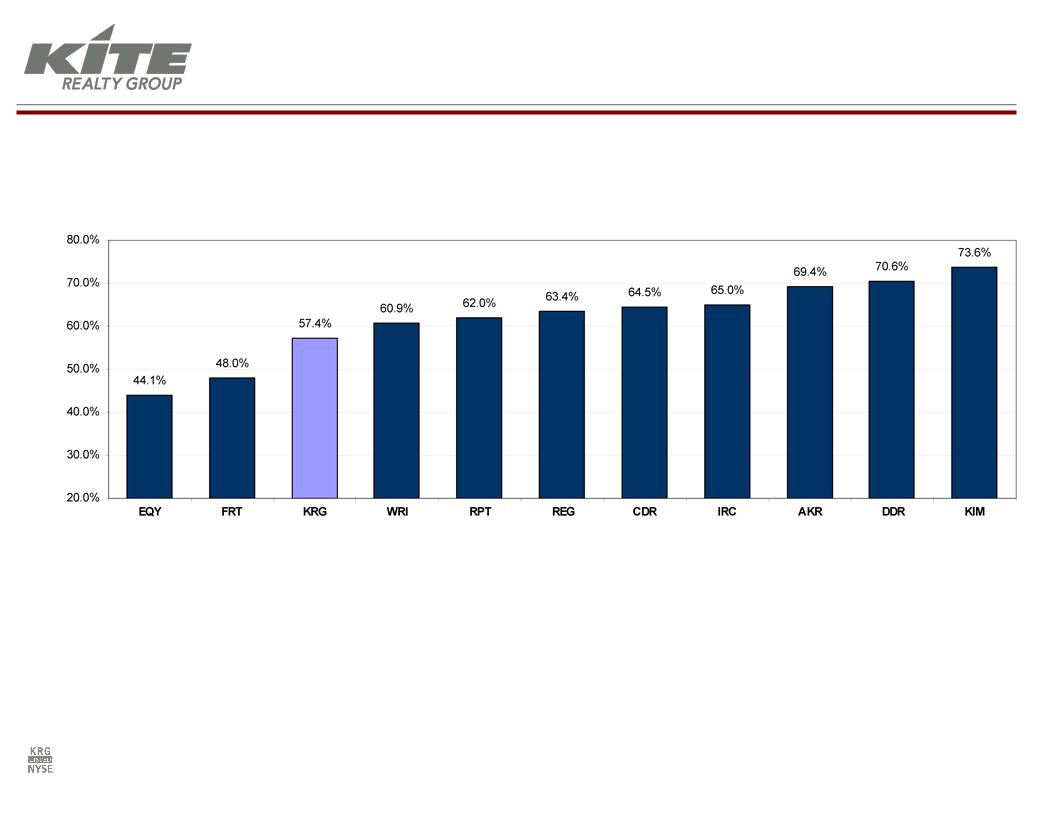

Peer

Group Assessment:

Top

Tenant as a Percent of Annualized Base Rent

|

Kroger

|

Bed

Bath

Beyond |

Home

Depot |

Publix

|

TJ

Maxx

|

Wal-Mart/

Sam’s |

Kroger

|

Supervalu

|

A&P

|

Publix

|

Giant

Foods |

Source:

Company filings.

Information as of

September 30, 2009

DIVERSE

TENANT BASE

5

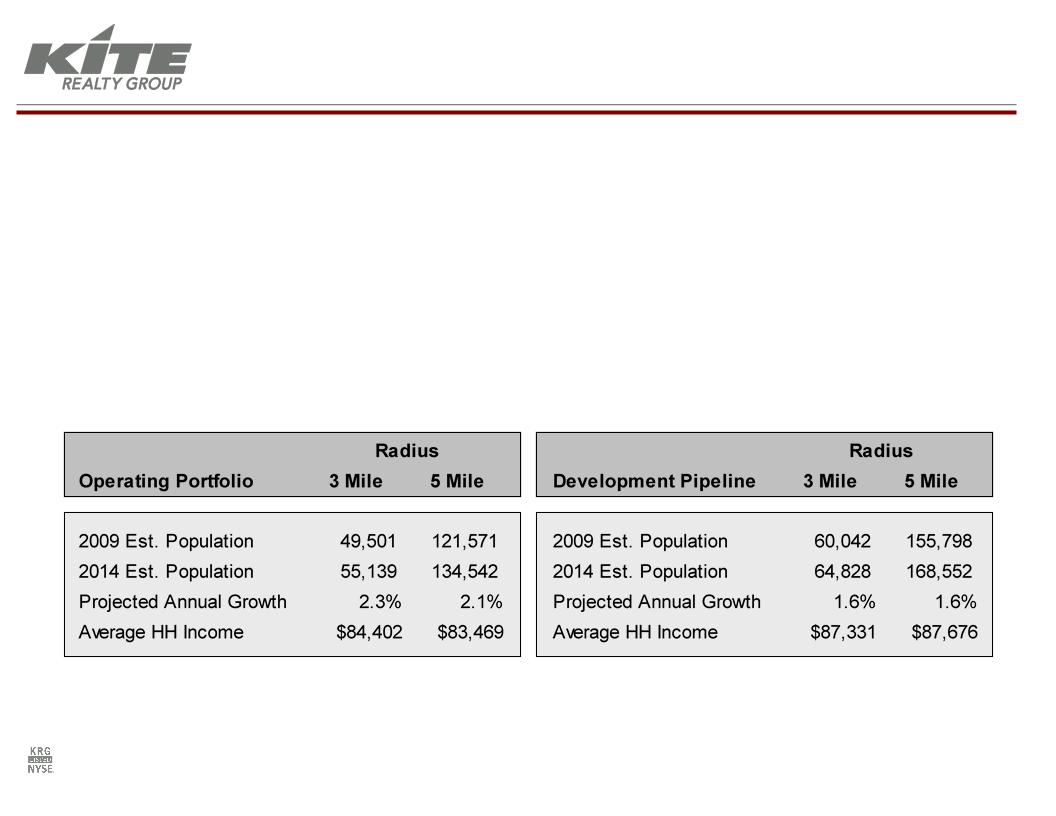

Source:

Applied Geographic Solutions.

§ High

quality assets with an average age of only eight years

§ Approximately

half of the current portfolio was developed by KRG

§ Portfolio

benefits from 100% non-owned anchor occupancy

§ Strong

household incomes surrounding operating portfolio and development

pipelines

Portfolio

Demographics Comparison

Operating Portfolio

vs. Development Pipelines

STRONG

DEMOGRAPHICS

6

(1) Lease

expirations of operating portfolio and excludes option periods and ground

leases. Annualized base rent represents the monthly contractual rent

for September 2009 for each applicable property multiplied by 12.

for September 2009 for each applicable property multiplied by 12.

§ No

more than 11.0% of total annualized rent is expected to rollover in any one

year

§ Higher

2011-2015 rollover defers renewal negotiations to a potentially

stronger

leasing environment

leasing environment

Percentage

of Lease Expiration by Total Annualized Base Rent (1)

Information as of

September 30, 2009

WELL-STAGGERED LEASE

EXPIRATIONS

7

|

§ Equity

Capital Markets

|

§ $88

million - May 2009 offering net proceeds

§ $48

million - October 2008 offering net proceeds

|

|

§ Unsecured

Term Loan

|

§ $55

million - August 2008 unsecured 3 year term loan

|

|

§ Line

of Credit

|

§ Only $78

million outstanding as of September 30, 2009

§ 2012

maturity date including extension option

|

|

§ Non-Core

Asset Sales

|

§ $11

million - June 2009 ground leased land sales

§ $24

million - December 2008 medical office and non-core shopping center

sale

§ Targeting

$50 million in land sales to end users through 2012

|

|

§ Property

Level Financing

|

§ $200

million in financings/extensions executed from Oct. 2008 through Sept.

2009

§ $29

million construction loan on Eddy Street Commons at Notre Dame in Dec.

2008

|

|

§ The

Result…

|

§ $102

million of cash and availability as of September 30, 2009

§ No

remaining 2009 debt maturities

§ Manageable

$90 million of debt (no CMBS) maturing in 2010

§ 53%

debt to gross assets at 9/30/09 - 900 basis point reduction from

9/30/08

§ 77%

of total debt is fixed rate

§ Only

2 CMBS loans totaling $20 million maturing through

2011

|

PROVEN

ACCESS TO CAPITAL

8

Peer

Group Assessment:

Debt

Plus Preferred as a Percent of Gross Assets

(1) Source: KeyBanc

Capital Markets Leaderboard, 11/9/09.

MANAGING

LEVERAGE

9

Scheduled

Debt Maturities

(1) Maturities

exclude annual principal amortization.

(2) Includes

effects of loan closings, payoffs, and commitments that occurred subsequent to

September 30, 2009.

(3) Amount

due in 2012 includes the outstanding balance on our unsecured revolving credit

facility, and assumes exercise of available extension option.

§ Extended

or refinanced over $200 million in maturing debt since Q3 2008

§ Only

$20 million of CMBS debt maturing through 2011

§ $17

million average loan balance maturing in 2010

§ Approximately

86% of debt maturities through 2012 are held on balance sheet by

relationship

banks including unsecured term loan

banks including unsecured term loan

MANAGING

LEVERAGE

10

§ Only 2 projects in

the Current Development Pipeline

§ Eddy Street Commons

at Notre Dame

§ 72% pre-leased or

committed

§ 67% of projected

costs incurred

§ Tenant openings

commenced September 2009

§ Cobblestone

Plaza

§ 41% pre-leased with

late-stage anchor negotiations

§ 92% of projected

costs incurred

§ Initial tenant rent

commencement occurred 2Q 2009

§ Capital

Summary

(Dollars in

thousands)

§ Eddy Street

Estimated Project Costs: $35,000

§ Cobblestone Plaza

Estimated Project

Costs:

$47,000

§ Total Cost Incurred

as of 9/30/09: ($68,420)

§ Remaining Cost to be

Spent:

$13,580 - Majority

to be funded by existing construction

loans

loans

Current

Development Pipeline

Information as of

September 30, 2009

REDUCING

DEVELOPMENT

11

§ Reduced the

estimated costs of the Shadow Pipeline by over $100 million

§ Capital Summary

(Dollars in

thousands)

KRG Share of

Projected Total Costs as of 12/31/08:

$293,800

KRG Share of

Projected Total Costs as of 9/30/09:

$186,500

Estimated

Cost Reduction: $107,300

§ Focus on ground

leases or land sales to transfer vertical construction costs to end

users

§ Phased development

aligns project scope with market conditions

§ Negotiated removal

of residential and parking garage components of Delray Marketplace

§ Reflects the

Company’s share of Parkside Town Commons at 20% upon commencement of

construction

construction

Shadow

Pipeline

Information as of

September 30, 2009

REDUCING

DEVELOPMENT

12

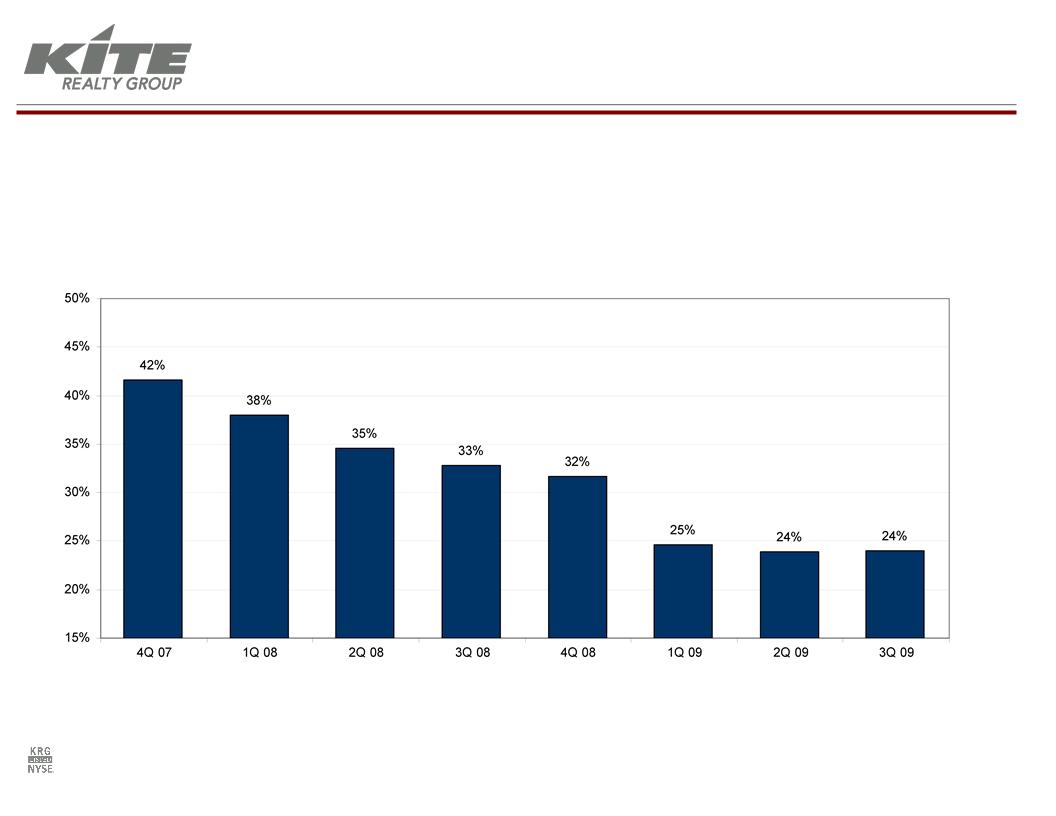

§ Ongoing

effort to reduce the size of our development pipeline.

Total

Development Pipeline as a Percent of Gross Real Estate Assets (1,2)

(1) Development

Pipeline includes Current Developments, Redevelopments and Shadow Pipeline with

the Company’s share of Parkside Town Commons reflected at 20%.

(2) Also

includes unconsolidated Gross Real Estate Assets with the Company’s share of

Parkside Town Commons reflected at 20%.

REDUCING

DEVELOPMENT

13

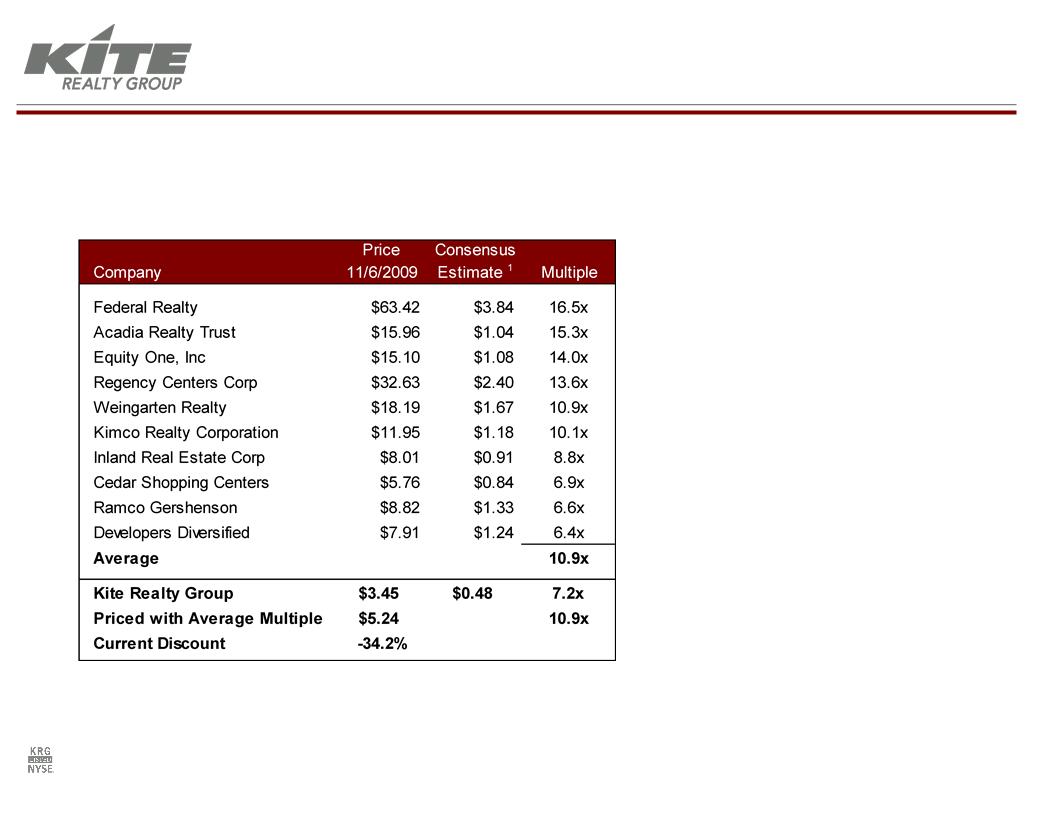

§ Assuming

a peer group average

multiple of 10.9x, our stock is

trading at a 34% discount

multiple of 10.9x, our stock is

trading at a 34% discount

(1) Source: Thomson

mean 2010 estimate as of November 6, 2009.

Peer

Group Assessment:

FFO

Multiple

PEER

GROUP ANALYSIS

14

Peer

Group Assessment:

2009

AFFO PAYOUT RATIO

(1) Source: Company

filings and KeyBanc Capital Markets Leaderboard, 11/9/09.

PEER

GROUP ANALYSIS

15

§ KRG’s

current dividend is fully

funded by free cash flow

funded by free cash flow

§ KRG’s

7.0% yield is 180 basis points

higher than the peer group average

higher than the peer group average

(1) Source: Company

filings.

(2) Source: KeyBanc

Capital Markets Leaderboard, 11/9/09.

Peer

Group Assessment:

Current

Dividend Yield

PEER

GROUP ANALYSIS

16

Peer

Group Analysis:

Implied

Cap Rate

(1) Source: Citigroup

Investment Research, November 5, 2009.

§ Using

the peer group average implied cap rate of 8.0%, KRG is trading at a 52%

discount

§ KRG

Share Price 11/6/09: $3.45

§ KRG

Share Price using 8.0% implied cap rate: $7.25

PEER

GROUP ANALYSIS

17

§ Secure

Off Balance Sheet JV Capital

§ Redeploy

Land Sale Proceeds

§ Lease-Up

of Vacant Junior Boxes

§ Complete

Current Development and Redevelopment Pipelines

§ Utilize

Lender Relationships for First Look at Distressed

Opportunities

Opportunities

GROWTH

STRATEGY

18

DISCLAIMER

This

presentation may include certain “forward-looking statements” within the

meaning

of the Private Securities Litigation Reform Act of 1995. These forward-looking

statements include, but are not limited to, our plans, objectives, expectations and

intentions and other statements contained in this document that are not historical facts

and statements identified by words such as “expects, “anticipates,” “intends,” “plans,”

“believes,” “seeks,” “estimates” or words of similar meaning. These statements are

based on our current beliefs or expectations and are inherently subject to significant

uncertainties and changes in circumstances, many of which are beyond our control.

Actual results may differ materially from these expectations due to changes in global

political, economic, business, competitive, market and regulatory risk factors.

Information concerning risk factors that could affect Kite Realty Group Trust’s actual

results is contained in the Company’s reports filed from time to time with the Securities

and Exchange Commission, including its 2008 Annual Report on Form 10-K and its

quarterly reports on Form 10-Q. Kite Realty Group Trust does not undertake any

obligation to update any forward-looking statements contained in this document, as a

result of new information, future events or otherwise.

of the Private Securities Litigation Reform Act of 1995. These forward-looking

statements include, but are not limited to, our plans, objectives, expectations and

intentions and other statements contained in this document that are not historical facts

and statements identified by words such as “expects, “anticipates,” “intends,” “plans,”

“believes,” “seeks,” “estimates” or words of similar meaning. These statements are

based on our current beliefs or expectations and are inherently subject to significant

uncertainties and changes in circumstances, many of which are beyond our control.

Actual results may differ materially from these expectations due to changes in global

political, economic, business, competitive, market and regulatory risk factors.

Information concerning risk factors that could affect Kite Realty Group Trust’s actual

results is contained in the Company’s reports filed from time to time with the Securities

and Exchange Commission, including its 2008 Annual Report on Form 10-K and its

quarterly reports on Form 10-Q. Kite Realty Group Trust does not undertake any

obligation to update any forward-looking statements contained in this document, as a

result of new information, future events or otherwise.