Attached files

Your Financial Bridge® 1 FDIC Assisted Acquisition of United Commercial Bank November 6, 2009 Nasdaq: EWBC Exhibit 99.2 |

Your Financial Bridge® 2 This presentation may include forward-looking statements that involve

inherent risks and uncertainties. East West Bancorp, Inc.

cautions readers that a number of important factors could cause

actual results to differ materially from those in any forward-looking statements. These factors include economic

conditions and competition in the geographic and business areas

in which East West Bancorp and its subsidiaries operate, inflation or deflation, fluctuation in interest rates, legislation and governmental regulations, investigation of acquired banks

and other factors discussed in the company’s filings with

the SEC. Additionally, there can be no assurance that East West Bancorp will realize the anticipated benefits related to the acquisition of United Commercial Bank. All forward-looking

statements speak only as of the date they are made, and East

West Bancorp undertakes no obligation to update them in light of

new information or future events. Safe Harbor Statement Notice |

Your Financial Bridge® 3 Transaction Overview 3 FDIC assisted acquisition of United Commercial Bank (“UCB”) with loss

sharing Purchase of $10.4 billion of total assets $7.7 billion loan portfolio $2.6 billion of cash and securities, all transferred at fair market values Assumption of $9.2 billion of total liabilities $6.5 billion of deposits $2.5 billion of FHLB and repo borrowings No holding company assets or liabilities included UCB-China bank subsidiary included as part of transaction Transaction will not affect normal business and operations of UCB-China Loss share agreement covers approximately $7.4 billion of loans FDIC covers 80% of losses up to $2.05 billion FDIC covers 95% of losses above $2.05 billion East West believes it has been conservative in its loss expectations and expects to

have minimal economic exposure under any loss scenario East West issued $500 million of common stock and mandatorily convertible preferred

securities via private placement Both acquisition and capital raise closed

on November 6, 2009 |

Your Financial Bridge® 4 Strategic Rationale 4 Creates premier commercial and retail bank focused on Asian-American markets

Expands East West deposit franchise both in the U.S. and in Hong Kong and China Acquisition adds $5.7 billion of deposits and 63 branches in the U.S. Creates presence in mainland China with 2 deposit-taking branches and approximately

$300 million of loans Adds 1 branch in Hong Kong and over $700 million of deposits Strengthens capital position and significantly increases earnings power of East

West Increased scale provides significant operating leverage that will further improve profitability Financially compelling for shareholders Significantly accretive to earnings per share Minimal credit exposure with low risk-weighting applied to acquired assets

Accelerates return to substantial profitability |

Your Financial Bridge® 5 Capital Raise 5 Private placement of $500 million of capital completed Initial investment consists of: $165 million of common equity (maximum issuance allowed under NASDAQ listing rules

without a shareholder vote) $335 million of cumulative perpetual convertible preferred that will automatically

convert into common equity upon receiving required shareholder

approval Capital sold predominantly to existing public shareholders

No investor or group of investors with a common investment adviser will own more

than 9.9% of voting securities of the Company All common stock issued at $9.04 per share (30 day average close as of October 30, 2009) Mandatory preferred converts at $9.04 per share Shareholder vote for conversion of mandatory preferred into common expected to be

completed in the near-term |

Your Financial Bridge® U.S. – 133 Branches: California – 112 Branches: Northern California – 35 Locations: 34 Full Service Branches 1 In-Store 99 Ranch Market Branch Southern California – 77 Locations: 68 Full Service Branches 9 In-Store 99 Ranch Market Branches New York – 9 Branches Atlanta – 5 Branches Boston – 3 Branches Houston – 2 Branches Seattle – 2 Branches 6 Greater China – 10 Locations: 4 Full Service Branches - Hong Kong (2), Shanghai and Shantou 6 Representative Offices - Beijing (2), Shanghai, Taipei (2), Guangzhou and Shenzhen East West is now the largest commercial bank headquartered in Southern California

Creates the largest retail presence in Asian communities in the United States with

133 branches in key markets across the U.S. Adds 63 branches in U.S., 2 in China 1 in Hong Kong Only Chinese American focused bank with full service banking offices in U.S. and

China Expanded Deposit Franchise |

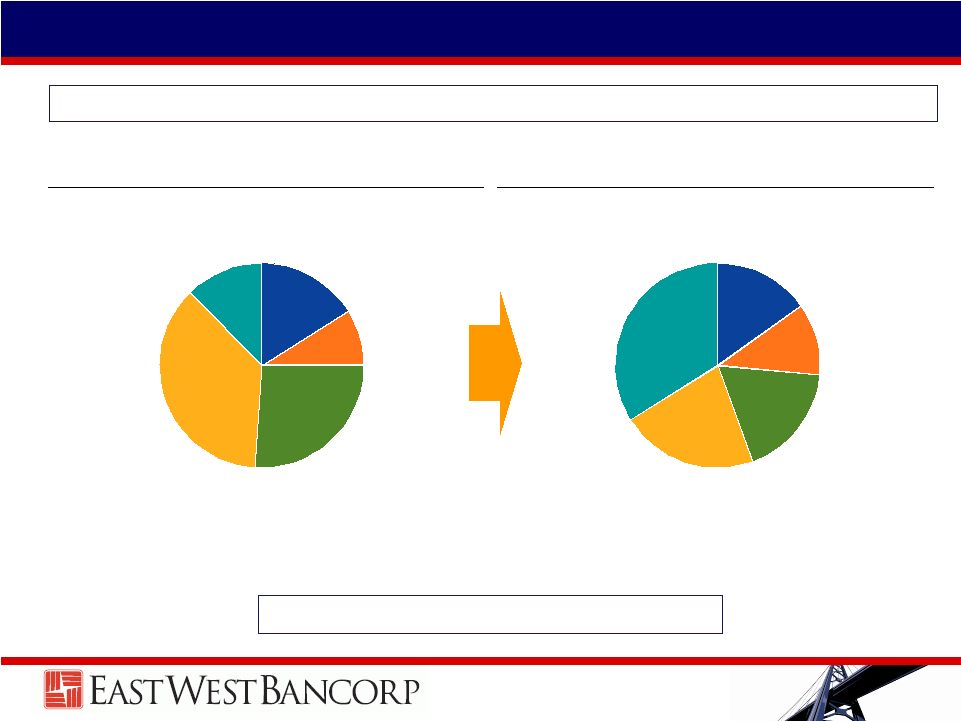

Your Financial Bridge® Noninterest- bearing 15% Savings & Interest- Bearing Demand 11% Money Market 18% Jumbo Time 22% Retail Time 34% Noninterest- bearing 16% Savings & Interest- Bearing Demand 9% Money Market 26% Jumbo Time 37% Retail Time 12% 7 Pro Forma Deposit Composition $8.7bn deposits $15.2bn deposits East West and UCB Pro Forma East West 9/30/09 Stand-Alone Total China & Hong Kong Deposits: $1.1bn On a pro forma basis, East West deposits as % of liabilities improves to 90% from

79% |

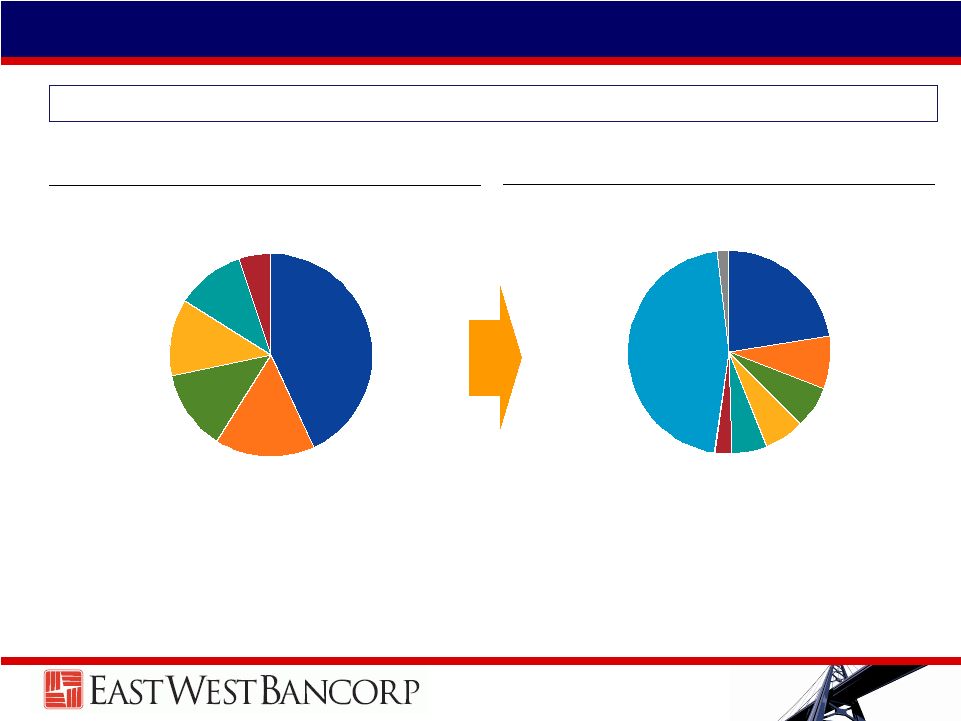

Your Financial Bridge® CRE 22% C&I and Trade 8% Construction & Land 7% MFR 6% SFR 6% Consumer 3% Acquired Loans with Loss Share 46% China 2% CRE 43% C&I and Trade 16% Construction & Land 13% MFR 12% SFR 11% Consumer 5% 8 Pro Forma Loan Portfolio 8 East West and UCB Pro Forma (a) East West 9/30/09 Stand-Alone $8.4bn loans $16.1bn loans On a pro forma basis, 46% of East West’s loan portfolio is subject to FDIC loss

share (a) Pro forma loan balance excludes purchase accounting marks.

|

Your Financial Bridge® Loans acquired expected to receive regulatory risk weighting relief Company plans to deleverage the balance sheet by approximately $3.6 billion using

predominately cash and securities acquired and liabilities assumed in the

transaction 9 Pro Forma Capital Impact at Close (a) Banks with approximately $60bn-$1 trillion of assets as of September 30, 2009.

(b) Excludes covered assets. Source: SNL Financial. On a pro forma basis, East West will have extremely strong capital ratios and asset

quality East West East West Stand Pro Regional Alone Forma Banks (a) Capital TCE / TA 6.6% 6.8% 6.6% Tier I Common Ratio 7.8 10.2 7.6 Tier 1 Leverage 10.6 9.5 9.6 Tier 1 Risk-Based 13.1 14.5 11.8 Total Risk-Based 15.1 16.2 15.9 Credit (b) NPAs / Assets 1.8% 1.1% 2.7% NPLs / Loans 2.5 1.5 3.7 Reserves / NPLs 112.0 112.0 80.3 |

Your Financial Bridge® 10 Integration Plan 10 East West management has formed a dedicated transition team to lead the integration

plan Credit risk management Expanding credit team to manage portfolio to include existing East West credit staff

and hire additional resources, including former UCB credit staff Branch Network All retail branches will be retained Customers will have access to broader products and services Hong Kong/China Stabilize Hong Kong and China business operations Customer/Employee retention Will honor deposit rates to maturity Key management is known to East West Strengthened capital base will help build customer and employee confidence Systems integration All critical systems on common platforms Retain key, talented management and enhance by adding additional management resources

|

Your Financial Bridge® 11 East West Strategy 11 Capitalize and leverage dominant retail position in Chinese-American market

Financially bridge Asian and mainstream customers Leverage growth opportunities in other regions Provide full range of products and services to broader customer base Maintain/improve efficiency of pro forma franchise Maintain solid balance sheet: strong liquidity, capital and reserves Continue to actively manage legacy credit and problem assets in the near term Focus on creating long-term shareholder value |