Attached files

| file | filename |

|---|---|

| 8-K - CSC FORM 8K 11112009 - COMPUTER SCIENCES CORP | csc8k_11112009.htm |

| EX-99.1 - EARNINGS RELEASE (FURNISHED HEREWITH) - COMPUTER SCIENCES CORP | exhibit99-1_11112009.htm |

*

2nd

QUARTER FY 2010

EARNINGS PRESENTATION

EARNINGS PRESENTATION

November 11,

2009

2nd

QUARTER FY 2010 EARNINGS PRESENTATION

*

All

written or oral statements made by CSC at this meeting or in these

presentation materials that do not directly and exclusively relate to

historical facts constitute “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

These statements represent CSC’s expectations and beliefs, and no

assurance can be given that the results described in such statements will

be achieved. These statements are subject to risks, uncertainties, and

other factors, many outside of CSC’s control, that could cause actual

results to differ materially from the results described in such statements.

For a description of these factors, please see CSC’s most recent Annual

Report on Form 10-K, and subsequently filed Form 10-Qs.

presentation materials that do not directly and exclusively relate to

historical facts constitute “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

These statements represent CSC’s expectations and beliefs, and no

assurance can be given that the results described in such statements will

be achieved. These statements are subject to risks, uncertainties, and

other factors, many outside of CSC’s control, that could cause actual

results to differ materially from the results described in such statements.

For a description of these factors, please see CSC’s most recent Annual

Report on Form 10-K, and subsequently filed Form 10-Qs.

2nd

QUARTER FY 2010 EARNINGS PRESENTATION

*

This

presentation includes certain non-GAAP financial measures, such as

operating income, operating margin, operating costs, and free cash flow.

These non-GAAP financial measures are not meant to be considered in

isolation or as a substitute for results prepared in accordance with

accounting principles generally accepted in the United States (GAAP). A

reconciliation of non-GAAP financial measures included in this

presentation to the most directly comparable financial measure

calculated and presented in accordance with GAAP is set forth

elsewhere in this presentation and on our web site at www.csc.com.

CSC management believes that these non-GAAP financial measures

provide useful information to investors regarding the Company's

financial condition and results of operations as they provide another

measure of the Company's profitability and ability to service its debt, and

are considered important measures by financial analysts covering CSC

and its peers.

operating income, operating margin, operating costs, and free cash flow.

These non-GAAP financial measures are not meant to be considered in

isolation or as a substitute for results prepared in accordance with

accounting principles generally accepted in the United States (GAAP). A

reconciliation of non-GAAP financial measures included in this

presentation to the most directly comparable financial measure

calculated and presented in accordance with GAAP is set forth

elsewhere in this presentation and on our web site at www.csc.com.

CSC management believes that these non-GAAP financial measures

provide useful information to investors regarding the Company's

financial condition and results of operations as they provide another

measure of the Company's profitability and ability to service its debt, and

are considered important measures by financial analysts covering CSC

and its peers.

*

2nd

QUARTER FY 2010 EARNINGS

2nd

QUARTER FY 2010 EARNINGS PRESENTATION

*

Financial

and Operational Performance Scorecard

|

Earnings

per Share

|

|

|

Operating

Margin

|

|

|

Free

Cash Flow

|

|

|

Revenue

|

|

|

Operational

Performance

|

|

|

New

Business Bookings

|

|

2nd

QUARTER FY 2010 EARNINGS PRESENTATION

*

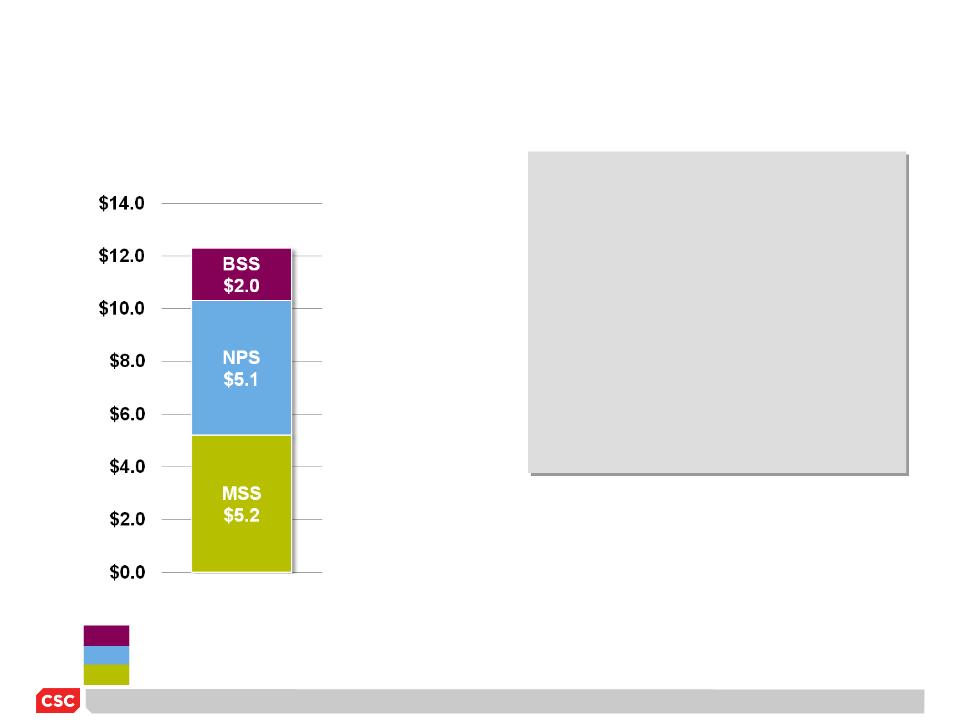

New

Business Bookings by Lines of Business

North

American Public Sector

NPS

Business

Solutions and Services

BSS

Managed

Services Sector

MSS

• DOE Hanford/Lockheed

Martin

• Nobel

Biocare

• Raytheon

• TSA

ITIP

• UK Atomic

Energy

• UK Identity and

Passport Service

• Xerox Business

Services

• Zurich Financial

Services*

|

$B

|

|

YTD

November

|

|

$12.3B

|

*Down

selected for negotiations

2nd

QUARTER FY 2010 EARNINGS PRESENTATION

*

Reaffirming

Full Year Guidance

MSS

growth based on

bookings and recovering

demand

bookings and recovering

demand

Lift

for BSS from an

improving demand for

discretionary projects

improving demand for

discretionary projects

Returning

to historic rates

of

growth for NPS

Increased

demand as

clients budget for CY10

and return to

transformational agendas

clients budget for CY10

and return to

transformational agendas

Business

Outlook for Second Half FY10:

Anticipated Improvements…

Anticipated Improvements…

Business

Outlook

2010

Outlook

2010

*

Mike

Mancuso

Vice President

Chief Financial Officer

Vice President

Chief Financial Officer

2nd

QUARTER FY 2010 EARNINGS

2nd

QUARTER FY 2010 EARNINGS PRESENTATION

*

2nd

Quarter FY 2010 Financial Accomplishments

• Significant new

business awards

• Sequential revenue

stability

• Operating income

growth

• Margin rate

improvement

• Achievement of

forecasted EPS

• Strong cash

generation

2nd

QUARTER FY 2010 EARNINGS PRESENTATION

*

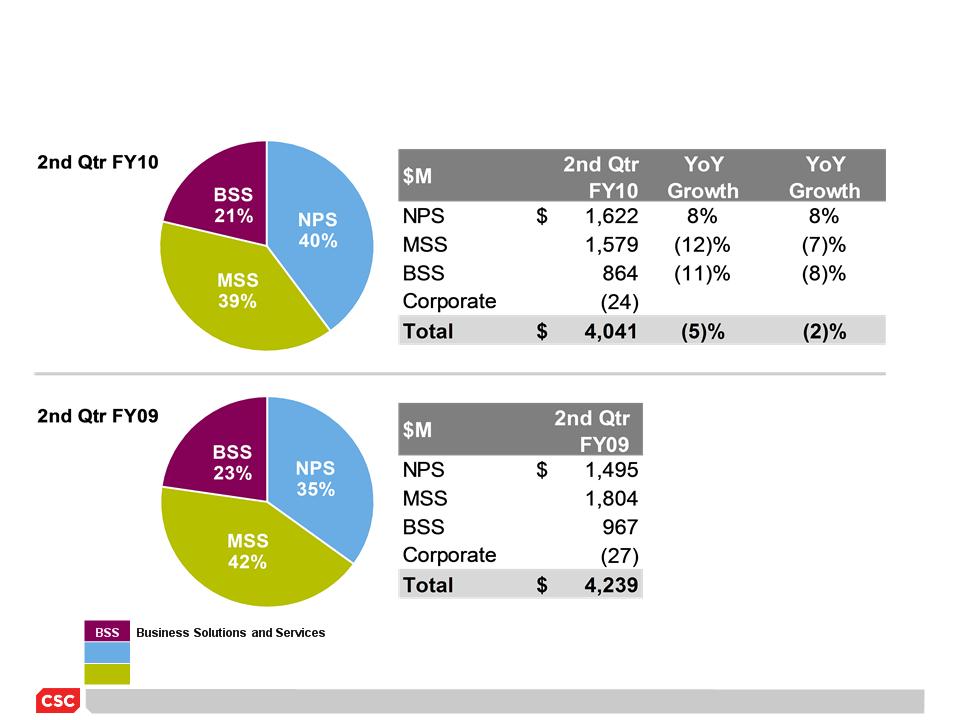

Revenue

by Lines of Business

FY09

reflects realignment for operating segments

North

American Public Sector

Managed

Services Sector

NPS

MSS

2nd

QUARTER FY 2010 EARNINGS PRESENTATION

*

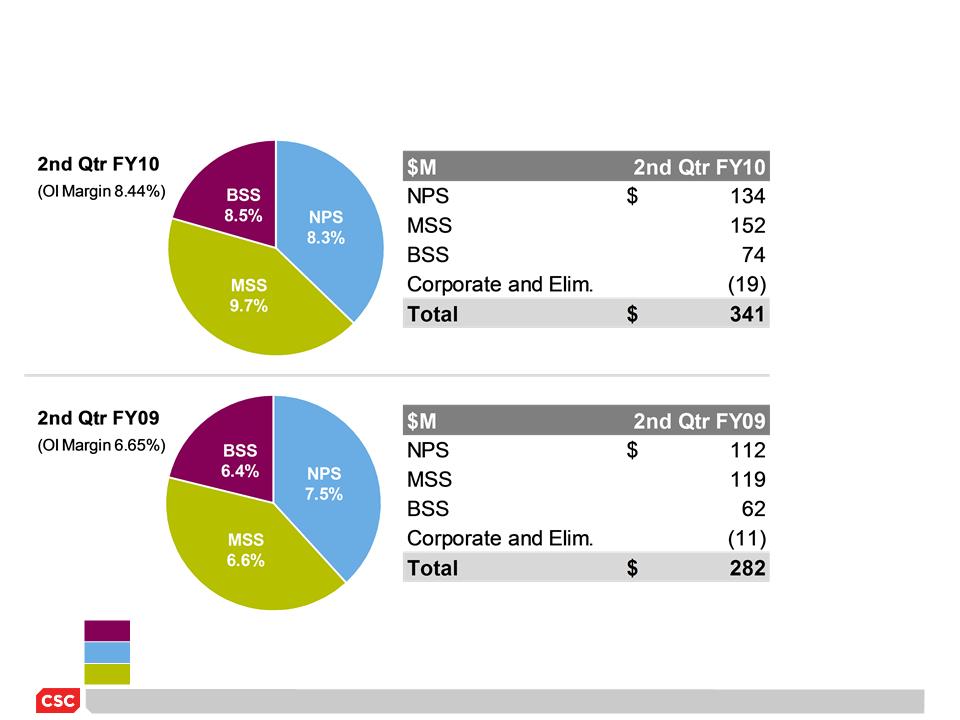

Operating

Income by Lines of Business

North

American Public Sector

Business

Solutions and Services

Managed

Services Sector

NPS

BSS

MSS

FY09

reflects realignment for operating segments

2nd

QUARTER FY 2010 EARNINGS PRESENTATION

*

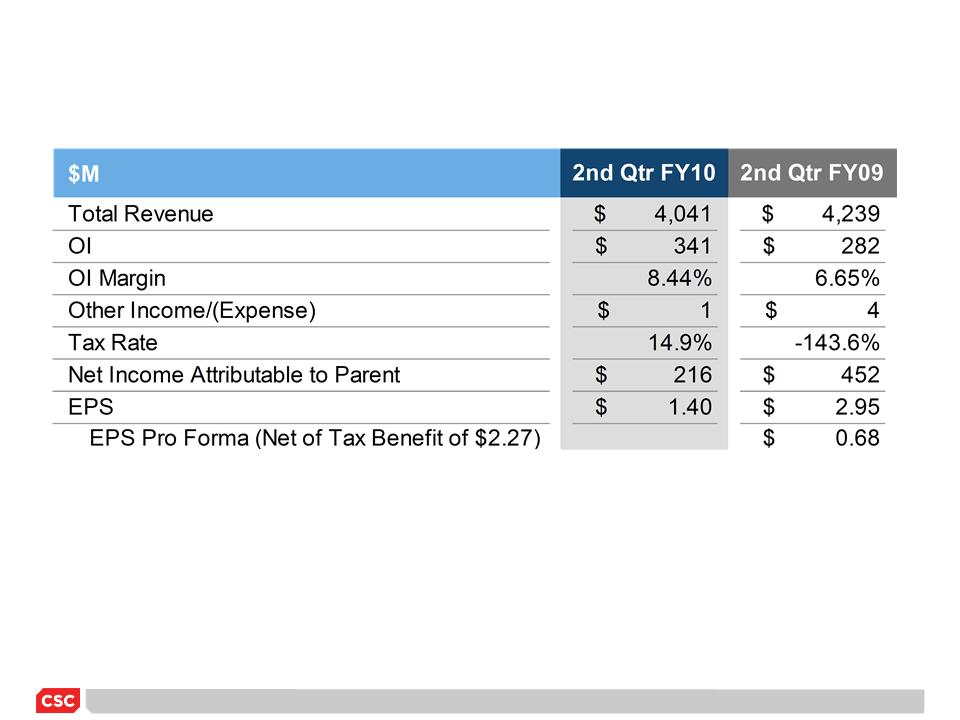

Selected

Financial Information

2nd

QUARTER FY 2010 EARNINGS PRESENTATION

*

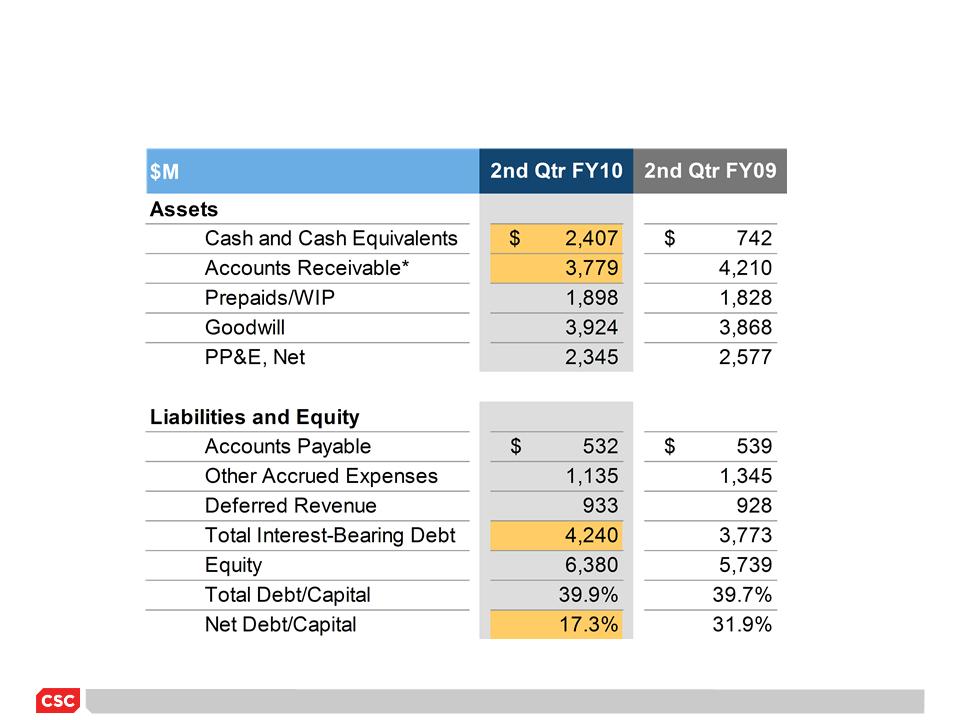

Selected

Balance Sheet Items

*Accounts

receivable excludes tax receivables of $71M and $34M for FY10 and FY09,

respectively

2nd

QUARTER FY 2010 EARNINGS PRESENTATION

*

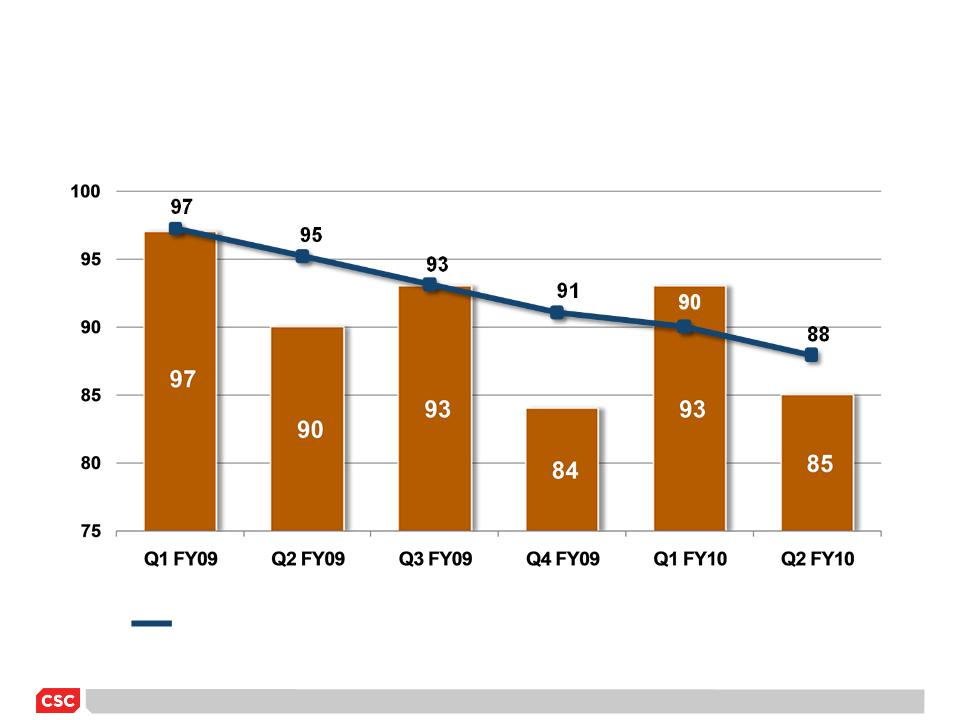

Days

Sales Outstanding (DSO)*

*DSO

excludes tax receivables

Four

Quarter DSO Average

Days

2nd

QUARTER FY 2010 EARNINGS PRESENTATION

*

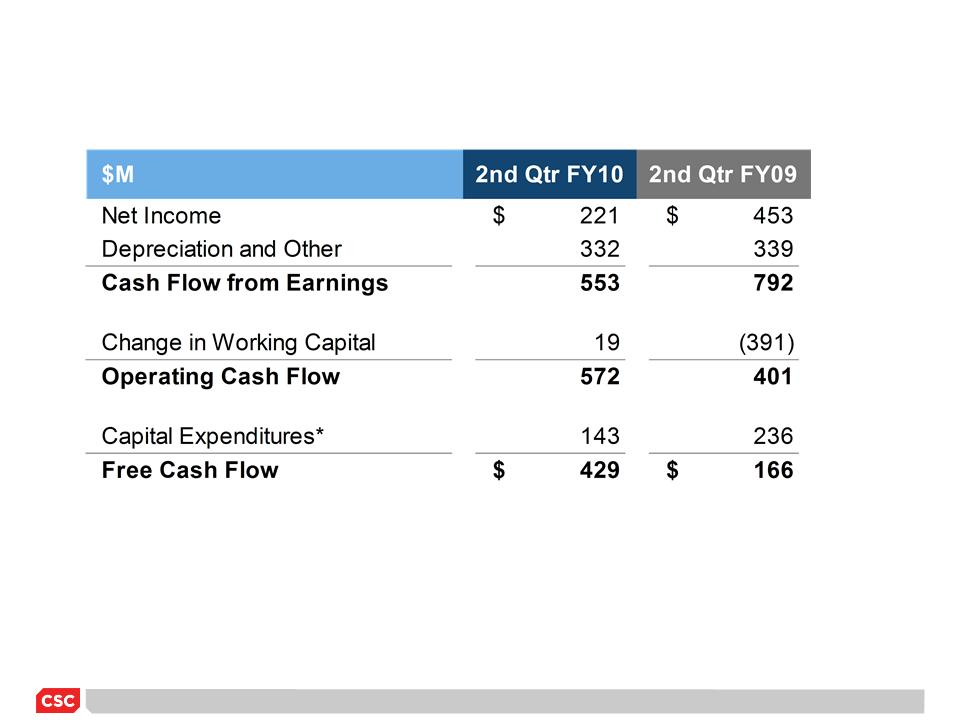

Selected

Cash Flow Items

*Capital

expenditures figures include capital lease payments and exclude cash

used/received for acquisitions/dispositions

2nd

QUARTER FY 2010 EARNINGS PRESENTATION

*

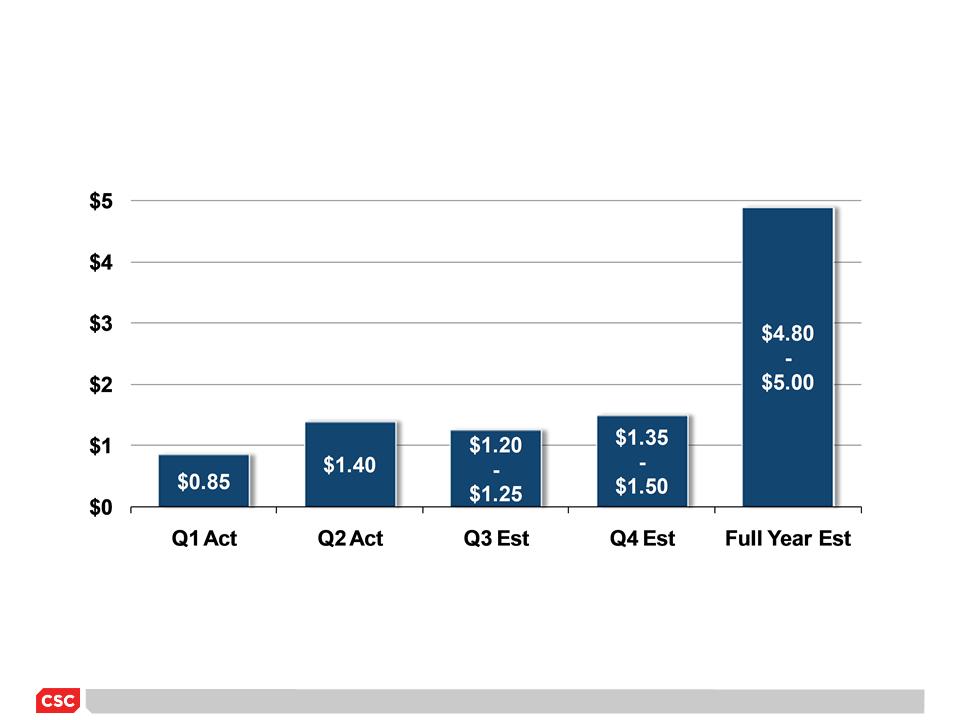

Earnings

per Share (EPS)

2nd

QUARTER FY 2010 EARNINGS PRESENTATION

*

Summary

FY 2010 Guidance

Positive

performance in 1st half provides confidence

in

delivery of full year guidance

• EPS between $4.80

and $5.00

• New Business

Bookings in the range of $17B to $18B

• Revenue in the range

of $16.0B to $16.5B

• Free Cash Flow

performance of 90% to 100% of net income

• Operating Margin

Improvement of 25 to 50 BPS

*

Supplemental

Information

Information

2nd

QUARTER FY 2010 EARNINGS

2nd

QUARTER FY 2010 EARNINGS PRESENTATION

*

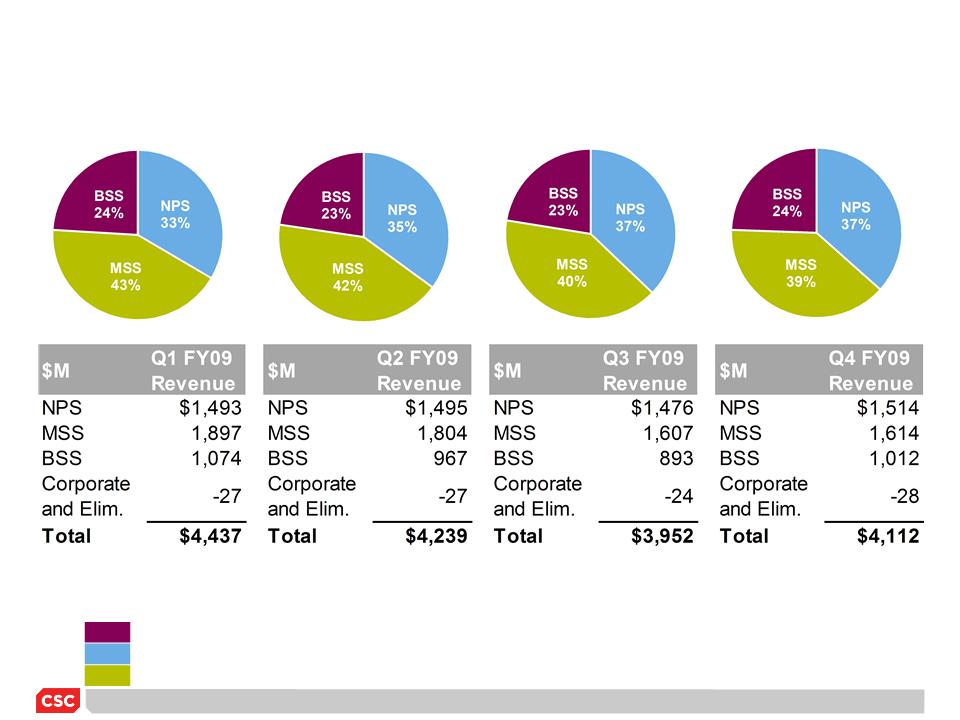

FY09

Revenue by Lines of Business*

*

Percentages exclude corp. and other eliminations

FY09

reflects realignment for operating segments

North

American Public Sector

Business

Solutions and Services

Managed

Services Sector

NPS

BSS

MSS

2nd

QUARTER FY 2010 EARNINGS PRESENTATION

*

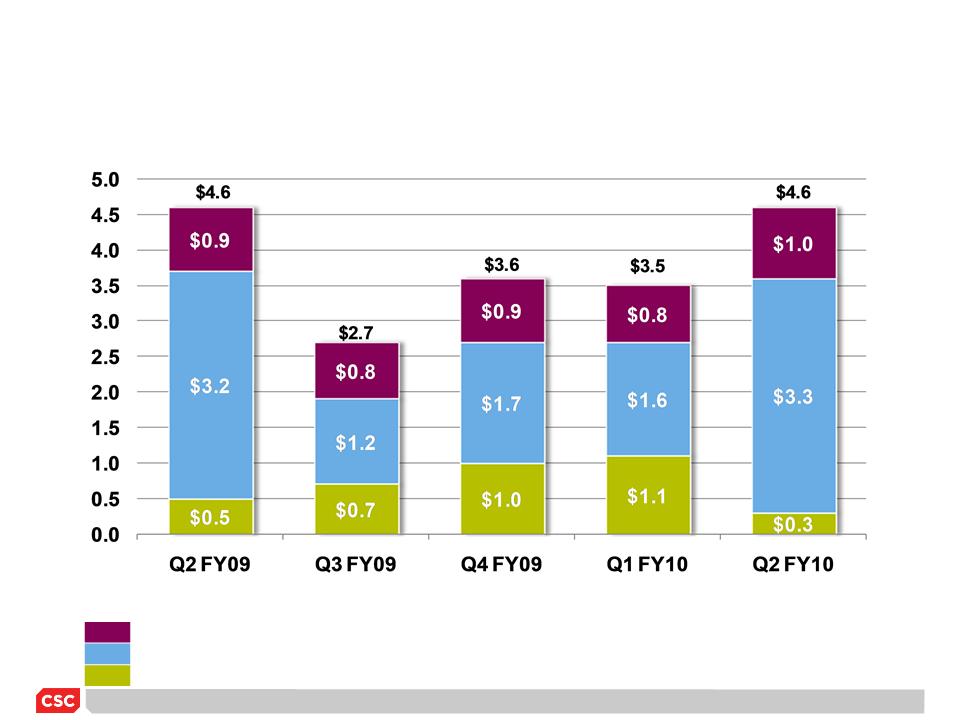

New

Business Bookings

$B

FY09

reflects realignment for operating segments

North

American Public Sector

Business

Solutions and Services

Managed

Services Sector

NPS

BSS

MSS

2nd

QUARTER FY 2010 EARNINGS PRESENTATION

*

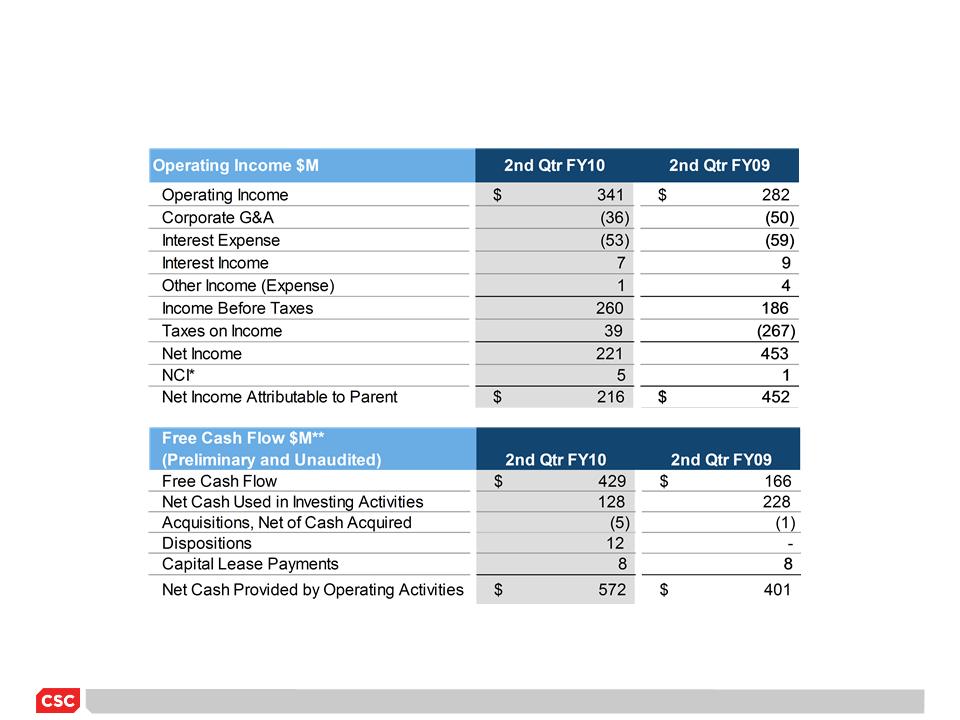

Non-GAAP

Reconciliation

*NCI:

Net Income Attributable to Non-Controlling Interest Net of Tax

**Capital lease

payments and proceeds from the sale of P&E (included in investing

activities)

are included in the calculation of Free Cash Flow

are included in the calculation of Free Cash Flow

2nd

QUARTER FY 2010 EARNINGS PRESENTATION

*

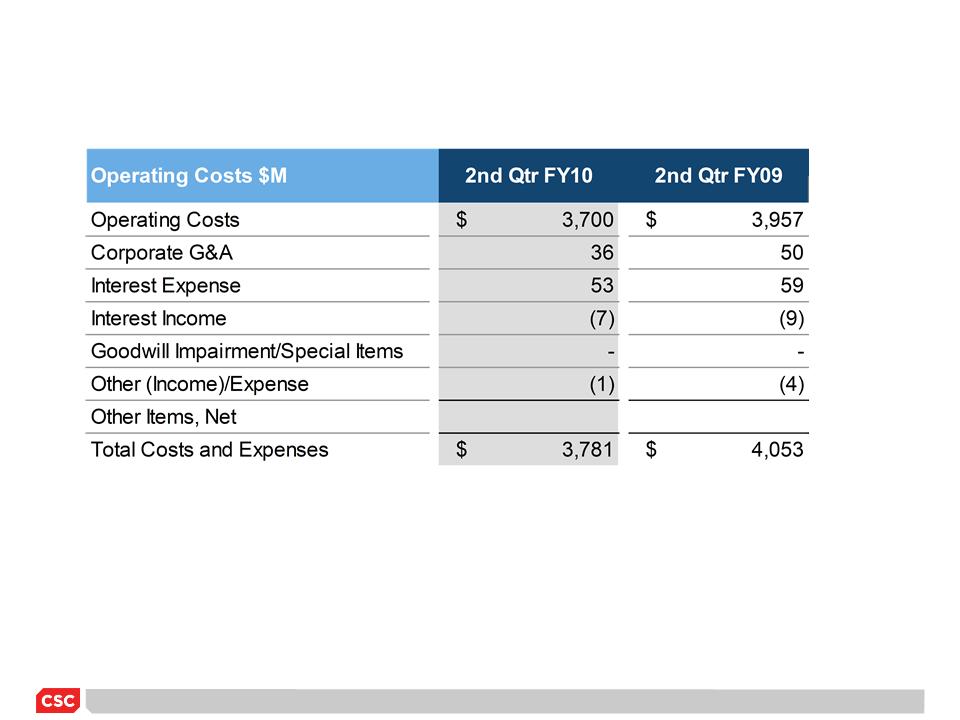

Non-GAAP

Reconciliation (Cont’d)

2nd

QUARTER FY 2010 EARNINGS PRESENTATION

*

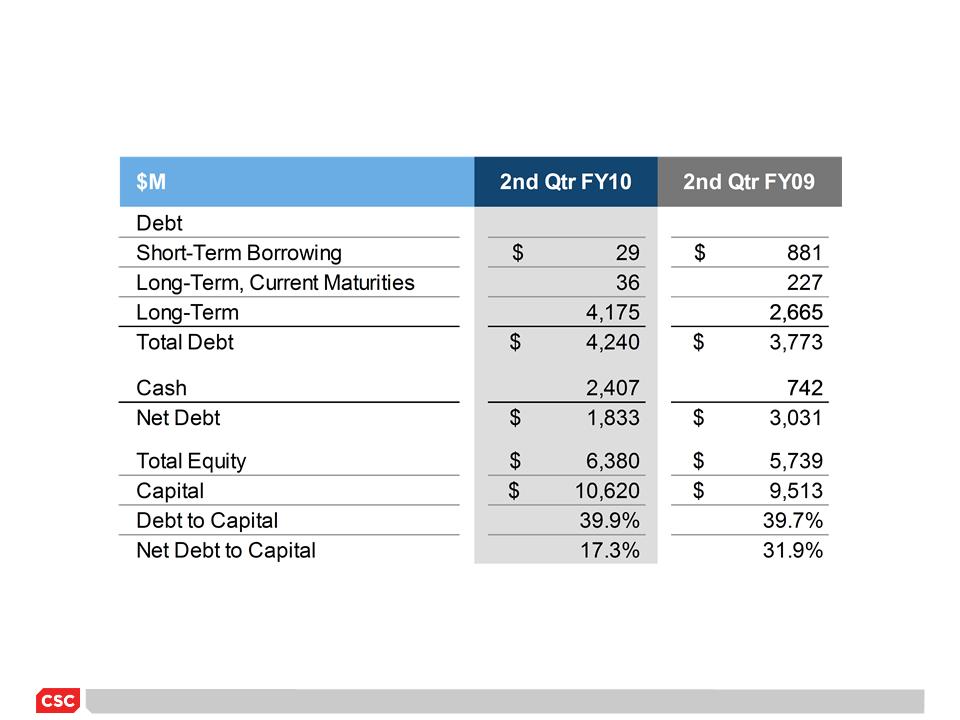

Net

Debt Reconciliation

2nd

QUARTER FY 2010 EARNINGS PRESENTATION

*

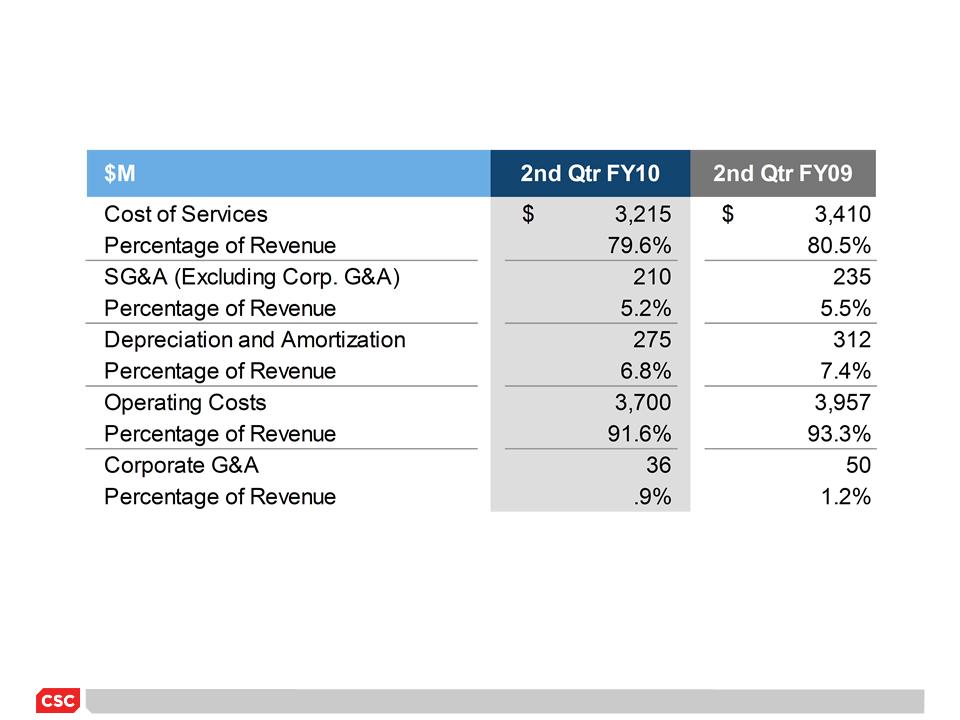

Components

of Operating Costs

2nd

QUARTER FY 2010 EARNINGS PRESENTATION

*

Non-GAAP

and Other Definitions

• Operating

Cost: Equal to the sum of

(1) cost of services, (2) business units

SG&A, (3) depreciation and amortization

SG&A, (3) depreciation and amortization

• Operating

Income: Revenue minus

operating cost

• Operating

Income Margin: Operating Income as

a percentage of revenue

• DSO:

Total

receivables at quarter end divided by revenue per day. Revenue per

day equals total revenues for the last quarter divided by the number of days in the

fiscal quarter. Total receivables includes unbilled receivables but excludes tax

receivables

day equals total revenues for the last quarter divided by the number of days in the

fiscal quarter. Total receivables includes unbilled receivables but excludes tax

receivables

• Free

Cash Flow: Equal to the sum of

(1) operating cash flows, (2) investing cash

flows, excluding business acquisitions and dispositions, purchase, or sale of

available for sale securities, and (3) capital lease payments

flows, excluding business acquisitions and dispositions, purchase, or sale of

available for sale securities, and (3) capital lease payments

• Net

Debt: Calculated as the

sum of long-term and short-term debt, less cash and

marketable securities

marketable securities

• Net

Debt to Capital: Calculated as the

ratio of net debt to capital (total debt

plus equity)

plus equity)

2nd

QUARTER FY 2010 EARNINGS PRESENTATION

*