As filed with the Securities and Exchange Commission on

November 10, 2009

Registration

No. 333-160417

UNITED STATES SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

Amendment No. 4

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

VUZIX CORPORATION

(Exact name of registrant as

specified in its charter)

| |

|

|

|

|

|

Delaware

|

|

3577

|

|

04-3392453

|

|

|

(State or other jurisdiction

of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification Number)

|

75 Town Centre Drive

Rochester, NY 14623

(585) 359-5900

(Address, including

zip code, and telephone number, including area code, of

registrant’s principal executive offices)

Copies to:

| |

|

|

|

Robert F. Mechur, Esq.

Boylan, Brown, Code, Vigdor & Wilson, LLP

2400 Chase Square

Rochester, New York 14604

(585) 232-5300

|

|

Kenneth G. Sam, Esq.

Jason Brenkert, Esq.

Dorsey & Whitney LLP

370 17th Street, Suite 4700

Denver, Colorado 80202

(303) 629-3400

|

Approximate date of commencement of proposed sale to the

public: As soon as practicable after the

effective date of this registration statement.

If any of the securities being registered on this form are to be

offered on a delayed or continuous basis pursuant to

Rule 415 under the Securities Act, check the following

box. þ

If this form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act,

check the following box and list the Securities Act registration

statement number of the earlier effective registration statement

for the same

offering. o

If this form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act, check the following

box and list the Securities Act registration statement number of

the earlier effective registration statement for the same

offering. o

If this form is a post-effective amendment filed pursuant to

Rule 462(d) under the Securities Act, check the following

box and list the Securities Act registration number of the

earlier effective registration statement for the same

offering. o

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated

filer, or a smaller reporting company. See the definitions of

“large accelerated filer,” “accelerated

filer” and “smaller reporting company” in

Rule 12b-2

of the Exchange Act. (Check one):

| |

|

|

|

|

|

|

|

Large accelerated filer o

|

|

Accelerated filer o

|

|

Non-accelerated filer o

|

|

Smaller reporting company þ

|

|

|

|

|

|

(Do not check if a smaller reporting company)

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proposed Maximum

|

|

|

Amount of

|

|

|

|

|

Aggregate

|

|

|

Registration

|

|

Title of Securities to be Registered

|

|

|

Offering Price(1)

|

|

|

Fee(6)

|

|

Units, each consisting of one share of Common Stock,

$0.001 par value, and one-half of one Common Stock Purchase

Warrant(2)

|

|

|

$

|

15,464,625.00

|

|

|

|

$

|

862.93

|

|

|

Shares of Common Stock included as part of the Units

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock Purchase Warrants included as part of the Units

|

|

|

|

|

|

|

|

|

|

|

|

Shares of Common Stock underlying the Common Stock Purchase

Warrant included in the Units

|

|

|

$

|

11,598,469.00

|

(3)(5)

|

|

|

$

|

647.19

|

|

|

Agent Compensation Options(4)

|

|

|

|

|

|

|

|

|

|

|

|

Shares of Common Stock included as part of the Agent

Compensation Options

|

|

|

$

|

1,933,079.00

|

|

|

|

$

|

107.87

|

|

|

Common Stock Purchase Warrants included as part of the

Compensation Options(5)

|

|

|

|

|

|

|

|

|

|

|

|

Shares of Common Stock underlying the Common Stock Purchase

Warrants included in the Compensation Options

|

|

|

$

|

1,449,808.00

|

(3)(5)

|

|

|

$

|

80.90

|

|

|

Total

|

|

|

$

|

30,445,981.00

|

|

|

|

$

|

1698.89

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Estimated solely for purposes of

calculating the registration fee in accordance with Rule 457(o)

under the Securities Act of 1933, as amended. In accordance with

Rule 457(o) under the Securities Act, the number of shares

being registered and the maximum offering price per share are

not included in this table.

|

| |

|

(2)

|

|

Public offering of units, each unit

consisting of one share of common stock, $0.001 par value,

and one-half of one common stock purchase warrant.

|

| |

|

(3)

|

|

Estimated pursuant to

Rule 457(g).

|

| |

|

(4)

|

|

Options entitling the Canadian

agents to purchase that number of shares of common stock and

warrants equal to 12.5% of the aggregate number of shares of

common stock and warrants sold under the offering, respectively,

at the offering price per share and warrant, respectively, for a

period of 12 months from the closing date.

|

| |

|

(5)

|

|

Pursuant to Rule 416, there

are also being registered such indeterminable additional

securities as may be issued as a result of any additional shares

of common stock that shall become issuable by reason of any

stock dividend, stock split, recapitalization or other similar

transaction effected without the receipt of consideration that

results in an increase in the number of the outstanding shares

of common stock.

|

| |

|

(6)

|

|

Registration fee previously paid in

connection with the initial filing of this Registration

Statement.

|

The Registrant hereby amends this Registration Statement on

such date or dates as may be necessary to delay its effective

date until the Registrant shall file a further amendment that

specifically states that this Registration Statement shall

thereafter become effective in accordance with Section 8(a)

of the Securities Act of 1933, as amended, or until the

Registration Statement shall become effective on such date as

the Commission, acting pursuant to said Section 8(a), may

determine.

EXPLANATORY

NOTES

This Registration Statement contains a prospectus relating to an

offering of shares of our common stock, warrants and common

stock acquirable upon exercise of warrants in the United States,

together with separate prospectus pages relating to an offering

of shares of our common stock, warrants and common stock

acquirable upon exercise of warrants in Canada. The

U.S. prospectus and the Canadian prospectus will be

identical in all material respects. The complete

U.S. prospectus is included herein and is followed by those

pages to be used solely in the Canadian prospectus. Each of the

alternate pages for the Canadian prospectus included in this

registration statement has been labeled “Alternate Page for

Canadian Prospectus.”

The

information in this prospectus is not complete and may be

changed. We may not sell these securities until the registration

statement filed with the Securities and Exchange Commission is

effective. This prospectus is not an offer to sell these

securities and it is not soliciting an offer to buy these

securities in any state where the offer or sale is not

permitted.

|

(Subject

to Completion) Dated November 10, 2009

PRELIMINARY PROSPECTUS

Vuzix

Corporation

Minimum Offering of

Cdn$6,000,000

Up to 50,000,000

Units

(each consisting of one share of

common stock and one half of one common stock purchase

warrant)

This is the initial public offering of our securities. We are

offering for sale up to 50,000,000 units at a price between

Cdn$0.15 and Cdn$0.25 per unit, on a best efforts basis. Each

unit consists of one share of our common stock and

one-half of

one common stock purchase warrant. Each whole warrant entitles

its holder to purchase one share of our common stock at a price

of 150% of the initial public offering price per unit at any

time for up to 36 months after the closing of this

offering. The shares of common stock and warrants underlying the

units will be issued separately. Our units are being

concurrently offered to the public in Canada by our Canadian

agents. Our agents are not purchasing any of the offered units.

The agents must sell the number of units that will result in us

receiving the minimum gross proceeds (Cdn$6,000,000) if any are

sold. The agents are required to use their best efforts to sell

the maximum number of units offered (50,000,000 units). The

funds received in payment for the units sold in this offering

will be deposited into a non-interest bearing escrow account and

held until the closing of the offering. The offering will close

as soon as practicable after the minimum gross proceeds have

been raised. If the minimum gross proceeds are not raised within

90 days of the date of this prospectus, all funds will be

returned to investors promptly without interest or deduction of

fees. There is currently no public market through which our

securities may be sold, and you may not be able to resell any

securities you purchase under this prospectus. We have

applied to list our common stock and the warrants included in

the units on the TSX Venture Exchange (TSX-V) under the symbols

“l”

and

“l”,

respectively. Listing of our common stock and warrants will be

subject to fulfilling all of the requirements of the TSX-V.

Our business and an investment in our securities involve

significant risks. These risks are described under the caption

“Risk Factors” beginning on page 8 of this

prospectus.

Neither the SEC nor any other securities commission or

regulatory authority has approved or disapproved of these

securities or has passed upon the accuracy or adequacy of this

prospectus. Any representation to the contrary is a criminal

offense.

If we raise the minimum proceeds from this offering

(Cdn$6.0 million or approximately US$5.63 million) by

selling 30,000,000 units at Cdn$0.20 per unit

(the midpoint of our estimated initial public offering

price range), we estimate that the net proceeds to us from the

offering, after agents commissions, would be approximately

Cdn$5.52 million or Cdn$0.184 per unit. If we sell the

maximum number of units we are offering (50,000,000 units)

at Cdn$0.25 per unit (the maximum of our estimated initial

public offering price range), we would receive gross proceeds of

Cdn$12.5 million (or approximately US$11.74 million)

and estimate that the net proceeds to us, after agents

commissions, would be approximately Cdn$11.5 million or

Cdn$0.23 per unit.

The public offering price for units offered in the United States

is payable in US dollars, and the public offering price for

units offered in Canada and elsewhere outside the United States

is payable in Canadian dollars, except as may otherwise be

agreed by the agents. The US dollar amount of the public

offering price will be

US$ l

(the equivalent of the Canadian dollar amount based on the

closing buying rate of the Bank of Canada on the date

immediately prior to the effective date of the registration

statement of which this prospectus forms a part) and converted

into Canadian dollar equivalents for purposes of determining

whether we have received minimum gross proceeds of Cdn$6,000,000.

The agents expect to deliver the shares of common stock and

warrants comprising the units in Toronto, Ontario, Canada on or

about ,

2009.

CANACCORD ADAMS INC.

The date of this prospectus

is ,

2009.

Through and

including ,

2009 (the 40th day after the date of this prospectus), all

dealers effecting transactions in units or shares of our common

stock, whether or not participating in this offering, may be

required to deliver a prospectus. This is in addition to a

dealer’s obligation to deliver a prospectus when acting as

an underwriter with respect to an unsold allotment or

subscription.

ii

PROSPECTUS

SUMMARY

This summary provides an overview of selected information

contained elsewhere in this prospectus and does not contain all

of the information you should consider before investing in our

securities. You should carefully read the prospectus and the

registration statement of which this prospectus is a part in

their entirety before investing in our securities, including the

information discussed under “Risk Factors” beginning

on page 7 and our financial statements and notes thereto

that appear elsewhere in this prospectus.

BUSINESS

Company

Overview

We are engaged in the design, manufacture, marketing and sale of

devices that are worn like eyeglasses and feature built-in video

screens that enable the user to view video and digital content,

such as movies, computer data, the Internet or video games. Our

products (known commercially as Video Eyewear, but also commonly

referred to as virtual displays, wearable displays, personal

viewers, personal displays, head mounted displays, or

near-to-eye

displays) are used to view high-resolution video and digital

information primarily from mobile devices (such as cell phones,

portable media players, gaming systems and laptop computers) and

from personal computers. Our products provide the user with a

virtual viewing experience that simulates viewing a large screen

television or desktop computer monitor practically anywhere,

anytime.

Our Video Eyewear products feature high performance miniature

display modules, low power electronics and related optical

systems. We produce both monocular and binocular Video Eyewear

devices that we believe are excellent solutions for many mobile

computer, mobile internet devices (MID) or video viewing

requirements, including general entertainment applications. We

focus on two markets: the consumer markets for gaming, mobile

video viewing and stereoscopic three-dimensional video viewing;

and rugged mobile displays for defense and industrial

applications. We also offer low-vision assist Video Eyewear

products that are designed to assist and improve the remaining

vision of people suffering from macular degeneration.

The development of intellectual property rights relating to our

technologies is a key aspect of our business strategy. We have

generated and continue to generate intellectual property as a

result of our ongoing performance of development contracts and

our internal research and development activities. We have also

acquired technologies developed by third parties and we may do

so in the future.

Our business is subject to numerous risks, as discussed more

fully in the section entitled “Risk Factors”

immediately following this prospectus summary. The risks we face

include the following:

|

|

|

| |

•

|

We have incurred net losses since our inception and if we

continue to incur net losses in the foreseeable future the

market price of our common stock may decline.

|

| |

| |

•

|

We have depended on defense related engineering contracts and

product orders from two customers for the majority of our sales

and our revenues would be materially reduced if we are unable to

obtain sales from government contracts or if either of our two

significant customers reduce or delay orders from us.

|

| |

| |

•

|

If management continues to own a significant percentage of our

outstanding common stock, management may prevent other

stockholders from influencing significant corporate decisions.

|

| |

| |

•

|

We do not manufacture our own microdisplays, one of the key

components of our Video Eyewear products, and we may not be able

to obtain the microdisplays we need.

|

| |

| |

•

|

If we fail to develop new products and adapt to new

technologies, our business and results of operations may be

materially adversely affected.

|

| |

| |

•

|

If microdisplay-based personal displays do not gain some

reasonable level of acceptance in the market for mobile

displays, our business strategy may fail.

|

| |

| |

•

|

We may incur substantial costs or lose important rights as a

result of litigation or other proceedings relating to our

products, patents and other intellectual property rights.

|

1

|

|

|

| |

•

|

Purchasers of our units will experience immediate and

substantial dilution as a result because their common stock will

be worth less on a net tangible book value basis than the amount

they invested.

|

Industry

Overview

Many mobile devices now allow the user to view high-resolution

full color content. We believe that typical displays currently

used on mobile devices do not work well for this purpose because

they are either too small, making it extremely difficult to view

the detail in their display images with a human eye, or too

large, making the mobile device cumbersome and difficult to use

and carry. Some mobile devices employ a touch screen with

software to magnify or zoom in on a partial image. We believe

that many consumers consider this solution unsatisfactory

because it is difficult to navigate and find information on the

portion of the page being viewed.

In contrast, our Video Eyewear products enable the user to

effectively view the entire screen on a small, eyeglass-like

device. Our products employ microdisplays that provide full

screen resolution but are smaller than one-inch diagonally, with

some as small as one-quarter of an inch. To make images on the

microdisplays viewable, our Video Eyewear products incorporate

proprietary magnifying optics that are usually designed by us.

The result is a detailed virtual image that appears to the

viewer to be similar to the image on a full size computer screen

from a normal desktop working distance or the image on a large

flat panel television from normal home TV viewing distance. For

example, when magnified through our optics, a high-resolution

0.44-inch diagonal microdisplay can provide a viewing experience

comparable to that on a

62-inch

diagonal television screen viewed at nine feet. We refer to this

as a 62-inch

virtual display.

We believe that there is growing demand for mobile access to

high-resolution content in both the consumer and industrial and

defense markets.

Our

Products

We offer products that use our proprietary technology and are

designed to meet the unique requirements of the consumer,

industrial and defense markets.

Binocular

Video Eyewear Products

Each binocular Video Eyewear product contains two microdisplay

screens, one in front of each eye, mounted in a frame attached

to eyeglass-style temples with headphones. These products enable

mobile private viewing of video content on virtual displays that

can simulate theater-sized screens. They are currently sold on

the basis of resolution and their effective virtual viewing

screen size. Our products today range from 320 × 240 pixels

(Quarter Video Graphics Array or QVGA) to 800 × 600 pixels

(Super Video Graphics Array or SVGA) resolution and provide

virtual screen sizes of 44- to

62-inch

screens viewed at nine feet. We also offer an interactive

version for PC gaming which includes our proprietary head

tracking technology, which enables the user to look around the

environment being displayed in the game by simply moving his or

her head, and a microphone to enable communication with others.

Finally, we offer a binocular Video Eyewear product that

integrates a high-resolution camera with digital magnification,

designed to assist and improve the remaining vision of persons

suffering from macular degeneration.

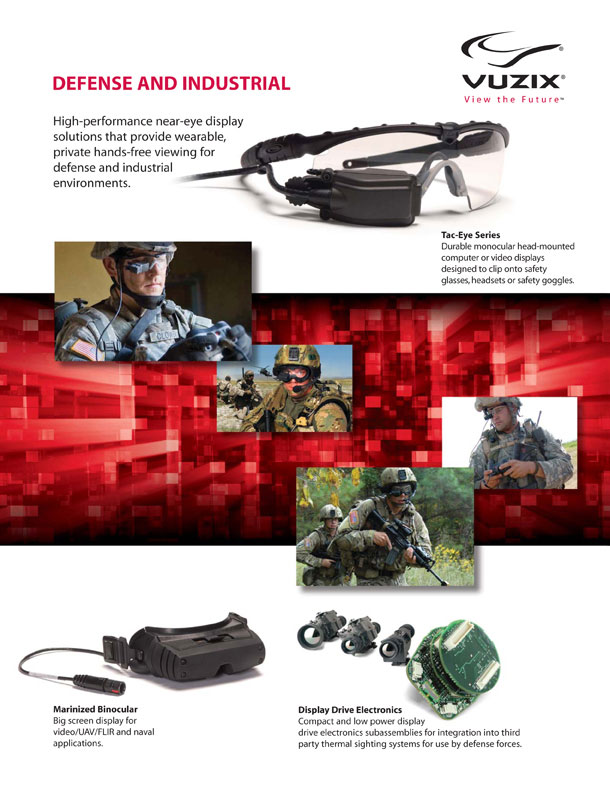

Monocular

Video Eyewear Products

Our

Tac-Eye®

monocular (single eye) Video Eyewear products are designed to

clip on to a pair of ballistic sunglasses, a head set or

conventional safety goggles. They can be used with rugged

laptops, security and night vision cameras and thermal night

vision sights, including those sights for which we currently

build the display drive electronics as a

sub-contractor

to the US Department of Defense.

Tac-Eye®

enables users to have wearable, private, hands-free and

glanceable access to high-resolution content or information

while retaining most of their real world view.

2

Defense

Sub-Assembly

and Custom Solutions

We are involved in several programs as part of contracting teams

that produce thermal night vision sights to the US Department of

Defense. We design and manufacture many of the display drive

electronic subassemblies for light, medium, and heavy weight

thermal weapon sighting systems for the US and other defense

forces. When possible, we obtain a first right of refusal to be

the volume manufacturer of our proprietary display subassemblies

as part of our contracting process for the custom design of

products.

Our

Strategy

Our strategy is to establish and maintain a leadership position

as a worldwide supplier of Video Eyewear and other virtual

display technology solutions. We intend to offer our

technologies across major markets, platforms and applications.

We will strive to be an innovator in designing virtual display

devices that enable new mobile video viewing as well as general

entertainment applications.

To maintain and enhance our position as a leading provider of

virtual display solutions, we intend to:

|

|

|

| |

•

|

improve our brand name recognition;

|

| |

| |

•

|

develop products for large markets;

|

| |

| |

•

|

broaden and develop strategic relationships and partnerships;

|

| |

| |

•

|

expand market awareness for virtual display solutions;

|

| |

| |

•

|

maintain and exploit any cost advantage our technology can

provide us;

|

| |

| |

•

|

extend our proprietary technology leadership; and

|

| |

| |

•

|

establish multiple revenue sources.

|

Company

Information

We were incorporated under the Delaware General Corporation Law

in 1997 as VR Acquisition Corp. In 1997 we changed our name to

Kaotech Corporation. In 1998 we changed our name to Interactive

Imaging Systems, Inc. In 2004 we changed our name to Vicuity

Corporation and then to Icuiti Corporation. In September 2007 we

changed our name to Vuzix Corporation.

Our principal executive offices are located at 75 Town Centre

Drive, Rochester, New York 14623. Our telephone number is

(585) 359-5900.

We maintain an Internet website at www.vuzix.com. The

information contained on, connected to or that can be accessed

via our website is not part of this prospectus. We have included

our website address in this prospectus as an inactive textual

reference only and not as an active hyperlink.

Our wholly-owned direct subsidiary is Vuzix (Europe) Limited,

which we refer to in this prospectus as Vuzix Europe. Vuzix

Europe was incorporated on April 10, 2008 pursuant to the

provisions of the Companies Act (England and Wales). The

registered and head office of Vuzix Europe is located at St.

John’s House, 5 South Parade, Summertown, Oxford OX2 7JL.

The

Offering

|

|

|

|

Securities offered by Vuzix |

|

Up to 50,000,000 units; each unit consisting of one share of our

common stock, par value $0.001 per share, and one half of one

common stock purchase warrant. |

| |

|

|

|

Up to 84,375,000 shares of our common

stock.(1) |

| |

|

|

|

Up to 25,000,000 common stock purchase warrants. Each whole

warrant will entitles its holder to purchase one share of our

common stock at a price of 150% of the initial public offering

price per unit at any time for 36 months after the closing

of this offering. If the weighted-average closing price of our

common stock on the TSX-V exceeds 250% of the initial public

offering price per unit for 20 consecutive trading days at any

time beginning 180 days after the date on which our common stock

is first traded on the TSX-V, we will have the right,

exercisable at our sole discretion, to accelerate the |

3

|

|

|

|

|

|

expiration date of the warrants by providing written notice to

each registered warrant holder within five business days and

issuing a press release to the effect that the warrants will

expire at 5:00 p.m. (Toronto time) on the date specified in

the notice and press release, provided that the accelerated

expiration date may not be less than 30 days following the date

of the notice and press release. |

| |

|

Minimum gross proceeds |

|

Cdn$6,000,000 |

|

|

|

|

Common stock to be outstanding after this offering |

|

Between 274,974,896 shares (assuming minimum gross proceeds of

Cdn$6,000,000 at the initial public offering price of Cdn$0.15

per unit) and 285,174,896 shares (assuming the sale of the

maximum number of units offered (50,000,000

units).(2) |

|

|

|

|

Agent Compensation |

|

As consideration for their services, the Canadian agents will

receive: (i) a commission equal to 8% of the gross proceeds

of the offering; (ii) options entitling the Canadian agents

to purchase that number of shares of our common stock and

warrants equal to 12.5% of the aggregate number of shares of our

common stock and warrants sold under the offering, at the

offering price per share and warrant, for a period of

12 months from the closing date; and (iii) a non-refundable

due diligence fee of Cdn$15,000. The Canadian agents will also

be reimbursed for their reasonable fees and expenses including

the reasonable legal fees and disbursements of legal counsel to

the agents. Canaccord Adams Inc. and any US selling agents that

the Canadian agents may appoint will be paid cash selling

commissions not to exceed 6% of the gross proceeds of the

offering in the United States and options entitling the US

selling agents to purchase that number of shares of our common

stock and warrants sold in the United States under the offering

equal to 8% of the aggregate number of shares of our common

stock and warrants at the initial public offering price for a

period of 12 months from the closing date. The commission paid

to US selling agents will be paid by the Canadian agents from

their commissions and the options issued to the US selling

agents will be assigned by the Canadian agents from their

options. This prospectus covers the sale of the shares of our

common stock and warrants issuable upon exercise of the

agents’ options. |

| |

|

|

|

In consideration of certain fiscal advisory services rendered by

the Canadian agents to us pursuant to a fiscal advisory fee

agreement between us and the Canadian agents, we have agreed to

issue to the Canadian agents at the closing of this offering, in

payment of a fiscal advisory fee, that number of shares of our

common stock equal to, depending on the gross proceeds of the

offering, between 1.0% and 2.0% of our common stock issued and

outstanding immediately upon the closing of the offering. The

issuance of these shares to the Canadian agents is not covered

by this prospectus. These shares will be subject to resale

restrictions under applicable United States and Canadian

securities legislation and a contractual lock-up agreement for

one year. See “Underwriting — Fiscal Advisory Fee

Agreement.” |

|

|

|

|

Use of proceeds |

|

The minimum gross proceeds to us from the offering will be

Cdn$6,000,000 (or approximately US$5.63 million) and we

estimate that the net proceeds to us from such amount, after

payment of agents’ commissions and offering-related

expenses, would be approximately Cdn$4,800,000. Assuming the

sale of the maximum number of units offered (50,000,000 units)

and an initial public offering price of Cdn$0.25 per unit (the

maximum of our estimated initial public offering price range),

we would receive gross proceeds of Cdn$12,500,000 (or

approximately US$11.74 million) and we estimate that the

net proceeds to us from such amount, after payment of |

4

|

|

|

|

|

|

agents’ commissions and offering-related expenses, would

be approximately Cdn$10,750,000. We expect to use $1,234,000 of

the net proceeds of this offering to repay outstanding

indebtedness, including accrued interest. The indebtedness to be

repaid includes $215,500 in principal amount plus interest

payable to our President and Chief Executive Officer. We intend

to use the remainder of the net proceeds from this offering new

product development and tooling expenses; for research and

development expenses; capital expenditures; selling, marketing,

general and administrative expenses; possible acquisitions of

businesses, technologies or other assets; and general corporate

purposes. For additional information see “Use of

Proceeds.” |

|

|

|

|

Risk Factors |

|

See “Risk Factors” beginning on page 8 and other

information included in this prospectus for a discussion of

factors you should carefully consider before deciding to invest

in our securities. |

|

|

|

|

(1) |

|

Consists of up to (i) 50,000,000 shares included in

the units; (ii) 25,000,000 shares issuable upon

exercise of the common stock purchase warrants included in the

units; and (iii) up to 6,250,000 shares issuable upon

exercise of the options issued to the agents as compensation and

up to an additional 3,125,000 shares issuable upon exercise

of common stock purchase warrants issuable upon exercise of the

options issued to the agents as compensation. |

|

|

|

|

(2) |

|

Includes (i) up to 5,592,246 shares issued to the agents in

payment of a fiscal advisory fee; (ii) up to 7,148,982 shares

issuable upon conversion of 168,500 outstanding shares of our

Series C 6% Convertible Preferred Stock (Series C Preferred

Stock), together with all accrued and unpaid dividends thereon

through September 30, 2009, at the rate of $0.2917 per share;

and (iii) up to 4,642,189 shares issuable upon conversion of

$575,000 in aggregate principal amount of convertible promissory

notes outstanding, together with all accrued and unpaid interest

thereon through September 30, 2009. Does not include (i) up

to 15,304,554 shares issuable upon exercise of options

granted under our 2007 Amended and Restated Stock Option Plan;

(ii) any of the shares described in footnote (1) above

other than those described in clause (i) of

footnote (1); (iii) up to 1,200,00 shares

issuable upon exercise of options under our 2009 option plan

that we intend to grant to our four new non-employee directors

at the closing of this offering; and (iv) up to 4,867,283

shares issuable upon exercise of outstanding warrants. |

5

Selected

Summary Financial Data

The following tables present our summary financial data and

should be read together with our financial statements and

accompanying notes and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations”

appearing elsewhere in this prospectus. The summary financial

data for the years ended December 31, 2008, 2007 and 2006

are derived from our audited annual financial statements, which

are included elsewhere in this prospectus. The unaudited summary

financial data as of June 30, 2009 and for the three and

six months ended June 30, 2009 and 2008 have been derived

from our unaudited interim financial statements, which are

included elsewhere in this prospectus, and include all

adjustments, consisting of normal recurring adjustments,

necessary for a fair presentation of our financial position and

results of operations for these periods.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

|

Statement of Operations Data

|

|

2009

|

|

|

2008

|

|

|

2009

|

|

|

2008

|

|

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

|

|

(Restated)

|

|

|

(Restated)

|

|

|

(Restated)

|

|

|

(Restated)

|

|

|

|

|

Sales

|

|

$

|

2,063,733

|

|

|

$

|

3,087,338

|

|

|

$

|

5,082,087

|

|

|

$

|

4,807,982

|

|

|

Cost of Sales

|

|

|

1,390,819

|

|

|

|

1,871,661

|

|

|

|

3,221,861

|

|

|

|

3,358,739

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Margin

|

|

|

672,914

|

|

|

|

1,215,677

|

|

|

|

1,860,226

|

|

|

|

1,449,243

|

|

|

Operating Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

428,737

|

|

|

|

1,224,265

|

|

|

|

945,897

|

|

|

|

1,960,982

|

|

|

Selling and marketing

|

|

|

520,257

|

|

|

|

483,695

|

|

|

|

976,041

|

|

|

|

933,257

|

|

|

General and administrative

|

|

|

534,142

|

|

|

|

438,831

|

|

|

|

990,729

|

|

|

|

972,630

|

|

|

Depreciation and amortization

|

|

|

167,509

|

|

|

|

123,696

|

|

|

|

306,343

|

|

|

|

247,392

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

1,650,645

|

|

|

|

2,270,487

|

|

|

|

3,219,010

|

|

|

|

4,114,261

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit (Loss) from operations

|

|

|

(977,731

|

)

|

|

|

(1,054,810

|

)

|

|

|

(1,358,784

|

)

|

|

|

(2,665,018

|

)

|

|

Interest and other income (expense)

|

|

|

11

|

|

|

|

—

|

|

|

|

59

|

|

|

|

166

|

|

|

Foreign exchange (loss) gain

|

|

|

(3,657

|

)

|

|

|

(300

|

)

|

|

|

(4,969

|

)

|

|

|

(33

|

)

|

|

Interest expense

|

|

|

(56,711

|

)

|

|

|

(57,353

|

)

|

|

|

(122,095

|

)

|

|

|

(99,019

|

)

|

|

Tax (expense) benefit

|

|

|

(888

|

)

|

|

|

(2,897

|

)

|

|

|

(1,776

|

)

|

|

|

(3,650

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total tax and other income (expense)

|

|

|

(61,245

|

)

|

|

|

(60,550

|

)

|

|

|

(128,781

|

)

|

|

|

(102,536

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (Loss)

|

|

$

|

(1,038,976

|

)

|

|

$

|

(1,115,360

|

)

|

|

$

|

(1,487,565

|

)

|

|

$

|

(2,767,554

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and fully diluted*

|

|

$

|

(0.0048

|

)

|

|

$

|

(0.0057

|

)

|

|

$

|

(0.0070

|

)

|

|

$

|

(0.0141

|

)

|

|

Weighted average common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and fully diluted*

|

|

|

220,268,927

|

|

|

|

200,424,027

|

|

|

|

219,935,594

|

|

|

|

200,015,546

|

|

6

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31,

|

|

|

|

|

|

Statement of Operations Data

|

|

2008

|

|

|

2007

|

|

|

2006

|

|

|

|

|

|

|

|

(Restated)

|

|

|

(Restated)

|

|

|

(Restated)

|

|

|

|

|

|

|

|

Sales

|

|

$

|

12,489,884

|

|

|

$

|

10,146,379

|

|

|

$

|

9,538,308

|

|

|

|

|

|

|

Cost of Sales

|

|

|

8,788,905

|

|

|

|

6,783,473

|

|

|

|

5,767,550

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Margin

|

|

|

3,700,979

|

|

|

|

3,362,906

|

|

|

|

3,770,758

|

|

|

|

|

|

|

Operating Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

3,366,518

|

|

|

|

2,365,412

|

|

|

|

1,279,239

|

|

|

|

|

|

|

Selling and marketing

|

|

|

2,128,625

|

|

|

|

1,920,164

|

|

|

|

1,191,800

|

|

|

|

|

|

|

General and administrative

|

|

|

2,299,685

|

|

|

|

1,718,627

|

|

|

|

1,560,278

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

510,133

|

|

|

|

374,078

|

|

|

|

276,989

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

8,304,961

|

|

|

|

6,378,281

|

|

|

|

4,308,306

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit (Loss) from operations

|

|

|

(4,603,982

|

)

|

|

|

(3,015,375

|

)

|

|

|

(537,548

|

)

|

|

|

|

|

|

Interest and other income (expense)

|

|

|

188

|

|

|

|

2,549

|

|

|

|

313

|

|

|

|

|

|

|

Foreign exchange (loss) gain

|

|

|

(24,216

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

Interest expense

|

|

|

(260,977

|

)

|

|

|

(241,692

|

)

|

|

|

(179,019

|

)

|

|

|

|

|

|

Legal settlement

|

|

|

—

|

|

|

|

96,632

|

|

|

|

—

|

|

|

|

|

|

|

Tax (expense) benefit

|

|

|

(5,212

|

)

|

|

|

98,372

|

|

|

|

(3,700

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total tax and other income (expense)

|

|

|

(290,217

|

)

|

|

|

(44,139

|

)

|

|

|

(182,406

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (Loss)

|

|

$

|

(4,894,199

|

)

|

|

$

|

(3,059,514

|

)

|

|

$

|

(719,954

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and fully diluted*

|

|

$

|

(0.0240

|

)

|

|

$

|

(0.0176

|

)

|

|

$

|

(0.0047

|

)

|

|

|

|

|

|

Weighted average common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and fully diluted*

|

|

|

207,710,498

|

|

|

|

185,263,660

|

|

|

|

173,254,715

|

|

|

|

|

|

|

|

|

|

* |

|

All outstanding warrants, options, and convertible debt are

anti-dilutive, therefore basic and diluted earnings per share

are the same for all periods. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31,

|

|

|

Six Months Ended June 30,

|

|

|

Cash Flow Data

|

|

2008

|

|

|

2007

|

|

|

2006

|

|

|

2009

|

|

|

2008

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

|

|

Cash flows provided by (used in) operating activities

|

|

$

|

(1,285,449

|

)

|

|

$

|

(3,295,900

|

)

|

|

$

|

120,053

|

|

|

$

|

(476,637

|

)

|

|

$

|

(107,925

|

)

|

|

Cash flows (used in) investing activities

|

|

|

(549,804

|

)

|

|

|

(316,743

|

)

|

|

|

(479,236

|

)

|

|

|

(148,777

|

)

|

|

|

(259,193

|

)

|

|

Cash flows provided by financing activities

|

|

|

2,289,116

|

|

|

|

3,408,328

|

|

|

|

874,569

|

|

|

|

91,820

|

|

|

|

106,255

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31,

|

|

|

As of June 30,

|

|

|

Balance Sheet Data

|

|

2008

|

|

|

2007

|

|

|

2006

|

|

|

2009

|

|

|

2008

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

818,719

|

|

|

$

|

364,856

|

|

|

$

|

569,171

|

|

|

$

|

285,126

|

|

|

$

|

103,993

|

|

|

Working Capital (deficiency)

|

|

|

(1,846,289

|

)

|

|

|

966,658

|

|

|

|

69,766

|

|

|

|

(2,808,676

|

)

|

|

|

(2,150,731

|

)

|

|

Total Assets

|

|

|

6,221,897

|

|

|

|

6,967,254

|

|

|

|

5,013,263

|

|

|

|

4,351,101

|

|

|

|

5,939,483

|

|

|

Long-Term Liabilities

|

|

|

1,754,379

|

|

|

|

2,014,476

|

|

|

|

1,980,476

|

|

|

|

1,797,680

|

|

|

|

1,606,559

|

|

|

Accumulated (deficit)

|

|

|

(14,687,276

|

)

|

|

|

(9,691,977

|

)

|

|

|

(6,531,363

|

)

|

|

|

(16,225,391

|

)

|

|

|

(12,510,081

|

)

|

|

Total Stockholders’ equity (deficit)

|

|

|

(2,089,942

|

)

|

|

|

423,236

|

|

|

|

(603,954

|

)

|

|

|

(3,253,196

|

)

|

|

|

(2,274,435

|

)

|

7

RISK

FACTORS

An investment in our securities involves a high degree of

risk. You should carefully consider the risks described below,

together with all of the other information included in this

prospectus, before making an investment decision. If any of the

following risks actually occurs, our business, financial

condition or results of operations could suffer. In that case,

the market value of our securities could decline, and you may

lose all or part of your investment.

RISKS

RELATED TO OUR BUSINESS

Because

we have a limited operating history in the Video Eyewear

industry, there is a limited amount of past experience upon

which to evaluate our business and prospects.

We were formed in 1997 to develop and sell virtual reality and

other personal display technology and products. Since our

inception the majority of our sales have been derived from the

sale of night vision display drive electronics and from research

and development contracts with suppliers to the US government

and others. In 2003, we discontinued our original virtual

reality product line to focus on Video Eyewear products. Since

that time, the market for Video Eyewear products has developed

more slowly than we anticipated. Although we sold our first

monocular Video Eyewear products in 2003 and our first binocular

Video Eyewear products in February 2005, since 2003 we have

continued to earn the majority of our revenues from defense

related engineering contracts. Accordingly, there is a limited

amount of Video Eyewear-related experience upon which to

evaluate our business and prospects, and a potential investor

should consider the challenges, expenses, delays and other

difficulties involved in the development of our business,

including the continued development of our technology and the

achievement of market acceptance for products using our

technology.

We

have incurred net losses since our inception and if we continue

to incur net losses in the foreseeable future the market price

of our common stock may decline.

We incurred annual net losses of $4,894,199 in 2008, $3,059,514

in 2007 and $719,954 in 2006 and net losses of $1,487,565 and

$2,767,554 for the six-month periods ended June 30, 2009

and 2008, respectively. We had an accumulated deficit of

$16,225,391 as of June 30, 2009.

We may not achieve or maintain profitability in the future. In

particular, we expect that our expenses relating to sales and

marketing and product development and support, as well as our

general and administrative costs, will increase, requiring us to

increase sales in order to achieve and maintain profitability.

If we do not achieve and maintain profitability, our financial

condition will be materially and adversely affected. We would

eventually be unable to continue our operations unless we were

able to raise additional capital. We may not be able to raise

any necessary capital on commercially reasonable terms or at

all. If we fail to achieve or maintain profitability on a

quarterly or annual basis within the timeframe expected by

investors, the market price of our common stock may decline.

We

have depended on defense related engineering contracts and two

customers for sales and our revenues would be materially reduced

if we are unable to continue to obtain sales from government

contracts or if either of our two significant customers reduce

or delay orders from us.

Since inception, the majority of our sales have been derived

from the sale of night vision display drive electronics to two

suppliers to the US government. Sales of night vision display

drive electronics to these customers amounted to 51%, 14% and

42% of our sales in 2008, 2007 and 2006, respectively, and 44%

and 16% for the six-month periods ended June 30, 2009 and

2008, respectively. We have no long-term contracts with these

customers. A significant reduction or delay in orders from

either of our significant customers would materially reduce our

revenue and cash flow and adversely affect our ability to

achieve or maintain profitability in the future.

The next largest source of revenues has been sales directly to

the US Department of Defense, primarily for engineering

programs. Such sales amounted to 12%, 54% and 27% of our sales

in 2008, 2007 and 2006, respectively, and 6% and 2% for the

six-month periods ended June 30, 2009 and 2008,

respectively. We have no long-term contracts with the US

government for engineering services. We plan to submit proposals

for additional

8

development contract funding. However, development contract

funding is subject to legislative authorization and, even if

funds are appropriated, such funds may be withdrawn based on

changes in government priorities.

Together, these two groups of customers accounted for 32%, 71%

and 69% of our sales in 2008, 2007 and 2006, respectively, and

for 50% and 18% of our sales in the six-month periods ended

June 30, 2009 and 2008. We may not be successful in

obtaining new government contracts or in receiving further night

vision display electronics orders. Our inability to obtain sales

from government contracts could have a material adverse effect

on our results of operations and would likely cause us to delay

or slow our growth plans, resulting in lower net sales and

adversely affect our liquidity and profitability.

Because

our US government defense contracts and subcontracts are subject

to procurement laws and regulations, we may not receive all of

the revenues we anticipate receiving under those contracts and

subcontracts.

Generally, US government contracts are subject to procurement

laws and regulations. Some of the our contracts are governed by

the Federal Acquisition Regulation (FAR), which lays out uniform

policies and procedures for acquiring goods and services by the

US government, and agency-specific acquisition regulations that

implement or supplement the FAR. For example, the Department of

Defense implements the FAR through the Defense Federal

Acquisition Regulations (DFAR).

The FAR also contains guidelines and regulations for managing a

contract after award, including conditions under which contracts

may be terminated, in whole or in part, at the government’s

convenience or for default. If a contract is terminated for the

convenience of the government, a contractor is entitled to

receive payments for its allowable costs and, in general, the

proportionate share of fees or earnings for the work done. If a

contract is terminated for default, the government generally

pays for only the work it has accepted. These regulations also

subject us to financial audits and other reviews by the

government of our costs, performance, accounting and general

business practices relating to our government contracts, which

may result in adjustment of our contract-related costs and fees.

Our US government contract and subcontract orders are funded by

government budgets that are proposed by the President of the

United States and reviewed and approved by the Congress. Funds

allocated to government agencies are administered by the

Executive Office of the President. There are two primary risks

associated with this process. First, the process may be delayed

or disrupted because of congressional schedules, negotiations

over funding levels for programs or unforeseen national or world

events. Second, funding for multi-year contracts can be changed

in future appropriations. Either of these events could affect

the allocation, timing, schedule and program content of our

government contracts and subcontracts.

Our

lack of long-term purchase orders and commitments from our

customers may lead to a rapid decline in our sales and

profitability.

All of our significant consumer division customers issue

purchase orders solely in their own discretion, often only two

to four weeks before the requested date of shipment. Our

customers are generally able to cancel orders (without penalty)

or delay the delivery of products on relatively short notice. In

addition, our customers may decide not to purchase products from

us for any reason. Any of our current customers may stop

purchasing our products in the future. If those customers do not

continue to purchase our products, our sales volume and

profitability could decline rapidly with little or no warning

whatsoever.

We cannot rely on long-term purchase orders or commitments to

protect us from the negative financial effects of a decline in

demand for our products. The limited certainty of product orders

can make it difficult for us to forecast our sales and allocate

our resources in a manner consistent with our actual sales.

Moreover, our expense levels are based in part on our

expectations of future sales and, if our expectations regarding

future sales are inaccurate, we may be unable to reduce costs in

a timely manner to adjust for sales shortfalls. Furthermore,

because we depend on a small number of customers for the vast

majority of our sales, the ramifications of these risks is

greater than if we had a greater number of customers. As a

result of our lack of long-term purchase orders and purchase

commitments, we may experience a rapid decline in our sales and

profitability.

9

If

either of the two customers on whom we depend fails to pay us

amounts owed in a timely manner, we could suffer a significant

decline in cash flow and liquidity which, in turn, could cause

us to fail to pay our liabilities and purchase adequate

inventory to sustain or expand our sales volume.

Our accounts receivable represented approximately 30%, 53% and

53% of our total current assets as of December 31, 2008,

2007 and 2006, respectively, and 20% and 11% as of June 30,

2009 and 2008, respectively. As of June 30, 2009, our two

major customers represented 17% of our total accounts

receivable. As a result of the substantial amount and

concentration of our accounts receivable, if any of our major

customers fails to pay us amounts owed in a timely manner, we

could suffer a significant decline in cash flow and liquidity

which could adversely affect our ability to pay our liabilities

and to purchase inventory to sustain or expand our current sales

volume and adversely affect our ability to continue our business.

In addition, our business is characterized by long periods for

collection from our customers and short periods for payment to

our suppliers, the combination of which may cause us to have

liquidity problems. We experience an average accounts settlement

period ranging from one month to as high as three months from

the time we deliver our products to the time we receive payment

from our customers. In contrast, we typically need to place

certain deposits and advances with our suppliers on a portion of

the purchase price. Because our payment cycle is considerably

shorter than our receivable collection cycle, we may experience

working capital shortages. Working capital management, including

prompt and diligent billing and collection, is an important

factor in our results of operations and liquidity. System

problems, industry trends, our customers’ liquidity

problems or payment practices or other issues may extend our

collection period, which would adversely impact our liquidity,

our ability to pay our liabilities and to purchase inventory to

sustain or expand our current sales volume, and adversely affect

our ability to continue our business.

Our

future growth and profitability may be adversely affected if our

marketing initiatives are not effective in generating sufficient

levels of brand awareness.

Since inception, the majority of our sales have been derived

from the sale of night vision display electronics and from

research and development contracts with suppliers to, or

directly to the US government and other customers. Our long-term

business plan contemplates that we will transition our business

so that the majority of our sales are earned from consumer

products sales. In connection with this transition, we are

engaged in a variety of marketing initiatives intended to

promote sales of our consumer products. Our future growth and

profitability from our consumer products will depend in large

part upon the effectiveness and efficiency of these marketing

efforts, including our ability to:

|

|

|

| |

•

|

create awareness of our brand and products, including general

awareness of this new Video Eyewear product category;

|

| |

| |

•

|

identify the most effective and efficient levels of spending for

marketing expenditures in our new target market;

|

| |

| |

•

|

effectively manage marketing costs (including creative and

media) in order to maintain acceptable operating margins and

return on marketing investment;

|

| |

| |

•

|

select the right markets in which to market; and

|

| |

| |

•

|

convert consumer awareness into actual product purchases.

|

Our planned marketing expenditures may not result in increased

total sales or generate sufficient levels of product and brand

name awareness. We may not be able to manage our marketing

expenditures on a cost-effective basis.

The

current decline and any future decline in general economic

conditions could lead to reduced consumer demand for our

products and otherwise have an adverse effect on our liquidity

and profitability.

We believe that purchases of our consumer Video Eyewear products

are dependent upon levels of discretionary spending by our

customers. This means that our financial performance will be

sensitive to changes in overall

10

economic conditions that affect consumer spending. Consumer

spending habits are affected by, among other things, prevailing

economic conditions, levels of employment, salaries and wage

rates, consumer confidence and consumer perception of economic

conditions. As widely reported, general worldwide economic

conditions have experienced a downturn due to, among other

things, slower economic activity, concerns about inflation,

decreased consumer confidence, reduced corporate profits and

capital spending, and adverse business conditions. This can

impact us through reduced sales, elongated selling cycles,

delays in product implementation and increased competitive

margin pressure. We are unable to accurately predict the likely

duration and severity of the current disruption in financial

markets and adverse economic conditions in the United States and

other countries. The continuation of this downturn, the further

deterioration of economic conditions in the United States or key

international economies or uncertainty as to the economic

outlook could reduce discretionary spending or cause a shift in

consumer discretionary spending to other products. Any of these

factors would likely cause us to delay or slow our growth plans,

result in lower net sales and adversely affect our liquidity and

profitability. Similarly, the tightening of credit markets may

adversely affect our supplier base and increase the potential

for one or more of our suppliers to experience financial

distress or bankruptcy, which could materially and adversely

affect our business.

If we

fail to accurately forecast seasonal demand for our consumer

Video Eyewear products, our results of operations for the entire

fiscal year may be materially adversely affected.

Historically, a high percentage of our consumer Video Eyewear

product annual sales have been attributable to the winter

holiday selling season. Like many manufacturers of consumer

electronics products, we must make merchandising and inventory

decisions for the winter holiday selling season well in advance

of actual sales. Further compounding this forecasting are other

fluctuations in demand for the consumer electronics products

that work with our Video Eyewear products, often due to the same

seasonal influences, as well as technological advances and new

models which are often introduced later in the calendar year.

Inaccurate projections of demand or deviations in the demand for

our products may cause large fluctuations in both our fourth

quarter results and could have a material adverse effect on our

results of operations for the entire fiscal year. We expect that

our fourth quarter sales of consumer products will remain

dependent on our performance during the winter holiday selling

season.

Our

Video Eyewear products require ongoing research and development

and we may experience technical problems or delays and may not

have the funds necessary to continue their development which

could lead our business to fail.

Our research and development efforts remain subject to all of

the risks associated with the development of new products based

on emerging and innovative technologies, including, for example,

unexpected technical problems or the possible insufficiency of

funds for completing development of these products. If we

experience technical problems or delays, further improvements in

our products and the introduction of future products could be

delayed, and we could incur significant additional expenses and

our business may fail.

We anticipate that we will require additional funds and further

US government engineering services contracts to maintain our

current levels of expenditure for research and development of

new products and technologies, and to obtain and maintain

patents and other intellectual property rights in these

technologies, the timing and amount of which are difficult to

forecast. Our cash on hand after the successful completion of

this offering coupled with the possibility of further negative

cash flow from operations may not be sufficient to meet all of

our future needs. We have no commitment for additional funds.

Any funds we need may not be available on commercially

reasonable terms or at all. If we cannot obtain any necessary

additional capital when needed, we might be forced to reduce our

research and development efforts which would materially and

adversely affect our business. If we attempt to raise capital in

an offering of shares of our common stock, preferred stock,

convertible securities or warrants, or if we engage in

acquisitions involving the issuance of such securities, our

then-existing stockholders’ interests will be diluted.

11

We

depend on advances in technology by other companies and if those

advances do not materialize, some of our products may not be

successfully commercialized and our anticipated new products

could be delayed or cancelled.

We rely on and will continue to rely on technologies (including

microdisplays) that are developed and produced by other

companies. The commercial success of certain of our planned

future products will depend in part on advances in these and

other technologies by other companies. We may, from time to

time, contract with and support companies developing key

technologies in order to accelerate the development of them for

our specific uses. Such activities might not result in useful

technologies or components for us.

If we

fail to develop new products and adapt to new technologies, our

business and results of operations may be materially adversely

affected.

The market for our products is characterized by rapid changes in

products, designs and manufacturing process technologies. Our

success depends to a large extent on our ability to develop and

manufacture new products and technologies to match the varying

requirements of different customers and groups in order to

establish a competitive position and become profitable.

Furthermore, we must adapt our products and processes to

technological changes and emerging industry standards and

practices on a cost-effective and timely basis. Our failure to

accomplish any of the above could harm our business and

operating results.

Consumer electronics products are subject to rapid technological

changes. Companies within the consumer electronics industry are

continuously developing new products with increased performance

and functionality. This puts pricing pressure on existing

products and constantly threatens to make them, or causes them

to be, obsolete. During the last two fiscal years, we sold one

product below cost after introducing new product models and as a

result incurred a negative gross margin of approximately 20% or

approximately $28,000 in negative margin. As our unit sales

increase, our ability to manage and mitigate future clearance

discounting activities may be harder and greater sales with

negative margins could increase. Our typical product life cycle

is relatively short, generating lower average selling prices as

the cycle matures. With cost reductions in component design and

increased manufacturing volumes we have not faced significant

margin erosion as we introduce new models of our Video Eyewear

products. If we fail to accurately anticipate the introduction

of new technologies, we may possess significant amounts of

obsolete inventory that can only be sold at substantially lower

prices and gross margins than we anticipated. In addition, if we

fail to accurately anticipate the introduction of new

technologies, we may be unable to compete effectively due to our

failure to offer products most demanded by the marketplace. If

any of these failures occur, our sales, profit margins and

profitability will be adversely affected.

If

microdisplay-based personal displays do not gain some reasonable

level of acceptance in the market for mobile displays, our

business strategy may fail.

The mobile display market is dominated by displays larger than

one-inch, based on direct view liquid crystal display

(LCD) and organic light emitting display (OLED) technology.

A number of companies have made and continue to make substantial

investments in, and are conducting research to improve

characteristics of, small direct view LCDs. Many of the leading

manufacturers of these larger direct view LCDs, including LG

Electronics, Royal Philips Electronics, Samsung Electronics Co.,

Ltd., Sony Corporation and Sharp Corporation, are large,